Download a Generic Service Invoice Template for Easy and Professional Billing

Managing financial transactions efficiently is key to maintaining a smooth workflow in any business. Whether you’re a freelancer, contractor, or small business owner, having a reliable document to request payment for your services is crucial. This article explores the importance of using a standardized format for requesting payment and how it can save time while ensuring professionalism in your dealings.

With the right document, you can clearly outline the products or services you’ve provided, set payment terms, and maintain a record for both you and your clients. This approach not only facilitates accurate financial tracking but also helps avoid confusion and delays in payment. By adopting a well-structured billing system, you can streamline your business operations and keep everything organized for future reference.

Utilizing a structured document ensures that all necessary information is included, which can help prevent errors and ensure transparency in the payment process. In the following sections, we’ll discuss how to create, customize, and manage such billing forms for your business needs, making sure you maintain a professional appearance while simplifying the entire process.

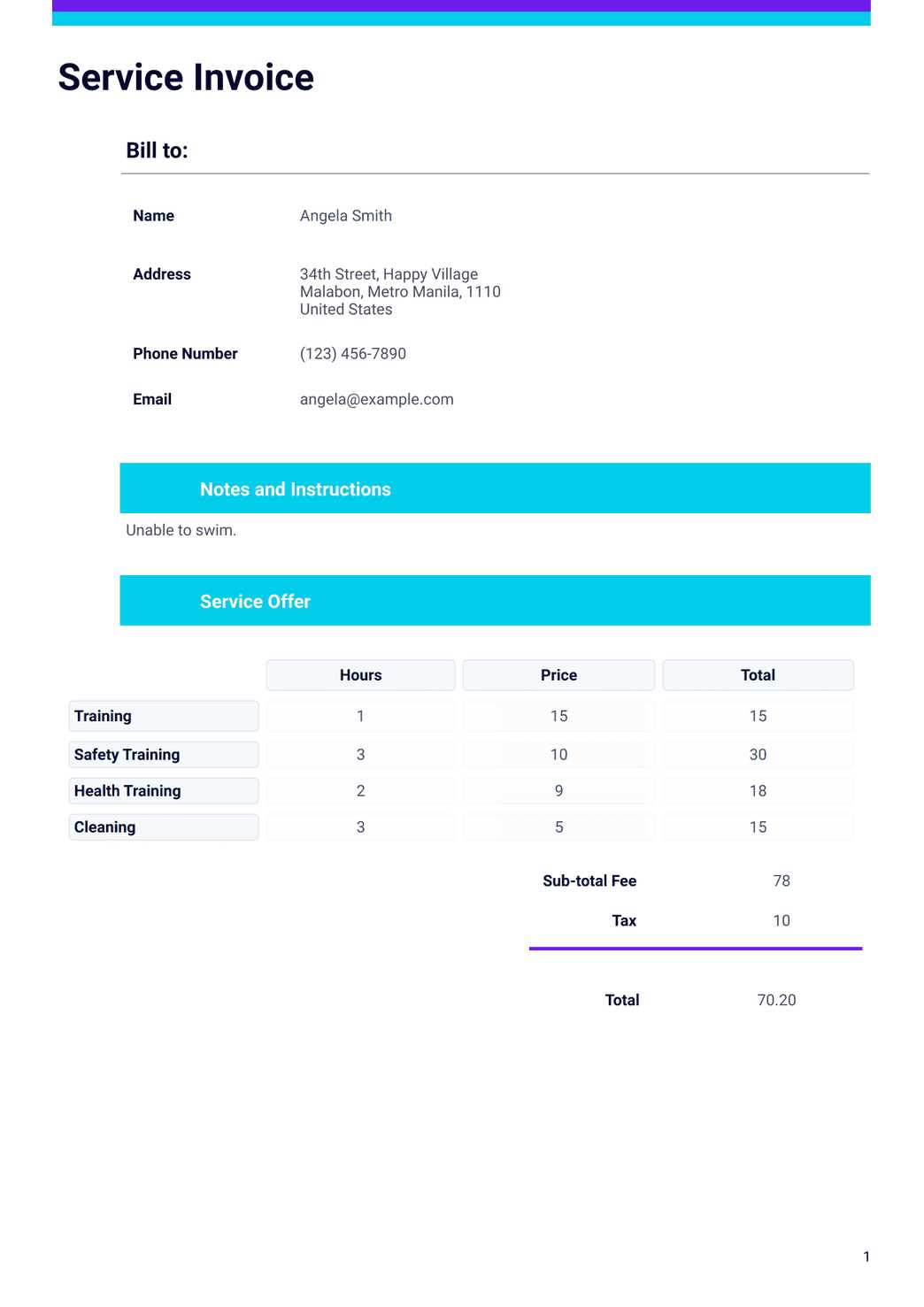

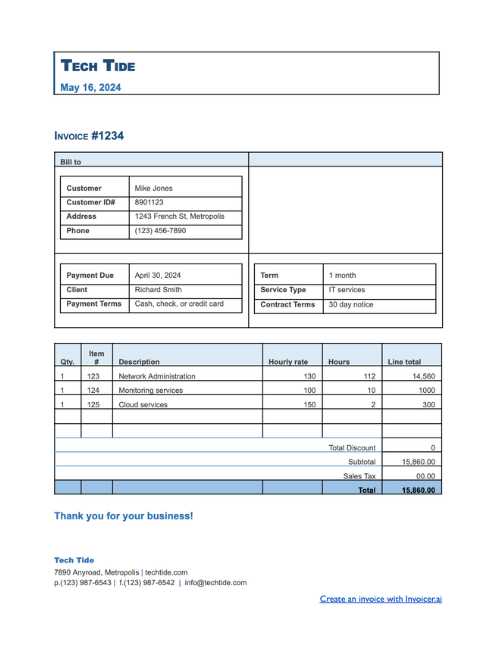

Generic Service Invoice Template Overview

For any business, maintaining clear records of the work completed and the corresponding payments is essential for smooth operations. A well-structured document designed to request payment is an invaluable tool for professionals in various industries. This type of document not only helps outline the specifics of a transaction but also serves as a formal request, ensuring that all relevant details are presented in an easy-to-understand format.

The document in question typically includes sections for client information, the description of the work provided, the payment amount, and terms. With a standardized approach, business owners can minimize errors, improve efficiency, and maintain professionalism in every transaction.

| Section | Description |

|---|---|

| Client Information | Includes the name, contact details, and address of the client. |

| Work Description | A detailed list of the products or services provided, including quantities and rates. |

| Payment Amount | The total amount due, including any applicable taxes or discounts. |

| Terms and Conditions | Details on the payment deadlines, methods, and penalties for late payment. |

This type of document can be easily customized to meet the specific needs of different professionals, whether they are offering one-time projects or ongoing services. By providing a clear and standardized format, it reduces the potential for misunderstandings and keeps both the client and the provider on the same page regarding payment expectations.

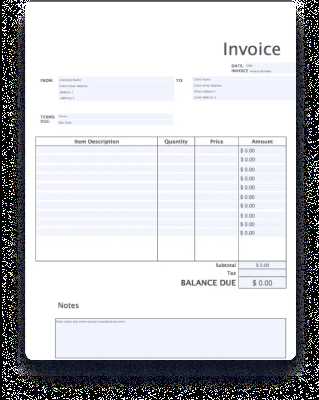

What Is a Service Invoice Template

A billing document is a formal request for payment, providing detailed information about the products or services rendered. It serves as a record of the transaction between the business and the client, ensuring that both parties are clear about the terms of the deal. This document typically includes key information such as the scope of work, cost breakdown, payment terms, and due date.

When creating this document, it’s important to follow a consistent structure to avoid missing any crucial details. A standardized format makes it easier to create and send invoices quickly, while maintaining a professional appearance. It helps to streamline the billing process, reducing errors and ensuring timely payments.

- Client Information: Name, address, and contact details of the client.

- Work Description: A detailed explanation of the tasks performed or items sold.

- Amount Due: The total cost of the work, including taxes and fees.

- Payment Terms: The method and deadline for payment, as well as any penalties for late payments.

- Dates: The date of issue and payment due date.

By using a pre-designed structure, businesses can ensure consistency and professionalism in their payment requests. This not only helps avoid confusion but also ensures that all the necessary legal and financial details are captured in one document. For business owners, it’s a vital tool for efficient financial management and communication with clients.

Benefits of Using an Invoice Template

Using a structured document for requesting payments offers numerous advantages to businesses and freelancers alike. By relying on a consistent format, you can ensure clarity, accuracy, and professionalism in every transaction. A standardized approach saves time and effort, allowing you to focus on other important aspects of your work while maintaining an organized financial system.

One of the primary benefits of using a pre-designed format is the reduction in errors. Having a fixed layout ensures that all necessary information is included, minimizing the chances of forgetting crucial details. It also helps in keeping your financial records well-organized and easily accessible, which is essential for both tracking payments and meeting tax obligations.

- Time-Saving: Quickly create payment requests without starting from scratch each time.

- Consistency: Maintain uniformity in all financial communications with clients.

- Professionalism: Present a polished and formal document that reflects well on your business.

- Reduced Errors: Ensure all essential details are included, such as amounts, dates, and payment terms.

- Efficiency: Streamline your billing process, leading to faster payments and fewer delays.

- Record Keeping: Easily track outstanding payments and create a clear financial history for future reference.

Ultimately, using such a structured document not only simplifies the process but also builds trust with clients. It shows that your business operates with clear processes in place, enhancing your professional reputation.

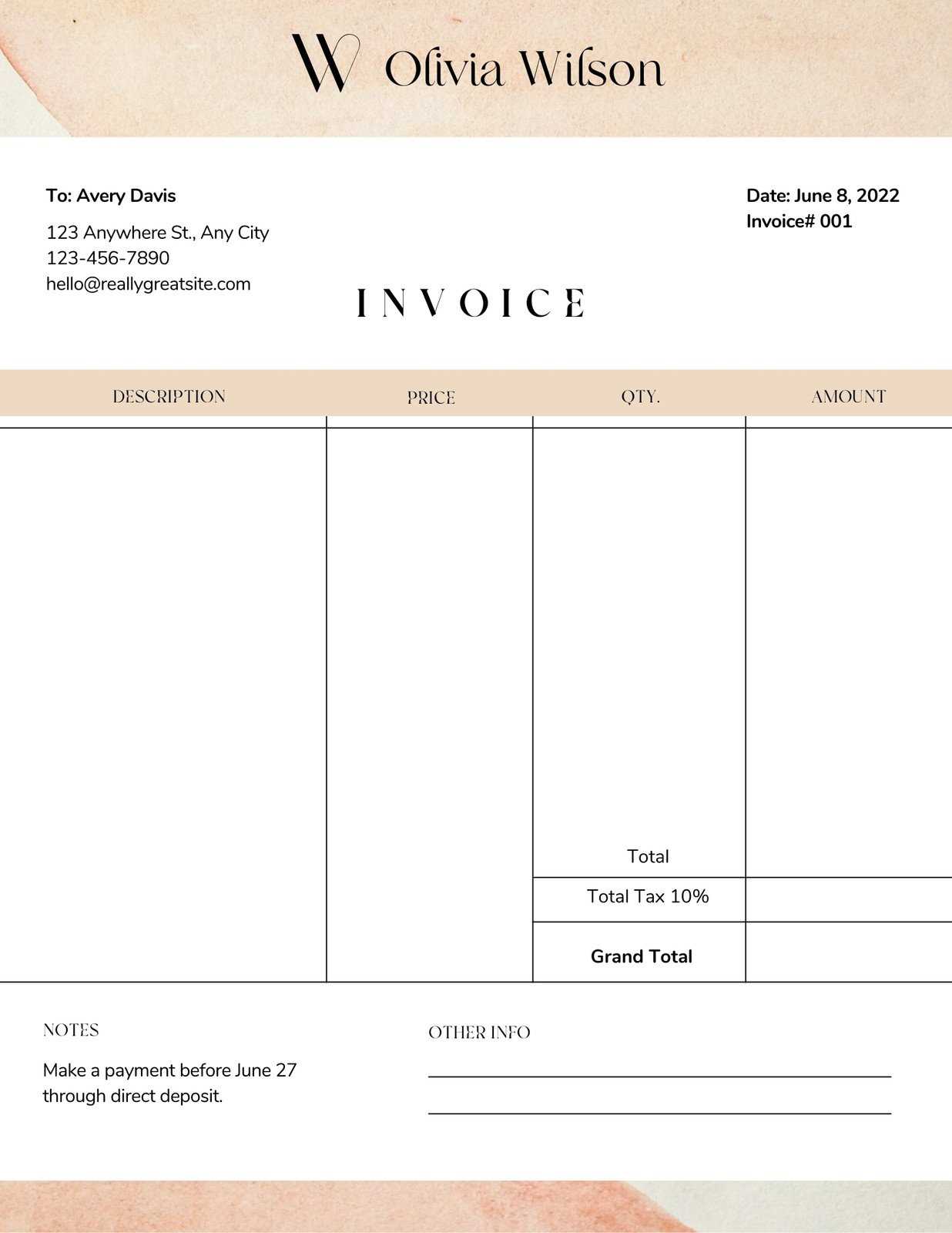

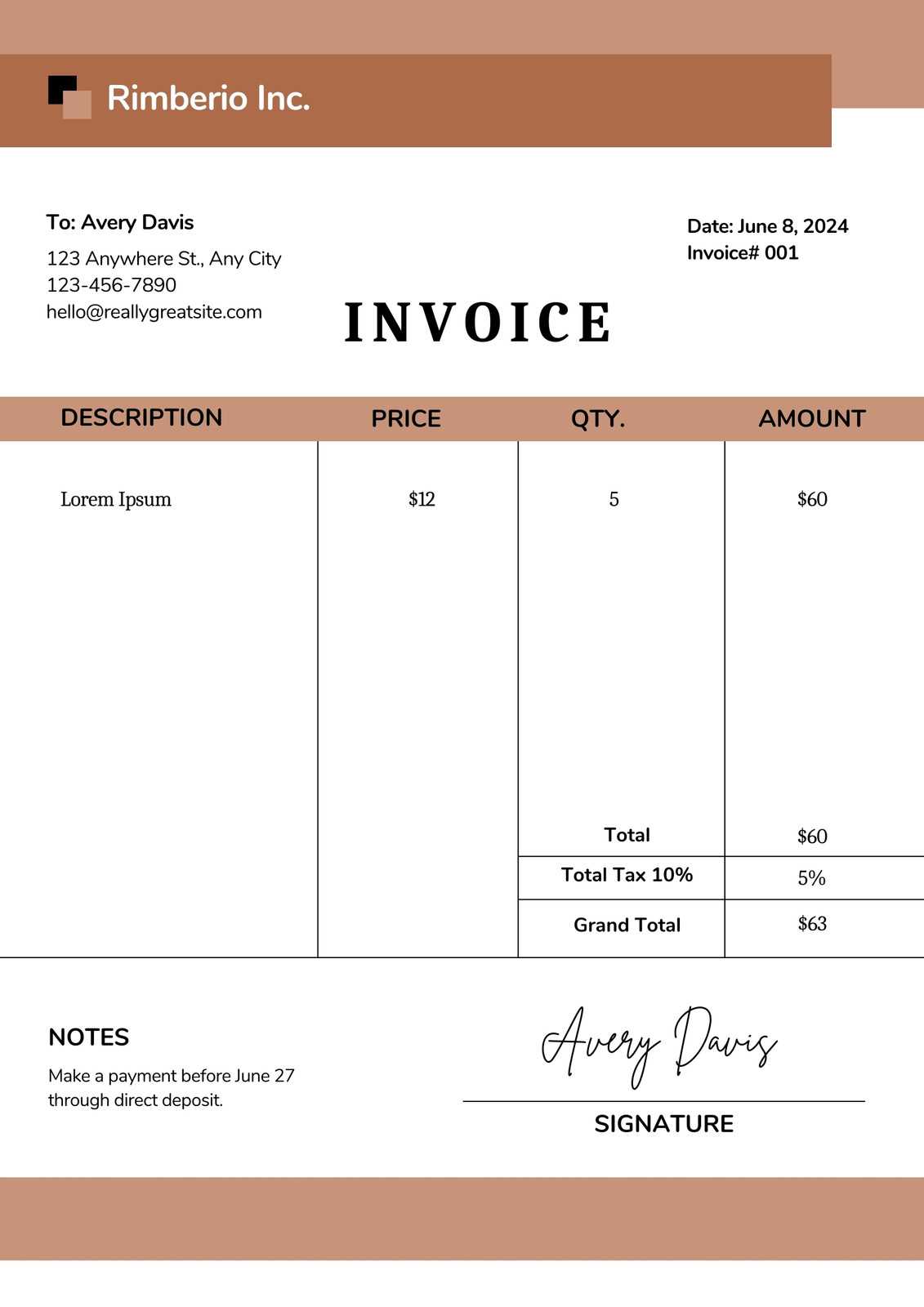

How to Customize Your Service Invoice

Tailoring your billing document to fit the unique needs of your business and clients is a crucial step in maintaining professionalism and clarity. Customization allows you to add specific details that reflect your brand, the nature of your work, and the terms you wish to establish with each client. By adjusting certain elements, you can make the document more aligned with your business practices and create a better experience for your customers.

Adjusting Key Information

The first step in customizing your billing form is ensuring that all relevant information is clearly presented. This includes your business name, logo, and contact details, as well as the client’s name and contact information. Adding these elements helps personalize the document and ensures that both parties have the correct contact details in case of questions or issues.

- Business Details: Include your business name, logo, and contact information.

- Client Information: Make sure to include the client’s name, address, and contact details.

Including Payment Terms and Conditions

Customizing payment terms is another important aspect. Specify the method of payment you accept, whether it’s through bank transfer, credit card, or another method. Additionally, set clear expectations regarding the due date, late fees, and any discounts for early payment. This helps avoid misunderstandings and establishes clear guidelines for both parties.

- Payment Methods: Clearly state which methods of payment you accept.

- Late Fees: If applicable, specify any penalties for delayed payments.

- Discounts: Offer early payment discounts if your business model includes them.

By customizing your billing documents to reflect these personalized elements, you can enhance the professionalism and functionality of your financial communications, making it easier for both you and your clients to understand the terms of each transaction.

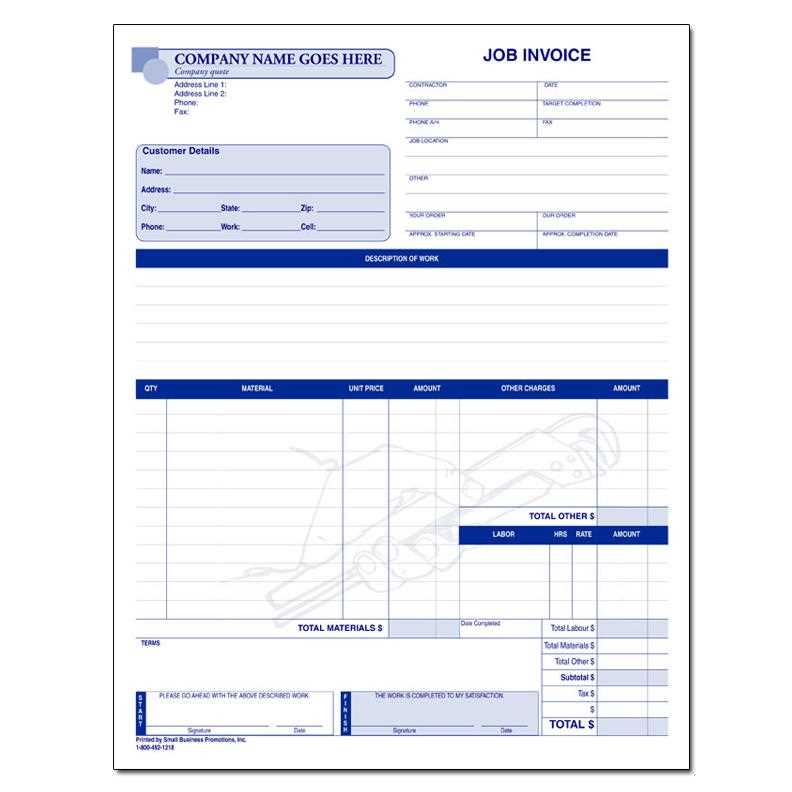

Essential Elements of a Service Invoice

For a billing document to be clear, effective, and legally binding, it must contain certain key components. These elements ensure that both the provider and the client are on the same page regarding the details of the transaction. Including all relevant information not only helps avoid confusion but also ensures timely payment and a smooth professional relationship.

The following are the most important components to include in any billing document:

- Business Information: This includes your business name, address, and contact details, ensuring the recipient knows who is issuing the request for payment.

- Client Details: Include the client’s name, address, and contact information to avoid any confusion about where the document is being sent and who is responsible for payment.

- Unique Reference Number: Assign a unique number to each document for easy tracking. This is especially useful for record-keeping and follow-up purposes.

- Description of Work: Clearly outline the tasks or products provided, with sufficient detail to avoid any ambiguity. Include quantities, unit prices, and any other relevant details.

- Payment Terms: Specify the payment due date, the accepted payment methods, and any late fees or penalties for overdue payments.

- Total Amount Due: The total cost should be prominently displayed, including any taxes, discounts, or additional charges.

- Dates: Include the date the document was issued as well as the due date for payment to ensure clarity about when payment is expected.

By ensuring these essential elements are present in your billing document, you not only maintain a professional image but also facilitate a smoother transaction process. Having all the necessary information at hand can help prevent misunderstandings and expedite payment, benefiting both you and your clients.

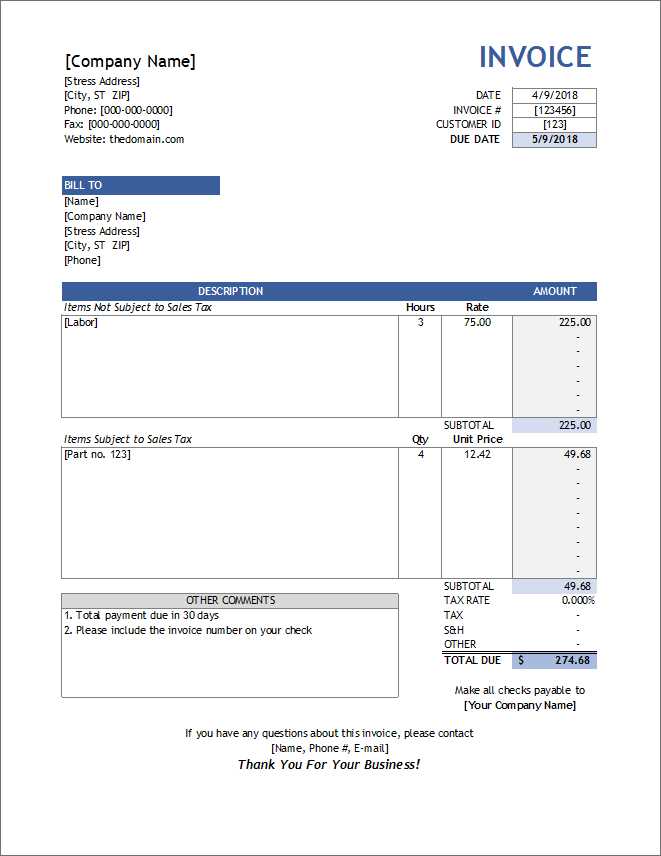

Choosing the Right Invoice Format

Selecting the appropriate layout for your billing document is crucial for ensuring that all essential information is presented clearly and professionally. The format you choose should align with your business needs, client preferences, and the nature of the work provided. A well-organized document helps avoid misunderstandings and ensures timely payment, so it’s important to make an informed decision when choosing the structure.

There are various formats available, each offering different advantages. For example, some formats are more suitable for detailed breakdowns of costs, while others are better for simpler transactions. Understanding the differences will help you decide which format best suits your business and the services you provide.

| Format | Best For | Advantages |

|---|---|---|

| Simple Layout | Small businesses or freelancers with minimal details | Quick to create, easy to understand, straightforward. |

| Detailed Breakdown | Businesses with complex pricing or multiple services | Clear itemization of costs, transparent for clients. |

| Recurring Billing | Subscription-based businesses or regular clients | Automatic calculations, consistent format for recurring payments. |

Choosing the right format depends on your specific requirements. If your business involves multiple types of services or products, a more detailed breakdown might be necessary. On the other hand, if you offer a single service or product, a simpler format may suffice. The goal is to ensure that the document is not only functional but also easy to read and process by your clients.

Free vs Paid Service Invoice Templates

When it comes to selecting a document format for requesting payments, businesses often face the choice between free and paid options. Each type has its own set of advantages and disadvantages, and the right choice depends on the specific needs and resources of your business. Understanding the key differences can help you make an informed decision and select the best option for your financial operations.

Free options are widely available and can be a good starting point for small businesses or freelancers just getting started. However, they often come with limitations in terms of design, customization, and features. On the other hand, paid formats usually offer more advanced features, higher levels of customization, and ongoing support, but come at a cost.

Advantages of Free Formats

- Cost-Effective: No financial investment is required, making it a great option for startups or businesses on a tight budget.

- Simple to Use: Basic designs are easy to implement and don’t require much technical know-how.

- Basic Features: Free options usually include the essential components needed to create a functional document.

Advantages of Paid Formats

- Customization: Paid options often allow for more extensive customization, letting you tailor the document to better match your brand or business style.

- Advanced Features: Some paid formats come with features like automatic calculations, recurring billing options, and integrated payment gateways.

- Support and Updates: With a paid option, you typically get ongoing customer support and access to updates, ensuring your format remains up-to-date with any regulatory or technological changes.

Ultimately, the decision between free and paid formats depends on the complexity of your needs and how much customization or functionality you require. While free formats can serve as a great starting point, a paid solution might be worth considering as your business grows and your requirements become more advanced.

Tips for Professional Invoicing

To maintain strong client relationships and ensure timely payments, it’s essential to approach the process of requesting payment with professionalism. A well-crafted document reflects your business’s credibility and establishes clear expectations with your clients. By following a few simple guidelines, you can enhance the effectiveness of your payment requests and avoid common pitfalls.

Here are some key tips to help you create professional billing documents:

- Be Clear and Detailed: Provide a detailed breakdown of the work completed, including quantities, rates, and descriptions. This clarity ensures that your client understands exactly what they are paying for.

- Use a Consistent Format: Ensure your payment requests follow a consistent layout with the same structure for every document. This makes it easier for clients to navigate and understand the information.

- Set Clear Payment Terms: Include specific payment deadlines, accepted methods, and any penalties for late payments. This helps set clear expectations and reduces the likelihood of delays.

- Double-Check for Accuracy: Before sending your document, verify all the details are correct. Check the client’s contact information, payment amount, and dates to avoid any discrepancies.

- Personalize Your Requests: Adding a personalized message or a thank-you note to your client can go a long way in building positive relationships and showing your appreciation for their business.

- Keep It Professional: Use a professional tone and design. Ensure your document looks polished, and avoid using overly casual language or unprofessional graphics.

By adhering to these best practices, you’ll not only streamline your payment process but also present your business as organized and trustworthy. Professional invoicing builds client confidence and improves your chances of receiving prompt payments, which is essential for the smooth operation of your business.

How to Add Payment Terms in Invoices

Including clear payment terms in your billing document is essential to ensure that both you and your client are on the same page regarding payment expectations. Payment terms outline when and how the client is expected to pay, and they help prevent misunderstandings or delays. Properly specifying these terms not only establishes professional boundaries but also fosters trust between you and your clients.

Here are some key steps to effectively add payment terms to your billing documents:

- Specify Payment Due Date: Clearly state the date by which the payment must be made. This date should be reasonable and take into account the nature of your work or product delivery. For example, “Payment due within 30 days of receipt.”

- Define Accepted Payment Methods: List the methods by which clients can make payments. This could include options such as bank transfers, credit cards, checks, or online payment systems like PayPal or Stripe. Clearly stating the accepted methods avoids confusion.

- Late Fees and Penalties: Include a clause for late payments. Specify the additional charges that will apply if the client does not pay by the due date. For example, “A late fee of 2% per month will be charged on overdue amounts.”

- Discounts for Early Payment: If applicable, offer incentives for early payment. This could be in the form of a percentage discount, such as “5% discount if paid within 10 days.” This encourages prompt payments and can help with cash flow.

- Payment Installments: If you allow clients to pay in installments, clearly outline the schedule, amounts, and due dates for each payment. For example, “50% due upfront, with the remaining 50% due 30 days after project completion.”

Incorporating these payment terms ensures both clarity and fairness, which can improve the likelihood of timely payments. When clients know exactly when and how to pay, they are more likely to comply with the terms, reducing the chances of delays and disputes.

Best Practices for Accurate Invoicing

Ensuring accuracy in your billing documents is essential for maintaining professional relationships and ensuring timely payments. Small mistakes, such as incorrect amounts or missing information, can lead to misunderstandings, delays, and even disputes. Adopting best practices for accuracy helps prevent errors and establishes trust with clients, allowing you to focus on growing your business.

Key Practices to Ensure Accuracy

- Double-Check Client Information: Always verify the client’s contact details, such as name, address, and email, before sending out your document. Mistakes in these areas can lead to confusion or even non-payment.

- Verify Services and Costs: Ensure that all descriptions, quantities, and prices are correct. Cross-check the details of the work done or products provided, and be sure the pricing matches what was agreed upon in your contract or proposal.

- Confirm Payment Terms: Clearly state the payment due date, methods of payment, and any additional terms, such as late fees or discounts for early payments. Make sure the payment terms are in line with your agreement with the client.

- Track Previous Payments: If your client has made partial payments or if there are any outstanding balances from previous transactions, be sure to update the current document accordingly. This will prevent confusion and ensure the correct amount is requested.

- Use Reliable Software: Consider using accounting or billing software that automates the creation of documents. Such tools often include built-in features to minimize human error, such as automatic calculations and pre-set formatting.

Additional Tips for Improved Accuracy

- Keep Consistent Documentation: Establish a standard process for creating and tracking payment requests. Using the same structure each time makes it easier to spot errors and ensure consistency.

- Set a Reminder System: Implement reminders for reviewing and sending documents. This way, you can ensure that invoices are sent promptly and accurately without missing important deadlines.

- Review Before Sending: Always proofread your document before sending it. Double-check all the numbers, dates, and details to avoid the embarrassment and inconvenience of sending an incorrect request.

By following these best practices, you can significantly reduce errors in your billing documents and create a smoother experience for both you and your clients. Accurate invoicing is a key aspect of running a successful business and can help improve cash flow, maintain professionalism, and avoid potential payment delays.

How to Track Service Invoices

Effectively tracking payment requests is essential for ensuring timely payments, maintaining accurate financial records, and staying on top of your business’s cash flow. Whether you are managing a small business or a large enterprise, having a system in place to track issued documents will help you monitor outstanding balances and prevent any missed payments or errors in your accounting.

Tracking is not just about knowing when and how much clients owe you; it’s about maintaining transparency, keeping records up to date, and simplifying your financial management. Below are several key strategies to track your payment requests efficiently.

Methods for Tracking Payment Requests

- Use Accounting Software: One of the most efficient ways to track all outstanding and paid amounts is to use accounting software. These tools automatically track all the details of issued documents, providing you with up-to-date records and easy access to reports on payments and overdue amounts.

- Create a Manual Tracking System: For businesses that prefer not to use software, a simple spreadsheet can be an effective tool. Record each document’s details, including the client name, date issued, due date, and payment status. This method requires more manual updates but offers control over your data.

- Assign Unique Reference Numbers: Each request should have a unique identification number. This helps to track and organize them easily, whether you are using software or a manual system. Reference numbers simplify searching for specific documents and help prevent confusion.

- Set Up Payment Reminders: Ensure that you set up reminders for both you and your clients. Whether through software or a manual system, reminders help track the due dates and notify clients of upcoming payments. They also prompt you to follow up on overdue amounts.

Additional Tips for Effective Tracking

- Monitor Payment Status Regularly: Make it a routine to review the status of all outstanding requests. Regular checks ensure that nothing falls through the cracks and that you stay on top of any overdue amounts.

- Maintain Detailed Records: Keep detailed logs of all payments received, including partial payments and any communication with clients regarding payment delays or issues. This transparency can prevent disputes and clarify any discrepancies.

- Utilize Cloud Storage: If you’re storing physical copies of your payment requests, consider scanning and storing them digitally on a cloud service. This ensures easy access and backup, preventing the loss of important documents.

By implementing these strategies, you can improve the accuracy of your financial records and ensure that you are consistently paid on time. Whether you use software or manual systems, effective tracking of payment requests is a cornerstone of strong business operations and financial health.

Common Invoice Mistakes to Avoid

When creating payment requests, small errors can lead to confusion, payment delays, and even disputes with clients. These mistakes, though often overlooked, can cause unnecessary stress for both parties involved. By being aware of the most common errors and taking steps to avoid them, you can ensure that your documents are clear, professional, and accurate, ultimately streamlining your payment process.

Below are some of the most frequent mistakes that businesses make when preparing payment requests:

| Common Mistake | Consequence | How to Avoid |

|---|---|---|

| Missing or Incorrect Client Information | Delays in payment or confusion about who the document is for. | Always double-check the client’s name, address, and contact details before sending. |

| Unclear or Incomplete Descriptions of Work | Disputes over the services or products provided, leading to delayed payments. | Provide detailed descriptions of the work or items, including quantities, rates, and dates. |

| Incorrect Amounts or Calculations | Overcharging or undercharging, causing clients to question the accuracy of the document. | Double-check all numbers and use automated tools or calculators for accuracy. |

| Failure to Include Payment Terms | Misunderstanding about when and how payment is due, leading to delays. | Clearly state the due date, accepted payment methods, and any late fees. |

| Not Assigning a Unique Reference Number | Difficulty tracking or referencing specific documents, leading to confusion. | Assign a unique identifier to each document for easy tracking and referencing. |

| Sending Invoices Too Late | Delays in receiving payments, which could impact cash flow. | Send payment requests promptly after the work or delivery is completed. |

By recognizing and correcting these common mistakes, you can create more efficient and professional payment requests that help ensure timely payment and maintain good relationships with clients. Careful attention to detail will not only reduce confusion but also improve the overall experience for both you and your clients.

How to Handle Late Payments on Invoices

Late payments are a common challenge for businesses of all sizes, and while they can be frustrating, they don’t have to disrupt your operations. Knowing how to approach overdue payments professionally and effectively is key to maintaining cash flow and client relationships. By taking a structured approach to managing delayed payments, you can ensure your business remains financially stable without damaging your reputation.

There are several strategies you can implement to handle overdue payments, including setting clear expectations, following up regularly, and enforcing late fees. Below are some steps to help you manage delayed payments efficiently.

Steps to Handle Overdue Payments

- Set Clear Payment Terms in Advance: Prevent confusion by defining payment deadlines and penalties for late payments before any work begins. Make sure your client knows when to expect the request and what the penalties will be if payment is late.

- Send a Friendly Reminder: If a payment is overdue, send a polite reminder. Often, late payments are simply a result of forgetfulness, and a courteous follow-up can prompt your client to settle the balance promptly.

- Follow Up Consistently: If the payment is still not made, follow up regularly. Send emails, make phone calls, and use other communication channels to stay in touch until the issue is resolved. Be firm but respectful in your approach.

- Offer Payment Plans: If your client is facing financial difficulties, offer a payment installment plan. This can help ensure that you get paid over time while maintaining a good business relationship.

- Enforce Late Fees: After the payment due date has passed, enforce the agreed-upon late fee. Clearly state the additional charge on your follow-up requests and keep communication professional.

- Consider Suspension of Services: If the overdue payments continue to pile up, you may want to suspend further services until the account is brought up to date. Be transparent about this action in advance to avoid surprises.

Table: Late Payment Follow-Up Timeline

| Timeframe | Action | Details | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1-3 Days After Due Date | Friendly Reminder | Send a polite email or message to remind the client of the overdue balance. | |||||||||||||

| 1 Week After Due Date | Second Reminder | Follow up with a second reminder, including a request for immediate payment or an explanation of the late fee. | |||||||||||||

| 2 Weeks After Due Date | Formal Notice | Send a formal notice indicating that the account is past due and that further actions, like suspending services or charging a late fee, will occur. | |||||||||||||

| 1 Month After Due Date | Enforce Late F

Creating Recurring Invoices for ServicesFor businesses that provide ongoing services or products, setting up recurring payment requests can simplify the billing process. Recurring documents automatically generate and send regular payment reminders to clients, ensuring that you don’t need to manually create a new request each time. This method saves time, reduces the risk of human error, and ensures that payments are consistently made according to the agreed schedule. When creating recurring billing requests, it’s important to clearly define the frequency of payments, the amounts due, and the duration of the agreement. Automating this process can help maintain regular cash flow and avoid missed payments. Here’s how to set up recurring payment requests effectively. Steps to Create Recurring Billing Requests

Tools to Automate Recurring Billing

By establishing a clear and consistent process for recurring requests, you’ll not only save time but also improve the overall payment experience for both you and your clients. This method ensures that your revenue stream remains predictable, while minimizing administrative work and potential payment delays. Importance of Clear Invoice DescriptionsProviding detailed and precise descriptions on payment requests is crucial for both businesses and clients. Clear descriptions ensure that clients understand exactly what they are being charged for, reducing the potential for confusion or disputes. When payment requests lack sufficient detail, clients may question the charges, delay payments, or fail to recognize the value of the work or products provided. Incorporating well-written descriptions not only promotes transparency but also helps maintain a professional image. It shows that you are organized, trustworthy, and committed to clear communication. Here are some key reasons why clear descriptions are vital. Reasons for Clear Descriptions

Best Practices for Writing Descriptions

Ultimately, clear and well-organized descriptions enhance the credibility of your business and foster trust between you and your clients. By making sure your payment requests are precise and transparent, you not only help clients u How to Use Invoice Templates for Tax Purposes

Accurate documentation is essential for tax compliance, and using structured payment records can help streamline the process. When preparing financial documents, it’s important to include all necessary details that can support tax reporting and deductions. By using standardized payment records, you can easily track business expenses and revenue, which simplifies the preparation of your tax returns. Using organized templates for financial records ensures that every transaction is captured correctly and consistently, making tax filing easier. Below are some key points on how these records can help during tax season. Key Tax Benefits of Using Organized Records

Essential Information for Tax PurposesWhen creating payment records for tax purposes, it’s important to include specific details that can be used in the preparation of your taxes. Here are the key components:

|