Invoice for Reimbursement Expenses Template to Simplify Your Process

Managing company-related costs efficiently is essential for maintaining smooth financial operations. A well-structured document that tracks and requests reimbursement can help ensure that employees and contractors are reimbursed accurately and promptly. Having the right tool to capture all necessary details is key to avoiding errors and delays in the process.

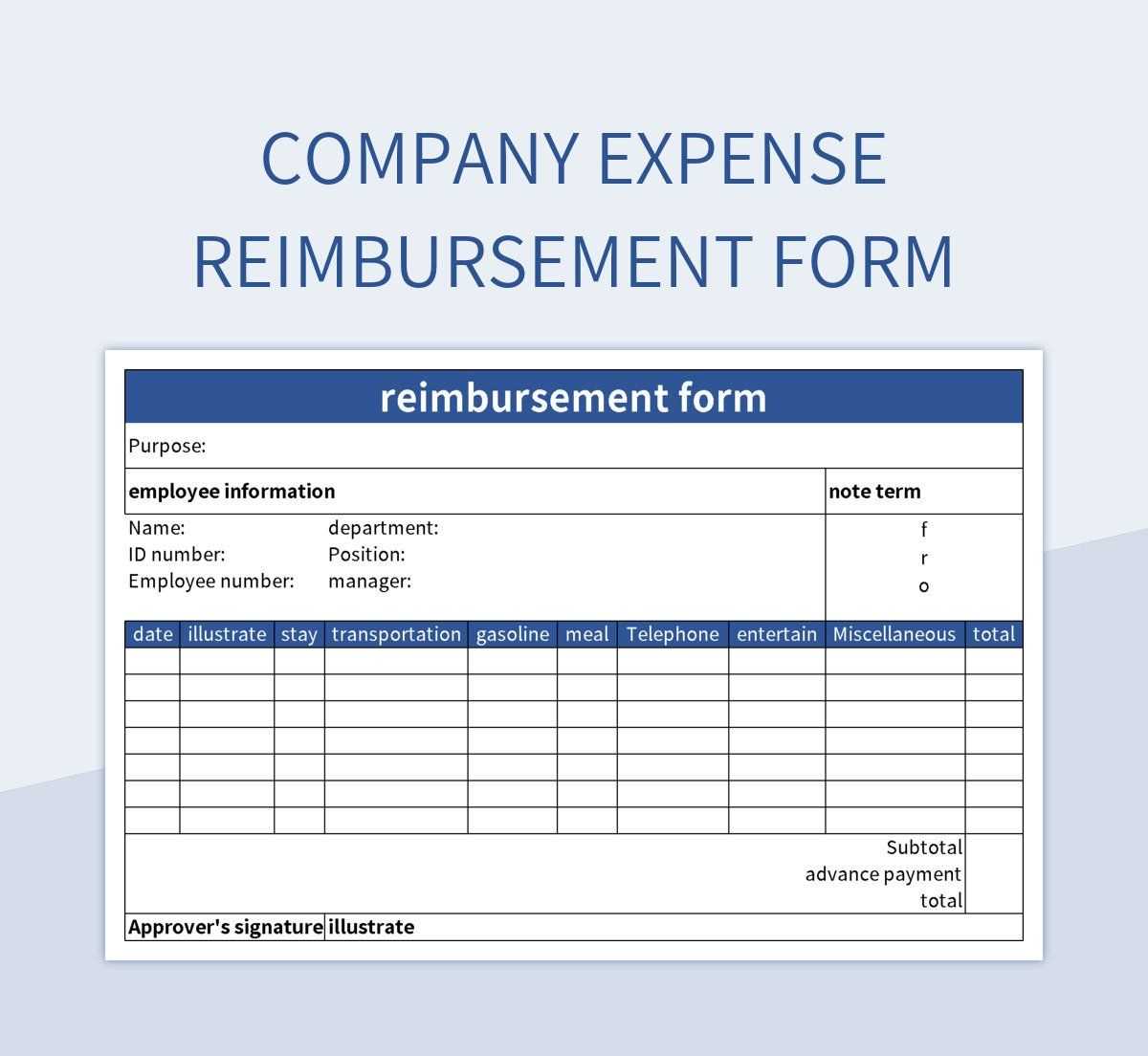

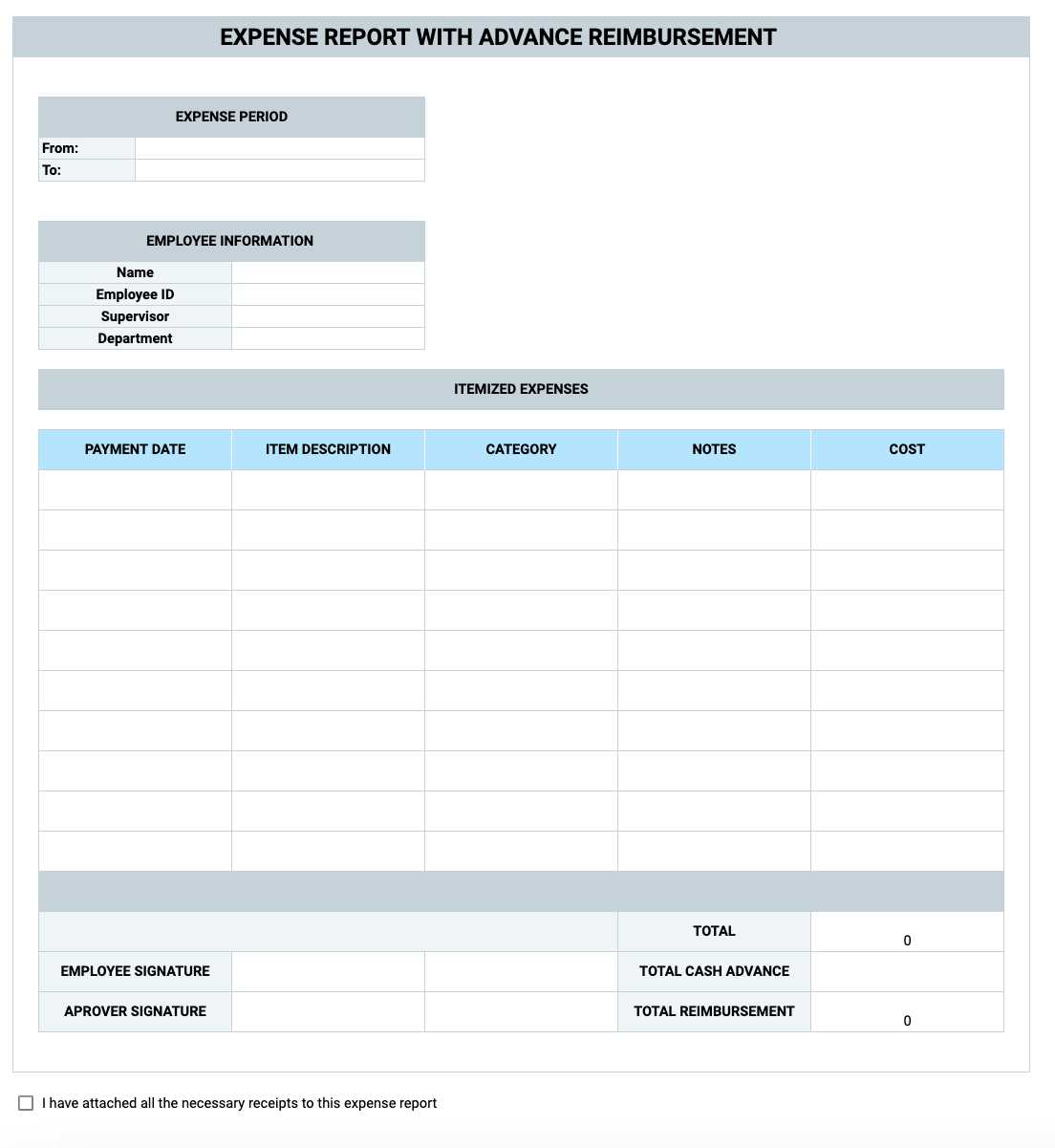

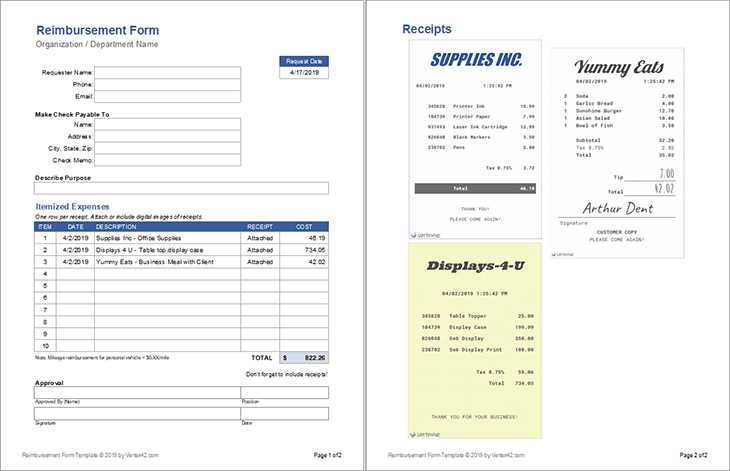

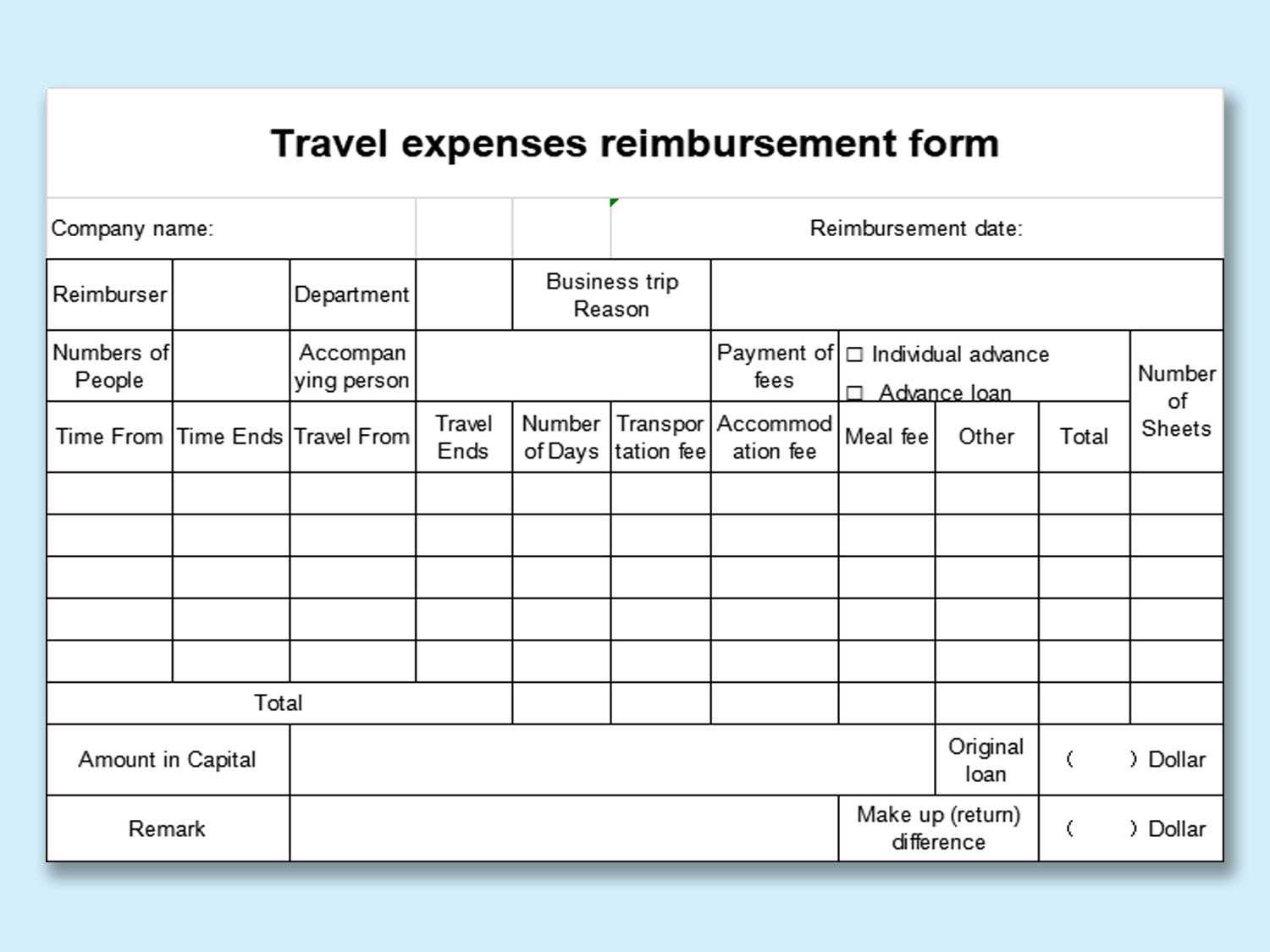

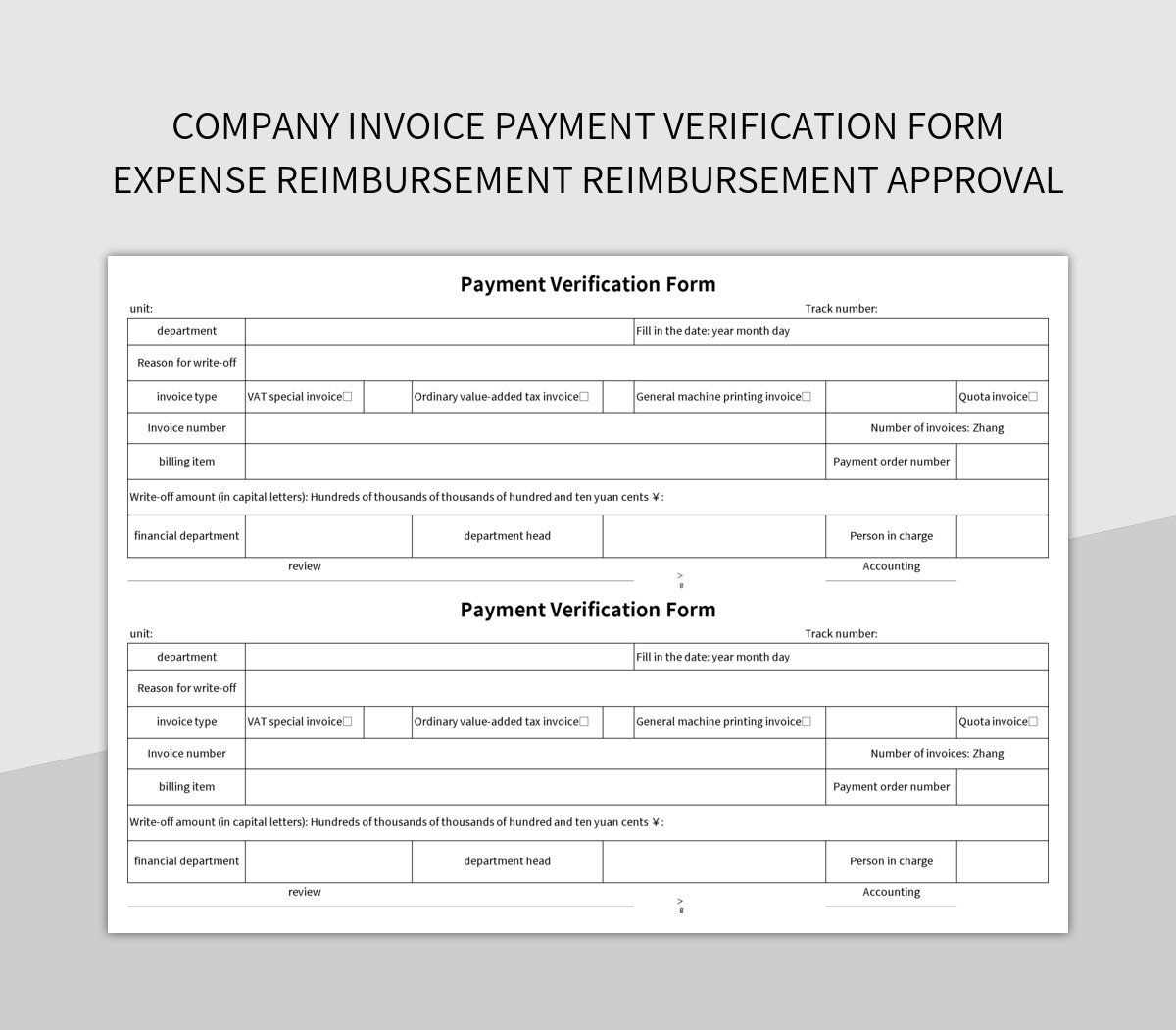

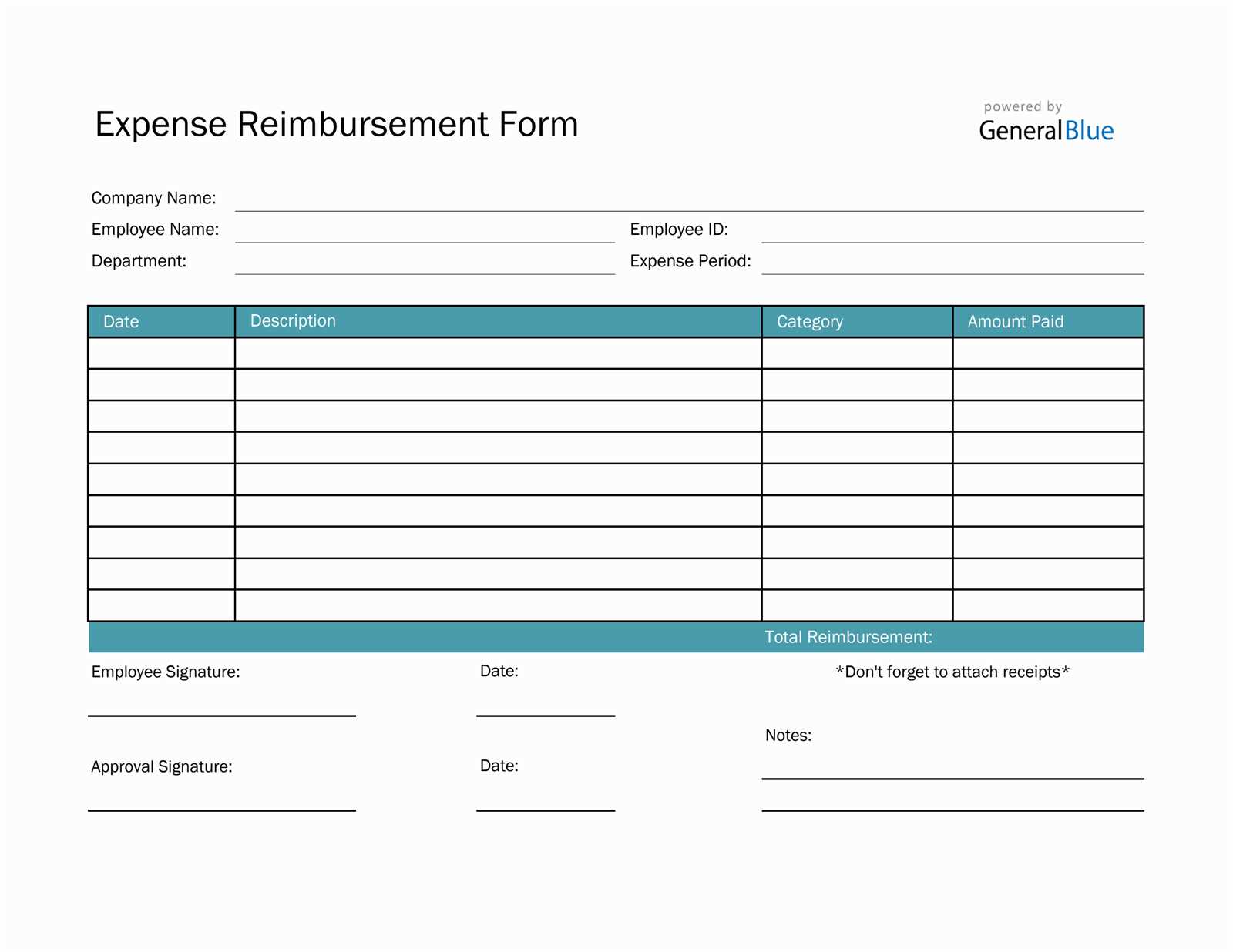

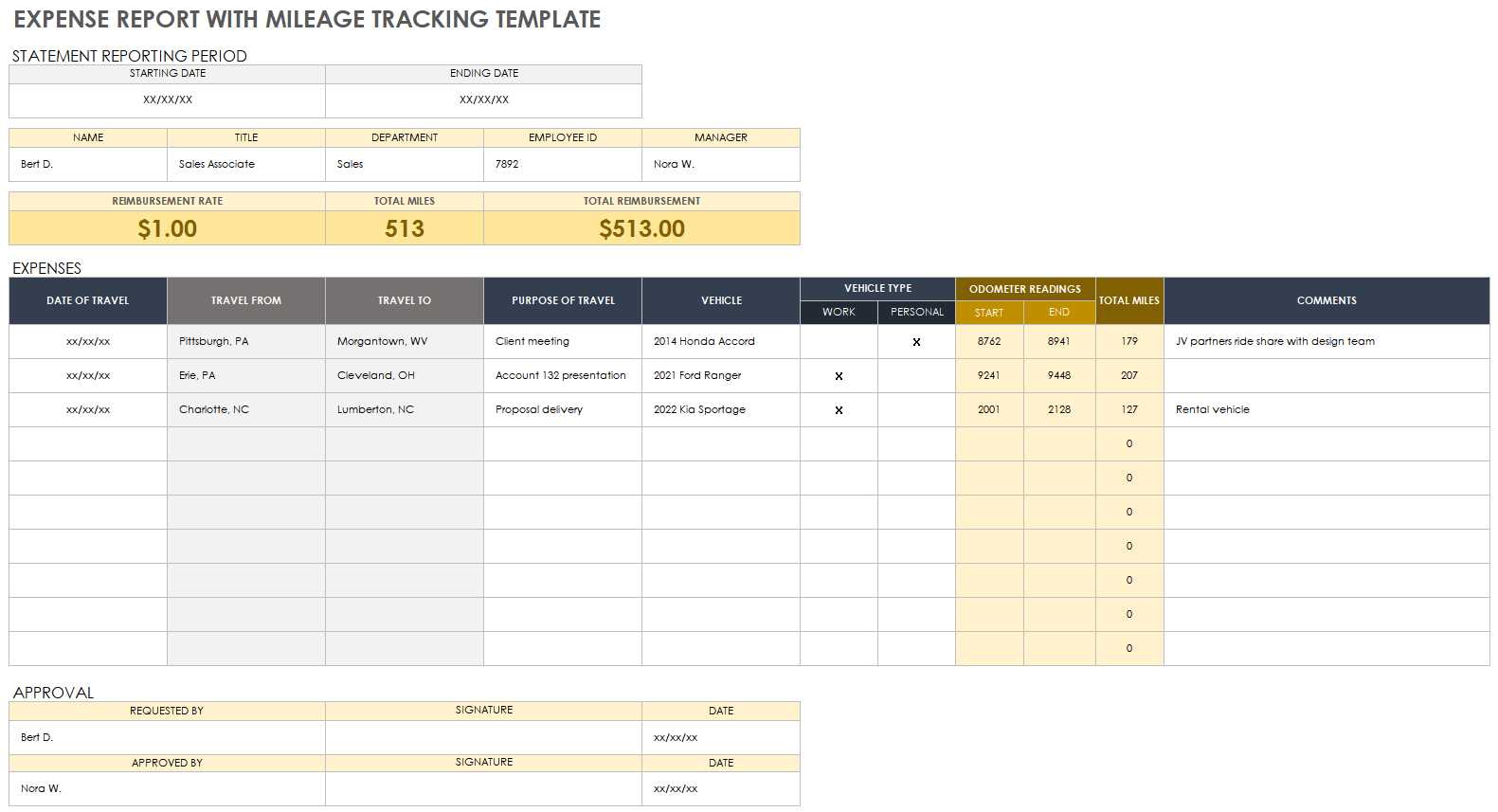

Customizable forms can simplify the entire process by providing a consistent format that suits various needs. These documents typically include the necessary sections to record payment details, date of expense, purpose, and the involved parties. Using a pre-designed structure eliminates confusion and saves time when submitting claims.

Whether you’re looking to streamline accounting tasks or make the approval process more efficient, adopting the right document format can lead to better tracking and smoother financial workflows. Clear and professional forms make sure that no important information is left out, helping to avoid complications down the line.

Understanding Reimbursement Expenses for Businesses

In any business, employees or contractors often incur costs on behalf of the company, whether for travel, supplies, or other work-related activities. These out-of-pocket costs must be tracked and refunded promptly to maintain financial transparency and employee satisfaction. Properly managing these claims is essential for both legal compliance and efficient financial operations.

There are several types of situations where individuals might request compensation for costs incurred during their duties. These can range from travel and lodging to business meals, office supplies, or even client-related expenses. Understanding these categories helps businesses establish clear guidelines for processing such claims.

To ensure smooth handling of these situations, businesses should follow a standardized process for reviewing and approving requests. This typically involves the following steps:

- Employees submit detailed documentation of the costs incurred.

- The documents are reviewed for accuracy and relevance.

- Once approved, funds are disbursed to the individual.

- All transactions are recorded for accounting and tax purposes.

By establishing a consistent and transparent process, businesses can minimize disputes and delays. This also fosters trust between employers and employees, ensuring that work-related expenditures are managed efficiently. Proper documentation is crucial, as it allows for easier tracking and compliance with financial regulations.

Why Use an Invoice Template for Expenses

Managing cost claims can be a complex task, especially when numerous individuals are submitting requests for various types of business-related spending. Without a standardized format, the process can become disorganized, leading to confusion and delays. A pre-designed document that clearly outlines necessary details helps streamline the approval process, saving time and reducing errors.

Consistency and Clarity

Using a structured form ensures that all necessary information is captured uniformly. This consistency makes it easier for finance teams to review claims and ensures that no essential details are overlooked. A well-organized structure also simplifies the verification process, as each claim follows the same format, reducing the likelihood of misunderstandings or missing information.

Efficiency and Time-Saving

Pre-built documents save time by eliminating the need to manually create forms from scratch for each claim. Employees and contractors can quickly fill out the required fields, allowing finance teams to process requests faster. This streamlined workflow not only speeds up approvals but also allows the company to handle a higher volume of claims without sacrificing accuracy.

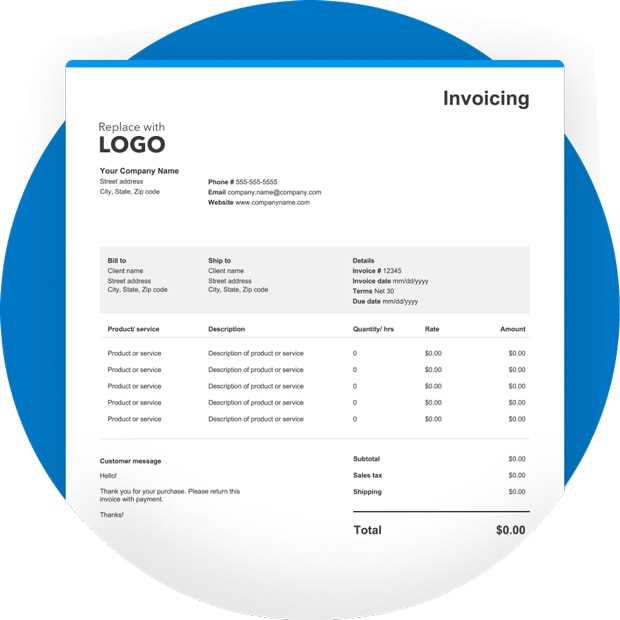

How to Create a Simple Reimbursement Invoice

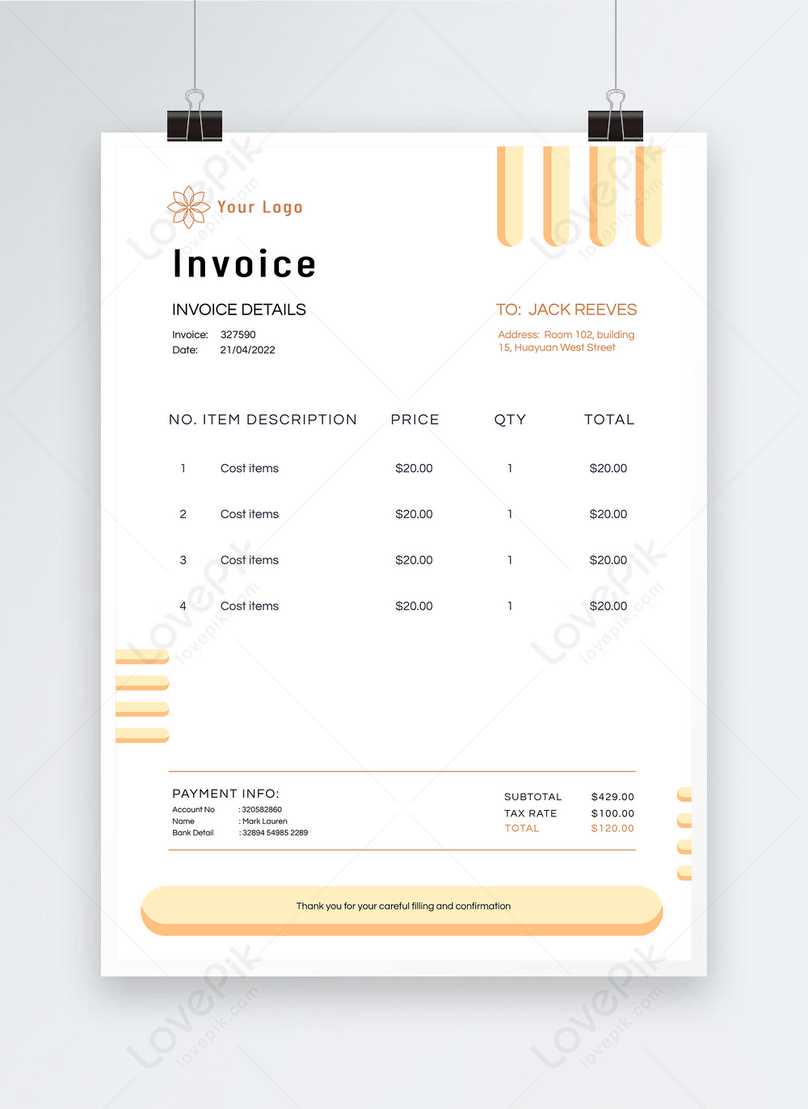

Creating a straightforward document to track business-related claims can be simple yet highly effective. By following a few basic steps, you can ensure that all the necessary details are included, which will help both the claimant and the finance team process the request quickly and accurately. Here’s a step-by-step guide to creating a simple and functional form for such submissions.

The key to designing a clear and efficient document lies in organizing the relevant information in an easy-to-follow format. Be sure to include essential elements that will allow for quick review and approval. Here are the main components to include:

- Title and Identification: Label the document with a clear title such as “Cost Reimbursement Request” or “Business Expense Claim.” Include unique identifiers such as a claim number, employee ID, or date of submission.

- Claimant Information: Provide fields to input the name, position, department, and contact details of the individual submitting the request.

- Cost Breakdown: List each item or service for which reimbursement is being requested, including the date, description, amount, and any supporting documentation such as receipts or invoices.

- Approval Section: Leave space for manager or supervisor signatures, along with the date of approval. This ensures that the claim is validated by the appropriate authority before processing.

- Payment Information: Provide a section to specify how the reimbursement should be paid, such as by bank transfer, check, or another method.

By organizing the form this way, you create a clear, transparent, and easy-to-use document. This approach minimizes errors, streamlines the approval process, and ensures that all claims are processed efficiently.

Key Elements of an Expense Invoice

To ensure that claims are processed accurately and efficiently, it’s essential to include all necessary details in a structured format. A well-designed form serves not only as a record of the transaction but also as a reference point for both the individual submitting the claim and the department reviewing it. The following are the critical components that should appear in any such document.

| Section | Description |

|---|---|

| Claimant Information | Include the name, job title, department, and contact details of the individual submitting the request. |

| Claim Number | A unique identifier that helps track the claim throughout the approval and payment process. |

| Claim Date | The date on which the claim is being made or the relevant costs were incurred. |

| Itemized List of Costs | A detailed breakdown of each expense, including a description, date, amount, and any supporting documentation (e.g., receipts or invoices). |

| Payment Method | Specify how the claim should be paid, whether by check, bank transfer, or another method. |

| Manager’s Approval | Space for the supervisor or manager to sign, verifying that the claim has been reviewed and approved. |

These elements ensure that all required information is captured, making the process of reviewing and approving the request more efficient. A clearly organized document reduces the risk of delays and misunderstandings, ultimately contributing to smoother financial operations within the organization.

Common Mistakes in Expense Invoicing

In the process of submitting claims for incurred costs, several errors can often arise. These mistakes can result in delays, confusion, and even denials. Understanding the key pitfalls can help streamline the process and ensure smoother approval of claims. Below are some frequent missteps to avoid.

1. Incomplete or Missing Information

One of the most common errors is failing to provide all necessary details. Whether it’s omitting dates, amounts, or specific descriptions, incomplete documents can lead to complications. Ensure that every required field is filled out thoroughly to avoid back-and-forth communication that may slow down the approval process.

2. Lack of Proper Documentation

Supporting documents such as receipts or proof of payment are crucial when submitting claims. Without clear, legible copies of these documents, your submission may be rejected or flagged for further investigation. Always ensure your receipts are intact and easy to read before submission.

3. Incorrect Amounts or Miscalculations

Simple errors in math, such as adding wrong totals or misapplying rates, can create unnecessary complications. Double-check the figures to confirm they align with the actual amounts spent. Even small discrepancies can lead to delays or require corrections, so accuracy is key.

4. Submitting Claims Too Late

Timely submission is crucial. Delays in filing claims may result in missed deadlines or complications in processing. Always be aware of the timeframes within which submissions must be made and adhere to them strictly.

5. Failing to Follow Established Procedures

Each organization has its own process for handling claims. Whether it’s specific formats, filing systems, or approval hierarchies, failing to follow the correct procedures can cause confusion and delay. Make sure you understand the guidelines and stick to them closely to avoid any setbacks.

6. Not Considering Tax Implications

It’s important to account for any tax regulations when submitting claims. Failing to include taxes or incorrectly calculating them could result in rejected submissions. Verify the correct tax rates and ensure they are applied where necessary.

Benefits of Using Templates for Expense Reports

Utilizing pre-designed forms can significantly streamline the process of documenting and submitting financial claims. By offering a structured format, these resources provide clarity and consistency, reducing the likelihood of errors and improving efficiency. Here are the key advantages of relying on such ready-made solutions.

- Consistency – A standardized format ensures that all necessary details are consistently captured in each submission. This reduces variation and minimizes the chances of missing critical information.

- Time-Saving – Pre-built formats eliminate the need to manually create reports from scratch. This speeds up the process of filling out claims, making it easier to stay organized and submit them promptly.

- Accuracy – With set fields and calculations in place, there’s less room for mistakes. Automated systems within some forms help verify amounts and avoid errors in math or data entry.

- Clarity – Well-designed formats provide clear sections and instructions, ensuring that users understand what is required in each step. This simplifies the process for both the person submitting and the one reviewing the documentation.

- Improved Compliance – Many of these resources are created to comply with organizational or legal standards. By using a pre-made form, you can be more confident that your submissions meet necessary requirements, reducing the risk of rejection.

- Tracking and Reporting – Using a consistent format makes it easier to keep track of multiple claims over time. It allows for better record-keeping and smoother audits when necessary.

How to Customize Your Invoice Template

Personalizing the structure used to document and request financial recoveries can significantly improve both the clarity and professionalism of your submission. Tailoring the design and content allows you to meet specific needs and ensure the document aligns with organizational or personal standards. Here’s how to adjust a standard format to best suit your requirements.

Step 1: Adjusting the Layout

The layout is essential for readability and clarity. Start by deciding on the overall organization–how to structure sections such as dates, amounts, descriptions, and totals. A well-organized layout helps ensure that all the necessary information is included and easy to understand. Consider separating sections with bold headings and adequate spacing.

Step 2: Adding Custom Fields

Depending on your specific requirements, you may want to add or remove certain fields. For example, you might want to include a unique reference number or an approval section for easier tracking. Custom fields can help tailor the form to your company’s or your own reporting needs.

| Field | Description |

|---|---|

| Reference Number | A unique identifier for tracking purposes |

| Approval Section | Area where supervisors or managers can sign off |

| Tax Information | To include applicable tax rates or exempt status |

By customizing these fields, you ensure that the document fits your exact needs and is optimized for processing. Custom fields can help streamline internal approval workflows and ensure that all necessary information is readily available for auditing or reporting purposes.

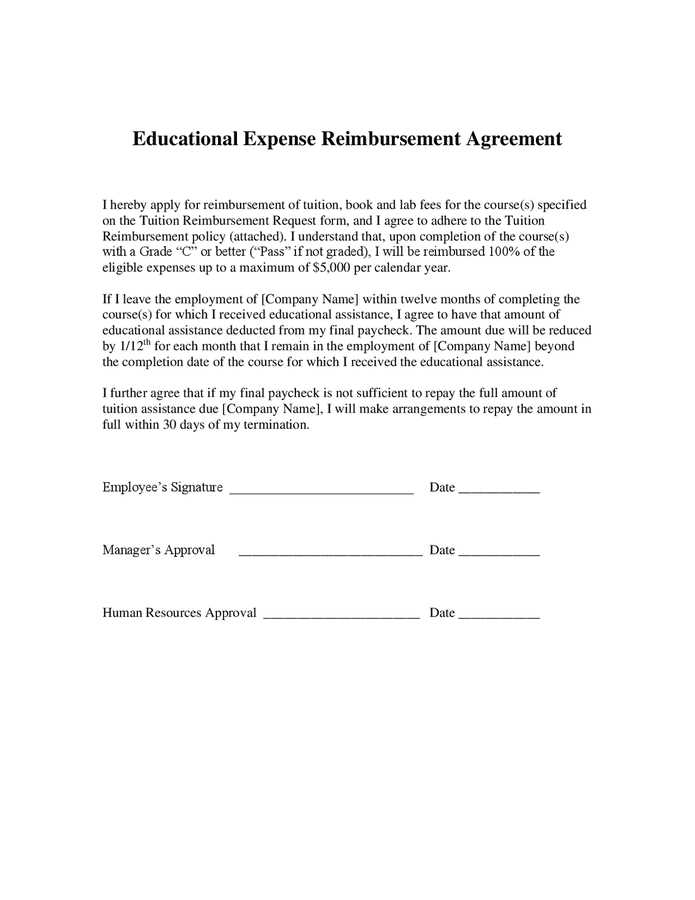

Legal Requirements for Reimbursement Invoices

When submitting claims for cost recovery, it is essential to ensure that the document complies with all relevant legal and tax regulations. Each jurisdiction may have its own set of rules and guidelines regarding what information must be included and how the document should be presented. Adhering to these requirements helps prevent delays, errors, and potential disputes. Below are the common legal elements that should be considered when preparing such documents.

- Clear Identification of the Claimant – The document should clearly state the name, address, and contact information of the individual or organization requesting the payment.

- Detailed Description of the Items – Each item or service for which compensation is being requested must be described in detail, including dates, purpose, and amounts. A lack of clarity can result in rejection or further scrutiny.

- Receipts and Proof of Payment – Supporting evidence, such as receipts, invoices, or bank statements, is typically required to substantiate the claim. These documents serve as proof that the amounts being claimed were actually paid.

- Applicable Taxes – Tax rates and calculations should be clearly stated if they apply to the costs. This ensures compliance with local tax laws and helps avoid any potential penalties.

- Authorization and Signatures – Depending on the organization or legal requirements, the document may need to be signed by the person submitting the claim and/or a supervisor or manager to confirm approval.

- Timely Submission – Legal guidelines may dictate a specific time frame in which claims should be submitted. Missing this window can result in the rejection of the claim.

It is crucial to verify that these elements are included and accurate when preparing a document, as non-compliance can delay the approval process or even lead to the rejection of the claim. Always consult with relevant legal or tax advisors to ensure that the submission adheres to all necessary regulations.

Best Practices for Reimbursement Invoice Submission

Submitting a financial claim efficiently requires following a set of best practices to ensure accuracy, compliance, and timely processing. By adhering to a few key guidelines, you can streamline the process, avoid common errors, and increase the chances of quick approval. Below are the top strategies to keep in mind when submitting a claim for cost recovery.

- Ensure Accuracy – Double-check all amounts, dates, and descriptions before submission. Small mistakes or discrepancies can lead to delays and require resubmission, which can slow down the entire approval process.

- Provide Complete Documentation – Always attach the necessary supporting documents, such as receipts, proof of payment, or contracts. Missing documentation can lead to the rejection of your submission, causing unnecessary back-and-forth communication.

- Submit Claims on Time – Be aware of deadlines and ensure that you submit your documents within the required time frame. Late submissions may not be processed or could be subject to penalties.

- Follow Organizational Procedures – Adhere to the specific procedures set by your company or the governing body for submitting claims. This includes using the correct formats, filing in the appropriate system, and getting the necessary approvals before submitting your claim.

- Include Clear Descriptions – Provide detailed and transparent descriptions of the items or services being claimed. Vague or unclear descriptions can lead to confusion and delays in processing your claim.

- Check Compliance with Tax Regulations – Make sure that taxes, where applicable, are calculated correctly and clearly shown in your submission. Ensuring compliance with local tax laws will prevent any issues during the approval process.

- Keep a Copy of Your Submission – Always retain a copy of your submitted documents for your own records. This helps with tracking and provides a reference in case there are any questions or issues that arise during the review process.

By following these practices, you can improve the likelihood of your claim being processed quickly and accurately, reducing the chances of delays or rejections.

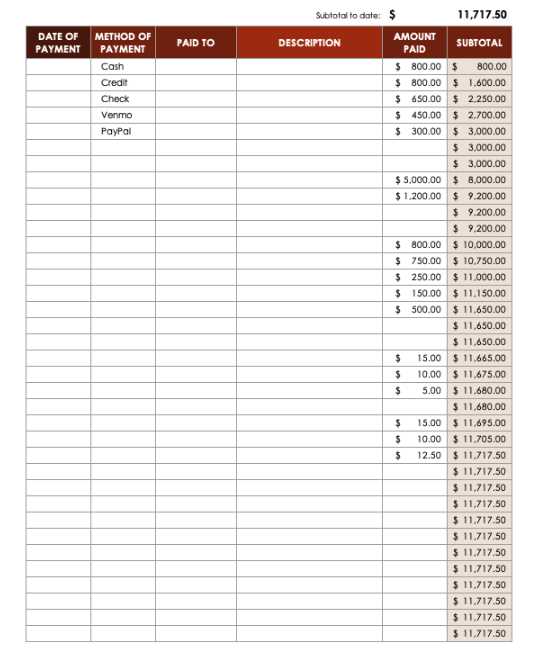

Tracking Reimbursement Requests Efficiently

Effectively managing and monitoring requests for financial recoveries is crucial to ensuring timely approval and payment. By implementing a structured tracking system, you can keep an eye on the progress of each submission, quickly identify any issues, and ensure all claims are processed within the necessary time frame. Below are some key strategies for tracking and managing requests more efficiently.

1. Use a Centralized Tracking System

One of the most effective ways to track requests is by using a centralized system, whether it’s a software solution or a shared spreadsheet. This allows you to see the status of all submissions in one place and helps avoid the confusion of managing multiple forms or communications. Each claim can be updated with its current status, approval steps, and any feedback from reviewers.

2. Implement Milestone Tracking

Breaking the process into key milestones can make it easier to monitor progress. For example, you can track when a claim is submitted, when it is reviewed, when any additional information is requested, and when it is finally approved. This helps pinpoint any delays and allows for timely follow-ups.

- Submission Date: Mark when the claim is submitted for processing.

- Approval Steps: Track each level of approval or review required.

- Payment Date: Record when the claim is paid or processed for payment.

By breaking down the process into specific milestones, you can ensure that no steps are missed and that everything moves forward smoothly.

3. Set Reminders and Notifications

Timely follow-ups are essential to avoid unnecessary delays. Setting automatic reminders or notifications can ensure that both you and the relevant parties are aware of important dates. For instance, reminders can be set to follow up if there has been no update after a certain period or to ensure that deadlines are met.

4. Regularly Review Pending Requests

It’s important to regularly review all ongoing requests to ensure that nothing is overlooked. Keeping track of pending claims allows you to stay on top of approvals and avoid missed deadlines. Regular check-ins can help identify any bottlenecks early on and allow you to address them before they cause significant delays.

By implementing these strategies, you can efficiently track the progress of all financial claims and ensure that the process remains smooth and transparent. A well-organized approach not only saves time but also improves communication and reduces the risk of errors or missed payments.

Choosing the Right Invoice Template for Your Business

Selecting the appropriate format for submitting financial claims is essential for maintaining professionalism, accuracy, and efficiency in your business operations. A well-designed form can help ensure that all necessary details are included, reduce errors, and improve the overall workflow. Below are key factors to consider when choosing a format that best fits your company’s needs.

| Factor | Consideration |

|---|---|

| Business Size | Smaller businesses may benefit from a simpler layout, while larger companies may need a more detailed structure with additional sections for approvals, taxes, and multiple items. |

| Industry Requirements | Certain industries may have specific documentation requirements. For instance, legal or healthcare sectors may need specialized sections or regulatory information. |

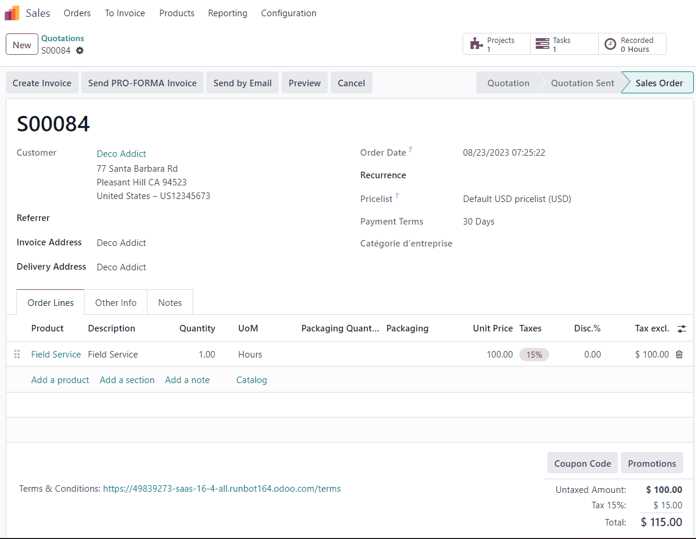

| Software Compatibility | Consider the software tools your business uses for tracking and processing financial information. Choose a format that integrates seamlessly with your accounting software. |

| Level of Detail | If your claims involve complex or numerous items, choose a layout that allows space for detailed descriptions, dates, and amounts. A minimalist format might work better for simple claims. |

| Customization | Select a format that can be easily customized to include your company logo, branding, or specific fields unique to your needs. |

By evaluating these factors, you can select the right structure that will streamline the submission process, ensure accuracy, and maintain consistency in your claims. Whether you choose a basic, pre-made solution or a more customizable option, the goal is to find a format that suits both the size and complexity of your business.

Digital vs. Paper Expense Invoices

When it comes to submitting and managing financial claims, businesses often face the choice between using traditional paper forms or modern digital solutions. Each approach has its own set of advantages and disadvantages, and the best option depends on the specific needs of the organization. Below, we explore the key differences between digital and paper forms to help you make an informed decision.

Advantages of Digital Formats

Digital submissions offer several significant benefits that can improve efficiency and reduce costs in the long run. These include:

- Speed – Digital forms can be submitted instantly, reducing the time spent on mailing or physically delivering paperwork. This allows for faster approval and processing.

- Storage and Organization – Storing digital records is more efficient. Documents can be easily categorized, searched, and retrieved with just a few clicks, reducing the need for physical storage space.

- Automation – Many digital solutions allow for automatic calculations, reducing human error and ensuring accuracy in financial records.

- Environmental Impact – By reducing the use of paper, businesses can lower their environmental footprint, contributing to sustainability efforts.

Advantages of Paper Formats

While digital options are growing in popularity, paper submissions still have their place in certain contexts. Some benefits include:

- Tangible Proof – Some organizations or individuals may prefer having a physical document that can be signed, stamped, and filed, offering a sense of security in certain industries.

- No Technology Dependence – Paper forms don’t rely on internet connectivity, software, or hardware, making them a reliable option in areas with limited access to digital tools.

- Legal Requirements – In some jurisdictions, there may be legal or regulatory reasons to submit physical documentation. This may be the case for certain industries or contracts where a physical signature is required.

Ultimately, the choice between digital and paper formats depends on your business’s specific needs, resources, and compliance requirements. Many businesses are now adopting a hybrid approach, where both methods are used depending on the situation.

How to Avoid Delays in Reimbursement

Submitting financial claims promptly and accurately is essential to avoid delays in the approval and payment process. Missteps in the preparation or submission of documents can cause unnecessary setbacks, leading to frustration and delayed cash flow. To ensure a smooth and efficient processing cycle, it’s important to follow best practices that minimize errors and expedite approval. Below are some key strategies to help prevent delays.

1. Complete All Required Information

Incomplete forms or missing details are a common cause of delays. To ensure that your submission is processed quickly, make sure to include the following information:

- Personal or Company Details: Ensure that your contact information and any relevant identification numbers are accurately filled in.

- Clear Descriptions: Provide detailed descriptions for each item or service included in the claim, such as dates, amounts, and purposes.

- Supporting Documentation: Attach clear copies of receipts, proof of payment, or any necessary contracts to substantiate the claim.

- Approval Signatures: If required, ensure the proper signatures or approvals are included before submission.

2. Submit Within the Designated Time Frame

Late submissions can result in rejection or delays in processing. Adhering to the deadlines set by your organization or governing body is critical for timely approval. Some key tips include:

- Track Deadlines: Set reminders for submission deadlines to ensure you don’t miss any key dates.

- Submit Early: Aim to submit your claim as early as possible, leaving room for any last-minute issues that may arise.

- Monitor Processing Status: Regularly check the status of your submission to catch any potential delays before they escalate.

3. Ensure Accuracy in Your Calculations

Errors in calculations, such as incorrect totals or misapplied rates, can lead to processing delays. To avoid these issues, take the following precautions:

- Double-Check Numbers: Review all amounts and totals before submitting your claim. Ensure that taxes, discounts, and any other adjustments are correctly applied.

- Use Automation: If possible, use automated systems that calculate totals or convert currencies to ensure consistency and accuracy.

4. Follow Organizational Guidelines

Each company or organization may have its own specific processes for submitting claims. Failing to follow these procedures can lead to rejection or delays. To avoid this, consider the following:

- Understand Requirements: Familiarize yourself with the guidelines set by your organization, including format, documentation requirements, and submission methods.

- Use the Correct Forms: Ensure that you are using the right forms or digital solutions that are compatible with your organization’s systems.

- Seek Clarification: If unsure, contact the relevant department for guidanc

Integrating Reimbursement Invoices with Accounting Systems

Efficiently managing financial records is crucial for businesses of all sizes. By linking payment requests with financial software, companies can streamline the process of tracking and processing payments. This integration reduces manual input, enhances accuracy, and improves the overall workflow of managing financial documents. Automating data entry from documents into the system ensures a smoother reconciliation process and minimizes the risk of errors that could lead to discrepancies in accounting records.

Integrating these documents into accounting platforms offers several advantages. It not only simplifies the documentation process but also ensures that all financial transactions are properly recorded and categorized. The system automatically updates accounts and generates reports, allowing businesses to gain insights into their financial health with ease. Additionally, this integration facilitates compliance with regulatory standards by ensuring all documentation is properly stored and accessible when needed for audits or reviews.

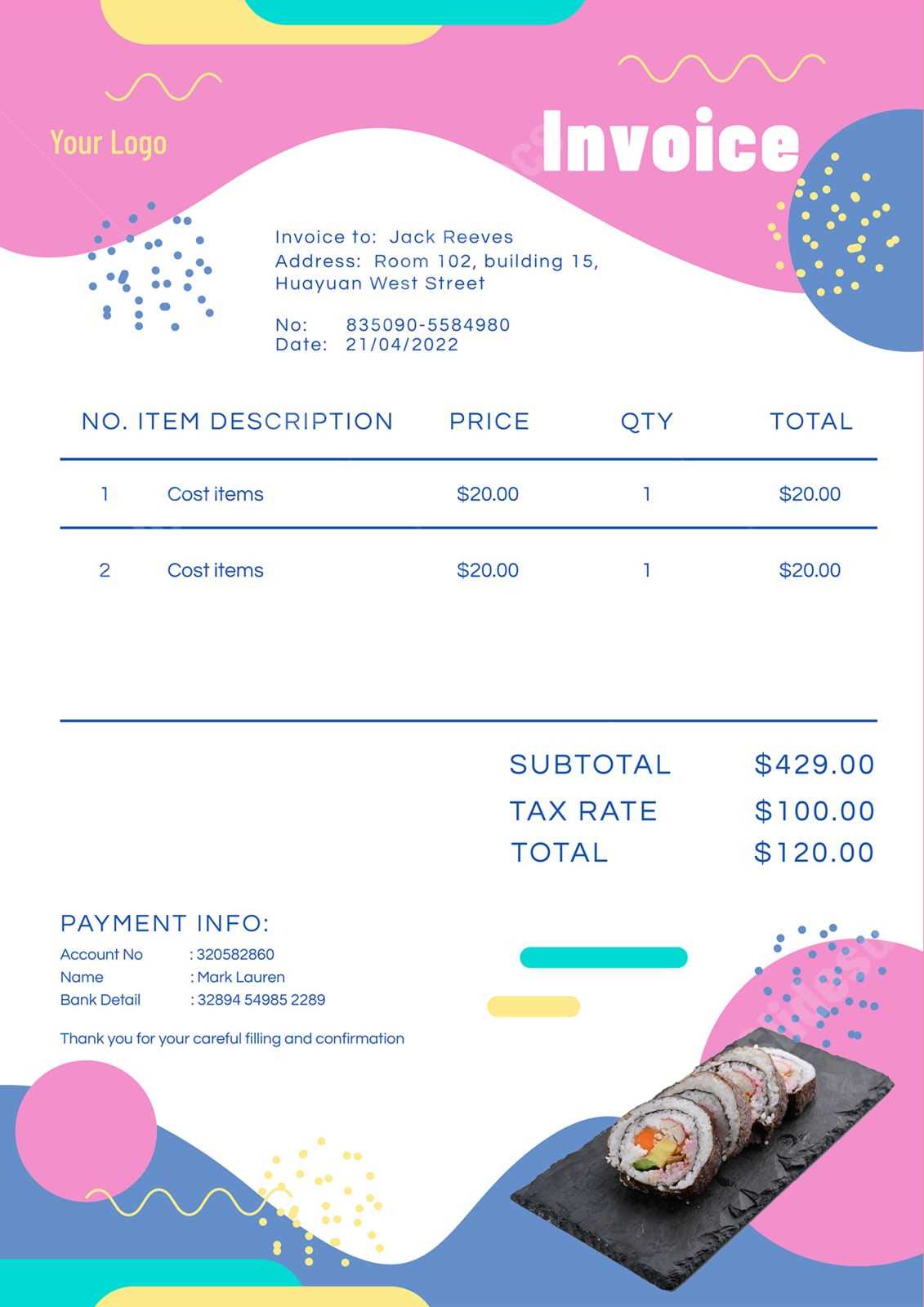

Free Invoice Templates for Expense Reporting

Access to free resources for documenting and organizing financial claims can save time and improve efficiency in many businesses. These ready-made forms allow users to easily structure their financial records without the need for creating documents from scratch. With various layouts available, individuals and companies can choose one that best fits their reporting needs, ensuring consistency and accuracy in the data provided.

Benefits of Using Free Resources

By utilizing no-cost options, businesses and freelancers can avoid additional software expenses. These forms are designed to be simple and adaptable, helping users maintain organized records. Whether for individual transactions or more complex reporting, these documents ensure that all details are clearly laid out, minimizing errors during financial reviews.

Customization and Flexibility

Even with free formats, customization is often possible. Many options allow for easy editing, ensuring that users can add specific information, adjust the layout, and tailor the document to their particular needs. This level of flexibility ensures that no matter the industry or purpose, these documents can be adapted to suit various reporting styles and preferences.