W9 Invoice Template for Easy Tax and Payment Management

When working as a freelancer or independent contractor, ensuring proper documentation for tax purposes is essential. One key document often required in these situations is a tax form that verifies your taxpayer information and allows clients to report payments made to you. This form helps both parties stay compliant with tax regulations and avoid issues during the filing process.

Whether you’re a business owner, a contractor, or a self-employed professional, having an efficient system for handling such documents is crucial. By using a well-structured form, you can ensure that all necessary details are captured, reducing the risk of errors or missing information. A proper record can also simplify the process of submitting your taxes, making the overall experience smoother and more organized.

In this guide, we will explore how to properly use this important form, offering practical advice on completing it and understanding its components. Knowing how to navigate this document will not only help you stay compliant but also save time during tax season.

What is a W9 Invoice Template

A W9 form is an essential document used by freelancers, independent contractors, and businesses to report earnings to the IRS. It is typically required when a company hires someone to perform work and needs to collect taxpayer details for accurate reporting of payments. In the context of financial transactions, this form serves as a means of providing crucial information like your name, address, and taxpayer identification number (TIN), which helps both you and the payer stay compliant with tax laws.

Key Features of a W9 Form

- Taxpayer Identification Number (TIN): This is your unique number for tax purposes, which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Legal Name and Business Name: You must include your legal name as well as any business name if you operate under one.

- Certification of Tax Status: The form requires a certification that the information you provide is accurate and that you are not subject to backup withholding.

How It Works in Practice

When working as an independent contractor or receiving income from a company, you may be asked to complete this form. Once you fill it out and submit it to the payer, they use the information to report the payments to the IRS at the end of the year. This helps both parties avoid penalties and ensures that all earnings are appropriately documented. The payer may also use this information to issue a 1099 form, which summarizes the total amount paid to you over the course of the year.

Essentially, this document ensures that accurate records are kept for tax reporting purposes, streamlining the entire process for both businesses and contractors alike. It is a critical step in maintaining proper financial documentation and ensuring tax compliance.

Why Use a W9 Invoice Template

When managing financial transactions as an independent contractor or freelancer, it’s crucial to maintain organized and accurate records for tax reporting. Using a structured form that collects necessary information in a consistent manner can help streamline the entire process. This approach simplifies communication between contractors and clients and ensures that all required data is captured to avoid mistakes or delays in filing taxes.

One of the main reasons for using this form is to ensure that all necessary details, such as taxpayer identification numbers and addresses, are correctly documented and easily accessible for both parties. Without a reliable method for gathering and organizing this information, there’s a risk of missing key details that could complicate tax filings and cause unnecessary issues with the IRS.

Benefits of Using a Structured W9 Form

| Benefit | Description |

|---|---|

| Accuracy | Prevents errors in recording essential tax information, reducing the chance of mistakes during the filing process. |

| Efficiency | Provides a clear and standardized format for quickly capturing required details, saving time for both contractors and clients. |

| Compliance | Ensures that all relevant data is collected to meet IRS requirements, helping both parties stay compliant with tax laws. |

| Consistency | Using a uniform method for collecting taxpayer information ensures that all future transactions follow the same clear structure. |

By adopting a well-organized method for handling these records, you not only make your tax preparation easier but also build trust with clients by showing professionalism and attention to detail. Whether you’re just starting out or have been working for years, using a structured form helps keep your financial paperwork in order and compliant with the law.

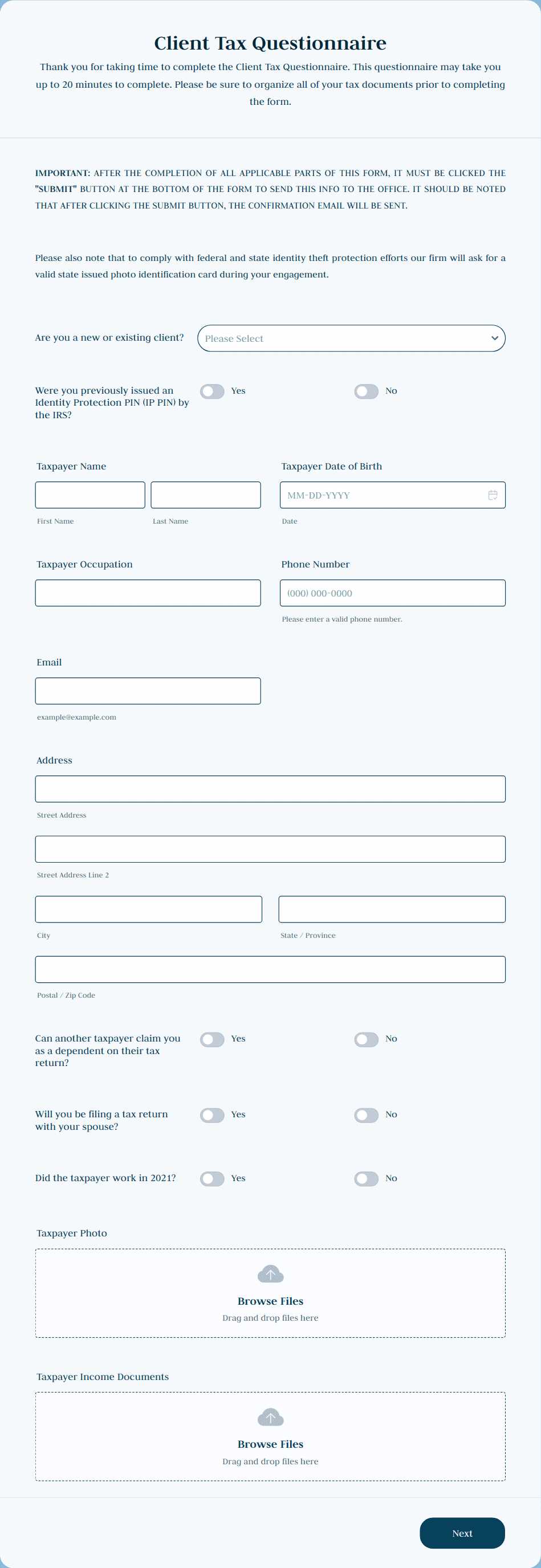

How to Fill Out a W9 Invoice

Completing a W9 form is a straightforward process, but it’s important to ensure that every section is filled out accurately. This document collects necessary taxpayer information, which businesses and clients use for tax reporting purposes. By following the proper steps, you can ensure that your details are correctly captured, reducing the risk of delays or complications when the time comes to file taxes.

The process of filling out this form involves providing your personal or business information, including your name, address, and taxpayer identification number. It’s important to double-check your entries to ensure everything is correct before submitting it to the requesting party. Below is a guide to help you understand each section and how to complete it properly.

Step-by-Step Guide to Completing the Form

- Section 1: Name – Enter your legal name or business name (if applicable). If you’re submitting the form as an individual, use your full name. If you’re working under a business name, include that as well.

- Section 2: Business Name – If you operate under a different business name, list it here. If not, leave this section blank.

- Section 3: Tax Classification – Choose the appropriate tax classification based on your status. For example, you may select “Individual/Sole Proprietor” or “Corporation.”

- Section 4: Address – Provide your current mailing address, including street address, city, state, and ZIP code. This is where tax documents will be sent.

- Section 5: Taxpayer Identification Number (TIN) – Enter your TIN, which can be your Social Security Number (SSN) or Employer Identification Number (EIN). Ensure the number is entered correctly to avoid issues with tax reporting.

- Section 6: Certification – Read the certification statement carefully. By signing, you verify that the information you provided is accurate. If applicable, you may need to mark whether you are subject to backup withholding.

Once you have completed each section, review your entries to ensure everything is correct. After that, sign and date the form. You can then send it to the requesting party, who will use this information for their tax reporting. Remember, keeping a copy for your records is always a good practice.

Benefits of Using a W9 Template

Using a well-organized document to collect and record essential taxpayer information provides several advantages, particularly when managing financial transactions with clients or businesses. This approach simplifies the process of capturing important details, reduces the chances of errors, and ensures that all necessary information is available when required. By relying on a structured format, both contractors and businesses can maintain accurate and compliant records for tax reporting purposes.

Improved Accuracy and Efficiency

One of the main benefits of using a structured form is the increased accuracy it offers. By following a predefined format, you ensure that all critical data, such as your taxpayer identification number (TIN) and business address, is captured correctly. This reduces the risk of errors that could lead to tax reporting issues. Additionally, having all the information in one place allows for faster processing, saving time for both you and your clients.

Enhanced Compliance and Record-Keeping

Another key advantage is the boost to compliance. By providing the requested information in a consistent format, you make it easier for clients to accurately report payments made to you. This not only helps with IRS compliance but also reduces the likelihood of penalties due to missed or incorrect information. Moreover, keeping these forms organized ensures that you have all necessary documentation for future reference, especially when filing taxes or dealing with audits.

In summary, using a structured format to handle your taxpayer details streamlines the entire process, offering significant time savings and reducing the risk of errors or omissions. It simplifies financial record-keeping, ensuring that both contractors and businesses can meet their tax obligations with ease.

Key Information on a W9 Invoice

When completing a W9 form, it’s essential to provide several key pieces of information to ensure accuracy and compliance with tax regulations. This document serves as a means of identifying and verifying the taxpayer details of an individual or business, making it a critical component for tax reporting. The required information must be precise to avoid any issues with the IRS or clients who rely on the form for their financial records.

Essential Details to Include

| Information Required | Description |

|---|---|

| Legal Name | Your full legal name as it appears on your tax returns. If you are submitting the form for a business, include the business name here. |

| Business Name | If you operate under a different business name (DBA), list it in this section. Otherwise, leave it blank. |

| Taxpayer Identification Number (TIN) | Enter your Social Security Number (SSN) if you’re an individual or your Employer Identification Number (EIN) if you operate as a business. |

| Address | Provide your current address, including street address, city, state, and ZIP code. This is where any tax-related documents will be sent. |

| Tax Classification | Select the appropriate classification for your tax status, such as “Individual/Sole Proprietor,” “Corporation,” or “Partnership.” |

| Certification | Sign and date the form to certify that the information you provided is correct and that you are not subject to backup withholding (if applicable). |

Why Each Piece of Information Matters

Each section of the form plays a crucial role in identifying you as a taxpayer and ensuring that your payments are accurately reported. The taxpayer identification number (TIN) is particularly important for matching your income to your tax records. The certification section ensures that the form is legally binding and that the information is true and complete, which is necessary for avoiding potential penalties or issues with tax authorities.

By providing this essential information clearly and correctly, you help your clients stay compliant with tax laws, and you protect yourself from potential complications when filing your own taxes.

Common Mistakes in W9 Invoices

When filling out a W9 form, accuracy is crucial. Even small errors can lead to delays or complications in tax reporting, both for contractors and businesses. There are several common mistakes that individuals often make, which can cause confusion or lead to compliance issues. By understanding these errors, you can ensure that your form is completed correctly and avoid potential setbacks.

Frequent Errors in Completing a W9

- Incorrect Taxpayer Identification Number (TIN): One of the most common mistakes is entering the wrong TIN. This could be a mix-up between your Social Security Number (SSN) and Employer Identification Number (EIN). Make sure to double-check this number to avoid mismatches with IRS records.

- Missing or Incorrect Name: Another issue arises when the name on the form doesn’t match the one associated with your TIN. This can lead to delays or confusion in reporting. Be sure your legal name or business name is spelled correctly and matches official records.

- Failure to Sign or Date the Form: The form will not be valid without your signature and the correct date. Some individuals overlook this step, but without it, the form cannot be processed.

- Choosing the Wrong Tax Classification: Selecting the wrong tax status, such as incorrectly indicating you are a corporation when you are a sole proprietor, can result in the form being rejected or misfiled. Make sure to choose the tax classification that applies to your situation.

- Missing Address Information: Omitting your mailing address or entering it incorrectly can prevent important tax documents from reaching you. Double-check your address to ensure it is complete and accurate.

- Not Updating Information: If there have been any changes in your personal or business details, such as a new address or a change in your tax classification, be sure to update the form accordingly. Using outdated information can cause unnecessary complications during tax season.

How to Avoid These Mistakes

The best way to avoid these common errors is to carefully review the form before submitting it. Take your time to ensure all details are accurate and complete. If you’re unsure about any section, seek advice or consult the IRS website for guidance. By being diligent, you can ensure the form is processed smoothly and without issues.

Free W9 Invoice Templates Online

Finding the right document for collecting tax information doesn’t have to be difficult or expensive. There are numerous free resources available online where you can download or customize forms that suit your needs. These free options are ideal for contractors, freelancers, and small business owners who need to gather taxpayer details in a structured format without spending money on specialized software or services.

Many websites offer ready-made forms that can be easily accessed, downloaded, and filled out on your computer or printed. By using these free resources, you can ensure your documents meet IRS requirements without the hassle of manually creating the form from scratch.

Where to Find Free Resources

- Government Websites: The IRS provides a downloadable version of the W9 form on their official site, ensuring that you have access to the latest and most accurate version of the document.

- Online Accounting Platforms: Many accounting software providers, such as QuickBooks or FreshBooks, offer free access to basic forms, including the W9, for registered users. These platforms also help with tracking payments and taxes.

- Freelance and Contractor Websites: Websites like Upwork or Fiverr often provide free resources, including forms and guides, to help independent professionals manage their finances and tax responsibilities.

- PDF Resources: Some online platforms allow you to download and edit a W9 form directly in PDF format. These tools enable you to fill out the form digitally and print it when needed.

Benefits of Using Free Online Forms

- Convenience: You can access and fill out the form at any time, from anywhere, making it easier to manage your tax-related documents.

- Cost-Effective: Free resources eliminate the need for paid software or professional services, saving you money.

- Accuracy: Downloading forms from reputable websites ensures that the document is up to date and compliant with IRS standards.

- Customizability: Some free online platforms allow you to customize the form to include your branding or personal information.

By utilizing these free resources, you can streamline your record-keeping and tax reporting process while saving time and money. Whether you need a simple downloadable form or more advanced options for managing your finances, the internet offers a variety of tools to suit your needs.

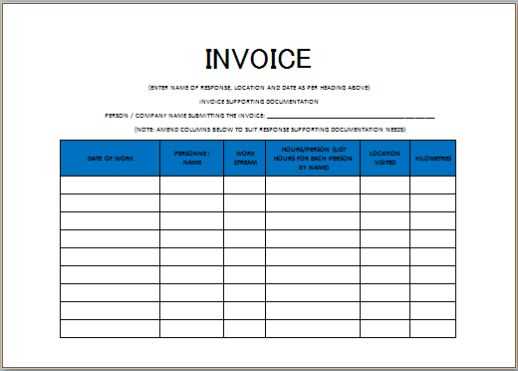

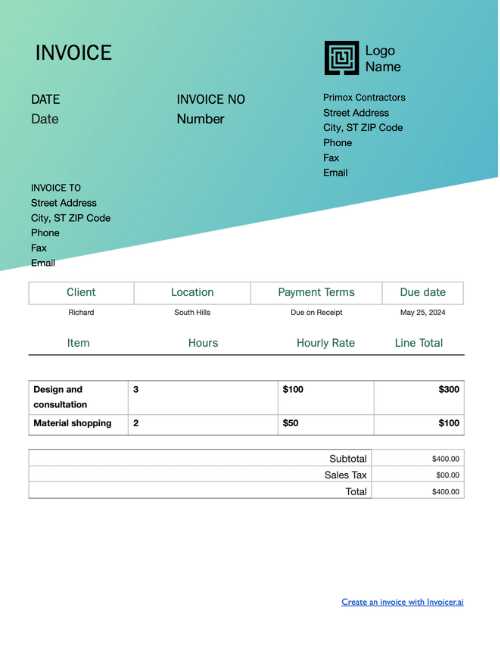

W9 Template vs Standard Invoice

While both documents play an important role in business transactions, they serve very different purposes. One is primarily focused on providing tax-related information, while the other is used for detailing the services or goods provided, along with the payment terms. Understanding the key differences between these two forms is essential for both freelancers and businesses to ensure proper documentation and smooth financial processes.

Key Differences Between the Two Documents

- Purpose: The primary purpose of a W9 form is to collect taxpayer information, such as the individual’s or business’s legal name, taxpayer identification number (TIN), and classification. It is used by clients to report payments made to contractors or freelancers for tax purposes. In contrast, a standard form is used to outline the details of a business transaction, including the products or services provided, payment amount, and due dates.

- Content: A W9 form contains specific fields related to tax identification, such as your name, address, TIN, and certification. It focuses on verifying your tax status for reporting purposes. On the other hand, a regular document usually includes the transaction’s description, quantity, price, payment method, and terms of service.

- Usage: The W9 form is used when a business or client needs to collect tax details from a contractor, typically for reporting purposes at the end of the year (e.g., issuing a 1099 form). A standard form is used in the course of regular business operations to request payment for goods or services rendered, usually within a set time frame.

When Each Document is Used

- W9 Form: This document is typically requested when a contractor begins working with a new client, especially if the payments will exceed $600 in a year. It helps ensure that both parties are compliant with tax regulations and enables the business to properly report payments to the IRS.

- Standard Form: A standard form is issued after a product or service is delivered, detailing the amount due and payment conditions. It serves as a formal request for payment and is commonly used in business-to-business or business-to-consumer transactions.

While both forms are essential for managing financial records and ensuring compliance, they serve distinct functions and should be used accordingly. Knowing when to use each can help avoid confusion and ensure smooth transactions in any business relationship.

When to Submit a W9 Invoice

Submitting a W9 form is an important step in ensuring that tax records are accurate and up-to-date. It is typically required when you start working with a new client or when there are changes in your personal or business information that affect your tax status. Understanding when to submit this document is essential for maintaining compliance and avoiding delays in payment or tax reporting.

When Is It Necessary to Submit a W9 Form?

| Situation | Reason for Submission |

|---|---|

| Starting a New Job or Contract | When you begin working with a new client or company, they will typically request a W9 form to collect your taxpayer information. This is necessary for accurate reporting of payments made to you. |

| Annual Tax Reporting | If you’ve been working with a client who needs to report your earnings for the year (for example, issuing a 1099 form), they may ask for an updated W9 form before issuing tax forms at the end of the year. |

| Change in Tax Status or Business Information | If your tax status or business details change, such as a change in your legal name, business name, or taxpayer identification number (TIN), it’s important to submit a new W9 to ensure your records are correct. |

| Request from a Client or Business | Occasionally, businesses or clients may request an updated form if they don’t have one on file or if there is a gap in their records. Always provide this form promptly to ensure smooth transactions. |

Knowing when to submit this form helps streamline the payment and reporting process, ensuring that both you and your clients are in compliance with tax laws. It is always better to submit the form early to avoid any delays in payment or potential issues with the IRS later on.

How W9 Templates Help with Taxes

Using a structured form to provide taxpayer information plays a critical role in ensuring that tax records are accurate and compliant with IRS regulations. This form simplifies the process of reporting income, tracking payments, and verifying taxpayer details for both individuals and businesses. By organizing essential information in a consistent format, this document helps prevent errors that could lead to issues with tax filings or audits.

Ensuring Accurate Tax Reporting

One of the main benefits of using a well-organized document is that it ensures all necessary information is clearly provided. For businesses, collecting accurate taxpayer details from contractors or freelancers is essential for correctly reporting payments to the IRS. By submitting the form, you enable your clients to file the required tax forms, such as the 1099, without delay or confusion.

Simplifying Year-End Tax Filing

At the end of the year, businesses use the details collected in this document to report income paid to contractors. By submitting a W9 form at the beginning of a contract, you ensure that your income is correctly accounted for, making year-end tax filing smoother for both you and the client. Without the accurate taxpayer information provided by this form, businesses may face difficulties when issuing necessary tax documents, potentially leading to mistakes or delays in payment.

Reducing Risk of IRS Penalties

By submitting a completed and accurate form, both businesses and independent contractors avoid unnecessary complications with the IRS. Incorrect or missing information can lead to penalties or delays in tax processing. The form helps ensure that both parties remain in compliance with tax laws, reducing the chances of fines or other penalties.

In summary, using a structured format for providing taxpayer information makes the tax reporting process more efficient and reliable. Whether you’re a contractor, freelancer, or business owner, this form is an essential tool for ensuring smooth financial operations and compliance with IRS guidelines.

W9 Template for Independent Contractors

For independent contractors, providing accurate taxpayer information to clients is essential for smooth business operations and compliance with tax regulations. A well-structured form allows contractors to easily share necessary details, such as their legal name, taxpayer identification number, and business classification, ensuring that payments are properly recorded and reported. This document is particularly important for contractors working with multiple clients, as it helps maintain accurate records and simplifies year-end tax reporting.

When a client hires an independent contractor, they typically request this document to gather key information required for reporting payments to the IRS. This ensures that both the contractor and the client comply with tax laws, minimizing the risk of errors or penalties down the line. For the contractor, submitting this form ensures that income is correctly reported, which is crucial for filing taxes and avoiding complications with the IRS.

By submitting a completed form at the start of a contract, independent contractors can prevent delays in receiving payments or tax documents. The form serves as a way to authenticate the contractor’s taxpayer status, making it easier for clients to meet their end-of-year reporting obligations, such as issuing a 1099 form. The use of this document streamlines financial and tax processes for both parties, saving time and ensuring accuracy.

Creating Custom W9 Invoice Templates

Customizing a document for collecting taxpayer information can be a great way to streamline your workflow and ensure all necessary details are captured accurately. By creating a personalized version, businesses and independent contractors can adjust the layout and content to suit their specific needs, making the process of gathering and submitting required details easier. A customized version not only ensures that all essential information is included but also helps maintain a professional appearance when sharing the form with clients or partners.

Why Customize Your W9 Form?

Creating a personalized version of this form can provide several benefits, including:

- Branding: Businesses can add their logo and other brand elements to the form to make it more consistent with their other professional materials.

- Improved Organization: By adjusting the layout, you can highlight key sections, making it easier for clients or contractors to fill out the form accurately and efficiently.

- Flexibility: Customization allows you to add any extra fields you may need for your specific requirements, such as additional contact information or a reference number.

How to Create a Custom Form

There are several ways to create a custom version of this form. You can use online form builders that allow for easy drag-and-drop customization, or you can design one yourself using spreadsheet software like Excel or Google Sheets. The key is to ensure that all necessary fields are present, such as:

- Legal name and business name (if applicable)

- Taxpayer Identification Number (TIN)

- Tax classification

- Certification and signature section

- Current address

Once the layout is customized, be sure to double-check that the form remains compliant with IRS guidelines, ensuring that it meets all requirements for reporting and submission.

W9 Form Requirements for Invoices

When conducting business transactions, especially between independent contractors and clients, ensuring accurate tax documentation is essential. The W9 form plays a vital role in this process, as it provides the necessary taxpayer information that businesses need to report payments to the IRS. While this form is not typically part of the payment request itself, it is a crucial step in preparing for tax reporting and ensuring compliance with IRS regulations.

When Is a W9 Form Needed?

Although the W9 form is not directly linked to requesting payments, it is required in certain situations to ensure that businesses can properly report earnings. Below are key instances when this form is typically necessary:

- For Payments Over $600: If a business or client pays an independent contractor $600 or more in a year, they are required to request a W9 form to collect the contractor’s taxpayer information.

- At the Start of a New Contract: When beginning work with a new client, it is common for businesses to request this form to ensure they have the correct tax details on file before making any payments.

- For Year-End Tax Reporting: Businesses need to submit a W9 form before issuing year-end tax forms such as the 1099, which reports payments made to contractors.

Key Requirements for the W9 Form

The W9 form must include accurate and complete information to be valid for tax reporting purposes. The following details are typically required:

- Legal Name: The contractor’s full legal name or business name (if applicable) must be clearly stated.

- Taxpayer Identification Number (TIN): Either the contractor’s Social Security Number (SSN) or Employer Identification Number (EIN) is needed for tax reporting.

- Tax Classification: The contractor must specify their tax status, such as individual, corporation, or partnership.

- Address Information: A current address where the contractor can receive tax-related documents should be provided.

- Signature and Date: The form must be signed and dated by the contractor to verify the accuracy of the information provided.

By submitting a completed W9 form, contractors ensure that their client can properly report payments made during the year, helping to avoid potential delays in tax filings or issues with the IRS. It is essential for both parties to ensure that this document is accurate, up to date, and submitted on time to prevent complications in the payment and reporting process.

Digital W9 Templates for Quick Filing

In today’s fast-paced digital world, using electronic forms for collecting and submitting taxpayer information has become the preferred method for many businesses and contractors. Digital forms offer convenience, speed, and accuracy, making the process of filling out and submitting necessary documents easier than ever. Whether you are an independent contractor or a business owner, using an online version of the form ensures that tax-related paperwork is completed and filed in a timely manner, helping you stay compliant with IRS requirements.

Benefits of Using Digital Forms

- Speed and Efficiency: Digital forms can be filled out and submitted much faster than paper forms. You can complete the document in minutes, saving time and reducing the chances of errors.

- Easy Access: Electronic forms can be accessed and completed from any device, whether it’s a computer, tablet, or smartphone, allowing flexibility in when and where you fill them out.

- Instant Submission: Many digital solutions allow for immediate submission, meaning the document can be sent directly to the client or business requesting it, without the need for printing or mailing.

- Automatic Validation: Some digital forms come with built-in validation checks to ensure that all required fields are completed accurately before submission, reducing the risk of mistakes.

Where to Find Digital Forms

- Online Form Builders: Many websites offer digital versions of this form that can be filled out and saved directly to your computer or cloud storage. These platforms often offer customizable options, making it easy to personalize the form for your needs.

- Tax Software: Several tax software programs include a digital version of this document as part of their suite of tools, helping contractors and businesses track payments and prepare for tax season.

- Official IRS Website: The IRS offers a downloadable version of this form that can be filled out and submitted digitally using e-filing options, ensuring compliance with official IRS requirements.

Using a digital form not only streamlines the process but also ensures that your information is delivered securely and promptly. Whether you need to submit it to a client, save it for tax reporting, or use it to maintain accurate records, digital solutions provide a simple and effective way to handle your tax documentation needs.

W9 Invoice Template for Freelancers

For freelancers, having a structured way to provide tax information to clients is crucial for smooth financial operations. A well-organized form designed for collecting and submitting the necessary details can help ensure that both parties comply with tax regulations. Freelancers often work with multiple clients, and having a consistent method for sharing taxpayer information can streamline processes, improve accuracy, and reduce delays in receiving payments or tax documents.

Why Freelancers Need a Structured Form

Freelancers are typically required to submit tax information to clients when they begin a working relationship or when payments exceed a certain threshold, often $600 or more. The proper documentation ensures that the client can accurately report payments made to the freelancer at the end of the year, often through forms like the 1099. Below are some key reasons why a well-organized form is essential for freelancers:

- Tax Compliance: Having a complete and accurate form ensures that the freelancer’s tax details are properly reported to the IRS, avoiding issues during tax season.

- Faster Payment Processing: A correctly completed form helps clients process payments and tax documents without delays or errors.

- Clear Communication: By submitting a standardized form, freelancers make it easy for clients to collect the necessary information, fostering professional and clear communication.

Key Information for Freelancers to Include

When filling out a form for reporting purposes, freelancers should ensure that the following details are accurately provided:

- Full Legal Name: The freelancer’s name or business name (if applicable) must be provided clearly.

- Taxpayer Identification Number (TIN): Either the freelancer’s Social Security Number (SSN) or Employer Identification Number (EIN) should be listed to ensure correct tax reporting.

- Tax Classification: The freelancer should specify whether they are an individual, sole proprietor, or another business classification.

- Address: A current address for the freelancer to receive tax-related documents should be included.

- Signature: The form must be signed and dated to certify the accuracy of the information provided.

Using a properly filled-out form helps ensure that both freelancers and clients are on the same page and that tax reporting is completed without issues. By staying organized and submitting the correct paperwork, freelancers can avoid delays, penalties, and other complications related to tax filings.

How to Store Completed W9 Invoices

Once a taxpayer information form is completed, it is important to store it properly for future reference and compliance purposes. The information provided in these forms is critical for accurate tax reporting and must be preserved securely. Both businesses and freelancers should have a clear strategy for organizing and storing these documents to ensure they are easily accessible during tax season or if an audit occurs. Whether stored physically or digitally, maintaining these forms with care is essential to avoid issues down the line.

Best Practices for Storing Physical Forms

If you prefer to keep physical copies of the forms, it is crucial to create a safe and organized filing system. Here are a few tips:

- Use a Secure Filing Cabinet: Store completed forms in a locked, fireproof filing cabinet to protect them from damage, theft, or unauthorized access.

- Label and Categorize: Clearly label folders or files with the name of the client, the date the form was received, and the tax year to make retrieval easier when needed.

- Keep Copies: Always make photocopies of the completed forms before filing them away in case of damage or loss.

Best Practices for Storing Digital Forms

For those who prefer digital storage, keeping electronic copies is an efficient and secure way to store taxpayer information forms. To ensure proper organization and protection, follow these steps:

- Use Cloud Storage: Store your forms in a secure cloud storage service that offers encryption and backup options, ensuring the documents are accessible but protected from loss or unauthorized access.

- Organize Files by Client and Year: Create separate folders for each client and organize them by year. This way, you can quickly find the correct document when needed for tax filings or audits.

- Implement a Backup System: Keep an additional copy of all forms in a separate location, such as an external hard drive, to safeguard against data loss.

By adopting either a physical or digital filing system–and ensuring that the completed forms are easily accessible and securely stored–you can ensure compliance with IRS requirements and be prepared for any future tax reporting needs.

W9 Invoices for Small Business Owners

As a small business owner, managing tax documentation is essential for staying compliant with the IRS and ensuring smooth financial operations. One critical aspect of this process involves collecting taxpayer information from contractors, freelancers, or other non-employees you work with. This form provides the necessary details for accurate tax reporting, allowing you to report payments made throughout the year, especially when they exceed the threshold of $600. Understanding how to request and store these forms properly is key to maintaining good financial practices and avoiding any potential issues with the IRS.

When working with contractors, vendors, or freelancers, you will typically need to collect their tax information early in your working relationship. Not only does this ensure that you are prepared for year-end reporting, but it also helps prevent delays in payments and tax filings. As a small business owner, it’s important to be proactive about requesting these forms as soon as you begin working with a new contractor, so you can keep your financial records accurate and up to date.

Additionally, small business owners must ensure that these forms are stored securely and are accessible when preparing year-end tax filings, such as the 1099 forms. Keeping accurate records is an essential part of being a responsible business owner and can save time and effort during tax season.