Free DJ Invoice Template PDF for Professional Billing

As a DJ, managing your finances effectively is just as important as perfecting your craft. Whether you’re working at private parties, corporate events, or large festivals, having a clear and professional way to request payment is crucial for maintaining smooth business operations. Proper documentation ensures you get paid promptly and helps establish credibility with clients.

One of the most efficient ways to handle payments is by using a structured document that outlines the services provided, the agreed-upon fees, and payment details. A well-organized bill can make all the difference in how clients perceive your professionalism and can streamline your accounting process.

In this article, we’ll explore how to create, customize, and use a digital format that simplifies your billing tasks. We’ll also cover best practices to make sure your records are both clear and legally compliant. By the end, you’ll be equipped to enhance your financial management with ease and confidence.

DJ Invoice Template PDF Overview

For DJs, having a standardized document to request payment for services is essential in maintaining organization and professionalism. This document serves as an official record of the work performed, the agreed fees, and the payment terms. It’s a clear and concise way to communicate expectations to clients while keeping your business dealings transparent.

The format you use for your payment requests plays a significant role in how your services are perceived. A well-structured file can streamline your financial management, making it easier to track earnings and provide clients with the necessary details for processing payments. With digital formats, you can also ensure easy customization and quick delivery.

In this section, we’ll explore the advantages of using a professional document for payment requests, highlight key elements to include, and explain why digital formats are particularly beneficial for DJs working across different events and locations. Whether you’re a seasoned pro or just starting out, using a formalized system will help simplify your business operations.

Why You Need a DJ Invoice

As a DJ, it’s essential to have a clear and formal way to request payment for your services. Without a proper method to outline the details of your work and the amount owed, misunderstandings can arise, and you risk losing payments or damaging client relationships. Having a structured document ensures both you and your clients are on the same page, making the transaction process smoother and more professional.

These payment requests not only protect you legally but also help you keep track of your finances. Whether you’re performing at a wedding, a corporate event, or a nightclub, it’s crucial to have a record of the services rendered, the agreed fees, and the payment terms. This record can also be useful for tax purposes or for resolving any disputes that may come up in the future.

Furthermore, presenting clients with a formalized payment request can enhance your professional image. It shows that you take your business seriously and are committed to providing a transparent and organized service. This level of professionalism can lead to repeat business, referrals, and long-term success in the industry.

How to Customize DJ Invoices

Personalizing your payment request documents is crucial for tailoring them to your business needs and making them reflect your brand. Customization allows you to include specific details that are relevant to the services you offer, making the document more professional and clear for your clients. Whether you’re creating a new payment record or modifying an existing one, customizing the content can help you present a more polished image.

Key Details to Include

When personalizing your payment requests, make sure to include all necessary information that outlines the work you’ve done and the payment terms. Some important fields to customize include:

| Section | Details |

|---|---|

| Client Information | Include the client’s name, address, and contact details. |

| Service Description | Specify the services provided, such as event type, date, and hours worked. |

| Payment Terms | Clearly state the agreed-upon amount, payment due date, and any additional fees. |

| Branding | Incorporate your logo and use your brand colors to enhance professionalism. |

Adjusting for Different Events

Another aspect of customization is adjusting the content based on the event type. For instance, a corporate event may require more formal language, while a wedding or private party request can be more relaxed. Always ensure the tone and details align with the nature of the event to maintain consistency and professionalism.

Benefits of Using PDF Invoices

Utilizing a digital format for your payment requests offers several advantages that can significantly improve both efficiency and professionalism in your business. The main appeal of digital documents lies in their ease of use, accessibility, and reliability, which makes managing payments more straightforward and less time-consuming. With a well-structured digital file, you can ensure clarity and consistency in every transaction.

Ease of Access and Delivery

One of the key benefits of using a digital format is the convenience it provides in terms of accessibility. You can easily create, store, and share payment records from any device, whether it’s a smartphone, tablet, or computer. This makes it much easier to deliver your documents instantly to clients via email or other digital platforms. With just a few clicks, you can ensure that your payment request reaches the client in no time, avoiding delays and increasing the chances of timely payments.

Enhanced Professionalism and Security

Another significant benefit is the enhanced professionalism that comes with using a digital document. Clients are more likely to take you seriously when they receive a formal, clean, and easy-to-read file instead of a handwritten note or informal email. Additionally, digital files are less prone to damage, unlike paper documents, and they can be encrypted for added security. This ensures that the sensitive information on your payment request is protected, providing peace of mind for both you and your clients.

In summary, opting for a digital format streamlines the billing process, reduces errors, and improves the overall client experience. The flexibility, security, and professionalism it offers are essential for any DJ looking to manage their finances more effectively and grow their business.

Key Elements of DJ Invoices

When creating a payment request, it’s essential to include all necessary details to ensure clarity and avoid misunderstandings. A well-crafted document not only specifies the agreed terms but also reinforces your professionalism and helps maintain a smooth payment process. Understanding the key elements to include can make all the difference in ensuring your business operations run efficiently.

Essential Information

To begin, there are certain core details that must always be present to make the document legally binding and clear. These include:

- Client’s Contact Information: Ensure the client’s full name, address, and phone number are listed correctly.

- Service Description: Include a detailed breakdown of the services provided, including the event type, duration, and any additional offerings.

- Payment Terms: Specify the total amount due, any deposits paid, and the final payment deadline.

Professional Touches

In addition to the basic details, there are several elements you can add to enhance the document’s professionalism:

- Branding: Adding your logo, business name, and color scheme helps reinforce your brand identity.

- Unique Reference Number: Assigning a reference number to each payment request ensures you can track and organize your documents effectively.

- Payment Methods: Specify acceptable methods of payment, such as bank transfer, credit card, or cash, to provide clarity.

Including these key elements will not only make your payment requests clear but also enhance your reputation as a professional in the industry.

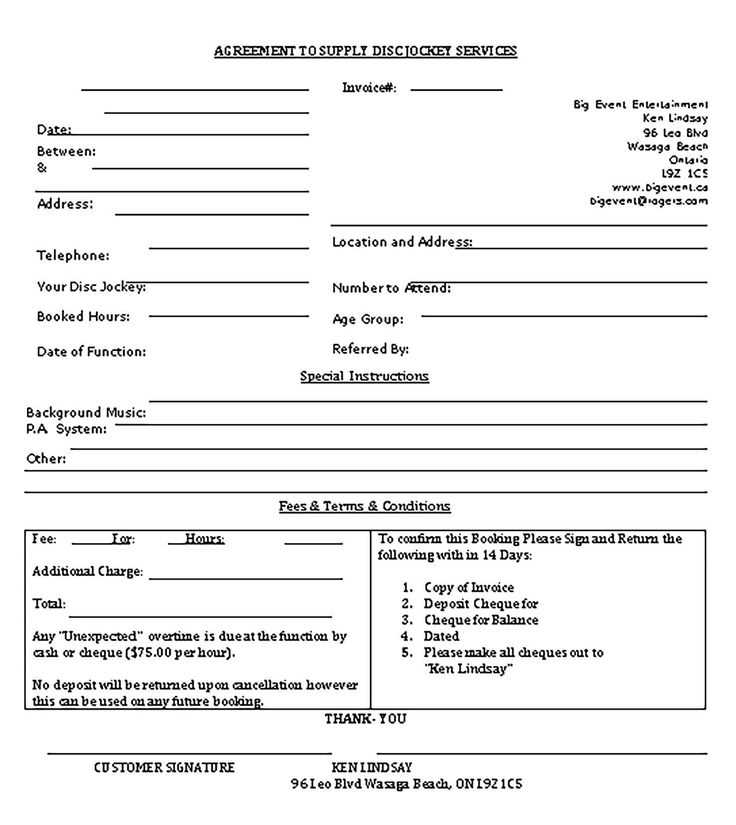

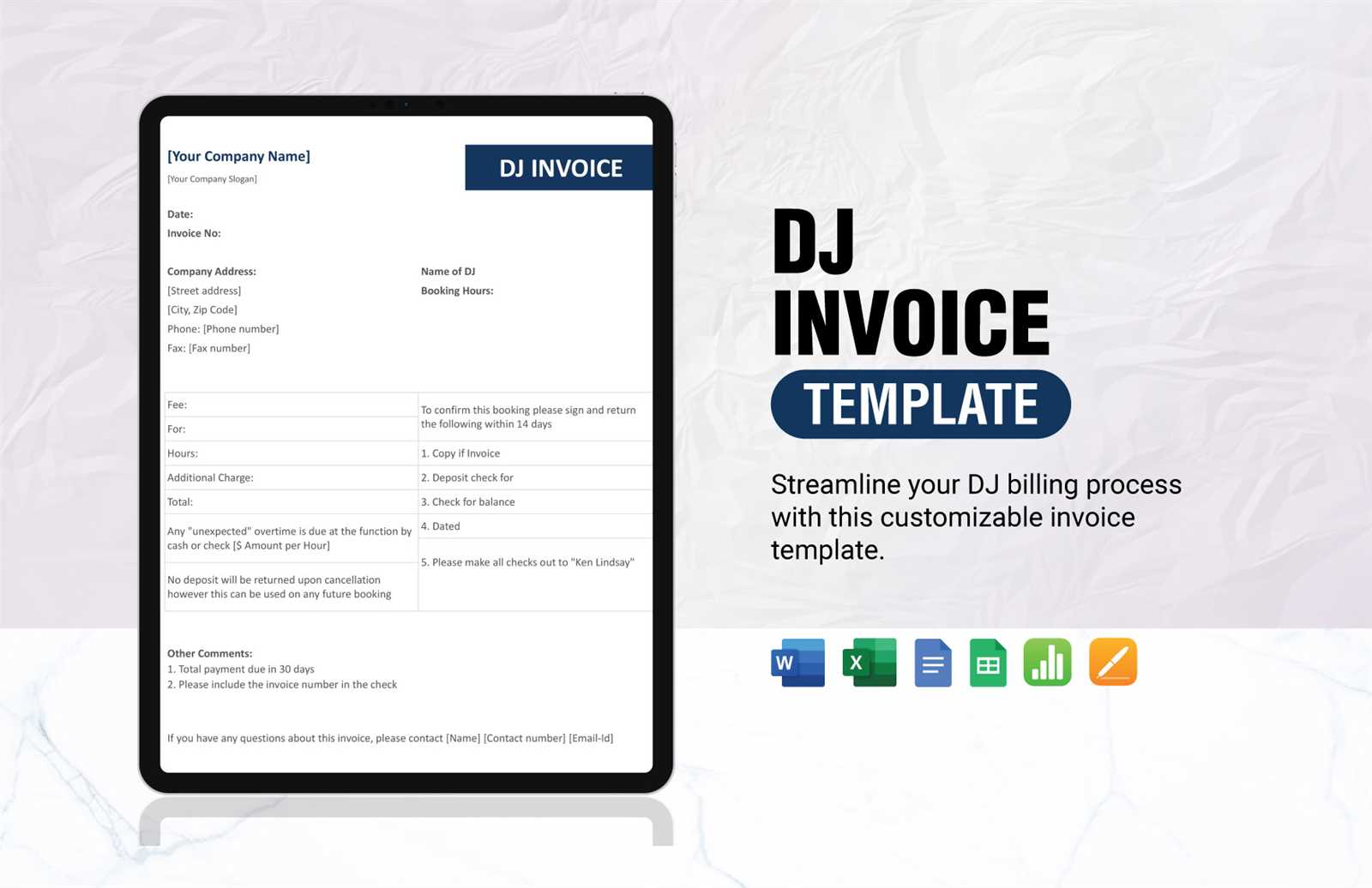

Free DJ Invoice Templates Online

For DJs just starting out or those looking to streamline their payment process, there are many free resources available online to help you create professional payment request documents. These ready-made formats allow you to quickly generate accurate, polished records without needing to design one from scratch. By using these free resources, you can save time and ensure that every detail is included in your payment records, giving your business a more professional appearance.

Where to Find Free Resources

There are numerous websites that offer customizable and free payment request documents designed specifically for DJs. These resources often provide a variety of formats, allowing you to select the one that best suits your needs. Whether you prefer a minimalist design or a more detailed layout, you can easily find options that align with your brand and services. Some popular platforms include:

- Template Websites: Sites like Canva, Invoice Generator, and Free Invoice Builder offer a range of free options tailored for DJs.

- Google Docs and Sheets: These tools provide free customizable templates that you can personalize to fit your business style.

- Music Industry Blogs: Many industry-specific websites share downloadable files designed for DJs, often including features like event-specific categories and payment breakdowns.

Benefits of Using Free Templates

Using free resources online comes with several advantages. Not only are these options cost-effective, but they are often designed with the needs of DJs in mind, meaning they include important details such as hourly rates, event descriptions, and payment deadlines. Furthermore, many of these templates are highly customizable, giving you the flexibility to adjust them as needed for each event or client.

In conclusion, taking advantage of free payment request formats can help simplify your business operations, ensuring you stay organized and professional without the hassle of creating documents from scratch. These resources are especially helpful for new DJs looking to manage their finances efficiently and improve their client relations.

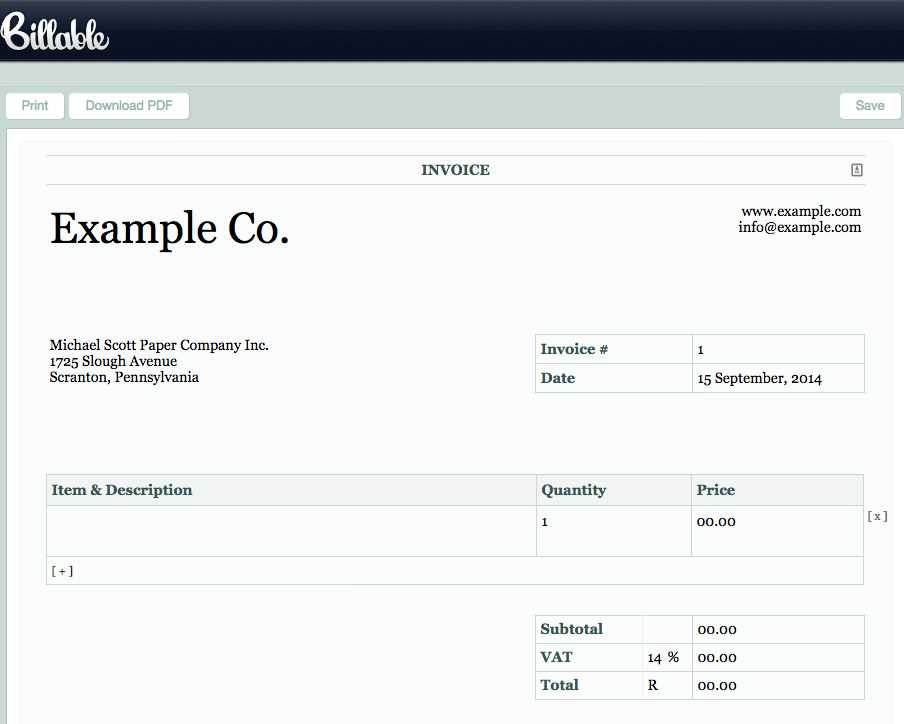

How to Download DJ Invoice PDF

Once you’ve created or customized your payment request document, the next step is to download it in a format that is easy to share, secure, and professional. Choosing a digital format ensures your document is accessible, and allows you to email it quickly to clients without losing any of the document’s integrity. In this section, we’ll guide you through the process of downloading your finalized document and making sure it’s ready for distribution.

Step-by-Step Download Process

Downloading a payment record typically involves a few simple steps, depending on the platform you use. Most online tools or document editors allow you to save your file in various formats, including the one best suited for your needs. Here’s a general outline of how to download your completed file:

- Create Your Document: After entering all necessary details, review your document to ensure accuracy.

- Choose the Download Option: On the platform or editor, look for a “Download” button, usually located at the top or bottom of the screen.

- Select Your Desired Format: Most platforms allow you to select from various file types, such as DOC, PDF, or XLS. Choose the format that suits your needs.

- Save the Document: Click “Download” and select a location on your device to save the file. Ensure you name the document for easy identification.

Where to Save Your File

Once downloaded, it’s important to save your document in a location where you can easily access it. For efficient management, consider creating a dedicated folder on your device or cloud storage for all payment records. This will help you stay organized and ensure that your documents are safely backed up in case of any technical issues.

In just a few simple steps, your document will be ready for sharing with clients, streamlining your payment process and enhancing your professional image.

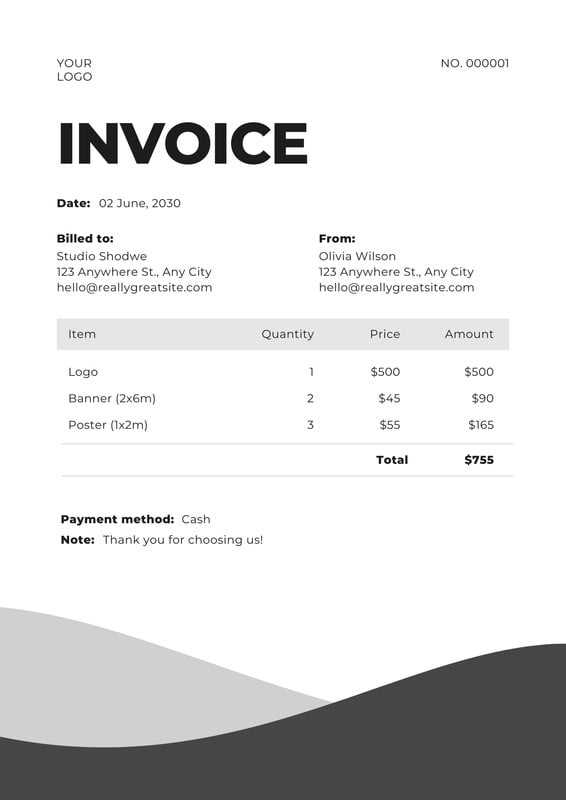

Best Practices for Invoice Design

Designing a professional payment request is crucial for any DJ looking to establish a strong business presence. A well-crafted document not only helps communicate essential payment details but also reinforces your professionalism and attention to detail. The design of your payment record should be clean, clear, and easy to read, while also reflecting your brand identity. Following certain best practices can help you create an effective and visually appealing payment document every time.

Keep It Simple and Organized

One of the most important design principles is simplicity. A cluttered or overly complex document can confuse clients and make the payment process feel less professional. Ensure that your document has a clear structure with all the necessary sections laid out logically. Key elements, such as service description, payment terms, and contact information, should be easy to locate. Use headings, bullet points, and spacing to create a clean, organized layout.

Enhance Branding and Professionalism

Another key aspect of effective document design is branding. Including your logo, business name, and consistent use of color schemes will help your document stand out and make a strong first impression. Using a font that is both readable and reflects your style is also important–avoid overly decorative fonts that can be hard to read. Consistency is key; make sure your branding elements align with your website, social media, and any other promotional materials you use.

Additional Tips for a Polished Look:

- Use High-Quality Images: Ensure that your logo and any other visuals are high resolution for a professional appearance.

- Clear Payment Instructions: Be specific about how clients can pay, listing all accepted methods clearly.

- Maintain Consistency: Use a consistent style for fonts, spacing, and colors across all documents to reinforce your brand identity.

By following these design best practices, you can create a payment record that not only looks professional but also ensures your clients understand exactly what is expected, helping to facilitate quicker payments and stronger business relationships.

Choosing the Right Invoice Software

For DJs looking to streamline their financial processes, selecting the right software to generate payment documents is a key decision. The right software can save time, reduce errors, and offer customizable features that suit your unique business needs. Whether you’re a solo DJ or part of a larger team, having an intuitive and efficient tool to create, manage, and track payments is essential for maintaining a smooth workflow.

Factors to Consider

When selecting the right software for your payment documents, consider these important factors:

- Ease of Use: The software should be user-friendly and intuitive, even if you don’t have a background in accounting or design. Look for tools that require minimal setup and allow for quick creation of documents.

- Customization Options: A good software program should allow you to fully customize your documents, from adding your logo and colors to adjusting the layout and content.

- Payment Tracking: The software should help you track payments, send reminders for overdue balances, and generate reports for financial analysis.

- Integration with Other Tools: Check if the software integrates with accounting software, payment gateways, or your calendar for a seamless workflow.

Popular Software Choices

There are many software solutions available, each catering to different needs. Some options you might consider include:

- QuickBooks: Ideal for managing payments, expenses, and tax records with professional-grade tools.

- FreshBooks: Known for its user-friendly interface, this tool is great for invoicing and time tracking, especially for freelancers.

- Wave: A free and intuitive software that’s perfect for small businesses or those just starting out.

- HoneyBook: Tailored to service providers, this software offers customizable payment request creation alongside project management features.

Choosing the right tool ultimately depends on your specific needs and preferences. By considering the above factors, you’ll be able to find the software that helps you stay organized, efficient, and prof

How to Send DJ Invoices Professionally

Sending a payment request to clients is not just about asking for money – it’s an opportunity to reinforce your professionalism and establish a clear line of communication. How you send your documents can significantly impact how clients perceive your business. To ensure prompt payment and build trust, it’s important to follow a process that is professional, clear, and easy to follow. This section will guide you on how to send your payment records effectively.

Choose the Right Delivery Method

Once you’ve created your payment request, the next step is delivering it to the client in a way that reflects professionalism. The most efficient method for most DJs is via email. Sending a digital file ensures the client can access the document instantly, reducing the chances of any delays. However, there are a few key points to keep in mind:

- Personalized Email: Always include a brief, polite message in your email to explain the payment request and highlight the key details. A personal touch goes a long way in building rapport.

- Attach the File: Attach the payment document directly to the email. Ensure the file is named clearly (e.g., “Event_Name_Payment_Request”) for easy identification.

- Use Professional Email Etiquette: Use a professional email address and avoid informal language. Keep your email concise but polite.

Follow-Up Effectively

Sending the document is just the first step – following up is just as important. If the payment hasn’t been received by the due date, sending a polite reminder is a crucial part of maintaining professionalism. Here’s how to follow up efficiently:

- Timing: Send a reminder a few days before the payment is due to avoid last-minute delays. If the payment is late, send a follow-up reminder with a gentle tone.

- Clear Communication: Be polite but firm about the payment terms. Mention the due date and any late fees, if applicable, but keep the tone courteous.

- Offer Assistance: If there are any issues with the payment process, offer to assist the client in resolving them promptly.

By following these steps, you ensure that sending your payment requests is a smooth process for both you and your clients, while reinforcing your professionalism and encouraging timely payments.

Common Mistakes in DJ Billing

Billing for your DJ services is an essential part of running a professional business. However, many DJs make common mistakes that can lead to confusion, delayed payments, or even damage to client relationships. Understanding these mistakes and how to avoid them can help ensure a smoother payment process, improve client satisfaction, and maintain your business’s credibility. Below are some of the most frequent errors DJs make when billing clients and tips on how to avoid them.

Unclear Payment Terms

One of the most common mistakes DJs make is not clearly defining payment terms. If the client is unsure about when or how to pay, it can lead to confusion or delays. To avoid this, always be explicit about the following:

- Due Date: Specify exactly when the payment is expected–whether it’s before or after the event or within a certain number of days after the performance.

- Accepted Payment Methods: Clearly outline which payment methods you accept, such as bank transfers, credit cards, or cash.

- Late Fees: If applicable, include any penalties for late payments, so clients are aware of the consequences for not meeting the terms.

Omitting Key Details

Another mistake is not including enough information on the payment request. It’s essential to provide comprehensive details to avoid any ambiguity or questions from the client. Be sure to include:

- Event Description: Include specifics about the event, such as the date, location, and duration of the service.

- Itemized Services: Break down what the client is being charged for, whether it’s hourly rates, equipment rental, or travel expenses. Transparency helps build trust.

- Client Contact Information: Ensure that both you and your client’s contact details are included so that communication can be easily maintained.

Forgetting to Follow Up

Many DJs make the mistake of not following up if the payment hasn’t been received by the due date. It’s important to send polite reminders to ensure that your payment request doesn’t get lost or forgotten. Here’s what you should do:

- Set Reminders: After sending the payment request, set a reminder to follow up if payment is not received by the due date.

- Polite Communication: Always follow up with a courteous tone. A simple reminder email or message can go a long way in maintaining a professional relationship.

- Be Firm, But Respectful: If payment continues to be delayed, politely reinforce the terms and any consequences for non-payment.

Avoiding these common billing mistakes will help you maintain a smooth and professional relationship with your clients, ensure timely payments, and allow you to focus on what you do best–performing and growing your DJ business.

How to Track DJ Payments Effectively

Efficiently tracking payments is a vital part of managing your DJ business. Whether you perform at weddings, parties, or corporate events, keeping a close eye on payments ensures you’re paid on time and that your finances remain organized. Proper tracking also helps prevent misunderstandings with clients and gives you a clearer picture of your business’s cash flow. Here are some strategies to help you stay on top of your payments and avoid financial headaches.

Use a Dedicated Payment Tracking System

The first step to tracking payments effectively is to implement a system. Relying on memory or simple spreadsheets can lead to mistakes. Here are a few options for tracking payments:

- Accounting Software: Programs like QuickBooks or FreshBooks automatically track payments and send reminders for overdue balances. These tools also offer reports that help you assess your financial health.

- Spreadsheets: If you prefer a more hands-on approach, use tools like Google Sheets or Excel. Create columns for client name, event date, total amount, deposit paid, balance due, and payment status.

- Mobile Apps: Apps like PayPal, Venmo, or Square allow you to track payments made through those platforms and even integrate with other accounting tools for seamless tracking.

Track Key Payment Details

When tracking payments, make sure you document the essential information to avoid confusion down the road:

- Client Details: Record the client’s name, contact information, and event details, so you can easily reference past transactions.

- Payment Amounts: Keep track of the amount paid and any remaining balance to ensure the full payment is received.

- Payment Dates: Note when the payment was made. This helps you stay on top of due dates and follow up if necessary.

- Payment Methods: Record how payments were made (e.g., bank transfer, credit card, cash) to avoid any discrepancies.

Set Up Reminders and Follow-Ups

It’s crucial to set up reminders for when payments are due or when a follow-up is needed. Even with a tracking system in place, human error can still occur, and clients may forget to send payment. Setting up a reminder system can help you stay proactive:

- Automated Alerts: Use your accounting software or calendar app to set up reminders for upcoming payments and overdue balances.

- Polite Follow-Ups: If payments are late, send a courteous follow-up message. Include clear details about the amount due and the payment method.

By staying organized and implementing a reliable tracking system, you can ensure that your payments are processed smoothly and on time. This will help you avoid cash flow problems and maintain positive relationships with your clients.

Invoice Templates for Different Event Types

As a DJ, every event you perform at has unique requirements and pricing structures. Whether you’re working at a wedding, a corporate event, or a private party, customizing your payment request documents to match the specific details of each event can help ensure clarity and professionalism. Tailoring your documents allows you to outline the specific services you provided and the agreed-upon payment terms, making it easier for both you and your clients to keep track of financial transactions.

Wedding Events

Weddings often involve multiple services, such as ceremony music, reception entertainment, and additional equipment. A well-structured payment document for weddings should clearly detail each service provided and any additional costs for extended hours or extra equipment. Consider including the following:

- Event Details: Include the wedding date, venue, and specific times for the ceremony and reception.

- Service Breakdown: Itemize services such as ceremony music, cocktail hour entertainment, and reception DJing.

- Additional Costs: List any extra charges for equipment rental (e.g., lighting, microphones), extended hours, or travel fees.

- Payment Terms: Specify deposit requirements, payment deadlines, and accepted payment methods.

Corporate Events

Corporate events often require a more formal approach to billing, with more detailed terms due to the larger scale of these events. You may be providing services for conferences, team-building activities, or large corporate parties. Key details to include in payment documents for corporate events are:

- Event Description: Include details about the type of corporate event, such as a conference, gala, or product launch.

- Service Hours: Outline your performance hours, including setup and teardown times, especially if the event lasts for multiple days.

- Equipment & Services: Specify any special equipment provided, like sound systems, microphones, or AV gear, and whether they were included in the base price or billed separately.

- Corporate Discounts: If applicable, note any special rates or discounts for corporate clients.

Private Parties

Private parties, such as birthday parties, anniversaries, or intimate gatherings, often have different expectations and budgets compared to weddings or corporate events. For these types of events, the payment request should be clear but not overly complex. Consider including the following:

- Event Overview: Include the event type (birthday, anniversary, etc.), date, location, and hours of performance.

- Service Provided: Specify the services included, such as music selection, lighting setup, and sound equipment.

- Special Requests: If the client has any specific music preferences or requests, make sure to note them to avoid misunderstandings.

- Payment Due Dates: Specify when the deposit is due and when the balance should be paid, along with accepted payment methods.

Customizing your payment request documents for each event type ensures that you capture all the important details specific to that event, helping both you and your clients stay organized and avoid confusion. Whether it’s a wedding, corporate event, or private party, tailoring your documents adds a level of professionalism that can strengthen client relationships and ensure timely payments.

Protecting Your DJ Invoices from Fraud

As a DJ, managing your financial transactions and ensuring the safety of your payment requests is crucial. Fraudulent activities, such as payment manipulation or identity theft, can have serious consequences for your business. Taking steps to protect your payment documents from fraud not only safeguards your income but also maintains your professionalism. In this section, we’ll explore various strategies you can implement to secure your financial transactions and reduce the risk of fraudulent activity.

Use Secure Payment Methods

One of the most effective ways to protect your payment requests is to ensure that your clients use secure and trustworthy payment methods. Avoid relying on cash transactions, which can be harder to trace. Instead, encourage clients to use digital payment systems that offer security features:

- Bank Transfers: Direct bank transfers are secure and provide a clear paper trail, reducing the risk of fraud.

- Payment Processors: Services like PayPal, Stripe, or Square offer buyer protection and encryption, ensuring both parties are protected.

- Credit Cards: Credit card payments come with fraud detection mechanisms and can be reversed in case of fraudulent claims.

Secure Your Payment Documents

Ensuring that your payment records are protected is another important step in preventing fraud. This includes both the document content and how it is shared with your clients:

- Watermark Your Documents: Adding a watermark to your payment requests can deter unauthorized edits or copies, helping to maintain the integrity of the document.

- Password Protection: If you’re sending payment records via email, consider password-protecting the file. This ensures that only the intended recipient can access it.

- Digital Signatures: Use digital signatures to verify the authenticity of your payment documents and to prevent unauthorized alterations.

Monitor Your Payments

Keeping a close eye on payments is crucial for spotting any fraudulent activity early on. Regularly reviewing payment statuses can help you identify discrepancies before they escalate:

- Track All Transactions: Use accounting software or spreadsheets to track every payment made and its status. This will help you spot any missing payments or irregularities.

- Verify Payment Details: Double-check the payment details, especially for large sums. If you receive a payment notification from a service like PayPal or bank transfer, verify that it matches the agreed amount.

- Follow Up on Overdue Payments: If a payment is delayed or seems suspicious, follow up with the client promptly to clarify the situation.

Educate Your Clients

Educating your clients on the importance of secure payment methods can help reduce the risk of fraud. By setting clear expectations for payment security, you help ensure that both you and your clients are on the same page:

- Share Best Practices: Let

Legal Requirements for DJ Invoices

As a DJ, ensuring that your payment requests comply with legal requirements is essential for running a legitimate business. Properly documented financial transactions not only help you stay organized but also protect you in case of legal disputes. Certain pieces of information are legally required to be included in any formal payment request, and failing to include them could result in penalties or complications during tax season. In this section, we will explore the key legal elements that should be included in your payment records.

Essential Information to Include

Every payment document you create should contain specific details that are required by law, depending on your location and the nature of your business. Here are the most common elements you should include:

- Your Business Information: Always include your full name (or business name), contact details, and tax identification number (TIN) if applicable. This allows authorities to recognize your business and ensures proper tax reporting.

- Client Information: The document should contain your client’s full name, business name (if applicable), and contact details. This helps to clearly identify both parties involved in the transaction.

- Event Details: Specify the date and location of the event, as well as any other relevant details such as the service duration or special requests made by the client. This makes the payment record clear and traceable.

- Service Description: Clearly outline the services you provided, including any equipment used, hours worked, or special tasks performed. This provides transparency for both you and your client.

- Payment Amount: Clearly list the total amount due, broken down by each service if necessary. Include any taxes, fees, or discounts applied to the final amount.

Tax and Legal Compliance

Depending on where you operate, you may be required to charge sales tax or VAT on your services. To remain compliant with tax laws, you must:

- Include Tax Information: If you are required to collect tax, make sure to list the tax rate and amount on your payment document. Ensure that the tax rate is correct according to local or national laws.

- Maintain Proper Records: Keep accurate records of all your transactions for tax filing purposes. These documents will be necessary when filing business taxes and may be requested by tax authorities in case of an audit.

- Follow Local Regulations: Research the specific legal requirements for payment documents in your region. Different countries or states may have specific rules about what needs to be included in a formal transaction record.

Digital and Paper Records

Whether you choose to send your payment records digitally or on paper, make sure they are stored securely. Digital records are legally acceptable in most jurisdictions, but they must be properly organized and backed up. If you opt for paper records, ensure they are stored in a safe, organized manner to comply with retention policies.

By including all legally required information in your payment documents, you not only stay compliant with tax laws but also protect your business from legal complications. Always stay informed about the legal requirements in your area to ensure your business runs smoothly and without unn

Using Invoices to Build Client Trust

For any DJ, establishing trust with clients is crucial for long-term success. One powerful way to build that trust is through the clear, professional presentation of your payment records. A well-organized and transparent payment document not only outlines your services but also demonstrates your professionalism, reliability, and attention to detail. By providing clients with clear, comprehensive documents that accurately reflect the services you’ve provided, you show that you are serious about your business and dedicated to offering an exceptional experience.

Transparency in your payment records helps set expectations and eliminates any potential confusion about costs or services. When clients can easily see what they’re paying for and feel confident that all terms are fair and clear, they are more likely to trust you for future events or refer you to others. Here are several ways that well-constructed payment documents can foster trust:

- Clear Breakdown of Services: When you itemize your services and related costs, clients know exactly what they’re paying for. This level of detail shows professionalism and transparency, which builds trust.

- Consistency in Billing: Providing consistent and well-structured records for every event, regardless of size or type, shows that you adhere to a standard of excellence. Clients will appreciate this consistency and be more likely to return for future engagements.

- Respecting Agreed Terms: When payment requests reflect what was previously agreed upon in contracts or negotiations, it reassures clients that they are being treated fairly. This consistency in following through on promises builds credibility and strengthens relationships.

By carefully crafting and sharing these records with clients, you create an environment of trust where both parties feel confident in their business relationship. Clients are more likely to recommend your services to others and become repeat customers when they trust that their financial transactions are handled professionally and honestly.

Automating DJ Invoices for Efficiency

Managing payment requests efficiently is crucial for any DJ, especially when juggling multiple events and clients. Automating the process of creating and sending payment records can save you valuable time, reduce human error, and ensure consistency across all your transactions. By implementing automated systems, you can focus more on your performances and less on administrative tasks. In this section, we’ll explore how automation tools can streamline your billing process and improve overall efficiency.

Choosing the Right Automation Tools

To begin automating your payment records, it’s important to select the right tools that match your business needs. There are many software solutions available that offer features tailored to DJs and small business owners. These tools often include:

- Recurring Billing: Many DJs work with clients on a regular basis. Automation tools can set up recurring payment requests that are sent automatically at regular intervals, such as weekly, monthly, or after each event.

- Customizable Templates: You can use pre-designed formats that align with your branding. These tools allow you to fill in client-specific details quickly and generate professional-looking payment records.

- Integration with Payment Platforms: Some systems can connect directly with payment processors like PayPal, Stripe, or Square, allowing for seamless transaction tracking and automatic updates when payments are received.

Benefits of Automation

Automating your billing system offers numerous advantages that help you run a more efficient and profitable DJ business:

- Time Savings: Automation reduces the time spent creating individual payment requests. This allows you to focus more on performing and expanding your business.

- Consistency: Automated systems ensure that every payment record sent is consistent in format, structure, and accuracy. This builds professionalism and trust with your clients.

- Error Reduction: Automated tools eliminate the risk of manual mistakes, such as incorrect payment amounts or missing client details, ensuring that your financial records are always accurate.

- Streamlined Follow-ups: Many automation tools include reminders for overdue payments, allowing you to follow up with clients promptly without having to remember every detail yourself.

By automating your payment processes, you ensure that your business remains organized and professional, while also saving time and reducing the chances of costly errors. The right automation tools not only improve efficiency but also enhance your overall workflow, giving you more time to focus on your passion for DJing.