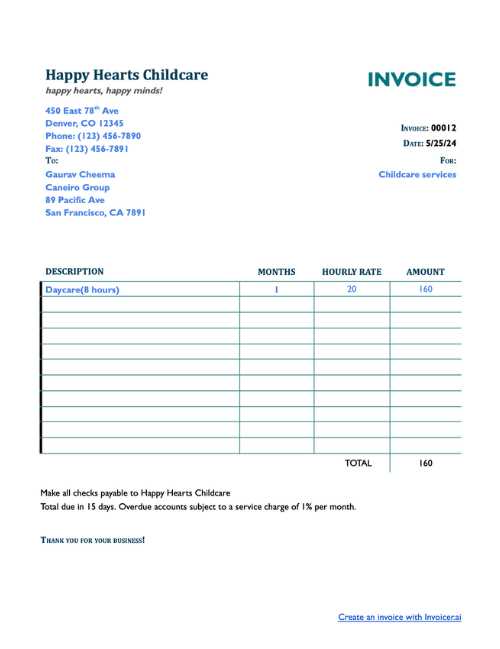

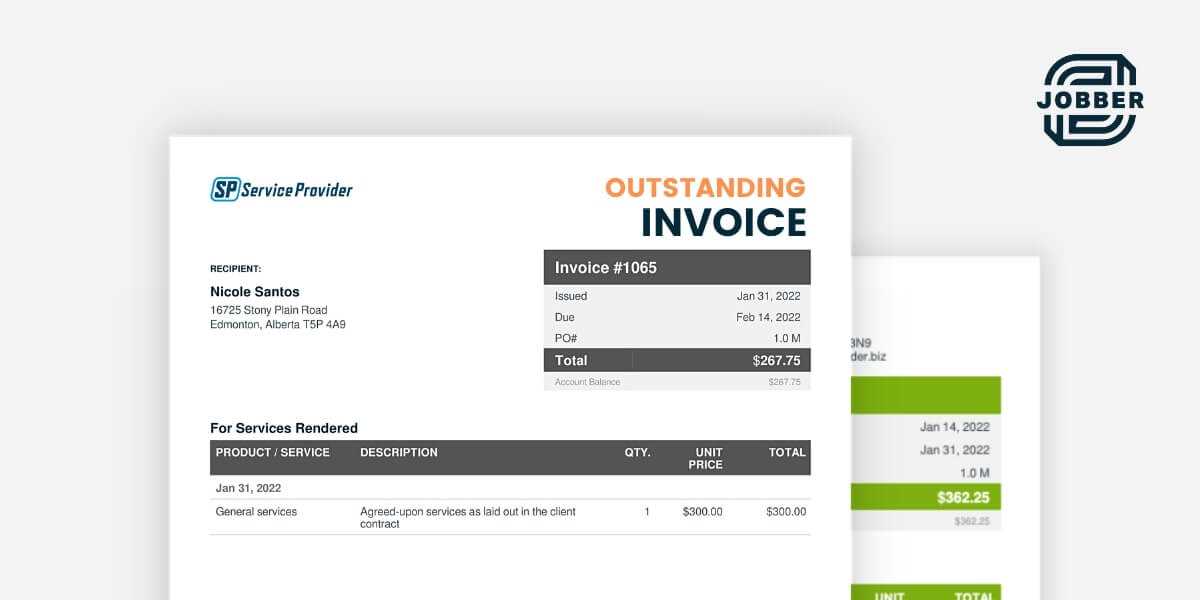

Outstanding Balance Invoice Template for Efficient Payment Management

Keeping track of unpaid amounts in business transactions can be a challenge. For many companies, ensuring that clients settle their debts on time is a crucial part of maintaining cash flow. Using a well-structured document to outline the owed amount, payment terms, and deadlines can help streamline this process and reduce misunderstandings. A properly formatted payment reminder document is not only practical but also reflects professionalism in dealings with clients.

Incorporating clear and concise details in such documents can significantly improve the chances of receiving timely payments. When designed correctly, these forms are easy for clients to understand and act upon. Customizing these forms to fit specific needs can be a game changer in managing accounts receivable and maintaining healthy business operations.

Understanding Unpaid Payment Documents

Managing unpaid payments is an essential aspect of maintaining smooth operations in any business. A well-crafted document that outlines the amounts owed and terms of payment can serve as a helpful reminder for clients. These documents are designed to provide clarity, ensuring both parties are on the same page regarding the financial obligations. Their primary function is to prompt timely settlements while maintaining a professional tone in all interactions.

There are several key components that should be included in any such document to make it effective:

- Amount Due: Clearly state the total amount that is to be paid.

- Payment Terms: Outline any relevant payment conditions, including due dates and acceptable methods of payment.

- Due Date: Specify when the payment is expected to be received.

- Contact Information: Provide details on how clients can reach out for any inquiries or clarifications.

- Late Fees: Mention any penalties for delayed payments, if applicable.

These documents are not just reminders but also tools to foster better relationships with clients by ensuring transparency and reducing confusion. With all the necessary details in one place, clients are more likely to honor their payment commitments and settle outstanding debts promptly.

Why Use an Invoice Form?

Using a standardized document for tracking payments provides numerous advantages for businesses. It ensures that all necessary details are included, reducing the likelihood of errors or omissions. A consistent structure also enhances professionalism, making it easier for clients to understand the terms of their financial obligations. By relying on a pre-designed form, businesses can save time and streamline their accounting processes.

Consistency and Accuracy

Having a ready-made structure allows for uniformity across all transactions. This consistency minimizes the chance of missing important information, such as due dates, payment amounts, and contact details. When the same format is used for every transaction, both the business and client know exactly what to expect, leading to fewer misunderstandings.

Time-Saving Efficiency

Creating payment reminders from scratch for each transaction can be time-consuming. By using a pre-formatted document, businesses can quickly input the necessary details and send them to clients without having to worry about formatting or content structure. This efficiency allows business owners to focus on other essential tasks while ensuring that payments are tracked effectively.

Key Features of a Payment Reminder Document

When creating a document to request payment, it’s essential to include certain key elements to ensure clarity and effectiveness. These features help both the business and the client understand the amount due, the terms of payment, and the expectations moving forward. A well-constructed reminder is not just a tool for tracking funds; it’s a professional way to maintain transparency and encourage timely payments.

Here are some of the most important elements to include:

- Clear Payment Amount: The document should clearly state the total amount that is owed, ensuring there is no ambiguity about what needs to be paid.

- Detailed Payment Instructions: Include specifics on how payments should be made, such as accepted payment methods and bank details.

- Due Date: Clearly list the date by which the payment is expected, to avoid any confusion about deadlines.

- Contact Information: Provide details on how clients can reach out for any questions or concerns regarding the payment.

- Late Fee Clause: If applicable, state any penalties or interest charges for late payments, encouraging timely settlements.

Including these features in your payment reminder documents not only improves communication but also ensures that clients are aware of their responsibilities. It sets a professional tone while providing all necessary information in one straightforward document.

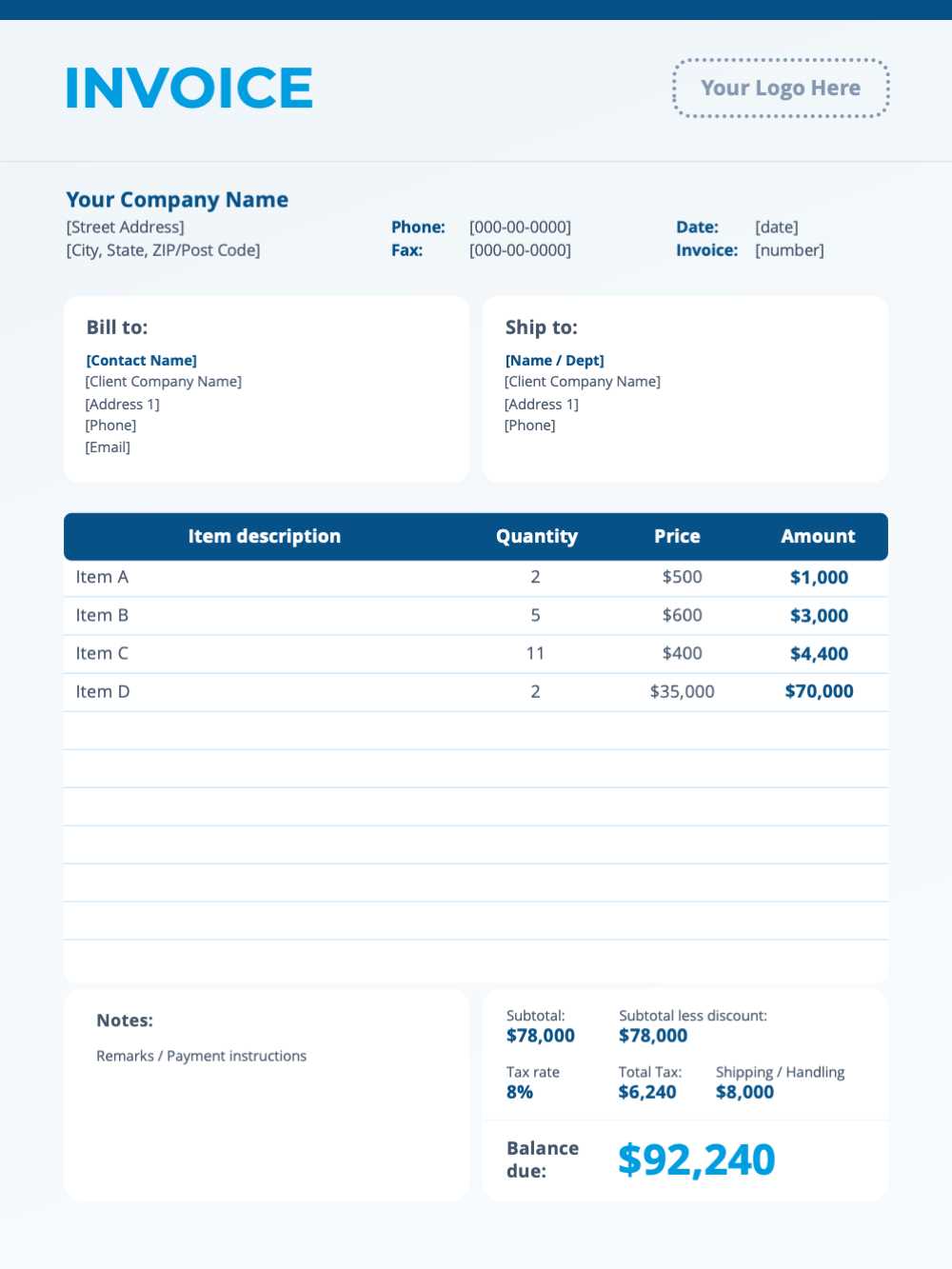

How to Customize Your Payment Request Document

Customizing a document used to request payments is an essential step in tailoring it to your business needs. A well-designed, personalized document not only reflects your brand but also ensures that the necessary details are easy to read and understand. By adjusting the content and layout, you can create a professional tool that meets your specific requirements while maintaining clarity and consistency in communication.

Here are some key areas to focus on when customizing your payment reminder document:

- Branding: Add your company logo, business name, and contact details at the top to make the document easily recognizable and professional.

- Payment Terms: Customize the payment conditions based on your business model, whether it’s due immediately, within 30 days, or with installment options.

- Client Information: Include fields for client-specific details such as their name, address, and unique reference numbers for easier tracking.

- Additional Notes: Add a section for any special instructions, discounts, or custom messages that might be relevant to the transaction.

- Payment Methods: Clearly outline the payment methods you accept, such as bank transfers, credit cards, or online payment platforms.

By adjusting these aspects, you can create a document that is both functional and aligned with your business’s needs, helping to encourage prompt payments while reflecting your company’s professionalism.

Benefits of Clear Payment Terms

Establishing clear payment terms is crucial for smooth financial transactions between a business and its clients. When the conditions for payment are outlined in a straightforward and unambiguous manner, it minimizes confusion and helps ensure that payments are made on time. Transparent terms not only benefit the business but also create trust and understanding with clients, leading to better long-term relationships.

Here are some key benefits of having clearly defined payment conditions:

| Benefit | Description |

|---|---|

| Fewer Disputes | Clear terms reduce the chances of misunderstandings regarding when and how payments should be made, leading to fewer disputes. |

| Timely Payments | When clients understand the deadlines and methods for payment, they are more likely to pay on time, improving cash flow for the business. |

| Improved Relationships | Transparent communication builds trust and encourages a positive working relationship, making future transactions smoother. |

| Reduced Late Fees | Clear penalties for late payments help clients take deadlines seriously, reducing the need to enforce additional fees or charges. |

| Professional Image | Well-defined terms convey professionalism, showing clients that the business is organized and serious about its financial operations. |

By ensuring that payment terms are clearly communicated, businesses can prevent many common issues related to delayed or misunderstood payments, while also maintaining a professional image and fostering positive client interactions.

Setting Payment Due Dates Effectively

Establishing clear and reasonable due dates is a key component of any successful payment system. When deadlines are well-defined and communicated, it encourages clients to prioritize and complete their payments on time. Setting appropriate due dates also helps businesses plan their finances more effectively and maintain steady cash flow.

Considerations for Determining Due Dates

Several factors should be taken into account when deciding on a payment deadline. These include the nature of the service or product provided, the payment terms agreed upon, and the client’s payment history. By adjusting the due date to suit both the business and the client, you create a balanced approach that fosters timely payments while maintaining flexibility.

Strategies for Setting Clear Deadlines

Effective strategies for setting due dates involve being realistic about payment expectations and clearly communicating them upfront. Offering options such as early payment discounts or clear penalties for late payments can also motivate clients to settle their obligations promptly.

| Strategy | Benefit |

|---|---|

| Set Realistic Deadlines | Providing sufficient time for clients to make payments while avoiding unnecessarily long periods encourages timely action. |

| Offer Early Payment Discounts | Incentivizing early payments can encourage clients to settle their debts ahead of schedule, benefiting both parties. |

| Include Late Payment Penalties | Establishing clear penalties for late payments motivates clients to avoid delays and pay on time. |

| Communicate Due Dates Clearly | Ensure that due dates are prominently displayed on payment reminders, so clients know exactly when payments are expected. |

By setting clear and effective due dates, businesses not only encourage timely payments but also establish trust and professionalism with clients, leading to smoother financial operations.

Common Mistakes to Avoid in Payment Documents

When creating documents to request payment, it’s important to avoid certain mistakes that can lead to confusion, delays, or even disputes. A well-constructed document not only ensures timely payments but also reflects professionalism and trustworthiness. Simple errors, whether related to format, details, or communication, can create unnecessary problems for both the business and the client.

Common Mistakes to Watch Out For

Even minor mistakes in the content of a payment reminder can have significant consequences. Here are some of the most common errors that businesses should avoid:

- Incomplete Client Information: Failing to include accurate client details, such as their address or contact information, can lead to confusion or difficulty in communication.

- Missing Payment Terms: Omitting important details such as the payment deadline, late fees, or accepted payment methods can create misunderstandings and delays.

- Ambiguous Descriptions: Providing vague or unclear descriptions of the product or service being charged can lead to disputes over the amount owed.

- Incorrect Amounts: Errors in calculating the total amount due can lead to frustration and mistrust, especially if clients feel they are being charged incorrectly.

- Failure to Follow Up: Not following up with clients who miss a payment deadline can result in delayed settlements, reducing cash flow and increasing administrative work.

How to Avoid These Mistakes

To prevent these errors, double-check all details before sending out any documents. Use a consistent format to ensure that all necessary information is included and easy to read. Clear communication, accuracy, and timely follow-ups are essential to maintaining a smooth and efficient payment process.

Choosing the Right Document for Your Business

Selecting the right document format for requesting payments is crucial for ensuring clarity, professionalism, and efficiency in your transactions. The right design can simplify the payment process for both you and your clients, while also reflecting your company’s brand and values. A document that is easy to understand and tailored to your business needs will help maintain positive client relationships and improve cash flow.

Factors to Consider When Selecting a Payment Document

There are several important factors to consider when choosing the right form for your business. These factors will help ensure that the document is functional, clear, and aligned with your company’s goals:

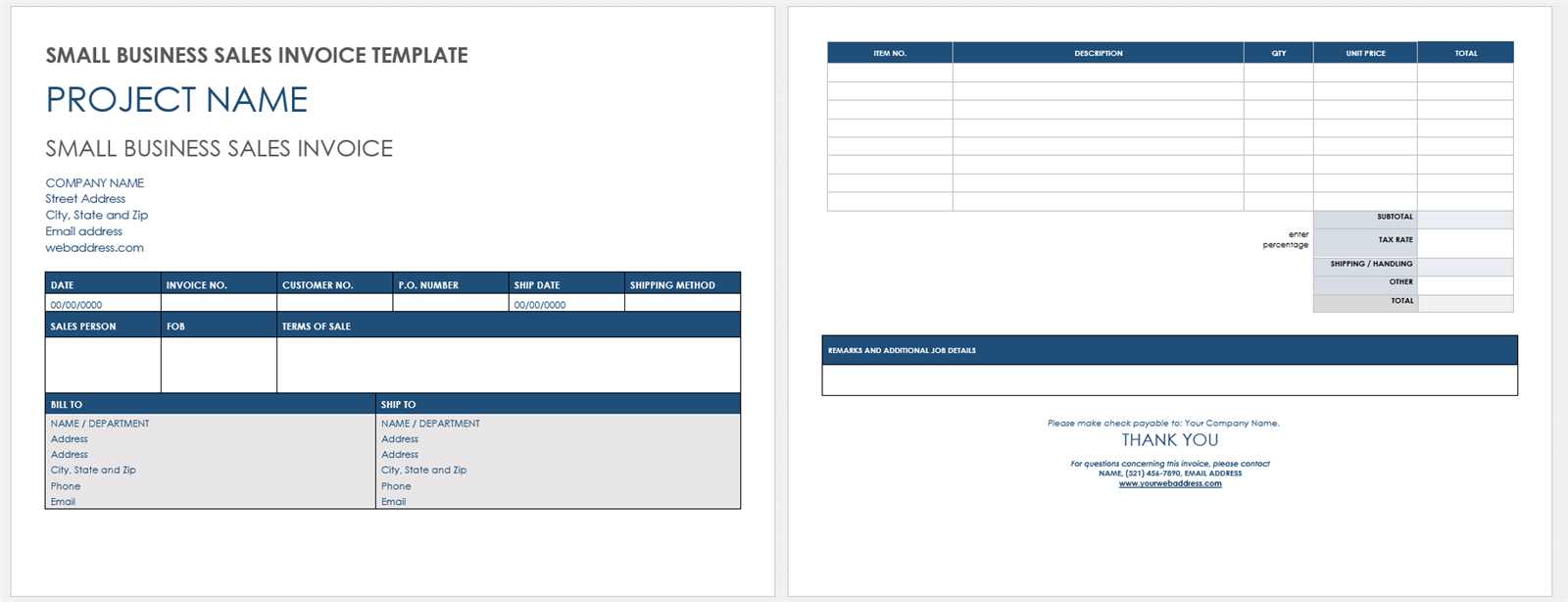

- Business Type: Different industries may require different formats. For example, service-based businesses might need more detailed descriptions of work performed, while product-based businesses can focus on itemized costs.

- Branding Needs: Ensure the document reflects your business’s branding by incorporating your logo, business name, and consistent colors and fonts.

- Payment Terms: Choose a format that accommodates your specific payment terms, whether it’s for immediate payments, installment plans, or future due dates.

- Client Preferences: Consider the preferences of your target audience. Some clients may prefer a more formal, detailed document, while others may appreciate simplicity.

- Legal Requirements: Make sure the document includes all legally required information, such as tax identification numbers, in accordance with local regulations.

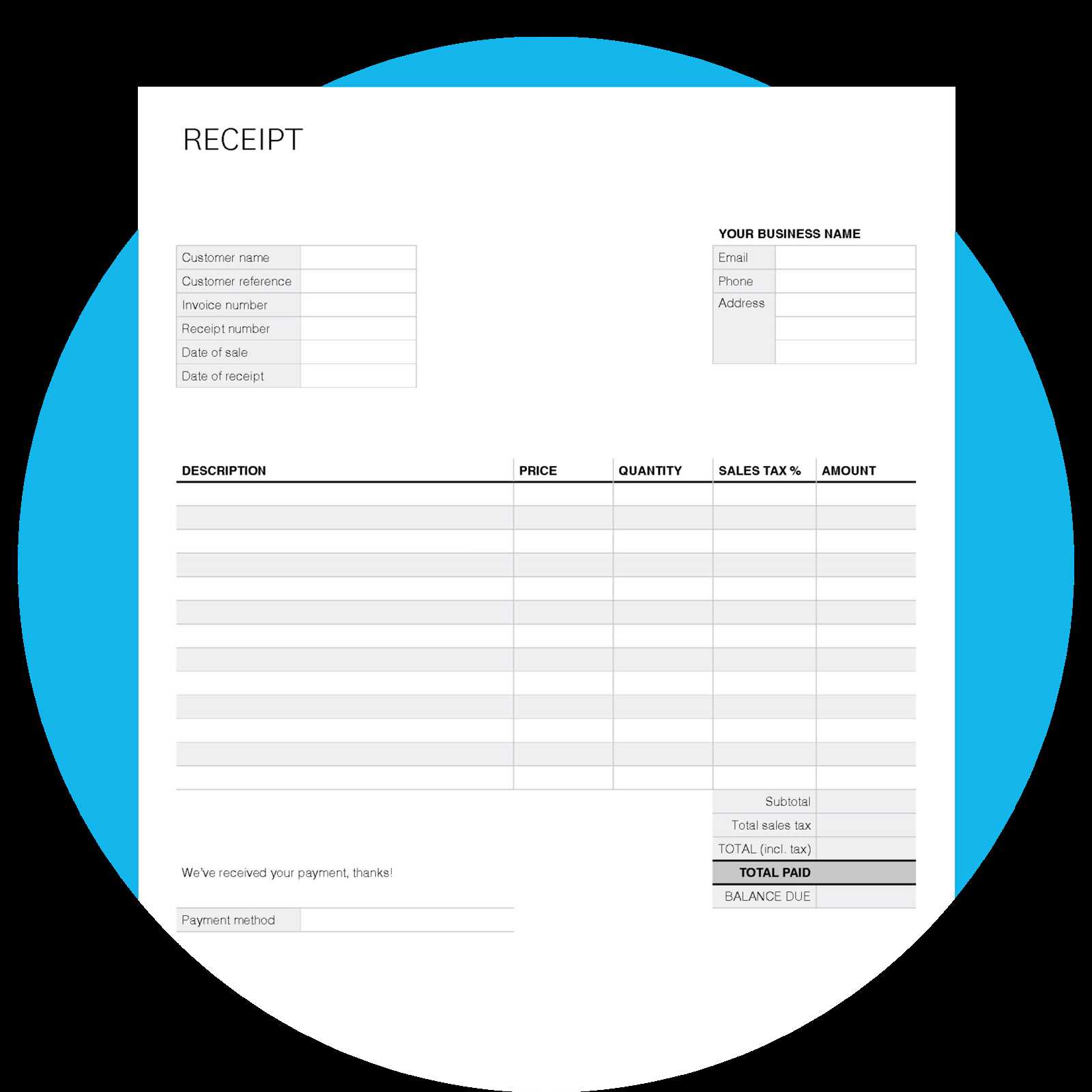

Choosing the Right Document for Different Purposes

Not all payment documents are created equal, and depending on the specific nature of the transaction, different formats might be more appropriate:

- Simple Payment Reminders: Use a straightforward design for clients who have a single payment due or who are new to working with you.

- Recurring Payments: If your business offers subscription services or regular invoicing, consider a recurring payment document format with clear installment options.

- Detailed Itemized Requests: For businesses that deal with multiple products or services, an itemized list with unit prices, quantities, and totals helps avoid confusion.

By selecting the appropriate document for your business type, payment terms, and client needs, you create a streamlined process that benefits both parties and encourages prompt payments.

How to Send Payment Requests Professionally

Sending a payment request professionally is essential for maintaining a positive business relationship and ensuring that payments are processed smoothly. The way you present your request can reflect the professionalism of your company and set the tone for the transaction. By following best practices, you can encourage timely payments while maintaining a positive image with your clients.

Steps to Sending a Payment Request Professionally

There are several key steps to take when sending payment requests to ensure that they are both professional and effective:

- Use Clear and Concise Language: Ensure that the language used in the document is easy to understand and free from jargon. The request should clearly state the amount due, due date, and payment methods accepted.

- Send the Request Timely: Always send your request well in advance of the payment due date. Sending it promptly gives clients enough time to process the payment and avoids unnecessary delays.

- Double-Check for Accuracy: Before sending any document, verify that all details, including the payment amount, client information, and due dates, are accurate. Mistakes can lead to confusion and delays.

- Choose the Right Medium: Whether you send it by email, postal mail, or through an online payment system, ensure the method is convenient for the client and that the document is professionally formatted.

- Attach Supporting Documents: If necessary, attach any relevant documentation (e.g., purchase orders, contracts, or receipts) to provide clarity and justify the payment amount.

Additional Tips for a Professional Approach

In addition to following these steps, here are a few extra tips to enhance your professional approach:

- Personalize Your Message: Always address the client by name and reference the specific goods or services provided. A personalized note adds a professional touch and helps build rapport.

- Maintain a Polite Tone: Even if payments are late, keep your language polite and courteous. Avoid sounding demanding or aggressive.

- Follow Up Respectfully: If the payment isn’t received by the due date, send a gentle reminder. Keep follow-ups professional and non-confrontational.

By sending well-crafted payment requests, businesses can foster better client relationships while ensuring their cash flow remains steady and efficient.

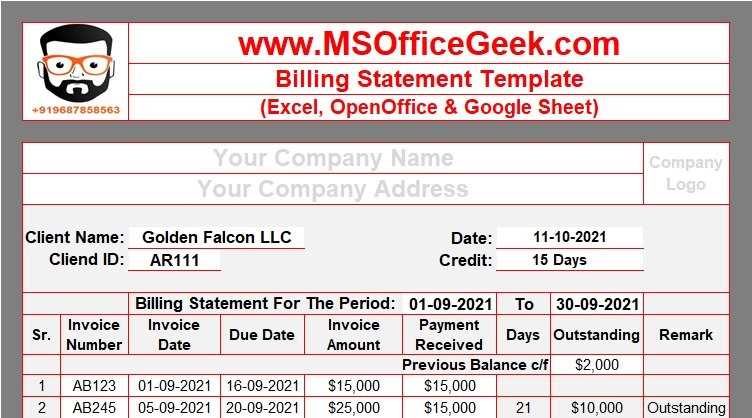

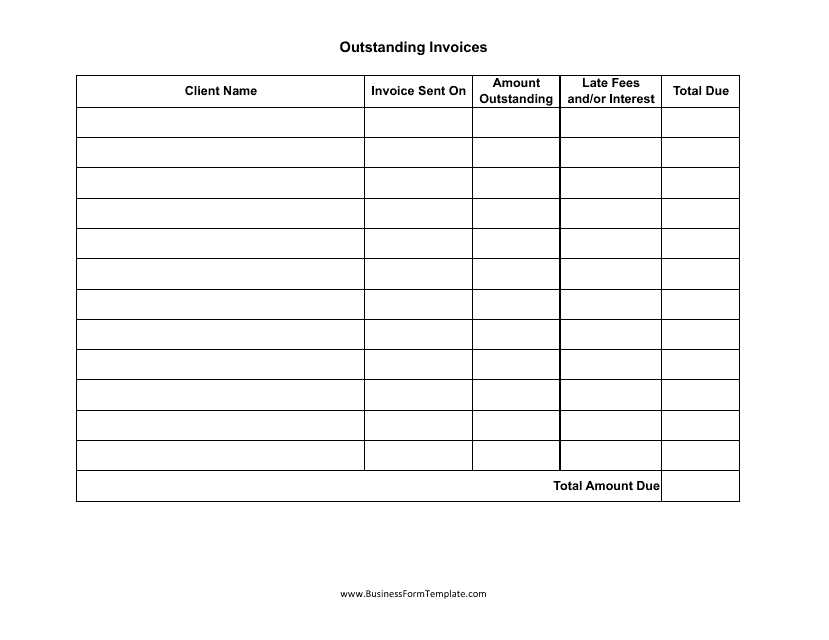

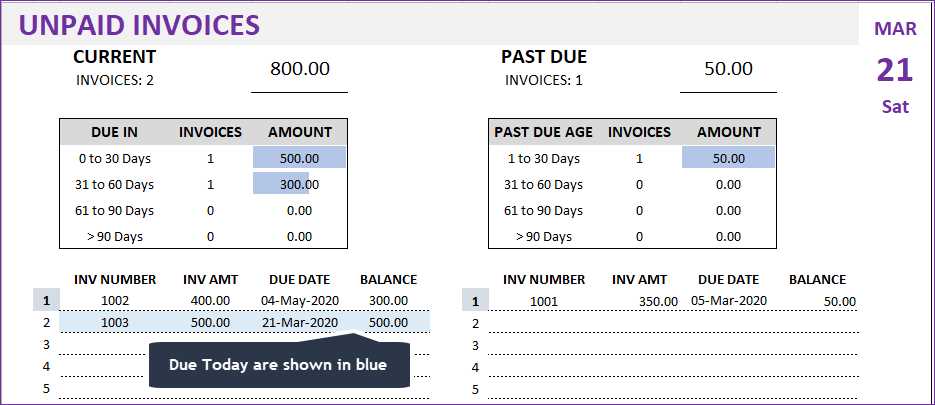

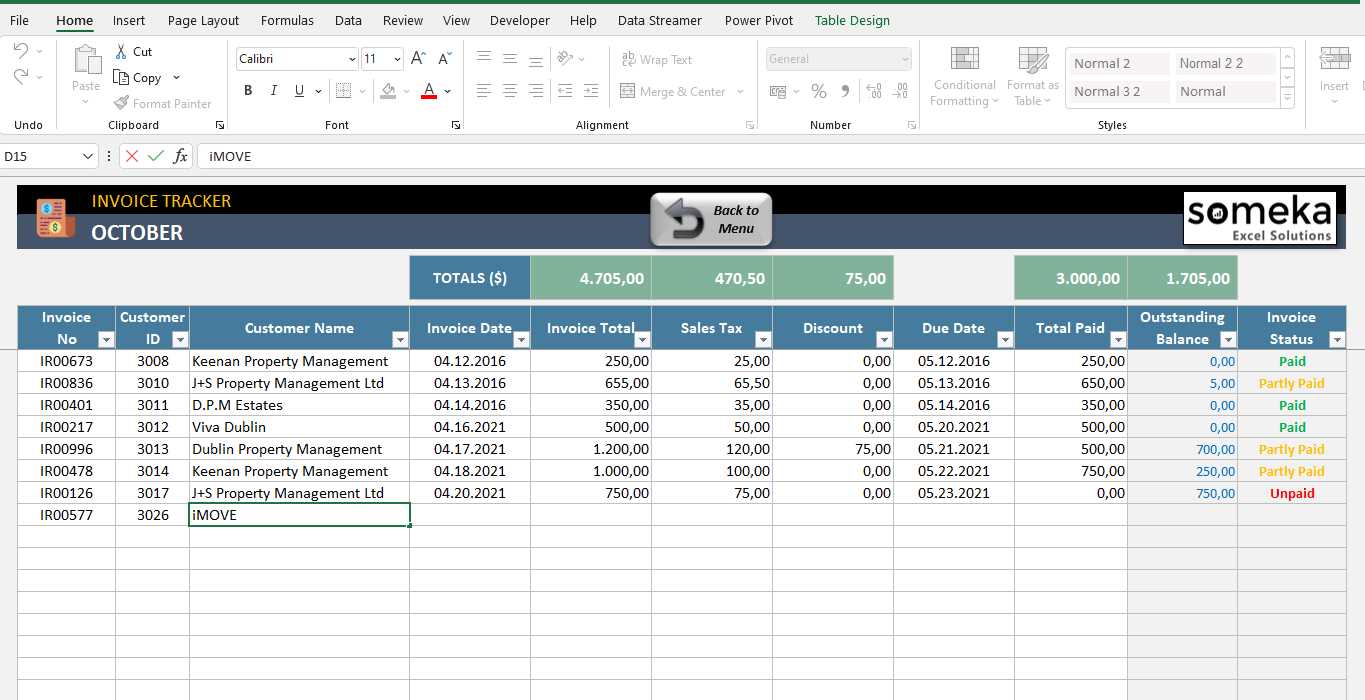

Tracking Unpaid Amounts Accurately

Effectively tracking unpaid amounts is essential for maintaining financial stability in any business. Without proper tracking, overdue payments can slip through the cracks, negatively impacting cash flow and increasing administrative overhead. By keeping accurate records and using the right tools, businesses can stay on top of what is owed, minimize the risk of missed payments, and ensure timely follow-up actions when needed.

To manage unpaid amounts efficiently, consider implementing the following practices:

- Use Accounting Software: Modern accounting tools allow businesses to track outstanding debts automatically, generating reports and reminders when payments are due. These systems can integrate with other business functions, making the entire process streamlined and organized.

- Maintain Detailed Records: Keep comprehensive records of each transaction, including client names, payment amounts, dates, and payment terms. This will help you quickly identify overdue accounts and make accurate follow-ups.

- Set Up Payment Reminders: Automate reminders for upcoming or overdue payments. Sending gentle reminders to clients before the due date, and following up once the payment is late, helps to ensure that payments are received on time.

- Monitor Payment Status Regularly: Regularly review your accounts to ensure no payments have been missed or overlooked. This helps to stay on top of all debts and address issues before they become larger problems.

By adopting these strategies, you can ensure that your business has a clear view of unpaid amounts and can take appropriate action to resolve them quickly. Accurate tracking leads to better cash flow management, reduces the chance of disputes, and fosters strong financial health.

Improving Cash Flow with Payment Request Documents

Efficient cash flow management is crucial for the sustainability and growth of any business. One key way to improve cash flow is by ensuring that payment requests are clear, professional, and timely. Using a well-structured payment document allows businesses to communicate expectations effectively and reduces the time spent chasing late payments. By streamlining the payment process, businesses can receive payments faster and maintain a healthy cash flow.

How Payment Documents Contribute to Cash Flow

When payment requests are clear and well-designed, it not only helps clients understand the amount due and when it should be paid but also reduces confusion and delays. Well-crafted documents can encourage quicker payments and make the process smoother for both businesses and their clients. Here are a few ways payment documents can impact cash flow:

| Benefit | Impact on Cash Flow |

|---|---|

| Clarity of Payment Terms | Clear payment terms help clients understand exactly when and how to pay, reducing the chances of delayed payments. |

| Professional Appearance | A polished, well-designed document enhances credibility and encourages prompt action from clients. |

| Automated Reminders | Automating payment reminders reduces the administrative burden and ensures that no payment is overlooked, speeding up the process. |

| Accurate Payment Tracking | Using a consistent format helps track which payments have been made, which are pending, and which are overdue, allowing businesses to follow up quickly. |

Best Practices for Streamlining Cash Flow

To take full advantage of payment documents for improving cash flow, businesses should follow these best practices:

- Send Requests Promptly: Always send payment requests immediately after delivering the product or service, or as per your agreed-upon schedule.

- Include Payment Methods: Make it easy for clients by listing multiple payment options (credit card, bank transfer, online payment systems, etc.).

- Offer Incentives for Early Payment: Consider offering discounts or other incentives for clients who pay before the due date, encouraging faster payments.

- Follow Up Regularly: Send polite reminders before and after the due date to ensure payments are received on time.

By implementing these strategies, businesses can use well-crafted payment documents not only to streamline operations but also to enhance cash flow, ensuring a more predictable and healthier financial future.

Legal Considerations for Payment Request Design

When creating payment request documents, it’s important to be aware of the legal requirements that govern their structure and content. A properly designed document ensures compliance with local laws and protects both the business and the client. Legal considerations can help prevent disputes and ensure that the payment process is both fair and transparent for all parties involved.

Here are several key legal factors to keep in mind when designing payment request documents:

- Accurate Business Information: Always include your business’s legal name, address, and contact information. This ensures transparency and allows clients to reach you if needed. In some regions, businesses are also required to include tax identification numbers or company registration details.

- Clear Payment Terms: Clearly outline the payment terms, including the due date, late fees (if applicable), and any other relevant terms. This helps avoid confusion and ensures that clients understand their obligations.

- Tax Compliance: Ensure that any applicable taxes, such as sales tax or VAT, are correctly calculated and displayed. Failure to include the correct tax information could result in legal issues or fines.

- Legal Disclaimers: Depending on your jurisdiction, you may need to include specific disclaimers, such as refund policies, or terms related to warranties or liabilities. Be sure to consult legal advisors to include any necessary clauses.

- Correct Pricing Information: Double-check that all amounts are accurate and that any discounts or additional charges are clearly stated. Providing a clear breakdown of charges can help prevent future disputes.

- Client Consent: If the document references a contract or agreement, ensure that clients have previously agreed to the terms in writing, either through a signed contract or by accepting terms electronically.

By incorporating these legal elements into your payment documents, you not only help protect your business but also foster trust and clarity with clients. A legally compliant payment request can reduce the risk of payment disputes and improve overall business operations.

Integrating Payment Request Documents into Your Accounting System

Integrating well-designed payment request documents into your accounting system streamlines the entire financial process, from creating requests to tracking payments. This integration ensures that all financial data is accurately captured and organized, minimizing errors and improving overall efficiency. By automating the process of generating and sending payment reminders, businesses can save time, reduce administrative tasks, and maintain a consistent approach to managing accounts receivable.

Steps to Integrating Payment Requests into Your System

To effectively integrate payment request documents into your accounting workflow, follow these steps:

- Choose the Right Accounting Software: Select accounting software that allows you to create and send professional payment requests, track due amounts, and manage payment history. Look for systems that offer integration with your existing financial tools or customer relationship management (CRM) software.

- Automate Document Generation: Set up automated document generation so that payment requests are created as soon as a sale or service is completed. This reduces the need for manual entry and ensures that no payments are overlooked.

- Sync Payment Data: Ensure that all payment data, including received payments, partial payments, and overdue amounts, sync automatically with your accounting system. This eliminates the need for manual tracking and ensures your records are up to date.

- Integrate Payment Gateways: Link your payment request system to payment gateways so that clients can pay directly through the documents they receive. This makes the payment process more convenient and speeds up collection times.

- Track Payment Status: Monitor the status of each request directly from your accounting system. This allows you to easily follow up on overdue payments and track payment trends for better financial forecasting.

Benefits of Integration

Integrating payment request documents into your accounting system offers several key advantages:

- Improved Efficiency: Automating document creation and payment tracking reduces administrative workload and ensures that payments are processed quickly.

- Better Accuracy: By syncing payment data automatically, you minimize the risk of human error, ensuring that your financial records are accurate and up to date.

- Faster Payments: Integration with payment gateways allows clients to pay directly from the document, speeding up the payment process and improving cash flow.

- Increased Transparency: Both businesses and clients can track the status of payments in real time, leading to fewer disputes and clearer communication.

By integrating payment request documents into your accounting system, you can create a more efficient, accurate, and streamlined process that benefits both your business and your clients.

Creating a Payment Reminder System

Establishing a payment reminder system is essential for ensuring that clients pay on time and that your business maintains healthy cash flow. A well-structured reminder process helps prevent missed payments, reduces late fees, and minimizes the administrative burden of manually tracking overdue amounts. By automating and personalizing reminders, businesses can maintain a professional image while encouraging timely payments.

To create an effective payment reminder system, consider the following steps:

Steps for Setting Up a Reminder System

- Define Clear Payment Terms: Ensure that clients are fully aware of the payment due date and the terms associated with late fees. This sets clear expectations and serves as the foundation for your reminder system.

- Automate Reminder Notifications: Use accounting software to automate reminders, ensuring that clients receive timely notifications. Set up multiple reminders at key intervals: a few days before the due date, the day of the due date, and one or two days after the payment is overdue.

- Personalize Your Messages: Personalize the reminder emails or messages with client names and relevant details. This adds a professional touch and reduces the likelihood of the reminder being overlooked.

- Provide Payment Options: Make sure to include easy payment options and instructions in your reminders, allowing clients to settle their debts conveniently and quickly.

- Track Reminder Sent Dates: Keep a log of when each reminder was sent, and ensure that subsequent reminders are issued according to your pre-established schedule.

Effective Reminder Strategies

In addition to automating and personalizing reminders, consider these strategies to improve the effectiveness of your payment reminder system:

- Friendly Tone: Keep your tone polite and professional. Avoid sounding accusatory or aggressive, as this can damage client relationships. A gentle nudge is often more effective than a stern reminder.

- Offer Flexible Payment Options: If appropriate, provide clients with different payment methods (e.g., online payments, bank transfers) and offer installment plans for larger amounts, making it easier for them to pay on time.

- Use Multiple Communication Channels: Reach out to clients through different channels–email, phone calls, or even text messages–depending on their preferences. This increases the likelihood that your reminders are received and acted upon.

- Set a Final Reminder: If a payment remains unpaid after a set number of reminders, send a final notice indicating the consequences of continued non-payment (e.g., service suspension, legal action). Be firm but professional in your communication.

By creating an automated and efficient payment reminder system, businesses can improve their chances of receiving timely payments, reduce the time spent on follow-ups, and maintain strong professional relationships with clients.

How to Handle Late Payments Efficiently

Effectively managing delayed payments is crucial for maintaining a healthy cash flow in any business. When payments are late, it can create financial strain and disrupt operations. However, a strategic approach to addressing late payments can minimize the impact, maintain strong client relationships, and ensure that payments are eventually collected. By following a clear, consistent process, businesses can handle overdue accounts with professionalism and efficiency.

Steps for Managing Late Payments

Here are several key steps to take when addressing overdue payments:

- Review the Payment Terms: Before taking any action, double-check the original payment terms and ensure that the payment was indeed overdue. Verify any agreements that were made regarding payment due dates or possible extensions.

- Send a Friendly Reminder: Often, late payments are simply the result of forgetfulness. Send a polite reminder with all the necessary payment details, such as the amount due, the original due date, and available payment methods.

- Offer Flexible Payment Options: If a client is struggling to pay the full amount, consider offering alternative payment methods, such as installment plans, to help them fulfill their obligation without further delay.

- Follow Up with a Formal Notice: If the payment remains unpaid after the initial reminder, send a more formal follow-up notice. Clearly explain the impact of continued non-payment and include any applicable late fees or penalties as per the original agreement.

- Set a Deadline for Payment: Provide a specific deadline for payment in your formal notice. This creates urgency and helps set clear expectations for both parties.

When to Escalate Late Payment Issues

If a payment remains unresolved despite repeated reminders, it may be necessary to escalate the situation. Here are steps to consider:

- Contact a Collections Agency: If the client still fails to settle their debt after the agreed-upon deadline, consider working with a collections agency to recover the funds. Be sure to evaluate the cost of this service and whether it’s worth pursuing in each case.

- Legal Action: As a last resort, consult with a lawyer to explore potential legal options for pursuing the debt. This step should be taken with caution, as it can damage business relationships and incur significant costs.

- Evaluate Future Contracts: For future transactions, consider revising your payment terms or requiring upfront payments to avoid similar issues down the road.

By addressing late payments systematically and professionally, businesses can minimize the impact on cash flow, reduce disputes, and maintain strong client relationships. The key is to approach each situation with patience, persistence, and a clear strategy in mind.