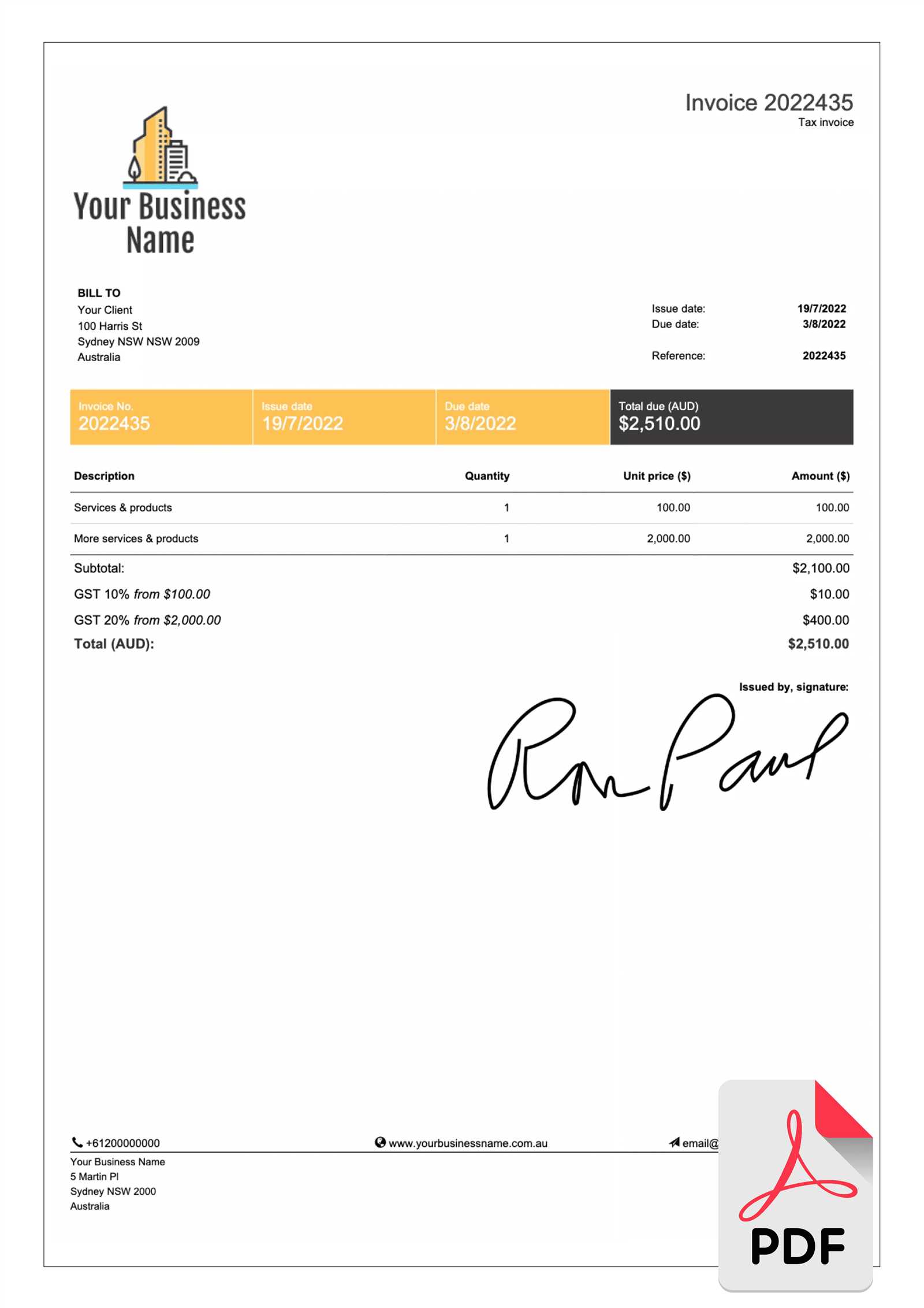

Free Fillable Invoice Template in Word Format

Managing payments and ensuring proper record-keeping is essential for any business. Whether you are a freelancer, small business owner, or large corporation, having an efficient and professional way to document transactions can streamline operations and enhance communication with clients.

One of the most effective ways to handle this task is by using a pre-designed, editable document that can be easily customized. These documents are user-friendly and can be tailored to meet the specific needs of different businesses or industries.

With the right format, you can effortlessly update the details of each transaction, include important terms, and ensure that all the necessary information is clear and accurate. This helps both parties avoid confusion and promotes timely payments, ultimately improving your financial workflow.

Customizable Billing Document for Easy Use

Having a document that allows for quick adjustments and simple formatting is essential when managing business transactions. A pre-made structure designed for efficient transaction recording can save you significant time and effort. With an editable format, you can tailor the layout to match your business needs while maintaining a professional appearance.

These documents are often made with flexibility in mind, allowing users to fill in relevant fields such as client details, amounts, payment terms, and itemized services. The ability to customize them ensures that the document fits your specific workflow and requirements without the need for extensive design skills.

Whether you are invoicing for a product, service, or any other form of transaction, this approach makes managing payments simpler. It also enhances clarity and consistency, both for you and your clients, fostering smoother financial interactions and ensuring timely settlements.

Why Choose a Fillable Template

Opting for a customizable document design offers several advantages for businesses looking to streamline their financial processes. These ready-made formats allow for quick input, saving valuable time while ensuring consistency and accuracy in all transactions. They are especially useful for those who need to create multiple records efficiently without compromising on quality.

Benefits of Using Customizable Designs

Using an editable document structure provides the flexibility to adjust details for every transaction. This eliminates the need to start from scratch each time and reduces the risk of errors. Here are some reasons why this approach is beneficial:

| Advantage | Description |

|---|---|

| Efficiency | Allows for quick updates and easy repetition of tasks. |

| Accuracy | Ensures all relevant fields are filled correctly without oversight. |

| Professionalism | Maintains a polished and consistent look for every document. |

| Customization | Adapts to your unique needs, offering flexibility across different industries. |

Practical Use Across Various Industries

These documents can be used in many industries, from freelance work to large-scale operations. Their adaptability ensures they fit a wide range of business models, improving workflow and organization. Whether you’re managing a small business or handling complex transactions, a customizable format enhances both efficiency and professionalism.

Benefits of Using Word Format

Choosing a familiar, widely used software for creating customizable documents brings numerous advantages. The ease of access and the ability to make detailed adjustments quickly are some of the reasons this format is preferred by many. It allows users to focus on content without worrying about complex formatting, making it ideal for businesses looking for simplicity and efficiency in their financial records.

Accessibility and Compatibility

One of the primary benefits of using this format is its universal compatibility. Nearly every computer has software capable of handling this format, making it easy to share documents across different platforms and devices. Whether working in an office or on the go, users can create, edit, and send documents with ease.

Ease of Customization

This format also offers a high level of flexibility in customization. From adjusting font sizes and styles to adding logos and headers, users have full control over the document’s appearance. The intuitive interface ensures even those with minimal design experience can modify the layout according to their needs, giving a professional touch to every document.

Additional features like spell check, easy table creation, and a variety of built-in styles make this format a reliable choice for any business looking to maintain consistency and accuracy in their records. Furthermore, it supports a range of file formats, allowing for easy conversion and printing when needed.

How to Customize Your Invoice

Personalizing your billing document is essential for creating a professional and efficient record-keeping system. Customizing the structure allows you to include all necessary details while maintaining a consistent look that reflects your business identity. Whether you need to modify the design or add specific terms, adjusting your document ensures it suits your needs perfectly.

Steps to Personalize Your Document

Follow these steps to effectively customize your document:

- Adjust the Header: Include your business name, logo, and contact information at the top for a professional touch.

- Define Payment Terms: Clearly outline payment methods, due dates, and any other important instructions.

- Customize Field Labels: Modify the default labels to match your industry terminology, such as “service description” or “itemized charges.”

- Modify Layout and Design: Adjust margins, font styles, and sizes to make the document visually appealing and easy to read.

- Include Additional Details: Add fields for taxes, discounts, or shipping costs if necessary to accurately reflect the transaction.

Practical Tips for Effective Customization

- Keep It Simple: Avoid cluttering the document with too much information. Focus on the key details for easy readability.

- Ensure Accuracy: Double-check all fields for correctness to avoid errors in payments or client confusion.

- Save and Update: Save your customized format for future use, and update it as needed to reflect any changes in pricing or services.

With these simple adjustments, you can create a document that not only looks professional but also serves your specific business needs effectively, ensuring that all critical information is clearly presented to your clients.

Top Features of Fillable Templates

Using an editable document structure offers many practical benefits, designed to improve the accuracy and efficiency of managing financial transactions. These ready-to-use formats are equipped with specific features that help users tailor their records to meet unique business needs. Below are some of the standout features that make such documents highly effective in everyday use.

Key Features of Editable Formats

Editable document structures come with various options that allow businesses to create tailored records with ease. These include:

| Feature | Description |

|---|---|

| Customizable Fields | Easily adjust sections for client details, services, and payment terms. |

| Professional Design | Maintains a clean, polished look for consistency across documents. |

| Reusable Layout | Save and reuse the structure for future records, saving time and effort. |

| Flexibility in Formatting | Modify text, fonts, and add logos or other branding elements as needed. |

Practical Benefits for Users

These features not only save time but also enhance accuracy and professionalism. Whether for a small business or large corporation, the ability to customize and streamline the process improves workflow, reduces errors, and strengthens business relationships. By using such tools, users can create clear, consistent, and professional documents with minimal effort.

Where to Download Free Templates

Finding reliable sources for downloading editable document formats is essential for ensuring quick access to professional tools. These resources provide pre-made structures that can be easily customized to suit individual business needs. Whether you’re starting a new project or need to update existing records, knowing where to find high-quality options is crucial.

Top Sources for Downloading Editable Documents

Here are some popular places to find editable formats for your business:

- Online Document Libraries: Websites that specialize in business resources often offer a wide range of customizable layouts for various industries.

- Business Software Websites: Many software providers offer complimentary resources on their websites, including editable document formats designed for easy customization.

- Online Marketplaces: Platforms like Etsy or Creative Market have collections of pre-designed business documents, including customizable formats.

- Template Sharing Communities: Sites like Reddit or specialized forums allow users to share their own document formats, giving you a wide range of options to choose from.

Things to Consider When Downloading

- File Format Compatibility: Ensure that the downloaded format is compatible with the software you are using for editing.

- Licensing and Usage Rights: Always check the terms of use to ensure the resource is legally free and can be used for commercial purposes.

- Customization Flexibility: Look for resources that allow easy modification, from simple text changes to more advanced design elements.

By exploring these resources, you can easily find customizable documents that will help you maintain a professional and efficient system for managing transactions.

Using Word for Professional Invoices

Creating professional billing documents is crucial for maintaining clear and accurate financial records. By using a widely recognized software platform, you can easily craft documents that not only look professional but also include all necessary details for a smooth transaction process. The flexibility and accessibility of this tool make it an ideal choice for businesses of all sizes.

Advantages of Using a Document Editor for Billing

Here are some of the key benefits of using a document editor to manage business transactions:

- Ease of Customization: Quickly update fields, change layouts, or add additional details to suit the unique needs of each transaction.

- Professional Design: Create a clean, uniform look that aligns with your branding, ensuring that every document reflects your business’s standards.

- Convenient Accessibility: The software is readily available on most devices, allowing you to create and send documents from anywhere.

- Cost-Effective: Since this tool is commonly included with office software suites, it reduces the need for additional costs associated with specialized billing programs.

Steps to Create a Professional Document

Follow these steps to ensure your documents are clear, accurate, and visually appealing:

- Start with a Clean Layout: Begin with a basic structure that includes all the necessary fields, such as company name, contact details, and payment terms.

- Incorporate Branding Elements: Add your logo, use company colors, and select appropriate fonts to maintain a professional identity.

- Ensure Accuracy: Double-check that all information, including amounts and client details, is correct before sending.

- Save for Future Use: Save your customized format for future billing cycles to save time and maintain consistency.

By leveraging the power of a versatile document editor, you can ensure that your billing documents are professional, accurate, and tailored to your business’s needs.

Design Tips for Better Invoices

A well-designed billing document not only reflects your professionalism but also ensures that all essential information is easily accessible. The layout and visual appeal of your records can influence how your clients perceive your business. By following simple design tips, you can create documents that are both functional and aesthetically pleasing, making it easier for clients to understand the details and for you to maintain clear financial records.

Key Design Tips to Improve Your Documents

Here are some practical suggestions for creating a more effective and visually appealing record:

- Keep It Simple: Avoid cluttering the document with too much text or excessive design elements. A clean, straightforward layout ensures that the key information stands out.

- Use Clear Section Headings: Organize your content into sections such as “Billing Details,” “Services Rendered,” and “Payment Terms.” This makes it easier for your clients to navigate the document.

- Choose Readable Fonts: Use legible fonts that are easy on the eyes. Stick to one or two complementary fonts to avoid distractions.

- Ensure Consistency: Use consistent font sizes, colors, and layout throughout your document. Consistency enhances readability and professionalism.

- Highlight Important Information: Make key details like the total amount due or payment instructions stand out by using bold or larger fonts. This helps prevent important items from being overlooked.

Effective Layout and Structure

For better organization and clarity, follow these layout principles:

- Include a Clear Header: Your company’s name, logo, and contact details should be prominently displayed at the top.

- Use Tables for Clarity: Use tables to break down services, quantities, rates, and amounts. This makes it easy for your clients to understand how the total is calculated.

- Leave Enough White Space: Avoid overcrowding by leaving sufficient margins and spacing between sections. This enhances the overall look and readability.

- Ensure Proper Alignment: Align text, numbers, and tables neatly. Misaligned text can make the document appear disorganized and unprofessional.

By following these design tips, you can create polished and easy-to-read documents that help maintain a professional image and simplify the billing process for both you and your clients.

Common Mistakes to Avoid in Invoices

When creating financial documents, it’s crucial to ensure accuracy and clarity to avoid confusion and delays. Small mistakes can lead to misunderstandings, missed payments, or even damage to your business’s reputation. By being aware of common errors, you can ensure that your billing documents are professional and effective, helping to maintain a smooth flow of transactions with clients.

Frequent Errors to Watch Out For

Here are some of the most common mistakes to avoid when preparing billing documents:

- Incorrect or Missing Contact Information: Ensure that both your business’s and the client’s contact details are accurate and clearly presented. Missing or incorrect information can lead to delays in processing payments.

- Not Including Payment Terms: Always include clear payment terms, such as the due date, late fees, and accepted payment methods. Without this, clients may be confused about when and how to pay.

- Failure to Break Down Charges: Avoid lumping all charges into one amount. Provide a clear breakdown of services, rates, and quantities, making it easy for clients to understand what they’re being charged for.

- Spelling or Calculation Errors: Double-check the spelling of names and the accuracy of calculations. A single typo or mathematical mistake can cause issues with payment or trust.

- Unclear or Missing Invoice Number: Always assign a unique reference number to each document. This helps both you and your client keep track of transactions and is essential for record-keeping and future communication.

Tips for Preventing These Errors

To minimize the risk of mistakes, follow these guidelines:

- Review Each Document Carefully: Always proofread before sending. A second look can help you spot small errors you might have missed.

- Use Consistent Formatting: Stick to a clear, consistent layout, which makes it easier to spot errors and ensures that clients can read and understand the document without confusion.

- Utilize Software Tools: Consider using software with built-in checks and templates that automatically calculate totals and verify common mistakes.

By taking the time to avoid these common mistakes, you can create accurate, professional documents that reflect positively on your business and help ensure timely payments.

How to Add Payment Terms Easily

Clearly specifying payment expectations in your billing documents is essential for ensuring timely transactions and avoiding misunderstandings. Payment terms set the stage for how and when your clients should settle their bills. Whether you’re offering discounts for early payments or detailing late fees for overdue balances, adding clear terms can significantly improve cash flow management.

Steps to Include Payment Terms Effectively

Follow these simple steps to ensure your payment terms are easy to understand and properly communicated:

- Use Clear Language: Be direct and simple in your wording. Instead of using jargon, state payment expectations in clear, concise sentences that are easy for clients to understand.

- Specify Due Dates: Always include a specific due date for payments. Phrases like “Due upon receipt” or “Net 30 days” help set clear expectations regarding when payment is expected.

- Include Payment Methods: Indicate the accepted methods of payment, whether it’s through bank transfer, check, credit card, or online payment systems. This gives clients all the necessary information to make their payment promptly.

- State Late Fees: If applicable, mention any fees for late payments. For example, “A 5% late fee will be applied if payment is not received within 30 days.” This encourages clients to pay on time.

- Offer Discounts for Early Payments: If you provide a discount for early payment, make it clear in your terms. For example, “5% discount if paid within 10 days” gives an incentive for quicker payments.

Where to Place Payment Terms

Payment terms should be prominently placed in your document to ensure they are easily seen. Consider the following locations:

- Near the Total: Position your payment terms directly below the total amount due so that the client can easily see them as they review the payment amount.

- At the End of the Document: You can also place the terms at the bottom, as a reminder after all details have been provided.

By clearly outlining payment expectations, you make it easier for clients to understand their obligations and help avoid any confusion or delayed payments.

Including Tax and Discounts in Templates

Incorporating taxes and discounts into your financial documents is crucial for providing an accurate breakdown of the amounts owed by your clients. Whether you’re adding sales tax, service fees, or offering special promotions, making these adjustments clear can prevent confusion and ensure transparent billing practices. Properly applying taxes and discounts will also help maintain consistency in your records and reporting.

How to Add Taxes

Sales tax or other applicable taxes should be added clearly and precisely. Here are a few steps to do so:

- Calculate the Tax Rate: Determine the applicable tax rate based on the location of your business or the client’s location, ensuring that the rate is correct for the type of goods or services provided.

- Apply the Tax to the Total: Multiply the total cost of your services or products by the tax rate. Add the result to the subtotal before calculating the total amount due.

- Display the Tax Clearly: List the tax amount as a separate line item to avoid confusion. This way, your client can easily see the breakdown of the tax added to the original amount.

How to Include Discounts

Offering discounts can be a great way to incentivize early payment or reward loyal clients. Here’s how you can incorporate discounts into your financial documents:

- Define the Discount Type: Decide whether you’re offering a percentage-based discount (e.g., 10% off) or a fixed amount (e.g., $50 off). Make sure the terms are clear.

- Apply the Discount: If it’s a percentage, calculate the discount based on the subtotal. If it’s a fixed amount, subtract that value from the total before taxes.

- Show the Discount Line: Clearly list the discount as a separate line item so that the client knows exactly what was deducted from the total cost.

Adding taxes and discounts to your billing documents helps create transparency, ensuring that clients understand exactly what they are paying for and any reductions they may have received. Being clear about these charges and deductions can improve customer satisfaction and reduce disputes.

How to Save and Print Your Invoice

Once your billing document is finalized, it’s important to save it properly for future reference and to ensure that you can easily share or print it when necessary. Both saving and printing require attention to detail to ensure the document retains its formatting and is accessible when you need it. By following a few simple steps, you can ensure that your document is stored securely and printed clearly for professional presentation.

Steps to Save Your Document

Saving your document correctly ensures that it remains intact and can be accessed whenever needed. Here’s how you can save your document effectively:

- Select the Right Format: Choose a file format that suits your needs. Common formats include PDF for easy sharing and printing, or DOCX for continued editing.

- Save Locally or in the Cloud: Decide whether you want to store the document on your computer or in a cloud storage service for easier access from multiple devices.

- Organize with a Clear File Name: Give the document a clear, descriptive name, such as “ClientName_Invoice_Date,” so it’s easy to locate later.

Steps to Print Your Document

Once you’ve saved your document, printing it involves setting up your printer and ensuring the document appears as expected on paper:

- Check the Print Preview: Always preview the document before printing to ensure that it looks correct and that no content is cut off.

- Choose the Right Printer Settings: Adjust the printer settings to ensure the document prints in the desired format, such as portrait or landscape orientation, and at the right paper size.

- Print a Test Copy: If you’re unsure about the formatting, print a test copy to check that everything appears as expected, including margins, fonts, and line spacing.

Printing and Saving Tips

Here are additional tips to enhance your document management:

| Tip | Benefit |

|---|---|

| Use a High-Quality Printer | Ensures the document looks professional and sharp for clients. |

| Save Multiple Copies | Provides backup copies in case of technical issues or future reference. |

| Keep Track of Sent Documents | Helps you stay organized and ensures that you have a record of all transactions. |

By properly saving and printing your documents, you ensure they are secure, easily accessible, and presented professionally to your clients. This helps to streamline your billing process and reduces the risk of errors or missing records.

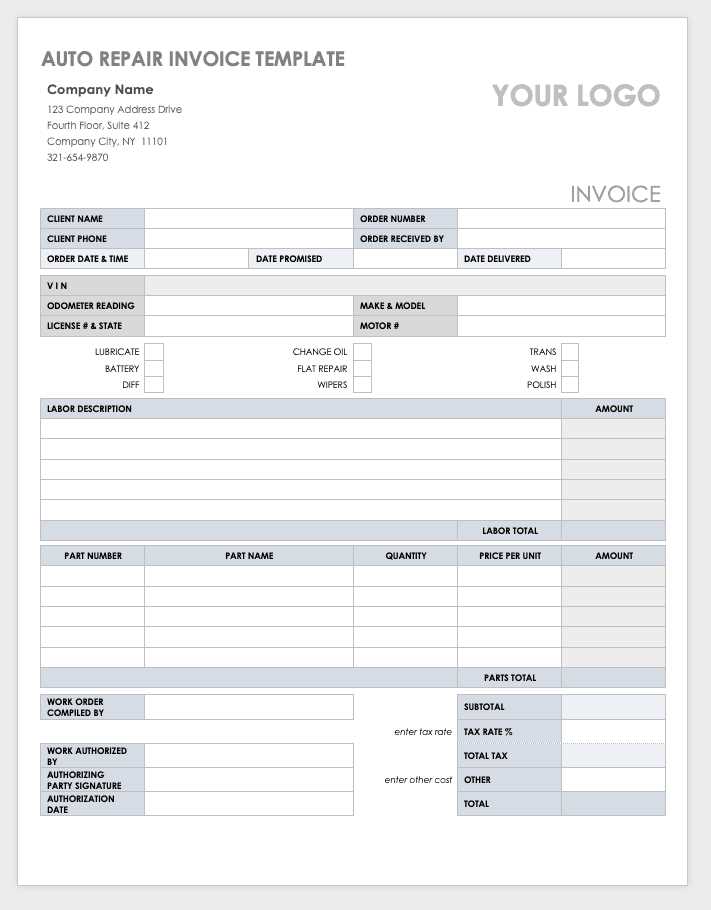

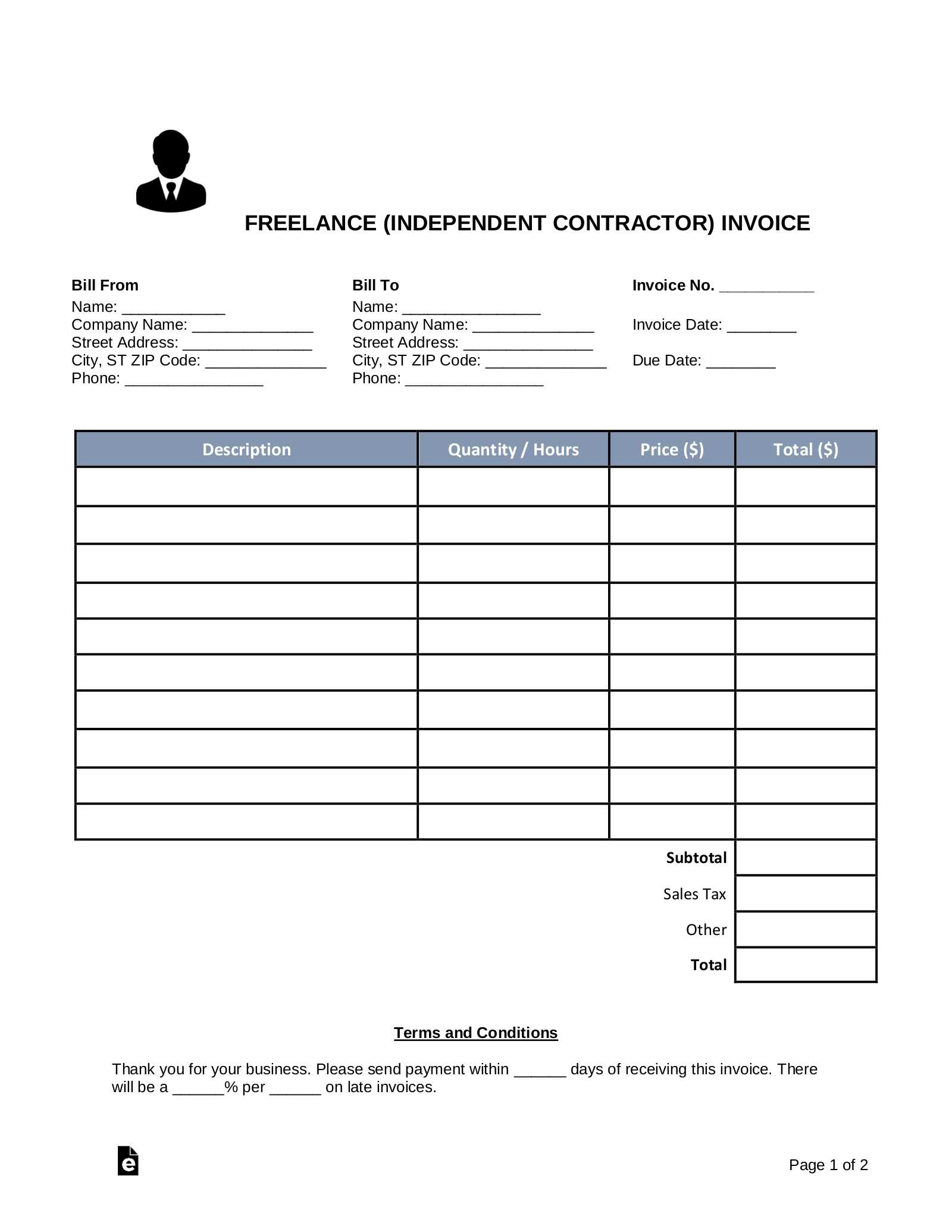

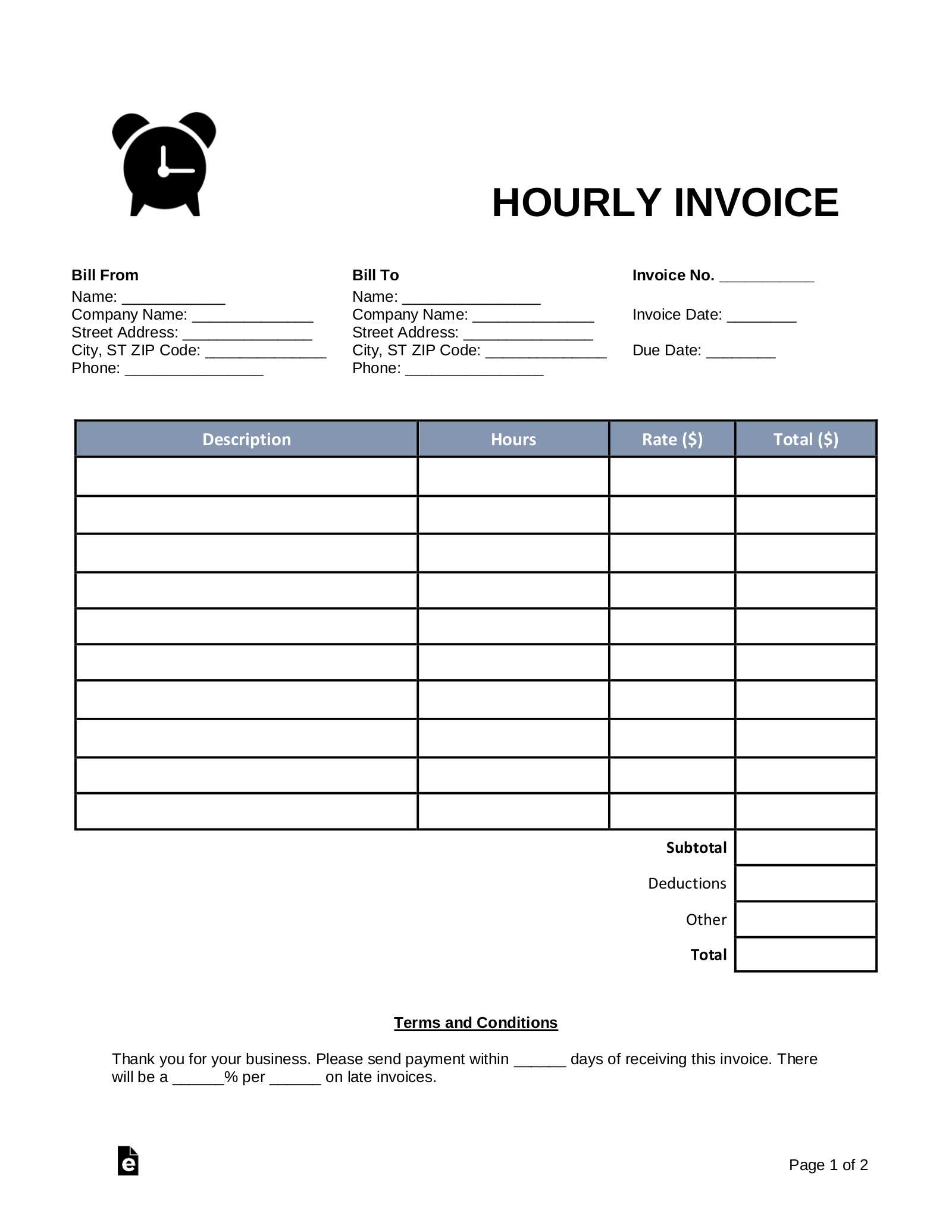

Invoice Templates for Different Industries

Each industry has unique requirements when it comes to billing and payment collection. To streamline this process, many businesses turn to specialized documents designed to meet specific needs. These forms allow for a more tailored approach, ensuring that all necessary details are captured and presented clearly for clients. Understanding the variations in these forms across different fields can help you select the right one for your business.

Creative and Design Industries

For creative professionals such as graphic designers, photographers, and writers, their billing needs often involve itemizing services based on hours worked or project milestones. The document should reflect creative services with detailed descriptions, hourly rates, and total costs. These invoices can also include provisions for royalties or licensing fees, which are common in industries like design and media.

- Clear breakdown of services provided – Ensures the client understands the value of the work done.

- Project-based pricing – Reflects custom pricing structures rather than standard hourly rates.

- Space for detailed descriptions – Important for showcasing unique aspects of the creative work.

Construction and Trade Industries

In construction and trade, invoicing typically involves both labor and materials, with specific terms related to project phases or milestones. A specialized document may include sections for tracking the cost of materials, subcontractor charges, and labor costs, along with details for any permits or inspections. This ensures transparency between contractors and clients and helps prevent misunderstandings.

- Itemized list of materials and labor – Provides clarity on how costs are distributed.

- Project milestones – Ensures clients are billed according to progress.

- Detailed terms and conditions – Useful for addressing payment schedules or disputes.

Retail and Wholesale Businesses

For businesses in retail or wholesale, invoicing often involves large quantities of products sold, with detailed item descriptions, quantities, and unit prices. These forms must clearly indicate bulk discounts, delivery charges, and terms for payment. A well-structured document helps maintain professional relations and ensures that there is no ambiguity regarding product pricing or delivery details.

- Clear product descriptions and quantities – Helps avoid confusion for both parties.

- Discounts and pricing adjustments – Shows any discounts provided based on order size.

- Delivery and shipping costs – Reflects all extra charges related to fulfillment.

Healthcare and Medical Industries

In healthcare, detailed invoicing is essential for capturing the costs of medical services, tests, and equipment used. These forms should include information about patient treatments, diagnostic codes, and insurance details, making it clear which services are covered under insurance and which are out-of-pocket. Specialized formats help medical professionals stay organized while ensuring patients and insurance companies are billed appropriately.

- Itemized list of medical services – Makes it easier for patients and insurers to understand charges.

- Insurance and patient payment breakdown – Ensures accuracy when filing claims.

- Space for diagnostic and procedural codes – Important for medical billing and insurance purposes.

Professional Services

Professional service providers, such as lawyers, consultants, and accountants, need billing forms that reflect the complexity and scope of their work. These forms typically include hourly rates or fixed fees, along with details about the hours worked, specific services provided, and any expenses incurred during the service. Clear and concise invoicing helps professionals maintain credibility and ensures clients understand the charges they are paying for.

- Hourly rate breakdown – Helps clarify the cost for each hour of service rendered

How to Track Payments with Templates

Effectively managing and monitoring payments is a crucial aspect of running a business. Using structured documents that allow you to track incoming payments ensures that no transactions are missed and that you maintain accurate financial records. A well-organized system not only helps with cash flow management but also reduces the risk of errors or disputes with clients.

To track payments efficiently, your document should include essential sections for noting payment statuses, due dates, amounts received, and outstanding balances. Many businesses choose to design their own forms to include these details or use pre-designed ones that can be easily modified for ongoing use. By doing so, you can quickly see which payments have been made and which are still pending.

Key Information to Include

When tracking payments, it’s important to capture several key details in your document:

- Invoice Number – A unique identifier for each transaction, helping to avoid confusion when cross-referencing records.

- Payment Date – The date when the payment was made, which is essential for maintaining accurate records.

- Payment Amount – The total amount received for each transaction, ensuring you can reconcile the figures later.

- Outstanding Balance – A section that reflects any remaining balance, helping you follow up on unpaid amounts.

- Payment Method – Noting whether the payment was made via credit card, bank transfer, or another method.

Setting Up Payment Reminders

Another effective way to keep track of payments is by setting up automated reminders for clients. Many businesses choose to include payment due dates directly in the document, alongside payment status updates. This can help reduce the number of overdue payments by prompting clients to pay on time. Additionally, reminders can be programmed into email systems or business management software to send notifications when payments are due or overdue.

- Automated Reminders – Set up automated email reminders that are triggered a few days before the due date.

- Payment Status Updates – Update the payment status after each payment is received to maintain an accurate record.

- Follow-up Procedures – Outline steps for following up with clients if payments become overdue.

By including these elements and following a structured approach to tracking payments, you ensure that your records remain up-to-date and you can easily identify which transactions have been completed and which ones need follow-up. This method promotes a more organized and efficient workflow, freeing up time to focus on other critical aspects of your business.

Legal Considerations When Creating Invoices

Creating proper and legally compliant transaction records is essential for any business. These documents not only serve as a request for payment but also provide evidence in case of disputes, audits, or legal proceedings. Ensuring that your document includes all the necessary elements and follows relevant laws helps protect both the business and the client, making sure that the financial transactions are clear, transparent, and enforceable.

There are several key legal aspects to consider when designing a document for payment requests, ranging from the inclusion of accurate information to adhering to tax regulations. These considerations vary by jurisdiction, so it’s important to be aware of local rules and regulations that govern financial documentation.

Essential Legal Information

To avoid any potential issues, your document should include specific details that ensure it is legally valid. These include:

- Business Information – Full name, address, and contact details of the business, as well as any relevant registration numbers, such as a tax ID or business license number.

- Client Information – Accurate details of the client, including their name, business name (if applicable), and contact information.

- Payment Terms – Clear terms about payment deadlines, penalties for late payments, and any interest charges or discounts for early payments.

- Tax Information – Depending on your location, you may need to include sales tax or VAT information, along with tax identification numbers for both the business and the client.

- Unique Identification Number – A reference number or code for the transaction helps both parties track payments more easily and adds a layer of accountability.

Tax and Regulatory Compliance

In many regions, it’s required to follow specific guidelines when charging tax or handling cross-border transactions. Understanding your obligations, such as whether or not sales tax should be included, and applying it correctly is critical. Furthermore, businesses must ensure they comply with laws regarding digital record-keeping, electronic transactions, and data protection. Here are some guidelines to follow:

- Tax Codes – Ensure that any sales tax or VAT applied is in line with the tax rates in your jurisdiction. Make sure to specify whether tax is included in the price or added separately.

- Cross-Border Considerations – If you are working internationally, understand the tax obligations for both your country and the client’s country. You may need to apply different tax rates or follow additional documentation rules for overseas transactions.

- Record Keeping – Retain records of all transactions for the required duration as stipulated by law. This is vital for both tax reporting and in case of an audit.

By paying attention to these legal details when drafting your transaction records, you can avoid misunderstandings and potential disputes. Additionally, proper documentation supports a smooth and transparent business relationship, which benefits both parties in the long term.

Ensuring Accuracy in Your Invoices

Maintaining precision in your financial documents is crucial for smooth business operations and to avoid confusion or legal complications. Accurate records help both businesses and clients keep track of payments, ensure proper accounting, and minimize the risk of disputes. Whether you’re creating a request for payment for goods or services, getting the details right is essential for maintaining professionalism and financial integrity.

Ensuring accuracy in your payment documents involves careful attention to detail, such as verifying numerical values, business information, and payment terms. Even small mistakes can lead to delays or incorrect charges, potentially damaging your reputation or leading to missed payments.

Common Areas to Double-Check

Before finalizing your documents, consider reviewing the following key areas for accuracy:

- Client Information – Make sure all client contact details are up to date and correctly entered. Incorrect information can result in miscommunications or failed delivery of documents.

- Transaction Dates – Check that all relevant dates, including issue date, due date, and any payment deadlines, are accurate. Errors in dates can lead to confusion about when payments are due.

- Payment Amounts – Double-check all amounts, including any discounts, taxes, or additional charges. Ensure that the totals match the calculations and reflect any applicable terms.

- Descriptions of Goods or Services – Ensure that each item or service provided is clearly and accurately described. This helps clients understand exactly what they are paying for and minimizes the risk of disputes.

Verification Methods

To prevent errors, there are several strategies you can use:

- Double-Check Calculations – Use tools like automated calculators or spreadsheet software to ensure the math is correct, especially when adding taxes or discounts.

- Review Client Agreement – Cross-reference your document with the original agreement or contract with the client to ensure consistency in pricing, terms, and expectations.

- Proofreading – Review the document thoroughly before sending it. Consider having a colleague or team member proofread it to catch any overlooked errors.

By prioritizing accuracy in your financial records, you can improve your business’s reputation, reduce confusion, and foster stronger client relationships. Investing time in getting it right the first time will ultimately save you time and hassle in the long run.

How to Share and Send Invoices

Efficiently sending financial requests is just as important as creating them. Once you have prepared your document, the next step is ensuring that it reaches the recipient in a timely and secure manner. Whether you choose to send it electronically or via traditional mail, it’s essential to use the appropriate method that ensures clarity, professionalism, and ease of access for your client.

There are several ways to share and send your financial documents, each offering different advantages depending on your preferences and your client’s needs. The right method can help streamline your processes and ensure that payments are received promptly.

Electronic Methods

Sending documents electronically is quick, convenient, and environmentally friendly. Here are a few popular options:

- Email: The most common and immediate method. You can attach the document as a PDF, ensuring that your client receives an easy-to-read, secure file. Many email platforms allow you to track whether the message has been opened, which is helpful for follow-up.

- Cloud Storage: If the file is too large or contains multiple documents, using a cloud service like Google Drive, Dropbox, or OneDrive allows you to share a link with your client for easy access. Just be sure that the recipient has the necessary permissions to view or download the file.

- Online Payment Platforms: Some online payment services, such as PayPal or Stripe, allow you to send invoices directly through their platform. These services also allow clients to make payments quickly and securely.

Traditional Methods

While digital methods are increasingly preferred, some clients may still prefer receiving hard copies or if your industry requires formal delivery methods. Here’s how you can go about it:

- Postal Mail: For businesses that require physical copies, sending a printed version of the document via postal services is an option. Ensure that the address is correct and consider using tracking services to guarantee safe delivery.

- Courier Services: For urgent or high-value documents, courier services provide more secure and expedited delivery options. This can also be ideal for international transactions.

No matter the method, it’s crucial to include clear instructions for payment, set expectations regarding deadlines, and provide the necessary contact information in case your client has questions. The quicker and easier it is for your client to receive and process the document, the faster you can expect to be paid.