Best Invoice Cleaning Template for Streamlined Financial Management

Managing financial records efficiently is crucial for any business, especially when it comes to ensuring that all the necessary details are correctly formatted and easy to understand. Having a structured approach to organizing and presenting billing information can save time, reduce errors, and improve overall business operations. A well-organized system allows businesses to maintain accuracy and clarity in their documentation while also simplifying communication with clients and partners.

Effective organization plays a significant role in improving cash flow management. When all required data is clearly structured, businesses can easily track payments, spot discrepancies, and keep records in order for tax and auditing purposes. Whether you are handling a large volume of transactions or just starting out, a clean and organized record-keeping system is a valuable asset that ensures smoother financial management.

In this guide, we will explore tools and strategies that can help you establish a seamless system for preparing and managing your financial records. From choosing the right software to customizing your forms, these insights will provide the foundation for optimizing your business’s documentation process.

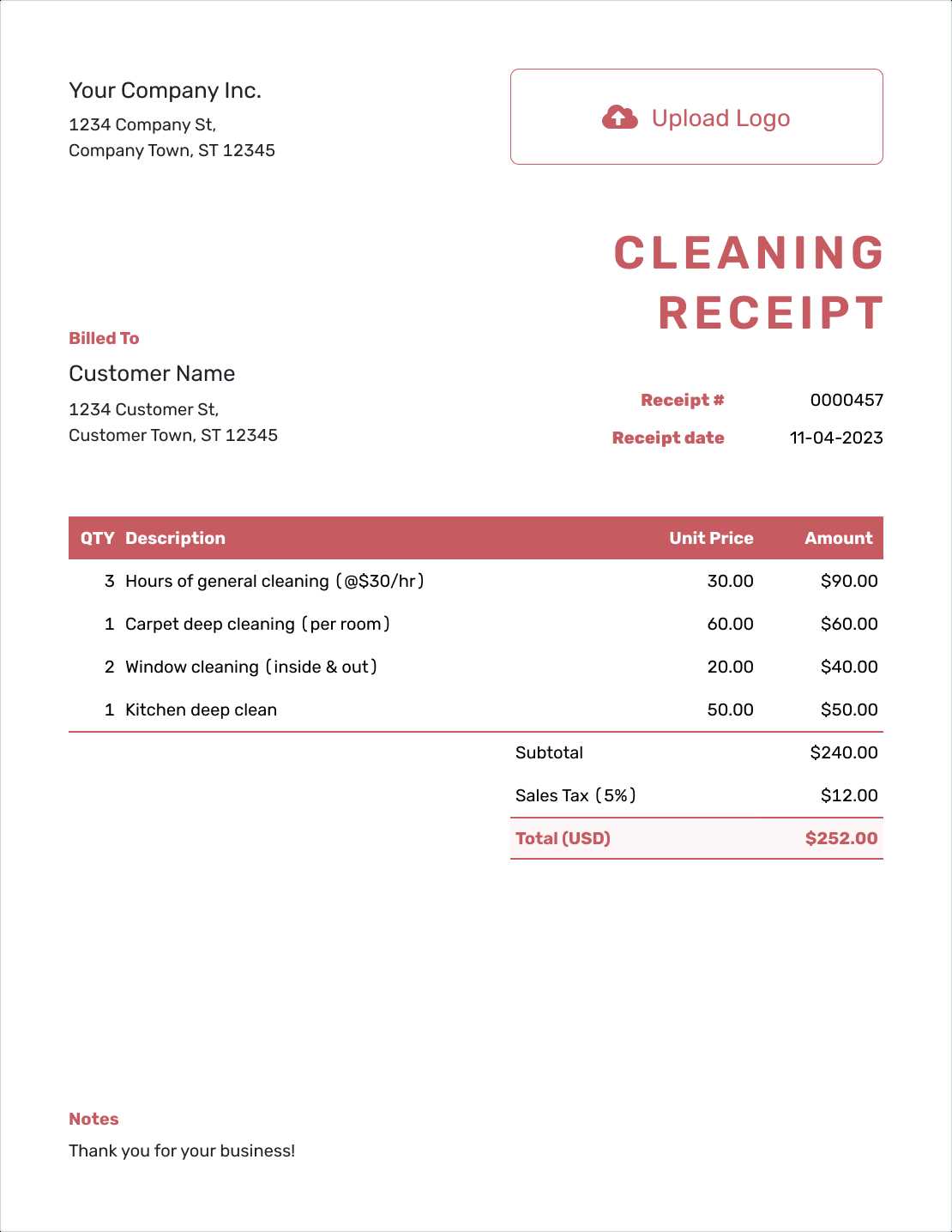

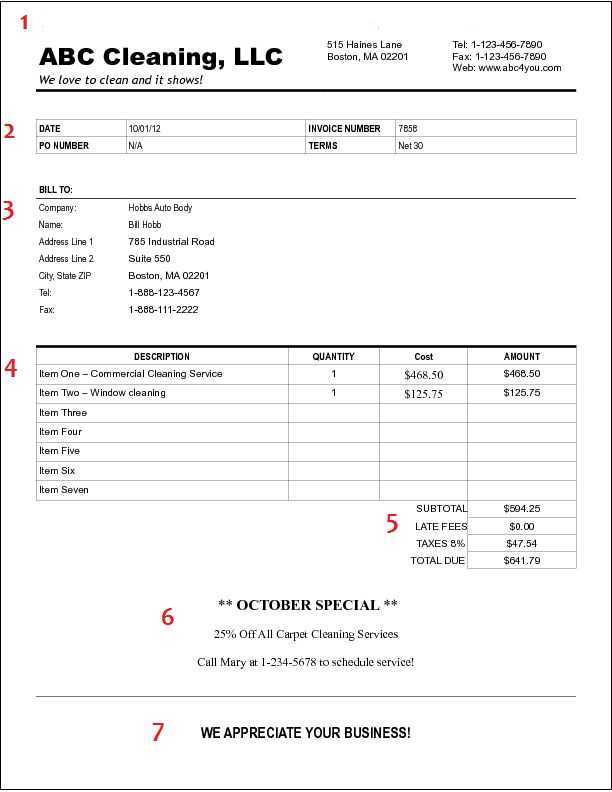

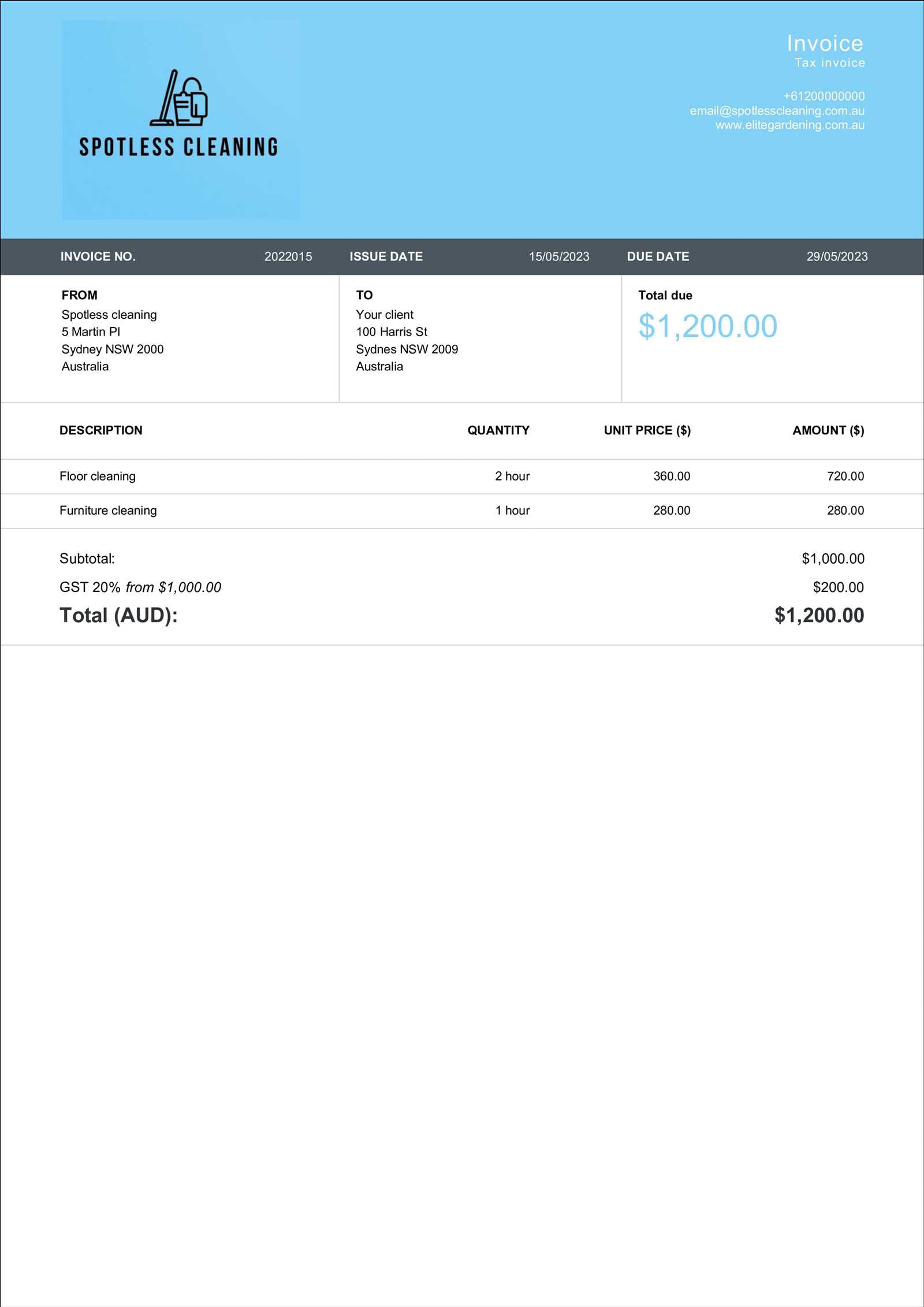

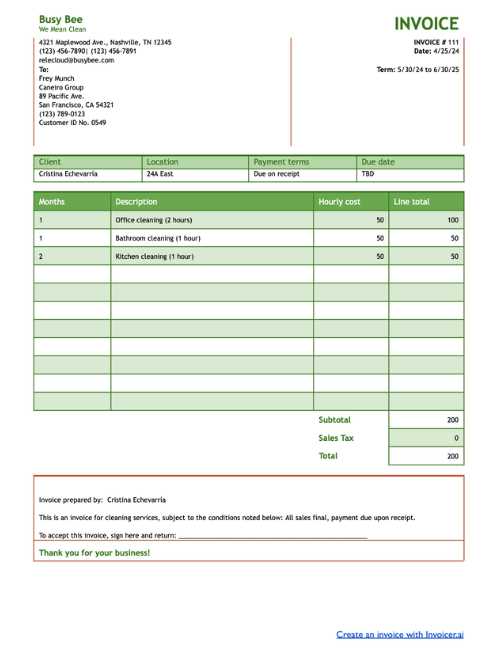

Invoice Cleaning Template Overview

Effective management of financial documents is essential for ensuring clarity and accuracy in business operations. One of the most crucial aspects of this process is having a standardized method for organizing and presenting data. A structured system can help streamline your workflow, minimize errors, and improve the overall efficiency of your accounting practices.

This method involves using predefined formats or tools that allow you to arrange necessary information in a logical, consistent manner. By adopting a streamlined approach, businesses can maintain better control over their records, track transactions more effectively, and ensure that all financial details are presented clearly. Whether you’re preparing for audits, managing client transactions, or handling daily records, a well-organized framework is key to simplifying complex financial tasks.

In the following sections, we will delve into the benefits, key features, and customization options available for optimizing this process, making it easier for you to maintain accurate and organized documentation at all times.

Why Use an Invoice Cleaning Template

Maintaining consistent and accurate financial records is essential for the smooth operation of any business. Without a well-organized system, it becomes easy to overlook important details or make mistakes that could lead to financial discrepancies. Using a structured approach for organizing billing data offers several advantages, making the process more efficient and error-free.

Time-saving is one of the primary benefits. A pre-designed structure allows you to quickly enter information without having to manually format each entry. This reduces the amount of time spent on repetitive tasks and helps ensure that all necessary data is included in a standardized manner. Additionally, a clear and consistent format makes it easier to spot errors or missing information before it becomes a problem.

Moreover, adopting a streamlined system helps maintain better communication with clients and partners. When all documentation follows a uniform structure, it becomes easier to understand, share, and process. This not only improves accuracy but also fosters trust and professionalism in business relationships.

Key Features of an Effective Template

An effective system for organizing and presenting financial data must possess certain characteristics to ensure ease of use, accuracy, and efficiency. A well-designed structure should not only streamline data entry but also help maintain consistency across all documents. The goal is to create a format that simplifies record-keeping while providing a clear overview of all essential information.

Clarity and simplicity are crucial features of a well-designed framework. The layout should be easy to navigate, with clearly labeled sections that guide users through the process. This ensures that no important details are overlooked and that all necessary information is consistently included. A minimalist approach, free from unnecessary complexity, helps users focus on the core elements without confusion.

Another key feature is flexibility and customization. While consistency is important, the system should also allow for adjustments based on individual needs. Whether you’re working with different types of transactions or adjusting for specific client preferences, the ability to modify and adapt the layout makes it more versatile for a range of business scenarios.

Additionally, an efficient system should support automation and integration with other software tools. This integration can help reduce manual data entry and make it easier to track payments, generate reports, or even sync with accounting software for accurate financial tracking. Automation can significantly improve accuracy and save time, eliminating the risk of human error and ensuring that all records remain up-to-date.

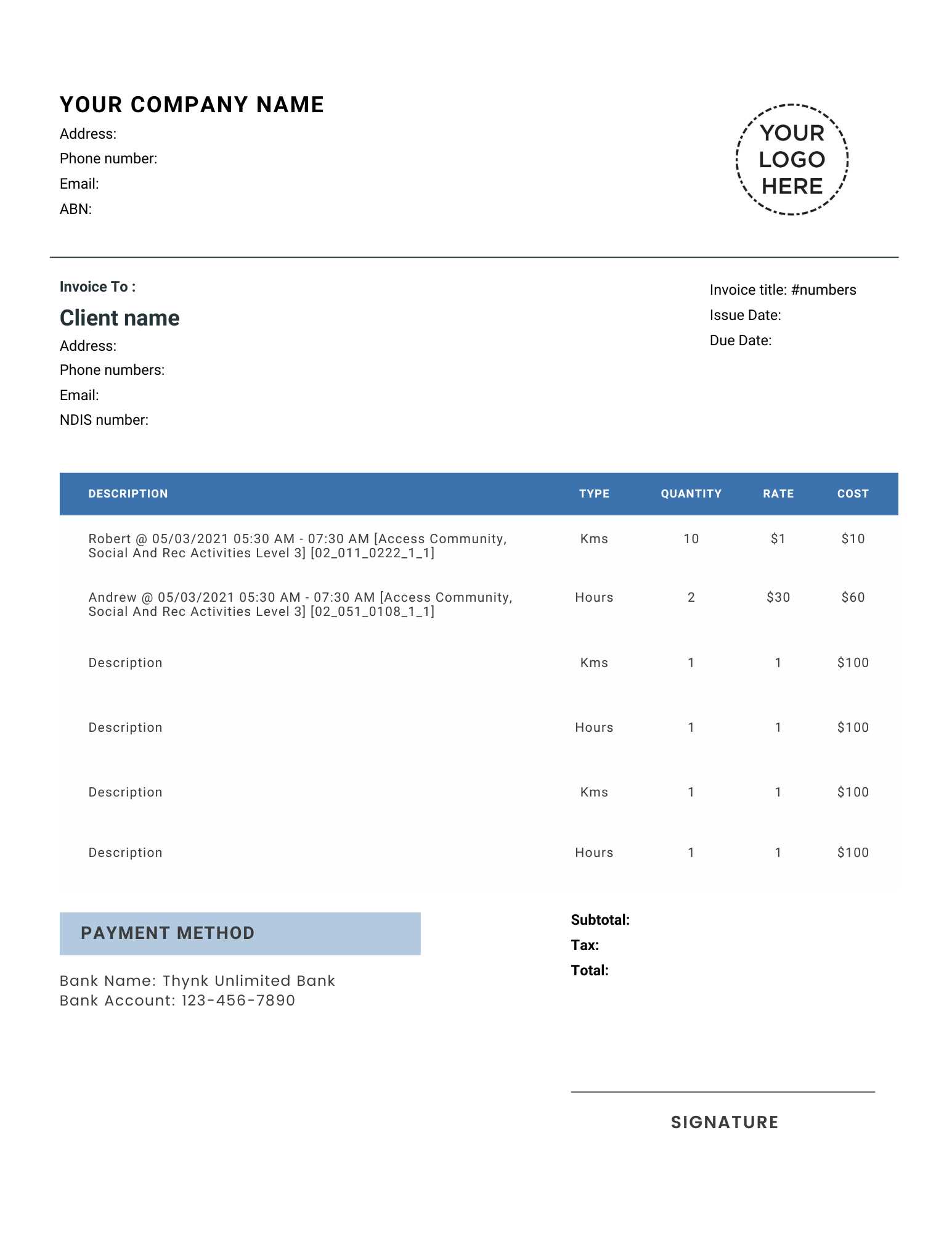

How to Customize Your Template

Personalizing your financial documentation system allows you to tailor it to your specific business needs. Customization not only ensures that all necessary details are included but also provides a level of flexibility to adapt to changing requirements. By adjusting elements such as design, structure, and data fields, you can create a more efficient and user-friendly record-keeping system.

Choosing the Right Structure

When personalizing your layout, start by selecting the right structure that aligns with the type of transactions you handle. Whether it’s for client billing, internal record-keeping, or expense tracking, the design should support your objectives. Consider these options:

- Clear sections for key information such as dates, amounts, and descriptions.

- Customizable fields for additional details like discounts, taxes, or payment methods.

- A logical flow that minimizes confusion and streamlines data entry.

Adjusting the Aesthetics

The visual appearance of your records plays an important role in readability and professionalism. Customizing the design can make a significant difference in how your documents are perceived. Consider the following adjustments:

- Fonts and colors: Choose fonts that are easy to read and a color scheme that is simple yet professional.

- Branding: Include your company logo, business name, and contact information for a personalized touch.

- Spacing: Ensure adequate space between sections to avoid clutter and improve clarity.

Once the design is set, review the layout for consistency and make sure it suits the way you manage your financial data. Customizing a system to meet your specific business needs will help improve efficiency and ensure that your documentation remains both professional and functional.

Best Practices for Invoice Management

Efficient management of financial records is essential to maintain smooth business operations and ensure timely payments. By adopting best practices for organizing, tracking, and processing financial documents, businesses can reduce errors, improve cash flow, and streamline administrative tasks. The following practices provide a solid foundation for managing records effectively and ensuring accuracy in every transaction.

Establish Clear Documentation Guidelines

One of the first steps in optimizing financial management is setting clear guidelines for how records should be prepared, organized, and reviewed. This ensures consistency and helps reduce the risk of mistakes. Key guidelines to consider include:

- Standardized formats: Use consistent layouts and structures for all records, making it easier to input and review data.

- Required fields: Ensure that all necessary information, such as dates, amounts, and descriptions, is included in every document.

- Clear labels: Use clear and descriptive labels for each section to improve readability and avoid confusion.

Implement Timely Record Review

Regularly reviewing your records is essential to catch errors early and ensure that everything is up to date. Set aside dedicated time for reviewing financial documents and correcting any discrepancies. Consider these steps:

- Frequent checks: Schedule regular reviews (e.g., weekly or monthly) to ensure accuracy and completeness.

- Double-check calculations: Always verify totals and other key figures to avoid mistakes that could lead to financial discrepancies.

- Audit trails: Keep a detailed log of any updates or changes to documents for accountability and transparency.

Automate Where Possible

Automation can significantly improve the efficiency of managing financial records. By integrating tools that allow for automatic generation, submission, and tracking of documents, businesses can reduce manual entry and avoid human error. Here are some automation tips:

- Set up recurring tasks: Automate recurring billing or reporting tasks to save time and ensure consistency.

- Integrate with accounting software: Sync your financial records with software to streamline reporting, payments, and reconciliation.

- Notifications: Set up reminders for upcoming payments or overdue items to keep everything on track.

By following these best practices, businesses can ensure that their financial records are well-organized, accurate, and easy to manage, ultimately leading to improved efficiency and better financial oversight.

Common Mistakes in Invoice Cleaning

Even with the best systems in place, mistakes can still occur when managing financial records. These errors can lead to confusion, delays, or even disputes, which is why it’s important to be aware of the most common pitfalls in the process. By identifying and avoiding these mistakes, businesses can maintain accuracy and efficiency in their financial management tasks.

Missing or Incorrect Information

One of the most frequent issues is the omission of essential details or providing incorrect data. This can create confusion and may lead to payment delays or discrepancies. Common oversights include:

- Missing payment dates that prevent proper tracking of when transactions are due.

- Incorrect amounts or totals which can lead to misunderstandings between businesses and clients.

- Inaccurate tax or discount calculations that affect the final amount due.

Inconsistent Formats and Layouts

Using different layouts or inconsistent formats across documents can create confusion and reduce professionalism. It’s crucial to maintain a standardized approach to ensure clarity and ease of review. Common mistakes include:

- Changing document styles between different records, making it harder to compare or process them efficiently.

- Lack of clear section labels that make it difficult for recipients to quickly locate necessary information.

- Inconsistent use of fonts or colors that hinder readability and professionalism.

Neglecting Regular Updates

Another common mistake is failing to keep financial records up-to-date. When information isn’t regularly updated or reviewed, it can result in outdated details being shared or processed. Some issues that arise include:

- Outdated contact information that leads to communication breakdowns.

- Failure to reflect payment status which causes confusion about whether a transaction has been completed or is still pending.

- Unreconciled records that lead to discrepancies during audits or financial reviews.

By being mindful of these common mistakes and addressing them promptly, businesses can improve the accuracy and reliability of their financial documentation, leading to smoother operations and stronger relationships with clients and partners.

Time-Saving Benefits of Automation

Automating routine tasks related to managing financial documents can significantly reduce the time spent on manual processes. By eliminating repetitive work, businesses can focus on more strategic activities, improve accuracy, and enhance overall productivity. Automation streamlines workflows, ensuring that essential tasks are completed efficiently and on time.

Faster Data Entry

Automation speeds up the process of entering and updating data by eliminating the need for manual input. With automated systems, key information such as dates, amounts, and client details can be filled in automatically based on pre-set rules. This not only saves time but also reduces the risk of human error. Benefits include:

- Reduced typing errors that often occur with manual entry.

- Quicker processing of new records, reducing bottlenecks in the workflow.

- Instant updates that ensure all records are accurate and current without delay.

Streamlined Workflow

Automated systems help organize tasks in a more structured and efficient manner, ensuring that nothing is overlooked. When certain actions, like sending reminders or generating reports, are handled automatically, employees can allocate their time to higher-priority activities. Key advantages include:

- Automatic notifications for overdue payments or upcoming deadlines, preventing last-minute rushes.

- Faster report generation that saves hours spent manually creating financial summaries.

- Seamless integration with other tools, such as accounting software, for quicker data syncing and processing.

Reduced Administrative Workload

By automating routine administrative tasks, businesses can significantly reduce the manual effort involved in maintaining and updating financial records. With fewer tasks requiring human intervention, employees can focus on higher-level functions such as strategy or customer engagement. Automation benefits include:

- Lower administrative costs due to reduced reliance on manual labor.

- Increased focus on critical business activities rather than time-consuming tasks.

- Minimized need for training since automated systems typically require less intervention or troubleshooting.

By adopting automation, businesses can free up valuable time, improve operational efficiency, and reduce the chance of errors–resulting in a more streamlined and productive workflow.

How to Organize Your Invoices

Proper organization of financial documents is essential for maintaining clear records, ensuring timely payments, and staying on top of your business’s financial health. A well-structured system allows for quick access to key information, helping you track transactions, identify discrepancies, and streamline reporting. The following steps will guide you in creating a system that works efficiently for your needs.

Create a Consistent Filing System

Establishing a consistent filing structure is the first step toward effective organization. A logical and easy-to-navigate system helps you avoid confusion and ensures that all necessary details are accessible when needed. Consider these guidelines:

- Sort by date: Group records chronologically to track the sequence of transactions more easily.

- Sort by client or project: If you handle multiple clients or projects, consider organizing documents by these categories for easier reference.

- Use clear labels: Label each file or folder with meaningful, descriptive titles to make retrieval faster and more intuitive.

Digitalize and Backup Records

Digitizing your records provides several advantages, including easier access, better security, and protection against data loss. Transitioning to digital formats can save physical space and allow for faster retrieval of information. Follow these best practices:

- Scan all physical documents: Convert paper records into digital files and store them in a secure, organized system.

- Use cloud storage: Store files in a cloud-based system to ensure they are easily accessible and backed up in case of an emergency.

- Implement naming conventions: Use clear, consistent naming conventions for digital files (e.g., “ClientName_Date_Description”) to make searching simple.

Track Payment Status and Due Dates

Keeping track of payments and due dates is crucial for effective financial management. A system that highlights pending payments or overdue items helps you stay on top of your cash flow. Some tips for tracking payment status include:

- Use a spreadsheet or software: Use a digital tool to track payment statuses, including due dates, amounts, and outstanding balances.

- Set reminders: Schedule reminders for upcoming payment due dates to avoid missing any deadlines.

- Mark paid and unpaid items: Clearly mark which records have been paid and which are still outstanding, using color codes or labels.

Maintain Regular Reviews

Routine reviews of your financial records ensure that everything is up to date and accurate. Regular audits help you spot discrepancies early and ensure that all documents are accounted for. Consider these practices:

- Schedule periodic checks: Set a regular time each week or month to review your documents and update any outstanding items.

- Reconcile with bank statements: Cross-reference your records with bank statements to ensure accuracy and identify any missing transactions.

- Remove outdated records: Regularly clear out old or unnecessary documents to keep your system lean and efficient.

By following these steps, you can ensure that your financial records are well-organized, up-to-date, and easy to manage, leading to better business decisions and smoother operations.

Ensuring Accuracy with Invoice Templates

Maintaining precision in financial documents is crucial for businesses to avoid errors and ensure clear communication with clients. A well-structured system can help eliminate mistakes that commonly arise from manual data entry. By utilizing predefined structures, you can reduce the chances of inaccuracies and improve the consistency of all your financial paperwork. Proper formatting and automated tools play key roles in achieving this level of accuracy.

Use of Standardized Formats

Adopting a consistent layout for all financial records helps to prevent confusion and errors, as it ensures that all necessary details are included every time. This consistency makes it easier to spot missing or incorrect information. Standardized formats typically include fields for:

| Field | Description |

|---|---|

| Date | The date of the transaction, which is vital for tracking and reconciling records. |

| Amount | The exact amount to be paid, ensuring there are no discrepancies in calculations. |

| Descriptions | A detailed description of the transaction, ensuring transparency and preventing misunderstandings. |

| Client Information | Details of the client or customer, including name, address, and contact information. |

Leverage Automated Calculations

One of the most effective ways to ensure accuracy is through automation. Using systems that perform calculations automatically eliminates the possibility of human error. For example, tax calculations, discount applications, or total amounts should be handled by software that performs these actions in real-time. Automated tools offer these advantages:

- Instant error detection: Any discrepancies in calculations are immediately flagged for review.

- Consistent application of rules: Tax rates, discounts, or other business-specific rules are applied consistently across all documents.

- Time savings: Calculations are done in seconds, reducing the time spent on manual work and ensuring quick processing.

By following these methods, businesses can significantly reduce errors in their records, leading to smoother operations, better customer satisfaction, and more reliable financial reporting.

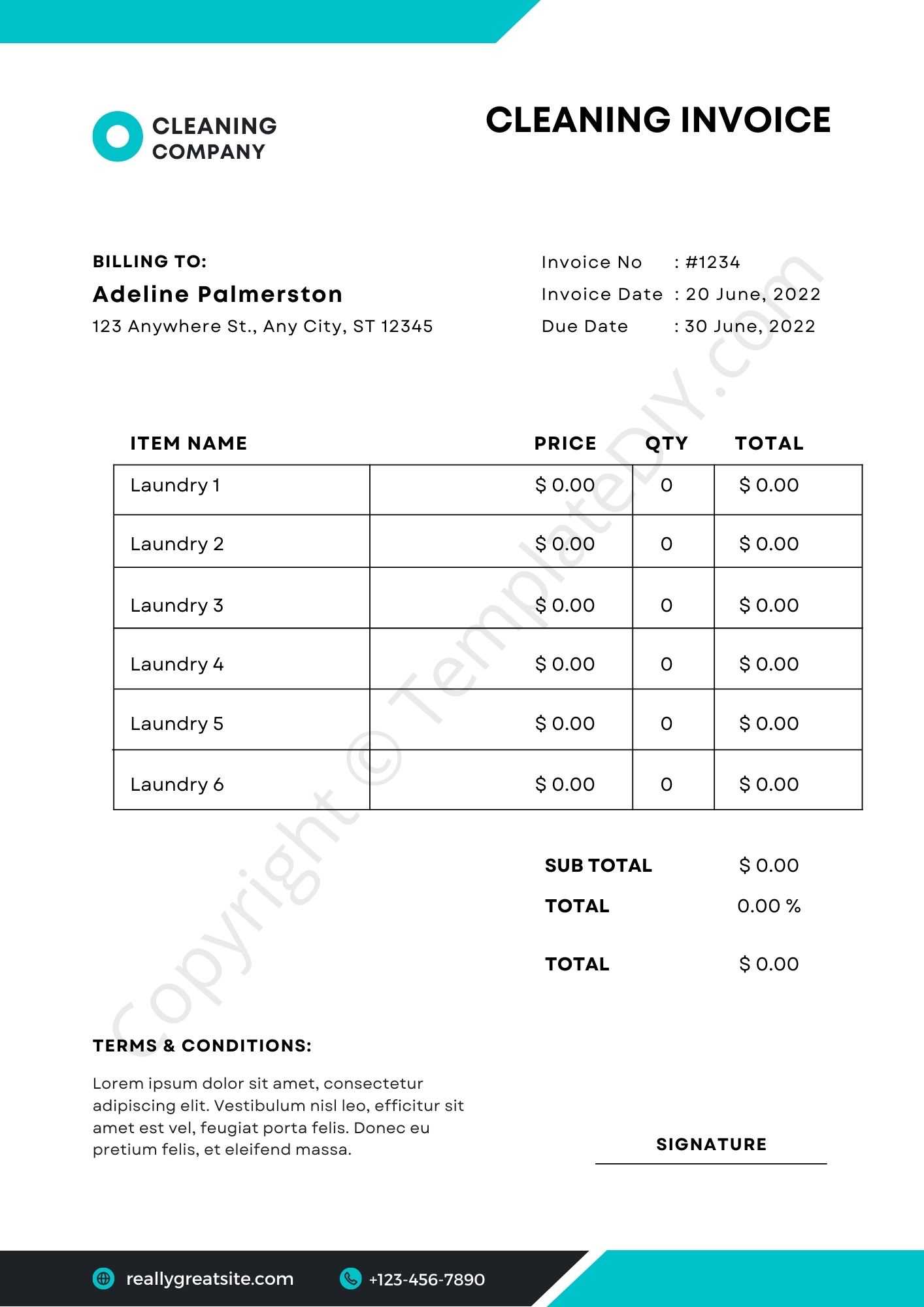

Free vs Paid Invoice Templates

When choosing a system for organizing financial documents, businesses often face the decision between using free or paid options. Both free and premium solutions offer distinct advantages, but understanding the differences between them is essential for selecting the right one based on your specific needs. While free resources may seem attractive, paid solutions can offer additional features and customization options that might be necessary for more complex business requirements.

Advantages of Free Systems

Free systems provide an excellent starting point for small businesses or startups with limited budgets. These solutions typically offer the basics, such as the ability to create and manage records, without any financial commitment. Key benefits of free options include:

- No upfront cost: Free options are, as the name suggests, available at no charge, making them accessible to anyone starting out.

- Simplicity: Many free solutions are designed to be user-friendly, focusing on essential functions without overwhelming users with complex features.

- Quick setup: Since they typically offer fewer customization options, free systems can be set up and ready to use in a matter of minutes.

Benefits of Paid Solutions

Paid systems are often more robust, offering advanced features and better support that can help businesses grow and scale. These solutions usually provide additional benefits, such as:

- Customization: Paid tools often allow for deeper customization, enabling businesses to tailor their documents and processes to their specific needs.

- Advanced automation: Many premium options offer automated calculations, payment reminders, and reporting features, saving time and reducing the risk of human error.

- Support and updates: Paid systems usually include customer support and regular updates, ensuring you have access to the latest features and assistance when needed.

While free options may work for businesses with straightforward needs, a paid solution could be a better investment for growing companies that require more advanced features, flexibility, and support.

Invoice Cleaning for Small Businesses

For small businesses, maintaining accurate financial records is crucial to ensure smooth operations and healthy cash flow. However, managing these documents can often become cumbersome without proper organization. By focusing on refining your record-keeping processes, you can prevent errors, reduce delays, and ultimately improve your business’s financial efficiency. Streamlining your records is a simple yet effective way to minimize time spent on administrative tasks and keep everything in order.

Key Benefits of Streamlining Financial Records

Implementing an organized system for managing financial paperwork provides several advantages, particularly for small businesses looking to grow. Some of the key benefits include:

- Time-saving: With a structured approach, you can quickly find necessary documents, reducing the time spent searching for missing or misplaced records.

- Reduced errors: Properly structured records minimize the risk of inaccuracies in your financial data, preventing costly mistakes.

- Improved cash flow management: A clear overview of your outstanding payments and due dates ensures timely follow-ups and helps you stay on top of your finances.

Tips for Organizing Financial Documents

Small businesses can easily implement a system that improves the organization and tracking of financial documents. Here are some helpful tips for staying organized:

- Use standardized formats: Consistency in how records are presented makes it easier to track, review, and reconcile payments.

- Go digital: Digital systems provide the advantage of cloud storage and easy access to all records, reducing the physical space needed and improving security.

- Set regular review schedules: Make it a habit to review financial records weekly or monthly to catch errors early and ensure that all documents are up-to-date.

- Use automated tools: Leverage software that automatically calculates totals, generates reports, and sends reminders, reducing manual workload and improving accuracy.

By following these strategies, small businesses can ensure that their financial records are well-maintained, leading to better decision-making, reduced stress, and more efficient operations. Streamlining this part of your business may seem like a small effort, but the long-term benefits are significant.

How to Track Invoice Changes

Keeping track of modifications made to financial documents is essential for maintaining transparency, accountability, and accuracy in your records. Whether you’re updating payment details, adjusting amounts, or correcting mistakes, it’s important to monitor any changes made to ensure consistency and avoid discrepancies. Having a clear system in place allows businesses to stay on top of any alterations and ensures that all changes are properly documented and justified.

Using Change Logs for Record-Keeping

One of the most effective ways to track changes is by maintaining a detailed change log. A change log allows you to record every modification made to a document, including the reason for the change, the person responsible, and the date. This approach helps to maintain a complete audit trail. Key elements to include in a change log are:

| Field | Description |

|---|---|

| Change Date | The date when the modification was made. |

| Details of Change | A description of what was changed (e.g., amount adjusted, details corrected). |

| Person Responsible | The individual who made the change or update. |

| Reason for Change | An explanation of why the modification was necessary (e.g., correction, update). |

Utilizing Software for Change Tracking

Many modern financial systems and management tools include built-in features to track and log changes automatically. These tools not only help record modifications but also allow businesses to monitor alterations in real time. The advantages of using software include:

- Real-time updates: Changes are logged immediately and can be reviewed at any time, ensuring the most up-to-date information is always available.

- Version history: Many systems maintain a version history, allowing you to see previous versions of documents and compare changes over time.

- Access control: With user permissions, you can limit who can make changes and ensure that only authorized individuals are able to modify key documents.

By using both manual and automated tracking methods, businesses can keep a clear record of all changes made to their financial documents, ensuring transparency, reducing errors, and making it easier to reconcile accounts or respond to inquiries.

Integrating Templates with Accounting Software

Integrating predefined document structures with accounting software can streamline your financial processes, making them more efficient and accurate. By automating the transfer of data between different systems, businesses can save time on manual data entry and reduce the risk of human errors. This integration allows for seamless management of records, enabling businesses to focus more on growth and decision-making rather than administrative tasks.

Benefits of Integration

When templates are integrated with accounting tools, several key advantages emerge, enhancing the overall efficiency and accuracy of financial management:

- Automation of data entry: Automatically transferring data between your document templates and accounting software eliminates the need for double-entry, reducing the chance of errors and saving valuable time.

- Consistent formatting: Integration ensures that the documents generated follow the same structure, improving consistency and reducing the chances of confusion when reviewing records.

- Real-time updates: Changes made to records in the accounting system are automatically reflected in related documents, ensuring that all information is always up-to-date.

How to Set Up Integration

To successfully integrate your document system with accounting software, consider the following steps:

- Choose compatible software: Ensure that your accounting tool supports integration with your document generation system or offers API access for third-party integrations.

- Map your data: Identify which fields need to be shared between the two systems (e.g., amounts, dates, client names), and ensure they are properly mapped to avoid misalignment.

- Test the integration: Before fully implementing the integration, run tests to ensure that data is being transferred accurately and that documents are generated as expected.

- Monitor and maintain: After integration, continue to monitor the system to ensure smooth operation and make updates as needed to address any issues or software updates.

By integrating your document creation process with accounting software, you can enhance the accuracy, efficiency, and scalability of your financial operations, enabling your business to operate more smoothly and focus on its core activities.

Maintaining Consistency Across Invoices

Ensuring uniformity in financial documents is essential for building a professional reputation and ensuring smooth business operations. Consistency across all records not only improves clarity but also minimizes confusion and errors when dealing with clients or reconciling accounts. A well-organized approach to creating these documents helps reinforce your brand and makes your record-keeping more efficient.

Why Consistency Matters

Consistency in financial paperwork is crucial for several reasons, ranging from professional image to operational efficiency. Some of the key reasons to maintain uniformity include:

- Professional appearance: Uniform documents give the impression of an organized and reliable business, fostering trust and credibility with clients and partners.

- Ease of tracking: When all records follow a similar format, it becomes much easier to track and analyze payments, identify discrepancies, and ensure accuracy.

- Compliance and audit readiness: Consistent formatting and data presentation make it simpler to adhere to legal or tax requirements and respond to audits if necessary.

How to Maintain Consistency

Achieving consistency across all your financial documents requires some intentional practices and attention to detail. Here are a few tips to help you maintain uniformity:

- Use a standardized structure: Whether you’re creating documents manually or using software, ensure that all forms follow the same layout, including headings, fonts, colors, and key fields.

- Incorporate branding elements: Ensure that your company logo, contact information, and other branding elements appear consistently across all documents. This creates a cohesive look that reinforces your brand identity.

- Automate document generation: By using software that generates standardized forms automatically, you can eliminate variations in formatting and content, ensuring that each document meets your set criteria.

- Regularly review templates: Regularly update and audit your existing documents to ensure they still meet your business needs and reflect any changes in your processes or branding.

By following these strategies, businesses can maintain consistency across their financial documents, creating a more professional and organized workflow while minimizing errors and confusion.

Template Design Tips for Better Clarity

Creating clear and easy-to-understand financial documents is crucial for both businesses and clients. The design of these documents plays a significant role in ensuring that all the necessary information is presented logically and is easy to read. A well-designed format helps reduce misunderstandings, improves communication, and enhances the overall professionalism of your documents.

Key Design Principles for Clarity

When designing your financial documents, focus on elements that contribute to readability and comprehension. Here are a few key principles to keep in mind:

- Use a clean layout: Avoid clutter by leaving enough white space around sections. A clean, organized layout helps the reader quickly scan and understand the key points.

- Prioritize hierarchy: Make sure important details, like totals or due dates, stand out by using larger fonts or bold text. This visual hierarchy guides the reader to the most relevant information first.

- Consistent fonts and colors: Stick to simple, legible fonts and a consistent color scheme. Too many font styles or colors can make the document feel chaotic and difficult to read.

Effective Use of Sections and Tables

Breaking down information into logical sections or using tables can greatly enhance the clarity of your financial documents. Consider the following tips:

- Use clear headings: Divide the document into clearly labeled sections (e.g., payment details, itemized charges, contact information) so that each part is easily identifiable.

- Incorporate tables for numbers: When dealing with numerical data, such as itemized costs or payment amounts, tables provide an organized way to display information that is easy to follow.

- Use bullet points for lists: Bullet points can help break down complex information into digestible chunks, making it easier for readers to process and understand.

By implementing these design tips, you can create documents that are not only visually appealing but also functional and easy to read. Clear and well-structured documents help improve the overall customer experience and ensure that important information is easily accessible.

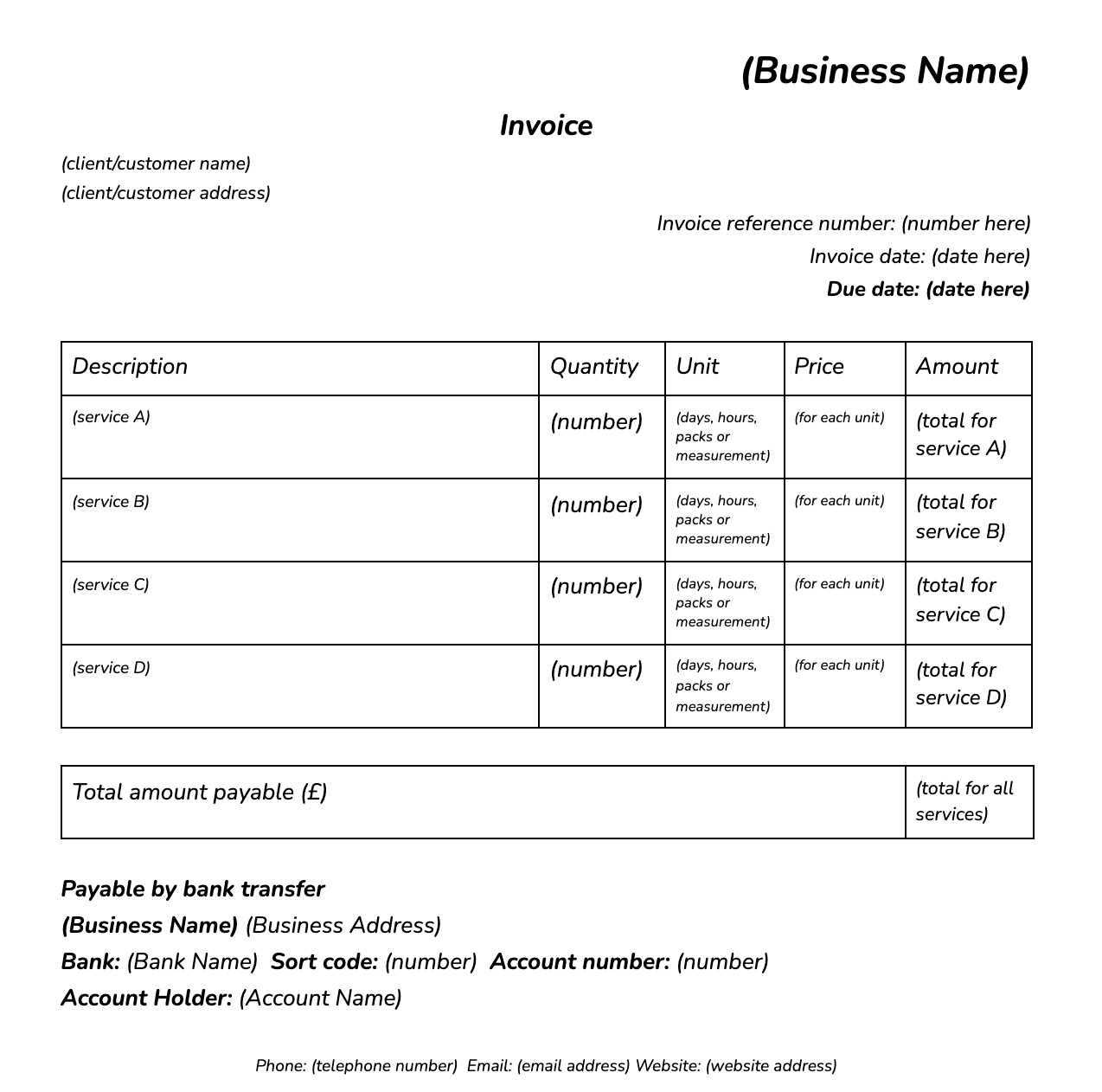

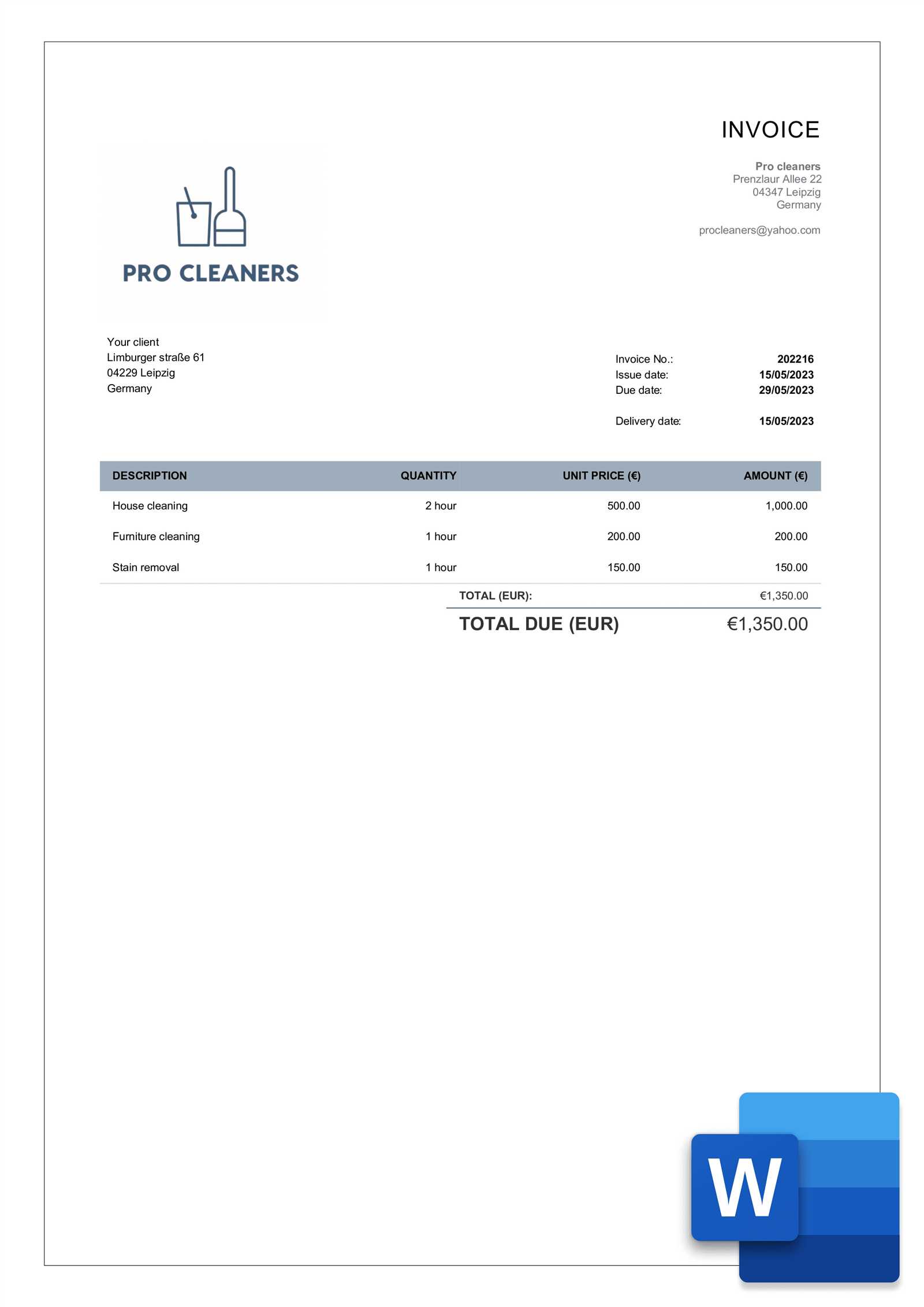

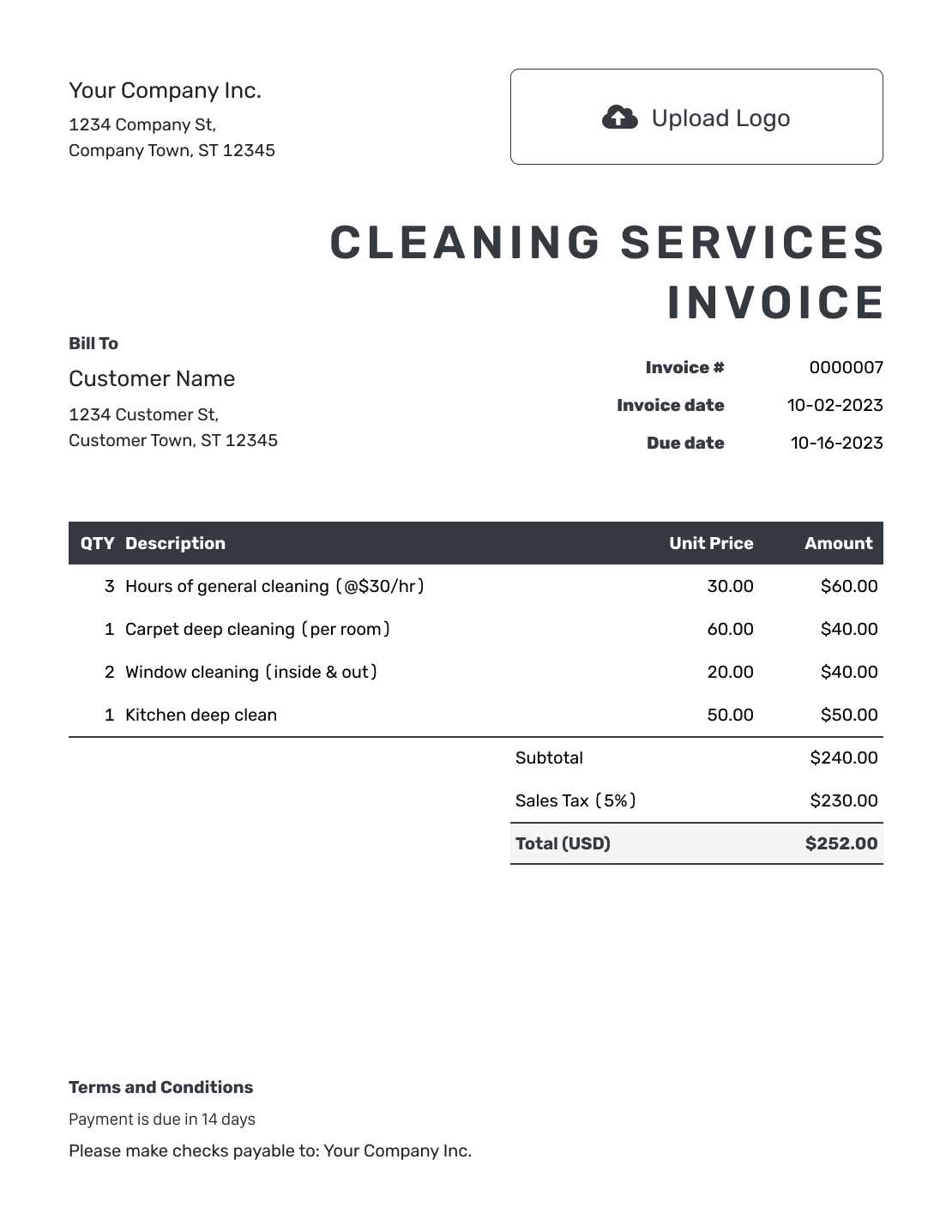

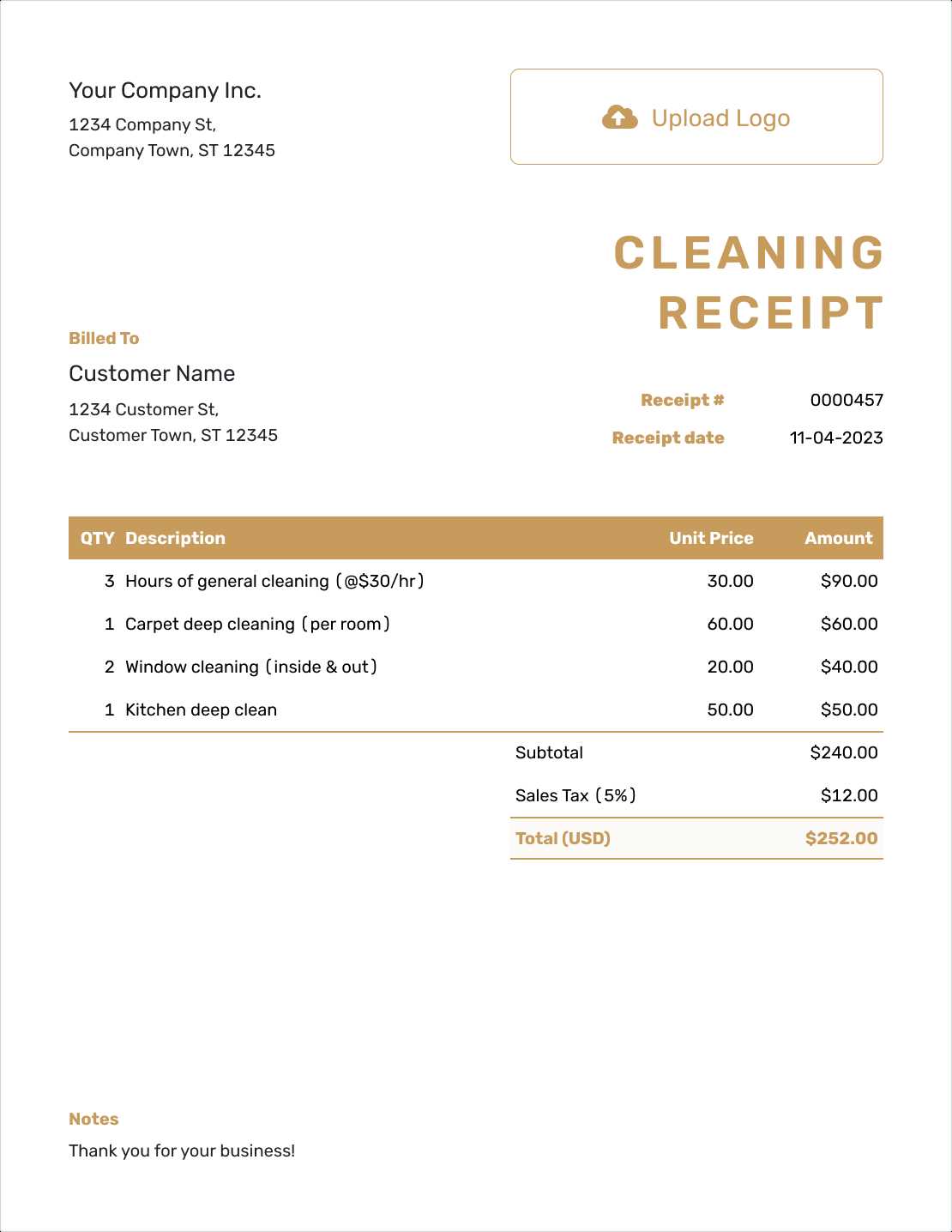

Common Formats for Invoice Templates

When designing financial documents, it’s important to choose the right format that ensures clarity, ease of use, and compatibility with your business processes. Different formats can serve various needs depending on the type of information you need to communicate and how you intend to deliver or store the documents. Selecting the appropriate format helps streamline operations, whether you’re working with clients, vendors, or internal teams.

Popular Formats for Financial Documents

Several formats are commonly used for creating professional documents, each offering unique benefits. Here are some of the most popular ones:

- PDF (Portable Document Format): PDF is the most widely used format for sharing finalized documents because it preserves the layout, fonts, and images across devices. It is ideal for sending completed financial records to clients or storing official versions that need to remain unchanged.

- Excel (XLS or XLSX): Excel is commonly used for documents that require detailed calculations or analysis. It’s flexible, allowing users to easily update data and perform calculations. This format is especially useful for businesses that need to track quantities, costs, or manage ongoing transactions.

- Word (DOC or DOCX): Word is often used for creating editable documents that may need to be customized or updated frequently. It’s useful for businesses that prefer a more flexible document format that can be quickly edited before sending out or printing.

Choosing the Right Format for Your Needs

Each format serves different purposes, so it’s important to consider how the document will be used before choosing one. Here are some factors to consider when deciding which format to use:

- Security: If the document contains sensitive information, using a PDF with password protection can help secure the data from unauthorized access.

- Flexibility: For documents that require ongoing updates or additional calculations, Excel is a great choice because it allows for easy editing and formula use.

- Presentation: If you need a document that looks polished and professional with consistent formatting across devices, a PDF is the most reliable option.

- Collaboration: If multiple people need to edit or contribute to the document, a Word document or Excel sheet may be more suitable due to its collaborative features, such as comments and trackable changes.

By selecting the appropriate format, businesses can ensure that their financial documents are not only easy to work with but also meet the needs of all parties involved.

How to Share Clean Invoices with Clients

Efficiently sharing accurate financial documents with clients is essential for maintaining professionalism and ensuring smooth business transactions. By sending well-organized records, you can avoid confusion, speed up payment processing, and build trust with your clients. The method you choose to share these documents can greatly impact how quickly and easily clients can access and process the information.

Choosing the Right Delivery Method

There are several ways to share financial documents, and selecting the right method depends on the preferences of your clients, as well as your own business needs. Consider the following options:

- Email: One of the most common and efficient methods. Attach the document in a secure format (such as PDF) and ensure the email includes a clear subject line and any necessary instructions. This method is quick and ensures the document reaches the client directly.

- Cloud Storage: Using cloud storage services (such as Google Drive or Dropbox) allows you to store documents in one centralized location and share a link with your client. This method is ideal for clients who need access to multiple records or for larger businesses with frequent transactions.

- Online Client Portals: If your business has a client portal, this is an excellent way to share documents securely. Portals provide a centralized place where clients can view, download, and even track the status of their financial documents.

Ensuring Security and Clarity

Regardless of the sharing method you choose, it’s crucial to prioritize both security and clarity when sending financial records. Here are some best practices to follow:

- Use secure formats: Always send documents in a format that preserves their structure and is difficult to tamper with. PDFs are ideal, as they are not easily editable and maintain the integrity of the document.

- Label your documents clearly: Ensure your documents are appropriately named (e.g., “Payment Summary – [Client Name] – [Date]”). This makes it easier for clients to identify the document and keep their records organized.

- Provide context: In your communication (email or message), briefly explain what the document contains, any action required by the client, and any important deadlines. This helps ensure that your clients understand the document’s purpose and know how to proceed.

By following these steps, you can ensure that your financial documents are delivered professionally, securely, and in a way that is easy for clients to access and process.

Improving Cash Flow with Invoice Templates

Maintaining a healthy cash flow is crucial for the sustainability and growth of any business. One effective way to ensure timely payments and avoid delays is by using well-structured financial documents. By streamlining the process of creating and sending these records, businesses can significantly reduce the time it takes to receive payments, which directly impacts cash flow.

How Properly Designed Documents Impact Cash Flow

Financial documents that are clear, concise, and professionally designed play an important role in ensuring timely payments. Here’s how a well-organized document can positively affect your cash flow:

- Faster Processing: When documents are clear and easy to understand, clients can quickly review the details, reducing the time spent on clarifications or disputes. This leads to faster approvals and quicker payments.

- Minimized Errors: A well-structured document reduces the chances of mistakes, such as incorrect billing amounts or missing information. Fewer errors mean fewer delays in payment processing.

- Clear Payment Terms: Including clear terms and due dates helps set expectations for clients, encouraging them to make payments on time to avoid late fees or penalties.

Best Practices for Improving Cash Flow

To further improve your cash flow, consider adopting the following practices when creating and sending financial documents:

- Set Clear Payment Deadlines: Clearly state the due date on each document. Make it visible and unambiguous so that clients know exactly when payment is expected.

- Offer Multiple Payment Options: Allow clients to choose from a variety of payment methods (e.g., bank transfer, credit card, PayPal). This flexibility can encourage faster payments.

- Automate Reminders: Set up automated reminders for clients as the payment due date approaches. This can serve as a gentle nudge to ensure timely payments.

- Incorporate Early Payment Discounts: Offering a small discount for early payments can incentivize clients to pay sooner, improving your cash flow in the long run.

By using well-structured financial documents and following these best practices, businesses can improve their cash flow, ensuring they have the liquidity needed to meet expenses and invest in future growth.