Proforma Invoice for Export Template and Guidelines

When conducting global transactions, businesses often need to provide preliminary paperwork that outlines the terms and conditions of a deal before the actual delivery takes place. This documentation helps clarify the expected costs, delivery schedules, and other important details. It’s an essential step in international trade that ensures both parties are on the same page before finalizing the shipment.

Such documents serve multiple purposes, from offering an advance estimate of the goods and services involved to providing customs authorities with necessary information. By using the right format, businesses can ensure accuracy and transparency, which is crucial for smooth operations and avoiding potential delays or misunderstandings.

Whether you’re a seasoned exporter or new to international business, mastering the correct format of these preliminary documents can make a significant difference in streamlining your transactions. With a well-structured document, you can efficiently communicate the terms, minimize risks, and set the stage for a successful partnership.

Document Preparation for International Transactions

In global business transactions, certain documents are used to outline the terms of a deal prior to the actual shipment of goods. These forms are vital for communicating the value, description, and terms of sale between the buyer and seller. They act as a preliminary agreement that provides essential details for both parties to review before committing to the actual shipment and payment process.

Key Information in International Transaction Forms

These documents typically contain crucial data such as product details, payment terms, and shipping information. It’s essential that they include all relevant information to prevent any misunderstandings. Below is a sample of the key sections typically found in such forms:

| Section | Description |

|---|---|

| Seller Information | Name, address, and contact details of the seller |

| Buyer Information | Name, address, and contact details of the buyer |

| Product Description | Details of the goods including quantity, quality, and unit price |

| Shipping Details | Information about the delivery method, schedule, and destination |

| Payment Terms | Methods of payment, currency, and payment due dates |

Benefits of Using a Structured Document

By using a clearly structured document, businesses can ensure that both parties are aware of the terms and expectations before finalizing the transaction. This minimizes the risk of miscommunication and can expedite the process of customs clearance, payment, and delivery. A well-organized format is especially helpful for international shipping, where clear documentation is often required for regulatory purposes.

Understanding the Importance of Preliminary Transaction Documents

In international business, providing a detailed document prior to shipment is essential for setting clear expectations between the buyer and the seller. This type of paperwork outlines the key terms of the transaction, such as pricing, delivery conditions, and product details, and serves as a formalized estimate. By using this document, both parties gain clarity on the agreed-upon terms before the goods are shipped and the final contract is executed.

These documents play a critical role in international trade as they help prevent misunderstandings by offering an early confirmation of the agreement. They are often required by customs authorities to assess the shipment’s value and ensure proper tax and duty calculations. Additionally, they assist in securing payment by providing a clear outline of the expected costs and terms for the buyer.

Moreover, they are essential tools for managing risks. By establishing a detailed outline of the transaction beforehand, both parties can mitigate potential disputes and ensure that all aspects of the deal, from shipping to payment, are agreed upon and documented properly. This preliminary paperwork also supports smoother logistics and customs processes, helping avoid delays and ensuring compliance with international trade regulations.

Key Elements of an International Transaction Document

When preparing the preliminary paperwork for international transactions, it’s essential to include certain details that ensure both parties are clear on the terms of the agreement. These documents are typically used as a reference to provide a summary of the transaction, and each section should serve to clarify the goods or services involved, payment expectations, and other critical details. A well-structured form ensures that there is no ambiguity in the agreement and can help avoid future disputes.

Among the most important sections to include are the seller’s and buyer’s details, which provide the full name, address, and contact information for both parties. This is essential for accurate delivery and billing. The product description is equally important, as it details the items being shipped, including quantity, price per unit, and total value. Shipping details, such as the method of delivery and destination, must also be clearly outlined to avoid confusion during the shipping process.

Payment terms must be specified clearly, indicating the method of payment, the currency, and the expected due date. This helps in managing expectations and ensuring timely financial transactions. Additionally, any special conditions or agreements related to taxes, customs, or other regulatory requirements should be included to ensure compliance with both local and international trade laws.

How to Create an Effective Document Layout

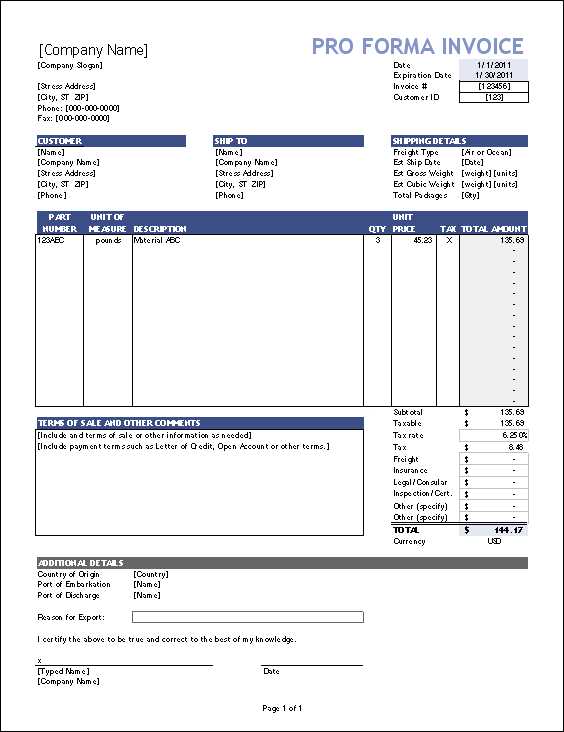

Designing an efficient layout for international transaction paperwork is essential for ensuring that all necessary details are included in a clear and organized manner. A well-structured layout makes it easier for both the buyer and the seller to understand the terms of the agreement, reduces the chance of errors, and accelerates the approval process. The key is to prioritize clarity and accuracy, while keeping the format professional and straightforward.

To create an effective document, follow these steps:

- Include All Necessary Sections: Make sure to include key information such as buyer and seller details, product descriptions, payment terms, and delivery information. These are crucial for a complete document.

- Maintain a Clear Structure: Use headings and subheadings to divide the document into sections that are easy to follow. This helps both parties quickly locate specific information.

- Be Concise and Precise: Avoid unnecessary details and ensure that all descriptions are clear and to the point. This will help prevent misunderstandings.

- Ensure Flexibility: The layout should be adaptable to different types of transactions, allowing for modifications depending on the specifics of each deal.

- Use a Professional Design: Choose a clean, formal style with appropriate fonts, spacing, and alignment. This contributes to a polished and reliable appearance.

By following these guidelines, businesses can create a document layout that not only meets legal and logistical requirements but also ensures smooth communication between the parties involved in the transaction.

Common Mistakes to Avoid in Transaction Documents

When preparing documentation for international transactions, it’s easy to make mistakes that can lead to confusion, delays, or even financial loss. Ensuring accuracy and clarity is crucial, as errors can affect payment schedules, shipping timelines, and even customs clearance. By being aware of common pitfalls, you can take steps to prevent them and streamline your global dealings.

Typical Errors in Document Preparation

The following are some of the most frequent mistakes that businesses should avoid when drafting important transaction paperwork:

- Missing or Incorrect Buyer/Seller Information: Not having accurate contact details or legal names for both parties can lead to shipping delays and legal issues. Always double-check this information before finalizing any documents.

- Incomplete Product Descriptions: Omitting specific details such as product specifications, quantity, or total value can cause misunderstandings. Ensure every item is listed clearly and completely.

- Vague Payment Terms: Failing to specify payment methods, due dates, or currency can result in confusion about how and when money should be exchanged. Be specific about all financial terms.

- Overlooking Shipping Details: Inaccurate delivery addresses, missing shipping methods, or incomplete delivery instructions can cause delays. Always provide clear and thorough information regarding the shipping process.

- Ignoring Customs and Regulatory Requirements: Every country has its own set of rules regarding imports and exports. Neglecting to include necessary details related to taxes, duties, or customs clearance can lead to complications at the border.

How to Avoid These Errors

To prevent these mistakes, ensure that your document includes all necessary details and is reviewed carefully before submission. Double-check names, addresses, and all transactional terms. It’s also helpful to use a checklist to ensure every section is completed correctly. When in doubt, consult with professionals who are familiar with international trade practices to ensure full compliance.

Legal Requirements for International Transaction Documents

When engaging in international trade, it’s crucial to ensure that the necessary documentation complies with both domestic and international legal standards. These documents often serve as the foundation for customs clearance, payment processing, and contract enforcement. Understanding the legal obligations associated with them helps businesses avoid penalties, delays, and disputes that could arise from improper paperwork.

One of the key legal requirements is that the document must include accurate and complete details about the goods being sold, the terms of sale, and the identities of the involved parties. This ensures that both parties can verify the agreed-upon terms and facilitates the customs process. Additionally, compliance with tax laws is crucial, as customs authorities often use these documents to assess duties, taxes, and other charges on imported goods.

Another important factor is the proper declaration of the currency and payment terms, as discrepancies in these areas can cause legal issues related to international financial regulations. Furthermore, depending on the countries involved, some jurisdictions may require additional certifications or supporting documents to accompany these records, especially for regulated or restricted products. It’s essential to research and adhere to the specific regulations that apply to your shipment to avoid complications.

Essential Information to Include in a Document Layout

When preparing essential paperwork for international transactions, certain information must always be included to ensure clarity and compliance with regulations. A well-organized layout helps to clearly communicate the terms of sale, product details, and payment conditions to both parties. It also aids in the efficient processing of customs and other logistics requirements.

The following table outlines the key sections that should always be included in such a document:

| Section | Description |

|---|---|

| Seller Information | Full name, address, contact details, and business registration number of the seller |

| Buyer Information | Full name, address, contact details, and business registration number of the buyer |

| Product Details | A detailed description of the items being sold, including quantities, unit prices, and total value |

| Payment Terms | Information on the payment method, due date, and currency used in the transaction |

| Shipping Information | Delivery terms, shipping method, destination address, and estimated arrival date |

| Legal Statements | Any required declarations or certifications based on the product type or destination country |

Including these sections ensures that the document serves its purpose in both facilitating international trade and complying with relevant legal requirements. It also helps to minimize errors and disputes by making all terms clear to both parties involved in the transaction.

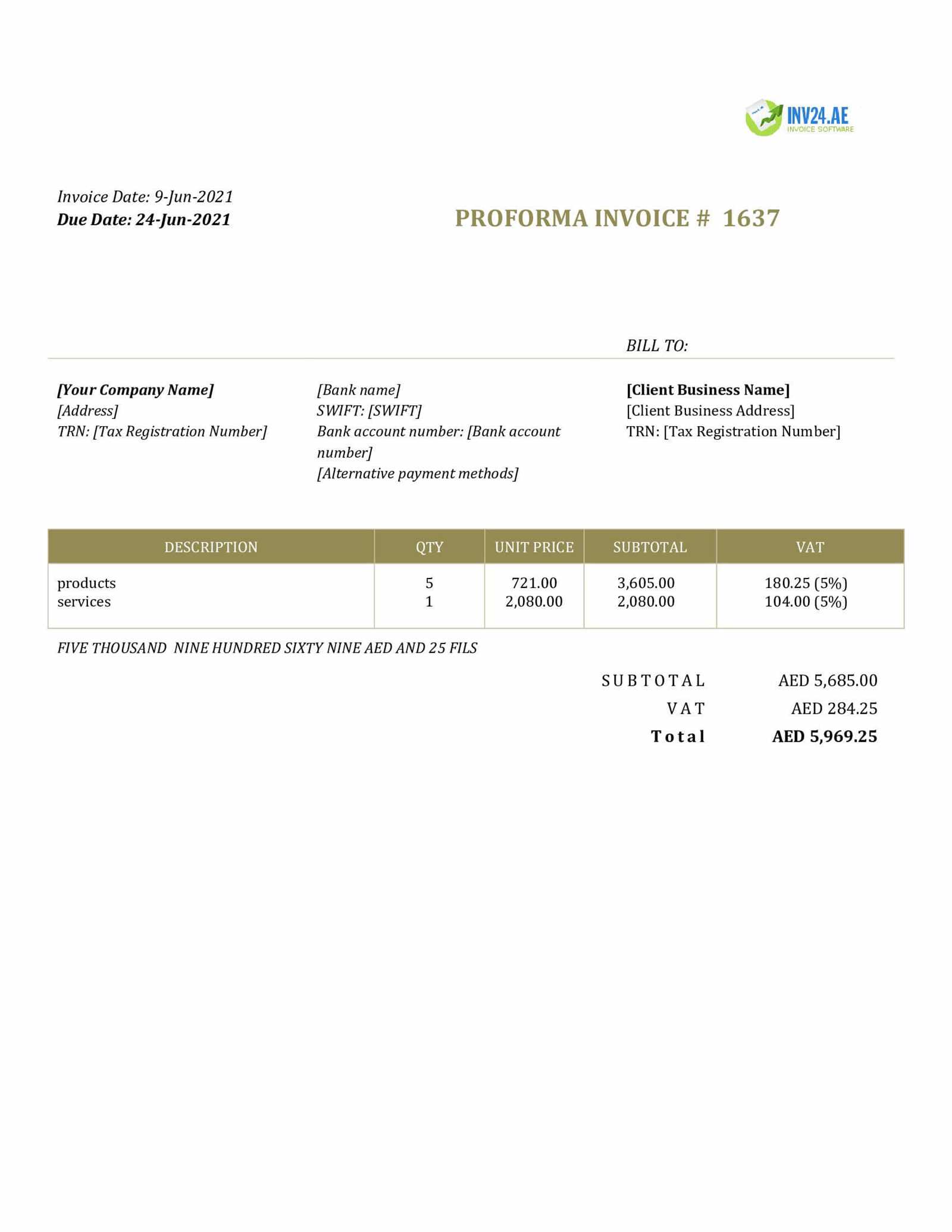

Using a Preliminary Document for International Trade

In the context of global business transactions, preparing a preliminary document is an essential step in ensuring smooth operations between buyers and sellers. This document acts as an official estimate and agreement, providing both parties with a clear understanding of the terms before the goods are shipped. By establishing mutual expectations early, it helps to avoid misunderstandings, delays, and potential disputes.

Here are the key benefits of using such a document in international trade:

- Clarifies Transaction Terms: It helps both parties agree on the price, quantity, and delivery terms before any financial commitments are made.

- Supports Customs Procedures: This document is often required by customs authorities to assess the value of goods and determine applicable taxes and duties.

- Facilitates Payment Arrangements: It outlines the payment schedule and methods, ensuring that both parties are aligned on the timing and method of transaction.

- Helps in Securing Financing: Lenders and financial institutions often require such a document to assess the creditworthiness of a transaction before issuing trade finance or letters of credit.

- Risk Management: It serves as a record to ensure both parties have agreed on the terms in case of future disputes or claims.

Overall, using a preliminary document in international trade streamlines the process, reduces the risk of disputes, and ensures compliance with both local and international trade regulations. It is an invaluable tool for businesses involved in cross-border transactions.

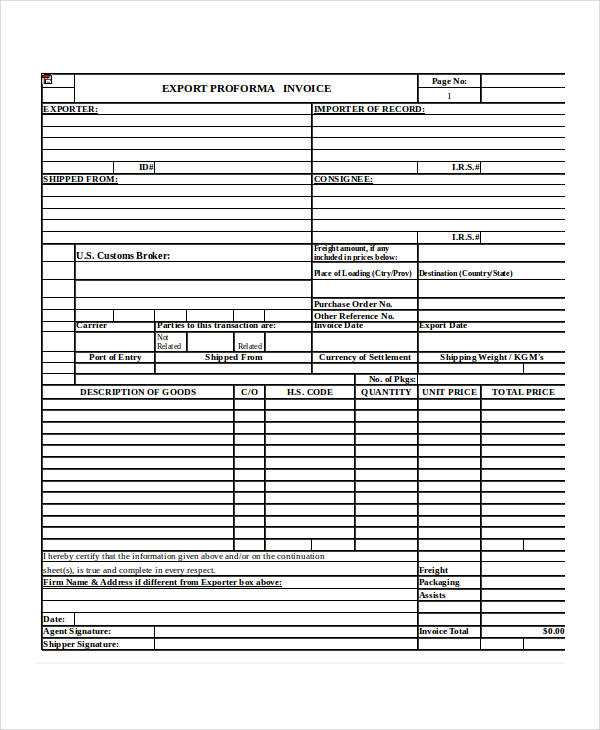

How Preliminary Documents Differ from Commercial Documents

When it comes to international transactions, two commonly used types of paperwork play distinct roles in the process: preliminary documents and commercial documents. While both serve important functions in the trade cycle, they differ in terms of their purpose, legal standing, and usage. Understanding these differences helps businesses manage their transactions more efficiently and ensures that each document serves its intended purpose.

Key Differences Between Preliminary and Commercial Documents

Here are the primary distinctions between these two types of documents:

- Purpose: A preliminary document is essentially a draft or estimate, used to outline the terms of the transaction before the actual sale occurs. It serves as a way for both parties to agree on key details, such as price and delivery terms, before committing to the transaction. In contrast, a commercial document is a final, legally binding record of the sale, used to complete the transaction once the goods are shipped or the services are rendered.

- Legal Status: Preliminary documents hold no legal weight in terms of payment obligations or ownership transfer. They are essentially an agreement in principle. A commercial document, on the other hand, serves as a legal document that can be used for payment processing, tax purposes, and customs clearance.

- Customs Use: Preliminary documents are often used to help customs authorities understand the potential value and nature of the goods before they are shipped. Commercial documents, however, are used by customs to assess actual duties and taxes once the goods arrive at the destination.

- Finality: While preliminary documents are often subject to revision or change based on negotiations, commercial documents are final and reflect the agreed terms of the sale. Once signed and processed, they cannot be easily altered without the agreement of both parties.

When to Use Each Type of Document

Businesses typically use preliminary documents early in the transaction process to provide a clearer picture of the deal’s terms. These documents help buyers and sellers avoid misunderstandings and can be a prerequisite for financing or obtaining insurance. Commercial documents, however, are used to finalize the sale and complete the payment process once the goods or services have been provided.

By understanding the differences between these documents, businesses can ensure that they use the correct paperwork at the right time, facilitating smoother international transactions and reducing the risk of costly mistakes.

Formatting Tips for a Professional Document Layout

Creating a clean and professional layout for your transaction paperwork is essential to ensure clarity and trust in your business dealings. A well-structured document not only helps in presenting the information clearly but also creates a positive impression for both buyers and sellers. Proper formatting ensures that all necessary details are easily accessible and reduces the risk of errors or confusion.

Keep It Clear and Organized

Consistency is key when formatting such documents. Use a clear, legible font and maintain consistent font sizes throughout the document. Make sure the headings are bold and stand out to guide the reader through the sections. You can break the content into clearly defined sections, such as contact information, payment terms, product details, and delivery schedules.

Use bullet points or numbered lists to organize information such as item descriptions, payment options, and delivery details. This helps the reader quickly locate specific details without having to search through dense paragraphs of text.

Ensure Proper Alignment and Spacing

Proper alignment and spacing contribute significantly to the readability of the document. Align text to the left for consistency and use appropriate margins to avoid a cluttered appearance. Ensure there is enough space between sections, especially between headings and body text, to make the document visually appealing and easy to navigate.

Additionally, use tables where applicable to clearly display product details, quantities, prices, and totals. This allows for easy comparison and prevents confusion when processing the transaction.

By following these formatting guidelines, you can create a professional and effective layout that conveys important information in a clear, organized manner, making the entire transaction process smoother for all parties involved.

Customizing Your Document for Specific Shipments

When preparing documentation for specific transactions, it’s essential to tailor the layout and content to suit the unique requirements of each shipment. Customizing the document ensures that the correct details are provided, meeting the needs of both the buyer and seller, as well as complying with legal and regulatory standards. Different types of products or markets may require specific information, and addressing these needs can prevent delays and complications during the trade process.

To customize your document effectively, consider the following:

- Product-Specific Details: Ensure that all relevant product specifications, such as model numbers, weights, and dimensions, are clearly listed. If the items are subject to specific regulations, such as certifications or safety standards, include this information as well.

- Customs and Tariffs: Some regions may have unique tariff codes, taxes, or documentation requirements. Make sure that these are reflected in the document to avoid complications during the shipping and clearance process.

- Payment Terms and Currency: Depending on the buyer’s location and preferences, the payment terms might need to be adapted, such as the inclusion of payment deadlines or different payment methods. Additionally, include the relevant currency for the transaction.

- Delivery Requirements: Specify any delivery conditions or shipping methods that are required for the transaction. This could involve providing details about freight forwarders, delivery times, or packaging requirements specific to certain countries or goods.

By customizing the documentation to meet the specific needs of each shipment, you ensure a smooth and efficient process from start to finish. Clear communication and detailed customization help build trust and prevent misunderstandings between trading partners.

Documents for Different Shipping Methods

When preparing documentation for international trade, it’s important to consider how the chosen shipping method affects the content and structure of the paperwork. Different shipping options, such as air, sea, or land transport, may require specific details to ensure smooth processing and compliance with international trade regulations. Tailoring the document to match the shipping method can help avoid delays and facilitate a quicker transaction.

Air Freight

For air shipments, documentation often needs to be more detailed due to the fast-paced nature of air transport. Key details that should be included in the document for air shipping include:

- Flight details: Include flight numbers, departure and arrival times, and any required air waybill information.

- Insurance: Specify the insurance coverage if applicable, as air shipments can be more prone to risk due to weather or transit issues.

- Customs and clearance: Make sure that necessary customs documentation, such as permits or certificates, is included to avoid delays at both departure and arrival airports.

Sea Freight

Sea freight shipments typically involve larger quantities and longer transit times. For these shipments, the document should highlight:

- Container details: Include information about the type and size of containers being used, as well as the weight and volume of the shipment.

- Port information: Clearly indicate the ports of origin and destination, along with any transshipment points, to prevent confusion during the shipping process.

- Bill of Lading: Include any relevant Bill of Lading information, which serves as the primary document for sea freight and details the terms of the shipment.

By customizing the document for each shipping method, you ensure that all necessary information is present for smoother handling, quicker clearance, and more efficient trade processes. This also helps establish trust and professionalism with international buyers and customs authorities.

Best Practices for Document Accuracy

Maintaining accuracy in business documentation is critical for ensuring smooth international transactions and avoiding legal or financial complications. Accurate paperwork helps prevent misunderstandings, disputes, or delays during the shipping process. By following certain best practices, businesses can ensure that all necessary details are correctly included and aligned with legal requirements.

Key Accuracy Considerations

There are several essential factors to focus on when preparing any trade-related document:

- Double-Check Details: Always verify the recipient’s information, such as name, address, and contact details, to ensure everything is correct and up-to-date.

- Item Descriptions: Provide clear and concise descriptions of the goods, including model numbers, quantities, and individual prices. This ensures that there are no ambiguities during the shipping and customs clearance process.

- Payment Terms: Clearly define the payment method, deadlines, and any discounts or penalties that apply to the transaction. This reduces the chances of confusion after the trade is completed.

- Correct Currency: Ensure that the appropriate currency is used in the document, and confirm the exchange rate if necessary.

Tips for Improved Document Accuracy

Following a systematic approach will help ensure accuracy every time you create a document:

- Use a Standardized Format: Stick to a clear and consistent layout to minimize errors. This should include standardized fields for all required details and easy-to-read fonts.

- Review Before Submission: Always take the time to review the document before finalizing or sending it. Small errors can lead to significant issues down the road.

- Update Regularly: Ensure that your document format is regularly updated to meet changing legal or regulatory requirements.

By adhering to these best practices, you can ensure that your documents are accurate, professional, and in compliance with all necessary regulations, facilitating smooth international business transactions.

How to Handle Currency and Payment Terms

When conducting international transactions, specifying the correct currency and payment terms is crucial for clarity and to ensure that both parties are in agreement. Misunderstandings in this area can lead to delays, disputes, and complications in financial settlements. Therefore, it’s important to establish clear and mutually acceptable terms regarding the currency used for payment, as well as the deadlines and methods of payment.

Start by agreeing on the currency that will be used for the transaction. This is particularly important when dealing with clients or suppliers from different countries, as exchange rates can fluctuate and affect the overall cost of the transaction. It’s essential to specify whether the agreed amount is in a local currency or a global currency like US dollars or euros. If necessary, clarify the exchange rate to avoid confusion.

In addition to the currency, payment terms should also be carefully outlined. This includes specifying the payment due date, the accepted methods of payment, and any early payment discounts or penalties for late payment. Clearly outlining the terms will not only help avoid payment delays but also strengthen the relationship between the parties involved.

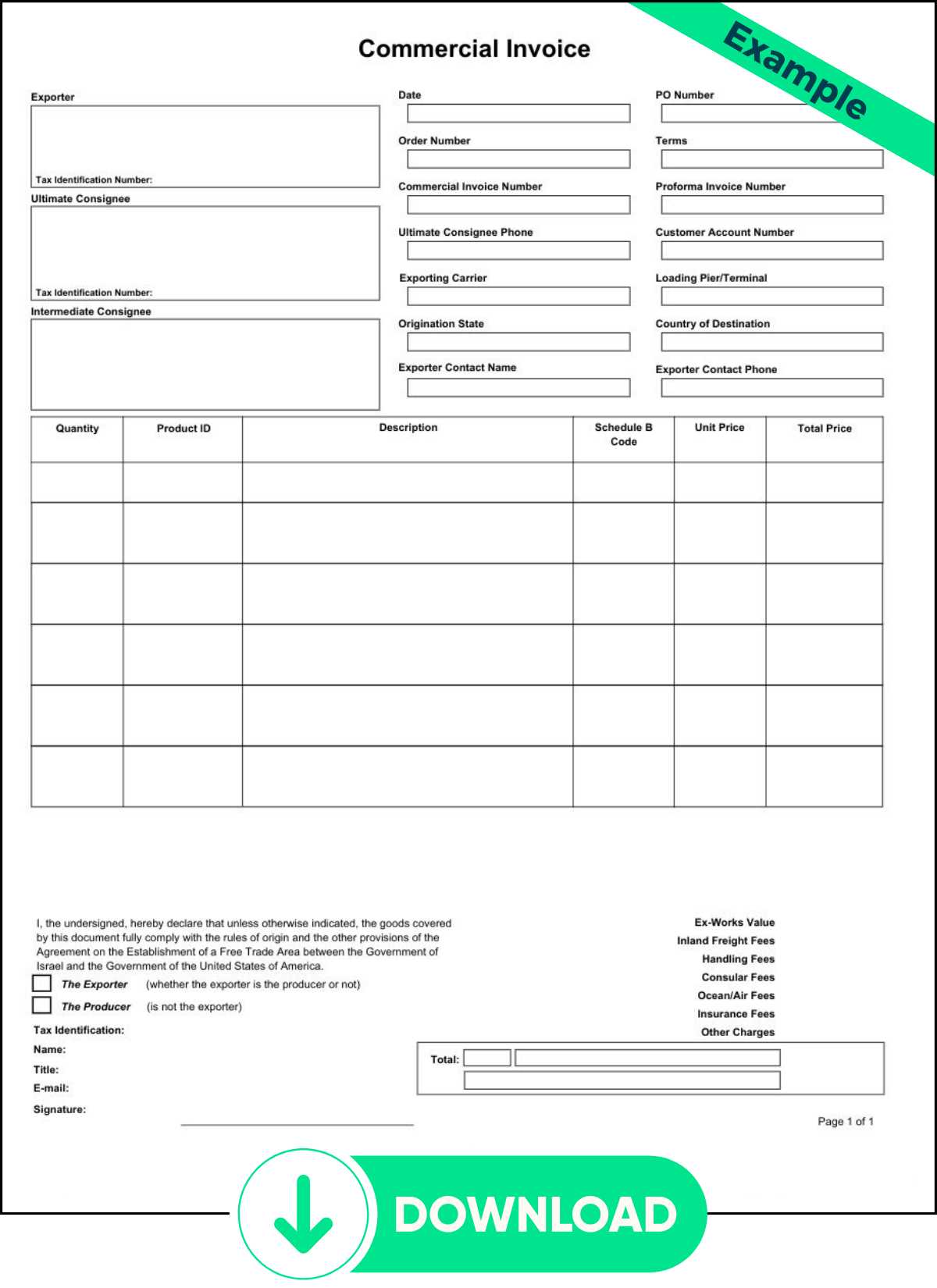

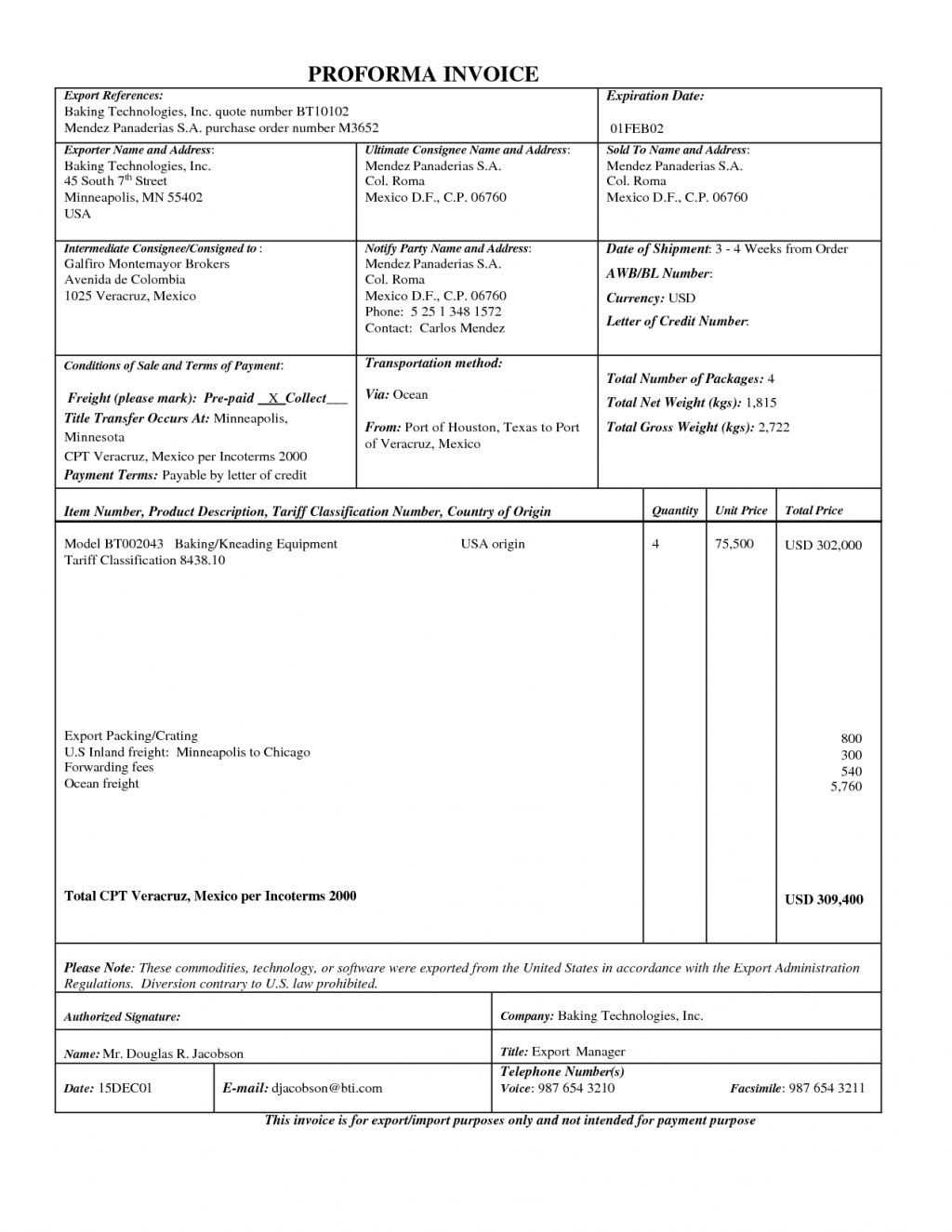

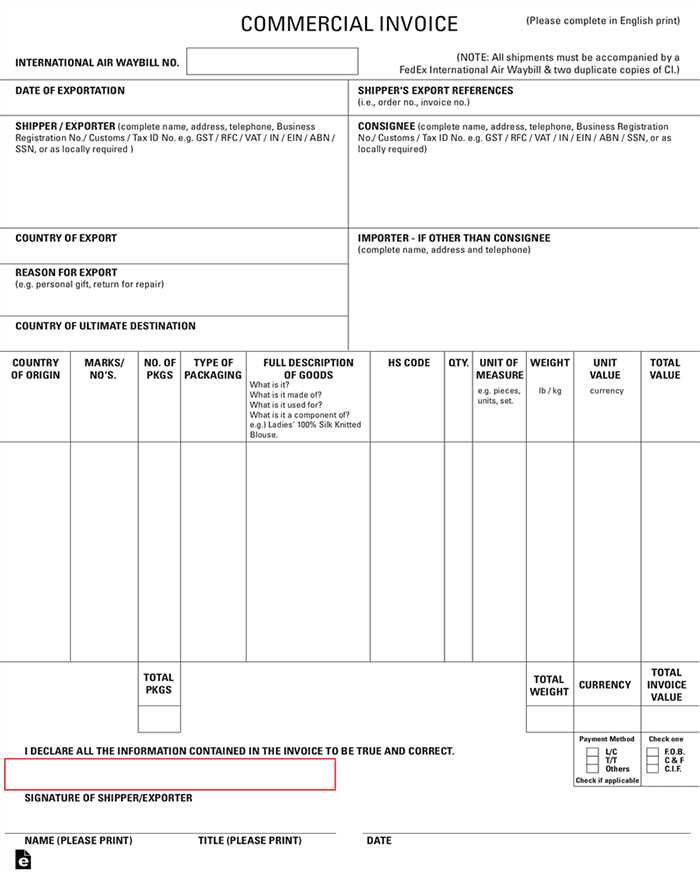

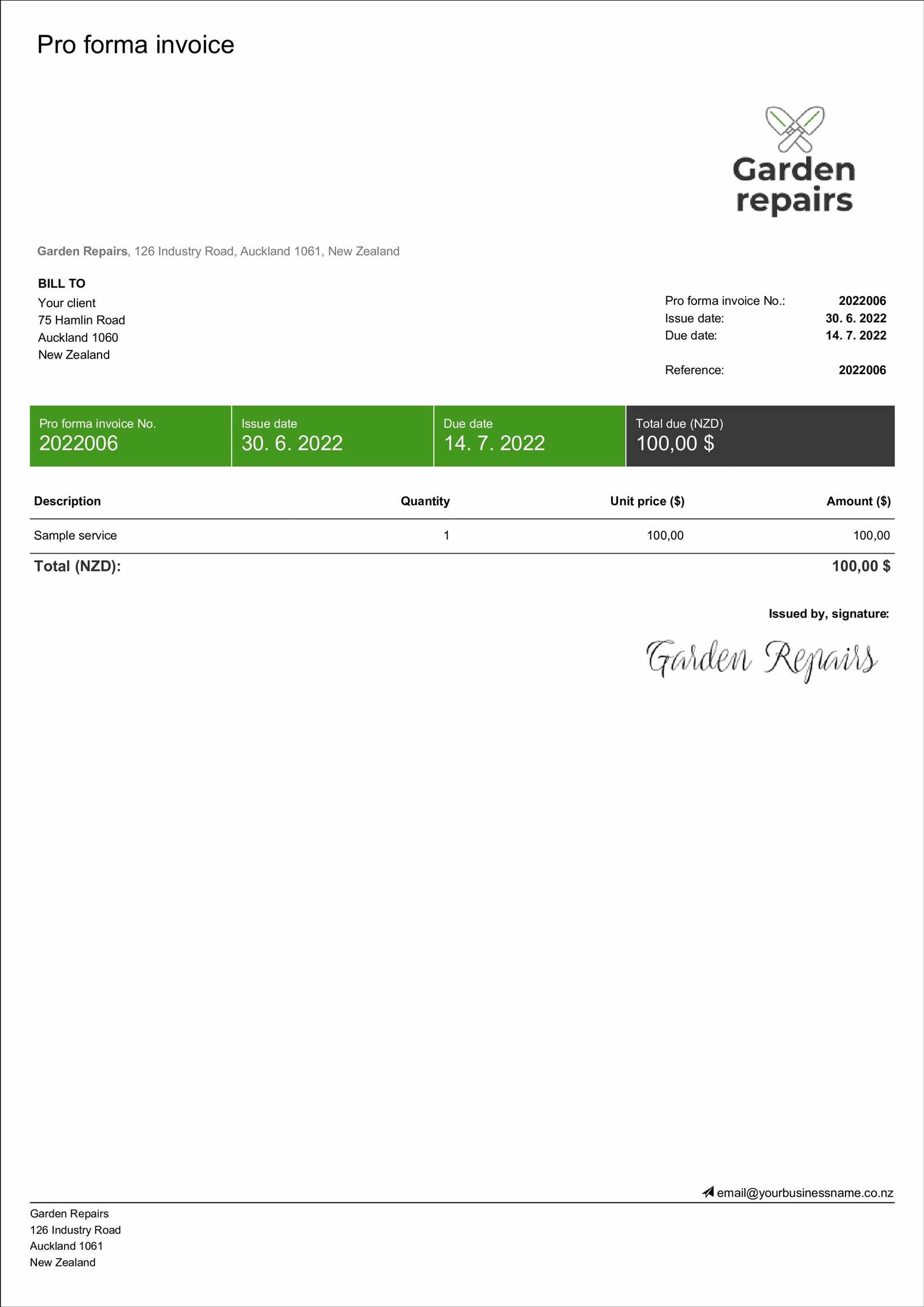

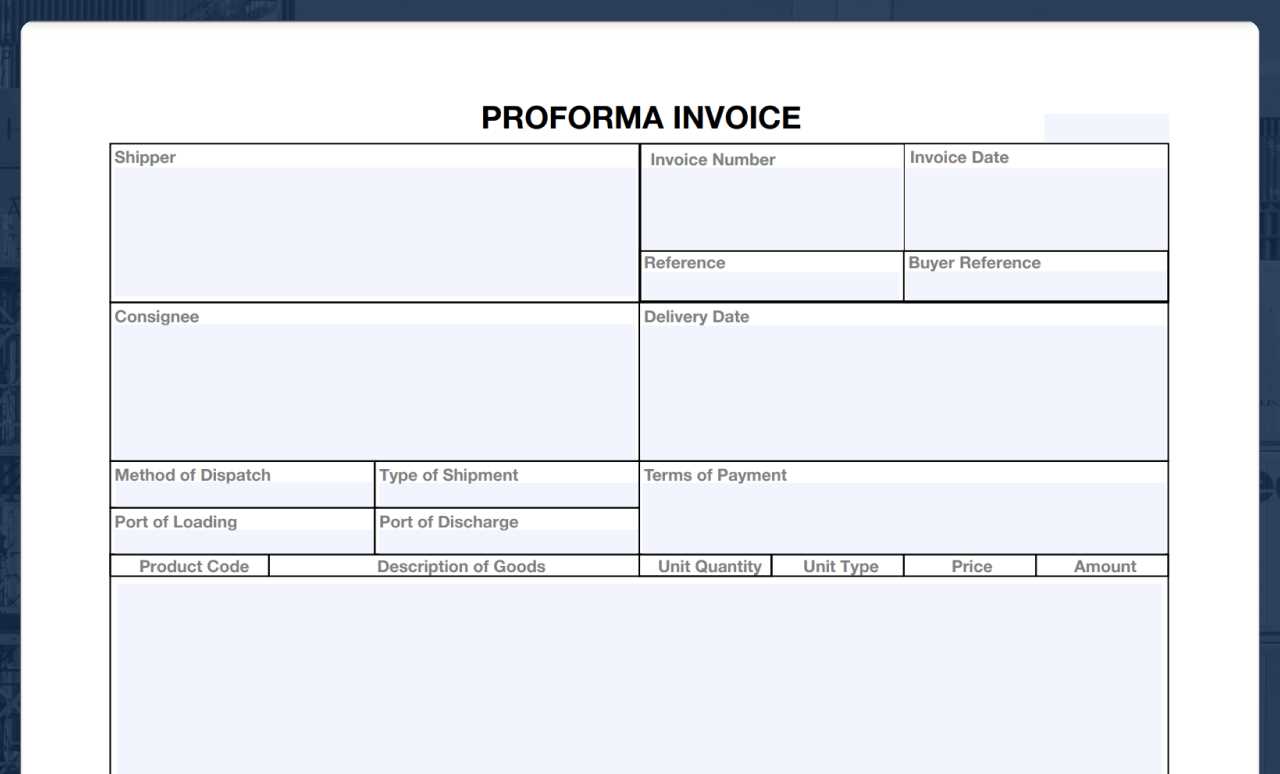

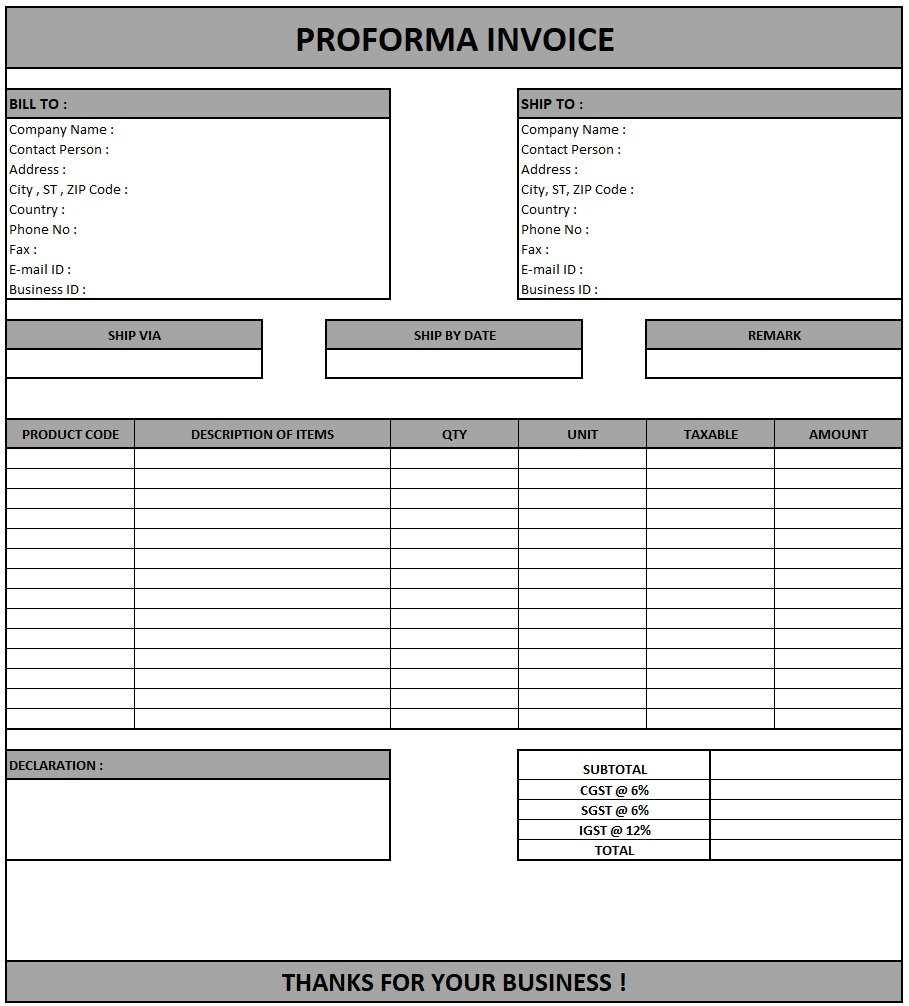

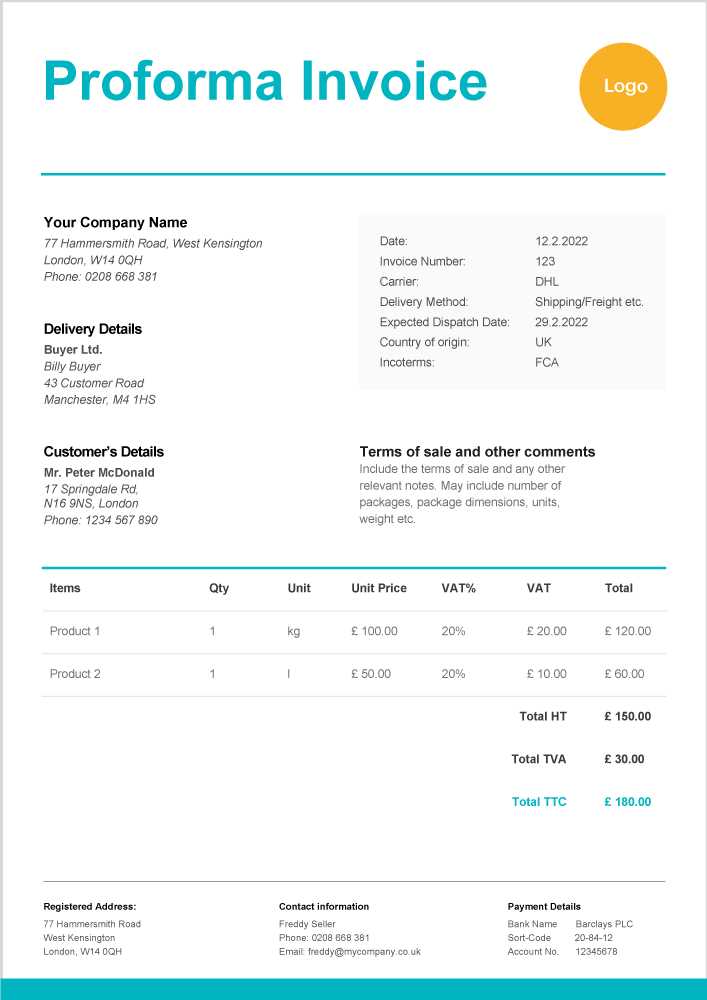

Examples of Commercial Document Formats

In international trade, it’s important to have a well-structured format for pre-sale documents. These documents not only outline the transaction details but also serve as a reference for customs clearance and financial processing. Below are some common examples of formats used in trade that can be adapted to suit different business needs.

Basic Commercial Document Format

This format is simple and effective for most trade scenarios. It includes all the necessary details without being overly complex:

- Document Title: Clearly labeled as a commercial document or sales agreement.

- Seller and Buyer Information: Name, address, and contact details of both parties involved.

- Product Details: List of items, descriptions, quantities, unit prices, and total cost.

- Shipping Details: Expected shipment date, transport method, and destination.

- Payment Terms: Clear information on the method of payment, due dates, and currency used.

Advanced Commercial Document Format

This format includes additional details that are often required for higher-value transactions or complex shipments:

- Additional Terms: Specific conditions regarding returns, warranties, and penalties.

- Currency and Exchange Rate: The agreed-upon currency for payment and the exchange rate if applicable.

- Customs and Regulatory Information: Any details required for customs processing, including classification codes and duty responsibilities.

- Insurance and Liability: Information on insurance coverage, if applicable, and the allocation of liability in case of loss or damage during transport.

These examples can be tailored based on specific needs, ensuring that each document serves its intended purpose effectively in different trade scenarios.

Benefits of Using Digital Commercial Documents

In the modern business world, digital formats for pre-sale documents offer numerous advantages over traditional paper-based ones. The shift towards electronic solutions not only enhances efficiency but also improves accuracy, security, and accessibility. Below are some key benefits of utilizing digital versions of these documents in international trade.

- Time-Saving: Digital formats can be created, edited, and shared instantly, cutting down on the time spent on manual paperwork and physical delivery.

- Reduced Errors: Automation tools help ensure the accuracy of details such as item quantities, pricing, and calculations, minimizing human errors that are common in paper-based processes.

- Easy Storage and Retrieval: Digital documents are easily stored in cloud-based systems, making it simple to access and retrieve past transactions for reference, audits, or dispute resolution.

- Enhanced Security: Digital files can be encrypted, password-protected, and backed up, providing a higher level of security compared to physical paperwork.

- Environmental Impact: By reducing paper usage, businesses contribute to sustainability and lower their carbon footprint, supporting eco-friendly practices in global commerce.

- Cost Efficiency: Going digital eliminates the need for printing, postage, and physical storage, leading to cost savings for businesses.

Overall, embracing digital versions of commercial documents helps streamline the transaction process, fosters better communication, and supports sustainable business practices in today’s global economy.

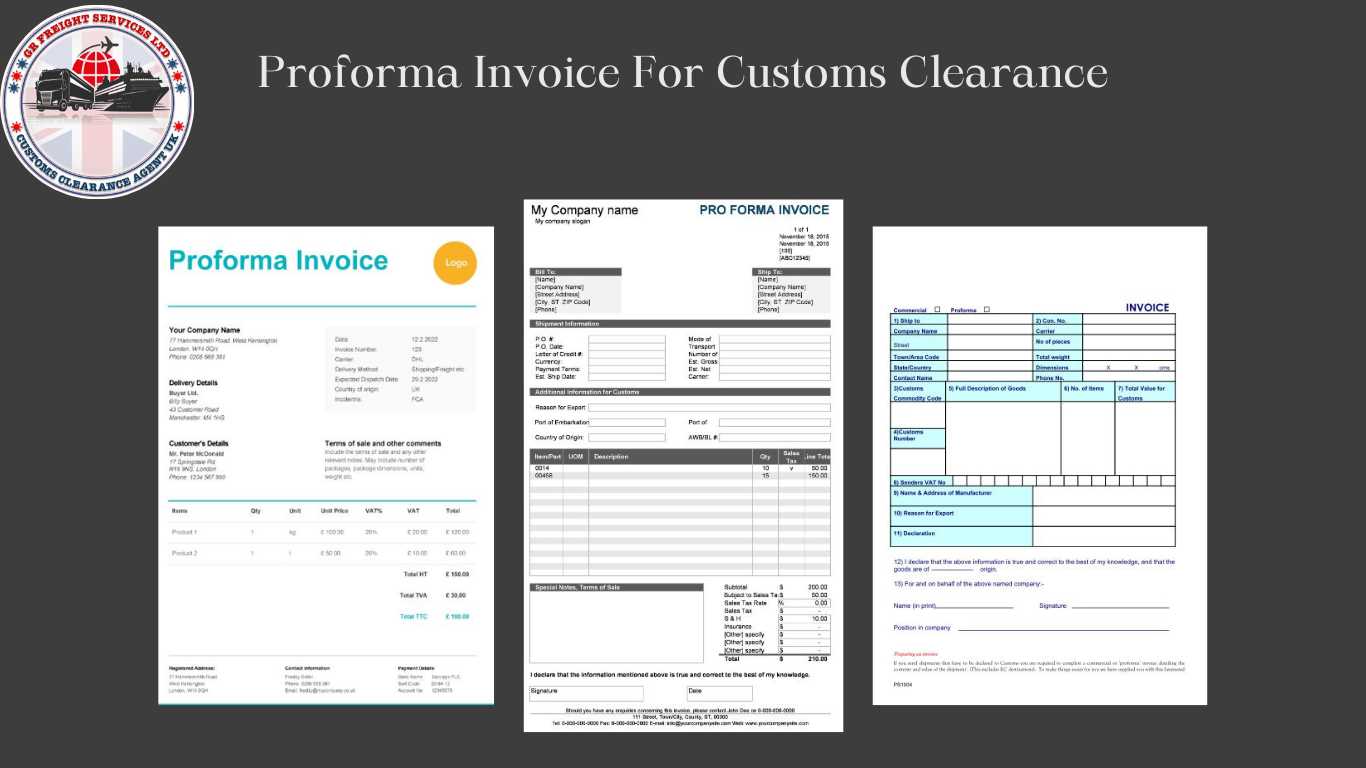

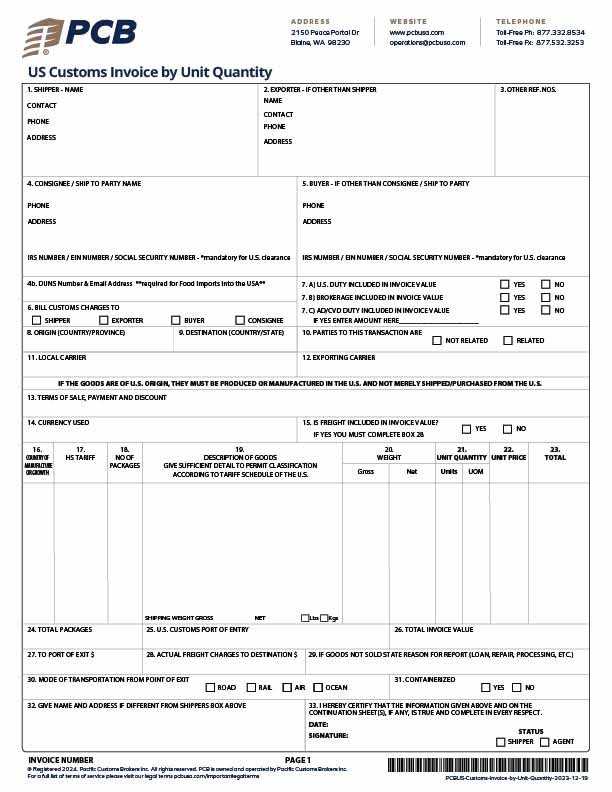

Commercial Document for Customs Clearance

When goods are being shipped internationally, customs authorities require certain documentation to ensure smooth clearance of the items across borders. A specific type of pre-shipment paperwork is commonly used to inform customs officials about the value, nature, and other key details of the goods. This document helps customs officials determine duties, taxes, and compliance with regulations. Below is a breakdown of the critical components that should be included in such a document to ensure successful customs clearance.

Essential Information for Customs Clearance

| Information Required | Details |

|---|---|

| Exporter Information | Name, address, and contact details of the seller or manufacturer. |

| Importer Information | Name, address, and contact details of the buyer or consignee. |

| Description of Goods | Clear and accurate description of each item, including quantity, weight, and dimensions. |

| Value of Goods | Market value of the goods being shipped, to assist in calculating customs duties. |

| Harmonized Code | HS code (Harmonized System) for the goods, which classifies the item for tariff and regulatory purposes. |

| Shipping Terms | Terms that define the responsibilities of the buyer and seller during shipping (e.g., Incoterms). |

Why It Is Important

Providing accurate and detailed information on the document ensures that customs clearance is efficient and compliant with regulations. Any inaccuracies or missing details can result in delays, additional charges, or even the rejection of the shipment by customs authorities. Proper documentation facilitates a smooth process, allowing businesses to maintain a timely and cost-effective supply chain for international shipments.