Invoice Template for Plumbing Services for Easy Billing

Running a business involves various administrative tasks, and one of the most essential is properly documenting completed work and ensuring payments are collected on time. A well-organized method for detailing charges can significantly improve your workflow and enhance client satisfaction. Having a clear and professional approach to billing helps maintain trust and transparency with your clients.

By using a structured approach to generating invoices, you ensure that all necessary details, from labor costs to material fees, are clearly communicated. This not only prevents misunderstandings but also speeds up the payment process. A tailored document that reflects your business’s needs and image can go a long way in improving efficiency and professionalism.

Efficiently managing your billing allows you to focus more on growth and client relationships, rather than being bogged down by administrative tasks. Whether you’re a contractor, technician, or small business owner, streamlining this aspect of your operations will lead to smoother interactions and quicker payments.

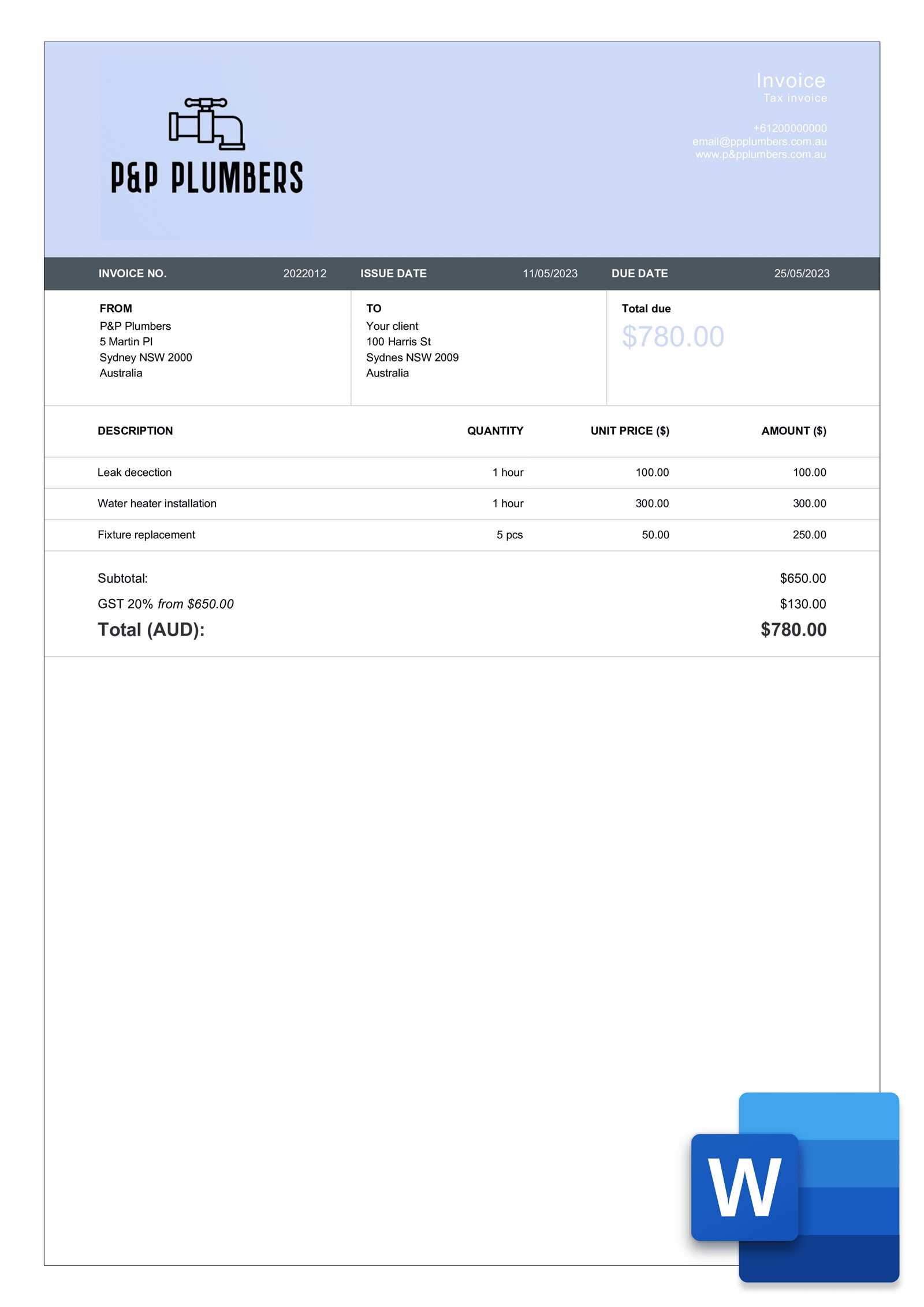

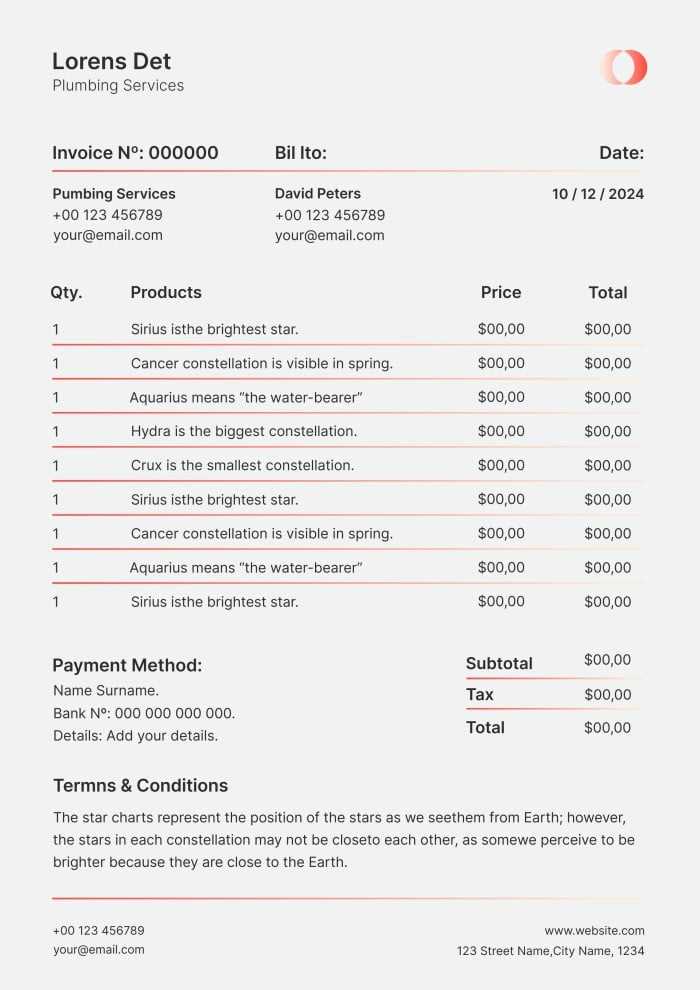

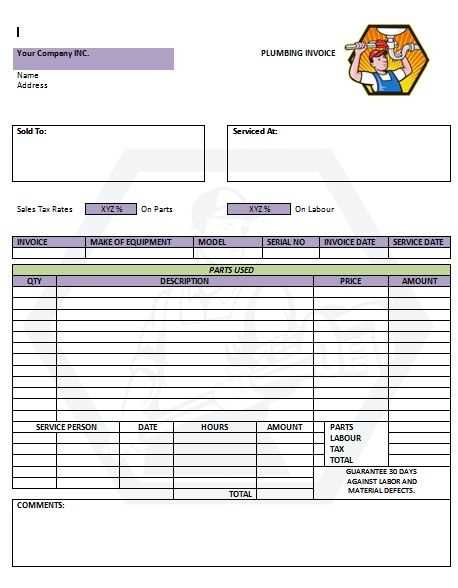

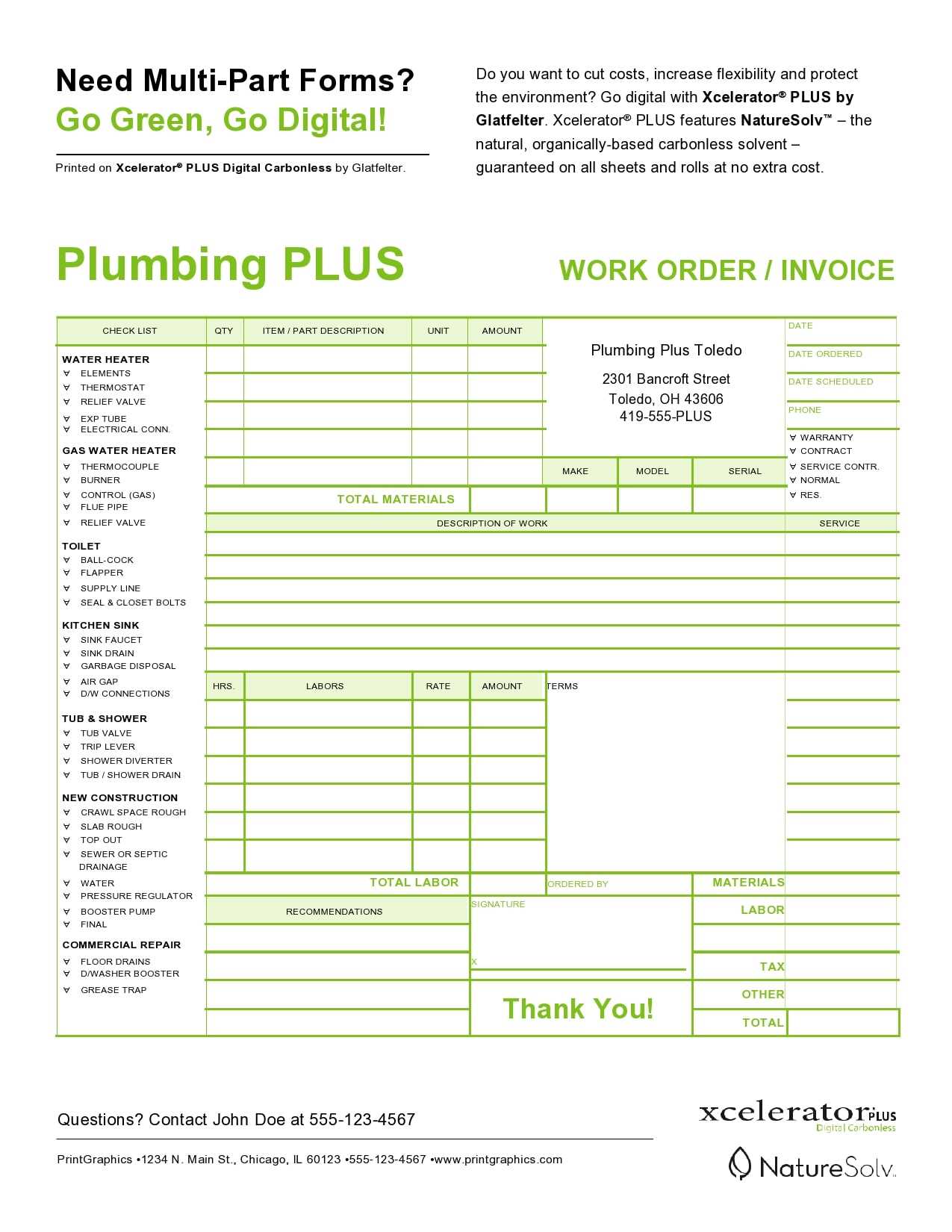

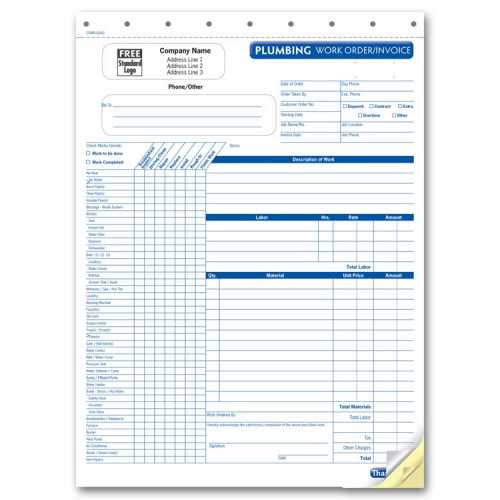

Invoice Template for Plumbing Services

Creating a professional document to detail the work completed and the associated charges is essential for any business. This organized document not only ensures transparency but also helps establish trust with clients. By including all necessary information in a clear and structured manner, businesses can avoid confusion and facilitate prompt payments.

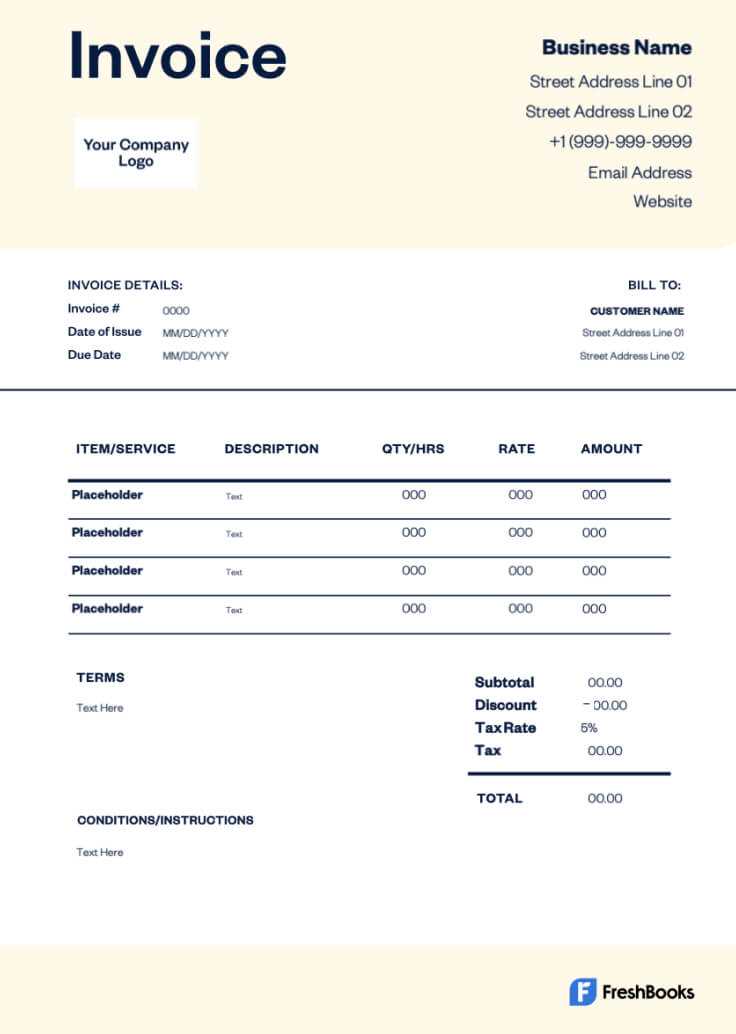

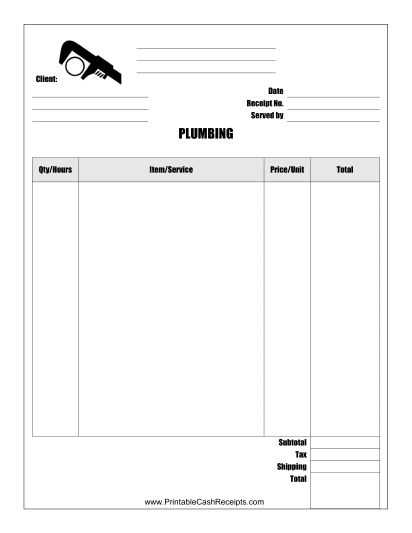

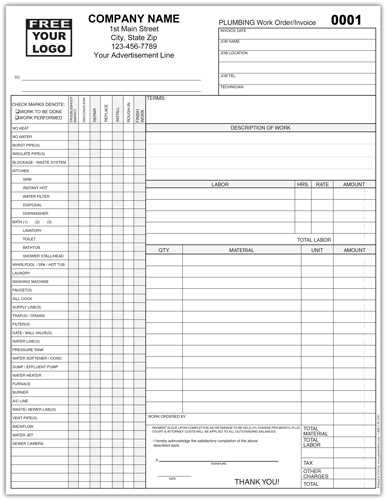

For those in the construction or maintenance industry, having a pre-designed format to use after completing a job can save time and effort. A customized version allows you to include specific details such as labor costs, materials used, and additional fees. This helps you present a polished, accurate summary of the job, leaving clients with a positive impression of your business practices.

With a well-organized system in place, payments are more likely to be processed without delay. A clear, straightforward document reduces the chances of mistakes or disputes, creating a smoother transaction process for both parties involved. This approach ultimately helps in managing cash flow and improving operational efficiency.

Why Use an Invoice Template

Having a standardized approach to documenting completed work and payment details is crucial for maintaining organization and professionalism in any business. Using a pre-designed format offers several advantages, from simplifying the billing process to ensuring all necessary details are included. Without a consistent structure, businesses risk overlooking important information or creating confusion for clients.

Here are some reasons why adopting a structured method for your business transactions is beneficial:

- Consistency: A set format ensures that each document follows the same layout, making it easier for clients to read and understand.

- Time-Saving: Pre-designed formats allow you to quickly fill in relevant details without having to start from scratch each time.

- Professional Appearance: A well-organized document reflects positively on your business and can help establish credibility with clients.

- Minimized Errors: Using a fixed structure reduces the chances of missing key details or making mistakes that could delay payments.

- Customizability: Even with a standard format, you can adjust specific elements to suit your business needs, such as payment terms or special charges.

By implementing a uniform approach, you streamline your operations, improve your client’s experience, and ensure that your business transactions are handled smoothly and efficiently.

Benefits of Customizing Plumbing Invoices

Customizing the billing documents used in your business offers numerous advantages that help improve both your internal processes and client relationships. Tailoring these documents to your specific needs ensures they contain all the necessary details and present your brand in the best light. By making adjustments that reflect your services and business practices, you can provide a more personalized experience for your clients while maintaining a professional appearance.

Here are several benefits to consider when customizing your business forms:

- Brand Consistency: Customizing allows you to include your logo, business colors, and fonts, making your documents easily recognizable and reinforcing your brand identity.

- Accurate Information: Tailoring the structure helps ensure that all relevant charges, materials, and terms specific to each job are clearly listed, preventing confusion or disputes.

- Enhanced Professionalism: A well-designed, customized document makes a positive impression on clients, showing them that you are detail-oriented and organized.

- Client Trust: When clients see that you’ve tailored the document to reflect their specific needs, it builds trust and demonstrates that you take the time to properly document the work you’ve done.

- Flexibility: Customizing allows you to easily adjust sections such as payment terms, discounts, or additional fees, making it adaptable to different situations.

- Improved Cash Flow: When clients see a professional, clear, and detailed record of charges, they are more likely to pay promptly, which helps maintain positive cash flow.

Incorporating these customizations into your process will not only streamline your operations but also enhance client satisfaction and retention. Personalizing your documents ensures that both you and your clients are on the same page, ultimately leading to smoother transactions and better business relationships.

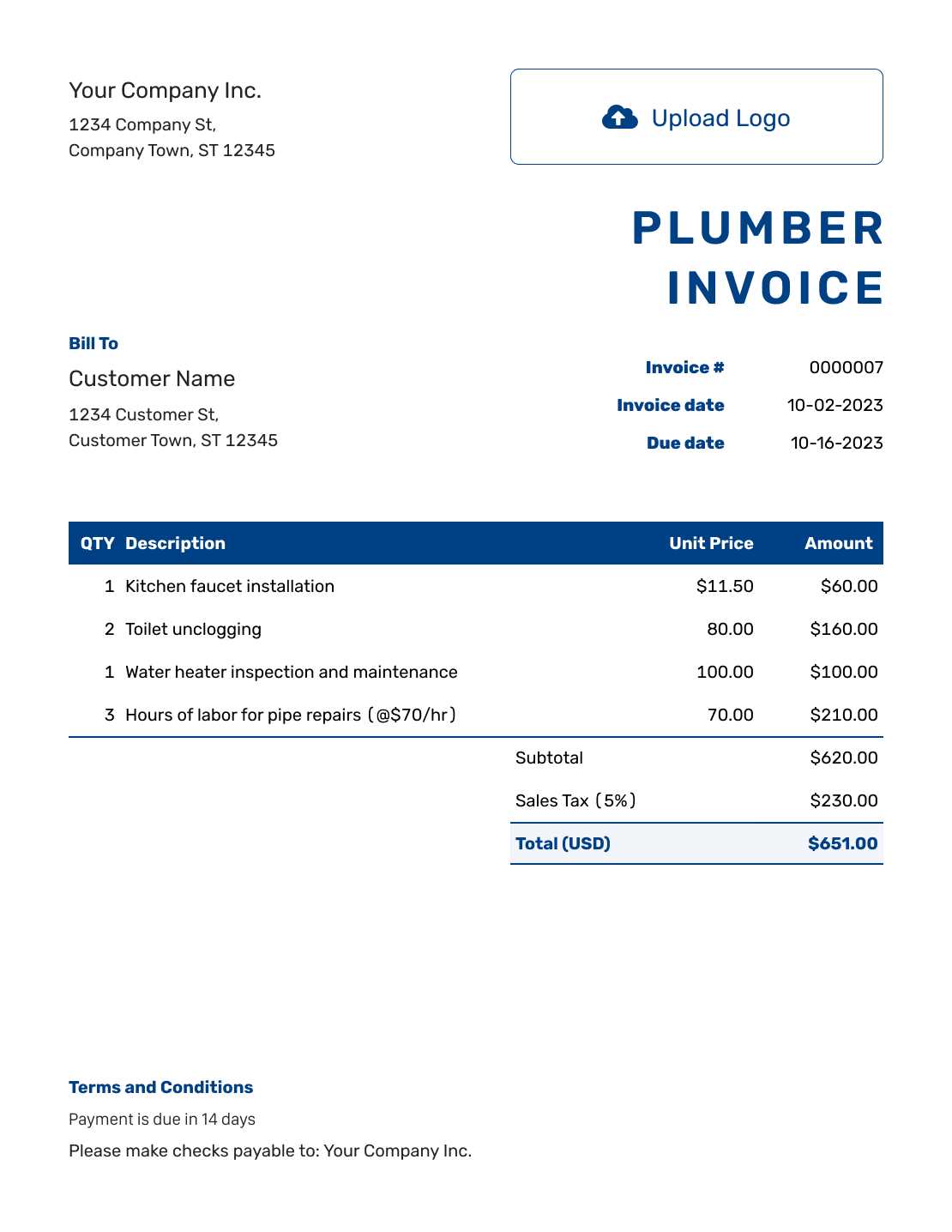

How to Create a Plumbing Invoice

Creating a well-structured document to record charges for completed work is essential for clear communication with clients and efficient business management. The process involves including all necessary details to ensure that both parties understand the work performed, the associated costs, and the payment terms. A thorough and accurate record helps ensure timely payments and minimizes the potential for misunderstandings.

Here are the key steps to follow when creating a billing document:

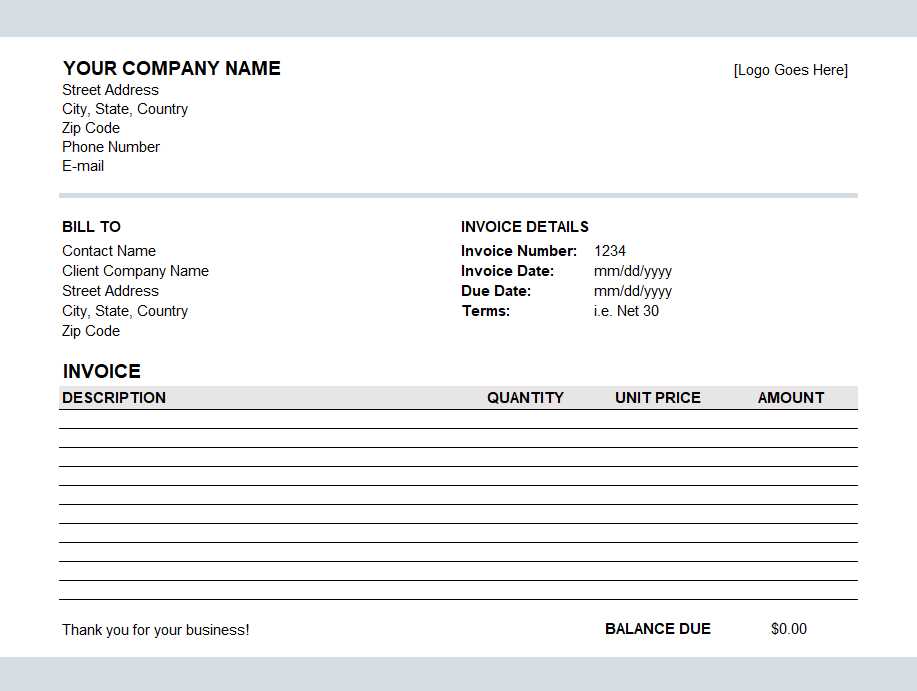

- Include Your Business Information: Start by adding your company name, address, phone number, and email at the top of the document. This makes it easy for clients to contact you with any questions.

- Add Client Details: Include the client’s name, address, and contact information. This helps ensure that the document is correctly attributed and makes it easier to track your records.

- List the Work Done: Provide a clear description of the tasks completed, materials used, and any additional charges incurred. Be as specific as possible to avoid confusion.

- Breakdown of Costs: Itemize labor costs, material expenses, and any other applicable fees. This ensures transparency and helps clients understand what they are being charged for.

- Set Payment Terms: Clearly state the due date and preferred payment methods. You may also wish to include late fees or discounts for early payment.

- Add a Unique Reference Number: Assign a reference number to each document. This helps with organization and makes it easier to track payments or address any potential issues.

- Include Your Business’s Payment Details: Provide the necessary information for clients to pay, such as bank account details, online payment links, or a mailing address for checks.

By following these steps, you ensure that your billing process is streamlined and professional, minimizing the chances of errors and improving the likelihood of prompt payment. A well-prepared document helps keep your business operations running smoothly and fosters good relationships with your clients.

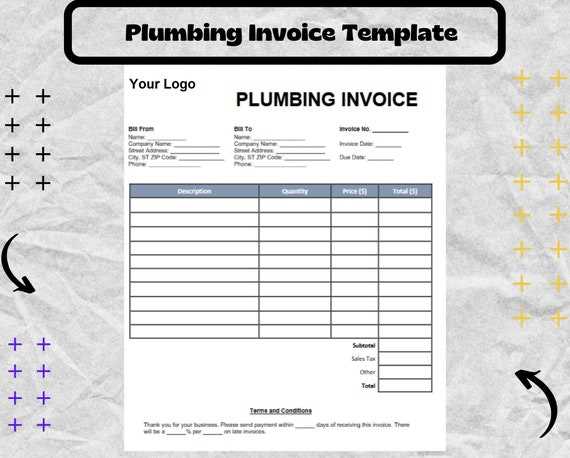

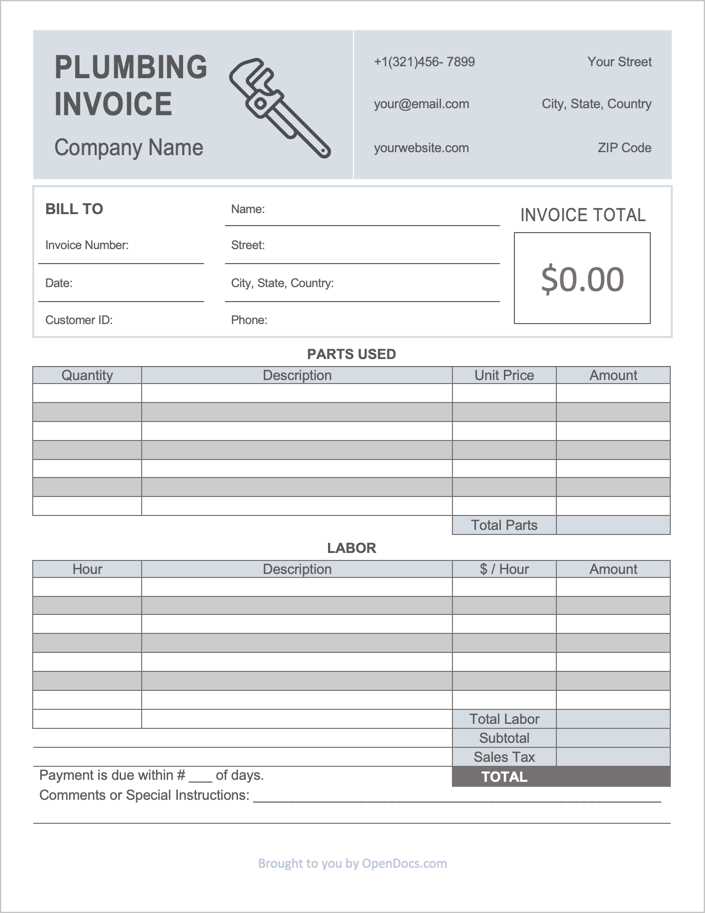

Essential Elements of a Plumbing Invoice

To ensure smooth transactions and avoid confusion, it’s crucial to include all the necessary details in the billing document. A well-constructed record clearly communicates the work completed, costs, and payment expectations. Whether you are working with residential or commercial clients, providing complete information helps maintain professionalism and fosters trust.

Here are the key components that should be present in every billing document:

- Business Information: This includes your company name, address, contact details, and any relevant identification numbers (e.g., tax ID or license number). This information helps clients identify the source of the bill and provides them with a way to reach you if needed.

- Client Details: Ensure the recipient’s name, address, and contact information are accurate. This prevents any potential confusion and ensures that the right person is billed.

- Description of Work: Clearly list all tasks performed, including any special requests or specific solutions provided. A detailed description ensures clients understand exactly what they are being charged for.

- Cost Breakdown: Itemize all charges, including labor, materials, and any additional fees. Breaking down the costs makes it easier for the client to see how the total was calculated and prevents misunderstandings.

- Payment Terms: State the payment due date and include any relevant conditions such as late fees, early payment discounts, or preferred payment methods. Clear terms help set expectations for both parties.

- Unique Reference Number: Assign a unique number to each bill. This reference number aids in tracking payments, resolving disputes, and organizing records efficiently.

- Payment Instructions: Provide clear instructions on how clients can make payments. Include bank details, payment platform links, or physical addresses for checks if applicable.

By ensuring these elements are consistently included, you create a comprehensive and professional document that builds client confidence and streamlines the payment process. A well-detailed statement not only helps ensure timely payments but also strengthens the client-business relationship over time.

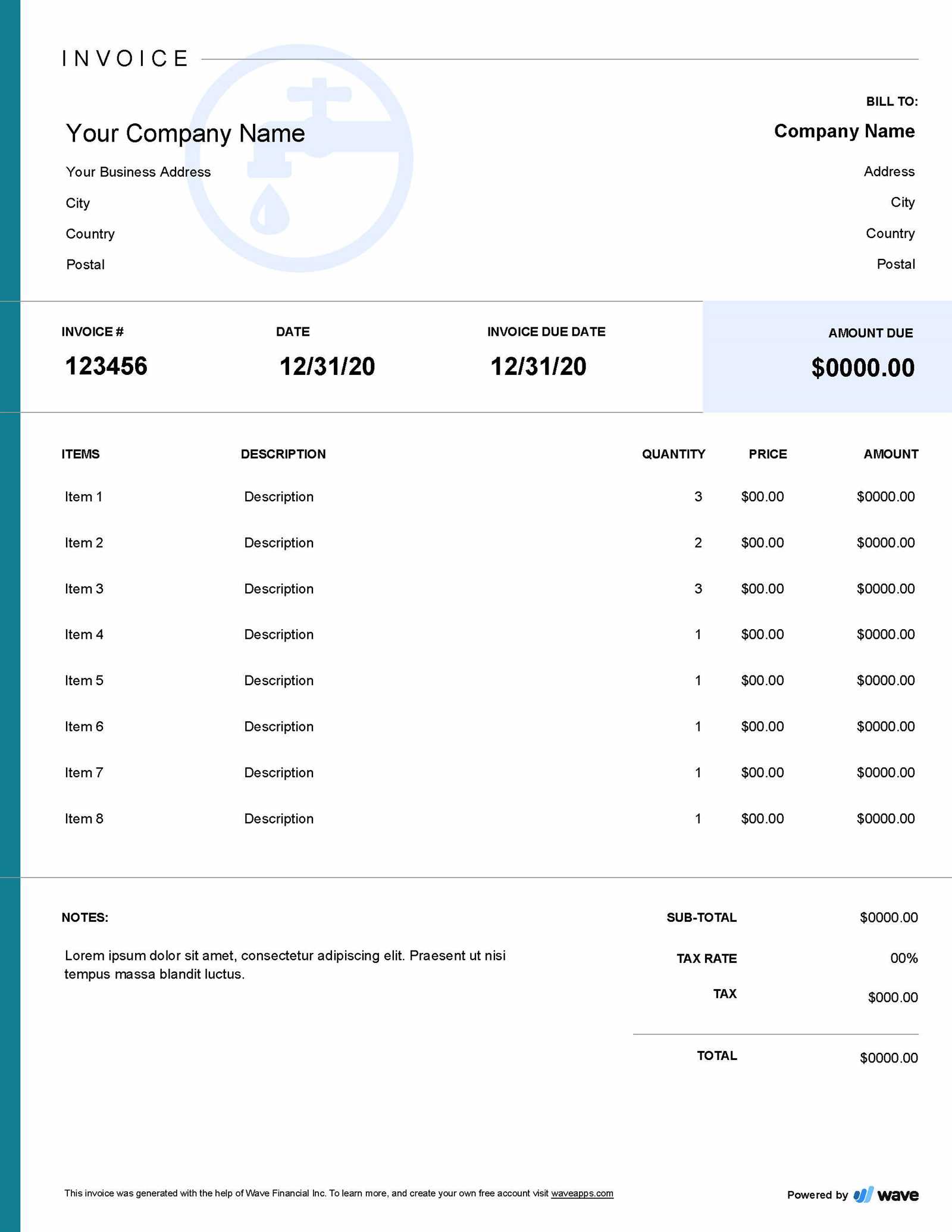

Free Plumbing Invoice Templates Online

There are many resources available online that offer free, customizable billing documents to simplify the payment process. These tools allow business owners to quickly generate professional-looking records without the need for expensive software or complex design work. By using pre-made formats, you can save time and ensure that each document is consistent and easy to understand.

Advantages of Using Free Online Tools

Free online resources can help small business owners and contractors easily generate accurate and detailed billing documents. Here are some key benefits of using these platforms:

- Cost-Effective: Many online resources are available at no cost, making them an affordable option for businesses with tight budgets.

- Easy Customization: Most tools offer editable fields, allowing you to add your business name, adjust pricing, and customize the layout according to your needs.

- Instant Access: You can generate and download your document immediately, speeding up the billing process and reducing delays in payments.

- User-Friendly: These platforms are typically designed with simplicity in mind, allowing users to quickly create professional records without technical expertise.

Where to Find Free Tools

There are several websites that provide free, high-quality resources for creating professional billing documents. These platforms often allow you to download documents in various formats such as PDF, Word, or Excel, so you can choose the one that best fits your needs.

- Template Websites: Sites like Template.net or Invoice Generator offer a range of free tools that are easy to use and modify.

- Google Docs and Sheets: Google offers free, customizable document formats that can be used to create professional-looking records. You can find templates in the Google Docs and Sheets galleries or start from scratch using their easy-to-navigate platform.

- Accounting Software Platforms: Some free accounting software, such as Wave or Zoho Invoice, provides free document creation tools along with additional financial tracking features.

By utilizing these free tools, you can streamline your billing process and create polished, clear documents that enhance your professionalism and help maintain smooth transactions with clients.

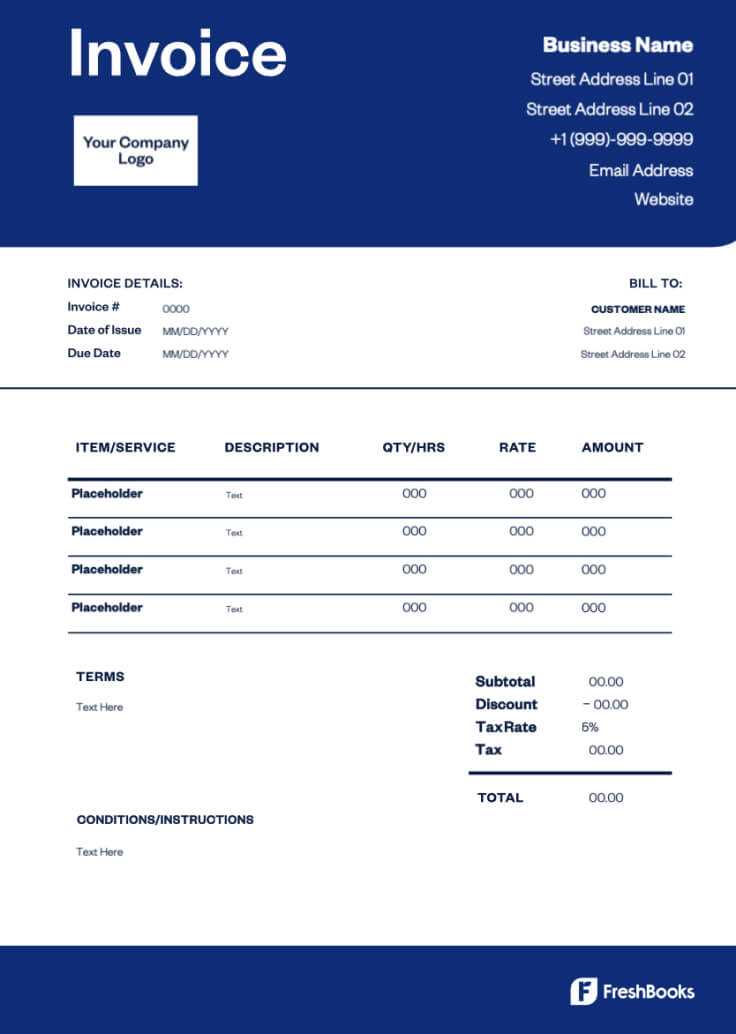

Best Invoice Software for Plumbers

For businesses in the maintenance and repair industry, having the right software can significantly improve the billing process. The best programs help streamline the creation of billing records, automate payment reminders, and offer features that make managing transactions easy. These tools can save time, reduce errors, and enhance your professionalism by ensuring that each record is accurate and delivered on time.

Here are some of the top software options for professionals in the trade:

- QuickBooks: A popular choice for small businesses, QuickBooks offers easy-to-use tools for creating and managing business records, tracking payments, and generating financial reports. It’s known for its user-friendly interface and integration with other financial systems.

- FreshBooks: Ideal for service-based businesses, FreshBooks allows you to create personalized records quickly. It also includes time-tracking and project management features, which makes it an excellent choice for managing both work and payments in one platform.

- Zoho Invoice: Zoho offers a free version with essential features like creating professional records, automated reminders, and multi-currency support. It’s a great option for freelancers or small businesses looking for an affordable and efficient solution.

- Wave: This free accounting software includes powerful features for billing, payment tracking, and even bank reconciliation. Wave is ideal for businesses on a tight budget but still needing essential invoicing features.

- Bill.com: Known for its simplicity and automation features, Bill.com allows users to send and track payments effortlessly. It’s great for small businesses that need an intuitive platform for invoicing and payment management.

By choosing the right software, you can optimize your billing process, improve cash flow, and spend more time focusing on your core business activities. Look for a solution that aligns with your business size, budget, and specific needs to get the most out of these tools.

Choosing the Right Format for Your Invoice

Selecting the right format for your billing document is an essential part of maintaining a professional and efficient business. The format you choose should not only align with your business needs but also be clear, easy to understand, and quick to generate. A well-organized layout ensures that your clients can easily review the details, reducing the chances of confusion or delays in payments.

Key Considerations When Choosing a Format

When determining the best layout for your documents, keep these factors in mind:

- Clarity: Ensure that all relevant details, such as work description, costs, and payment terms, are easy to locate and understand.

- Professional Appearance: A clean and polished design makes a positive impression and helps establish trust with your clients.

- Customization: Choose a format that allows for customization so you can adjust it for different projects and specific client needs.

- File Type: Select a format that suits your preferences and is easy to share, such as PDF for universal compatibility or Excel for easy tracking and editing.

Common Formats to Consider

Here are some common formats to choose from, each with its own benefits:

| Format | Description | Best For |

|---|---|---|

| Portable and easy to share, preserves the layout and design across all devices. | Sending professional documents via email or printing them for clients. | |

| Excel | Editable, ideal for tracking payments and modifying information quickly. | Businesses that need to manage multiple records and adjust charges easily. |

| Word | Simple to customize, good for small projects or one-time use. | Freelancers or small business owners who need flexibility with text and format. |

| Online Billing Tools | Automates the process, with the ability to track and send documents directly from the platform. | Businesses that want to automate the billing process and streamline payment tracking. |

By choosing the right format, you can ensure that your billing process is efficient, clear, and professional, making it easier for clients to review and pay their dues promptly. Select a format that best meets your business needs and helps maintain smooth communication with your clients.

How to Add Tax to Plumbing Invoices

In many locations, adding taxes to completed jobs is a required practice. This step ensures that your business remains compliant with local tax laws while providing transparency for your clients. Including the correct tax rates on your records can be straightforward, but it’s essential to understand the process to avoid errors and potential legal issues.

Steps to Add Tax to Your Bill

Here are the basic steps to ensure tax is added correctly:

- Determine the Tax Rate: The first step is to find out the applicable tax rate for your location. Tax rates can vary by region, so it’s important to know the percentage that applies to your business activities.

- Calculate the Tax Amount: Once you know the rate, multiply it by the subtotal (the total cost of materials and labor before tax) to find the amount of tax you need to add.

- Add the Tax to the Total: After calculating the tax, add it to the subtotal to determine the final amount due. Ensure that the tax amount is clearly labeled so the client understands what portion of the total is due to tax.

- List the Tax Details: Include a line or section in your document that explicitly breaks down the tax, indicating the rate applied and the amount calculated. This provides transparency and ensures your clients are fully aware of the charges.

Example Calculation

Here’s a simple example of how to calculate and add tax:

- Subtotal: $500

- Tax Rate: 8%

- Tax Amount: $500 x 0.08 = $40

- Total Due: $500 + $40 = $540

In this case, the tax of $40 is added to the original amount, and the final total due is $540. Ensure that all taxes are accurately calculated and displayed, as this helps build trust and keeps your records compliant with tax regulations.

By including tax in a clear and organized manner, you not only comply with local regulations but also maintain professionalism in your financial dealings with clients. Keep track of your taxes carefully to avoid potential issues down the line.

Including Payment Terms on Invoices

Clearly stating payment terms in your billing document is essential for setting expectations and ensuring timely compensation for your work. Payment terms outline the conditions under which payments should be made and can help avoid confusion or delays. These terms provide transparency, making it easier for both you and your client to agree on when and how payments will be handled.

Here are some common payment terms that should be included in your billing document:

| Payment Term | Description |

|---|---|

| Due Upon Receipt | This means the client should pay immediately upon receiving the document. It’s ideal for smaller jobs or repeat clients. |

| Net 30 | Payment is due 30 days after the document is issued. This gives clients some time but still ensures relatively prompt payment. |

| Net 60 | Similar to Net 30 but with a 60-day window for payment. This is more common in larger projects or with businesses that have long billing cycles. |

| Late Fee | Specifies that a fee will be added if payment is not received by the due date. For example, you might charge a fixed fee or a percentage of the outstanding amount. |

| Early Payment Discount | Offering a discount (e.g., 2% off if paid within 10 days) can incentivize clients to pay sooner. |

Including these terms in your document ensures that both you and your client are on the same page regarding when payment is expected, how it should be made, and the consequences for late payments. By clearly outlining payment expectations upfront, you minimize the potential for misunderstandings and help ensure a smoother business transaction.

Invoice Design Tips for Professionalism

Creating a polished and professional document is essential for making a strong impression on clients. A well-designed document not only helps communicate the details of the work but also reinforces the professionalism of your business. The layout, fonts, colors, and structure of the document can all contribute to how clients perceive your business. It’s important to keep it clear, concise, and easy to navigate.

Key Elements of a Professional Design

When designing your document, consider the following elements to ensure it looks professional and is easy to read:

- Clarity: Ensure that all important details such as the work completed, total amount due, and payment instructions are easy to find. Use headings, bullet points, and spacing to organize information logically.

- Branding: Incorporate your company’s logo, color scheme, and fonts to make the document visually aligned with your brand identity. This creates consistency and reinforces your business’s image.

- Legibility: Choose readable fonts, ideally sans-serif for modern aesthetics, and maintain a balanced font size. Avoid using too many different font types or colors, as this can make the document look cluttered.

- Professional Layout: Keep the layout simple but structured. Use well-defined sections such as a header with your business details, a section for the client’s information, and a clear breakdown of costs. A clean layout enhances readability.

Design Tips to Enhance Client Perception

Small details in your document design can make a big difference in how clients view your business. Here are some additional tips:

- Whitespace: Don’t be afraid of leaving some blank space. Whitespace helps improve the document’s overall appearance and makes it feel less crowded, making it easier for clients to find key information.

- Alignment: Align text consistently to the left or center to create a cohesive, neat look. Misaligned text can make the document seem disorganized and unprofessional.

- Consistency: Use the same formatting, colors, and fonts throughout the document to give it a unified and polished look. This consistency reflects the reliability and organization of your business.

- Use of Color: While it’s important to keep the design professional, a subtle use of color can add an elegant touch. Use it for headings, borders, or key information to help draw attention to the most important sections.

By focusing on the design, you not only improve the aesthetics of your documents but also communicate professionalism and attention to detail. A well-designed document can leave a lasting impression, increase client confidence, and contribute to the smooth operation of your business.

Common Mistakes to Avoid in Invoices

When creating billing documents, even small errors can lead to misunderstandings or delays in payments. Mistakes in the details or structure of your document can make the process more complicated for both you and your clients. Avoiding common pitfalls helps ensure a smooth transaction and maintains professionalism in your business interactions.

Here are some of the most frequent mistakes to avoid when preparing your billing records:

- Missing or Incorrect Client Information: One of the most important aspects of any document is ensuring that the client’s name, address, and contact details are accurate. Incorrect information can delay payment or cause confusion regarding who the document is intended for.

- Failure to Include Clear Payment Terms: Always specify the payment deadline and methods. Leaving out these details can result in delayed payments or disagreements about when payment is due.

- Not Listing All Work or Costs: Be sure to provide a clear breakdown of all tasks completed, along with associated costs. Clients need to see exactly what they are being charged for to avoid any disputes. Omitting even a small detail can lead to confusion or dissatisfaction.

- Not Adding Tax Details: If applicable, ensure you include the appropriate tax rate and the total tax amount. Failing to do so can lead to discrepancies in the final amount due and potential legal or financial issues.

- Overcomplicating the Design: A cluttered or overly complex layout can make your document hard to read. Keep the design clean, with clear headings and organized sections, so clients can easily understand the breakdown of charges.

- Incorrect Total Amount: Double-check the final sum before sending it out. Arithmetic errors can create confusion and erode your credibility. Always verify the total, including tax and any discounts.

- Omitting Payment Instructions: Make sure to clearly state how the client can pay, whether through bank transfer, online payment, check, or another method. Not specifying this can cause unnecessary delays in receiving payment.

- Using Unprofessional Language: The tone of your document should remain courteous and professional. Avoid using slang or overly casual language, which could detract from the professional image of your business.

By paying attention to these common mistakes, you can avoid misunderstandings and ensure your billing documents reflect the professionalism and attention to detail that your clients expect. Clear, accurate, and well-organized records contribute to smoother transactions and a more positive client experience.

How to Send Invoices Efficiently

Efficiently sending billing documents not only helps ensure prompt payments but also saves time and reduces the chance of errors. Whether you’re handling a few clients or a large number of transactions, streamlining your process can greatly improve your workflow and cash flow. Understanding the best methods for sending these records will help maintain professionalism and prevent delays.

Here are some key steps to send your documents efficiently:

- Choose the Right Format: Sending your records digitally is the quickest method. Choose a format that is easy to open and read, such as PDF. This format ensures that your layout and design remain intact across all devices, making it easy for your clients to view and understand the details.

- Use Online Billing Platforms: Consider using an online system or billing software to automate the process. Many platforms allow you to send records directly to clients, track payments, and even set up reminders for overdue payments. This can save you considerable time, especially if you handle multiple clients.

- Send Immediately After Completion: Don’t wait too long after finishing a project to send the document. Sending it promptly, ideally within a few days, helps reinforce professionalism and can speed up payment. The sooner the client receives it, the sooner they can process it.

- Automate Payment Reminders: Many online platforms offer automated reminder systems that notify clients when their payment is due or overdue. This reduces the need for manual follow-up and helps ensure timely payments.

- Use Email Effectively: If you’re sending the document via email, write a clear and concise subject line and include a brief message that highlights the key details, such as the amount due and the payment deadline. Attach the document in a universally accessible format, such as PDF, and avoid sending large files that may be difficult for clients to open.

- Confirm Receipt: Always follow up with your client to confirm that they received the document. A simple email or phone call can ensure that the process is moving forward and that there are no issues with the delivery.

By adopting these methods, you can streamline the process of sending documents and improve your business operations. A well-organized, timely approach ensures that clients receive the information they need promptly, helping you maintain positive relationships and secure timely payments.

Tracking Payments with Plumbing Invoices

Keeping track of payments is a vital part of managing any business. It ensures you stay on top of your cash flow and helps avoid misunderstandings with clients regarding amounts owed. Properly monitoring payments can also help you identify outstanding debts and follow up with clients in a timely manner. By using a systematic approach, you can simplify the process and avoid missed payments.

Steps to Effectively Track Payments

Here are some steps to make payment tracking more efficient:

- Use Clear Payment Deadlines: Always include clear payment terms in your billing document. Whether it’s due immediately or within a set number of days, make sure the client understands when the payment should be made. This minimizes confusion later on.

- Set Up a Payment Log: Maintain a record or log of all the payments made. This could be a simple spreadsheet or part of your accounting software. For each transaction, include the client’s name, the amount due, the amount paid, and the payment date. This log will serve as a reference in case you need to verify any details.

- Mark Paid Transactions: Once a client has paid, mark that entry as “paid” in your records. This ensures you don’t mistakenly follow up on already settled debts and provides a visual cue for your progress.

- Monitor Payment Deadlines: Use calendar reminders or a payment management system to keep track of when payments are due. This proactive approach allows you to send timely reminders or follow-ups when necessary.

Helpful Tools for Payment Tracking

There are several tools available to help automate and simplify the payment tracking process:

- Accounting Software: Programs like QuickBooks, Xero, or FreshBooks can automatically track and categorize payments. These platforms often allow you to set up automated reminders, create payment logs, and generate reports on outstanding balances.

- Online Payment Systems: Payment processors such as PayPal, Stripe, or Square provide tracking tools that show when payments are made, when funds are processed, and whether any payments have failed or been delayed.

- Spreadsheets: If you prefer a more manual approach, you can use Excel or Google Sheets to track payments. You can set up a simple table to log transactions, which gives you easy access to the data you need to follow up on overdue payments.

By implementing these strategies and tools, you can efficiently manage and track payments, which will improve your cash flow and reduce the risk of missed payments. Clear records and proactive management will keep your business running smoothly and help maintain strong client relationships.

How to Manage Late Payments

Dealing with late payments is an inevitable part of running a business. However, the way you handle overdue amounts can have a significant impact on your cash flow and relationships with clients. Managing late payments effectively requires a combination of clear communication, timely reminders, and a structured approach to follow-ups. A proactive system helps ensure you maintain steady revenue and avoid unnecessary stress.

Strategies for Handling Late Payments

Here are some practical steps you can take to manage overdue amounts and encourage timely payments:

- Send Friendly Reminders: A gentle reminder can often resolve a late payment issue. If the deadline has passed, send a courteous email or message notifying the client of the overdue amount. In some cases, clients simply forget or overlook the due date, and a polite nudge can help get things back on track.

- Set Clear Payment Terms: To avoid confusion in the future, make sure your payment terms are always clear and upfront. Specify when payments are due, any penalties for late payments, and accepted methods of payment. This reduces ambiguity and provides a clear reference point for both you and your client.

- Implement Late Fees: Late fees can act as a deterrent for clients who consistently pay after the deadline. Clearly state your late fee policy in your billing document, specifying the amount or percentage added to overdue payments. Make sure to enforce this policy consistently to maintain fairness.

- Offer Payment Plans: For larger amounts, consider offering a payment plan if a client is struggling to pay the full sum at once. This shows flexibility and may help ensure that the client still pays, even if it’s in smaller installments.

Steps to Take if Payment Remains Unpaid

If reminders and follow-up efforts don’t result in payment, it’s time to escalate your approach. Here are some actions you can take:

- Send a Formal Notice: If informal reminders don’t work, send a more formal written notice requesting payment within a specific time frame. This document should outline the outstanding balance, the due date, and any consequences for further delays.

- Call the Client: Sometimes a personal phone call is more effective than an email. Discuss the situation calmly and professionally, and try to understand any reasons behind the delay. Offering a solution, like a payment plan, might help resolve the issue.

- Seek Legal Advice: If the amount remains unpaid and all attempts to collect have failed, consider consulting with a legal professional. They can advise on the next steps and help you pursue the matter through formal collections procedures if necessary.

By staying organized, maintaining clear communication, and following up consistently, you can reduce the impact of late payments on your busi

Why Invoices Matter for Plumbing Businesses

Proper documentation of completed work is essential for any business, and especially important when it comes to ensuring timely payments and maintaining professionalism. Clear and well-organized records of services rendered provide both the business owner and the client with transparency regarding financial transactions. They help create a clear understanding of the agreed-upon costs, prevent misunderstandings, and ensure a smooth flow of revenue.

In the context of a business that handles a wide range of repairs and installations, creating and sending thorough records is an integral part of operations. These documents not only protect the financial health of the business but also ensure legal compliance, help manage cash flow, and improve customer relations.

- Ensures Accurate Payments: Without clear records, it’s easy to overlook payments or miscalculate amounts owed. By providing detailed statements, you ensure that both parties are on the same page regarding what was provided and how much is due.

- Facilitates Tax Filing: Detailed records are also invaluable when it comes to tax season. Keeping track of all financial transactions throughout the year makes tax filing easier and ensures that you have the correct documentation for any deductions or business expenses.

- Enhances Professionalism: Providing clients with clear and comprehensive billing records helps project a professional image. It reassures clients that they are dealing with a well-organized business, which in turn can improve customer satisfaction and loyalty.

- Avoids Disputes: Having a detailed breakdown of costs, materials used, and hours worked ensures that both you and your clients are clear on the pricing. This reduces the likelihood of disputes or confusion over payments after the job is completed.

- Improves Cash Flow: By establishing a routine of issuing detailed records promptly, you help streamline the payment process. Clients will know exactly when payments are due, which leads to faster processing of payments and a healthier cash flow for your business.

Ultimately, maintaining a system of issuing clear, professional documentation for all transactions is essential to running a successful business. Not only does it help avoid issues, but it also establishes a foundation of trust and transparency with your clients, leading to long-term success and smoother operations.

Improving Cash Flow with Better Invoicing

Effective management of financial transactions plays a crucial role in the stability and growth of any business. One of the key components of maintaining positive cash flow is ensuring that payments are collected promptly. By refining the way you handle and send billing statements, you can streamline the payment process, reduce delays, and boost your financial health. Small improvements in how you issue documents can result in faster payments and better overall cash flow.

Steps to Improve Cash Flow

Implementing a few strategic changes in your payment processes can have a significant impact on your cash flow:

- Send Documents Promptly: The quicker you send out payment requests after completing work, the faster you can expect payments to come in. Make it a habit to issue payment requests within 24-48 hours of finishing a project. Delays in issuing documents only extend the time before you receive your money.

- Establish Clear Payment Terms: Ensure that your payment terms are crystal clear. Include specific due dates, payment methods, and any late fees in your billing document. By providing clients with a clear payment schedule, they are less likely to delay payment.

- Offer Multiple Payment Options: The easier it is for clients to pay, the quicker you will receive payment. Offering multiple payment methods–such as bank transfers, credit card payments, or online payment platforms–gives clients flexibility, making it more likely they will pay on time.

- Incorporate Automated Reminders: Automated payment reminders can significantly reduce the amount of time spent chasing overdue payments. Set up reminders through your accounting software or manually follow up when payments are close to or past due. Consistent reminders keep payments top-of-mind for clients.

Additional Tips for Financial Stability

- Offer Early Payment Discounts: Providing a small discount for clients who pay early can incentivize quicker payments. Even a 2-5% discount can be enough to encourage clients to settle their balance ahead of the due date.

- Track Payments and Outstanding Balances: Keep a close eye on all payments made and any outstanding balances. Having a clear overview of your financial situation helps you stay on top of overdue payments and allows you to act quickly if you notice a pattern of delays.

- Use Recurring Billing: For ongoing projects or long-term contracts, consider setting up recurring billing. This eliminates the need for repeated administrative work and ensures that payments come in on time at regular intervals.

By taking these steps and optimizing your payment processes, you can reduce delays, improve the efficiency of collections, and ultimately maintain a healthier cash flow. A proactive approach to billing not only keeps the business running smoothly but also helps foster stronger, more professional relationships with clients.

Legal Requirements for Plumbing Invoices

When running a business, it’s crucial to ensure that all financial documentation adheres to legal standards. Properly issued records of completed work are not only essential for maintaining clear communication with clients but also for complying with various regulations. These documents play an important role in ensuring that transactions are documented in a manner that is both legally acceptable and fair to both parties involved.

Key Legal Considerations

There are several legal requirements that must be met when preparing and issuing financial statements for completed work. These requirements may vary based on your location, the scale of your business, and other factors, but here are some common legal elements that should be included:

- Business Information: Include your full business name, address, and contact information. This helps confirm the identity of the service provider in case of disputes and provides clarity for clients about who they are dealing with.

- Client Information: Include the client’s name and contact information, ensuring there is no ambiguity regarding the recipient of the financial document.

- Transaction Date: Always include the date when the transaction took place or when the work was completed. This provides a clear reference point for both you and your client for record-keeping and dispute resolution.

- Description of Work: A detailed description of the tasks performed, including materials used, labor hours, and specific actions taken, is necessary. This helps avoid confusion and ensures transparency in the transaction.

- Amount Due: Clearly state the amount owed, breaking down the costs of materials, labor, taxes, and any additional charges. This is essential for both parties to understand the exact financial obligation.

- Payment Terms: Clearly outline when payment is due, acceptable methods of payment, and any penalties or fees for late payments. This helps avoid misunderstandings and legal issues in the future.

- Tax Identification Number: Many countries require businesses to include a tax identification number or VAT number on financial records. This ensures that your business complies with tax reporting requirements and facilitates any potential audits.

Additional Legal Considerations

- Compliance with Local Laws: Depending on your location, there may be additional legal requirements or guidelines specific to your industry. Research the regulations in your area to ensure full compliance.

- Contractual Agreement: If a contract exists between you and the client, refer to the terms of that contract within your financial record. This helps ensure that all billing aligns with previously agreed-upon conditions.

- Digital Records and E-Signatures: If you are sending electronic records, ensure that your digital systems comply with relevant e-signature laws and digital record-keeping standards.

By following these legal guidelines and ensuring all necessary details are included in your documents, you can protect your business from potential legal issues and build trust with your clients. Always stay informed about local regulations and adapt your processes to ensure full compliance.