Top Invoice Receipt Templates for Your Business

Efficient record-keeping is essential for any business, ensuring that transactions are well-documented and easily accessible. Having a streamlined system for tracking payments and providing clients with clear, professional documentation is a key part of maintaining good business practices.

Using pre-designed structures for financial documents helps save time and reduce the risk of errors. These ready-to-use solutions allow you to focus on the core aspects of your business, while ensuring that every transaction is properly accounted for. Whether you’re a small entrepreneur or part of a larger organization, these systems offer flexibility and accuracy.

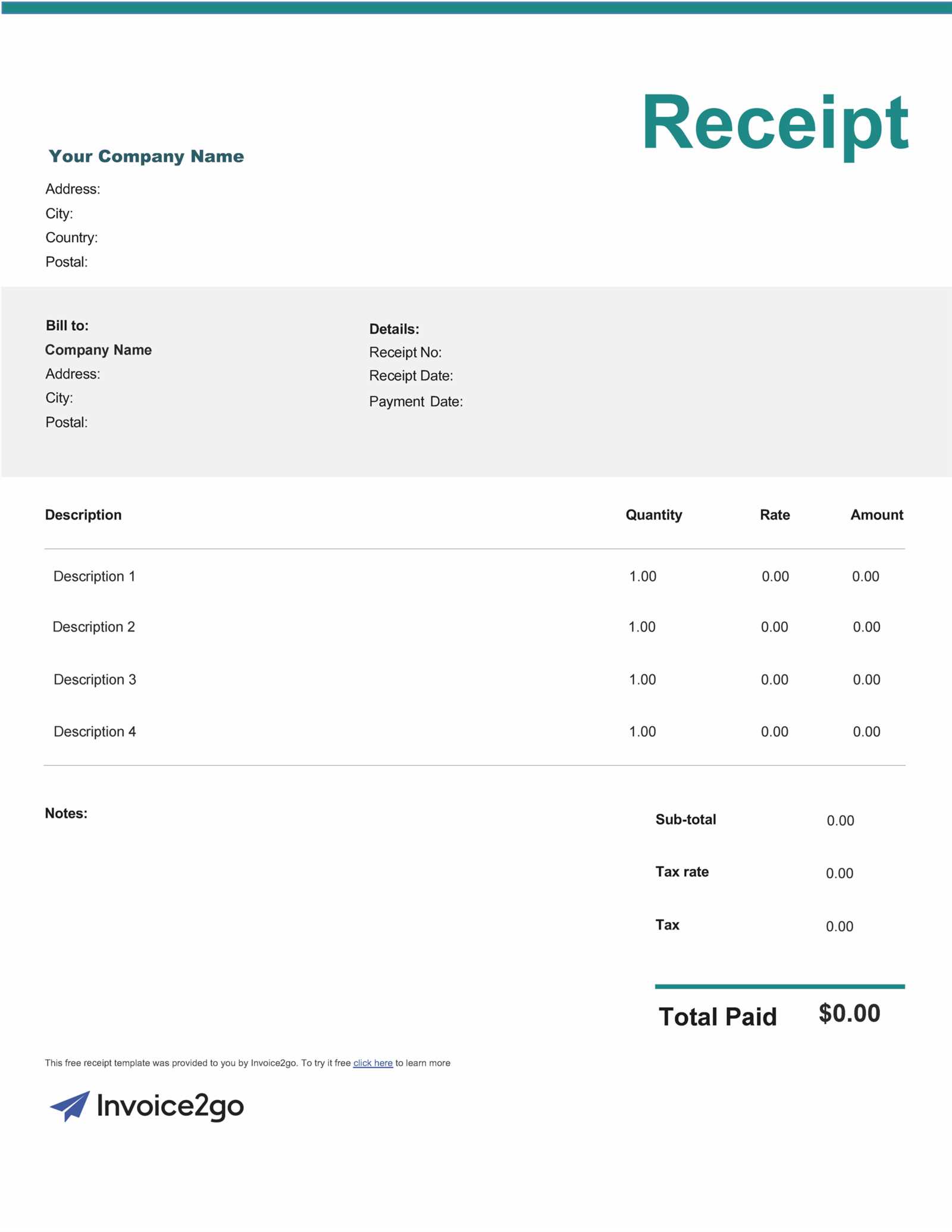

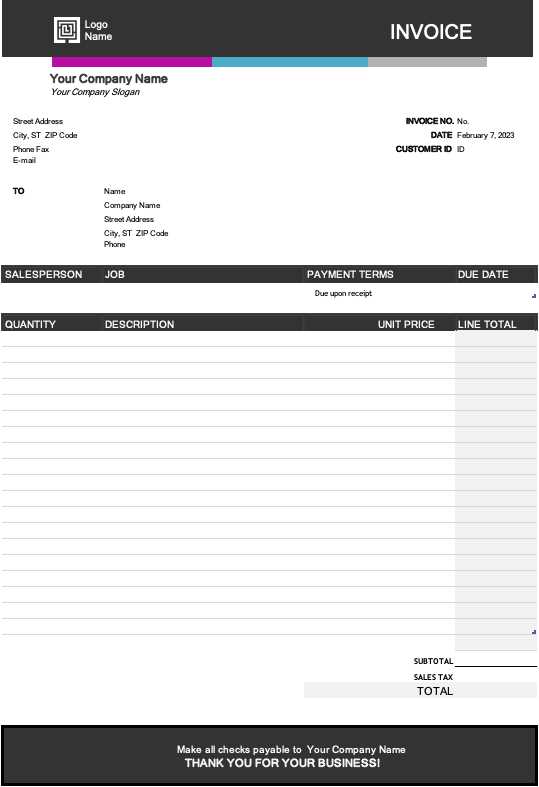

Customizable formats make it easy to tailor documents to your specific needs. With various fields and design elements, you can create professional outputs that align with your brand’s identity, adding a personal touch to the process while maintaining a high level of professionalism.

Invoice Receipt Templates for Every Business

Every business, regardless of size, requires a reliable method for documenting financial exchanges with clients and customers. The ability to provide clear and professional documentation not only ensures transparency but also helps to establish trust and streamline the accounting process. These documentation systems can be tailored to fit the needs of various industries, from freelancers to large corporations.

Custom Solutions for Different Industries

Different sectors have specific requirements when it comes to documenting transactions. For example, service-based businesses may need to include detailed descriptions of services rendered, while retail businesses may focus more on itemized product lists. Customizable options allow businesses to select the format that suits their particular operations, ensuring that the documentation is both relevant and effective.

Streamlining the Billing Process

Automating the creation of financial documents significantly speeds up the billing process, reducing human error and ensuring consistency. With user-friendly systems, businesses can generate accurate documentation in just a few clicks, saving valuable time and effort that can be better spent on growing the business. These solutions can also be adapted to suit specific business models, helping you to stay organized and compliant with any industry regulations.

Importance of Professional Receipt Templates

Providing well-organized and clear documentation for every transaction is an essential part of maintaining professionalism in business. Whether you are selling goods, offering services, or managing client accounts, having a structured format for documenting payments not only enhances transparency but also builds trust with customers. Clear and consistent financial records are vital for managing cash flow, auditing, and tax reporting.

Benefits of Well-Designed Documentation

Professional documentation ensures that both the business and the client have a clear understanding of the transaction details. It simplifies communication, reduces misunderstandings, and provides a reference in case of disputes. Moreover, it gives a polished appearance to your business, making it more credible and trustworthy in the eyes of your clients. Properly formatted financial records can also support your business in handling legal or accounting requirements.

Key Features of Effective Formats

Effective documentation includes essential details such as transaction dates, payment methods, itemized lists, and total amounts. These features help track transactions efficiently, offering clarity in the process. Below is an example of key components commonly found in a professional document format:

| Field | Description |

|---|---|

| Date | The date when the transaction occurred |

| Transaction Details | A brief description of the products or services provided |

| Total Amount | The total value of the transaction |

| Payment Method | The method used for the payment (e.g., credit card, bank transfer) |

By including these key elements, you ensure that your documentation is comprehensive, helping to maintain order and providing a solid foundation for future business transactions and financial reviews.

How to Customize Your Invoice Template

Customizing your financial documentation is essential to align it with your business’s branding and specific needs. By adjusting the layout and content, you can ensure that every document you provide looks professional and includes all relevant information for both your business and your clients. Tailoring these documents also allows you to emphasize the aspects of your transactions that matter most, such as discounts, payment terms, or product descriptions.

Customizing your document structure involves editing key fields and designing the layout to reflect your business identity. Most solutions offer user-friendly tools that allow you to make changes easily without the need for advanced design skills. Here are the basic areas you should focus on:

| Customizable Field | How to Modify |

|---|---|

| Header | Add your company logo, business name, and contact information for a professional touch |

| Itemized List | Modify or add descriptions for the goods or services provided to reflect your offerings |

| Payment Terms | Adjust payment due dates, discounts, or late fees according to your business policies |

| Design Layout | Change the color scheme, font style, or layout to match your brand’s aesthetics |

By carefully adjusting these fields, you can create a personalized, visually appealing document that not only serves its functional purpose but also reinforces your brand’s image in the eyes of your clients.

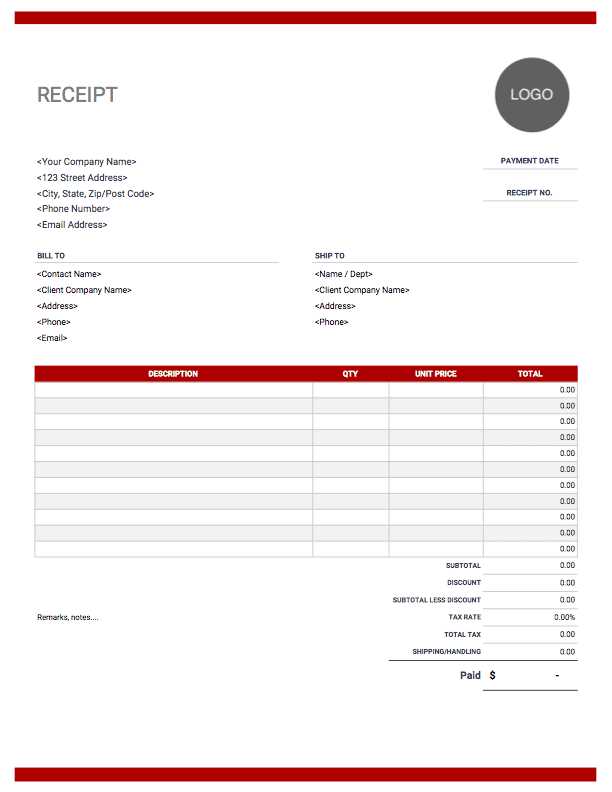

Free Invoice Receipt Templates Available Online

Finding high-quality, no-cost solutions for creating professional financial documentation is easier than ever. Many websites offer customizable options that allow businesses of all sizes to generate documents quickly, without the need for expensive software. These free resources can save both time and money, while still ensuring that the final product meets your business’s specific needs.

These online platforms typically provide a variety of formats, from basic designs to more advanced structures, catering to a range of industries. You can easily access, download, and adjust these documents, making them ideal for businesses looking for cost-effective ways to stay organized and professional. Below is a breakdown of common features available in free online tools:

| Feature | Benefit |

|---|---|

| Customizable Layout | Adjust fields, fonts, and colors to match your brand’s style |

| Download Options | Choose from different file formats like PDF, DOC, or XLS for easy sharing |

| Pre-filled Fields | Save time with fields for business details, payment terms, and other essentials |

| Industry-Specific Designs | Access layouts tailored to different types of businesses, from retail to services |

With these free tools, businesses can create functional, professional documents that meet their needs without the added cost of premium software. This makes it simple to maintain a consistent and organized approach to financial record-keeping, regardless of your business’s size or budget.

Key Elements of an Invoice Receipt

For any business transaction, it’s essential to have a well-structured document that captures all relevant details clearly and accurately. This document serves as both a proof of the exchange and a reference for future record-keeping. Including the right information ensures transparency, helps in managing financial data, and provides a reliable point of reference in case of disputes or audits.

Several key components are crucial to ensure the document is both professional and functional. Below are the most important elements that should always be included:

- Business Information: The name, address, and contact details of your company or business.

- Customer Information: The name and contact details of the person or entity being billed.

- Transaction Date: The exact date when the transaction took place.

- Description of Goods or Services: A detailed list of the products or services provided, including quantities, prices, and any other relevant details.

- Payment Terms: The agreed-upon payment methods, due dates, and any terms regarding discounts or late fees.

- Total Amount: The final amount owed, including any taxes or additional charges.

Including these key elements ensures that your document is comprehensive, accurate, and professional. It also makes the process of tracking and managing business finances much easier and more organized.

Choosing the Right Template for Your Needs

Selecting the right document format is crucial to ensure that it suits both your business requirements and the expectations of your clients. With various options available, it’s important to understand the specific elements you need in order to effectively manage your transactions. By tailoring the layout, design, and information fields, you can create a professional and efficient solution that reflects your brand and improves your workflow.

Understanding Your Business Requirements

Each business has unique needs when it comes to financial documentation. For example, service-based companies may require more detailed descriptions of services provided, while product-based businesses may focus on itemized lists of items sold. Understanding the specific components your business requires will help you choose the right format that aligns with your operational model.

Choosing Between Simple and Detailed Designs

Simple designs work well for straightforward transactions, offering a clean, minimal layout that focuses on essential details. These are ideal for small businesses or freelancers who need quick, easy-to-generate documents. On the other hand, detailed designs provide more advanced features, such as fields for additional terms, discount structures, or extended payment options. These are better suited for larger businesses or those with more complex billing needs.

Choosing the right structure is about balancing ease of use with the ability to communicate all necessary details clearly. The goal is to create a format that works efficiently for both your team and your clients.

Common Mistakes in Invoice Receipts

Even though financial documentation is essential for any business, errors are often made when creating these important records. Mistakes can lead to confusion, delayed payments, and even legal or financial issues. Understanding the common errors and how to avoid them is key to ensuring that every document is accurate and professional.

Some of the most frequent mistakes involve missing details, incorrect calculations, or inconsistent formats. Below are some common errors businesses should watch out for when creating transaction documents:

| Common Mistake | Explanation |

|---|---|

| Missing Business Information | Failing to include important details such as your business name, address, or contact information can make the document seem unprofessional and cause confusion. |

| Incorrect Total Amount | Errors in summing up the transaction total, including taxes and discounts, can lead to inaccurate payments or disputes. |

| Unclear Payment Terms | Not specifying payment methods, due dates, or other terms clearly can result in late payments or misunderstandings. |

| Inconsistent Formatting | Using inconsistent fonts, layout styles, or field placements can make the document harder to read and reduce its professional appearance. |

By paying attention to these common mistakes and ensuring all fields are complete and accurate, businesses can create professional, reliable documents that facilitate smooth transactions and strong client relationships.

How to Add Your Branding to Templates

Integrating your business’s branding into your financial documents is essential for creating a professional and cohesive identity. By customizing your layout, colors, and logos, you ensure that every piece of documentation reflects your company’s values and strengthens its presence. Personalizing these records not only enhances brand recognition but also conveys a sense of professionalism and attention to detail.

Key Elements to Brand Your Documents

When customizing your documents, several elements should be adjusted to align with your brand’s identity. These changes ensure consistency and a unified appearance across all communication with clients. Here are the key areas to focus on:

- Logo: Place your company logo prominently at the top or in the header area.

- Color Scheme: Use your brand’s primary colors for the background, text, or headings to maintain a consistent visual identity.

- Typography: Choose fonts that match your brand’s style, whether they are modern, classic, or minimalist.

- Tagline or Slogan: Include your company’s slogan or tagline if applicable to reinforce your brand message.

Choosing the Right Design for Your Brand

Not all designs are suited for every brand. It’s essential to select a layout that reflects your company’s tone, whether it’s formal, casual, or creative. Here are some tips to help you make the right choice:

- Professional Look: For more corporate or professional businesses, choose clean, minimalist layouts that focus on clarity and structure.

- Creative Touch: If your brand is more creative, you can experiment with bold fonts, vibrant colors, and unique designs.

- Consistency: Keep the design consistent with other branded materials, such as your website, business cards, or promotional items.

By thoughtfully incorporating these branding elements, you create a cohesive and professional appearance for all your financial documentation, reinforcing your company’s identity with every transaction.

Best Software for Invoice Template Creation

Creating customized business documents is essential for any organization to maintain a professional appearance and streamline financial processes. The right software can simplify this task by providing flexible tools for creating and managing documents tailored to your specific needs. From free online tools to comprehensive accounting software, there are various options available that offer intuitive design and functionality.

Here are some of the best software options to help you create professional, branded financial documents:

Top Software for Document Creation

- Microsoft Word: A versatile tool that allows easy customization of document layouts, fonts, and designs. It’s perfect for businesses looking for a simple, straightforward option.

- Google Docs: A free, cloud-based solution that enables real-time collaboration. It offers a variety of customizable document templates and is accessible from anywhere.

- Canva: Known for its user-friendly design tools, Canva allows businesses to create visually appealing documents with templates that can be fully customized to match your branding.

- FreshBooks: A popular accounting software with built-in features for creating custom financial documents. It automates invoicing, payment tracking, and client communication, making it a great all-in-one solution.

- Zoho Invoice: This software offers comprehensive features for creating, sending, and tracking financial documents. Its easy-to-use interface and customization options make it suitable for small to medium-sized businesses.

Choosing the Right Tool for Your Business

When selecting software, consider your specific business needs, such as the level of customization, integration with other tools, and ease of use. Here are some key factors to keep in mind:

- Customization Options: Look for software that offers flexibility in terms of layout, colors, and fonts to align with your company’s brand.

- Ease of Use: Choose a tool that is intuitive and easy to navigate, especially if you don’t have extensive design experience.

- Automation: If you regularly send similar documents, consider software that automates the creation and distribution process to save time and reduce errors.

By using the right software, you can efficiently create professional, branded documents that help streamline your business operations and enhance client relations.

PDF vs Word Format for Receipts

When creating business documents for transactions, selecting the right file format is crucial for both presentation and functionality. The two most commonly used formats are PDF and Word. Each format has its unique advantages and is suited for different purposes, depending on your specific needs. Understanding the strengths of both formats can help you make an informed decision on which is best for your documents.

Advantages of PDF Format

The PDF format is widely used for business documentation due to its ability to maintain the integrity of the layout, regardless of the device or software used to view it. Here are some of its key benefits:

- Consistency: PDF files maintain their formatting across all devices and platforms, ensuring that your document looks exactly as intended.

- Security: PDFs allow you to password-protect documents, making them more secure for sensitive information.

- Professional Appearance: PDFs typically look more polished and professional, which can leave a lasting impression on clients.

- File Size: PDF files can be compressed without losing quality, making them easier to share and store.

Advantages of Word Format

While PDFs are great for finished documents, Word format offers a range of flexibility when it comes to editing and customization. Here are the main advantages:

- Editable: Word documents can be easily edited and updated, which is ideal for ongoing changes or reusing content.

- Ease of Use: Word offers a wide range of customization tools, including templates and styles, to help you create documents quickly.

- Integration: Word files are compatible with many business software solutions, which can be useful for integrating them into your workflow.

- Collaboration: Multiple users can collaborate on the same document in real time, which is beneficial for teams working together.

Which Format Should You Choose?

The decision between PDF and Word depends on your specific requirements for the document. Consider the following:

- For final documents that need to be shared securely and professionally: PDF is often the best choice, as it preserves the document’s integrity and ensures compatibility across all platforms.

- For documents that need frequent updates or customization: Word is ideal because it allows for easy editing and adjustments.

Ultimately, both formats are valuable tools, and the choice comes down to how you intend to use and share your documents.

How to Organize Receipts for Recordkeeping

Efficiently organizing business documents is essential for maintaining accurate financial records and ensuring easy access during audits or tax season. Proper recordkeeping not only helps businesses stay compliant but also streamlines the process of tracking expenses, monitoring cash flow, and managing overall finances. By setting up a clear system, you can ensure that all documents are readily available and easy to manage when needed.

Steps to Organize Financial Documents

Here are some key steps to help you organize your business documents for effective recordkeeping:

- Create Categories: Organize your documents by category such as expenses, sales, taxes, and payments. This makes it easier to retrieve specific records when necessary.

- Establish a Filing System: Whether physical or digital, have a filing system in place. For physical documents, use labeled folders, binders, or filing cabinets. For digital records, set up clear folder structures on your computer or cloud storage.

- Use Date Ranges: Organize documents by month, quarter, or year. This allows for easy tracking of transactions over time and helps you stay on top of tax filings.

- Track Document Types: Keep different types of documents (e.g., invoices, payments, contracts) in separate folders for easy identification and retrieval.

Digital vs. Physical Organization

When choosing how to organize your documents, consider the advantages of both physical and digital recordkeeping systems:

- Digital: Digital files are easier to search, can be backed up for security, and take up less physical space. Many accounting software programs also allow you to store documents directly within the platform for easy access and integration.

- Physical: Physical records may be preferred by some businesses, especially for legal or compliance reasons. It’s important to maintain proper storage in fireproof or secure locations to avoid any loss of important documents.

Regardless of the method you choose, it’s important to maintain consistency and ensure that documents are regularly updated and reviewed. This will save you time and effort in the long run and make it easier to maintain financial accuracy.

Simple Steps to Generate an Invoice

Creating a professional business document for transactions is an essential part of managing finances. A well-structured document helps ensure clear communication with clients, sets expectations for payment, and provides a reference for both parties. Generating such a document doesn’t have to be complicated–following a few straightforward steps can lead to a polished and accurate result.

Key Steps to Follow

Here are the basic steps to generate a business document for transactions:

- Include Your Business Information: At the top of the document, clearly list your company name, address, phone number, and email. This ensures your client can easily contact you if needed.

- Add Client Information: Include the client’s full name or business name, address, and contact information. This helps to avoid confusion, especially when dealing with multiple clients.

- Provide a Unique Identification Number: Assign a unique identifier to each document, such as a serial number or reference code. This will help with tracking and organizing documents for future reference.

- Detail the Products or Services: Clearly list the products, services, or work completed, including descriptions, quantities, and unit prices. This allows your client to understand what they are paying for.

- Set the Payment Terms: Specify the total amount due, payment methods accepted, and the due date. It’s essential to make payment instructions as clear as possible to avoid any misunderstandings.

- Include Tax Information: If applicable, include tax rates and amounts so that the total due is clearly stated. Be sure to follow any local tax regulations in your area.

Additional Tips for Accuracy

To ensure your document is accurate and professional, consider these helpful tips:

- Double-Check for Accuracy: Always verify that the amounts, dates, and details are correct before sending the document.

- Keep It Simple: A clutter-free, easy-to-read document looks more professional and reduces the chance of errors.

- Use Consistent Branding: If you’re using a customized layout or software, include your logo, brand colors, and consistent fonts to reinforce your business identity.

By following these simple steps, you can create a clear and organized business document that will facilitate smooth transactions and help maintain a professional relationship with your clients.

Automating Invoice Receipt Generation

Automating the creation of business documents can significantly improve efficiency, reduce errors, and save time. By setting up automated processes, businesses can quickly generate accurate documents every time a transaction occurs, ensuring consistency and compliance without manual intervention. The integration of automation tools allows for faster, more streamlined workflows, making it easier to focus on other essential tasks.

Benefits of Automation

Automating document creation offers several advantages:

- Time-Saving: Automation reduces the time spent on manual document creation, allowing employees to focus on more critical tasks.

- Consistency: Every document generated is uniform in style, structure, and accuracy, ensuring professionalism across all transactions.

- Reduced Errors: Automation minimizes human errors such as typos, incorrect calculations, or missing details.

- Improved Efficiency: Automated systems can generate documents instantly after each transaction, streamlining your overall workflow.

- Better Organization: Automation ensures that all documents are stored in a centralized system, making it easier to track and retrieve them when needed.

How to Set Up Automation

Setting up an automated system for generating business documents can be done by following these steps:

- Choose the Right Software: Select software that supports automation features, such as generating and sending documents automatically after each transaction.

- Integrate with Your Payment System: Link your payment or order processing system with your automated document generation tool. This ensures that data flows seamlessly between platforms.

- Customize Your Document Layout: Use the software’s customization options to design a professional document that reflects your brand and business style.

- Set Up Triggers: Configure triggers that will automatically generate and send the document when a payment is received or an order is completed.

- Monitor and Review: Regularly monitor the automation system to ensure everything is running smoothly and documents are being generated correctly.

By automating document generation, businesses can save valuable time and reduce the chances of errors, ultimately enhancing the overall operational efficiency of the organization.

Customizing Fields in an Invoice Template

Personalizing the fields in your business document layout is crucial to ensure it reflects your unique needs and brand identity. Customization allows you to tailor the document to include only the most relevant information, while ensuring it looks professional and is easy for clients to understand. Whether you’re managing a small business or a large enterprise, adjusting fields in your document can help streamline your processes and enhance client relationships.

Key Fields to Customize

Here are some of the most important fields you may want to adjust in your business document:

- Business Details: Include your company name, logo, address, and contact information to make the document clearly identifiable.

- Client Information: Personalize the client section with their name, business name, address, and relevant contact details for accurate communication.

- Product or Service Descriptions: Modify this section to fit the specifics of your offerings, including quantities, item descriptions, and pricing.

- Payment Terms: Adjust payment instructions to specify due dates, payment methods accepted, and any late fees or discounts.

- Tax Information: Customize this section to include applicable tax rates and calculations based on your region or industry standards.

How to Customize Fields Effectively

Customizing the fields in your business documents can be done using various software tools, offering flexibility and ease. Here are some steps to follow:

- Choose a Customizable Platform: Select a platform that allows you to easily adjust the fields according to your needs, such as invoicing or accounting software.

- Use Pre-set Templates: Many platforms offer pre-set designs that can be customized, which is a good starting point for those with limited design skills.

- Incorporate Branding: Ensure that your document reflects your brand by adding your logo, color scheme, and specific fonts.

- Automate Fields Where Possible: Automate recurring fields like client information or item descriptions to save time and ensure consistency.

- Review Customizations Regularly: As your business grows, make sure to revisit your customized fields to ensure they’re still serving your evolving needs.

Customizing fields in your business documents can help create a polished, professional look, while making sure the content is relevant and accurate. This allows you to present a clear and consistent message to your clients, contributing to better business relationships.

Legal Considerations for Invoice Receipts

When creating business documents to record transactions, it’s essential to ensure that they comply with relevant laws and regulations. These documents serve as a legal record of a business transaction and may be required for tax purposes, audits, or dispute resolutions. Therefore, understanding the legal requirements surrounding these documents is critical for businesses of all sizes. The information included in these documents must meet the standards set by local authorities and be presented in a clear, accurate, and consistent manner.

Key Legal Requirements

There are several legal aspects to consider when creating business records for transactions:

- Accurate Information: Always ensure that the details on the document are precise and truthful. This includes names, addresses, transaction dates, and amounts.

- Tax Compliance: Many regions require specific tax-related information, such as tax identification numbers, tax rates, and tax amounts. Ensuring this information is correct is essential for both your business and your clients.

- Retention Period: Keep records of your business transactions for the legally required period, which may vary depending on your country or industry. Failure to retain these records could result in penalties or difficulties during audits.

- Payment Terms: Clearly state the terms of payment, including due dates, penalties for late payments, and accepted payment methods. These terms are essential for protecting both parties in the transaction.

- Legal Disclaimers: Depending on the nature of your business, you may need to include disclaimers about refunds, warranties, or limitations of liability.

How to Ensure Legal Compliance

Ensuring that your business records are legally compliant can be straightforward if you follow these best practices:

- Consult a Legal Professional: If you’re unsure about the requirements in your area, it’s always a good idea to seek advice from a legal expert who specializes in business law or tax regulation.

- Use Reputable Software: Many invoicing and accounting tools are designed to help businesses stay compliant with tax laws and regulations. Choose a software solution that automatically includes the necessary fields for legal compliance.

- Stay Updated: Tax laws and legal requirements can change. Ensure that you review and update your documents regularly to stay current with any legal updates.

- Ensure Transparency: Make sure that your terms and conditions are clear and easy to understand. Ambiguous or misleading terms can lead to legal disputes.

By adhering to these guidelines, businesses can avoid potential legal issues and ensure that their transaction records are not only accurate but also legally sound. Proper documentation protects both your business

Tips for Sending Receipts Electronically

In today’s digital age, sending transaction records electronically is a common practice that offers numerous benefits. It allows for faster delivery, better organization, and the ability to reduce paper waste. However, it’s important to ensure that the process is secure, professional, and efficient. Following some best practices can help streamline this task and ensure that both businesses and clients are satisfied with the transaction experience.

Best Practices for Sending Electronic Documents

Here are a few important tips for sending business transaction documents electronically:

- Use Secure Methods: Always send documents through secure platforms to protect sensitive information. Consider using encrypted email or secure cloud storage services with password protection to ensure confidentiality.

- Choose the Right File Format: The most common file formats for electronic documents are PDF and Word. PDFs are typically preferred due to their professional appearance and the ability to be easily opened by anyone, regardless of software.

- Clear Subject Line: When sending an electronic document, make sure your email subject line is clear and informative. Include relevant information such as the transaction date, customer name, or document type for easy reference.

- Personalize Your Message: Even though the document is being sent electronically, include a brief, personalized message in the email. A polite note thanking the recipient and confirming receipt of payment or transaction can help maintain professionalism.

- Double-Check the Information: Before sending, always review the document for accuracy. Verify that all the necessary details such as transaction amounts, dates, and parties involved are correct.

- Ensure Mobile Compatibility: Many clients may open the documents on their phones or tablets. Make sure that the format and layout are easily readable on mobile devices to enhance user experience.

- Confirm Delivery: Whenever possible, request a read receipt or ask your client to confirm receipt of the document. This helps avoid any misunderstandings about whether the transaction record was received.

Advantages of Sending Documents Electronically

Sending transaction records electronically offers several key advantages:

- Faster Delivery: Electronic documents can be sent instantly, reducing waiting times for both businesses and customers.

- Environmental Benefits: Reducing paper usage helps conserve resources and minimizes the carbon footprint of your business.

- Better Organization: Digital records are easier to store, search, and manage compared to physical paperwork, making it simpler to retrieve them when needed.

- Reduced Costs: Sending documents electronically eliminates printing, postage, and other related costs.

By following these tips, you can ensure that sending transaction records electronically is secure, efficient, and professional, while offering a convenient option for your clients.

Creating Recurring Invoice Templates

For businesses that deal with regular billing cycles, having a system in place to generate consistent and accurate transaction records is crucial. The ability to automate and customize these documents can save time, reduce errors, and ensure that your clients are billed appropriately. Setting up recurring formats helps streamline the process and maintain a professional approach to regular financial exchanges.

Steps for Creating Recurring Billing Formats

Creating recurring formats involves a few essential steps to ensure efficiency and accuracy:

- Identify Key Information: Determine which details remain the same for every cycle, such as client information, payment terms, and the products or services provided. These elements can be pre-filled in the template, saving time.

- Customize for Flexibility: Design the document to accommodate changing variables, such as the amount or additional services provided in each billing cycle. This flexibility allows you to modify certain fields without having to redesign the entire document each time.

- Automate the Process: Use software or digital tools that allow you to automate the creation and sending of recurring billing documents. This ensures timely and consistent delivery, reducing the need for manual intervention.

- Set Up Reminders: Ensure that both you and your client are aware of upcoming payments by setting up automated reminders. These can be sent before each billing cycle to confirm the upcoming transaction details.

Advantages of Using Recurring Billing Formats

Implementing a recurring structure for transaction documents has several benefits:

- Time Efficiency: By automating the process, you free up time for other business tasks, ensuring that billing is handled quickly and without repeated manual work.

- Consistency: Regular formats ensure uniformity in how transactions are presented, making it easier for clients to understand and for businesses to track their finances.

- Improved Accuracy: Automation reduces the chances of human error, ensuring that amounts, dates, and client details are correct each time.

- Professional Appearance: A well-designed, recurring system enhances your business’s image, showing clients that you are organized and committed to providing clear financial documentation.

Example of a Recurring Document Format

Below is a basic structure for a recurring format:

| Client Name | Billing Date | Amount | Payment Terms | Due Date |

|---|---|---|---|---|

| John Doe | 01/01/2024 | $100 | Net 30 | 01/31/2024 |

| John Doe | 02/01/2024 | $100 | Net 30 | 02/29/2024 |

By following these steps and incorporating the right tools, you can create an effective recurring system for your business that ensures both you and your clients remain on the same page, streamlining the entire billing process.