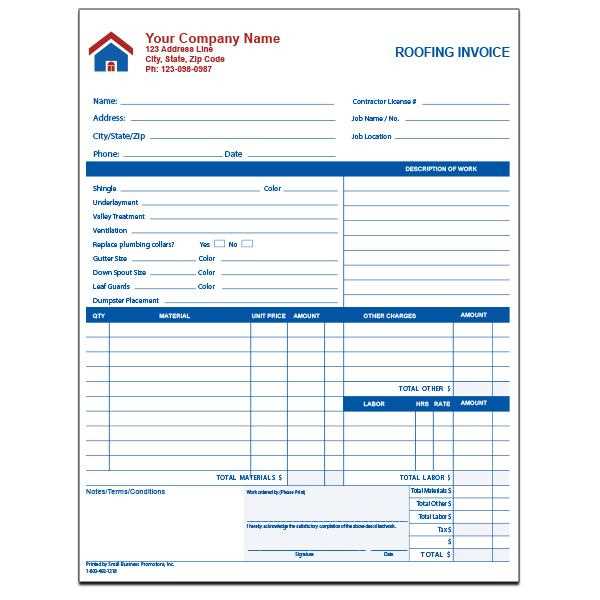

Essential Roof Invoice Template for Contractors

Efficient billing is crucial for maintaining a successful business in the construction industry. Having a well-structured document not only streamlines the payment process but also enhances professionalism in client interactions. This resource will guide you in creating a comprehensive and user-friendly billing document that meets industry standards.

Understanding the key elements of an effective billing document can significantly impact your cash flow and client relationships. By utilizing a customizable format, contractors can ensure all necessary information is clearly presented, making it easier for clients to process payments promptly.

Emphasizing clarity and organization in your billing practices helps to minimize misunderstandings and disputes. With the right approach, your documentation will not only facilitate transactions but also reflect the quality and reliability of your services.

Understanding Billing Documents

In the realm of construction and service industries, having an organized approach to financial documentation is vital. A well-crafted financial record serves as both a request for payment and a detailed account of the services rendered. This section will explore the essential aspects of these documents and how they contribute to efficient business operations.

Key Features of Effective Documents

There are several important elements to consider when creating a structured financial record:

- Contact Information: Clearly state the names, addresses, and contact details of both parties involved.

- Service Description: Provide a detailed list of the work performed, including dates and specific tasks.

- Payment Terms: Outline the payment schedule, including due dates and accepted methods of payment.

- Total Amount Due: Clearly present the total cost for the services provided, breaking down any applicable taxes and fees.

Benefits of Utilizing a Structured Approach

Adopting a systematic method for your financial documentation can lead to numerous advantages:

- Enhances professionalism and builds trust with clients.

- Facilitates faster payments due to clarity and organization.

- Reduces errors and discrepancies, minimizing potential disputes.

- Simplifies record-keeping for accounting purposes.

By understanding the components and benefits of these financial documents, contractors can improve their overall business efficiency and client satisfaction.

Importance of Professional Billing

Maintaining a high standard in financial documentation is essential for any business, particularly in the construction industry. Well-organized billing not only aids in collecting payments efficiently but also serves to reinforce a company’s reputation. This section delves into the critical reasons why professional financial records are necessary for successful operations.

Building Trust with Clients

Accurate and polished financial documents instill confidence in clients. When they receive a clear and well-structured request for payment, it demonstrates the contractor’s commitment to professionalism. Key aspects that foster trust include:

- Clear itemization of services provided.

- Transparency in pricing and any additional charges.

- Consistent branding and formatting that reflects the company’s identity.

Enhancing Cash Flow Management

Effective billing practices directly influence a business’s cash flow. By implementing a professional approach, companies can:

- Encourage timely payments through clear terms and reminders.

- Reduce delays caused by confusion or disputes over charges.

- Facilitate better financial planning by having accurate records of income.

Overall, adopting a professional approach to financial documentation is crucial for fostering strong client relationships and ensuring the financial health of the business.

Key Components of a Billing Document

Creating a comprehensive financial record involves several essential elements that ensure clarity and facilitate prompt payments. Each component plays a significant role in conveying important information to clients while maintaining professionalism. Understanding these key features can help streamline the billing process and enhance communication.

| Component | Description |

|---|---|

| Contact Information | Includes the names, addresses, and phone numbers of both the service provider and the client. |

| Service Description | Details the work completed, including specific tasks and dates of service. |

| Payment Terms | Outlines the due date, accepted payment methods, and any late fees applicable. |

| Itemized Costs | Breaks down the total amount due into individual charges, making it easier for clients to understand. |

| Tax Information | Indicates any applicable taxes, ensuring compliance with local regulations. |

| Notes and Additional Information | Provides space for any special instructions or comments relevant to the billing. |

By incorporating these essential components, businesses can create effective financial records that promote transparency and facilitate timely payments from clients.

How to Customize Your Document

Tailoring your financial record to fit your business needs is essential for creating a professional image and ensuring clarity for your clients. Customization allows you to reflect your brand identity while also meeting specific requirements of your services. This section outlines the steps you can take to effectively modify your documentation.

Incorporating Brand Identity

Start by adding your company logo and using your brand colors to create a cohesive look. This enhances recognition and conveys professionalism. Make sure to:

- Choose a clean layout that is easy to read.

- Use consistent fonts and styles that align with your branding.

Adjusting Content to Fit Services

Modify the sections of your record to better suit the types of services you provide. Consider the following adjustments:

- Include specific categories for the services offered, allowing for easier tracking of different projects.

- Adjust payment terms based on your standard practices and client preferences.

- Provide additional notes or disclaimers that might be relevant to specific jobs.

By personalizing your financial documentation, you can create a more effective tool that not only enhances your branding but also improves communication with clients.

Common Mistakes to Avoid

When creating financial records, certain pitfalls can hinder effectiveness and lead to misunderstandings with clients. Being aware of these common errors can help you maintain professionalism and ensure timely payments. This section highlights frequent missteps to avoid in your documentation process.

One frequent mistake is failing to include complete contact information for both parties. Omitting essential details can lead to confusion and delays in communication. Ensure that you provide:

- Full names and addresses.

- Phone numbers and email addresses.

Another common error is not itemizing services adequately. A vague description can lead to disputes and dissatisfaction. Always break down the services rendered, specifying the:

- Tasks completed and their respective costs.

- Dates when the work was performed.

Additionally, neglecting to clarify payment terms is a significant oversight. Clear payment terms help set expectations and encourage prompt payments. Always include:

- Due dates for payments.

- Accepted payment methods and any penalties for late payments.

Avoiding these mistakes will enhance the clarity and professionalism of your financial documents, fostering better relationships with clients and ensuring smoother transactions.

Benefits of Using a Structured Document

Utilizing a well-designed financial document can significantly streamline your billing process, saving time and enhancing professionalism. This section outlines the advantages of implementing a standardized format for your financial records, which can improve efficiency and client satisfaction.

Time Efficiency

One of the most notable benefits is the ability to save time when creating financial records. With a pre-designed format, you can:

- Easily input relevant details without starting from scratch.

- Quickly adjust pricing and service descriptions for different clients.

- Reduce the likelihood of errors by following a consistent structure.

Enhanced Professionalism

A structured document not only conveys information clearly but also enhances your professional image. By maintaining a consistent format, you can:

- Build trust with clients through clarity and organization.

- Showcase your attention to detail and commitment to quality.

- Facilitate better communication regarding services and payments.

Overall, adopting a standardized approach to your financial documentation can lead to greater efficiency and improved client relationships, contributing to the overall success of your business.

Integrating Payment Options Effectively

In today’s fast-paced business environment, providing diverse payment methods is essential for enhancing customer satisfaction and ensuring timely transactions. This section explores how to effectively incorporate various payment options into your financial documents, making it easier for clients to settle their accounts.

Diverse Payment Methods

Offering multiple payment options can significantly improve the likelihood of prompt payments. Consider integrating the following methods into your documentation:

- Credit and debit card payments for convenience.

- Online payment platforms that allow for quick transactions.

- Direct bank transfers for larger amounts.

Clear Instructions and Accessibility

It’s crucial to provide clear instructions on how clients can make payments. Ensure that your financial records include:

- Step-by-step guidance on each payment method.

- Contact information for any inquiries regarding payment processes.

- Deadlines for payment submissions to avoid confusion.

By effectively integrating various payment options and providing clear guidance, you can enhance the customer experience and facilitate smoother financial transactions.

How to Track Payment Transactions

Keeping a close eye on payment transactions is essential for maintaining a healthy cash flow and ensuring timely reconciliations. This section discusses effective strategies for monitoring financial exchanges and managing records efficiently.

Utilizing Accounting Software

Investing in reliable accounting software can greatly simplify the tracking of financial transactions. These tools typically offer features that allow you to:

- Automatically record payments as they are received.

- Generate reports to summarize outstanding balances.

- Set reminders for pending payments to stay on top of collections.

Manual Tracking Methods

If software isn’t an option, consider manual tracking techniques to stay organized. This can include:

- Maintaining a spreadsheet that logs payment details, dates, and amounts.

- Creating a checklist of transactions to mark off as payments are received.

- Regularly updating and reviewing records to identify any discrepancies.

By implementing these methods, you can effectively track payment transactions, ensuring you remain informed about your financial status and can follow up promptly on any outstanding balances.

Legal Considerations for Invoices

Understanding the legal aspects related to financial documents is essential for businesses to ensure compliance and avoid potential disputes. This section outlines the critical legal considerations that should be taken into account when creating and managing these documents.

Key legal points include proper documentation, adherence to regulations, and ensuring that the details are clear and accurate. Below is a summary of important legal factors to keep in mind:

| Legal Aspect | Description |

|---|---|

| Record Keeping | Maintain copies of all transactions for a specified period to comply with tax laws. |

| Terms and Conditions | Clearly outline payment terms, including due dates and penalties for late payments. |

| Tax Compliance | Ensure all relevant taxes are calculated and indicated on financial documents. |

| Confidentiality | Protect sensitive client information and ensure compliance with privacy laws. |

By addressing these legal considerations, businesses can minimize risks, enhance professionalism, and foster trust with their clients, ultimately leading to smoother financial operations.

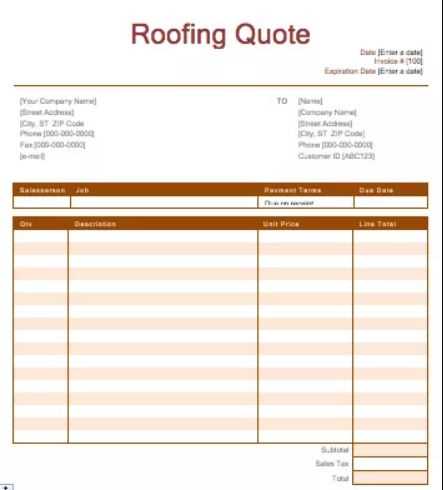

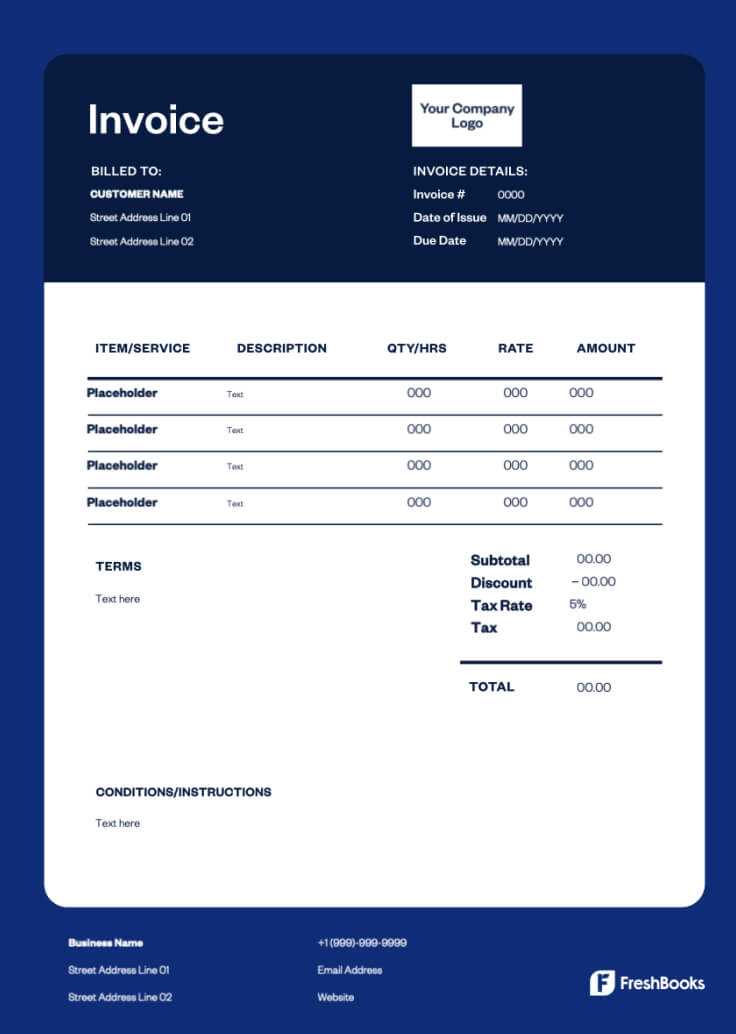

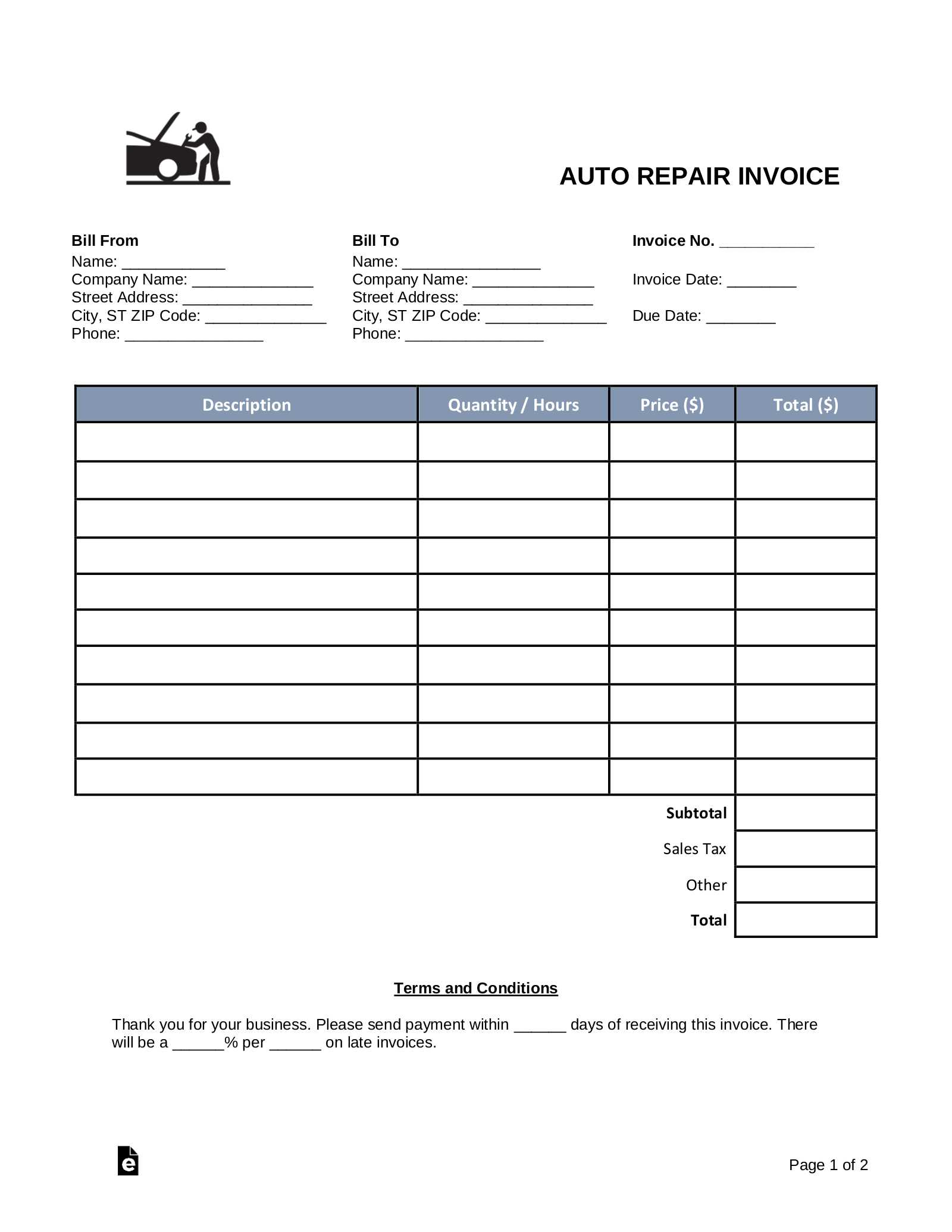

Examples of Invoice Formats

Exploring various formats for financial documents can provide valuable insights into their structure and content. This section presents different examples that showcase how these documents can be tailored to meet specific business needs while maintaining professionalism.

Here are a few common examples of invoice structures used across different industries:

| Format Type | Description |

|---|---|

| Standard Invoice | A basic format that includes essential details like item descriptions, quantities, and total amounts due. |

| Proforma Document | A preliminary version that outlines proposed costs before the final transaction is completed. |

| Recurring Payment Structure | Designed for ongoing services, this format specifies regular billing cycles and amounts. |

| Credit Note | Issued when a refund or credit is necessary, detailing adjustments made to prior transactions. |

By examining these examples, businesses can better understand how to structure their documents to enhance clarity and effectiveness, ultimately leading to improved financial management and client satisfaction.

Tips for Clear Communication

Effective communication is crucial in any business transaction, particularly when it comes to financial documents. Ensuring that all parties understand the terms and details can prevent misunderstandings and foster positive relationships. Here are some strategies to enhance clarity in your communications.

Be Concise and Specific

When conveying important information, brevity and precision are essential. Consider the following points:

- Use straightforward language that avoids jargon.

- Clearly outline key details, such as amounts, due dates, and payment methods.

- Break down complex information into manageable sections.

Utilize Visual Aids

Incorporating visual elements can significantly improve comprehension. Here are some effective techniques:

- Employ tables or charts to present data clearly.

- Highlight important sections using bold or italicized text.

- Provide examples or templates as references for clarity.

By implementing these tips, you can ensure that your communications are clear, fostering better understanding and collaboration between all parties involved.

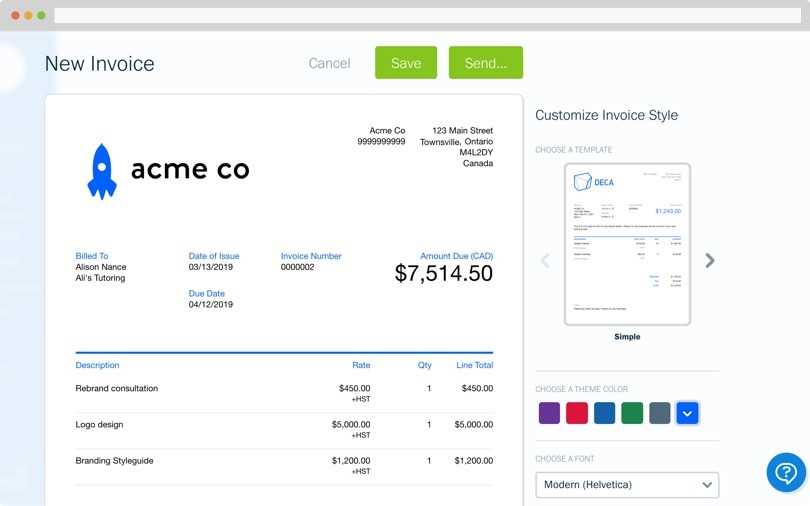

Creating Invoices with Software Tools

Utilizing software solutions for generating financial documents can streamline the process, enhance accuracy, and save time. Various tools are designed to facilitate the creation of professional billing statements, making it easier for businesses to manage their finances effectively.

Here are some advantages of using software for generating these documents:

- Efficiency: Automated systems can quickly generate documents, reducing manual effort and time spent.

- Customization: Many programs allow users to personalize layouts, logos, and content to reflect their brand identity.

- Error Reduction: Automated calculations help minimize mistakes that can occur in manual entries.

When selecting software tools, consider the following features:

- User-Friendly Interface: Look for intuitive designs that make it easy to navigate and use.

- Integration Capabilities: Choose software that can integrate with existing accounting systems or other business tools.

- Cloud-Based Options: Consider platforms that offer cloud storage for easy access and sharing.

By leveraging the right software solutions, businesses can create accurate and visually appealing financial documents that enhance their professionalism and efficiency.

How to Handle Disputes

Disagreements regarding financial documents can arise for various reasons, and addressing them promptly and effectively is crucial for maintaining healthy client relationships. Understanding how to navigate these situations can help ensure resolutions that are satisfactory for all parties involved.

Establish Clear Communication

Open lines of communication are essential when handling disputes. Here are some strategies to facilitate effective dialogue:

- Listen Actively: Give the other party a chance to express their concerns without interruption. Acknowledging their viewpoint can create a more collaborative atmosphere.

- Remain Professional: Keep discussions respectful and focused on resolving the issue rather than assigning blame.

- Document Everything: Maintain records of all communications and agreements made during the dispute resolution process.

Propose Solutions

Once the concerns have been identified, it’s important to work towards a resolution. Consider the following approaches:

- Offer Adjustments: If appropriate, consider making changes to the original agreement or document to address the concerns raised.

- Seek Mediation: If direct communication fails, involving a neutral third party can help facilitate a resolution.

- Follow Up: After reaching an agreement, ensure that both parties are clear on the next steps and follow up to confirm satisfaction with the outcome.

By taking a proactive and constructive approach to disputes, businesses can not only resolve issues but also strengthen relationships with clients through effective conflict management.

Updating Your Template for Efficiency

Enhancing your documents for optimal performance is essential in today’s fast-paced business environment. Regular updates can lead to streamlined processes, improved accuracy, and a more professional appearance, ultimately benefiting both your business and clients.

Here are several strategies to consider when revising your documents:

- Incorporate Feedback: Gather input from users to identify common pain points or areas for improvement. This can help create a more user-friendly experience.

- Utilize Automation: Consider implementing software tools that automate repetitive tasks. This can reduce errors and save valuable time in document preparation.

- Standardize Elements: Ensure consistency in formatting, language, and layout. A uniform appearance can enhance clarity and professionalism.

- Review Legal Compliance: Periodically check that your documents adhere to current regulations and standards to avoid potential legal issues.

By committing to regular updates, you can ensure that your documents not only meet the current needs of your business but also adapt to evolving industry standards and client expectations.

Comparing Different Invoice Formats

Evaluating various document structures is crucial for businesses seeking to enhance their billing processes. Each format has distinct features that can impact clarity, ease of use, and client satisfaction. Understanding these differences allows organizations to select the most suitable option for their specific needs.

Here are some common formats to consider:

- Itemized Statements: This format provides a detailed breakdown of each service or product, making it easier for clients to understand charges.

- Simplified Invoices: A more straightforward approach that lists only essential information, suitable for small transactions or repeat clients.

- Recurring Billing Formats: Ideal for businesses with subscription-based services, this structure automates the billing process and ensures timely payments.

- Electronic Formats: Digital documents often include interactive elements that allow clients to pay online, streamlining the payment process.

When comparing these structures, consider factors such as client preferences, transaction volume, and the need for detailed documentation. Choosing the right format can enhance communication and improve the overall efficiency of your billing operations.

Client Feedback on Invoicing Practices

Understanding clients’ perspectives on billing methods is vital for improving business relationships and operational efficiency. Gathering insights from customers can reveal strengths and weaknesses in current practices, guiding adjustments that enhance overall satisfaction. This feedback helps businesses tailor their approaches to meet client expectations better.

Here are some common themes that often emerge from client feedback:

- Clarity of Information: Clients appreciate documents that present charges in a straightforward manner, making it easy to understand what they are being billed for.

- Timeliness: Receiving statements promptly can significantly impact a client’s perception of professionalism and reliability.

- Flexibility in Payment Options: Clients prefer having various methods available for settling accounts, such as online payments, checks, or direct bank transfers.

- Responsiveness to Queries: Quick and helpful responses to any questions regarding charges enhance client trust and satisfaction.

Incorporating client feedback into billing practices can lead to improved communication and stronger relationships. Regularly soliciting and acting on this input is essential for any organization striving for excellence in service delivery.