Free Invoice Template PDF for Easy Billing and Organization

Managing payments and keeping track of business transactions is essential for any professional. However, creating accurate and consistent records can be time-consuming without the right tools. By utilizing the right documents, you can simplify the entire process, ensuring clarity and professionalism in every exchange.

Whether you’re a freelancer, small business owner, or a contractor, having access to a structured format helps you present your charges clearly. These pre-designed forms allow you to input the necessary details without starting from scratch each time, saving you both time and effort.

Automating your financial paperwork through these ready-made solutions ensures consistency and reduces errors. It helps you maintain a high standard in your transactions, while also making the payment process more efficient for your clients. With these customizable forms, you can easily adjust fields to suit your specific needs, whether you’re billing for services, products, or projects.

Embrace efficiency and professionalism by using documents that not only make your workflow smoother but also help you stay organized and ahead in your business operations.

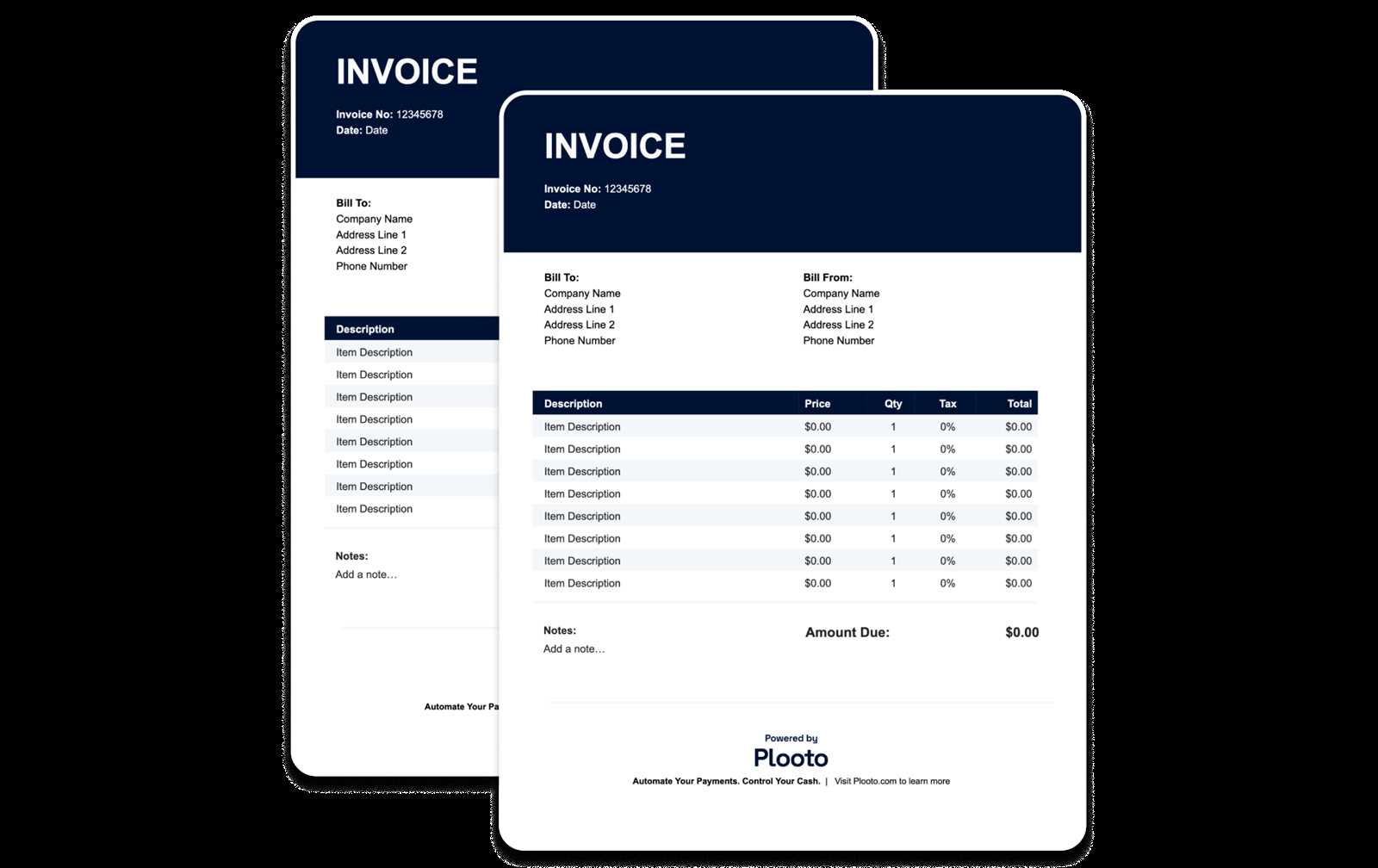

Free Invoice Templates for Your Business

Every business, regardless of its size, needs an efficient way to handle billing. Having a set structure for charging clients not only saves time but also creates a professional appearance. Using ready-made forms designed for this purpose can help streamline the process, making sure nothing is overlooked.

When you find the right set of documents, you can easily fill in the required details like amounts, dates, and services rendered. These pre-designed files are fully customizable, allowing you to adjust them to your unique requirements. This flexibility ensures that you’re always able to meet specific client needs without starting from scratch.

Utilizing such tools can significantly reduce the administrative burden, allowing you to focus more on running your business. With clearly structured paperwork, you can eliminate common errors and ensure all transactions are clearly documented. It also enhances your credibility and ensures that your clients receive accurate, easy-to-understand records.

By implementing these efficient solutions, you can improve your overall workflow and get paid on time without unnecessary delays or confusion.

Why Use a PDF Invoice Template

Using a well-structured document format for billing is essential for maintaining professionalism and consistency in business transactions. This format ensures that all necessary information is presented clearly and efficiently, making it easier for both you and your clients to keep track of payments and services rendered.

One of the main advantages of using such a format is its universal compatibility. Documents saved in this format are easily accessible across various devices and platforms, ensuring that your clients can view them without encountering technical issues. This ensures smooth communication and eliminates potential obstacles during the payment process.

Additionally, this format is ideal for protecting the integrity of your documents. Unlike editable file formats, it is more difficult for others to modify the contents, offering an added layer of security. This helps maintain the accuracy and authenticity of your financial records, safeguarding both your interests and those of your clients.

By adopting this approach, you not only streamline the billing process but also enhance your credibility and professionalism, making your transactions smoother and more transparent.

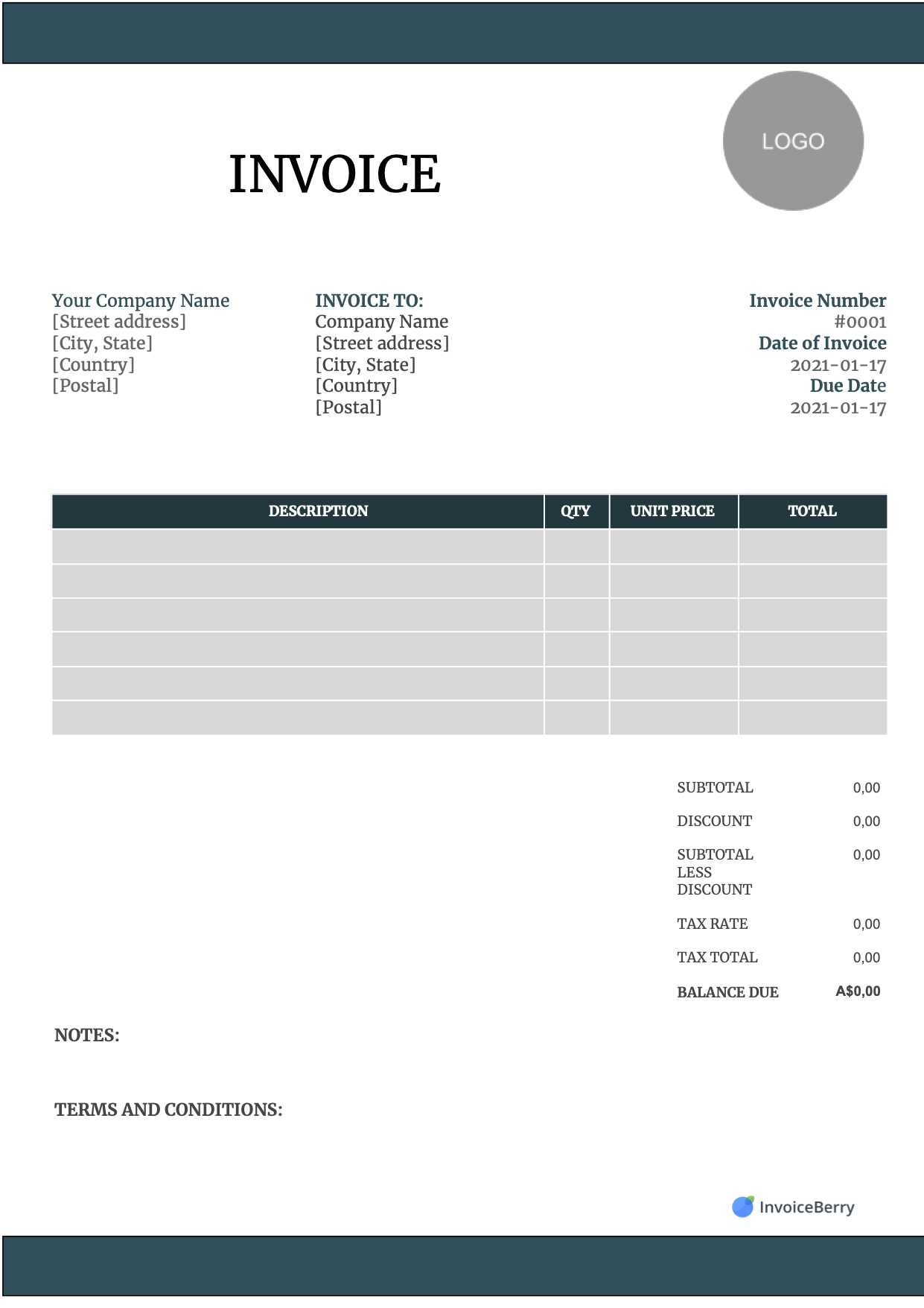

How to Customize an Invoice Template

Customizing a billing document is a straightforward way to make sure it aligns with your business needs. This process allows you to add your branding, include specific details, and ensure the format matches your preferences. Personalizing these forms can enhance your professional image and make transactions smoother for both parties involved.

Step 1: Modify the Header Information

The first section of the document typically includes your business details and the client’s information. You should customize this area with:

- Your company name, logo, and contact details

- The client’s name and address

- Any specific reference numbers (such as project codes or invoice numbers)

Step 2: Adjust the Line Items and Payment Terms

- Adding detailed descriptions of the services or goods

- Specifying the unit price, quantity, and total cost

- Including tax rates, discounts, or additional fees as needed

Make sure to set clear payment terms, such as the due date and accepted payment methods, to avoid any misunderstandings.

Step 3: Include Additional Information

Depending on the nature of your business, you may need to add other sections to your form, such as:

- Payment instructions or bank details

- Notes on late fees or early payment discounts

- Terms and conditions related to the transaction

By making these adjustments, you ensure that each document is perfectly suited to the specific needs of your business and clients.

Top Benefits of Using PDF Invoices

Choosing the right format for sending billing statements can greatly improve the efficiency and security of your business transactions. Opting for a well-structured and universally recognized format offers numerous advantages, ensuring that both you and your clients experience a smooth and professional process.

1. Universality and Accessibility

One of the key advantages of using this type of file format is its compatibility across various devices and operating systems. This makes it easy for clients to open and view the document, whether they’re on a computer, tablet, or mobile phone. Some of the specific benefits include:

- Easy access from any device without requiring special software

- Consistent formatting that remains intact regardless of the platform

- Convenience for clients, allowing them to view the file immediately after receiving it

2. Enhanced Security and Integrity

Using this file type helps maintain the accuracy of your billing records. Unlike editable formats, this option reduces the risk of unauthorized changes. Additional benefits include:

- Document encryption for extra security during transmission

- Immutability, ensuring the content stays exactly as intended

- Ability to add password protection or digital signatures for further verification

These features give both you and your clients peace of mind that the document is both legitimate and secure.

Where to Download Free Invoice Templates

Finding the right document format for billing your clients can be a time-consuming task, but fortunately, there are numerous reliable sources where you can download pre-designed files to make the process easier. These platforms provide ready-made solutions that can be quickly customized to suit your needs, saving you valuable time and effort.

1. Online Business Resource Websites

Many websites dedicated to supporting small businesses offer a variety of downloadable billing forms. These resources typically allow you to search for the most appropriate layout for your industry, whether you’re a freelancer, consultant, or service provider. Some of the most popular platforms include:

- Business-related blogs or forums

- Small business support websites

- Financial tool providers offering free downloads

2. Document Sharing Platforms

Another great option is using document sharing platforms where users upload and share their own templates. Websites like these often have large libraries, allowing you to choose from a variety of formats, all of which can be easily downloaded and edited. Some well-known platforms are:

- Google Docs and Google Drive (various templates available in the template gallery)

- Microsoft Office (Word, Excel templates)

- Template-sharing platforms such as Template.net

By exploring these resources, you can quickly find a well-designed document that fits your needs, saving time while maintaining a professional appearance in your business dealings.

Creating Professional Invoices with Ease

Generating accurate and professional billing statements is essential for maintaining smooth business operations. With the right tools, you can create well-organized documents that not only reflect your professionalism but also streamline the payment process. By using ready-made structures, you can ensure that all important details are included while keeping things simple and efficient.

1. Quick Customization for Every Job

Modern document formats allow for easy customization, meaning you can quickly adjust each file to match the specifics of your work. Whether you’re providing a service or delivering a product, you can:

- Insert your company logo and branding

- Add specific details about the products or services provided

- Adjust the layout to suit your style or client’s preferences

This flexibility makes it easy to maintain a consistent appearance for all your transactions, ensuring that every document looks professional and aligned with your business identity.

2. Automatic Calculations for Accuracy

Many document editing platforms offer automatic calculation features, which can save you time and reduce errors. By setting up the correct fields, these systems can:

- Automatically calculate totals and taxes

- Apply any discounts or additional charges based on your preferences

- Update numbers as you make changes to quantities or pricing

By using these tools, you can ensure that your billing statements are not only accurate but also look polished and professional, allowing you to focus more on your business and less on administrative tasks.

How to Fill Out an Invoice Template

Filling out a billing document might seem like a simple task, but accuracy is key to maintaining professionalism and ensuring timely payments. Knowing what information to include, where to place it, and how to format everything correctly can make a big difference. By following a clear process, you can easily complete this task every time you need to send a statement to a client.

1. Include Your Business Information

The first step is to ensure that your business details are clearly visible at the top of the document. This includes:

- Your business name and logo

- Your address, phone number, and email

- Your tax identification number or any other relevant legal details

Ensure that this information is accurate and up-to-date, as it helps your client recognize the document as legitimate and official.

2. Add Client Details and Transaction Information

Next, provide your client’s information. This includes:

- The client’s full name or company name

- The client’s billing address

- Any relevant reference numbers, such as purchase orders or contracts

Once you’ve completed this section, move on to the details of the transaction, such as the services provided, quantities, rates, and any applicable taxes. Be sure to check that all amounts are correct and that you’ve included any discounts or adjustments if necessary.

Legal Requirements for Invoices

When creating billing documents, it’s important to ensure that they comply with local tax laws and regulations. There are certain pieces of information that are legally required to be included in such documents to ensure they are valid for both tax and legal purposes. Failing to provide the necessary details could result in delays, disputes, or even legal consequences.

The key requirements can vary depending on the country or jurisdiction, but generally, all official documents should include the following elements:

- Seller’s Information: Your business name, address, and contact details, along with your tax identification number (TIN) or VAT number if applicable.

- Buyer’s Information: The client’s full name or company name, address, and contact information.

- Unique Document Number: Every document should have a unique reference number to help track and identify transactions.

- Transaction Date: The date when the goods or services were provided, or when the payment is due.

- Detailed Description: A clear breakdown of the services rendered or goods sold, including quantities, rates, and any applicable taxes or discounts.

- Total Amount Due: A precise total including all charges, taxes, and adjustments.

- Payment Terms: The agreed-upon payment method and due date, as well as any penalties for late payment.

These essential elements ensure that your documents are legally compliant and that you’re protected in case of any disputes or audits. Always double-check the specific requirements for your country or industry to ensure full compliance.

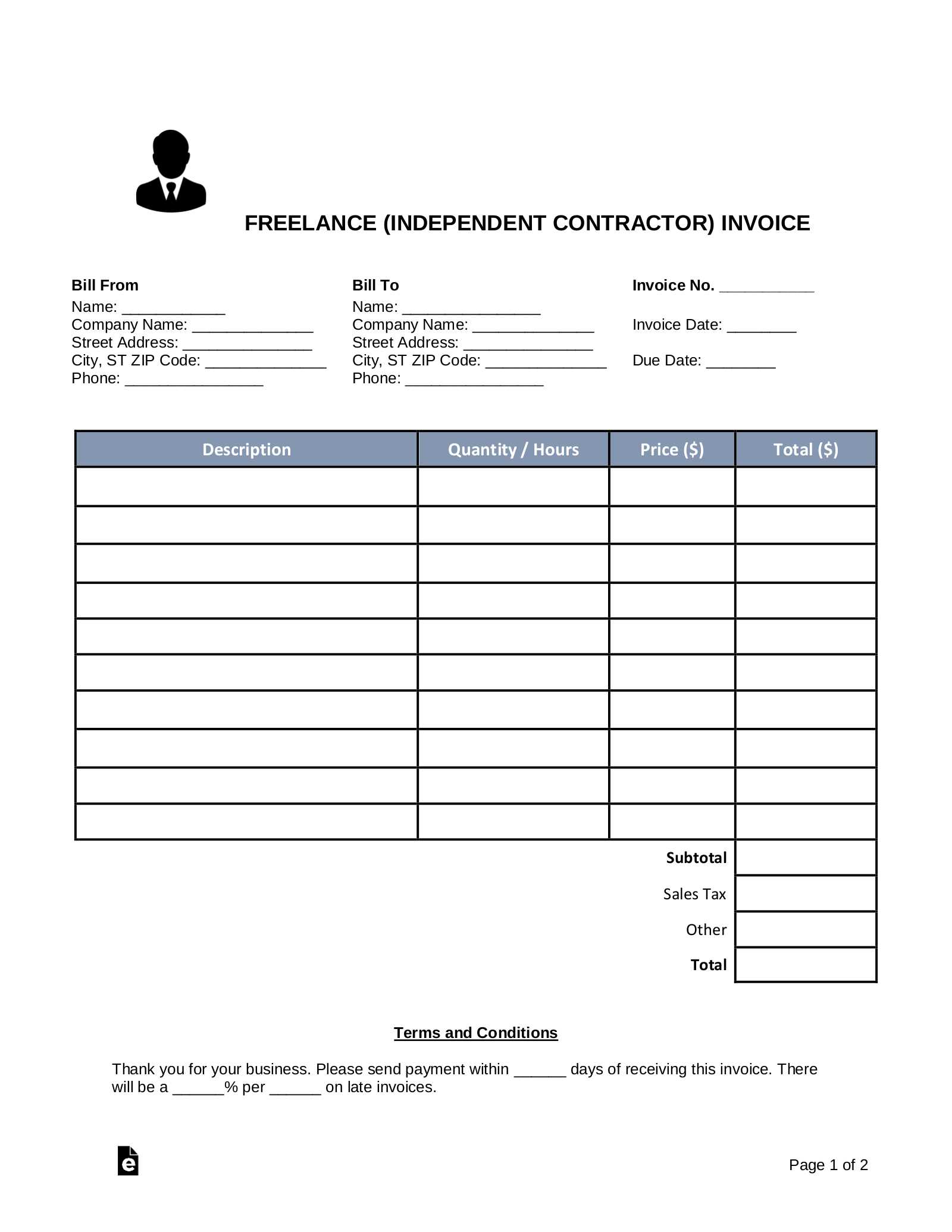

Best Invoice Template Formats for Freelancers

For freelancers, having a professional and easy-to-use billing format is essential for ensuring that clients are clearly informed about services rendered and payments due. Choosing the right layout helps streamline the billing process, maintain professionalism, and avoid confusion. The format you choose should be simple to customize, visually appealing, and legally compliant.

1. Simple and Clean Layout

A straightforward design is often the best choice for freelancers who want to keep things clear and professional without overwhelming clients. Key features of this format include:

- Large sections for service descriptions with clear breakdowns

- A simple, easy-to-read table for listing charges

- Minimalist design with your brand logo and contact details

This format ensures that the client can quickly understand what services were provided, how much each item costs, and when payment is due.

2. Time-Based or Hourly Format

Freelancers who charge by the hour can benefit from a format that emphasizes time tracking and rates. This layout typically includes:

- Hourly rate and total number of hours worked

- Breakdown of tasks or services performed

- Space for additional notes or project milestones

This format is ideal for professionals offering consulting, design, or other time-based services where detailed tracking is important for both you and your client.

3. Project-Based Format

For freelancers working on larger projects or long-term contracts, a project-based format provides more flexibility. Key features include:

- Project name or code for easy reference

- Comprehensive breakdown of deliverables and timelines

- Payment schedule tied to project milestones

This layout ensures that both parties are clear on expectations and payment terms throughout the course of the project.

Saving Time with Automated Invoices

For businesses and freelancers alike, managing billing can quickly become time-consuming and repetitive. The process of creating, sending, and tracking payments can take up valuable time that could be spent on more important tasks. By automating key steps in the billing process, you can reduce manual work, speed up invoicing, and ensure greater accuracy in your financial transactions.

Automated systems allow you to set up custom templates that can be quickly populated with client details, services, amounts, and due dates. Once configured, these tools can generate and send documents at specified intervals, ensuring that no step is missed and that your workflow stays organized.

Additionally, many automation tools can integrate with your accounting software, allowing you to seamlessly track payments and outstanding balances. This reduces the likelihood of human error and ensures that you’re always up-to-date with your finances without needing to manually check each transaction.

By adopting automation, you free up time to focus on what truly matters–growing your business and providing excellent service to your clients.

How to Track Payments with Invoices

Tracking payments effectively is crucial for maintaining a healthy cash flow and ensuring that your business runs smoothly. Proper documentation not only helps you track the amount due but also serves as a reminder to clients about their outstanding balances. By using a well-structured system for documenting payments, you can easily monitor your finances and stay organized.

Here’s how you can keep track of payments and ensure your records are accurate:

- Assign Unique Reference Numbers: Each transaction should have a unique identifier that allows you to track it easily. This number helps you match the payment with the correct billing statement.

- Include Payment Terms: Make sure your document clearly states the payment due date and any penalties for late payments. This encourages timely settlements and helps you keep track of overdue balances.

- Update Records Immediately: As soon as a payment is received, update your system to reflect this change. This ensures that your records are always up to date and gives you a real-time view of your outstanding amounts.

- Monitor Payment Status: Use a system to track whether payments are pending, partially paid, or completed. Many billing systems allow you to mark payment statuses, which make

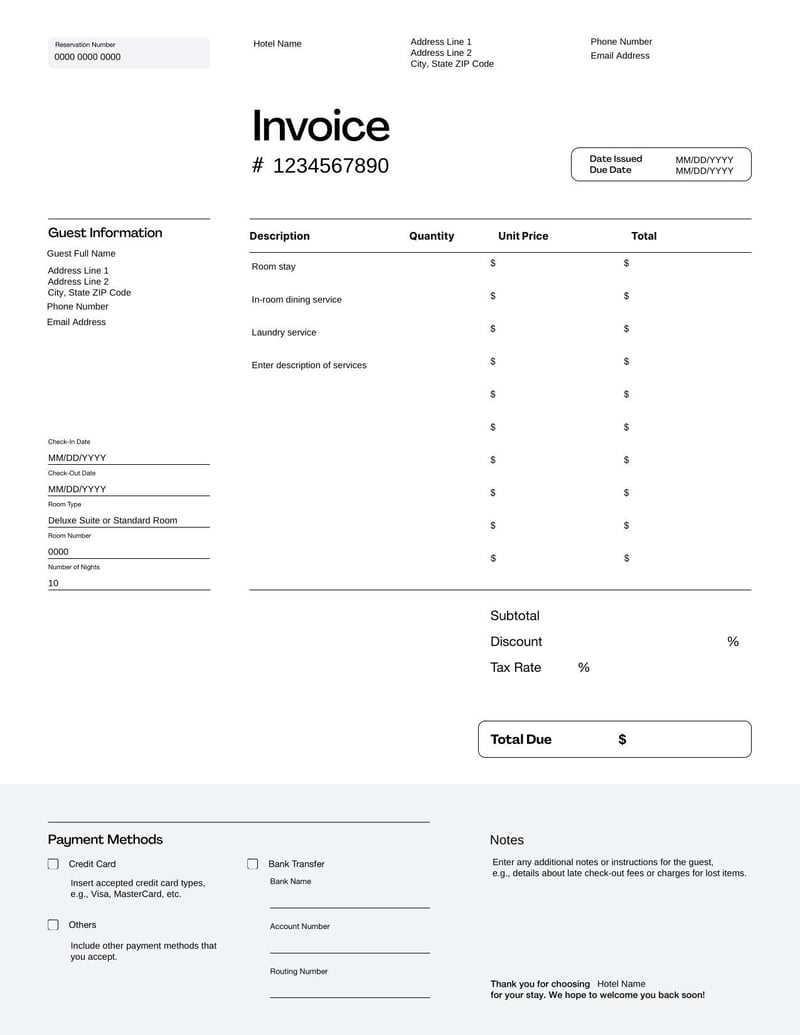

Free Invoice Templates for Small Businesses

For small business owners, managing finances efficiently is crucial for long-term success. One of the most important tasks is ensuring that clients receive clear and professional billing statements. Fortunately, there are various tools available that allow businesses to generate these documents quickly and without any cost, ensuring they remain organized and timely in their billing practices.

These readily available solutions can save business owners time and effort, while also ensuring that each document is formatted correctly. Many of these options offer customizable features, allowing you to add your company logo, client details, and specific service descriptions. This customization can help you maintain a professional appearance while keeping track of payments.

By using these resources, you can ensure that your small business stays on top of its financial management without having to invest in expensive software or hire an accountant. These solutions are especially beneficial for entrepreneurs and freelancers who may not have the resources to use complex billing systems but still need a reliable and professional way to manage their finances.

Utilizing these easy-to-use options means you can focus more on growing your business, knowing that your billing process is automated, accurate, and hassle-free.

Choosing the Right Invoice Design

The design of your billing document plays a significant role in how your business is perceived by clients. A well-crafted and professional-looking layout can help convey reliability and attention to detail, while a poorly structured document can lead to confusion or a lack of trust. Choosing the right design is not just about aesthetics but also about functionality, ensuring that all important information is clearly presented.

When selecting the right format for your business, consider factors like the type of services or products you provide, your brand’s visual identity, and how your clients prefer to receive information. The right design can improve your overall workflow, make it easier to track payments, and enhance the customer experience.

1. Simplicity vs. Branding

A clean, simple layout often works best for straightforward transactions, while a more elaborate design may be suitable for businesses that want to emphasize their brand. The key is to strike the right balance between functionality and design. Here’s a comparison:

Design Style Best For Key Features Minimalist Simple services or freelancers Clear sections, easy-to-read font, simple colors Branded Established businesses with a clear visual identity Custom logo, color scheme, professional typography 2. Functionality and Usability

The layout of your document should focus on usability, making it easy for clients to find the information they need quickly. Important details such as amounts, dates, and service descriptions should be prominently displayed. A well-organized structure often includes:

- Clear headers for each section

- A breakdown of charges in an easy-to-understand table

- Space for payment terms and instructions

Choosing the right design ensures that your document serves both as a professional communication tool and a record-keeping system, making it easier for clients to process payments and for you to manage your accounts.

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is vital for maintaining a strong relationship with clients and ensuring timely payments. However, even small errors can lead to confusion, delays, and disputes. By being aware of common mistakes, you can avoid costly errors and maintain a smooth and efficient invoicing process.

1. Missing or Incorrect Client Information

One of the most common mistakes is neglecting to include the correct client details. Always ensure that the client’s name, address, and contact information are accurate. Also, verify any reference numbers, such as purchase orders or account numbers, to avoid mix-ups. Failing to include this information or making errors can lead to delays in payment or confusion on the client’s side.

2. Not Including Payment Terms and Deadlines

Clearly stating the payment due date and any applicable terms is crucial. Without these details, clients may not know when to pay or what the conditions are for late fees. Missing this information can lead to delays and potential disputes. Always make sure your documents include:

- Payment due date: When the payment should be received.

- Payment method: Specify the acceptable payment methods (bank transfer, PayPal, check, etc.).

- Late fees: Any penalties or interest that will apply if the payment is late.

3. Incorrect Calculations or Omitted Charges

Ensure all amounts are calculated correctly, including taxes and discounts. An error in calculations, such as missing a tax rate or applying the wrong discount, can create confusion and distrust. Always double-check your figures and use automated tools if possible to avoid manual mistakes. Additionally, ensure that all services or items provided are listed accurately, with the corresponding prices and quantities. Omitting any charges can lead to lost revenue and frustration.

By avoiding these common mistakes, you can create clear, professional, and effective billing documents that help you maintain positive relationships with your clients and improve your cash flow.

Why PDF is the Best Invoice Format

When it comes to sending billing documents, the format in which you deliver them plays an important role in ensuring they are professional, secure, and easy to manage. Among various options, one format stands out as the best choice for most businesses–an easily accessible, stable file format that preserves the document’s layout and content across all devices and platforms.

1. Universal Compatibility

One of the key reasons this file format is widely preferred is its ability to be opened on almost any device or operating system. Whether the recipient uses Windows, Mac, Linux, or a mobile device, this format will appear the same for everyone. This ensures that the appearance of your document remains intact, no matter the platform.

- Cross-platform support: Open on computers, tablets, and smartphones.

- No software limitations: Doesn’t require specialized software to view, just a reader (which is usually built-in on most devices).

2. Document Integrity and Security

This format helps ensure that your document’s layout, text, and design remain consistent over time. Once created, it can’t be easily altered or edited, making it a reliable choice for keeping your financial documents secure. Additionally, password protection and encryption features allow for extra security, ensuring sensitive client information stays confidential.

- Unalterable design: Prevents unintended modifications.

- Enhanced security: Password protection and encryption options ensure safe transmission.

Choosing this format gives both businesses and clients peace of mind that the document’s content will not change and that it will be received as intended. These benefits make it the most secure and dependable option for professional correspondence.

How to Share Your Invoices Efficiently

Sharing billing documents with clients in a timely and professional manner is crucial for maintaining a smooth workflow and ensuring timely payments. Choosing the right method of delivery can not only improve communication but also streamline the process, allowing both you and your clients to stay organized. The goal is to send your statements in a way that is convenient, secure, and easy to track.

1. Email Delivery

One of the most common and efficient methods of sharing documents is through email. This allows you to quickly send the document directly to your client’s inbox, ensuring they receive it immediately. To make this process even more effective, consider the following:

- Attach the document in a universally accessible format: Ensure your file is in a format that can be opened by any recipient, such as a widely used file type.

- Include a brief message: In the body of the email, briefly explain what the document is and any actions the client needs to take, such as the due date or payment instructions.

- Use a clear subject line: A concise and descriptive subject line helps the recipient know what the email pertains to, such as “Payment Due – [Your Business Name].”

2. Cloud Storage and Link Sharing

If you prefer to keep your billing documents stored in a cloud system for easier access and organization, you can share a link directly with your clients. This method provides several advantages:

- Centralized access: Your client can access all their statements in one place without needing to search through emails.

- Easy updates: If any revisions are needed, you can quickly upload a new version without having to resend the entire document.

- Secure access: Cloud storage services often offer password protection and access permissions to ensure only the right people can view the document.

Whether you choose to send your documents by email or share a link to a secure cloud platform, the key is to make sure your clients can easily access and view the information without unnecessary hassle. Efficient sharing not only helps improve the payment process but also strengthens your professional relationship with clients.

Improving Your Billing System with Templates

Streamlining your business’s financial processes is essential for maintaining accuracy and efficiency. One of the best ways to enhance your billing system is by adopting structured, pre-designed forms that allow you to quickly generate consistent and professional statements. Using such resources can reduce errors, save time, and ensure that all the necessary information is included in each document.

1. Consistency and Professionalism

When you use predefined forms, you ensure that every document looks uniform, regardless of the person preparing it or the specific transaction. This consistency helps present your business as organized and trustworthy. Clients will appreciate receiving clear, well-structured statements that follow the same format every time.

- Branding elements: Pre-designed layouts can include your logo, business name, and other elements that reinforce your brand identity.

- Clear sections: These forms often come with clearly labeled sections that help you organize critical details like item descriptions, costs, and payment terms.

2. Time and Error Reduction

Using structured forms also reduces the likelihood of mistakes, such as missing essential details or miscalculating amounts. Instead of creating a new document from scratch for each transaction, you can quickly fill in the required fields. This not only speeds up the process but also minimizes the chances of errors, helping you avoid costly corrections and disputes with clients.

- Time-saving: Quickly complete a new document without having to manually create the structure each time.

- Fewer mistakes: Predefined fields ensure that all necessary information is included, and standardized formatting reduces human error.

By incorporating these organized structures into your workflow, you can focus more on growing your business while ensuring that your billing process remains efficient and professional.