Janitorial Invoice Template for Streamlined Cleaning Service Billing

Running a cleaning business involves more than just providing quality services–it also requires a smooth and efficient billing process. Managing payments and ensuring clients are charged correctly can quickly become overwhelming without the right tools. A well-structured document for outlining the work performed and the costs involved is essential for maintaining professionalism and avoiding confusion.

By using a structured billing document, you can keep track of services rendered, ensure all charges are accurate, and provide clients with a clear breakdown of their expenses. Whether you’re an independent cleaner or manage a team, having a reliable method for creating and sending financial records is key to maintaining cash flow and building trust with your customers.

In this article, we will explore the essential elements needed to create an effective billing document for your cleaning services. With the right approach, you can save time, reduce errors, and make your business operations more efficient, ultimately helping your company grow.

Essential Guide to Cleaning Service Billing

When managing a cleaning business, having a structured and clear system for documenting payments is crucial. A comprehensive billing document ensures that both the service provider and client understand the charges, reducing potential disputes and streamlining the payment process. This guide will help you understand the key components of an effective billing record and how to use them to improve your business operations.

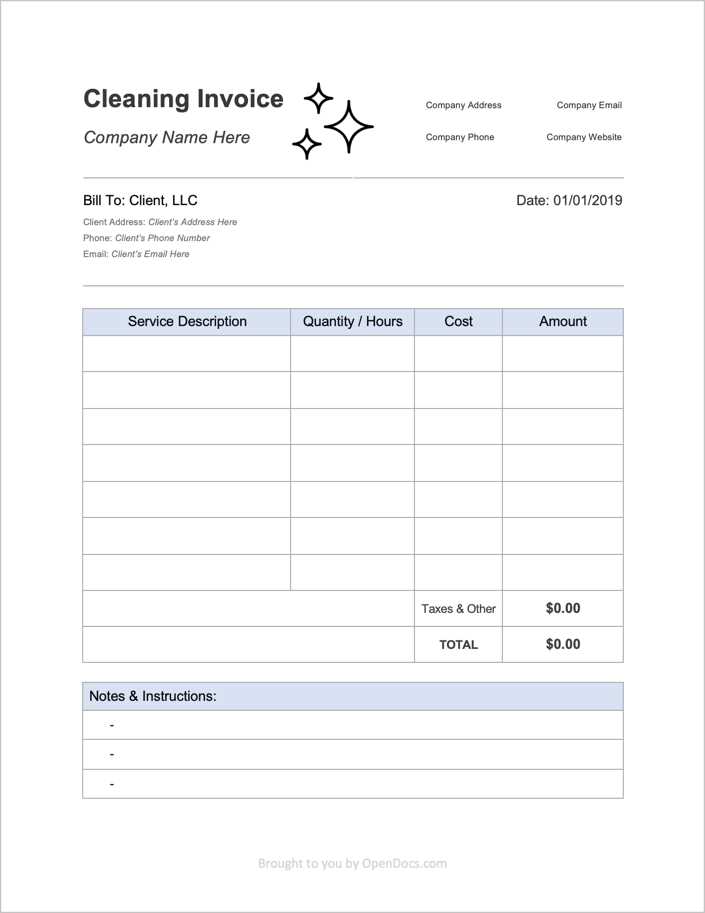

In order to create a well-organized payment document, it’s important to include several critical details. This helps ensure clarity for both parties and speeds up the processing of payments. Below is a table outlining the key elements to include in your billing document:

| Element | Description |

|---|---|

| Business Information | Includes your company name, contact details, and tax identification number. |

| Client Information | Client’s name, address, and contact details should be clearly outlined. |

| Service Description | A detailed breakdown of the services provided, including the date, type of cleaning, and any special requirements. |

| Payment Terms | Clearly state when payments are due and the accepted methods of payment. |

| Total Amount | The sum of all services rendered, including any additional charges or discounts. |

By incorporating these key elements into your billing system, you can ensure transparency, accuracy, and efficiency in your financial transactions, ultimately leading to a smoother relationship with your clients and improved cash flow for your business.

What is a Cleaning Service Billing Document?

A well-structured billing document serves as a formal record for the services provided, outlining the charges, terms, and other relevant details for payment. It is a vital tool for businesses offering cleaning or maintenance services, ensuring that both the provider and client are on the same page regarding costs and expectations. This document helps avoid confusion, delays, and payment issues, making it an essential part of business operations.

In essence, a billing record is a pre-designed form that simplifies the process of charging clients for work completed. It includes all necessary information to ensure transparency and accuracy, helping both parties keep track of financial transactions. Below is a breakdown of what this kind of document typically includes:

| Section | Purpose |

|---|---|

| Service Provider Information | Contains your business name, contact details, and any necessary licensing or tax identification. |

| Client Details | Includes the customer’s name, address, and contact information for easy communication. |

| Work Description | Details the services performed, including dates, frequency, and any special tasks completed. |

| Cost Breakdown | Shows the total charges for services rendered, with itemized fees for transparency. |

| Payment Terms | Indicates the due date, late fees (if applicable), and accepted payment methods. |

By using a well-designed billing document, service providers can ensure accurate payments, build trust with clients, and reduce the risk of administrative errors. It makes the billing process more professional and helps maintain a positive cash flow for the business.

Benefits of Using a Pre-designed Billing Document

Utilizing a pre-designed form for charging clients provides a variety of advantages for businesses in the cleaning industry. It simplifies the entire process, ensures consistency, and reduces the potential for errors. By leveraging a ready-made structure, businesses can streamline their financial transactions, improve their professional image, and save time.

Key Advantages

- Time Efficiency – A pre-structured document eliminates the need to create new billing records from scratch for every job. You can quickly fill in the necessary details and send it out without delay.

- Consistency – Using the same format for all transactions ensures uniformity across your business. Clients will receive clear, professional-looking records that are easy to read and understand.

- Reduced Errors – Pre-designed forms often come with built-in sections and fields to prevent missing crucial information, minimizing the chances of costly mistakes.

- Professional Image – A well-organized billing document helps convey a sense of professionalism and reliability, enhancing client trust and your business’s reputation.

How It Improves Business Operations

- Faster Payment Processing – With all necessary information clearly presented, clients can process payments more quickly, leading to improved cash flow for your business.

- Easy Customization – Pre-designed forms can often be easily customized to suit your specific needs, allowing for flexibility while maintaining a standardized format.

- Legal and Tax Compliance – Many billing structures include sections for tax-related information, ensuring your documents comply with legal and tax requirements.

By using a ready-made form, you not only save valuable time but also enhance the efficiency and professionalism of your business operations, leading to a smoother financial workflow.

How to Customize Your Billing Document

Customizing your billing record allows you to tailor it to your business needs, ensuring that it includes all the necessary details specific to the services you offer. By adjusting the structure and content, you can create a document that aligns with your brand, meets client expectations, and ensures clarity. Here are the key steps to make your billing form work for you.

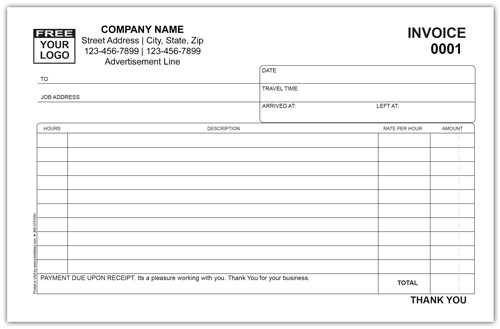

1. Add Your Branding

Make your record reflect your business by including your company logo, colors, and font choices. This adds a professional touch and helps reinforce your brand identity with every transaction. Customize the header section with your business name, slogan, and contact information, making it easy for clients to reach you when needed.

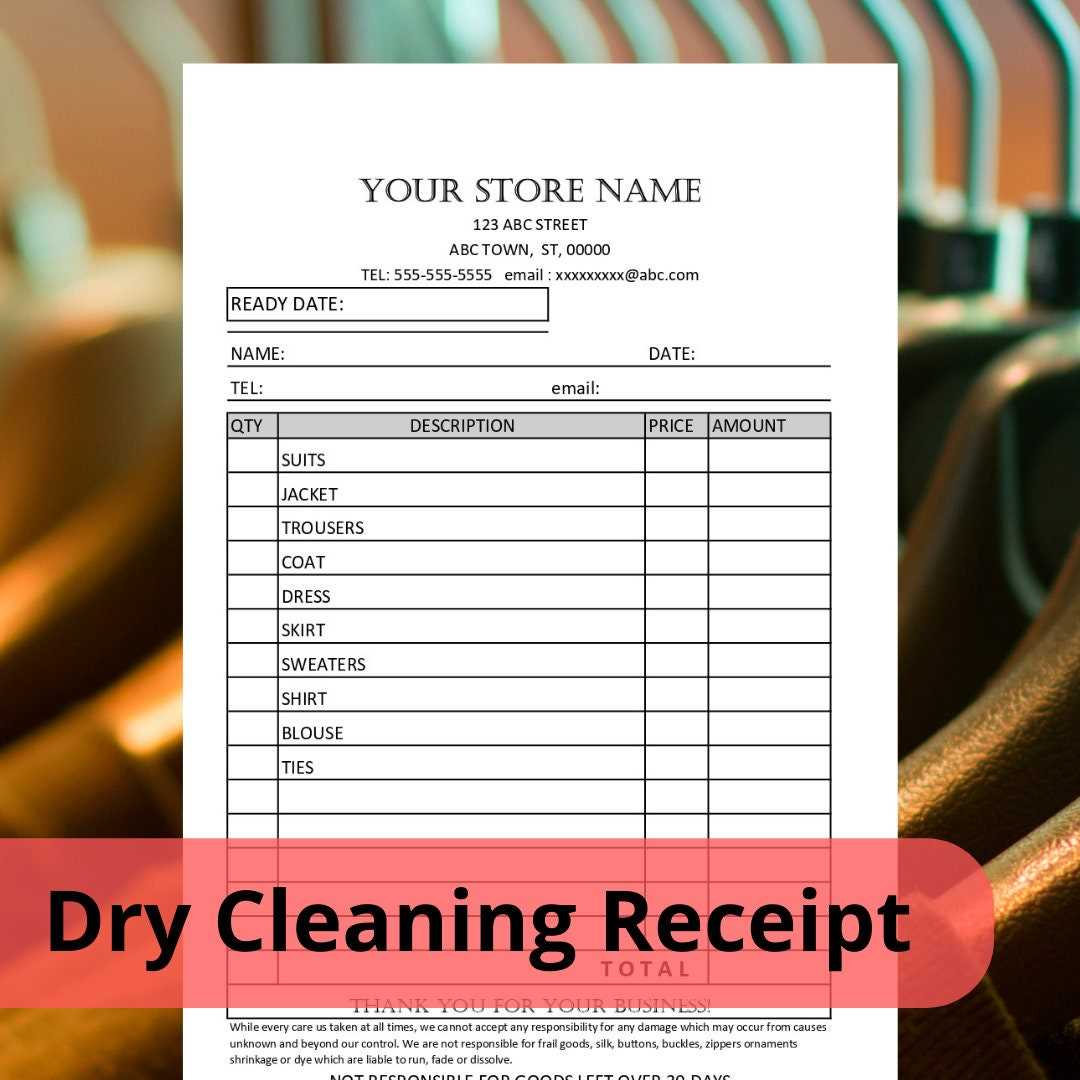

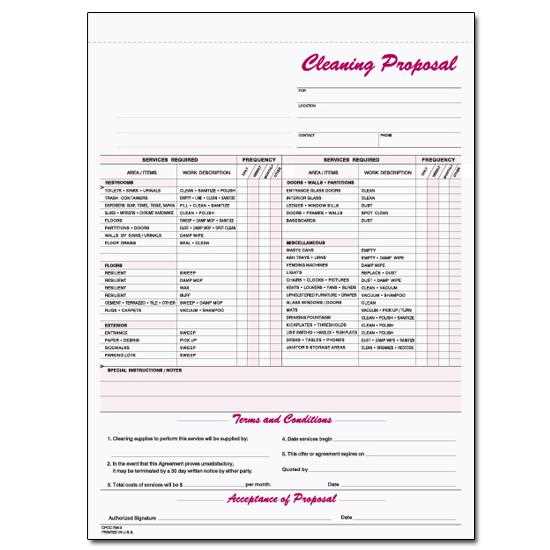

2. Tailor the Service Details

Each service you provide may have different pricing, terms, and specifications. Customize the service description section to accurately reflect the unique aspects of each job. For instance, if you offer specialized cleaning services or packages, include specific details to avoid confusion and ensure the charges are clear.

3. Include Payment Terms

Be sure to adjust the payment terms to suit your business model. You can specify the payment due date, accepted payment methods, and any applicable late fees. Clear payment terms help clients understand when payments are expected and how they can be made, reducing the likelihood of delays.

4. Use a Flexible Layout

Ensure the layout is organized and easy to read by adjusting the number of sections or columns to suit your needs. Some businesses may need to include additional fields, such as a description of cleaning frequency or discounts offered. A flexible layout allows you to add or remove sections as needed while maintaining clarity and readability.

5. Make It Easy to Update

As your services evolve, so should your billing document. Make sure the format you use allows for easy updates and edits. Whether it’s adding new services, adjusting rates, or modifying your contact details, being able to quickly update the document ensures it always reflects your current offerings and policies.

By customizing your billing records, you not only enhance your professionalism but also streamline your financial processes, making it easier for both you and your clients to track payments and services rendered.

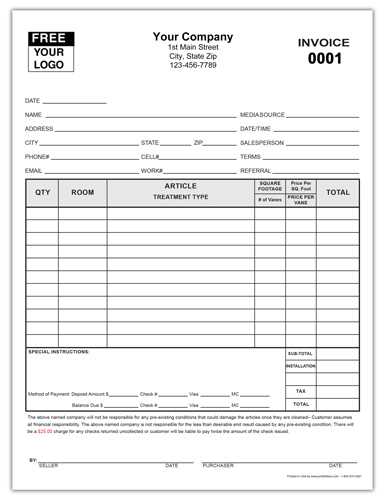

Key Information to Include in a Cleaning Service Billing Record

When creating a billing document for your cleaning business, it’s essential to include all the necessary details to ensure accuracy and transparency. A well-structured record helps prevent misunderstandings and speeds up the payment process. Below are the critical elements that should be included in your document to ensure clarity and professionalism.

- Service Provider Information – Include your business name, address, phone number, and email. If applicable, also add your tax identification number or any necessary licensing details.

- Client Information – Clearly list the client’s name, address, and contact details to ensure that both parties are easily identifiable in case of follow-ups or disputes.

- Job Description – Provide a detailed description of the services performed, including the date, time spent, and any special requests. This helps clients understand exactly what they’re paying for.

- Cost Breakdown – Break down the charges for each service or task performed. If there are additional costs, such as supplies or travel fees, make sure these are listed separately for transparency.

- Payment Terms – Clearly state the payment due date, any late fees, and the accepted methods of payment (credit card, bank transfer, etc.).

- Total Amount Due – Summarize the total amount that the client is expected to pay, including taxes and any applicable discounts.

Including these key pieces of information will ensure your billing documents are clear, professional, and legally sound. It also makes it easier for clients to understand the services provided and promptly settle their payments.

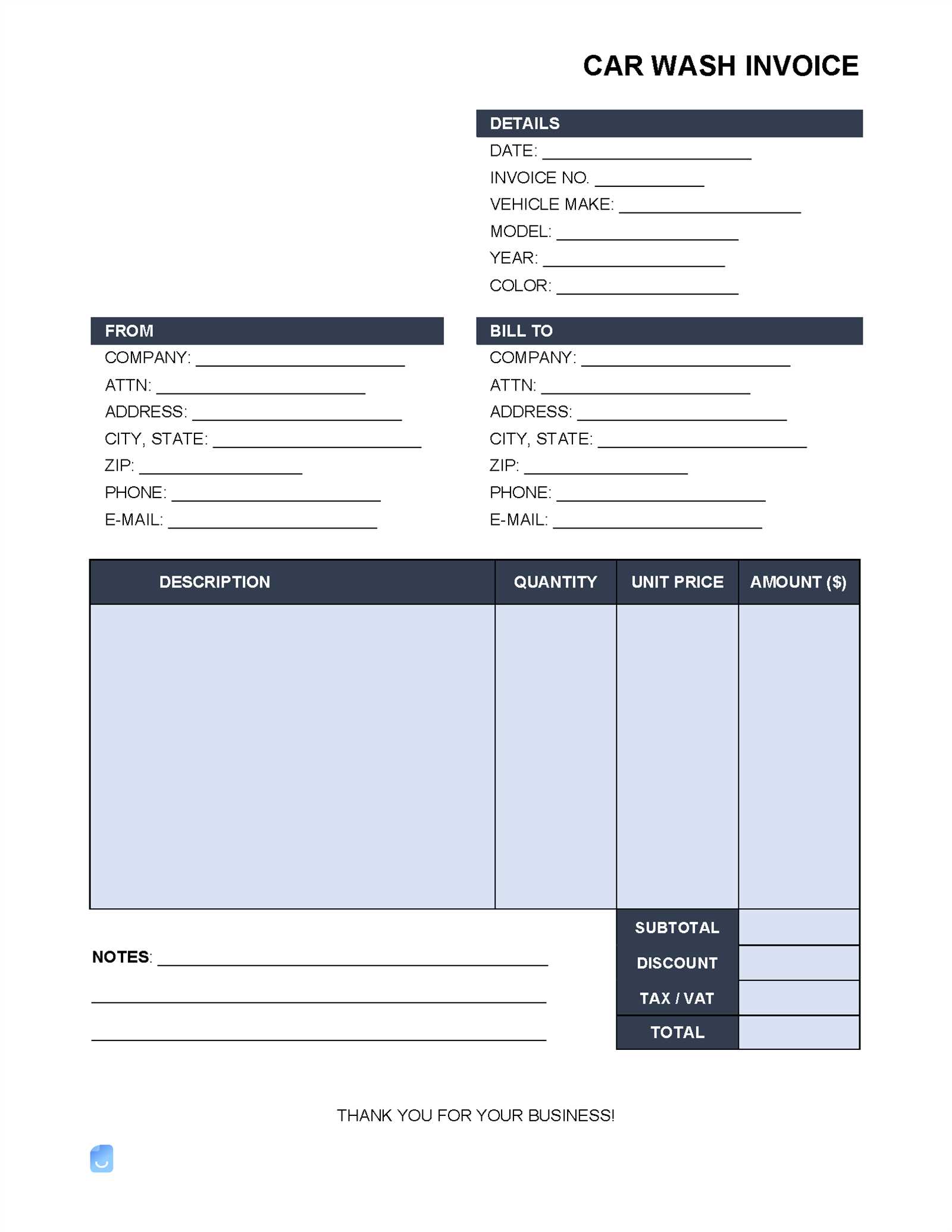

Choosing the Right Billing Format

Selecting the appropriate format for your billing records is essential to maintaining clarity and efficiency in your business. The format you choose should not only reflect your brand but also make it easy for both you and your clients to process and track payments. A well-designed structure ensures that all necessary details are included and that the document is easy to read and understand.

Considerations for Selecting a Format:

- Clarity and Simplicity – Choose a format that is straightforward and easy to read. Avoid overcomplicating the design; the goal is to ensure your client quickly understands the services rendered and the amount due.

- Customization Options – Ensure the format you choose allows for easy customization. Your billing records may require adjustments from time to time, such as adding new services or changing pricing. A flexible format makes these updates simpler.

- Professional Appearance – A clean, professional-looking document builds trust with your clients. Use a format that allows you to incorporate your business branding, including your logo, colors, and fonts.

- Legal and Tax Compliance – Make sure the format includes all required legal details, such as tax identification numbers and relevant tax rates. This ensures your billing records are compliant with local laws.

- Digital vs. Paper – Consider whether you want to use a digital format or a traditional paper version. Digital formats are easier to store and share, while paper documents may be necessary for certain clients or industries.

Choosing the right format is crucial for streamlining your billing process and ensuring that your financial transactions run smoothly. Whether you’re sending out paper records or using a digital platform, selecting a well-organized format will save you time and reduce the risk of errors.

Common Mistakes to Avoid in Billing

Billing is a critical part of running a business, and even small errors can lead to misunderstandings, delayed payments, and unnecessary administrative work. It’s important to avoid common pitfalls that can disrupt your cash flow and damage your relationship with clients. Below are some of the most frequent mistakes businesses make when creating billing records and tips on how to prevent them.

Incomplete or Incorrect Information

- Missing Client Details – Always ensure the client’s name, address, and contact information are accurate and complete. Missing details can cause confusion or delays when following up on payments.

- Unclear Descriptions – Vague or unclear descriptions of the services provided can lead to disputes. Always include a detailed breakdown of the tasks performed, including dates and specific requests.

- Incorrect Pricing – Double-check your rates and calculations before sending the billing document. Incorrect prices can not only cause delays in payment but also harm your credibility.

Failure to Set Clear Payment Terms

- Unspecified Payment Deadlines – Always include a clear due date for payment to avoid confusion. Without a deadline, clients may not prioritize payment.

- Lack of Late Fees or Penalties – If you charge late fees, make sure to outline this in the document upfront. Clients should know the consequences of delayed payments.

- Ambiguous Payment Methods – Clearly state the accepted payment methods, whether it’s credit card, bank transfer, or check. Make it as easy as possible for clients to pay.

By avoiding these common mistakes, you can ensure a smoother billing process, quicker payments, and better communication with your clients. Keeping your documents clear, accurate, and professional will strengthen your business’s financial operations.

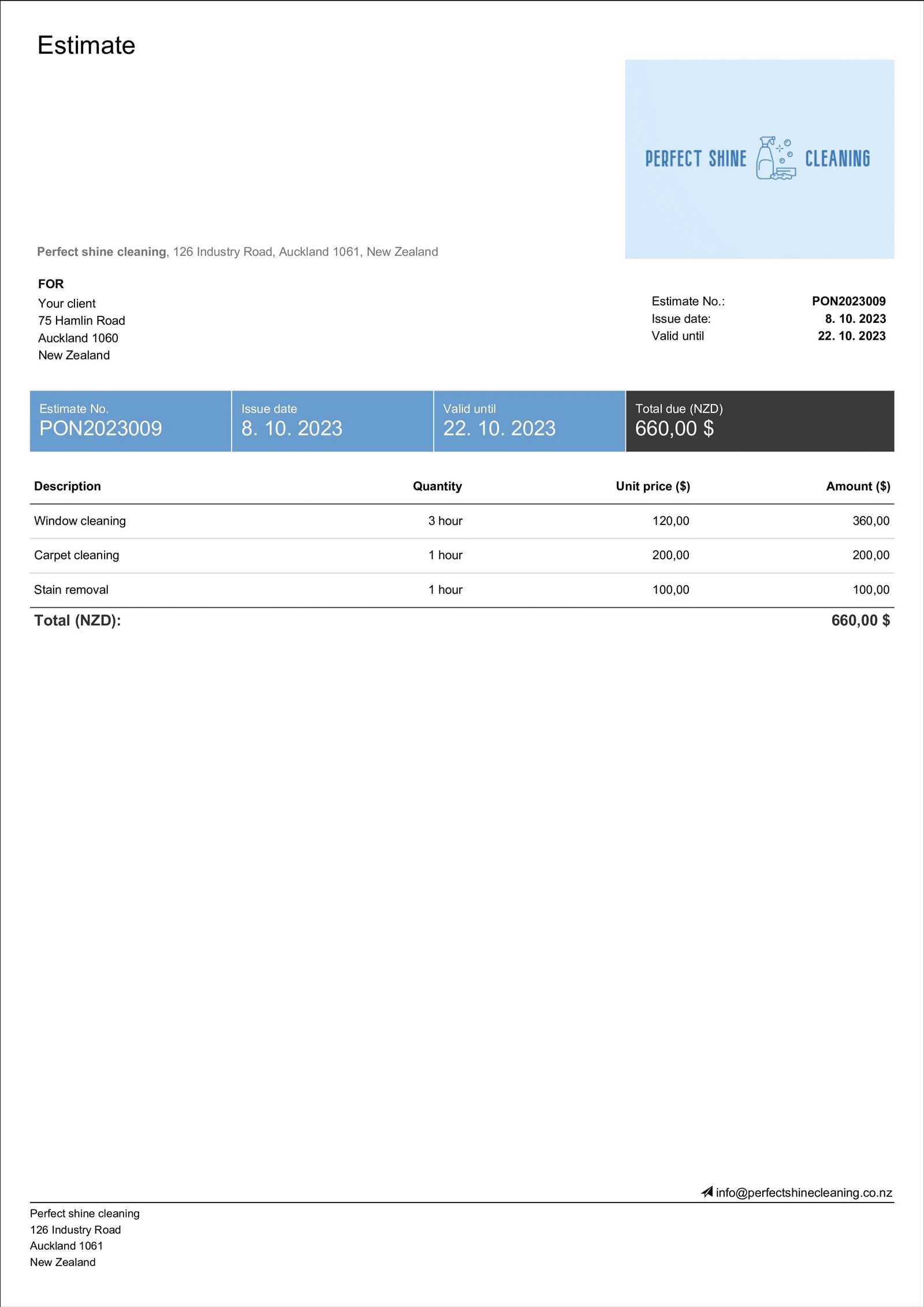

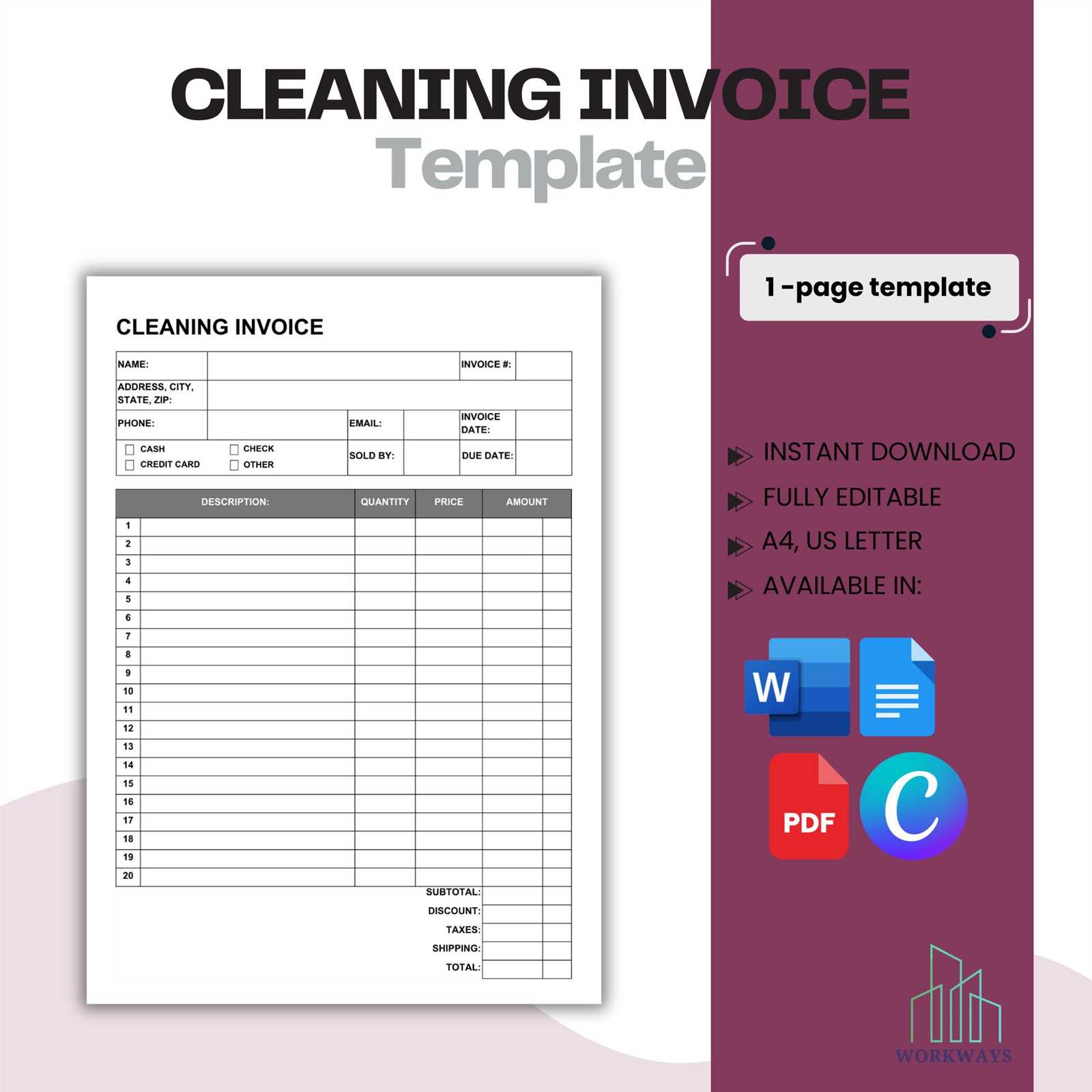

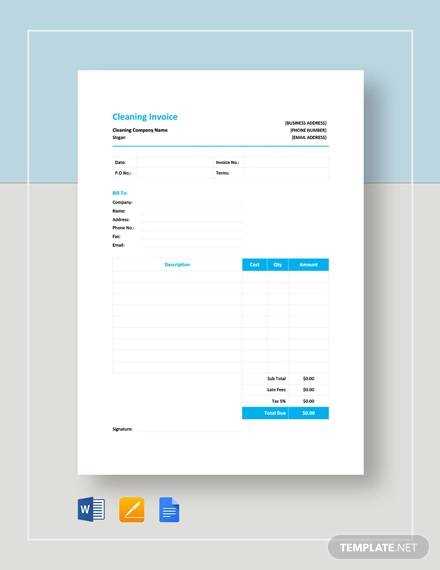

Free Billing Templates Available Online

Finding a reliable and professional billing document doesn’t have to be difficult or expensive. There are numerous free resources available online that offer ready-made forms, designed specifically for service businesses like cleaning. These free tools can help streamline your payment process, save time, and ensure that your records are clear and organized.

Benefits of Using Free Online Resources

- Cost-Effective – Free templates mean you don’t have to invest in costly software or hire a designer to create a customized document. These resources give you access to high-quality formats at no charge.

- Quick Setup – Many online resources allow you to download and use the templates instantly. You can customize the forms with your business information, saving you time and effort.

- Variety of Styles – Whether you need a simple, straightforward format or something more detailed, there are many options available to fit your specific needs.

Where to Find Free Templates

- Business Websites – Many business websites and industry-specific blogs offer free downloadable documents tailored for service providers.

- Software Tools – Online platforms like Google Docs or Microsoft Office provide free billing templates that can be customized for any business.

- Template Directories – Websites dedicated to providing a range of business forms often include free billing options for cleaning services, with the ability to edit and download instantly.

By taking advantage of these free resources, you can ensure your business has the necessary tools to maintain professional billing practices without added expense. These templates are a great way to get started quickly, keep things organized, and stay on top of your financial transactions.

How to Automate Your Billing Process

Automating your billing process can save you valuable time and reduce errors, allowing you to focus more on growing your business. With the right tools, you can streamline the creation and delivery of your payment records, ensuring accuracy and consistency while improving cash flow. Here are some effective ways to automate your financial documentation.

Steps to Automate Billing

- Use Online Billing Software – Many platforms offer built-in automation for creating and sending payment records. These tools can generate detailed documents, calculate totals, and even send reminders for overdue payments.

- Set Recurring Payments – For clients with regular services, set up recurring billing. This allows payments to be automatically generated and sent at pre-set intervals, ensuring timely and consistent transactions.

- Integrate with Payment Gateways – Link your billing software with payment systems like PayPal or Stripe. This integration lets clients pay directly through the document, reducing friction and speeding up the payment cycle.

- Automate Reminders – Set up automatic reminders for upcoming or overdue payments. These can be sent via email or text, reducing the need for manual follow-ups and helping you maintain steady cash flow.

Benefits of Automation

- Reduced Administrative Work – Automation handles repetitive tasks like document creation and sending, freeing up your time for other important business activities.

- Fewer Errors – Automated tools reduce the risk of mistakes in calculations, dates, or client information, ensuring greater accuracy in your records.

- Faster Payments – With automated payment links and reminders, clients are more likely to pay promptly, leading to quicker cash flow and reduced late fees.

- Improved Client Experience – Automated billing offers a streamlined, professional experience for your clients, enhancing their trust and satisfaction with your services.

By automating your billing, you can simplify your business operations, reduce time spent on administrative tasks, and improve overall financial efficiency.

Legal Considerations for Cleaning Services

Operating a cleaning service involves more than just providing excellent work; it also requires a thorough understanding of legal requirements and industry regulations. Adhering to legal obligations helps protect your business from potential disputes, fines, and liability issues. In this section, we’ll explore key legal considerations that cleaning businesses should keep in mind when offering services and managing financial transactions.

Key Legal Aspects to Consider

- Business Structure and Licensing – It’s important to register your business and choose the right structure (sole proprietorship, LLC, corporation, etc.). Depending on your location, you may also need a business license or specific permits to operate legally.

- Contracts and Service Agreements – Establishing clear contracts with clients helps set expectations and protects both parties. A well-drafted service agreement should outline the scope of work, payment terms, cancellation policies, and any other important conditions.

- Insurance Requirements – Most cleaning businesses need general liability insurance to cover potential damages or accidents that may occur while providing services. It’s also wise to consider bonding, which protects clients in case of theft or employee dishonesty.

- Employment Laws – If you hire employees or subcontractors, you must comply with employment laws, including proper classification (employee vs. independent contractor), wage laws, and worker’s compensation insurance requirements. Make sure all workers are legally authorized to work in your jurisdiction.

- Health and Safety Regulations – Cleaning services are often subject to specific safety regulations, especially regarding the use of cleaning chemicals and equipment. Ensure compliance with Occupational Safety and Health Administration (OSHA) standards to protect workers and clients.

- Tax Obligations – Be aware of the tax responsibilities associated with your business. This includes collecting sales tax (where applicable), keeping proper records for tax reporting, and ensuring timely payment of both federal and state taxes.

Why Legal Compliance is Crucial

- Avoid Legal Disputes – Having clear contracts and understanding your obligations can reduce the chances of conflicts with clients or employees.

- Protect Your Reputation – Operating within the law builds trust with clients and partners, strengthening your professional reputation and increasing business opportunities.

- Ensure Business Continuity – Following legal requirements minimizes risks that could disrupt your operations, such as fines or legal claims, allowing you to focus on growing your business.

By addressing these legal considerations, cleaning service providers can operate with greater confidence and ensure long-term success in a competitive market.

Importance of Accurate Billing Record Tracking

Maintaining accurate records of payments and services rendered is essential for any business. Proper tracking ensures that all transactions are accounted for, helps prevent errors, and allows businesses to monitor their financial health. For service providers, keeping detailed and up-to-date billing records is not just a matter of organization, but also an essential part of ensuring cash flow and client satisfaction.

Why Accurate Tracking is Crucial

- Improves Cash Flow Management – By keeping a clear record of payments due and received, you can better manage your cash flow, making it easier to plan for expenses and allocate funds where needed.

- Reduces Errors – Accurate tracking minimizes the risk of overcharging or undercharging clients. It ensures that all amounts are correct and consistent across your financial documents.

- Prevents Late Payments – Tracking due dates and sending reminders for overdue payments helps ensure that clients pay on time, reducing the need for follow-ups and improving business cash flow.

- Enhances Financial Reporting – Accurate records provide the data needed for creating financial reports, making tax filings easier, and helping with budgeting or forecasting.

How to Ensure Accurate Tracking

- Use Automated Systems – Implementing an automated billing system can significantly reduce human error and ensure that all transactions are recorded accurately in real-time.

- Establish Clear Payment Terms – Set clear payment due dates and terms in every agreement. This reduces confusion and makes tracking deadlines more straightforward.

- Regularly Review Records – Periodically review your financial records to identify any discrepancies or outstanding payments. Regular checks help catch mistakes early and prevent larger issues later on.

- Use Consistent Formats – Ensure all your records follow a consistent format, making it easier to track payments, services, and dates across multiple clients.

By investing time and resources into accurate billing record tracking, you ensure the smooth operation of your business, reduce administrative headaches, and build stronger relationships with your clients.

Using Software for Billing Records

Using specialized software for managing payment documents can significantly improve the efficiency and accuracy of your business operations. By automating tasks such as document creation, tracking, and delivery, software solutions save time, reduce errors, and help you stay organized. Whether you’re a small business or a large service provider, billing software can simplify your financial processes and improve cash flow management.

Benefits of Using Software for Billing

- Time Efficiency – With software, you can quickly generate payment records without having to manually enter details each time. Pre-set templates and automated calculations speed up the process, allowing you to focus on other aspects of your business.

- Improved Accuracy – Automated systems help eliminate the risk of human error, ensuring that calculations, dates, and client details are correct every time. This reduces disputes and the need for corrections.

- Customization Options – Most billing software allows you to customize documents to fit your brand, including logos, color schemes, and personalized messages. This helps maintain a professional image when dealing with clients.

- Easy Tracking and Reporting – Software solutions often include features to track outstanding payments, send reminders, and generate financial reports. This makes it easier to monitor your business’s financial health and ensure timely payments.

Choosing the Right Software

- Consider Your Business Size – Choose software that fits the scale of your operation. Smaller businesses may need simpler tools, while larger companies may benefit from more complex systems with additional features like payroll or tax reporting.

- Look for Integrations – Make sure the software can integrate with other tools you use, such as accounting software, CRM systems, or payment processors. This creates a seamless experience across your operations.

- Check for Cloud Storage – Cloud-based billing systems allow you to access your documents from anywhere, reducing the risk of losing important data due to technical issues or hardware failures.

- Evaluate Customer Support – Choose software from a provider that offers reliable customer support. This is crucial in case you encounter issues or need assistance with setting up your system.

Investing in billing software is an excellent way to streamline your business operations, reduce manual effort, and ensure timely payments from clients. With the right tools in place, managing financial records becomes easier, more accurate, and more efficient.

How to Set Payment Terms in Billing Documents

Setting clear and concise payment terms is essential for maintaining smooth financial operations and ensuring timely payments from clients. Well-defined terms help avoid confusion and miscommunication, providing both parties with a clear understanding of when and how payments should be made. In this section, we’ll explore how to establish effective payment terms in your billing documents to support your business’s financial stability.

Key Elements of Payment Terms

- Due Date – Clearly state when the payment is expected. Common options include “Net 30,” which means payment is due 30 days after the billing date, or “Due on Receipt,” where the payment is expected immediately.

- Accepted Payment Methods – Specify how you accept payments. This can include bank transfers, credit cards, checks, or online payment systems like PayPal or Stripe. The easier you make it for clients to pay, the more likely they are to do so on time.

- Late Payment Fees – Consider including penalties for overdue payments. For example, “A 5% late fee will be applied for payments made after 30 days.” This encourages timely payment and compensates for the delayed funds.

- Discounts for Early Payments – You might also offer incentives for early payments. For example, a “2% discount for payments made within 10 days” can encourage clients to pay sooner, improving cash flow.

How to Communicate Payment Terms Effectively

- Include Terms on Every Document – Ensure that your payment terms are clearly stated on each billing record, proposal, or contract. This way, clients are reminded of the expectations every time they review the document.

- Highlight Important Details – Make key details like the due date, late fees, and accepted payment methods stand out. This can be achieved by bolding, underlining, or placing these terms in a separate section for easy reference.

- Discuss Terms in Person or via Email – Before finalizing agreements, discuss payment terms with clients. This can help prevent misunderstandings later on and provide an opportunity to address any questions or concerns.

By setting clear and consistent payment terms, you create a professional approach that enhances trust and encourages timely payments. This clarity helps both you and your clients stay on the same page, ultimately improving cash flow and business relationships.

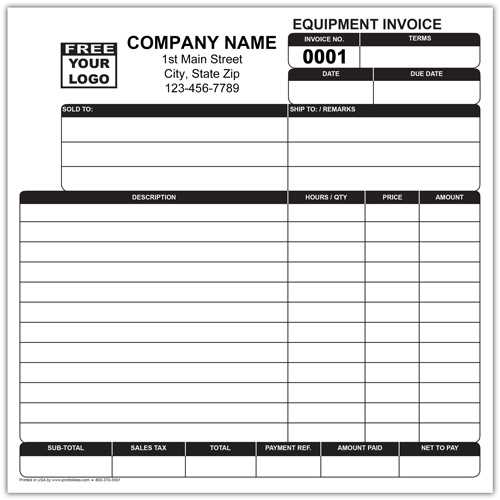

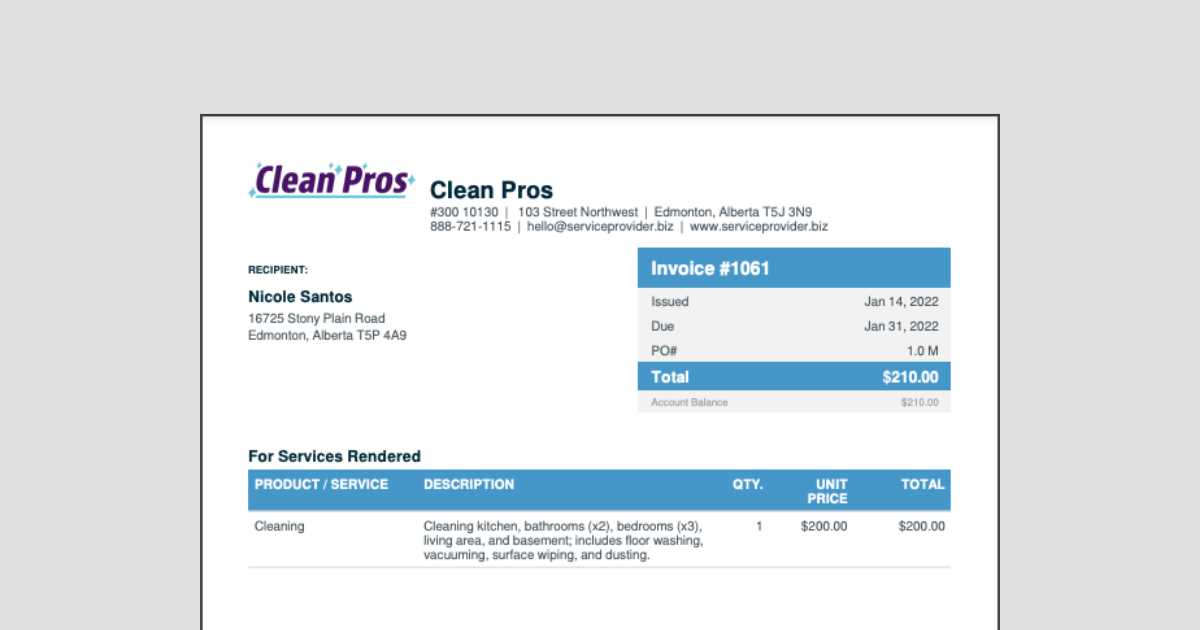

Creating Professional Billing Documents for Clients

Creating professional billing records is essential for maintaining a strong business reputation and ensuring timely payments. Well-designed payment documents not only reflect the quality of your service but also make the payment process smoother for both you and your clients. In this section, we’ll discuss how to craft clear, concise, and professional billing records that instill confidence and trust in your clients.

Key Elements of a Professional Billing Document

- Business Information – Include your company name, address, phone number, email, and website. This ensures that clients know exactly who the payment is going to and how to reach you for any questions.

- Client Details – Clearly list the client’s name or company name, contact information, and billing address. This helps ensure that the document is personalized and accurate.

- Invoice Number – Assign a unique reference number for each billing record. This helps both you and the client track payments and avoid confusion, especially when handling multiple clients or services.

- Payment Due Date – Clearly state when the payment is due. This sets clear expectations and prevents delays. Common options include “Net 30,” meaning payment is due 30 days from the date of the document.

- Detailed Service Description – Provide a breakdown of services rendered, including quantities, rates, and dates. This level of detail ensures that the client understands exactly what they are being charged for and helps prevent disputes.

- Total Amount Due – Clearly display the total amount due, including taxes, discounts, or additional fees. Transparency in pricing is essential for maintaining trust.

- Payment Instructions – Include information on how clients can make the payment, such as bank transfer details, PayPal links, or check payment instructions. The easier you make it for clients to pay, the faster you’ll receive payment.

Tips for Enhancing Professionalism

- Use a Consistent Format – Ensure that all your billing documents follow the same structure, making it easy for clients to recognize and understand them. Consistency in design helps reinforce professionalism.

- Include Your Logo – Incorporate your business logo at the top of the document to reinforce your brand identity and make the document look polished.

- Check for Accuracy – Double-check all information for spelling errors, correct amounts, and accurate dates. Small mistakes can create confusion or make your business appear unprofessional.

- Be Clear and Concise – Avoid using jargon or complicated language. Keep the language simple and direct so that the client can easily understand the terms and amounts involved.

By creating professional, well-organized billing documents, you establish a level of trust with your clients that goes beyond just delivering quality services. Clear communication and attention to detail in your billing process will enhance your business’s reputation and encourag

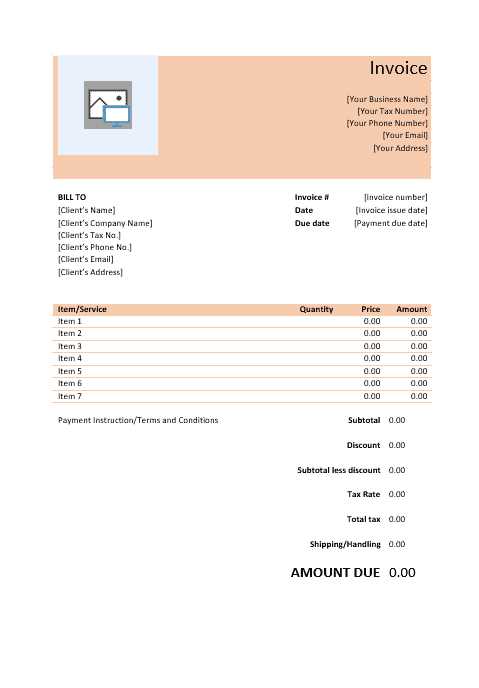

Invoice Templates vs Custom Billing Systems

When managing billing records, businesses face the decision between using pre-designed document formats or opting for a fully customized solution. Both approaches have their advantages, but the choice depends on the specific needs of the business, the scale of operations, and the complexity of billing requirements. This section explores the differences between using ready-made billing formats and investing in custom-built systems, helping you determine which option is the best fit for your business.

Advantages of Using Pre-Designed Billing Formats

- Quick Setup – Ready-made billing formats are easy to implement. They require minimal setup, allowing businesses to start generating billing records immediately. This is ideal for small businesses or those just starting out.

- Cost-Effective – Pre-designed solutions are typically free or low-cost, making them a budget-friendly option for businesses that don’t have the resources to invest in custom software or systems.

- Simple and User-Friendly – These formats are often simple to use, with an intuitive design that allows even those without technical expertise to generate professional documents easily.

- Consistent Format – Using a standardized billing format ensures consistency across all records, which can help build a professional image and reduce errors or confusion.

Benefits of Custom-Built Billing Systems

- Tailored to Your Business Needs – A custom-built solution can be designed to meet the specific requirements of your business, including unique service offerings, pricing structures, or complex payment terms.

- Automation Features – Custom systems often allow for automation of repetitive tasks, such as generating billing records, sending reminders, and tracking payments. This saves time and reduces the chances of human error.

- Integration with Other Tools – Custom billing systems can be integrated with other business tools, such as accounting software, CRM systems, and payment gateways, creating a seamless workflow and more efficient financial management.

- Scalability – As your business grows, a custom solution can be adjusted to accommodate increasing volume, new services, and evolving billing requirements. This level of scalability is not typically available with pre-designed formats.

Ultimately, the decision between using pre-designed formats and a custom system depends on your business’s size, needs, and long-term goals. If you’re looking for a cost-effective, quick solution with minimal customization, ready-made formats may be the way to go. However, for businesses with specific or growing needs, a custom billing system provides greater flexibility, automation, and long-term value.

How to Handle Late Payments

Dealing with late payments is a common challenge for businesses, but it’s essential to handle them in a way that maintains client relationships while ensuring cash flow remains steady. Clear communication, consistent follow-ups, and having well-defined policies can help reduce the occurrence of late payments. This section offers strategies to effectively manage overdue payments and minimize their impact on your business.

Steps to Address Late Payments

- Send a Reminder – If the payment has passed its due date, send a polite reminder to the client. Sometimes payments are simply overlooked, and a gentle nudge can resolve the issue.

- Establish Clear Payment Terms – Clearly define the payment expectations from the beginning, including due dates, late fees, and payment methods. This transparency helps prevent misunderstandings and sets a professional tone.

- Offer Flexible Payment Options – If a client is struggling to make the payment, consider offering alternative payment options such as installment plans or extended deadlines. This shows flexibility while still getting paid.

- Follow Up Regularly – If payment is not received within the agreed timeframe, continue following up through email or phone calls. Consistent communication is key to ensuring payments are made as soon as possible.

Dealing with Chronic Late Payers

- Apply Late Fees – Make it clear that a penalty will be applied for overdue payments. This can serve as a deterrent and encourage clients to pay on time in the future.

- Review Client Relationships – If late payments become a recurring issue with a particular client, consider reviewing your business relationship. You may need to set stricter payment terms or even reconsider working with that client if payments remain unreliable.

- Consider Legal Action – As a last resort, if a client continues to withhold payment despite multiple reminders, consider consulting a lawyer or pursuing legal action to recover the funds. While this is a drastic step, sometimes it’s necessary to protect your business.

By implementing clear payment terms, maintaining consistent communication, and having policies in place to deal with overdue payments, businesses can minimize the negative effects of late payments and maintain healthy cash flow.

Why Timely Billing Matters for Your Business

Issuing billing records promptly is a crucial aspect of financial management that often gets overlooked. However, when payments are processed quickly and efficiently, it benefits both you and your clients. The timeliness of your billing not only ensures that you receive compensation for your services, but it also helps to build trust and maintain smooth cash flow for your business. In this section, we’ll explore the reasons why timely billing is essential for the success and stability of your business.

Benefits of Timely Billing

- Improved Cash Flow – Promptly sending billing records ensures that payments are collected on time, which in turn helps maintain a steady cash flow. This is crucial for covering operational expenses and reinvesting in your business.

- Reduced Payment Delays – The sooner you send out billing records, the sooner clients can process and pay. Delays in issuing bills can result in delays in receiving payment, potentially affecting your ability to pay vendors or employees.

- Enhanced Professionalism – Consistently delivering billing documents on time demonstrates professionalism and reliability, which builds trust with clients and strengthens your reputation as a business.

- Avoiding Late Fees – By sending bills promptly, you reduce the likelihood of late payments, which means you are less likely to have to deal with the frustration of unpaid bills or late fees.

How Timely Billing Strengthens Client Relationships

- Transparency – Sending timely records shows that you are organized and transparent with your pricing. Clients appreciate knowing what they owe and when they need to pay, which builds a sense of mutual respect and trust.

- Improved Communication – Regular and on-time billing creates a clear line of communication with your clients. This ensures that any questions or issues regarding the bill can be addressed quickly, preventing disputes down the road.

- Positive Business Reputation – Clients are more likely to recommend and return to a business that is prompt and professional in its billing process. A reputation for timely billing contributes to client satisfaction and long-term relationships.

In conclusion, timely billing is an essential practice that positively impacts your business’s cash flow, reputation, and client satisfaction. By making it a priority to send billing documents promptly, you ensure that your financial processes run smoothly and you maintain healthy business relationships.

Tips for Improving Billing Clarity

Clear and concise billing documents are essential for smooth transactions and maintaining positive client relationships. When your billing records are easy to understand, clients are less likely to have questions or disputes about charges. The goal is to ensure that every detail is transparent, so clients know exactly what they are paying for and why. Here are some effective tips to enhance the clarity of your billing records.

1. Provide Detailed Descriptions of Services

Be specific about the services you’ve provided, including dates, quantities, and unit prices. The more detailed your descriptions are, the less likely clients will feel confused or unsure about what they are being charged for. Instead of vague terms like “cleaning services,” break it down into clear items such as “office floor cleaning (2 hours)” or “window washing (5 windows).”

2. Use Simple Language and Formatting

- Avoid jargon – Use clear, everyday language that your clients can easily understand.

- Keep it organized – Break down the document into sections such as “Service Description,” “Amount Due,” and “Payment Terms” to make it easier to follow.

- Highlight key information – Make the total amount due and payment due date stand out using bold text or larger font size, so it’s immediately visible.

3. Break Down Costs Clearly

Clients should never have to guess how the total was calculated. Break down the costs into individual line items, showing the price per unit and the total amount for each service. This transparency helps prevent confusion and potential disputes.

4. Provide Payment Instructions

Make the payment process as clear and easy as possible. Include specific instructions on how the client can make the payment, whether it’s via bank transfer, credit card, or check. If applicable, list your payment details (e.g., bank account number or PayPal link) directly on the document.

5. Include Clear Terms and Deadlines

Ensure that payment terms and due dates are clearly outlined. If there are any penalties for late payments, include this information in bold text so that there are no surprises. Clear terms reduce the chance of misunderstandings and help clients pay on time.

By following these tips, you can ensure that your billing records are clear, professional, and easy for your clients to understand, ultimately fostering smoother transactions and better business relationships.