Editable Free Invoice Template PDF for Easy Use

Managing business transactions efficiently requires precise and professional documentation. Having the right tools to create professional receipts or bills can save time and prevent mistakes. With the right digital forms, creating detailed records becomes a quick and straightforward task.

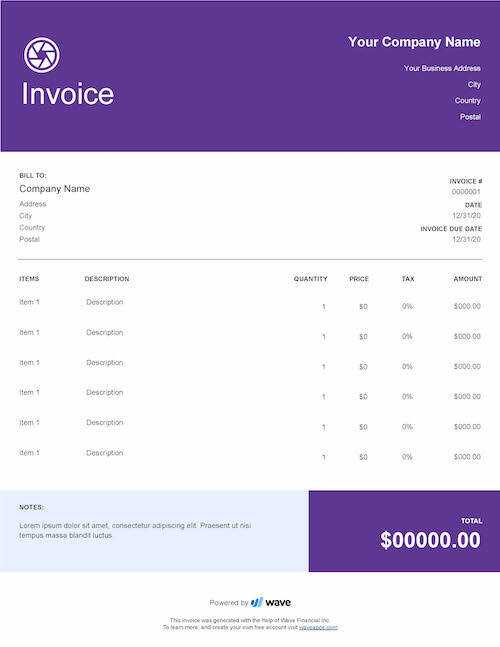

Whether you run a small enterprise or handle freelance work, you need reliable methods to issue financial statements. Customizable documents allow you to easily adjust them to your specific needs, ensuring they reflect your brand identity and meet legal standards. You can update these records as required, from adding items to adjusting amounts or applying special terms.

By using customizable documents, businesses can maintain a consistent and organized approach. These forms are designed to simplify financial reporting while remaining flexible enough for a variety of industries. You can tailor them to suit different situations and quickly produce clear, accurate records that are easy to understand for both you and your clients.

Customizable Document Forms for Billing

Creating tailored documents for financial transactions allows businesses to streamline their processes and maintain professionalism. These digital records provide the flexibility to adjust and update details, making it easier to cater to different client needs. They can be used for a variety of purposes, from issuing receipts to documenting services rendered or products sold.

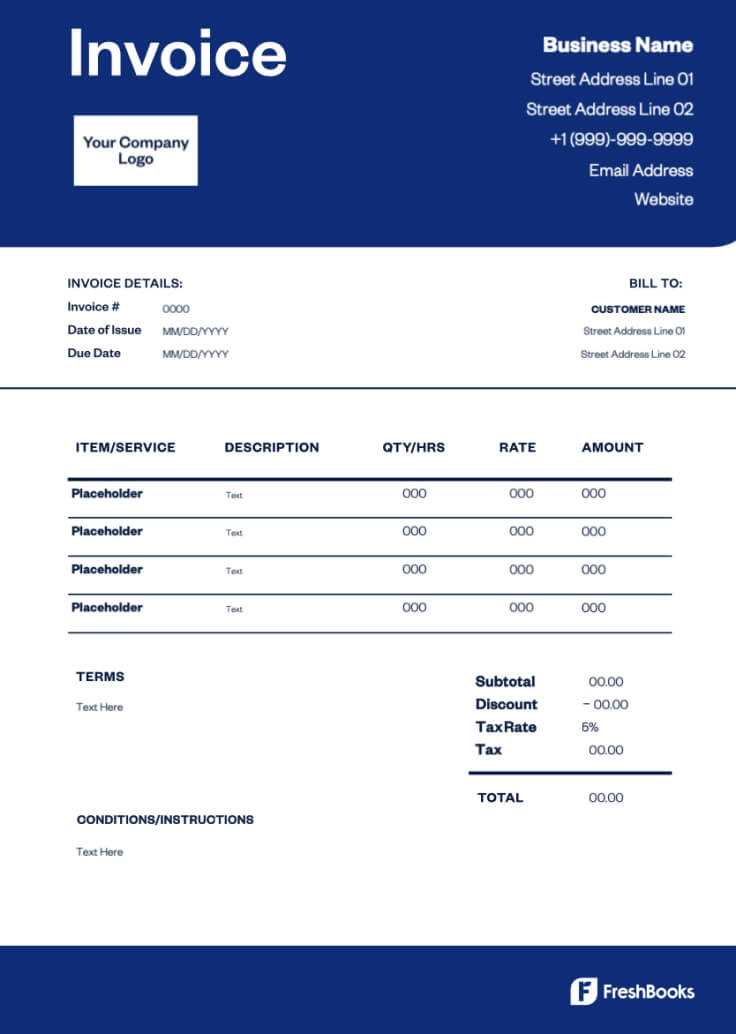

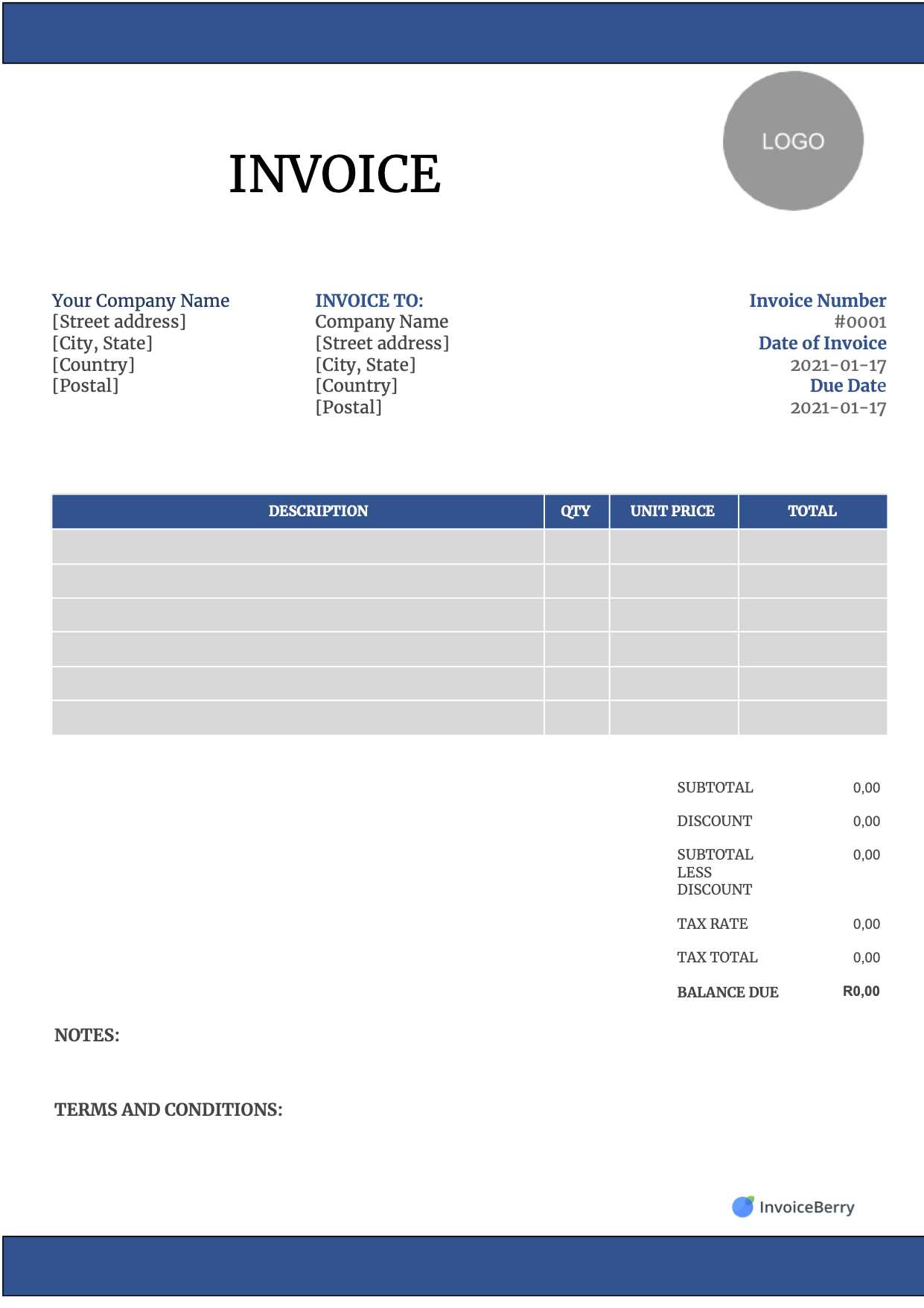

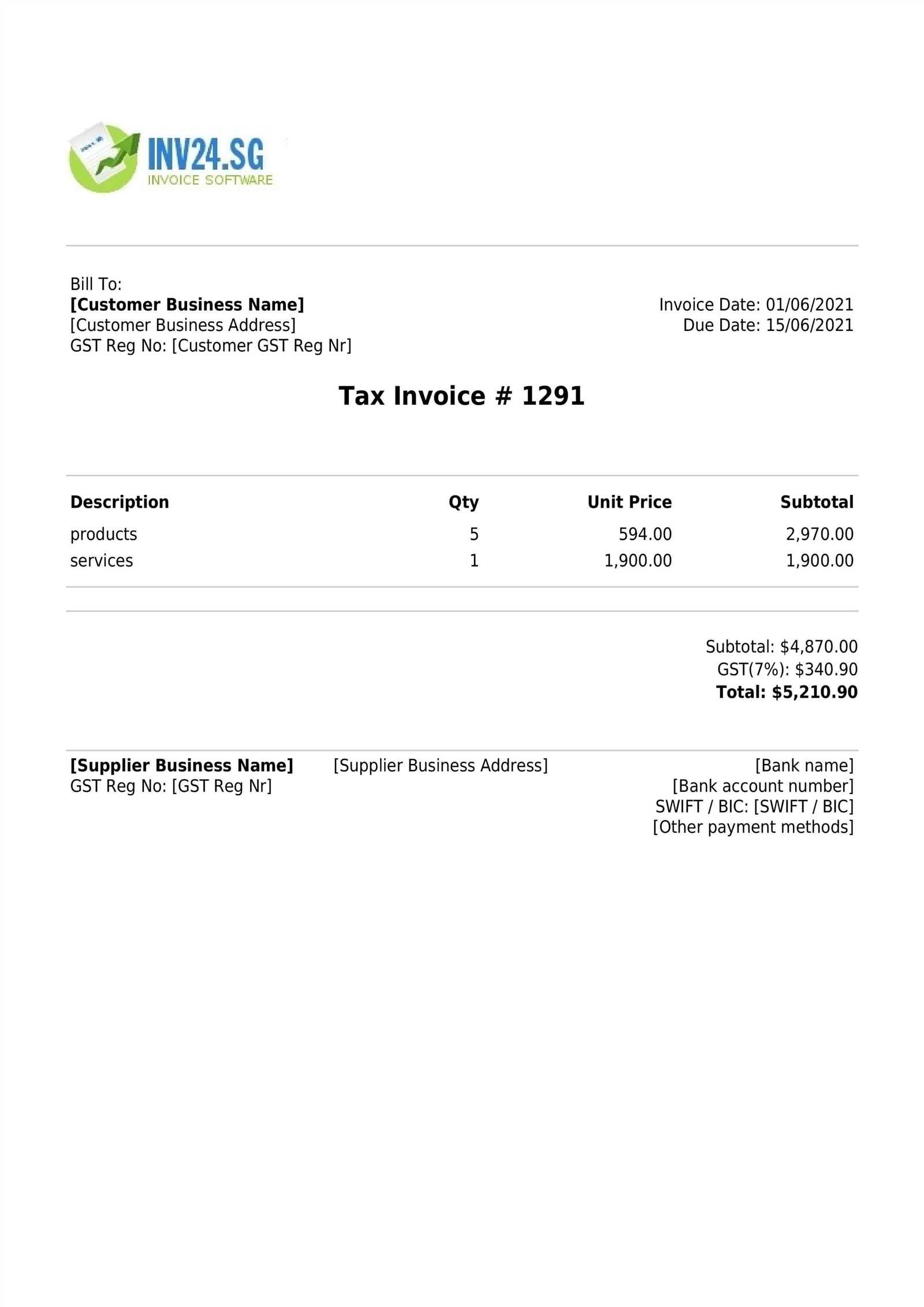

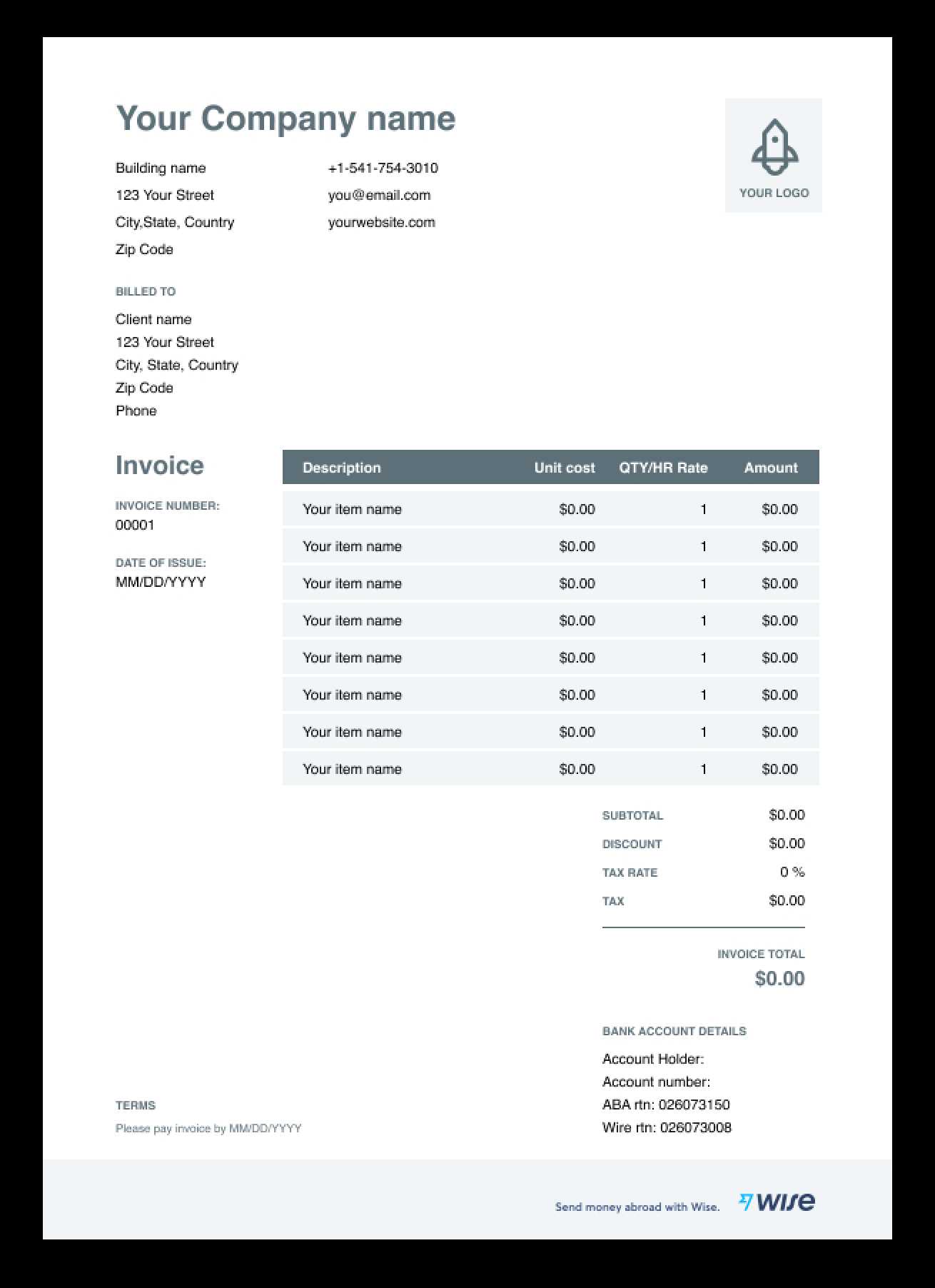

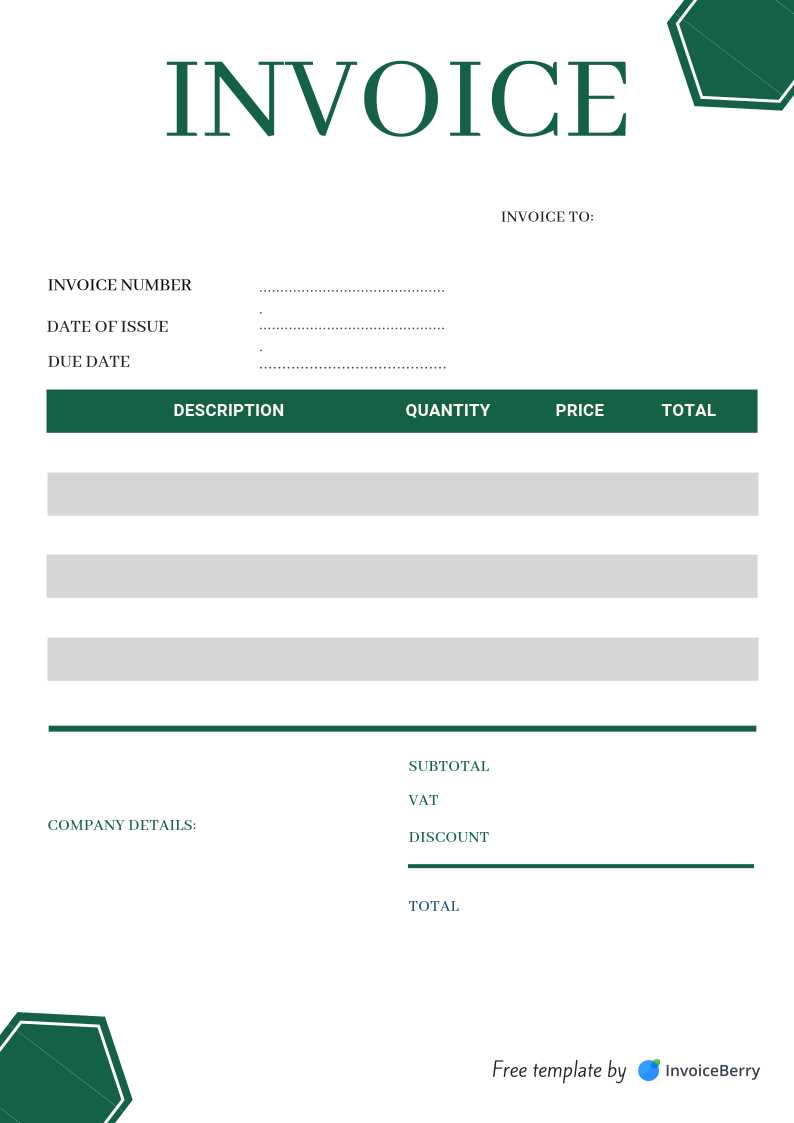

With a customizable structure, these forms offer the ability to modify key information such as:

- Company and client details

- Itemized lists of products or services

- Pricing, taxes, and discounts

- Payment terms and deadlines

By using such forms, businesses can ensure that each record is tailored to the transaction at hand while keeping all necessary details intact. Whether you are invoicing for a single product or a series of services, these forms offer the flexibility to make quick adjustments and produce accurate documents.

Additionally, these forms are convenient for sharing and archiving, allowing both parties to have a clear understanding of the terms and details. Whether for personal use or managing business accounts, having access to well-structured digital documents is an essential tool for efficient financial management.

Why Use a Free Invoice Template

For businesses and freelancers alike, maintaining a professional appearance in financial transactions is essential. Using a pre-designed, customizable document ensures that your records are consistent, accurate, and presentable. These ready-to-use forms simplify the process of creating billing statements while still allowing for personalization to meet specific needs.

Efficiency and Time-Saving

One of the main advantages of utilizing such forms is the amount of time saved. Instead of creating documents from scratch, you can use a well-structured format that only requires minimal adjustments. This lets you focus on your work and get paid faster, without worrying about formatting or the necessary details to include.

Professional Appearance

Utilizing a pre-made design that looks polished and organized not only saves time but also presents a more credible image to clients. A neat, clear, and easy-to-read format helps avoid confusion and improves communication. It ensures that all critical information is conveyed in a professional manner, building trust and reliability.

Additionally, these forms are easy to distribute and archive, making them a practical solution for both short-term and long-term record-keeping. With the ability to edit and customize details, you can adjust each document as necessary, offering a flexible approach to managing your finances effectively.

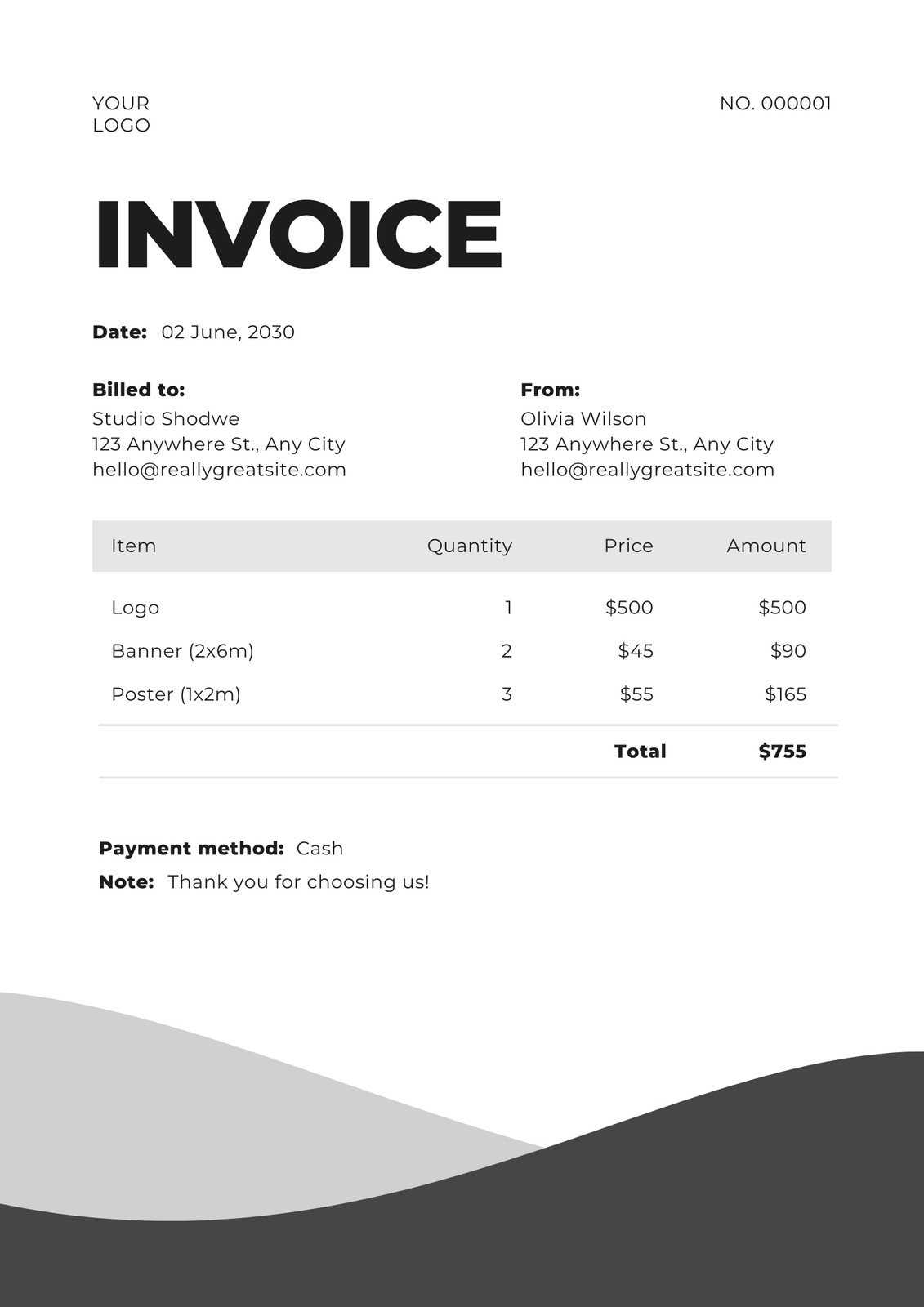

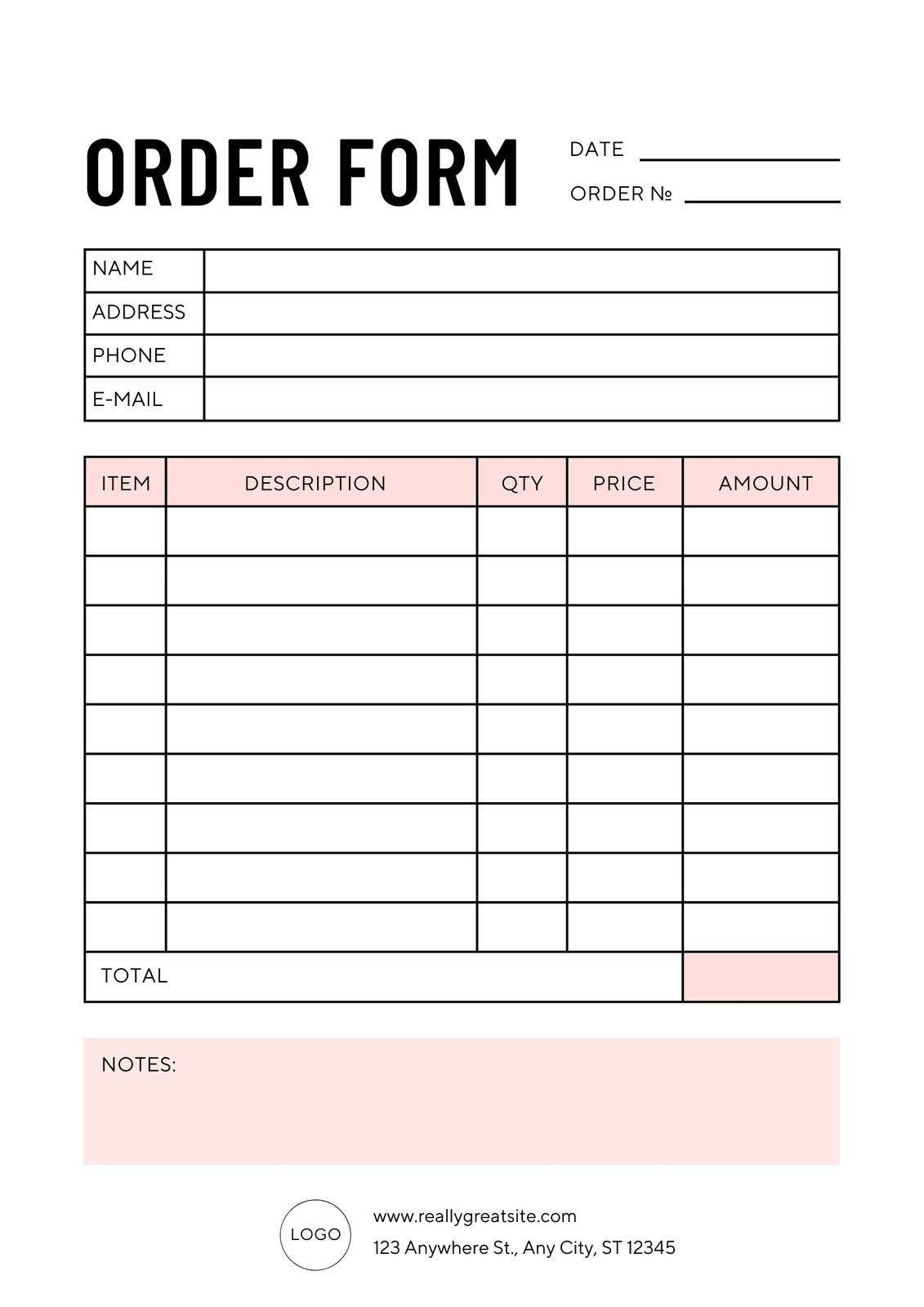

How to Customize an Invoice Template

Personalizing a document for billing purposes allows you to adapt it to your specific business needs. Whether you need to update contact information, adjust the layout, or add specific items, customization ensures that the final document accurately reflects the transaction. By following a few simple steps, you can tailor a standard form to make it uniquely yours.

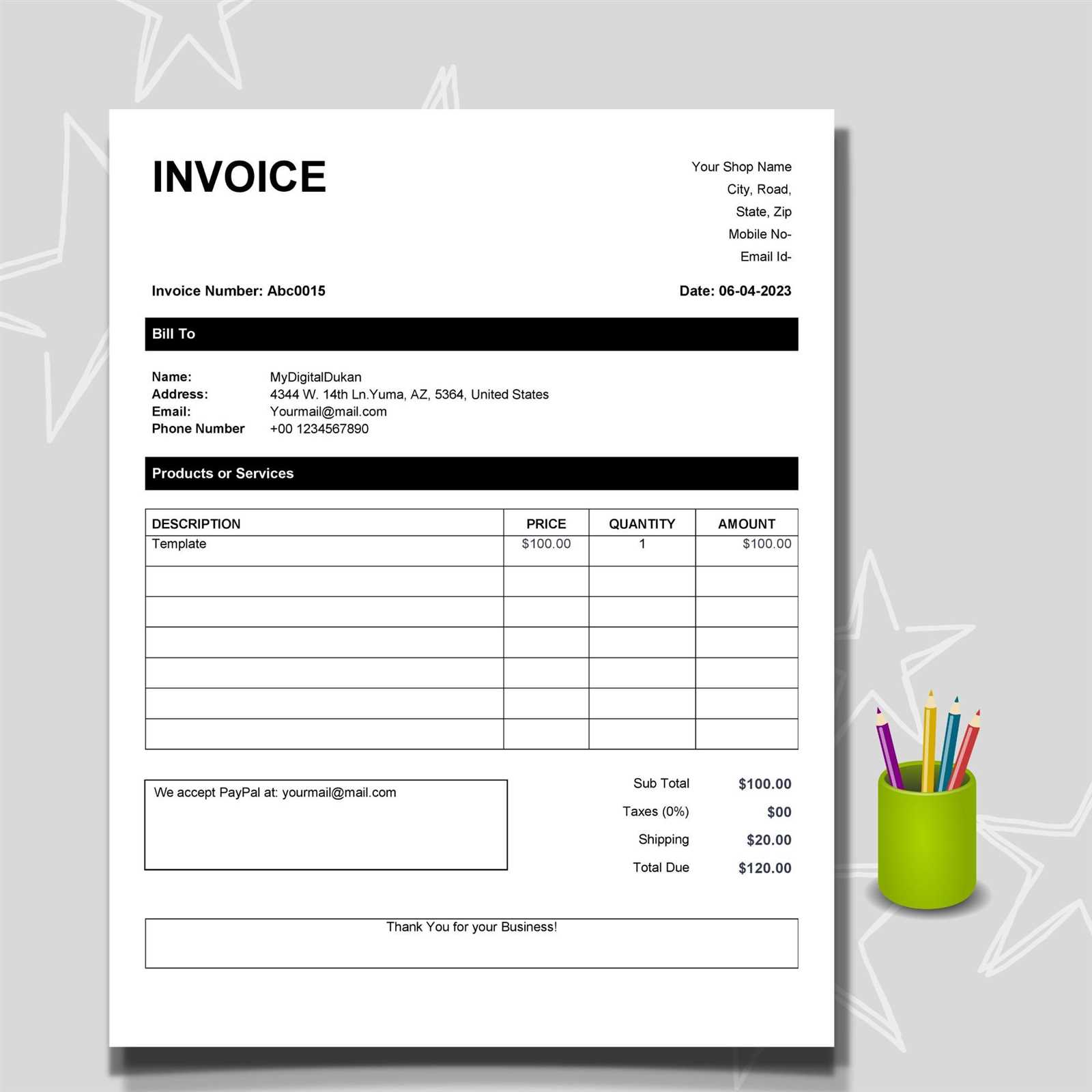

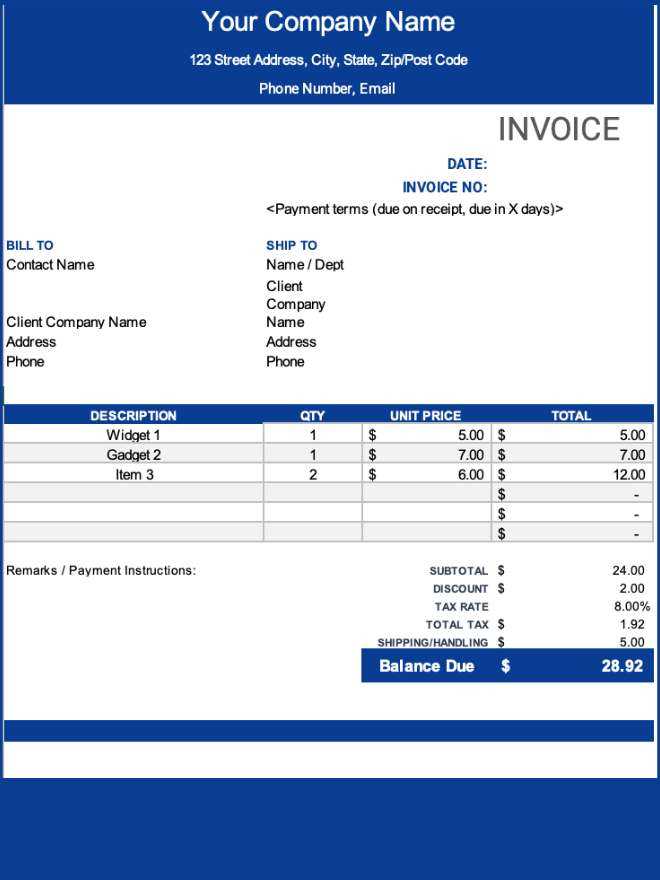

The first step in the process is to modify the header section. This typically includes your business name, logo, and contact details. Make sure that these elements clearly represent your company and are easy for clients to identify.

Next, you’ll need to add or modify the items or services you are charging for. This includes specifying quantities, unit prices, and any applicable taxes or discounts. Be sure to list everything in a clear, organized manner so that clients can easily understand the charges.

Finally, ensure that the payment terms are accurately reflected. This could include the due date, payment methods accepted, or any late fees that may apply. Providing this information upfront helps set clear expectations for both parties.

Once you’ve made your changes, double-check the document for any errors or missing information. A well-organized and complete form will help ensure smooth transactions and improve your overall business efficiency.

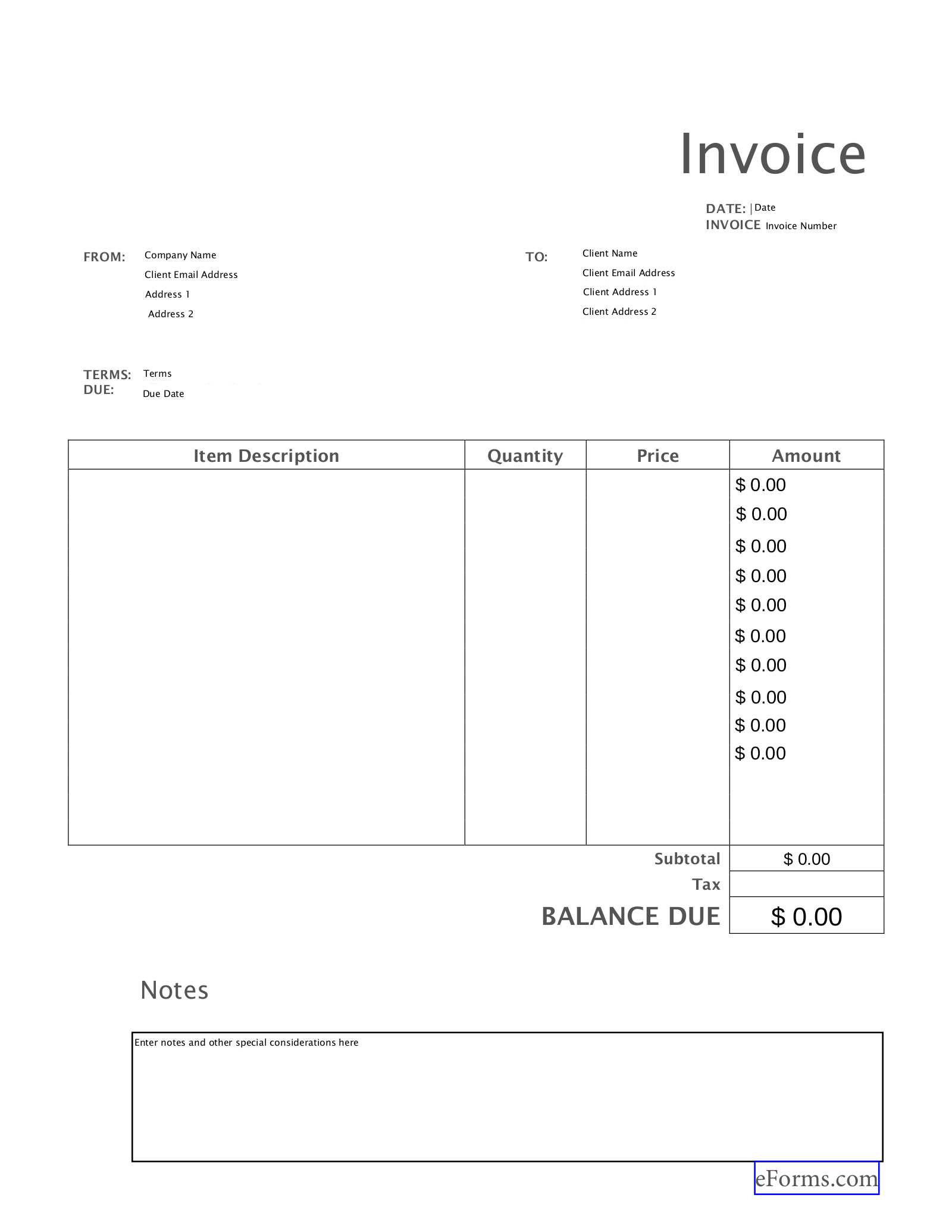

Benefits of PDF Invoice Format

Using a digital format for your billing documents offers numerous advantages, from ease of distribution to ensuring that the document is displayed correctly across all devices. Choosing a widely accepted file format guarantees that your business communications are both professional and reliable. This format is perfect for ensuring that your records stay intact and look great, no matter the circumstances.

Universal Compatibility

One of the primary benefits of using this format is its universal compatibility. Files are easily opened on any device, from computers to smartphones, without worrying about software incompatibility. This makes it simple for both you and your clients to access and view the details of your financial transactions.

Maintaining Document Integrity

Another significant benefit is the preservation of the document’s layout and formatting. When using this format, the file remains unchanged, preventing any alterations from being made by unauthorized users. The structure of the document is fixed, ensuring it appears exactly as intended each time it’s opened.

- Prevents accidental changes or corruption of data

- Ensures consistent visual appearance across all platforms

- Ideal for archiving and long-term storage

With these advantages, choosing this format for your billing documents not only enhances professionalism but also makes managing and sharing your records easier and more secure.

Where to Find Free Templates

There are many online resources available where you can access well-designed, customizable forms for financial transactions. These resources cater to a wide range of business needs and can help you quickly create professional documents for your clients. Below are some of the most popular platforms where you can find these tools without any cost.

| Website | Description |

|---|---|

| Canva | A popular graphic design platform offering customizable billing forms with an easy-to-use editor. |

| Microsoft Office | Free downloadable options available for Word or Excel, offering basic but professional designs. |

| Google Docs | Provides editable document forms through Google Drive that can be tailored and shared instantly. |

| Zoho | A cloud-based service with customizable forms for businesses, available with basic free plans. |

| Invoice Generator | Offers a simple tool to create documents quickly, allowing you to customize details and export them. |

These platforms offer a variety of designs and features to suit different needs. Whether you’re a freelancer or a business owner, using these resources can make the process of generating professional documents much more efficient.

Top Features of Editable Invoices

When creating financial documents, certain features are essential for streamlining the process and ensuring accuracy. These forms are designed with flexibility and clarity in mind, making them easy to customize and manage. Below are some of the key attributes that make these documents highly functional for both small and large businesses.

Customization Options

One of the most important features is the ability to personalize each document. Whether it’s changing business details, adding item descriptions, or adjusting the format, having full control over the content ensures that the document is tailored to fit your specific requirements. This flexibility allows for more efficient communication between businesses and their clients.

Ease of Distribution

These forms are simple to share through email, file-sharing services, or even directly via cloud-based tools. Their compatibility across different platforms ensures that they can be easily sent and received without any issues. This makes the entire billing process faster and more reliable.

| Feature | Benefit |

|---|---|

| Customizable Fields | Allows the inclusion of specific details for each transaction, making the document unique. |

| Standardized Format | Ensures uniformity across all documents, improving professionalism and consistency. |

| Easy to Modify | Allows for quick adjustments, whether for a single transaction or on a regular basis. |

| Cross-Device Compatibility | Ensures documents open and function properly across all devices, from mobile to desktop. |

With these essential features, businesses can enhance their efficiency, maintain professionalism, and create clear and well-organized records for their clients.

Creating Professional Invoices Quickly

Generating polished and detailed financial documents doesn’t have to be a time-consuming task. With the right tools, you can craft professional statements in a matter of minutes. The key is to use efficient methods that allow for quick customization while maintaining accuracy and clarity in the details. This section will explore how to streamline the process and ensure that your documents always reflect your business’s professionalism.

| Step | Action | Benefit |

|---|---|---|

| 1 | Use Pre-Designed Layouts | Start with a ready-made structure to save time on formatting and design. |

| 2 | Fill in the Details | Quickly add relevant transaction information such as dates, amounts, and client details. |

| 3 | Ensure Accuracy | Double-check calculations and details to avoid errors before sending. |

| 4 | Save and Share | Once finalized, easily save and send the document via email or cloud services. |

By following these steps, creating detailed and clear records becomes a simple and fast process. With pre-built formats and an easy-to-follow structure, you can focus on other important aspects of your business while maintaining efficiency and professionalism in your financial documentation.

Steps to Edit Your Invoice PDF

Modifying a completed financial document allows for quick adjustments to suit any changes in business transactions. Whether it’s updating client details or correcting itemized charges, the process of altering these forms should be simple and effective. Below, we’ll outline a clear guide for making necessary modifications while ensuring all information is accurate and up-to-date.

Step 1: Open the Document

Start by opening the financial document in a reliable editing tool that supports changes. This can be an online service or a downloadable program. Make sure you have access to the file and that the software allows for text input and field modification.

Step 2: Make Necessary Changes

Once open, carefully go through the sections that need modification. This can include adding new details, altering existing fields, or adjusting figures. Be sure to double-check any changes for accuracy before proceeding.

Editing is a straightforward task, and with the right tools, you can ensure that your documents remain correct and professional, ready to be shared with clients or colleagues.

How to Add Your Business Information

Incorporating your company’s details into financial documents is essential for professional communication and easy reference. It ensures clients can contact you when needed and adds credibility to your documents. The process of including your business information is simple but must be done accurately to maintain professionalism.

- Business Name: Include your official company name at the top of the document to ensure clients know who the document is from.

- Address: Provide a physical address, or if applicable, your registered office location, for client reference.

- Contact Information: Include phone numbers, email addresses, and possibly a website link so clients can easily get in touch.

- Tax Identification Number: If necessary, include your business tax ID number for legal or accounting purposes.

- Logo: Adding a business logo is a great way to reinforce brand identity and enhance the document’s appearance.

Once all the necessary information is entered, your document will be complete and ready for professional use. Always double-check for accuracy and consistency to avoid any errors that could cause confusion or delay in communication.

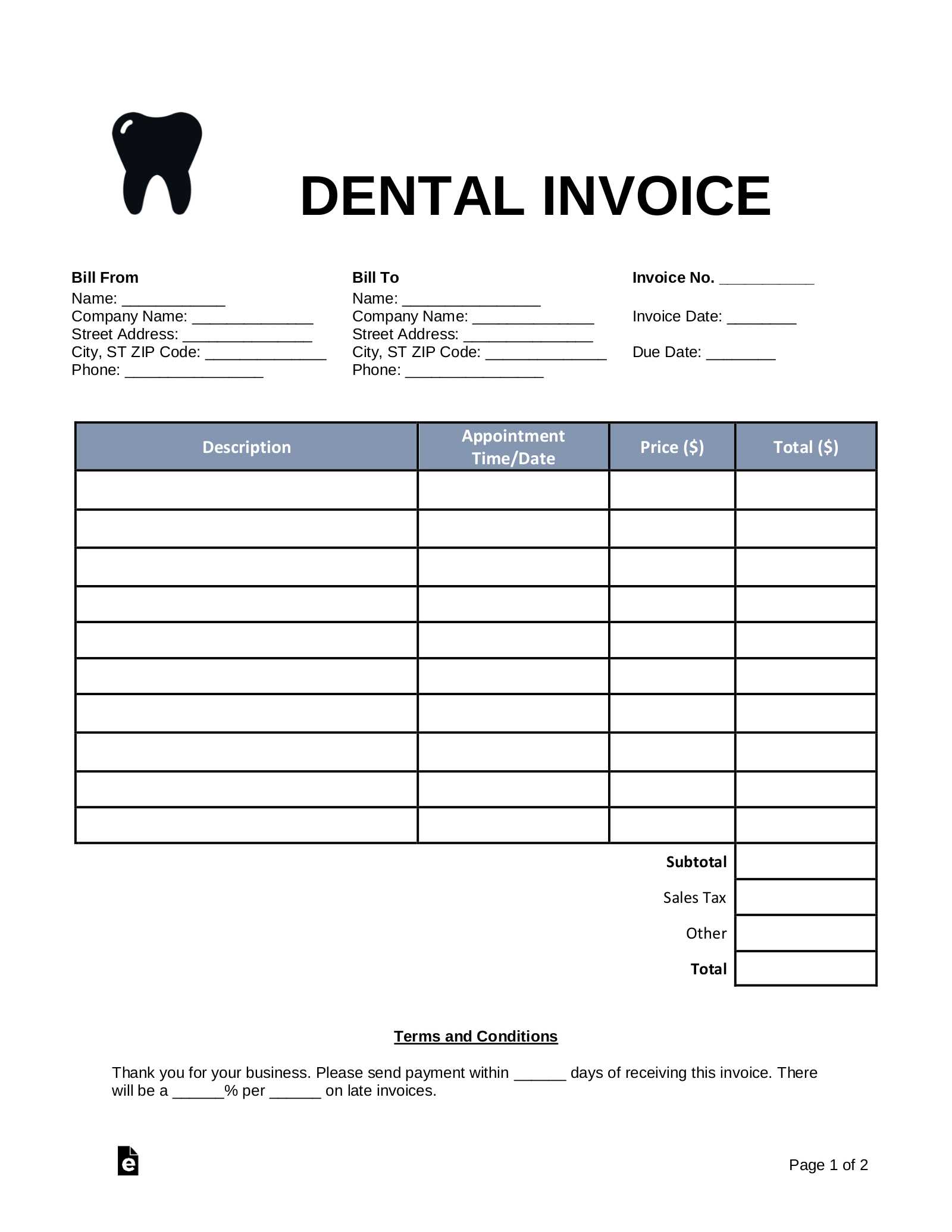

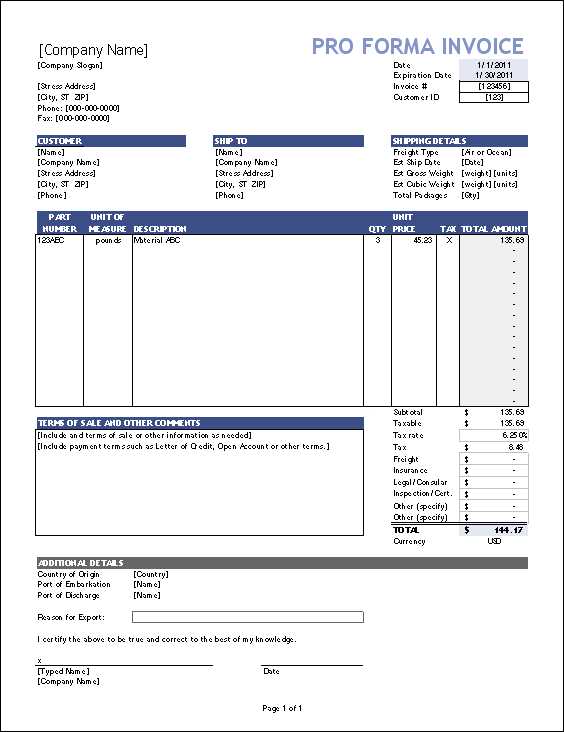

Invoice Templates for Different Industries

Different sectors have unique needs when it comes to organizing financial documents. Each industry requires specific details to be highlighted and formatted in a way that suits its particular workflow. Whether you’re in retail, service, or construction, customizing financial forms ensures all necessary information is included, helping businesses maintain clarity and professionalism in transactions.

| Industry | Required Information |

|---|---|

| Retail | Product names, quantities, prices, and total cost. |

| Services | Hourly rates, services provided, dates of service, and total hours. |

| Construction | Project description, labor costs, material costs, and job completion dates. |

| Consulting | Consulting hours, project milestones, and fees for each milestone. |

| Freelance | Project name, work performed, hourly rate, and payment terms. |

Tailoring financial documents to each specific industry not only helps with organization but also builds trust with clients. When forms include all necessary details, both parties can be sure that there are no misunderstandings regarding payment terms or services rendered.

How to Add Itemized Billing Details

Breaking down the total charges into individual items allows for greater transparency and helps your clients understand exactly what they are paying for. Including clear itemized details ensures that all aspects of a service or product are covered, making it easier for both the business and the client to review the financial transactions. This practice not only improves communication but also helps avoid disputes or confusion regarding pricing.

Steps to Itemize Billing Information

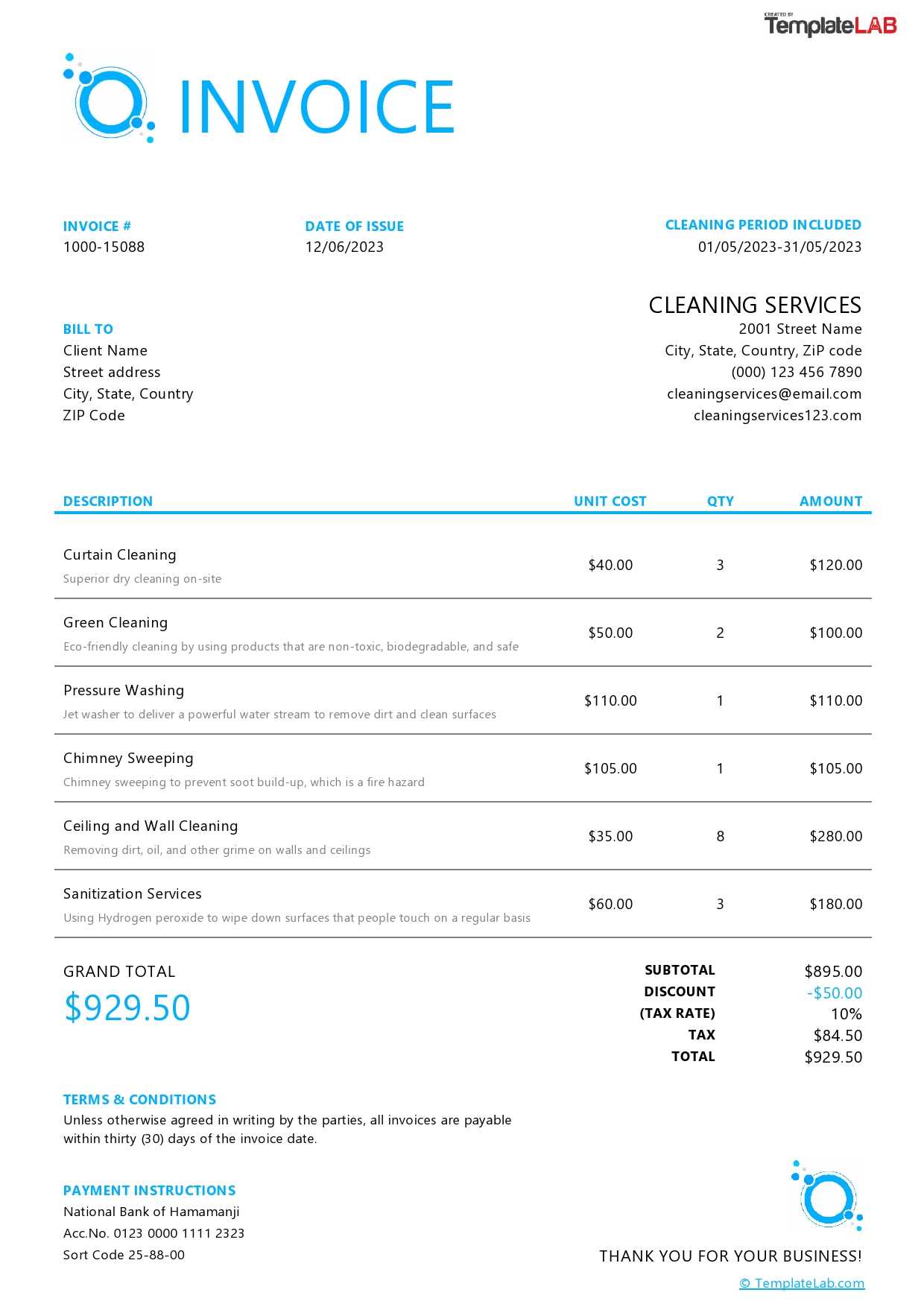

- List Products or Services: Clearly name each product or service provided during the transaction.

- Include Quantities: Indicate the number of units or hours for each item.

- Specify Unit Costs: Show the price for each unit, whether it’s an hourly rate or a per-item charge.

- Provide Total for Each Line: Multiply the quantity by the unit cost for each item and include the subtotal for each service or product.

- Apply Discounts or Additional Charges: If applicable, include any promotions, discounts, or extra fees to be added or subtracted from the total.

- Sum Up the Total: Calculate the overall sum, factoring in all items, charges, and discounts.

Benefits of Itemized Billing

- Increased Clarity: Both parties have a clear view of what has been purchased or completed.

- Better Record Keeping: Helps businesses track services provided and ensure all costs are accounted for.

- Prevents Misunderstandings: Clients can easily review the charges and know exactly what they are being billed for.

Adding itemized details to your financial forms not only enhances professionalism but also fosters a sense of trust and transparency with your clients. This practice can improve your reputation and customer satisfaction while ensuring smooth transactions.

How to Include Tax and Discounts

When finalizing a financial document, it’s crucial to incorporate taxes and discounts in a clear and organized manner. This ensures that the customer fully understands the breakdown of the total amount, including any additional costs or savings applied. Properly adding taxes and discounts not only promotes transparency but also ensures compliance with legal requirements. It can also help businesses maintain accurate records for accounting and reporting purposes.

Steps to Include Tax

- Identify Applicable Tax Rates: Determine which tax rates apply to your goods or services. This may vary depending on location, industry, or specific product/service type.

- Calculate the Tax Amount: Multiply the subtotal (the total of all items before tax) by the applicable tax rate to determine the tax amount.

- Clearly Display the Tax: Add a line item that clearly states the tax amount, including the rate applied, so the client can see how much tax they are being charged.

Steps to Apply Discounts

- Define the Discount Type: Specify if the discount is a percentage off the total, a fixed amount, or a promotional offer.

- Calculate the Discount: For percentage discounts, multiply the subtotal by the discount rate. For fixed amount discounts, subtract the agreed amount directly from the subtotal.

- Apply the Discount: Clearly list the discount on the document and subtract it from the subtotal to show the adjusted total after the discount.

- Provide Discount Terms: If the discount is part of a special promotion, include any relevant conditions or expiration dates to avoid confusion.

Benefits of Including Tax and Discounts Properly

- Clearer Financial Breakdown: Clients can easily see the total price and how it was calculated, avoiding misunderstandings.

- Transparency and Trust: Clear and accurate display of taxes and discounts fosters trust between businesses and clients.

- Compliance: Properly applying taxes ensures your business complies with local tax regulations, avoiding legal issues.

Accurately including taxes and discounts in your billing process ensures that your financial documents are both professional and transparent, leading to improved client satisfaction and smoother transactions.

Saving and Sharing Your Invoice

Once you’ve created your financial document, it’s important to save it securely and share it with your client in a professional manner. This ensures that both parties have access to a copy of the document for reference, payment, or record-keeping. Additionally, it is essential to choose the best file format and sharing method for easy access and security.

Steps to Save Your Document

- Choose a Secure Format: Select a format that maintains the layout and details of your document, such as a commonly used digital file format that is universally accessible.

- Use a Descriptive File Name: Name your document clearly with details like client name, date, and purpose (e.g., “ClientName_Invoice_2024-11”). This makes it easy to locate later.

- Save in a Safe Location: Store the document in a dedicated folder on your computer or cloud storage to prevent accidental loss or misplacement.

How to Share Your Document

- Email: Attach the saved file to an email with a brief message explaining the contents. Ensure the email subject is clear, such as “Invoice for [Client Name]”

- Cloud Storage: Upload the document to a secure cloud storage service (e.g., Google Drive, Dropbox) and share the link with the client. This provides easy access from any device.

- Direct Download Links: If hosting on your website, provide a direct download link that clients can access at their convenience.

Best Practices for Sharing

- Confirm Receipt: Always ask clients to confirm they’ve received and can access the document, ensuring there are no issues.

- Maintain Privacy: If sending sensitive information, consider using encrypted emails or password-protected files to ensure the document remains secure.

- Timely Delivery: Send the document promptly after completing it to avoid delays in payments or misunderstandings.

By following these steps, you can ensure that your documents are securely saved and shared in a way that facilitates easy access for both you and your client, maintaining professionalism throughout the process.

Tips for Using Invoice Templates Efficiently

Utilizing pre-designed documents for billing and record-keeping can significantly streamline your workflow. However, to maximize their benefits, it’s important to use them correctly and with consistency. These documents help save time and reduce errors, but understanding how to optimize their use is key for efficiency.

Organize Your Information

- Standardize Client Details: Keep all client information such as names, addresses, and contact details organized and up-to-date. This minimizes the need for re-entering the same data for each new transaction.

- Maintain a Service List: Have a master list of your products or services with consistent descriptions and prices. This allows you to quickly select the items for each billing without looking them up every time.

- Use Consistent Formatting: Use uniform formatting for numbers, dates, and descriptions. This creates a professional appearance and reduces confusion.

Automate Repetitive Tasks

- Pre-fill Recurring Details: For frequent clients or similar transactions, pre-fill standard details like payment terms and business information in your document format.

- Save Custom Versions: Create customized versions of the document for different types of clients or services. This saves time on future edits.

- Use Software or Tools: Consider using accounting or document management tools that automatically generate and fill in billing details based on your input.

Review and Double-Check Before Sending

- Check Accuracy: Always verify that the details on your document are correct, including the client’s name, the amount, and the due date.

- Proofread: Look for any spelling or formatting errors that could affect the professionalism of the document.

- Confirm Payment Terms: Ensure that your payment terms are clear and accurate to avoid any confusion later on.

By following these best practices, you can ensure that you’re using billing documents effectively, saving both time and effort while maintaining accuracy and professionalism in every transaction.

Protecting Your Invoice PDF from Edits

Ensuring that your billing documents remain secure and unaltered is essential for maintaining accuracy and preventing fraudulent modifications. By protecting your files, you can preserve their integrity and ensure that they are viewed as official and final records. There are several strategies to prevent unauthorized changes, offering peace of mind when sharing sensitive details.

- Password Protection: One of the most effective ways to safeguard your document is by applying a password. This restricts access and ensures that only authorized individuals can view or modify the content.

- Use Encryption: Encrypting your document adds an extra layer of security by making it unreadable to anyone without the correct decryption key, even if they manage to obtain the file.

- Set Permissions: Many tools allow you to set specific permissions on your files. You can restrict actions like editing, copying, or printing, ensuring that only intended users can interact with the document in certain ways.

- Watermarking: Adding a watermark to your document can discourage unauthorized modifications by making it clear that the file is official and traceable back to you.

- Sign Your Document: Digital signatures provide verification of the document’s authenticity and confirm that no alterations have been made after it was signed.

By utilizing these protective measures, you can secure your files and minimize the risk of unauthorized changes, ensuring that your billing records are both reliable and protected.

Using Invoice Templates for Small Businesses

Small businesses often rely on well-organized financial records to ensure smooth operations. Having a structured way to bill clients not only saves time but also presents a professional image to customers. By using pre-designed billing structures, entrepreneurs can simplify their administrative tasks, reduce errors, and focus on growing their businesses. These formats make it easy to input necessary information without creating documents from scratch each time.

Advantages for Small Business Owners

- Time-saving: Ready-made billing formats help business owners quickly generate documents without needing design expertise or extensive time investment.

- Professional Appearance: These documents give a polished, consistent look that reflects the business’s attention to detail and trustworthiness.

- Customization Options: Many of these structures allow for adjustments, such as adding company logos, changing color schemes, or adding specific details that align with business needs.

- Accurate Record Keeping: With predefined fields for essential details, these structures help maintain consistency in tracking payments, services rendered, and dates.

How to Make the Most of Billing Structures

- Stay Organized: Keep a separate folder or system for these documents to ensure they’re easy to access when needed.

- Track Payments: Use these structures to include payment terms, due dates, and transaction statuses, making it simpler to follow up on pending payments.

- Ensure Accuracy: Double-check the entries before sending them out to avoid errors that could affect client relationships or cash flow.

Utilizing pre-designed billing structures is an efficient way for small business owners to streamline their financial processes, presenting clear and organized documents that contribute to long-term success.

Free vs Premium Invoice Templates

When selecting a design for client billing, businesses face the choice between using no-cost options or opting for paid versions that offer enhanced features. While both types offer functional solutions, they come with differences in terms of customization, support, and advanced features. It’s essential to weigh the advantages and limitations of both to determine the most suitable choice based on individual needs and business goals.

Advantages of No-Cost Options

- Cost-effective: The primary benefit of no-cost solutions is that they are available without any initial investment, which can be ideal for startups and small businesses with tight budgets.

- Basic Functionality: These designs typically cover the essential fields required for billing, offering a simple way to send professional documents without unnecessary extras.

- Quick Setup: Most no-cost options are ready to use immediately, allowing business owners to quickly start sending documents to clients without delays.

Benefits of Paid Options

- Advanced Features: Paid designs often come with extra functionalities, such as automatic calculations for taxes, discounts, and totals, making the process more efficient.

- Customization: Premium choices typically offer greater flexibility in terms of branding, allowing users to modify the design to match their business identity by adding logos, color schemes, or specialized fields.

- Professional Support: With a paid solution, you may receive dedicated customer service and support to assist with any issues or customizations you may need.

Ultimately, the decision between no-cost and paid options depends on the specific needs of your business. For those seeking simplicity and cost savings, no-cost solutions may be sufficient. However, for businesses that require more advanced functionality or branding options, paid alternatives may offer better long-term value.

How to Stay Organized with Invoices

Keeping track of client billing is a critical aspect of managing a business. To ensure a smooth workflow and avoid confusion, staying organized is key. By adopting a systematic approach, businesses can easily manage their billing, ensuring timely payments and reducing administrative stress. Proper organization not only helps streamline cash flow but also enhances professional relationships with clients.

Establish a Consistent Naming System

- Unique Identifiers: Assign a distinct number or code to each document. This can help you quickly locate specific entries and track their status.

- Organized Folders: Create folders for different periods or projects. This way, you can efficiently sort and retrieve documents based on timeframes or client names.

Utilize Digital Tools

- Cloud Storage: Using cloud platforms allows for easy access to your records from anywhere. It also ensures that documents are backed up and safe from physical damage.

- Automation: Many digital tools offer automated reminders for payments or recurring charges. This helps reduce the chances of missing deadlines.

- Accounting Software: Implementing specialized accounting systems can further improve organization by automatically categorizing and calculating your documents.

By integrating these strategies into your business routine, staying organized with billing becomes a simple and efficient task. Regular tracking, coupled with the right tools, can streamline your process, saving both time and effort in the long run.