QuickBooks Sample Invoice Template for Simplified Billing

Managing financial transactions can be a complex task, but with the right tools, it becomes significantly easier to stay organized and on track. Whether you’re a freelancer or running a larger business, having an organized system for documenting payments and charges is essential. A well-structured method not only saves time but also ensures accuracy in all your records.

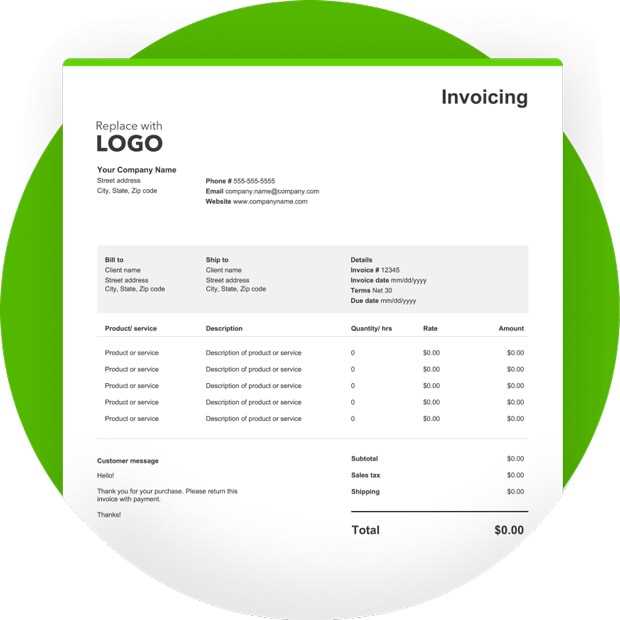

Automating key processes can help streamline your workflow. By using pre-designed formats, you can easily create professional-looking documents that capture the necessary details of each transaction. These formats can be tailored to suit various business needs, whether you’re dealing with single payments or regular billing cycles.

With the right setup, your financial management becomes more efficient, allowing you to focus on growing your business. The ability to customize your records also ensures that you’re ready for any audit or tax-related requirements that may arise.

Understanding Invoice Templates

Having a pre-designed structure for documenting transactions is a game-changer for businesses. These ready-to-use structures allow you to quickly generate professional records with minimal effort. Whether you’re managing client payments or tracking purchases, using a structured format ensures consistency and saves time, reducing the chances of errors.

The goal is to simplify the billing process and enhance the overall experience for both the business and its clients. By utilizing customized structures, businesses can maintain a high level of professionalism while making sure all required details are included in the document.

Benefits of Pre-Designed Structures

- Time-saving: Quickly generate documents without starting from scratch.

- Consistency: Ensure all necessary information is included every time.

- Professional appearance: Maintain a polished look that builds trust with clients.

- Customization: Adapt the structure to fit specific business needs.

How to Use These Documents Effectively

- Choose the right structure based on the type of transaction.

- Ensure all essential fields are filled out, such as payment terms and contact information.

- Regularly update the structure to reflect any changes in business needs or legal requirements.

- Save the format for future use, streamlining future billing cycles.

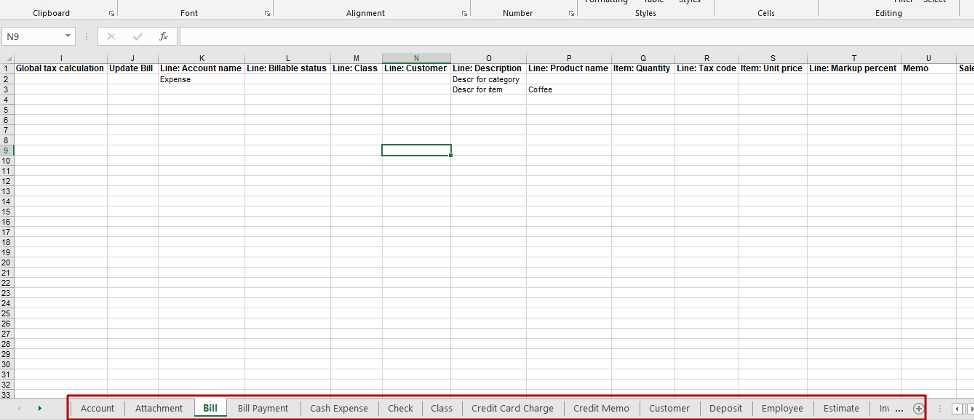

Why Use QuickBooks for Invoicing

Managing financial records and billing can be a challenging task, especially when dealing with numerous clients and transactions. A reliable software solution can simplify this process, making it easier to generate and track payments while ensuring accuracy. Such a tool can not only streamline your workflow but also provide a professional appearance that strengthens client relationships.

One of the key reasons businesses opt for automated financial solutions is the ability to customize documents according to their specific needs. With flexible options, you can tailor your records to match your company’s branding and policies, ensuring consistency across all communications.

Advantages of Using Automated Solutions

- Efficiency: Save time by quickly generating records with predefined fields.

- Accuracy: Minimize errors by reducing manual data entry.

- Professionalism: Maintain a consistent and polished format with each transaction.

- Flexibility: Easily adapt the system to meet changing business requirements.

Key Features for Businesses

| Feature | Description |

|---|---|

| Customization Options | Adjust fields and layout to suit your specific needs, including payment terms and client details. |

| Tracking Capabilities | Easily track payments, due dates, and outstanding balances. |

| Recurring Payments | Set up automated cycles for repeat clients or subscriptions, reducing manual work. |

| Client Management | Store and access client information for streamlined communication and billing. |

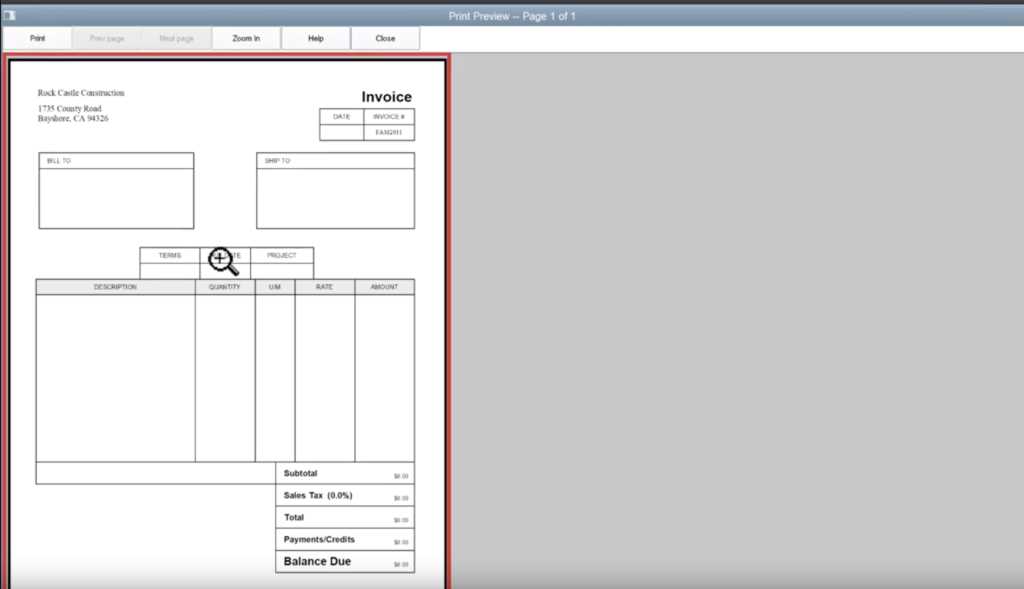

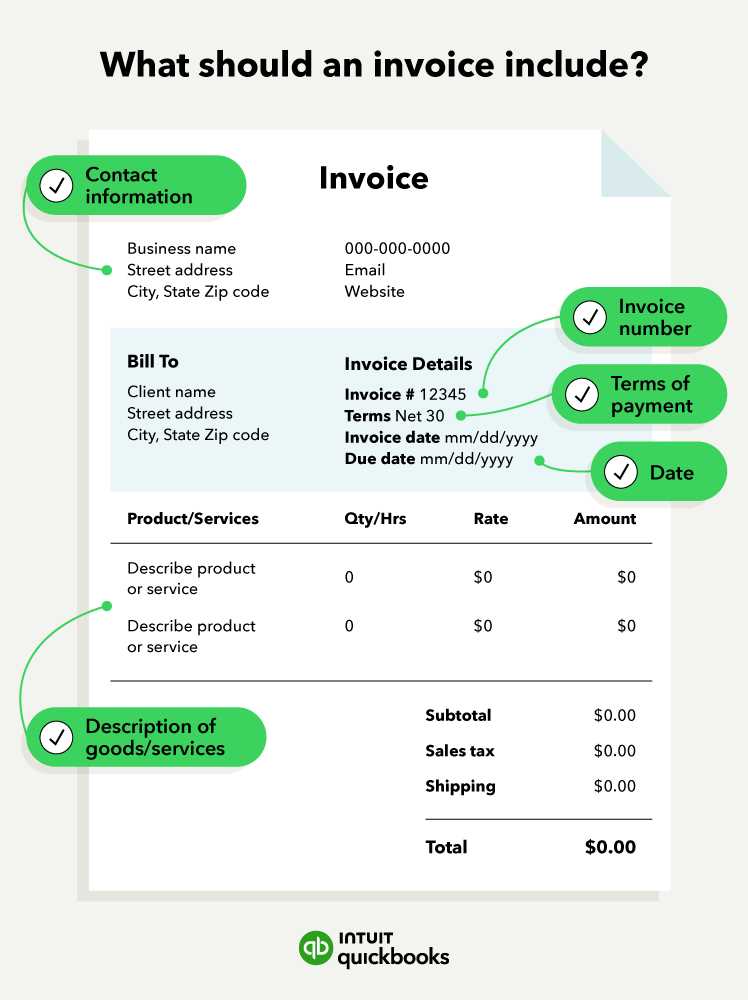

Creating Professional Invoices with QuickBooks

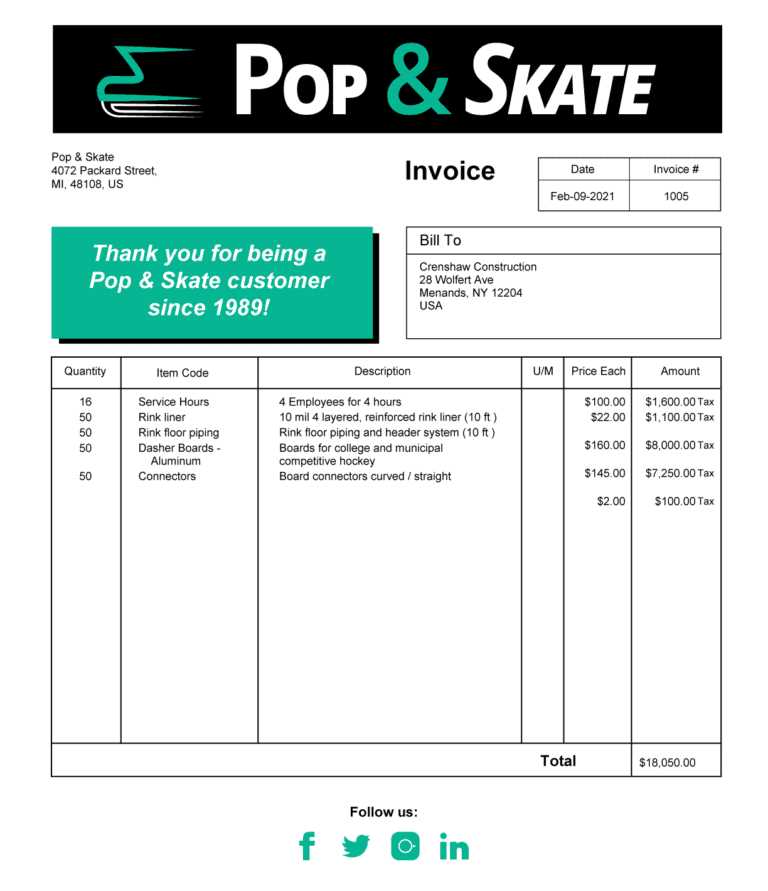

Generating polished and accurate billing documents is essential for maintaining a professional image and ensuring smooth transactions with clients. By using an automated system, businesses can quickly create formal records that reflect the quality of their services or products. This approach not only saves time but also provides a consistent and well-organized method for managing financial communications.

When setting up billing documents, it’s crucial to consider design, content, and structure. A well-crafted record should include all necessary details while maintaining a clean and professional layout. By leveraging customizable systems, businesses can tailor the documents to meet specific needs while preserving a high level of professionalism.

Key Elements to Include in Billing Documents

- Client Information: Always include the client’s name, contact details, and billing address for clear communication.

- Payment Terms: Specify when payments are due, any late fees, or discounts for early payment.

- Itemized List: Provide a detailed breakdown of products or services offered, including quantities and individual prices.

- Clear Totals: Ensure the final amount is clearly stated, including any taxes or additional charges.

Benefits of Using Automated Systems for Billing

- Time Efficiency: Quickly generate accurate records without starting from scratch.

- Accuracy: Reduce errors by automating calculations and ensuring all fields are correctly filled.

- Consistency: Maintain uniformity in design and content, building trust with clients.

- Easy Tracking: Easily track outstanding balances, payment dates, and overdue charges.

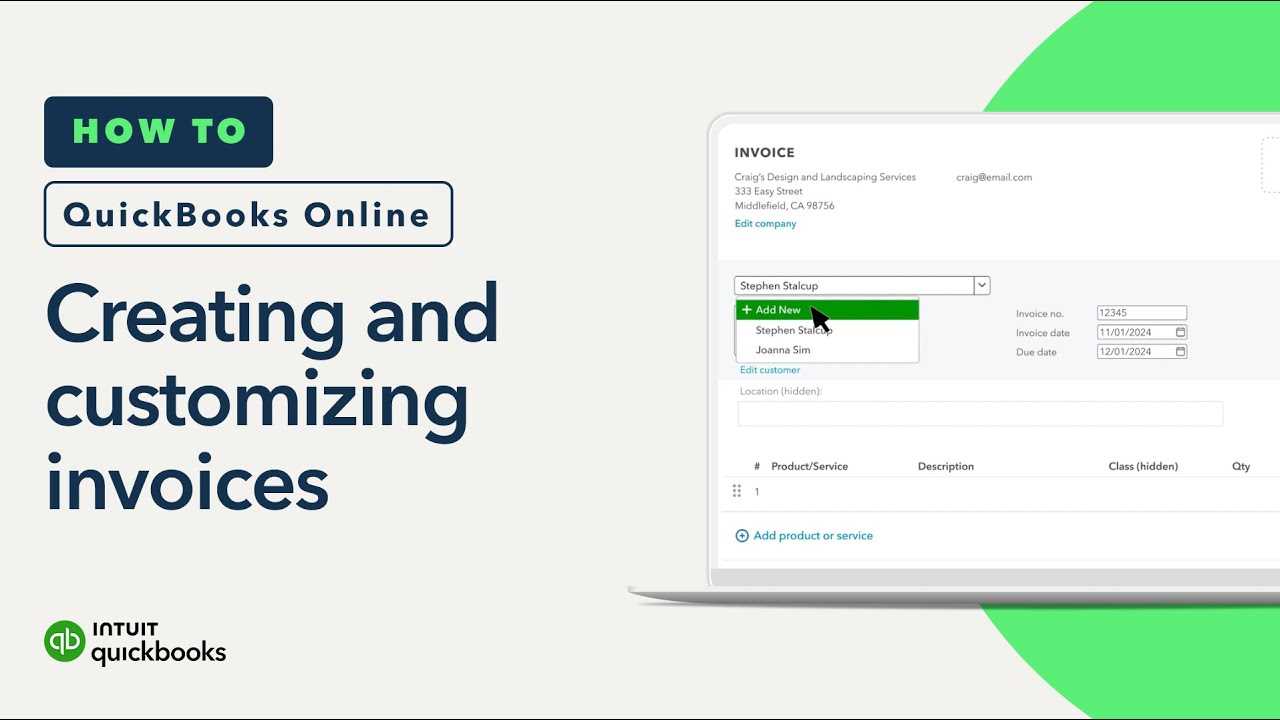

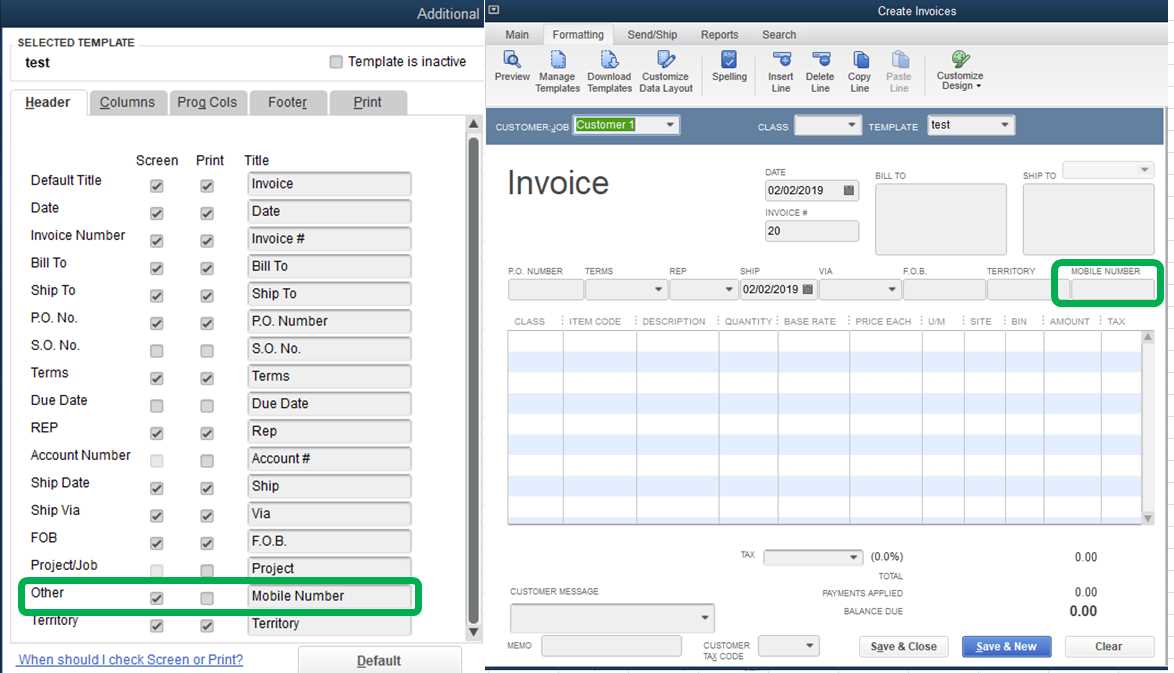

Customizing Your Billing Document in QuickBooks

Personalizing your financial records ensures that they align with your business’s unique identity and needs. By adjusting the layout, fields, and design, you can create documents that not only reflect your brand but also provide a clear, professional communication tool for your clients. Customization allows you to include specific information, ensuring that each document serves its intended purpose effectively.

Whether you want to add your logo, modify the color scheme, or include additional fields, making these changes is straightforward. These customizations improve the overall experience for both you and your clients, fostering transparency and consistency in your business dealings.

Steps to Customize Your Billing Documents

- Choose the layout that best fits your needs and start modifying the structure.

- Add or remove fields based on the type of transaction you’re documenting.

- Include your company’s branding, such as logos, colors, and contact details.

- Modify payment terms, due dates, and any additional instructions to suit your policies.

Benefits of Customization

- Brand Consistency: Ensure that your records reflect your business’s visual identity, including logos and design elements.

- Clear Communication: Tailor the format to include all necessary information, reducing misunderstandings.

- Professional Appearance: Maintain a polished and cohesive look that builds trust with clients.

- Improved Efficiency: Save time by setting up standardized fields and structures for frequent transactions.

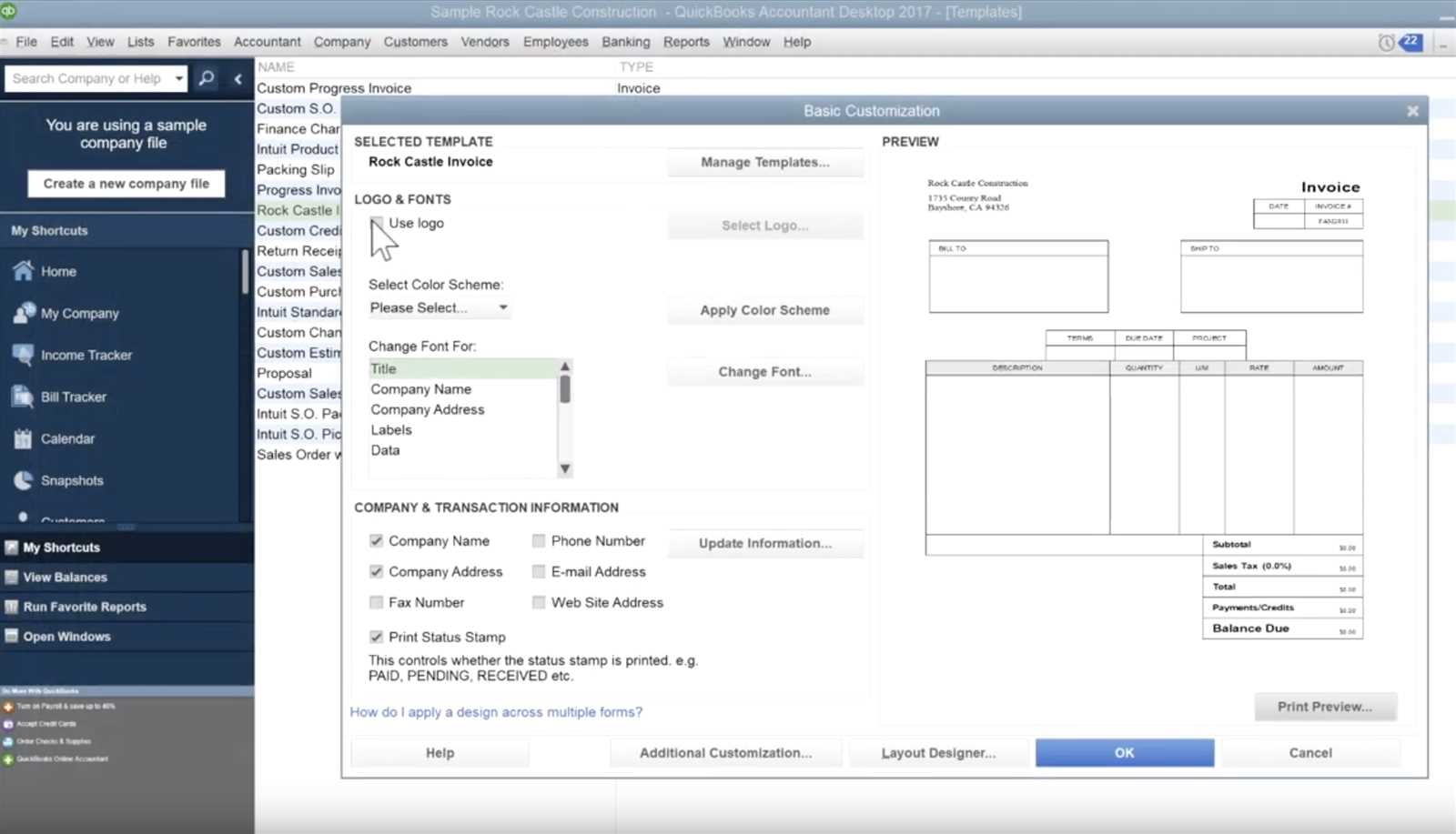

Adding Your Company Logo to Invoices

Including your company logo in your financial documents enhances brand recognition and adds a professional touch to your business communications. By displaying your logo, you not only promote your business but also establish a sense of credibility and trust with your clients. The logo serves as a visual cue, ensuring that your records are instantly identifiable and aligned with your company’s identity.

Incorporating your logo into your billing documents is a straightforward process. Once added, the logo remains consistent across all generated records, reinforcing your brand with every transaction. This customization is a small yet impactful step in maintaining a cohesive and professional appearance for your business.

Steps to Add Your Logo

| Step | Action |

|---|---|

| Select Document | Choose the document format you wish to edit. |

| Upload Logo | Click on the upload option to select and insert your logo file from your computer. |

| Position Logo | Adjust the logo placement to ensure it aligns properly with the layout. |

| Save Changes | Once satisfied, save the new design and apply it to future records. |

Benefits of Adding a Logo

- Brand Visibility: Your logo helps make your documents instantly recognizable to clients.

- Professional Appearance: A logo enhances the polished, formal look of your business documents.

- Consistency: Maintain a cohesive visual identity across all your business communications.

- Trust Building: A branded document fosters trust and credibility with clients and partners.

Steps to Generate Invoices Quickly

Creating accurate and professional financial documents doesn’t have to be time-consuming. With the right tools and a streamlined process, businesses can generate billing records quickly without sacrificing quality. The key is to follow a simple, step-by-step approach that ensures all necessary information is included, while minimizing the time spent on each document.

By utilizing automated systems, businesses can reduce manual entry and create formatted documents in just a few clicks. Setting up essential fields ahead of time and using pre-designed formats allows for faster document creation, making it easier to stay on top of billing cycles and manage finances efficiently.

Steps to Create Documents Efficiently

- Prepare Your Information: Gather all necessary details, including client contact information, services rendered, and payment terms.

- Select a Pre-Formatted Layout: Choose a pre-designed structure that suits your needs, ensuring it includes all required fields.

- Fill in the Details: Quickly input client and transaction-specific information into the predefined fields.

- Review and Customize: Make any necessary adjustments, such as adding special instructions or payment deadlines.

- Save and Send: Once completed, save the document and send it to your client via email or other communication channels.

Tips for Speeding Up the Process

- Use Recurring Entries: For repeat clients, set up recurring billing cycles to automate future document generation.

- Store Client Information: Keep a database of client details for quick access during document creation.

- Use Default Terms: Set default payment terms and conditions to avoid manually entering them each time.

- Review Templates Regularly: Keep your document structure updated to reflect any changes in your business practices.

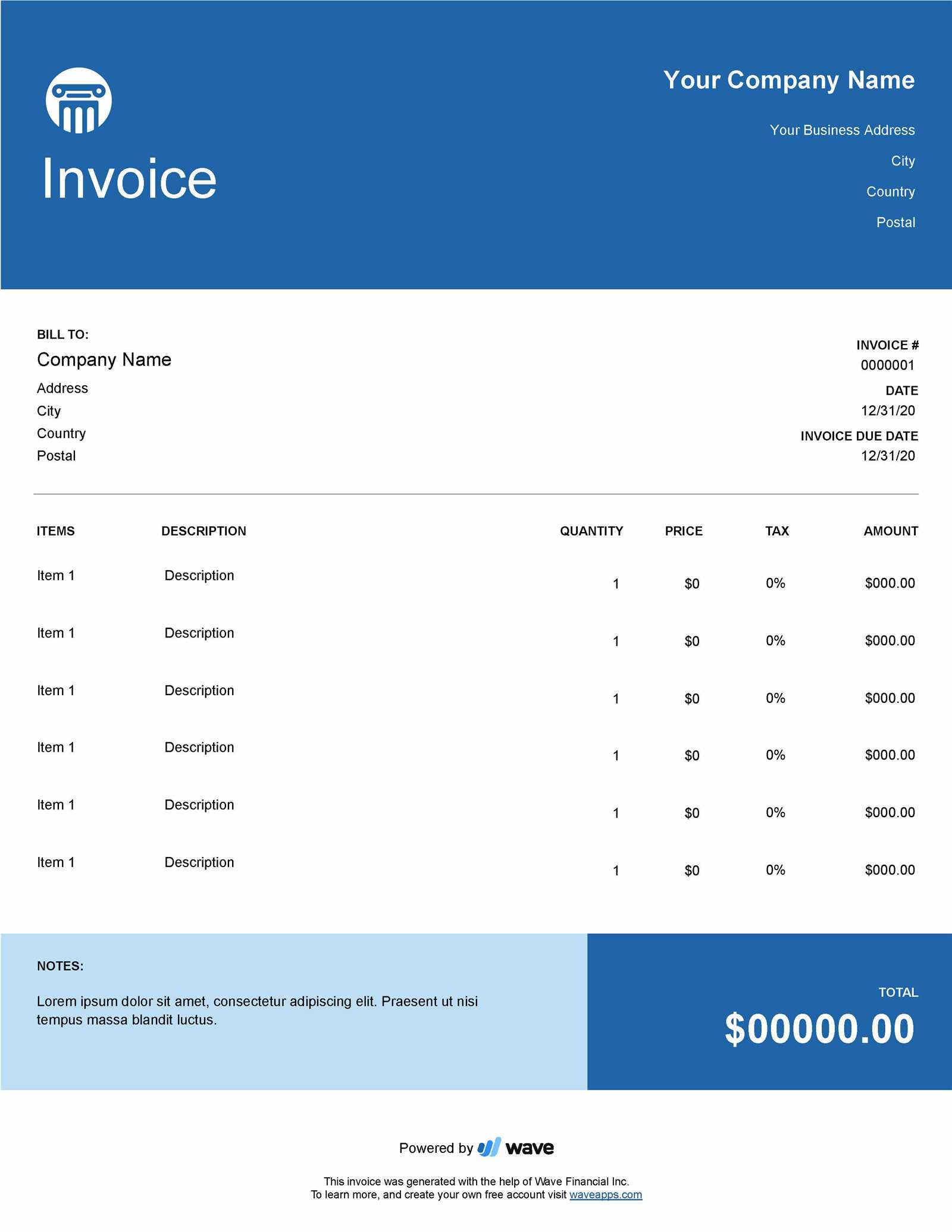

How to Choose the Right Template

Selecting the appropriate structure for your billing documents is crucial for maintaining a professional appearance and ensuring clarity. A well-chosen design can enhance the readability of the information, making it easier for clients to understand the details of the transaction. It also helps in aligning the format with your company’s branding and policies, creating a cohesive look across all financial communications.

When choosing a layout, it’s important to consider both functionality and aesthetics. A functional layout should be easy to navigate, with clearly defined sections for all relevant details. At the same time, the design should be visually appealing and match the tone of your business. The right format should cater to the nature of your transactions and the preferences of your clients.

Factors to Consider When Selecting a Layout

- Business Type: Choose a design that fits the nature of your business, whether it’s formal, creative, or service-based.

- Client Preferences: Consider your client’s expectations for the document layout and style.

- Document Complexity: If your transactions are straightforward, a simple design may suffice. For more detailed records, opt for a structure that allows for an itemized breakdown.

- Branding Needs: Ensure the chosen layout aligns with your company’s visual identity, including logo placement, fonts, and color scheme.

Steps for Selecting the Perfect Format

- Assess your business and client needs to determine the most appropriate style.

- Explore various options, from basic to detailed designs, depending on your requirements.

- Ensure that the layout allows for customization, such as adding logos, terms, and personalized notes.

- Test a few options to see which one works best in terms of ease of use and professional appeal.

Including Payment Terms on Invoices

Clearly defining payment expectations is an essential part of any financial document. Including specific terms for payment helps avoid confusion and ensures that both you and your client are on the same page regarding deadlines and conditions. This transparency not only fosters trust but also minimizes the risk of late payments and disputes.

Payment terms outline the due date, acceptable payment methods, and any late fees or discounts, providing a clear framework for the transaction. By incorporating these details in your documents, you help manage client expectations while streamlining your accounting process.

Key Payment Terms to Include

| Payment Term | Description |

|---|---|

| Due Date | Specify the exact date by which the payment is expected, such as “Due within 30 days of receipt.” |

| Late Fees | Include any additional charges if payment is not received on time, such as a percentage or flat fee. |

| Early Payment Discounts | Offer a discount for early settlement of the amount due, which can encourage quicker payments. |

| Accepted Payment Methods | List the methods available for payment, such as credit cards, bank transfers, or checks. |

Benefits of Clear Payment Terms

- Improved Cash Flow: Clear terms encourage timely payments, ensuring steady cash flow for your business.

- Avoid Disputes: Defined expectations reduce the likelihood of misunderstandings or disagreements.

- Professionalism: Including payment terms shows that your business is organized and transparent.

- Client Convenience: Clear instructions on how and when to pay make the process easier for your clients.

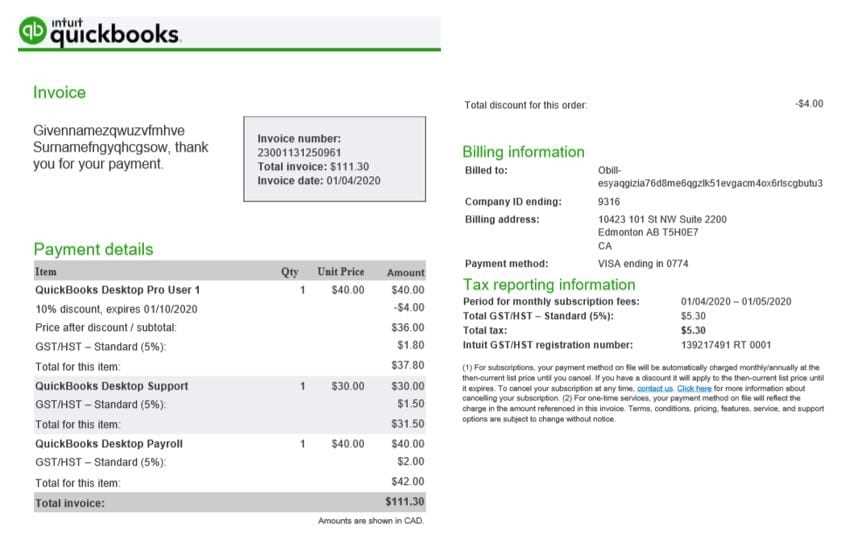

Tracking Invoice Payments with QuickBooks

Keeping track of payments is a vital part of managing your business’s finances. Monitoring incoming payments ensures that you can effectively manage cash flow and stay on top of outstanding balances. By utilizing an efficient tracking system, businesses can stay organized and ensure that no payments are overlooked or delayed.

With the right tools, businesses can easily record payments, track due dates, and send reminders for overdue balances. This system not only helps in maintaining financial accuracy but also improves client relationships by providing clear and timely updates about their payment status.

Steps to Track Payments Efficiently

- Record Payments: As payments are made, enter them into your system to ensure all financial records are up-to-date.

- Match Payments to Transactions: Ensure each payment is linked to the correct transaction to prevent discrepancies.

- Monitor Due Dates: Set up automatic reminders to alert you when payments are due or overdue.

- Generate Payment Reports: Regularly generate reports to review outstanding balances and the status of received payments.

Benefits of Efficient Payment Tracking

- Improved Cash Flow Management: Timely tracking ensures your business always has a clear picture of incoming funds.

- Reduced Risk of Errors: A well-organized system minimizes the chances of missing or misapplying payments.

- Enhanced Client Communication: By providing clients with updated payment statuses, you foster trust and professionalism.

- Faster Issue Resolution: Quick identification of overdue payments allows for prompt follow-up, preventing financial delays.

Tips for Managing Multiple Invoice Templates

When running a business with diverse services or product offerings, you may find it necessary to create different billing structures for various purposes. Efficiently managing multiple formats ensures consistency, professionalism, and organization in your financial communications. A well-organized approach will allow you to easily switch between different layouts, ensuring that each document suits the particular client or service.

Having various designs can also help streamline the billing process, as you can use specific layouts for different types of transactions or clients. It’s essential to keep everything organized to avoid confusion and ensure that the right style is used for each situation.

Best Practices for Managing Multiple Formats

- Organize by Category: Categorize designs based on the type of service or client to make selection easy.

- Keep It Simple: Avoid overcomplicating layouts. Ensure each format is clear, easy to use, and consistent across different documents.

- Standardize Key Information: Keep core elements like terms, payment details, and branding consistent across all formats for uniformity.

- Label Formats Clearly: Use descriptive names or labels for each design, making it easy to identify the correct one quickly.

- Test for Functionality: Ensure that all layouts work properly, such as fields for amounts, discounts, and taxes, before using them for real transactions.

Advantages of Proper Format Management

- Efficiency: Easily choose the right layout for each transaction, speeding up the billing process.

- Professionalism: Offering various designs allows you to match the tone and needs of different clients, enhancing your business’s image.

- Organization: Keeping multiple formats neatly organized reduces confusion and improves accuracy in your records.

- Flexibility: With multiple layouts on hand, you can tailor your documents to different industries, clients, or service offerings, giving your business more flexibility.

How to Set Up Recurring Invoices

Setting up automated billing for clients who require regular payments is an efficient way to save time and ensure consistency. By automating the process, businesses can reduce manual entry, avoid errors, and maintain steady cash flow. Recurring billing setups allow you to define a schedule, frequency, and amount, so invoices are sent automatically according to the agreed-upon terms.

Once the parameters are set, the system will generate and send these financial documents at the designated intervals, whether monthly, quarterly, or annually. This process not only improves efficiency but also helps build stronger, long-term relationships with clients by ensuring timely and reliable billing.

Steps to Set Up Recurring Billing

- Choose a Client: Start by selecting the customer who will receive recurring payments.

- Define Payment Schedule: Set the frequency of payments–monthly, bi-weekly, quarterly, etc.

- Set Amount and Terms: Specify the amount due and any terms or discounts that apply to the regular charges.

- Automate Invoice Generation: Ensure that the system is configured to generate and send the document at the scheduled times.

- Review and Adjust: Periodically review the settings to ensure everything is accurate and update as needed based on changes in pricing or service terms.

Benefits of Recurring Billing

- Time-Saving: Automating the billing process frees up time that can be spent on other areas of your business.

- Improved Cash Flow: Regular billing ensures consistent revenue and reduces the chances of delayed payments.

- Accuracy: Automating the process minimizes human error, ensuring that charges are correct every time.

- Client Satisfaction: Clients appreciate the ease of automatic billing, which simplifies their own payment management.

Using QuickBooks for International Invoices

When dealing with global clients, it’s essential to ensure that your billing process can handle multiple currencies, languages, and country-specific requirements. Managing international transactions involves understanding local tax laws, ensuring currency conversions are accurate, and providing clients with documents in their preferred language or format. With the right system, international payments can be processed smoothly, and you can maintain efficient communication with customers across different regions.

By leveraging specialized features, businesses can simplify the complexities of cross-border billing. This includes automated currency conversions, handling varying tax rates, and ensuring compliance with international accounting standards. These tools streamline the process, reduce errors, and improve the overall customer experience, making it easier for both the business and client to navigate financial transactions.

Key Features for International Billing

- Multi-Currency Support: Automatically convert foreign currencies based on current exchange rates to ensure accurate billing.

- Tax Compliance: Apply the appropriate local tax rates and ensure that your documents reflect the correct tax calculations for each region.

- Multi-Language Capabilities: Customize billing documents to be displayed in the client’s preferred language for easier communication.

- Automated Payment Reminders: Set up automatic reminders for payments due, reducing the need for manual follow-up with clients.

Benefits of Using the Right Tools for Global Transactions

- Accuracy: Automated conversions and calculations minimize human errors, ensuring precise billing and financial records.

- Time Efficiency: Automating international billing reduces the time spent on manual currency conversions and tax adjustments.

- Client Satisfaction: Providing professional, localized billing experiences fosters positive relationships with clients worldwide.

- Scalability: With the right system in place, your business can easily handle an expanding international client base without added complexity.

Integrating QuickBooks with Other Tools

Seamless integration between your accounting system and other business tools can significantly enhance efficiency and streamline processes. By connecting your financial management platform with software solutions for project management, time tracking, payment processing, and customer relationship management (CRM), you can automate data flows and reduce the need for manual data entry. This ensures that all information is consistent and up-to-date across various systems, saving time and minimizing the risk of errors.

Integrating various business tools allows for a more holistic approach to managing operations. Whether it’s syncing sales data, automating invoicing, or updating financial reports in real-time, the power of interconnected tools helps create a smooth and efficient workflow that benefits both the business and its clients.

Benefits of Integration

- Data Synchronization: Keep customer, financial, and transaction data consistent across platforms without manual updates.

- Increased Productivity: Reduce the time spent on repetitive tasks and allow teams to focus on high-priority activities.

- Improved Accuracy: Automated data entry reduces human errors, ensuring the reliability of financial reports and documents.

- Real-Time Updates: Instant updates across integrated systems ensure that your information is always current, no matter where you access it.

Popular Integration Options

- Payment Processing: Connect your billing system with payment gateways to facilitate direct, secure transactions with clients.

- Customer Relationship Management (CRM): Link your accounting software with CRM systems to track customer interactions and manage sales activities more effectively.

- Time Tracking: Integrate with time-tracking software to automatically convert hours worked into accurate billing records.

- Project Management Tools: Sync project management platforms to track budgets, expenses, and financial reporting for each project.

Automating Invoice Reminders in QuickBooks

Automating payment reminders helps streamline the collection process by ensuring that clients are notified of outstanding balances without requiring manual effort. This feature allows businesses to stay on top of receivables and maintain a professional relationship with clients by sending timely notifications. By setting up automated reminders, companies can reduce late payments, improve cash flow, and avoid the hassle of manual follow-ups.

Automated notifications can be customized to fit the needs of each business. From sending reminders at specific intervals before and after the due date to personalizing messages based on the client’s preferences, automation offers flexibility and consistency in communication. This approach not only saves time but also encourages clients to pay promptly, enhancing the overall financial health of the business.

Benefits of Automated Reminders

- Time Savings: Eliminate the need for manual tracking and follow-ups by automating the reminder process.

- Consistency: Ensure that all clients receive reminders at the same intervals, helping you maintain a professional and uniform approach.

- Improved Cash Flow: Increase the likelihood of receiving payments on time, which improves overall business liquidity.

- Reduced Errors: Minimize the chances of forgetting to send reminders or sending them too late, ensuring timely communication.

How to Set Up Automated Reminders

Setting up automated reminders is a straightforward process. The steps typically involve:

| Step | Action |

|---|---|

| 1 | Navigate to the reminder settings section in your accounting software. |

| 2 | Choose the interval at which you want the reminder to be sent (e.g., 3 days before due date, 1 day after). |

| 3 | Customize the message template to match your business tone and needs. |

| 4 | Activate the automated reminder system, ensuring it’s applied to all new and existing transactions. |

Once set up, the system will automatically handle reminders for all future transactions, allowing you to focus on other important tasks while keeping track of payments efficiently.

QuickBooks Invoice Features You Should Know

Managing financial transactions efficiently is key to maintaining smooth business operations. The right set of tools allows you to streamline processes like creating, tracking, and managing client payments. Understanding the various features available for crafting and managing billing documents ensures you can maximize your productivity and maintain a professional image.

Various options are available to enhance your billing process, from customizing documents to tracking payments and automating reminders. These features help businesses stay organized, ensure timely payments, and provide a clear financial record. Additionally, you can adapt the system to suit your business’s unique needs, making it more effective and tailored to your requirements.

Customization Options

Personalizing your billing documents is a critical feature that helps you maintain brand consistency. You can modify layout elements such as:

- Company logo: Easily upload your logo to give a professional touch to every document.

- Colors and fonts: Adjust color schemes and fonts to match your company’s style.

- Field adjustments: Customize the data fields to capture specific information important to your business.

Payment Tracking and Automation

Efficiently managing outstanding payments is made simple through automatic tracking systems. Key features include:

- Automatic payment reminders: Set up reminders to notify clients about upcoming or overdue payments.

- Real-time payment updates: Keep track of which transactions are paid and which are pending.

- Integrated payment options: Allow customers to pay directly via links included in your documents, making the process faster and more convenient for both parties.

These tools contribute to faster payment cycles and fewer missed payments, ensuring your business’s financial health remains strong.

Common Mistakes to Avoid with Invoices

When creating billing documents for clients, accuracy and clarity are crucial to maintaining smooth business operations and ensuring timely payments. Even small errors can lead to confusion, delayed payments, or financial discrepancies. It’s essential to be aware of common pitfalls and take steps to avoid them to keep your accounting process efficient and professional.

Frequent Errors to Watch Out For

Here are some of the most common mistakes that businesses make when generating billing statements:

- Missing or incorrect contact details: Always double-check that the recipient’s information, including the company name, address, and contact number, is correct. This avoids confusion and ensures proper delivery.

- Incorrect or missing dates: Failing to include the issue date or the due date can cause delays in payment processing and create misunderstandings. Always ensure both dates are clearly stated.

- Unclear payment terms: Failing to specify clear terms, such as payment deadlines or discounts for early payments, can lead to confusion and missed deadlines.

- Inconsistent pricing: Double-check that all prices are accurate and reflect the correct rates or agreements. Errors in pricing can lead to disputes and damage client relationships.

How to Prevent These Errors

To avoid these mistakes, consider the following tips:

- Use templates: Consistent formats reduce the chances of omitting key information or making mistakes in layout.

- Proofread everything: Before sending out any billing document, thoroughly review it for any inaccuracies or omissions.

- Automate reminders: Setting up automated reminders for due dates ensures you don’t forget to notify clients in advance of payment deadlines.

By staying vigilant and taking the time to carefully review your billing documents, you can avoid common mistakes and ensure a smoother, more efficient billing process for your business.