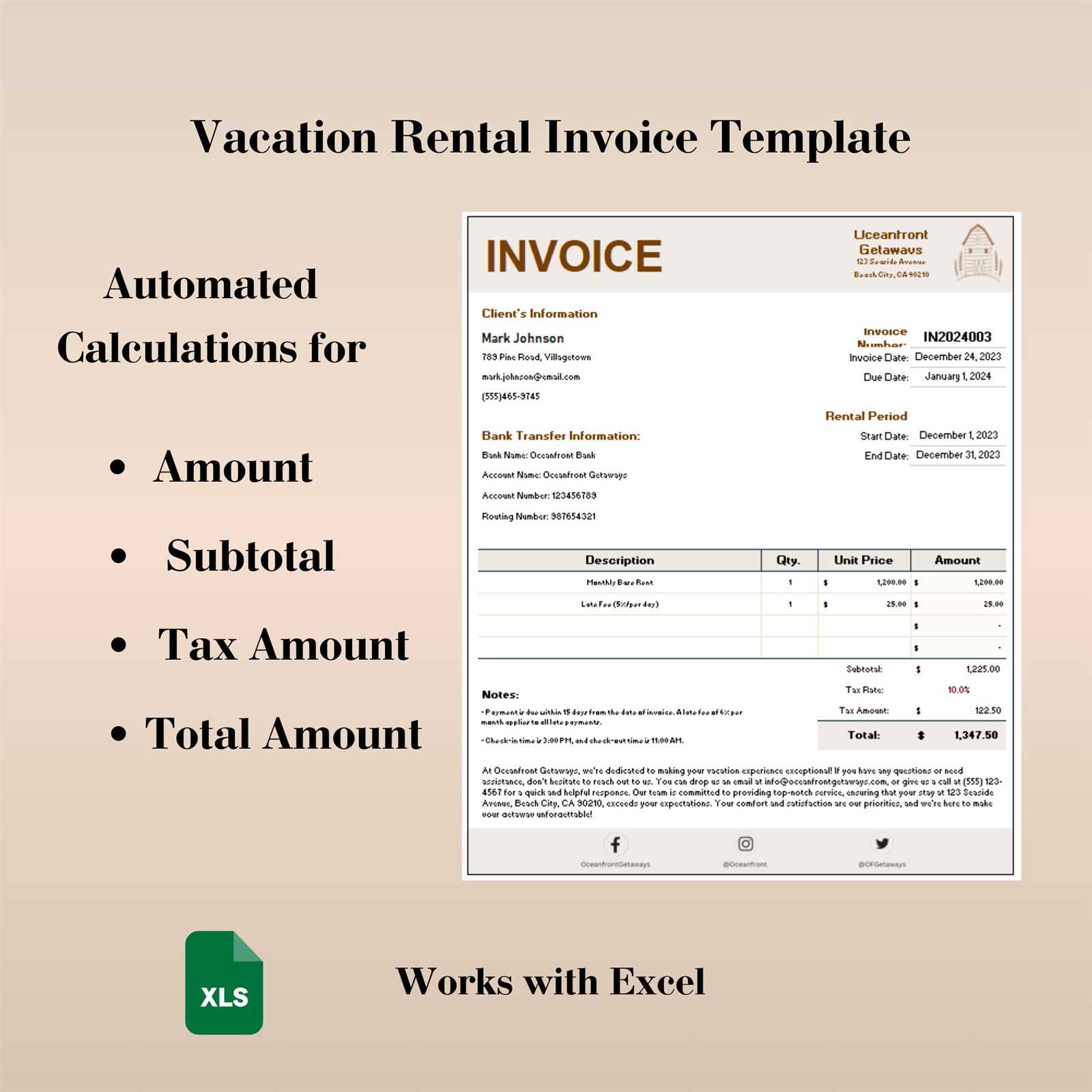

Download Free Excel Rental Invoice Template for Easy Billing

Managing payment records for rental properties can be time-consuming and complex. Having a well-organized system in place to track financial transactions is essential for both landlords and tenants. A digital tool that simplifies this process can save valuable time and reduce errors. Using an automated document for billing allows property owners to focus on other important aspects of their business while ensuring all payments are accurately recorded.

Creating a flexible and easy-to-use billing document offers many advantages. With a customizable format, landlords can quickly generate invoices for each lease period, adjusting terms and amounts as needed. This approach not only streamlines the administrative workload but also provides clarity and professionalism in communications with tenants. Additionally, it helps ensure that all payments are made on time and according to agreed-upon terms.

By adopting a structured, user-friendly document, property managers can enhance their operational efficiency. With just a few basic steps, even those with limited accounting experience can create, update, and track payments effortlessly. This tool can also be easily shared with tenants for transparency and mutual understanding.

Excel Rental Invoice Template Overview

Efficient financial management is crucial for anyone involved in property leasing. One of the most effective ways to streamline this process is by using a digital document that simplifies billing and payment tracking. A well-designed document can help landlords and property managers maintain accurate records, ensure timely payments, and reduce administrative errors. In this section, we will explore the key elements of such a tool, its purpose, and how it can be customized to fit various property management needs.

Key Features of a Billing Document

A good document for managing payments typically includes several key features that make the process more efficient. These include automatic calculation of charges, customizable fields for tenant information, and clear sections for payment details. Whether for a short-term lease or a long-term agreement, these tools can be tailored to include specific terms such as rental dates, amounts, and late fees.

| Feature | Description |

|---|---|

| Customizable Fields | Allows users to adjust the document for different tenants and property types. |

| Automatic Calculations | Reduces human error by automatically computing totals and taxes based on input data. |

| Payment Tracking | Enables landlords to track received and pending payments easily. |

| Clear Layout | Ensures the document is easy to read and professional in appearance. |

Why Use a Digital Document for Payments

Using a digital solution to generate and manage billing documents offers several benefits over traditional paper-based methods. Not only does it save time, but it also provides greater accuracy and ease of access. Property owners can quickly generate new documents, make updates when necessary, and keep digital records for future reference. These features improve both efficiency and organization in day-to-day operations, which is essential for those managing multiple properties.

Why Use an Excel Template for Rentals

When managing payments for properties, having a structured and organized method to track charges and receipts is essential. Digital tools designed to simplify the billing process provide many advantages, offering both convenience and efficiency. Such tools help minimize human error, save time, and ensure that all financial details are properly recorded. By using a flexible document that can be customized, property owners can streamline their operations and maintain accurate payment histories for each tenant.

Time-Saving and Efficiency

One of the primary reasons for using a digital solution is its ability to save time. Manually preparing billing documents for each lease can be tedious and error-prone. A well-designed document allows users to quickly input the necessary details and automatically calculate totals, taxes, and due amounts. This saves considerable time compared to traditional methods, where calculations must be done by hand, reducing the risk of mistakes.

Customization and Flexibility

Another advantage of using a digital solution is the level of customization it offers. Property managers can tailor the document to their specific needs, adjusting fields such as payment terms, tenant information, and amounts. This flexibility makes it easy to adapt the document for different properties or agreements, allowing for quick updates whenever changes arise. The ability to modify the layout and content ensures the document meets both the user’s and tenant’s expectations.

Increased Accuracy is another significant benefit of using such a tool. With built-in formulas and automatic updates, the chance of errors in calculations is drastically reduced. This leads to a more professional and reliable way of managing financial records.

Transparency and professionalism are also key advantages. By providing tenants with clear, well-organized records, landlords can foster trust and ensure that payment terms are fully understood. Clear documentation reduces confusion and provides both parties with a reference point for future transactions.

Key Features of Rental Invoice Templates

To ensure smooth financial management, it is important to have a structured document that clearly outlines the charges for a lease or property usage. Such a document must include essential details to avoid confusion and make transactions transparent for both parties involved. The most effective documents come with several key features that make them user-friendly, adaptable, and accurate in reflecting the terms of the agreement.

Essential Elements for a Complete Document

Here are the core features that make a document for property payments efficient and easy to use:

- Customizable Fields: This allows users to enter specific details for each transaction, such as the tenant’s name, payment period, and rental amount.

- Automatic Calculations: Built-in formulas for calculating totals, taxes, or late fees reduce manual work and help avoid mistakes.

- Clear Layout: A well-organized design with clear sections for different payment categories (e.g., base rent, utilities, late fees) ensures readability.

- Payment Tracking: Sections to record payments made and outstanding balances allow landlords to keep an accurate record of what is owed and received.

- Professional Appearance: A neat, consistent format presents a professional image and builds trust with tenants.

Benefits of Customization and Flexibility

One of the most important aspects of using such a document is its adaptability to different needs. For example, property managers can tailor the document to suit various lease types, payment schedules, or fee structures. This level of flexibility makes it easier to accommodate specific terms and ensures that each document reflects the unique aspects of the rental agreement. Key customization options include:

- Adjusting fields for different property types (e.g., apartments, houses, commercial spaces).

- Changing payment frequency (e.g., monthly, quarterly, annual) to match the terms of the lease.

- Incorporating specific clauses like maintenance fees or security deposits.

These features ensure that every document is fully aligned with the specific requirements of the landlord and tenant, making financial management both efficient and transparent.

How to Customize Excel Invoices for Rentals

Customizing a billing document to suit the specific needs of a property management business can significantly enhance efficiency and professionalism. By making adjustments to the layout, fields, and calculations, landlords and property managers can ensure that the document accurately reflects the terms of the lease and meets the unique requirements of each tenant. Customization allows for flexibility, ensuring that all the necessary details are included and easy to understand for both parties.

Steps to Personalize the Document

Follow these steps to tailor the billing document to your specific property and tenant needs:

- Update Contact Information: Start by adding the landlord’s or property manager’s contact details at the top of the document. Include fields for the tenant’s name, address, and contact information for clarity.

- Modify Payment Terms: Adjust the payment due date, frequency, and late fees according to the rental agreement. Be sure to include the start and end dates for each billing period.

- Include Additional Charges: Add sections for extra costs like utilities, maintenance fees, or parking charges. This ensures the tenant sees a clear breakdown of all costs associated with the property.

- Customize Layout and Design: Modify the formatting, colors, and font styles to match your branding or personal preferences. This helps create a more professional look and feel for the document.

- Integrate Automatic Calculations: Set up formulas to calculate totals, taxes, and late fees automatically based on the inputs. This reduces manual work and minimizes errors.

Ensuring Accurate Information

For each new lease or payment cycle, make sure all details are accurately reflected. Double-check the dates, amounts, and tenant information before sending the document to avoid confusion or disputes. Periodically review the customization options to ensure the document remains up to date with any changes in local laws or rental policies.

By following these steps, you can create a personalized, accurate, and professional document that reflects the unique terms of each property agreement, while also maintaining consistency in your business operations.

Benefits of Using Excel for Billing

Utilizing a digital solution to manage billing for properties offers numerous advantages. It simplifies the process, reduces errors, and saves valuable time. By leveraging a versatile tool for financial documentation, property owners and managers can quickly create, update, and track payments with minimal effort. This solution not only ensures accuracy but also enhances overall efficiency in managing financial records for tenants.

Time Efficiency and Automation

One of the biggest benefits of using a digital system for billing is the time it saves. Instead of manually calculating charges, due dates, or late fees, a well-designed system can automatically generate these details based on the data entered. This minimizes the time spent on administrative tasks, allowing property managers to focus on other important aspects of their work. Additionally, automation helps ensure that all calculations are correct, reducing the risk of human error.

Organization and Data Management

Another significant advantage is the ability to easily organize and manage data. With a digital solution, all billing records are stored in one place, making it easier to track payments, review past documents, and generate reports. This organization ensures that tenants’ payment histories are easily accessible, providing both parties with clear records and making it simple to resolve any disputes. Moreover, digital records are easily backed up, preventing the loss of important financial information.

By implementing a digital approach for property billing, managers can streamline their processes, reduce overhead costs, and increase their overall productivity, all while maintaining clear and accurate financial records.

Essential Information for Rental Invoices

For effective property management, it’s crucial that each billing document contains all the necessary details to ensure transparency and clarity for both the landlord and tenant. This information helps avoid misunderstandings, ensures timely payments, and maintains a professional standard. By including specific components in each document, property owners can guarantee that the terms of the agreement are clearly communicated and that payment processes are smooth and efficient.

Key Details to Include

Here are the essential elements that should be present in every financial document related to property agreements:

- Tenant Information: Include the tenant’s full name, address, and contact details for easy identification and communication.

- Property Details: Clearly state the address of the rented property to avoid any confusion with other properties.

- Billing Period: Specify the start and end dates of the rental period to ensure both parties know the scope of the charges.

- Amount Due: List the total amount to be paid, broken down into base rent, utilities, and any additional fees.

- Payment Due Date: Clearly mention the deadline for payment to avoid delays and misunderstandings.

- Late Fees: If applicable, include any penalties for late payments and how they are calculated.

- Payment Methods: Provide clear instructions on how payments can be made, including bank details or online payment options.

- Landlord Information: Include the name, address, and contact details of the landlord or property manager for transparency.

- Terms and Conditions: Mention any important terms related to the lease agreement, such as renewal clauses or maintenance responsibilities.

Importance of Clear Communication

Including these essential details ensures that both parties have a clear understanding of the financial arrangement. It also minimizes the risk of disputes and helps to maintain a professional relationship between the landlord and tenant. By presenting this information in an organized, easy-to-understand format, property managers can streamline the payment process and foster trust with tenants.

How to Automate Calculations in Excel

Automating calculations in financial documents can save significant time and reduce errors. By using built-in features to handle basic arithmetic, taxes, and fees, users can ensure that their records are accurate and consistent without manual intervention. This is particularly beneficial for property management, where accurate payment tracking is essential. Automating these tasks simplifies the process and helps streamline the entire billing workflow, making it easier to generate and update documents.

The key to automating calculations is understanding how to use formulas and functions that automatically update based on the data you input. For example, instead of manually adding charges for rent, utilities, and fees, you can set up formulas that automatically calculate these totals whenever you enter the relevant data. Below are some of the most common ways to automate calculations in financial documents:

- Sum Function: This basic function allows you to quickly add up different values (e.g., rent, additional charges). The sum function automatically adjusts when new data is added.

- Multiplication for Variable Rates: If there are varying rates for services (e.g., hourly maintenance fees), use multiplication formulas to calculate total costs based on hours worked or units used.

- Percentage Calculations: Use formulas to calculate taxes or late fees as a percentage of the total amount. This can be done with simple multiplication formulas to apply the percentage to the subtotal.

- Conditional Formatting: You can use conditional formatting to highlight overdue payments or unpaid balances automatically, ensuring that important details stand out visually.

- IF Statements: These functions allow for more complex calculations based on certain conditions. For example, an IF function could be used to apply a late fee only if the payment is received after the due date.

By setting up these automated calculations, you can create a reliable system that requires minimal manual input and reduces the chances of errors. With the right formulas in place, the document will automatically update each time you change a value, saving you time and ensuring consistent and accurate financial records.

Step-by-Step Guide to Creating Invoices

Creating a well-structured billing document is an essential task for any property manager or landlord. It not only helps in keeping financial records organized but also ensures that tenants are fully aware of their obligations. The process of generating a clear, professional document can be made simple by following a few key steps. This guide will take you through the process of creating a detailed and accurate billing statement, from gathering the necessary information to finalizing the document for distribution.

Here’s how to create an effective billing document for property transactions:

- Step 1: Gather Tenant and Property Information – Before starting, make sure you have all the required details, such as the tenant’s full name, property address, lease dates, and any agreed-upon fees or charges. Accurate information ensures the document is clear and personalized.

- Step 2: Set the Billing Period – Clearly define the time frame for which the charges apply. This could be monthly, quarterly, or based on a specific period outlined in the lease agreement. Include both the start and end dates of the billing cycle.

- Step 3: List Charges – Break down all charges included in the statement, such as base rent, utilities, maintenance fees, or additional services. Provide a clear description and amount for each charge.

- Step 4: Calculate Total Amount Due – Add up all charges and include any applicable taxes, discounts, or late fees. Ensure the total is clearly visible at the bottom of the document so the tenant can easily understand the amount due.

- Step 5: Include Payment Instructions – Provide clear details on how the tenant can make payments, including payment methods (bank transfer, online portal, etc.) and account information if necessary. Also, indicate the due date and any penalties for late payments.

- Step 6: Finalize and Send – Double-check all information for accuracy before sending the document to the tenant. Once everything is correct, share the document electronically or print it for physical delivery. Ensure you keep a copy for your records.

By following these steps, you can create a professional, accurate, and easy-to-understand billing document that helps maintain clear communication with tenants and ensures that payments are tracked efficiently.

Common Mistakes to Avoid in Rental Invoices

When managing property payments, ensuring accuracy in billing documents is essential for maintaining a smooth and professional relationship with tenants. Mistakes in financial records can lead to confusion, disputes, or even delays in payments. Understanding and avoiding common errors when preparing a billing statement can help ensure that the payment process runs efficiently and that both parties have a clear understanding of the terms. Below are some of the most frequent mistakes made when creating these documents and tips on how to avoid them.

Common Errors to Watch Out For

- Missing or Incorrect Tenant Information: Failing to include accurate details, such as the tenant’s name or address, can cause confusion. Always double-check that the tenant’s contact information is correct.

- Ambiguous Payment Dates: Be specific about the payment due date and the billing period. Vague or missing dates can create misunderstandings and delays in payment.

- Incomplete Breakdown of Charges: Not providing a detailed list of what is being charged (e.g., rent, utilities, or other fees) can lead to disputes. Always provide a clear and itemized breakdown.

- Calculation Mistakes: Errors in totaling the charges, adding taxes, or applying discounts can result in incorrect amounts due. Utilize automated formulas to ensure calculations are accurate.

- Failure to Include Payment Instructions: Not clearly stating how payments should be made (e.g., bank account details, payment platform) can confuse tenants and delay payments.

- Overlooking Late Fees or Penalties: If late fees apply, be sure to include them and specify the conditions under which they are charged. Failing to mention these can lead to delayed payments without consequences.

How to Avoid These Mistakes

To prevent these errors, always ensure that all the information in the document is accurate and complete. Double-check the figures and terms before sending the document to your tenant. Additionally, it’s beneficial to use a standardized format that automatically calculates totals, taxes, and penalties to minimize manual errors. By addressing these common mistakes proactively, you can maintain clear, accurate records that help foster trust and avoid payment-related issues.

Best Practices for Managing Rental Invoices

Effectively managing billing statements is crucial for maintaining smooth financial operations and fostering positive relationships with tenants. Adopting best practices in preparing, sending, and tracking payments ensures that both parties are clear on the terms and helps avoid misunderstandings or payment delays. By implementing organized, consistent strategies, landlords and property managers can streamline their financial processes while keeping records accurate and up-to-date.

Key Practices for Efficient Management

Here are some best practices to follow when managing property-related billing documents:

- Maintain Consistency: Use the same format for every document to ensure consistency. This makes it easier for tenants to understand the charges and for landlords to track payments.

- Be Transparent and Detailed: Always provide an itemized list of charges, including base rent, utilities, maintenance fees, and any other costs. Clear documentation avoids confusion and ensures tenants know exactly what they are paying for.

- Send Documents on Time: Deliver the billing statement promptly, ideally at the beginning of each billing cycle. This gives tenants enough time to review and make payments before the due date.

- Automate Calculations: Use automatic calculation tools to ensure that totals, taxes, and late fees are accurately calculated, reducing the risk of human error and saving time in the process.

- Track Payments and Outstanding Balances: Keep a record of payments made and outstanding balances to avoid missing or unrecorded transactions. This also makes it easier to follow up on overdue payments.

- Offer Multiple Payment Options: Make it easier for tenants to pay by providing various payment methods, such as online payment platforms, bank transfers, or checks. More options lead to timely payments.

- Store Records Securely: Keep digital or physical copies of all documents for future reference. Secure storage ensures that records are protected and can be easily accessed if needed.

Benefits of Following These Practices

By adhering to these practices, property managers and landlords can reduce administrative overhead, minimize errors, and ensure timely payments. It also fosters trust and professionalism, improving tenant relations and contributing to the long-term success of the property management business. Regularly reviewing and updating processes helps ensure that the management of billing statements remains efficient and effective.

How to Track Payments with Excel Templates

Managing payments effectively is an essential part of property management, ensuring that all financial transactions are accounted for and timely. By organizing payment data in a digital document, you can easily track which payments have been received, which are outstanding, and when follow-up actions are required. Tracking payments efficiently helps avoid confusion, ensures smooth operations, and provides clear records for both tenants and landlords.

Setting Up Payment Tracking

To efficiently monitor payments, it’s important to create a well-organized system that allows you to record each payment and its details. Here’s how you can structure your document to track payments effectively:

| Payment Date | Tenant Name | Amount Due | Amount Paid | Outstanding Balance | Payment Status |

|---|---|---|---|---|---|

| 01/10/2024 | John Doe | $1,200 | $1,200 | $0 | Paid |

| 01/10/2024 | Jane Smith | $1,100 | $500 | $600 | Partial Payment |

Using Functions to Automate Payment Tracking

To streamline the process, you can use simple formulas that automatically calculate outstanding balances and update payment statuses. Here are some ways to automate tracking:

- Automatic Balance Calculation: Use subtraction formulas to automatically calculate the remaining balance after a payment is made. For example, if the total due is in one column and the amount paid is in another, you can subtract the payment from the total to calculate the balance.

- Payment Status Indicator: Set up a conditional formula to display “Paid” or “Partial Payment” depending on whether the amount paid matches or falls short of the total amount due.

- Highlight Overdue Payments: Use conditional formatting to automatically highlight overdue payments, helping you stay on top of pending transactions.

By using these techniques, you can easily track payments, spot any discrepancies, and take necessary action when payments are overdue. Automation minimizes the chances of error and ensures that you always have up-to-date information on your payments.

Customizing Invoice Layout for Rentals

Tailoring the design of your billing documents can greatly enhance their readability and professional appearance. A well-organized layout not only helps you communicate information clearly but also ensures that tenants can easily understand the charges, payment terms, and deadlines. Customizing your document’s layout allows you to highlight the most important details while maintaining a clean, professional look. In this section, we will explore how to structure and personalize your documents for better efficiency and presentation.

Key Elements to Consider for Customization

When customizing your billing document layout, it’s important to prioritize clarity and ease of use. Here are the key areas to focus on:

- Header Information: Make sure to include your business or personal details at the top, such as the name, address, and contact information. This gives a professional touch and makes it easier for tenants to reach out if necessary.

- Clear Itemization: Organize charges in separate sections (e.g., rent, utilities, maintenance). Use tables to make each charge clearly visible and easy to read.

- Highlighting Key Dates: Ensure that the payment due date and billing period are prominently displayed. This helps tenants quickly understand when payment is expected.

- Total Amount: The total amount due should be clearly separated from other information, either by bolding the text or placing it in a separate box, making it easy for the tenant to spot the final amount.

Visual Enhancements and User-Friendly Design

In addition to structuring the content effectively, visual elements can further enhance the user experience. Here’s how to design an appealing and easy-to-read document:

- Use of Colors: Subtle use of color can help differentiate sections without overwhelming the document. For example, you can highlight headings or important dates in a soft shade to draw attention.

- Consistent Fonts: Choose clear, professional fonts that are easy to read. Use different font sizes to emphasize headings and ensure consistency across the document.

- Organized Sections: Break down the document into well-defined sections with proper spacing. This makes it easier to find relevant information quickly and keeps the layout uncluttered.

By customizing your billing document layout to be both functional and visually appealing, you create a more professional and efficient experience for both you and your tenants. A well-structured document not only makes payment processing smoother but also fosters better communication and trust.

How to Add Rental Terms in Excel

Clearly outlining the terms and conditions of an agreement is essential for both parties involved. Including these details in your financial document helps avoid confusion and ensures that both the landlord and tenant are on the same page regarding expectations. Whether it’s payment schedules, late fees, or the length of the agreement, specifying these terms within the document makes them easy to reference and understand. In this section, we will walk you through the process of incorporating rental terms into your financial records effectively.

Steps to Include Terms and Conditions

To properly integrate the key terms into your financial document, you can follow these simple steps:

- Section for Terms: Create a dedicated section for the terms of the agreement. This section should be clearly labeled (e.g., “Agreement Terms” or “Payment Terms”) and placed towards the end of the document for easy reference.

- Payment Schedule: List the agreed-upon payment intervals (e.g., monthly, quarterly) along with specific due dates. This helps both parties track when payments are expected and ensures there are no misunderstandings.

- Late Payment Penalties: If applicable, clearly state the late fees or penalties for overdue payments. This should include the percentage or fixed amount that will be added after a specific grace period.

- Duration of Agreement: Specify the start and end dates of the agreement. Including the duration prevents confusion regarding the length of the commitment and can also help clarify the terms for renewals.

- Additional Charges: If there are other charges (e.g., maintenance fees, utility costs), outline them clearly and specify when they apply. This ensures transparency in all aspects of the agreement.

Using Functions to Highlight Terms

For better organization, you can use formatting and automated functions to make these terms stand out:

- Bold and Italics: Highlight important clauses by using bold or italic fonts to make them stand out. This ensures that key points like payment deadlines or late fees are easy to identify.

- Conditional Formatting: Use conditional formatting to automatically highlight overdue dates or outstanding charges. This can help both parties track the agreement’s terms and payment history more efficiently.

- Cell Comments: Adding comments to specific cells (e.g., explaining a particular charge or fee) can provide additional context without cluttering the main body of the document.

Incorporating these terms directly into your financial record not only ensures that the document is comprehensive but also enhances clarity and reduces the risk of misunderstandings. With these steps, you can create a more organized and effective billing system that keeps all parties informed and aligned with the terms of the agreement.

Integrating Excel Templates with Accounting Software

Managing financial records effectively often requires more than just a simple document. To streamline workflows and ensure accuracy, integrating your financial tracking system with dedicated accounting software can significantly improve efficiency. This integration allows you to automate data transfer, eliminate redundant data entry, and create more detailed, real-time financial reports. By syncing your spreadsheets with accounting tools, you can simplify your operations and make better-informed decisions.

Benefits of Integration

Integrating your financial records with accounting software provides several advantages:

- Time Savings: Automating the transfer of payment data from your document into your accounting system reduces the need for manual data entry, saving valuable time.

- Improved Accuracy: With automated syncing, the chances of errors during data transfer are minimized, ensuring that all financial figures are accurately recorded.

- Real-Time Updates: Integration allows for real-time updates, meaning that whenever changes are made to your financial records, they are instantly reflected in your accounting system.

- Better Reporting: By having your financial data connected to accounting software, generating comprehensive reports becomes easier. You can quickly analyze trends, monitor cash flow, and manage accounts more efficiently.

- Easy Tax Filing: Having all your financial records integrated and organized in one place simplifies the process of tax reporting and filing, reducing stress during tax season.

How to Integrate Financial Records with Accounting Software

To successfully link your financial tracking system with your accounting software, follow these steps:

- Select Compatible Software: Choose accounting software that supports integration with your document management system. Popular software options often have built-in features to import or sync data from spreadsheets.

- Use APIs or Import Functions: Many accounting systems offer APIs (Application Programming Interfaces) or built-in import/export functions. These can help connect your documents directly to the software, enabling automatic updates and data flow.

- Map Data Fields: Ensure that the fields in your financial document (such as tenant names, payment amounts, and due dates) are mapped correctly to the corresponding fields in your accounting software to ensure data is transferred accurately.

- Test Integration: Before fully relying on the integration, test it by transferring a small batch of data. Verify that the data appears correctly in your accounting system and that everything syncs as expected.

- Regularly Sync Data: Set up automated syncing or reminder intervals to ensure that your data is updated frequently and remains consistent across both platforms.

By linking your financial management tools with accounting software, you create a seamless, automated process that reduces manual work, enhances data accuracy, and provides valuable insights for managing your financial operations. This integration is a smart move for anyone looking to streamline their accounting processes and improve overall efficiency.

Free vs Paid Excel Rental Templates

When it comes to creating financial documents, there are various options available depending on your needs and budget. You can choose between free and paid versions of document management solutions, each with its own set of advantages and limitations. While free options may seem like a great way to save money, paid versions often offer more advanced features and customization. In this section, we’ll compare the benefits and drawbacks of using free versus paid options to help you make an informed decision for your financial record-keeping needs.

Benefits of Free Document Management Solutions

Free options for managing financial records can be an excellent starting point for those with basic needs or a limited budget. Some of the key advantages include:

- Cost Savings: The most obvious benefit is that free solutions require no upfront investment, making them ideal for small businesses or individuals just starting out.

- Simple to Use: Free solutions often have fewer features, but this can make them more user-friendly for individuals who only need to track basic payments or simple agreements.

- Quick Setup: Since free solutions typically have fewer customization options, they are often quicker to set up and begin using without a steep learning curve.

However, while these solutions may be functional for simple tasks, they often lack advanced features or the ability to scale as your business grows.

Advantages of Paid Document Management Solutions

Paid solutions for managing your financial documents provide more comprehensive functionality, making them a good choice for those who require more flexibility, advanced features, and ongoing support. Here are some of the key advantages:

- Advanced Customization: Paid solutions allow you to customize your documents to better reflect your branding, include additional fields, or meet specific reporting requirements.

- Greater Functionality: Many paid options come with automated calculations, advanced data analysis tools, and integrations with accounting software, which can save time and increase accuracy.

- Customer Support: With paid options, you typically receive access to customer support, ensuring that any issues can be quickly resolved and technical assistance is available if needed.

- Enhanced Security: Paid solutions often include better data protection and backup options, giving you peace of mind that your records are safe from loss or unauthorized access.

While paid solutions require an upfront cost, they can provide more value in terms of functionality, scalability, and support in the long run.

Making the Right Choice

Ultimately, the decision between free and paid options depends on your specific needs. If you only need a basic document management solution and have a limited budget, free options can be a good place to start. However, if you require more advanced features, customization, or integration with other software, a paid solution may be a better investment for your business.

How to Protect Your Excel Invoice Files

Keeping financial documents safe is critical for maintaining privacy and preventing unauthorized access. Whether you’re managing sensitive client information, tracking payments, or storing important business details, securing your files should always be a top priority. There are several ways to protect your financial records, from simple password protection to more advanced encryption methods. In this section, we will explore some of the most effective ways to safeguard your files and ensure that your data remains private and secure.

Password Protection

The most basic level of protection you can apply to your documents is password encryption. This ensures that only authorized users can open and view the file. Here are the steps to add password protection:

- Set a Strong Password: Choose a password that is difficult to guess. Use a combination of letters, numbers, and special characters to enhance security.

- Encrypt the File: Most spreadsheet programs allow you to encrypt the file using a password. This option is usually found under the “File” or “Save As” menu, where you can select the “Encrypt with Password” option.

- Use Different Passwords: If you manage multiple files, it’s a good idea to use different passwords for each one, rather than reusing the same password across multiple documents.

Backup and Cloud Storage

Another essential step in protecting your files is ensuring that they are backed up. If your files are lost, corrupted, or compromised, having a backup ensures that you can recover your data quickly. Consider the following methods:

- Use Cloud Storage: Storing your documents in a reputable cloud service adds an extra layer of protection. Many cloud providers offer built-in encryption, and files can be accessed remotely from multiple devices.

- Regular Backups: Make sure to back up your files regularly, whether on an external hard drive or a secure cloud service. This will prevent data loss in case of system failure or accidental deletion.

- Version Control: Some cloud services offer version control, allowing you to revert to earlier versions of your document if necessary. This is especially helpful if changes are made accidentally or maliciously.

Limit Access and Permissions

Restricting access to your files is another effective method of protection. By limiting who can view, edit, or share your documents, you reduce the risk of unauthorized access. Consider the following practices:

- Restrict Editing Permissions: If you need to share your documents but want to prevent others from making changes, set the file to “view only” mode or remove editing permissions altogether.

- Set User Access Levels: In cloud-based systems, you can assign different access levels (e.g., admin, viewer, editor) to each user. This ensures that only trusted individuals can make changes to the document.

- Share Secure Links: If you need to share a document, use sec

How to Share and Print Rental Invoices

Once your financial documents are created and ready for distribution, it’s important to know the best methods for sharing and printing them efficiently. Whether you’re sending them to clients electronically or printing hard copies for your records, having the right approach ensures that your documents are received in a timely manner and in the correct format. In this section, we will cover different ways to share and print your financial records, ensuring they are both accessible and professional.

Sharing Documents Electronically

Sharing documents digitally has become a standard practice, providing convenience and quick delivery. Here are a few popular ways to share your documents securely:

- Email: One of the most common methods is sending the document as an email attachment. To protect sensitive information, consider encrypting the file or adding a password before sending it.

- Cloud Storage: You can upload your file to a cloud service and share a link with recipients. This method allows for easy access and collaboration, while also keeping a backup of your records.

- Secure File Sharing Platforms: Platforms like Google Drive or Dropbox provide an easy way to share documents with clients. You can control who has access and set permissions to either view or edit the document.

- Invoice Management Tools: Some online invoicing systems allow you to generate, store, and send documents directly through their platform. These tools often include features like automatic reminders for unpaid bills and online payment processing.

Printing Your Documents

In some situations, you may need to print physical copies of your financial documents. Here are a few tips for ensuring your printed copies are clear and professional:

- Use Quality Paper: Always print on good-quality paper to ensure your documents look professional and are easy to read.

- Check Layout and Formatting: Before printing, double-check your document’s layout and formatting. Ensure that all text is aligned correctly and that the print preview looks as expected. This will prevent wasted paper and ink.

- Print in Landscape or Portrait Mode: Depending on the content of your document, choose the appropriate orientation. Landscape mode is often ideal for wider formats, while portrait mode is better for standard documents.

- Save as PDF for Printing: If you want to ensure that the formatting is preserved, save your document as a PDF before printing. This ensures that the document will look exactly the same no matter where it is printed.

Sharing and printing your documents efficiently can streamline your workflow and help you maintain a professional image. Whether you choose electronic or physical delivery, knowing how to manage your documents

Tips for Using Excel Efficiently for Rentals

When managing financial records and documents, efficiency is key to staying organized and ensuring that tasks are completed accurately and quickly. By leveraging the full potential of spreadsheet software, you can streamline data entry, automate calculations, and easily track all the necessary information related to your business. This section provides practical tips for using spreadsheet tools effectively, helping you manage your tasks more efficiently and minimize errors.

Organize Your Data with Clear Structure

One of the most important aspects of working with spreadsheet software is setting up a clear and logical structure for your data. Here are some tips to keep things organized:

- Use Separate Sheets: For different categories of information, such as payment history, client details, or product inventory, create separate sheets within the same file. This makes it easier to locate and manage specific data.

- Label Columns Clearly: Always label each column with a clear header that describes the type of data contained within. This will help prevent confusion and ensure that you can easily filter and sort data as needed.

- Apply Consistent Formatting: Use consistent date formats, currency symbols, and text styles throughout the document. This uniformity makes it easier to interpret the data and ensures that reports and summaries are accurate.

Automate Repetitive Tasks

Spreadsheets can save you time by automating repetitive tasks like calculations or data entry. Below are some useful tips for automating your processes:

- Use Formulas: Instead of manually calculating totals, use built-in functions such as SUM, AVERAGE, or VLOOKUP to automate calculations. This reduces the chances of errors and speeds up your work.

- Implement Conditional Formatting: Conditional formatting can help highlight specific data points, such as overdue payments or high-value transactions, making it easier to focus on important items.

- Utilize Templates: Pre-built templates allow you to quickly enter data without worrying about formatting or structure. If you find yourself regularly creating similar documents, look for templates that fit your needs and modify them as necessary.

Enhance Collaboration and Data Sharing

If you need to work with others on your financial documents, using cloud-based spreadsheets can help you collaborate in real-time. Consider these tips for better teamwork:

- Share and Set Permissions: Most spreadsheet platforms allow you to share documents with others and set permissions, such as view-only or edit access. This ensures that team members can work together without altering critical information.

- Track Changes: Enable the “Track Changes” feature to keep an eye on edits made by collaborators. This feature helps prevent mistakes and allows you to revert to earlier versions of the document if necessary.

- Use Comments and Notes: Encourage team members to use comments or notes to provide feedback or explain changes. This ensures clear communication and helps avoid misunder