Easy to Use Software Invoice Template Excel for Streamlined Billing

Managing financial transactions is essential for businesses of all sizes. To ensure accurate record-keeping and timely payments, using structured documents can significantly improve efficiency. With the right tools, creating detailed billing statements becomes a straightforward task, helping professionals stay organized and focused on their core activities.

Customized documents offer a flexible solution, allowing users to easily input information, adjust formats, and track important details like payment terms and amounts. The ability to tailor these records to specific business needs enhances the billing process, making it faster and less prone to errors.

Many small businesses and freelancers turn to familiar software for creating these essential documents. By leveraging commonly used platforms, users can design personalized billing sheets that meet their specific requirements. This approach not only saves time but also reduces the need for external tools or complex setups.

Software Invoice Template Excel Overview

Creating detailed financial documents for client billing is a critical task for businesses and freelancers alike. With the right structure, these records not only ensure clear communication but also help maintain accuracy in tracking payments and outstanding balances. Simple, customizable documents can streamline this process and offer flexibility to meet specific business needs.

By using widely available spreadsheet programs, users can create dynamic and easily adjustable documents that suit a variety of industries. These files are designed to simplify calculations, organize payment schedules, and provide a professional appearance. The ease of editing and updating also allows for quick modifications, making it a valuable tool for those who need to manage multiple clients or projects.

Why Use Excel for Invoicing

Spreadsheets offer a versatile and efficient solution for managing client billing. Their flexibility and accessibility make them an ideal choice for businesses looking to streamline financial documentation and simplify the payment process. Here are several reasons why using spreadsheet software is a smart choice:

- Customization: Easily adjust layouts, fields, and formats to suit the specific needs of your business.

- Built-in Calculations: Automatically perform calculations, such as tax and total amounts, reducing human error.

- Cost-Effective: No need for expensive third-party tools when a spreadsheet program can do the job efficiently.

- Familiarity: Most users are already familiar with spreadsheet software, which means less time spent on learning new systems.

- Automation: Create recurring billing sheets and automate common tasks like calculations and updates.

- Data Organization: Easily track and organize information like client details, payment terms, and due dates in a structured format.

By leveraging the power of spreadsheets, businesses can create professional, error-free documents that save both time and resources. These features make it an ideal tool for managing client payments and keeping financial records organized.

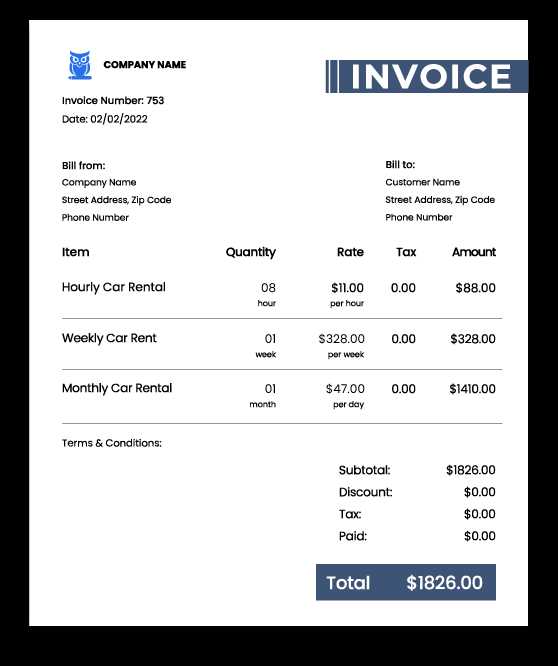

Key Features of an Invoice Template

To effectively manage billing processes, certain features are essential in any financial document. These elements not only ensure that the document looks professional but also help businesses track payments, manage transactions, and avoid errors. A well-structured billing sheet includes several important sections and functions to meet these needs.

Essential Sections for Clarity

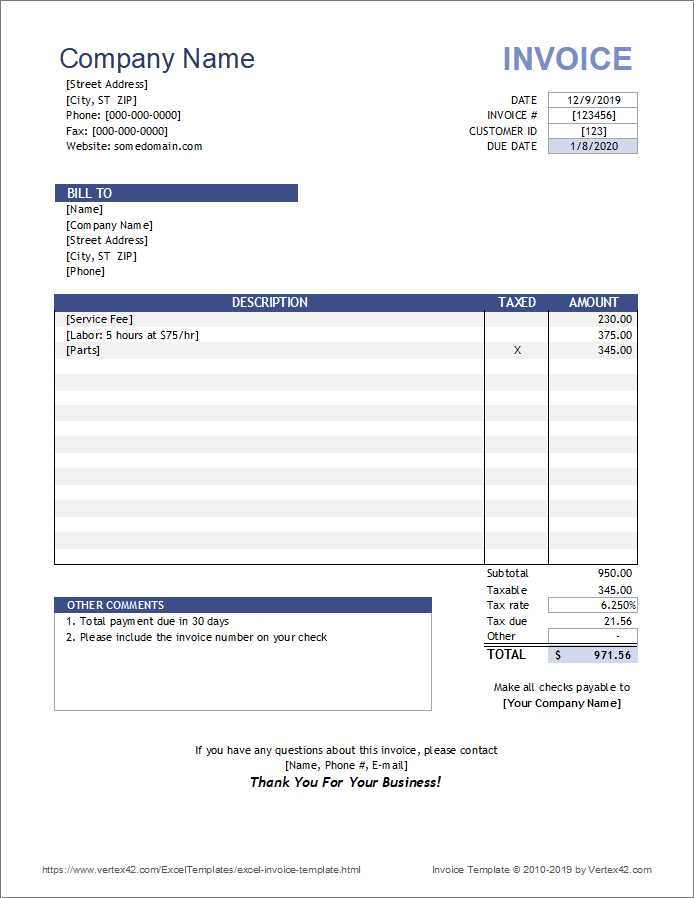

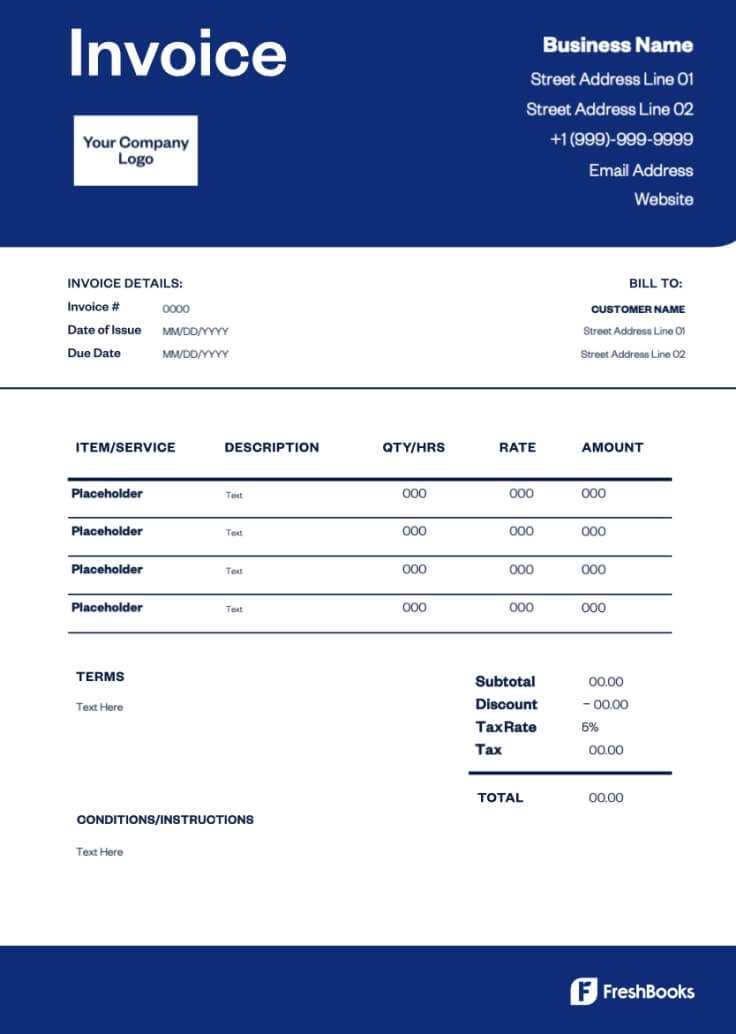

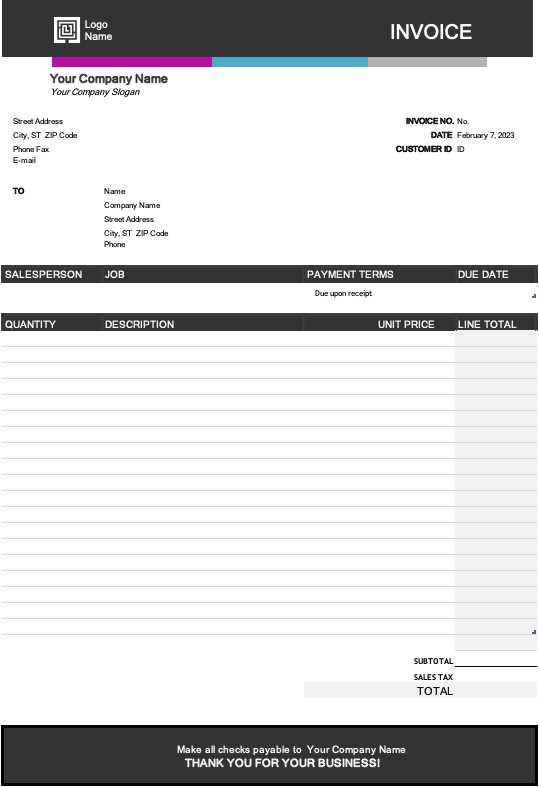

Any effective billing document should have the following key sections to ensure all necessary details are included:

- Business and Client Information: This includes the name, address, and contact details of both the business and the client, ensuring proper identification and communication.

- Unique Reference Number: A specific code or number to identify the transaction, helping to track records and prevent confusion.

- Itemized List of Products/Services: A breakdown of what was provided, including descriptions, quantities, and individual costs, offering transparency for both parties.

- Payment Terms: Clear information on payment deadlines, late fees, and accepted payment methods helps set expectations.

- Total Amount Due: The final sum, including taxes, discounts, and adjustments, ensuring all amounts are accounted for.

Advanced Features for Efficiency

Beyond the basic sections, modern financial documents can benefit from additional features that enhance usability and accuracy:

- Automated Calculations: Built-in formulas to automatically calculate totals, taxes, and discounts, minimizing the risk of human error.

- Recurring Billing Setup: The ability to easily set up and repeat billing cycles for ongoing services or subscriptions.

- Data Validation: Features that prevent errors by limiting the types of data that can be entered into certain fields, ensuring consistency.

- Payment Tracking: A built-in system to track paid and outstanding balances, helping businesses stay on top of collections.

These key features make financial documents more than just a tool for requesting payment–they provide a comprehensive, organized way to manage business transactions with ease and professionalism. By utilizing these functionalities, businesses can save time and reduce the potential for mistakes.

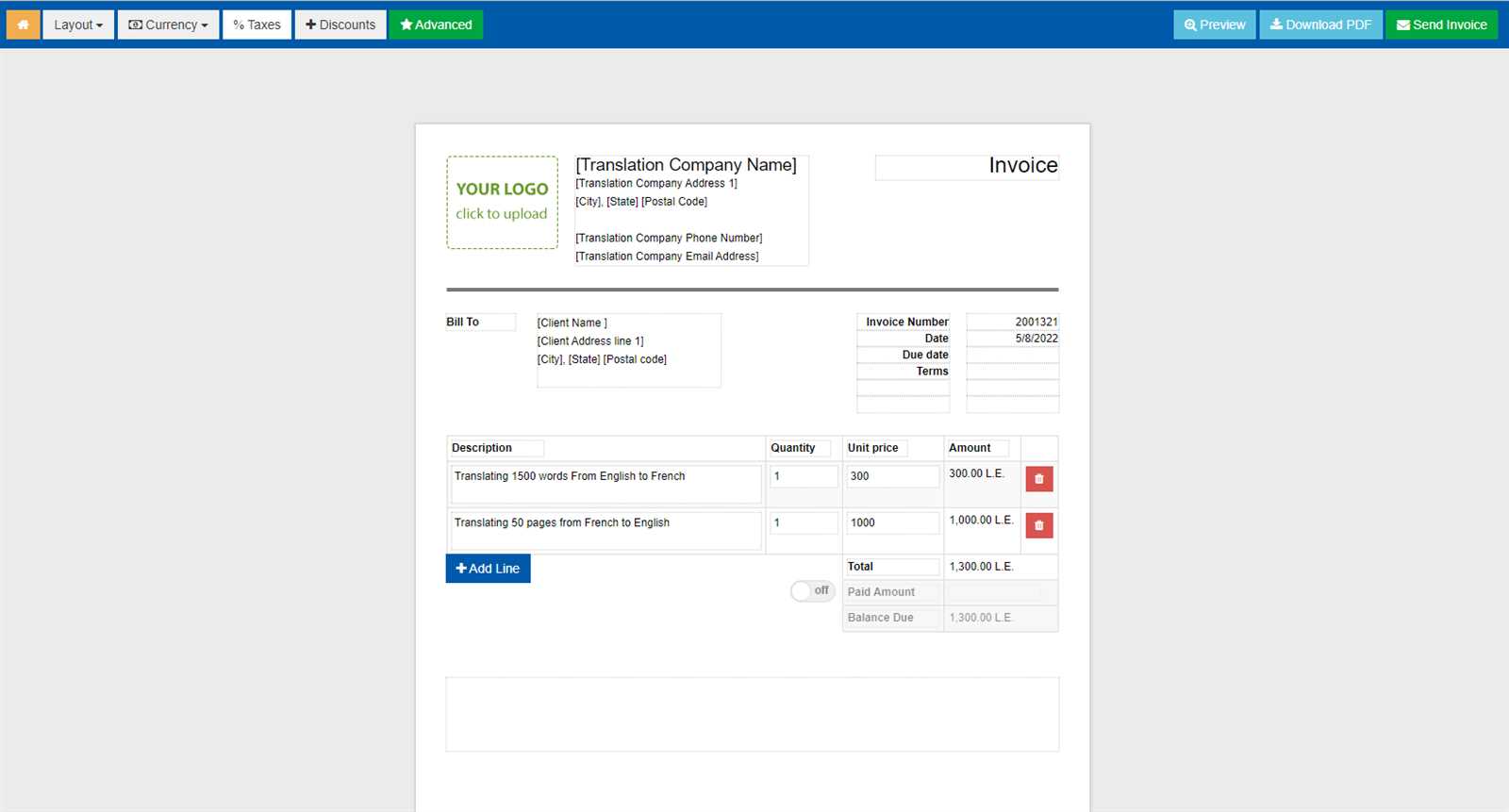

How to Customize Your Invoice Template

Customizing a financial document is essential for tailoring it to the specific needs of your business. By adjusting various elements, you can ensure that the document reflects your brand, meets legal requirements, and provides all necessary details in a clear, professional manner. Customization can range from changing basic text fields to incorporating advanced functions for improved efficiency.

Personalizing the Layout and Design

The first step in customization is to adjust the layout and design of the document to reflect your company’s branding and to make it more readable. Here are some common adjustments:

- Logo and Company Name: Add your company’s logo and clearly state your business name at the top for easy identification.

- Font and Colors: Use your brand’s color palette and select a clean, professional font for readability and consistency.

- Column Headings: Modify column titles to suit the products or services you offer, such as “Item Description” or “Service Hours”.

Incorporating Advanced Features

Once the layout is set, you can focus on more functional customizations that enhance the efficiency and accuracy of your billing process:

- Automatic Calculations: Implement formulas to automatically calculate totals, tax rates, and discounts based on the entered data. This minimizes errors and saves time.

- Payment Terms and Due Dates: Customize the payment terms section to match your business’s policy, such as net 30, net 45, or immediate payment due.

- Additional Fields: If needed, you can add custom fields for other details, like purchase order numbers or specific notes related to the transaction.

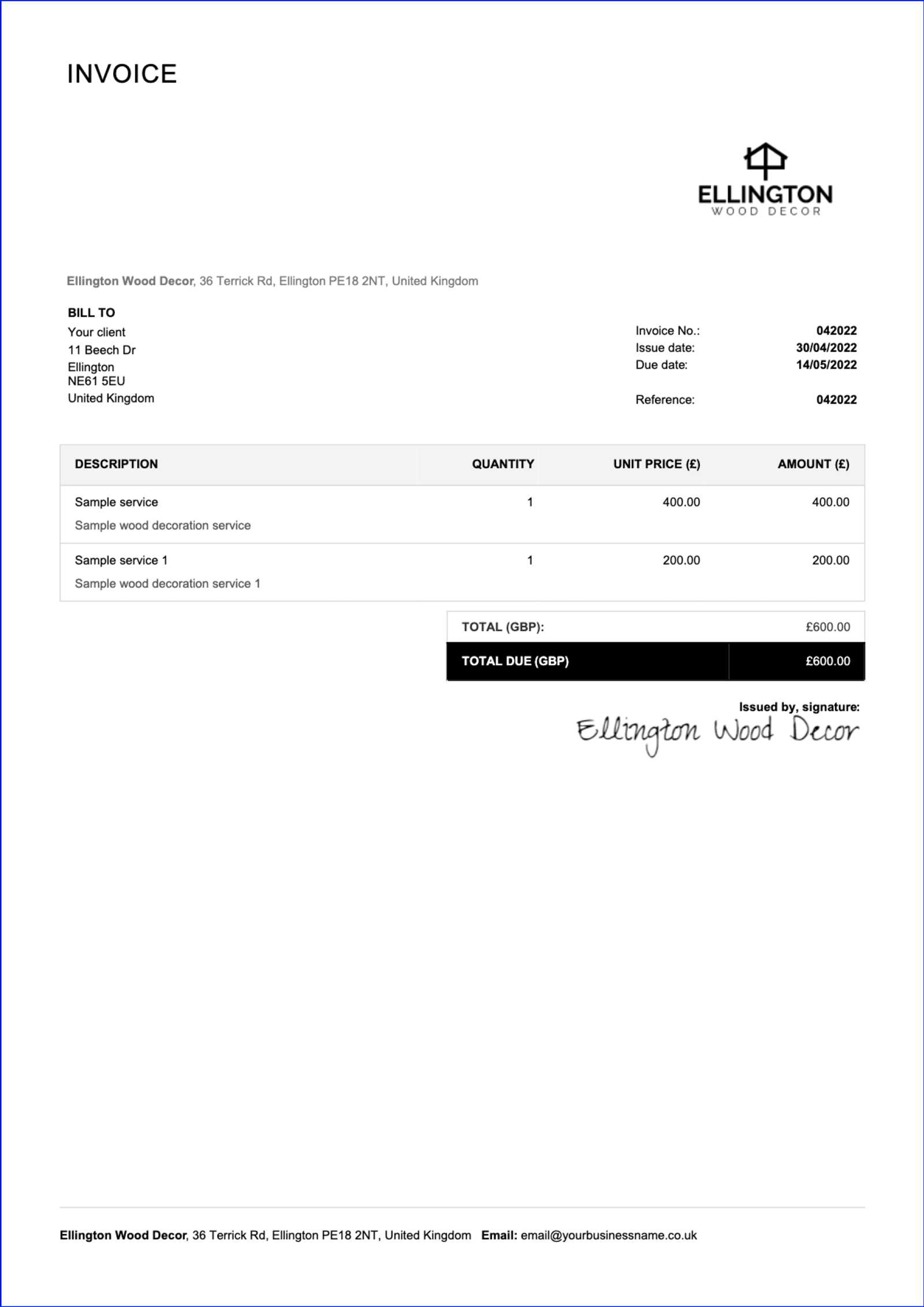

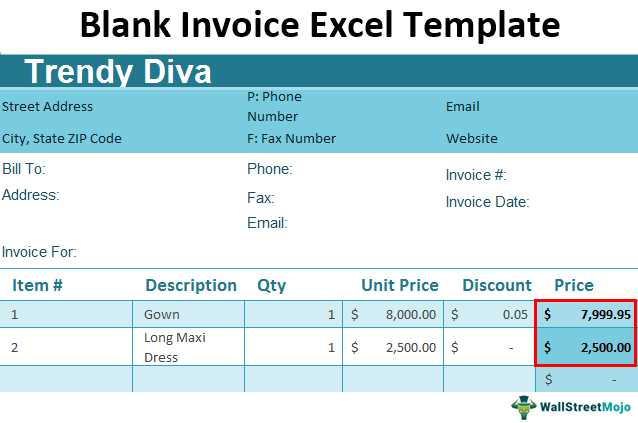

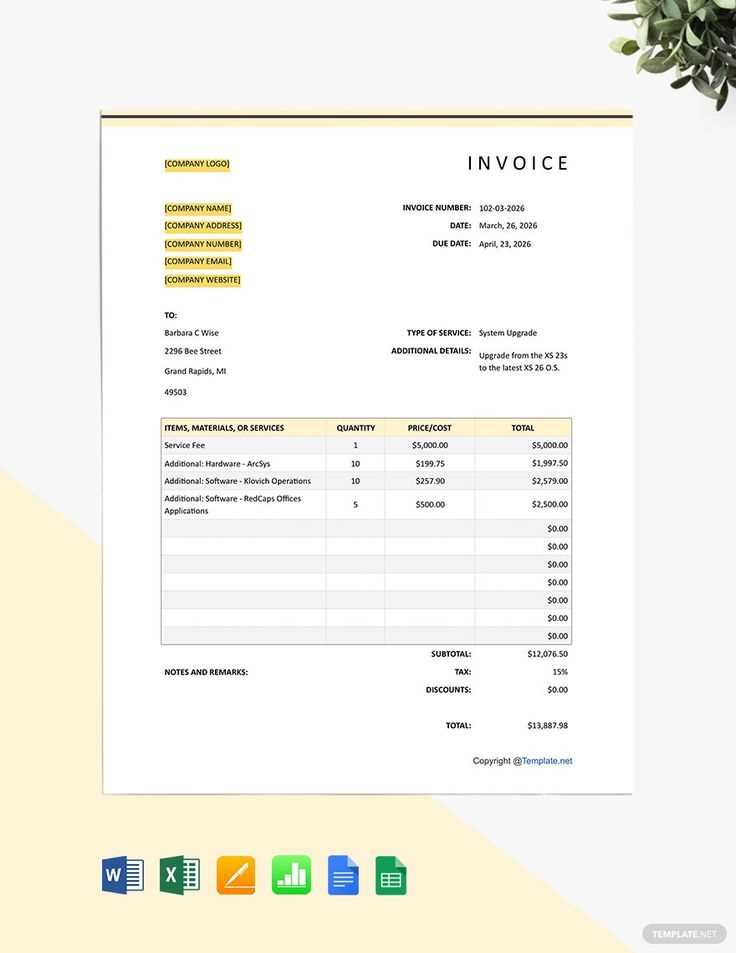

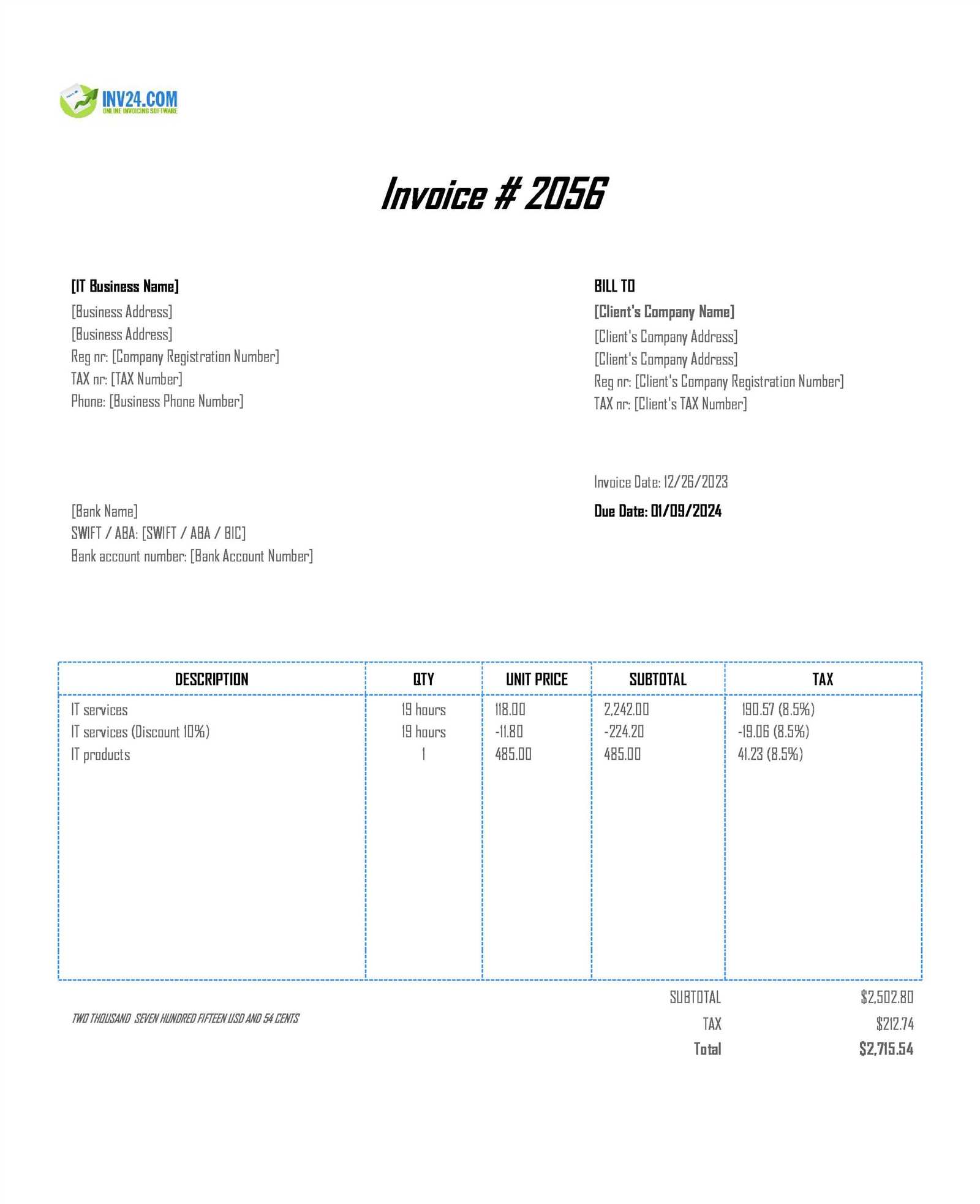

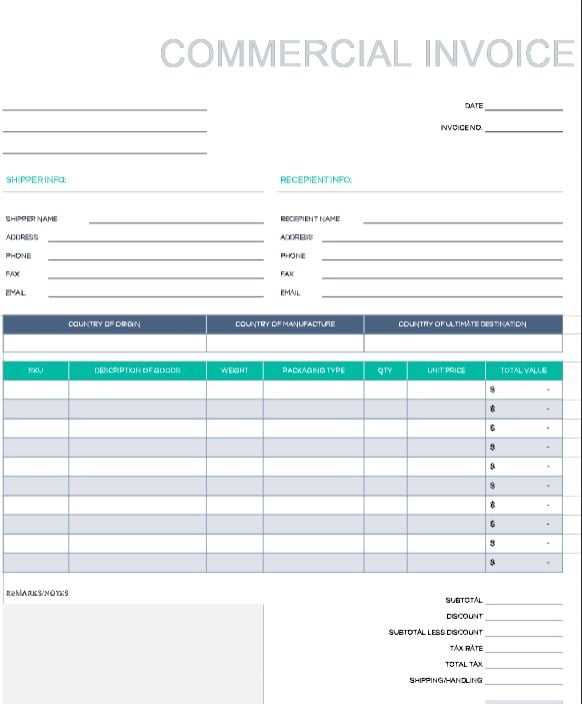

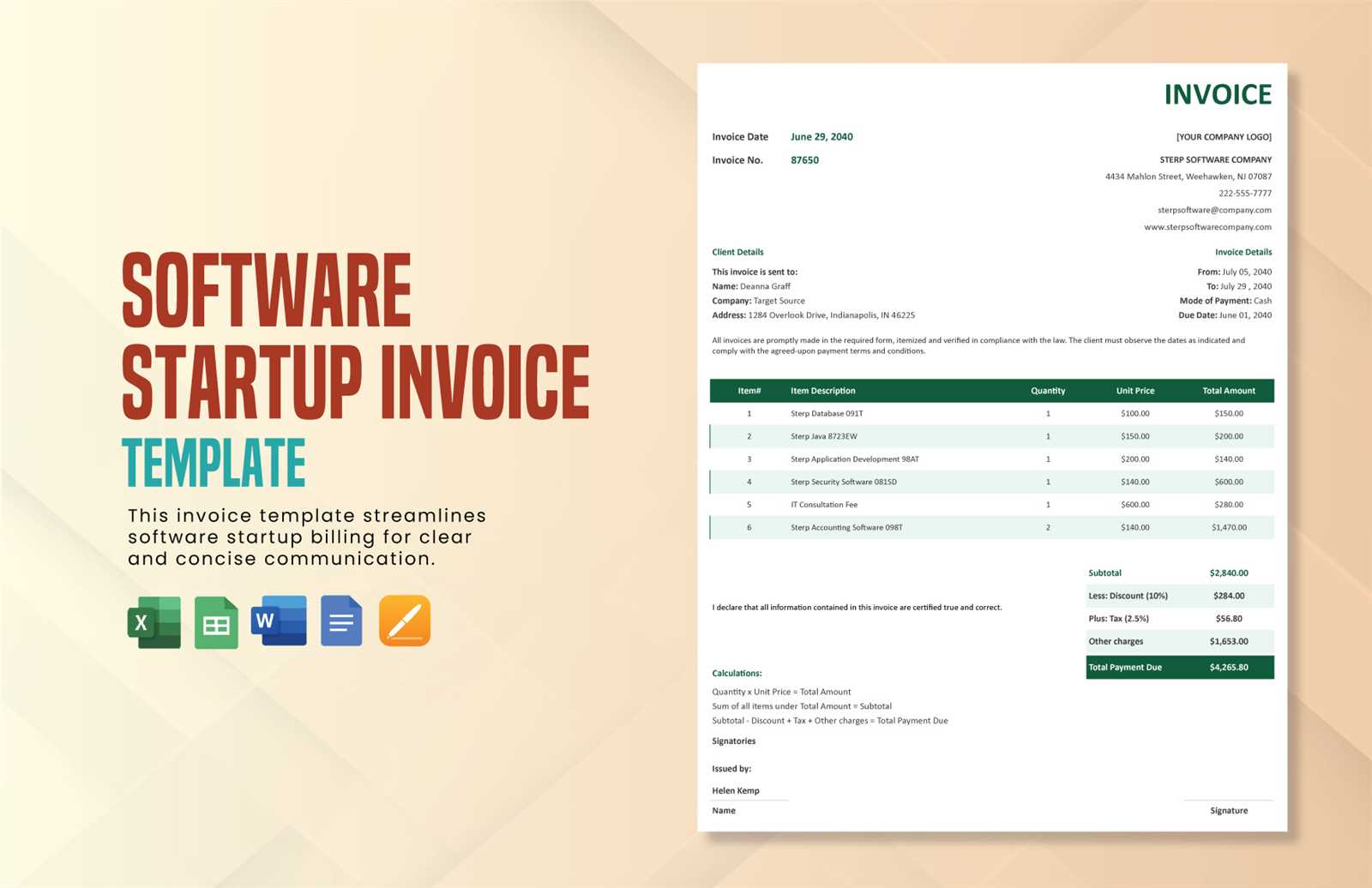

Example of a Customized Invoice Layout

Below is an example of a typical structure you might want to modify:

| Item Description | Quantity | Unit Price | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Consulting Service | 5 hours | $50 | $250 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Software License | 1 | $200 | $200 |

| Client Name | Service/Product | Amount Due | Due Date | Status |

|---|---|---|---|---|

| John Doe | Web Design | $500 | 2024-11-15 | Unpaid |

| Jane Smith | Consulting | $300 | 2024-11-20 | Paid |

Using a spreadsheet for managing financial records not only simplifies the process but also gives businesses the flexibility to grow and adapt. The ability to store and analyze data in an organized manner helps ensure smooth financial operations and timely payments.

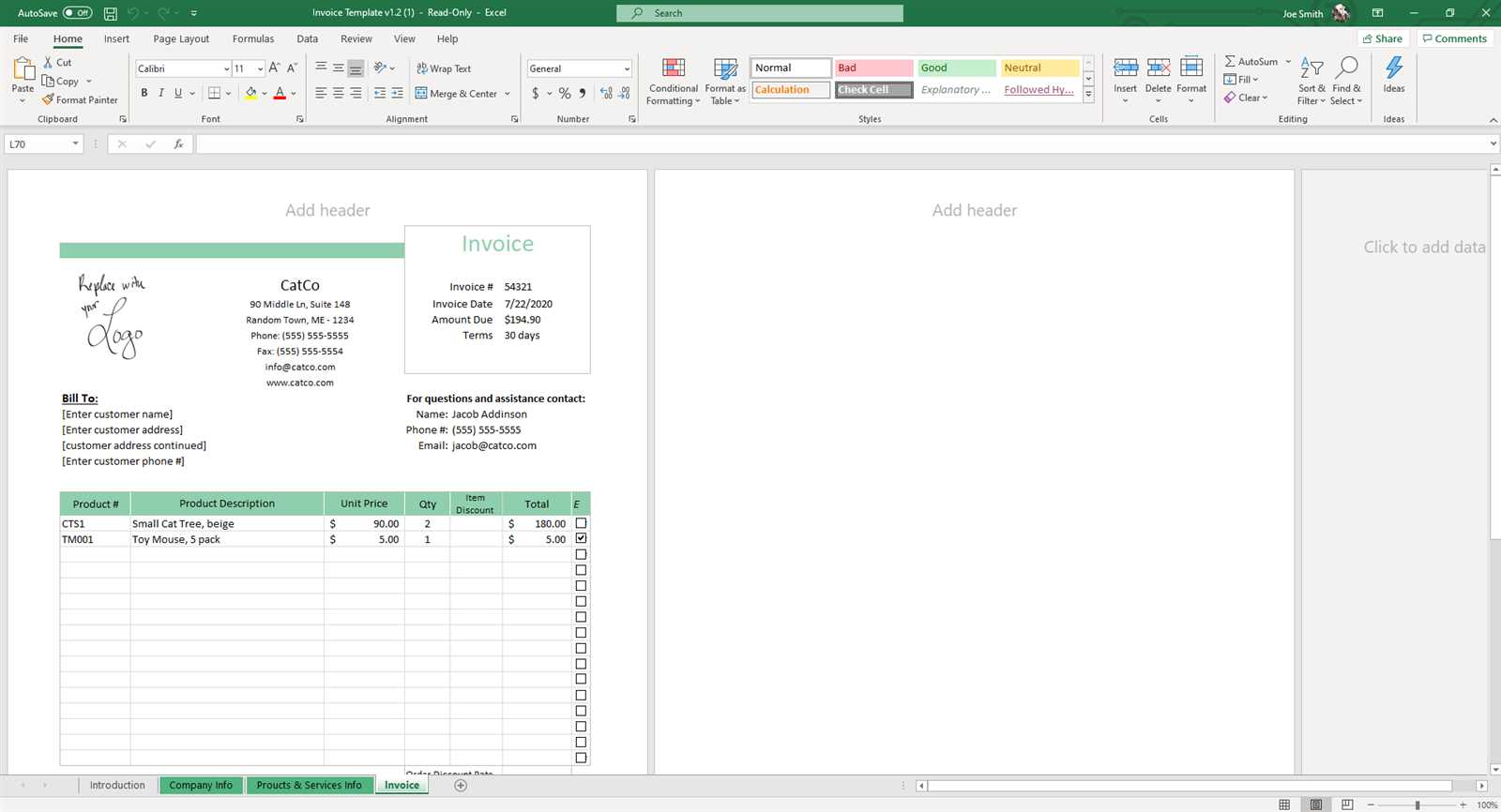

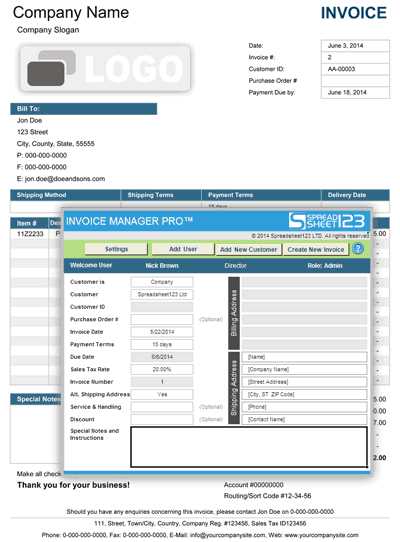

Step-by-Step Guide to Using Templates

Creating professional billing documents is an essential part of managing transactions, and using a ready-made structure can make this task much easier. By following a few simple steps, you can quickly set up a customized document that meets your business needs. This guide will walk you through the process of setting up and using a customizable document structure, saving you time and ensuring accuracy in your financial records.

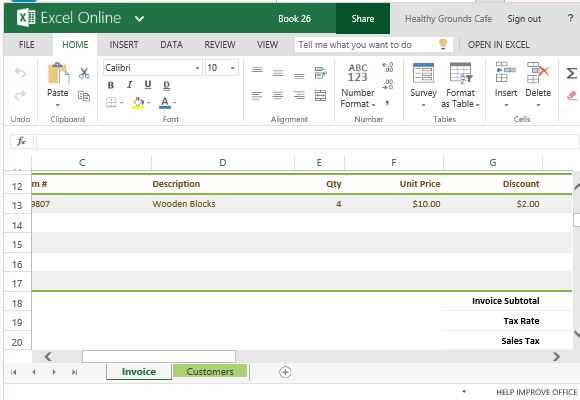

Getting Started

The first step is to open your preferred spreadsheet tool and locate a suitable layout for your document. Many programs offer built-in options, or you can create your own from scratch. Here’s how to get started:

- Open Your Spreadsheet Program: Start by opening the program you plan to use to create your billing document.

- Select a Blank or Pre-made Layout: You can either choose a pre-designed format from a template library or start with a blank sheet and design your own structure.

- Save Your Document: Before making any edits, save the file with a clear name, such as “Client Billing Sheet” or “Payment Record,” for easy reference later.

Customizing the Document

Once you have the basic structure set up, it’s time to personalize it for your specific needs. Customization helps ensure that all relevant information is included and that the document reflects your branding. Follow these steps to adjust the layout:

- Enter Your Business Information: Include your company name, logo, and contact details at the top of the document for easy identification.

- Define Client Details: Add sections for your client’s name, address, and contact information to ensure the document is personalized.

- List Products or Services: Create columns for item descriptions, quantities, unit prices, and any other necessary details. Make sure all data is accurate and clear.

- Add Payment Terms: Specify payment terms, such as due dates, discounts, and late fees if applicable, to set clear expectations.

- Set Up Calculations: Use built-in functions to automate the calculation of totals, taxes, and any discounts, ensuring accuracy and efficiency.

Final Adjustments

Once you’ve filled in the essential information, review the document for completeness and clarity. Here are some final adjustments to consider:

- Check Formatting: Make sure all sections are aligned properly, the fonts are consistent, and the document is visually appealing.

- Proofread: Double-check for spelling mistakes, missing information, and incorrect calculations before sending it out.

- Save and Share: Save your document and send it to the client via email or print it for physical delivery.

By following these simple steps, you can quickly set up and customize a professional billing document that meets your business needs and ensures that payments are handled efficiently. With a well-organized structure, you can save time and reduce errors while maintaining a professional appearance for your clients.

How to Track Payments with Excel

Effectively managing and tracking payments is crucial for maintaining a healthy cash flow and ensuring timely transactions. Using a spreadsheet program allows businesses to easily monitor payment status, keep records organized, and spot any overdue balances. By setting up a clear tracking system, you can quickly view outstanding amounts and follow up on late payments with minimal effort.

Setting Up a Payment Tracking System

The first step in tracking payments is to set up a well-organized system that allows you to track both incoming and pending payments. Start by creating a simple structure that includes all the necessary details for each transaction. Below are the steps for setting up an effective payment tracking sheet:

- Columns for Essential Information: Create columns for client name, amount due, payment date, payment status, and method of payment.

- Payment Status Field: Use a column to mark the status of each payment, such as “Paid,” “Pending,” or “Overdue.”

- Use Conditional Formatting: Highlight overdue payments in red or pending ones in yellow to make them easy to identify at a glance.

Tracking Payments Example

Here’s a simple example of how you can structure your payment tracking system:

| Client Name | Amount Due | Payment Date | Payment Status | Payment Method |

|---|---|---|---|---|

| John Doe | $500 | 2024-10-15 | Paid | Credit Card |

| Jane Smith | $300 | 2024-10-20 | Pending | Bank Transfer |

| Mike Johnson | $450 | 2024-10-10 | Overdue | Cash |

By entering the relevant payment information into your spreadsheet, you can easily track which clients have paid, which payments are still due, and which ones are overdue. Additionally, the use of filters and sorting options can help you quickly find and focus on the most important data, such as overdue payments, so you can take appropriate action.

Tracking payments in this way not only helps maintain accurate financial records but also provides a clear overview of your business’s cash flow, ensuring you stay on top of any outstanding debts.

Designing Professional Invoices in Excel

Creating polished, professional documents for billing is essential for establishing credibility and building trust with clients. A well-designed billing document not only ensures that all necessary information is clearly presented but also reinforces your brand’s image. With the right design elements and attention to detail, you can produce documents that are both functional and aesthetically appealing, helping you maintain a high standard of professionalism.

Key Design Principles

When designing your billing document, there are several important principles to consider to ensure it looks polished and communicates effectively. Focus on the following:

- Clarity: The document should be easy to read and understand at a glance. Use clear headings, well-spaced sections, and simple fonts to enhance legibility.

- Consistency: Keep the layout uniform across all sections. Align text and numbers properly, and use the same font style and color throughout the document for a cohesive look.

- Branding: Incorporate your company’s logo, color scheme, and other visual elements that reflect your brand identity. This helps reinforce your professionalism and makes the document instantly recognizable.

Designing the Layout

The layout of the document plays a significant role in how your clients perceive the professionalism of your business. To achieve a clean, structured look, follow these guidelines:

- Header Section: Include your business name, logo, and contact information at the top for easy identification. This section should also feature the recipient’s name and contact details.

- Itemized List: Create a clear table to break down products or services provided. Ensure that descriptions, quantities, and prices are easy to read and accurately aligned.

- Clear Total Section: Display the final amount due in a bold, prominent section, making it stand out from the rest of the document.

- Payment Instructions: Add clear instructions for payment, such as due date, payment methods, and bank account details if needed.

By following these design principles, you can create a billing document that not only functions well but also leaves a strong, positive impression on your clients.

Common Errors in Excel Invoice Templates

While using a structured billing document can streamline the process of managing payments, there are several common mistakes that can lead to inaccuracies or confusion. These errors, often caused by oversight or lack of attention to detail, can affect the professionalism of the document and potentially delay payments. Being aware of these common issues can help you avoid them and ensure your financial records are always accurate.

Frequent Mistakes to Watch Out For

Here are some of the most common errors made when using spreadsheet-based billing documents:

- Incorrect Calculations: One of the most common issues is failing to set up accurate formulas for totals, taxes, or discounts. Manual calculation errors can lead to discrepancies between the amount due and what is actually owed.

- Missing or Incorrect Client Information: Omitting or incorrectly entering client names, addresses, or other contact details can lead to confusion and delay payment processing.

- Inconsistent Formatting: Using different fonts, sizes, or colors within the same document can make it look unprofessional and harder to read. Consistent formatting is key for clarity and presentation.

- Not Updating Payment Terms: Failure to adjust payment terms or deadlines for specific clients or projects can create misunderstandings and affect timely payment.

- Unclear or Missing Payment Instructions: If the document does not clearly specify how or where to make a payment, clients may delay payments or need to contact you for clarification.

How to Prevent These Mistakes

To avoid the issues mentioned above, take the following steps to ensure accuracy and professionalism in your billing process:

- Double-Check Formulas: Review and test all calculations before sending out the document to ensure accuracy.

- Ensure Accurate Client Information: Verify that all details for clients, such as addresses and contact numbers, are correctly entered before finalizing the document.

- Standardize Formatting: Use a consistent style throughout the document. This helps make the document more readable and gives it a polished, professional appearance.

- Regularly Update Payment Terms: Adjust the payment terms to reflect the specific needs of the client and the project, ensuring clarity about deadlines and late fees.

- Provide Clear Payment Instructions: Always include precise instructions on how to make payments, including your preferred payment methods and account details.

By being mindful of these common errors and taking steps to avoid them, you can maintain a smooth and professional billing process that keeps both your business and clients satisfied.

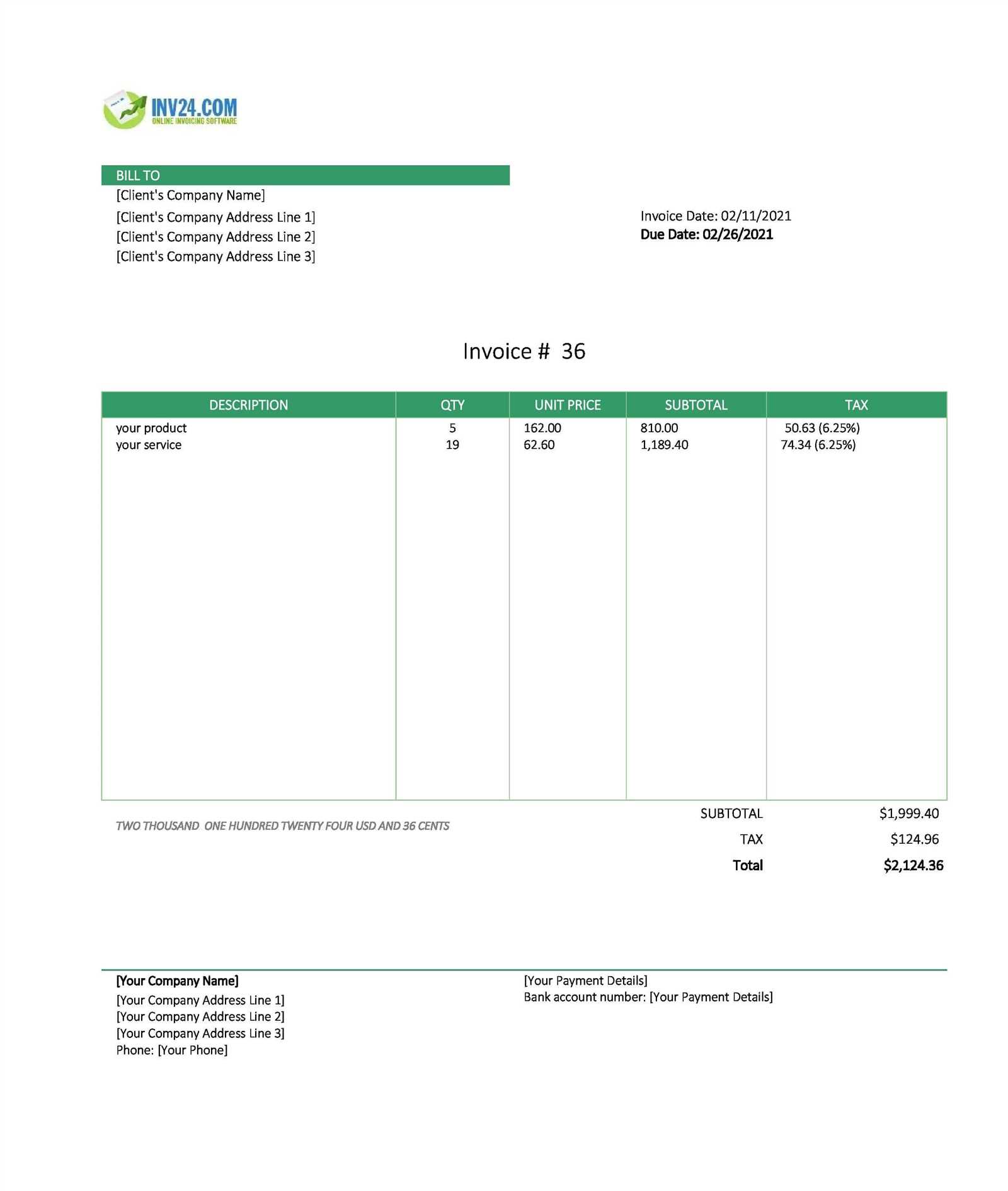

How to Add Taxes and Discounts

Incorporating taxes and discounts into your billing documents is essential for accurately reflecting the cost of goods or services. Whether you’re adding a sales tax or offering a discount for early payment, it’s important to ensure that these adjustments are clearly stated and calculated correctly. This section will guide you through the process of adding taxes and discounts to your billing structure to maintain transparency and accuracy in your financial records.

Adding Taxes

To properly include taxes in your document, you must first know the applicable tax rate for the region or product being billed. Once you have this information, you can easily calculate the tax amount based on the total cost of the goods or services provided. Here’s how you can add taxes:

- Determine the Tax Rate: Identify the percentage of tax that should be applied. This could be a state, federal, or VAT rate depending on your location.

- Apply the Tax to the Subtotal: Multiply the subtotal by the tax rate to get the tax amount. For example, if the subtotal is $100 and the tax rate is 10%, the tax will be $10.

- Display the Tax Amount: Clearly list the tax amount on your document, ensuring it is separate from the subtotal and final amount due.

Adding Discounts

Discounts can be applied to offer clients incentives, such as a reduced price for early payment or bulk orders. To ensure accuracy, you need to calculate the discount and subtract it from the subtotal before applying taxes. Here’s how to add discounts:

- Determine the Discount Type: Decide whether the discount is a percentage (e.g., 10%) or a fixed amount (e.g., $20 off).

- Apply the Discount: Subtract the discount from the subtotal. For a percentage-based discount, multiply the subtotal by the discount percentage and subtract that amount from the total.

- Display the Discount Amount: Clearly show the discount applied and how it affects the final price.

Example of a Tax and Discount Calculation

Here’s an example of how taxes and discounts are applied:

| Item Description | Amount | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product A | $100 | |||||||||||||||||||||||||||

| Discount (10%) | -$10 | |||||||||||||||||||||||||||

| Subtotal | $90 | |||||||||||||||||||||||||||

| Tax (10%) | $9 | |||||||||||||||||||||||||||

| Total Amount Due | $99 |

| Client Name | Amount Due | Due Date | Payment Status | Payment Date |

|---|---|---|---|---|

| John Doe | $500 | 2024-10-15 | Paid | 2024-10-16 |

| Jane Smith | $300 | 2024-10-20 | Pending | – |

| Mike Johnson | $450 | 2024-10-10 | Overdue | – |

By implementing these organizational strategies, you can easily keep track of multiple records, monitor payment status, and ensure that all necessary information is in one place. This will not only reduce errors but al

Protecting Your Invoice Data in Excel

When managing financial records, securing sensitive information is paramount. Billing documents often contain crucial details such as client data, transaction amounts, and payment terms, which, if exposed, can lead to data breaches or financial loss. Implementing proper security measures ensures that your records remain protected from unauthorized access, while maintaining confidentiality and compliance with regulations.

Methods to Protect Your Data

Here are some practical steps you can take to safeguard your financial documents and prevent unauthorized access:

- Password Protection: Set a strong password to restrict access to your file. Most spreadsheet programs offer an option to protect a document with a password, which prevents unauthorized users from opening or editing it.

- Encrypt Your Files: Encryption adds an additional layer of protection by encoding the file contents. Even if someone gains access to the document, they will not be able to read the data without the decryption key.

- Limit User Access: If you’re collaborating with others, ensure that you limit access to specific individuals or groups. Grant only necessary permissions (e.g., view-only or edit) to minimize the risk of accidental or intentional alterations.

- Regular Backups: To prevent data loss, make regular backups of your files, and store them in a secure location, such as an encrypted cloud service or external hard drive. This ensures that in case of a system failure or accidental deletion, your records remain intact.

Monitoring Changes and Audit Trails

Keeping track of any changes made to your financial records is essential for accountability. Many spreadsheet programs offer version history or audit trail features that allow you to view edits, who made them, and when they occurred. Here are ways to track changes effectively:

- Enable Version History: Use version control to keep track of all changes made to your documents. This feature allows you to revert to a previous version in case an error is introduced.

- Use Comments and Notes: If you work collaboratively, encourage colleagues to use comments or notes to explain changes made. This adds clarity and ensures that everyone understands the edits or adjustments.

Example of Protected Document Settings

Here’s an example of common settings you might use to protect your billing document:

| Protection Feature | Setting | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Password | Enabled, using a strong, unique password | |||||||||||||||||||||||||||

| Encryption | Enabled with AES 256-bit encryption | |||||||||||||||||||||||||||

| User Access | Restricted to specific team members with view/edit permissions | |||||||||||||||||||||||||||

| Backup | Weekly backup to a secure cloud service | |||||||||||||||||||||||||||

| Version History | Enabl

Automating Recurring Invoices in Excel

Managing regular billing cycles can be time-consuming, especially when each cycle requires similar steps to create and send new documents. Automating the process for recurring charges can save you time, reduce the chance for human error, and ensure that your clients are billed consistently. This section will guide you through setting up an automated system to handle repetitive transactions, making your workflow more efficient. Why Automate Recurring Billing?Automating the creation of repetitive billing documents offers several key advantages:

Steps to Automate Recurring BillingSetting up an automated system for periodic charges involves a few key steps. Here’s how you can achieve this in your document management system:

Example of a Simple Automated Recurring Billing SystemBelow is an example of how an automated document might work using date functions and client information:

|