Customizable Invoice and Receipt Template for Easy Business Management

In any business, having a consistent and organized way of issuing financial records is crucial. Whether you are a freelancer, a small business owner, or a large company, it’s important to present clear, professional paperwork when managing transactions. A well-structured document not only ensures clarity for your clients but also helps maintain a smooth workflow for accounting and record-keeping.

Creating these documents manually can be time-consuming and prone to error. That’s where ready-made solutions come in. By using customizable formats, you can easily generate accurate, polished statements for each transaction. These solutions are designed to save you time while improving the professionalism of your financial exchanges.

With the right set of tools, you can tailor each document to fit your brand’s style and the unique needs of your clients. From layout to content, everything can be adapted to ensure a seamless experience for both you and your customers. This approach allows businesses to focus on growth, while ensuring that all financial records are accurate and properly formatted.

Why Use Invoice and Receipt Templates

Efficient business operations depend on clarity and consistency in financial communication. Using predefined document structures allows companies to streamline their processes, reduce errors, and improve overall professionalism. These ready-to-use formats provide a framework that ensures all necessary details are included and presented clearly, without the need to start from scratch each time.

One of the primary advantages of utilizing structured forms is time-saving. By leveraging customizable layouts, you can quickly generate accurate documents, cutting down on the time spent manually creating each one. This efficiency is particularly beneficial for businesses that handle a high volume of transactions or need to issue multiple documents on a regular basis.

Additionally, standardized forms help ensure accuracy in every transaction. Pre-designed documents often include essential elements that minimize the risk of missing important information. This reduces human error and ensures that each record is consistent, making your financial management more reliable.

Another key benefit is the professional appearance these documents offer. Clean, well-organized paperwork reflects positively on your business, helping to build trust with clients and customers. A polished presentation can go a long way in fostering positive relationships and establishing credibility in the marketplace.

Benefits of Pre-Designed Billing Templates

Utilizing pre-made documents for financial transactions offers numerous advantages for businesses of all sizes. These ready-made formats simplify the process, ensuring consistency, accuracy, and a professional appearance with minimal effort. By adopting such solutions, companies can focus on core activities while maintaining streamlined financial practices.

Time Efficiency

One of the main reasons businesses opt for pre-built solutions is the significant amount of time saved. Instead of drafting documents from scratch each time, you can simply fill in the necessary information, saving valuable hours. This speed benefits businesses that frequently generate transaction records.

- Quick generation of financial records

- No need for manual formatting

- Faster processing of client requests

Consistency and Accuracy

Pre-designed structures help reduce the likelihood of errors, ensuring every transaction is recorded correctly. Since these forms include all required fields, there is little room for missing critical details, which is vital for maintaining accurate business records.

- Standardized format reduces human error

- Prevents omissions of essential information

- Ensures uniformity in every document generated

By relying on pre-designed billing solutions, companies can enhance both their internal processes and customer interactions, fostering a more professional and efficient business environment.

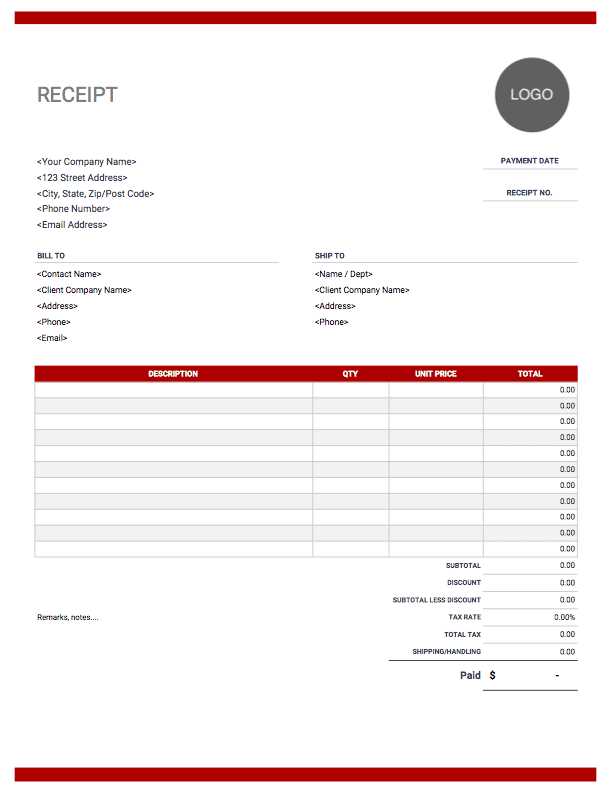

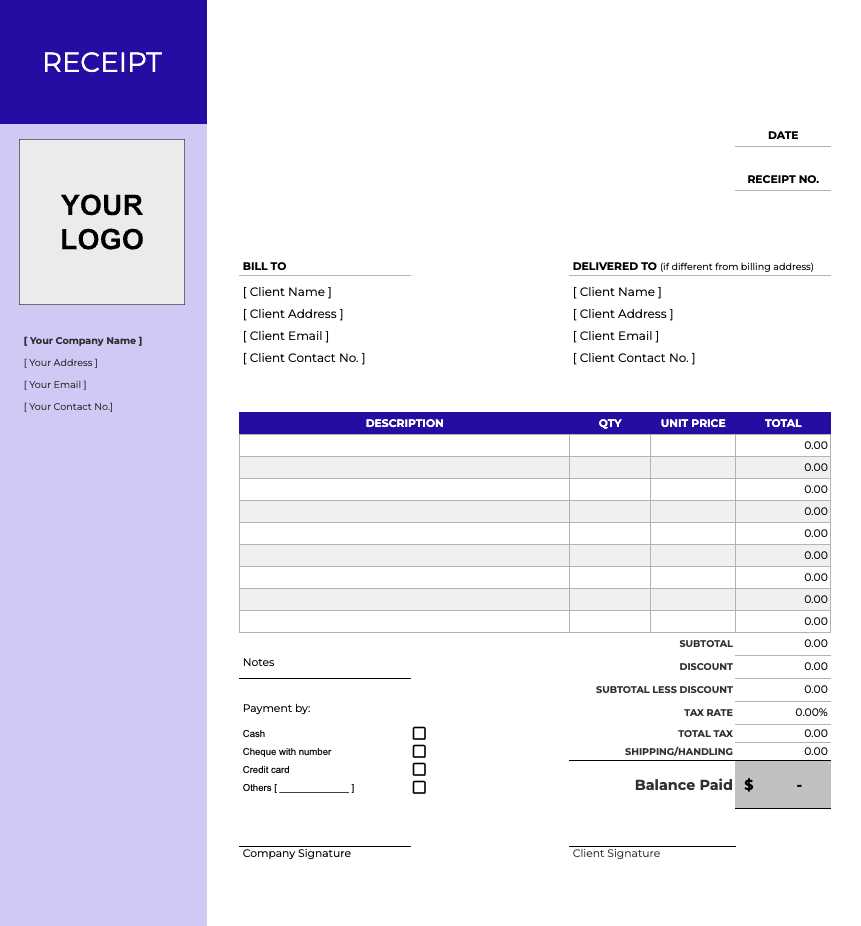

How to Customize Your Invoice Template

Customizing your financial documents is essential for reflecting your business’s unique brand and meeting specific needs. By adjusting certain elements, you can ensure that each record not only conveys the necessary details but also aligns with your company’s style and tone. The process is simple and can be done without any design expertise.

Adjusting Design Elements

One of the first steps in personalizing a billing document is altering the visual design. This includes adding your company logo, adjusting the color scheme, and selecting fonts that reflect your business identity. A well-designed document helps you make a lasting impression on your clients.

- Logo Placement: Position your logo in the header for better visibility.

- Colors: Use your brand’s color palette to create a cohesive look.

- Fonts: Choose easy-to-read, professional fonts that match your business’s tone.

Personalizing Content

Next, tailor the content to suit your specific needs. You can edit pre-filled information, such as payment terms, due dates, and descriptions of goods or services. Adding personal touches like a thank-you note or payment instructions can also enhance the customer experience.

- Payment Terms: Customize the terms based on your business practices.

- Item Descriptions: Provide clear, concise descriptions of each item or service.

- Additional Notes: Add a personalized message or instructions for your clients.

By making these adjustments, you can ensure that each document is aligned with your business’s standards and builds trust with clients while maintaining efficiency in your financial operations.

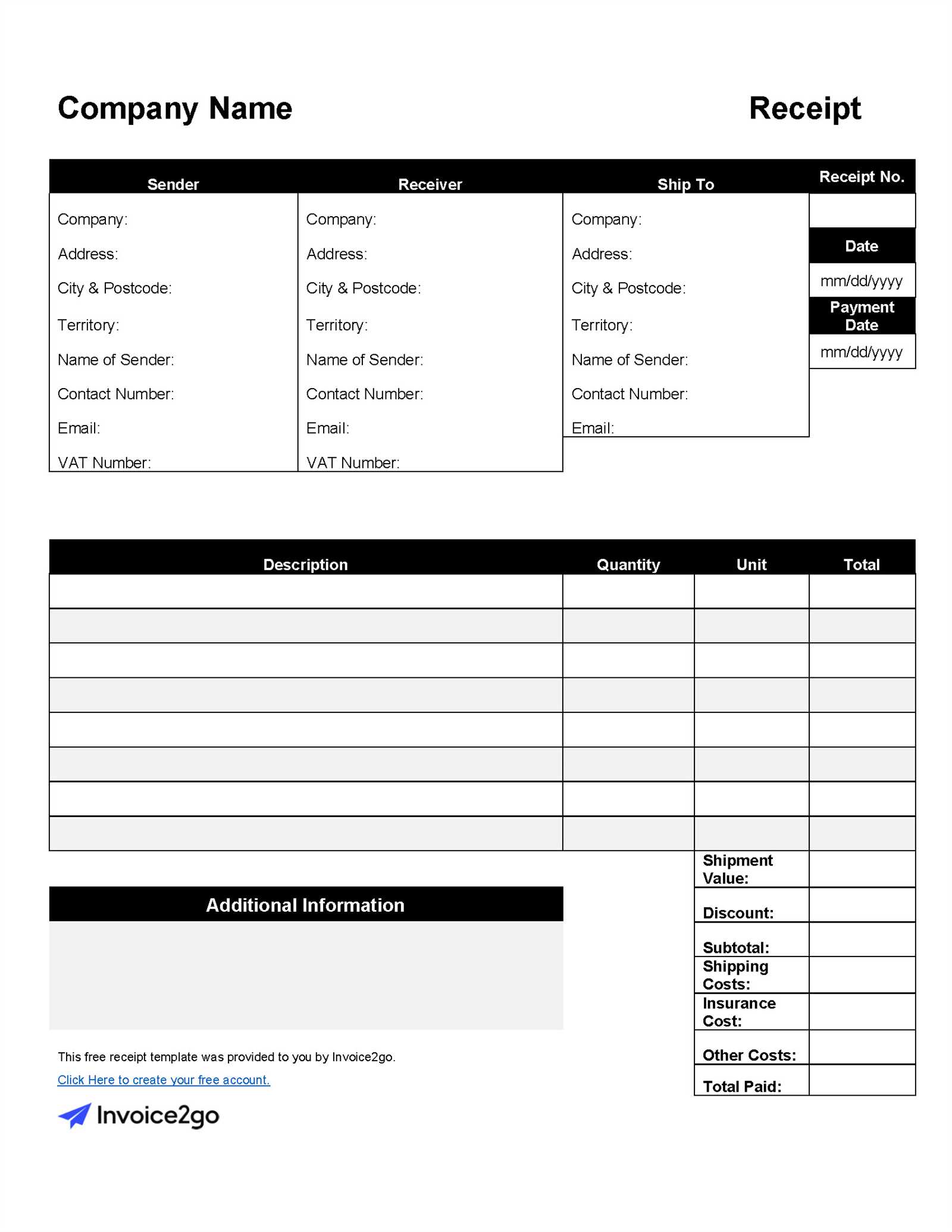

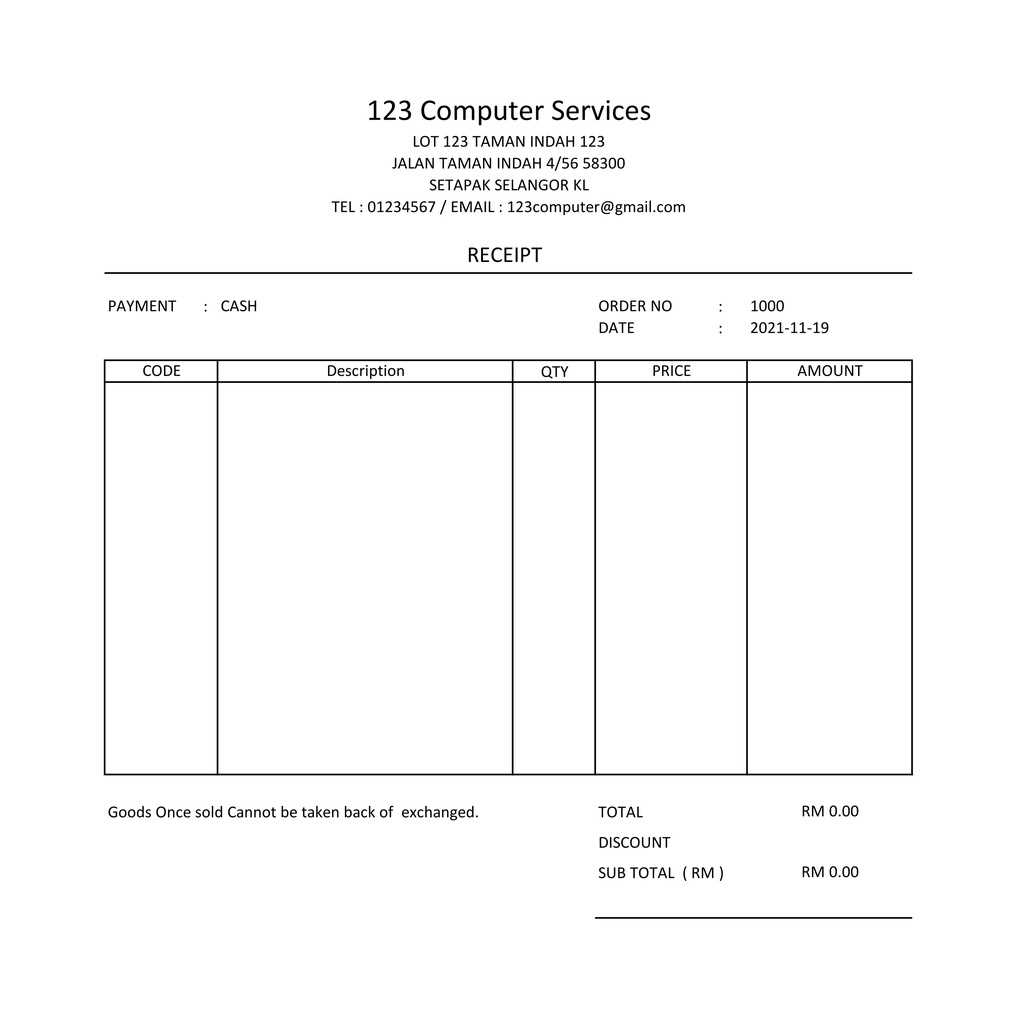

Essential Elements in a Receipt Template

For any transaction to be properly documented, it is important to include key pieces of information that verify the exchange of goods or services. A well-structured document serves not only as proof of purchase but also as a tool for both the buyer and the seller to maintain clear financial records. These documents should contain several vital elements to ensure clarity and accuracy.

Key Information to Include

Each document should have certain fields filled out to make it both comprehensive and functional. These details help confirm the transaction and provide a reference for any future communication or disputes.

- Business Details: The name, address, and contact information of the company issuing the document.

- Customer Information: The name and contact details of the customer or client.

- Transaction Date: The exact date when the purchase or service was completed.

- Payment Method: Indicate how the payment was made (e.g., credit card, cash, online transfer).

Itemized List of Products or Services

One of the most important sections is the detailed list of what was bought or provided. This helps the customer understand exactly what they paid for and ensures transparency in the transaction.

- Product/Service Description: A brief description of the item or service provided.

- Quantity: The amount or number of items purchased.

- Unit Price: The price per unit or service provided.

- Total Cost: The total cost of each item, including taxes or discounts if applicable.

These elements ensure that the document is both informative and legally valid, providing all the necessary details for both parties to retain an accurate record of the transaction.

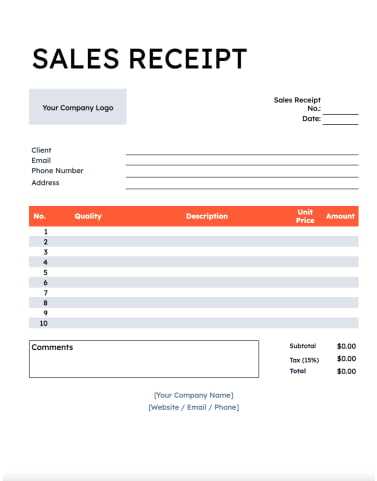

Choosing the Right Invoice Format

Selecting the appropriate format for your financial documents is essential to ensure clarity, professionalism, and accuracy. The format you choose will affect how easily clients can understand the details of the transaction, as well as how efficiently you can manage your records. Whether you prefer a minimalist design or a more comprehensive approach, the right structure will streamline your processes and enhance your business image.

Factors to Consider

There are several factors to keep in mind when choosing a structure for your billing records. The goal is to balance simplicity with completeness, ensuring that all necessary information is included without overwhelming the client with unnecessary details.

- Business Needs: Consider the nature of your business. A service-based business may not require as many details as a product-based one, where itemized lists and taxes are more complex.

- Client Preferences: Some clients may prefer a more detailed format with descriptions, while others may appreciate a straightforward layout that highlights only essential information.

- Legal Requirements: Ensure the document complies with any industry-specific regulations, especially regarding tax information or required disclaimers.

Simple vs Detailed Formats

When it comes to layout, you’ll typically have two main options: a simple or detailed format. Each has its own benefits depending on the type of transaction.

- Simple Format: Ideal for quick transactions where only the basic details are needed, such as total amount, payment method, and date.

- Detailed Format: Useful for complex transactions, providing a breakdown of each item, quantity, price, applicable taxes, and any discounts or additional fees.

Choosing the right structure ensures that your documents are effective tools for both communication and record-keeping, helping your business maintain clarity and professionalism with each transaction.

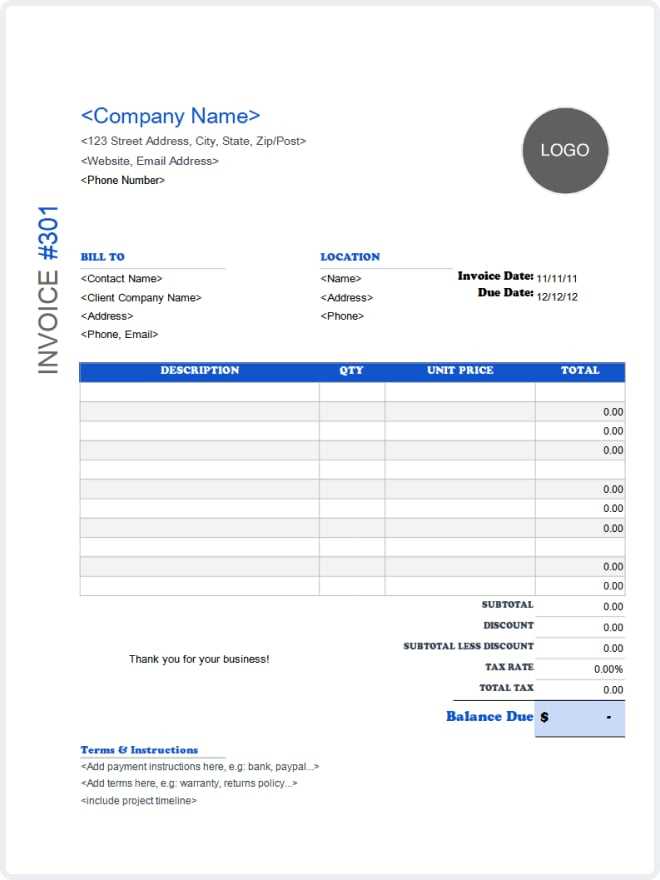

Invoice Template for Small Businesses

For small enterprises, creating clear and professional documents for transactions is crucial for maintaining financial organization. These documents serve as a formal record of the products or services provided, ensuring both parties are on the same page regarding payment terms and amounts.

Small business owners can benefit from having a customizable document that includes essential details, making transactions easier to track and process. By using a well-structured form, you can ensure consistency across all your financial exchanges, helping to streamline operations.

- Contact Information: Including business name, address, and contact details for both parties involved.

- Description of Goods/Services: Clear listings of the items or services delivered, including quantities and pricing.

- Payment Terms: The total amount owed, payment methods accepted, and deadlines for payment.

- Unique Identification Number: A reference code or number to track the document for future reference.

- Dates: The date of the transaction and the due date for payment.

These basic elements can be adapted depending on the specific needs of your business, ensuring that each document is tailored to suit your unique workflow. By having a professional format in place, you make it easier to maintain accurate financial records, enhancing both client trust and your business’s credibility.

Key Features of a Professional Invoice

A well-structured document for financial transactions not only ensures clarity but also fosters trust between the business and its clients. A professional layout provides a clear breakdown of the services or goods provided, making it easier for clients to understand the payment expectations. This document is a critical part of the communication between a company and its customers, highlighting important details that guide the payment process.

Essential Information for Clarity

To maintain a professional image, a document should include specific details that make it easy to identify the transaction. Key points such as the names, contact information of both parties, as well as the clear description of products or services are essential. This ensures transparency and reduces the chance of confusion or disputes later on.

- Business Information: Company name, address, phone number, and email.

- Client Details: The recipient’s name, contact information, and billing address.

- Itemization: Clear descriptions of all goods/services delivered with corresponding costs.

Clear Payment Terms

Setting clear expectations for payment is one of the most important aspects. A well-detailed financial summary should include the total amount due, applicable taxes, discounts, payment methods, and deadlines. This section prevents misunderstandings regarding the payment schedule and offers both parties a clear path to settle the transaction.

- Total Due: The final amount payable after all adjustments.

- Due Date: The deadline by which payment must be made.

- Accepted Payment Methods: Information about how clients can pay, such as credit card, bank transfer, or other methods.

Incorporating these features into every document helps businesses maintain a high level of professionalism, which in turn enhances their reputation and builds long-lasting client relationships.

How Receipts Improve Customer Trust

Providing a detailed confirmation document after each transaction can significantly strengthen the relationship between a business and its customers. When customers receive a clear record of their purchases, they feel more confident in the accuracy of the transaction, knowing exactly what they have paid for and why. This simple yet effective practice fosters a sense of transparency, which in turn helps build trust.

Transparency is key to maintaining a positive reputation. By offering a breakdown of the goods or services purchased, along with clear financial details, businesses show their commitment to fairness and accountability. Customers appreciate knowing exactly what they are being charged for, without hidden fees or surprises.

- Proof of Payment: A written record ensures that both the customer and the business are on the same page regarding the transaction.

- Clear Financial Breakdown: Transparent listing of items, prices, and taxes ensures customers know exactly where their money is going.

- Security: Customers feel more secure when they have documentation to refer back to in case of any issues, such as returns or disputes.

Offering these documents not only helps avoid misunderstandings but also enhances the customer experience, leading to increased loyalty and repeat business. Customers are more likely to return to a business they trust, knowing that their purchases are properly recorded and easily traceable.

Digital vs Printed Invoice Templates

When managing business transactions, companies must choose the most effective way to share financial records with clients. Two common options are digital formats and physical copies, each offering unique advantages depending on the needs of the business and the preferences of the customer. Understanding the differences between these formats can help ensure a more efficient workflow and better customer satisfaction.

| Feature | Digital Format | Printed Format |

|---|---|---|

| Convenience | Easy to send and store electronically via email or cloud storage. | Requires physical printing and mailing, which can be time-consuming. |

| Accessibility | Accessible from anywhere with an internet connection, convenient for both parties. | Only accessible to the recipient who has the physical document in hand. |

| Cost | No additional costs for printing, paper, or postage. | Costs for paper, ink, and postage add up over time. |

| Environmental Impact | More eco-friendly, with no paper or printing materials required. | Higher environmental impact due to paper waste and resource usage. |

| Security | Electronic records can be encrypted for added security and easily backed up. | Physical copies may be lost, damaged, or stolen more easily. |

Each option has its own merits. Digital versions are generally more efficient, cost-effective, and environmentally friendly, making them ideal for businesses looking to streamline their operations. On the other hand, physical documents may be preferred for certain clients who value tangible records or when legal requirements mandate a hard copy. Ultimately, the choice depends on the specific needs and preferences of the business and its customers.

Top Tools for Creating Templates

Businesses looking to streamline their financial documentation process can benefit from using specialized tools that help generate professional records quickly and efficiently. These tools simplify the creation of customized forms that meet specific needs, whether for one-time use or repeated transactions. With the right software, you can ensure consistency, accuracy, and ease in managing business transactions.

Several platforms offer intuitive interfaces and versatile features that allow users to create fully personalized forms. These tools range from free, basic solutions to more advanced options with robust customization capabilities. Whether you’re an entrepreneur or managing a larger team, choosing the right software can significantly improve your workflow.

- Canva: A user-friendly graphic design platform that offers customizable layouts for creating professional documents, including billing forms and contracts.

- Microsoft Word: With built-in templates and a wide range of customization options, Word remains a popular tool for creating structured financial forms.

- Zoho Invoice: A cloud-based service specifically designed for creating and managing billing documents, with various templates and automation features.

- Google Docs: A free, web-based tool that allows for easy collaboration and the creation of customized forms with built-in templates.

- FreshBooks: A comprehensive invoicing and accounting solution that provides users with professional document creation features along with time tracking and financial management tools.

Each of these tools has unique strengths, allowing users to tailor their documentation processes to their specific business needs. By leveraging these resources, you can ensure that your financial forms are not only professional but also effective in keeping records accurate and organized.

How to Automate Invoice Generation

Automating the creation of financial documents can save businesses time, reduce human error, and improve overall efficiency. By implementing automated systems, businesses can ensure that all transactions are accurately recorded and promptly sent to clients. This streamlines the process, freeing up valuable resources for other important tasks.

Benefits of Automation

Automation eliminates the need for manual input, reducing the risk of mistakes and allowing businesses to focus on more critical aspects of their operations. By automating document generation, businesses can ensure consistency, speed, and accuracy in all their financial transactions. Additionally, automated systems can integrate with existing tools, such as accounting software, to further enhance workflow efficiency.

| Feature | Benefit |

|---|---|

| Accuracy | Reduces the chance of errors that can occur when manually inputting details. |

| Time-Saving | Automatic document creation eliminates the need for repetitive tasks, speeding up the process. |

| Consistency | Ensures a uniform structure for all financial records, improving professionalism. |

| Integration | Links with other software, such as payment processors or accounting platforms, to streamline the workflow. |

How to Set Up Automated Document Creation

To implement automated generation, businesses can use a variety of software tools that integrate with existing systems. These tools allow you to set up templates, input client information, define payment terms, and customize other details. Once configured, the system can automatically generate documents based on predefined rules, such as billing frequency or specific product/service purchases. Many tools also offer automatic email notifications to clients, ensuring timely delivery without manual intervention.

By adopting these technologies, businesses can create a smoother, more efficient process, ensuring that transactions are consistently documented and clients are promptly billed.

Free vs Paid Invoice Templates

When it comes to creating professional documentation for transactions, businesses can choose between free and paid solutions. Both options offer distinct advantages depending on the specific needs of the company. While free options are cost-effective, paid solutions often come with more features and better customization. Understanding the differences between the two can help you decide which best suits your business’s requirements.

Advantages of Free Options

Free solutions provide a budget-friendly way to generate documents without any upfront costs. These are perfect for small businesses or freelancers who are just starting out or need to generate documents infrequently. Despite their lack of advanced features, free solutions often provide all the basic elements needed for creating clear and professional forms.

- No Cost: No upfront investment required.

- Simple Setup: Easy to use with little to no learning curve.

- Basic Customization: Basic fields and structure to suit simple needs.

- Quick Access: Ready to use with minimal effort.

Advantages of Paid Options

Paid solutions offer a broader range of features, often including advanced customization, automation, and integration with other tools. These options are ideal for businesses that need to generate a high volume of documents or require more sophisticated functionality. Paid platforms also tend to provide better customer support, which can be crucial for businesses with more complex needs.

- Advanced Features: Includes additional tools for automation, reporting, and customization.

- Better Support: Access to customer service and help when needed.

- Integration: Ability to link with accounting software, payment gateways, etc.

- Professional Look: High-quality design options for a more polished appearance.

Both free and paid options have their place depending on your business’s size and needs. Free solutions are perfect for startups or businesses with minimal documentation requirements, while paid options are better suited for those who need more advanced features and functionality. By evaluating your needs and budget, you can choose the best option to help streamline your business processes.

Common Mistakes with Invoice Templates

When creating financial documents for clients, many businesses encounter mistakes that can lead to confusion, delays, or disputes. These errors can be as simple as missing details or as significant as miscalculations that affect the transaction’s accuracy. Identifying these common issues can help businesses avoid unnecessary complications and improve their overall professionalism.

Missing or Incorrect Information

One of the most frequent mistakes businesses make is failing to include all necessary information, or including incorrect details, which can cause delays in payment or create misunderstandings. Without complete and accurate information, clients may struggle to verify their purchases, leading to unnecessary back-and-forth communications.

- Client Details: Ensure that the recipient’s name, contact information, and billing address are accurate.

- Product/Service Descriptions: Clearly list all items or services, including quantities, pricing, and any applicable discounts.

- Payment Terms: Double-check that the due date, payment method, and other relevant terms are clearly outlined.

Calculation Errors

Another common mistake is failing to accurately calculate the total amount due. Even small errors in math can lead to frustration for both businesses and clients. It is important to double-check all calculations, including taxes, discounts, and shipping fees, to ensure the final amount is correct.

- Tax Rates: Ensure the correct tax rate is applied based on the client’s location.

- Discounts: If offering discounts, clearly show the original price and the reduced amount to avoid confusion.

- Total Amount: Double-check the final total to confirm that all items, taxes, and discounts are properly accounted for.

By paying close attention to these common mistakes, businesses can maintain a smooth process, avoid confusion, and establish stronger, more professional relationships with clients.

Design Tips for Clean Receipt Layouts

Creating clear and easy-to-read documents is essential for enhancing customer satisfaction and ensuring that all transaction details are easily understood. A well-organized structure, combined with a simple design, can help eliminate confusion and ensure clients can quickly access important information. Below are some helpful design tips for creating professional, clutter-free layouts that leave a lasting impression.

Prioritize Readability

The main goal of any document is to communicate important details efficiently. Keeping the layout clean and organized ensures that clients can easily find the information they need. Use simple fonts and adequate spacing to enhance readability.

- Font Choice: Opt for clear, easy-to-read fonts like Arial or Helvetica. Avoid overly decorative fonts that can distract from the content.

- Font Size: Ensure headings, totals, and key details are slightly larger to stand out, but avoid making the font size too small for the body text.

- White Space: Give enough space between sections, such as item descriptions and totals, to avoid overcrowding.

Organize Information Clearly

When presenting data, use logical grouping to help users navigate through the document. Dividing the content into sections, such as product/service details, totals, and payment instructions, helps clients find the information they need quickly.

- Logical Flow: Arrange information in a top-to-bottom, left-to-right order. Group related items together, such as contact details and payment terms.

- Visual Hierarchy: Use bold or larger text for important details like totals, due dates, or company names to draw attention to them immediately.

- Consistent Alignment: Keep similar elements aligned (e.g., aligning prices and quantities) to make the document easier to scan.

By following these design tips, businesses can create documents that are both functional and aesthetically pleasing. A clean layout ensures that customers understand their purchase details at a glance, which promotes clarity, professionalism, and trust in your business.

Integrating Templates with Accounting Software

Seamlessly connecting financial documentation with accounting systems can significantly streamline business operations. By automating the transfer of data between these tools, businesses can reduce manual entry, prevent errors, and ensure that financial records are consistently updated. This integration enables more efficient tracking of payments, taxes, and expenses while maintaining a high level of accuracy.

Benefits of Integration

Integrating documentation with accounting platforms offers several advantages, such as improved time management, reduced risk of human error, and enhanced financial reporting. When the systems are connected, businesses can instantly generate records that align with their accounting software, ensuring consistency across the board.

- Automatic Data Sync: Automatically transfer details like amounts, dates, and descriptions to the accounting system.

- Real-Time Updates: Ensure that both the document and financial records are updated simultaneously, reducing delays.

- Improved Reporting: Quickly generate accurate financial reports with data automatically pulled from all generated documents.

How to Integrate

Integrating documentation systems with accounting platforms is typically done through third-party apps or built-in features. Many popular accounting software providers, such as QuickBooks or Xero, offer built-in tools that allow users to link external document creation platforms, while others may require additional plugins or integrations. These systems often come with step-by-step guides for connecting them, ensuring ease of use even for businesses with limited technical expertise.

By adopting this integration, businesses can save valuable time and reduce administrative overhead, making their financial processes more efficient and accurate.