Free Jewellery Invoice Template for Easy Customization and Professional Billing

When running a business that involves selling precious items, clear and professional billing is essential for maintaining customer trust and ensuring smooth transactions. An organized record of sales helps both the seller and the buyer keep track of purchases, payments, and other essential details. Whether you’re a small independent designer or part of a larger company, the ability to present a polished and legally compliant sales document is crucial.

Having the right structure for these documents not only streamlines the financial process but also elevates your brand image. By using a well-crafted format, you can ensure accuracy in pricing, taxes, and any additional fees, which helps to avoid confusion. With customizable options, such records can be tailored to suit your specific needs while maintaining a professional look and feel. This article explores the key elements to consider when creating such documents and offers tips for maximizing their effectiveness in your business operations.

Jewellery Invoice Template Overview

In any business where valuable goods are exchanged, having a clear, standardized document for recording transactions is essential. These documents not only serve as proof of sale but also provide important details like item descriptions, pricing, payment terms, and customer information. A well-designed form ensures that all the necessary elements are included, helping both parties stay organized and avoid potential misunderstandings.

For businesses in the precious goods sector, creating such documents from scratch can be time-consuming. This is where a pre-designed structure comes in handy. By using a customizable format, sellers can quickly adapt the document to meet their needs without starting from zero each time. This helps streamline the billing process and maintain consistency across all sales, while still allowing for personalization to reflect the unique nature of each transaction.

Whether you are an independent artisan or part of a larger operation, a structured document can enhance your professionalism and establish trust with your clients. It provides clarity on the specifics of the sale, including any taxes, discounts, and payment methods, which can be crucial in preventing disputes and ensuring smooth financial management.

What is a Jewellery Invoice?

A sales document is a formal record of a transaction between a seller and a buyer. It serves as an official acknowledgment that goods or services have been provided, detailing the price and terms agreed upon. Such documents are crucial for both the buyer and seller as they ensure transparency and provide a point of reference for any future inquiries or disputes.

Purpose and Importance

In any business dealing with valuable items, these records are essential for keeping track of sales, managing inventory, and maintaining accurate financial records. They provide a clear summary of the transaction, including item descriptions, prices, and applicable taxes, offering a reliable reference for both parties. A well-structured document helps prevent misunderstandings, especially when dealing with high-value products or bespoke items that may require detailed specifications.

Key Features of a Sales Document

A properly formatted document typically includes information such as the seller’s contact details, the buyer’s information, the date of the transaction, a description of the goods sold, unit prices, and the total amount due. It may also outline payment terms, delivery details, and any applicable warranties. These elements help ensure that all aspects of the sale are clearly understood, creating a professional and transparent process.

Importance of Accurate Invoices for Jewellers

For any business, maintaining precise records of sales and payments is vital for smooth operations. This is particularly true for artisans and retailers working with high-value goods. Clear, well-documented transactions ensure that both the seller and the buyer have a mutual understanding of the deal, reducing the risk of disputes and improving overall professionalism.

Benefits of Accuracy in Sales Documents

Ensuring that all details are correct in your sales documents can prevent a range of issues. Some key advantages include:

- Financial Clarity: A well-detailed record helps businesses track revenue, monitor cash flow, and manage their accounting effectively.

- Legal Protection: Accurate records protect against potential legal issues, should the need for proof of sale or payment arise.

- Customer Trust: Clear, professional documents help build credibility and customer confidence, which is especially important in the luxury market.

- Streamlined Communication: Providing complete details in the sales paperwork reduces the need for follow-up clarification and improves customer satisfaction.

Consequences of Errors in Documentation

Small mistakes in a sales record can lead to significant issues down the line. Common consequences of inaccurate records include:

- Disputes: Incorrect pricing or missing details can lead to misunderstandings and customer complaints.

- Delayed Payments: Errors in payment terms or amounts could result in delayed or missed payments, affecting cash flow.

- Tax Issues: Incorrectly listed sales amounts or tax details can cause complications during tax filing and audits.

Ensuring accuracy in all aspects of your sales paperwork not only safeguards your business operations but also fosters long-term customer relationships and builds trust in your brand.

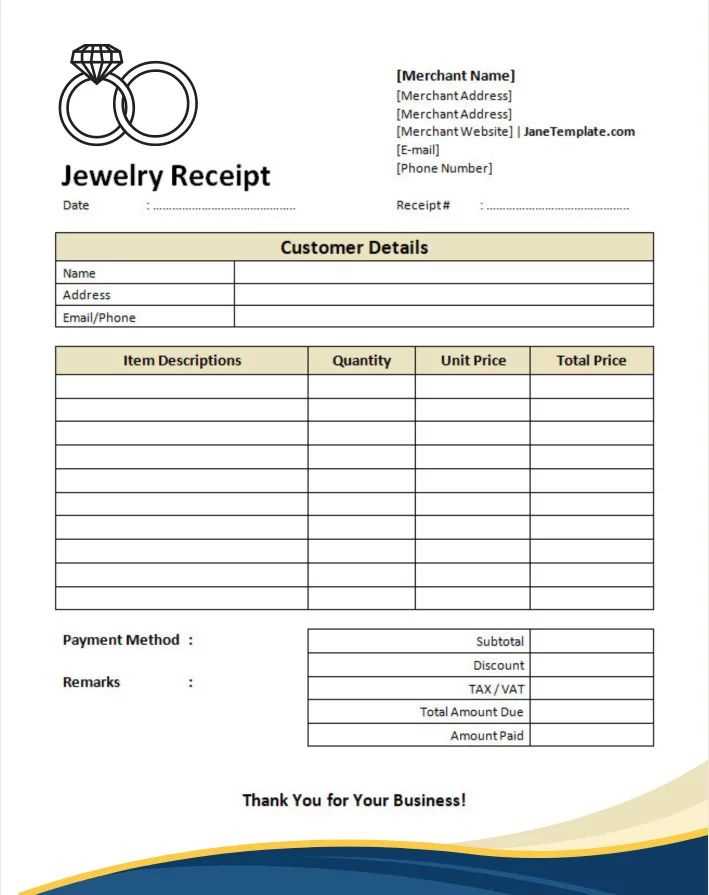

Key Elements of a Jewellery Invoice

For any business transaction, especially one involving valuable items, it is essential to have a document that accurately reflects the terms of the sale. This formal record should include all the necessary details to ensure clarity and prevent confusion. A well-structured document serves as a reference for both parties, keeping the transaction transparent and organized.

Essential Information to Include

When creating a sales record, certain details are non-negotiable. These key components ensure that the document is complete and legally sound:

- Business Information: The seller’s name, contact details, and business address should be clearly stated, along with any relevant registration or tax identification numbers.

- Buyer’s Information: The buyer’s name, address, and contact details help ensure that the document accurately reflects the transaction and can be used for future communication.

- Transaction Date: The exact date of the sale should be included to provide a reference point for both parties and for accounting purposes.

- Product Description: Clear and detailed descriptions of the items being sold are essential, especially when dealing with customized or high-value products.

- Pricing Information: This includes individual item prices, total amounts, applicable taxes, discounts (if any), and the overall total.

- Payment Terms: Outlining payment methods, due dates, and any installment details ensures that both parties agree to the payment process and timeline.

Optional but Helpful Details

While the above information is critical, additional elements can further enhance the document’s clarity and usefulness:

- Shipping Information: If applicable, providing details about shipping methods, charges, and expected delivery dates can avoid future misunderstandings.

- Order Number or Reference: Including a unique order number helps keep records organized and easily traceable in case of any follow-up queries.

- Warranty and Return Information: If any warranties or return policies apply, it is important to clearly state them on the document to manage customer expectations.

By including these elements, businesses can ensure that their records are not only accurate but also professional, helping to build trust and promote smooth transactions with customers.

How to Create a Jewellery Invoice

Creating a document to formally request payment for a piece of fine craftsmanship involves several key elements. The goal is to ensure clarity for both the seller and the buyer, while also providing the necessary legal information. A well-organized bill should include a clear breakdown of all charges, details of the transaction, and the terms of payment.

Here are the essential steps to follow when preparing this type of transaction record:

- Include Your Business Information: Start by adding your business name, address, and contact details. This makes it easy for the customer to reach you if they have questions or need further clarification.

- Provide Customer Details: Include the buyer’s name, address, and contact information. This helps ensure the document is tailored to the specific transaction.

- List the Items or Services Provided: Clearly describe the products or services, including their materials, weights, and any distinguishing features. Be precise to avoid misunderstandings.

- Show Prices and Quantities: Indicate the unit price and quantity for each item, as well as the total cost for that particular line.

- Include Taxes and Discounts: Be sure to add any applicable taxes, and note if a discount was applied to the purchase. The net total should reflect all adjustments.

- State Payment Terms: Specify the agreed-upon payment method, due date, and any late fees if applicable. This helps set clear expectations for both parties.

- Provide a Unique Reference Number: Assigning a reference number ensures you can track the transaction easily for accounting purposes.

- Terms and Conditions: Add any relevant policies, such as return or warranty information, to avoid confusion down the line.

Once all the information is gathered, ensure that the document is professionally formatted and easy to read. This approach not only ensures legal compliance but also fosters trust between the business and its customers.

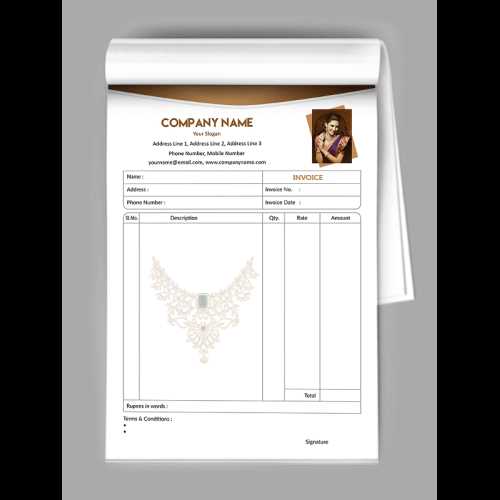

Customizing Your Jewellery Invoice Template

Tailoring your billing document to reflect your brand identity and meet your specific needs is an essential step in maintaining a professional appearance. Personalization not only improves the customer experience but also ensures that every transaction is documented in a consistent and clear manner. By adjusting various elements, you can create a unique and functional record that aligns with your business style and operational requirements.

Adjusting Layout and Design

The visual presentation of your billing record plays a significant role in making a positive impression. You can customize the layout by changing the font style, size, and color to match your company’s branding. Additionally, incorporating your logo and adjusting margins or spacing ensures the document is easy to read while still appearing polished.

Adding Custom Fields

Adding custom fields to the document allows you to provide more detailed information. Some common additions include payment terms, item descriptions, and serial numbers for products. These fields help avoid ambiguity and create a more thorough record for both you and your client.

| Field Name | Description |

|---|---|

| Product Description | A detailed explanation of the item sold, including any distinguishing features or materials used. |

| Serial Number | A unique identifier for each item, useful for inventory tracking or warranty claims. |

| Payment Instructions | Specific guidelines on how the client can make a payment, including available methods. |

Customizing these elements allows you to enhance your document’s functionality and create a better experience for both your business and your customers.

Free Jewellery Invoice Templates for Business

For small businesses, finding cost-effective solutions to streamline administrative tasks is essential. One of the most practical tools is the use of free billing documents, which help you maintain professionalism without any added expenses. These ready-made forms are designed to simplify the process of requesting payment while ensuring all necessary details are included.

Free templates are available for various business needs, offering flexibility to accommodate different types of transactions. They come in a range of designs, from simple formats to more elaborate ones, depending on your business style and preferences. These documents can be easily customized with your branding, business details, and transaction specifics.

Using free options provides the advantage of saving time and money. You don’t need to hire a designer or spend time creating a document from scratch. Instead, you can download a pre-made format and make minor adjustments to suit your requirements. This is especially beneficial for new or growing businesses with limited budgets.

Whether you run an online store or a physical shop, a reliable and professional-looking form ensures trust between you and your clients. With a free solution, you can focus on what matters most–running your business–while keeping your administrative tasks organized and efficient.

Best Software for Jewellery Invoice Creation

Creating professional billing documents can be time-consuming without the right tools. Fortunately, there are several software solutions designed to simplify the process, making it quicker and more efficient. These programs allow you to generate detailed transaction records, customize layouts, and track payments all in one place. Choosing the right software can save time and ensure that every detail is captured accurately.

Key Features to Look For

When selecting software for generating your billing documents, consider the following features:

- Customizability: The ability to adjust templates to match your brand identity and include specific details related to your business.

- Ease of Use: An intuitive interface that allows you to create and send documents quickly without a steep learning curve.

- Integration with Payment Systems: Directly linking with payment gateways to track transactions and reduce manual data entry.

- Multi-Device Compatibility: Accessing and editing documents from various devices, such as desktops, laptops, and mobile phones, ensures flexibility.

Top Software Solutions

| Software | Key Features | Best For |

|---|---|---|

| FreshBooks | Simple interface, automated reminders, and customizable designs. | Small businesses needing an easy-to-use, all-in-one tool. |

| QuickBooks | Comprehensive financial tracking, invoicing, and reporting tools. | Businesses looking for detailed financial management alongside billing. |

| Zoho Invoice | Customizable templates, multi-currency support, and automated workflows. | Global businesses or freelancers who need flexible billing options. |

| Wave | Free, easy-to-use software with basic accounting features and customizable forms. | Startups or small businesses on a tight budget. |

Using the right software can make your billing process more efficient, professional, and accurate, saving you time and improving your customer experience.

Legal Requirements for Jewellery Invoices

When creating a formal transaction document, there are certain legal standards and regulations that must be followed to ensure compliance with local and international business laws. These requirements vary by country and region, but they generally include necessary information to protect both the business and the customer. Understanding these legal obligations is crucial to avoid potential disputes and ensure the accuracy of all financial records.

Key Legal Elements to Include

Every business must include specific information in their billing documents to comply with regulations. The following elements are typically required:

- Business Details: Include the business name, address, and contact information, as well as any relevant registration numbers (e.g., tax ID or VAT number).

- Client Information: The buyer’s name and address are essential for identifying the parties involved in the transaction.

- Transaction Date: Clearly stating the date of the transaction or when the payment is due helps establish timelines for legal and tax purposes.

- Itemized List: Detailed descriptions of the goods or services sold, including quantities, prices, and any applicable taxes or discounts.

- Payment Terms: Clearly outlining the terms of payment, including due date

Common Mistakes in Jewellery Invoicing

Creating accurate and professional transaction records is crucial for any business, but mistakes in these documents can lead to financial confusion, delays in payments, and potential legal issues. Understanding the most common errors in documenting transactions helps businesses avoid costly misunderstandings and maintain smooth operations. Even small mistakes can have significant consequences, from incorrect totals to missing details.

One of the most common errors is failing to include all the necessary information. When key details like the buyer’s contact information, the transaction date, or an accurate item description are left out, it can create confusion or delays in payment. Another frequent mistake is incorrectly calculating totals or taxes, which can lead to discrepancies that harm your business reputation.

Another typical issue is using non-professional or unclear formatting, which can make the document difficult for customers to read and understand. Lack of clarity in payment terms or failure to specify deadlines also often leads to misunderstandings. Additionally, neglecting to update outdated details, such as your business address or payment methods, can create unnecessary complications for both parties.

Avoiding these mistakes ensures that every transaction is transparent, professional, and legally compliant, fostering trust between your business and your customers.

How to Add Taxes to Jewellery Invoices

When preparing a formal document for a transaction, it’s important to include taxes correctly to comply with local regulations. This ensures that both your business and your customers are clear about the total cost, including any applicable tax rates. Tax calculations may vary depending on your location and the type of products or services offered, so it’s crucial to know how to apply these taxes accurately.

The first step in adding taxes is to determine the appropriate tax rate for your area. Different regions may have varying tax rates, and some products or services may be subject to special tax categories or exemptions. For instance, some areas may apply a higher sales tax on luxury goods, while others may exempt certain categories altogether.

Once you know the tax rate, it’s time to calculate the tax amount. The simplest method is to multiply the subtotal of the transaction by the tax rate percentage. For example, if the total before tax is $100 and the tax rate is 10%, the tax amount would be $10, making the total due $110.

Including taxes on the document is just as important as the calculation itself. Make sure to clearly separate the base cost from the tax amount to avoid confusion. Include a line item for taxes, specifying the tax rate and the total tax charged. This transparency helps build trust and ensures that your customer understands the full breakdown of costs.

Subtotal Tax Rate Tax Amount Total Due $100 10% $10 $110 By following these steps and keeping tax calculations clear and accurate, you ensure that all transactions are handled professionally and in accordance with local tax laws.

Jewellery Invoice Template for Online Stores

For online businesses, creating professional and clear transaction records is essential to maintain customer trust and ensure smooth financial operations. An organized document for each sale helps confirm the details of the transaction and provides both the business and the customer with necessary proof of purchase. In the case of e-commerce, where transactions are often completed digitally, having a reliable and customizable format can streamline the process and enhance the buyer’s experience.

For online shops, it’s crucial to provide a document that not only lists the items purchased but also includes essential details such as payment methods, shipping information, and delivery dates. This transparency helps customers feel more confident about their purchase and provides the business with a reliable record for future reference, returns, or exchanges.

A well-structured document for an online store should include the following key components:

- Order Number: A unique identifier for each transaction to easily track orders.

- Customer Details: Name, address, and contact information of the buyer for shipping and communication purposes.

- Itemized List: Clear descriptions of each item, including quantities, prices, and any customization options.

- Shipping Information: Delivery method, expected shipping time, and tracking number if applicable.

- Payment Summary: Total amount, taxes, discounts, and payment method used.

For online stores, offering a simple yet comprehensive document not only helps with legal and accounting purposes but also strengthens customer relationships by demonstrating professionalism and attention to detail. Providing a digital copy of this document instantly after a purchase further enhances the customer experience, allowing them to review all transaction details easily.

How to Include Discounts on Invoices

Offering discounts is a common practice for businesses to attract customers, increase sales, or promote certain products or services. When creating a transaction record, it’s essential to clearly show any discounts applied to the purchase to ensure transparency and maintain customer trust. Properly documenting discounts also helps with accurate accounting and avoids confusion during payment processing.

Here are the key steps to correctly include discounts on your transaction documents:

- Specify the Type of Discount: Clearly state whether the discount is a percentage (e.g., 10% off) or a fixed amount (e.g., $5 off). This will help the customer understand the savings they’re receiving.

- Apply the Discount to the Subtotal: Ensure that the discount is calculated based on the total cost before taxes are applied. If it’s a percentage discount, calculate the discount amount and subtract it from the subtotal.

- Clearly List the Discount: Include a separate line item for the discount, showing the amount or percentage and the total discount applied. This ensures there is no confusion about the discount details.

- Show the Updated Total: After applying the discount, ensure the updated total reflects the reduction. This final amount is what the customer will pay, and it should be clearly marked as the “total due” on the document.

- Include Discount Codes or Promotions: If the discount is linked to a special offer or promo code, make sure to include that information on the document for reference.

By following these steps, you ensure that discounts are applied accurately and clearly, providing a transparent and professional transaction record for both your business and your customers.

Design Tips for Professional Jewellery Invoices

Creating an elegant and functional billing document is crucial for any business. A well-structured layout not only reflects the professionalism of your brand but also ensures clarity and ease of understanding for your clients. Below are key design tips to enhance the overall presentation of your billing statements.

- Use a Clean and Simple Layout: Keep the design minimalistic with plenty of white space. Avoid cluttered sections, which can make the document harder to navigate.

- Incorporate Your Brand Elements: Include your logo, business name, and brand colors to create a cohesive look that aligns with your identity.

- Organize Information Clearly: Ensure that the key details–such as item descriptions, pricing, and payment terms–are easy to find. Use tables or grids for better structure.

- Font Choice and Size: Select readable fonts, ideally sans-serif, and maintain consistency in size for headings and body text. Ensure the text contrasts well with the background.

- Highlight Important Information: Use bold or a larger font size to emphasize critical elements, like due dates or total amounts due, so they stand out immediately.

- Offer a Summary Section: A brief summary at the bottom or top of the document can make it easier for the client to quickly review key charges or totals.

- Include Contact Information: Don’t forget to add your contact details, including email and phone number, in case clients have questions or need assistance.

Integrating Payment Methods on Jewellery Invoices

Including clear and efficient payment options in your billing documents is essential for a smooth transaction process. By offering multiple methods and clear instructions, you ensure convenience for your clients and expedite the payment cycle. Below are important considerations when adding payment options to your statements.

Offer a Variety of Payment Methods

Provide multiple payment choices to accommodate your clients’ preferences. Common methods include bank transfers, credit card payments, online payment platforms, and checks. The more options you offer, the more likely your clients will complete their payments quickly.

Clear Payment Instructions

It is crucial to include detailed instructions for each payment option. For bank transfers, list your account number, bank name, and any other relevant details. For online payments, provide links to the payment portal. Additionally, clearly state the due date and any late payment fees, if applicable.

- Bank Transfer: Provide the bank details and ensure they are easy to find.

- Online Payment: Include a clickable link to the payment platform and instructions for use.

- Credit Card: Mention if credit card payments are accepted, along with any necessary information.

- Checks: If accepting checks, provide the mailing address and instructions on where to send the payment.

By ensuring payment methods are clear and easy to use, you will enhance client satisfaction and improve your business’s cash flow.

How to Track Jewellery Orders with Invoices

Monitoring and managing orders efficiently is essential for maintaining smooth business operations. By integrating a structured system into your billing documents, you can easily track the status of each order, ensuring that both clients and businesses stay informed throughout the process.

Include a Unique Order Number

Each order should have a unique identifier, typically an order number, that is included on all related documents. This number acts as a reference point for both the business and the customer. It can be used to quickly locate the details of an order and track its status at any stage.

Provide Order Status and Timeline

Make it clear where the order is in the process by including a section that outlines key milestones, such as payment received, item prepared, and shipped. This helps clients stay informed and can also serve as a reminder for businesses to follow up on outstanding tasks.

- Order Number: A unique identifier for easy reference.

- Status Updates: Include tracking information, payment status, and shipping updates.

- Timeline: Provide estimated dates for completion, delivery, or dispatch.

By implementing these features, you enhance transparency and ensure efficient communication with your clients, making the order process smoother for both parties.

Printing and Sending Your Jewellery Invoices

Once your billing document is ready, it’s important to ensure that it reaches your clients in a professional and timely manner. Whether you choose to send it digitally or through traditional mail, the method of delivery should align with your business practices and client preferences. Below are essential tips for printing and sending your billing documents effectively.

Printing Your Billing Documents

When preparing printed versions, ensure that the document is of high quality, with clear text and images. Use good-quality paper to give a professional appearance, and ensure all details are legible. If your business includes any branded materials, consider printing on customized stationery to reinforce your identity.

Sending via Email or Postal Service

Decide whether you will send the document digitally or by mail based on your customer’s preferences. Sending via email is fast and cost-effective, but make sure the document is in a secure format, like PDF, to preserve formatting and prevent alterations. For physical delivery, choose a reliable postal service to ensure the document arrives on time and in good condition.

- PDF Format: Send via email using a secure, non-editable file format.

- Postal Delivery: Use quality envelopes and select a trustworthy courier to ensure timely delivery.

- Customization: Consider using branded paper or envelopes for a more personalized touch.

By carefully considering how to print and send your documents, you ensure that your communications are both professional and efficient, meeting your client’s needs and enhancing your brand’s credibility.

Why Choose a Digital Jewellery Invoice Template

Opting for a digital version of your billing document offers numerous advantages over traditional paper methods. The convenience, flexibility, and efficiency of digital files make them a preferred choice for many businesses. Below are some key reasons why using an electronic version is a smart decision.

Time-Saving and Convenient

With a digital billing solution, you can generate and send documents instantly, without waiting for printing or postal delays. The process is quick, and clients receive their statements in a matter of minutes, allowing for faster payments and a more efficient workflow.

Cost-Effective and Eco-Friendly

Digital billing reduces the costs associated with paper, printing, and postage. It also helps minimize your environmental impact, as there’s no need for physical materials or transportation, contributing to a greener, more sustainable approach to business.

Advantages Details Instant Delivery Send your documents immediately via email or secure portals. Lower Costs Eliminate printing and shipping fees by opting for digital formats. Enhanced Security Use encrypted formats, ensuring the privacy of your business and clients. Easy Storage and Access Store digital files securely, allowing for easy access and retrieval when needed. By choosing digital versions, businesses not only improve efficiency but also save valuable resources, allowing them to focus on what truly matters–providing exceptional service to their clients.