Overdue Invoice Reminder Email Template for Clear and Professional Communication

Chasing overdue payments is an inevitable part of business. However, handling late fees in a professional and efficient way can significantly improve cash flow without damaging client relationships. Sending polite yet clear communications is essential to prompt timely action. Crafting an appropriate message for this purpose requires balance between professionalism and persistence.

While reminders are necessary, the approach matters. It’s important to communicate in a manner that is both respectful and firm, ensuring the client understands the urgency without feeling pressured. Properly structured follow-ups increase the likelihood of receiving payments while maintaining positive business interactions.

In this guide, we’ll explore how to create effective communication that encourages timely payments. Whether you’re addressing a single overdue account or managing a wider set of financial obligations, adopting a strategic communication plan can make a world of difference in your business operations.

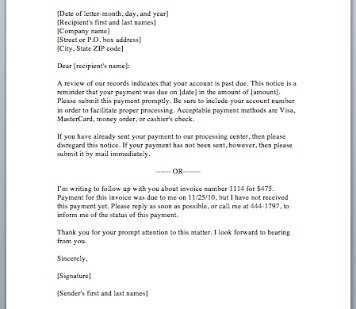

Payment Follow-Up Communication Example

When clients miss a payment deadline, it’s important to approach the situation with a message that is clear, concise, and professional. A well-crafted letter or message can help address the issue effectively while maintaining a positive business relationship. This section will provide an example of how to structure your message, ensuring it delivers the right tone and information without causing any discomfort for your client.

Key Components to Include

Your communication should include the following elements to ensure clarity and professionalism:

| Element | Description |

|---|---|

| Subject Line | A concise, polite statement such as “Payment Due” or “Action Required: Outstanding Balance.” |

| Greeting | Address the recipient respectfully with their name or company name. |

| Account Details | Provide a clear breakdown of the outstanding amount and the original due date. |

| Action Requested | Clearly state what you expect the recipient to do, whether it’s making payment or contacting you. |

| Closing | End the message with appreciation for their attention and any follow-up contact information. |

Example Communication

Here’s an example of how to structure your message:

Dear [Client Name],

I hope this message finds you well. I am writing to follow up regarding the payment for [Product/Service], which was due on [Original Due Date]. According to our records, the balance of [Amount Due] is still outstanding.

We kindly request that the payment be processed as soon as possible. If you have already made the payment, please disregard this message and let us know. If you need any assistance or have questions regarding your balance, feel free to contact us.

Why Send a Payment Follow-Up

When a payment is delayed, reaching out to the client is essential for maintaining smooth financial operations. By sending a polite and clear communication, you not only encourage the client to settle their balance but also ensure your business continues to operate without interruptions. Following up in a professional manner helps avoid confusion and promotes accountability from both sides.

One of the key reasons for sending a follow-up is to avoid unnecessary strain on your cash flow. Payments that are delayed for too long can disrupt your ability to manage expenses, pay vendors, and reinvest in your business. A timely follow-up can help speed up the process, ensuring that your financial needs are met.

Another important factor is maintaining healthy relationships with clients. A well-crafted message reflects your professionalism and helps to remind clients of their responsibilities without sounding harsh or demanding. This can lead to improved trust and communication, which is valuable for future collaborations.

In addition, sending a payment follow-up helps establish a precedent for how you handle financial matters. By consistently following up on delayed payments, you signal to clients that you value timely transactions and expect the same level of commitment in return. This can lead to fewer late payments in the future, as clients understand that you take payment deadlines seriously.

Best Practices for Writing Payment Reminders

Effectively communicating about unpaid balances requires a thoughtful approach to ensure the message is clear, professional, and encouraging prompt action. When crafting your follow-up message, it’s essential to balance firmness with politeness to maintain positive client relationships. Here are some best practices to consider when writing payment follow-ups.

- Be Clear and Direct: Clearly state the amount due, the original due date, and the specific action you expect from the recipient. Ambiguity can lead to delays in payment as clients may not fully understand the urgency or the amount they need to pay.

- Maintain a Professional Tone: Even if the payment is significantly late, keep the tone polite and professional. A respectful tone encourages better response rates and minimizes any tension between you and the client.

- Offer Payment Options: Make it easy for clients to settle their balance by providing clear instructions on how to make the payment, such as bank details or payment links. Offering flexible payment methods can also improve the likelihood of timely settlements.

- Include a Deadline: It’s important to set a specific deadline for when the payment should be made. This helps set expectations and ensures both parties are on the same page regarding the time frame for resolution.

- Follow Up Regularly: If you don’t receive a response after your first communication, it’s essential to follow up. A series of polite but persistent messages can increase the chances of getting the payment.

- Express Appreciation: Always end your communication by thanking the recipient for their attention and cooperation. Expressing gratitude can help maintain a positive relationship, even in the context of a payment request.

By incorporating these best practices into your payment follow-ups, you increase the likelihood of prompt payments while preserving a professional relationship with your clients.

How to Maintain a Professional Tone

When addressing outstanding payments, maintaining a professional tone is crucial to ensuring that the conversation remains productive and respectful. While it’s important to be firm about expectations, it’s equally important to avoid sounding accusatory or demanding. A well-balanced approach helps preserve relationships while ensuring that your message is taken seriously. Below are key strategies for maintaining a professional tone when requesting payment.

- Use Polite Language: Start with a courteous greeting and choose words that show respect. Phrases like “I hope this message finds you well” or “We kindly request your attention to this matter” set a positive tone right from the beginning.

- Be Clear but Not Harsh: Clearly state the purpose of the message, but avoid using harsh language. Instead of saying “This is an urgent issue,” say “We would appreciate your prompt attention to this matter.” This communicates urgency without sounding confrontational.

- Avoid Negative Assumptions: Do not assume that the delay is intentional or the result of negligence. Phrases like “We understand that sometimes delays happen” or “If there was an issue with the payment process” help maintain a neutral stance and show understanding.

- Offer Assistance: Let the recipient know you are available to help in case there are any issues or questions. A statement like “Please don’t hesitate to contact us if there’s any issue with processing the payment” shows that you are open to resolving any potential concerns.

- Be Empathetic: Acknowledge that the client may be facing challenges, and express understanding. For example, “We understand that financial matters can sometimes be difficult, and we are happy to work with you on a suitable resolution” can go a long way in preserving goodwill.

- Use a Positive Closing: End on a positive note, expressing appreciation for their cooperation. “Thank you for your prompt attention to this matter” or “We appreciate your continued business” reinforces a cooperative, professional relationship.

By applying these techniques, you can ensure that your communication remains professional, encouraging prompt action while maintaining a respectful relationship with your clients.

Key Elements of an Effective Payment Follow-Up

When requesting payment for a past-due balance, it’s important to craft a message that is clear, professional, and actionable. A well-structured communication ensures that the recipient understands the situation and knows exactly what steps to take next. Below are the key elements to include in a payment follow-up to make it effective and impactful.

- Clear Subject Line: The subject line should immediately convey the purpose of the message, such as “Payment Due” or “Action Required: Outstanding Balance.” This sets the tone and ensures the recipient understands the urgency of the matter.

- Polite and Professional Greeting: Always address the recipient with respect, using their name or company name. A friendly greeting helps start the message on a positive note and keeps the tone professional.

- Details of the Outstanding Balance: Be specific about the amount due, the original due date, and any other relevant information. This allows the recipient to quickly identify the purpose of the communication and avoid confusion.

- Requested Action: Clearly state what you want the recipient to do, whether it’s making the payment, contacting you for more information, or resolving an issue. Provide any necessary instructions, such as payment methods or links, to make the process as easy as possible for them.

- Flexible Payment Options: If applicable, offer different payment methods or solutions to make it easier for the client to settle their balance. This shows that you’re willing to work with them and can increase the likelihood of a timely payment.

- New Deadline or Follow-Up Plan: If the original deadline has passed, provide a new deadline for the payment or state when you will follow up again. Setting expectations helps the recipient understand what’s at stake and when action is required.

- Polite and Positive Closing: End the communication on a positive note, expressing gratitude for their attention to the matter. A closing such as “Thank you for your prompt attention to this matter” maintains a professional tone and encourages a cooperative response.

By incorporating these elements, your communication will be more effective in encouraging timely payments, while preserving strong relationships with clients.

How to Avoid Delays in Payment

Delays in receiving payments can disrupt cash flow and affect your business operations. To prevent these issues, it’s important to implement proactive measures that encourage prompt settlement. By setting clear expectations from the start and maintaining open communication, you can reduce the likelihood of delays and ensure timely payments.

Strategies for Preventing Payment Delays

Here are several practices that can help you avoid delays in payments:

| Strategy | Description |

|---|---|

| Clear Payment Terms | Establish and communicate payment terms upfront, including deadlines, late fees, and accepted methods of payment. The more transparent the terms, the less room there is for confusion. |

| Early Invoicing | Send out invoices as soon as possible after the delivery of goods or services. The sooner the client receives the bill, the sooner they can process the payment. |

| Offer Multiple Payment Methods | Provide clients with various payment options (bank transfer, online payment platforms, credit cards) to make it easy for them to pay on time. |

| Automated Payment Reminders | Set up automated systems to remind clients of upcoming or due payments. A gentle nudge before the deadline can prevent delays and encourage clients to act on time. |

| Prompt Communication of Issues | If a client indicates that they may face difficulties making a payment, address the situation quickly. Offer solutions or payment plans to help them meet their obligations without delay. |

Building a Payment-Friendly System

In addition to these strategies, building a strong payment culture within your business is key. Set expectations early in your relationships with clients, ensure clear and consistent communication, and be proactive in managing any potential issues. By taking these steps, you can significantly reduce the chances of delays and maintain smooth financial operations.

Timing Your Payment Follow-Up

One of the most critical factors in encouraging prompt payment is the timing of your follow-up communication. Reaching out at the right moment ensures that your message is effective without being intrusive. Too early, and it may seem premature; too late, and the client might forget about the payment. Understanding the best time to contact your client can make a significant difference in securing the payment quickly.

| Timing Strategy | Recommended Action |

|---|---|

| Before the Payment Due Date | Send a friendly reminder a few days before the due date to ensure the client is aware of the upcoming payment. This is a great way to give them a heads-up and avoid any last-minute delays. |

| On the Due Date | Send a polite notification on the due date itself, reiterating the amount and the expected payment. This ensures there is no confusion and reinforces the deadline. |

| Shortly After the Due Date | If payment hasn’t been made by the due date, send a follow-up within a few days. Be firm yet respectful, as waiting too long may give the impression that late payments are acceptable. |

| One Week After the Due Date | If there’s still no payment, send another follow-up after one week. This message should maintain a professional tone and reiterate the importance of settling the balance. |

| Two Weeks After the Due Date | If payment is still pending, this is the time to escalate the communication. This follow-up should be more direct, highlighting any consequences of non-payment and offering a final opportunity for resolution. |

By carefully timing your follow-ups, you can encourage timely payments while maintaining a professional relationship with your clients. It’s important to strike a balance between persistence and courtesy, ensuring that your communication supports your financial goals without jeopardizing client rapport.

Crafting a Polite Yet Firm Message

When requesting payment for an outstanding balance, it’s essential to strike the right balance between being polite and firm. A well-crafted message conveys professionalism and maintains a respectful tone while ensuring the urgency of the situation is clear. The goal is to motivate the client to take action without damaging the relationship.

- Start with a Friendly Greeting: Begin your message with a courteous greeting, such as “Dear [Client Name],” or “Hello [Client Name].” This sets a positive tone and fosters goodwill.

- Express Understanding: Acknowledge that delays may happen for various reasons. Use phrases like “We understand that unforeseen circumstances can arise,” or “We know that managing payments can sometimes be challenging.” This demonstrates empathy and shows you’re not jumping to conclusions.

- State the Issue Clearly: Be direct about the situation but without sounding accusatory. For example, “Our records show that the balance of [Amount Due] is still pending, and the payment was due on [Due Date].” Clear information helps eliminate any confusion and makes it easier for the client to understand the urgency.

- Be Firm but Respectful: After stating the issue, firmly request the client’s attention. Instead of saying “Please pay soon,” try a more assertive yet polite approach like “We kindly ask that the balance be settled by [New Deadline].” This sets a clear expectation without sounding harsh.

- Offer Help or Alternatives: Offer assistance if there are any issues preventing the client from making the payment. For example, “If there are any issues with processing the payment, please let us know how we can assist.” This shows your willingness to collaborate on a solution.

- End with Appreciation: Close your message with a positive note, expressing gratitude for their cooperation. Something like “Thank you for your prompt attention to this matter” shows appreciation and keeps the tone respectful and cordial.

By incorporating these elements into your communication, you ensure that your request for payment is professional, clear, and likely to encourage a prompt response. It’s important to remember that the tone you set can make a big difference in how your message is received and acted upon.

Using Friendly Language for Clients

When reaching out to clients about an outstanding payment, it’s essential to use language that fosters a positive atmosphere and encourages cooperation. Friendly language helps avoid any feelings of discomfort or resentment, ensuring that your message is well-received while still conveying the importance of the matter. By adopting a conversational and approachable tone, you can maintain a strong, professional relationship with your clients.

- Start with a Warm Greeting: Opening your message with a friendly salutation, such as “Hi [Client Name],” or “Hello [Client Name],” sets a positive tone right from the start and makes the client feel respected.

- Avoid Harsh or Demanding Phrases: Instead of using phrases like “You must pay now” or “This is urgent,” opt for softer, more inviting language, such as “We kindly request” or “We would appreciate your prompt attention to this matter.” This helps maintain professionalism without sounding confrontational.

- Use Positive and Supportive Phrasing: Rather than focusing on what hasn’t been done, focus on the potential for resolution. For example, “We’d love to get this settled soon” or “Let us know if there’s any way we can assist in processing this payment” encourages collaboration.

- Express Empathy and Understanding: Acknowledge that situations arise that might prevent timely payments. Phrases like “We understand that things can get busy” or “We know that unforeseen circumstances can happen” convey empathy and help ease any tension in the conversation.

- Be Courteous with Deadlines: When setting a new deadline or requesting action, keep the tone polite. Rather than saying “You must pay by [date],” you could say “We would greatly appreciate it if the payment could be processed by [date].” This gives the client a sense of flexibility and respect.

- End on a Positive Note: Close your communication with a phrase that emphasizes your appreciation for the client’s cooperation. A statement like “Thank you for your time and attention” or “We look forward to resolving this together” reinforces the idea that you’re working as a team.

By using friendly, considerate language, you not only encourage timely payments but also build a rapport that strengthens your relationship with the client. Maintaining this positive communication style can help ensure that future transactions go smoothly as well.

Customizing Your Message for Different Situations

When communicating about outstanding payments, it’s important to tailor your message to the specific situation. Not all clients or scenarios are the same, so customizing your approach ensures that you address the issue appropriately while maintaining a professional tone. Whether the payment is slightly late, there’s been a misunderstanding, or the client has been unresponsive for an extended period, adjusting your message will help you achieve the best outcome.

Adjusting Tone Based on the Situation

The tone of your message should be flexible depending on the circumstances. Here are some examples of how to modify your approach:

- For a First-Time Delay: When a payment is only slightly delayed, a more gentle tone is appropriate. Use language like, “We just wanted to check in regarding your recent balance” or “We understand that sometimes delays happen, and we’d like to assist you in resolving this promptly.” This shows understanding while encouraging a quick resolution.

- For a Long-Standing Balance: If the payment has been pending for a while, your tone should be firmer but still respectful. Consider saying, “Our records indicate that your payment remains unsettled, and we kindly request that it be addressed at your earliest convenience.” This communicates the seriousness of the matter without being overly confrontational.

- For Unresponsive Clients: If the client has not responded to previous communications, a more direct message may be needed. You could say, “We’ve not yet received payment for the amount due. Please let us know if there are any issues we should be aware of.” This is firm but still leaves room for the client to explain any challenges they may be facing.

Key Modifications to Consider

In addition to adjusting the tone, there are other aspects of your message that should be tailored depending on the situation:

- Adjust Payment Terms: If there’s a special circumstance, such as a client experiencing cash flow issues, offer alternative payment options or extended terms. “We’d be happy to discuss a payment plan if that would be helpful for you” shows flexibility and willingness to work with the client.

- Provide Clear Instructions: For clients who may not have processed the payment correctly, provide clear instructions or check-ins. For example, “Please confirm if you encountered any issues with the payment method” can help identify and resolve any confusion.

- Reaffirm Your Relationship: In situations where the client is a long-term partner, it’s important to reaffirm the value of your relationship. “We truly value our partnership and want to ensure we resolve this matter quickly” emphasizes t

Common Mistakes to Avoid in Payment Follow-Ups

When requesting payment for a past-due balance, it’s easy to make mistakes that can undermine your efforts and damage your professional relationship with the client. A well-crafted follow-up should be polite, clear, and effective. To help you avoid setbacks, here are some common errors to steer clear of when crafting your communication.

- Using an Aggressive Tone: While it’s important to be firm, using harsh or demanding language can create tension and make the client defensive. Avoid phrases like “You must pay now” or “This is your final warning.” Instead, opt for polite but direct language, such as “We kindly ask for your attention to this matter” or “We would appreciate your prompt action.”

- Neglecting to Check the Details: Sending a message with incorrect details–such as the wrong amount, due date, or payment information–can cause confusion and delay the process further. Double-check all the facts before sending a communication to ensure everything is accurate and up to date.

- Being Vague About Expectations: A follow-up without a clear call to action can leave the client unsure about how to proceed. Always specify what you need from the client, whether it’s payment by a certain date, confirmation of receipt, or clarification on an issue. Be clear and specific about the next steps.

- Sending Too Many Messages: Bombarding the client with frequent follow-ups can be overwhelming and even counterproductive. Be mindful of the timing and frequency of your communications. Give the client enough time to act before sending additional messages, and try to space out your follow-ups appropriately.

- Being Impersonal: A generic, impersonal tone can make the communication feel like a form letter and reduce its effectiveness. Use the client’s name, reference their account or transaction, and personalize the message to show that you care about resolving the issue promptly.

- Failing to Show Empathy: It’s important to consider the circumstances that may be affecting the client’s ability to make the payment. While it’s important to remain professional, showing understanding can go a long way. Phrases like “We understand that things can get busy” or “If there are any issues we should be aware of, please let us know” can help foster goodwill.

- Not Offering Solutions: Simply demanding payment without offering alternatives or solutions can create frustration for clients facing difficulties. If a client is unable to pay the full amount at once, offer flexible payment plans or ask if they need assistance with the payment process.

By avoiding these common mistakes, you can increase the likelihood of receiving payment while maintaining positive, professional relationships with your clients. Ensuring that your communication is respectful, clear, and considerate will help you address payment issues effectively a

Legal Considerations for Payment Follow-Ups

When pursuing payment for outstanding balances, it’s crucial to be mindful of the legal aspects surrounding your communication with clients. Payment follow-ups should not only be professional and courteous but also comply with relevant laws to protect both your business and your clients. Failing to adhere to these legal requirements can lead to complications or even legal disputes, so it’s important to understand the guidelines for proper conduct when requesting payments.

Understanding Debt Collection Laws

Debt collection is regulated by various laws that aim to prevent harassment and abuse in the process. These regulations ensure that businesses can recover payments while treating clients fairly and with respect. Some key points to keep in mind include:

- Fair Debt Collection Practices: Be aware of the Fair Debt Collection Practices Act (FDCPA) if you’re in the United States or similar regulations in other countries. This law limits the times and frequency at which you can contact clients, and restricts abusive, misleading, or coercive language in your communications.

- Privacy Laws: Respect your clients’ privacy by ensuring that payment-related communications are kept confidential. Avoid discussing payment issues with third parties, unless authorized by the client or required by law.

- Legal Tone and Language: When dealing with overdue accounts, the language used should be firm but respectful. Avoid threatening language, which could lead to potential legal repercussions. Instead, focus on providing clear and factual information regarding the outstanding balance and possible consequences if left unresolved.

Knowing When to Escalate

If repeated attempts to secure payment are unsuccessful, you may need to escalate the situation. However, this must be done within the bounds of the law:

- Issuing Legal Notices: If informal follow-ups do not lead to payment, sending a formal legal notice may be appropriate. This should be done in accordance with local laws and may include specific language regarding the consequences of non-payment, such as interest or legal action.

- Engaging a Collection Agency: In some cases, working with a third-party collection agency might be necessary. However, make sure any agency you work with complies with the relevant debt collection laws and acts professionally. You may also want to ensure that you are clear on any fees or commissions associated with this process.

- Litigation: As a last resort, businesses can pursue legal action to recover the amount owed. This involves filing a lawsuit in court and may be subject to local jurisdiction and procedural requirements. Consult with an attorney before taking this step to understand the process and potential costs.

In summary, ensuring compliance with debt collection laws is essential when following up on unpaid balances. By following proper procedures, using respectful language, and understanding the legal rights of both parties, you can safeguard your business from potential legal risks while still encouraging timely payments.

How to Follow Up After the First Reminder

After sending the initial communication regarding a past-due payment, it’s important to follow up effectively if the issue remains unresolved. A follow-up message should be polite yet assertive, reinforcing the importance of settling the balance while maintaining professionalism. Timing, tone, and clarity are all critical components in ensuring that your second message encourages a response and prompts action.

When following up, it’s crucial to remain patient and understanding, as clients may have overlooked the initial request or may be dealing with issues that prevent timely payment. However, a clear and concise approach is necessary to prevent delays from continuing.

- Give a Reasonable Time Gap: Allow a few days to a week after your first contact before sending the follow-up message. This gives the client adequate time to address the matter or respond to your initial inquiry.

- Restate the Details Clearly: In your follow-up, briefly reiterate the details of the original request–such as the amount due, due date, and payment method. This helps the client quickly understand the issue at hand and provides a helpful reference point for resolving the matter.

- Maintain a Professional and Respectful Tone: While it’s important to assert the urgency of the situation, avoid sounding accusatory or demanding. Keep your tone polite and neutral, using language like, “We’d appreciate your prompt attention to this matter,” or “Kindly let us know if there are any issues preventing the settlement of this balance.”

- Offer Solutions: If you suspect that the client is facing difficulties, provide potential solutions. For example, “If you’re experiencing any issues with processing the payment, please feel free to reach out. We’d be happy to discuss alternative arrangements if needed.” This shows flexibility and understanding, which can foster goodwill.

- Include a Clear Call to Action: Clearly state the desired next step. For example, “Please process the payment by [new deadline]” or “Let us know how we can assist you in completing the payment.” A direct but courteous call to action makes it easier for the client to know exactly what is expected.

Following up after the first communication is often crucial to getting a response. By remaining polite, clear, and focused on finding a solution, you increase the likelihood of a positive outcome while maintaining a healthy business relationship.

Personalizing Messages for Better Results

Personalizing your communication can significantly improve the chances of getting a positive response. Tailoring your message to the individual recipient helps create a connection and shows that you value them as a client. Instead of sending generic, one-size-fits-all messages, take the time to customize your communication to better resonate with the recipient. This approach not only enhances the professionalism of your message but also increases the likelihood of prompt action.

Why Personalization Matters

Personalization shows the client that you are attentive to their unique situation, and it can make them feel more accountable. It can also help build trust and rapport, which can lead to stronger long-term relationships. Some benefits of personalization include:

- Building a Positive Relationship: Addressing the client by name and referencing specific details about their account or previous interactions helps establish a more human connection. This makes the conversation feel less transactional and more collaborative.

- Reducing the Risk of Miscommunication: Personalization allows you to tailor your message to the client’s specific needs or challenges. Whether they’ve encountered payment issues or simply overlooked the request, addressing these factors in your message can lead to quicker resolution.

- Encouraging Action: A customized message feels more relevant to the recipient, making them more likely to act on the request. It shows that you’ve made an effort to understand their circumstances, which can increase the likelihood of a timely response.

How to Personalize Your Communication

There are several ways to personalize your follow-up messages, making them more engaging and effective:

- Use the Client’s Name: Starting the message with “Dear [Client’s Name],” or “Hi [Client’s Name],” creates a personal touch that makes the communication feel less formal and more conversational.

- Refer to Past Interactions: Mentioning any previous discussions, agreements, or relevant transactions can remind the client of the context and help them quickly recall the details of their account. For instance, “As per our agreement on [date],” or “Following our recent conversation, we wanted to follow up on…”

- Address Specific Needs or Issues: If you are aware of any challenges the client might be facing (such as financial difficulties or payment processing issues), acknowledge this in your message. “We understand that things can get busy” or “If there’s anything preventing you from completing the payment, please let us know” can show empathy while keeping the focus on finding a solution.

- Offer Flexible Solutions: Clients may appreciate knowing that you are open to discussing payment options. Personalize your message by suggesting potential solutions that meet their needs, such as offering a payment plan or an extension on the deadline if necessary.

Personalizing your follow-up communication not only makes your message stand out but also increases your chances of a positive response. By showing empathy and understanding, and taking the time to tailor your message to the recipient, you can foster stronger relationships and en

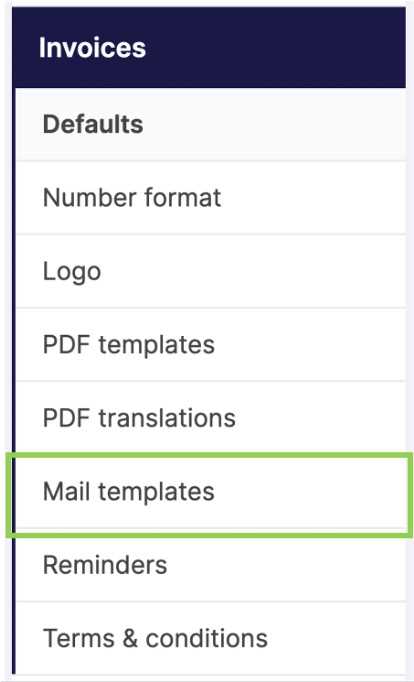

Automating Your Payment Follow-Up Process

Managing payment requests manually can be time-consuming and prone to human error. Automating your payment follow-up process allows you to streamline this task, ensuring timely and consistent communication with clients while freeing up your time for other important business operations. By using automated tools and systems, you can ensure that no payment request is missed and that clients receive the right information at the right time.

Automation can take many forms, from setting up automated notifications to using customer relationship management (CRM) software to track outstanding balances. With the right tools, you can send customized payment reminders, track responses, and maintain a smooth and professional process without having to manually follow up on each account.

Benefits of Automation

Automating your payment follow-ups offers several key advantages for your business:

- Time Efficiency: Automating repetitive tasks saves you time and reduces the chances of overlooking any follow-up actions. You can set up automated messages that are sent out based on predefined rules, ensuring that every client receives timely notifications.

- Consistency and Reliability: Automation ensures that your payment follow-up process remains consistent and reliable. Every client receives the same professional treatment, and no follow-up is missed or delayed.

- Customization: Even though the process is automated, you can still personalize the communication. Many systems allow you to include the client’s name, account details, and relevant transaction information, ensuring that the messages remain relevant and personalized.

- Improved Cash Flow: By automating follow-ups, you can reduce the number of late payments and improve your cash flow. Timely communication helps remind clients about their obligations, prompting faster payments and fewer delays.

Tools for Automating Payment Follow-Ups

There are a variety of tools available that can help you automate the process effectively:

- Accounting Software: Platforms like QuickBooks, Xero, and FreshBooks offer automation features that allow you to send follow-up notifications based on payment due dates. These systems can send gentle reminders or alerts when payments are approaching, due, or past due.

- Customer Relationship Management (CRM) Tools: CRM tools such as HubSpot or Zoho enable you to manage customer interactions and automate follow-up communications. These tools allow you to set rules and triggers for sending automated reminders, and also offer reporting features to track the status of payments.

- Automated Messaging Services: Services like Mailchimp, SendGrid, or ActiveCampaign can be used to create and send automated messages. These platforms allow you to design sequences of automated messages, which can be customized to reflect your brand’s voice while maintaining a professional tone.

By integrating automated systems into your payment follow-up process, you can ensure a more efficient, consistent, and professional approach to managing outstanding balances. Automation not only saves time and effort but also helps maintain a positive client experience while improving your business’s cash flow.

How to Handle Non-Responsive Clients

Dealing with clients who do not respond to payment requests or follow-up communications can be frustrating, but it’s important to remain professional and take strategic steps to address the issue. Non-responsive clients may be facing financial difficulties, overlooking your messages, or simply neglecting their obligations. Regardless of the reason, it’s essential to approach the situation methodically and tactfully to ensure that you eventually receive the payment or resolve the situation in a way that maintains the business relationship.

Here are some steps you can take to handle non-responsive clients and increase your chances of receiving payment:

1. Double-Check Communication Channels

Before escalating the situation, make sure your message has been received. Sometimes clients might not respond because they didn’t see your communication or it was lost in their inbox. Here are some ways to confirm:

- Verify the Correct Contact Information: Ensure you have the correct email address, phone number, or physical address on file. If you suspect the communication didn’t reach the client, try using an alternative contact method.

- Check for Delivery Issues: If you used email, check for delivery failures. If using a postal service, ensure that the address is valid and that there were no delays or issues with delivery.

- Try a Different Medium: If emails go unanswered, consider calling the client or reaching out via social media platforms or messaging apps. A direct call might be more effective in getting a response.

2. Escalate the Tone of Communication

If the client still does not respond, it may be time to adjust the tone of your messages. While it’s important to remain professional, escalating the urgency can help prompt action. Here are some tactics to consider:

- Be More Direct: Clearly state that this is a follow-up regarding an outstanding balance and express the importance of resolving the matter promptly. For example, “This is a friendly reminder that payment is now due. We ask that you settle the balance immediately to avoid any further issues.”

- Outline Consequences: If previous messages have not been effective, you may need to mention potential consequences. However, always be careful to avoid using harsh language or making legal threats. A more diplomatic approach might be, “Please note that further delays could result in additional fees or the involvement of a third-party collection service.”

- Offer Assistance: Sometimes a non-response may indicate that the client is facing challenges. Offering flexible solutions, such as a payment plan, can help show understanding and encourage a positive outcome.

3. Document All Communications

Ensure that you keep a record of all your communication attempts. Documenting each interaction can serve as evidence in case the situation escalates or legal action

Increasing Your Chances of Prompt Payment

Ensuring timely payments from clients is crucial for maintaining healthy cash flow and business operations. While occasional delays are inevitable, there are several strategies you can employ to encourage faster payments and minimize the risk of late settlements. By proactively setting clear expectations, providing convenient payment options, and maintaining consistent communication, you can significantly increase your chances of receiving payments on time.

1. Set Clear Terms from the Start

The foundation of smooth payment processing begins with setting clear, transparent terms at the outset of the business relationship. Make sure that your clients fully understand your payment terms, deadlines, and any potential penalties for late payments. Providing clear documentation from the beginning can prevent misunderstandings down the line and help clients prioritize your payments. Consider these steps:

- Specify Payment Due Dates: Clearly outline when payments are due and the acceptable methods of payment.

- Define Late Fees: Let your clients know that late payments may result in additional charges or service interruptions. This can create a sense of urgency.

- Provide Payment Instructions: Offer clear guidance on how clients can settle their bills, including online payment portals, bank details, or check submission guidelines.

2. Offer Multiple Payment Methods

Make it as easy as possible for your clients to pay by offering a range of payment methods. Different clients have different preferences, and providing various options increases the likelihood of prompt payment. Some options include:

- Online Payment Systems: Services like PayPal, Stripe, or credit card payments allow clients to pay instantly and securely.

- Bank Transfers: Many clients prefer direct bank transfers, especially for larger amounts. Ensure you provide the necessary details for wire transfers.

- Checks or Cash Payments: While less common, some clients may prefer paying by check or in cash. Ensure you have a process in place for handling these payments.

3. Send Invoices Early

Sending invoices promptly, right after a product or service is delivered, is crucial for timely payment. The sooner your client receives the bill, the sooner they can arrange the payment. Early invoicing also sets the expectation that you expect payment soon after the work is completed. This reduces the likelihood of delays and helps with cash flow management.

4. Send Gentle Payment Follow-Ups

If a payment is delayed, sending a polite follow-up is an effective way to remind clients of their obligation. Regular, courteous reminders keep the payment top of mind and show that you are actively managing your accounts. The table below highlights the importance of spacing out payment follow-ups:

Days Past Due Message Type Tone 0-7 Days Initial Follow-Up Friendly reminder, polite inquiry 7-14 Days Second Reminder Firm, but still polite