Order Invoice Template for Easy Billing and Customization

Managing transactions efficiently is essential for any business. Having a standardized method for documenting purchases and sales not only ensures clarity but also improves professionalism. A well-organized billing system helps you maintain accurate records, manage payments, and avoid confusion with clients.

Instead of creating new documents from scratch every time, many businesses choose to use pre-designed formats that can be easily customized. These structured forms simplify the process, allowing you to focus on other important tasks while keeping your financial documentation consistent and error-free.

In this guide, we will explore various options for creating and personalizing such documents, covering essential components, design tips, and how these ready-to-use solutions can enhance your workflow. Whether you’re running a small startup or a large enterprise, a smart approach to billing can save you time and reduce administrative burdens.

Order Invoice Template Overview

Efficiently managing transactions is a key aspect of any successful business. One of the easiest ways to ensure clarity and consistency in your billing process is by using pre-designed forms that can be customized to fit your specific needs. These documents help streamline your operations, reduce the chances of errors, and save valuable time.

What Makes a Good Billing Document?

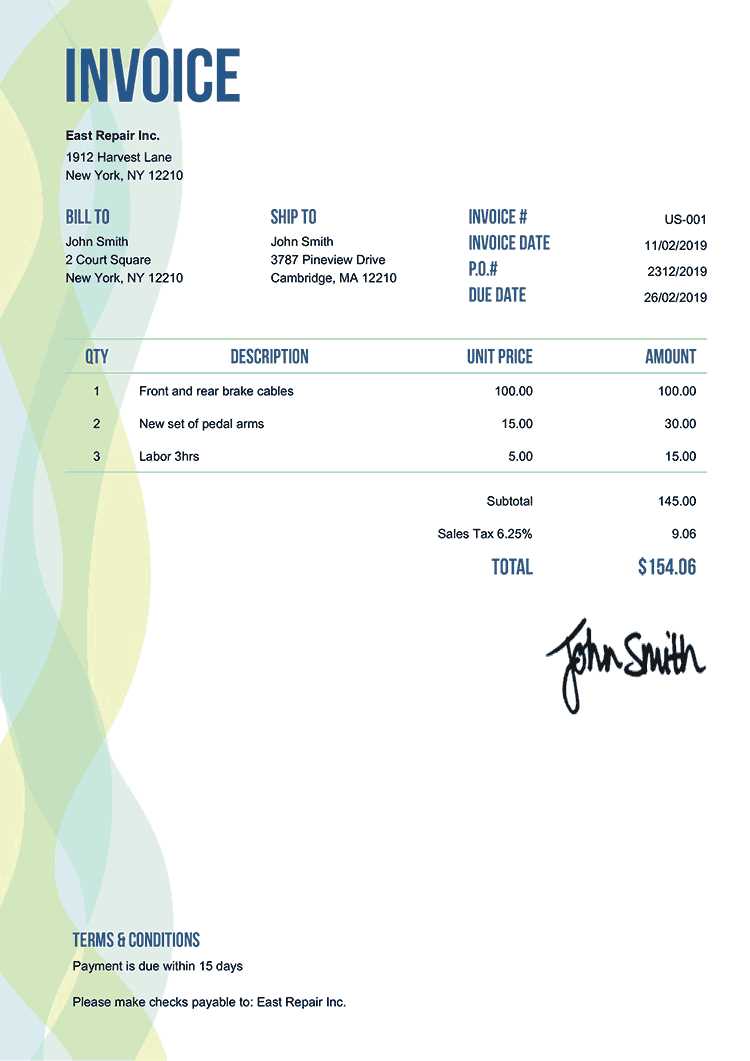

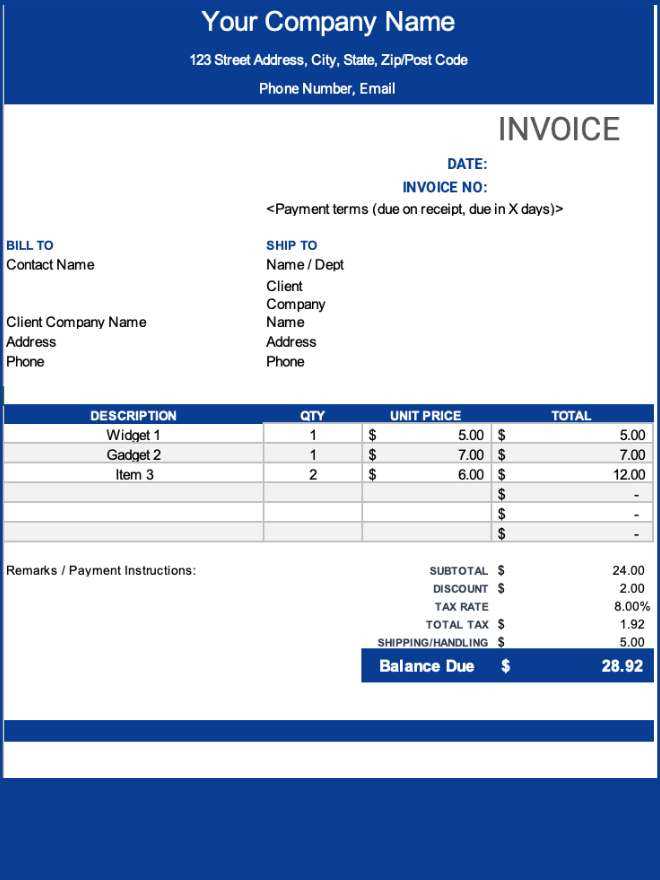

A well-designed form for recording payments should include several important components that ensure it is both clear and functional. Key elements often include:

- Business Information: Clearly displaying your company’s name, address, and contact details.

- Customer Information: Including the client’s name, address, and contact data for future reference.

- Transaction Details: Listing the products or services, quantities, prices, and any applicable taxes or discounts.

- Payment Terms: Outlining the due date, payment methods, and any late fees or penalties.

How Using Pre-designed Forms Helps

By using ready-made forms, businesses can quickly generate documents without reinventing the wheel each time. This not only saves time but also improves accuracy. The most common advantages include:

- Consistency: Every transaction follows the same structure, making it easier to track and manage.

- Professional Appearance: Customizable forms help maintain a polished and cohesive brand image.

- Time Efficiency: Pre-designed layouts reduce the effort needed to create new documents from scratch.

What is an Order Invoice?

A business document used to record a sale or purchase is an essential tool for tracking transactions and ensuring clear communication between a company and its clients. This document provides a detailed summary of the products or services exchanged, as well as the amounts owed and payment terms. It serves as a legal record for both parties, protecting their interests and helping to maintain accurate financial records.

Key Components of the Document

Each form typically includes the following important details to ensure clarity and correctness:

- Transaction Overview: A breakdown of the goods or services provided, including quantities, unit prices, and total amounts.

- Client and Business Information: Contact details of both the buyer and the seller, such as names, addresses, and phone numbers.

- Payment Terms: Specific instructions regarding when payment is due, how it can be made, and any penalties for late payment.

- Tax Information: If applicable, the document will include sales tax or other relevant fees added to the total amount due.

Why It’s Important for Your Business

This type of document plays a crucial role in maintaining professionalism and organization within a company. It ensures transparency in business dealings, reduces the risk of disputes, and helps businesses keep accurate records for tax and auditing purposes. Additionally, it acts as a formal request for payment, prompting clients to settle their dues within the agreed-upon timeframe.

Importance of Using an Invoice Template

In business, consistency and accuracy are key when managing transactions. Having a predefined structure for documenting sales not only speeds up the process but also ensures all necessary information is included. This practice minimizes errors and prevents missing crucial details that could complicate financial records or cause misunderstandings with clients.

Efficiency and Time-Saving

One of the primary benefits of using a pre-designed document is the significant amount of time it saves. Instead of manually creating a new document for every transaction, businesses can quickly fill in the required fields. This streamlined process allows employees to focus on other important tasks while ensuring each sale is properly recorded.

Reducing Errors and Enhancing Accuracy

Another major advantage is the reduction of human error. When creating a document from scratch, it’s easy to forget key components such as taxes, discounts, or payment terms. A standardized structure ensures that these elements are always included and clearly presented, minimizing the chance of oversight.

Cost Comparison: Manual vs Pre-designed Forms

While manually preparing billing documents might seem simple, it often leads to unnecessary time spent correcting mistakes or chasing incomplete payments. Below is a comparison of manual creation versus using a pre-made structure:

| Process | Time Spent | Risk of Error | Cost of Mistakes |

|---|---|---|---|

| Manual Creation | High | High | Potential delays, financial disputes |

| Pre-designed Document | Low | Low | Reduced financial discrepancies |

By using a consistent format, businesses not only ensure greater accuracy but also improve client trust and satisfaction. This simple step can have a significant impact on your overall business operations.

Benefits of Customizing Your Invoice

Tailoring your billing document to meet the unique needs of your business can offer a range of advantages. By making adjustments to a pre-designed form, you ensure that it aligns perfectly with your company’s specific requirements, helping to reinforce your brand identity, maintain consistency, and improve communication with clients. A customized document also helps you avoid unnecessary confusion and ensures that the most relevant information is always highlighted.

Enhancing Brand Identity

One of the most powerful reasons for personalizing your billing forms is to strengthen your brand image. A customized document gives your company a professional appearance, making it clear that your business is well-organized and detail-oriented. Key branding elements can be incorporated, such as:

- Logo and Colors: Including your company’s logo and color scheme helps clients recognize your business instantly.

- Personalized Messaging: Adding a friendly thank-you note or payment reminder strengthens your customer relations.

- Consistent Design: A uniform appearance across all documents ensures a cohesive experience for your clients.

Improving Clarity and Reducing Errors

Customizing your document allows you to highlight the most important details that align with your business process. For example, you can add specific fields for discounts, recurring billing, or additional charges that are relevant to your industry. This reduces the chances of clients missing key information and minimizes errors in the transaction.

- Clearer Payment Terms: Specify your preferred payment methods, deadlines, and any applicable late fees in a way that’s easy for clients to understand.

- Tailored Sections: Include or exclude specific details based on the type of service or product, making each document as relevant as possible.

- Faster Processing: A customized format ensures that both you and your clients can quickly interpret and process the information.

Ultimately, customizing your billing documents allows you to deliver a more professional, user-friendly experience for both your business and your clients, while ensuring all necessary information is presented clearly and accurately. This small but impactful change can boost your company’s credibility and efficiency in the long run.

Key Elements of an Order Invoice

When documenting a transaction, there are certain vital components that ensure clarity and proper record-keeping. These elements not only facilitate smooth communication between the buyer and the seller, but also serve as legal and financial proofs of the exchange. Knowing what details should be included can help prevent errors, avoid confusion, and maintain accurate business records.

- Business Information – This includes the name, address, and contact details of the seller, as well as any relevant business identification numbers.

- Recipient Information – Details of the customer or client, including their name, address, and other necessary contact information.

- Date of Issue – The date when the document is generated, marking the official time of the transaction.

- Unique Reference Number – A distinct identifier to track and differentiate each document in a company’s records.

- List of Products or Services – A clear description of what has been sold or provided, along with quantities, unit prices, and any applicable item codes.

- Pricing Details – The total cost for each item or service, including taxes, discounts, and any applicable charges for delivery or handling.

- Total Amount Due – The final amount that the recipient is required to pay, summing up all individual costs.

- Payment Terms – Clear instructions about when and how the payment should be made, including any applicable deadlines or penalties for late payment.

- Method of Payment – The options available for completing the transaction, such as bank transfer, credit card, or cash.

- Additional Notes – Any supplementary information or conditions relevant to the transaction, such as delivery instructions or warranties.

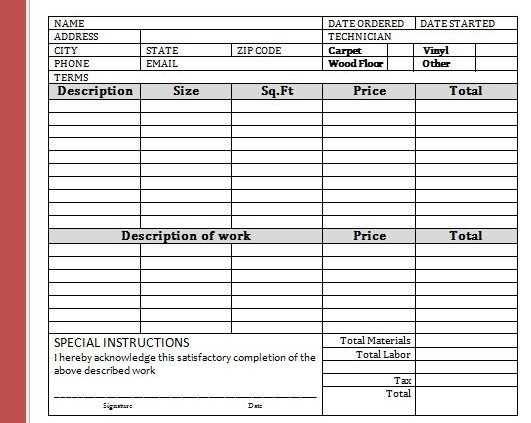

How to Choose the Right Template

Selecting the appropriate document layout for recording transactions is essential to ensure both efficiency and accuracy. A well-structured format can streamline the process, enhance communication, and make it easier to track financial exchanges. Whether for personal use or business purposes, the right choice can improve organization and minimize errors. When making this decision, consider several key factors to match your needs and requirements.

Key Considerations

- Industry Specifics – Depending on the type of business, certain designs and features may be more suitable. For instance, a retail business might need a straightforward layout, while a service-based company might prefer one that allows detailed descriptions of the services rendered.

- Customization Options – Look for layouts that allow flexibility in adding or removing sections. Customizable elements can make the document fit your branding, product offerings, and the complexity of your transactions.

- Ease of Use – The design should be user-friendly, enabling you to quickly fill in all necessary details without confusion or errors.

Features to Look For

- Clear Layout – A clean and organized structure ensures that all details are easy to read and understand, which is crucial for both the sender and recipient.

- Legal and Tax Compliance – Make sure the layout includes spaces for required legal and tax-related details, such as tax rates, business identifiers, and payment terms.

- Integration Capabilities – The format should be compatible with accounting software or spreadsheets for easy data tracking and reporting.

- Visual Appeal – A well-designed document that is visually appealing can enhance the professionalism of your communication, making a positive impression on recipients.

How to Choose the Right Template

Selecting the appropriate document layout for recording transactions is essential to ensure both efficiency and accuracy. A well-structured format can streamline the process, enhance communication, and make it easier to track financial exchanges. Whether for personal use or business purposes, the right choice can improve organization and minimize errors. When making this decision, consider several key factors to match your needs and requirements.

Key Considerations

- Industry Specifics – Depending on the type of business, certain designs and features may be more suitable. For instance, a retail business might need a straightforward layout, while a service-based company might prefer one that allows detailed descriptions of the services rendered.

- Customization Options – Look for layouts that allow flexibility in adding or removing sections. Customizable elements can make the document fit your branding, product offerings, and the complexity of your transactions.

- Ease of Use – The design should be user-friendly, enabling you to quickly fill in all necessary details without confusion or errors.

Features to Look For

- Clear Layout – A clean and organized structure ensures that all details are easy to read and understand, which is crucial for both the sender and recipient.

- Legal and Tax Compliance – Make sure the layout includes spaces for required legal and tax-related details, such as tax rates, business identifiers, and payment terms.

- Integration Capabilities – The format should be compatible with accounting software or spreadsheets for easy data tracking and reporting.

- Visual Appeal – A well-designed document that is visually appealing can enhance the professionalism of your communication, making a positive impression on recipients.

How to Add Your Business Information

Including accurate and complete details about your company is essential for any document used in a transaction. This not only ensures clarity but also helps build trust with your clients. Properly presenting your business information allows for easy identification and smooth communication, both of which are critical in maintaining a professional reputation. The key is to make sure that all necessary elements are included in a clear and accessible format.

1. Company Name – Start with the official name of your business. This is the primary identifier and should be prominent on the document. Make sure it matches your registered business name to avoid any confusion.

2. Business Address – Include your company’s physical address. This provides the recipient with the location of your business and is especially important for legal and mailing purposes.

3. Contact Information – Provide at least one method for the recipient to contact you, such as a phone number or email address. This makes it easy for your clients to reach out in case of inquiries or follow-ups.

4. Business Identification Number – If applicable, include any relevant identifiers, such as a tax ID number or company registration number. This is particularly important for legal documentation or in jurisdictions that require businesses to have an official registration number.

5. Website URL – If your business has an online presence, adding your website URL can help clients access more information or manage their accounts through your digital platform.

6. Logo (Optional) – Including your company’s logo adds a professional touch and reinforces your brand identity. It is optional, but it can help make the document visually appealing and recognizable.

How to Add Your Business Information

Including accurate and complete details about your company is essential for any document used in a transaction. This not only ensures clarity but also helps build trust with your clients. Properly presenting your business information allows for easy identification and smooth communication, both of which are critical in maintaining a professional reputation. The key is to make sure that all necessary elements are included in a clear and accessible format.

1. Company Name – Start with the official name of your business. This is the primary identifier and should be prominent on the document. Make sure it matches your registered business name to avoid any confusion.

2. Business Address – Include your company’s physical address. This provides the recipient with the location of your business and is especially important for legal and mailing purposes.

3. Contact Information – Provide at least one method for the recipient to contact you, such as a phone number or email address. This makes it easy for your clients to reach out in case of inquiries or follow-ups.

4. Business Identification Number – If applicable, include any relevant identifiers, such as a tax ID number or company registration number. This is particularly important for legal documentation or in jurisdictions that require businesses to have an official registration number.

5. Website URL – If your business has an online presence, adding your website URL can help clients access more information or manage their accounts through your digital platform.

6. Logo (Optional) – Including your company’s logo adds a professional touch and reinforces your brand identity. It is optional, but it can help make the document visually appealing and recognizable.

How to Add Your Business Information

Including accurate and complete details about your company is essential for any document used in a transaction. This not only ensures clarity but also helps build trust with your clients. Properly presenting your business information allows for easy identification and smooth communication, both of which are critical in maintaining a professional reputation. The key is to make sure that all necessary elements are included in a clear and accessible format.

1. Company Name – Start with the official name of your business. This is the primary identifier and should be prominent on the document. Make sure it matches your registered business name to avoid any confusion.

2. Business Address – Include your company’s physical address. This provides the recipient with the location of your business and is especially important for legal and mailing purposes.

3. Contact Information – Provide at least one method for the recipient to contact you, such as a phone number or email address. This makes it easy for your clients to reach out in case of inquiries or follow-ups.

4. Business Identification Number – If applicable, include any relevant identifiers, such as a tax ID number or company registration number. This is particularly important for legal documentation or in jurisdictions that require businesses to have an official registration number.

5. Website URL – If your business has an online presence, adding your website URL can help clients access more information or manage their accounts through your digital platform.

6. Logo (Optional) – Including your company’s logo adds a professional touch and reinforces your brand identity. It is optional, but it can help make the document visually appealing and recognizable.

Using Digital vs Paper Invoices

When it comes to documenting transactions, businesses have two main options: using digital or physical documents. Each method has its own set of advantages and challenges. Choosing between the two depends on factors such as cost, convenience, environmental impact, and the specific needs of your business. Understanding the pros and cons of each approach can help you decide which method is more suitable for your operations.

Benefits of Digital Documents

- Efficiency – Digital records can be created, sent, and stored with just a few clicks, reducing the time spent on paperwork and manual processing.

- Cost-Effective – By eliminating the need for paper, printing, and postage, digital formats can significantly reduce operating costs.

- Easy Access – Digital files can be accessed from anywhere, allowing both you and your clients to retrieve them quickly and easily, at any time.

- Environmentally Friendly – Using electronic documents helps reduce paper consumption and waste, contributing to a greener business practice.

- Automated Features – Many digital systems offer automation tools that can help with reminders, recurring payments, and even integrations with accounting software.

Advantages of Physical Documents

- Formal Appearance – Physical records may feel more official and tangible, which can be important for certain clients or industries that prefer traditional methods.

- Familiarity – Some businesses and clients are more comfortable with paper and prefer it due to habit or lack of digital literacy.

- Legal and Tax Compliance – In some cases, physical documents may be required for legal or regulatory purposes, depending on the jurisdiction or industry.

- No Need for Technology – Physical formats do not rely on internet access or digital devices, making them a suitable option in areas with limited technological infrastructure.

Using Digital vs Paper Invoices

When it comes to documenting transactions, businesses have two main options: using digital or physical documents. Each method has its own set of advantages and challenges. Choosing between the two depends on factors such as cost, convenience, environmental impact, and the specific needs of your business. Understanding the pros and cons of each approach can help you decide which method is more suitable for your operations.

Benefits of Digital Documents

- Efficiency – Digital records can be created, sent, and stored with just a few clicks, reducing the time spent on paperwork and manual processing.

- Cost-Effective – By eliminating the need for paper, printing, and postage, digital formats can significantly reduce operating costs.

- Easy Access – Digital files can be accessed from anywhere, allowing both you and your clients to retrieve them quickly and easily, at any time.

- Environmentally Friendly – Using electronic documents helps reduce paper consumption and waste, contributing to a greener business practice.

- Automated Features – Many digital systems offer automation tools that can help with reminders, recurring payments, and even integrations with accounting software.

Advantages of Physical Documents

- Formal Appearance – Physical records may feel more official and tangible, which can be important for certain clients or industries that prefer traditional methods.

- Familiarity – Some businesses and clients are more comfortable with paper and prefer it due to habit or lack of digital literacy.

- Legal and Tax Compliance – In some cases, physical documents may be required for legal or regulatory purposes, depending on the jurisdiction or industry.

- No Need for Technology – Physical formats do not rely on internet access or digital devices, making them a suitable option in areas with limited technological infrastructure.

Using Digital vs Paper Invoices

When it comes to documenting transactions, businesses have two main options: using digital or physical documents. Each method has its own set of advantages and challenges. Choosing between the two depends on factors such as cost, convenience, environmental impact, and the specific needs of your business. Understanding the pros and cons of each approach can help you decide which method is more suitable for your operations.

Benefits of Digital Documents

- Efficiency – Digital records can be created, sent, and stored with just a few clicks, reducing the time spent on paperwork and manual processing.

- Cost-Effective – By eliminating the need for paper, printing, and postage, digital formats can significantly reduce operating costs.

- Easy Access – Digital files can be accessed from anywhere, allowing both you and your clients to retrieve them quickly and easily, at any time.

- Environmentally Friendly – Using electronic documents helps reduce paper consumption and waste, contributing to a greener business practice.

- Automated Features – Many digital systems offer automation tools that can help with reminders, recurring payments, and even integrations with accounting software.

Advantages of Physical Documents

- Formal Appearance – Physical records may feel more official and tangible, which can be important for certain clients or industries that prefer traditional methods.

- Familiarity – Some businesses and clients are more comfortable with paper and prefer it due to habit or lack of digital literacy.

- Legal and Tax Compliance – In some cases, physical documents may be required for legal or regulatory purposes, depending on the jurisdiction or industry.

- No Need for Technology – Physical formats do not rely on internet access or digital devices, making them a suitable option in areas with limited technological infrastructure.

Common Mistakes in Order Invoices

Creating accurate records for transactions is crucial for maintaining clear financial communication. However, errors in these documents are more common than one might think, and they can lead to confusion, delays, and even legal issues. Identifying common mistakes can help ensure that the document is both clear and correct, protecting both your business and your clients from potential problems.

Frequent Errors to Avoid

- Incorrect or Missing Contact Information – Failing to include complete and accurate contact details, whether for your business or the client, can cause delays in communication and payment.

- Wrong or Unclear Item Descriptions – Ambiguous or incorrect descriptions of products or services can lead to misunderstandings. It’s vital to include clear and precise information about each item, including quantities, prices, and any special terms.

- Math Errors – Simple calculation mistakes, like incorrect totals or tax calculations, are among the most common and potentially costly errors. Double-checking sums and ensuring accurate tax rates are applied is essential.

- Omitting Payment Terms – Failing to specify the payment terms, including due dates, accepted payment methods, and late fees, can create confusion and delay payments.

- Not Including a Unique Identifier – Without a unique reference number or transaction ID, it becomes difficult to track and manage transactions, which can cause organizational problems down the line.

- Overlooking Legal and Tax Requirements – Certain jurisdictions require specific legal information or tax codes to be included on financial documents. Failing to comply can lead to penalties or disputes.

How to Avoid These Mistakes

- Double-Check All Details – Always verify contact information, item descriptions, pricing, and totals before finalizing the document.

- Use Software for Accuracy – Consider using automated tools or accounting software to help with calculations and formatting to reduce human error.

- Review Legal Requirements – Make sure that you are familiar with the legal and tax obligations in your region or industry, and include all necessary details to ensure compliance.

Ensuring Legal Compliance in Invoices

Adhering to legal requirements when preparing transactional documents is essential for maintaining smooth business operations. Failure to comply with industry-specific regulations or tax laws can result in penalties, disputes, or loss of credibility. Understanding the mandatory components and guidelines for financial records helps protect your business and ensures that transactions are conducted in a legally sound manner.

Key Legal Elements to Include

- Tax Identification Number – Depending on the jurisdiction, businesses are often required to include a tax ID number or VAT number to comply with tax laws.

- Itemized List of Goods or Services – Clear descriptions of products or services, including quantities, prices, and applicable tax rates, are often mandated by law to prevent misunderstandings and disputes.

- Applicable Taxes – Ensure that tax rates are clearly stated and correctly applied based on local tax laws. This includes sales tax, VAT, or any other relevant taxes.

- Payment Terms and Conditions – Stipulating payment deadlines, late fees, and acceptable payment methods ensures clarity and may be legally required in some industries or regions.

- Business Identification Details – Besides your business name, it may be necessary to include your registered business address and contact details for legal transparency and to comply with business registration laws.

Staying Compliant with Local and International Laws

- Understand Jurisdictional Requirements – Regulations can vary by country, state, or region. Familiarize yourself with the specific legal requirements applicable to your location.

- Incorporate International Standards – If dealing with international transactions, ensure that you follow international trade laws, including currency conversion, cross-border tax compliance, and customs documentation.

- Consult Legal Advisors – To avoid mistakes, it’s always a good idea to consult with legal or tax professionals who are familiar with the relevant laws and regulations for your business.

How to Automate Invoice Generation

Automating the process of generating transactional documents can save time, reduce errors, and streamline your business operations. By using software or systems that automatically create and distribute financial records, you can ensure accuracy and consistency while freeing up valuable resources for other tasks. Implementing automation for this purpose is a smart move for businesses looking to improve efficiency and reduce manual workload.

Steps to Automate Document Creation

- Choose the Right Software – Select a reliable platform or software that fits your business needs. Many accounting and billing systems offer built-in features for automated document generation.

- Set Up Templates – Once you’ve chosen a tool, customize your document layout to include all necessary details like business information, pricing, taxes, and payment terms. This ensures that each document is consistent and professional.

- Integrate with Your Accounting System – Link your automation system with your financial software to pull

How to Deliver Your Invoice to Clients

Delivering financial documents to clients efficiently and professionally is a critical step in ensuring smooth transactions. The method of delivery you choose can impact the timeliness of payment, the clarity of communication, and even the overall relationship with your customers. It’s important to consider various options for sending these records based on convenience, security, and the preferences of both your business and the recipient.

Methods for Delivering Documents

- Email – The most common and quickest method for sending transactional documents. You can attach a PDF version of the document, ensuring that the recipient can easily view, save, or print it. Make sure the file is named clearly and professionally (e.g., “Invoice_12345.pdf”).

- Postal Mail – For clients who prefer physical copies or when required by law, sending printed copies via postal services may be necessary. This option ensures that the document is tangible and can be kept for legal or tax purposes.

- Online Client Portal – If your business offers a digital platform for clients, providing access to their records via a secure portal can be an excellent choice. This allows clients to view, download, and even pay for services online, offering a seamless experience.

- Messaging Platforms – Some businesses use messaging platforms (like WhatsApp, Slack, or other tools) for faster communication. This option works well if your clients are comfortable with digital communication and you need to send reminders or updates quickly.

- Fax – Although less common today, faxing can still be used in some industries. It provides a simple way to send documents when other options are not available or when clients specifically request it.

Best Practices for Delivery

- Confirm Receipt – Whenever possible, confirm with the client that they received the document. If using email, ask for an acknowledgment; for physical mail, you can request a return receipt.

- Provide Clear Instructions – Ensure that the recipient knows how to process the document, including payment instructions, due dates, and any other relevant details.

- Maintain Security – If sending sensitive financial data, ensure that the method you choose is secure. For digital delivery, consider using encrypted email services or secure file-sharing platforms to protect client information.

- Keep a Record – Always maintain

Tracking Payments and Follow-ups

Properly monitoring payments and following up with clients is essential for maintaining healthy cash flow and ensuring that financial obligations are met on time. Keeping track of outstanding balances, payment dates, and reminders can prevent missed payments and avoid unnecessary confusion. By staying organized and proactive, you can improve your business’s financial management and strengthen relationships with clients.

Tracking Outstanding Payments

Maintaining an up-to-date record of all transactions is critical for ensuring that no payment goes unnoticed. Using a tracking system helps you quickly identify which clients have paid, which still owe, and what amounts are overdue. Below is an example of a basic table you can use to track payments effectively:

Client Name Amount Due Due Date Payment Status Follow-Up Date Client A $500 October 15 Paid October 16 Client B $1,200 October 18 Pending October 25 Client C $750 October 22 Pending October 29 Follow-Up Strategies

- Set Clear Payment Terms – Ensure that your clients are aware of the due dates, late fees, and any other payment-related terms when the transaction occurs. This reduces misunderstandings and sets expectations upfront.

- Send Reminders – For pending payments, send a reminder message a few days before the due date. After the due date passes, follow up promptly with a polite but firm reminder about the outstanding balance.

- Automate Reminders – Use automated systems or accounting software to send reminders to clients as soon as a payment becomes overdue. These systems can be set up to trigger emails or notifica