How to Create an Effective Hourly Billing Invoice Template

For freelancers and small businesses, keeping track of work completed and ensuring accurate payment can be a challenge. One of the most efficient ways to handle this process is through a structured document that outlines hours worked, services provided, and agreed-upon rates. By using such a system, both clients and service providers can avoid misunderstandings and ensure transparency in financial transactions.

Creating a clear and professional document for time-based work is essential for smooth financial interactions. This method not only helps with maintaining records but also saves time when it comes to calculating payments. A well-organized format enables businesses to focus on their core activities while still ensuring prompt compensation for services rendered.

Hourly Payment Record Guide

Managing payments for services based on time can be straightforward when you use the right documentation. A well-structured record ensures both parties have a clear understanding of the work completed and the associated costs. This method helps streamline the payment process, making it easier to track hours worked and ensure timely compensation for services provided.

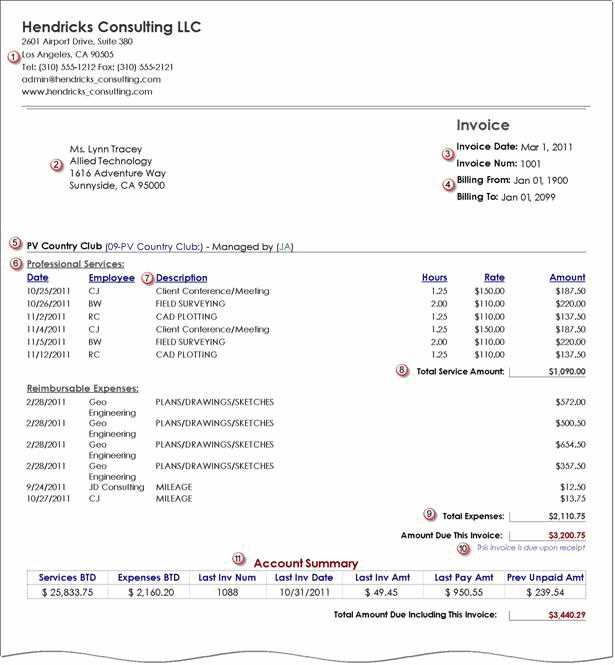

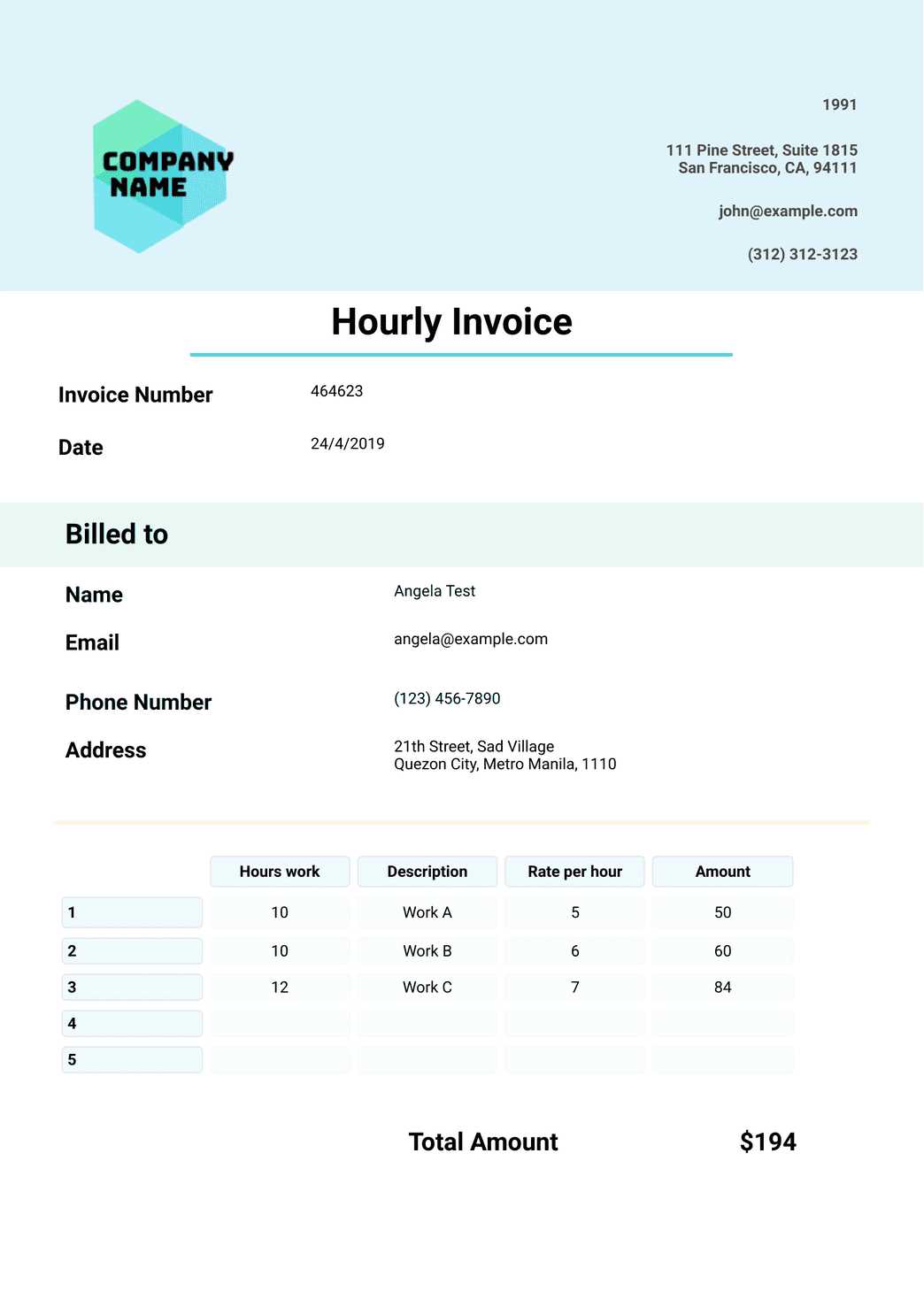

To create a comprehensive and professional record, it’s important to include several key elements. These should cover all aspects of the work arrangement, from the number of hours spent on each task to the agreed-upon rate. Providing a detailed breakdown helps maintain transparency and trust between you and your clients. Additionally, a clear format reduces the likelihood of errors or misunderstandings that could arise from vague or incomplete records.

In this guide, we’ll walk you through the essential components needed to design an effective system for time-based work. By following these steps, you’ll ensure that each payment request is accurate, professional, and easy to understand.

Why Use a Time-Based Payment Record

Tracking work and ensuring accurate compensation is essential for freelancers and service providers. A time-based payment system allows both parties to agree on a rate per unit of time, making it easier to calculate fair compensation for the services rendered. By using a well-organized record, you can maintain clarity, prevent confusion, and avoid disputes over payment details.

One of the main advantages of using this system is the flexibility it offers. It allows service providers to charge clients based on the actual time spent, ensuring that all hours worked are compensated. This method is particularly beneficial for projects where the scope may change, as it accounts for variations in workload without the need for renegotiating the terms of the agreement.

Additionally, a time-based payment method promotes transparency and builds trust between the provider and the client. Both parties know exactly how time is being spent and can quickly verify any discrepancies. This level of accountability helps ensure that payments are fair and that the client is only paying for the work completed.

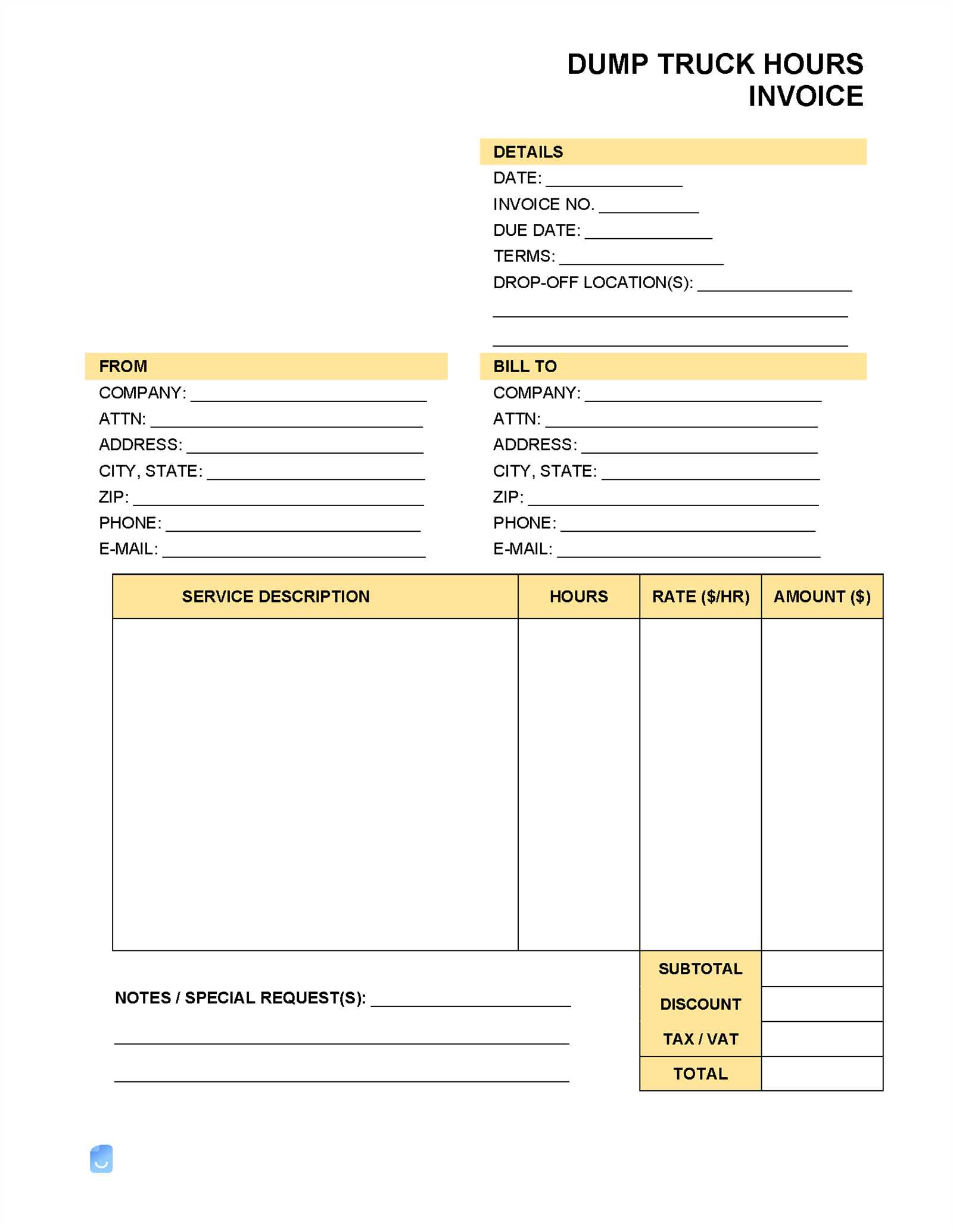

Essential Elements of a Payment Record

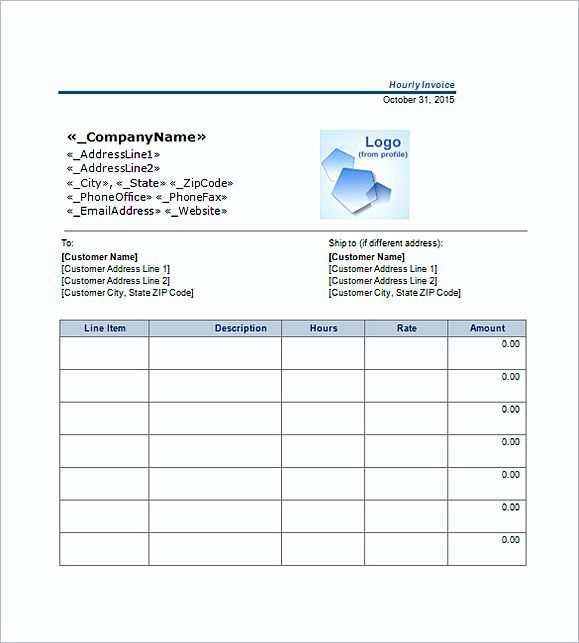

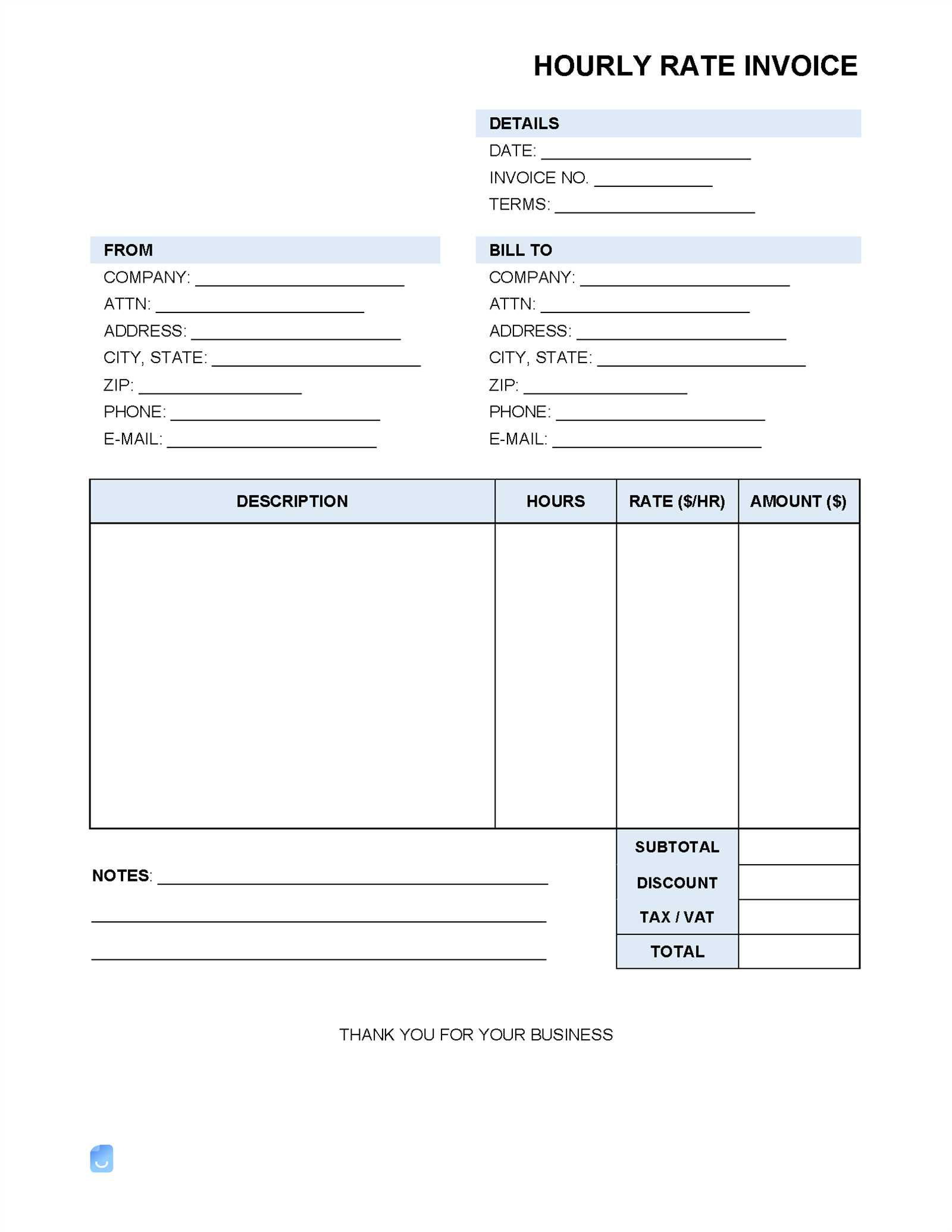

When creating a document for time-based work, it’s important to ensure that all necessary information is included to maintain clarity and professionalism. A well-structured record helps both the service provider and the client understand the details of the work completed, the time spent, and the agreed-upon compensation. Below are the key components that should be included in such a document:

| Element | Description |

|---|---|

| Client Information | Include the full name or company name, address, and contact details of the client. |

| Service Provider Details | Provide your business or personal details, including name, address, and contact information. |

| Work Description | Clearly list the tasks or services provided, ensuring the client knows exactly what they are being charged for. |

| Time Worked | Break down the total time spent on each task, along with the dates of service. |

| Rate | Specify the rate you charge per hour or per unit of time worked. |

| Total Amount | Calculate the total payment based on the hours worked and rate. |

| Payment Terms | Outline when payment is due, any late fees, and accepted payment methods. |

Including these essential elements ensures that your document is complete, clear, and professional, allowing for easy verification and smooth transactions between you and your clients.

How to Customize Your Payment Record

Personalizing your time-based payment record can help reflect your brand, make the document more user-friendly, and ensure that all necessary details are easy to locate. Customization allows you to tailor the document to your specific business needs, creating a more professional and polished appearance. Whether you’re creating a simple document or a detailed breakdown, there are a few key areas you can focus on for customization.

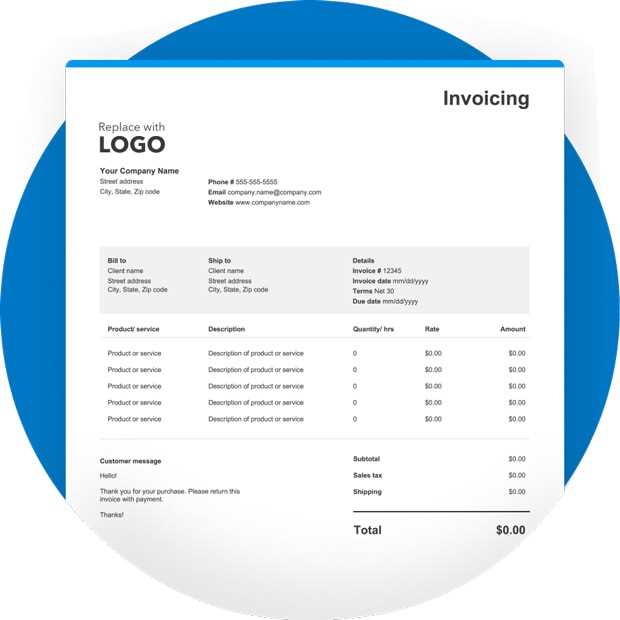

Design and Layout

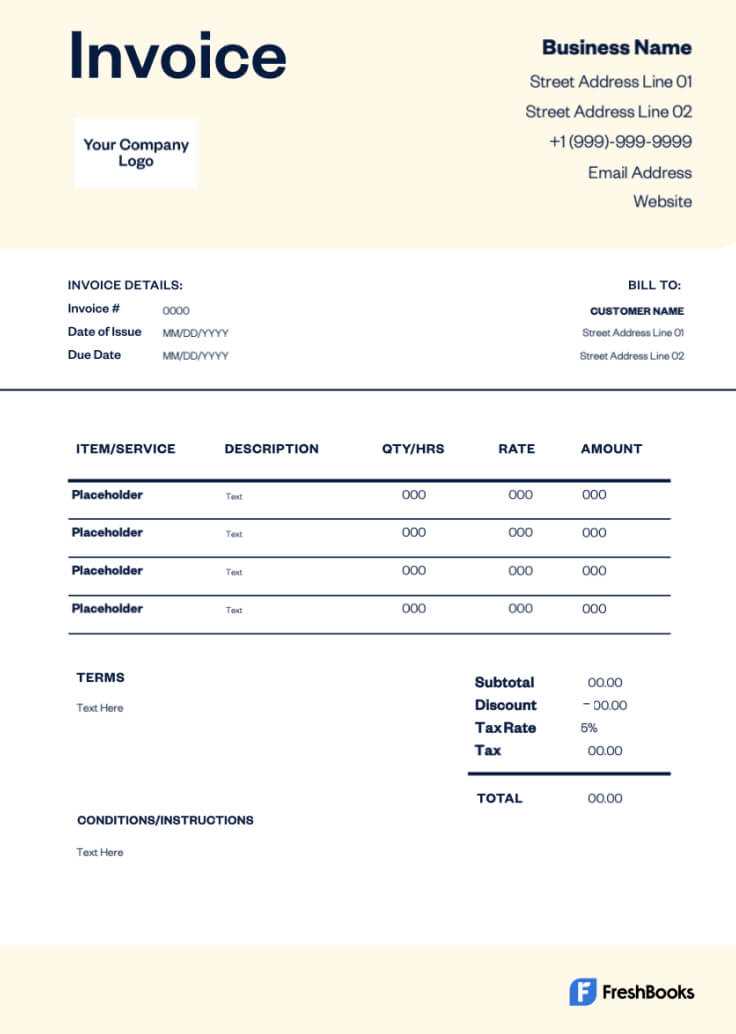

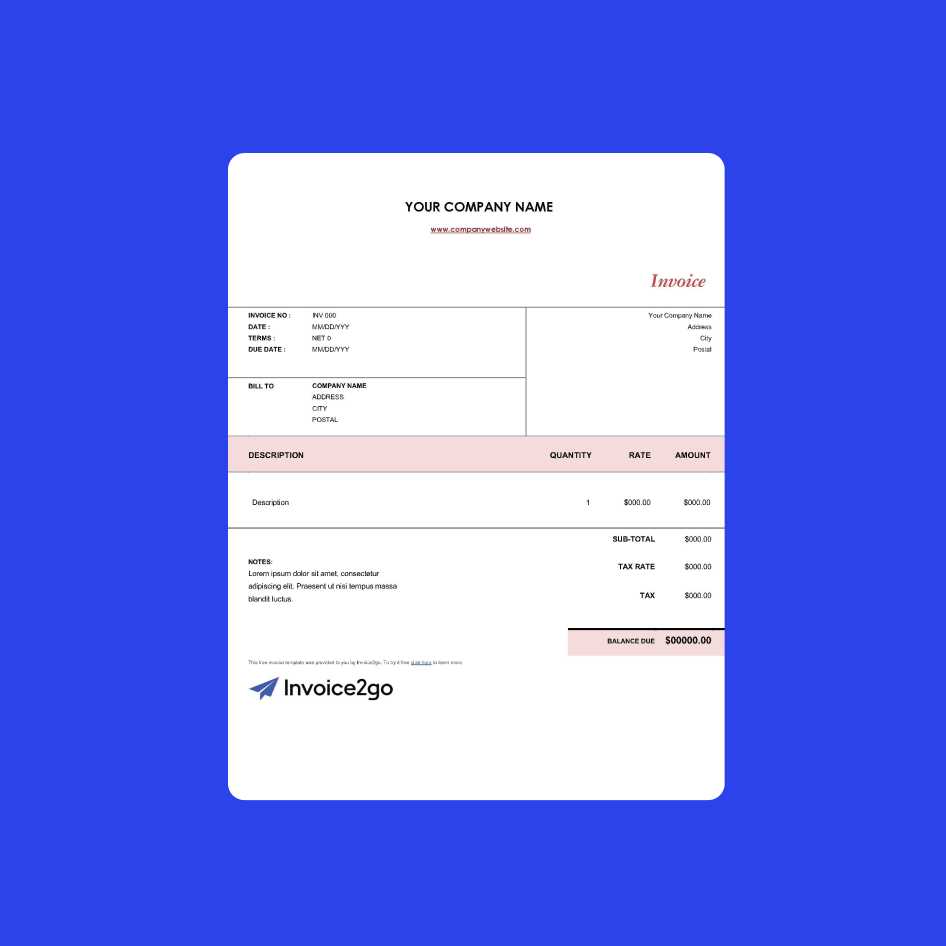

The design of your payment record should be clean and easy to read. Choose a layout that clearly separates each section, such as client details, work description, time spent, and payment calculations. You can also add your logo and company colors to make the document uniquely yours. The use of bold headings and clear font sizes helps to draw attention to the most important details.

Incorporate Custom Fields

Adding custom fields to your document can be an effective way to tailor it to specific projects or client needs. For instance, you may want to include a section for project milestones, references to contracts, or notes on special terms. Custom fields allow you to easily update the document based on the nature of the job and the requirements of each client.

By focusing on these aspects, you can create a personalized and professional record that enhances your business relationships and streamlines your payment process.

Top Benefits of Time-Based Compensation

Charging clients based on the actual time spent working on a project offers several advantages, both for service providers and clients. This model ensures that the provider is fairly compensated for every hour worked, while also allowing clients to pay only for the services they receive. Below are some of the key benefits of using a time-based payment structure:

| Benefit | Description |

|---|---|

| Flexibility | This model allows for adjustments in the scope of work without the need for constant renegotiation of fees. If a project changes or evolves, the payment can easily be adjusted based on the actual time invested. |

| Fair Compensation | Service providers are paid for every hour they work, ensuring that they receive compensation for the time spent, regardless of the size or complexity of the project. |

| Transparency | Clients have a clear understanding of how their money is being spent. The breakdown of hours worked and tasks completed promotes trust and helps avoid misunderstandings. |

| Accurate Payment | Since payments are tied directly to time spent, clients can be confident that they are only paying for the exact amount of work completed, leading to a more accurate and fair transaction. |

| Adaptability | This model is ideal for projects where the full scope of work cannot be defined upfront, such as ongoing services or tasks with unpredictable timelines. |

Incorporating a time-based structure into your business not only ensures fairness but also builds a foundation of trust between you and your clients, contributing to long-term relationships and repeat business.

How to Track Your Hours Efficiently

Accurate time tracking is essential for ensuring that clients are billed correctly and that you are fairly compensated for your work. Efficient tracking methods can help you manage your time better, avoid errors in calculation, and keep a detailed record of your activities. Whether you’re working on multiple projects or handling a single task, there are several tools and strategies you can use to track your time effectively.

Use Time Tracking Software

One of the most reliable ways to track your hours is by using time tracking software. These tools automatically log the time spent on each task and often allow you to categorize different projects. Some software also provides reports and analytics, helping you assess how efficiently you’re working. Popular options include apps like Toggl, Clockify, and Harvest, all of which offer user-friendly interfaces and various integrations with project management tools.

Set Clear Work Intervals

If you prefer a manual approach, setting clear time intervals throughout your workday can help. Break your tasks into smaller segments and track the exact start and end times for each one. This method ensures that you’re accounting for all your time and prevents overestimating or underestimating the hours spent on each project.

Review Your Logs Regularly

Consistency is key to effective time tracking. Make it a habit to review your time logs at the end of each day or week. This review process helps you identify any discrepancies or missing hours and ensures that your records are always up-to-date. Regular checks also allow you to assess your productivity and make adjustments if necessary.

By using the right tools and setting up a solid tracking system, you can ensure that your work is properly documented and that you’re compensated for every minute spent on a task.

Common Mistakes in Time-Based Payment Records

While creating a time-based payment document may seem straightforward, there are several common mistakes that can lead to confusion, disputes, or delayed payments. These errors can be easily avoided with careful attention to detail. Below are some of the most frequent pitfalls when preparing such records.

- Not Documenting Time Accurately – Failing to track the exact hours spent on each task can result in discrepancies between what was worked and what is being charged. Always keep precise records to ensure accuracy.

- Missing Client Information – Omitting important client details such as full name, address, or contact information can cause confusion and delay processing. Make sure all client information is complete and up-to-date.

- Vague Descriptions of Work – A lack of clarity in describing the services provided can lead to misunderstandings. Be specific about the tasks performed to justify the time spent and the amount charged.

- Incorrect Calculation of Time – Adding up the hours incorrectly or forgetting to account for breaks or interruptions can lead to overcharging or undercharging. Double-check your calculations to ensure the total is accurate.

- Unclear Payment Terms – Not specifying payment deadlines, late fees, or accepted methods of payment can create confusion. Always outline the terms clearly to avoid disputes over when and how payments should be made.

- Failing to Include Taxes or Additional Fees – Not including taxes or additional service fees may cause financial complications. Make sure all applicable charges are included in your final record.

By paying attention to these common errors, you can ensure that your time-based payment records are accurate, professional, and free from misunderstandings, leading to smoother transactions and stronger client relationships.

Best Software for Creating Payment Records

When it comes to managing time-based payments, using the right software can make the process much easier and more efficient. The right tools can help automate calculations, streamline record-keeping, and ensure that every detail is accurately accounted for. Below are some of the best software solutions for creating and managing payment documents.

Top Features to Look For

Before diving into the options, it’s important to know what features to look for in payment management software:

- Ease of Use – A user-friendly interface that makes creating and customizing documents quick and simple.

- Customization Options – The ability to tailor documents to fit your business needs, such as adding custom fields or changing the layout.

- Automation – Automated time tracking, calculations, and reminders for overdue payments can save you time.

- Integration – Look for software that integrates with other tools, such as project management systems or accounting software, to make data transfer seamless.

- Reporting Features – Detailed reporting and analytics help you track your earnings and analyze trends over time.

Recommended Software for Payment Records

Here are some of the most popular and highly recommended tools for creating accurate and professional payment documents:

- FreshBooks – Known for its easy-to-use interface and extensive customization options, FreshBooks also offers time-tracking features and integrates with other business tools.

- QuickBooks – A powerful tool for both small businesses and freelancers, QuickBooks allows you to create professional documents, track time, and generate financial reports.

- Zoho Invoice – A highly customizable platform with automated payment reminders, recurring billing options, and integration with Zoho’s CRM system.

- Wave – A free option for small businesses, Wave offers an intuitive dashboard and automatic calculation of payments, along with invoicing features for service-based businesses.

- Harvest – Ideal for freelancers and teams, Harvest excels at time tracking and integrates with accounting software like QuickBooks and Xero, allowing seamless payment processing.

By choosing the right software, you can ensure that your time-based payment records are created efficiently and accurately, giving you more time to focus on delivering great service to your clients.

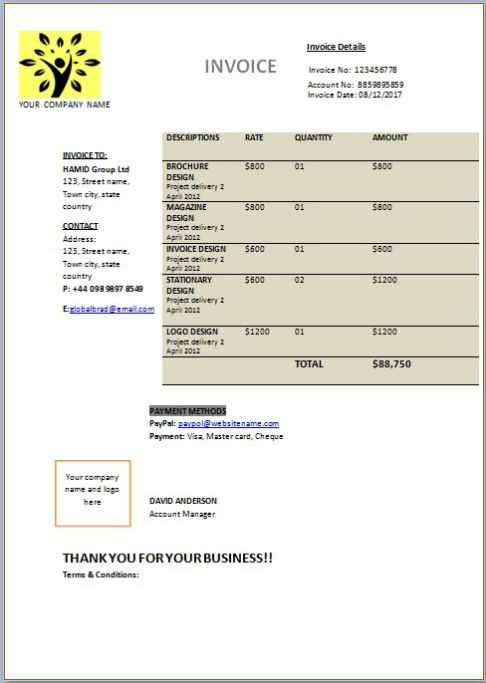

Creating a Professional Payment Record Design

Designing a professional document for time-based services is crucial for leaving a lasting impression on your clients. A well-designed record not only reflects your professionalism but also makes it easier for clients to understand the details of the services provided. A clean, structured layout ensures that all necessary information is easily accessible and clearly presented.

Here are some key tips for creating a visually appealing and functional payment document:

- Keep It Simple – Avoid cluttering the document with unnecessary elements. A simple design with clear headings and sections helps clients focus on the most important details.

- Use Consistent Branding – Incorporate your company logo, color scheme, and fonts to reinforce your brand identity. This adds a professional touch and makes your document easily recognizable.

- Focus on Readability – Use legible fonts and a clean layout to make the document easy to read. Consider the size and spacing of text to ensure that information is not overcrowded.

- Organize Information Logically – Divide the document into clear sections such as client details, services provided, time spent, and payment terms. This organization makes the document easy to navigate.

- Highlight Key Information – Use bold or larger fonts for important sections like the total amount due and payment terms. This draws attention to the critical information and helps prevent errors.

- Include a Professional Footer – A footer with your contact information, website, and payment methods adds credibility and ensures clients can easily reach you if needed.

By following these guidelines, you can create a payment record that not only looks professional but also enhances the clarity of your business transactions. A well-crafted design helps foster trust and ensures smooth communication with clients.

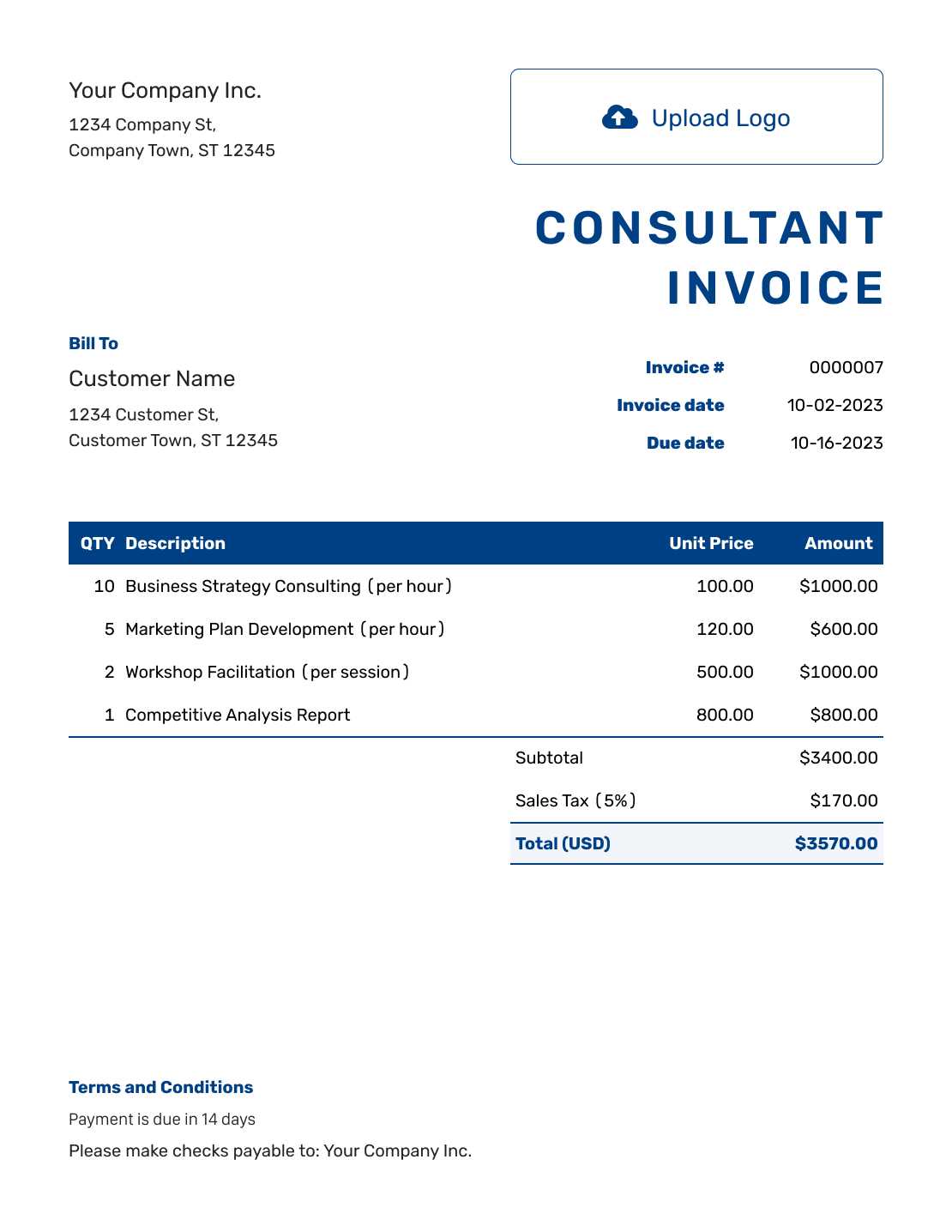

How to Include Taxes in Your Payment Record

Including taxes in your time-based payment record is an essential part of ensuring compliance with local laws and providing transparency to your clients. It’s important to account for the appropriate tax rates and display them clearly in the document to avoid confusion and ensure that your clients know exactly what they are being charged for. Below are some key steps to properly include taxes in your payment records.

| Step | Description |

|---|---|

| Identify Applicable Tax Rates | Research and determine the correct tax rate based on your location and the nature of the services provided. This could be a state, local, or national rate depending on your business setup. |

| Calculate the Tax Amount | Multiply the total amount due by the applicable tax rate to determine the tax amount. For example, if the total amount for services is $500 and the tax rate is 10%, the tax amount will be $50. |

| Show Tax Breakdown | Clearly display the tax amount separately in your payment record. This makes it easy for clients to see the tax calculation and avoid confusion. |

| Include Total with Tax | After showing the tax amount, include a final total that reflects the service cost plus tax. For example, the total would be $500 (service) + $50 (tax) = $550 (total). |

| Verify Tax Exemptions | If your client is tax-exempt or qualifies for reduced rates, make sure to mention this and adjust the total accordingly. |

By clearly outlining the taxes in your payment record, you ensure that your client is fully informed and that all tax requirements are met. Properly accounting for taxes also helps maintain compliance and avoids potential issues with tax authorities.

Payment Terms and Conditions

Establishing clear payment terms and conditions is a vital part of any service agreement. It ensures that both parties–the service provider and the client–are on the same page regarding expectations, deadlines, and payment processes. Clear terms help prevent misunderstandings, ensure timely payments, and protect both parties in case of disputes.

Payment Due Date

Always specify when the payment is due. This could be within a set number of days, such as 15, 30, or 45 days from the date the document is issued. Clearly state whether payments are due on receipt or if there’s a grace period.

Late Fees

To encourage timely payment, include a policy for late fees. Specify the amount or percentage of the outstanding balance that will be charged after the payment due date has passed. For example, you might charge 1.5% per month on overdue balances.

Accepted Payment Methods

Clearly outline which payment methods are accepted. Whether you prefer bank transfers, credit card payments, checks, or online payment platforms like PayPal or Stripe, make sure to list them so that your client knows their options for making payments.

Deposit or Prepayment Requirements

If you require a deposit or prepayment before beginning work, include this in the terms. This helps protect you in case the client decides to cancel the project midway. The deposit amount should be reasonable, often around 20–50% of the total service cost.

Dispute Resolution

In case of disagreements or disputes, it’s helpful to include a clause on how disputes will be handled. Specify whether the dispute will be settled through mediation, arbitration, or legal action, and which jurisdiction’s laws will apply in such cases.

Clearly defined payment terms and conditions not only set expectations but also promote professionalism and transparency in all financial dealings, ensuring smooth transactions for both parties.

Hourly vs Fixed Rate Payment Comparison

When determining how to charge for services, businesses often face the decision of whether to use a time-based pricing model or a fixed price model. Both methods have their advantages and disadvantages, and understanding these can help service providers choose the best approach for different types of projects and client relationships. Below is a comparison of both methods to help you determine which one best suits your needs.

Advantages of Time-Based Pricing

Time-based pricing is often used when the scope of a project is unclear, or when the work involved requires ongoing adjustments. Here are the main benefits:

- Flexibility – It allows for adjustments as the project evolves, meaning that clients only pay for the actual time spent on the work.

- Fair Compensation – You are paid for every hour worked, ensuring you are compensated for all of your time, even if the scope of work increases during the project.

- Transparency – Clients can track the time spent and know exactly what they are paying for, helping to build trust.

- Suitable for Unpredictable Work – Ideal for projects where the outcome or time commitment is difficult to estimate up front.

Advantages of Fixed Price Pricing

Fixed-rate pricing is more suitable for projects where the scope of work and timelines are clearly defined. Below are the benefits of this approach:

- Predictability – Clients know exactly how much they will be paying, which makes budgeting easier.

- Incentive for Efficiency – You are encouraged to work more efficiently to stay within the agreed-upon price, which can lead to higher profit margins.

- Clear Expectations – Both the client and the service provider have a clear understanding of the cost and deliverables from the start, reducing the likelihood of misunderstandings.

- Better for Well-Defined Projects – It works well when the project requirements, timeline, and final deliverables are fixed and easy to estimate.

Choosing between time-based or fixed-rate pricing depends on the type of project, the client’s preferences, and the level of flexibility required. Time-based pricing works best when the scope is uncertain, while fixed-rate pricing is ideal for projects with well-defined requirements and deliverables.

How to Send Your Payment Record

Once you’ve completed your work and prepared a detailed account of the time spent, the next step is to send the payment record to your client. This is an important part of the process, as it sets expectations for payment and provides a clear record of the transaction. The method you choose for sending your document can have a big impact on how quickly you are paid and how professional your communication appears.

Choose the Right Delivery Method

There are several ways to send your payment request to a client. Choosing the right method depends on the client’s preferences and the tools you have at your disposal. Below are some common delivery methods:

- Email – Sending the document via email is the most common and efficient way to deliver a payment request. Ensure that the file is in an easily accessible format, such as PDF, and include a brief note with payment instructions.

- Online Payment Systems – Many online platforms allow you to generate and send payment records directly through their system. Services like PayPal, Stripe, and Square offer a streamlined process where clients can view and pay immediately.

- Mail – Although less common today, sending a physical copy of the document may still be necessary for some clients. Make sure to use a professional envelope and provide all relevant payment details clearly on the document.

Ensure Professionalism and Clarity

Regardless of how you send your document, it’s crucial to maintain a professional tone and ensure that the payment details are clear and easy to understand. Here are some tips:

- Use Clear Subject Lines – When sending via email, use a subject line that clearly indicates the purpose, such as “Payment Request for [Project Name]”.

- Include Payment Instructions – Make sure to include all relevant information, such as accepted payment methods, payment deadlines, and any additional fees for late payments.

- Follow Up if Needed – If you don’t receive payment within the agreed timeframe, send a polite reminder. This helps ensure timely payments while maintaining professionalism.

By following these steps, you can send your payment records efficiently, professionally, and in a way that facilitates quick and accurate payment.

Setting the Right Rate for Your Services

Determining the right price for your time and expertise is crucial for sustaining a profitable business. While you want to be competitive and fair to your clients, you also need to ensure that your rate reflects the value of the services you provide. Setting the right price involves balancing several factors, including your skills, industry standards, and the market demand for your services. Below are some key considerations for setting an appropriate rate.

Factors to Consider When Setting Your Rate

There are several factors that should influence the rate you charge for your services. These include:

- Your Experience and Expertise – If you have specialized skills or extensive experience, you can generally charge higher rates. Consider your level of expertise when determining your price.

- Industry Standards – Research what other professionals in your field are charging. Understanding the average rate in your industry helps you remain competitive and ensures you’re not undercharging.

- Market Demand – If the demand for your services is high, you can likely charge more. Conversely, if the market is saturated with similar offerings, you may need to adjust your pricing accordingly.

- Client Type – Different clients may have different budgets. Large corporations may be willing to pay more than small startups or individuals. Adjust your rates based on your client’s financial capacity.

- Geographic Location – Rates can vary significantly based on location. Consider local economic conditions, as well as regional differences in pricing standards, when setting your rate.

How to Calculate Your Rate

Once you’ve considered the factors above, it’s time to calculate your rate. Here’s a simple method to help you determine an appropriate price:

- Calculate Your Desired Annual Income – Start by determining how much you want to earn per year. This can be based on your personal financial goals.

- Estimate Billable Hours – Determine how many hours you can realistically work each week and multiply that by the number of weeks you’ll work each year. For example, if you plan to work 40 hours per week and 50 weeks per year, you’ll have 2,000 billable hours.

- Factor in Overhead Costs – Don’t forget to include business expenses such as software, equipment, taxes, and insurance when calculating your rate. These should be factored into your pricing structure to ensure you’re covering your costs.

- Divide Your Income Goal by Billable Hours – To calculate your hourly rate, divide your desired income by the total number of billable hours. For example, if your income goal is $100,000 and you plan to work 2,000 hours, your rate would be $50 per hour.

By carefully considering these factors and calculating your rate based on your financial goals and market conditions, you can set a price that reflects the true value of your services while ensuring the sustainability of your business.

Payment Records for Freelancers

For freelancers, managing payments and ensuring smooth financial transactions with clients is an essential part of the business. A well-structured document helps to clearly outline the work completed, the rates, and the total amount due. It also serves as a professional tool to maintain transparency and avoid any misunderstandings regarding payment. Below are the key elements of a well-designed payment record that every freelancer should consider using.

Essential Features for a Freelancer’s Payment Record

When creating a payment document for clients, there are several key features that should always be included to ensure clarity and professionalism:

- Contact Information – Include your name, business name (if applicable), address, phone number, and email, as well as the client’s contact details.

- Project Description – Clearly describe the work completed, including milestones or specific tasks. This gives the client a detailed breakdown of the services rendered.

- Payment Due Date – Set clear expectations by specifying the date by which payment is due. This helps avoid confusion and ensures timely payments.

- Payment Method – Clearly state the methods of payment you accept, such as bank transfers, PayPal, checks, or credit card payments.

- Total Amount Due – Provide a breakdown of the charges, including any applicable taxes or additional fees, and clearly display the total amount due at the end.

Benefits of Using a Payment Record

Having a structured and professional payment document offers numerous benefits for freelancers:

- Professionalism – Sending a detailed, well-organized payment document shows clients that you are professional and serious about your business.

- Clear Payment Terms – A payment document makes expectations clear, both for you and your client, ensuring that the transaction is completed without disputes.

- Trackable Records – Having a formal document for each payment helps you track your earnings, making it easier for tax purposes and financial planning.

- Client Trust – Providing a transparent and clear record can help build trust with clients, which may encourage repeat business and referrals.

By using a well-organized payment document, freelancers can streamline their payment process, reduce potential conflicts, and present themselves in a more professional light to clients.

What to Do if Payment is Delayed

When payments are delayed, it can be frustrating and disruptive to your cash flow. However, it’s important to handle such situations professionally and strategically to ensure you maintain good client relationships while protecting your business interests. There are several steps you can take to address delayed payments without causing unnecessary conflict.

Steps to Take When Payment is Late

If your payment is overdue, follow these steps to resolve the situation effectively:

- Check the Terms – Review the original agreement or payment record to confirm the due date and any agreed-upon terms, such as late fees or payment methods. This will ensure that you have all the correct information when you reach out to the client.

- Send a Polite Reminder – The first step is usually to send a friendly reminder email or message. Sometimes clients may overlook the due date, and a gentle nudge can prompt them to make the payment.

- Offer Flexible Payment Options – If the client is facing financial difficulties, consider offering payment plans or extensions. This can help maintain the relationship while ensuring you still get paid.

- Enforce Late Fees (If Applicable) – If your payment record includes terms for late fees, it’s time to apply them. Ensure that the client is aware of these fees and their accumulation to encourage prompt payment in the future.

When to Take Further Action

If polite reminders and flexible options don’t result in payment, you may need to escalate the situation. Here are additional steps to consider:

- Set a Final Deadline – Politely but firmly set a final deadline for payment. Make sure the client knows that this is the last opportunity to pay before more serious actions are taken.

- Use a Collection Service – If the payment remains outstanding after several attempts, you may consider using a professional collection agency. This should only be a last resort, as it can strain the relationship with your client.

- Seek Legal Action – In extreme cases, if the amount due is substantial and the client is unresponsive to all other efforts, seeking legal action or small claims court may be necessary. However, this step can be costly and time-consuming, so it should be approached carefully.

Payment Tracking and Prevention Tips

To avoid delayed payments in the future, consider implementing the following practices:

| Action | Benefit |

|---|---|

| Clear Payment Terms | Clear terms in your contract or agreement set expectations and reduce the chance of misunderstandings. |

| Invoice Reminders | Sending reminders before and after the due date can prompt clients to pay on time. |

| Incentives for Early Payments | Offering small discounts for early payment can encourage clients to pay ahead of the due date. |

By addressing delayed payments promptly and professionally, and implementing preventive strategies, you can ensure that your

Legal Considerations for Payment Documents

When it comes to managing financial transactions with clients, there are several legal aspects that freelancers and businesses must consider to ensure their payment records are both effective and compliant with the law. By understanding and adhering to these legal considerations, you can avoid potential disputes and ensure that your payment requests are enforceable. Below are the key legal factors to consider when preparing and sending payment documents.

Key Legal Elements to Include

To make your payment documents legally binding and clear, it is essential to include the following elements:

- Clear Terms of Service – Your contract or agreement with the client should include explicit terms outlining the services to be provided, the amount to be paid, and the payment schedule. These terms should be agreed upon before any work begins.

- Payment Due Dates – Clearly state when payment is due. This helps avoid ambiguity and provides a clear timeline for both parties to follow. Also, include any consequences for late payments, such as late fees or interest charges.

- Legal Jurisdiction – Specify the legal jurisdiction that will govern the payment document. This is particularly important in international transactions, as it dictates which country’s laws apply in case of a dispute.

- Detailed Descriptions of Work – Include a detailed description of the services rendered, materials used, or hours worked. This ensures both parties are on the same page regarding what was agreed upon and what has been delivered.

Compliance with Tax Laws

In addition to contractual elements, it is important to ensure that your payment records comply with local tax regulations. This includes:

- Proper Tax Identification – Make sure to include your tax identification number (TIN) or employer identification number (EIN), depending on your jurisdiction, to properly identify your business.

- Sales Tax – If applicable, include the sales tax or value-added tax (VAT) in the payment record, ensuring it is calculated correctly according to your local laws.

- Tax Deductions – Be aware of any allowable tax deductions and ensure that they are accounted for in your financial records. This can help reduce taxable income and maximize your business’s profitability.

By understanding and applying these legal elements, you can create payment records that are not only clear and professional but also protect your interests and ensure compliance with relevant laws.

How to Handle Multiple Clients on One Invoice

When working with several clients on a single project or providing services to multiple clients within a billing cycle, managing payments and tracking work can become complex. It’s important to clearly separate each client’s charges while maintaining an organized structure for your payment record. Here’s how to handle multiple clients in a single document effectively.

Steps for Including Multiple Clients in One Payment Record

To avoid confusion and ensure clarity, follow these steps when creating a payment record for multiple clients:

- Separate Sections for Each Client – Dedicate a distinct section for each client. Include their name, contact information, and the specific services rendered. This helps keep their charges and payment details clearly organized.

- Breakdown of Charges – Clearly list the tasks, hours, or services provided to each client, along with the respective costs. Ensure that the charges for each client are itemized separately, so there is no confusion regarding how the total amount is calculated.

- Individual Due Dates – If the clients have different payment terms or due dates, include these separately for each client. This helps ensure that payments are collected according to each client’s agreed-upon timeline.

- Total Amount for Each Client – Summarize the total amount due from each client at the end of their section. This helps them quickly see how much they owe.

Example Layout for a Payment Record with Multiple Clients

Here’s an example of how to structure a payment document for multiple clients:

| Client Name | Services Rendered | Amount Due |

|---|---|---|

| Client A | Website Design, Copywriting | $1,200 |

| Client B | SEO Services | $800 |

| Client C | Consultation, Branding | $500 |

Considerations for Efficiency

- Use an Accounting Software – Tools like QuickBooks or FreshBooks can help automate the process of creating and sending payment records for multiple clients, saving time and reducing errors.

- Offer Group Discounts – If the work is related or part of a package deal, consider offering a discount for the combined services, making it easier for clients to accept a single document.

- Clarify Payment Methods – Ensure that the payment options are clearly stated for each client, especially if the payment methods differ between them.

Handling multiple clients on one payment document requires attention to detail and clarity. By organizing the information effectively, you’ll make the process easier for both you and your clients, ensuring smooth transactions and professional relationships.