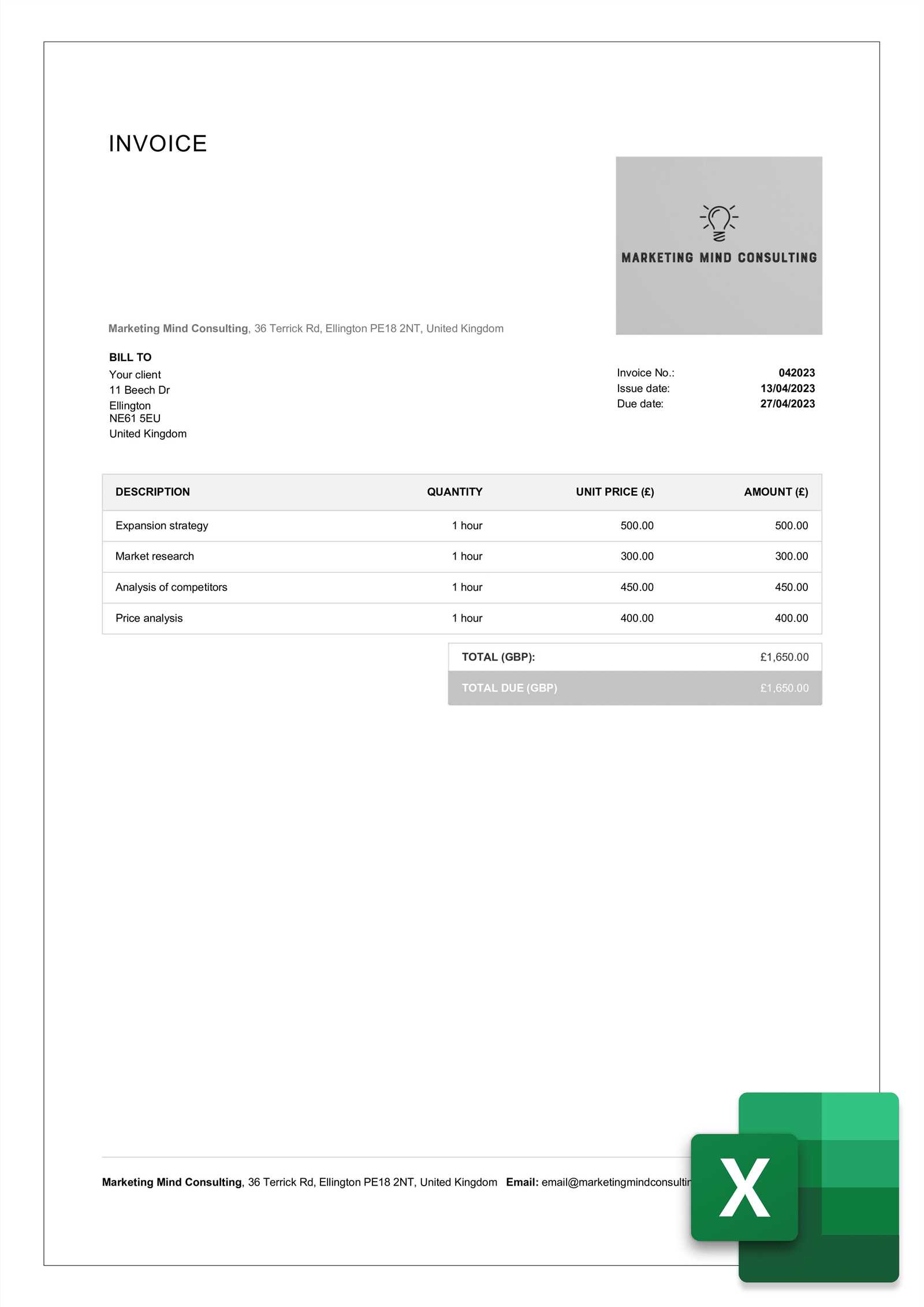

Download Free Invoice Template XLS for Simplified Billing

Managing finances efficiently is a critical aspect of running any business. One essential element of this process is creating clear, accurate documents that ensure smooth transactions with clients. Excel spreadsheets offer a versatile solution for businesses looking to simplify and organize their financial operations.

By using pre-designed formats, entrepreneurs and accountants can easily produce professional documents that are fully customizable. These tools provide a quick way to record essential details like amounts, due dates, and payment terms, all while maintaining flexibility and control over the content. Whether you are a freelancer or part of a large corporation, leveraging spreadsheets for financial documentation can significantly improve workflow and reduce errors.

Excel-based solutions also allow for easy integration with other business systems, making it simpler to track payments and manage records. Customizable fields and built-in calculations help automate much of the process, making it not only efficient but also reliable for long-term use.

What is an Invoice Template XLS

Creating consistent and professional documentation is essential for businesses to maintain accurate financial records. One effective way to manage this process is by using digital tools that help automate the creation of essential financial statements. These tools often come in the form of customizable spreadsheets that make it easy to track payments, due dates, and transaction details without needing advanced accounting software.

Understanding the Basics

At its core, this type of document is a structured spreadsheet designed to organize and display all the necessary components of a billing statement. It allows users to input relevant data such as customer information, item descriptions, amounts owed, and payment terms. The beauty of this approach lies in its simplicity and flexibility, as it can be tailored to suit the specific needs of any business or individual.

Key Features of a Digital Billing Document

One of the main advantages of using a spreadsheet for creating such documents is the built-in calculation functions that allow for automatic summation of costs and taxes. Additionally, these files can be easily modified to accommodate different currencies, languages, or tax rates, ensuring global compatibility. Customization is a key feature, giving businesses the ability to adjust the layout and content to better represent their branding or specific billing requirements.

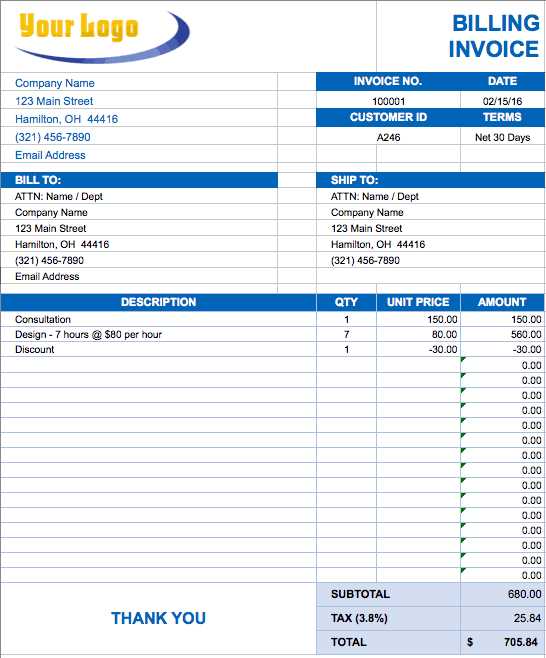

Why Use an Excel Invoice Template

Efficient financial management is crucial for any business, and having a reliable way to document and track payments can save both time and effort. Using a digital spreadsheet to create billing documents offers a straightforward approach to maintaining accurate records while minimizing errors. This method provides flexibility, customization, and the ability to automate many of the manual tasks involved in the billing process.

Time-Saving Automation

One of the primary reasons for choosing a spreadsheet-based approach is the automation of calculations. When dealing with multiple transactions or varying tax rates, manually adding up totals can lead to mistakes. With built-in formulas and functions, a digital document automatically performs complex calculations, saving time and reducing the risk of human error.

Easy Customization and Flexibility

Another advantage of using a spreadsheet is the level of customization it offers. You can easily modify the layout, design, and structure to meet your specific needs. Whether you are a small business owner or managing a large organization, you can adjust the format to include additional fields, different currencies, or even personalized branding. This flexibility ensures that the document aligns with your business style and provides clear, professional records for clients and stakeholders.

Benefits of XLS Invoices for Businesses

For businesses of all sizes, maintaining clear and accurate financial records is a vital part of operations. Using digital spreadsheets to create and manage billing statements offers significant advantages, making it easier to handle a variety of financial tasks. These tools not only streamline the process but also help improve accuracy, reduce errors, and enhance productivity.

Improved Accuracy and Automation

One of the main benefits of using spreadsheets for financial documents is the automation of calculations. When working with multiple clients or transactions, manually adding up totals or calculating taxes can lead to costly mistakes. Spreadsheets with built-in functions eliminate the need for manual math, ensuring accurate totals every time. This automation makes the process faster and more reliable, giving business owners more confidence in their records.

Cost-Effective and Accessible

Another advantage is the low cost and accessibility of digital spreadsheets. Unlike specialized accounting software, which may require expensive subscriptions or ongoing maintenance, spreadsheet software is typically free or low-cost and can be used on virtually any computer. This makes it a practical solution for small businesses or freelancers who need an efficient way to manage their finances without investing in complex systems.

Easy Record Management and Tracking

Spreadsheets make it easy to organize and track financial records over time. You can quickly update details, add new entries, or modify existing information. This ensures that your records are always up to date, and allows for easy reference or exporting of data when needed. Moreover, spreadsheets are compatible with other tools, making it simple to integrate them into larger accounting or management systems.

How to Create a Custom Invoice in Excel

Creating a personalized billing document in Excel is a straightforward process that allows businesses to maintain control over their financial records. By starting with a blank spreadsheet or modifying an existing structure, you can easily add your own details and ensure the document meets your unique needs. Follow these steps to create a custom form that fits your business style and requirements.

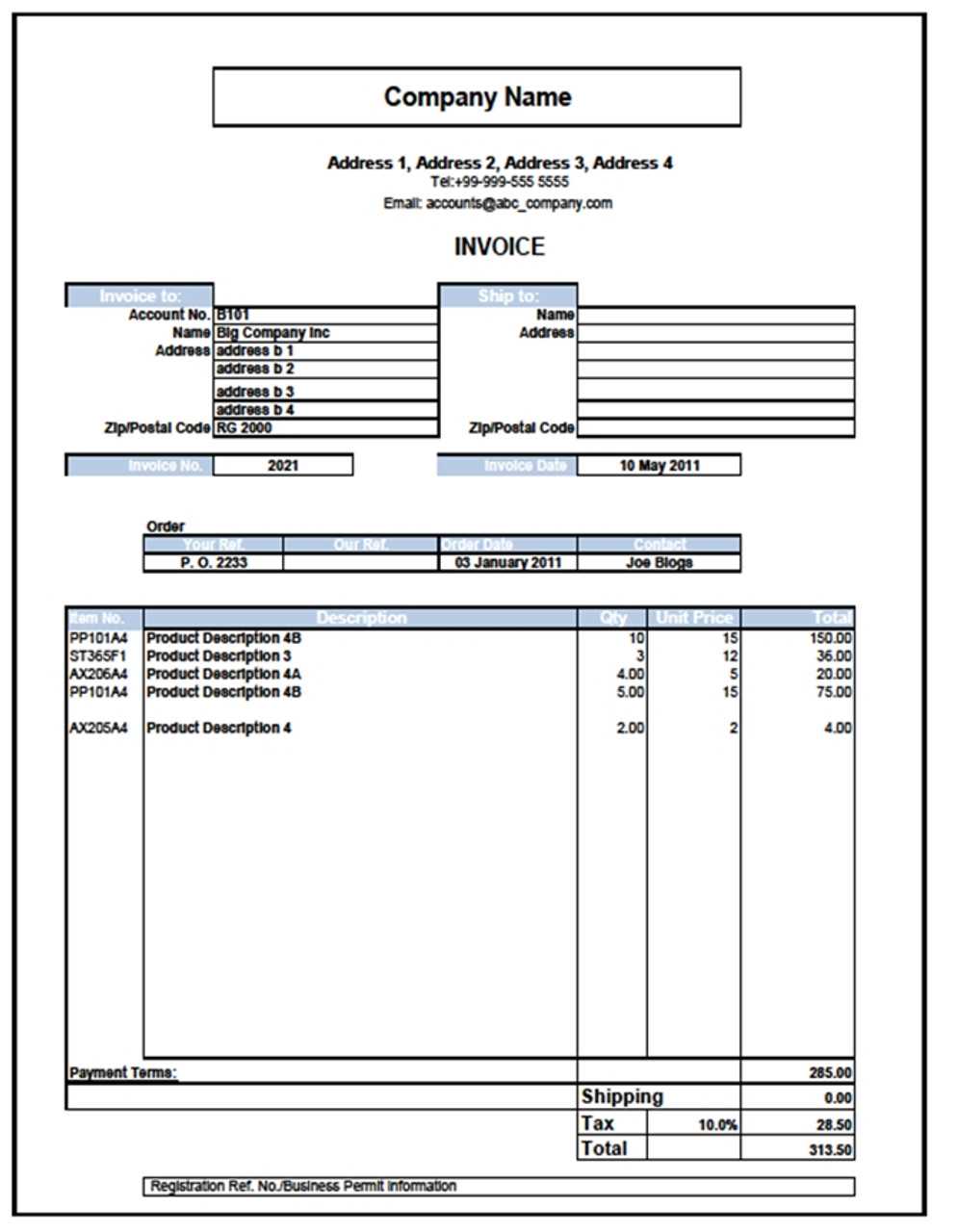

Step-by-Step Guide

To begin, follow these simple steps to craft a customized document:

- Open Excel: Start by opening a new workbook. You can choose a blank worksheet or use a simple financial structure as your base.

- Set up the Header: Add your business name, logo, and contact details at the top of the document. This section should also include the date and a reference number for easy tracking.

- Include Client Information: Below the header, create fields for the client’s name, company name (if applicable), address, and contact information.

- List Products or Services: In the main section of the sheet, create columns for descriptions of the products or services provided, quantities, unit prices, and totals. Make sure to leave enough space for each entry.

- Calculate Totals: Use Excel’s built-in formula functions to calculate the subtotal, tax, and grand total automatically.

- Payment Terms: Include sections for payment due date, method of payment, and any late fees or discounts.

- Formatting: Adjust fonts, borders, and cell colors to make the document visually appealing and easy to read.

Finalizing and Saving

Once you’ve completed your custom document, review it for any errors or missing information. When satisfied, save your file in a format that can be easily shared, such as PDF, for professional presentation. Excel allows you to make adjustments later, so you can modify the document as your needs evolve.

By following these simple steps, you’ll have a functional, customized financial document ready to send to your clients with a polished, professional touch.

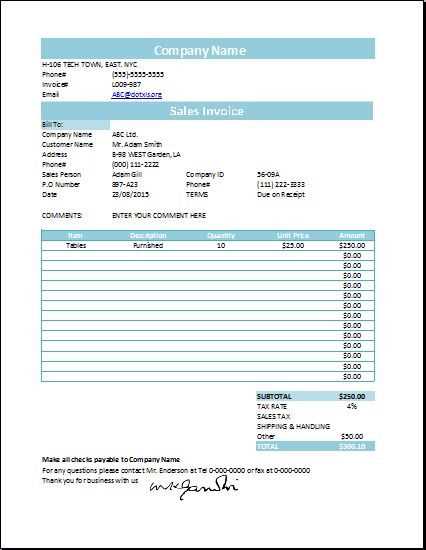

Key Features of an Invoice Template

When creating professional billing documents, having a structured and consistent format is essential for both clarity and efficiency. The right format includes several key elements that help organize the information in a way that is easy to understand and manage. These features ensure that all necessary details are captured, and the document can be processed quickly and accurately.

Essential Components

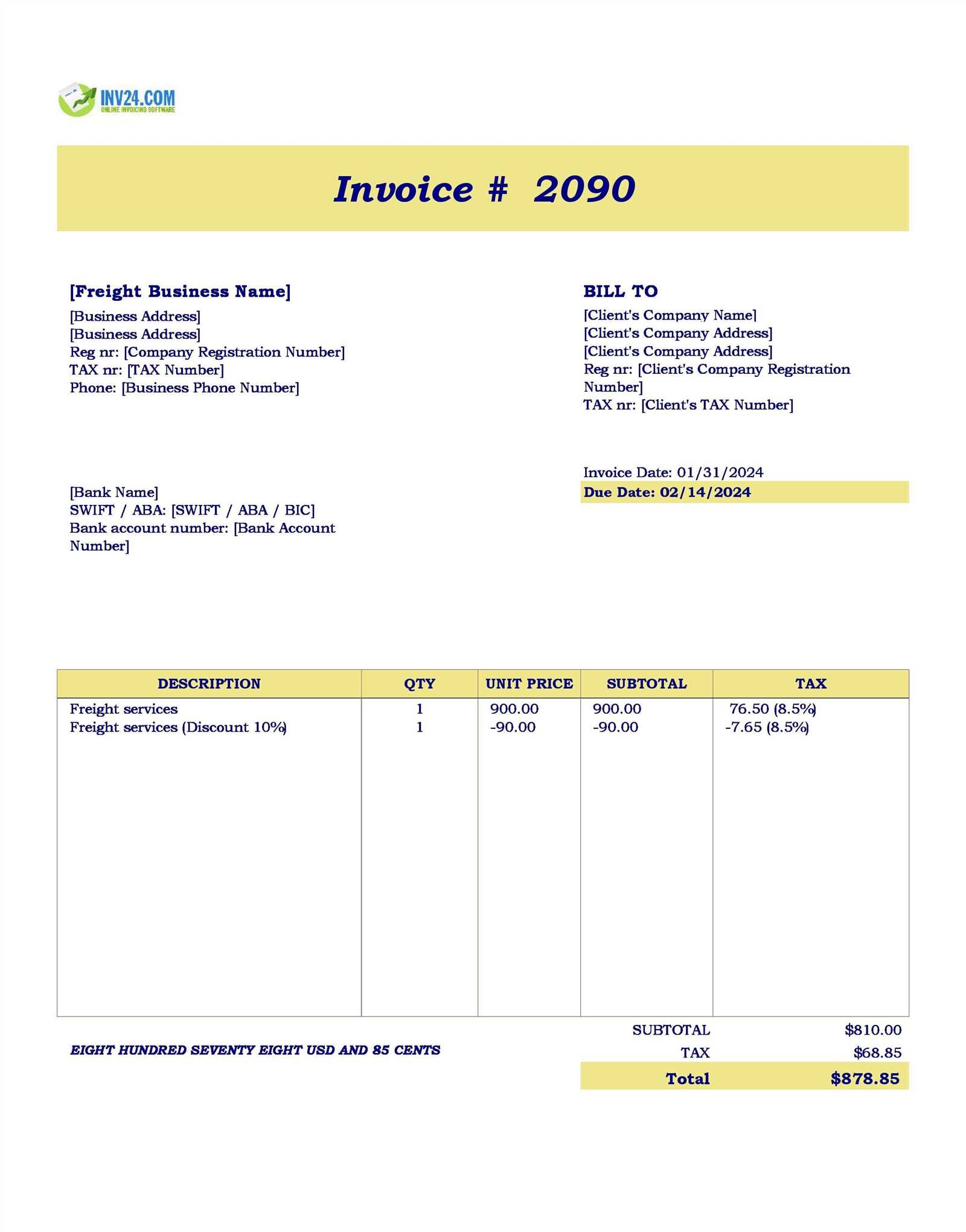

At the core of any billing document are several key sections that provide clarity and structure. These include:

- Header Information: This section should include the business’s name, logo, and contact information, as well as a reference number and issue date to ensure easy identification and tracking.

- Client Details: Including the name, address, and contact details of the recipient helps ensure the correct person or company receives the bill.

- Itemized List: This area outlines the products or services provided, including descriptions, quantities, unit prices, and total amounts for each entry.

- Payment Breakdown: Clearly list the subtotal, applicable taxes, discounts, and the final total amount due. This transparency prevents confusion and disputes.

- Payment Terms: Include payment due dates, accepted methods, and any relevant late fees or early payment discounts.

Additional Functional Features

To further enhance the usability of your document, there are several additional features that can make the process smoother:

- Automatic Calculations: Built-in formulas allow for quick and accurate calculation of totals, taxes, and discounts without the need for manual entry.

- Customizable Fields: The ability to modify fields based on the business’s specific needs ensures flexibility, whether it’s adding new charges, payment methods, or custom messages.

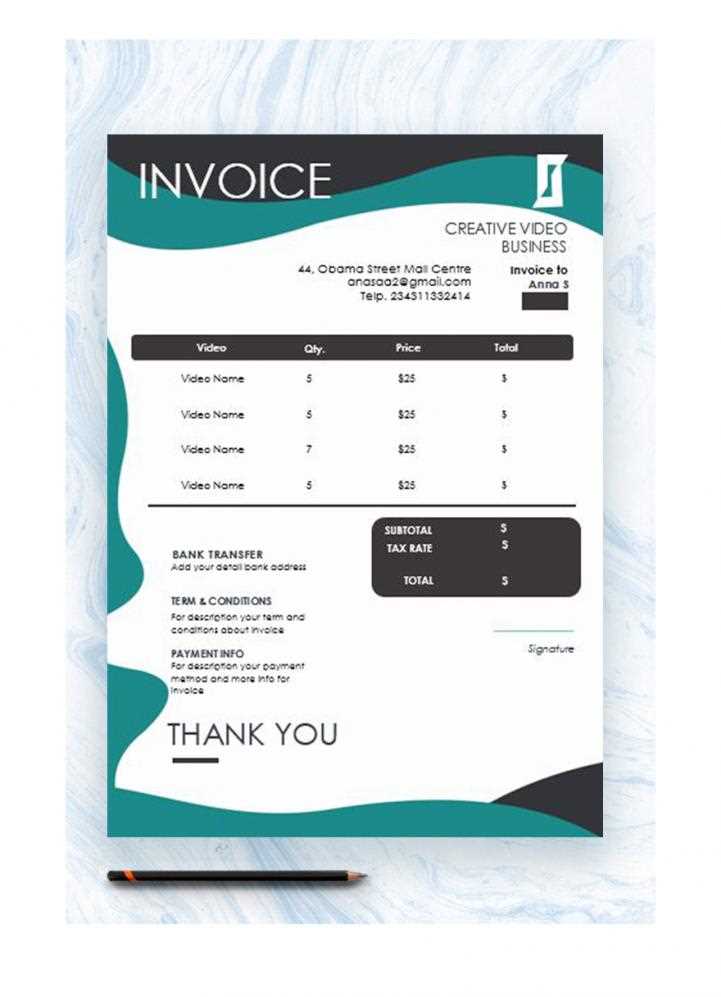

- Professional Design: Clean and easy-to-read formatting ensures that the document looks polished and presents a professional image to clients.

With these features, a well-organized financial document not only makes the billing process smoother but also helps maintain strong business relationships by ensuring that both parties have all the necessary details for seamless transactions.

Choosing the Right Invoice Template for Your Needs

Selecting the appropriate format for creating billing documents is a crucial step in streamlining your financial processes. Different businesses have unique requirements when it comes to presenting their charges and maintaining accurate records. Choosing the right structure allows you to customize the layout and functionality according to your specific needs, ensuring that every important detail is captured effectively.

Consider the Type of Business

When selecting a format, it’s important to consider the nature of your business. For example, a freelance consultant may only need a simple structure with basic fields for services rendered, while a retailer may require more detailed sections to list products, quantities, and prices. If your business involves multiple services or products, you may need a more complex layout with the ability to accommodate varying tax rates or additional fees.

Customization and Flexibility

Customization is another key factor. A well-designed system should allow for modifications, whether it’s changing the color scheme to match your brand or adding new fields for specific business needs. The more flexibility a format offers, the easier it will be to adjust as your business evolves.

Additionally, consider whether the structure allows for automatic calculations of totals, taxes, and discounts. This feature reduces manual errors and saves time. A simple, automated design can enhance your productivity and ensure more accurate records.

Choosing the right billing format involves evaluating your business’s specific needs, considering the level of detail required, and ensuring that the structure is flexible and easy to modify as your operations grow.

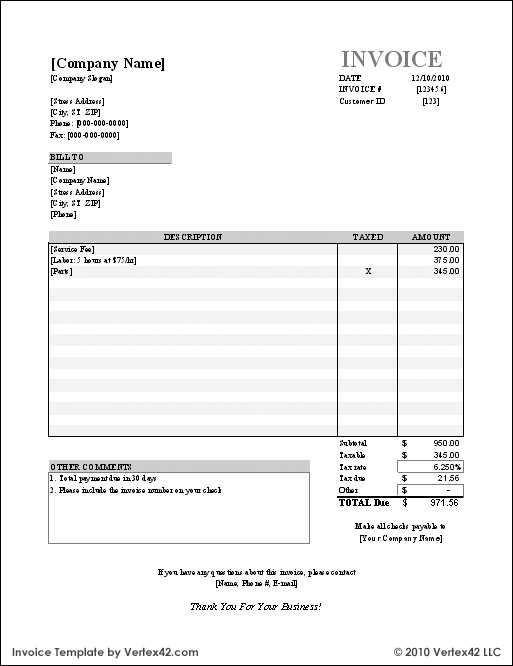

Free vs Premium Invoice Templates XLS

When selecting a structure for creating financial documents, businesses have the option to choose between free and premium options. Both types offer their own set of advantages, depending on the specific needs of your business. While free formats can provide basic functionality, premium versions often come with additional features that can enhance both the appearance and efficiency of your billing process.

Advantages of Free Options

Free billing formats are a great starting point for small businesses or freelancers who are just beginning and want to minimize costs. These formats typically include the essential fields needed for a basic billing document, such as client information, itemized lists, and totals. The key benefit of free options is that they are accessible and easy to find, requiring no financial investment upfront. For businesses with minimal invoicing needs or a limited budget, a free option can be perfectly adequate.

Benefits of Premium Formats

On the other hand, premium formats offer more advanced features and greater customization. These options often come with professional designs that are better suited for branding purposes, as well as additional functionalities like automatic tax calculations, multi-currency support, and more complex reporting tools. For businesses that deal with larger volumes of transactions or need highly tailored documents, premium versions provide a higher level of efficiency and professionalism. Customizable fields and the ability to integrate with other business systems are often key reasons why businesses opt for paid solutions.

Ultimately, the decision between free and premium structures depends on your business size, invoicing volume, and specific requirements. While free formats may suffice for small operations, growing businesses may benefit from the additional features and flexibility offered by premium options.

How to Edit an Invoice in Excel

Editing a billing document in Excel is a simple process that allows you to adjust and update details quickly. Whether you need to modify the quantities, add new items, or change the payment terms, Excel provides an intuitive interface for making changes without any complex software requirements. Here’s a step-by-step guide on how to edit your billing document.

Step-by-Step Editing Process

Follow these steps to make edits to your financial document in Excel:

- Open the File: Start by opening the document you want to modify. You can either open a saved file from your computer or a cloud-based system where the document is stored.

- Navigate to the Section You Want to Edit: In the spreadsheet, locate the area that needs editing. Common sections include client information, product details, or payment terms. For example, if you need to update a product or service list, find the section containing the relevant items.

- Make Changes in the Cells: Simply click on the cell you wish to edit and type in the updated information. For example, you can change the quantity or price, update the description, or modify the due date.

- Update Calculations: If your document includes automatic calculations for totals, taxes, or discounts, make sure to check if these are updating correctly. Excel uses formulas like SUM or PRODUCT, so if you change any numbers, these formulas will automatically adjust the final amounts.

- Adjust Formatting: You can also change the format of the text or cells. For example, if you want to highlight a certain field, you can change the cell’s background color or adjust the font size to make it more prominent.

Editing the Itemized List

If you need to modify the list of services or products, you can easily do so in the table. Here’s an example of how a typical itemized list looks:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Services | 1 | $500 | $500 |

| SEO Optimization | 1 | $200 | $200 |

To edit any line, simply update the fields under each column, and the total amounts will adjust automatically if the formulas are correctly applied.

After completing the necessary edits, don’t forget to save the file. You can save it in its original format or export it as a PDF for easy sharing with clients.

Common Mistakes in Invoice Creation

Creating accurate billing documents is essential for maintaining professional relationships and ensuring timely payments. However, there are several common errors that can occur during the process, leading to confusion, delays, or disputes. These mistakes often arise from overlooked details or improper formatting, but they can be easily avoided with attention to detail and good practices.

1. Missing or Incorrect Client Information

One of the most frequent mistakes is not including the correct client details, such as name, address, or contact information. Omitting this information or entering it incorrectly can lead to issues with delivery and confusion regarding who is responsible for the payment. Always double-check client data before finalizing your document to avoid miscommunication and ensure timely processing.

2. Incorrect Calculations or Totals

Another common mistake is failing to accurately calculate totals, taxes, or discounts. Even though spreadsheets often include built-in formulas, manual errors can still occur if the formulas are not applied correctly or if values are changed without updating the calculations. Always verify that all fields, such as unit prices, quantities, and totals, are correctly reflected before sending out your document. Double-checking your math can save you from costly errors and disputes.

3. Lack of Clear Payment Terms

Clear payment instructions are essential to avoid confusion over when and how payments are due. A common mistake is not specifying payment terms, such as the due date, accepted payment methods, or any penalties for late payments. Make sure these details are clearly stated, so both parties are on the same page and there are no misunderstandings about deadlines or payment procedures.

By avoiding these common mistakes and following best practices, you can ensure that your financial documents are clear, accurate, and professional, minimizing the chances of delays or disputes with clients.

How to Automate Invoice Generation in Excel

Automating the creation of billing documents in Excel can save you valuable time and reduce the risk of errors. By setting up formulas and using Excel’s built-in features, you can streamline the process and ensure consistency across all your financial records. Automation allows you to quickly generate professional documents with minimal manual input, freeing up time to focus on other aspects of your business.

Step-by-Step Process to Automate

To automate the generation of your financial documents, follow these simple steps:

- Set Up a Master Template: Start by creating a master document that includes all the necessary fields for your billing statements, such as client details, product descriptions, prices, taxes, and payment terms. Make sure that the fields you want to automate (e.g., totals, taxes) are clearly defined.

- Use Formulas for Calculations: Excel’s SUM, PRODUCT, and other built-in functions can automate calculations for totals, taxes, and discounts. For example, use the SUM function to add up the prices of multiple items, or the PRODUCT function to multiply quantities by unit prices.

- Create Drop-Down Menus: To speed up data entry, you can set up drop-down lists for fields like payment methods or client names using the “Data Validation” feature. This ensures consistency and reduces manual typing errors.

- Automate Date and Numbering: Use Excel’s “TODAY” function to automatically insert the current date, and set up an automatic numbering system for your documents using a simple formula or by linking to another sheet that tracks invoice numbers.

Generating New Documents with a Click

Once your master document is set up with all the necessary formulas and fields, you can quickly generate a new document for each client or transaction. Simply input the required data into the predefined fields, and Excel will automatically update the totals, apply any taxes, and generate a completed statement.

This automated approach allows you to create accurate and consistent billing documents with minimal effort. By utilizing Excel’s powerful features, you can save time and focus on growing your business while maintaining reliable and professional records.

Design Tips for Professional Invoices

Creating visually appealing and well-organized billing documents is essential for maintaining a professional image and ensuring that all necessary information is clearly communicated. A well-designed document not only looks good but also enhances readability and reduces confusion for clients. Here are some practical design tips to help you create professional, easy-to-read financial records.

1.

Best Practices for Invoice Data Management

Effective management of billing data is essential for maintaining accurate financial records and ensuring smooth operations. Proper handling of this information helps businesses track payments, reduce errors, and streamline administrative processes. By following best practices for organizing, storing, and processing financial records, you can ensure consistency, accuracy, and security in your financial management system.

1. Maintain Consistent Naming Conventions

Establishing a consistent naming convention for your billing records is key to keeping everything organized. This should include a clear and systematic way to name each document and file. For example, consider using a format that includes the client’s name, invoice number, and date:

- ClientName_InvoiceNumber_Date.xlsx

This helps in quickly identifying and retrieving the necessary documents, especially as your business grows and the volume of transactions increases.

2. Organize Data in Separate Folders

To avoid confusion and keep your financial records tidy, organize your documents into specific folders based on categories. These categories might include:

- By Client: Organize documents by client name or ID for easy retrieval.

- By Date: Create folders for different periods (e.g., monthly, quarterly, yearly) to track your financial records chronologically.

- By Payment Status: Consider grouping documents based on their payment status (e.g., paid, pending, overdue) to track outstanding amounts.

This structure ensures that you can access any record you need in just a few clicks, saving time and reducing errors when searching for specific documents.

3. Implement a Digital Filing System

In today’s digital world, storing documents on physical paper is both time-consuming and inefficient. Transition to a digital filing system to improve accessibility and security. Using cloud storage solutions or document management systems can help you:

- Access files from anywhere: Cloud storage allows you to access your billing documents from any device with an internet connection.

- Prevent data loss: Regular backups ensure that you won’t lose important financial records due to system failures or accidental deletion.

- Improve security: Use password protection and encryption to safeguard sensitive financial information.

4. Automate Data Entry and Calculations

Automating data entry and calculations can significantly reduce the chances of human error. Set up formulas and use tools like drop-down menus in your documents to automatically calculate totals, taxes, and discounts. This can save time and ensure that all data is accurate, especially when dealing with large volumes of transactions.

Additionally, automating the invoicing process allows you to quickly generate and send documents, improving efficiency and reducing the time spent on administrative tasks.

5. Regularly Review and Update Your Records

Regularly reviewing and updating your billing data is crucial to maintaining accurate records. Ensure that payments are properly recorded, and resolve any discrepancies as soon as they arise. This includes verifying:

- Payment status: Ensure that all paid invoices are marked accordingly to avoid confusion.

- Client details: Keep client information up-to-date to ensure that all records are current and correct.

- Legal and tax changes: Be aware of any changes to tax rates or regulations that may impact your billing structure.

By following these practices, you can create a more organized and efficient system for managing billing information, which will lead to smoother operations and better financial co

Tracking Payments with XLS Invoice Templates

Effectively monitoring payment statuses is crucial for managing cash flow and maintaining healthy client relationships. Using a spreadsheet-based system for tracking payments provides an organized and accessible way to record and update payment statuses, ensuring that all transactions are properly documented. By creating an efficient system for tracking payments, you can stay on top of overdue balances and reduce the risk of missed payments.

Setting Up a Payment Tracking System

To set up a payment tracking system in your financial documents, you can incorporate a column specifically for recording the payment status. This column allows you to easily track whether a payment has been made, partially paid, or is still pending. A typical layout for this system might look like the following:

| Client Name | Invoice Number | Amount Due | Amount Paid | Balance | Payment Status | Due Date |

|---|---|---|---|---|---|---|

| ABC Company | #001 | $500 | $500 | $0 | Paid | 2024-11-01 |

| XYZ Services | #002 | $1,200 | $600 | $600 | Partially Paid | 2024-11-05 |

| LMN Enterprises | #003 | $350 | $0 | $350 | Unpaid | 2024-11-10 |

Automating Payment Calculations

To make the process even more efficient, you can automate the payment tracking by using formulas. For example, in the “Balance” column, you can set up a formula that subtracts the amount paid from the amount due. This way, whenever a payment is recorded, the balance will update automatically. You can also create conditional formatting rules that highlight overdue payments in red, making it easy to identify outstanding balances at a glance.

By implementing a simple and effective system for tracking payments, you can ensure that your financial documents remain up-to-date and accurate, helping you avoid any confusion and ensuring timely follow-ups with clients regarding overdue payments.

Integrating Invoices with Accounting Software

Integrating billing documents with accounting software can significantly streamline your financial processes. By syncing data between your invoicing system and accounting tools, you can automate many of the manual tasks associated with tracking payments, calculating taxes, and managing cash flow. This integration not only improves efficiency but also reduces the risk of errors and ensures that all financial records are up-to-date and consistent across platforms.

Benefits of Integration

There are several key benefits to integrating your billing documents with accounting software:

- Time Savings: By automating the transfer of data from your billing system to your accounting platform, you eliminate the need for manual data entry, which can save a significant amount of time each day.

- Accuracy: Automated synchronization ensures that all financial data is accurate and reduces the chances of human error. This leads to more reliable records and fewer discrepancies.

- Better Financial Insights: Integration allows for real-time updates on the financial status of your business, making it easier to monitor cash flow, identify trends, and make informed decisions.

- Improved Compliance: With accurate and consistent data, you’ll be better prepared for audits and regulatory compliance, as your financial records are aligned across both systems.

How to Integrate Invoices with Accounting Software

There are a few methods you can use to integrate your billing documents with accounting software:

- Use Built-in Integration Features: Many modern accounting software solutions offer built-in features to import billing data directly from your spreadsheets. For example, platforms like QuickBooks and Xero allow you to upload financial documents in a format that can be easily integrated with their system.

- Use Third-Party Integration Tools: If your invoicing system doesn’t offer native integration, you can use third-party tools like Zapier to connect your billing documents to accounting software. These tools can automate the data transfer between systems without the need for coding.

- Custom API Solutions: For more complex needs, custom API integrations can be developed to sync your invoicing system with accounting software. This requires more technical expertise but provides a high level of customization for unique business processes.

By integrating your billing system with accounting software, you can save time, increase accuracy, and ensure a seamless flow of financial data across your business operations. This integration not only simplifies daily tasks but also enhances your overall financial management and decision-making process.

How to Share Invoices Created in Excel

Sharing billing documents created in spreadsheet software is a simple yet crucial task for businesses to manage payments and maintain communication with clients. Whether you are sending documents for approval, requesting payment, or simply keeping clients informed, it is important to choose the right method to ensure that your documents are easily accessible and securely shared. Fortunately, there are several ways to share Excel-based documents with clients and colleagues efficiently.

Emailing the Document

One of the most common methods for sharing documents is through email. By attaching your file to an email, you can send it directly to the intended recipient. To ensure clarity and professionalism, you should:

- Rename the file: Give the document a clear and informative name, such as “ClientName_Invoice_001.xlsx” to avoid confusion and make it easy for the recipient to locate.

- Check for file size: Before sending, make sure the file size is within the limits of your email provider. If it’s too large, consider compressing the file or using cloud storage links.

- Provide context: In the email body, briefly explain the document and any required actions, such as payment due dates or additional instructions.

Using Cloud Storage and File Sharing Services

If you need to share multiple documents or require collaboration features, using cloud storage services such as Google Drive, Dropbox, or OneDrive can be a great option. By uploading your spreadsheet to one of these platforms, you can generate a shareable link that allows others to access the document. Key benefits include:

- Access from any device: Cloud platforms enable clients or team members to access the document from any device with internet access, ensuring convenience and flexibility.

- Collaboration: Some platforms allow real-time collaboration, which can be useful for making updates or comments directly within the document.

- Enhanced security: You can set permissions to restrict who can view or edit the document, adding an extra layer of protection to sensitive data.

Sharing billing documents through email or cloud storage ensures your clients and colleagues have the information they need in a timely and secure manner. By choosing the best sharing method, you can streamline your workflow and enhance communication while maintaining a professional approach.