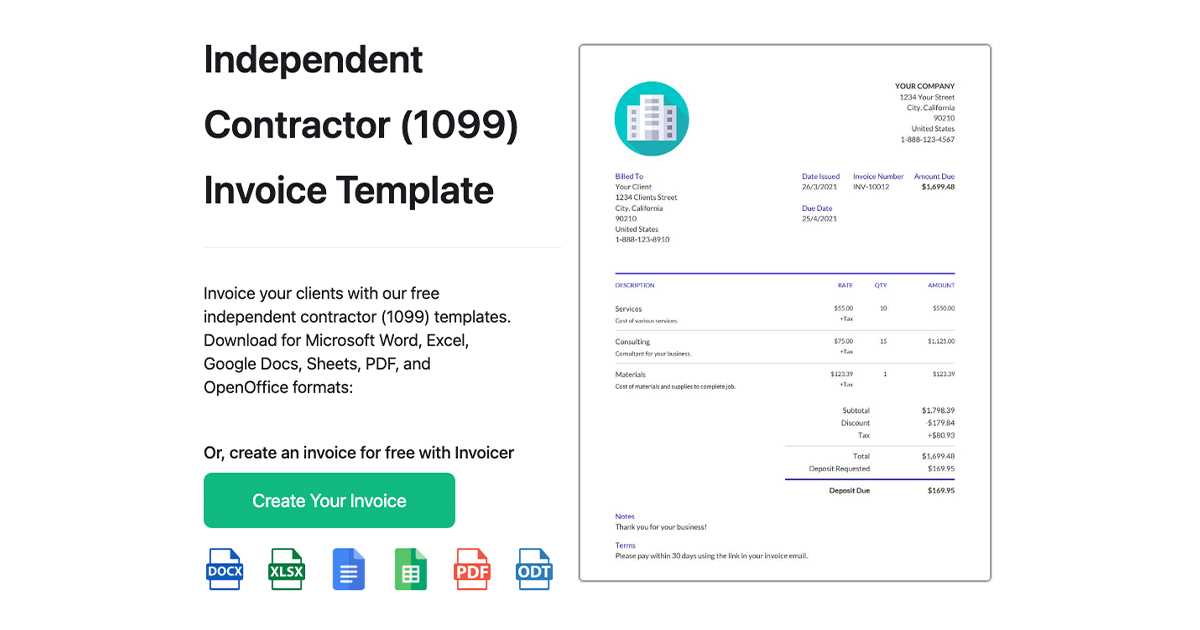

Free 1099 Invoice Template for Quick and Easy Contractor Billing

Managing payments for freelancers and independent workers can be challenging for businesses of all sizes. To ensure clear communication and accurate financial records, it’s essential to use structured forms that capture key details about each transaction. These documents simplify tax processes, reduce misunderstandings, and make it easier to organize business expenses over time.

Choosing the right payment form format can save you time, especially during tax season. A well-organized document provides clarity on amounts, dates, and payment terms, allowing both the payer and the recipient to stay on the same page. These templates are especially helpful for freelancers, as they often work with multiple clients and need to keep records up to date without added complexity.

Many small businesses and self-employed individuals prefer ready-made templates to avoid creating documents from scratch. This approach allows users to quickly fill in key fields, follow

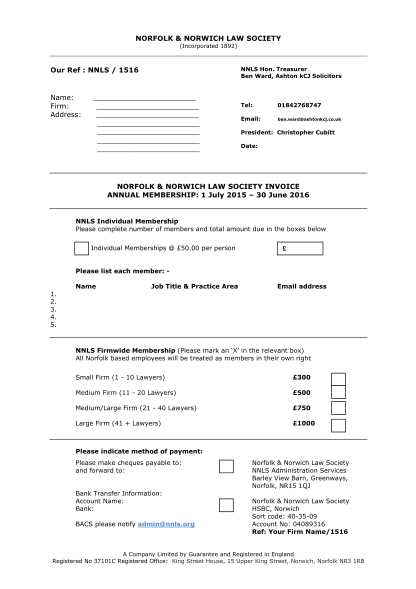

Free 1099 Invoice Template for Contractors

For independent contractors and freelancers, maintaining organized records of their earnings and work is essential. Having a standardized document format for payment requests helps ensure transparency with clients and simplifies the financial tracking process. It allows both contractors and their clients to have a clear record of the services provided, agreed-upon payment amounts, and relevant dates, which can be invaluable during tax time.

A well-crafted document template can streamline the payment process, especially for contractors juggling multiple projects. It eliminates the need to recreate forms for each client, providing a consistent and reliable way to outline essential details. This consistency benefits not only the contractors but also their clients, who receive a familiar format that reduces potential confusion.

Using a structured format also reflects professionalism and establishes clear expectations. Key fields such as payment terms, service descriptions, and dates are standardized, ensuring that each request is

Why You Need a 1099 Invoice Template

For freelancers and independent contractors, managing payments and keeping track of finances can quickly become overwhelming without the right tools. A structured document for billing is essential, as it standardizes the way you request compensation, ensuring each transaction is recorded accurately. This approach is particularly beneficial during tax season, where having a clear record of earnings can save time and reduce errors.

Streamlined Record-Keeping for Self-Employed Professionals

Using a consistent format for billing allows self-employed individuals to easily organize and review their financial history. With each payment documented in the same structure, tracking income from various clients becomes straightforward, and critical details are less likely to be missed. A ready-made format also makes it simpler to comply with tax regulations, as it ensures all required information is included from the start.

Improved Client Communication and Professionalism

Benefits of Using a 1099 Template

For self-employed individuals and businesses hiring contractors, having a consistent document format for payment requests brings clarity and ease to the financial process. This standardized approach provides clear communication, reduces administrative errors, and simplifies record-keeping. By utilizing a structured document, both contractors and clients can rely on a format that includes all necessary details, saving time and minimizing potential issues.

Enhanced Organization and Financial Tracking

A ready-made format allows contractors to organize payment records efficiently, making it easy to track income from different projects and clients. This organizational tool provides quick access to detailed records for both current and past transactions, which is particularly helpful for budgeting, tax preparation, and financial planning.

Time Savings and Increased Accuracy

Using a standard form eliminates the need to create new documents from scratch for each project, saving time and ensuring consistent accuracy. Each essential field, from payment terms to service descriptions, is r

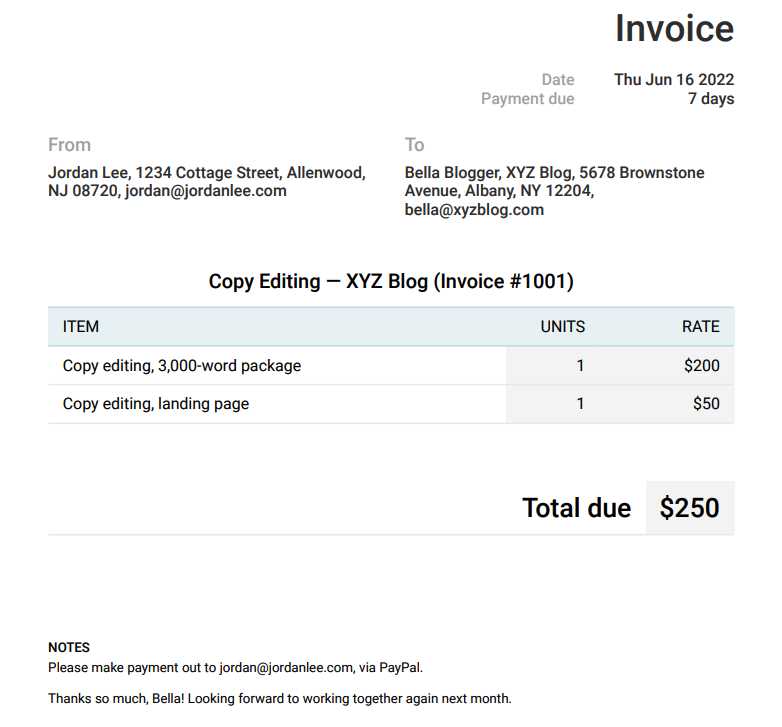

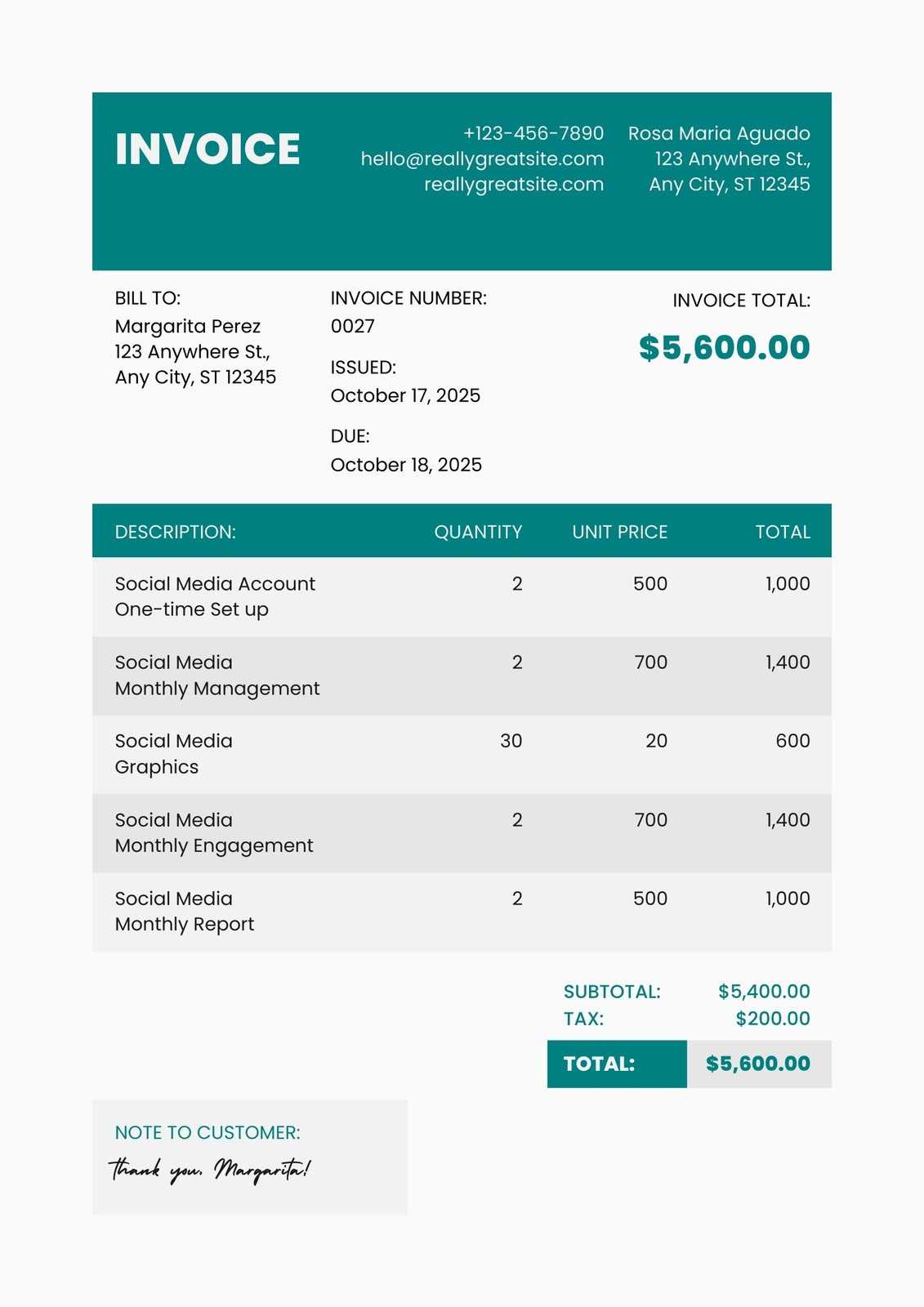

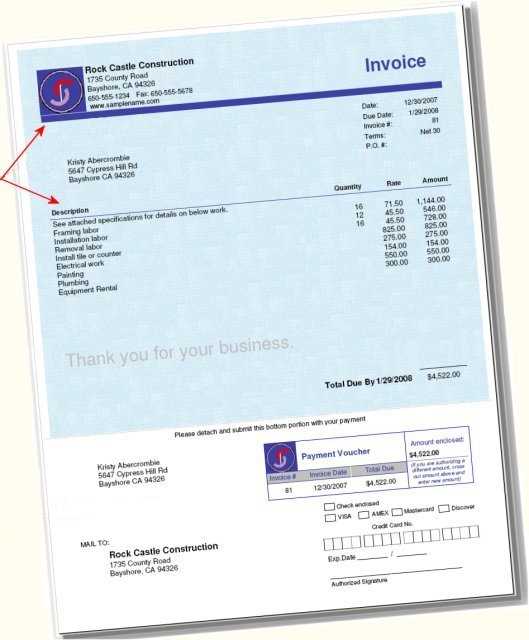

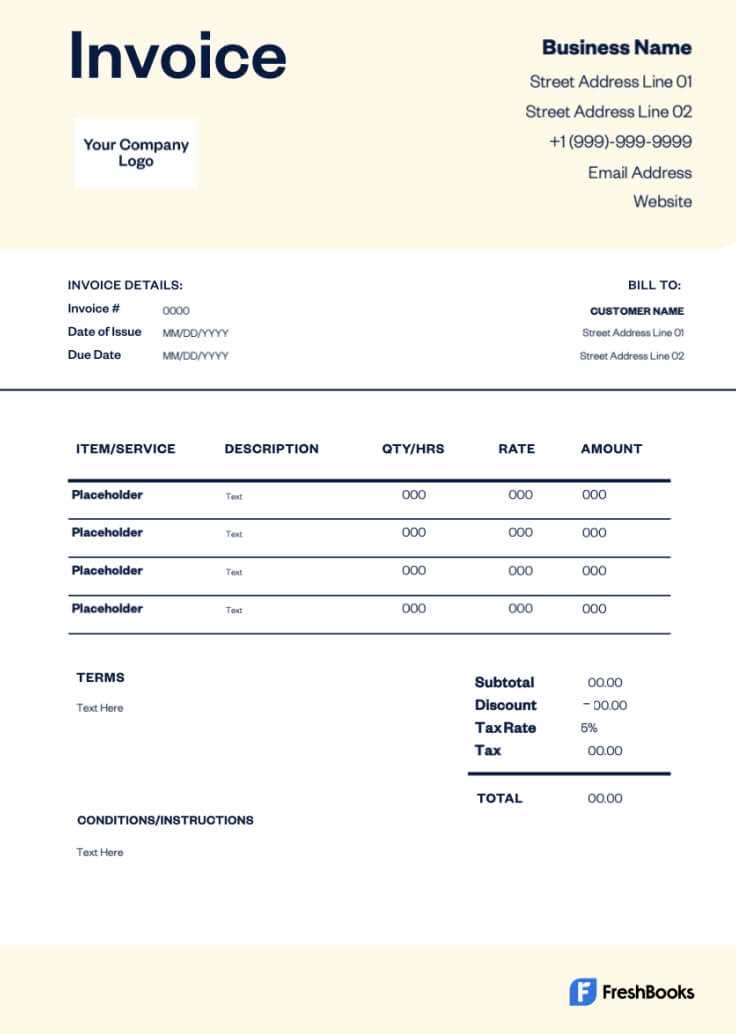

Key Elements in a 1099 Invoice

For freelancers and contractors, a well-structured document that includes essential details is crucial for ensuring smooth transactions and accurate record-keeping. Certain elements must be present to clearly outline the work provided, the amount due, and the agreed-upon terms. This standardization not only helps with payment clarity but also provides a complete record for future reference and tax purposes.

The following elements are fundamental in any payment document for independent work:

- Contact Information: Clearly include names, addresses, phone numbers, and email addresses for both the contractor and the client, making it easy for either party to follow up if needed.

- Description of Services: Provide a concise summary of the work completed or services rendered, including specific tasks or project phases as necessary.

- Date of Service: List the date or date range during which the work was performed, ensuring clarity on the project timeline.

- Payment Terms

How to Fill Out a 1099 Invoice

Creating a clear and professional billing document is essential for freelancers and contractors to ensure prompt and accurate payments. Filling out each section carefully helps to avoid misunderstandings and makes it easier for clients to process the payment. Each field should be completed with the necessary details to maintain transparency and professionalism.

Step-by-Step Guide for Completing Your Payment Document

Begin with the contact information section, listing both your details and the client’s. Include names, addresses, and phone numbers to ensure both parties can follow up if necessary. This section is essential for record-keeping and future correspondence.

Next, move to the service description. Clearly outline the work performed, including specifics such as project

When to Send a 1099 Invoice

Timing is an essential factor in maintaining a smooth financial process, especially when it comes to billing clients for completed services. Sending a well-timed payment request ensures that both you and your client are on the same page regarding payment schedules. Knowing the right moment to send your billing document can help avoid delays and misunderstandings.

After Completing the Work

The ideal time to send your payment document is after you’ve completed the agreed-upon work or services. This provides the client with all the necessary details about the work performed and the corresponding charges. It’s important to ensure that the document includes accurate descriptions and amounts, so the client has all the information to make the payment without any issues.

At the End of the Payment Cycle

If you have agreed upon a specific billing cycle, such as monthly or quarterly, send your document at the end of the cycle. This helps keep everything organized and ensures that your client has ample time to review the charges and process the payment. Timely submission also facilitates better financial planning for both parties, especially when it comes to tracking expenses and revenue.

Best Practices for 1099 Invoicing

Creating an effective and professional payment document is crucial for contractors and freelancers to maintain smooth transactions and ensure timely compensation. By following certain best practices, you can streamline the billing process, avoid errors, and build trust with your clients. A well-organized and clear document helps to keep both parties on the same page and simplifies future record-keeping.

Here are some best practices to consider when preparing your payment documents:

- Be Clear and Detailed: Provide a thorough description of the work done, including specific tasks or deliverables. This clarity helps prevent confusion and ensures that the client understands what they are paying for.

- Include All Relevant Information: Ensure that your document includes all necessary details such as names, addresses, dates of service, payment terms, and total amount due. Missing information can delay the payment process.

- Use a Professional Format: A clean, organized layout with a consistent structure makes your document look professional and easier to read. This can help foster a positive relationship with clients.

- Double-Check for Accuracy: Review all entries to ensure there are no mistakes in your calculations or details. Errors could lead to payment delays or disputes.

- Set Clear Payment Terms: Specify the due date for payment, preferred methods of payment, and any late fees or discounts. This helps establish clear expectations between you and your client.

- Send Promptly: As soon as the work is completed or at the end of the agreed billing cycle, send your document without delay. This keeps the payment process on track and helps you get paid in a timely manner.

By following these practices, you can ensure that your payment documents are accurate, clear, and professional, which will enhance your credibility and improve the efficiency of your business transactions.

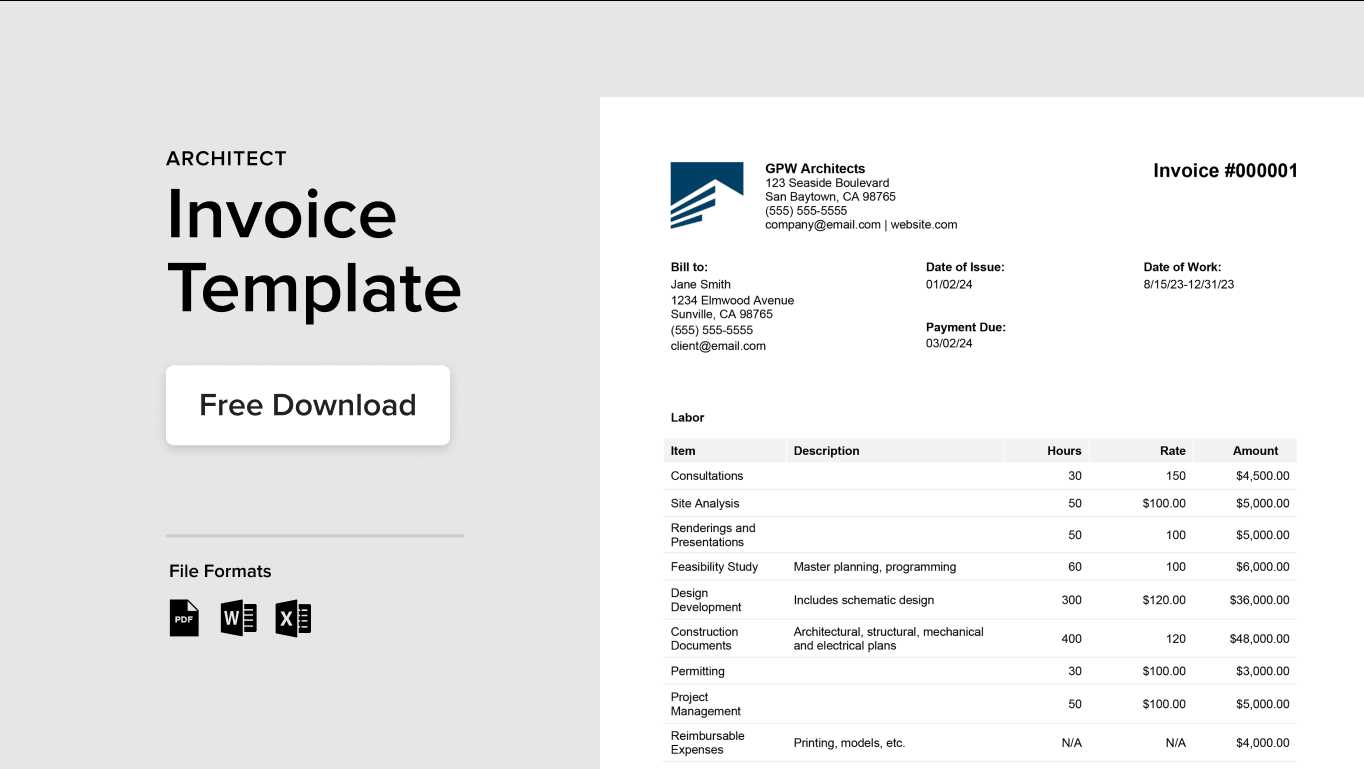

Creating a Customized 1099 Template

When managing your billing processes, customizing your payment documents can greatly enhance clarity and professionalism. Tailoring your documents ensures that they meet your specific needs and align with your business style. Creating a personalized version allows you to include essential details while keeping it simple and efficient for both you and your clients.

Start with the Basic Structure

The first step in creating a customized document is to establish the basic layout. This should include sections for essential information, such as your name, the client’s name, the services provided, the total amount, and the payment due date. Using clear headers and organized sections will make the document easy to read and understand.

Incorporate Your Branding

One of the benefits of creating a personalized document is that you can incorporate your business branding. Include your logo, brand colors, and any other elements that represent your business. This not only makes the document look professional but also reinforces your brand identity with every transaction.

Additionally, including your business contact details and payment instructions ensures that your clients can easily reach you or make payments without confusion. Customizing your payment document helps to present your services in a professional manner while providing all the necessary information in an organized way.

Common Mistakes in 1099 Invoices

When preparing billing documents, it’s easy to overlook certain details that can lead to confusion, delayed payments, or even disputes. Common mistakes in these documents often arise from missing information, calculation errors, or formatting issues. Being aware of these pitfalls can help ensure smoother transactions and avoid unnecessary setbacks.

One frequent mistake is failing to include all necessary details, such as the correct payment terms, full addresses, or itemized descriptions of services provided. This can lead to misunderstandings or delayed approvals from clients. Another common issue is incorrect calculations, whether it’s adding up the total or applying the wrong tax rates. These errors can cause frustration and require extra time to resolve.

Additionally, inconsistent formatting or a lack of professionalism in the document’s presentation can give the impression of carelessness. Ensuring that your document looks clean, organized, and easy to read is crucial for maintaining a professional image. Taking the time to avoid these common mistakes will help build stronger relationships with clients and ensure a smoother billing process.

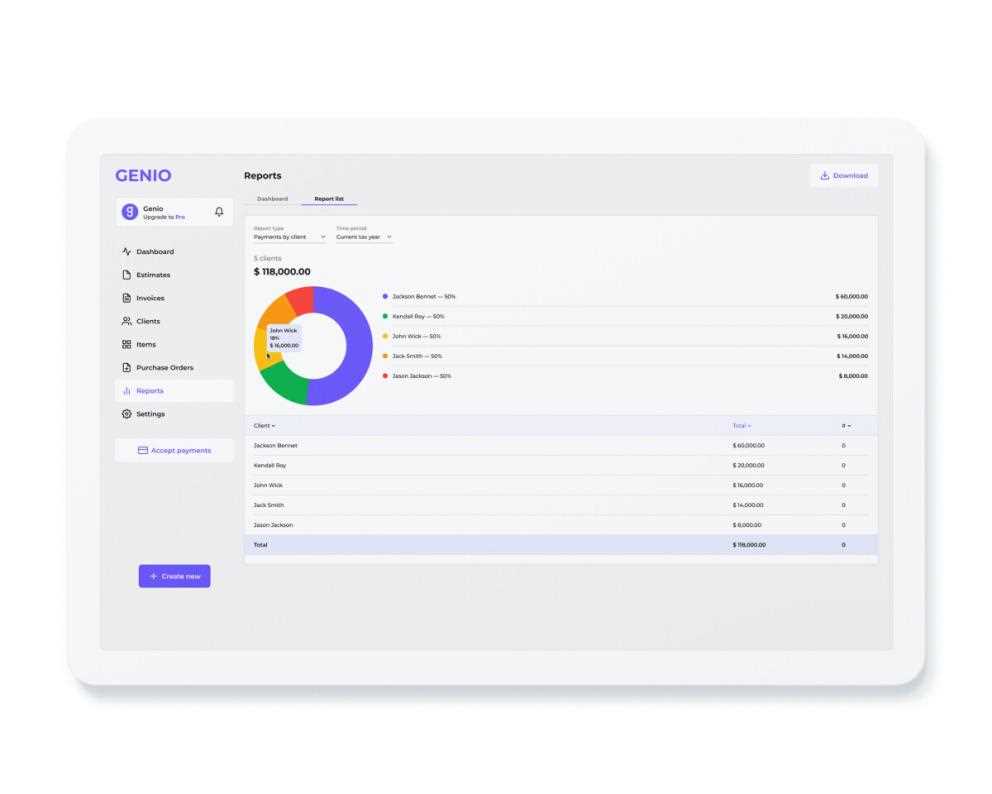

Saving Time with Free Invoice Templates

Managing payment documents can be time-consuming, especially when each one needs to be created from scratch. Fortunately, using pre-designed billing documents can help streamline the process, allowing businesses to save valuable time. These ready-made formats enable users to quickly fill in necessary details without having to design a new document for every transaction.

Here are a few ways that using pre-made billing forms can save time:

- Quick Setup: Pre-designed documents come with the essential structure in place, so you don’t need to spend time setting up the layout.

- Accurate Calculations: Many templates include automatic calculation fields that help avoid errors, saving time on manual math.

- Consistency: Using the same format for all documents ensures consistency and eliminates the need to redesign each time.

By using a standard format, businesses can speed up the invoicing process, reduce the risk of errors, and ensure that all required information is included. This makes it easier to stay on top of payments and frees up more time for other important tasks.

Essential Tips for 1099 Tax Compliance

Staying compliant with tax regulations can be complex, especially for businesses working with independent contractors or freelancers. To avoid penalties and ensure accuracy, it’s important to follow the proper procedures when handling financial documents. Understanding the key steps involved in tax compliance is essential for smooth operations and maintaining the integrity of your financial reporting.

Keep Accurate Records

Maintaining clear and detailed records of all transactions is crucial. Ensure that all payments made to contractors are documented, including the amount, date, and nature of the service provided. This will help you verify the amounts reported and avoid discrepancies during tax filing.

Know the Reporting Deadlines

Tax deadlines are critical for avoiding fines and interest. Be sure to submit the necessary forms to the IRS and provide copies to contractors before the due date. Staying on top of these deadlines will help ensure that your business remains compliant with federal and state tax laws.

By following these simple steps and staying organized, you can avoid common tax issues and make the process of tax filing much more efficient and straightforward.

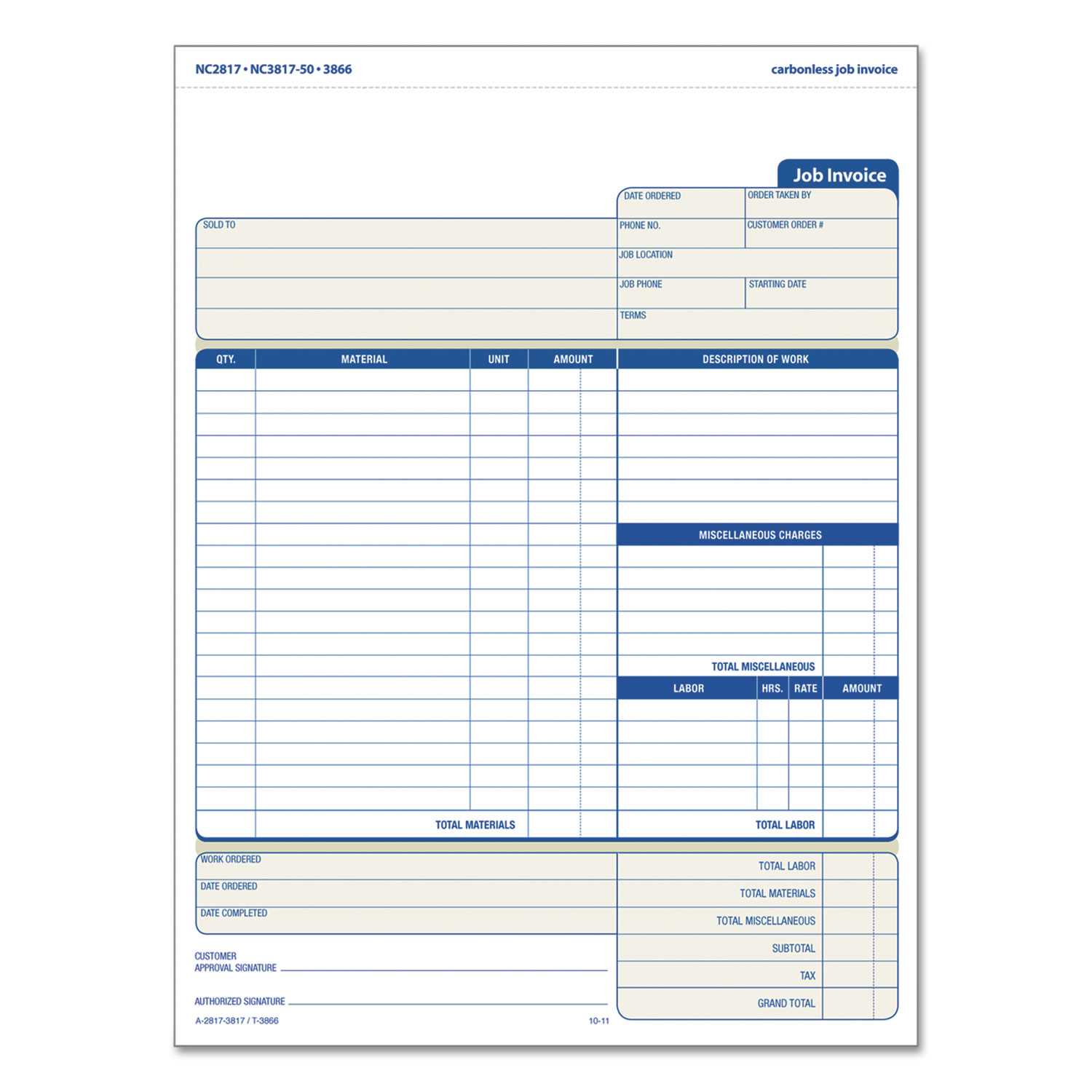

Comparing Digital and Paper 1099 Invoices

When it comes to financial documentation, businesses have the option to choose between digital and paper formats. Each method has its benefits and challenges, and selecting the right one can streamline your accounting process while ensuring compliance. Both approaches serve the same purpose but offer different levels of convenience, security, and cost-effectiveness.

Advantages of Digital Formats

Digital financial documents offer numerous advantages. They are easy to store, access, and share with clients or tax authorities. With the right software, digital forms can be filled out automatically, reducing the risk of human error. Additionally, they are environmentally friendly and help reduce the clutter of paper records.

Benefits of Paper Formats

On the other hand, paper forms still hold value for many businesses. They can be more tangible and may feel more official to certain clients. Some individuals and companies may also prefer physical documentation for legal reasons or due to personal preference. Paper forms might be necessary when digital methods are not accessible or when clients explicitly request them.

Ultimately, the choice between digital and paper documentation comes down to your business needs, resources, and the preferences of your clients. Weighing the benefits of each can help ensure smooth transactions and avoid compliance issues.

Free vs. Paid 1099 Templates

When choosing the right form for tracking earnings and expenses, businesses often face the decision between using free options or opting for paid versions. Each has its own set of benefits and potential drawbacks, and selecting the appropriate one depends on your needs, budget, and level of customization required. While both options can serve the purpose, there are notable differences in terms of features and support.

Benefits of Using Free Options

Free forms are often simple and easy to access, making them an attractive choice for small businesses or individuals with basic needs. They can be found easily online and usually require little setup. These free forms are often sufficient for those who need basic functionality without requiring advanced features such as detailed customization or additional support services.

Advantages of Paid Options

Paid forms, on the other hand, provide additional benefits that can save time and effort in the long run. These typically come with more robust features, including detailed customization options, professional design, and better integration with accounting software. Paid versions may also offer customer support and updates, ensuring that the documents are always compliant with current regulations.

Choosing between free and paid options depends on your specific needs, how often you need to generate these forms, and the level of detail required for your financial records. Each choice has its advantages, so consider what best fits your business.

Frequently Asked Questions about 1099 Invoices

Understanding the requirements and best practices for creating and managing financial documents can be challenging. Below are some of the most commonly asked questions about these forms, providing clarity on their use, importance, and how to handle them effectively. These answers should help guide your decisions when dealing with income reporting and tax documentation.

Question Answer What information is required for these forms? Typically, you will need to include the payer’s and recipient’s personal information, such as names, addresses, and taxpayer identification numbers. You will also need to specify the amounts paid for services provided during the year. When should these forms be submitted? These documents should be submitted to the recipient by January 31 and filed with the IRS by the end of February if submitted on paper or by March 31 if filed electronically. Do I need these forms for international contractors? No, typically these forms are only required for domestic contractors who have a valid taxpayer identification number within the country. What happens if I miss the deadline? Missing the deadline can result in penalties. It is important to file as soon as possible to avoid additional fees or complications with tax authorities. These are just a few of the common questions individuals and businesses have when preparing these documents. Understanding the essential details and requirements ensures you stay compliant with tax regulations and avoid unnecessary errors in your financial records.