Download and Customize Rental Invoice Template in Word

Managing payments and ensuring smooth financial transactions is essential for any business, especially those that deal with property or equipment rentals. One of the most effective ways to organize and present payment requests is by using well-structured, editable documents. These documents not only ensure clarity but also provide a professional appearance, building trust between the service provider and the client.

With the right format, creating clear and concise payment requests becomes much easier. Editable documents allow businesses to quickly generate and personalize each request according to specific agreements or rental periods. This flexibility can save time and reduce the chance of errors, leading to faster payments and fewer misunderstandings.

Whether you are a property manager, equipment hirer, or service provider, utilizing a customizable format can help you stay organized. It ensures that all essential information, such as terms, dates, and amounts, is clearly presented and easy to update when necessary. This approach makes it simple to stay on top of finances and maintain consistent communication with clients.

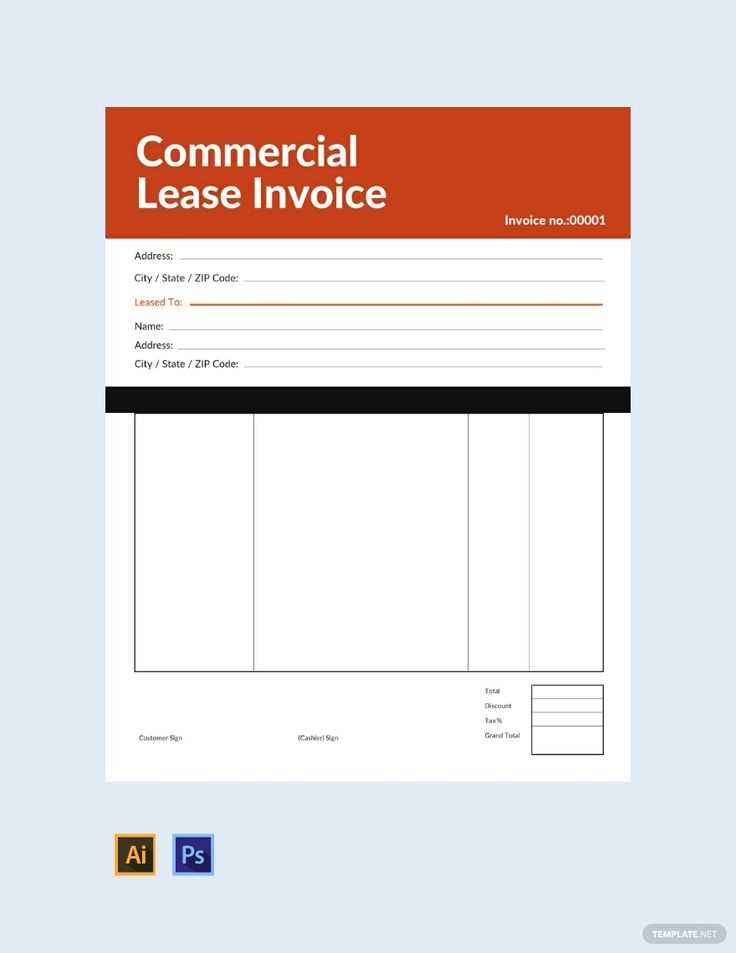

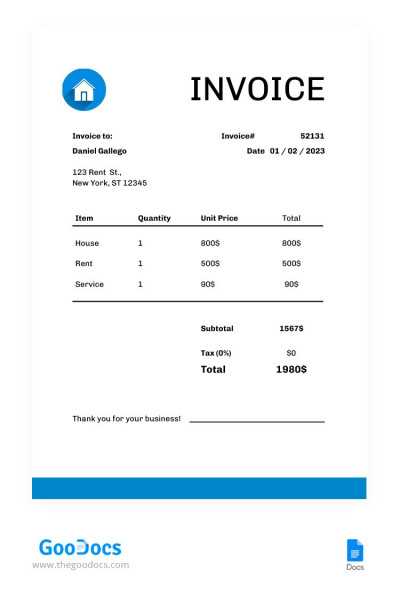

Rental Invoice Template in Word Format

When managing financial transactions, using a clear and professional document format can make a significant difference. A customizable layout allows businesses to easily generate payment requests that align with their specific needs. Such documents can be adjusted to reflect different rental durations, terms, and client information, ensuring every detail is captured accurately.

Creating these documents in a popular software format like Microsoft allows for seamless editing and sharing. The format is simple to use and accessible, making it ideal for businesses of all sizes. By choosing this flexible option, users can quickly adjust and personalize each document to suit individual agreements, saving time and ensuring consistency in all communications with clients.

Why Use a Word Invoice Template

Utilizing a pre-designed document format for payment requests offers numerous advantages. It provides consistency, saves time, and helps avoid errors, all while maintaining a professional appearance. A well-structured document can enhance the billing process, ensuring that all relevant details are included and easily understood by both parties.

Here are some key reasons why this approach is beneficial:

- Ease of Use: The format is simple to edit and customize, even for those with minimal technical skills.

- Time Efficiency: It eliminates the need to create a new document from scratch each time, speeding up the process.

- Consistency: Using the same structure for all transactions helps maintain uniformity across records, making it easier to track payments.

- Professional Presentation: A polished document conveys reliability and helps build trust with clients.

- Flexibility: The layout can be easily adjusted to fit different types of agreements or services provided.

With these benefits, it’s clear why many businesses choose to use this adaptable solution for managing payment requests effectively.

Benefits of Customizing Rental Invoices

Personalizing payment documents offers significant advantages for businesses, helping to ensure that all relevant details are included and presented in a clear, professional manner. Customizing these documents allows for greater flexibility, enabling businesses to adapt each request according to the specific terms of the agreement, the client, or the services provided.

Key Advantages of Personalization

- Accurate Information: Customizing allows you to add specific details such as service dates, rates, and payment terms that are unique to each agreement.

- Improved Professionalism: A tailored document reflects attention to detail and enhances the overall image of your business.

- Efficiency: By using an adaptable format, you can quickly make changes without starting from scratch every time, saving time in the process.

- Better Communication: A personalized request makes it easier for clients to understand the charges, deadlines, and payment instructions.

- Enhanced Branding: Including your company logo, colors, and contact details creates a cohesive, branded experience for your clients.

Flexibility in Adjustments

- Variable Terms: Easily adjust terms based on the nature of each agreement, whether it’s for short-term or long-term use.

- Tailored Payment Options: You can include personalized payment methods, instructions, and any applicable fees specific to each transaction.

Customizing payment documents not only streamlines the billing process but also improves the client experience, ensuring that all communications are clear, accurate, and professional.

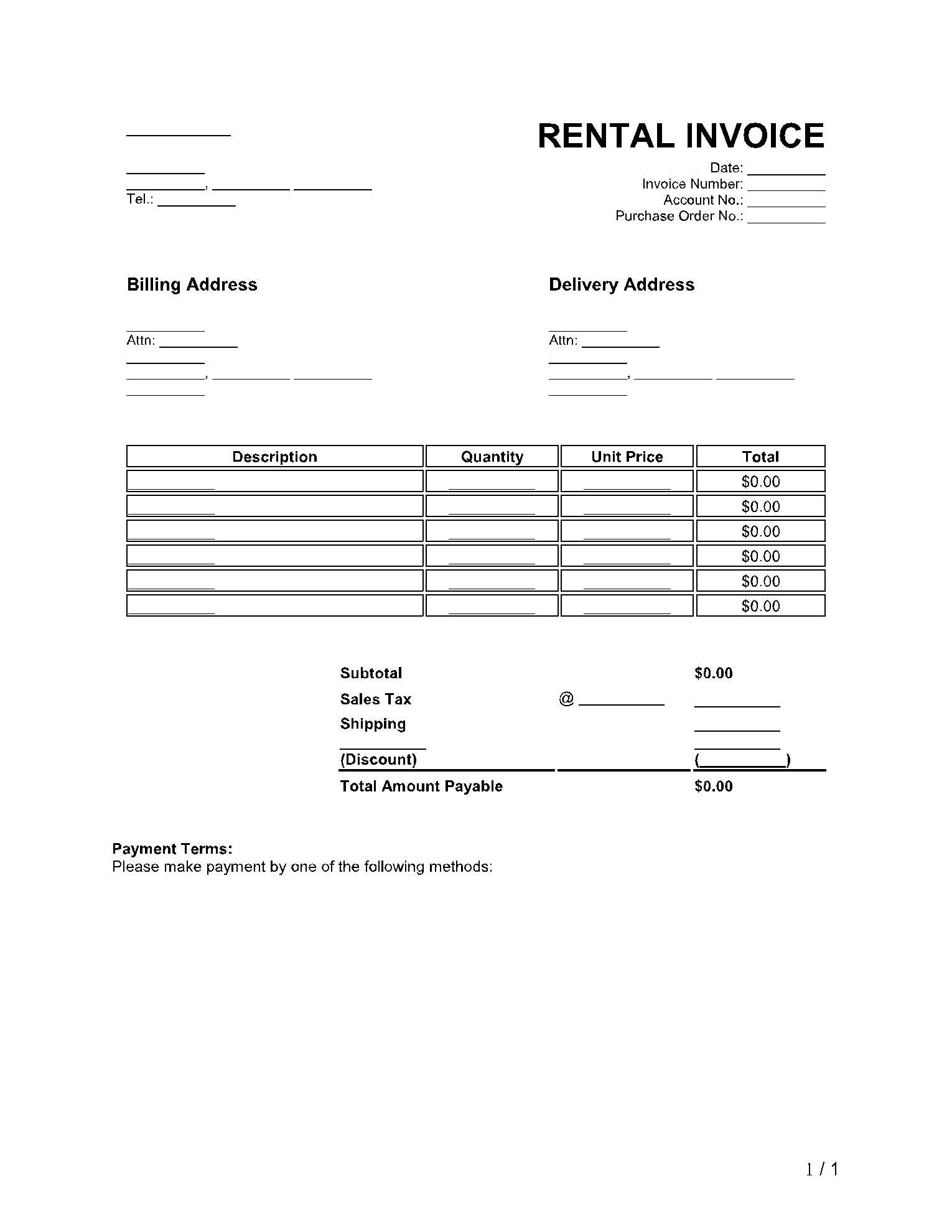

How to Create an Invoice in Word

Creating a professional payment request in a popular document editor is straightforward and efficient. By following a few simple steps, you can produce a clear and accurate document that includes all the necessary details for your transaction. Customizing the format allows you to personalize each request according to the specifics of the agreement, ensuring clarity for both parties involved.

Here is a basic guide to help you create a professional payment document:

- Start with a Blank Document: Open your document editor and choose a blank page to start from scratch or use an existing layout.

- Include Business Information: At the top of the page, add your company name, address, phone number, and email address for easy contact.

- Client Information: Include the recipient’s name, address, and contact details below your business information.

- Include Transaction Details: Clearly outline the services provided, the rates, and the duration of the agreement. You can present this information in a table format:

| Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service/Product Name | 1 | $100.00 | $100.00 |

| Additional Fee | 1 | $50.00 | $50.00 |

After entering all the transaction details, calculate the total amount due, ensuring that any taxes or discounts are properly accounted for. Finally, include payment terms and due dates to ensure there is no confusion. Once complete, save the document and share it with your client via email or print it for physical delivery.

Essential Elements of Rental Invoices

When preparing a document to request payment for leased property or services, it is crucial to include all necessary information to ensure clarity and accuracy. Such a document should serve as a clear record of the transaction, specifying key details about the terms, amounts, and involved parties. Below are the most important components to include when drafting this kind of financial request.

Key Information for Accuracy

First and foremost, clear identification of both the issuer and recipient is essential. This includes the names and contact details of the landlord and tenant or service provider and client. The document should also clearly state the item or property being rented, along with the applicable time frame, whether it’s a fixed duration or a recurring period. Additionally, it should specify the agreed-upon cost for the use of the property or service, along with any taxes or extra fees if applicable.

Clear Terms and Conditions

Providing detailed terms is critical to avoid misunderstandings. This includes the due date for payment, penalties for late payments, and any other special clauses that affect the transaction. By outlining these aspects clearly, both parties can refer back to the terms in case of a dispute, ensuring the process remains transparent and fair.

Choosing the Right Rental Invoice Template

Selecting an appropriate format for requesting payment is crucial to ensure the document is both professional and clear. It should be designed to reflect all necessary details while being easy for both parties to understand. Choosing the right structure can save time, reduce errors, and help maintain a positive relationship between the provider and recipient.

Factors to Consider

When deciding on the best format, consider the complexity of the transaction, frequency of use, and the need for customization. Some formats are simple and effective for one-time agreements, while others offer more robust options for recurring payments or large-scale agreements. Below are the most important aspects to evaluate when choosing the right structure.

| Feature | Simple Format | Detailed Format |

|---|---|---|

| Ease of Use | Quick to fill out, minimal fields | More detailed, may require additional time |

| Customization Options | Limited customization | Flexible, allows for multiple entries and detailed terms |

| Recurring Usage | Best for one-time agreements | Ideal for regular agreements and long-term rentals |

| Tracking Features | Basic tracking options | Advanced tracking, due dates, payment status |

Making the Right Choice

Ultimately, the right structure depends on the type of arrangement and how frequently such documents will be created. For straightforward agreements, a simple layout may be sufficient, while for ongoing or more complex transactions, a detailed approach may provide better results.

Steps to Edit Rental Invoice in Word

Modifying a payment request document requires a few straightforward steps to ensure all details are accurate and up to date. Whether you’re making a one-time adjustment or preparing for future transactions, following these steps will help you quickly customize your document with the correct information.

Basic Editing Steps

To start editing your document, follow these essential steps:

- Open the document on your computer.

- Identify the sections that require updates, such as the recipient’s name, date, or payment amount.

- Click on the text area you want to modify and type in the new information.

- Ensure that the formatting remains consistent, adjusting font size or alignment if necessary.

- Save the document after making the changes.

Advanced Customizations

If you need to add or remove sections, or if you require a more detailed layout, consider the following additional steps:

- Insert new fields for additional charges, terms, or specific dates.

- Adjust the table format to include more or fewer rows and columns for itemized lists or totals.

- Change fonts or colors to match your company’s branding or preferences.

- Review all fields for accuracy before finalizing the document.

By following these steps, you can ensure that your payment request document is clear, professional, and tailored to your needs.

Tips for Professional Invoice Design

Creating a well-designed document for payment requests is essential for maintaining a professional image. A clean, organized layout not only ensures that all critical information is easily accessible but also promotes trust and credibility with clients. Below are some important design tips to consider when crafting your payment request documents.

Key Design Principles

When preparing a document to request payment, consider the following guidelines to enhance readability and professionalism:

- Keep the design clean and uncluttered, focusing on essential details.

- Use clear, easy-to-read fonts that are consistent throughout the document.

- Incorporate your company logo and branding colors for a cohesive look.

- Ensure the layout is logically organized, grouping related information together.

Effective Use of Tables

Tables are an excellent way to organize data such as itemized charges and totals. Use them to break down complex information into digestible sections.

| Description | Amount |

|---|---|

| Item/Service 1 | $200 |

| Item/Service 2 | $150 |

| Total | $350 |

By following these design tips, you can create a payment request document that is visually appealing and easy to understand, helping to streamline the payment process.

How to Add Payment Terms in Word

Including clear payment conditions in your documents is essential to avoid misunderstandings and ensure timely compensation. These conditions outline when the payment is due, any discounts or penalties, and the available methods for payment. Adding such details helps both parties understand the expectations and responsibilities, facilitating smoother transactions.

Steps to Include Payment Conditions

To add the terms, follow these steps:

- Open your document and scroll to the section where the payment details are listed.

- Insert a new section titled “Payment Terms” or similar.

- Specify the due date clearly (e.g., “Due within 30 days from the date of issue”).

- If applicable, mention early payment discounts (e.g., “A 5% discount for payments made within 10 days”).

- State any late fees or penalties (e.g., “A 2% late fee will apply after the due date”).

- List acceptable payment methods (e.g., “Payments can be made via bank transfer, credit card, or check”).

Formatting the Payment Terms

Ensure that the payment terms are easy to spot by using bold or italic text, or by separating them in a box or shaded area. This makes it easier for the recipient to find and understand the conditions quickly.

Tracking Payments Using Rental Invoices

Monitoring payments is crucial to ensure that all financial transactions are completed on time and accurately. By organizing and tracking payment requests, you can easily keep a record of outstanding balances, payments received, and any overdue amounts. This process helps maintain a clear financial picture and ensures you are paid promptly.

Effective Payment Tracking Methods

To track payments efficiently, follow these best practices:

- Assign unique identifiers (such as numbers or codes) to each document to easily reference them.

- Note the payment due date and mark payments as received when made.

- Maintain a log of each transaction, including the amount paid, date of payment, and payment method.

- Review regularly to ensure all outstanding payments are followed up.

Payment Tracking Table

One effective way to track payments is by using a table to record transaction details. Below is an example format for tracking payments:

| Document Number | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|

| 001 | $500 | $500 | 2024-10-15 | Paid |

| 002 | $300 | $0 | 2024-10-20 | Pending |

| 003 | $200 | $200 | 2024-10-25 | Paid |

By using a table like the one above, you can quickly assess the payment status of each request, making it easier to follow up on any overdue amounts.

Using Templates for Consistency in Billing

Ensuring uniformity in billing documents is essential for maintaining professionalism and minimizing errors. By using a pre-designed structure, businesses can guarantee that all necessary details are included consistently, saving time and reducing the risk of mistakes. A standardized format also helps clients easily understand the charges, terms, and due dates, which can improve payment efficiency.

Benefits of Using a Pre-Designed Structure

Adopting a consistent structure for all payment requests offers several advantages:

- Reduces the time spent creating new documents from scratch.

- Ensures that all required fields and details are included every time.

- Improves clarity and readability for clients, leading to fewer misunderstandings.

- Provides a professional appearance, which helps build trust and credibility.

Key Elements to Include in a Standardized Format

When creating a standard format, make sure to include these essential elements for consistency:

- Contact information for both parties.

- A detailed list of charges or services provided.

- The payment due date and accepted payment methods.

- Any terms or conditions related to late fees or discounts.

- A unique reference number for tracking purposes.

By utilizing a consistent structure, businesses can streamline their billing process and ensure that each document conveys the same level of professionalism and clarity.

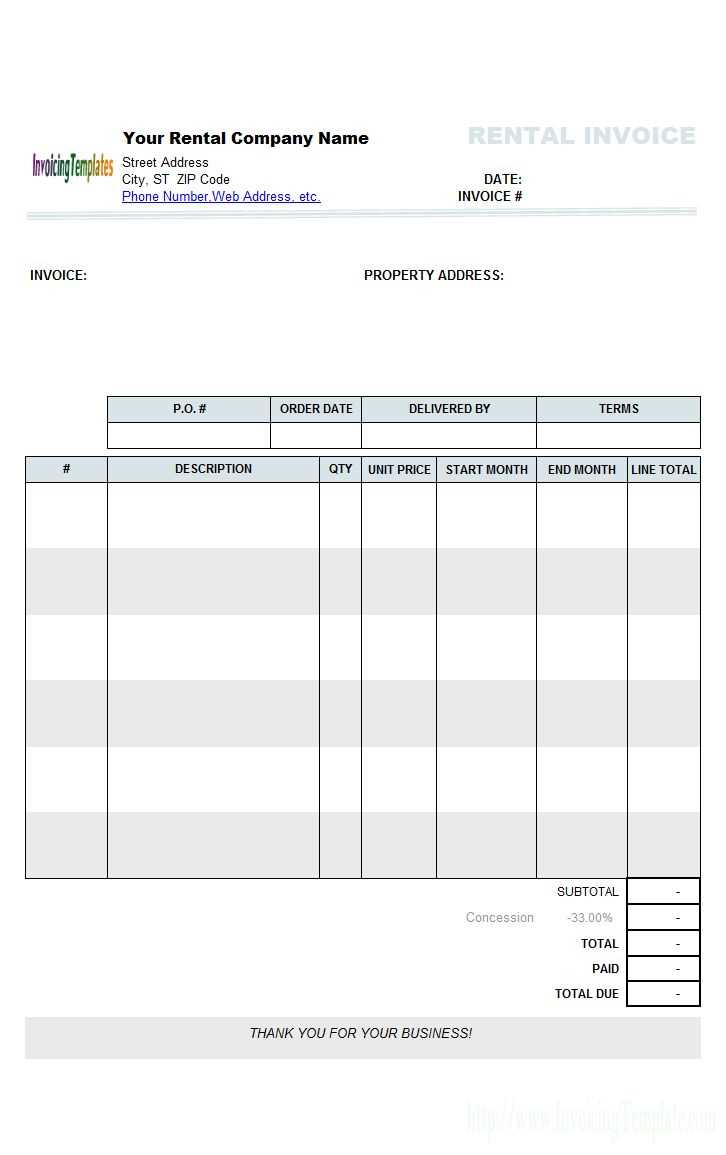

How to Include Rental Details in Invoices

When preparing a document for payment requests related to leased property or services, it is essential to clearly outline all relevant details to avoid confusion. This ensures that both parties understand the terms of the agreement and the specifics of what is being billed for. Including comprehensive rental information not only makes the document more transparent but also helps in avoiding any future disputes.

Key Details to Include

To provide clarity, consider including the following key details in the document:

- The description of the item or property being rented.

- The rental period, whether it is daily, weekly, monthly, or for a specific duration.

- The agreed-upon rate for the rental period, along with any applicable taxes or fees.

- Start and end dates of the rental agreement.

- Details of any deposits or upfront payments required.

Example of Rental Information in a Payment Request Document

The table below illustrates how rental details can be organized and presented for clarity:

| Description | Quantity | Rate | Amount |

|---|---|---|---|

| Property Lease – 1 Bedroom Apartment | 1 | $1,200/month | $1,200 |

| Security Deposit | 1 | $500 | $500 |

| Cleaning Fee | 1 | $100 | $100 |

| Total Due | $1,800 |

By including detailed rental information in a structured format like this, you ensure the clarity of the payment request and help facilitate smoother transactions.

Common Mistakes to Avoid in Invoicing

Creating payment requests may seem straightforward, but there are several common mistakes that can lead to confusion, delayed payments, or even disputes. Ensuring that your documents are accurate and complete is essential for maintaining good relationships with clients and ensuring timely compensation. Below are some of the most common errors to avoid when preparing a payment request.

Frequent Errors to Watch Out For

Here are some common mistakes that can lead to complications in the billing process:

- Not including a clear payment due date, which can cause confusion about when payment is expected.

- Forgetting to provide a detailed description of the services or products provided, leaving room for misunderstandings.

- Not double-checking the amounts or rates, which could lead to overcharging or undercharging.

- Omitting important payment terms, such as late fees or discounts for early payments.

- Using vague or incorrect client contact details, which can delay the payment process.

How to Prevent These Mistakes

To avoid these errors, follow these best practices:

- Always review the document before sending it to ensure all details are accurate and complete.

- Use a checklist to ensure that essential elements, such as payment terms and due dates, are not overlooked.

- Ensure the document is clear and easy to understand by avoiding jargon or ambiguous language.

- Double-check the recipient’s contact information to avoid sending the request to the wrong address.

By avoiding these mistakes, you can streamline your billing process, ensure timely payments, and maintain a positive relationship with your clients.

How to Protect Your Rental Income with Invoices

Securing timely payments and maintaining accurate records is essential for ensuring that your income from leased properties remains stable and protected. Using formal documents to request payment not only provides clarity but also offers a legal safeguard should any disputes arise. These documents act as proof of the terms agreed upon and the amounts due, helping to avoid misunderstandings and protecting both parties involved.

Essential Practices to Safeguard Your Income

To protect your income and avoid delays or disputes, consider incorporating the following practices:

- Include clear terms outlining the payment due date, amount, and method of payment.

- Detail any penalties or fees for late payments to encourage timely settlement of balances.

- Ensure all information, such as rental period and total charges, is accurate and easy to understand.

- Provide a unique reference number for each request to track payments easily and minimize confusion.

- Always send the document promptly after the service period to avoid unnecessary delays in payment.

Using Documentation for Legal Protection

By maintaining proper documentation of each transaction, you create a clear record that can be referenced if necessary. This is especially important if payment issues arise. A well-organized approach to requesting payment can help avoid misunderstandings and provide legal protection in case of non-payment or disputes.

Customizing Templates for Different Rentals

When managing various types of leased properties or services, it is important to adjust the structure of payment requests to suit the specific nature of the agreement. Customizing documents ensures that all the necessary details are included, and it helps to present clear and relevant information based on the type of asset or service being provided. Tailoring these documents can save time and avoid confusion, offering a professional approach for each situation.

Why Customization is Important

Different types of leased goods or services require different formats and levels of detail. Customizing the structure helps ensure clarity and appropriateness for the specific rental agreement. Here are some reasons to personalize your documents:

- Each asset may have unique terms, such as varying rates or rental periods, which need to be highlighted.

- Certain rentals may require specific clauses or disclaimers related to damage, maintenance, or insurance.

- Customized documents provide a more professional appearance and help avoid misunderstandings.

- They ensure that all relevant information is conveyed clearly to both parties.

How to Customize Documents for Different Types of Rentals

Here are some examples of how to adapt the structure for various types of leasing agreements:

- For equipment leasing, include details on usage limitations, maintenance responsibilities, and damage policies.

- For property leasing, emphasize the start and end dates, security deposit requirements, and any additional fees such as utilities or repairs.

- For vehicle rentals, outline insurance details, fuel policies, and mileage limitations.

- For event venue rentals, include specifics about the booking time frame, capacity, and any extra services like catering or security.

By customizing the payment request structure to fit the specific nature of each leasing agreement, you ensure that all necessary information is captured, reducing the chance of disputes and improving the efficiency of the payment process.

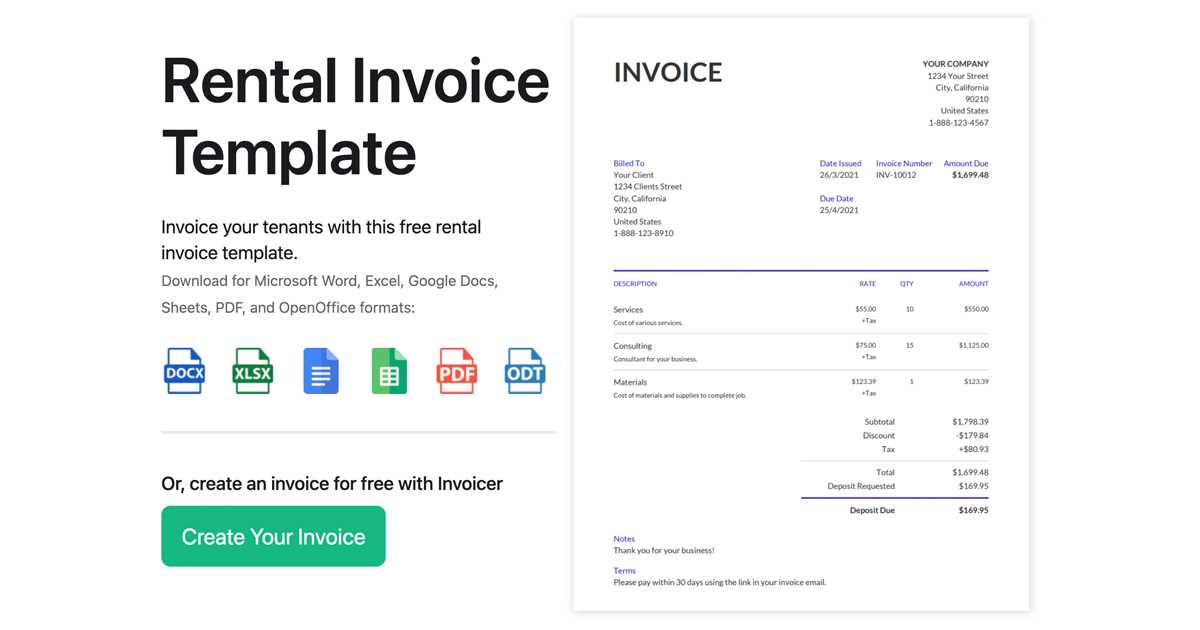

Free vs Paid Rental Invoice Templates

When selecting a format for payment requests, you can choose between free or paid options. Both offer distinct advantages, and the choice depends on your specific needs, preferences, and the level of customization required. While free formats might seem like an appealing choice for those looking to save money, paid versions often provide enhanced features, additional design options, and professional support that can benefit businesses with more complex requirements.

Advantages and Disadvantages

Here’s a comparison of the key differences between free and paid formats:

| Aspect | Free Options | Paid Options |

|---|---|---|

| Customization | Limited customization and flexibility. | High level of customization and personalized design features. |

| Design Quality | Basic, often with minimal design features. | Professional design with advanced formatting and branding options. |

| Support | Limited or no customer support. | Customer support and troubleshooting assistance available. |

| Advanced Features | Basic features, such as editable text fields. | Advanced features like automated calculations, multiple templates, and advanced integration with other tools. |

| Cost | Free of charge. | Requires a one-time payment or subscription. |

Which Option is Best for You?

The choice between free and paid formats depends on your needs. If you’re just starting out and need a simple solution, a free format might be sufficient. However, if you’re running a business that requires a more polished, customizable, and feature-rich solution, a paid version may be the better option to ensure professionalism and efficiency in your payment process.

Where to Find Reliable Invoice Templates

When creating a payment request, it’s crucial to find trustworthy and well-designed formats to ensure that your details are presented clearly and professionally. Reliable sources provide templates that are easy to use, customizable, and often tailored to specific industries. By choosing the right platform, you can save time and avoid errors, ensuring a smooth transaction process for both you and your clients.

Here are some recommended sources for finding reliable formats:

- Online Document Platforms: Websites such as Google Docs and Microsoft Office offer free and paid options with various designs and customization features.

- Professional Websites: Many industry-specific websites provide downloadable formats designed to meet the needs of different businesses and services.

- Design Tools: Platforms like Canva and Adobe Spark offer customizable, visually appealing formats with easy-to-use drag-and-drop features.

- Accounting Software: Popular tools like QuickBooks and FreshBooks often have built-in, automated payment request creation options that ensure accuracy and professionalism.

- Freelance Platforms: Websites like Fiverr or Upwork allow you to hire designers to create customized, branded formats tailored to your business needs.

By exploring these sources, you can find a solution that suits your style, enhances your workflow, and helps maintain a professional appearance for all your transactions.

Updating Your Payment Request Format Regularly

Keeping your payment request structure up-to-date is essential for maintaining accuracy and professionalism. Over time, business practices, tax laws, or industry standards may change, requiring adjustments to the way you present payment details. Regularly updating the format ensures that it reflects current requirements and avoids potential issues related to outdated information.

Why Regular Updates Are Important

- Compliance: Tax laws and regulations can change, and updating your format ensures you include the latest necessary information, like tax rates or compliance disclaimers.

- Professionalism: Using the most current design trends and features helps present your business in a polished, modern light.

- Efficiency: As your business evolves, so should the way you manage payment requests. Periodic updates can streamline the process, making it faster and more effective.

- Adaptation: New technologies, like automated billing systems or digital payment methods, may require changes to how you format your documents.

How to Update Your Payment Request Format

Here are a few steps to ensure your format stays relevant:

- Review Legal Requirements: Check for changes in tax laws or business regulations that affect the structure or required information.

- Incorporate New Payment Methods: If your business adopts new payment options, such as mobile payments or online transfers, update the format to include those details.

- Enhance Design: Make sure the layout is clean, modern, and easy to read. Update fonts, colors, or logos to align with your current branding.

- Automate Where Possible: If you use software to generate payment requests, ensure it’s integrated with the latest features for better efficiency.

By keeping your format up-to-date, you maintain a professional image and ensure that all legal and business requirements are consistently met.