Invoice Cover Letter Template for Clear and Professional Billing

Clear and professional communication is crucial when sending payment requests to clients. Including a well-written introductory message with your financial documents can help ensure timely processing and establish a strong, trustworthy relationship with your clients. A carefully crafted message can clarify the purpose of the document and make it easier for your clients to understand payment terms.

By using a structured and polite approach in your communication, you can reduce confusion and improve the likelihood of prompt payment. Whether you are a freelancer, a small business owner, or managing a larger company, having a reliable way to communicate payment details is essential. A well-organized document ensures that your request is taken seriously and professionally.

Tailoring your content to the needs of each client can make all the difference. Personalizing your approach based on the project or services rendered helps maintain a professional tone while also adding a touch of courtesy. The right words can go a long way in fostering positive working relationships and minimizing delays in payments.

Invoice Cover Letter Template Guide

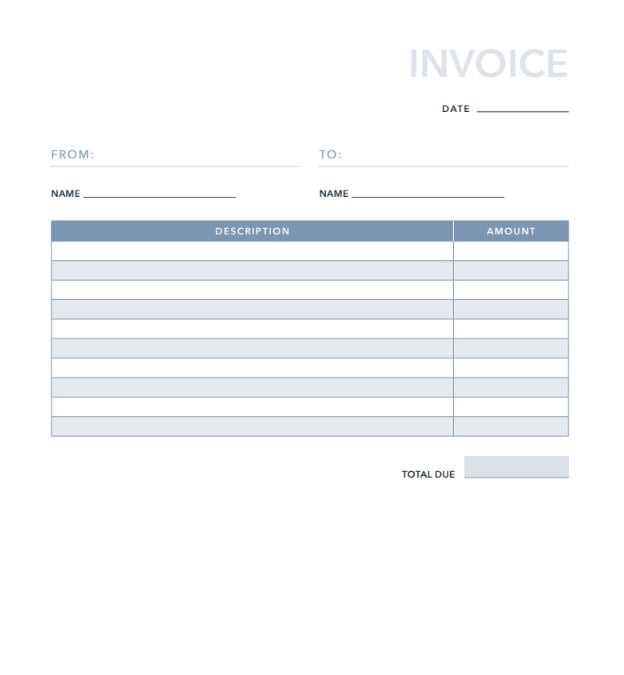

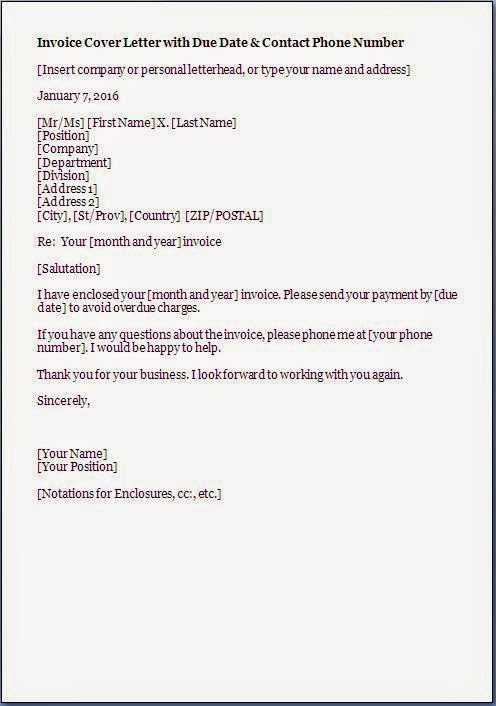

When sending a request for payment, it is important to accompany your billing document with a professional introduction. This message serves as a formal way to communicate the details of the charges, the terms of payment, and the expectations for a timely response. A well-constructed message ensures clarity and reduces the risk of confusion or delays in processing.

The structure of such a message should be clear, concise, and polite. Begin by addressing your client respectfully and providing a brief summary of the services or products provided. This sets the context for the request. Clearly state the amount due and outline the payment terms, including the due date and any late fees if applicable.

Key components of an effective message include a professional greeting, a summary of the transaction, payment instructions, and a polite closing. By following a consistent format, you make it easier for clients to understand and act on your request. Remember, a courteous tone and a clear, direct approach can help maintain strong business relationships.

For added professionalism, you can personalize the content to reflect the specific details of the project or your client’s preferences. This not only demonstrates attention to detail but also fosters a sense of trust and respect. A well-written introductory message makes your billing process smoother and more efficient for both parties.

Why Use an Invoice Cover Letter

Sending a formal message along with your billing documents serves as a professional way to communicate payment details and reinforce the terms of the agreement. This message ensures that the recipient clearly understands the charges, deadlines, and any other relevant conditions, reducing the likelihood of confusion or delays. It sets the tone for a professional relationship and facilitates a smoother transaction process.

By including a well-structured introduction, you make it easier for the recipient to review the charges and act promptly. This message helps to highlight key points such as the due date, payment methods, and any additional notes regarding the transaction. It also adds a layer of courtesy, showing that you value the client’s business and are organized in your communication.

Moreover, this form of communication can strengthen your reputation as a reliable and professional business partner. It offers an opportunity to remind clients of the agreed-upon terms while maintaining a positive and respectful tone. Overall, using such a message increases the chances of timely payments and reinforces the credibility of your business practices.

Key Elements of an Invoice Letter

A well-constructed payment request document includes several essential components to ensure clarity and professionalism. These elements provide the necessary information for the recipient to understand the terms of the payment, the amount due, and the next steps in the process. By including these key sections, you help prevent misunderstandings and ensure timely processing of the payment.

Professional Greeting and Introduction

Start by addressing the recipient politely and professionally. Begin with a greeting that reflects your business relationship. Follow with a brief introduction, providing context for the communication. For example, mention the services rendered or products delivered to remind the client of the transaction. This establishes the reason for the communication and sets the tone for the rest of the message.

Clear Payment Details and Terms

The most important section of any payment request is the clear presentation of the amount due and the terms of payment. Include the total amount, the due date, and any payment methods you accept. If necessary, outline any late fees or penalties for overdue payments. A well-organized and transparent breakdown ensures that the recipient understands exactly what is expected and by when.

Additional elements that can enhance your document include a reminder of the services or products provided, a polite closing statement, and any other relevant instructions. Be concise but thorough to maintain professionalism while avoiding unnecessary details.

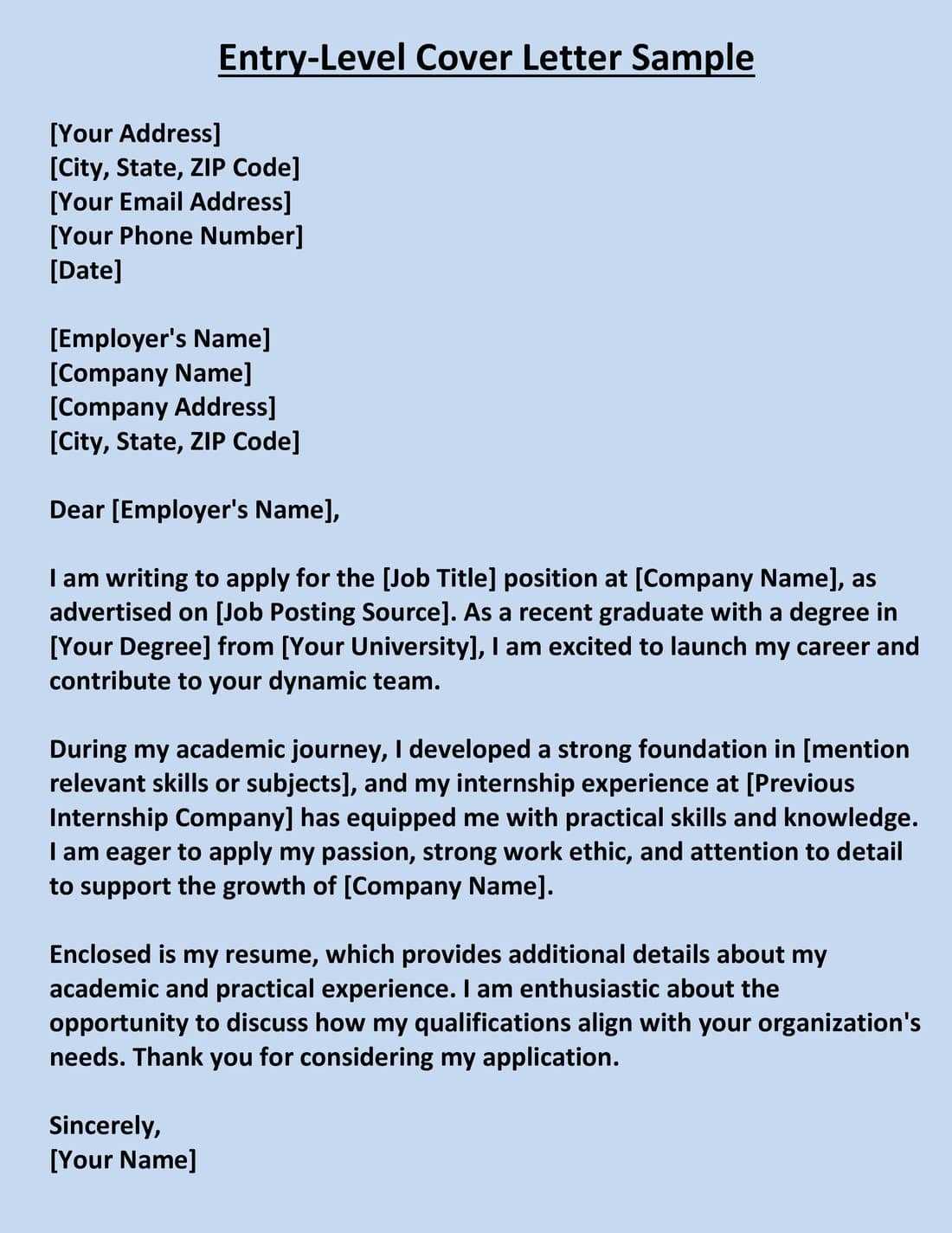

How to Customize Your Template

Adapting your payment request document to suit different clients or business situations is essential for maintaining a professional and personalized approach. Customization allows you to reflect the unique details of each transaction, helping to build trust and ensure that all relevant information is clearly communicated. Here’s how you can easily tailor your message to suit various needs.

- Personalize the Greeting: Address the recipient by name or use a specific salutation based on your relationship. This adds a personal touch and sets a respectful tone.

- Include Specific Transaction Details: Adjust the description of the services or products provided to reflect the current project. Be specific about what was delivered and the corresponding costs.

- Modify Payment Instructions: Different clients may prefer different payment methods or have specific requirements. Customize the payment details to reflect the most convenient option for each client.

- Adjust the Due Date: Ensure that the due date reflects the agreed-upon timeline for each client or project. If you offer flexible payment terms, make sure to specify them clearly.

By customizing these elements, you ensure that each message feels relevant and professionally tailored to your client’s needs. Personalization can also help resolve issues quickly, as it demonstrates that you’ve paid attention to the specifics of the transaction.

Additionally, you can make slight adjustments to the tone depending on the client’s preferences. For instance, a more formal approach may be appropriate for corporate clients, while a friendly tone may be suitable for long-term partners or smaller businesses.

Tips for Professional Invoice Letters

Crafting a polished and professional payment request document is crucial for maintaining positive relationships with clients and ensuring timely payments. A well-written communication reflects your business’s attention to detail and commitment to professionalism. Here are some key tips to help you enhance your communication and make a strong impression.

Maintain a Clear and Polite Tone

Whether you are sending a routine request or following up on a delayed payment, always keep the tone polite and respectful. A friendly yet professional tone helps foster goodwill while clearly communicating your expectations.

- Be concise: Avoid unnecessary information. Stick to the essential details of the transaction, such as the amount due and the payment terms.

- Use respectful language: Even if the payment is overdue, always address the recipient politely and with professionalism.

- Express gratitude: Thank your client for their business and for processing the payment promptly, even if it’s the first request.

Ensure Clarity and Accuracy

Accurate and transparent information is key to avoiding misunderstandings. Double-check all financial details and ensure the terms are clearly outlined. Being specific and organized helps to maintain professionalism.

- Double-check payment details: Ensure the amount due, payment methods, and any applicable deadlines are correct and easy to find.

- Highlight key information: Use bold or underlined text to emphasize important points like payment due dates and amounts.

- Proofread: Before sending, review the message for any spelling or grammatical errors that could affect your credibility.

By following these tips, you create a document that not only serves its purpose but also reflects your professionalism, helping to strengthen your business relationships and encourage timely payments.

Common Mistakes to Avoid

When preparing a payment request document, small errors can have a big impact on how your clients perceive your professionalism and on the likelihood of timely payment. Avoiding common mistakes is crucial to maintaining clear communication and ensuring a smooth transaction process. Here are some of the most frequent pitfalls to watch out for.

Incomplete or Incorrect Information

Providing incomplete or inaccurate details can cause confusion and delay payments. It’s important to double-check all information to ensure that your client fully understands the charges and terms.

- Missing payment details: Always include the total amount due, the due date, and acceptable payment methods.

- Wrong or outdated contact information: Make sure that your contact details are current and accurate in case the client needs to reach you.

- Incorrect payment terms: Double-check the agreed-upon payment schedule and ensure that it matches the terms outlined in your document.

Overly Complicated or Vague Language

Being too complex or vague in your communication can make it harder for the recipient to understand your request. The goal is to make the payment process as simple and clear as possible.

- Unclear instructions: Ensure that the payment method, due date, and any penalties for late payment are straightforward and easy to understand.

- Excessive jargon: Avoid using industry-specific terms that the client might not understand. Use simple, direct language instead.

- Overly detailed descriptions: While it’s important to provide context, too much detail can clutter the message and distract from the key points.

By steering clear of these mistakes, you ensure that your request is professional, clear, and easy for the client to act on, ultimately leading to a smoother and more efficient payment process.

How to Format an Invoice Cover Letter

Proper formatting plays a critical role in creating a clear, professional payment request. A well-organized document ensures that all relevant details are easy to find, which helps avoid confusion and promotes prompt payment. Here’s how to structure your communication effectively, so your client can quickly grasp the necessary information.

Basic Structure and Organization

The document should be divided into clear sections, with each one focusing on a specific piece of information. This helps the recipient process the content more efficiently. The key sections of your message typically include a formal introduction, details of the transaction, payment instructions, and a courteous closing.

- Introduction: Start with a professional greeting and a brief statement of the purpose of your message.

- Transaction details: Clearly state the services or products provided, along with any agreed-upon charges.

- Payment instructions: Include payment methods, due dates, and any penalties for overdue payments.

- Closing: Conclude with a polite expression of appreciation and an invitation for any questions.

Formatting Tips for Clarity

To enhance readability, focus on formatting that highlights key details and keeps the document clean. Use a simple and professional font, such as Arial or Times New Roman, and ensure consistent spacing throughout the message.

- Use headings and bullet points: Organize sections with headings, and use bullet points for lists of key information, such as payment terms or itemized charges.

- Bold important details: Highlight key information, like payment amounts and due dates, to make them stand out.

- Avoid clutter: Keep paragraphs short and concise to ensure that the message is easily digestible.

By following a clear and structured format, you improve the chances that your client will process your request accurately and promptly, leading to smoother business transactions.

Best Practices for Clear Communication

Effective communication is essential for ensuring that your payment requests are understood and acted upon quickly. Clear, concise, and professional messaging not only helps your clients understand what is expected but also reduces the risk of miscommunication, delays, or disputes. Following best practices for communication ensures that your messages are both efficient and courteous, leading to positive outcomes for both parties.

Be Concise and Direct

Avoid unnecessary complexity or over-explaining. Stick to the essential details, providing only the information that your recipient needs to know to process the payment. The more straightforward your message, the easier it will be for the client to act on it.

| Do | Don’t |

|---|---|

| Use short, clear sentences. | Overload the message with irrelevant information. |

| Include only necessary details like amounts, dates, and methods. | Write long paragraphs with unnecessary explanations. |

| Be straightforward with your expectations. | Be vague about the payment process or terms. |

Maintain a Professional and Respectful Tone

Even if you are requesting a payment or addressing a past-due situation, it’s important to keep your tone courteous and professional. Maintaining respect throughout your communication helps build trust and promotes a positive relationship with your clients.

- Use formal greetings: Address your recipient respectfully, especially in initial communications.

- Be polite but firm: Clearly state what is required, but avoid sounding demanding or harsh.

- Show appreciation: Always thank your client for their business or timely action when appropriate.

By applying these best practices, you create a clear and professional payment request that encourages positive responses and timely action from your clients.

How to Request Payment in Your Letter

When requesting payment from a client, it’s essential to communicate clearly and professionally. Your message should clearly state the amount due, the payment methods, and the due date, while maintaining a polite and respectful tone. This ensures that your client knows exactly what is expected of them and can easily fulfill their obligation without confusion or delay.

Here are the key elements to include when requesting payment, as well as examples of how to phrase your request effectively:

| Key Element | Example Request |

|---|---|

| Amount Due | “The total amount due for services rendered is $500.00.” |

| Due Date | “Please make the payment by the end of the month, November 30, 2024.” |

| Payment Methods | “Payments can be made via bank transfer, PayPal, or credit card.” |

| Late Fees (if applicable) | “A late fee of 5% will be applied to any payments received after the due date.” |

| Contact for Questions | “If you have any questions regarding this request, feel free to contact me at [your email or phone number].” |

By using clear, direct language and highlighting the key details, you help ensure that your client understands the payment requirements and can process it without any confusion. Always make sure to be polite, but firm, in your tone, and provide all necessary information to avoid delays in the payment process.

When to Send an Invoice Cover Letter

Timing plays a key role when it comes to sending a formal payment request. Knowing when to send your communication ensures that your client has enough time to process the payment while maintaining professionalism. Sending it too early may lead to confusion, while sending it too late could delay the payment or give the impression of disorganization. Here’s how to determine the best time to send your message.

Immediately after completing the work or delivering the product is typically the most appropriate time to send the payment request. This ensures that your client receives the document while the details of the transaction are still fresh in their mind. For ongoing projects or repeat clients, sending the request promptly after each milestone or delivery helps maintain a smooth cash flow.

If the agreed-upon payment terms include a specific due date, send your request a few days in advance to remind your client and give them time to review the document. This proactive approach can prevent delays and show that you are organized and on top of your business dealings.

For overdue payments, follow up with a polite reminder once the payment due date has passed. It’s important to wait for the agreed-upon grace period before sending a reminder, but timely follow-ups are critical to ensuring that payments are collected efficiently. Always maintain a professional tone, even when addressing overdue accounts, as this preserves the relationship with your client while encouraging prompt action.

Sending your communication at the right moment demonstrates your professionalism and helps to ensure that your business operations run smoothly.

Legal Considerations for Invoice Letters

When preparing a formal request for payment, it’s important to be aware of the legal aspects involved. A payment request document can serve as an important piece of evidence in case of disputes, so ensuring that it adheres to legal standards can help protect your business. Understanding the requirements for clear terms, deadlines, and conditions will help avoid potential legal issues and make your communication more enforceable if needed.

Ensure Clear Terms and Conditions

One of the most important legal considerations is the inclusion of clear terms and conditions. These should outline the specifics of the transaction, including the agreed-upon amount, payment methods, deadlines, and any penalties for late payment. If these terms are part of a contract, it’s essential that they match the terms outlined in your formal payment request.

- Payment Due Date: Clearly state when the payment is due to avoid confusion. Specify whether it’s due on a particular day or within a certain number of days after the services or goods have been delivered.

- Late Payment Fees: If you have terms that include late fees or interest on overdue payments, make sure these are clearly communicated in the message.

- Accepted Payment Methods: Specify which methods of payment are accepted to avoid misunderstandings and ensure that clients are aware of how to remit payment.

Maintain Professional and Legal Tone

While it is important to be firm about the payment request, the tone should always remain professional and respectful. This not only helps maintain a good relationship with the client but can also be important from a legal perspective. Threatening language or overly harsh demands could be construed as unprofessional and potentially damaging to your business’s reputation.

- Avoid Harassment: Repeated, harassing communication can lead to legal issues. Ensure that any follow-up reminders are respectful and reasonable.

- Comply with Consumer Protection Laws: Familiarize yourself with any local or international laws regarding consumer rights. Ensure that your communication complies with relevant regulations concerning billing and payment requests.

By addressing these legal considerations and making sure your payment request is clear, professional, and in compliance with relevant laws, you protect both your business and your client relationships.

How to Address Clients Professionally

Addressing clients professionally is a cornerstone of building strong business relationships. Whether you’re sending a payment request or responding to an inquiry, how you communicate with clients can have a lasting impact on your brand’s reputation. A respectful, clear, and courteous approach fosters trust and shows that you value the relationship. Here’s how to address clients in a way that reflects professionalism and enhances your business interactions.

Use Appropriate Salutations

Starting your communication with the right salutation sets the tone for the entire message. Whether you’re writing to a long-term client or a new one, a polite and respectful greeting ensures that the recipient feels valued.

- Formal Greetings: When addressing new or formal clients, it’s best to use titles and last names. For example, “Dear Mr. Smith” or “Hello Dr. Johnson.”

- Casual Greetings: For clients you have a closer relationship with, using first names is acceptable, but always ensure the tone remains respectful, such as “Hi John” or “Hello Sarah.”

- General Greetings: If you’re unsure of the recipient’s name, use a professional greeting such as “Dear Customer” or “Hello [Company Name] Team.”

Maintain a Polite and Respectful Tone

Regardless of the nature of your message, it’s important to maintain a tone of professionalism throughout the communication. Even when discussing payment terms, delays, or issues, staying polite and respectful helps foster goodwill and ensures that the conversation remains positive.

- Be Courteous: Always thank your client for their business and express appreciation for their time. Phrases like “Thank you for your continued partnership” or “We value your business” can strengthen the relationship.

- Stay Positive: Use language that focuses on solutions and cooperation. For instance, instead of saying “You haven’t paid yet,” say “We would appreciate your timely payment for the outstanding balance.”

- Be Clear and Direct: Ensure that your message is easily understood by avoiding overly complex language or jargon. Clear communication helps prevent confusion and delays.

By using appropriate salutations, maintaining a polite tone, and ensuring clarity in your communication, you demonstrate professionalism and respect, which is vital for nurturing long-term client relationships.

Using Templates for Efficiency

Utilizing pre-designed documents can significantly streamline your workflow, especially when you regularly need to send formal requests for payment. Templates allow you to maintain consistency, save time, and reduce the chances of errors in your communication. By creating or using an existing layout, you can focus on personalizing the content without starting from scratch each time.

Benefits of Using Pre-Designed Documents

One of the key advantages of using a standardized format is that it helps ensure all the necessary elements are included in every request. Whether you’re sending a payment reminder or a request after completing a service, having a reliable structure guarantees that important details like amounts due, due dates, and payment methods are never overlooked.

- Time-Saving: Templates allow you to prepare and send requests quickly without re-entering the same information every time.

- Consistency: Using a standard format ensures that all your documents have a professional appearance, making your business look more organized and reliable.

- Minimized Errors: When you use a template, you reduce the risk of forgetting key information, which can often happen when creating documents from scratch.

How to Customize for Specific Needs

While templates are great for efficiency, customization is essential to make each communication feel personal and relevant to the client. Adjust the details to reflect the specific terms of the transaction or any special agreements you have in place. This ensures that your client feels the document is tailored to their situation.

- Adjust Dates and Amounts: Make sure the payment amount, due date, and any special terms are accurately updated for each client.

- Add Personal Notes: Include a brief, personalized message if needed, thanking the client for their business or reminding them of special terms.

By combining the efficiency of templates with the personal touch of customization, you can create professional, accurate, and timely communication that strengthens client relationships and improves the payment process.

Invoice Cover Letters for Different Industries

Each industry has its own specific requirements and expectations when it comes to formal requests for payment. Understanding these nuances allows businesses to tailor their communication, ensuring that it resonates with clients in a way that’s both professional and effective. Whether you’re in the service, creative, or retail industry, customizing your payment requests according to the field you operate in can improve response times and build stronger client relationships.

1. Creative and Design Industries

In creative fields like graphic design, web development, or writing, clients often value personalized communication. Payment requests in these industries should not only be clear but should also reflect the creative nature of the business. Here’s what to consider:

- Showcase Creativity: While professionalism is key, don’t hesitate to reflect your creative style in your communication. For example, a unique design for the payment request or a creative header can leave a positive impression.

- Provide Detailed Breakdowns: Clients in the creative industry may want a breakdown of hours worked or specific deliverables. Ensure that your request is clear about what services were provided.

- Maintain a Friendly Tone: While remaining professional, a slightly more casual or friendly tone can be effective, as clients often appreciate a personal touch in creative fields.

2. Consulting and Professional Services

Consulting and professional services require more formal, structured communication. Here, your payment requests should emphasize clarity and transparency, outlining the services rendered and agreed-upon terms. Consider the following:

- Clearly Outline Services: Break down the work you’ve done in specific terms that clients can easily review. This transparency helps in building trust and reducing confusion.

- Professional and Formal Tone: A formal tone is important in industries like consulting or legal services, as it reflects the seriousness of the work.

- Reference Contracts: It’s helpful to refer to the terms of your agreement or contract, reinforcing that the request aligns with the previously agreed-upon conditions.

3. Retail and E-commerce

In retail and e-commerce, payment requests are typically more transactional. However, even in these cases, clear and polite communication is essential. Here’s what to keep in mind:

- Be Direct and Precise: Customers in retail expect quick and direct information. Provide a clear summary of the products or services purchased, the total due, and the payment terms.

- Highlight Payment Methods: Since online purchases may involve multiple payment options, ensure you clearly state which methods are accepted.

- Use Friendly Language: Even though the tone can be direct, it should still be warm and customer-oriented. A friendly sign-off like “Thank you for your business” adds a personal touch.

4. Construction and Contracting

In industries like construction, clear and detailed payment requests are essential due to the complexity of the projects and long timelines. Ensure that all work completed is properly itemized:

- Break Down the Work:

Incorporating Personalization in Letters

Personalization plays a crucial role in making business communications feel more genuine and thoughtful. When sending formal payment requests or similar documents, adding personalized touches can help strengthen your relationship with clients. It shows that you are attentive to their specific needs and values the business they provide. Simple adjustments to the tone, content, and structure can make your message stand out and foster goodwill.

Key Ways to Personalize Your Communication

There are several ways to incorporate personalization into your formal messages that go beyond just addressing the client by name. Here are a few strategies to make your communications more engaging and tailored:

- Use the Client’s Name: Always address your client by their first name or full name (depending on the level of formality), rather than using generic terms like “Dear Customer.” This simple gesture helps build rapport.

- Reference Previous Interactions: If you’ve worked with the client before, referencing past projects or conversations can create a sense of continuity. For example, “It was a pleasure working with you on the last project, and I look forward to continuing our collaboration.”

- Custom Content Based on the Client’s Business: If relevant, mention something specific about the client’s business or industry. For instance, if you know they’ve recently expanded, you could say, “Congratulations on the recent expansion of your business, and thank you for trusting us with this project.”

Making Your Message Relevant

Personalizing your message also means aligning it with your client’s specific needs, payment schedule, and previous agreements. Tailor the document’s content to show that you understand their unique situation:

- Use Relevant Terms and Conditions: If the client has specific payment terms or agreements, make sure to refer to them directly. This not only shows attentiveness but also helps avoid confusion.

- Offer Custom Payment Options: If applicable, suggest personalized payment methods or flexible terms based on your history with the client. This can be especially important for long-term clients.

- Show Appreciation: Acknowledge their loyalty or ongoing partnership. A simple statement such as “We truly appreciate your continued business” can make a big impact.

By incorporating these elements of personalization, you make your communications feel more thoughtful and considerate, which can enhance your professional relationship with clients. Personal touches show that you value them as individuals and not just as business transactions, ultimately leading to stronger partnerships.

Building Trust with Your Clients

Trust is the foundation of any successful business relationship. It is essential for clients to feel confident in the services or products you provide, as well as in your professional integrity. Establishing and maintaining trust is a gradual process that involves consistent communication, transparency, and reliability. When you build trust with your clients, it not only strengthens your current relationship but also encourages long-term loyalty and positive referrals.

1. Communicate Clearly and Honestly

Clear communication is crucial in any professional setting. Clients should always know what to expect from you, whether it’s regarding timelines, pricing, or services provided. Being transparent about what is included in a service or project scope can prevent misunderstandings and avoid frustrations later on. When there are issues or delays, it’s important to be open about the situation and provide realistic solutions. Here’s how to foster trust through communication:

- Be Transparent: Always communicate any potential issues or changes upfront. If there is a delay or a complication, let your client know immediately with a clear explanation and a plan to address the issue.

- Clarify Terms: Make sure the terms of agreements, payment schedules, and any other expectations are clearly outlined and agreed upon in advance to avoid confusion.

- Respond Promptly: Timely responses show your clients that you value their time and business. Whether it’s a follow-up email or addressing an inquiry, quick and thoughtful replies help build credibility.

2. Consistently Deliver Quality and Service

To maintain trust, it’s crucial that you consistently deliver on your promises. Meeting deadlines, staying within budget, and providing the level of quality that clients expect are all important aspects of trust-building. However, you can take it a step further by going above and beyond when possible. Small acts of exceeding expectations, such as offering additional insights or suggesting improvements, can demonstrate your commitment to your client’s success.

- Stick to Deadlines: If you’ve committed to a particular deadline, make sure to meet it. If unforeseen circumstances arise, inform the client in advance and work together to find an alternative solution.

- Provide High-Quality Work: Always ensure that the work you deliver meets or exceeds the quality standards you’ve outlined in the agreement. Consistently high-quality results help solidify your reputation as a reliable partner.

- Be Proactive: Anticipate your clients’ needs and offer proactive solutions. Clients will appreciate when you address potential challenges before they even arise, showing your attentiveness to their business.

By combining clear, honest communication with consistent high-quality service, you can foster trust that will lead to stronger relationships and more successful business outcomes. Trust is not built overnight, but with effort and dedication, you can create lasting partnerships with your clients.

How to Follow Up on Unpaid Invoices

Following up on outstanding payments is an essential part of maintaining healthy cash flow for your business. It can be uncomfortable, but it’s a necessary task to ensure that your business continues to thrive. A well-crafted follow-up can maintain professionalism while encouraging timely payments. Knowing how to approach overdue payments in a polite yet firm manner helps you keep good relationships with clients while ensuring that your financials are on track.

1. Send a Polite Reminder

Sometimes clients simply forget about payments due. Sending a gentle reminder can be a good first step. The tone should be polite and respectful while providing clear details about the outstanding balance. Here’s how to get it right:

- Be Courteous: Start your reminder by thanking the client for their business and expressing understanding that they might have missed the payment deadline.

- State the Facts: Clearly state the amount due, the original due date, and any payment terms previously agreed upon.

- Provide Payment Details: Include all necessary payment information, such as bank account details, online payment links, or other payment options to make it easy for the client to pay.

2. Follow Up with a Formal Request

If your initial reminder does not result in payment, a more formal follow-up might be needed. In this message, you should reiterate the outstanding balance and request a response or payment within a specific time frame. Here are the key elements to include:

- Express Urgency: Politely but firmly emphasize the importance of timely payment and the impact of any further delay on your business.

- Reiterate the Terms: Refer to any previous agreements, including the payment terms and deadlines, to reinforce your expectations.

- Offer Assistance: Sometimes clients may have issues with the payment process. Offering assistance or flexibility with payment methods can be helpful.

3. Use a Phone Call for Direct Communication

If the matter remains unresolved after sending formal emails, consider following up with a direct phone call. Speaking to the client personally can often be more effective in resolving issues. Here’s how to handle this approach:

- Be Professional: Maintain a calm and professional tone. Start by asking if there were any issues with the payment process or if they need more time.

- Reconfirm Details: Go over the payment details with the client during the call and ask if there are any issues on their end that might have delayed the payment.

- Offer Solutions: If necessary, suggest a payment plan or alternative payment methods to make the process smoother for the client.

4. Set Clear Consequences for Non-Payment

If the client continues to delay payment, it may be necessary to set clear consequences. This is the final step before more s

Improving Cash Flow with Invoice Letters

Effective management of payment communications can significantly improve your business’s cash flow. Ensuring that clients receive clear, timely, and professional payment reminders can speed up the process of receiving funds and reduce the time it takes for invoices to be settled. A well-crafted document not only ensures clarity but also builds a positive relationship with clients, encouraging prompt payments. By streamlining communication and setting expectations upfront, you can improve your business’s financial stability and minimize delays in cash inflow.

Key Factors for Improving Cash Flow

To maximize the impact of payment reminders on your cash flow, there are several important strategies to incorporate into your communications. These elements help reduce the risk of delayed payments and ensure that your financial operations remain steady:

Factor Explanation Clear Payment Terms Clearly state payment deadlines, terms, and methods in your initial agreements and subsequent reminders. The more transparent you are, the less room there is for confusion or delays. Timely Reminders Send reminders as soon as the due date approaches and again once the payment is overdue. Regular follow-ups encourage clients to prioritize your payments. Flexible Payment Options Offer various payment methods to accommodate clients. Providing multiple options, such as online payments, bank transfers, or credit card payments, makes it easier for clients to settle balances promptly. Early Payment Incentives Consider offering a small discount or incentive for clients who pay early. This can encourage faster payments and improve cash flow by motivating clients to act quickly. Professional Tone Maintain a professional and courteous tone in your communications. A respectful tone increases the likelihood that clients will respond positively to your payment requests. By integrating these factors into your payment communication, you can enhance the likelihood of timely payments, ultimately boosting your cash flow. Consistency in your approach ensures that clients understand the importance of prompt payment and the benefits of maintaining a reliable relationship with your business.