Pro Forma Invoice Template for Easy and Professional Invoicing

In business transactions, having clear and accurate documentation is essential for both parties involved. One common form of financial paperwork is used before the actual sale is completed, providing an outline of the proposed costs and details. This preliminary document plays a crucial role in ensuring that both the seller and the buyer are on the same page regarding terms, prices, and services.

Such documents serve as a useful tool for planning and budgeting, especially when goods or services are being prepared for shipment or delivery. They provide a structured overview of the expected costs and allow for any necessary adjustments before the final financial agreement is made. By using a standardized format, companies can streamline their processes and ensure consistency in their billing practices.

Having access to a well-designed version of this document can save time and reduce errors, making it easier to manage complex transactions. Whether you are a small business owner or part of a larger organization, understanding how to create and utilize this type of paperwork effectively is key to maintaining smooth operations and fostering trust between all parties involved.

What is a Pro Forma Invoice?

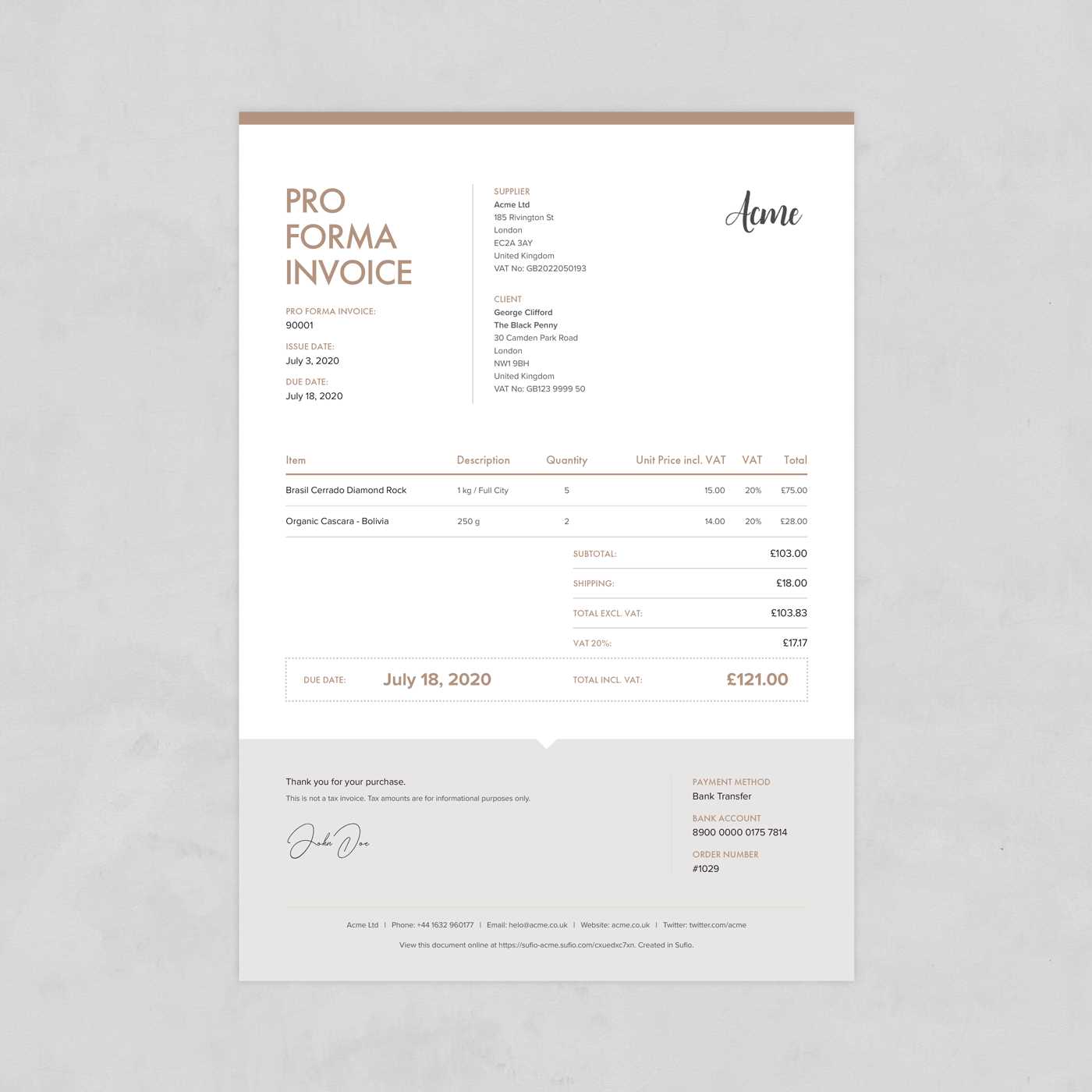

A preliminary document used in business transactions provides a detailed estimate of costs before the final sale is completed. It outlines the expected charges for goods or services, offering a clear overview of the terms, pricing, and delivery details. This kind of document is typically issued before the final purchase order and is not a request for payment, but rather a formal proposal that serves as a reference point for both the buyer and the seller.

Unlike a final billing document, this type of paperwork is not legally binding and does not demand payment. Instead, it helps both parties understand the projected cost structure and make necessary adjustments before proceeding with the transaction. It’s commonly used for international shipments, large projects, or whenever there is a need to confirm terms in advance.

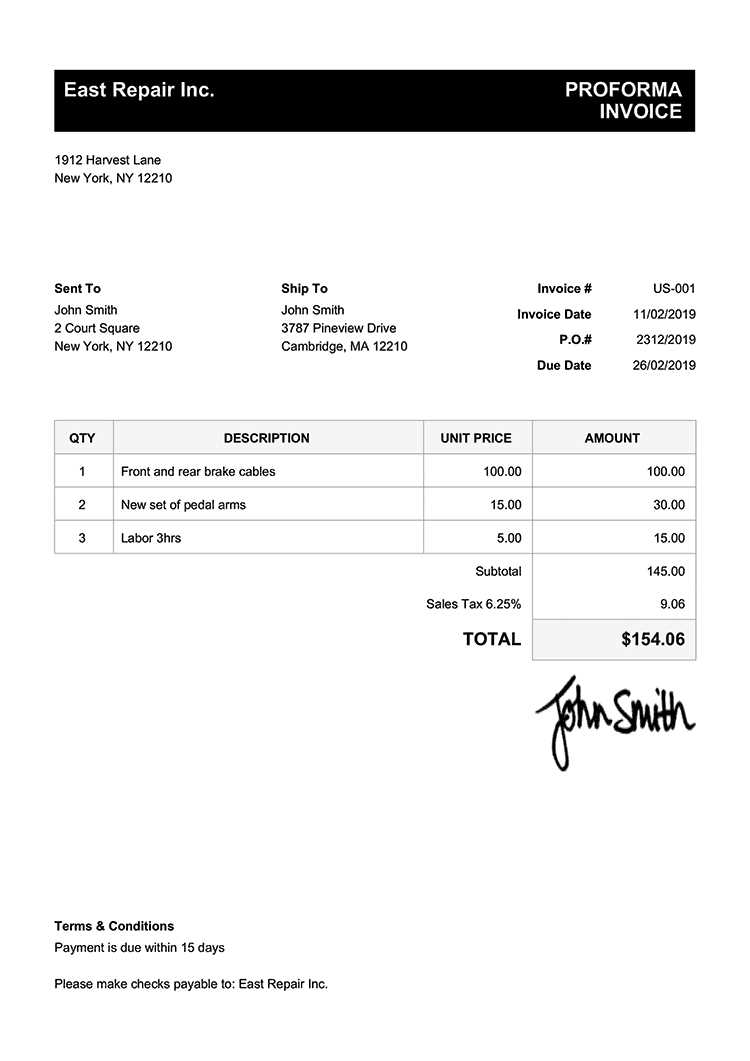

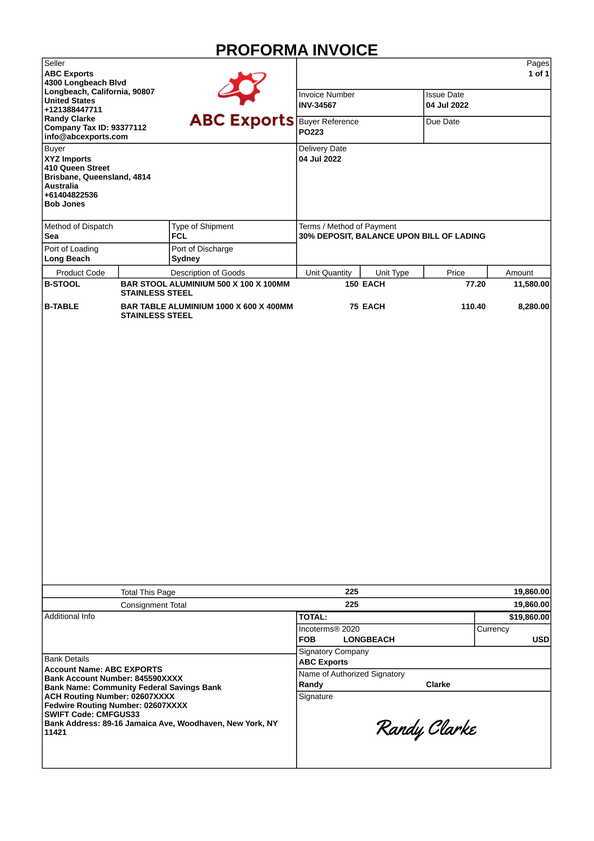

Below is an example of the key elements commonly found in such documents:

| Section | Description |

|---|---|

| Header | Contains the document title, date, and unique reference number. |

| Buyer and Seller Details | Lists contact information for both the buyer and the seller. |

| Description of Goods/Services | Details of the items or services being offered, including quantity and specifications. |

| Estimated Price | Shows the proposed costs for each item or service, as well as total costs. |

| Terms and Conditions | Outlines the payment terms, delivery schedules, and any other agreements between the parties. |

This document helps ensure that both sides agree on the main aspects of the deal before committing to the final transaction, thus reducing the potential for misunderstandings or disputes later on.

Key Differences Between Pro Forma and Regular Invoices

When it comes to financial documentation, two types of documents are often used to outline costs in business transactions: preliminary estimates and final billing statements. While both serve to detail prices and services, they have distinct purposes and legal implications. Understanding the differences between these two can help businesses manage their transactions more effectively and avoid potential confusion.

Purpose and Function

The primary difference lies in the purpose of the documents. A preliminary estimate is typically issued before the final agreement is made, offering an outline of the expected charges for goods or services. It acts as a reference document, not requiring immediate payment. On the other hand, a final billing statement is a request for payment based on the agreed terms and marks the conclusion of the transaction.

Legal Status and Payment

A preliminary estimate holds no legal standing and does not obligate the buyer to pay anything. It’s a tool for confirming pricing details and conditions. In contrast, a final billing document is legally binding, requiring the buyer to pay the amount stated within a specified timeframe. This payment request is the last step before the transaction is officially completed.

In summary, while both documents are crucial for facilitating clear communication in transactions, the preliminary document serves as an informative estimate, while the final statement is an actionable request for payment and is enforceable by law. Knowing when and how to use each is essential for maintaining transparency and trust in business dealings.

How to Create a Pro Forma Invoice

Creating a preliminary billing document is an important task for businesses when outlining the expected costs of goods or services. This document serves as an estimate, providing both the buyer and seller with a clear understanding of the proposed financial terms before the final transaction takes place. The process involves gathering specific information, ensuring accuracy, and following a structured format to present the details effectively.

Step-by-Step Guide

Follow these essential steps to create an accurate and professional preliminary document:

- Include Header Information: Start by clearly labeling the document as an estimate or a preliminary bill. Include the date of issue and a unique reference number for easy tracking.

- Seller and Buyer Details: Add the names, addresses, and contact details of both parties involved in the transaction.

- Describe Goods or Services: Provide a detailed list of the items or services being offered, including quantities, specifications, and any special terms.

- List Estimated Costs: Specify the price for each item or service and calculate the total cost. Be sure to include taxes, shipping fees, or other additional charges, if applicable.

- Set Payment Terms: Define the payment method, due date, and any conditions for discounts or penalties.

- Include Delivery Information: Mention the expected delivery dates, shipping methods, or any other logistical details that might be relevant to the transaction.

- Finalize Terms and Conditions: Add any legal terms, cancellation policies, or other important information that both parties must agree on before the final sale.

Helpful Tips for Accuracy

- Always double-check the pricing details to avoid errors that could lead to confusion or disputes.

- Clearly specify any optional fees, such as shipping or handling costs, to prevent hidden charges later on.

- Ensure the terms and conditions are comprehensive, covering potential changes to the agreement.

By following these steps, you can create a clear, accurate, and professional preliminary document that facilitates smooth transactions and helps prevent misunderstandings between all parties involved.

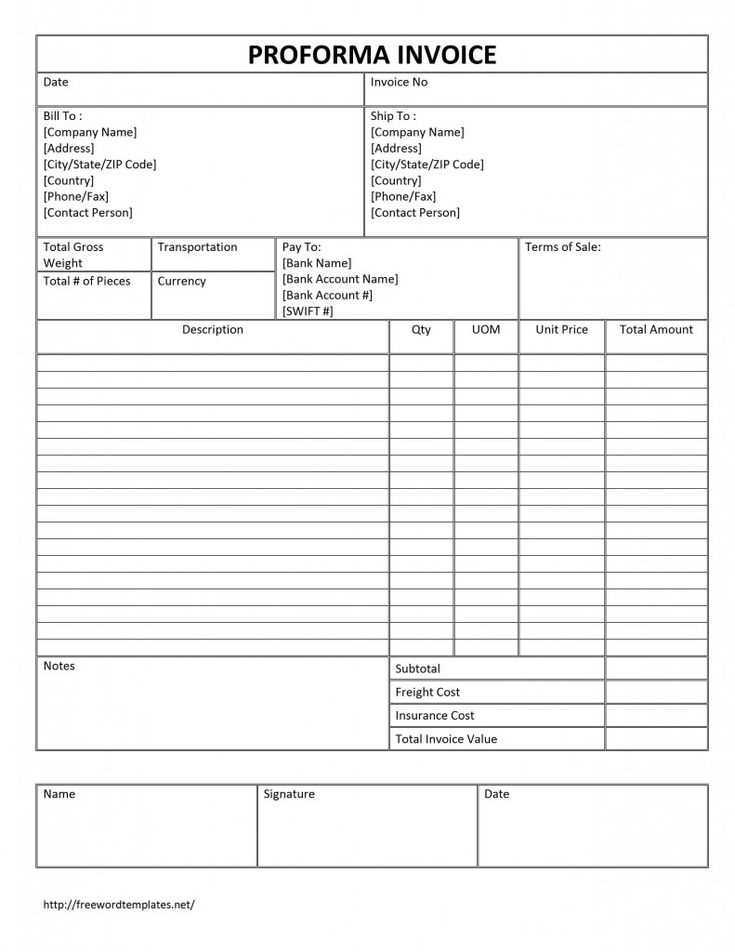

Essential Information in a Pro Forma Invoice

To ensure clear communication and prevent misunderstandings between buyers and sellers, a preliminary financial document must contain specific details. This document acts as an estimate, outlining expected costs, terms, and conditions before a final transaction. Including the right information not only enhances professionalism but also sets clear expectations for both parties involved.

Here are the key elements that should be included in such a document:

- Document Title: Clearly label the document as a preliminary estimate or quotation, ensuring there is no confusion with a final bill.

- Unique Reference Number: Assign a unique identifier or number to track the document and differentiate it from other records.

- Date of Issue: Include the date when the document is issued, as this helps establish the timeline for the transaction.

- Seller’s Contact Information: Provide the full name, address, phone number, and email address of the seller or service provider.

- Buyer’s Contact Information: Include the buyer’s details to ensure both parties are clearly identified and can be reached if needed.

- Description of Goods/Services: List the items or services being provided, including specifications, quantities, and unit prices.

- Estimated Costs: Provide a detailed breakdown of the costs, including taxes, discounts, and any additional fees, such as shipping or handling.

- Payment Terms: Specify how payment should be made, including due dates, accepted payment methods, and any conditions for deposits or final payment.

- Delivery Details: State the expected delivery date, shipping method, or any special delivery instructions relevant to the transaction.

- Terms and Conditions: Include any important contractual details, such as cancellation policies, return policies, and any legal obligations the buyer or seller must fulfill.

By ensuring that these essential details are included, businesses can avoid confusion, foster trust with clients, and streamline the process for completing transactions smoothly.

Common Mistakes to Avoid in Pro Forma Invoices

While creating a preliminary document for a transaction, it’s easy to overlook some crucial details. Small errors can lead to confusion, miscommunication, and delays in finalizing deals. To avoid complications and ensure professionalism, it’s important to be aware of common mistakes that often arise during the creation of such documents. Below are several key pitfalls to watch out for.

Incomplete or Incorrect Information

One of the most frequent issues is missing or incorrect details. Inaccurate descriptions of products or services, incorrect quantities, or mismatched prices can lead to confusion and frustration for both parties. It’s essential to:

- Double-check all prices: Ensure that unit prices are correct and consistent throughout the document.

- List all items and services clearly: Provide detailed descriptions and specifications, especially for customized or complex orders.

- Verify contact information: Ensure that both buyer and seller details are accurate, including addresses and contact numbers.

Unclear Terms and Conditions

Another critical mistake is leaving terms and conditions vague or undefined. This can lead to disagreements later on. Be specific about:

- Payment terms: Clearly state when payments are due, what methods are acceptable, and whether any deposits are required.

- Delivery details: Indicate expected delivery dates, shipping methods, and any potential additional charges.

- Cancellation and return policies: Ensure both parties understand the procedures for returns or cancellations, if applicable.

By carefully reviewing the content and avoiding these common mistakes, businesses can reduce the risk of misunderstandings, promote trust, and create more efficient transactions.

When to Use a Pro Forma Invoice

A preliminary billing document is commonly used in various situations where businesses need to outline the expected costs of goods or services before finalizing the transaction. This type of paperwork can be especially helpful for international trade, project-based services, or when a clear agreement on pricing and terms is needed before any actual payment is made. Understanding when to issue this kind of document is crucial for smooth operations and transparent communication between buyers and sellers.

Here are some common scenarios where such documents are typically used:

| Scenario | Reason for Use |

|---|---|

| International Trade | Helps to outline customs duties, taxes, and shipment details for goods crossing borders. |

| Large Projects | Provides a cost estimate for a complex project, allowing the client to review terms before committing. |

| Custom Orders | Used when creating customized products or services, where exact pricing and specifications need to be agreed upon beforehand. |

| Quotes for Potential Clients | Offers a formal estimate to potential clients, giving them a clear understanding of expected charges before making a purchase decision. |

| Internal Use | Allows internal departments to confirm the cost and availability of materials before placing orders or approving payments. |

By using this type of document in these scenarios, businesses can avoid confusion, prevent disputes, and establish a more professional relationship with their clients.

Pro Forma Invoice vs Commercial Invoice

In business transactions, two commonly used types of billing documents serve distinct purposes: a preliminary document that outlines expected costs before a sale is completed, and a final document issued once the transaction is confirmed. While both types provide similar information, they differ in function, legal status, and timing. Understanding these differences is key to ensuring the correct document is used in the right context.

Purpose and Timing

The main distinction between these two documents lies in their purpose and timing within the sales process. A preliminary document is issued before the final deal is closed, often used as a proposal or estimate. It provides a detailed breakdown of expected charges but is not a request for immediate payment. It allows both the buyer and seller to review and agree on the terms before proceeding with the final transaction.

In contrast, a final document is issued after both parties have agreed on the terms and the sale is complete. It serves as a formal request for payment, detailing the agreed-upon amount due. This document is legally binding and is used to record the financial transaction that has taken place.

Legal Status and Payment

The preliminary document holds no legal weight and does not require payment. It’s merely an outline of the costs and terms for reference. On the other hand, the final document is legally binding and serves as a confirmation of the agreement between the buyer and the seller. It includes payment details, such as the due date and methods of payment, and can be used to settle the transaction.

In summary, while both documents are integral to business transactions, the preliminary document is used for estimation and confirmation purposes, whereas the final document serves as the official request for payment and completion of the sale.

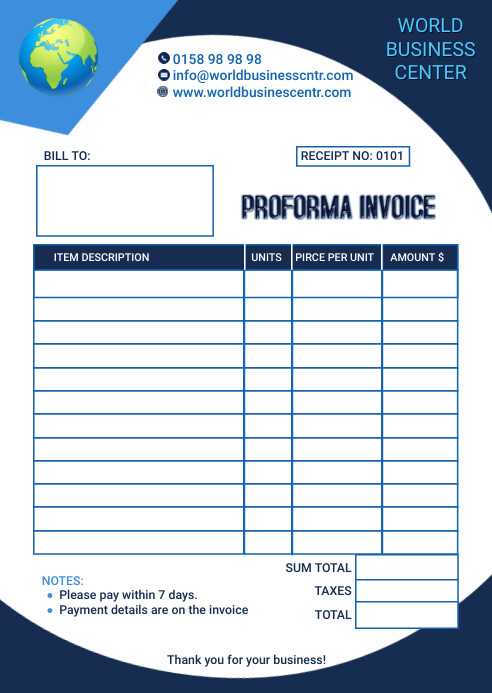

Pro Forma Invoice Template Features

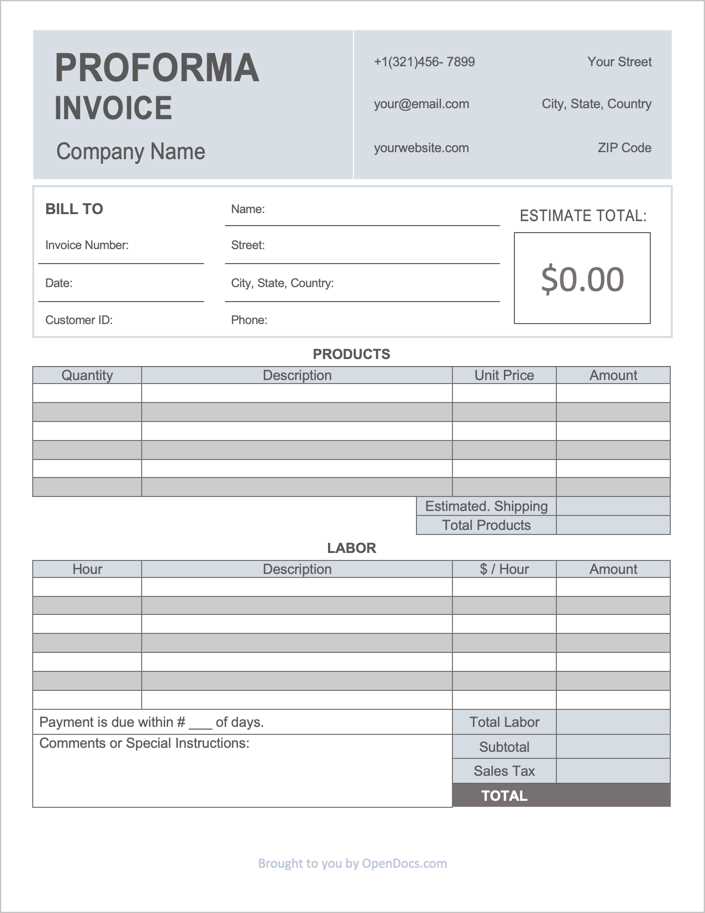

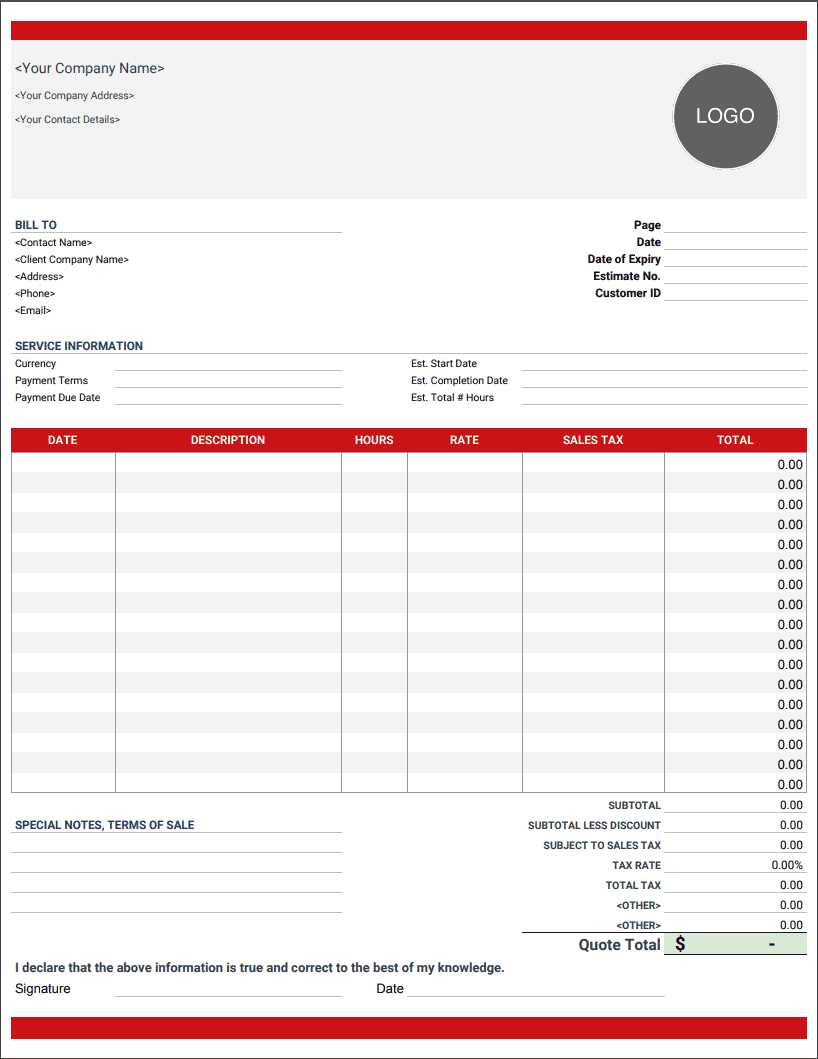

A well-structured preliminary billing document is essential for businesses that want to clearly communicate the terms of a transaction before it is finalized. This type of document should include key features that make it easy to understand and ensure both the buyer and seller are on the same page. A good format includes several sections that help outline expected costs, delivery terms, and other critical details.

Here are the core features that make an effective preliminary document:

- Clear Identification: The document should be clearly labeled as a “preliminary estimate” or “quotation” to avoid confusion with final billing records.

- Unique Reference Number: A distinct number for each document is essential for tracking and organizational purposes, allowing both parties to refer to it easily in case of any issues.

- Contact Details: Both the seller’s and buyer’s full contact information, including names, addresses, and phone numbers, should be listed to ensure communication is streamlined.

- Detailed Breakdown of Products/Services: A list of the items or services being provided, including specifications, quantities, and unit prices, helps clarify the scope of the transaction.

- Estimated Costs: This section should outline the expected charges, taxes, shipping costs, and any other additional fees to give the buyer a complete picture of the total cost.

- Payment Terms: Include specific payment instructions, such as due dates, acceptable payment methods, and any discounts or penalties that apply.

- Delivery Information: Details regarding the estimated delivery date, shipping method, and any special instructions related to logistics should be clearly stated.

- Terms and Conditions: This section should cover any relevant policies, including return procedures, warranty information, and other legal considerations that both parties must agree on.

Including these features ensures that the document is comprehensive and useful, providing both clarity and structure for any transaction. With a standardized format, businesses can streamline their processes and maintain a high level of professionalism in their dealings.

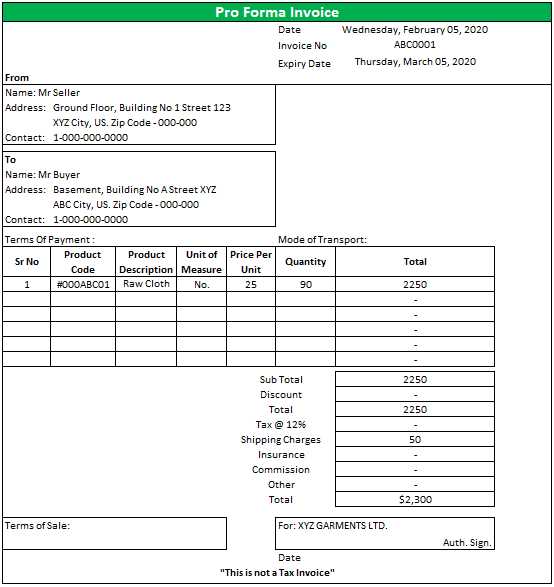

How to Customize Your Pro Forma Invoice Template

Customizing a preliminary billing document is a great way to ensure it aligns with your business needs and reflects your brand identity. Whether you’re creating a document for internal use, a potential client, or an international transaction, tailoring it to fit your specific requirements can make it more professional and effective. The key is to ensure the layout is clear, all necessary information is included, and the style matches your company’s image.

Steps to Personalize Your Document

Follow these steps to easily customize your preliminary billing document:

- Branding and Logo: Add your company logo, name, and contact details at the top of the document. This makes the document immediately recognizable and reinforces your brand.

- Update Section Titles: Customize section headings to fit the language and tone of your business. For example, you could use “Product List” instead of “Description of Goods,” or “Payment Instructions” instead of “Terms.”

- Include Custom Fields: If your business has specific requirements, such as adding order numbers, discount codes, or product categories, include custom fields to capture this information.

- Adjust Formatting: Change fonts, colors, or layout to ensure it matches your company’s visual identity. A consistent design helps build a professional appearance.

- Personalized Terms: Tailor the payment terms and conditions to reflect your business practices. For example, if you offer extended payment deadlines or early payment discounts, be sure to outline them clearly.

- Add or Remove Sections: Depending on your needs, you might want to remove unnecessary sections or add new ones, such as shipping instructions, payment due dates, or special instructions for custom orders.

Tips for Effective Customization

- Keep it Professional: While customization adds personality, always ensure the document remains professional and easy to read.

- Use Clear Language: Be concise and clear in describing terms and conditions to avoid confusion.

- Stay Consistent: Maintain consistency across all your financial documents to foster a unified business image.

By following these steps, you can create a personalized and professional preliminary document that not only fits your specific needs but also reinforces your brand and enhances client communication.

Legal Aspects of Pro Forma Invoices

When creating a preliminary billing document, it’s crucial to understand the legal considerations involved. Unlike final billing statements, these documents are not binding agreements, but they still carry significance in commercial transactions. While not directly enforceable like a standard bill, the preliminary document must still adhere to certain regulations and best practices to avoid legal issues or misunderstandings between parties.

Understanding the Legal Standing

Preliminary documents, unlike final invoices, do not represent a request for payment, but rather an estimate or quotation. However, they still play an important role in contract negotiations and can be used as evidence in disputes. The legal standing of this type of document largely depends on the jurisdiction and the context in which it’s used. While not a formal agreement, it is essential that both parties review the document thoroughly to ensure all details are correct before proceeding with any formal contract or transaction.

- Non-binding Nature: These documents are typically non-binding and serve only as a representation of estimated costs, terms, and conditions.

- Contractual Implications: If both parties agree to the terms outlined in the preliminary document and proceed with the transaction, the terms could eventually become part of a formal contract.

- Potential for Disputes: While not legally enforceable, errors in the document can lead to disputes. Clearly specifying terms, pricing, and conditions is important to prevent any potential legal confusion.

Key Legal Considerations

It’s essential to address several factors to ensure the document meets legal standards:

- Clear Terms: Make sure that terms related to payment, delivery, and other business conditions are clearly outlined to prevent confusion down the line.

- Accurate Pricing: Ensure that the prices are clearly listed and accurate to avoid any claims of misrepresentation or fraud.

- Compliance with Local Laws: Depending on the jurisdiction, there may be specific legal requirements for the content and format of such documents, especially for international transactions.

- Disclaimers: It is advisable to include disclaimers indicating that the document is a preliminary estimate, not a final demand for payment.

By understanding the legal aspects and including the right clauses and information, businesses can avoid potential disputes and ensure that the preliminary document serves its intended purpose in a clear and professional manner.

International Trade and Pro Forma Invoices

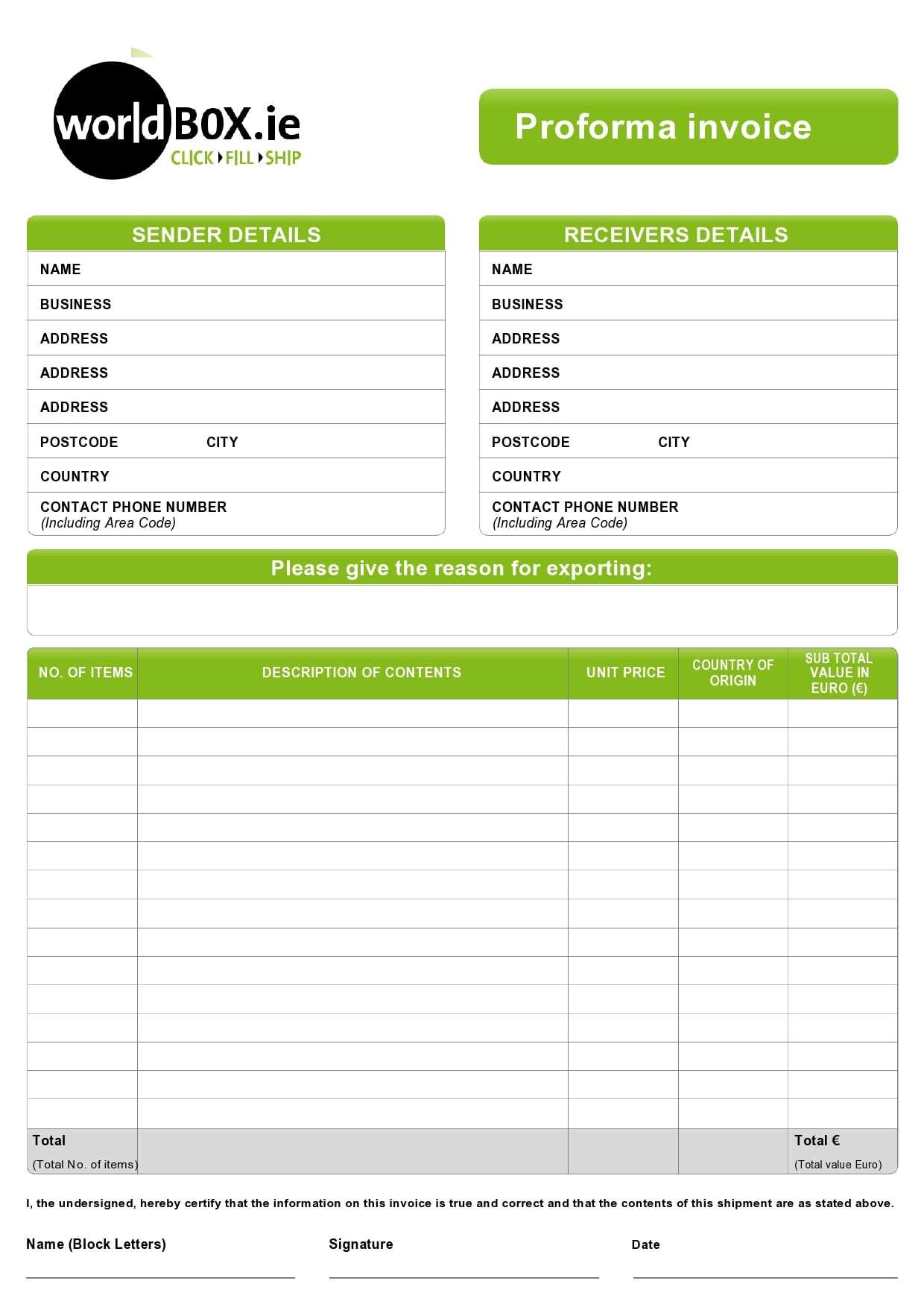

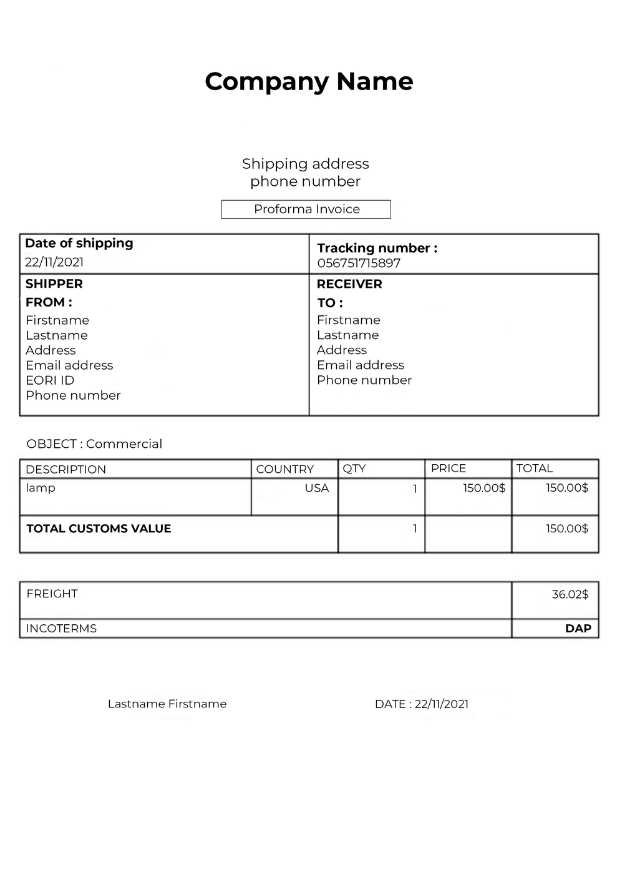

In international trade, clear communication regarding pricing, taxes, shipping, and customs is essential for smooth transactions between businesses located in different countries. One key document used in these cross-border dealings is a preliminary financial statement, which helps buyers and sellers outline the expected terms before the final purchase is made. This document not only facilitates smoother negotiations but also ensures that both parties have a clear understanding of the costs involved, including duties, taxes, and delivery charges.

Role in Cross-Border Transactions

When dealing with international transactions, this type of document serves as a vital tool to provide the buyer with an estimated cost of goods or services, as well as all associated fees such as shipping and customs duties. It plays a crucial role in customs clearance, as many countries require a detailed breakdown of costs and goods when goods are imported. While not a final request for payment, it ensures that both parties understand what to expect in terms of financial obligations before proceeding with the actual transaction.

- Customs and Shipping Information: The document typically includes detailed shipping information, including the mode of transport, delivery timelines, and packaging specifics, which are critical for customs processing.

- Estimated Duties and Taxes: It allows the buyer to understand and plan for any customs duties, taxes, and fees that may apply when goods cross international borders.

- Currency and Payment Terms: It outlines the agreed-upon currency and the payment terms for both the buyer and the seller, which is essential when working across different monetary systems.

Importance in Preventing Misunderstandings

For businesses engaged in international trade, using a preliminary document helps prevent misunderstandings between the buyer and seller. It provides transparency on all expected costs and fees, helping to avoid confusion or disputes during the actual transaction. Additionally, it helps the buyer to secure financing or obtain approval for a transaction, as banks and financial institutions often require such documents to verify the costs involved in international purchases.

- Clear Agreement on Pricing: Both parties can review and agree on the pricing structure, ensuring that there are no surprises later in the process.

- Regulatory Compliance: Some countries require this type of document to comply with import regulations and to prevent delays at customs.

- Risk Mitigation: By outlining all terms and conditions in advance, the risk of misunderstandings, unexpected costs, or regulatory issues is significantly reduced.

By using this document in international trade, businesses can ensure smoother transactions, better planning, and a clearer understanding of the financial and logistical obligations involved.

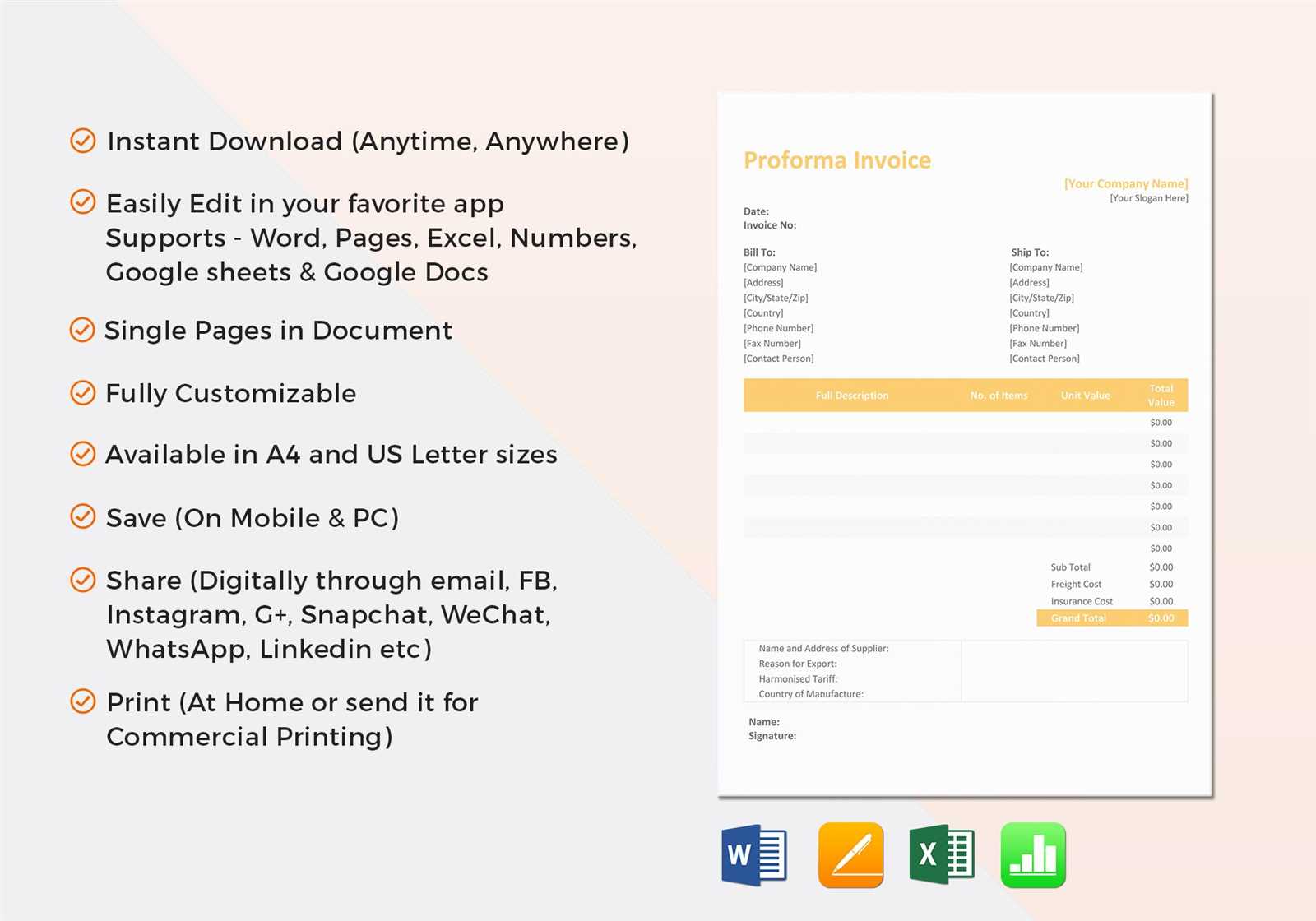

Free vs Paid Pro Forma Invoice Templates

When creating a preliminary financial document, businesses have the option of using free or paid resources. Both options come with their own sets of advantages and limitations. The decision between using a free or paid version often depends on the complexity of your business needs, the level of customization required, and the features offered by the chosen solution. Understanding the differences can help you select the best option for your particular situation.

Advantages of Free Templates

Free options can be a great starting point for businesses with straightforward needs or those just beginning to incorporate these documents into their processes. These resources typically come with basic features, and you can find many free versions available online. They are easy to access and often require minimal setup. For small businesses or one-time transactions, these free templates may be sufficient.

- Cost-Effective: No upfront cost, which is ideal for businesses with limited budgets.

- Quick Setup: Easy to download and use with minimal customization needed.

- Basic Features: Provides all the essential fields, including item descriptions, pricing, and contact details.

Advantages of Paid Templates

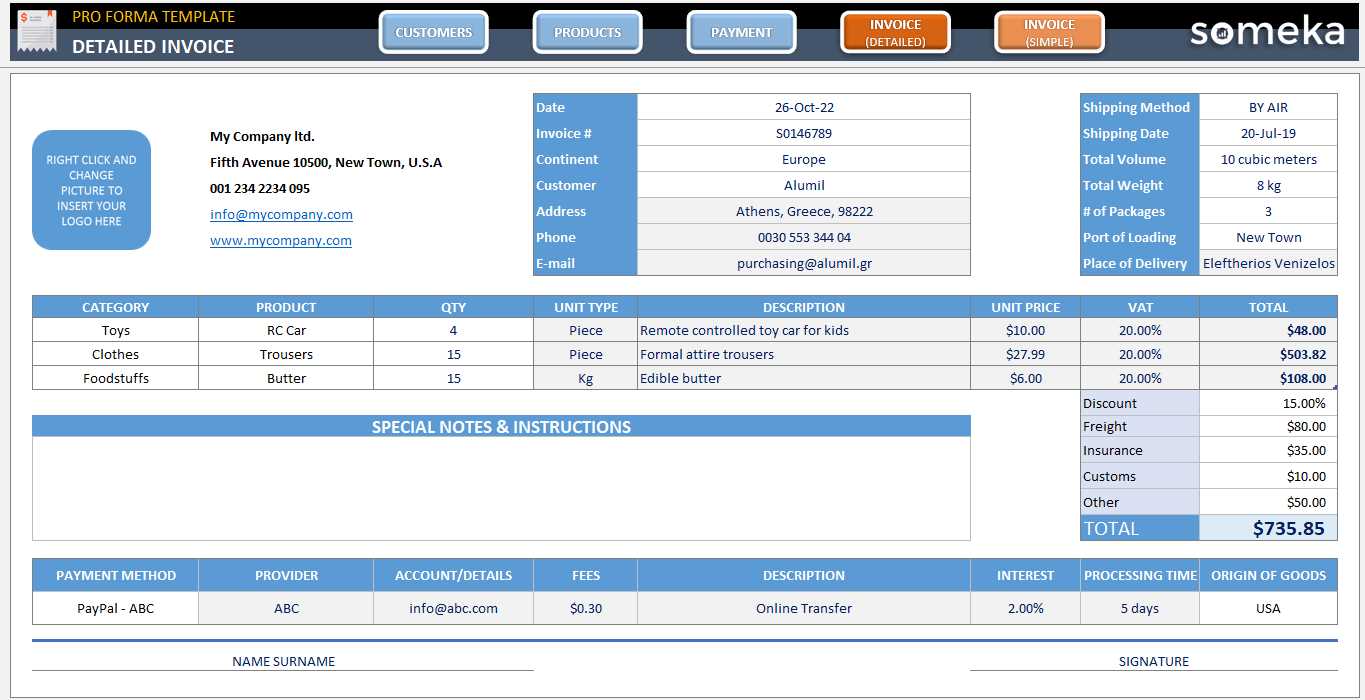

On the other hand, paid resources typically offer more advanced features and customization options. These templates often come with additional tools that can enhance the user experience, such as integrated tax calculations, custom branding options, and automated fields. For businesses with more complex needs or those looking for a professional edge, investing in a paid version may be worthwhile. Paid templates can also include customer support and regular updates, ensuring that you always have access to the latest features and compliance standards.

- Advanced Features: Includes customization options, such as adding logos, adjusting fields, and integrating with accounting software.

- Time-Saving: Streamlines the process by offering pre-filled sections and automated calculations.

- Professional Look: Provides a polished, branded appearance that can enhance the business’s credibility.

- Support and Updates: Access to customer service and regular software updates to ensure accuracy and compliance.

Ultimately, the choice between free and paid options depends on the specific needs of your business. Small or occasional users may find that a free version suits them perfectly, while larger or more established businesses may benefit from the added functionality and support that paid templates offer.

How to Save Time with Templates

Creating financial documents from scratch for every transaction can be time-consuming and repetitive. Using a pre-designed format can significantly streamline the process, allowing businesses to focus more on core tasks and less on administrative work. By utilizing a ready-made structure, you can eliminate the need to re-enter the same information multiple times, reduce errors, and ensure consistency across all your documents.

Efficiency and Automation

One of the main benefits of using a pre-designed structure is the ability to automate repetitive tasks. With a consistent layout and predefined fields, much of the work is already done. Simply inputting specific transaction details, such as quantities, prices, and dates, can be done in a matter of minutes. This cuts down on the time spent formatting and allows businesses to produce documents faster.

- Predefined Fields: Templates often come with preset sections like product descriptions, pricing, and payment terms, so you don’t have to start from scratch each time.

- Automation: Many formats allow you to automatically calculate totals, taxes, and discounts, saving you time on manual calculations.

- Consistency: Templates ensure that all documents follow a uniform format, reducing the risk of mistakes and ensuring a professional appearance.

Customization and Flexibility

While templates help speed up the process, they also offer enough flexibility for customization. You can adjust sections based on the specific needs of each transaction or client, allowing for personalized details without the need to redesign the entire document. This means you can maintain efficiency while still providing tailored content for each business deal.

- Easy Customization: Simply update fields such as client names, product details, and delivery dates without altering the overall structure.

- Flexible Layouts: Choose from various formats that suit different transaction types, whether for local deals or international trade.

- Save Templates for Reuse: Once you’ve customized a format for a specific type of transaction, you can save it and reuse it for future deals, further reducing time spent on document creation.

By using ready-made formats, businesses can achieve greater efficiency, reduce the risk of errors, and free up time to focus on more important aspects of their operations.

Pro Forma Invoice for Small Businesses

For small businesses, managing cash flow and maintaining clear communication with clients is crucial. One way to streamline business operations is by using a preliminary billing document. This document helps provide clarity on estimated costs, payment terms, and delivery schedules, especially when the final terms are still being negotiated. For small businesses, using such a document can improve professionalism, reduce confusion, and build trust with clients, all while simplifying the transaction process.

Why Small Businesses Should Use This Document

Using a preliminary financial statement offers several benefits to small businesses, particularly when it comes to transparency and organization. It provides an official record of the agreed-upon terms and sets expectations for both the seller and the buyer. This is especially important when working with new clients or dealing with large, complex transactions.

- Improves Communication: Clear breakdown of costs, including shipping and taxes, helps avoid misunderstandings later in the process.

- Professional Appearance: This type of document provides a formalized way of communicating key details, enhancing your business image.

- Helps Secure Financing: Financial institutions or investors may require such documents for approval when seeking funding or credit.

How Small Businesses Can Benefit from Using This Document

For small businesses with limited resources, time and accuracy are key. A preliminary financial statement can save time by providing a structure for quickly creating clear, consistent documents for clients. Additionally, it can assist in managing client expectations and improving cash flow by specifying payment deadlines and terms upfront.

- Streamlines the Process: Reduces the time spent on back-and-forth communication about pricing and payment terms.

- Ensures Accuracy: Provides a template to enter all relevant information accurately, reducing errors in calculations and documentation.

- Clarifies Payment Expectations: Clearly outlines the terms of payment and potential discounts, ensuring that both parties agree on the financial details.

By adopting this type of document, small businesses can ensure smoother operations, better client relationships, and more efficient financial management, all while appearing professional and reliable in the eyes of their customers.

Tracking Payments with Pro Forma Invoices

Efficiently managing payments is essential for any business, especially when dealing with preliminary billing documents. These documents help outline the terms of a transaction, including pricing and expected payment dates. While they are not formal requests for payment, they serve as useful tools for tracking financial progress, ensuring clarity on what is owed, and monitoring when payments are made. By keeping track of these estimates, businesses can stay on top of their financial obligations and ensure timely receipt of funds.

Using Preliminary Documents for Payment Tracking

While a preliminary financial statement is not a final demand for payment, it is an effective way to track payments throughout the course of a transaction. By keeping these documents organized, businesses can quickly refer back to them and verify whether payments have been made, or if any amounts are still outstanding. These documents allow for better tracking of the amounts owed and provide a point of reference for both the buyer and seller throughout the process.

- Clear Payment Terms: The document typically includes a breakdown of expected payments, including due dates and amounts, which can be used to track when payments are received.

- Organized Recordkeeping: Keeping a record of all preliminary documents ensures that businesses have easy access to payment history for future reference.

- Reduce Payment Delays: By having clear payment terms laid out upfront, both parties are more likely to adhere to agreed-upon deadlines.

Improving Cash Flow Management

By using a preliminary financial statement to track payments, businesses can better manage cash flow. These documents help ensure that all payments are accounted for and prevent missed or late payments. Additionally, they provide a way to follow up with clients if payment deadlines are approaching or have passed, streamlining the collection process.

- Effective Follow-ups: When payments are due, businesses can quickly reference the document to send polite reminders or invoices for the outstanding balance.

- Proactive Payment Monitoring: Keeping track of when payments are expected and received helps businesses avoid cash flow disruptions.

- Accurate Financial Records: Regularly updating payment status from preliminary documents ensures that your financial records are accurate and up-to-date.

Incorporating these documents into your payment tracking process can provide valuable insight into your business’s financial health, helping you stay organized, reduce errors, and ensure timely payments from clients.

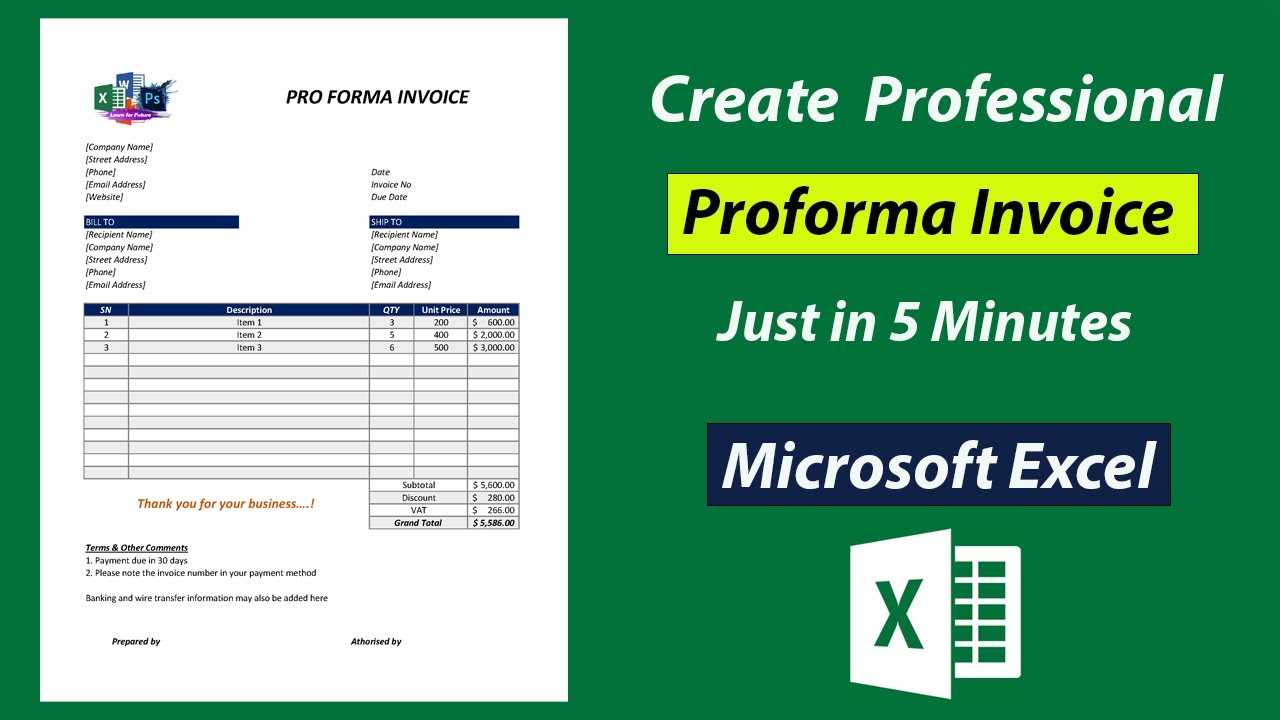

Best Software for Creating Pro Forma Invoices

When it comes to generating preliminary billing documents, choosing the right software can make a significant difference in efficiency and accuracy. With the variety of tools available today, businesses have access to easy-to-use platforms that streamline the process of creating, customizing, and managing these documents. The right software can save time, reduce errors, and improve overall workflow by automating key functions, allowing you to focus on running your business.

Top Features to Look for in Software

Before selecting a software solution, it’s important to understand the key features that make document creation easier and more efficient. The best tools offer user-friendly interfaces, customizable fields, and integration with accounting systems. Additionally, many platforms include built-in templates, automated calculations, and options for managing multiple transactions at once. These features ensure that your documents are not only professional but also accurate and consistent.

- Ease of Use: Look for a platform that is intuitive, with a simple interface that allows you to create documents quickly and easily.

- Customization: The ability to add company logos, adjust sections, and personalize fields to suit your business needs.

- Automation: Automated features such as tax calculations, date entries, and total pricing make the process faster and more accurate.

- Integration: Choose software that integrates with your accounting or CRM tools for seamless data management and financial tracking.

Best Software Options for Document Creation

Here are some of the most popular software tools that can help businesses easily generate preliminary financial statements:

- QuickBooks: A widely-used accounting software that offers templates for creating various financial documents. It also integrates well with bank accounts and other business tools for easy tracking of finances.

- Zoho Invoice: A cloud-based solution that provides customizable formats and automated billing features. It’s great for small to medium-sized businesses and integrates well with other Zoho apps.

- FreshBooks: Known for its ease of use, FreshBooks is an excellent option for small businesses. It offers a simple process for generating clear and professional documents and includes features like time tracking and project management.

- Bill.com: A highly rated platform designed for automating financial workflows. It’s especially useful for businesses that need to manage invoices and payments at scale, with strong tracking and reporting features.

- Wave Accounting: A free accounting software tool that provides an easy way to create professional documents, manage transactions, and track payments without any upfront cost.

By using the right software, businesses can greatly improve the efficiency of document creation, reduce the likelihood of errors, and ensure that transactions are tracked accurately. The best software will not only help you generate documents but also enhance your overall financial management processes.