Download Auto Repair Invoice Template PDF for Easy Billing

Managing financial transactions is a crucial aspect of running any vehicle service business. Having a structured document for recording charges, services, and client information not only helps maintain clarity but also enhances professionalism. Such a document simplifies communication between businesses and customers while ensuring that all necessary details are captured efficiently.

Organizing billing tasks effectively can save time and prevent misunderstandings. By using a reliable format, businesses can provide clear, concise, and accurate records, reducing the chances of errors in payments. This also promotes trust and transparency, making it easier to handle payments and keep track of outstanding balances.

With the right approach, you can create a flexible and user-friendly document that fits the specific needs of your service operations. Whether you’re handling minor fixes or extensive work, having a system in place will streamline your workflow and improve the overall customer experience.

Auto Repair Invoice Template Benefits

Utilizing a well-organized billing document can significantly enhance the efficiency of any vehicle service provider. A streamlined format offers numerous advantages, from saving time to ensuring better customer relationships. It simplifies the tracking of services, pricing, and payment status, all while helping to avoid mistakes that could lead to confusion or disputes.

Efficiency and Time-Saving

By adopting a predefined format for documenting charges, the entire billing process becomes faster and more accurate. Service providers can quickly fill out relevant details without having to create invoices from scratch every time. This reduces administrative workload and allows more time for handling actual vehicle services.

Improved Professionalism and Accuracy

Using a consistent structure creates a sense of professionalism. It ensures that every transaction is documented with the same attention to detail, which builds customer trust. A comprehensive format reduces the risk of missing crucial information, such as labor hours, parts used, or customer details, which could otherwise lead to confusion or errors in payment.

| Benefit | Description |

|---|---|

| Time Efficiency | Quickly generate detailed records without manual entry for each service. |

| Accuracy | Minimize errors in tracking services, pricing, and payments. |

| Professional Appearance | Provide clients with clear and well-structured documents that foster trust. |

| Ease of Tracking | Maintain a clean, easy-to-read record for both customers and service providers. |

Ultimately, having a standardized document for each transaction ensures smoother operations, better communication, and more satisfied clients.

Why Choose a PDF Invoice Format

When it comes to creating and sending billing documents, selecting the right format can make a significant difference in both convenience and professionalism. Certain file types offer advantages such as easy sharing, compatibility across devices, and secure data retention. Among the available options, a particular format stands out for its ability to preserve the integrity of documents and ensure a seamless experience for both businesses and clients.

One of the main reasons to choose this format is its consistency. Unlike editable formats, it locks the content, ensuring that all information remains intact when viewed by recipients. This ensures that the document appears exactly as intended, regardless of the software or device being used.

Another key advantage is the universal compatibility of this file type. Whether it’s opened on a computer, smartphone, or tablet, the appearance and layout remain unchanged. This makes it highly suitable for businesses that need to maintain a professional and consistent image when communicating with customers or partners.

Furthermore, this file format is widely accepted and trusted for official documentation. It provides an extra layer of security by preventing unauthorized editing or modifications, which helps to protect both the business and its clients from potential fraud or disputes.

How to Customize Your Invoice Template

Adapting your billing document to meet the specific needs of your business can significantly improve efficiency and customer satisfaction. Customization allows you to include relevant details, adjust the layout, and tailor the overall appearance to better reflect your brand. By doing so, you ensure that each document serves not only as a receipt but also as a professional communication tool.

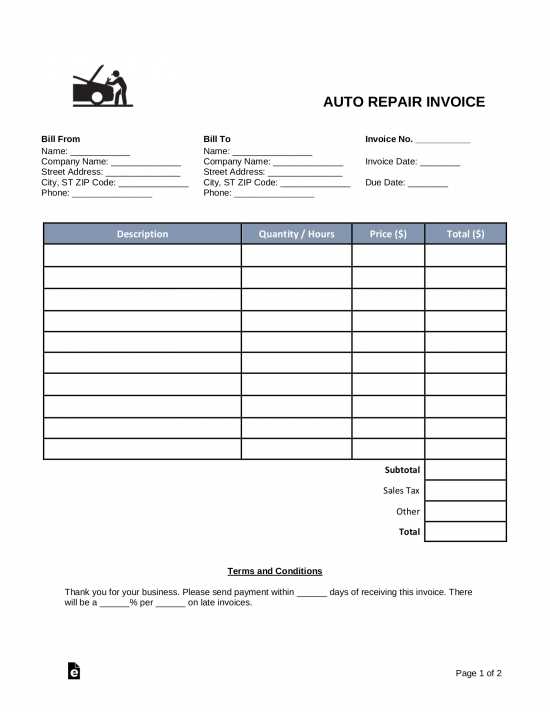

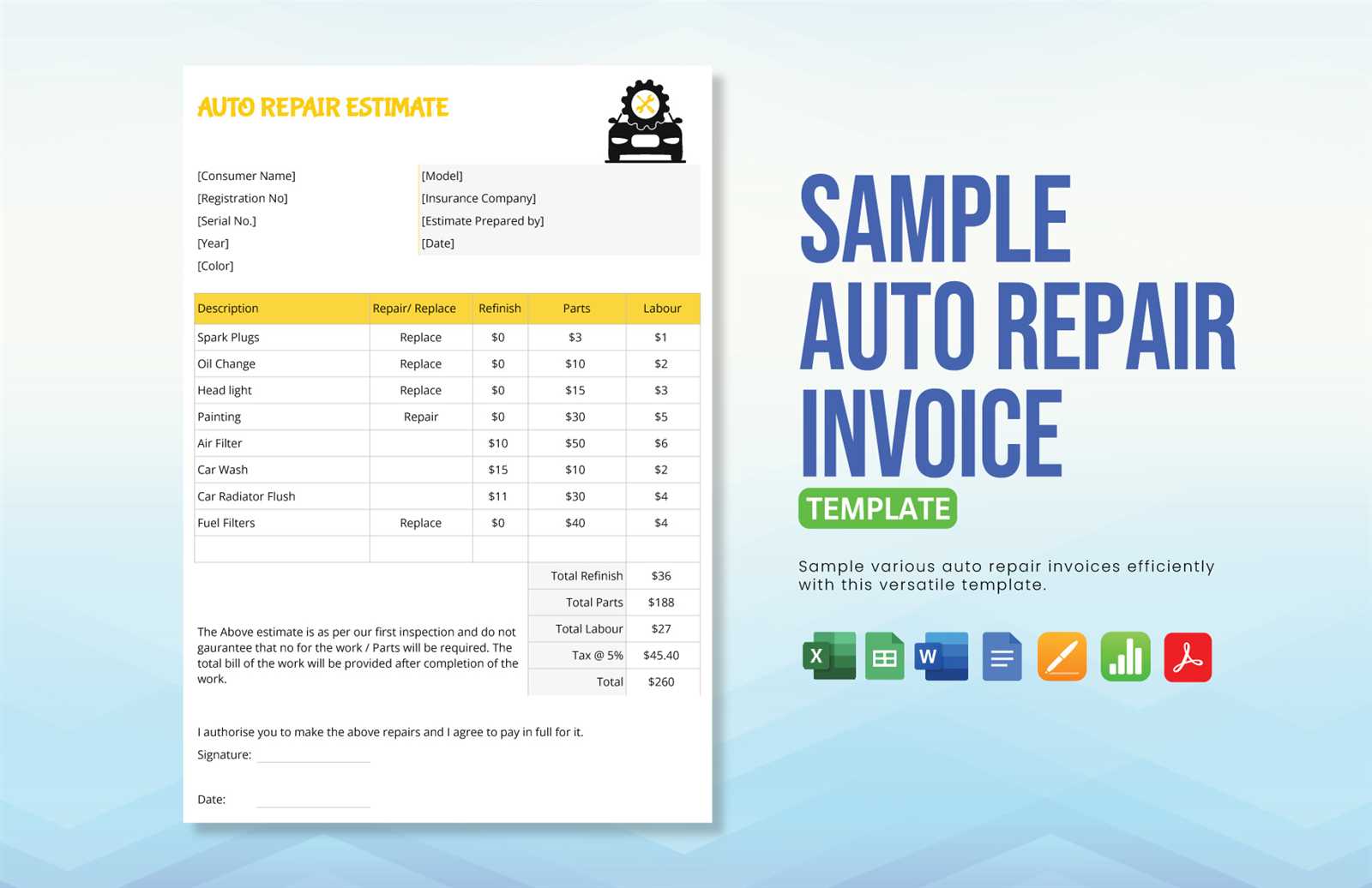

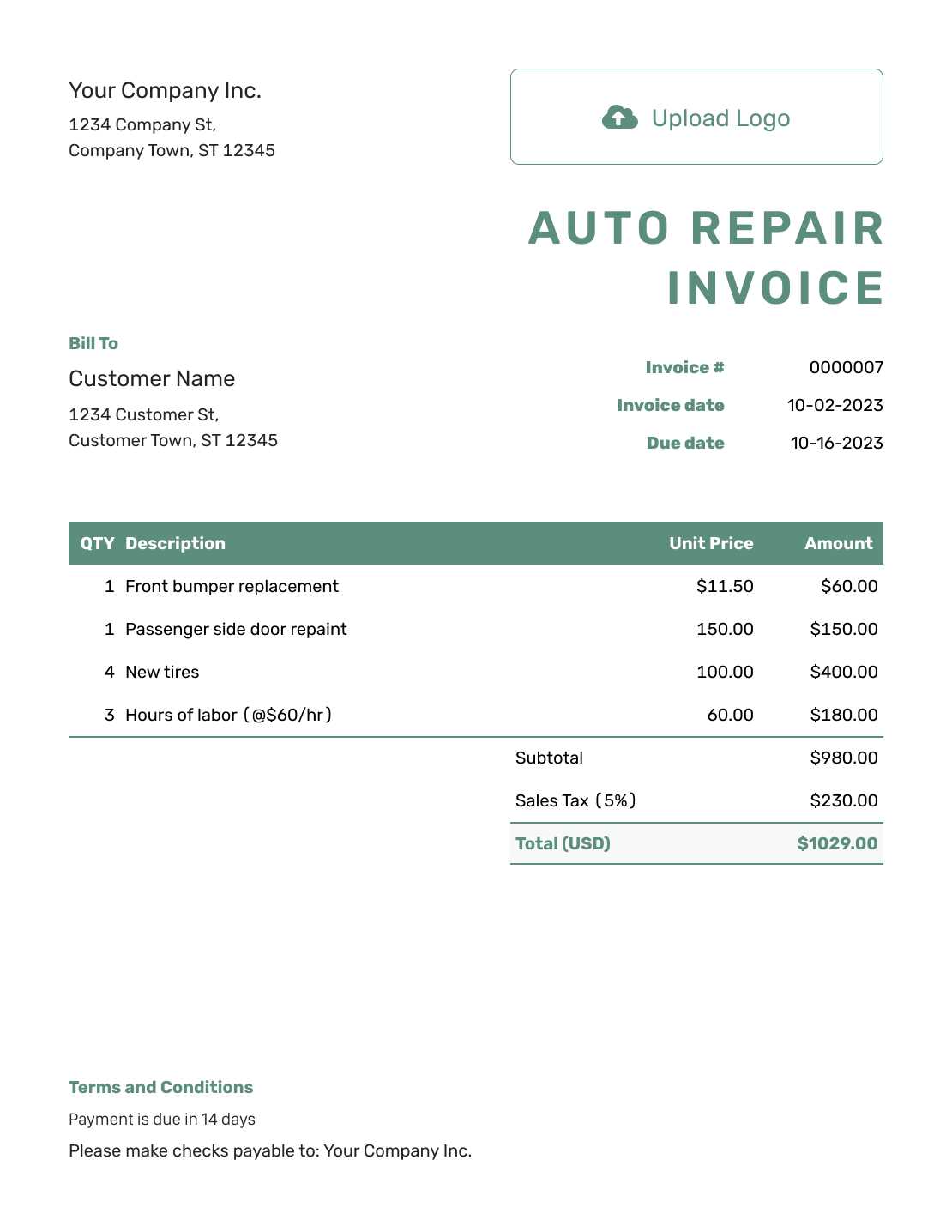

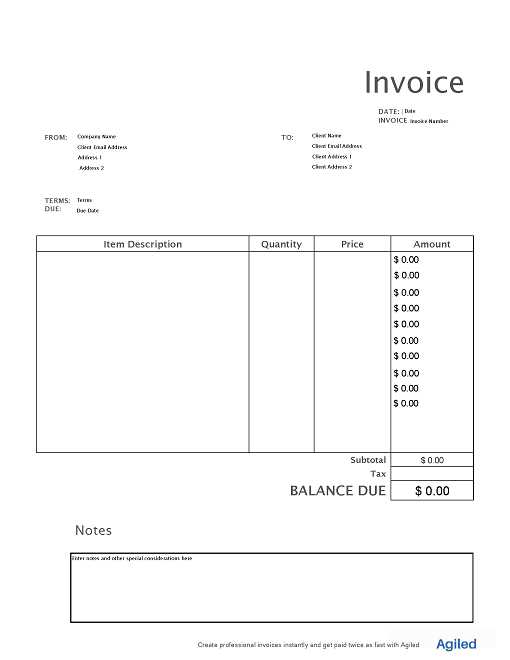

The first step in customizing your document is determining what information needs to be included. Basic elements like customer details, services rendered, and total charges are essential, but you may also want to add additional sections such as discounts, taxes, or payment terms to provide a comprehensive overview of the transaction.

Next, consider the design and layout of the file. Adjusting fonts, colors, and the overall structure can make your documents more visually appealing and in line with your business identity. A clean, well-organized format will enhance readability and leave a positive impression on your clients.

Finally, it’s important to ensure that the layout is easy to update. Whether you’re working with a standard format or a fully customized one, having a flexible design allows for quick adjustments when necessary, without having to recreate the entire document each time.

Essential Information for Auto Repair Invoices

For any business that provides vehicle services, having the right details in the billing document is crucial. A well-structured record ensures clarity for both the service provider and the customer. Including all necessary information helps prevent misunderstandings, facilitates prompt payments, and ensures compliance with any legal or financial requirements.

The following are key elements that should always be included to ensure the document is comprehensive and clear:

| Required Information | Description |

|---|---|

| Customer Details | Include the customer’s name, address, and contact information for easy reference and communication. |

| Service Description | Clearly list the services or work performed, including labor hours and parts used, to avoid confusion. |

| Pricing | Provide a breakdown of charges, including costs for labor, materials, and any additional fees. |

| Payment Terms | Specify the payment due date, accepted payment methods, and any late fees or discounts. |

| Invoice Number | A unique identifier for the document to help with tracking and reference. |

| Business Information | Include the business name, address, phone number, and email for correspondence and support. |

Including all of these details not only helps maintain organization and professionalism but also ensures both parties have a clear understanding of the transaction. This can also be important for tax purposes and legal documentation. Properly formatted records protect both the business and its clients, fostering trust and efficient financial management.

Step-by-Step Guide to Creating Invoices

Creating a professional billing document requires careful attention to detail and structure. Following a clear and organized process can help ensure that all necessary information is included, the layout is easy to read, and the document serves its purpose effectively. Below is a step-by-step guide to help you create comprehensive and accurate records for your service transactions.

Step 1: Gather Customer Information

Begin by collecting all necessary details about the customer, including their name, contact information, and service address. This will help ensure that the document is properly attributed and can be easily referenced in the future.

Step 2: List the Services or Products Provided

Clearly outline the services performed, including descriptions of each task or item, the amount of time spent, and any parts or materials used. Be as specific as possible to avoid any confusion later on.

Step 3: Specify the Costs

Include a breakdown of costs associated with labor, materials, and any additional charges such as taxes or service fees. Provide a total for each section and an overall total amount due.

Step 4: Set Payment Terms

Outline the payment terms, including the due date, accepted methods of payment, and any late payment penalties or discounts for early payment. This helps set clear expectations for the customer.

Step 5: Assign an Invoice Number

Assign a unique identifier to the document to make it easier to track and reference. This will help both you and your customer maintain accurate records.

Step 6: Add Your Business Information

Include your business name, address, phone number, and email address so that the customer can easily contact you with questions or concerns about the transaction.

Step 7: Final Review and Send

Before sending the document, review all the information for accuracy. Ensure that all calculations are correct, the customer details are accurate, and the document is free of errors. Once reviewed, send the document via email or another preferred method.

By following these steps, you can ensure that your billing documents are professional, accurate, and easy to understand, which will help you maintain good relationships with your clients and streamline your financial processes.

Top Features of Auto Repair Invoice Templates

When creating a billing document for vehicle service, having certain key features ensures that the document is both functional and professional. A well-designed file should not only include all necessary information but also make the process of generating, sending, and tracking payments easy. Below are some of the most important elements that make such a document effective for both businesses and customers.

Clear Structure and Layout

One of the most valuable aspects of an effective billing document is its layout. A clean, organized format makes it easy for both parties to quickly find relevant information, such as services provided, charges, and payment terms. A well-structured design eliminates confusion and helps maintain professionalism.

Customizable Fields

Flexibility is key when it comes to tailoring your documents. Customizable fields allow you to adjust the layout to suit the unique needs of your business, whether you need to add extra sections, change headings, or include specific pricing structures. This adaptability ensures that the document reflects your services accurately.

Automatic Calculations

Many modern billing formats include automatic calculation features. These allow you to input hourly rates, quantities, and material costs, while the document automatically computes totals, taxes, and any additional fees. This feature reduces human error and saves time, making the process quicker and more reliable.

Professional Design

A professional and polished look can enhance your business’s image. High-quality fonts, consistent branding, and an appealing color scheme can help make a lasting impression on your clients. This feature not only boosts your credibility but also fosters trust with customers, showing them that you value detail and professionalism.

Easy Payment Tracking

Efficient payment tracking is essential for keeping your business organized. Features such as payment status indicators, due dates, and outstanding balance reminders make it easy to follow up with clients and ensure timely payments. This tool is especially useful for businesses that need to monitor multiple transactions simultaneously.

Incorporating these features into your documents not only simplifies the billing process but also enhances communication, boosts professionalism, and ultimately improves your financial workflow.

Free vs Paid Auto Repair Templates

When selecting a document format for vehicle service billing, one of the first decisions is whether to use a free or paid option. Both choices have their advantages, but the right decision depends on your business needs, the level of customization required, and the features you want to access. Understanding the differences can help you determine which option best suits your requirements.

Free Options

Free billing documents are often simple and easy to access, making them a good choice for businesses just starting or for those that don’t need advanced features. These documents typically offer basic formatting with standard fields for services and charges. While they can be a good starting point, free versions may lack customization options and advanced functionality, such as automatic calculations or professional design elements.

Paid Options

On the other hand, paid formats usually come with more sophisticated features. These may include automatic tax calculations, customizable sections, enhanced security, and professionally designed layouts. Paid versions are typically more flexible, allowing you to adjust the document to match your branding or specific business needs. While they come with a cost, the additional features and customizability can be well worth the investment, especially for businesses looking to streamline their operations and present a polished image to clients.

Ultimately, the choice between free and paid options depends on your priorities. If you need a simple solution with minimal setup, a free format might suffice. However, for a more robust, professional, and customizable option, investing in a paid document may be a better long-term solution.

Best Tools for Editing Invoice PDFs

Editing and customizing billing documents is an essential task for businesses that want to ensure accuracy, professionalism, and ease of use. While various software tools are available for this purpose, selecting the right one depends on the level of customization you need and the type of features you’re looking for. Below are some of the best tools that can help you modify, update, and manage your documents efficiently.

Adobe Acrobat Pro DC

Adobe Acrobat Pro DC is one of the most popular tools for working with digital documents. It allows you to easily edit, add, or remove text and images, and offers a variety of templates and formatting options. With its advanced features, you can also annotate, sign, and share documents securely. It’s a great choice for businesses that need a comprehensive solution for document management.

Smallpdf

Smallpdf is an online tool that simplifies document editing, allowing you to merge, split, compress, and edit files with ease. Its user-friendly interface makes it ideal for quick adjustments or basic customizations. Smallpdf is a great choice for users who need a straightforward tool without any complex features or subscriptions.

PDFescape

PDFescape offers both a web-based and desktop version for editing and creating documents. With features like text editing, form filling, and page annotation, it’s an excellent tool for those who want to make simple modifications quickly. PDFescape also allows you to create new documents from scratch, making it versatile for various business needs.

Foxit PhantomPDF

Foxit PhantomPDF is a powerful editing tool that provides businesses with the ability to modify text, images, and layout. It also supports advanced features like document security, collaboration tools, and form creation. Its combination of user-friendly interface and advanced features makes it a top choice for professional document management.

Choosing the right tool depends on your specific needs. If you require advanced features for professional use, software like Adobe Acrobat Pro or Foxit PhantomPDF might be the best options. For simpler tasks or occasional edits, online tools like Smallpdf and PDFescape offer a more convenient and cost-effective solution.

How Auto Repair Invoices Improve Record Keeping

Maintaining accurate records is essential for any business, especially when it comes to tracking services provided, payments made, and outstanding balances. Using a standardized document for each transaction plays a significant role in improving organization and simplifying financial management. Here’s how such records enhance overall record-keeping:

- Consistency

A consistent format ensures that each transaction is recorded in the same way. This makes it easier to track service history, monitor payments, and reconcile accounts without confusion or errors. - Easy Tracking of Services

A detailed document enables you to clearly outline what services or products were provided, including labor hours, materials used, and associated costs. This allows both the business and the client to have a comprehensive view of the work completed. - Payment Monitoring

By including payment terms, due dates, and amounts paid, businesses can easily track payments and outstanding balances. This helps prevent missed payments and simplifies the process of following up with clients for overdue amounts. - Legal and Tax Purposes

Well-organized documents provide a reliable source of information for legal purposes or during tax preparation. Clear, accurate records help ensure that your business complies with financial regulations and tax laws. - Better Financial Management

With a proper record-keeping system, businesses can better manage their cash flow. By tracking all transactions, from estimates to payments, it becomes easier to spot trends, identify unpaid balances, and forecast future income.

Incorporating a clear and organized document into your financial processes helps streamline administrative tasks, minimize errors, and improve overall operational efficiency. These records not only keep businesses on track but also build trust with clients, who can easily review the details of their transactions.

Automating Invoice Generation for Your Business

In today’s fast-paced business environment, automation plays a crucial role in improving efficiency and reducing human error. Automating the process of creating and sending billing documents can save time, streamline workflows, and ensure accuracy. With the right tools in place, businesses can generate professional records with just a few clicks, leaving more time to focus on customer service and other important tasks.

How Automation Helps

Automating the generation of billing documents ensures that every record is consistent and accurate. Once set up, automation tools can quickly pull in customer information, service details, and pricing directly from your system, reducing the need for manual data entry. This minimizes the risk of errors and ensures that each document is complete and professional every time.

Time-Saving Benefits

Automation significantly cuts down on the time spent creating documents manually. Instead of drafting records for every service or sale, automation tools can generate them instantly, based on pre-set templates and customer data. This not only speeds up the billing process but also helps your team focus on more important aspects of the business, such as client communication or business development.

Consistent and Professional Output

Automated systems allow businesses to maintain a consistent format and design for all documents. This consistency reinforces a professional image and improves customer trust. Whether you’re working with new clients or long-term customers, having a standardized approach to documentation helps establish credibility.

Integration with Other Systems

Many automation tools can integrate with accounting software, customer relationship management (CRM) systems, and other business applications. This seamless integration ensures that customer information, service history, and payment details are always up-to-date, eliminating the need to manually cross-check records across multiple platforms.

By adopting automated document generation, businesses can increase productivity, reduce administrative costs, and improve customer satisfaction. The result is a more streamlined operation with fewer errors and a more professional approach to managing financial transactions.

Managing Payments and Due Dates in Invoices

Effectively managing payments and due dates is crucial for maintaining smooth cash flow and strong customer relationships. Clear communication about payment expectations and deadlines helps prevent confusion and delays. Properly managing these aspects of financial documents ensures that your business gets paid on time while fostering trust and transparency with clients.

Setting Clear Payment Terms

It’s important to clearly outline the payment terms within each document. Specify whether payments are due immediately, within 30 days, or after a specific event. Additionally, note which payment methods are accepted–such as credit cards, bank transfers, or checks. Clear terms make it easier for clients to understand their obligations and help reduce the chances of late payments.

Including Due Dates

Each document should have a clear due date prominently displayed. This helps both you and your clients stay on track and avoid unnecessary follow-ups. Having a set deadline for payment helps ensure that clients know when to submit payment and reduces the chances of delays. For businesses that have recurring services, you can also automate due dates to ensure consistency.

Tracking Payment Status

Keeping track of payments and due dates can be challenging without the right system in place. Using a digital tool or software allows businesses to track whether payments have been made and if any invoices are overdue. This makes it easy to send reminders or initiate follow-ups when necessary. Some systems even allow businesses to send automatic reminders before the due date, which can encourage timely payments.

Offering Discounts for Early Payments

One effective strategy to encourage prompt payments is offering discounts for early settlement. For example, offering a 5% discount if the bill is paid within 10 days can motivate clients to pay faster. This not only improves cash flow but also creates positive client experiences.

Handling Late Payments

Despite clear terms, late payments are sometimes inevitable. It’s important to establish a polite but firm process for dealing with overdue amounts. This may include sending a reminder after a few days, followed by additional notices if payments are not received. Some businesses even charge late fees to cover the costs of delayed payments and incentivize customers to pay on time.

By clearly managing payments and due dates, businesses can improve their financial stability, reduce administrative work, and maintain better client relationships. With clear policies in place, clients are more likely to understand expectations and honor payment deadlines.

Legal Requirements for Auto Repair Invoices

When generating financial records for any business transaction, it’s essential to understand the legal requirements surrounding them. Properly documented transactions are not only crucial for clarity between businesses and clients but are also necessary for tax compliance, audits, and legal protection. In particular, there are several key legal aspects that should be incorporated into your billing records to ensure they meet regulatory standards.

Key Elements of a Legally Compliant Document

Business Information

A legally sound record must contain the full business details, including the name, address, and contact information of the company providing the service. This provides transparency and allows clients to identify the provider easily. Some regions may require the business registration number or tax identification number as well.

Customer Information

The document should also include the name and contact details of the customer receiving the service or product. This ensures the transaction is properly attributed and helps avoid confusion in case of disputes. Including the customer’s address may also be necessary for certain types of transactions or services.

Payment Terms and Legal Obligations

Clear Payment Terms

It is crucial to include payment terms such as the total amount due, due date, and any applicable late fees. This ensures that the client knows exactly what is expected, legally protecting both parties. Some jurisdictions require businesses to specify whether taxes are included or not, and how those taxes are calculated.

Tax Compliance

For most businesses, sales tax or other applicable taxes must be clearly stated on the document. The rate of tax and the total amount of tax due should be broken down separately. Failure to include this information can lead to legal complications and penalties. Ensure that the tax rates applied are consistent with local or national laws.

Dispute Resolution Information

Including information on how disputes will be handled or what the procedures are for resolving payment issues is also essential in some jurisdictions. This provides both you and your customer with a clear path should issues arise, ensuring legal protection and reducing the risk of future conflict.

By adhering to these legal guidelines, businesses can avoid disputes, ensure compliance with tax regulations, and provide transparency for their customers. It’s always wise to consult with a legal professional or accountant to confirm that all necessary requirements are being met based on your location and industry.

How Invoices Help With Tax Filing

Accurate documentation is crucial for proper tax filing, and detailed records of services and transactions play a vital role in the process. Well-organized billing records not only help businesses stay compliant with tax regulations but also streamline the preparation and submission of tax returns. Properly maintained documents provide clear evidence of income and expenses, making it easier to track deductions, calculate taxable income, and avoid potential penalties.

Tracking Income and Expenses

Income Documentation

A key aspect of tax filing is reporting all earned income. Each completed transaction is typically accompanied by a billing document, which serves as proof of the revenue generated. By maintaining a record of every sale or service provided, businesses can easily calculate their total income for the year, ensuring that all earnings are accurately reported to tax authorities.

Expense Deductions

Similarly, properly documented transactions allow businesses to track and claim deductible expenses. Whether it’s the cost of materials, labor, or other business-related expenses, having a clear record ensures that these costs are easily identifiable during tax preparation. Clear documentation allows you to separate income from expenses, ensuring that you only report taxable income, while maximizing your deductions.

Ensuring Tax Compliance

Sales Tax Reporting

In many jurisdictions, businesses are required to collect and report sales tax on goods and services provided. Billing records help businesses calculate the exact amount of tax owed. By keeping accurate records of tax collected on each transaction, businesses ensure they comply with local, state, or national tax regulations. This also makes it easier to remit the correct tax amounts on time.

Avoiding Errors and Audits

Accurate and detailed financial records reduce the risk of errors when filing taxes. Incomplete or inconsistent data can trigger audits or result in penalties for underreporting income. By relying on thorough and organized billing documents, businesses can confidently prepare tax returns, knowing they have a solid foundation of evidence in case of any inquiries from tax authorities.

Overall, having well-organized and precise documentation plays a significant role in simplifying the tax filing process. Not only does it help ensure compliance, but it also allows businesses to make the most of available deductions and avoid costly mistakes. A clear record system ensures a smooth, stress-free tax season every year.

Protecting Client Data on Invoices

When handling business transactions, protecting client information is essential. Billing records often contain sensitive personal and financial details, such as names, addresses, payment methods, and transaction amounts. Safeguarding this data is not only important for maintaining customer trust but is also a legal requirement in many regions. Businesses must implement security measures to ensure that client data is kept private and secure throughout the entire process of document creation, storage, and transmission.

Ensuring Secure Data Storage

Storing Documents Safely

One of the first steps in protecting client data is ensuring that records are stored securely. This can be achieved by using encrypted digital storage systems or locked physical filing cabinets for paper records. For digital documents, using secure cloud services with robust encryption or maintaining local backups on encrypted drives adds an extra layer of security. Implementing strict access controls ensures that only authorized personnel can access sensitive information.

Limit Data Access

To further protect client data, businesses should limit who has access to the billing records. Only individuals who need the information to perform their job should have permission to view or modify the documents. By reducing access, businesses can minimize the risk of unauthorized use or data breaches.

Securing Electronic Transactions

Encrypting Files During Transmission

When sending billing records electronically, it’s critical to use secure channels. Using encryption protocols such as SSL/TLS ensures that data transmitted over the internet remains protected from interception. When sharing documents through email or online systems, make sure they are sent through secure, password-protected means. Avoid sending sensitive information through unencrypted or insecure channels.

Redacting Sensitive Information

Sometimes, certain client details may not need to be shared with other parties. In these cases, redacting sensitive information–such as credit card numbers or social security numbers–can reduce the risk of exposing private data. Only share the necessary details to avoid unnecessary exposure of client information.

Compliance with Privacy Regulations

Depending on your location, there may be specific legal obligations regarding data protection. Many countries have data privacy laws that require businesses to protect customer information, such as the General Data Protection Regulation (GDPR) in the European Union or the California Consumer Privacy Act (CCPA) in the United States. Make sure your business follows the appropriate regulations to avoid legal consequences and maintain client trust.

Ultimately, protecting client data on billing records not only ensures compliance with privacy laws but also strengthens the trust clients place in your business. By implementing security measures and safeguarding sensitive information, you demonstrate your commitment to maintaining a secure and reliable service.

Common Mistakes to Avoid on Invoices

Creating billing documents may seem straightforward, but several common mistakes can lead to confusion, delayed payments, or even legal complications. Small errors can accumulate over time and affect the professionalism of your business. Ensuring that every detail is accurate and clear is essential to maintaining smooth financial operations and fostering good relationships with clients. Here are some of the most frequent errors to watch out for when generating these important documents.

Missing or Incorrect Client Information

Incomplete Client Details

One of the most common mistakes is leaving out important client information, such as their full name, contact details, or billing address. This can lead to confusion or delays when processing payments. Always double-check that all the necessary information is included and accurate before sending out the document.

Incorrect Service Details

It’s essential to list the services provided clearly, including any relevant descriptions, quantities, and pricing. Failing to include detailed descriptions or listing incorrect quantities can lead to misunderstandings or disputes over payment. Always verify that the items or services listed match what was actually delivered or performed, ensuring your client is not confused about the charges.

Errors in Payment Terms or Amounts

Incorrect Total Amount

Another common mistake is miscalculating the total amount due. This could result from simple math errors or forgetting to include taxes or discounts. Double-check that the final amount is accurate and matches the sum of all listed services or products, including any applicable taxes or fees. It’s also important to confirm that discounts or adjustments are correctly applied.

Unclear Payment Terms

Vague or missing payment terms can lead to confusion regarding when and how payments should be made. Always specify the due date, accepted payment methods, and any penalties for late payments. This will help avoid any misunderstandings about the payment schedule, ensuring both you and your client are on the same page.

Failure to Include Legal or Tax Information

Lack of Tax Details

Not including the correct tax rates or failing to break down the tax amount separately is a common oversight. Depending on your location, you may be legally required to itemize tax charges. Missing this information can lead to confusion and potential issues with tax authorities. Ensure the tax rate and amount are clearly shown, and follow local regulations regarding tax reporting.

Not Including Legal Disclaimers

Certain jurisdictions require specific legal disclaimers or clauses on business documents. These may include return policies, dispute resolution processes, or other legal terms. Omitting these details can expose your business to unnecessary risk. Always check the legal requirements for your region and industry to ensure your documents are compliant.

By avoiding these common mistakes, you ensure that your billing documents are clear, accurate, and professional. This reduces the likelihood of delays, disputes, and legal issues, helping you maintain strong relationships with your clients and keep your business running smoothly.