Free Excel Invoice Template for Quick and Easy Invoicing

Managing payments and maintaining accurate financial records is essential for any business. Whether you’re a freelancer, small business owner, or part of a larger enterprise, having a well-organized system for generating billing statements can save time and prevent errors. There are simple, effective solutions that allow you to quickly produce professional documents that meet all necessary requirements.

One such method involves using downloadable tools designed to streamline this process. These solutions provide all the structure needed to create clear and concise financial statements. With the right tool, you can easily input details such as amounts, terms, and client information, ensuring a smooth workflow every time.

By utilizing readily available templates, you can eliminate the need for complicated software or extensive formatting. These resources offer an efficient way to generate the necessary paperwork, allowing you to focus on other important aspects of your work. It’s a practical approach to ensuring consistency and accuracy in your financial dealings.

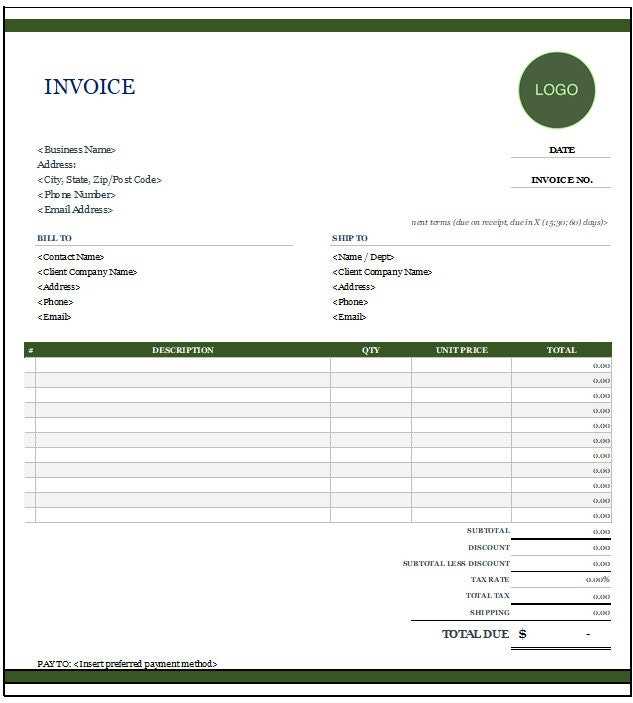

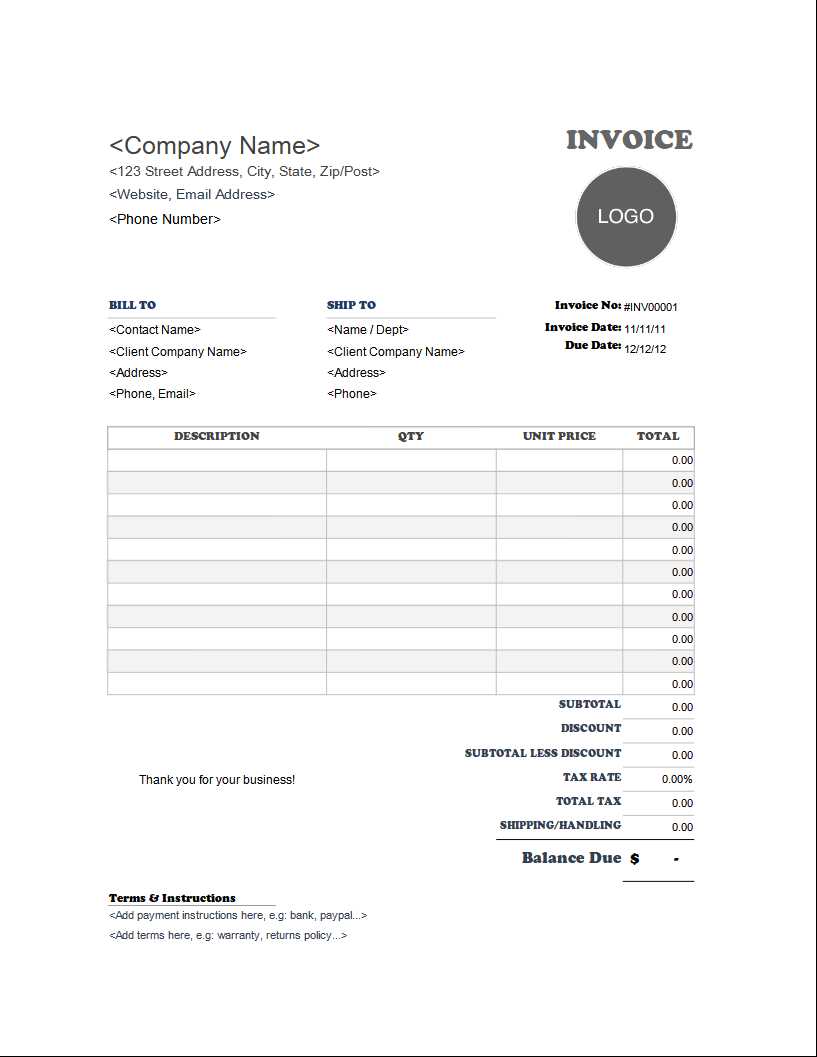

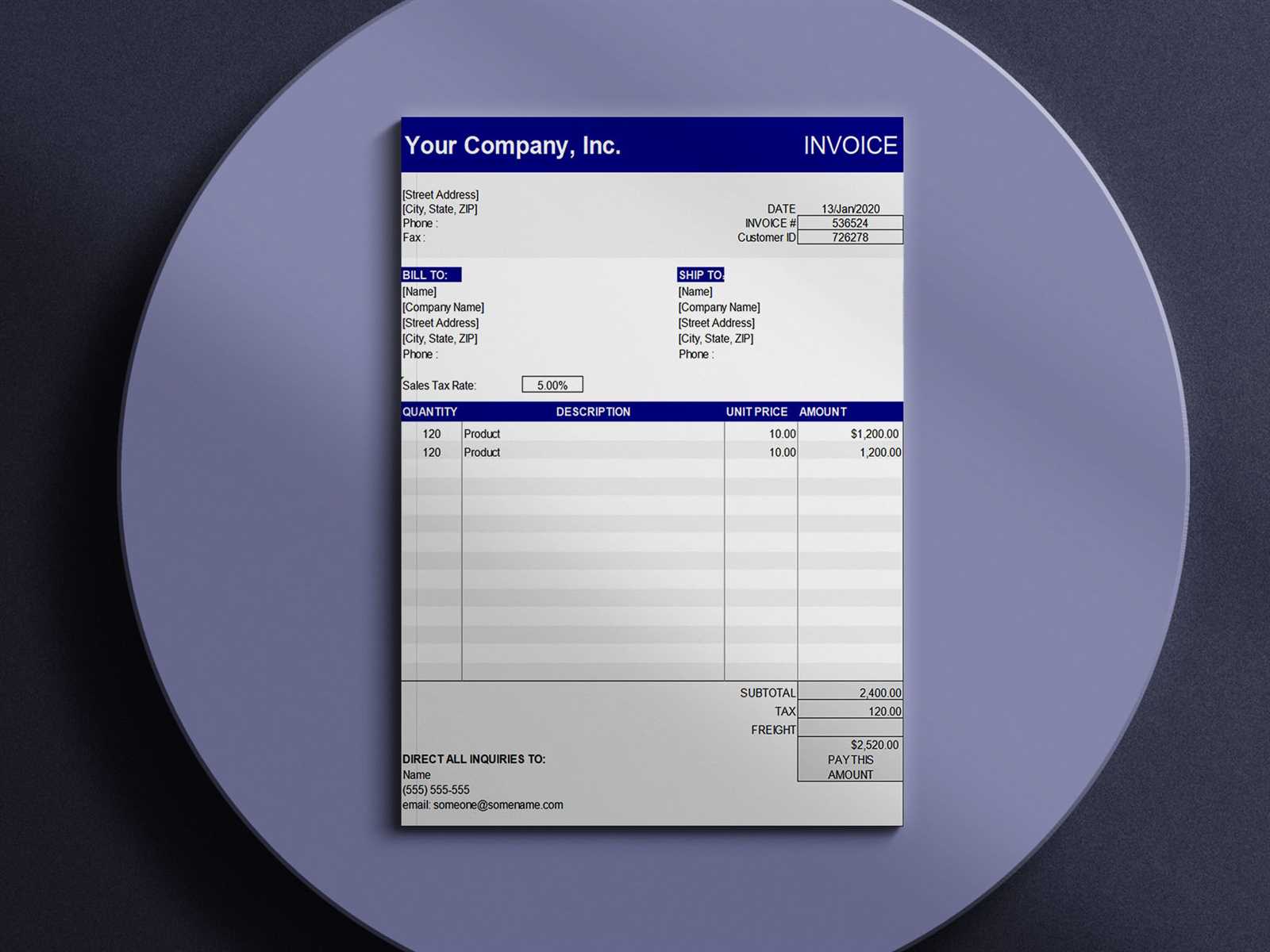

Free Invoice Template in Excel Format

Creating accurate billing documents doesn’t have to be time-consuming or complex. By utilizing ready-made structures, you can easily craft professional statements tailored to your business needs. With the right tools, you can ensure that all essential details, such as amounts, payment terms, and client information, are correctly displayed in a clear and organized manner.

Why Choose a Ready-Made Solution?

Using a pre-designed solution significantly reduces the effort required to produce professional financial paperwork. These tools are customizable, allowing you to modify fields to suit specific requirements. Whether you’re managing a few transactions or handling a larger volume of clients, these solutions provide a simple, efficient way to manage your accounts.

Key Features to Look For

A reliable tool should offer all the essential elements for smooth billing. Look for one that allows you to quickly input key information like the amount due, payment terms, and contact details. Customizable fields are crucial, as they let you tailor the document to reflect the unique needs of your business. Additionally, a clean, professional layout enhances your client’s experience and ensures clarity.

How to Download an Excel Invoice Template

Obtaining a reliable structure for creating billing statements is a simple process that can save you valuable time. Many online platforms offer downloadable options that can be quickly accessed and tailored to your needs. These tools are designed to make the process of generating financial documents much more efficient, allowing you to focus on other aspects of your business.

Steps to Access and Download

To get started, follow these easy steps to download a billing structure that suits your requirements:

| Step | Description |

|---|---|

| 1 | Visit a reputable website offering downloadable business documents. |

| 2 | Search for the section dedicated to billing or financial documents. |

| 3 | Choose the format that best fits your needs and click on the download button. |

| 4 | Save the file to your computer or cloud storage for future use. |

Important Considerations

When downloading a billing structure, ensure that the file is compatible with your spreadsheet software. Additionally, consider selecting a version that is customizable to better fit your business needs. Once downloaded, you can adjust the fields and layout to match your preferred style and requirements.

Benefits of Using Excel for Invoices

Using a spreadsheet program to generate financial documents offers numerous advantages, particularly in terms of flexibility, customization, and ease of use. With the right tools, creating professional and accurate payment requests becomes a straightforward task. This method allows for efficient management and organization of billing data, making it an ideal choice for businesses of all sizes.

Customization and Flexibility

One of the key benefits of using a spreadsheet for financial statements is the level of customization it offers. You can easily modify the layout, adjust columns and rows, and add or remove fields based on your specific needs. Whether you need to include additional client information or change the style, the flexibility of this tool makes it simple to adapt the document as required.

Efficient Data Management

Spreadsheets allow for seamless organization and manipulation of data. With built-in functions, it’s easy to calculate totals, apply taxes, or track payment statuses. Using formulas and automated calculations eliminates the risk of manual errors and speeds up the entire process. This results in more accurate records and better financial oversight, freeing up time for other critical tasks.

Top Features of Free Invoice Templates

When selecting a pre-designed document for generating payment requests, certain features can make the process much more efficient and professional. The best tools offer a range of customizable options, making it easy to adapt the structure to fit the specific needs of your business. Below are some of the key features that you should look for when choosing a suitable option for your billing tasks.

Essential Features for Professional Documents

- Customizable Fields: The ability to adjust fields like item descriptions, prices, and payment terms ensures your document fits your specific needs.

- Automatic Calculations: Built-in formulas that automatically compute totals, taxes, and discounts can save time and reduce errors.

- Clear Layout: A well-organized, easy-to-read layout helps improve the professional appearance of your financial documents.

- Currency Options: Being able to choose your preferred currency symbol or format makes the document more tailored to your location.

Additional Benefits

- Client Information Storage: You can store client names, addresses, and other contact details for quick reuse in future transactions.

- Multilingual Support: Some options allow you to generate documents in different languages, making them suitable for international clients.

- Easy File Sharing: These documents are typically available in formats that are easy to email or print directly from the program.

Customizing Your Excel Invoice Template

Personalizing your document for business use can enhance both its professional appearance and functionality. Whether you’re managing a small enterprise or handling personal transactions, adjusting elements such as design, structure, and content can make your paperwork more tailored to your needs. Customizing these details ensures clarity and a more polished presentation for clients or customers.

Essential Modifications to Consider

- Company Branding: Incorporate your logo, choose a color scheme, and select fonts that align with your brand identity. This creates consistency across all your business documents.

- Header Information: Make sure your business name, address, and contact details are clearly visible at the top. This allows your recipients to easily reach out when needed.

- Itemized List Customization: Adjust the columns and rows to fit your product or service offerings. You can add custom fields, such as discounts or tax rates, to make the document more specific.

Advanced Adjustments for Better Functionality

- Automatic Calculations: Set up formulas for automatic totals, taxes, and subtotals to reduce errors and save time. This feature is especially useful when dealing with large quantities or varying rates.

- Payment Terms: Add specific payment conditions, due dates, and late fees. This ensures that both parties are clear on the financial expectations and timeline.

- Interactive Fields: If you’re distributing the document electronically, make it interactive by allowing clients to select options, enter data, or even add their own notes.

By customizing these aspects, you can streamline your workflow, improve your document’s clarity, and create a more professional image for your business interactions.

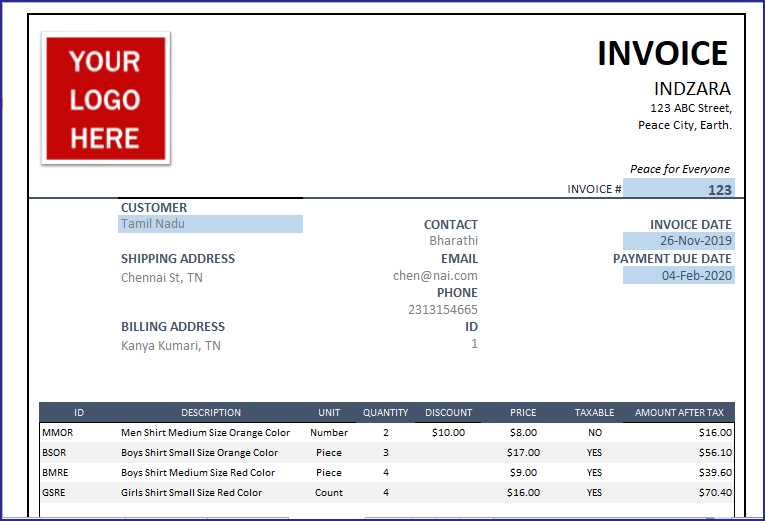

How to Fill Out an Invoice Template

Creating a detailed document for a transaction requires attention to several key pieces of information. Each section should be filled out accurately to ensure clarity and prevent misunderstandings. Whether you’re billing for a service or a product, it’s important to include all necessary details to facilitate smooth communication between you and your client.

1. Include Your Business Information

Start by adding your business name, address, phone number, and email at the top. This helps the recipient identify who the document is from and how they can contact you if necessary.

2. Add the Client’s Information

Next, enter the client’s name, company (if applicable), and contact details. This ensures that the document is directed to the correct party, reducing any potential confusion.

3. Specify the Products or Services

Clearly list the items or services provided. For each entry, include a description, quantity, rate, and total amount. Be as specific as possible to avoid any ambiguity.

4. Include Payment Terms and Due Date

Make sure to specify the payment terms–whether it’s due immediately or within a certain number of days (e.g., 30 days). Clearly indicate any late fees or discounts offered for early payment, if applicable.

5. Calculate the Total Amount

Sum up all the items and include any additional fees, taxes, or discounts. The final total should be easy to identify so your client knows exactly how much to pay.

6. Add Additional Notes or Instructions

If necessary, include any special instructions, terms, or messages for the client, such as instructions on how to pay or a thank-you note for their business.

By carefully filling in these details, you ensure that your document is complete, professional, and easy to understand for both you and your client. Properly filled-out paperwork helps avoid delays and fosters a smoother business relationship.

Best Practices for Creating Professional Invoices

Creating a polished and clear document for billing is crucial for maintaining professionalism and ensuring timely payments. A well-structured record not only reflects the credibility of your business but also helps avoid confusion or disputes. By following a few key guidelines, you can make sure your paperwork is both functional and professional.

1. Keep It Simple and Organized

A clean, uncluttered design ensures that your document is easy to read. Use clear headings, well-spaced sections, and a logical flow of information. Avoid unnecessary details or distractions that could make the document look messy.

2. Use Clear and Consistent Language

Be straightforward and concise with your descriptions. Avoid jargon or overly complex terms that may confuse the recipient. Consistent terminology for pricing, products, and services will make it easier for clients to understand the charges.

3. Include All Necessary Information

Always include your business details (name, address, and contact information), the recipient’s information, a unique reference number, and a clear breakdown of charges. Specify the payment due date and any terms or conditions to prevent misunderstandings.

4. Provide Detailed Descriptions

List the items or services provided in detail, including quantities, rates, and individual costs. Being transparent with your calculations builds trust and helps the client understand exactly what they are paying for.

5. Add Professional Branding

Incorporating your business logo, color scheme, and fonts that align with your brand identity adds a level of professionalism. This helps to create a cohesive experience for your clients and reinforces your brand image.

6. Set Clear Payment Terms

Clearly state the payment method(s) accepted, any discounts for early payment, or penalties for late payment. Specifying these terms upfront reduces the chances of confusion and ensures that both parties are aligned on expectations.

7. Proofread Before Sending

Before sending your document, double-check for errors in pricing, calculations, or client details. A mistake can negatively impact your professionalism and delay payment. A quick review ensures accuracy and avoids costly oversights.

By adhering to these best practices, you can create professional documents that not only look great but also promote clarity, trust, and efficient payment processing.

How to Calculate Tax on Invoices

Accurately calculating taxes is essential to ensure compliance and transparency when billing clients. Taxes can vary depending on your location, the type of goods or services, and the applicable tax rates. By understanding how to calculate tax and apply it correctly, you help avoid errors and create a clear breakdown for your clients.

Steps for Calculating Tax

- 1. Identify the Tax Rate: First, determine the applicable tax rate for the specific products or services you provide. This rate is usually expressed as a percentage and may differ depending on local regulations or the type of transaction.

- 2. Calculate the Taxable Amount: Next, calculate the amount that is subject to tax. This is typically the total cost of the products or services before any discounts are applied. Be sure to check whether any items are tax-exempt or qualify for reduced rates.

- 3. Multiply the Taxable Amount by the Tax Rate: To calculate the tax, multiply the taxable amount by the tax rate (as a decimal). For example, if the taxable amount is $100 and the tax rate is 8%, the tax would be $100 * 0.08 = $8.

- 4. Add the Tax to the Total: Once the tax is calculated, add it to the original amount to determine the final total. If your taxable amount is $100 and the tax is $8, the total amount due would be $108.

Considerations When Applying Taxes

- Tax Exemptions: Be aware of any tax exemptions that may apply to your transactions, such as for certain non-profit organizations or specific product categories. These should be clearly indicated on the record.

- Multiple Tax Rates: In some cases, multiple tax rates may apply, such as federal, state, and local taxes. Ensure that each rate is applied to the correct portion of the total cost.

- International Transactions: If you’re dealing with international clients, be sure to consider whether taxes apply in the client’s location or if your products/services are subject to VAT or other import duties.

By following these steps and considerations, you can ensure that tax calculations are accurate and clearly presented to your clients, avoiding any potential issues or misunderstandings down the line.

Adding Payment Terms to Your Invoice

Clearly stating the conditions for payment is crucial for managing expectations and ensuring timely compensation for goods or services rendered. Payment terms outline how and when the client is expected to settle the amount due, and they help protect both parties in the transaction. By specifying these terms, you can avoid misunderstandings and ensure smoother financial operations.

- 1. Specify the Due Date: Always include a clear due date, whether it’s a set number of days after the issue date (e.g., “Due in 30 days”) or a fixed calendar date (e.g., “Due by December 15th”). This helps avoid confusion and sets expectations for when payment should be made.

- 2. Include Accepted Payment Methods: Clearly list the methods by which the payment can be made, such as bank transfer, credit card, PayPal, or checks. This ensures the client knows their options and can choose the most convenient method for them.

- 3. State Late Payment Penalties: If you charge interest or fees for late payments, be sure to specify the rate (e.g., “Late payments will incur a 2% monthly fee”). This encourages clients to pay on time and protects you from cash flow issues.

- 4. Offer Early Payment Discounts (Optional): Some businesses offer a small discount if the payment is made before the due date, such as “5% off if paid within 10 days.” This can motivate prompt payment and strengthen your cash flow.

- 5. Define Partial Payments (if applicable): If you accept partial payments, outline the terms clearly. Indicate how much must be paid upfront (e.g., a deposit) and when subsequent payments should be made.

- 6. Include Bank Account Information: If a bank transfer is one of the payment methods, provide your banking details, including account number, routing number, and bank name. This makes it easier for clients to pay via this method without delays.

By incorporating clear and concise payment terms, you provide transparency and clarity, reducing the risk of delayed payments or disputes. Properly stated terms contribute to a smoother transaction process and can help strengthen client relationships.

How to Track Invoice Payments in Excel

Monitoring payments is essential to keep your cash flow under control and ensure that all transactions are completed on time. A well-organized system can help you track which payments have been made, which are pending, and when they are due. Using a spreadsheet to record and manage these payments simplifies the process and gives you a clear overview of your financial situation.

Setting Up a Payment Tracking System

- 1. Create a New Spreadsheet: Start by setting up a new document where you can track all payments. Label columns for relevant information, such as “Invoice Number,” “Client Name,” “Amount Due,” “Amount Paid,” “Due Date,” “Payment Date,” and “Balance Remaining.”

- 2. Record Transaction Details: For each transaction, input the details in the appropriate columns. This will include the amount due, the amount paid, and the remaining balance, allowing you to easily see which payments have been received and which are still outstanding.

- 3. Add Payment Status: To further organize the data, include a “Status” column that indicates whether the payment is “Paid,” “Pending,” or “Overdue.” You can also use color coding for visual clarity, making it easier to spot outstanding payments at a glance.

Using Formulas to Automate Calculations

- 1. Calculate Remaining Balance: Use a simple formula to calculate the remaining balance for each transaction. For example, subtract the “Amount Paid” from the “Amount Due” to get the remaining balance.

- 2. Track Payment Dates: If you want to calculate the days until the payment is due, you can use a formula to subtract the “Payment Date” from the “Due Date” to calculate the time left for payment.

- 3. Sum Total Payments: Use the SUM function to automatically calculate the total payments received across all transactions. This helps you quickly see how much has been paid and how much is still owed.

By creating a system like this, you can easily monitor your accounts, avoid missed payments, and maintain a clear record of your financial activities. The use of formulas and organized columns ensures that your payment tracking is both efficient and accurate.

Common Mistakes to Avoid in Invoices

When creating a billing document, even small errors can lead to confusion, delays in payment, or disputes with clients. It’s essential to ensure that every detail is correct and clearly presented. Avoiding common mistakes can help maintain a professional image, streamline your accounting process, and prevent unnecessary complications with customers.

Key Errors to Watch Out For

- 1. Missing or Incorrect Contact Information: One of the most common mistakes is failing to include accurate details, such as your business name, address, and contact information. This can make it difficult for clients to get in touch with you if there are any issues.

- 2. Incorrect Dates: Always double-check the issue and due dates. Missing or incorrect dates can cause confusion about when payments are expected, leading to delayed or missed payments.

- 3. Unclear Descriptions of Products or Services: Ensure each item or service is described clearly, including any relevant details like quantities, unit prices, or service descriptions. Lack of clarity can lead to misunderstandings and disputes over charges.

- 4. Failure to Include Tax Information: If taxes apply, they should be clearly indicated, along with the applicable rate. Omitting taxes or applying incorrect rates can result in financial discrepancies or legal issues.

- 5. Missing Payment Terms: If payment terms are not specified, clients may not know when payment is due or what methods are acceptable. This can cause confusion and delay payments.

- 6. Incorrect Totals: Double-check the math, including subtotals, tax amounts, and the final total. Mistakes in calculations can create trust issues with clients and complicate your accounting.

Other Considerations

- 1. Not Numbering the Document: Every billing record should have a unique reference number. This helps keep your financial records organized and makes it easier to track transactions.

- 2. Overcomplicating the Design: While it’s important to include all necessary information, the layout should remain clean and easy to follow. An overly complex design can make it difficult for the client to find important details quickly.

- 3. Failing to Proofread: Small spelling or grammatical errors can detract from the professionalism of the document. Always proofread before sending it to ensure accuracy and clarity.

By being mindful of these common mistakes and taking the time to review your billing documents, you can improve your professionalism, reduce errors, and ensure smoother transactions with clients.

How to Save and Share Excel Invoices

Once your billing document is ready, it’s important to save it properly and choose the most efficient way to share it with clients. Saving the file in a secure format and sharing it through reliable methods ensures that both parties have easy access to the document while maintaining professionalism and privacy.

Saving the Document

- 1. Choose the Right File Format: When saving your document, consider the file format that will best suit your needs. The most common format for sharing business documents is .xlsx, but you can also save it as a PDF for easy viewing and printing by the recipient. PDFs are especially useful as they preserve formatting and are less likely to be altered.

- 2. Name the File Properly: Use a clear and consistent naming convention for your files. For example, you might name your document “ClientName_Invoice_Date” (e.g., “ABCCompany_Invoice_2024-11-06”). This makes it easier for both you and the client to locate specific documents in the future.

- 3. Create Backup Copies: Always create backups of important files. You can store them on a cloud service like Google Drive or Dropbox or save them to an external hard drive for added security. This helps ensure you never lose access to your billing records.

Sharing the Document

- 1. Emailing the File: The most common way to share your document is by sending it through email. Attach the saved file and provide a brief message outlining key details such as the amount due, the payment due date, and any other important information. Be sure to use a professional email address.

- 2. Using Cloud Storage Services: For larger files or if you need to share multiple documents, consider uploading them to a cloud storage platform and sending a link to your client. Services like Google Drive, OneDrive, or Dropbox offer easy file sharing options and allow for quick access from anywhere.

- 3. Sharing via Secure File Transfer: If you are concerned about privacy or need to send sensitive data, you can use secure file transfer services. These services encrypt your files, ensuring that they are safely shared and protected from unauthorized access.

Tracking Shared Files

| Sharing Method | Pros | Cons | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quick and easy, widely used | Can get lost in clutter, file size limits | |||||||||||||||||||||||||||

| Cloud Storage | Easy access, can share multiple documents | Requires internet connection, potential security concerns | ||||||||||||||||||||||||||

| Secure File Transfer | Highly secure, suitable for sensitive data

Why Use a Free Invoice TemplateUsing a ready-made document format can save time and reduce the complexity of creating financial records from scratch. Whether you’re a small business owner, freelancer, or managing personal projects, having a structured document that’s easy to fill out and customize helps streamline your billing process. Opting for a no-cost solution can be an efficient choice when you’re just starting out or looking to simplify administrative tasks.

By using a ready-made, no-cost document layout, you can save both time and money, all while keeping your financial records organized and professional. Whether you’re just getting started or seeking a simpler approach to handling transactions, this solution can streamline your process and boost your efficiency. How to Update Your Invoice TemplateWhether you’re managing a small business or freelancing, it’s essential to regularly revise your billing documents to ensure they remain accurate and professional. Keeping these records up-to-date not only helps you maintain a polished image but also ensures compliance with any new regulations or business practices. Here’s how to make sure your billing documents reflect the latest information and fit your current needs. Review Your Current DetailsStart by verifying all the details that are included in your document. Ensure that the fields for client names, addresses, payment terms, and company information are accurate. Small errors, such as outdated contact information or incorrect payment terms, can lead to confusion or delays in processing payments. Customize for New Services or FeaturesIf your offerings have changed, make sure to update the breakdown of services or products. Add new categories or remove any outdated ones. A well-organized layout that accurately reflects the current offerings can make it easier for clients to understand and approve the charges.

Using Excel for Multiple Invoice FormatsWhen managing various client accounts or projects, it’s often necessary to customize your billing documents to match different requirements. A versatile spreadsheet program allows you to easily create and adjust different billing layouts without the need for complex software. With a few simple modifications, you can adapt your records to suit multiple scenarios and present them professionally. Benefits of Customizing Your Billing Documents

Using a flexible platform for your financial records provides several advantages:

How to Set Up Different FormatsHere’s how you can create various formats using simple tools:

Excel vs Other Invoice Software SolutionsWhen it comes to managing billing documents and payment tracking, businesses have several options for tools to use. While some prefer a simple, customizable approach with spreadsheet software, others opt for specialized software designed for creating professional billing records. Each method has its advantages, depending on the complexity of the business and its needs. Understanding the key differences can help you choose the right solution for your organization. Advantages of Using Spreadsheet SoftwareSpreadsheets offer flexibility and ease of use, making them an appealing choice for small businesses or freelancers. Some benefits include:

Benefits of Specialized Billing SoftwareOn the other hand, purpose-built solutions for managing billing processes offer advanced features that may be beneficial for larger businesses or those with complex invoicing needs:

|