Essential Invoice Template for Freelance Writers

Efficient financial management is essential for any independent professional, especially when it comes to managing payments. Having a well-organized system to present your charges ensures clarity and minimizes delays in compensation. A properly structured document can streamline this process, offering both you and your clients an easy-to-follow record of the transaction.

Designing a clear, consistent document can help avoid misunderstandings and provide a professional impression. It should include all the necessary details, from service descriptions to agreed-upon amounts, to ensure both parties are on the same page. By customizing these records to your needs, you create a seamless experience for clients while maintaining an organized financial structure for yourself.

With the right approach, you can not only simplify payment tracking but also enhance your credibility. Clear documentation shows clients you are serious about your work and helps build trust over time. Whether you’re just starting or have years of experience, having a structured way to present charges is crucial for long-term success.

Why Freelancers Need a Billing System

Maintaining a clear and organized record of completed work and payments is crucial for any independent professional. It provides structure to the payment process and ensures both parties are aligned in terms of compensation. A reliable system to outline charges simplifies financial tracking and reduces the risk of errors or disputes.

Having a consistent format for documenting completed tasks, rates, and due amounts not only speeds up the billing process but also establishes a sense of professionalism. Without this, keeping track of payments becomes cumbersome, and the potential for miscommunication increases. A well-structured approach helps avoid delays and ensures clients know exactly what they owe and when it is due.

Additionally, utilizing a pre-designed structure can save time and effort, allowing independent professionals to focus more on their craft. It removes the need for starting from scratch each time, ensuring consistency in every transaction.

| Benefit | Description |

|---|---|

| Efficiency | A standardized document streamlines the process, making it quicker and easier to issue payments. |

| Accuracy | Predefined sections help reduce errors in calculation or missing information. |

| Professionalism | Provides a polished look that builds trust and credibility with clients. |

| Consistency | Ensures uniformity in the way payments and services are presented, avoiding confusion. |

Streamlining Your Billing Process

Efficiently managing payments and work agreements is a critical aspect of any independent professional’s business. By simplifying how charges are communicated and tracked, you reduce administrative tasks and ensure smoother financial operations. A streamlined approach allows you to focus on what matters most–your work–while ensuring that payments are processed quickly and accurately.

Automating the Process

One of the easiest ways to streamline your payment process is by automating repetitive tasks. Tools and software can help you create and send documents quickly, reducing the time spent on manual entry. By setting up automation for recurring tasks such as reminders and overdue notifications, you can ensure that nothing slips through the cracks and that clients are reminded of payments on time.

Standardizing Communication

Establishing a consistent format for communicating charges, payment terms, and deadlines ensures that both you and your clients are always on the same page. A standardized method minimizes confusion and eliminates the need to explain your terms repeatedly. It also helps prevent errors and misunderstandings that may arise from inconsistent communication.

How to Create Professional Billing Documents

Creating a polished and clear document is crucial to ensuring timely payments and maintaining a professional relationship with clients. A well-crafted document helps avoid confusion, communicates all necessary details, and ensures both parties understand the agreed terms. Here’s how to design a professional document that leaves a positive impression.

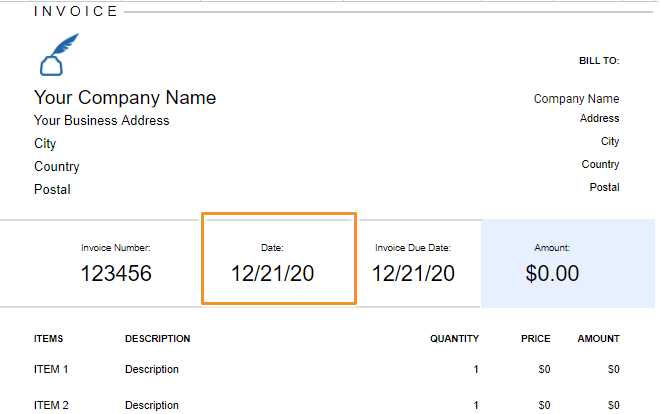

Essential Components of a Billing Record

A professional record includes several key components to ensure clarity and accuracy. These essential elements help both you and your clients stay organized:

- Your contact information: Name, address, phone number, and email.

- Client’s contact details: Include their name, business name, address, and any relevant contact information.

- Itemized list of services: A detailed description of each service or project, with quantities and rates.

- Total amount due: Ensure the total is clearly visible, with tax and discounts (if applicable) specified.

- Payment terms: Specify payment methods, due dates, and late fees, if any.

- Unique reference number: Helps you and your client track the payment.

Design Tips for Clarity

A clean, well-organized layout not only helps the client easily understand the charges but also showcases your attention to detail. Here are a few tips to improve the readability and visual appeal:

- Use a clear, readable font: Choose professional fonts like Arial or Times New Roman, and avoid using too many different styles.

- Keep it simple: Stick to a minimal design to highlight important details. Avoid unnecessary images or graphics.

- Ensure consistency: Use the same format and layout across all records to maintain professionalism and make the process more efficient.

- Highlight important information: Make the total amount due bold or use a larger font size to make it stand out.

Key Elements of a Billing Document

Creating a comprehensive record of services rendered is essential for clear communication and smooth financial transactions. A well-structured document should contain several key components that ensure both parties have all the necessary information for accurate payment processing. These elements help maintain professionalism and reduce the risk of errors or confusion.

To make sure your document serves its purpose efficiently, include the following crucial details:

- Your Contact Information: Always start with your name or business name, address, phone number, and email so that clients can easily reach you if needed.

- Client’s Information: Clearly include the client’s name, business name, and contact details to ensure there’s no ambiguity about who the charges are directed to.

- Unique Reference Number: A unique reference or document number helps both you and your client track the transaction more easily.

- Description of Services: Provide a detailed breakdown of the work completed. Include the date(s) of service, the hours worked (if applicable), and the rate charged for each service.

- Total Amount Due: Make sure the final amount is easy to find, including any taxes, discounts, or other adjustments.

- Payment Terms: Clearly state when the payment is due, acceptable payment methods, and any penalties for late payments.

Incorporating these elements into your financial documents ensures clarity, promotes timely payments, and reflects professionalism in your interactions with clients.

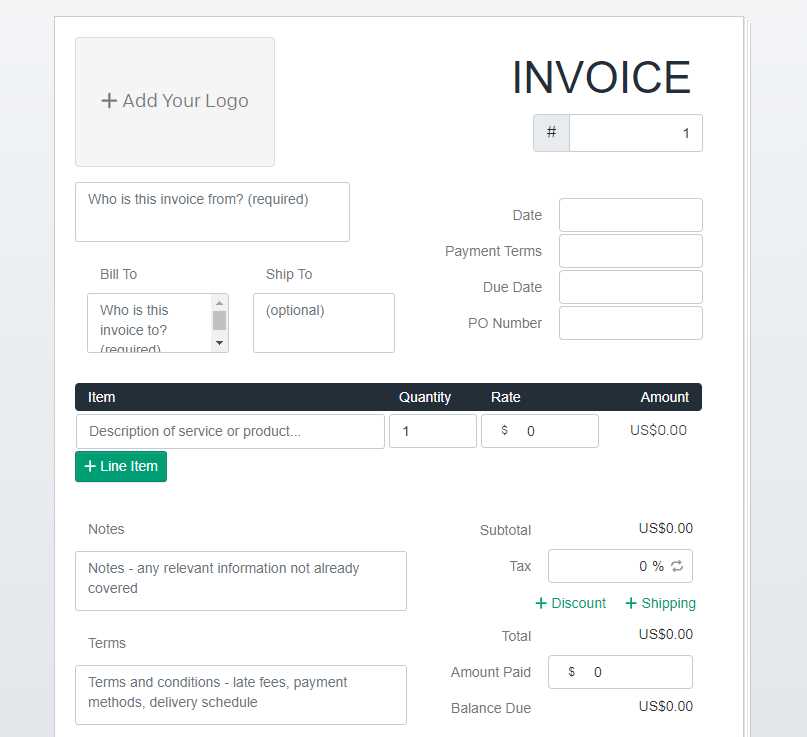

Customizing Documents for Your Business

Personalizing the structure of your financial records can greatly enhance the efficiency and professionalism of your billing process. Tailoring the design and content to reflect the unique needs of your business not only makes the process more streamlined but also creates a consistent experience for your clients. A customized approach helps communicate your brand, making transactions more memorable and organized.

Adapting Content for Your Services

Depending on the nature of your work, you may need to adjust the details presented in your documents. For example, if you charge per hour, ensure your records clearly state the hours worked and the corresponding rate. If you offer various types of services, it’s beneficial to list each separately with its own pricing. This allows clients to easily understand what they are paying for, and helps avoid confusion.

Incorporating Branding Elements

Customizing your records also means integrating your branding elements, such as your logo, colors, and fonts. This not only makes the document look more professional but also reinforces your brand identity. A well-designed document that aligns with your brand can create a lasting impression, further establishing trust and professionalism in your business relationships.

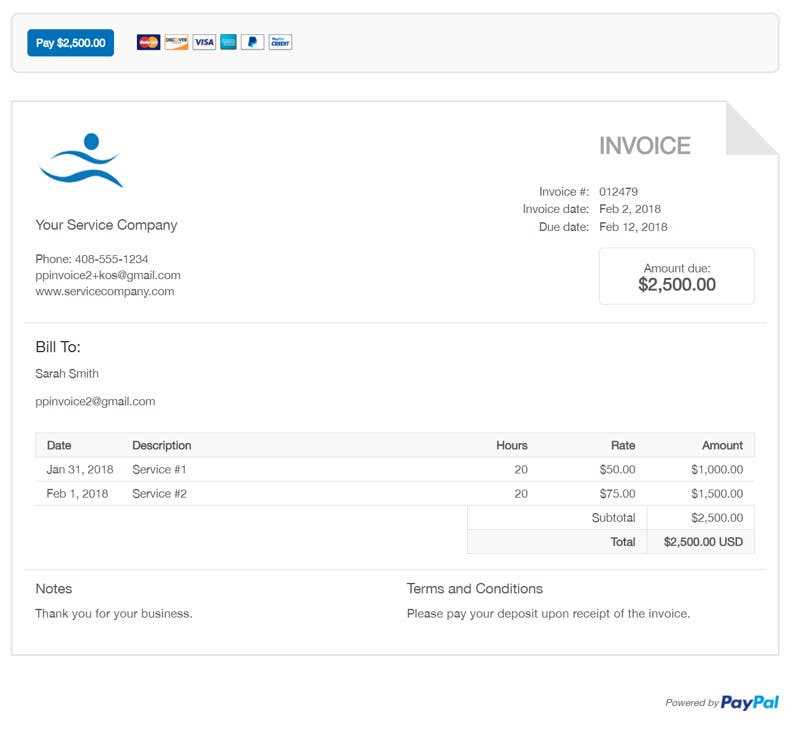

Best Billing Software for Independent Professionals

Managing payments and financial records manually can be time-consuming and prone to error, especially when handling multiple clients. To streamline the process and stay organized, many professionals turn to software solutions. These tools help automate many aspects of the billing process, from creating documents to tracking payments, making it easier to focus on your core work.

Top Features to Look For

When choosing software for managing your financial records, it’s important to consider the features that will best support your needs. Look for tools that offer:

- Customization: The ability to personalize documents to match your brand and service details.

- Automation: Features that allow for automatic generation of records based on work completed and recurring billing cycles.

- Integration: The capability to integrate with payment gateways or accounting systems for seamless transactions and tracking.

- Reporting Tools: Access to financial reports to track income, expenses, and other key metrics.

Popular Software Options

Several software tools stand out for their ease of use and comprehensive features, including:

- FreshBooks: Known for its intuitive interface and strong automation features, making it ideal for those new to digital billing systems.

- Wave: A free, full-featured solution with strong invoicing capabilities and financial tracking tools.

- QuickBooks: A comprehensive accounting software with advanced billing and reporting tools, perfect for those needing more robust financial management.

Common Mistakes to Avoid on Billing Documents

While preparing financial documents, it’s easy to overlook small details that can cause confusion or delays in payment. Even minor errors can affect professionalism and result in unnecessary back-and-forth with clients. Avoiding these common mistakes will help ensure your records are clear, accurate, and prompt payment.

Missing or Incorrect Client Information

One of the most frequent errors is failing to include the correct client information or leaving it incomplete. This can lead to confusion or misplaced payments. Always double-check that you’ve listed the client’s full name, business name (if applicable), and contact information accurately. Missing contact details can make it difficult for clients to reach out if they need to clarify anything about the charges or due dates.

Errors in Calculations or Pricing

Another critical mistake is inaccurate calculations, whether it’s incorrect hourly rates, missing services, or wrong totals. Ensure that each service or item is clearly listed with its corresponding cost. Double-check all math, including taxes or discounts. Even a small mistake, such as an overlooked discount or extra fee, can cause confusion and delay payments. Using an automated tool can help prevent this issue, but manual checks are always advisable.

Unclear Payment Terms

Ambiguous or missing payment terms can lead to confusion about due dates and accepted payment methods. Be specific about when the payment is due, what methods are acceptable, and whether late fees apply. Vague language could delay the payment process, so it’s essential to communicate these details clearly and in a way that leaves no room for misunderstanding.

How to Track Payments Effectively

Keeping track of payments is essential for maintaining a smooth cash flow and ensuring that you are compensated for your services in a timely manner. Without an organized system, it can become challenging to monitor outstanding balances, overdue payments, and payment histories. Having an effective tracking method in place will help you stay on top of your financial records and reduce the risk of missed payments.

Set Up a Payment Tracking System

The first step in effective payment tracking is to establish a reliable system to record each transaction. Whether you prefer using accounting software or a simple spreadsheet, it’s essential to document all relevant details such as the date of the transaction, the amount paid, and the client’s information. A clear record will make it easier to follow up with clients if necessary and keep track of any outstanding payments. Organizing by date or project can help you identify overdue balances more easily.

Use Automated Reminders and Alerts

One of the best ways to stay organized is by setting up automated reminders for upcoming payments or overdue balances. Many accounting tools offer features to send out reminders or alerts, either through email or within the software itself. Automating this process reduces the chances of forgetting to follow up with clients and ensures that payments are received on time. Additionally, clear and timely reminders can prevent misunderstandings and help maintain a professional relationship with clients.

What to Include in a Payment Reminder

Sending a payment reminder is an essential part of maintaining a healthy cash flow and ensuring timely compensation for your services. A well-crafted reminder should be polite yet firm, providing the recipient with all the necessary details to facilitate swift payment. By including the right elements, you can increase the chances of prompt resolution without damaging your professional relationship.

Key Details to Mention

Your reminder should include several key pieces of information to avoid confusion and ensure that the recipient knows exactly what is owed. At a minimum, include:

- Clear Reference to the Transaction: Mention the work completed, the project name, or the reference number that was previously assigned.

- Amount Due: State the exact amount that is still owed, including any taxes, fees, or adjustments.

- Due Date: Remind the recipient of the original payment terms, including the payment deadline.

- Payment Methods: Reiterate the available payment methods, making it easy for the client to choose one and make the transaction.

Maintaining Professional Tone

While it’s important to be clear and direct, always maintain a polite and respectful tone in your communication. Use language that encourages cooperation and provides reassurance that you are available to discuss any questions. A well-balanced approach fosters goodwill while emphasizing the importance of settling the outstanding balance promptly.

Legal Requirements for Billing Documents

When preparing financial records, it’s essential to ensure that your documents comply with legal requirements. Different countries and regions may have specific laws that govern what must be included in billing statements, as well as how transactions should be reported. Adhering to these requirements not only helps you avoid legal complications but also ensures transparency and professionalism in your business dealings.

Key Legal Components

To ensure your records meet legal standards, include the following essential components:

- Business Identification: Your full legal business name or personal name (if self-employed), along with contact details such as your address, phone number, and email address.

- Client Information: The name and contact details of the individual or company being billed.

- Unique Reference Number: Each document should have a unique identification number to ensure proper tracking and organization.

- Clear Breakdown of Charges: Provide a detailed list of services rendered or products delivered, with dates and corresponding rates.

- Tax Information: Include applicable tax rates and amounts, and any tax identification number or business registration number if required by your jurisdiction.

- Payment Terms: Clearly state the due date, accepted payment methods, and any penalties or interest for late payments.

Additional Considerations

In some jurisdictions, you may need to provide additional information depending on your business structure, such as VAT numbers or tax deductions. It’s important to familiarize yourself with local tax laws and any industry-specific regulations. Consulting a legal professional or accountant can help ensure your records meet all necessary legal standards.

Setting Payment Terms in Your Document

Establishing clear payment terms is crucial for ensuring timely compensation for your services. By clearly outlining when and how you expect to be paid, you can avoid misunderstandings and ensure that both parties are on the same page. Well-defined terms help create a professional image and can also protect you in case of delayed payments.

When setting payment terms in your document, consider the following factors:

- Due Date: Specify the exact date by which payment should be made. A clear deadline ensures there is no ambiguity regarding when the payment is expected.

- Accepted Payment Methods: Indicate which payment methods are acceptable (e.g., bank transfer, PayPal, check, etc.). This reduces confusion and streamlines the payment process.

- Late Fees: Include information about any penalties for overdue payments. This could be a flat fee or a percentage of the outstanding amount per day/week.

- Partial Payments: If applicable, mention whether partial payments are allowed, and under what circumstances they are accepted.

- Currency: Be sure to specify the currency in which payment should be made, especially when working with international clients.

By including clear and detailed payment terms in your documents, you provide transparency and reduce the likelihood of disputes. This ensures a smooth financial transaction and builds trust with clients.

How to Handle Late Payments

Dealing with late payments can be frustrating, but it’s a common challenge in many businesses. Taking a proactive approach to managing overdue balances helps maintain a healthy cash flow and ensures that clients are reminded of their financial obligations. Knowing the right steps to take can help you stay professional while encouraging timely payments.

Steps to Address Late Payments

If a payment becomes overdue, consider following these steps to resolve the situation:

- Send a Reminder: Start by sending a polite reminder, emphasizing the agreed-upon due date and providing any relevant details about the outstanding balance.

- Communicate Directly: If the reminder doesn’t prompt payment, follow up with a more direct communication, such as an email or phone call. Make sure to remain respectful but firm in your request.

- Offer Payment Options: Sometimes, clients may face financial difficulties. Offering flexible payment options or setting up a payment plan can help facilitate the process without creating conflict.

- Assess Late Fees: If late fees were part of the original agreement, remind your client of these fees and the consequences of not paying on time.

When to Take Further Action

If a client continues to delay payment despite reminders, you may need to consider more serious steps:

- Send a Final Notice: A final notice should clearly state that the payment is now significantly overdue and that further action will be taken if the balance remains unpaid.

- Seek Legal Advice: In extreme cases, consult with a lawyer to explore legal options for recovering the debt.

While it’s important to maintain a professional relationship with clients, it’s equally important to protect your financial well-being. A structured approach to managing late payments helps you maintain control while preserving client relationships.

Using Digital Tools for Easy Billing

In the digital age, managing financial transactions has never been easier. There are many tools available that streamline the process of creating, sending, and tracking payments. These tools not only save time but also reduce human error, ensuring that your financial records remain accurate and up to date.

Benefits of Digital Billing Tools

Digital tools offer a range of advantages over traditional paper-based methods:

- Efficiency: Automate the creation and delivery of documents, allowing you to focus more on your work rather than administrative tasks.

- Accuracy: Reduce the likelihood of errors with built-in features such as calculations, date tracking, and formatting.

- Customization: Personalize your documents with your business logo, payment terms, and other details to maintain a professional appearance.

- Track Payments: Monitor payment statuses in real-time, receiving notifications when payments are made or overdue.

- Cloud Storage: Access your records from any device, making it easier to stay organized and manage finances on the go.

Popular Digital Billing Tools

There are many platforms available to help simplify your billing process. Some of the most widely used tools include:

- QuickBooks: Offers invoicing, payment tracking, and financial reporting all in one platform.

- FreshBooks: Designed specifically for small business owners, it helps with billing, project management, and time tracking.

- PayPal: Known for its ease of use and integration with various payment methods, this platform allows you to send and receive payments quickly.

- Zoho Invoice: A versatile tool that lets you create customized documents and automate billing cycles.

- Wave: A free, cloud-based solution that includes invoicing and accounting features.

By leveraging these digital tools, you can simplify your administrative tasks and improve your overall financial management. Whether you’re working with clients locally or internationally, these platforms help keep your processes smooth and efficient.

Why Consistency is Key in Billing

Maintaining uniformity in your financial communications is crucial for ensuring professionalism and avoiding confusion. By establishing a consistent approach to how you create and send payment requests, you create clear expectations for your clients, which can help foster trust and timely payments. Whether it’s the format, style, or frequency of your documents, consistency plays a major role in streamlining your administrative tasks and enhancing your credibility.

Building Professionalism

Consistency helps reinforce your brand identity and professionalism. When clients receive clear, well-organized documents from you every time, they begin to associate your name with reliability and attention to detail. A uniform structure–such as always including specific payment terms, due dates, and your contact information–shows that you take your work seriously and value the business relationship.

Improving Efficiency

Having a standard process for generating and sending requests also makes your workflow more efficient. Once you develop a method that works for you, it becomes easier and quicker to generate the necessary documents. This consistency not only saves time but ensures that no important details are left out or overlooked, reducing the risk of errors.

Overall, consistency in how you handle your financial communications can improve both your client relationships and your internal processes, making your business more effective and professional.

Design Tips for a Professional Billing Document

When creating a financial request, the design and layout are just as important as the information it contains. A well-structured and visually appealing document not only makes a positive impression on your clients but also ensures that all essential details are easy to read and understand. Here are some design tips to help you create a polished and professional look for your billing document.

Use Clear and Readable Fonts

Choosing the right font is essential for ensuring readability. Select fonts that are clean, professional, and easy to read both on screen and in print. Avoid using too many font styles or sizes, as this can make the document look cluttered. Stick to one or two fonts, one for headings and another for the body text.

- Use sans-serif fonts like Arial or Helvetica for a modern and clean appearance.

- For a more formal feel, consider serif fonts like Times New Roman or Georgia.

- Keep font sizes between 10–12 points for body text and slightly larger for headings.

Keep the Layout Simple and Organized

A cluttered or complex layout can confuse clients and make it difficult to find important details. Instead, aim for a simple and organized layout with clear sections that guide the reader’s eye. Here’s how you can keep it neat:

- Align all text neatly, using tables or grids where needed for clear separation of data.

- Leave enough white space around sections to avoid overcrowding.

- Use bold headers to separate different sections, such as payment details, services provided, and due dates.

By focusing on clarity and simplicity, you can ensure your financial documents are both professional and effective, enhancing your reputation and encouraging timely payments.

Understanding Tax and Billing Requirements

When managing payments, it is essential to be aware of the various tax obligations and billing rules that apply to your business. Proper documentation ensures not only compliance with tax laws but also maintains transparency and professionalism in your financial transactions. Understanding the key tax elements and necessary details in your billing documents can prevent errors and delays, ensuring smooth business operations.

Essential Tax Details to Include

When preparing your financial documents, you must include specific tax-related information that is required by law. This helps in maintaining accuracy for both your records and the tax authorities. The following table highlights the most common tax details that should be included in your documents:

| Tax Information | Description |

|---|---|

| Tax Identification Number (TIN) | Used to identify you or your business for tax purposes. |

| Tax Rate | Indicates the percentage rate of tax applied to the services or products sold. |

| Tax Amount | The total amount of tax being charged on the payment. |

| Exemption Status | If applicable, indicate if the services are tax-exempt under any local law. |

Understanding Local Tax Regulations

Tax laws vary depending on your location and the type of services you provide. It’s important to familiarize yourself with local and international tax regulations that may apply. This includes knowing whether you need to charge VAT, sales tax, or other region-specific taxes. Additionally, if your business operates internationally, you may need to apply different tax rates based on your client’s location.

- Ensure you’re registered for the correct tax categories relevant to your business.

- Always check whether tax exemption applies to your services or products.

- Stay updated on changes in tax laws that may affect your billing process.

By adhering to these tax requirements, you can avoid legal complications and ensure that your financial documents meet the necessary standards for both local and international clients.

How to Protect Your Work with Invoices

When you provide services or create content, it is crucial to safeguard your intellectual property and ensure that your work is properly credited and compensated. One of the most effective ways to achieve this is through properly documenting your transactions. By using formal records to outline the terms of your work, you can prevent misunderstandings, avoid payment delays, and protect your rights as a service provider.

Utilizing clearly defined documentation serves as an official agreement between you and your client. This not only acts as a payment request but also provides proof of the scope of work completed and the agreed-upon compensation. In case of a dispute, these records can serve as legal evidence to protect both your intellectual property and financial interests.

Key Steps to Ensure Protection:

- Detailed Descriptions: Clearly describe the nature of the work provided, including deadlines and specific deliverables. This helps set clear expectations.

- Ownership Clauses: Include terms that outline ownership of the work, specifying whether the rights are transferred upon payment or if you retain ownership.

- Payment Terms: Specify payment schedules, including the due dates and any late fees. This ensures clients are aware of their obligations and encourages timely payment.

By incorporating these measures into your business documents, you can establish clear boundaries and protect both your creative and financial interests.

Building Trust with Clear Invoicing

Establishing a strong relationship with clients relies on transparency, communication, and reliability. One of the most effective ways to build trust is by providing clear, detailed records of services rendered and payments due. When you communicate expectations upfront and consistently follow through, clients feel more confident in your professionalism and are more likely to continue working with you long-term.

Clear documentation not only ensures you get paid on time but also minimizes confusion or disputes that can arise. When clients understand exactly what they are being charged for, when to expect payment, and the terms of the agreement, they are more likely to trust you and your work.

Key Aspects of Transparent Billing:

- Itemized Services: List every service or product provided with corresponding costs. This allows clients to see exactly what they are paying for.

- Clear Payment Instructions: Provide specific details on how and when payment should be made, including bank details or online payment platforms.

- Open Communication: Include a contact point for any questions or concerns, demonstrating that you are open to dialogue and value customer satisfaction.

The Benefits of Clarity:

- Prevents Disputes: A well-structured breakdown of services helps prevent misunderstandings about costs and expectations.

- Enhances Reputation: Being transparent in your business practices fosters a reputation for honesty and professionalism.

- Builds Long-Term Relationships: Clients who feel secure in their financial dealings with you are more likely to return for future projects and recommend your services to others.

By maintaining clear and open communication throughout the billing process, you create an environment of mutual respect and trust, which ultimately benefits both you and your clients.