Online Tax Invoice Template for Streamlined Billing

Efficient billing is crucial for every business, ensuring that financial transactions are clear, accurate, and easily processed. Having a structured approach to documenting payments and calculating necessary fees can save time and prevent costly errors. This is where well-designed billing documents come into play, offering a reliable and professional way to manage financial records.

By using a customizable structure for creating financial statements, businesses can improve their workflow and maintain consistency in their operations. These tools provide a simple yet effective method for generating professional documents quickly, reducing the chances of manual mistakes while ensuring compliance with necessary regulations.

In this section, we will explore how to create and utilize these resources, highlighting their advantages, customizable features, and ways to integrate them into your existing processes. Whether you are a small business owner or managing a larger company, understanding how to leverage these tools can greatly enhance your efficiency and accuracy in financial dealings.

Online Tax Invoice Template Overview

For businesses looking to streamline their billing processes, a well-structured document that outlines payments, fees, and customer information is essential. Such tools allow for quick generation of professional records, reducing the need for manual entry and minimizing the risk of errors. By utilizing a consistent format, companies can ensure their financial documents are accurate, easy to read, and aligned with industry standards.

These tools offer numerous advantages, from ease of customization to the ability to track payments and generate reports. Whether you are working with a small team or managing large-scale operations, adopting a digital method for creating these documents can save both time and effort while improving organizational efficiency.

| Key Feature | Description |

|---|---|

| Customizable Fields | Adjustable to fit specific business needs, such as adding personalized logos or changing fee structures. |

| Automated Calculations | Instantly calculate totals, taxes, and discounts to avoid errors and speed up the process. |

| Ease of Use | Designed for quick setup and simple usage, with intuitive interfaces that require no advanced technical skills. |

| Compliance | Ensure your financial records meet legal requirements and industry standards for documentation. |

Why Use an Online Tax Invoice

For businesses of all sizes, simplifying the process of generating and managing financial documents is crucial. Using a digital solution for creating professional records can save time, reduce errors, and ensure consistency. These tools offer a seamless way to document payments, calculate charges, and track financial transactions, all in one place.

Efficiency and Time Savings

By automating the creation of these records, businesses can eliminate repetitive tasks and speed up their workflow. With just a few clicks, a complete financial document is generated, eliminating the need for manual calculations and formatting. This efficiency leads to quicker billing cycles and faster payments.

Accuracy and Compliance

Automated systems are designed to ensure the correctness of every calculation. By using a digital solution, companies can avoid manual errors, such as incorrect totals or missed fees, which can lead to disputes or legal complications. Additionally, these tools are often designed to meet legal requirements, helping businesses stay compliant with industry standards and regulations.

Key Features of Tax Invoice Templates

When it comes to creating professional financial documents, certain features can significantly improve the process, ensuring consistency, accuracy, and ease of use. These tools are equipped with various customizable elements that allow businesses to tailor records to their specific needs while maintaining a high standard of clarity and organization.

One of the most valuable aspects of these tools is their ability to automate complex calculations. This not only reduces the risk of human error but also speeds up the entire billing process. Additionally, many of these solutions come with pre-set layouts that ensure all essential details are included, making it easier to stay organized and compliant with legal standards.

Customizable Fields allow businesses to adjust the structure of their documents according to their preferences, including adding logos, modifying payment terms, or including special notes. Automated Calculations handle complex fee structures and discounting, ensuring that the final amounts are accurate every time. Furthermore, these tools often feature cloud storage integration, making it easy to store and retrieve past records whenever needed.

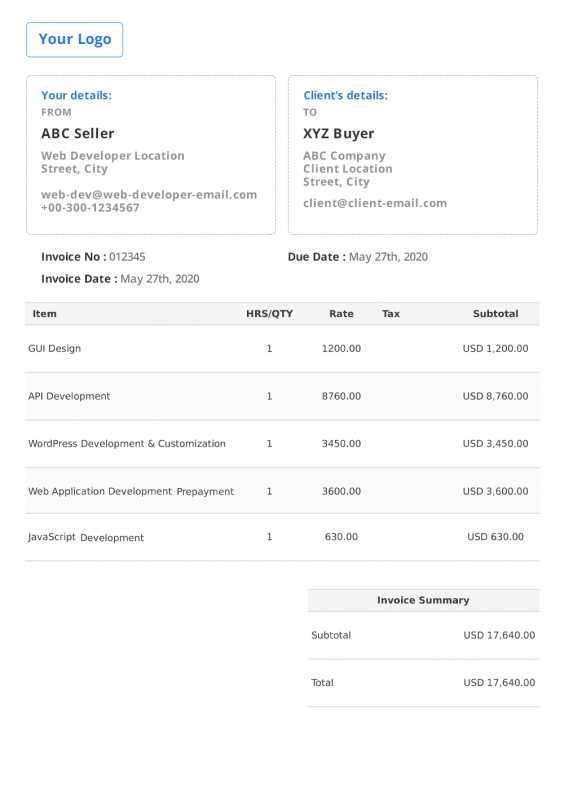

How to Customize Your Invoice Template

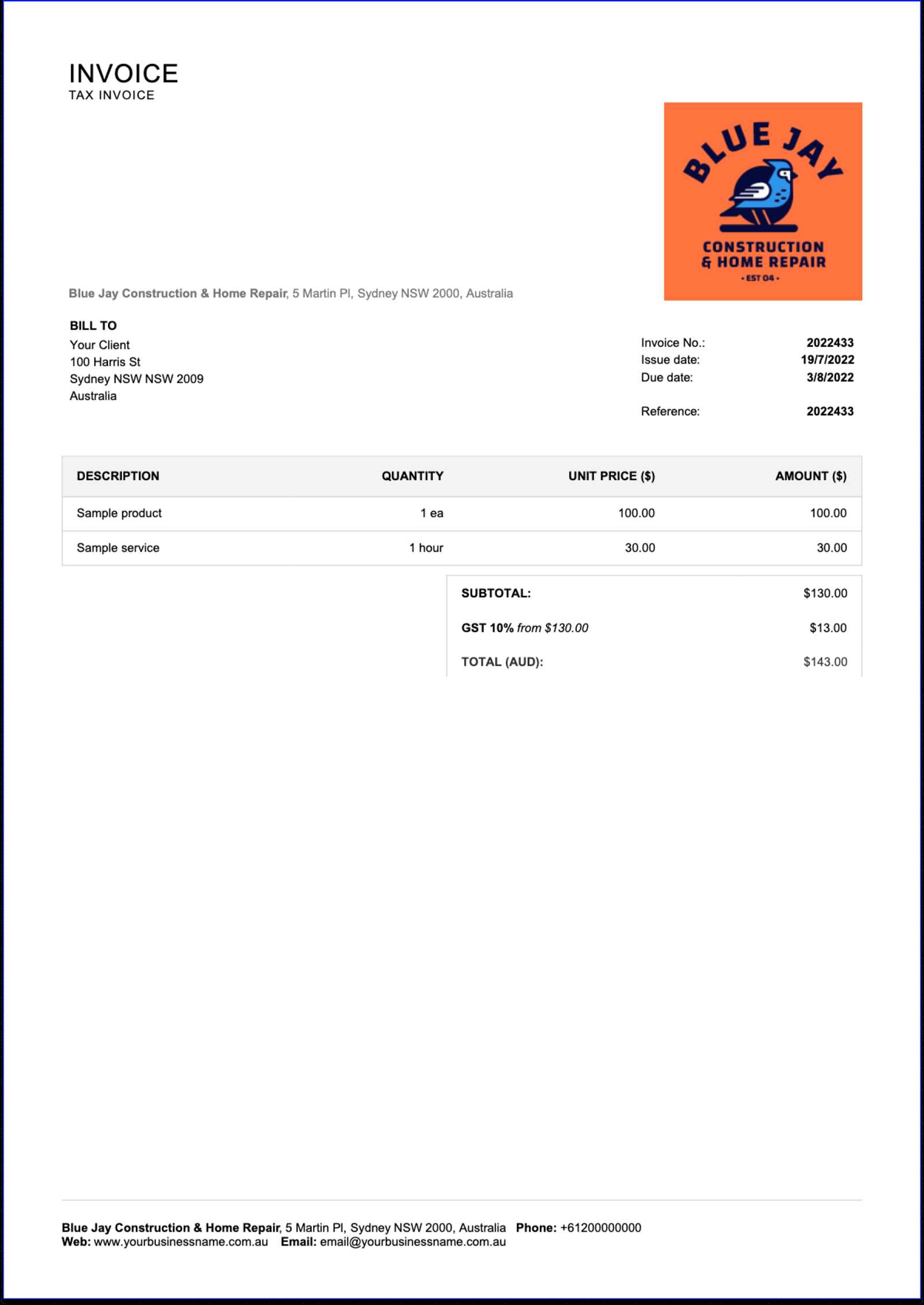

Customizing your financial documents allows you to tailor them to your specific business needs and create a unique, professional appearance. By adjusting various elements, you can ensure that the records align with your brand, meet industry standards, and include all necessary information for accurate transactions.

Here are some key steps to personalize your billing documents:

- Add Your Logo – Incorporating your company’s logo enhances brand recognition and gives the document a professional look.

- Modify Contact Information – Ensure that your business details, including address, phone number, and email, are clearly visible.

- Adjust Payment Terms – Customize the payment due dates, discounts, or late fees to fit your business model.

- Include Personalized Notes – Add a section for special notes, such as thank-you messages or specific payment instructions.

- Customize Layout and Design – Choose a layout that suits your brand and ensures clarity in the financial breakdown.

By making these adjustments, you can create a consistent and professional appearance across all your financial documents, ensuring they are easily understood and aligned with your business’s needs.

Benefits of Automated Tax Invoicing

Automating the process of creating financial records offers several significant advantages for businesses. By reducing manual tasks, it increases efficiency, minimizes errors, and allows for faster processing. This streamlined approach not only saves time but also ensures greater consistency across all financial documents, leading to improved accuracy and professionalism.

One of the key benefits is time savings. Automation speeds up the creation of financial records, eliminating the need for repetitive manual entries. This allows businesses to focus on other important tasks while still maintaining an accurate record of transactions.

Reduced Errors is another major advantage. By automating calculations, businesses can avoid common human mistakes such as incorrect totals or missed charges. This leads to fewer disputes with clients and ensures compliance with industry standards.

Finally, automated systems make it easier to track and store records. All generated documents are stored digitally, making it simple to access past transactions, monitor payments, and keep accurate historical records for accounting or legal purposes.

Choosing the Right Template for Your Business

Selecting the right format for your financial documents is crucial to ensure consistency, professionalism, and accuracy. A well-chosen design can not only reflect your brand but also streamline your workflow, making it easier to manage transactions and maintain organized records. Understanding your specific business needs will help guide your choice of layout and features, ultimately improving efficiency.

When choosing a structure for your records, it’s important to consider customization options. You’ll want to ensure that the layout can be tailored to fit your business’s unique requirements, such as including specific service details, customer information, or payment terms. Additionally, simplicity and clarity should be prioritized to avoid overwhelming the recipient with unnecessary information.

Another factor to consider is compatibility with existing systems. Make sure that the format you choose integrates well with your accounting software or other tools. This ensures smooth data transfer, minimizing the need for duplicate entries and reducing the potential for errors. Lastly, think about the scalability of your chosen design–ensure it can grow with your business as your financial needs become more complex.

Integrating Tax Invoices with Accounting Software

Integrating financial records with accounting software can greatly enhance efficiency and accuracy in managing business transactions. By synchronizing billing documents with your accounting system, you ensure that all data is automatically updated, reducing manual entry and minimizing the risk of errors. This integration streamlines the entire financial workflow, making it easier to track payments, monitor outstanding balances, and generate reports.

One of the main advantages of integration is real-time data synchronization. This means that once a document is created, it is automatically reflected in your accounting system, saving time and reducing the chances of discrepancies between records. Additionally, this process ensures accurate financial reporting, as all figures are consistent across both platforms.

Moreover, integrating your financial documents with accounting software allows for automated reconciliation, which simplifies the process of matching payments with recorded transactions. This reduces the workload for accountants and bookkeepers, allowing them to focus on higher-priority tasks. By leveraging these tools together, businesses can improve overall financial management and enhance their ability to make informed decisions based on real-time data.

Ensuring Accuracy in Tax Calculations

Accurate financial calculations are essential for any business to maintain compliance, avoid disputes, and ensure smooth operations. Properly calculating charges, fees, and applicable rates helps prevent costly mistakes and ensures that all records reflect the correct amounts. With the right tools and strategies in place, businesses can achieve precision in every financial transaction.

One of the key methods to guarantee accuracy is by utilizing automated calculation tools. These systems reduce the likelihood of human error by instantly calculating the correct totals, applying the correct rates, and adjusting for discounts or additional charges. This ensures that businesses can quickly generate accurate documents without needing to manually input each number.

Another important step is regularly updating rate information. Financial regulations, including rates for services or fees, can change over time, and staying informed about these updates is crucial for ensuring that calculations remain correct. Automation also allows for the easy incorporation of updated information, ensuring that all financial documents are based on the most current data available.

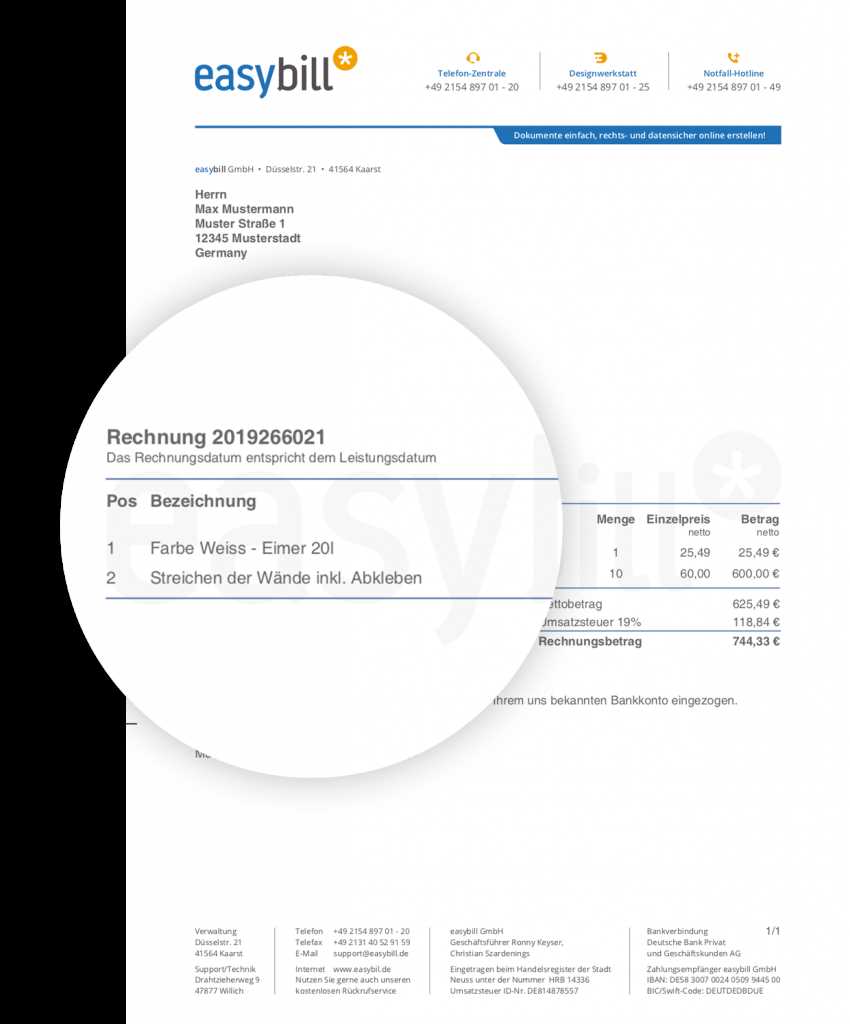

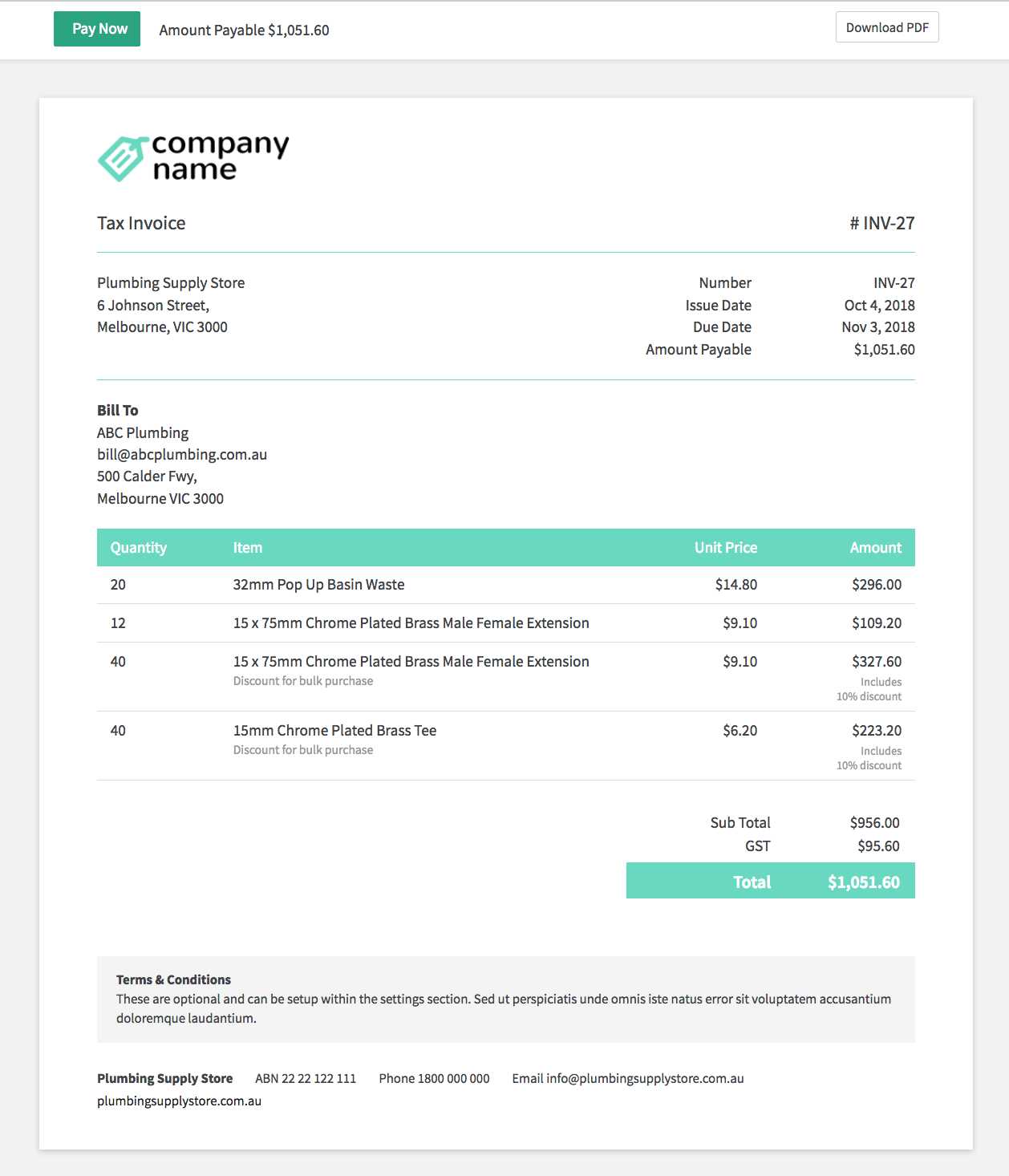

How to Add Tax Details to Invoices

Including accurate financial details in your business documents is essential for clarity and compliance. When adding tax-related information, it’s important to structure the details in a clear and organized manner, ensuring both the customer and your accounting system can easily understand the charges. This process helps maintain transparency and prevents misunderstandings in future transactions.

Step 1: Include the Correct Tax Rate

To ensure accuracy, always specify the correct rate that applies to the products or services you are charging for. This can vary depending on the location, the nature of the item, or special exemptions that may apply. Using an automated calculator or reference table will help in applying the correct percentage each time.

Step 2: Clearly Label the Tax Amount

After calculating the tax, clearly label the amount on your financial document. This includes listing the exact figure for the tax charged as well as the subtotal of the goods or services before tax is applied. Transparency is key in this step to avoid confusion for your clients and ensure that they can see exactly what they are being charged for.

Additionally, don’t forget to include any relevant legal information, such as your business’s tax identification number, especially if required by local regulations. This ensures that your records are not only accurate but also compliant with industry standards.

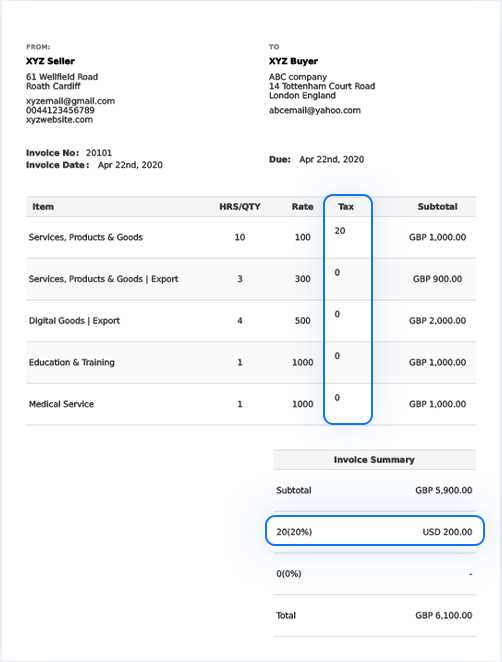

Common Mistakes in Tax Invoices

Even small errors in financial documents can lead to confusion, delayed payments, and compliance issues. Identifying and correcting common mistakes is essential for maintaining professionalism and accuracy in your records. Below are some of the most frequent issues businesses encounter when preparing financial statements for their clients.

1. Incorrect or Missing Details

- Client Information: Always double-check that the customer’s name, address, and contact details are accurate. Missing or incorrect information can cause delays or miscommunication.

- Business Information: Ensure your company details, including business name, address, and registration number, are complete and up-to-date.

2. Calculation Errors

- Incorrect Amounts: Double-check the math behind your subtotal, taxes, and total amounts. Even small miscalculations can lead to incorrect charges.

- Wrong Rates: Ensure that the correct rates are applied based on current legislation or agreements with clients.

3. Lack of Tax Identification Number

In many regions, it is required to include a tax identification number (TIN) or similar ID in your documents. Failing to add this crucial information can result in compliance issues or delays in payment.

4. Missing Payment Terms

- Due Date: Clearly specify when payment is due to avoid misunderstandings.

- Late Fees: If applicable, mention any late fees or interest for overdue payments.

By paying attention to these common mistakes, businesses can ensure their financial documentation is accurate, professional, and compliant with relevant regulations.

Improving Efficiency with Digital Invoicing

Switching to digital formats for financial documents can significantly streamline your business operations. By automating the process of creating, sending, and tracking records, businesses can save time, reduce errors, and improve cash flow management. This transition not only boosts productivity but also enhances the overall experience for both businesses and customers.

One of the key benefits of going digital is the ability to automate repetitive tasks. Instead of manually entering data or creating documents from scratch each time, digital systems allow for templates and preset information to be reused, significantly speeding up the entire process. This leads to fewer errors, especially in calculations, and helps businesses maintain consistency across all documents.

Moreover, digital records can be easily stored and retrieved, eliminating the need for physical storage. This makes document management more efficient and accessible, allowing businesses to quickly find and review past transactions. Furthermore, the ability to send documents electronically reduces mailing time and cost, ensuring faster communication and payment cycles.

| Benefits | Details |

|---|---|

| Time-Saving | Automating document creation and reducing manual data entry. |

| Reduced Errors | Automated calculations and consistent document formats lead to fewer mistakes. |

| Cost-Effective | Eliminates the need for paper, printing, and mailing costs. |

| Faster Payments | Electronic submission and tracking speeds up payment processing. |

By embracing digital tools, businesses can enhance their overall operational efficiency, reduce overhead costs, and create a more seamless experience for their clients and customers.

Tracking Payments with Tax Invoices

Effective management of financial transactions is crucial for ensuring smooth cash flow and maintaining accurate records. By properly tracking payments and related documents, businesses can streamline their accounting processes and avoid discrepancies. Clear tracking systems help businesses keep a detailed history of payments, which is vital for both operational efficiency and compliance with regulations.

Key Strategies for Payment Tracking

- Payment Terms and Deadlines: Clearly define the payment due dates and any late fees on your records. This ensures both parties understand the expectations and helps in tracking overdue payments.

- Payment Status Updates: Regularly update the status of each payment. Mark transactions as paid, pending, or overdue to maintain an up-to-date overview of your accounts.

- References and Transaction IDs: Include a unique reference or transaction number for each record. This makes it easier to cross-reference payments and identify specific transactions in case of discrepancies.

Organizing Payment Records

- Consolidating Information: Group payments by date, client, or product/service to create clear categories. This enables you to easily spot trends or follow up on overdue payments.

- Using Automated Systems: Digital tools can help automate tracking, sending reminders, and generating reports, making it easier to manage large volumes of transactions.

By incorporating these tracking strategies into your financial process, you can ensure greater accuracy, reduce the risk of missed payments, and maintain a solid overview of your business’s financial health.

Legal Considerations for Tax Invoices

When managing financial documentation, it is essential to adhere to legal requirements to avoid potential disputes or penalties. Understanding the legal aspects of your business records ensures that your transactions are compliant with applicable laws. This includes ensuring that all necessary details are included, maintaining accurate records, and following proper protocols for data protection and taxation.

In many jurisdictions, businesses are required to include specific information on their financial documents, such as the full name and address of both the buyer and seller, unique reference numbers, and the correct application of applicable charges. Failure to include the necessary details can lead to complications, including non-compliance with regulatory authorities, delayed payments, or even legal disputes.

Additionally, businesses must be aware of the retention periods for financial documents, which can vary by region and industry. Some countries mandate that companies retain records for several years, while others may have specific rules on how long certain types of documents need to be kept for auditing or tax purposes. Ensuring that your documents are both accurate and properly archived is crucial for protecting your business in case of future inquiries.

Data protection and confidentiality are also important considerations when handling client information. Ensure that personal and financial details are stored securely and that access to sensitive documents is restricted to authorized individuals. Following privacy laws and regulations prevents potential breaches and helps to build trust with your clients.

How to Export and Print Your Invoice

Once your financial document is ready, the next step is to export it for record-keeping or distribution purposes. Exporting allows you to save a digital copy that can be shared with clients or used for your business’s accounting processes. Printing the document ensures that you can provide a physical copy when required, helping you maintain a reliable, traceable paper trail.

Exporting the Document

To export your financial record, choose the format that best suits your needs, whether it’s PDF, Excel, or another supported file type. PDF is often the most commonly used format because it preserves the document’s layout and ensures that it can be easily opened on any device without alterations. When exporting, make sure to:

- Check formatting: Ensure that the layout remains clear and that all relevant fields are visible in the exported file.

- Save a copy: Store the document securely in a dedicated folder for easy access in the future.

- Include a reference number: Make sure that the document retains any unique identifiers or reference numbers that make it easy to track the transaction.

Printing the Document

For businesses that require hard copies, printing is a straightforward process. Before printing, review the document on your screen to ensure that everything appears correctly. Once satisfied, follow these steps:

- Preview before printing: Always use the print preview option to verify the document’s layout and content.

- Choose the correct paper size: Select the appropriate paper size (usually A4 or letter) to avoid misalignment or cut-off sections.

- Print in high quality: Ensure your printer settings are optimized for clear text and sharp images.

By following these simple steps for exporting and printing your financial record, you ensure that your documents are easily accessible both digitally and physically, supporting efficient business operations.

Design Tips for Professional Invoices

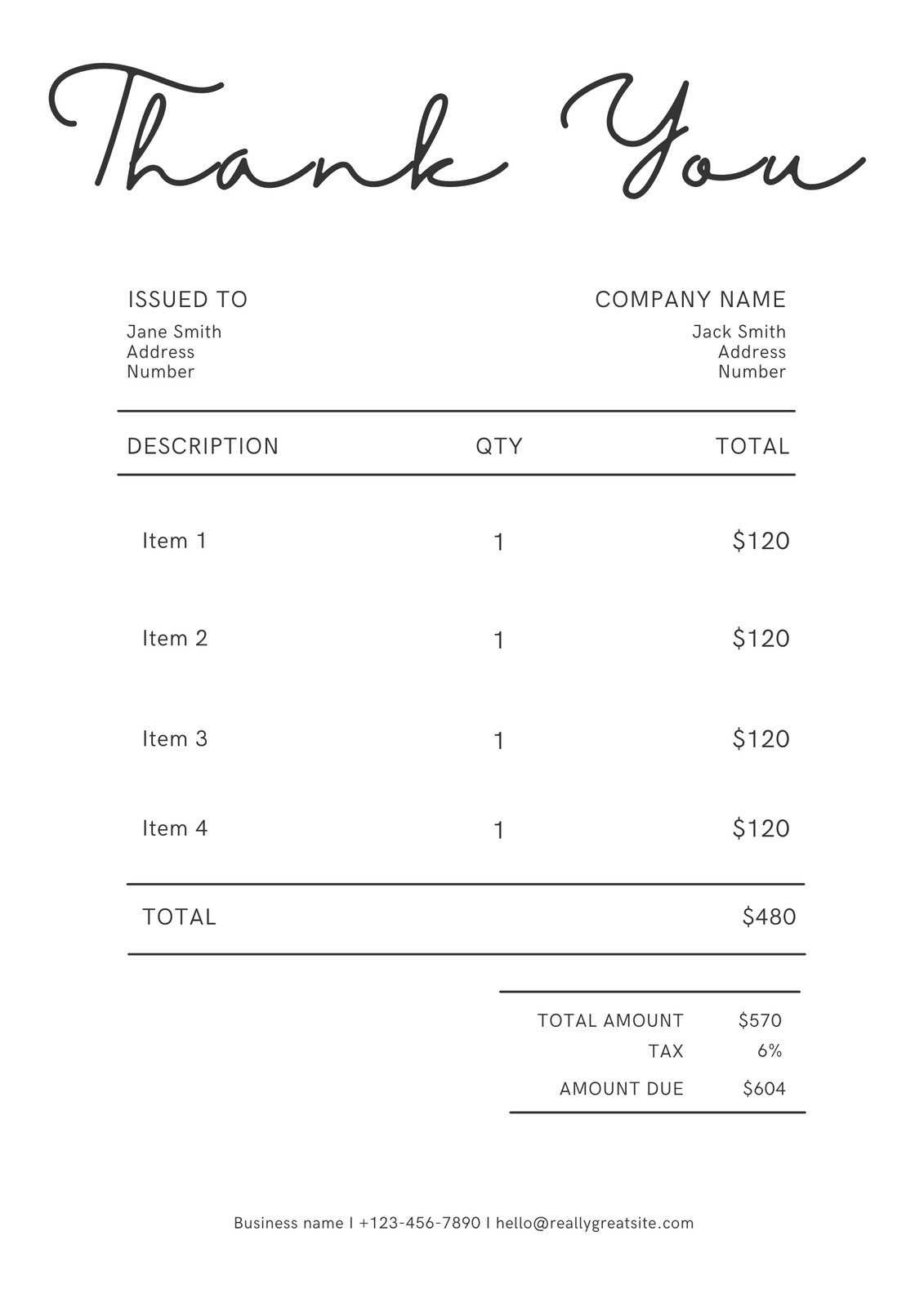

Creating a visually appealing and professional financial document is crucial for presenting your business in a positive light. A well-designed document not only helps establish credibility but also makes it easier for your clients to understand the information provided. Below are some essential design tips to ensure that your document looks polished and is functional for both you and your clients.

Clarity and Simplicity

Keep the design clean and uncluttered. Avoid overwhelming your clients with too much information in one place. Focus on the most important details, such as product or service descriptions, amounts, and payment terms. A simple, easy-to-follow layout improves readability and reduces the risk of errors.

- Use ample white space: White space helps separate sections, making the document easier to scan.

- Limit the number of fonts: Stick to one or two fonts to maintain a professional appearance.

- Align text properly: Ensure that all elements such as dates, amounts, and names are aligned consistently for better organization.

Brand Consistency

Your document should reflect your brand’s identity. Use your company logo, brand colors, and consistent fonts to create a cohesive look across all your business communications.

- Logo placement: Place your company logo at the top of the document, making it prominent without overpowering the content.

- Colors: Use your brand colors subtly in headings or borders to keep the design professional yet personalized.

- Font choice: Choose professional fonts that align with your company’s branding and ensure legibility.

Essential Information Layout

Clearly organize key information to avoid confusion. Use tables to present numerical data, ensuring it’s easy for your clients to follow.

| Description | Amount |

|---|---|

| Product/Service 1 | $100.00 |

| Product/Service 2 | $200.00 |

| Total | $300.00 |

By following these design tips, you can create documents that not only look professional but are also functional, making it easier for your clients to review and process payments promptly.

Cost-Effective Solutions for Tax Invoicing

Managing financial documents effectively doesn’t have to come at a high cost. There are numerous affordable tools and methods available that can streamline your business processes without breaking the bank. By utilizing the right resources, businesses can simplify their documentation procedures while maintaining accuracy and professionalism. Below are some cost-effective approaches to managing your billing and payment processes efficiently.

Utilizing Free Software Tools

There are several free software options that offer essential features for creating and managing documents. These tools allow businesses to generate accurate documents quickly, without needing to invest in expensive accounting software.

- Open-source software: Many free, open-source solutions are available for small businesses, offering customizable templates and tracking capabilities.

- Cloud-based platforms: These allow you to store documents securely while enabling easy access from anywhere, all at no cost.

- Basic accounting tools: Many free platforms provide fundamental functionalities such as invoice creation, financial reporting, and basic analytics.

Automating Routine Tasks

Automation can significantly reduce manual errors and save time in generating regular documents. There are affordable automation tools that allow for easy integration with your existing systems, making it easier to track payments and generate recurring financial reports.

- Automated reminders: Set up automatic reminders for clients about upcoming payments or overdue balances.

- Batch processing: Generate multiple documents at once, eliminating the need to create each document individually.

- Recurring templates: Use saved templates to quickly generate repeat documents, saving time and reducing the chance of errors.

Leveraging Templates and Pre-designed Formats

Using ready-made formats and templates can help businesses save both time and money. Many free or low-cost options are available that provide professional-looking designs, making it easy to create and send documents with minimal effort.

- Pre-built formats: Choose from a variety of pre-designed layouts that only require minor customization.

- Editable files: Use formats like PDF, Word, or Excel that allow for quick adjustments to suit your specific needs.

By implementing these cost-effective strategies, businesses can improve their financial documentation processes while keeping expenses low and maintaining accuracy. Taking advantage of free tools, automating tasks, and using pre-designed formats can all contribute to smoother operations and better cost control.