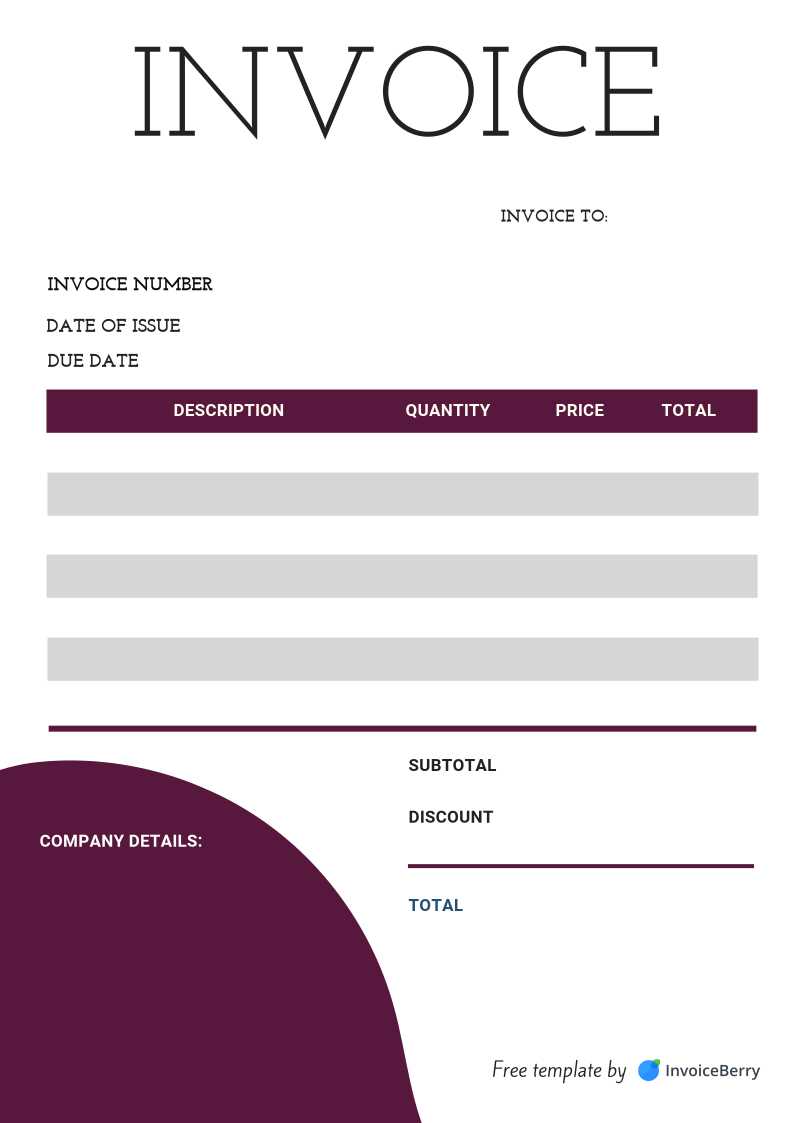

Download a Free Sample Invoice Template for Easy Billing

When managing business transactions, having a clear and organized method of requesting payments is essential. A well-structured document can help ensure that all necessary details are included and understood by both parties. This not only promotes professionalism but also reduces the likelihood of misunderstandings or delays in payment.

By utilizing a pre-designed form for payment requests, you can simplify the process of billing. These documents are customizable, allowing you to adjust them to fit the specific needs of your business and clients. Whether you’re a freelancer, a small business owner, or a large enterprise, having a standard format can save time and enhance your overall efficiency.

Efficient billing ensures smooth financial transactions and fosters trust with clients. A well-crafted document provides a straightforward way to communicate amounts owed, payment methods, and deadlines. By adopting the right approach, you can focus more on growing your business and less on administrative tasks.

Understanding the Importance of Invoice Templates

When it comes to requesting payment for goods or services, clarity and organization are crucial. A well-structured document that outlines the terms of the transaction helps ensure that both the provider and the customer are on the same page. It allows for smoother communication and reduces the risk of errors or delays in the payment process.

By using a standardized document, businesses can streamline their billing process, saving time and effort. It offers a consistent way to present key information such as amounts owed, payment methods, and deadlines. This consistency not only helps keep everything in order but also projects a professional image to clients and partners.

Effective documentation helps avoid confusion and ensures that all necessary details are captured accurately. Whether you are handling a small project or managing large-scale transactions, having a reliable structure in place allows you to focus on your work while maintaining a clear record of financial dealings. This approach contributes to smoother operations and better financial management in the long run.

Why Use a Sample Invoice Template

Having a pre-designed document for payment requests offers numerous advantages, especially for businesses looking to save time and reduce errors. By relying on a structured format, you ensure that all necessary details are included, making the process more efficient and less prone to mistakes. This approach eliminates the need to start from scratch each time a new transaction occurs, allowing you to focus more on your work.

Consistency and Professionalism

Using a pre-made structure provides consistency, which is essential in establishing a professional image. Clients appreciate when documents are clear, organized, and uniform, as it demonstrates attention to detail and reliability. A consistent format fosters trust and reinforces your commitment to quality, whether you’re dealing with a one-time customer or long-term partners.

Time-Saving and Efficiency

By using a ready-to-fill form, you can quickly generate payment requests without having to manually format each one. This time-saving approach is particularly beneficial for freelancers, small business owners, and those managing multiple transactions. With a structured framework, all essential fields are already included, allowing you to spend less time on administrative tasks and more on your core business activities.

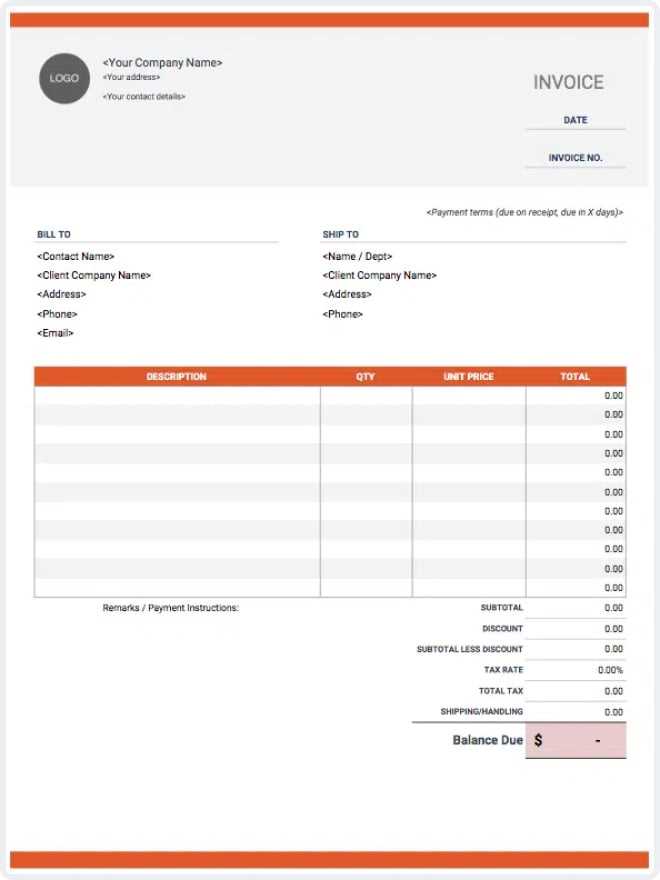

Key Features of an Effective Invoice

An effective payment request document serves as a clear and organized record of a transaction. It ensures that all necessary details are included, which helps avoid confusion between the service provider and the client. The right structure not only facilitates smoother financial exchanges but also promotes professionalism, making it easier to track and manage payments.

Clear and Detailed Information

One of the most important features of a well-designed document is the clarity of information. It should clearly state the amounts due, including itemized lists where necessary, and specify the payment terms. Precise details reduce the chance of errors or disputes and help the client understand exactly what they are being charged for. This includes listing all services, quantities, and prices in an organized manner.

Easy-to-Find Contact and Payment Details

Another essential feature is the inclusion of clear contact and payment details. The recipient should easily locate the business’s contact information, such as phone numbers, email addresses, and payment options. By providing these details in a prominent place, you help clients quickly settle their accounts. This not only speeds up the payment process but also fosters trust by showing that you are readily available for any inquiries or issues.

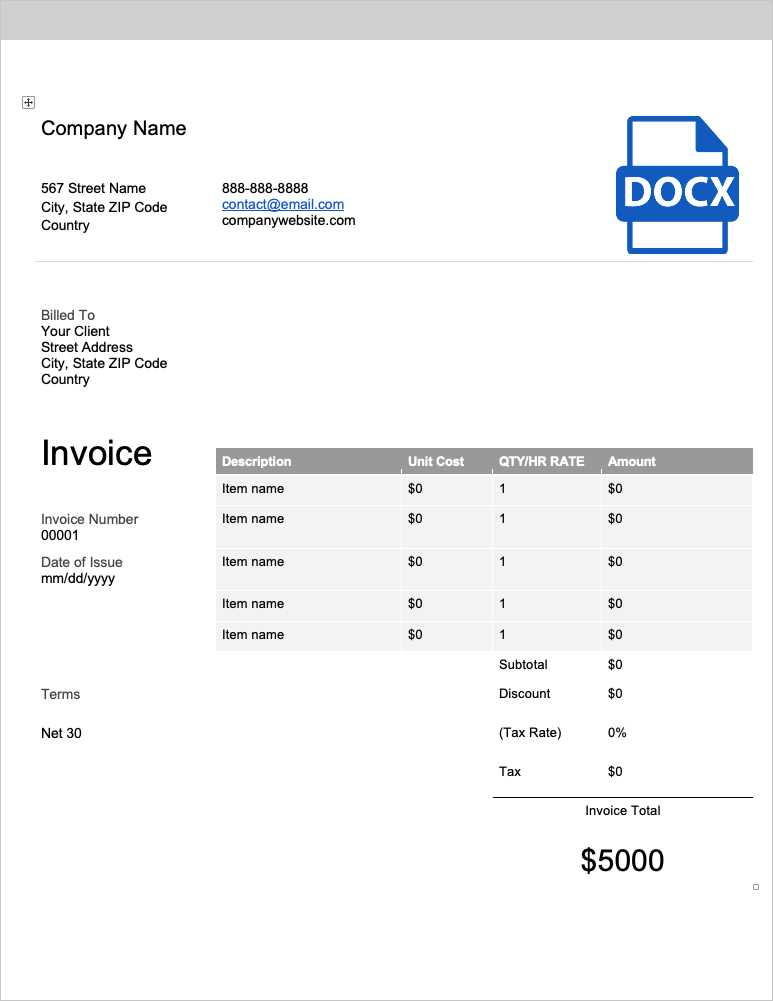

How to Customize Your Invoice Template

Personalizing a payment request document allows you to tailor it to your specific business needs while maintaining a professional appearance. Customization ensures that all relevant information is accurately presented, enhancing both functionality and branding. A well-adjusted document not only reflects your business style but also improves efficiency by incorporating elements suited to your particular transaction process.

Adjusting Layout and Design

Begin by modifying the overall design to match your company’s branding. This can include adjusting the font, colors, and logo placement to ensure the document aligns with your corporate identity. A visually appealing document with a clean and organized layout enhances readability and demonstrates attention to detail. Design consistency is key to presenting a professional image, making it easier for clients to recognize your business at a glance.

Incorporating Business-Specific Information

Next, customize the fields to fit the specifics of your operations. You can add or remove sections based on the services you provide, payment methods you accept, or client requirements. For instance, if you offer discounts or have varying tax rates, including these details on the document is essential. Ensuring that all relevant information is included helps reduce confusion and makes your billing process more transparent and accurate.

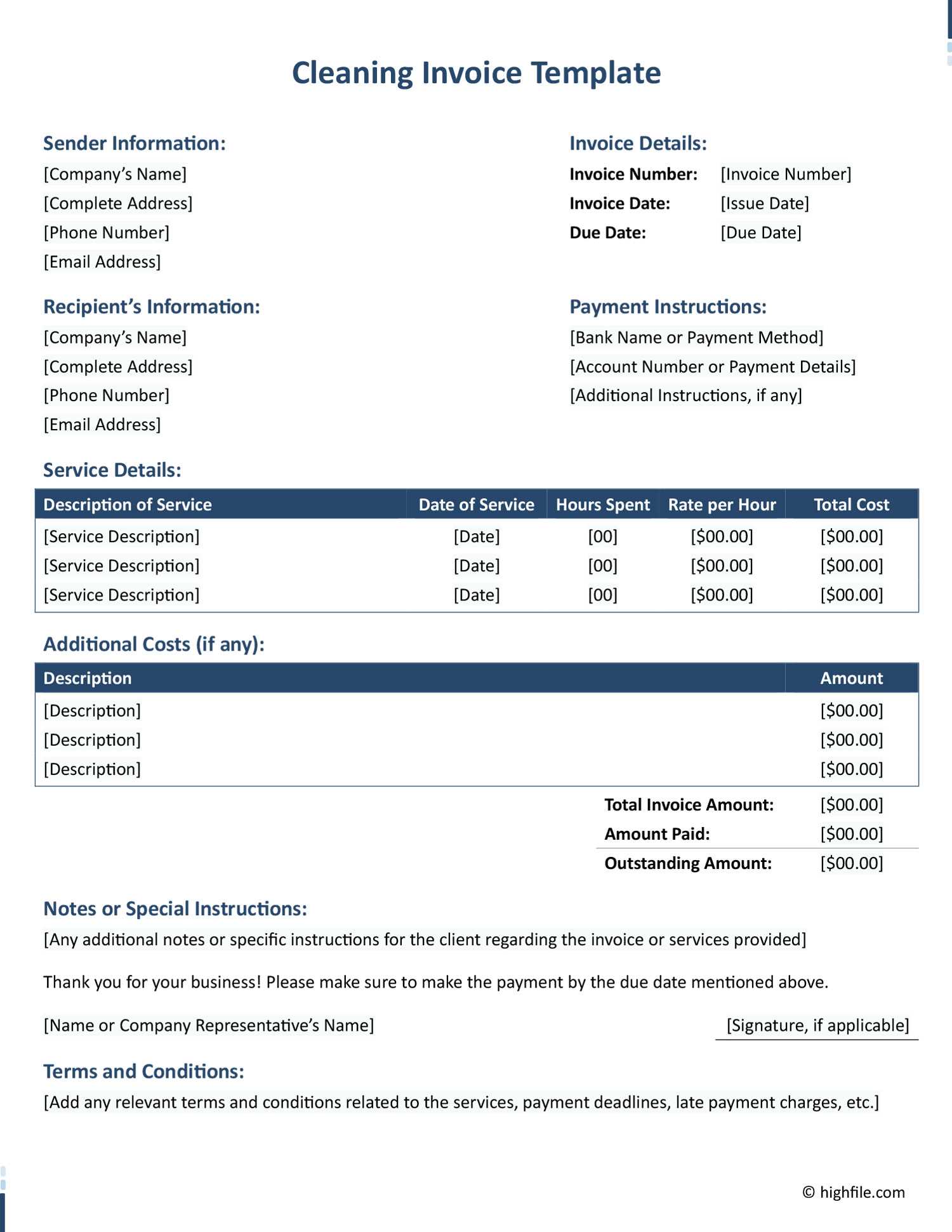

Different Types of Invoice Templates

There are various types of billing documents, each suited to different business needs and industries. Choosing the right structure can help streamline your payment process and ensure that all necessary details are presented clearly. Below, we explore the most common types and how each can benefit your business operations.

| Type | Description | Best For |

|---|---|---|

| Standard Billing Document | A straightforward format that includes basic details like items or services, quantities, and prices. | Freelancers, small businesses |

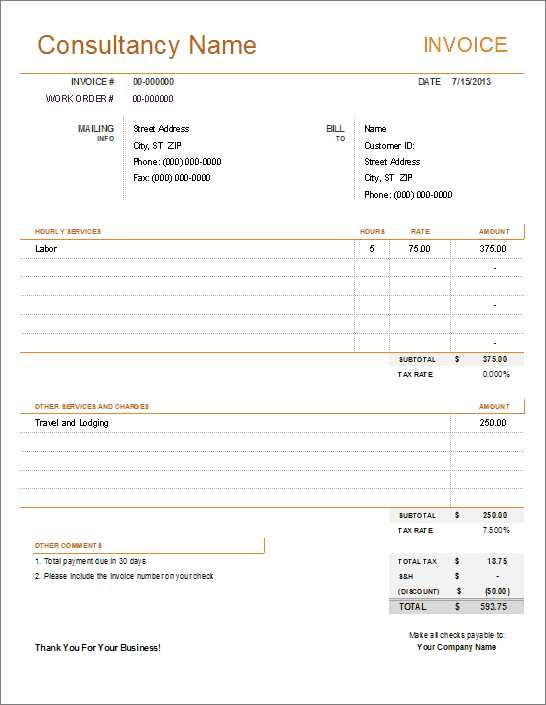

| Time-Based Billing | Focuses on hourly or project-based charges, often including a breakdown of hours worked and hourly rates. | Consultants, contractors |

| Recurring Billing | Designed for clients with subscription-based services or ongoing contracts. It highlights regular payments and dates. | Subscription services, memberships |

| Pro Forma Billing | Issued before a transaction is completed, often used to outline costs and secure payment agreements. | International transactions, large contracts |

| Credit Billing | Used when offering customers credit terms, showing the balance due and credit applied. | Retail, large suppliers |

Steps to Create an Invoice From Scratch

Creating a payment request from the ground up requires careful attention to detail to ensure all relevant information is included. A clear and comprehensive document not only facilitates smooth financial transactions but also helps maintain professionalism. By following a structured approach, you can design a custom request form that meets your business needs and communicates effectively with your clients.

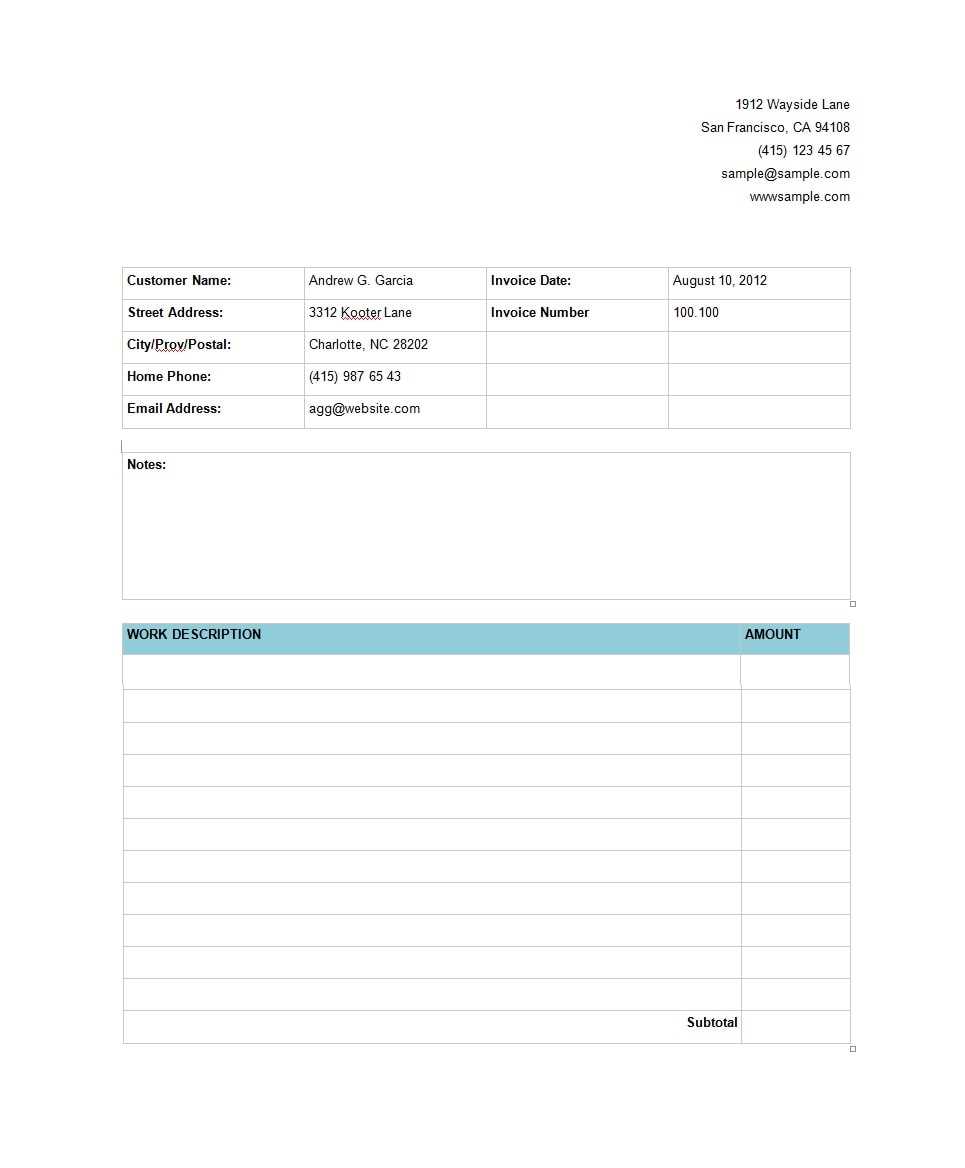

1. Include Your Business Details

The first step in creating a payment request is to add your business information at the top of the document. This typically includes your business name, address, phone number, and email. Contact details are essential for clients to reach out in case of any queries, making this a crucial part of the document.

2. Add Client Information

Next, include the recipient’s information. This should contain the client’s name, company (if applicable), and contact details such as address and email. Make sure this section is clear and accurately reflects the client’s billing information. Accurate client details help ensure that your payment request reaches the correct recipient and facilitates timely payment.

3. Itemize Services or Products

Clearly list the products or services provided, along with their individual prices or rates. Include quantities if applicable, and make sure each item is easy to read. This itemized list should provide full transparency, helping the client understand the breakdown of costs. Detailed descriptions will reduce the chance of disputes or confusion.

4. Set the Payment Terms

Specify the payment due date and any applicable late fees or early payment discounts. Clear payment terms establish expectations and encourage timely payments, helping to maintain smooth business operations.

5. Include Total Amount Due

Finally, calculate the total amount due, including taxes, fees, or discounts. This total should be easily distinguishable from other information on the document to avoid confusion. A clear final amount ensures both parties are on the same page regarding the amount owed.

Common Mistakes in Invoice Creation

Even with the best intentions, creating a billing document can lead to errors that can complicate the payment process. Mistakes, whether small or significant, can cause confusion, delay payments, or even damage client relationships. Recognizing and avoiding these common errors is crucial to maintaining an efficient and professional approach to financial transactions.

- Missing or Incorrect Contact Information – Failing to include accurate contact details for both parties can lead to missed communications and delayed payments.

- Unclear Payment Terms – Not specifying when the payment is due or the consequences of late payments can create confusion and result in clients ignoring deadlines.

- Incomplete or Incorrect Item Descriptions – Providing vague or inaccurate descriptions of products or services can lead to disputes and dissatisfaction.

- Failure to Include Tax Details – Forgetting to include taxes or not clearly breaking down tax rates and amounts can lead to misunderstandings and non-compliance.

- Not Double-Checking Totals – Mistakes in calculating the total amount due, including taxes, discounts, or fees, can result in overcharging or undercharging clients.

By avoiding these common mistakes, you ensure that your payment request documents are accurate, clear, and effective, helping to facilitate smooth transactions and maintain strong professional relationships with clients.

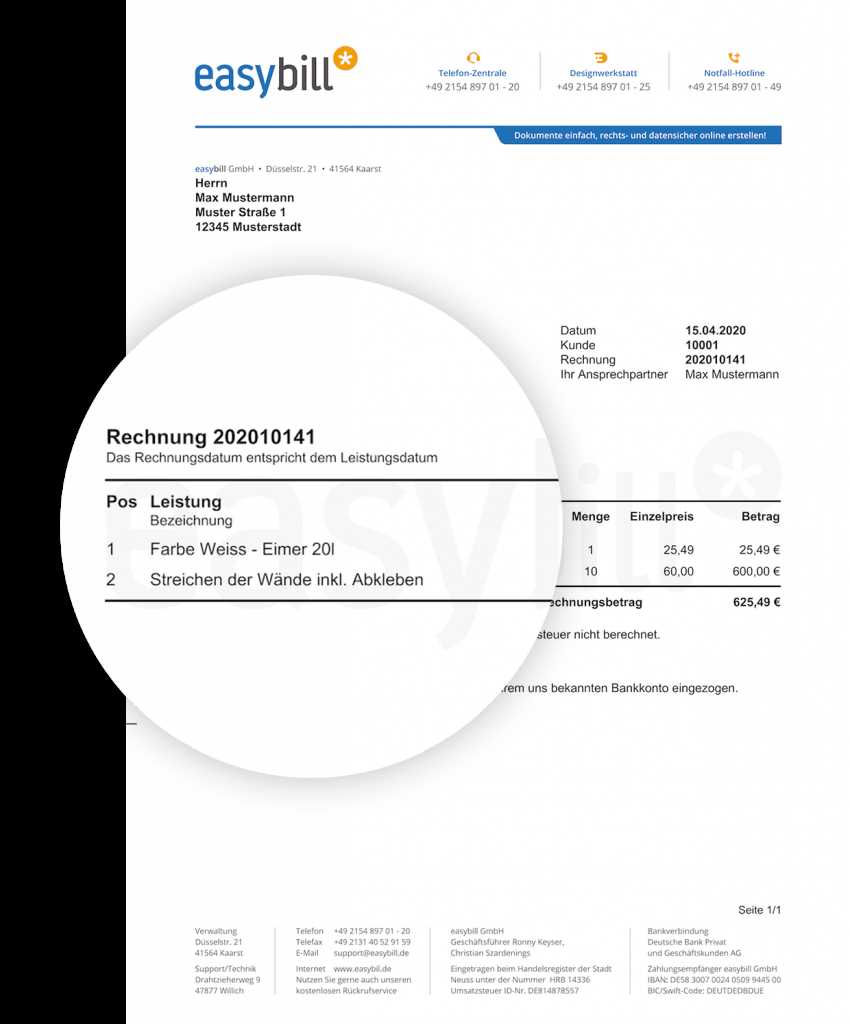

Best Tools for Editing Invoice Templates

When it comes to creating and customizing billing documents, having the right tools can make a significant difference in both the quality and efficiency of your work. There are numerous software and online platforms available that allow for easy editing, designing, and management of these documents. Choosing the right tool depends on your specific needs, whether it’s for simple formatting or advanced customization features.

Top Tools for Editing Billing Documents

- Microsoft Word – A widely-used word processing software that offers easy-to-use templates and editing capabilities for creating professional billing documents.

- Google Docs – A free, cloud-based alternative that allows easy collaboration and sharing while providing basic formatting options for payment requests.

- Canva – A graphic design platform offering customizable templates with advanced design features, perfect for businesses looking to add a personal touch to their billing documents.

- Zoho Invoice – An all-in-one invoicing tool with a range of templates and automated features for managing billing tasks, including recurring billing and multi-currency support.

- FreshBooks – A popular invoicing and accounting software that allows users to create and send customized billing documents, track payments, and manage financial reporting.

Why Choose These Tools?

- Ease of Use – Most tools are user-friendly, allowing even non-designers to create professional documents quickly and easily.

- Customization Options – Many platforms offer customizable features to adjust the layout, colors, and fonts to match your branding.

- Automation Features – Tools like Zoho Invoice and FreshBooks automate recurring payments, saving you time and reducing manual effort.

By utilizing the right tool, you can streamline the process of creating and managing your payment documents, ensuring accuracy and professionalism in every transaction.

Benefits of Digital Invoice Templates

Using electronic billing documents has become increasingly popular due to their efficiency and convenience. Unlike traditional paper-based methods, digital payment requests offer a wide range of advantages that help streamline the billing process and improve overall business operations. These benefits not only save time but also enhance the professional appearance of your business.

Improved Efficiency and Time-Saving

One of the most significant benefits of digital payment documents is the time saved through automation. With digital tools, you can quickly create, edit, and send a request with just a few clicks. This eliminates the need for manual writing, printing, and posting, allowing businesses to focus on other important tasks. Faster processing means quicker turnaround times for both you and your clients.

Cost-Effective and Environmentally Friendly

Digital billing documents help reduce the costs associated with printing and mailing physical copies. Additionally, this method reduces paper waste, making it an eco-friendly choice for businesses looking to lower their carbon footprint. The reduced cost of printing, paper, and postage adds up over time, making this method more cost-effective in the long run.

Enhanced Accuracy and Security

Electronic documents can be automatically populated with accurate data, minimizing human error in calculations and details. Furthermore, digital requests are often more secure, as they can be encrypted and stored in cloud-based systems with restricted access. This ensures that sensitive information remains safe from unauthorized access. Increased accuracy and improved security features help protect both your business and your clients from potential mistakes or fraud.

By adopting digital billing solutions, businesses can enhance efficiency, reduce costs, and improve accuracy, all while contributing to a more sustainable future.

How to Track Payments with Invoices

Tracking payments efficiently is crucial for maintaining accurate financial records and ensuring timely cash flow. By incorporating clear and detailed payment requests, businesses can easily monitor the status of payments and follow up when necessary. Tracking payments helps to avoid missed payments, disputes, and confusion while keeping your accounting organized.

Key Steps to Track Payments

- Assign Unique Identifiers – Each request should have a unique reference number. This makes it easy to track individual transactions and ensures there are no mix-ups with other records.

- Specify Payment Terms and Due Dates – Clearly state the payment due date and any late fees or discounts. This helps clients understand when payment is expected and helps you track overdue amounts.

- Mark Payments as Received – Once a payment is received, mark it as paid on your records or software. This makes it easier to identify outstanding amounts and helps maintain accurate financial records.

- Use Payment Tracking Software – Leverage online tools or accounting software to track incoming payments automatically. These platforms help keep track of paid and unpaid amounts, making it easier to manage cash flow.

- Send Payment Reminders – If payments are overdue, sending reminders can help prompt clients to settle the outstanding balance. Automated reminders can be set up to save time and ensure consistency.

By following these steps and utilizing the right tools, businesses can track payments efficiently and maintain accurate financial records, reducing errors and improving overall cash flow management.

Invoice Template for Freelancers and Contractors

For freelancers and contractors, having a well-organized and professional billing document is essential for ensuring prompt payments and maintaining a positive relationship with clients. These payment requests serve as formal agreements, outlining the services provided and the amount due. A clear and accurate document not only helps with financial tracking but also boosts credibility with clients.

Key Elements for Freelance and Contract Billing Documents

- Business Information – Include your name or company name, contact details, and any business registration number. This ensures clients can reach you if needed.

- Client Information – Clearly state the client’s name or business name, contact information, and address. This ensures the document reaches the correct recipient.

- Project Details – Describe the work completed, including the scope of services, deadlines, and any additional relevant information. Clear descriptions help avoid disputes.

- Payment Terms – Specify the payment due date, any discounts for early payments, and penalties for late payments. This keeps expectations clear and prevents delays.

- Payment Methods – Include the payment methods you accept, such as bank transfers, checks, or online payment platforms, to offer convenience for the client.

Why a Professional Billing Document is Important for Freelancers

- Maintaining Professionalism – A properly formatted payment request reflects professionalism and can improve your chances of getting paid on time.

- Tracking Work and Payments – Keeping records of completed work and payments ensures financial transparency, helping you track revenue and stay organized.

- Establishing Legal Protection – Including clear terms and conditions protects both parties in case of disputes or non-payment issues.

By creating an organized, professional, and clear billing document, freelancers and contractors can streamline their payment process, avoid misunderstandings, and maintain smooth client relationships.

How to Ensure Professional Invoicing

Ensuring professionalism in billing is essential for maintaining a trustworthy image and ensuring timely payments. A well-structured and clear payment request not only conveys the details of the transaction but also reflects the level of professionalism of your business. By following a few key principles, you can enhance the way you manage financial exchanges and maintain positive relationships with clients.

Key Elements for Professional Payment Requests

- Consistency in Format – Use a consistent format for all your billing documents. This includes uniform font styles, header placement, and a clean layout that makes it easy for the client to read and understand the details.

- Clear and Accurate Information – Ensure that all information, including dates, amounts, and descriptions of services, is accurate. Double-check all figures to avoid errors that could lead to delays or confusion.

- Timeliness – Issue payment requests promptly after completing a service or delivery. Delaying this step can confuse clients or raise doubts about the professionalism of your business.

- Professional Language – Use polite and formal language in your payment request, avoiding slang or overly casual expressions. This adds credibility and maintains the professional tone of your business communications.

Best Practices for Handling Payment Follow-ups

- Set Clear Payment Terms – Include clear payment deadlines, payment methods, and penalties for late payments in your documents. This sets the right expectations from the start.

- Send Polite Reminders – If payment is delayed, send gentle and polite reminders. Maintain a respectful tone to ensure that the client feels valued while encouraging timely payment.

- Keep Communication Open – Always be available to address any questions or concerns about the payment request. Open communication helps build trust and resolve potential issues efficiently.

By adopting these best practices, you can ensure that your payment requests reflect professionalism, are clear and precise, and ultimately help streamline your financial processes.

How to Manage Invoice Records Efficiently

Efficiently managing billing documents is essential for keeping your financial records organized and ensuring smooth operations. By establishing a system for tracking and storing these documents, you can easily access past transactions, avoid errors, and maintain compliance with tax and accounting requirements. This process not only saves time but also enhances your ability to track cash flow and financial health.

Key Strategies for Effective Record Management

- Use a Centralized System – Store all payment requests in a single, organized location, whether digital or physical. This helps in quickly locating past records and reduces the risk of losing important documents.

- Maintain Clear Labeling – Label each document with specific identifiers such as date, client name, and unique reference number. This makes it easier to search for and retrieve relevant records when needed.

- Track Payment Status – Keep track of which requests have been paid, partially paid, or are still pending. Use clear markings or a spreadsheet to monitor this status and send reminders when necessary.

- Implement a Regular Review Process – Regularly review your financial documents to ensure everything is up to date. Periodic checks help identify discrepancies or errors early, preventing bigger issues down the line.

Digital Tools for Streamlined Management

- Accounting Software – Utilize accounting tools like QuickBooks or Xero to manage, categorize, and track payments easily. These platforms can automate much of the record-keeping process.

- Cloud Storage Solutions – Store your documents in the cloud for easy access and backup. Google Drive, Dropbox, or other cloud services ensure your records are safe and accessible from anywhere.

- Spreadsheets – For a more budget-friendly option, create an organized tracking system using Excel or Google Sheets. Create custom fields to track all necessary details and use built-in features to automate calculations.

By adopting these strategies and utilizing the right tools, you can keep your records organized and manage your billing documents with greater efficiency, reducing the risk of mistakes and improving financial clarity.

Choosing the Right Format for Your Invoice

Selecting the appropriate format for your payment request is crucial for ensuring clarity, ease of understanding, and efficient processing. The format you choose should match both your business needs and the expectations of your clients. A well-structured document can enhance the professional appearance of your company and reduce confusion, leading to faster payments.

Factors to Consider When Choosing a Format

- Client Preferences – Some clients may prefer digital formats like PDFs, while others may need physical copies. Understanding your client’s preferences helps you decide the most suitable method of delivery.

- Clarity and Readability – Ensure that the format you choose highlights key details such as services provided, payment amounts, and deadlines clearly. A simple, easy-to-read structure reduces the chances of misunderstandings.

- Automation and Customization – If you need to generate multiple requests regularly, consider a format that allows easy automation. Digital platforms often provide tools for customization, allowing you to adjust the format to your needs quickly.

Popular Formats for Payment Requests

- PDF – Portable Document Format is one of the most common and professional formats. It preserves the layout and is easily shareable and printable.

- Word Documents – Microsoft Word documents are editable and useful for clients who may want to make minor adjustments before processing the request.

- Excel Sheets – For businesses that deal with numerous transactions or need to track payments, using spreadsheets offers the flexibility to add calculations and sorting functions.

- Online Invoicing Platforms – These offer customizable formats and automated features for recurring billing, making them an excellent choice for frequent transactions.

Choosing the right format for your payment documents not only streamlines the billing process but also ensures that clients can process and settle payments with ease. By considering your business needs and client preferences, you can select the most effective method for presenting your requests.

Why Accurate Billing is Crucial

Ensuring that billing records are precise and error-free is vital for maintaining smooth business operations and fostering trust with clients. When payment requests contain mistakes, it can lead to confusion, delays in payment, and damaged business relationships. Accuracy in this area not only reflects professionalism but also helps to avoid potential legal issues and financial discrepancies.

Building Trust with Clients

Clients expect transparency when it comes to financial transactions. An accurate billing process demonstrates that your business is reliable and trustworthy. Any discrepancies in the figures or terms can lead to misunderstandings and erode the confidence clients have in your services, potentially causing them to seek alternatives.

Avoiding Financial Losses

Inaccurate records can directly impact your cash flow. Overcharging or undercharging can result in lost revenue or unnecessary refunds. Additionally, if clients dispute incorrect billing, it could lead to delays in receiving payments, affecting your business’s financial stability.

Ensuring Legal Compliance

Accurate billing is essential for meeting tax obligations and adhering to financial regulations. Mistakes in billing can lead to issues with audits or legal disputes, which can be time-consuming and costly. Properly documenting transactions and ensuring the correctness of details is necessary to stay compliant with applicable laws and avoid penalties.

Efficient Financial Management

Accurate billing allows for better tracking of income and expenses, simplifying financial management tasks such as bookkeeping, budgeting, and reporting. When billing records are consistently accurate, it becomes easier to maintain organized financial statements, making business operations more efficient and less prone to errors.

In conclusion, the importance of precision in billing cannot be overstated. Accurate records are fundamental for maintaining client relationships, protecting revenue, and ensuring legal compliance. By prioritizing accuracy, businesses can avoid unnecessary complications and foster long-term success.