Free Generic Commercial Invoice Template for Easy Billing

Managing transactions efficiently is essential for any business, and having a clear, structured document for tracking payments can significantly simplify the process. Such documents not only provide clarity but also ensure that both parties involved have a reference point for their agreements. Whether you are a freelancer, small business owner, or large corporation, using a well-organized record for your financial exchanges is key to maintaining professional relationships.

These structured documents typically include all the necessary details to facilitate easy communication about the goods or services provided, including payment terms and contact information. Customizing these records to suit your business needs ensures that every transaction is handled smoothly. With the right format, creating and managing these documents becomes an automated task, freeing up time for more important matters.

Having the right document format allows you to focus on what matters most–growing your business and ensuring your customers are satisfied. By using the appropriate structure, you help establish trust and professionalism with clients, paving the way for continued success.

Essential Features of an Invoice Template

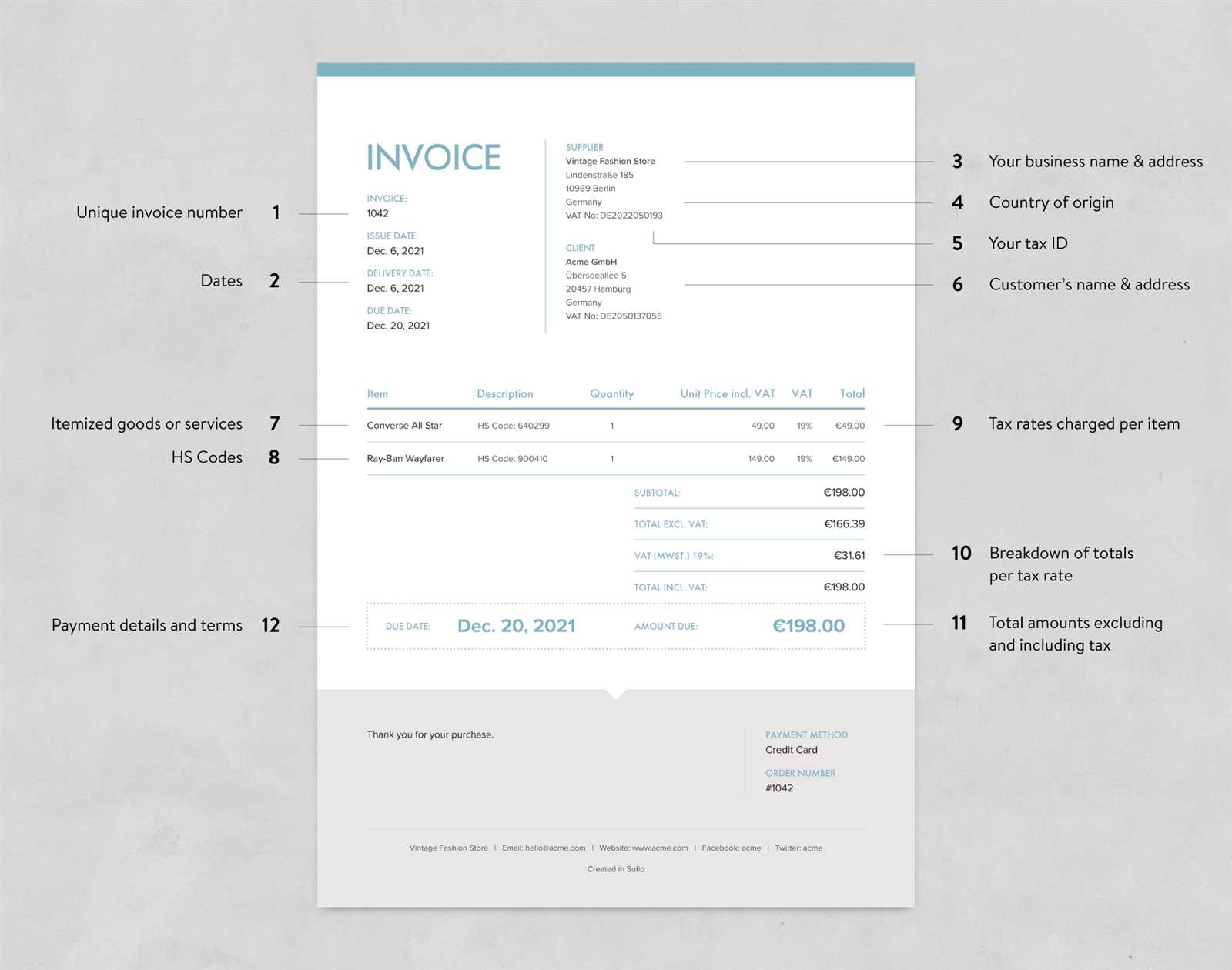

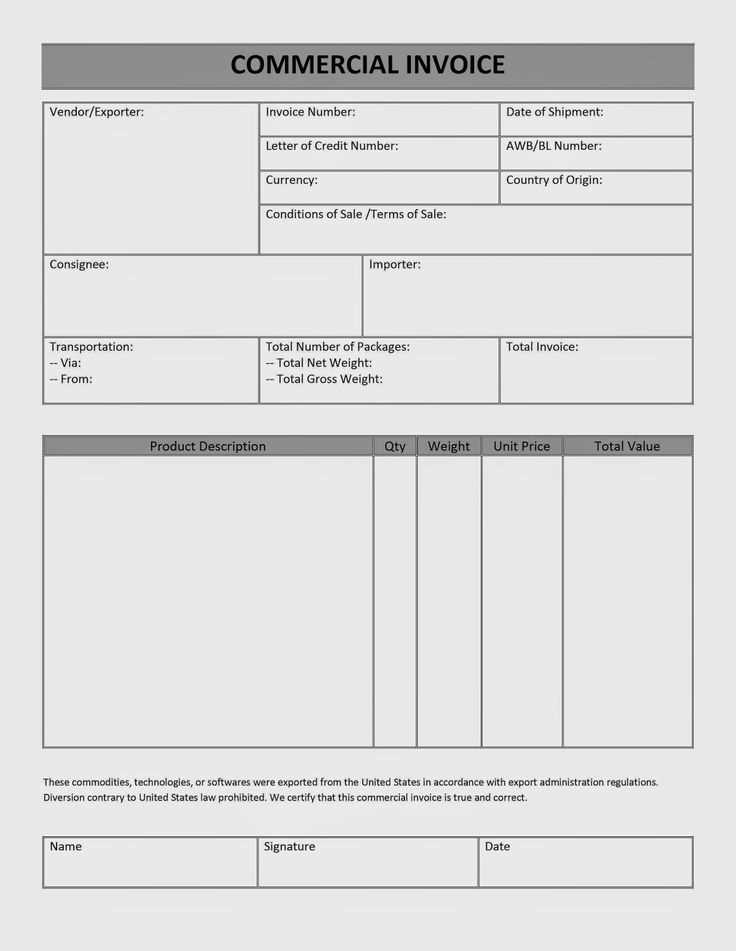

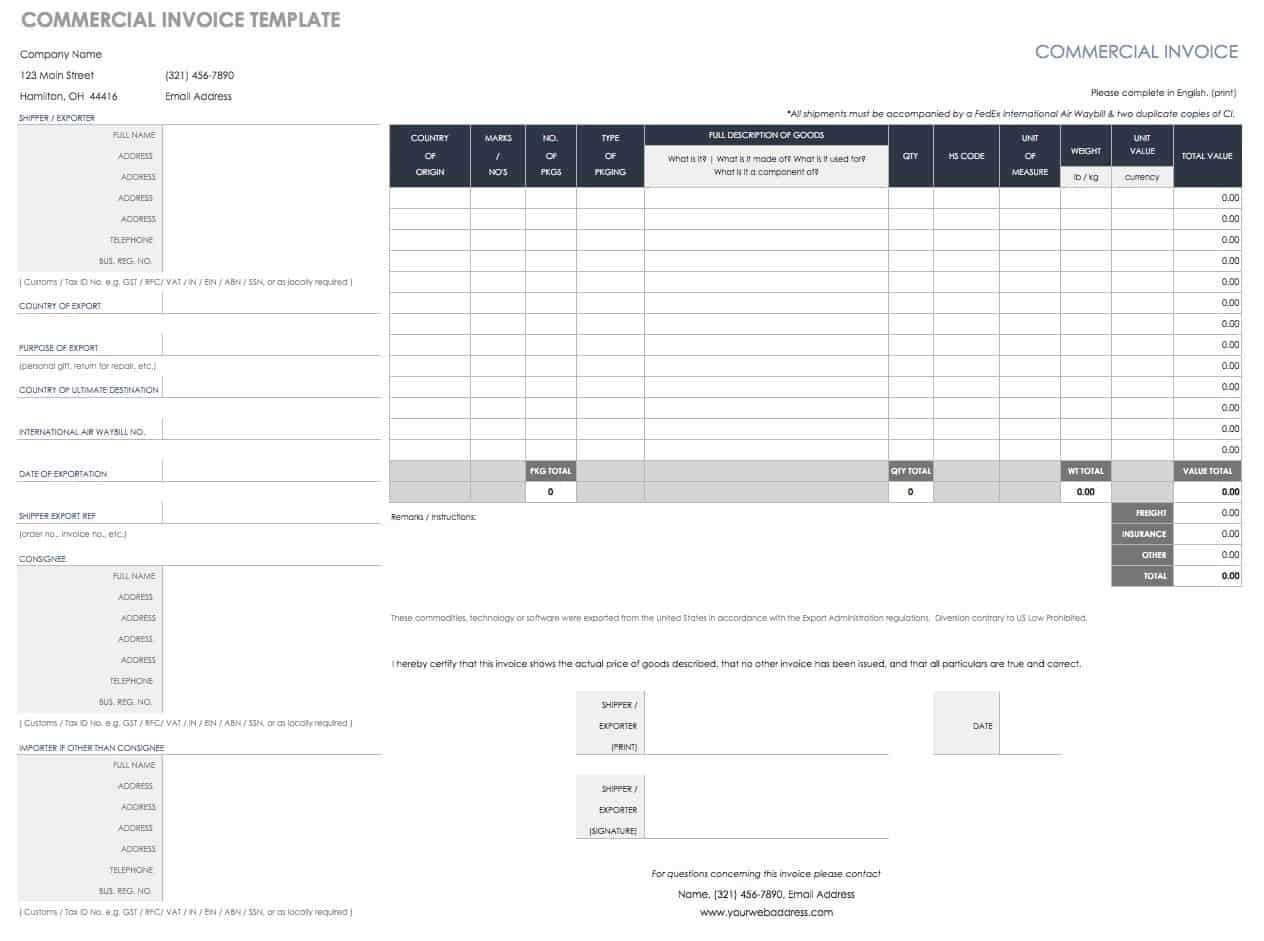

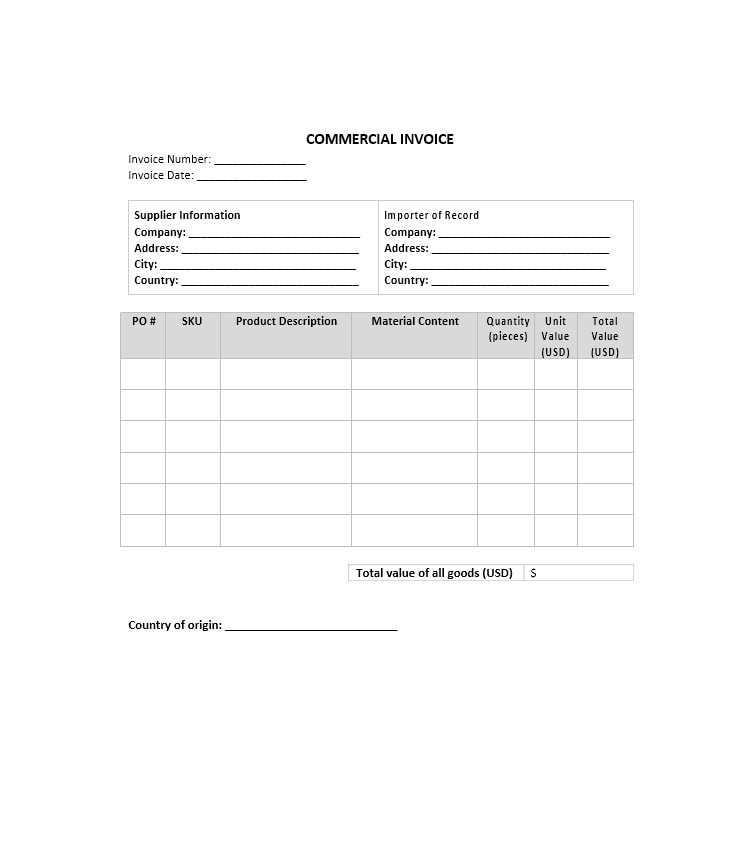

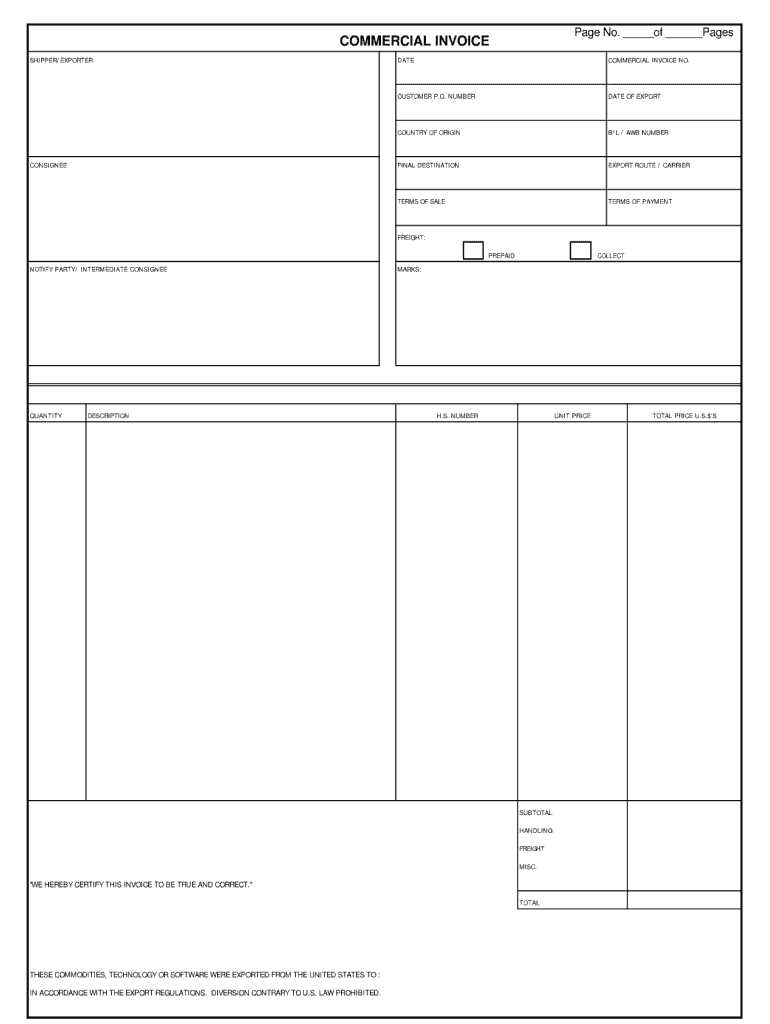

For any business transaction, it is crucial to have a document that clearly outlines the details of the exchange. A well-structured document serves as a record for both the seller and the buyer, ensuring that both parties are on the same page. There are certain elements that must be included to make sure the document is comprehensive, clear, and legally binding.

Basic information such as the names and contact details of both parties is vital. This helps identify the entities involved in the transaction. Additionally, having a unique reference number for each document is important for tracking and managing records. Itemized descriptions of the products or services provided should be detailed, including quantities, unit prices, and any applicable taxes or discounts. This ensures that both parties understand the value of what has been exchanged.

Payment terms are another essential feature. Clearly stating the due date, payment methods, and late fees (if any) can help avoid misunderstandings later. Including a clear total amount due is necessary to eliminate any confusion about the balance to be paid. A properly structured document with all these essential features helps facilitate smooth transactions and strengthens business relationships.

Why You Need a Commercial Invoice

Having a structured document to record financial transactions is crucial for businesses of all sizes. This document serves not only as proof of the exchange but also as a key tool for tracking payments, managing accounts, and maintaining legal compliance. Whether you are shipping goods internationally or providing services to clients, this document plays an important role in establishing trust and ensuring clarity between both parties involved.

For businesses, it is important to have a consistent method for documenting each transaction. This helps to avoid confusion and ensures that both the seller and the buyer are clear on the agreed terms. It also provides an official record that can be used for accounting, audits, and tax reporting.

| Reason | Benefit |

|---|---|

| Legal Documentation | Acts as proof of transaction for legal and compliance purposes |

| Payment Tracking | Helps businesses monitor outstanding balances and payment status |

| Customer Clarity | Ensures both parties understand the transaction details and terms |

| Tax and Accounting | Supports accurate record-keeping for tax filings and financial reports |

Without a structured record, businesses can face delays in payments, misunderstandings with clients, and even legal issues. Therefore, this document is essential for keeping financial operations smooth and transparent.

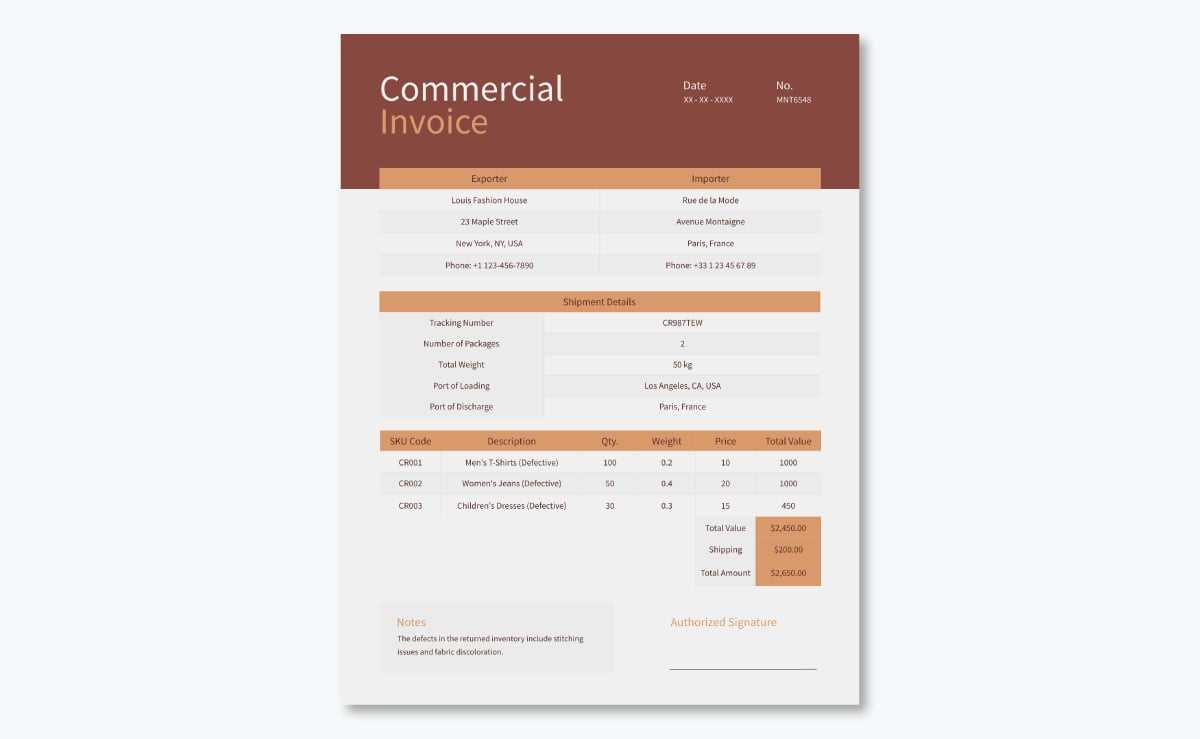

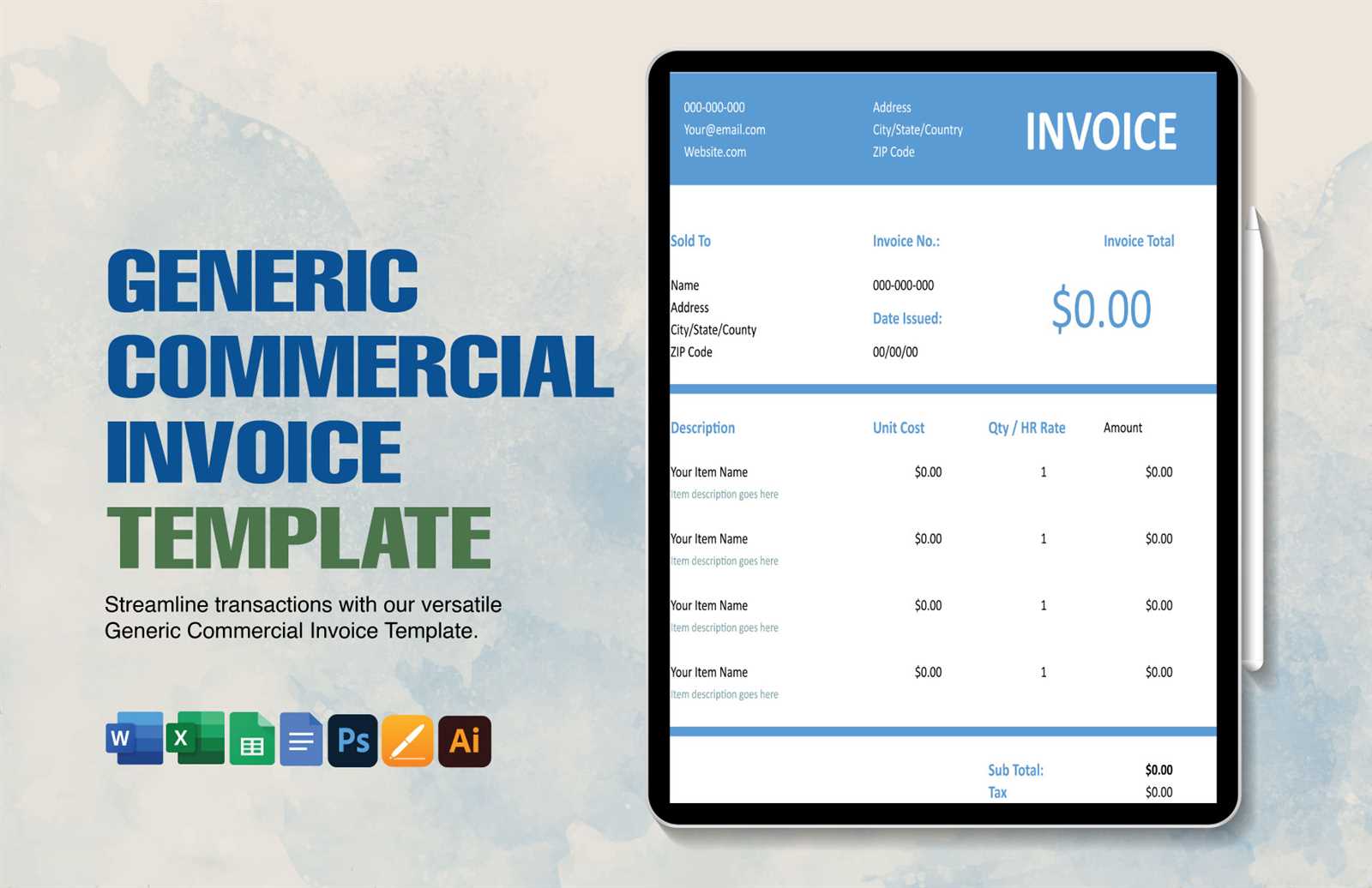

Customizing Your Invoice for Business

Tailoring your financial documents to meet the specific needs of your business is essential for ensuring smooth transactions and professional interactions. Customization allows you to include business-specific details, branding, and unique payment terms that align with your company’s operations. By adapting these records, you can create a consistent experience for your clients while streamlining internal processes.

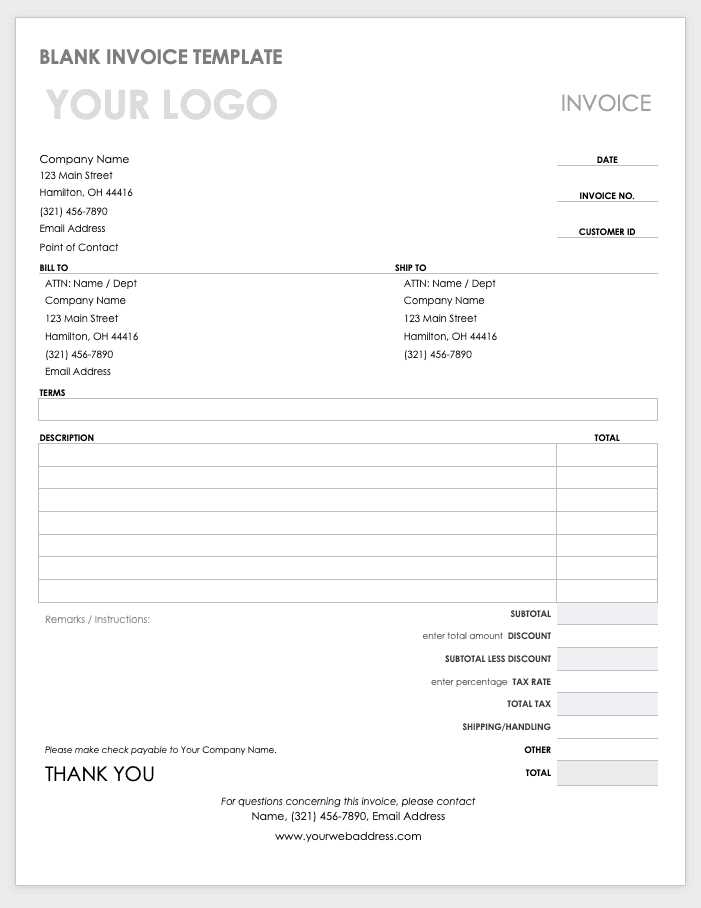

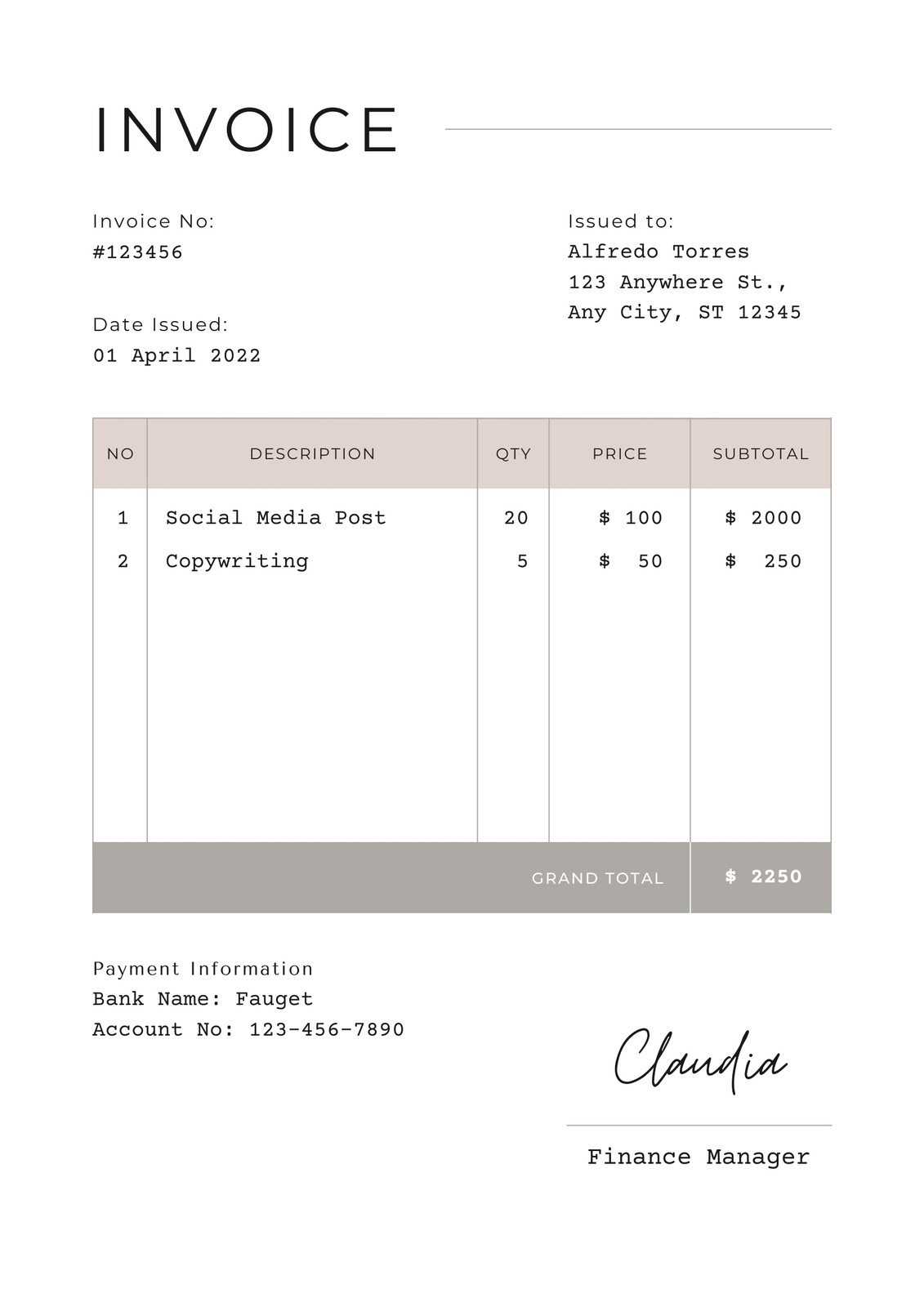

Incorporating Branding Elements

One of the most effective ways to personalize your financial records is by incorporating your company’s branding. Adding your logo, business colors, and contact information helps reinforce your brand identity while maintaining a professional look. This also makes your documents easily recognizable to clients, strengthening your business presence.

Adding Business-Specific Details

Customization also involves including details unique to your business operations. This could be specialized payment terms, discounts, or any additional charges that apply to your particular industry. For example, if you provide recurring services, you might include subscription billing options or payment plans. The ability to add these specifics ensures that your documents accurately reflect the nature of each transaction.

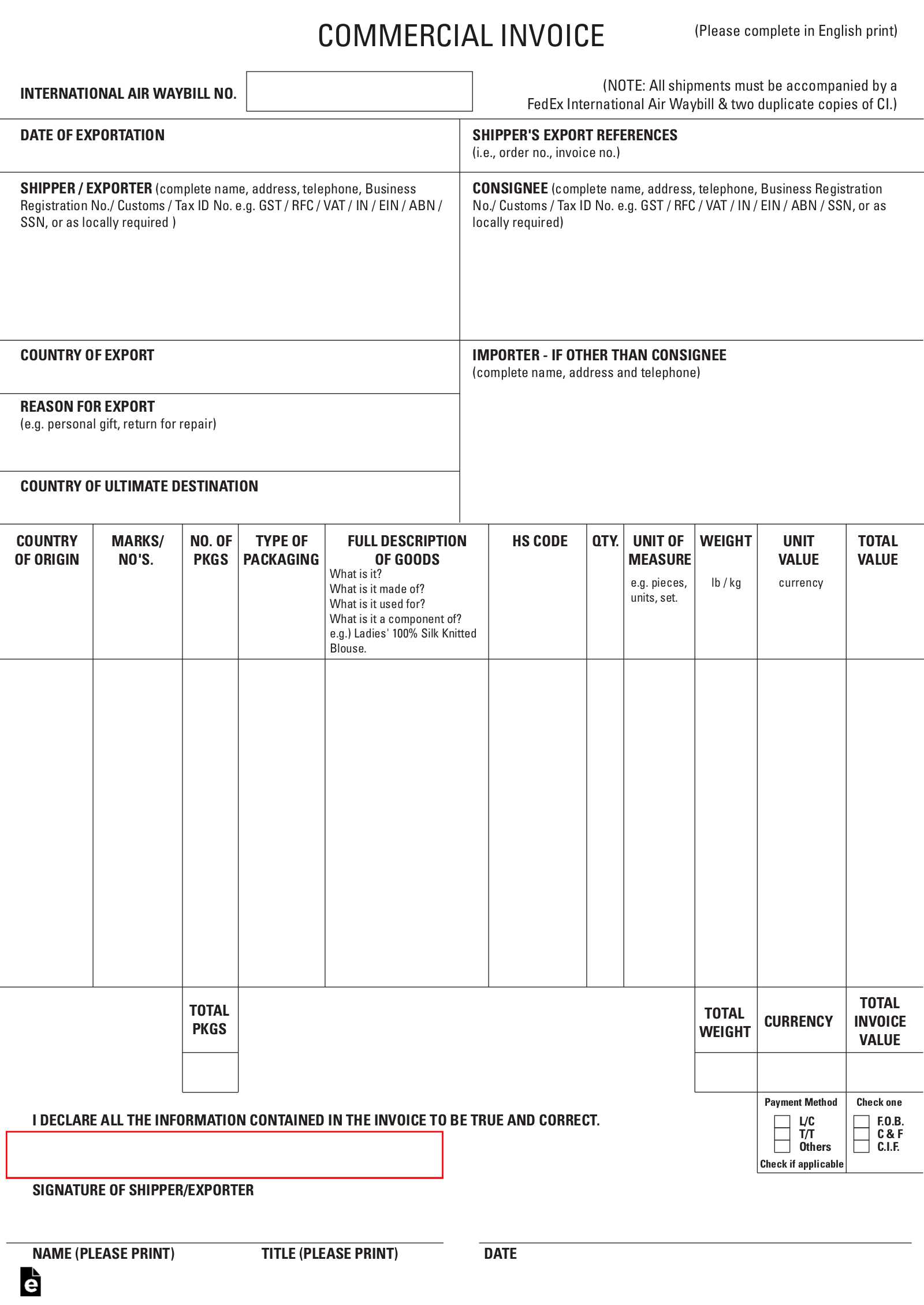

How to Fill Out an Invoice Template

Completing a financial document for a transaction may seem straightforward, but it is important to ensure that all the necessary fields are filled correctly to avoid confusion or disputes later. Every section of the document plays a role in providing clarity for both the buyer and the seller, and missing even small details can lead to misunderstandings or delays in payment.

The first step is to enter the basic information of both parties involved, including names, addresses, and contact details. Make sure to include a unique reference number for easy tracking and future reference. After that, you will need to describe the goods or services provided, including quantities, unit prices, and any applicable taxes or discounts. Clear and accurate descriptions are essential to avoid confusion.

Once you have filled in the transaction details, it’s important to specify payment terms. This includes the due date, payment methods, and any late fees that may apply. Finally, double-check the total amount to ensure everything is calculated correctly, including any additional charges or adjustments. By carefully following each step, you can complete the document with confidence and professionalism.

Benefits of Using Invoice Templates

Utilizing pre-designed formats for documenting transactions offers a range of advantages that can save both time and effort. By using a standardized structure, businesses can maintain consistency across their records and ensure that all necessary information is included. These benefits help streamline the process of creating and managing financial documents, improving overall efficiency.

Time-Saving and Efficiency

One of the main advantages of using a predefined structure is the time it saves. Instead of starting from scratch for each transaction, you can simply fill in the relevant details, reducing the risk of errors and speeding up the process. This efficiency can be particularly useful for businesses that handle a large volume of transactions, ensuring quick and accurate document generation.

Consistency and Professionalism

Using a consistent structure ensures that every document maintains the same professional appearance, which helps establish trust with clients. Whether you are a small business or a large corporation, having a uniform format demonstrates attention to detail and a commitment to professionalism. This consistency also makes it easier for your clients to understand and process the documents, creating a smoother experience for both parties.

Key Components of a Standard Invoice

To ensure smooth transactions and clear communication between buyer and seller, it is essential to include specific details in every financial document. These key elements not only help both parties understand the terms of the exchange but also provide a structured record for accounting and tax purposes. Each component serves a unique role in documenting the transaction accurately and comprehensively.

| Component | Description |

|---|---|

| Header | Includes your company name, logo, and contact information for easy identification. |

| Unique Reference Number | A distinct code for tracking and referencing the document in the future. |

| Buyer and Seller Details | Names, addresses, and contact information of both parties involved in the transaction. |

| Transaction Date | The date the goods or services were provided, marking the start of payment terms. |

| Item Descriptions | Details of the products or services provided, including quantities, unit prices, and totals. |

| Payment Terms | Clearly stated terms, including the due date, payment methods, and any late fees. |

| Total Amount Due | The final balance after taxes, discounts, or other adjustments have been applied. |

These components work together to ensure the document is clear, accurate, and legally binding, helping prevent any confusion or disputes down the line.

Creating Professional Invoices Quickly

Generating clear and professional documents for your transactions doesn’t have to be time-consuming. By following a streamlined process and using the right tools, you can produce polished records in just a few minutes. This allows you to focus on other important aspects of your business while maintaining accuracy and professionalism in your financial documentation.

Using Software or Online Tools

One of the fastest ways to create professional documents is by utilizing software or online tools designed specifically for this purpose. These tools often come with pre-built fields and customizable formats, making it easy to input data quickly. Key advantages include:

- Pre-set templates for fast entry

- Automatic calculations for totals and taxes

- Customization options for branding and business-specific details

- Easy tracking and storage of past transactions

Steps to Efficient Document Creation

For businesses looking to manually create records, a systematic approach can speed up the process. Follow these steps to ensure a quick turnaround:

- Start with a clean layout that includes all required sections (e.g., seller, buyer, items, totals).

- Fill in the relevant details such as dates, item descriptions, and quantities.

- Double-check totals and payment terms for accuracy.

- Include your company logo and contact information to maintain consistency.

- Save and send the document directly to the client, either digitally or in print.

By following these strategies, you can generate professional, error-free documents without investing excessive time, allowing for more efficient business operations.

How to Avoid Common Invoice Errors

Accurate documentation is essential for smooth transactions, but errors can still occur, potentially leading to payment delays, misunderstandings, or even legal issues. To ensure your financial records are both accurate and clear, it’s important to be mindful of common mistakes and take proactive steps to avoid them. By focusing on key details and following a systematic process, you can minimize the risk of errors and maintain professional standards.

Common Mistakes to Watch Out For

There are several common mistakes that can occur when creating financial documents. These errors can range from simple typographical issues to more serious miscalculations. Here are a few that are particularly important to avoid:

| Error | How to Avoid It |

|---|---|

| Incorrect or Missing Details | Always double-check that all information, including names, addresses, and dates, is accurate and complete. |

| Calculation Errors | Use software with built-in formulas or double-check manual calculations to ensure totals, taxes, and discounts are correct. |

| Missing Terms | Clearly specify payment terms, due dates, and methods to avoid confusion. |

| Unclear Descriptions | Ensure each item or service is clearly described with the correct quantities and prices to prevent disputes. |

Best Practices for Accuracy

To further reduce the risk of errors, following a few best practices can help keep your financial documents consistent and error-free:

- Utilize a standardized format for all transactions to ensure no details are overlooked.

- Use automated tools or templates that provide fields for required information and perform calculations automatically.

- Review each document before sending it to the client, paying particular attention to spelling, numbers, and terms.

By being aware of common errors and taking the necessary precautions, you can ensure that your transactions are smooth and professional, which ultimately strengthens your business relationships.

Printable vs. Digital Invoice Templates

When managing business transactions, the format of your financial documents plays a crucial role in ensuring efficiency and clarity. The choice between printing physical records or using digital formats can impact workflow, delivery time, and even client preferences. Both options have their distinct advantages, and understanding these differences can help you select the best approach for your business.

Benefits of Printable Documents

Physical copies of transaction records offer a sense of formality and are often required for certain industries or legal purposes. They can be useful in situations where a paper trail is needed for documentation or auditing. Some advantages of printed records include:

- Easy to distribute in person or by mail

- Required in specific legal or tax-related situations

- Provides a tangible copy for record-keeping or client reference

Advantages of Digital Formats

Digital records, on the other hand, offer a faster, more efficient way to create, store, and send documents. With digital files, businesses can avoid printing costs and streamline communication, especially for international transactions. Key benefits of digital formats include:

- Instant delivery through email or cloud storage

- Automatic updates and customization options

- Easier to store, organize, and retrieve for future reference

While both options are valid, the choice ultimately depends on your business model, industry requirements, and client preferences. By understanding the strengths of each, you can optimize your document-handling process to suit your needs.

Invoice Template Formatting Best Practices

Proper formatting is essential when preparing professional documents for financial transactions. The way a document is laid out can affect its clarity, professionalism, and ease of use for both the sender and recipient. By following certain best practices, you ensure that your records are not only accurate but also easy to understand and process.

Consistency and Clarity

When formatting your financial records, it’s important to maintain consistency in structure and design. A well-organized document will make it easier for both parties to locate key information quickly. Some key points to consider:

- Use clear headings and subheadings for each section.

- Ensure uniform font styles and sizes throughout the document.

- Make use of bold or underlined text to highlight important details such as payment terms or totals.

- Align text and numbers properly, making it easier to read and understand.

Essential Elements to Include

While keeping the design neat and professional, it’s also crucial to include all the necessary details. Some important components that should always be present in your document include:

- Contact details of both the sender and recipient

- Itemized list of goods or services provided

- Total amount due, including taxes or discounts if applicable

- Payment terms and due date

By adhering to these formatting best practices, your documents will not only look professional but also provide clarity and transparency, leading to smoother transactions and fewer misunderstandings.

Tracking Payments Using Invoice Templates

Keeping track of payments is essential for maintaining healthy cash flow and ensuring that all transactions are settled promptly. By using well-structured documents for billing, you can easily track the status of payments, avoid missed deadlines, and maintain accurate financial records. A clear system for monitoring payments will help you stay organized and avoid unnecessary confusion.

How to Monitor Payment Status

One effective way to track payments is by clearly marking the status of each transaction. Including a payment status field in your document helps both parties stay informed about whether the balance is due, partially paid, or fully settled. Below is an example of how this can be represented in a table:

| Invoice Number | Amount Due | Amount Paid | Status | Due Date |

|---|---|---|---|---|

| #12345 | $500 | $500 | Paid | 01/15/2024 |

| #12346 | $750 | $300 | Partial | 01/20/2024 |

| #12347 | $600 | $0 | Unpaid | 01/25/2024 |

Benefits of Tracking Payments

Tracking payments not only helps ensure that all dues are settled on time but also provides insights into the financial health of your business. Some key benefits include:

- Identifying overdue payments early to take appropriate action.

- Having a clear record of payments for accounting and auditing purposes.

- Improving customer communication by providing updates on outstanding balances.

By using detailed records and monitoring payment statuses effectively, you can streamline your billing process and minimize the risk of missed payments or financial discrepancies.

Improving Cash Flow with Invoices

Managing cash flow is critical for the financial health of any business. A well-structured billing system can significantly enhance how quickly and efficiently payments are received, which in turn can improve your cash flow. By ensuring that payment requests are clear, accurate, and timely, you can minimize delays and ensure a smooth transaction process for both you and your clients.

One of the most important strategies for improving cash flow is to ensure that billing documents are issued promptly after services are provided or products are delivered. This will reduce the time between providing the goods or services and receiving payment. Additionally, incorporating clear payment terms and reminder systems into your billing process can further streamline cash flow management.

Setting Clear Payment Terms

Clear and concise payment terms are essential to avoid confusion or delays. Clearly specifying the due date, payment methods, and late fees (if applicable) will help ensure that customers understand their responsibilities and when payments are expected. Some businesses also choose to offer early payment discounts to incentivize faster payment and improve cash flow.

Regular Follow-Ups and Reminders

Establishing a process for regularly following up on overdue payments can greatly benefit cash flow. Sending gentle reminders before the due date and following up promptly after the due date passes ensures that payments are not forgotten. Automated reminders can save time, allowing you to focus on other aspects of the business while keeping accounts up to date.

By optimizing your billing processes and ensuring that all payment expectations are clearly communicated, you can reduce the time it takes to receive funds, helping to stabilize and improve cash flow over time.

How to Customize Invoice for Clients

Customizing billing documents for each client not only enhances the professional appearance of your business but also allows you to address specific needs or preferences. A personalized approach helps foster stronger client relationships, ensures clarity in the transaction, and demonstrates attention to detail. Tailoring the format and content of your bills is a valuable step toward streamlining your business operations.

Including Client-Specific Information

One key aspect of customization is including personalized information about the client, such as their name, address, contact details, and a reference number for easy identification. By integrating these details into your documents, you make it easier for clients to process the transaction and locate the necessary information when needed. You can also include specific payment instructions or notes relevant to that particular client to avoid misunderstandings.

Adjusting the Layout and Design

The layout and design of your billing documents can also be adjusted to suit individual client preferences. For example, some clients may prefer a more detailed breakdown of the products or services provided, while others may prefer a simplified version. Customizing elements like logos, fonts, colors, and headers helps maintain consistency with your brand identity while ensuring the document meets the client’s expectations.

In addition to these elements, you can also offer flexible payment terms tailored to different clients. For instance, offering longer payment deadlines or installment options for larger transactions may increase client satisfaction and encourage quicker payment processing. With thoughtful customization, your business can establish stronger connections with clients while improving overall operational efficiency.

Choosing the Right Template for Your Needs

Selecting the right document format for your billing needs is essential for streamlining your business processes. The right structure helps ensure accuracy, reduces errors, and provides a professional appearance for your business transactions. Understanding your specific requirements and the needs of your clients can guide you in choosing the most effective format.

Consider Your Industry Requirements

Different industries have varying standards and expectations when it comes to billing documents. For instance, a service-based business may require detailed time logs, while a product-based business may need to highlight product descriptions and quantities. Choosing a structure that aligns with your business type can make the billing process smoother and more efficient. Ensure the format allows for clear categorization of goods or services and accommodates industry-specific information, such as tax codes or shipping details.

Evaluate Client Preferences

Your clients’ preferences should also influence your decision. Some clients might prefer a simple and minimalistic design, while others may require more comprehensive information. It’s essential to select a format that meets their needs and matches their expectations for clarity and detail. Flexibility in layout design and the ability to adjust payment terms or add custom fields can significantly enhance the client experience and improve communication.

By considering both your business’s requirements and your clients’ preferences, you can choose the most suitable document structure, ensuring a seamless transaction process and improving the efficiency of your operations.