How to Create and Use Microsoft Template Invoice for Your Business

For businesses of all sizes, sending clear and professional payment requests is essential for smooth financial transactions. One of the most efficient ways to achieve this is by utilizing pre-designed formats that streamline the process. These tools allow entrepreneurs and professionals to easily generate custom records for their services, helping them maintain a polished image while saving time on repetitive tasks.

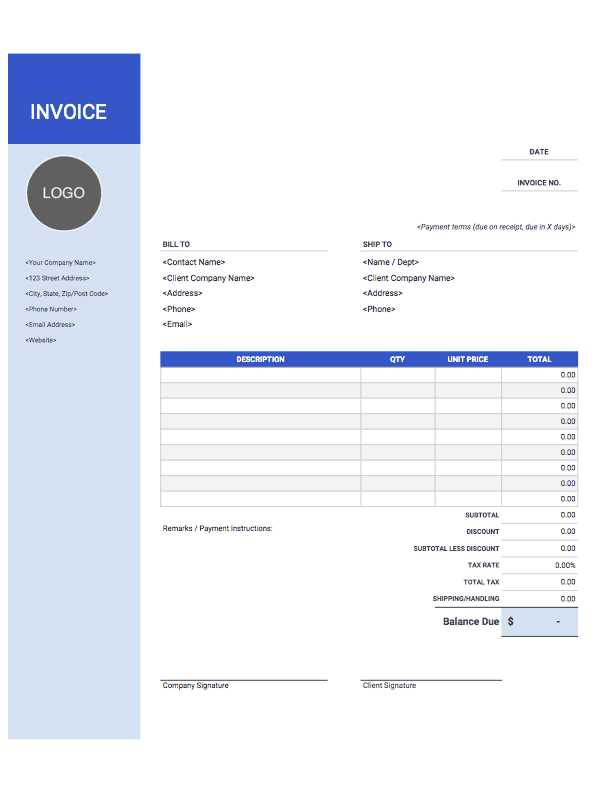

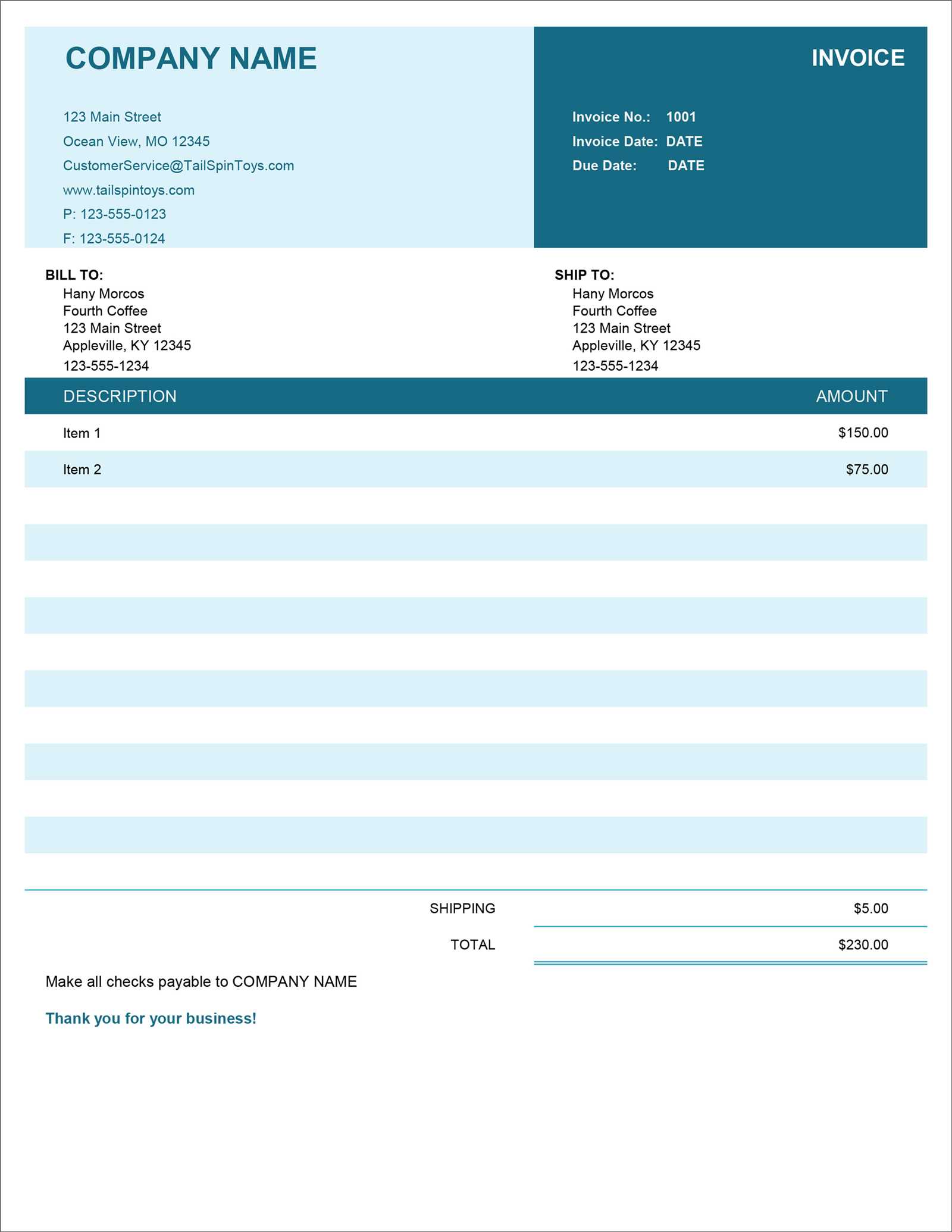

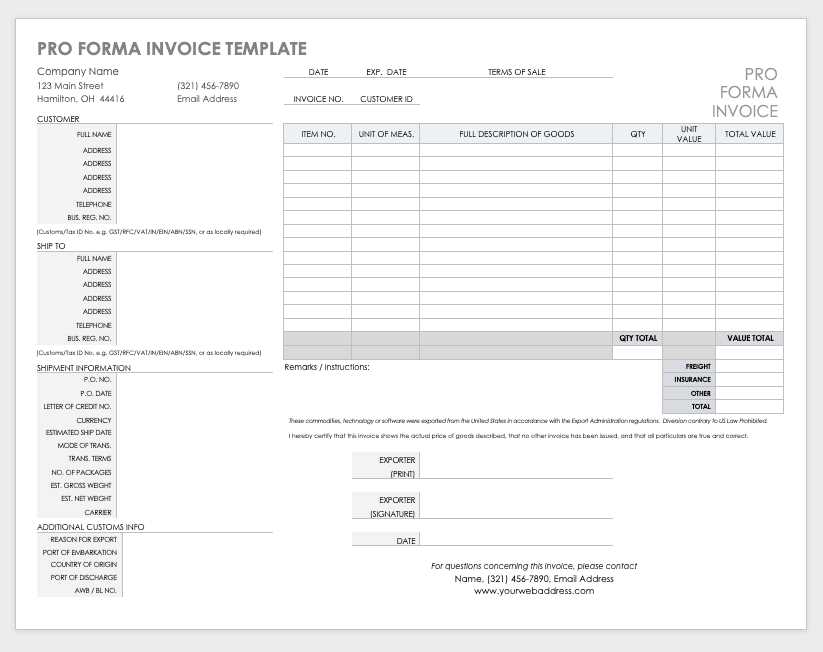

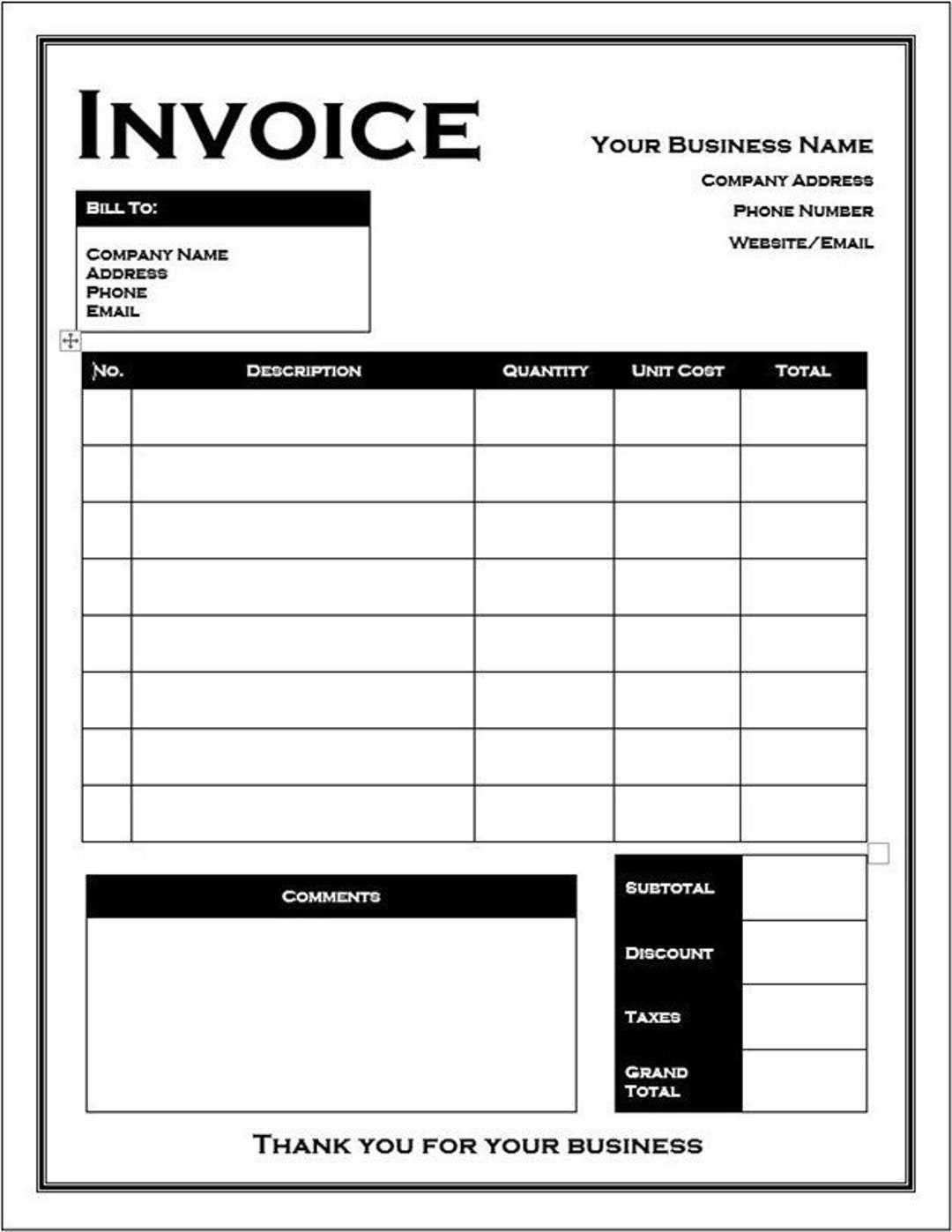

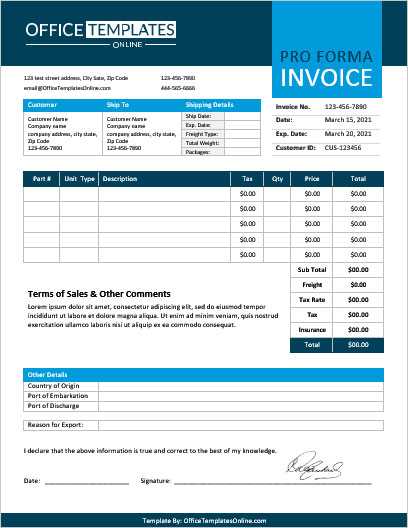

When it comes to creating these essential records, having access to flexible and easy-to-use formats can make all the difference. Such documents typically include sections for business information, itemized charges, and payment instructions, which can be personalized to suit specific needs. By using a well-organized framework, users ensure accuracy, reduce errors, and present a professional image to their clients.

Customizable features make these formats ideal for businesses of all types, from freelancers to large corporations. Whether you’re running a small shop or managing a larger enterprise, these structured files help ensure that your billing is both efficient and aligned with your brand’s identity.

Benefits of Using Invoice Templates

Using structured billing formats offers several advantages for businesses looking to improve their payment process. By leveraging pre-designed documents, organizations can save valuable time, reduce the chance of errors, and ensure consistency across all transactions. These tools provide a clear framework, making it easier to keep track of financial exchanges with clients, while maintaining a professional appearance.

Time Efficiency

One of the key benefits of using ready-made formats is the time it saves. Instead of starting from scratch each time a payment request needs to be sent, these documents come pre-structured, with all necessary fields and sections already in place. This allows business owners to quickly input the relevant information and send out their records without delays, ensuring faster processing for both parties.

Improved Accuracy

Accuracy is crucial when managing financial transactions. Pre-designed formats help minimize human errors, such as missing details or incorrect calculations, by offering automatic calculations and predefined fields. This ensures that all critical elements, like pricing, taxes, and payment terms, are included and formatted correctly, reducing the risk of disputes or misunderstandings with clients.

Additionally, having a consistent layout for all your records enhances professionalism and helps build trust with clients, as they will know exactly what to expect every time. Overall, using structured documents improves not only the efficiency of billing but also the overall client experience.

How to Access Microsoft Invoice Templates

Accessing ready-made billing documents is easy, thanks to numerous tools and platforms that provide them. These pre-designed files can be found through various software programs and online resources. Whether you’re working from a desktop application or prefer using a web-based tool, obtaining these resources is a simple and quick process.

Using Desktop Software

If you use a popular office suite, finding these structured documents is straightforward. Most software suites offer access to a library of pre-built forms, including those for financial records. Follow these steps to locate and use the available options:

| Step | Action |

|---|---|

| 1 | Open your software program (Word, Excel, etc.). |

| 2 | Navigate to the “File” menu and select “New.” |

| 3 | Search for “billing,” “payment,” or similar terms in the template gallery. |

| 4 | Choose a design that fits your needs and start editing. |

Accessing Templates Online

In addition to desktop software, you can access a wide range of options through online platforms. Many websites and cloud services offer customizable billing formats that can be downloaded or used directly in your browser. All you need is an internet connection and a compatible account, such as a cloud-based productivity service.

Simply search for “billing documents” or “payment records” in the platform’s search bar, and select a design that matches your business’s requirements. Afterward, you can edit the content as needed and download or share the document with your clients.

Customizing Templates for Your Business

Once you’ve chosen a pre-designed billing document, the next step is to make it your own. Customizing these forms ensures that they reflect your business’s branding, meet specific needs, and provide accurate information to your clients. With just a few adjustments, you can transform a generic document into a unique, professional record tailored to your company’s identity.

Personalizing Business Information

The first customization step involves adding your business details. This includes your company name, address, contact information, and logo. It’s essential to ensure that your branding is consistent across all communications, including financial documents. By adding these personal touches, you make the document instantly recognizable to your clients and reinforce your business identity.

Adjusting Layout and Content

Customizing the layout is another important aspect. While pre-designed formats provide a useful structure, you might need to adjust sections to reflect the unique aspects of your business. This could mean adding or removing specific fields, such as a section for recurring payments, product descriptions, or service fees. Consider highlighting important details like due dates or payment methods in bold or with different colors to ensure clarity and emphasis.

Consistency and clarity are key when modifying any document. Make sure that the final result is visually appealing, easy to understand, and professionally formatted. This not only helps with client satisfaction but also promotes efficiency in your business’s financial operations.

Step-by-Step Guide to Editing Invoices

Once you’ve selected a billing document, the next task is to personalize and update it with the specific details of your business and transaction. Editing a financial record is a straightforward process that can be done in just a few steps. This guide will walk you through the essential changes, ensuring the final result meets your needs and maintains a professional appearance.

1. Open the Document

- Launch the software or online tool where you have saved the document.

- Locate and open the file you wish to edit from your computer or cloud storage.

2. Modify Business Information

- Update your company’s name, address, and phone number to ensure they are correct.

- Replace the logo with your business logo if necessary.

- Check that all contact details are accurate, including email and website address.

3. Adjust Billing Details

- Update the client’s name and address with the most recent information.

- Include specific transaction dates, such as the service date and the payment due date.

- Modify item descriptions or service details if the products or services differ from previous entries.

4. Add Pricing Information

- Ensure that unit prices, quantities, and total amounts are accurate.

- Include any applicable taxes, discounts, or additional fees.

- Double-check that the final amount reflects any adjustments or special terms for the client.

5. Finalize the Document

- Review the entire document for accuracy and completeness.

- Make any final formatting adjustments to ensure everything is aligned and legible.

- Save the document with a new file name or version to keep track of changes.

Once these steps are complete, your financial record is ready to be shared or printed. Editing these documents regularly will allow you to maintain consistency in your billing process, ensuring your clients always receive clear and professional communications.

Choosing the Right Template for Your Needs

Selecting the appropriate billing document design is essential for ensuring that your financial records are clear, professional, and tailored to your business requirements. The right layout not only helps convey the necessary information to your clients but also ensures a smooth and efficient process for both parties. Understanding what features and styles suit your business can make all the difference in maintaining consistency and professionalism.

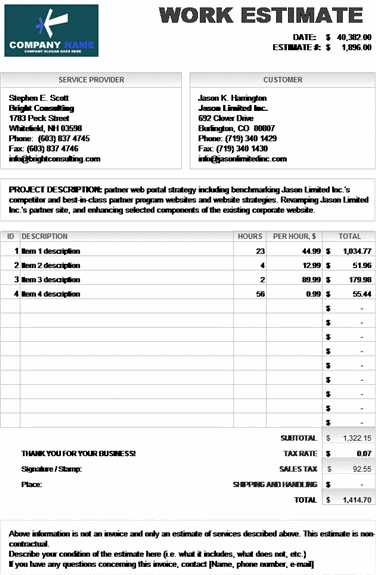

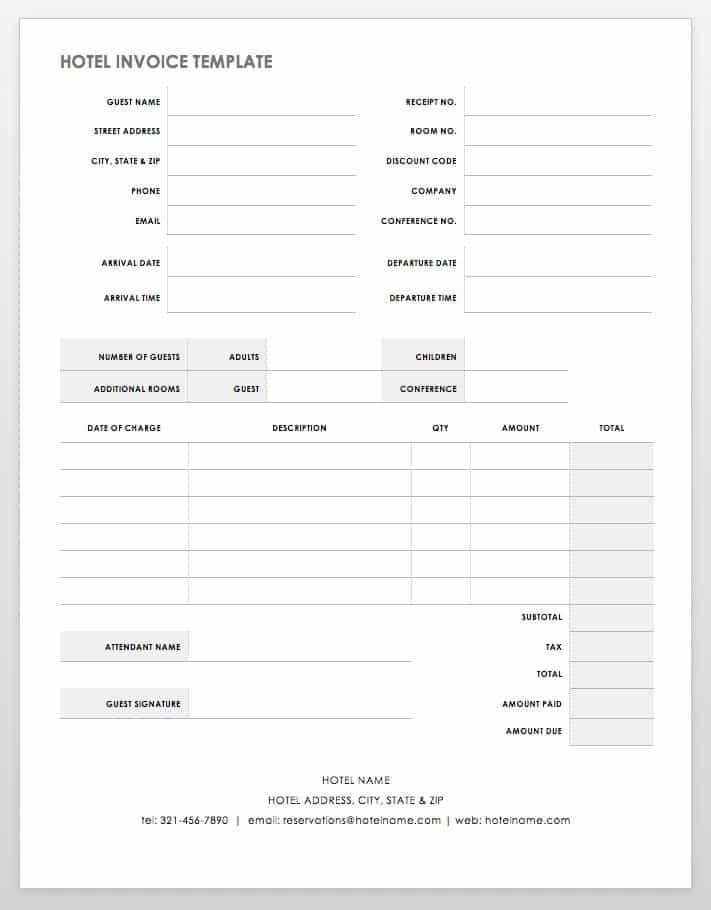

1. Identify the Type of Business

- If you run a service-based business, choose a format that emphasizes service descriptions and hourly rates.

- For product-based businesses, opt for a design that allows you to clearly list item names, quantities, and prices.

- Consider whether you need a more detailed record (such as for complex projects) or a simple summary of charges.

2. Consider the Design and Layout

- Look for a clean and easy-to-read format, ensuring that all sections are clearly separated for better readability.

- If your business has a strong brand identity, select a design that allows you to incorporate your logo, colors, and fonts.

- Choose a layout that aligns with your client’s expectations – more formal for corporate clients or creative for smaller, personal businesses.

3. Evaluate the Functional Features

- Ensure the document includes sections for all the necessary details, such as the client’s name, payment terms, and due dates.

- If your billing involves taxes or discounts, select a format that allows you to easily input such adjustments.

- Look for customizable fields that allow you to add extra charges or specific terms based on individual transactions.

4. Think About Future Use

- Consider whether the document can be reused or adapted for future projects without needing a complete redesign.

- Choose a format that is flexible enough to accommodate different types of transactions or clients in the future.

By carefully considering these factors, you can choose a billing document design that suits your business and helps maintain a professional relationship with your clients. The right design will save time, reduce errors, and ensure that you project the right image for your company.

Formatting and Design Tips for Invoices

A well-designed billing document not only helps convey the right information but also enhances the professional image of your business. Proper formatting ensures that your clients can easily understand the charges and payment terms, which leads to faster payments and fewer misunderstandings. The design should reflect your brand, maintain clarity, and organize information in a way that is both visually appealing and functional.

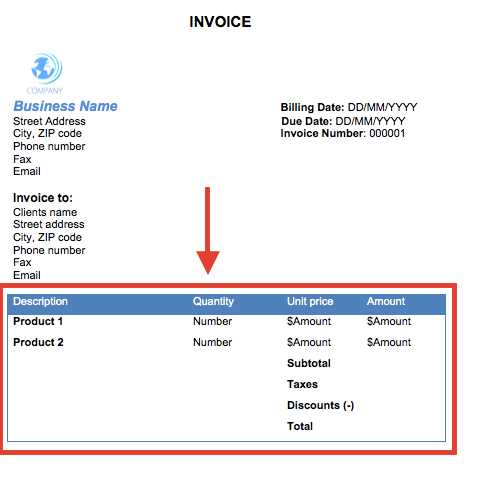

1. Keep It Simple and Clear

- Avoid cluttering the document with excessive information or decorative elements that may distract from the key details.

- Use clear headings and subheadings for different sections, such as “Bill To,” “Item Description,” and “Total Amount Due.”

- Ensure all text is legible with a font size that is easy to read, especially for important details like totals and payment terms.

2. Use Consistent Branding

- Incorporate your company logo and use consistent colors and fonts that align with your brand identity.

- Place your logo at the top of the document, and use your brand colors to highlight important sections, like the total amount due.

- Ensure that the design complements your other business documents, maintaining consistency across all communications.

3. Organize Information Logically

- List items or services in a clear, itemized format, including quantities, unit prices, and totals for each entry.

- Group similar information together, such as client details, service or product descriptions, and payment terms.

- Leave enough space between sections to prevent the document from appearing crowded or overwhelming.

4. Highlight Important Details

- Make the due date, total amount, and payment instructions stand out by using bold text or a larger font size.

- Use color or shading to draw attention to critical sections, but avoid using too many colors that can make the document look busy.

- Ensure payment terms, including penalties for late payments, are clear and easy to find.

By following these design and formatting tips, you can create billing documents that are not only professional but also easy for your clients to navigate, ensuring smoother transactions and stronger business relationships.

How to Add Your Business Details

Including accurate business information in your billing documents is essential for creating a professional and trustworthy impression. By properly displaying your company’s contact details, you make it easier for clients to reach you and ensure that the transaction is correctly recorded. Adding your business details is a simple but important task that helps to formalize your communication and maintain consistency across all your financial documents.

1. Company Name and Logo

Your company name should be prominently displayed at the top of the document. This ensures that the client immediately recognizes who the billing record is from. If you have a company logo, include it next to your name or in the header section. A well-placed logo can enhance your brand’s identity and add a professional touch to the document.

2. Contact Information

- Include your full business address, including street, city, state, and ZIP code.

- List your phone number and email address so clients can contact you with questions or concerns.

- If you have a website, include the URL for easy reference, especially for clients who may need to check additional details about your services.

3. Tax Identification and Business Registration

- If applicable, include your tax ID number or business registration number to ensure legal compliance, especially for larger transactions or international clients.

- Place this information in a section that is easy to locate, often near the bottom or in a designated “business details” area.

4. Payment Methods and Terms

Clearly state the accepted payment methods (e.g., bank transfer, credit card, PayPal) along with any relevant account information if necessary. Additionally, include your payment terms, such as the due date and any late fees or discounts for early payments. This clarity helps to set the right expectations and ensures timely payments.

By following these steps and adding the necessary details, you create a document that is not only complete but also reflects your brand’s professionalism and commitment to transparency.

Incorporating Payment Terms in Invoices

Clear payment terms are essential for ensuring that both parties understand their financial obligations and deadlines. By including these terms in your billing documents, you set expectations for the timing of payments, methods of payment, and any penalties for late or missed payments. This transparency not only helps prevent confusion but also improves the likelihood of timely payments from clients.

1. Specify the Due Date

The due date is one of the most critical aspects of your payment terms. It tells your client when the payment should be made and helps avoid delays. Be specific about the date, using a format that is easy to understand, such as “Due by April 30, 2024.” If you work on a recurring basis with clients, consider including the frequency of payments (e.g., monthly, quarterly).

2. Define Accepted Payment Methods

Clearly outline the methods by which you accept payment. This can include bank transfers, credit cards, online payment systems, or checks. Providing multiple payment options can make it easier for your clients to settle their bills quickly. Be sure to include any necessary account details or instructions for each method to avoid confusion.

3. Late Fees and Discounts

- If you charge late fees, be explicit about the rate (e.g., “2% interest per month on overdue amounts”).

- Consider offering early payment discounts to encourage quicker payments, such as “2% discount if paid within 10 days.”

- Make sure the late fee and discount terms are clearly visible, so the client understands the financial implications of their payment behavior.

By clearly incorporating payment terms into your financial records, you help protect your business’s cash flow and create a more professional, trustworthy relationship with your clients.

Including Taxes and Discounts Correctly

Accurately adding taxes and discounts to your billing records is crucial for maintaining transparency and ensuring that both you and your clients are clear on the final amounts due. Whether you’re applying a sales tax, offering a discount for early payment, or including special charges, it’s important to include these elements in a straightforward and correct manner. This helps prevent misunderstandings and ensures compliance with legal requirements.

1. Calculating and Displaying Taxes

When applying taxes, it’s essential to clearly specify the tax rate, the amount charged, and the total amount of tax applied. Be sure to include the correct tax percentage based on your location and the nature of the product or service. For instance, if your country or state requires a 10% sales tax, you should explicitly show both the rate and the total tax amount:

- Subtotal: $100

- Sales Tax (10%): $10

- Total: $110

Ensure the tax is clearly itemized so the client understands the breakdown of costs. If your region has specific tax codes or exemptions, include any relevant information to avoid confusion.

2. Applying Discounts Correctly

Discounts are a great way to incentivize early payments or reward loyal customers, but they need to be applied consistently and clearly. If offering a percentage-based discount, such as a 5% reduction for early payment, it should be calculated based on the total amount before tax. Always show the discount amount and the new total, ensuring transparency:

- Original Total: $100

- Discount (5%): -$5

- Subtotal after Discount: $95

- Sales Tax (10%): $9.50

- Total: $104.50

Note: If you’re offering a fixed amount discount, such as $10 off, make sure it’s applied before taxes to prevent confusion.

Properly including taxes and discounts not only ensures compliance but also improves client trust, showing that you’re diligent and transparent in your business dealings.

Saving and Storing Your Invoice Files

Properly saving and organizing your financial documents is key to maintaining a smooth and efficient workflow. Storing these records securely ensures that they are easily accessible when needed for tracking payments, handling disputes, or preparing for audits. Additionally, efficient storage practices help avoid the risk of losing important data and make it easier to retrieve information in the future.

1. Choose the Right File Format

The first step in saving your billing records is selecting an appropriate file format. Common formats include PDF, which is universally accessible and preserves formatting, or Excel/CSV, which allows for easy editing and data manipulation. PDFs are generally preferred for final versions since they are not easily altered, while Excel or CSV files may be better for internal tracking and updates.

2. Organize Files by Date or Client

- For easier retrieval, organize your documents by either date or client name. You can create folders for each year or month to keep your files organized.

- If you frequently deal with multiple clients, consider creating a subfolder for each client. Name the files using a consistent format, such as “ClientName_InvoiceNumber_Date,” to quickly locate the correct document.

3. Use Cloud Storage for Backup and Accessibility

Storing your records in the cloud offers several advantages, such as automatic backups, remote access, and enhanced security. Cloud services like Google Drive, Dropbox, or OneDrive ensure that your documents are safe from local system failures and can be accessed from any device with an internet connection.

4. Keep a Local Backup

Although cloud storage is highly reliable, it’s still important to maintain a local backup on an external hard drive or USB drive. This provides an additional layer of security in case of internet outages or cloud service issues.

Tip: Ensure your storage method follows data protection regulations, especially if you’re dealing with sensitive client information. Encrypt your files or use password protection when necessary to ensure privacy and security.

By implementing these best practices, you can ensure your business records are safe, well-organized, and easy to access whenever you need them.

How to Print or Send Invoices

Once your billing record is completed and all details are verified, the next step is delivering it to your client. Depending on your preferences and your client’s requirements, you can either print a hard copy or send it electronically. Both methods have their advantages, and choosing the right one ensures timely communication and payment.

1. Printing and Mailing a Physical Copy

For clients who prefer receiving a paper copy, printing and mailing the document is a traditional yet effective option. To do this:

- Ensure the document is formatted correctly and looks professional on paper, with proper margins and font sizes for readability.

- Use high-quality paper for printing to give the document a polished appearance.

- Mail the document using your preferred postal service. If the payment is time-sensitive, consider using a tracked delivery method.

2. Sending via Email

For quicker delivery, sending your billing document electronically is the most efficient method. Here’s how:

- Convert your document into a PDF file to ensure the format remains intact and cannot be altered.

- Attach the file to a professional email that includes a brief message, such as “Please find attached the billing record for your recent transaction.”

- Verify the recipient’s email address to avoid sending the document to the wrong person.

3. Using Online Payment Platforms

Some online platforms allow you to both create and send your billing records directly through their systems. These platforms often include automated delivery options, allowing you to:

- Send your document via email automatically after payment is created.

- Provide clients with a secure online payment link for easy and immediate settlement.

By choosing the method that best fits your business and your client’s preferences, you can ensure that your records are delivered accurately and on time, streamlining the payment process.

Common Mistakes to Avoid in Invoices

Creating accurate billing documents is essential to ensure smooth transactions and maintain professional relationships with clients. Small errors can lead to confusion, delayed payments, or even disputes. By understanding and avoiding common mistakes, you can improve the accuracy and clarity of your financial records, making it easier for both you and your clients to stay on track.

1. Missing or Incorrect Client Information

One of the most frequent mistakes is failing to include or incorrectly listing client details. This can lead to payment delays or miscommunication about the service or product provided. Always double-check:

| Information | Common Mistake | Correct Approach |

|---|---|---|

| Client Name | Spelling errors or missing name | Double-check the correct spelling of the client’s name |

| Address | Incorrect or outdated address | Ensure the current address is included, especially for shipping or legal purposes |

| Contact Information | Missing or outdated phone number or email | Verify the contact details are current and correct |

2. Incorrect or Missing Payment Terms

Unclear payment terms can cause confusion and delay payments. Common errors include forgetting to mention the due date, payment methods, or late fee policies. Be specific with the following:

- Clearly state the due date or payment schedule.

- List all accepted payment methods and related details (e.g., bank account info, PayPal address).

- Include any penalties for late payments or discounts for early payments.

3. Calculation Errors

Errors in calculations are one of the easiest mistakes to make but also the most damaging. Whether it’s adding up totals, applying taxes, or calculating discounts, small errors can quickly add up and cause frustration. To avoid this:

- Double-check all mathematical calculations, including the subtotal, tax amount, and final total.

- Use accounting software or spreadsheets that automatically perform calculations to minimize human error.

4. Lack of Clear Descriptions

Failing to provide clear and detailed descriptions of the products or services provided can lead to misunderstandings or disputes. Always ensure that each item or service is described accurately, including:

- What was delivered or performed.

- The quantity and unit price (if applicable).

- The dates the services were provided or the goods were delivered.

5. Forgetting to Include a Unique Identifier

Every billing document should have a unique identifier (e.g., invoice number or reference code) to make it easy to track and refer to.

How to Update Templates for Future Use

Keeping your financial records up to date is crucial for maintaining consistency and efficiency in your business operations. As your business evolves, you may need to update your existing documents to reflect changes in pricing, services, or contact information. Regularly reviewing and adjusting these records ensures they stay accurate, professional, and in line with any new legal or business requirements.

1. Review and Adjust Business Information

Over time, your business details may change. It’s important to keep these records up to date. Review the following sections regularly:

- Business name and logo: If you rebrand or update your logo, make sure these are reflected in your documents.

- Contact information: Update your phone number, email, or physical address if there are any changes.

- Payment details: Ensure that the correct payment methods or bank account information are included, especially if you change providers or add new options.

2. Update Pricing and Services

As your products or services evolve, so should the pricing and descriptions in your records. Make sure that:

- Any changes in prices are reflected in the document template.

- Descriptions of services or products are updated to match current offerings.

- If applicable, new taxes, discounts, or other charges are included in the calculations.

3. Adjust Legal or Tax Information

Changes in tax laws or regulations may require adjustments to your billing documents. Always stay informed about:

- Changes to tax rates or tax codes that may apply to your transactions.

- Legal requirements related to the format or content of your documents in your region or industry.

4. Save and Organize Updated Versions

Integrating Templates with Accounting Software

Seamlessly integrating your financial documents with accounting software can streamline your business processes, reduce manual work, and ensure greater accuracy in record-keeping. By connecting your prepared records with accounting systems, you can automate data entry, track transactions, and maintain a consistent workflow without needing to manually input each transaction. This integration ensures that your financial operations are efficient and less prone to errors.

1. Benefits of Integration

Linking your billing documents with accounting software provides several key advantages, including:

- Automatic Data Syncing: Once you generate a document, the details automatically update in your accounting system, saving you time and reducing the risk of errors.

- Financial Reporting: Integration allows for easier generation of financial reports, helping you track income, expenses, and other key metrics.

- Tax Compliance: With real-time data syncing, you can stay compliant with tax regulations by ensuring that all transactions are recorded accurately.

- Payment Tracking: The software can track when payments are made, and it will update your records to reflect the payment status.

2. How to Integrate Billing Documents

To integrate your documents with accounting software, follow these general steps:

- Choose Compatible Software: Ensure that your accounting software supports integration with the type of documents you use. Popular options include QuickBooks, Xero, and FreshBooks.

- Use API or Built-In Integration: Many accounting platforms offer direct integration features. You can either upload your documents manually or use an API to automate the transfer of data between your records and the software.

- Customize Fields: Customize your document fields to match the categories used in your accounting software (e.g., expense types, payment methods, and tax codes) for a smooth sync.

- Test Integration: Before fully relying on the integration, perform a few test runs to ensure that data transfers correctly and that the formatting of your documents remains intact.

By integrating your billing system with accounting software, you save time, reduce the risk of manual errors, and ensure that your financial records are always up to date. This system offers greater efficiency and allows you to focus more on growing your business rather than managing paperwork.

Ensuring Legal Compliance with Invoices

To avoid legal complications and ensure that your business operates within the law, it is crucial to create financial documents that comply with local, national, and international regulations. Legal compliance ensures that both your business and clients are protected, reduces the risk of disputes, and guarantees that your documents are accepted by tax authorities and other regulatory bodies.

1. Essential Information to Include

Depending on your jurisdiction, there may be specific legal requirements regarding what information should appear in your financial documents. Here are some common elements that are legally required:

- Business Information: Your business name, address, contact details, and registration number (if applicable).

- Client Information: The recipient’s name, address, and contact details.

- Document Number: A unique identifier for each record to help track transactions.

- Service or Product Details: Clear descriptions of the products or services provided, including quantities and prices.

- Tax Information: Relevant tax numbers, such as VAT, and the applicable tax rate or amount.

- Payment Terms: The due date, payment methods accepted, and any late payment fees or discounts for early payment.

2. Adhering to Tax Regulations

Tax laws are a major aspect of legal compliance, and failing to correctly calculate and display taxes can lead to fines or other legal issues. Here are some key practices to ensure your documents meet tax regulations:

- Include Applicable Taxes: Make sure to apply the correct tax rate based on the location of your business and the client. Different regions may have different rates for products and services.

- Show Tax Breakdown: Clearly display the tax amount separately from the total amount to ensure transparency.

- Follow Reporting Guidelines: Ensure that the format and structure of your documents align with local tax reporting requirements. This may include using specific terminology or including tax registration numbers.

3. Retaining Records for Legal Purposes

For legal and tax compliance, it’s essential to retain your financial records for a certain period. In many countries, businesses are required to keep documents for at least 5 to 7 years. Ensure that your documents are easily accessible and stored in a secure way, whether digitally or physically. Proper archiving and record-keeping will help you during tax audits or legal disputes.

By including the necessary information, adhering to tax regulations, and keeping proper records, you ensure that your financial documents remain legally compliant, protecting both your business and your clients.