Microsoft Excel Templates for Invoices to Enhance Your Billing Efficiency

Managing billing can often be time-consuming and prone to errors. However, using well-designed documents can streamline this process, making it quicker and more accurate. With the right approach, you can create professional, customized records without needing complex software.

By utilizing preformatted spreadsheet files, businesses can easily track payments, calculate totals, and keep a consistent structure. These solutions offer flexibility, allowing users to adapt the layout and formulas to meet their unique needs. Whether you’re handling a few transactions or managing multiple clients, this method saves time and reduces the risk of mistakes.

With the ability to automatically calculate totals, taxes, and discounts, these documents offer a practical way to manage your financial transactions. By making use of simple, yet powerful tools, you’ll be able to create clear, professional records with minimal effort.

Spreadsheet Solutions for Professional Billing

Creating clear, organized financial records is essential for any business. Using structured files that simplify calculations and layouts helps streamline the billing process. These ready-to-use documents can be customized to fit various needs, enabling accurate tracking of transactions and ensuring professionalism in every interaction.

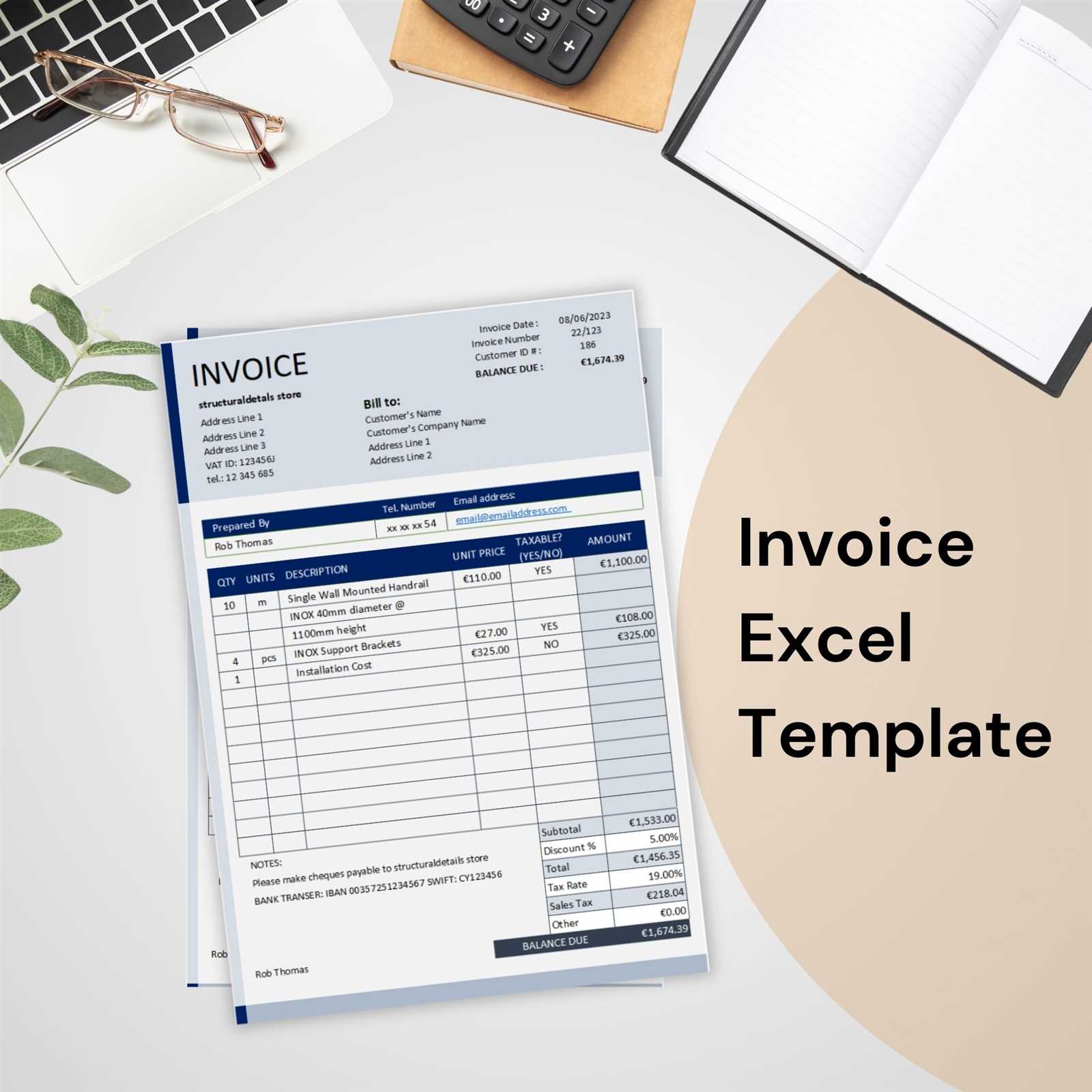

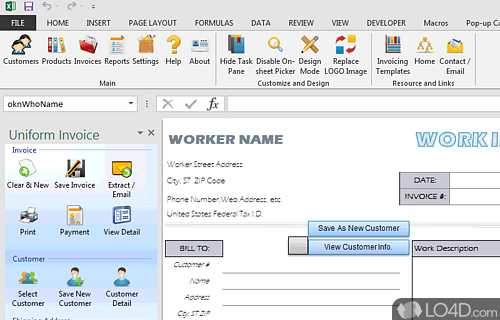

With these user-friendly tools, it is possible to create professional billing statements without the need for specialized software. By adjusting a few details, such as client information and pricing, a high-quality record is quickly produced. Here is an example of a typical structure that can be used to generate such statements:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 | $100 | $500 |

| Software License | 2 | $150 | $300 |

| Subtotal | $800 | ||

| Tax (5%) | $40 | ||

| Total Amount Due | $840 |

This format ensures that all necessary details are captured clearly, providing both the customer and the business with an organized breakdown of services rendered and amounts due. Adjusting such records to suit your specific needs is easy, making it a convenient tool for both small and large-scale operations.

Why Use Excel for Invoices

Using a simple spreadsheet program to create billing statements offers numerous advantages. Its accessibility, flexibility, and ease of use make it an ideal tool for managing financial transactions. Instead of relying on costly or complex software, you can leverage straightforward functions to generate professional, customized documents quickly.

Cost-Effectiveness

One of the primary reasons businesses choose this method is its low cost. Most users already have access to the software, and there are no additional fees for creating and customizing financial documents. This makes it a perfect solution for small businesses and freelancers looking to keep their expenses low while maintaining high-quality records.

Efficiency and Automation

With the right setup, spreadsheet tools allow you to automate calculations such as totals, taxes, and discounts. This reduces the risk of manual errors and saves valuable time, enabling you to focus on other aspects of your business. Custom formulas and functions can also speed up the creation of these records, ensuring that each transaction is tracked accurately.

Overall, this method offers a straightforward, effective way to manage your financial documentation without the hassle of specialized software or complicated systems.Is there anything from this conversation you’d like me to remember for next time?

Top Benefits of Invoice Templates

Using preformatted billing documents provides several advantages, simplifying the entire process of creating and managing financial records. These ready-made structures allow businesses to save time, improve accuracy, and maintain consistency in their transactions. Here are some of the top benefits:

- Time-Saving: Pre-designed documents allow you to quickly fill in relevant details without the need to start from scratch each time.

- Professional Appearance: With a polished, standardized layout, you can create well-structured and professional statements that reflect your business’s credibility.

- Accuracy: Built-in formulas reduce the risk of errors, especially when calculating totals, taxes, and other fees.

- Customizability: You can easily adjust the format, layout, and content to match your specific needs and branding.

- Consistency: Having a consistent document style helps maintain uniformity in your financial records, making it easier to track past transactions.

Incorporating these streamlined solutions into your business operations helps ensure that billing remains clear, efficient, and error-free, freeing up time for other important tasks.

How Excel Simplifies Billing

Billing can be a complex and time-consuming process, but using a well-organized digital document makes it much easier to manage. With simple tools, calculations, and easy customization, creating and tracking financial records becomes more efficient, reducing the chances of errors and saving valuable time.

Streamlining the Process

One of the primary ways this software simplifies the billing process is through automation. By using predefined structures, you can automatically calculate important values such as totals, taxes, and discounts, minimizing the need for manual input and reducing the chance of mistakes.

- Automatic Calculations: Automatically sum up item costs, taxes, and discounts with built-in formulas.

- Customizable Fields: Tailor the document to include specific details such as client names, product descriptions, and payment terms.

- Efficient Data Entry: Easily input information using simple dropdown lists or pre-set fields that guide the user.

Improving Accuracy and Consistency

With structured forms, every transaction follows the same layout, ensuring that all necessary details are included and nothing is overlooked. This consistency is vital for smooth business operations, especially when dealing with multiple clients or transactions.

- Standardized Layouts: Keep your billing records uniform, ensuring consistency across all documents.

- Reduced Human Error: By relying on automated calculations, the chance of miscalculations is significantly reduced.

- Easy Tracking: Organized records make it simpler to find past transactions and manage payments efficiently.

In summary, using digital sheets for financial documentation simplifies the billing process by automating key tasks, ensuring uniformity, and improving accuracy, which ultimately saves time and effort.

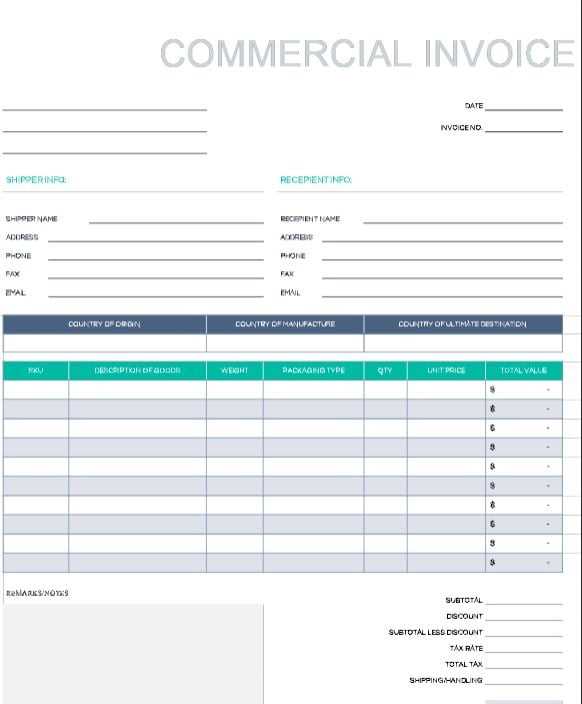

Key Features of Invoice Templates

Ready-made billing documents offer several essential features that make creating financial records simpler and more efficient. These features ensure accuracy, customization, and professionalism, providing businesses with a reliable tool for managing transactions. Here are some of the key aspects that make these tools highly beneficial:

Essential Layout Elements

Every effective billing statement needs a structured layout to display important details clearly. A well-organized document ensures that information is easy to find and that no essential data is missed. Common layout elements include:

| Section | Description |

|---|---|

| Header | Contains company name, logo, and contact information for easy identification. |

| Client Information | Includes the client’s name, address, and contact details for accurate billing. |

| Itemized List | Displays a breakdown of services or goods provided, with costs for each item. |

| Terms and Payment Details | Lists payment methods, deadlines, and any other conditions for the transaction. |

Automation and Customization

Another important feature is the ability to automate key calculations and customize the content. This allows users to generate consistent records without manually entering data each time, saving both time and effort. Key functions include:

- Auto-Calculation of Totals: Automatically calculate subtotals, taxes, and final amounts based on entered data.

- Customizable Fields: Tailor the document to include specific details related to your business or client, such as unique product descriptions or service categories.

- Flexible Design: Easily change fonts, colors, or layouts to match branding or personal preferences.

With these features, ready-made billing forms make it easier to maintain a professional appearance, reduce errors, and ensure accurate tracking of financial data. Customization options also make them adaptable for different industries and business needs.

Customizing Excel Templates for Your Needs

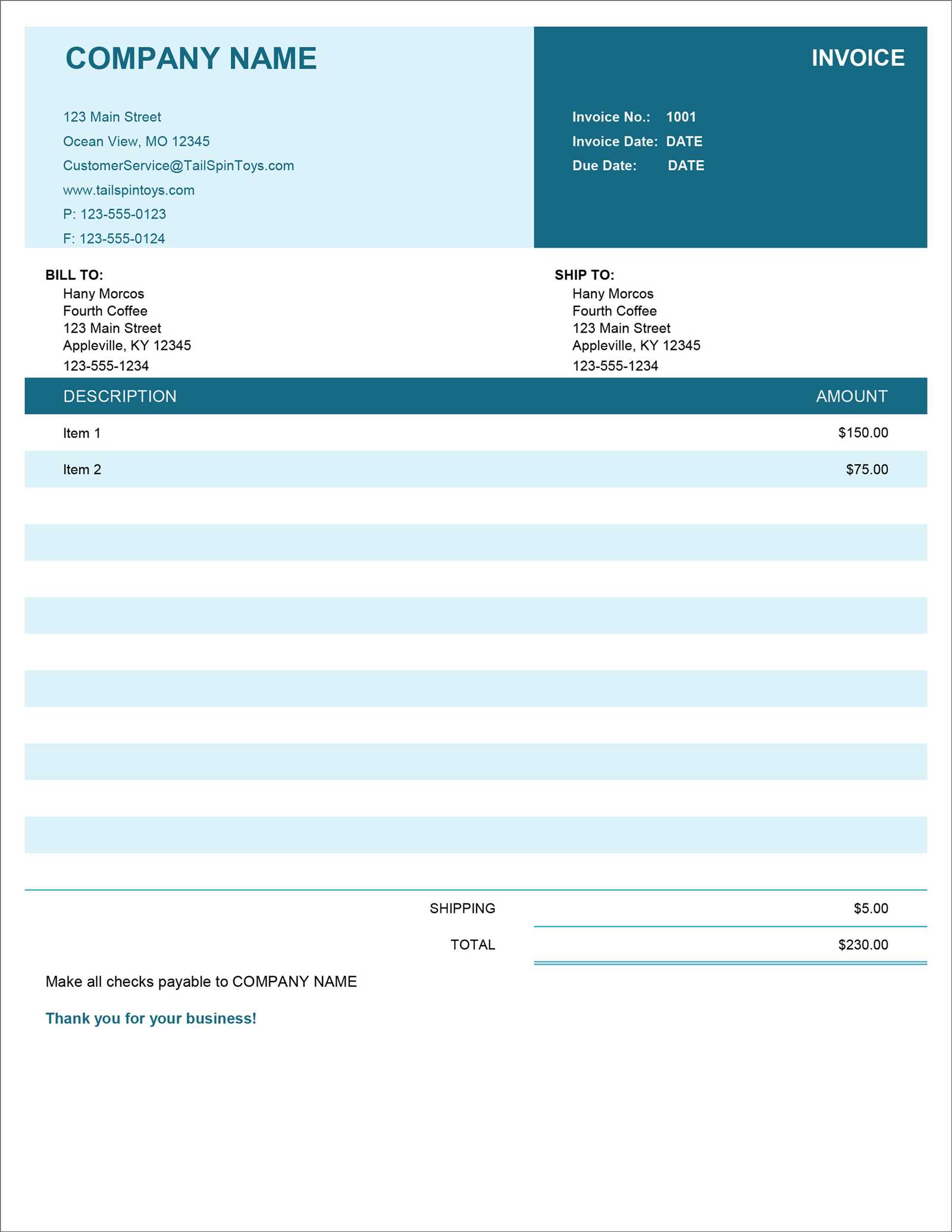

Adapting pre-made billing documents to your specific business requirements allows you to enhance both efficiency and accuracy. Customization ensures that the document reflects your unique brand, includes all necessary details, and suits the specific way you manage your transactions. Below are several ways you can adjust these documents to fit your needs:

Modifying Layout and Design

One of the most significant advantages of using customizable documents is the ability to modify the layout. Whether you want to add or remove sections, adjust the style, or organize data in a more intuitive way, this flexibility helps streamline your workflow. Common design changes include:

- Adding Company Branding: Insert your logo, adjust fonts, and modify colors to align with your business’s visual identity.

- Resizing Columns and Rows: Adjust the size of fields to accommodate more information or ensure that each section is clearly visible.

- Including Custom Fields: Add additional fields for unique items, such as special discounts or additional service details.

Automating Calculations and Data Entry

Another way to customize is by incorporating automatic calculations and data entry features that align with your business needs. By using simple formulas and settings, you can ensure that numbers are updated automatically, reducing the potential for errors. Features to consider include:

- Auto-Calculating Totals: Set up formulas that automatically add the cost of items, taxes, and discounts for fast calculations.

- Pre-filled Dropdowns: Create dropdown menus for frequently used items or services to speed up data entry.

- Customizable Payment Terms: Adjust payment terms, such as deadlines and methods, to suit each client’s needs.

By making these adjustments, you can ensure that your billing system meets your business’s unique requirements while saving time and improving accuracy.

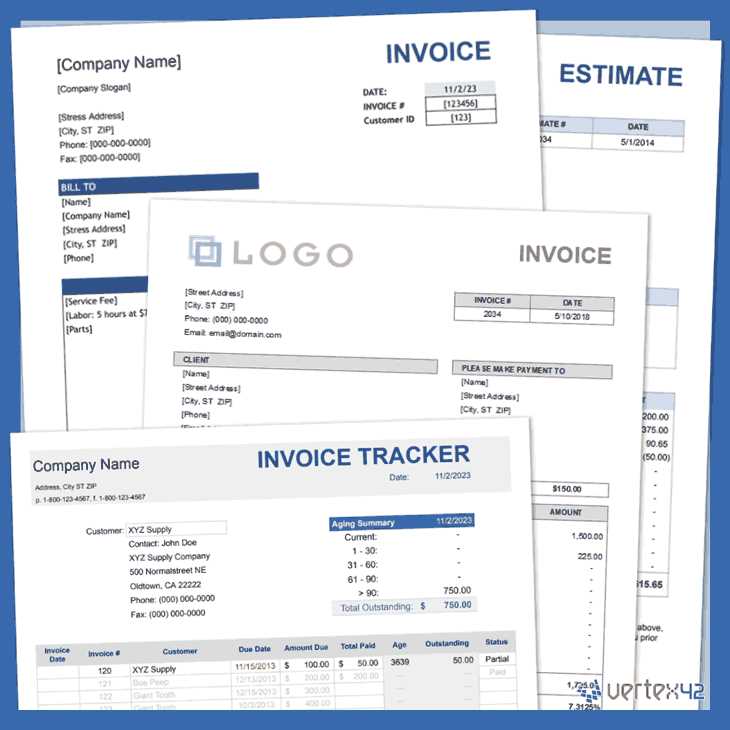

Choosing the Right Invoice Format

Selecting the right billing document format is crucial for ensuring clarity, professionalism, and efficiency in your transactions. The format you choose should reflect your business’s needs, the nature of your products or services, and the expectations of your clients. There are various formats available, each with its own advantages and best-use scenarios. Here are key considerations when choosing the ideal structure for your business:

Understanding Your Business Needs

Different types of businesses may require different structures. For example, a service-based company might need a simpler document with fewer line items, while a product-oriented business may require more detailed information, such as descriptions and quantities. Identifying what information is most important to include will guide your format selection. Some factors to consider include:

- Amount of Detail: Decide how much detail you want to display for each item, such as a breakdown of services or product features.

- Frequency of Transactions: If you have recurring payments, a format that includes space for subscription or installment payments may be more suitable.

- Client Preferences: Understanding how your clients prefer to receive billing records can also influence your choice of format.

Choosing Between Simple and Detailed Formats

Once you’ve determined your business needs, you’ll need to decide whether a simple or more detailed format is necessary. A streamlined layout can speed up processing time, while a more complex document can provide additional information that may be helpful for clients. Consider the following:

- Simple Format: Ideal for straightforward transactions that don’t require in-depth descriptions or multiple pricing options.

- Detailed Format: Best for businesses that need to list multiple items, taxes, or additional terms such as delivery charges or discounts.

By choosing the right format, you can ensure that your billing process is efficient, professional, and easy to understand for both you and your clients.

Automating Invoice Calculations in Excel

Automating the process of calculating totals, taxes, and discounts can save a significant amount of time and reduce the chances of human error. By setting up formulas and automation in your billing documents, you can ensure accuracy and consistency. Below are some common ways to automate calculations, helping you streamline the process:

Using Basic Formulas

Basic formulas can be used to perform essential calculations quickly. These formulas can add up item costs, apply discounts, or calculate taxes. Common formulas include:

- SUM: Automatically adds up the values in a range of cells, such as the total price of products or services.

- PRODUCT: Multiplies numbers together, useful for calculating the total cost based on quantity and price.

- IF: Sets conditional statements that can apply different rules, such as giving discounts based on certain conditions (e.g., purchase over a certain amount).

Applying Tax Calculations

Including tax in your documents can be automated by applying a tax formula. This ensures taxes are always correctly calculated, without needing to manually update the amount. You can:

- Set a fixed percentage: Apply a constant tax rate to the total amount using a simple multiplication formula.

- Use dynamic tax rates: Adjust tax rates for different regions or types of transactions by setting variable values in your formulas.

Discounts and Custom Pricing

Discounts can also be automated by applying specific rules. You can use formulas to apply discounts based on order size or customer status. These automatic adjustments help maintain consistency and ensure pricing is always accurate.

- Percentage-based discounts: Use formulas to subtract a certain percentage from the total price based on predefined criteria.

- Fixed amount discounts: Deduct a fixed amount based on the number of items or specific discounts offered for promotions.

By incorporating these automated features, you can streamline the billing process, improve accuracy, and make your workflow much more efficient.

Saving Time with Prebuilt Templates

Using ready-made documents designed for billing tasks can significantly reduce the time spent on creating and formatting each new record. These pre-designed files allow users to focus on the data, instead of spending time on layout and structure. Here are several ways in which using such documents can help save time:

Quick Setup

Prebuilt documents come with a predefined structure, so users can start entering their information immediately without setting up rows, columns, or headings. This streamlines the entire process and avoids the need for manual adjustments. Common features include:

- Predefined fields: Fields like item description, unit price, quantity, and total are already set up, so you don’t need to manually create them.

- Customizable sections: Easily adaptable to fit different types of billing scenarios, such as adding new line items or changing rates.

Consistency and Accuracy

Using prebuilt documents ensures uniformity across all records. When you use the same layout every time, you reduce the risk of errors related to formatting or missing data. Advantages include:

- Standardized look: Consistent presentation for all your records, giving a professional appearance to every document.

- Auto-calculation features: Pre-set formulas help to automatically calculate totals and taxes, reducing the likelihood of mistakes in calculations.

Ease of Customization

Even though these documents are ready to use, they can still be modified to suit individual needs. Whether it’s adjusting colors, fonts, or adding specific details, the flexibility of prebuilt files ensures they can be tailored to your business’s unique requirements.

- Personalized branding: Add your logo, company details, and unique elements to make the documents your own.

- Adaptable layouts: Easily switch between different formats, such as adding or removing sections as per your billing model.

By utilizing prebuilt documents, you can significantly reduce the time spent on each billing task, increase accuracy, and maintain a consistent, professional image across all your transactions.

How to Download Free Excel Templates

Finding and downloading free documents to streamline billing tasks is simple and efficient. These files are widely available and can be accessed from various online resources that cater to users needing ready-made solutions. Below are steps to help you find and download these helpful tools quickly.

Step 1: Visit Trusted Sources

The first step is to identify reliable websites that offer free downloadable documents. Look for well-known platforms that specialize in business resources and office productivity tools. Websites that have a wide selection of templates are usually trustworthy and frequently updated.

- Official Business Resource Websites: Many business-focused websites offer free tools for professionals, including pre-built billing documents.

- Online Marketplaces: Sites like marketplaces often offer both paid and free versions of various types of records designed for different needs.

Step 2: Select the Right Format

Once you have located a trusted source, browse the available options and select a format that best suits your needs. Pay attention to the layout and the information fields, ensuring that it aligns with your billing process.

- Predefined Layouts: Choose from various predefined formats that already include the necessary fields like price, quantity, and descriptions.

- Customization Options: Look for versions that allow you to adjust the layout according to your specific requirements.

Step 3: Download and Save the File

After selecting the appropriate document, click the download link, and save the file to your computer. Most downloads will be in standard formats, making them easy to open and edit with standard office software.

- Save to Local Storage: Save the file to your computer or cloud storage for easy access whenever you need it.

- Immediate Use: Once downloaded, open the file and begin customizing it with your information without delay.

With just a few simple steps, you can access a wide range of free tools that can save you valuable time in your billing process, ensuring both accuracy and efficiency.

Creating Professional Invoices in Minutes

Generating polished and clear billing documents doesn’t have to take long. With the right tools and structure, it’s possible to create professional records quickly and easily. By following a few simple steps, you can produce accurate and well-organized documents that convey all necessary details to your clients.

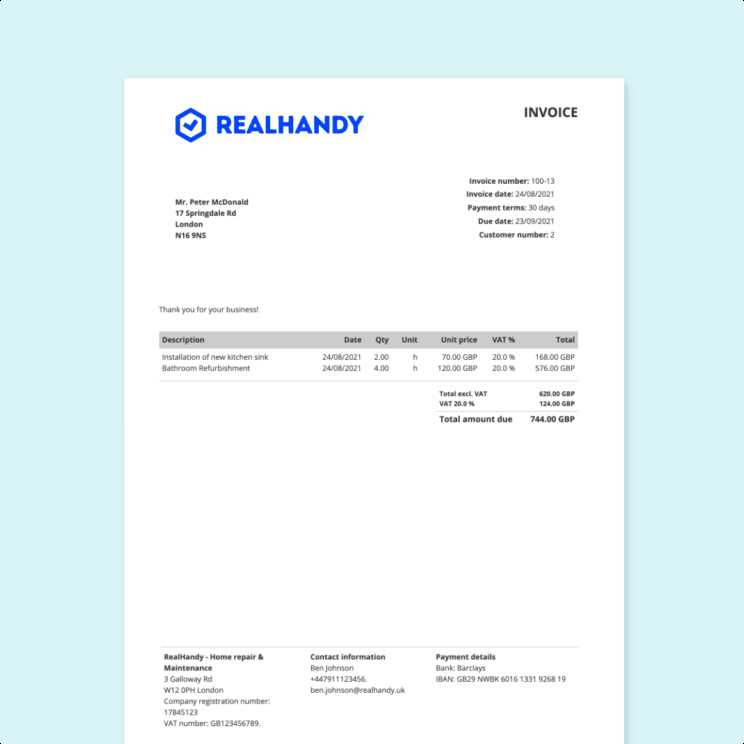

Start by selecting a pre-built document that includes the essential fields, such as item descriptions, prices, taxes, and total amounts. Customizing this document to reflect your business details, such as your logo, business name, and contact information, can be done in just a few clicks. The time-saving power of ready-to-use formats helps you focus on the specifics rather than on designing the layout.

Basic Structure of a Professional Document

The following table outlines the typical components included in a complete billing document:

| Component | Description |

|---|---|

| Business Information | Details of your business including name, address, and contact information. |

| Client Information | Recipient’s name, address, and any relevant contact information. |

| Itemized List | A breakdown of products or services provided, with individual costs and descriptions. |

| Subtotal and Tax | Clear calculations showing the total before taxes and any applicable taxes. |

| Total Amount Due | The final amount the client owes, including taxes and other charges. |

Once the essential fields are filled in, you’re ready to finalize the document. A professional-looking billing document can be created in just a few minutes, leaving you more time to focus on other business tasks. This method ensures that all your documents are consistent, accurate, and presentable, adding credibility to your business interactions.

Organizing Your Invoices in Excel

Efficiently keeping track of billing records is essential for smooth business operations. Organizing your financial documents in a clear, accessible way can save time and ensure you never miss an important detail. By using a simple system, you can keep all relevant information at your fingertips, making it easy to review, update, or generate new records as needed.

The key to organization is setting up a structured system that allows you to quickly find and sort documents based on various factors, such as date, client, or payment status. This process can be done using simple tools, ensuring that your data remains consistent and easy to navigate.

Setting Up a Clear Filing System

To start organizing, consider the following steps:

- Use Columns for Key Data: Assign specific columns for essential information such as date, client name, amounts, and payment status.

- Create Categories: Group entries based on their status (paid, pending, overdue), making it easier to track progress.

- Sort and Filter: Use sorting tools to view records by client, due date, or amount, and filter them as necessary for better organization.

Benefits of a Well-Organized System

With a well-maintained system in place, you can quickly locate past transactions, identify outstanding payments, and generate new documents without searching through a cluttered file. This method minimizes the chances of errors and helps streamline your accounting process. Plus, it’s a simple way to stay on top of all financial obligations.

Managing Multiple Clients with Excel Templates

Handling several clients at once requires a well-organized approach to keep track of transactions, payments, and communication. When you need to manage various projects simultaneously, it’s crucial to maintain clear records for each client. Using a structured system allows you to easily update, search, and access information, minimizing confusion and improving efficiency.

By using a flexible tool, you can tailor your record-keeping to meet the needs of each individual client, whether it’s customizing details or managing due dates. This enables you to stay organized while ensuring no client’s information gets lost or overlooked.

Creating Separate Sheets for Each Client

One effective method for organizing client data is by creating separate sheets or sections for each one. This makes it easy to track specific details such as:

- Client Information: Store basic contact details and service agreements.

- Payment Records: Keep a log of every payment, including amounts and dates.

- Project Milestones: Track progress on ongoing projects and mark completion stages.

Using Conditional Formatting to Stay on Track

Conditional formatting is another useful feature that can help highlight important information such as overdue payments or upcoming deadlines. By setting up color codes or other visual cues, you can easily monitor the status of each project and take action when needed.

Tracking Payments with Invoice Templates

Maintaining a clear record of payments is essential for keeping financial operations smooth and ensuring that all due amounts are settled. An efficient system for tracking received payments helps prevent any errors and ensures that you never miss a transaction. By organizing payment details systematically, you can quickly determine outstanding balances, payment statuses, and any discrepancies.

A structured approach allows you to monitor both incoming and pending payments, providing a clear overview of your financial transactions with clients. This system can help you identify trends in payment patterns, manage overdue accounts, and maintain a transparent relationship with clients.

Setting Up a Payment Tracking System

To track payments effectively, set up a detailed record that includes essential information such as:

| Client Name | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|

| John Doe | $500 | $300 | 2024-10-01 | Partial Payment |

| Jane Smith | $1,000 | $1,000 | 2024-10-05 | Paid |

This table format helps keep track of the payment amounts, their due dates, and the current payment status, making it easier to follow up on outstanding balances and stay organized.

Common Mistakes to Avoid in Invoices

Accurate billing is essential for maintaining a healthy cash flow and a professional relationship with clients. However, errors in billing documents can lead to confusion, delayed payments, and unnecessary disputes. To avoid these issues, it’s crucial to ensure that every detail is correct and that all necessary information is included in the document. Below are some of the most common mistakes to watch out for when creating billing documents.

1. Missing or Incorrect Contact Information

One of the most important aspects of any billing document is the correct contact details of both the service provider and the client. Failing to include or incorrectly entering addresses, phone numbers, or email addresses can lead to communication breakdowns. Always double-check these details to ensure that everything is accurate.

2. Incorrect Payment Terms

Clearly stating payment terms is essential for avoiding misunderstandings. If payment deadlines, accepted methods, or any late fee policies are not specified correctly, clients may delay payments. Ensure that payment conditions are clear and consistent across all documents.

3. Overlooking Taxes or Discounts

Another common mistake is neglecting to include applicable taxes or discounts. Omitting tax amounts or incorrectly calculating discounts can cause discrepancies that might result in payment delays or disputes. Always verify that tax rates are correctly applied and that any discounts are properly accounted for.

4. Errors in Itemization

When listing products or services, accuracy is key. Providing incorrect descriptions, quantities, or prices can create confusion and cause clients to question the charges. Double-check all item details and ensure that the amounts match what was agreed upon.

| Client Name | Service Provided | Amount | Tax | Total |

|---|---|---|---|---|

| John Doe | Web Design | $500 | $50 | $550 |

| Jane Smith | Consultation | $200 | $20 | $220 |

By avoiding these common mistakes, you can ensure that your billing documents are clear, professional, and free from errors, helping to build trust and facilitate prompt payments.

Ensuring Accuracy in Your Invoices

Correct billing is crucial to maintaining professionalism and ensuring that payments are processed without delay. Any inaccuracies in the details can cause confusion, disputes, or even lead to missed payments. Taking the time to check and double-check your documentation before sending it can save time and prevent unnecessary complications in the long run. Below are a few strategies to help you maintain precision when creating financial documents.

1. Double-Check All Data

The most fundamental step in guaranteeing precision is verifying the information in the document. Ensure that all details, such as the recipient’s name, contact information, service descriptions, and pricing, are accurate. A minor error in any of these areas can cause confusion and disrupt the payment process. Always review your entries before finalizing the document.

2. Use Formulas to Avoid Calculation Errors

To avoid manual errors, make use of automated formulas that calculate totals, taxes, and discounts. These formulas will help to maintain consistent accuracy throughout all your documents. The use of built-in functions eliminates the potential for human error, ensuring that totals are always correct and calculations are consistent across different transactions.

Key Areas to Focus On:

- Itemized charges – Make sure quantities, rates, and descriptions are correct.

- Taxes – Double-check tax rates and confirm that they are applied correctly.

- Payment terms – Review deadlines, late fees, and accepted payment methods to ensure clarity.

By incorporating these practices into your routine, you can minimize errors and create professional, precise documents every time. Accuracy not only helps build trust with your clients but also streamlines your financial operations.

How to Protect Your Excel Templates

Securing your financial documents and ensuring that they cannot be altered or accessed by unauthorized individuals is essential. Protecting your work helps maintain the integrity of your data and prevents accidental or malicious changes. There are several strategies available to secure your documents, ensuring they remain safe while you continue to use them efficiently.

One of the most effective ways to secure your files is by using password protection. By setting a password for access, you can ensure that only authorized users are able to open or modify the document. Additionally, locking specific cells or sections of the document can prevent accidental changes to key information such as totals or formulas.

Another strategy is to create backup copies regularly. Keeping secure backups in multiple locations ensures that you have access to your data even if the original file is corrupted or lost. Cloud storage solutions offer added security with encryption and automatic syncing, allowing you to protect your files while keeping them accessible across multiple devices.

Finally, consider using document protection features such as “read-only” mode or restricting editing permissions. These settings allow you to share your file with others while ensuring that only certain areas can be edited. This is especially useful when collaborating or sharing documents with clients, as it reduces the risk of unintended modifications.

Excel Invoice Templates for Small Businesses

Small business owners often face challenges when it comes to maintaining consistent and professional financial documentation. One of the most important documents is the billing statement, which should be clear, accurate, and easy to create. Utilizing pre-designed systems can help simplify this task and ensure accuracy without the need for specialized software.

By using ready-made systems, small business owners can save time and effort while still producing professional-quality documents. These tools allow customization of essential fields, such as client details, itemized lists, and total amounts, to suit individual business needs. Furthermore, many of these systems include built-in features that automatically calculate totals, taxes, and discounts, reducing the risk of errors.

Key Features for Small Business Use

When selecting a system for your billing needs, it’s important to consider key features that will support your business operations:

- Customizable Fields: Easily adjust client information, payment terms, and item descriptions.

- Automatic Calculations: Reduce the chances of mathematical errors with automatic summing of totals, taxes, and discounts.

- Branding Options: Add your logo and brand colors to create a more professional appearance for your documents.

- Tracking Capabilities: Keep a record of sent bills, payment statuses, and outstanding balances in an organized way.

Benefits of Using Pre-Designed Billing Systems

Pre-designed systems provide several advantages for small business owners:

- Time Efficiency: Quickly generate accurate bills without spending hours formatting documents from scratch.

- Consistency: Maintain uniformity in your business’s financial records and make a strong impression with clients.

- Cost-Effective: Avoid the need for expensive invoicing software or hiring professionals to create custom documents.

| Feature | Benefit |

|---|---|

| Customization | Allows personalization to suit your business style and needs. |

| Automation | Helps reduce errors and speeds up the billing process. |

| Tracking | Keeps you organized with easy access to payment statuses and records. |