Create Your Own Custom Invoice Template Easily

For any business, a well-organized and professional payment request is essential. Whether you’re a freelancer, small business owner, or part of a large company, having a personalized method to request payment helps streamline your processes and creates a lasting impression on clients.

Instead of relying on generic solutions, it’s beneficial to build a unique version tailored to your needs. This can ensure that all the necessary information is clearly presented, making it easier for both you and your clients to handle transactions efficiently. A bespoke document can not only improve organization but also reinforce your brand identity.

In this guide, we’ll explore how you can easily craft a personalized payment form that aligns with your specific requirements. From structuring content to including essential details, we’ll walk you through the process and help you design an effective solution that reflects your business’s values and professionalism.

Why You Need a Personalized Billing Document

Having a tailored method for requesting payments is crucial for maintaining professionalism and clarity in any business transaction. A standardized approach that fits your unique needs not only saves time but also reduces the risk of errors and confusion, ensuring that both you and your clients are on the same page regarding payment terms.

Improved Brand Recognition

A personalized payment form can serve as an extension of your brand. By including your company logo, colors, and design elements, you reinforce your identity and leave a lasting impression. This level of attention to detail can make your business appear more established and trustworthy, helping to build stronger client relationships.

Increased Accuracy and Efficiency

When you design a payment request to suit your specific needs, you can ensure that all necessary fields and details are included in a logical, easy-to-follow format. This reduces the chances of missing important information, such as deadlines, tax rates, or payment instructions, which can lead to costly mistakes and delays.

Overall, a tailored approach helps create a seamless and professional experience for both parties involved, ultimately making financial processes smoother and more effective.

Understanding the Basics of Payment Requests

When it comes to managing transactions, a well-structured payment request is an essential tool for any business. It serves as a formal communication between the seller and the buyer, detailing the amount owed, services or goods provided, and the terms of payment. A properly designed document ensures that both parties are clear on the agreed-upon terms and prevents misunderstandings.

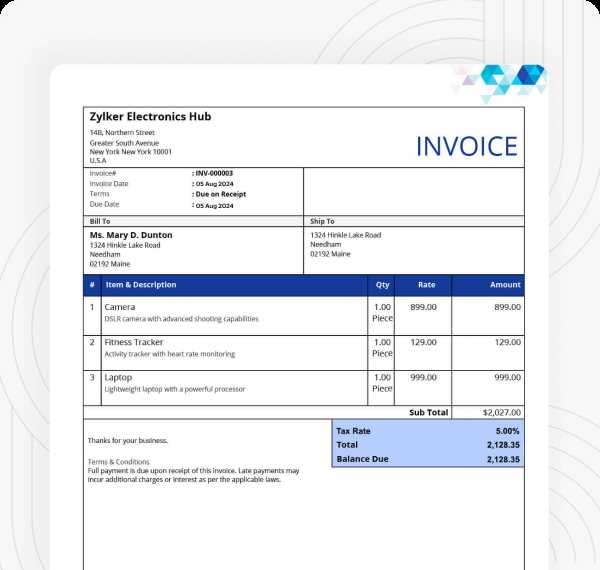

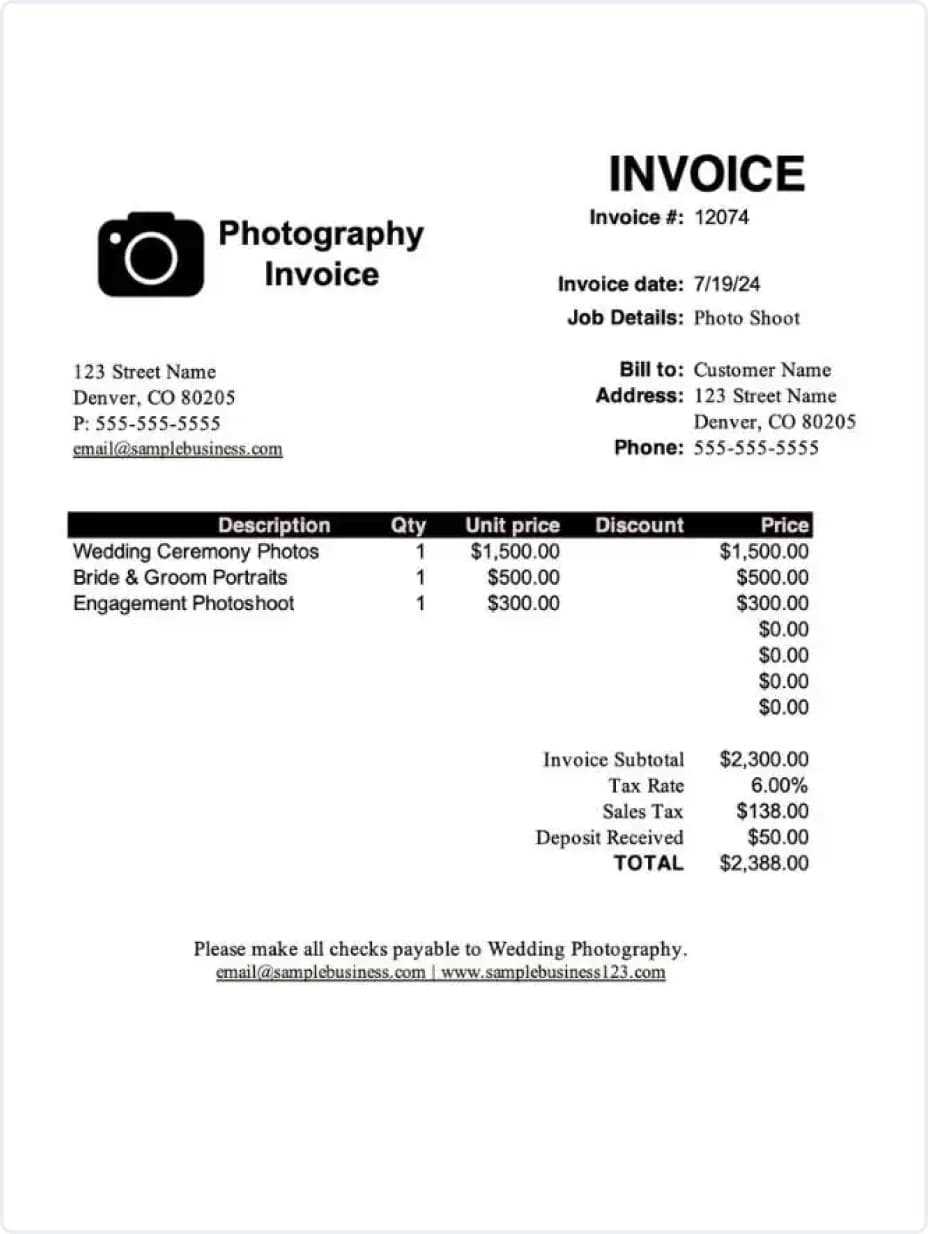

Key Components of a Payment Request

To ensure your document is clear and effective, it should include several critical pieces of information. These elements help both you and your client stay organized and maintain a professional approach. Below are the most common components:

- Seller Information: Name, address, and contact details of the business requesting payment.

- Buyer Information: Name and contact details of the customer or client.

- Description of Goods/Services: A detailed breakdown of the items or services provided, including quantities and prices.

- Amount Due: The total amount to be paid, including any taxes or additional charges.

- Payment Terms: This includes the due date, late fees, and accepted payment methods.

- Unique Reference Number: A specific code or number to identify the transaction for future reference.

Why Accuracy is Crucial

Accuracy in each section is crucial for avoiding disputes and ensuring timely payments. Any discrepancies in details such as pricing or payment deadlines can cause delays or confusion. A well-organized document can also reflect your professionalism and attention to detail, which may lead to faster payments and better relationships with clients.

Steps to Design a Personalized Billing Document

Designing a tailored payment request document requires careful consideration of both functionality and appearance. The goal is to make the document easy to understand for your clients while ensuring it includes all necessary details. By following a structured process, you can create a streamlined and professional-looking form that serves your business needs effectively.

Here are the key steps to design a personalized billing document:

- Step 1: Define the Essential Elements

Start by identifying the key components that must be included, such as contact details, payment terms, description of goods or services, and total amount due. These elements will form the foundation of your document.

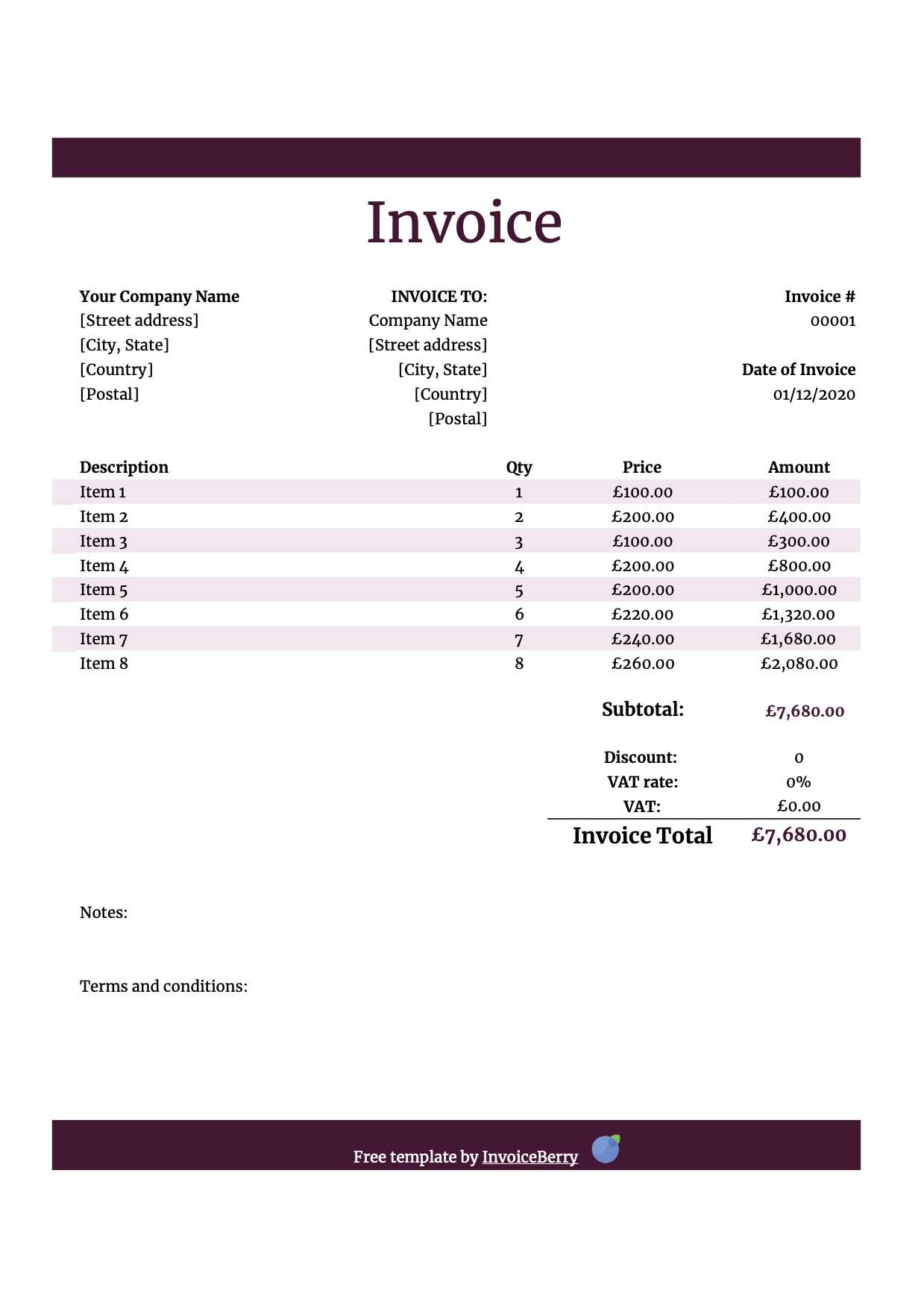

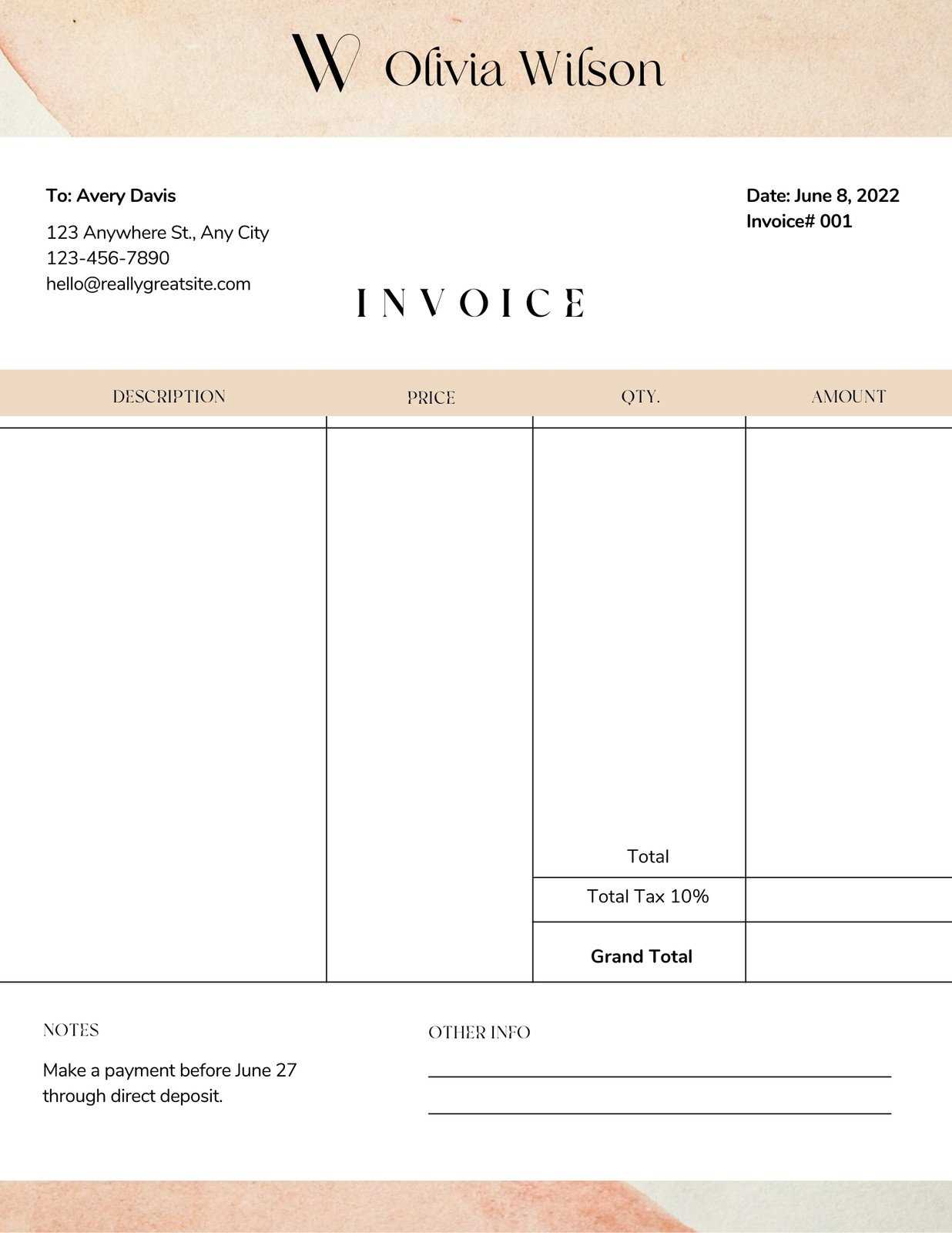

- Step 2: Choose a Layout

Decide on the layout that best suits your needs. Consider whether you prefer a clean, minimalist approach or a more detailed design with additional sections for notes, discounts, or payment instructions.

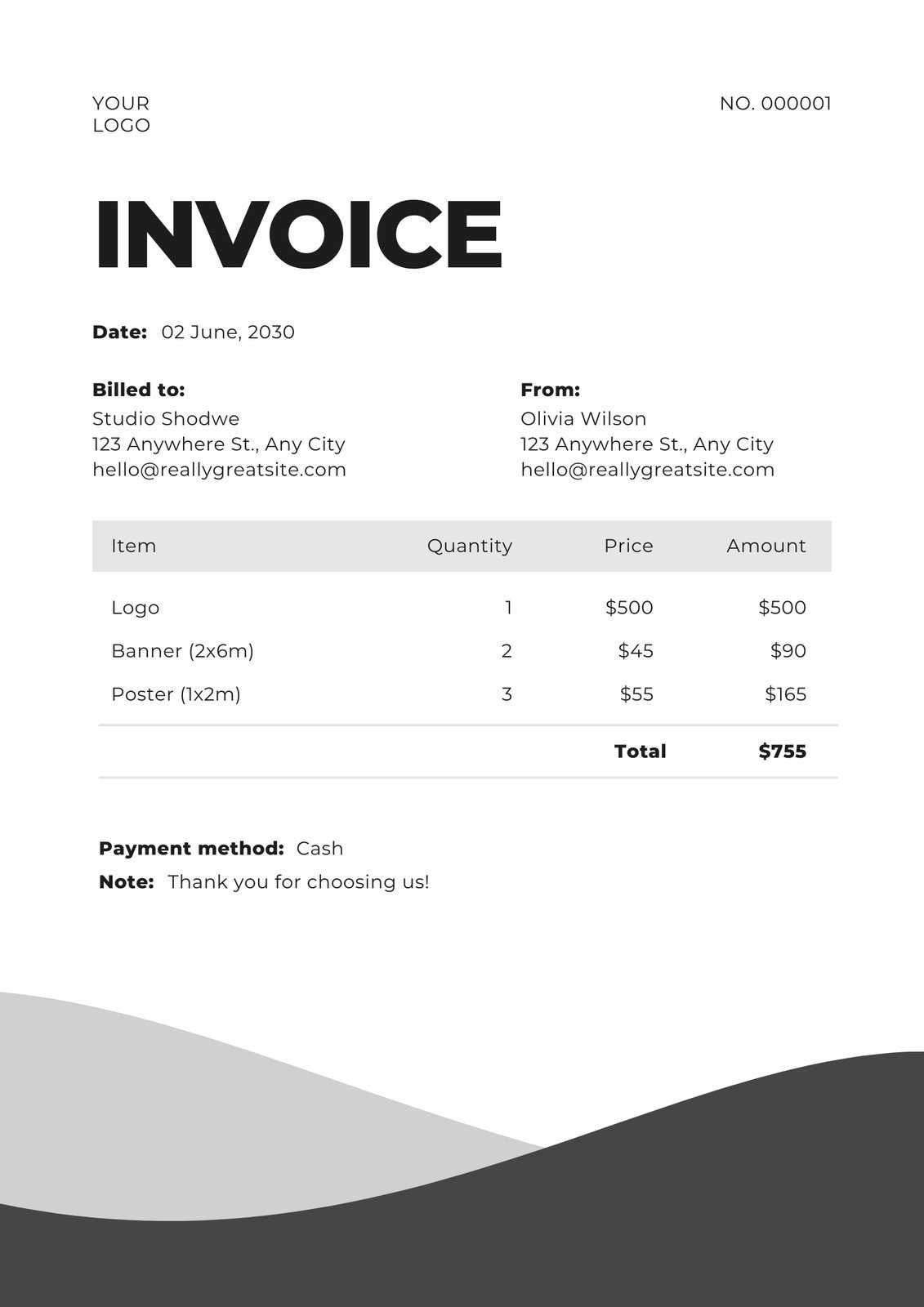

- Step 3: Add Branding Elements

Include your business logo, color scheme, and font style to make the document visually aligned with your brand identity. This creates a cohesive experience for clients and reinforces your professional image.

- Step 4: Organize Information Clearly

Arrange the information in a logical order so that it’s easy to navigate. Use headings, bullet points, and bold text for key details like the total amount due or payment deadlines to highlight important items.

- Step 5: Include Legal and Payment Terms

Clearly state your payment terms, late fees, and any applicable taxes or charges. This will help avoid misunderstandings and ensure that both you and your client are aligned on expectations.

By following these steps, you’ll ensure your payment request is not only effective in communicating the necessary details but also professional in appearance, improving both client satisfaction and timely payments.

Choosing the Right Format for Your Billing Document

Selecting the right structure for your payment request is crucial to ensure it is both functional and professional. The format you choose will determine how easily your client can understand and process the information, which can impact the efficiency of the transaction. An appropriate structure not only makes the document visually appealing but also enhances its clarity and effectiveness.

Factors to Consider When Choosing a Format

When deciding on a layout for your payment request, consider the following factors to ensure that it aligns with your business needs and client expectations:

- Clarity: The format should allow for easy reading and quick identification of essential details, such as the total amount due and payment terms.

- Professionalism: Choose a clean and well-organized structure that reflects your brand’s professionalism and attention to detail.

- Ease of Use: The format should be user-friendly for both you and your client, ensuring that the document is easy to fill out, edit, and read.

- Compatibility: Ensure the format you choose is compatible with the tools you use to create and send the document (such as PDF, Word, or Excel files).

- Customization: Consider how much flexibility you need. A more flexible layout may allow for adding or removing sections based on the nature of the transaction.

Popular Formats for Payment Requests

There are several popular formats to consider when designing your payment request, each with its own advantages:

- Simple Layout: Ideal for straightforward transactions, this format typically includes basic information such as item descriptions, prices, and totals in a clean, no-frills layout.

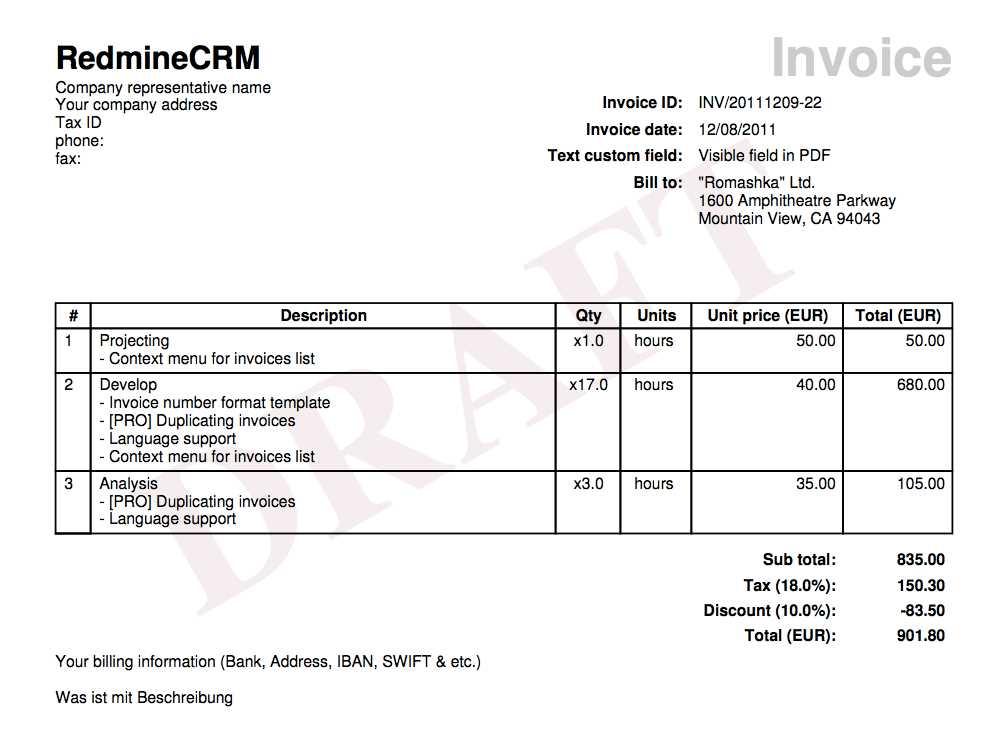

- Itemized List: Useful for businesses that offer multiple products or services, this format breaks down each item or service with detailed descriptions, quantities, and individual prices.

- Time-Based Billing: Best for freelancers or consultants, this format focuses on hourly rates or project milestones, clearly outlining the time spent and corresponding charges.

- Branded Layout: If branding is important, you might choose a format that incorporates your company’s visual identity–logos, colors, and fonts–to enhance your business image.

By carefully selecting the right format, you can ensure your payment request is clear, professional, and easy to process, ultimately helping your business maintain efficient and smooth transactions with clients.

Key Elements to Include in a Payment Request

When designing a document to request payment, it’s essential to include all the necessary details to ensure that both you and your client are clear on the terms and conditions. A well-structured document will help avoid misunderstandings, ensure timely payment, and create a professional image for your business. Below are the key elements that should always be included in such a document.

- Contact Information: The name, address, phone number, and email address of both your business and the client. This ensures both parties can reach each other if needed.

- Document Title: Clearly state the purpose of the document. Use a straightforward title, such as “Payment Request” or “Billing Statement,” to make it clear what the document is for.

- Unique Reference Number: Assigning a unique identifier helps both parties track the transaction. This can be useful for record-keeping and resolving any issues that arise.

- Service or Product Description: Provide a detailed description of the goods or services delivered, including quantities, unit prices, and total amounts for each item or service.

- Total Amount Due: Clearly state the total amount the client is required to pay. This figure should include any applicable taxes, shipping fees, or additional charges.

- Payment Terms: Include the payment due date, accepted payment methods, and any late fees or discounts for early payments. This helps set clear expectations and ensures both parties are aligned.

- Due Date: Mention the exact due date for payment. This helps prevent delays and ensures timely processing of payments.

- Notes or Additional Information: Include any extra instructions or information that may be relevant to the payment process, such as bank account details, online payment links, or terms for late payments.

By including these key elements, you can ensure that your payment requests are clear, complete, and professional, which can help you maintain a smooth and efficient financial process with your clients.

How to Add Your Branding to Billing Documents

Incorporating your brand identity into your payment requests not only enhances professionalism but also helps reinforce your business’s presence and recognition. A strong visual identity can make your communications more memorable and create a consistent experience for your clients. Below are several ways to effectively integrate your brand into the design of your payment requests.

1. Use Your Business Logo

Including your logo at the top of the document is one of the easiest and most effective ways to brand your payment request. This immediately signals to your client that the document is official and linked to your business.

- Place your logo in the header or top-left corner for maximum visibility.

- Ensure that the logo is high-resolution and fits well within the document’s layout.

2. Choose Brand Colors and Fonts

Colors and typography are powerful tools to represent your business’s personality. Using your company’s color palette and fonts helps reinforce your brand’s visual identity.

- Match text color to your brand’s primary or secondary colors.

- Use your company’s standard fonts for headings and body text to maintain consistency with other brand materials.

3. Add a Company Tagline or Slogan

Including a tagline or slogan under your logo or in the footer can further strengthen your brand’s message. It also reminds your clients of what your business stands for and what value you provide.

- Place the tagline in a subtle location so it doesn’t overwhelm the main content.

- Ensure it aligns with your brand voice and communicates a clear message to your audience.

4. Incorporate Consistent Layout and Design

Maintaining a layout that reflects your business’s style across all documents ensures consistency. Consider adding borders, design elements, or section dividers that align with your overall branding theme.

- Use borders or lines in brand colors to separate different sections or emphasize important details like the payment amount.

- Consider using background colors or watermarks that subtly reflect your brand’s visual style without distracting from the content.

By carefully adding these branding elements, you ensure that your payment requests are not only functional but also act as a tool to strengthen your brand identity and enhance your business’s professionalism.

Customizing Billing Fields for Specific Needs

When designing a payment request, it’s important to adapt the fields to your particular business requirements. Every industry and transaction type may have unique needs that must be addressed to ensure all relevant information is included and easy to understand. Tailoring the fields to reflect the nature of your services or products allows for more accurate communication and helps prevent confusion.

1. Adjusting for Different Services or Products

For businesses offering a variety of products or services, it’s essential to adjust the fields to reflect the specific details that apply to each transaction. Here are a few suggestions for customization:

- Service Descriptions: Provide detailed descriptions for services rendered, especially if they involve multiple steps or phases.

- Product Specifications: If you sell physical products, add fields for SKU numbers, sizes, colors, or product variations.

- Unit Pricing: Break down the costs into unit prices, especially for bulk orders, so clients can clearly see how charges are calculated.

2. Adding Specialized Payment Terms

Payment terms can vary significantly depending on the type of business or transaction. Customize the fields to include specific payment conditions tailored to your needs.

- Deposit Information: If you require an upfront deposit, include a field to clearly state the deposit amount and its due date.

- Milestone Payments: For larger projects, divide the total amount into milestones, specifying when payments are due after each completed stage.

- Late Fees: Add fields to specify late payment penalties or discounts for early payments, ensuring that your terms are clear from the outset.

3. Including Project or Job-Specific Details

Some businesses work on unique projects or contracts that require additional information. Adjust the fields to accommodate these specifics.

- Job Number or Contract Reference: Include a reference number for jobs or contracts to help with tracking and organization.

- Time Spent: For businesses that charge by the hour, include a field for recording the time worked, the hourly rate, and the total amount due based on hours.

- Additional Charges: Add fields for handling any additional charges such as shipping, handling, or special requests that weren’t part of the initial agreement.

By adapting the fields to suit the specifics of your business and clients, you can ensure that each payment request is not only accurate but also tailored to provide the necessary clarity for all involved parties.

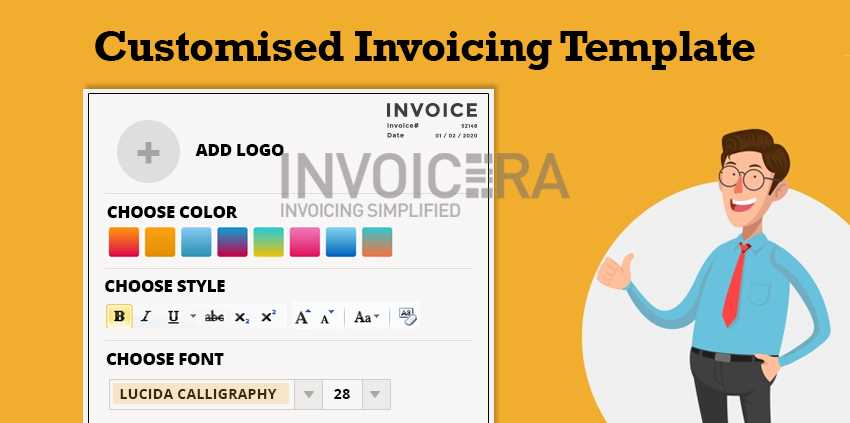

Best Software for Designing Personalized Billing Documents

Choosing the right software to design and manage payment requests can greatly improve the efficiency and professionalism of your business. The right tool will allow you to streamline the process, ensuring that your documents are clear, visually appealing, and consistent across all transactions. There are many options available, each with unique features to suit different business needs, from simple designs to more advanced customization.

1. Popular Tools for Small Businesses

For small businesses and freelancers who need straightforward, easy-to-use solutions, the following software options are ideal:

- FreshBooks: A cloud-based accounting software that allows users to quickly generate professional payment requests. It includes features like time tracking, expense management, and customizable designs.

- Wave: This free accounting software offers tools for creating and sending payment requests, along with other essential financial management features. It’s great for businesses looking for a cost-effective option.

- Zoho Invoice: A robust invoicing solution that lets you customize documents with your branding, automate reminders, and manage clients all in one place.

2. Advanced Options for Larger Businesses

For businesses that need more advanced features, such as batch invoicing, integration with other software tools, and additional payment processing options, consider these more sophisticated solutions:

- QuickBooks Online: A comprehensive accounting tool that offers powerful invoicing capabilities, including automated reminders, recurring billing, and deep customization options for large companies or teams.

- Invoicely: Ideal for businesses that need to handle large volumes of transactions, Invoicely allows for multiple users, bulk invoicing, and advanced reporting, making it a great choice for scaling businesses.

- Xero: Known for its robust financial features, Xero offers advanced invoicing with integration to various third-party apps, detailed reporting, and the ability to handle multiple currencies.

By selecting the right software, you can ensure your billing process is efficient, streamlined, and aligned with the needs of your business. Each of these tools offers a unique set of features that can help you manage transactions with ease while maintaining a professional appearance in all your communications.

Why Consistency in Billing Documents Matters

Maintaining consistency across all payment requests is essential for establishing a professional image and ensuring smooth transactions. A uniform approach to structuring and presenting these documents makes it easier for both you and your clients to understand the terms of the agreement. Consistent formatting not only enhances the overall experience but also helps prevent errors, miscommunication, and delays.

Professional Image: When your payment requests look the same every time, they send a clear message of organization and professionalism. Clients are more likely to trust businesses that present themselves consistently and with attention to detail. This trust can lead to faster payments and stronger client relationships.

Clarity and Readability: Consistent formatting allows for a smoother reading experience. When all your documents follow the same structure, clients can easily locate essential details such as amounts, deadlines, and payment methods. This clarity reduces the chances of confusion and misunderstandings.

Efficiency in Record-Keeping: Consistency makes it easier to track payments and manage records. Whether you’re organizing past transactions or preparing for tax season, having a uniform approach to payment requests simplifies the process of keeping everything in order.

Streamlined Workflow: A consistent design means less time spent making adjustments and ensuring accuracy. When the structure of your payment documents is pre-established, you can quickly generate new ones with minimal effort. This leads to increased efficiency and productivity.

In summary, consistency in your payment requests ensures that your business appears more professional, reduces the risk of confusion, and helps maintain an organized system for managing finances. By adhering to a consistent approach, you not only improve client relations but also streamline your internal processes.

Tips for Making Billing Documents Look Professional

A well-designed payment request can significantly impact how your business is perceived. Professional-looking documents help establish credibility and trust with your clients, ensuring that your business is taken seriously. Below are several tips to enhance the appearance of your payment requests and make them look polished and business-like.

- Use a Clean, Simple Layout: Keep your design uncluttered and easy to read. Use ample white space, clear headings, and organized sections to ensure that key information stands out. A minimalist approach often works best.

- Incorporate Your Branding: Make sure your company’s logo, colors, and fonts are present in the document. This not only reinforces your brand identity but also makes your documents easily recognizable to clients.

- Choose Professional Fonts: Stick to clean, legible fonts such as Arial, Helvetica, or Times New Roman. Avoid using too many different font styles, as this can make the document look unprofessional.

- Ensure Consistency: Maintain consistency in formatting across all your payment requests. Use the same layout, fonts, colors, and structure for every document to present a cohesive, professional appearance.

- Highlight Important Information: Make key details, such as the total amount due and payment terms, stand out by using bold text or larger font sizes. This draws attention to the most critical parts of the document.

- Double-Check for Accuracy: Ensure that all information, including contact details, amounts, and dates, is correct. A professional document is free of errors and inconsistencies, which can help avoid confusion or delays.

- Use High-Quality Paper (if printed): If you’re sending physical documents, use high-quality paper that reflects your business’s professionalism. The feel of the paper can make a lasting impression on your client.

By following these tips, you can elevate the appearance of your payment requests, giving them a polished and professional look that reflects well on your business and encourages timely payments.

Common Mistakes When Designing Billing Documents

Even though payment requests are essential for business transactions, many entrepreneurs make mistakes when preparing them. These errors can lead to confusion, delayed payments, or even damage to client relationships. Understanding the most common pitfalls can help you avoid them and ensure your payment documents are accurate, clear, and professional.

1. Missing or Incorrect Contact Information

One of the most basic yet critical mistakes is failing to include the correct contact details. Whether it’s your business information or your client’s, any inaccuracies can create delays or issues in communication.

- Incorrect Address or Email: Ensure that both your business and client’s contact details are up-to-date and accurate.

- Missing Phone Numbers: Including phone numbers makes it easier for clients to reach you if there are any issues with the payment.

2. Failing to Include Clear Payment Terms

Not specifying when the payment is due, what methods are acceptable, or if there are any late fees can create confusion and delays. Clear terms protect both parties and help avoid misunderstandings.

- Unclear Due Date: Always state an explicit due date for payment to set clear expectations.

- Payment Methods: Clearly mention the methods you accept (bank transfer, credit card, PayPal, etc.).

- Late Fees or Discounts: Specify any penalties for late payments or rewards for early payments to encourage prompt settlement.

3. Inconsistent Formatting

Inconsistent layout, fonts, or style can make your payment request look unprofessional and difficult to read. Consistency is key to maintaining a clear and trustworthy image for your business.

- Inconsistent Fonts or Colors: Stick to a limited number of fonts and colors for a cohesive design.

- Unorganized Sections: Ensure all relevant details (e.g., item descriptions, totals, payment terms) are grouped in a clear and logical order.

4. Incorrect Amounts or Calculations

Errors in amounts or calculations can result in trust issues with your clients. Always double-check your math to ensure accuracy and avoid confusion or disputes later.

- Misleading Totals: Ensure that the total amount due is clearly calculated, including taxes, discounts, or any additional fees.

- Missing Subtotals: List itemized subtotals and taxes to help clients understand how the final amount was determined.

5. Lack of Professional Branding

Failing to incorporate your business’s branding, such as a logo, color scheme, or tagline, can make your payment request look generic and unprofessional. A well-branded document not only reinforces your identity but also enhances your credibility.

- No Logo: Including your logo at the top makes the document look official and trustworthy.

- Unaligned Design: Ensure the layout reflects your c

How to Automate Billing Document Generation

Automating the generation of payment requests can save valuable time, reduce the risk of errors, and streamline your business’s financial operations. By using automated tools and systems, you can easily generate professional documents without having to manually input data every time. Automation ensures consistency, accuracy, and efficiency in handling transactions, especially when dealing with high volumes of clients or recurring services.

1. Use Accounting Software

Many accounting software solutions offer built-in features that automate the creation and delivery of payment requests. These tools can pull client information directly from your database and generate documents based on predefined criteria.

- Automated Data Entry: Once client details are entered into the system, the software can automatically fill in necessary fields such as names, addresses, and amounts due.

- Recurring Billing: For businesses that provide subscription-based services or regular deliveries, most software can set up automatic recurring requests at specified intervals.

- Integration with Payment Systems: Many systems integrate with online payment gateways, allowing clients to pay directly from the document, streamlining the entire process.

2. Implement Invoice Generation Tools

Several online tools and platforms specialize in automating the generation of payment requests. These platforms allow you to input client and transaction details once, then use this information to automatically generate new documents with a few clicks.

- Cloud-Based Solutions: Platforms like FreshBooks or Zoho Invoice can store data securely and automatically generate documents whenever a new transaction occurs.

- Predefined Templates: These tools allow you to design a document layout, then automatically populate fields such as item descriptions, quantities, and prices based on your database.

- Scheduled Reminders: Many tools can automatically send payment requests to clients on specific dates, ensuring that you never miss a deadline or forget to follow up.

3. Set Up Triggers and Workflows

Automating billing requires setting up triggers and workflows that determine when and how the documents are generated. These triggers can be set based on certain actions, such as completing a project or reaching a specific date in the billing cycle.

- Automated Triggers: For example, once a service is marked as completed, the system can automatically create a payment request.

- Workflow Integration: You can integrate automated billing into your workflow by using tools like Zapier, which can connect different software to trigger document creation and delivery based on specific actions.

4. Leverage Batch Processing

For businesses with multiple clients or large volumes of transactions, batch processing can speed up the process of generating payment documents. Instead of creating each document individually, batch processing allows you to generate multiple requests simultaneously.

- Bulk Billing: Software like QuickBooks and Xero allows users to generate and send multiple payment requests at once, saving time and reducing administrative overhead.

- Customizable Fields: Even in batch processing, you can customize fields for different clients, ensuring each request is tailored to the specific needs of the transaction.

By implementing automated systems and processes, you can simplify your billing procedures, ensure accuracy, and focus more on growing your business rather than getting bogged down with administrative tasks.

Ensuring Legal Compliance in Billing Documents

Ensuring that your payment requests meet legal standards is crucial for protecting your business and avoiding potential disputes. Legal requirements vary by country, region, and industry, but generally, there are key elements that every business must include to ensure their documents are compliant. Failing to adhere to these requirements could result in penalties, delayed payments, or even legal issues.

1. Include Required Information

There are several essential details that need to be included in any formal payment request to meet legal standards. These items help establish the legitimacy of the document and protect both parties involved in the transaction.

- Business Information: Include your full business name, address, and contact details, as well as your tax identification number (TIN) or employer identification number (EIN) if required by law.

- Client Information: Ensure that the client’s full name or business name, address, and contact details are included.

- Clear Payment Terms: Clearly state the payment due date, acceptable methods of payment, and any penalties for late payments, including interest rates or fees.

- Unique Reference Number: Use a unique reference number for each document to keep transactions organized and traceable for both your business and the client.

2. Adhere to Tax Regulations

Proper tax handling is one of the most important aspects of legal compliance. Depending on your location and the nature of your business, you may be required to include certain tax information on your documents.

- Tax Identification Numbers: Make sure that both your business and the client’s tax identification numbers (if applicable) are present on the document, especially in international transactions.

- Sales Tax or VAT: If your business is subject to sales tax or VAT, include the correct tax rate applied to the transaction. Clearly display the amount of tax charged, as well as the total including tax.

- Tax Exemptions: If any goods or services are exempt from tax, indicate this on the document and explain why the exemption applies, if necessary.

By ensuring that your billing documents comply with legal requirements, you not only avoid potential legal trouble but also foster transparency and trust with your clients. Legal compliance is a vital part of conducting business and helps protect both your business interests and your client relationships.

Personalized Billing Documents for Small Businesses

For small businesses, having personalized payment requests can enhance professionalism and help streamline financial processes. Tailoring these documents to reflect your business’s identity and meet specific client needs not only improves the overall client experience but also helps maintain consistency and efficiency in your operations. Whether you are working with a few clients or scaling up, a well-designed and consistent approach to financial documentation is essential for smooth business management.

1. Benefits of Tailoring Payment Documents

Personalizing your financial documents is more than just about design. It involves ensuring that the document aligns with your business model, client expectations, and legal requirements.

- Branding and Professionalism: Tailored documents allow small businesses to present a cohesive image. By including your logo, company colors, and consistent design elements, you create a professional impression that can increase client trust and boost brand recognition.

- Improved Client Relationships: By adapting your financial paperwork to suit client needs, you demonstrate attention to detail and a commitment to excellent service, which can foster long-term business relationships.

- Efficient Record Keeping: A personalized structure makes it easier to track and manage payments, reducing the risk of errors and simplifying the process of financial auditing.

2. Key Features for Small Business Payment Documents

While personalizing your financial documents, it’s important to ensure that certain essential components are always included. These elements help maintain clarity and ensure that transactions are processed efficiently.

- Clear Payment Instructions: Clearly state when the payment is due and the accepted methods of payment. This reduces confusion and ensures prompt payments.

- Itemized Breakdown: Providing a detailed list of goods or services rendered can prevent misunderstandings and allows clients to easily see what they are being charged for.

- Company and Client Details: Include all necessary business information, including contact details, tax identification numbers, and client addresses, as this helps maintain transparency and meet legal requirements.

- Legal Compliance: Ensure your documents include any mandatory tax information, payment terms, and other legal requirements specific to your location and industry.

For small businesses, personalized financial documents are an investment in professionalism, efficiency, and clarity. They not only improve internal processes but also play a key role in building strong, trust-based relationships with clients. By focusing on these essential features, you can ensure your billing system supports your growth while maintaining a high standard of service.

How to Save Time with Billing Document Formats

Efficient business management often involves optimizing repetitive tasks, and one of the most time-consuming activities is generating payment requests. By using predefined formats, you can save hours of work each week and focus more on growing your business. These ready-made structures allow you to quickly input transaction details, ensuring that your financial documents are both accurate and professional with minimal effort.

1. Reuse Pre-Formatted Structures

Using predefined designs allows you to save time by eliminating the need to start from scratch each time. With a consistent format in place, you can quickly fill in the necessary information for each new transaction.

- Quick Data Entry: When you have a pre-set structure, most fields, like client details and services rendered, are already in place. You only need to input new or updated information for each transaction.

- Consistency Across Documents: A standardized layout ensures that all documents look the same, helping your business appear professional and organized.

- Easy Adjustments: You can easily adjust specific details, like pricing or services, without needing to redesign the entire document each time.

2. Automate Repetitive Tasks

By leveraging tools that support predefined formats, you can automate many aspects of the document creation process. This reduces the manual workload, making the entire process faster and more reliable.

- Auto-Populating Fields: Many systems allow you to set up fields that auto-populate based on previously entered information, such as client contact details or previous transactions.

- Recurring Billing: If you offer subscription-based services, you can schedule payment requests to be automatically generated and sent to clients at set intervals, reducing the need for manual input.

- Integration with Accounting Systems: Linking your payment request system with accounting software can automatically pull transaction details and generate accurate, error-free documents without manual input.

By utilizing predefined formats, you can significantly reduce the time spent on creating financial documents. This approach not only increases productivity but also ensures that each document is consistent, professional, and compliant with your business needs.