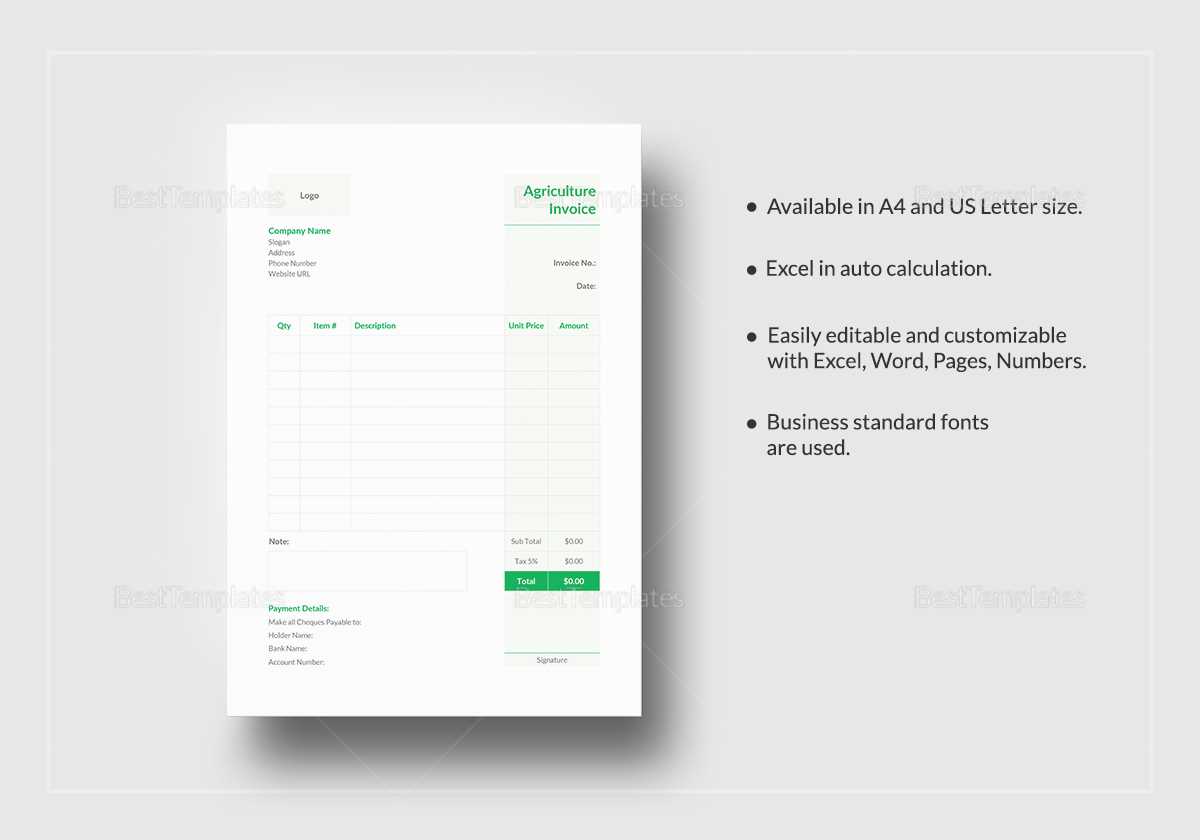

Farm Invoice Template for Efficient Billing and Record Keeping

When running an agricultural business, proper billing is essential to maintain financial stability and ensure smooth transactions. A well-organized document for requesting payment not only helps in keeping records but also projects a professional image to clients. Clear and accurate billing is crucial in managing your business’s cash flow and ensuring that all transactions are transparent.

In this guide, we will explore how to create and utilize a customizable document for your business needs. Whether you are selling produce, livestock, or other goods, having a structured approach to payment requests can save time and reduce errors. From including key details to formatting for clarity, the right document can streamline your entire process.

Understanding the structure and practical use of such documents will help you avoid common mistakes and increase efficiency. We’ll walk through the essential components to include, how to customize it to fit different business scenarios, and provide tips for using technology to simplify your workflow.

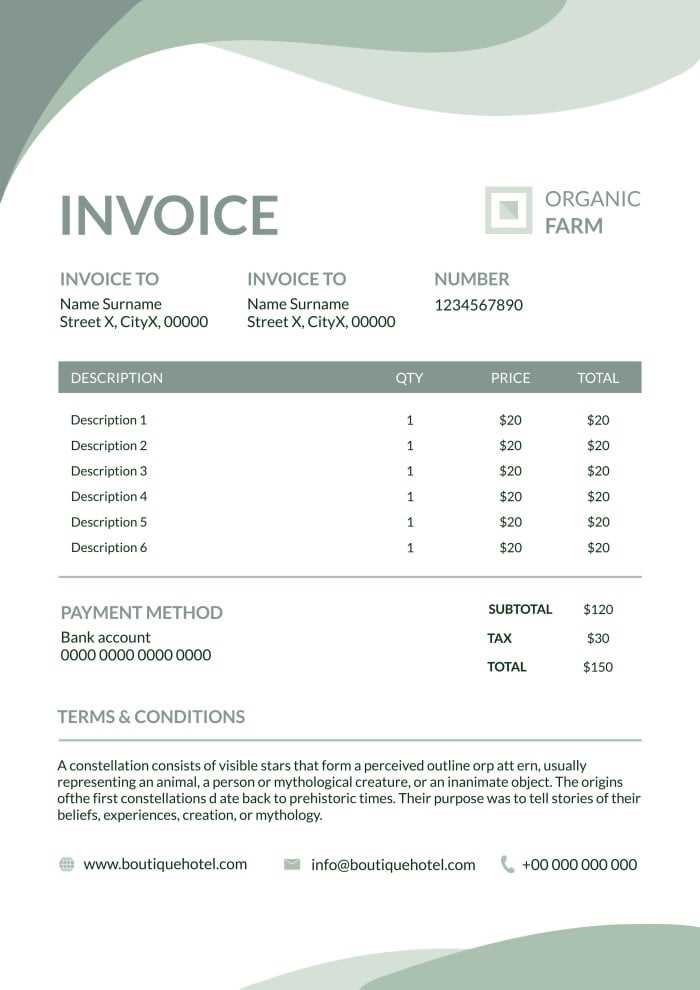

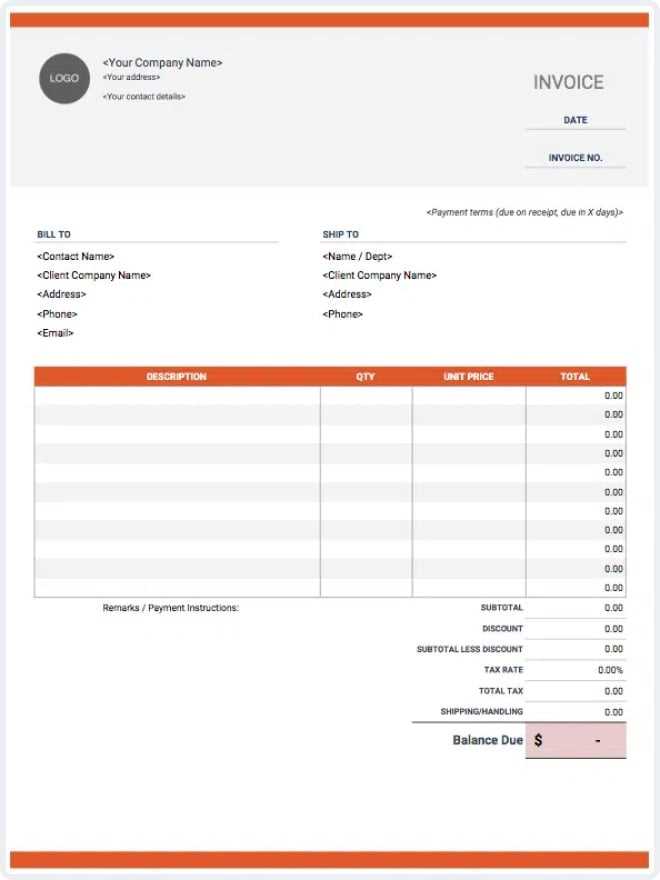

Farm Invoice Template Overview

Creating an effective billing document is essential for any agricultural operation. This document serves as the formal request for payment, helping to maintain transparency and organization in financial transactions. By structuring it properly, you ensure that all critical details are included, reducing confusion for both you and your clients. It’s more than just a request for money–it’s a record of the goods or services provided and serves as proof of the transaction.

Key Features of a Billing Document

There are several elements that make up a well-organized request for payment. These components ensure that the transaction is clearly documented and can be easily understood by both parties. The most important features include:

| Feature | Description |

|---|---|

| Header Information | Includes business name, address, and contact details for both the seller and the buyer. |

| Itemized List | A breakdown of goods or services provided, with quantities, descriptions, and unit prices. |

| Total Amount Due | The sum of all charges, including any applicable taxes or discounts. |

| Payment Terms | Specifies when payment is due and acceptable methods of payment. |

Why Use a Structured Billing Document?

A structured document not only ensures that all required details are included but also helps in keeping your records organized. By using a consistent format, you can save time and reduce errors when managing multiple transactions. Additionally, having a standardized approach enhances professionalism, which can strengthen relationships with your customers. It also facilitates easier tracking of payments and can be essential for tax reporting purposes.

Why You Need a Farm Invoice

For any agricultural business, ensuring clear and organized billing is crucial for maintaining cash flow and fostering trust with clients. A structured document that requests payment provides a formal record of transactions, helping both the seller and buyer understand the terms of the sale. Without such a system, it’s easy for important details to be overlooked, leading to confusion or disputes down the line.

Having a standardized payment request form in place ensures that all necessary information is communicated effectively. It serves as an essential tool for managing finances, tracking sales, and maintaining professional relationships. Whether you’re selling crops, livestock, or other products, this document provides clarity and reduces the risk of errors or misunderstandings.

Benefits of Using a Payment Request

There are several key reasons why it’s beneficial to adopt a well-structured billing document for your agricultural transactions:

| Benefit | Description |

|---|---|

| Clarity | Clearly outlines the goods or services provided, ensuring both parties agree on what was sold. |

| Financial Organization | Helps in tracking sales and payments, ensuring smooth cash flow management. |

| Professionalism | Displays a polished, professional approach to business, building trust with clients. |

| Legal Protection | Acts as a legal document in case of disputes or for tax and accounting purposes. |

By using a consistent and formalized document to request payment, agricultural businesses can reduce errors, increase efficiency, and maintain better control over their financial transactions. It’s not just a formality; it’s a critical tool for sustaining and growing your business.

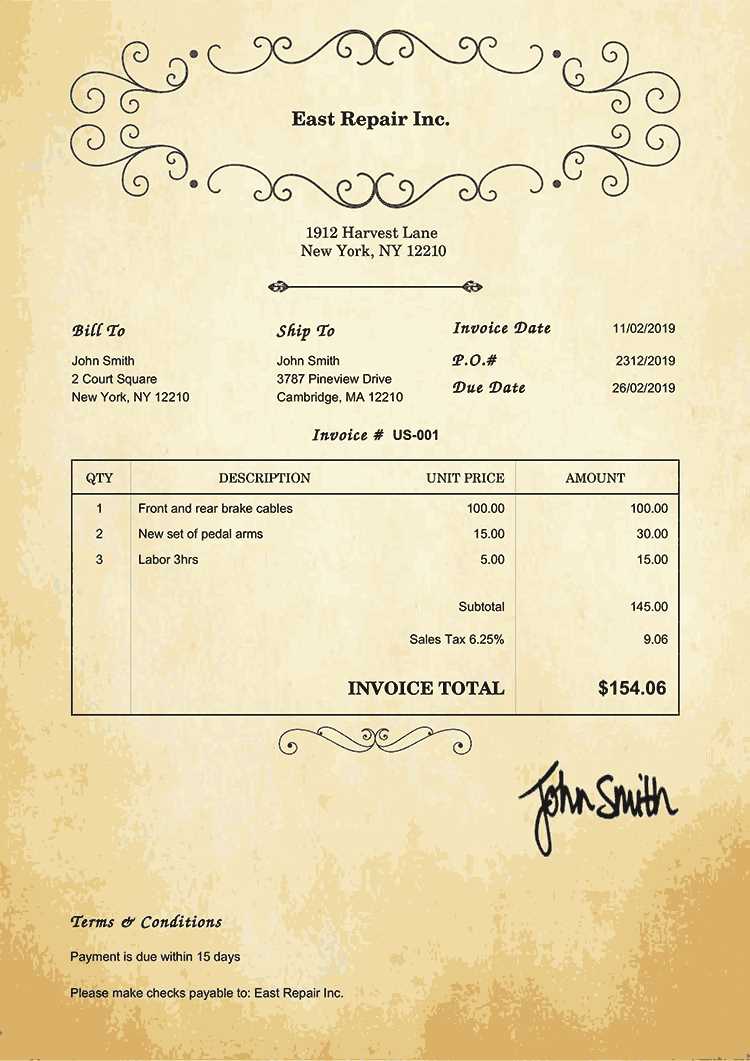

Key Elements of a Farm Invoice

For a payment request document to be effective, it must contain several key components. These essential elements ensure that the transaction is clear, legally sound, and easy to process for both the seller and the buyer. A well-structured payment request not only facilitates communication but also reduces the chances of mistakes or confusion down the line.

Every document requesting payment should include detailed information about the transaction. From the identification of both parties to a comprehensive breakdown of the goods or services provided, the accuracy and clarity of each element are crucial. Let’s explore the key components that should always be included to make sure your request for payment is complete and professional.

| Element | Description |

|---|---|

| Header Information | Includes the business name, contact details, and the recipient’s information for easy identification. |

| Itemized List | A detailed description of each item sold or service rendered, along with the quantity and price per unit. |

| Amount Due | The total amount for all items or services, including taxes, discounts, and additional charges. |

| Payment Terms | Specifies when payment is due and any penalties for late payments, along with accepted payment methods. |

| Unique Identifier | A reference number or code to track the document and match it with payments and records. |

Each of these elements serves a distinct purpose, ensuring that both the seller and buyer are on the same page regarding the terms of the sale. By including all necessary details, you protect your business and make the payment process as smooth and transparent as possible.

Customizing Your Farm Invoice Template

When it comes to managing payments, customizing the document you use for transactions is essential for reflecting your unique business needs. A personalized document not only improves clarity but also helps streamline your billing process, making it easier for both you and your clients. Tailoring the structure allows you to align it with the specific products or services you offer, ensuring all relevant details are included and presented professionally.

Customizing the document goes beyond just adding your logo. It involves adjusting the format, layout, and content to suit your operational style. This includes modifying fields, adding custom terms, and adjusting the appearance to reflect your brand. In this section, we’ll explore how to make this document work best for your agricultural business.

Adjusting the Layout and Structure

The first step in personalizing your payment request form is deciding on the layout that works best for your operations. For example, if you regularly sell multiple products in a single transaction, having a clear itemized list section is essential. You may also want to make sure that the document highlights the most critical details, such as the due date and payment terms, so they stand out.

Including Custom Terms and Conditions

Another important aspect of customization is incorporating specific terms and conditions that align with your business practices. Whether it’s setting up payment plans, including early payment discounts, or specifying the consequences of late payments, tailoring this section ensures that clients are fully aware of your expectations. By being clear on these terms upfront, you can prevent misunderstandings and protect your business interests.

Personalizing your payment request document can save you time and ensure that all important details are captured in a format that’s easy for your clients to read and understand. This simple step can enhance professionalism and improve the efficiency of your billing process.

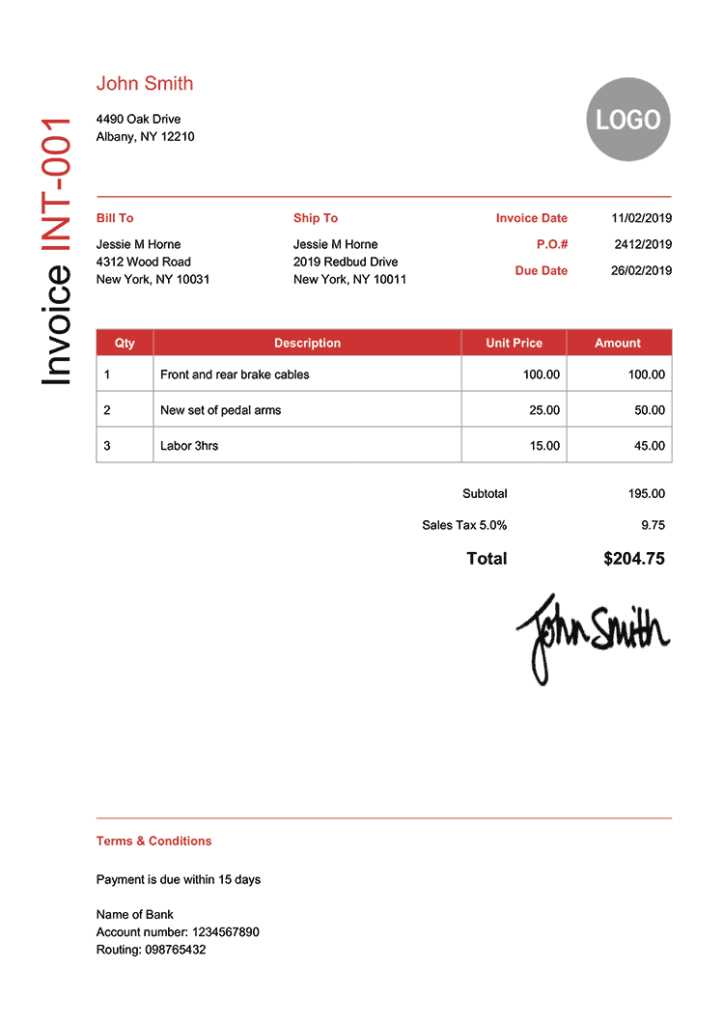

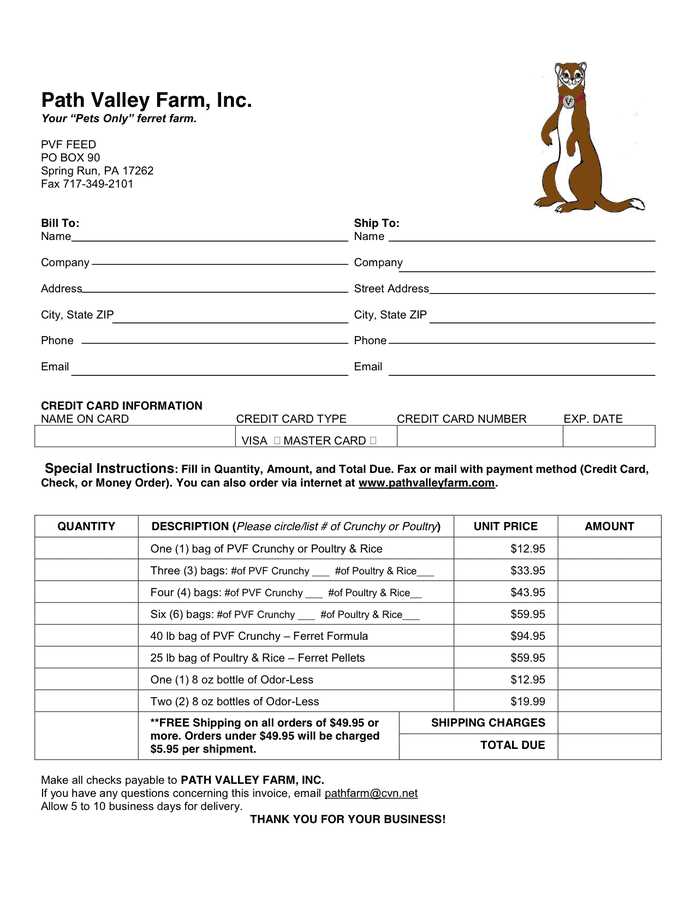

How to Create a Farm Invoice

Creating an effective payment request document is a simple process that requires careful attention to detail. By following a step-by-step approach, you can ensure that all necessary components are included, making the transaction clear and professional. This document not only helps you request payment but also serves as a record for both you and your client, making it an essential tool for managing your business’s finances.

The process of creating this document starts with understanding the essential elements that need to be included. From adding the right contact details to providing an itemized list of products or services, each part plays a vital role in ensuring the document is complete and accurate. Here’s a breakdown of the steps you need to follow to create a comprehensive payment request.

Step-by-Step Guide to Creating a Payment Request

Follow these simple steps to craft an accurate and clear request for payment:

| Step | Description |

|---|---|

| 1. Add Header Information | Include your business name, contact information, and the recipient’s details (name, address, etc.). |

| 2. List Products or Services | Provide a detailed list of items sold or services rendered, including quantities, descriptions, and unit prices. |

| 3. Calculate Total Amount | Sum up the cost of the products or services and add any applicable taxes or discounts. |

| 4. Set Payment Terms | Clearly state when payment is due and specify the accepted methods of payment (e.g., bank transfer, check, online payment). |

| 5. Include a Unique Reference Number | Assign a unique number or code to each request to keep track of the transaction for future reference. |

Finalizing and Sending the Document

Once all the necessary information is included, review the document for accuracy. Check that all amounts are correct and that the details match the actual transaction. After confirming the details, you can either print the document and send it by mail or send it electronically via email or an online payment system. Be sure to keep a copy for your records as well.

By following these steps, you can easily create a prof

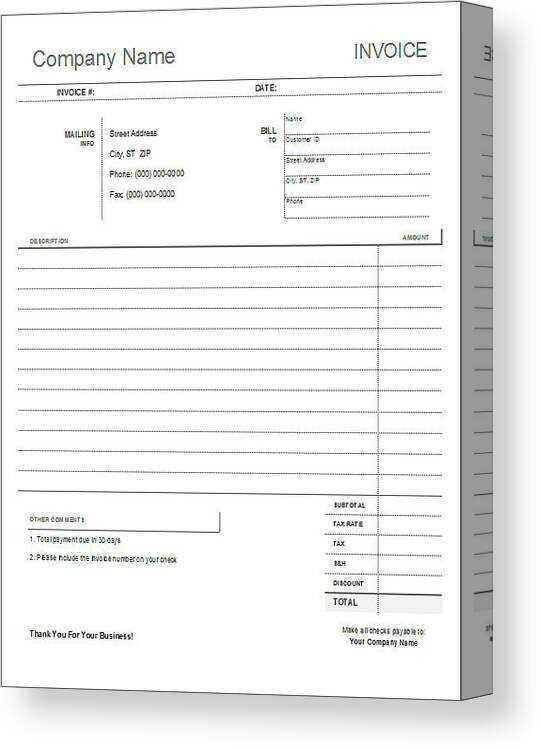

Choosing the Right Invoice Format

Selecting the appropriate format for your payment request document is crucial for ensuring clarity and professionalism. The format you choose directly impacts how easy it is for both you and your client to process the transaction. A well-organized document improves communication, reduces errors, and makes it easier to track payments and manage finances.

When choosing a format, consider the nature of your business, the number of transactions you handle, and the level of detail you need to provide. There are various options available, from simple forms for one-time sales to more complex layouts for recurring transactions. Selecting the right style will make the billing process more efficient and reduce administrative overhead.

Factors to Consider When Choosing a Format

Before settling on a specific design, take time to assess the following factors:

- Transaction Volume: If you handle a high volume of sales, consider a format that is easy to update and automate, such as using software or digital platforms.

- Item Complexity: If your business involves selling multiple products or services in one transaction, a more detailed format with itemized descriptions may be necessary.

- Customization Needs: Determine if you need to include additional sections like payment terms, discounts, or shipping charges, which could influence the layout.

Popular Formats for Payment Request Documents

There are several common formats you can choose from, depending on your business requirements:

| Format | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Simple Layout | Basic format with minimal details. Suitable for one-time sales or small businesses with few products or services. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Itemized Layout | Detailed format that lists each product or service separat

Top Tools for Farm InvoicesUsing the right tools for creating and managing payment requests can save significant time and effort. With the variety of software and online platforms available today, you can streamline your billing process, automate tasks, and reduce errors. The right tool helps you create professional-looking documents quickly, track payments, and manage records efficiently, all while keeping your operations organized. There are several options tailored to businesses of all sizes, from basic document generators to full-fledged accounting systems. Selecting the right tool depends on your needs, such as the volume of transactions, your preferred level of customization, and your budget. Below are some of the most effective tools for managing payment requests and business finances. Popular Software SolutionsThese tools offer comprehensive features that help you automate and simplify the process of generating and tracking payment requests:

Online Platforms for Simple BillingIf you need a more straightforward solution with less complexity, these tools are ideal for creating and sending payment requests without the need for advanced accounting features:

Each of these tools offers unique features to help simplify your bil Common Mistakes in Farm InvoicesEven with the best intentions, mistakes can happen when creating payment requests. These errors can lead to confusion, delayed payments, or even damage to your professional reputation. Understanding the most common pitfalls will help you avoid them and ensure that your billing process is smooth, accurate, and efficient. Whether it’s a missing detail, incorrect calculation, or unclear terms, each mistake can result in wasted time and frustration for both you and your clients. By being aware of these frequent errors and how to prevent them, you can create payment requests that are clear, professional, and legally sound. Common Errors to AvoidHere are some of the most common mistakes that can occur when creating payment request documents and how to avoid them:

How to Minimize ErrorsTo minimize these errors, consider using a digital platform or software that automates much of the process. Automation reduces the likelihood of human mistakes, especially when it comes to calculations and formatting. Additionally, always review the document thoroughly before sending it to ensure all necessary details are present and accurate. A final check can save you from costly mistakes down the line. By being vigilant and paying attention to these common mistakes, you can improve the accuracy and professionalism of your payment requests, leading to smoother transactions and stronger client relationships. How to Send a Farm InvoiceSending a payment request is an essential step in ensuring you get paid for your products or services. It’s important not only to create a clear and accurate document but also to deliver it effectively to your clients. The way you send the document can affect how quickly you receive payment and how professionally your business is perceived. Whether you choose to send it by email, mail, or through an online platform, it’s crucial to ensure that all the necessary information is included and that the process is seamless. In this section, we will cover the different methods for sending your billing documents, as well as best practices for making sure they reach your client in a timely and professional manner. Methods for Sending Payment Requests

There are several ways to send a payment request to your clients, each with its own advantages. The choice of method depends on your client’s preferences, your business practices, and the urgency of the payment.

Best Practices for Sending a Payment RequestRegardless of the method you choose, there are several best practices to follow to ensure that your payment request is received, understood, and processed promptly:

|