Free Printable Invoice Template Download for Easy Billing

Managing payments and ensuring timely receipts is essential for any business. One of the easiest ways to organize transactions is by using ready-made documents that can be quickly adapted and printed. These documents not only save time but also help maintain a professional image for your company.

By utilizing pre-designed formats, you can create detailed records that are both accurate and visually appealing. Whether you’re a freelancer, small business owner, or part of a larger enterprise, having a consistent method to issue requests for payment is crucial to keeping finances in check.

In this section, you’ll find various options to help you streamline the process, offering both flexibility and ease of use. These tools allow for customization, ensuring that every record reflects your unique business needs and complies with the necessary legal requirements.

Free Invoice Templates for Small Businesses

For small business owners, keeping track of payments and maintaining a steady cash flow is crucial. One of the simplest ways to manage this is by using customizable billing documents that can be quickly prepared and sent to clients. These documents help ensure that all necessary information is included, making the process efficient and professional.

Many small business owners turn to accessible resources that offer ready-made formats. These documents can be tailored to fit the specific needs of a business, allowing for customization of details such as pricing, terms, and branding. By choosing a document that suits your business style, you can streamline your administrative work and focus more on growing your company.

Additionally, these tools are typically easy to use, with no design or technical skills required. They provide a fast way to generate and manage payment requests, helping business owners stay organized and improve their overall workflow.

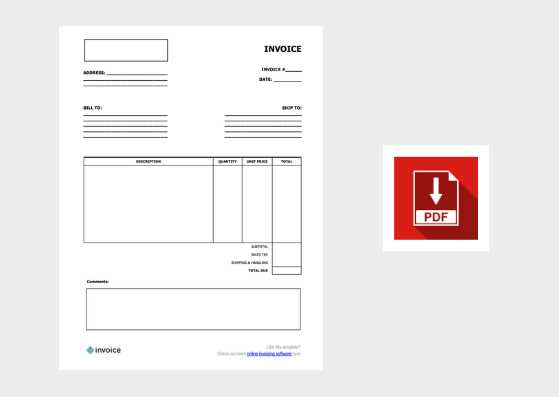

How to Download Printable Invoices Easily

Obtaining well-structured documents for requesting payments has never been simpler. With numerous online resources available, business owners can quickly access pre-designed files that can be customized and printed. These resources provide a fast and efficient way to generate accurate records without the need for advanced software or design skills.

Choosing the Right Platform

The first step is selecting a reliable website or service that offers customizable files. Look for platforms that provide easy navigation, clear instructions, and options tailored to your business needs. Many sites offer a variety of designs, so you can choose the one that best reflects your brand and style.

Customizing and Preparing for Print

Once you’ve selected the appropriate document, customization is straightforward. Fill in the necessary details such as client information, services rendered, and payment terms. Many platforms allow you to adjust fonts, colors, and logos, ensuring that the document fits your professional image. After editing, the final step is simply to save the file and print it directly from your device.

Benefits of Using Free Invoice Templates

Using ready-made billing documents offers a range of advantages, especially for small business owners who need to manage their finances efficiently. By utilizing these pre-designed solutions, you can streamline your administrative tasks and ensure consistency in your business operations.

- Saves Time – Ready-made documents eliminate the need to start from scratch, allowing you to focus on other important aspects of your business.

- Professional Appearance – These documents are often designed with a clean and professional layout, helping to establish trust with clients and reflect your business’s credibility.

- Easy Customization – Most options allow you to personalize details like logos, colors, and payment terms, making it easy to adapt them to your business’s needs.

- Consistency – Using the same format for all your payment requests ensures that your records are organized and standardized, helping to reduce errors and confusion.

- Cost-Effective – Many platforms offer these documents at no cost, which can save your business money that would otherwise be spent on design software or professional services.

- Legal Compliance – Many templates are created with legal and tax requirements in mind, ensuring that you include the necessary information for all transactions.

Overall, using these tools simplifies the process of managing payments, ensuring that you maintain a professional image and keep your business organized.

Top Websites for Free Invoice Templates

There are numerous online platforms that offer ready-made documents to help businesses manage payment requests. These websites provide a variety of styles and layouts, making it easy to find the perfect option for your needs. Whether you’re looking for a simple format or something more customized, these platforms have you covered.

1. Invoice Generator

Invoice Generator is a user-friendly platform that allows you to create and customize payment records quickly. With a range of templates available, it’s perfect for small business owners and freelancers looking for a hassle-free solution. The service also lets you download and print the documents in multiple formats.

2. Zoho Invoice

Zoho Invoice offers both free and paid options for creating detailed billing documents. The platform’s templates are highly customizable, allowing you to add logos, adjust colors, and personalize terms. Zoho Invoice also integrates with other accounting software, making it a powerful tool for business owners who need an all-in-one solution.

By exploring these top websites, you can find the perfect tools to streamline your billing process and save valuable time. Most offer easy-to-use features that can help businesses of all sizes create professional payment requests in minutes.

Customize Your Printable Invoice Template

Personalizing your billing documents allows you to reflect your business’s unique identity and ensure that all relevant details are included. Customization gives you control over the design, making it possible to match your company’s branding, adjust the layout, and add specific terms or conditions. With the right tools, modifying these documents is simple and quick.

Most platforms offer several customization options, such as:

- Adding Your Logo – Insert your business logo to create a professional, branded appearance.

- Choosing Fonts and Colors – Adjust fonts and color schemes to align with your company’s aesthetic and style.

- Including Custom Fields – Customize sections like payment terms, discounts, or additional notes to suit your needs.

- Setting Payment Information – Personalize the payment method options to reflect your preferred channels, such as bank transfers, online payments, or checks.

By taking advantage of these features, you can ensure that your documents are not only functional but also aligned with your brand and business practices. Customization helps to maintain consistency and makes a lasting impression on clients.

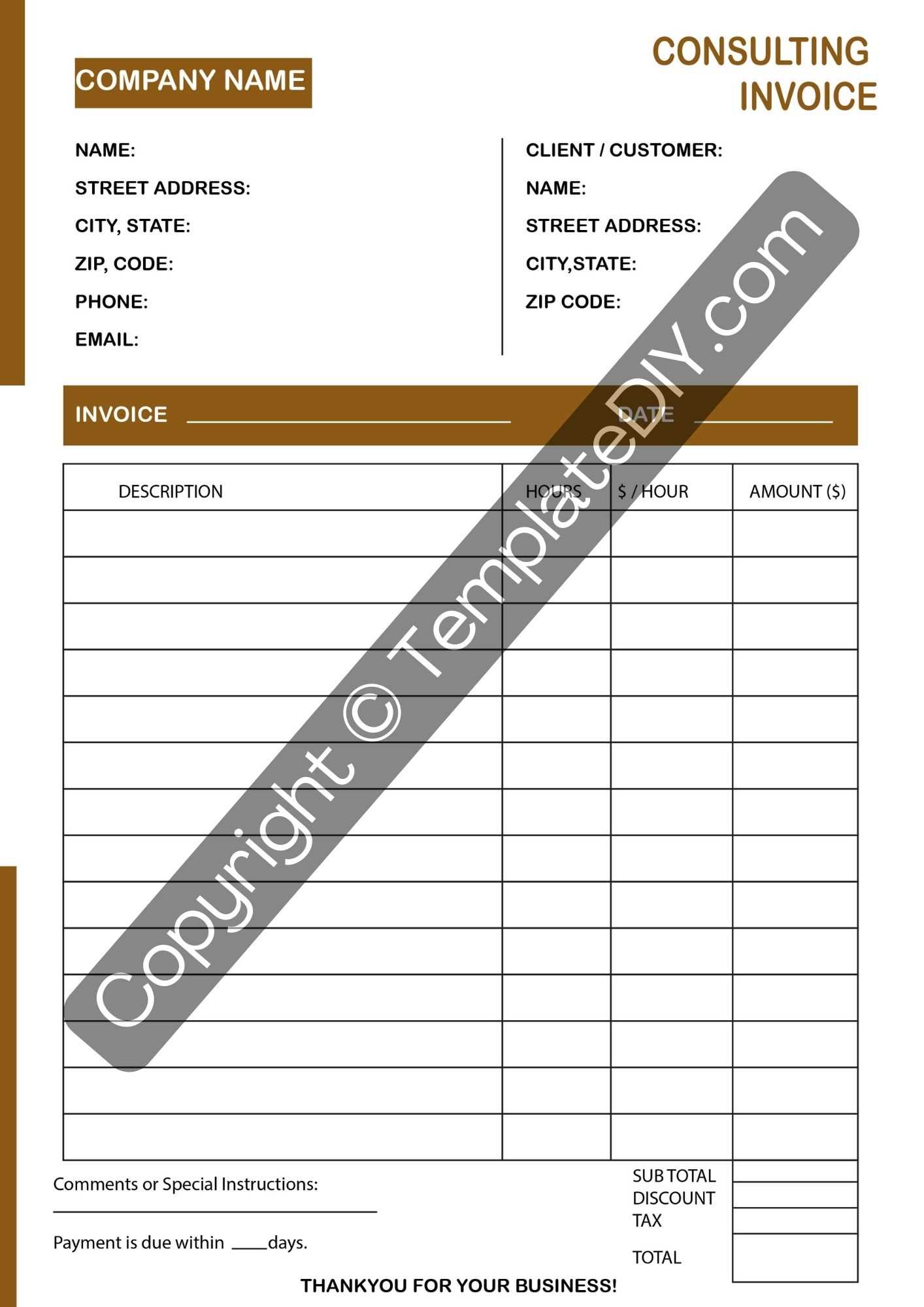

Invoice Templates for Freelancers and Contractors

Freelancers and independent contractors often need a simple yet professional way to request payments for their services. Customizable documents can help streamline this process, ensuring that all necessary details are included while maintaining a consistent appearance. These records are crucial for managing cash flow and building strong relationships with clients.

Key Features for Freelancers and Contractors

When selecting a document format, freelancers and contractors should look for options that include the following:

- Hourly Rates or Fixed Prices – The ability to specify whether you charge by the hour or by project.

- Payment Terms – Clear instructions on when payment is due and any late fees that may apply.

- Client Details – Spaces to input both your details and your client’s information for easy tracking.

- Work Descriptions – A section to describe the services provided, helping clients understand exactly what they’re being billed for.

- Tax Information – Include any necessary tax details, such as VAT or sales tax, to ensure legal compliance.

Benefits for Independent Professionals

These tools not only save time but also help maintain professionalism. By providing a clear, detailed record of your work and charges, you create an impression of reliability and expertise. Having a standardized format can also minimize errors and prevent misunderstandings with clients regarding payment expectations.

For freelancers and contractors, using well-organized billing documents is key to maintaining efficient business operations and getting paid on time. These formats help create consistency and clarity in your financial dealings, allowing you to focus more on the creative or service-oriented aspects of your work.

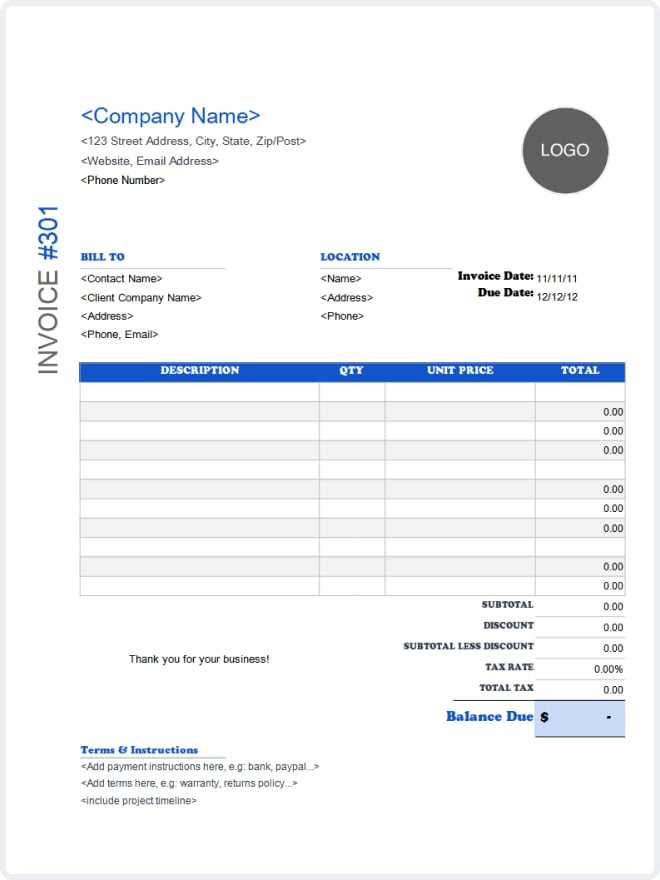

Steps to Create Professional Invoices

Creating well-organized and professional billing documents is essential for maintaining a smooth financial workflow. Whether you are a freelancer or a business owner, following a structured process ensures that you communicate payment expectations clearly and maintain a professional image. Here are the key steps to create a polished and effective request for payment.

1. Include Essential Information

Start by making sure all necessary details are included in your document. These elements ensure that both you and your client have a clear understanding of the transaction:

- Your Contact Details – Include your business name, address, phone number, and email address.

- Client Information – Add your client’s name, company, and contact details for easy reference.

- Unique Reference Number – Assign a number to each document for tracking purposes.

- Date – Include the issue date and, if necessary, the due date for payment.

2. Detail Services or Products Provided

Provide a breakdown of the work completed or products delivered. This section helps clients understand exactly what they are being charged for and can help avoid any confusion:

- Description of Work – Clearly state the services or goods delivered with detailed descriptions.

- Quantities and Rates – Specify the number of hours worked or quantity of items provided, along with the corresponding rates or prices.

- Total Amount Due – Add up the charges and include any applicable taxes, discounts, or additional fees.

3. Set Clear Payment Terms

Clearly outlining payment terms helps avoid misunderstandings. Include the following:

- Due Date – Specify when payment is expected, such as “Due within 30 days.”

- Accepted Payment Methods – Mention the payment options you accept, like bank transfers, credit cards, or online payments.

- Late Payment Penalties – If applicable, note any late fees that may be charged for overdue payments.

Following these

Why You Need a Printable Invoice Template

For any business, having a standardized way to request payments is crucial for maintaining professionalism and organization. Customizable billing documents not only help streamline the payment process but also ensure that all necessary details are consistently included. Here’s why these tools are essential for running a smooth operation:

- Professionalism – A well-structured document helps establish credibility and trust with your clients. It shows that you take your business seriously and are committed to providing clear, accurate records.

- Time Efficiency – Using pre-designed formats saves you time, allowing you to quickly create and send billing requests without starting from scratch each time.

- Consistency – By using a uniform layout for all payment requests, you ensure that your documents are always clear and easy to understand, reducing confusion for both you and your clients.

- Organization – These tools help you keep track of transactions and manage records more effectively. With consistent formatting, it’s easier to stay organized and follow up on unpaid balances.

- Legal Compliance – Many platforms ensure that their documents include all the necessary elements required by law, such as tax information and payment terms, helping you avoid potential legal issues.

- Easy Customization – These documents can be tailored to reflect your business’s specific needs, including your branding, payment terms, and service descriptions.

Having a reliable and professional way to issue payment requests is a key part of managing your finances effectively. Using these tools ensures accuracy, reduces errors, and helps you maintain positive relationships with your clients.

How to Use Invoices for Business Management

Effectively managing business finances requires more than just generating payment requests. It involves tracking income, maintaining accurate records, and ensuring that payments are received on time. Using properly formatted billing documents as part of your workflow can help you manage all of these tasks seamlessly and maintain a well-organized financial system.

Tracking Payments

One of the key ways to use billing documents in business management is to track payments over time. Keeping a record of when payments are due and when they are received helps you stay on top of your cash flow. This system also makes it easier to identify overdue balances and follow up with clients when necessary.

| Invoice Number | Client Name | Amount Due | Due Date | Status |

|---|---|---|---|---|

| #1001 | ABC Corp. | $1,500 | Nov 30, 2024 | Paid |

| #1002 | XYZ Ltd. | $2,000 | Dec 15, 2024 | Unpaid |

| #1003 | 123 Enterprises | $800 | Dec 1, 2024 | Paid |

Improving Financial Planning

Using these documents regularly not only helps with payment tracking but also plays a key role in financial planning. By analyzing past payments and keeping detailed records, businesses can forecast future cash flow more accurately, set realistic financial goals, and ensure they have enough working capital to cover expenses.

Incorporating billing records into your management system helps provide valuable insights into the financial health of your business, contributing to better decision-making and long-term success.

Printable Invoice Template Formats Explained

When it comes to creating payment requests, the format you choose plays a crucial role in how the document is perceived by clients. The right structure not only ensures that all necessary details are included but also contributes to the clarity and professionalism of your communication. Different formats cater to different business needs, and understanding these options will help you select the best one for your situation.

Common Formats for Business Billing Documents

There are several types of formats that businesses can choose from, each serving a different purpose. Some are simple and straightforward, while others are more detailed and customizable. The most common formats include:

| Format | Description | Best For |

|---|---|---|

| Basic | A clean, no-frills layout with essential information only. | Small businesses or freelancers with straightforward transactions. |

| Detailed | Includes breakdowns of services, taxes, and payment terms. | Companies needing to provide in-depth descriptions of services and charges. |

| Customized | Fully customizable, allowing for branding, logos, and personalized elements. | Businesses looking to create a branded experience or those with unique billing requirements. |

Choosing the Right Format for Your Business

Selecting the right structure depends on the complexity of your services and the level of detail required. A simple, basic format may suffice for small-scale or one-off transactions, while more complex businesses with multiple services or varying tax rates may benefit from a more detailed format. Customizing your format can also help strengthen your brand image and create a more professional look.

By understanding the different formats available, you can ensure that your documents are not only functional but also aligned with your business needs and client expectations.

Best Practices for Invoice Design

Creating clear and effective billing documents is essential for both ensuring timely payments and maintaining a professional image. The design of these documents plays a significant role in how clients perceive your business. A well-designed document makes it easier for clients to understand the payment terms and services rendered, while also reflecting the quality of your brand. Here are some best practices to keep in mind when designing your billing documents.

1. Keep It Simple and Clean

A cluttered or overly complex design can confuse your client and create delays in payment. Aim for simplicity by using clear fonts, logical structure, and enough white space to make the document easy to read. Stick to a minimalistic style that highlights key information such as the amount due, payment terms, and services provided.

2. Make Your Brand Stand Out

Incorporating your company logo, colors, and fonts will not only make your documents more professional but also reinforce your brand identity. Ensure that your brand elements are used consistently and subtly, so they don’t distract from the essential information but rather complement it.

3. Prioritize Legibility

Make sure that your text is large enough to be read easily and that there is sufficient contrast between the text and the background. This improves accessibility and ensures that your client can quickly grasp important details like the total amount due, due date, and payment instructions. Use clear section headings and bullet points where appropriate.

4. Include Clear Payment Instructions

It is essential to provide explicit payment instructions, including the methods you accept and any necessary account details. Highlight the payment due date, and, if applicable, any late fees or discounts for early payment. These details should be easy to locate within the document to prevent misunderstandings.

5. Use a Logical Structure

Ensure that your document follows a logical flow. Start with your contact information and that of your client, followed by the details of the products or services provided, and conclude with the payment information. Organizing the information in a consistent and easy-to-follow order improves the overall user experience and prevents confusion.

6. Make It Mobile-Friendly

Many clients may open and review your billing documents on their phones or tablets. Make sure your document design adapts well to different screen sizes by choosing responsive layouts. This ensures that your clients can view and read the document easily, regardless of the device th

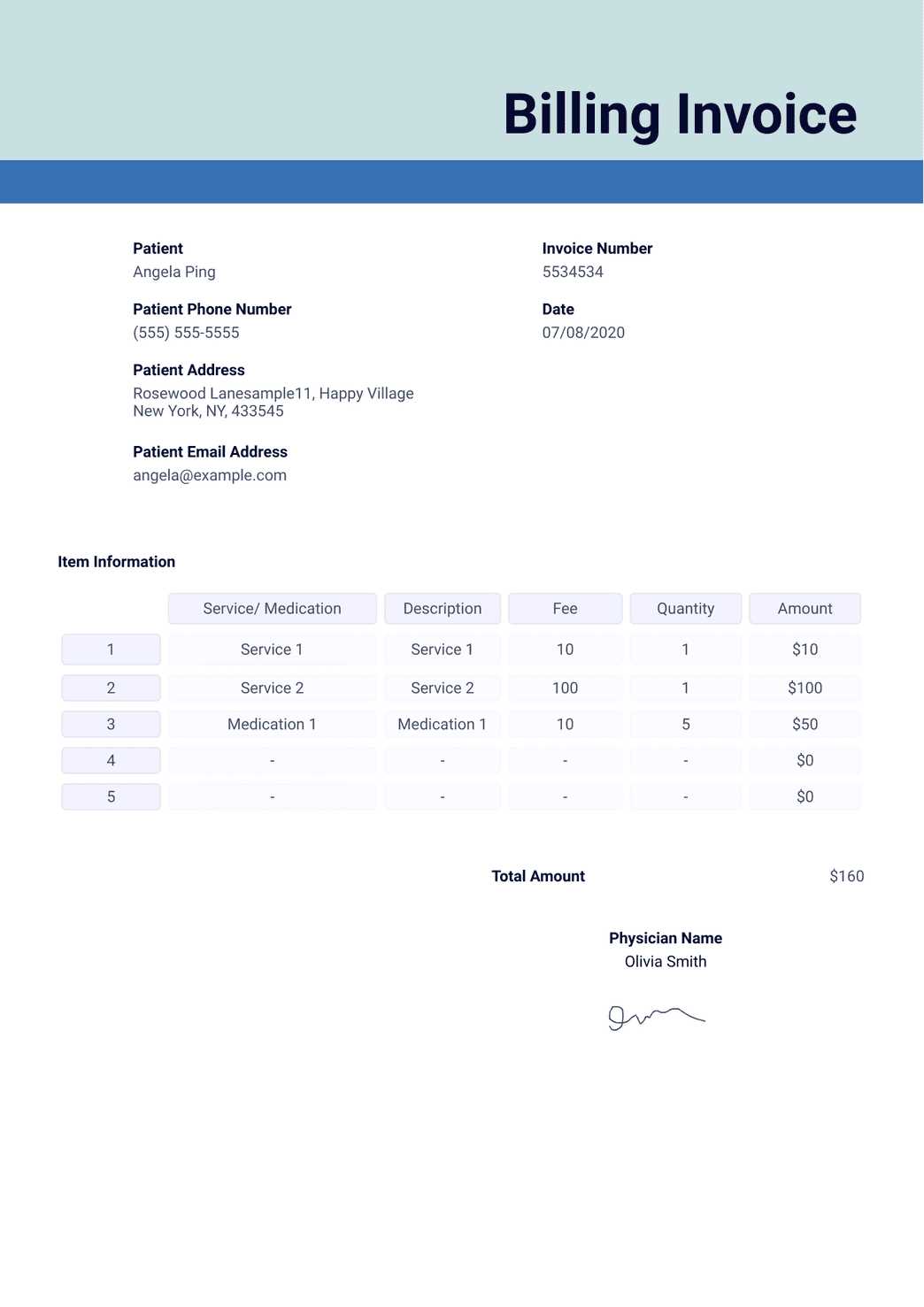

Free Invoice Templates for Online Stores

For online stores, managing transactions and maintaining a professional image is essential. One of the most efficient ways to do this is by using well-structured billing documents that clearly communicate the details of each sale. These documents not only help keep your finances organized but also provide your customers with a clear record of their purchases. Below are some key features and benefits of using billing formats tailored for e-commerce businesses.

- Detailed Product Information – An ideal billing document for online stores should include specific details about the products purchased, such as item descriptions, quantities, and prices. This ensures clarity for both the store owner and the customer.

- Tax Calculations – With various tax laws applicable to online businesses, it’s essential to have a format that allows you to calculate and display taxes clearly. This helps ensure compliance with tax regulations and provides transparency to the customer.

- Shipping Information – Since online stores often deal with shipping, including sections for shipping addresses, methods, and costs can make it easier to manage orders and clarify delivery expectations with customers.

- Payment Methods

How to Print and Send Invoices Quickly

Efficiency is key when it comes to managing payments for your business. Sending out billing documents in a timely manner ensures smooth transactions and keeps your cash flow on track. By adopting streamlined processes for creating, printing, and sending these documents, you can significantly reduce administrative time and avoid delays in receiving payments. Here are some steps you can follow to quickly handle these tasks without compromising accuracy or professionalism.

Step-by-Step Process

Follow these steps to ensure you can generate and send your billing documents efficiently:

Step Action Tips 1 Prepare the Document Use pre-designed formats that automatically populate with client and service details for faster processing. 2 Review the Details Double-check for any errors or missing information like tax rates, payment terms, and amounts due. 3 Print the Document Ensure your printer is set up correctly for high-quality output. If using a digital format, ensure it is saved as a PDF to preserve formatting. 4 Send Electronically For faster delivery, send the document via email, using a professional subject line and clear instructions for payment. 5 Follow-Up If the payment hasn’t been received by the due date, send a polite reminder with a copy of the document attached. Tips for Speeding Up the Process

To further streamline the process of generating and sending your billing documents, consider these tips:

- Automate recurring billing for clients with regular transactions.

- Use accounting software that integrates with payment processors to track and send billing requests directly.

- Keep a list of frequently used services or products to quickly populate details in the document.

- Set up te

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for maintaining smooth business operations and ensuring timely payments. However, small errors or oversights can lead to confusion, delayed payments, or even damage to your business reputation. By understanding and avoiding these common mistakes, you can ensure that your documents are clear, concise, and effective.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include accurate and complete contact details for both the seller and the buyer. Missing contact information can lead to confusion and delays, especially if there are any issues or disputes regarding the transaction. Always ensure that the name, address, phone number, and email of both parties are clearly stated on the document.

2. Incorrect Payment Terms

Clearly stating the payment terms is crucial. Whether you offer a 30-day payment window, discounts for early payments, or penalties for late payments, these terms need to be accurate and clearly communicated. Any ambiguity can result in misunderstandings, which may lead to delayed payments.

3. Lack of Item Descriptions

Not providing detailed descriptions of the products or services rendered can create confusion for your clients. Always list each item or service with a clear description, the quantity provided, the unit price, and the total cost. This transparency helps ensure that the client knows exactly what they are paying for and reduces the risk of disputes.

4. Failing to Include Tax Information

For many businesses, including sales tax or other applicable fees is mandatory. Forgetting to include this information, or not properly calculating it, can result in legal issues or disputes. Be sure to list the applicable tax rates and any additional charges (such as shipping fees), and calculate the total amount due correctly.

5. Using Vague Language

Vague or unclear wording can lead to confusion and delays in payment. Avoid using ambiguous terms like “miscellaneous” or “service charge” without further explanation. If additional charges are included, provide clear details about what those charges entail.

6. Not Including an Invoice Number

How to Keep Track of Paid Invoices

Efficiently managing your financial records is essential for any business. Keeping track of which bills have been settled and which are still outstanding helps ensure that your cash flow remains healthy. Proper tracking also enables you to quickly identify overdue payments and maintain good relationships with clients. Here are several effective strategies to help you stay on top of your paid and pending transactions.

1. Use Accounting Software

One of the most effective ways to manage your paid bills is by using accounting or invoicing software. These tools can automatically track payments, send reminders, and generate reports on outstanding balances. Many software solutions also allow you to mark transactions as paid, making it easy to stay updated with minimal manual input.

2. Organize with a Payment Log

If you prefer a manual approach, maintaining a payment log is a great option. This can be done in a spreadsheet or physical ledger. You should include the following details for each transaction:

- Invoice Number

- Client Name

- Amount Due

- Amount Paid

- Payment Date

- Outstanding Balance (if applicable)

By updating the log each time a payment is received, you can quickly see which accounts are current and which need attention.

3. Send Payment Confirmation

Once a client settles their balance, always send a confirmation of payment. This can be done via email or through your invoicing platform. Having a record of paid transactions helps you track which clients have fulfilled their obligations and ensures that you have documentation in case of any disputes.

4. Follow Up on Unpaid Bills

Tracking paid bills is only effective if you also actively monitor unpaid ones. Set up a regular schedule to review your outstanding balances and send reminders to clients who haven’t yet paid. Automated reminders or personalized follow-up emails are excellent ways to prompt action.

5. Create a Reporting System

Consider setting up periodic financial reports that give you a snapshot of your paid and unpaid transactions. Many accounting platforms allow you to generate custom reports for specific time frames, which can help you