Download Free eBay Invoice Template in Word Format

When running an online store, keeping track of financial transactions and maintaining clear records is essential. One of the most important aspects of this process is providing your customers with clear and professional documentation of their purchases. A well-organized receipt not only helps you stay on top of your sales but also builds trust with buyers, ensuring a smooth and transparent shopping experience.

Using pre-made document formats allows sellers to save time while ensuring that each sale is recorded in a consistent and professional manner. Customizable formats are especially useful, as they can be tailored to suit individual business needs, whether you’re managing small sales or running a large-scale online shop. These documents can be easily adjusted to include necessary details, such as buyer information, shipping costs, and item descriptions, without requiring advanced design skills.

With the right tools, creating these essential records becomes a simple task. By utilizing free and easily accessible formats, online sellers can quickly generate the documents they need to keep their business operations running smoothly, whether for personal use or for tax reporting. Learn how to make this process effortless and efficient in just a few simple steps.

Why Use eBay Invoice Templates

Providing clear and professional documentation for each transaction is a crucial part of maintaining trust with your customers. Using pre-made formats for generating receipts can save time and reduce errors, allowing you to focus more on your business operations. These structured documents offer a streamlined solution for organizing and presenting all the necessary details of a sale in a standardized way.

By utilizing ready-to-use formats, sellers can quickly create comprehensive records that include key information such as item descriptions, pricing, and buyer details. These documents also help keep your financials organized, making them easier to track and reference when needed, whether for reporting purposes or customer service inquiries.

Here are a few reasons why these formats are essential for online sellers:

| Benefit | Description |

|---|---|

| Time-Saving | Pre-made formats allow you to quickly generate documents without starting from scratch, streamlining your workflow. |

| Professional Appearance | These formats ensure that your documents maintain a polished and consistent look, which can enhance your business image. |

| Customization | You can easily adjust the documents to fit your unique business needs, adding relevant information and making them suitable for any type of sale. |

| Accuracy | Using a standardized structure minimizes the risk of missing key details and reduces human error in the documentation process. |

| Organization | These formats help you keep your financial records organized and accessible, making it easier to manage your transactions and prepare for tax season. |

In summary, using ready-to-go documents is an efficient way to maintain professionalism and accuracy in your sales operations, while ensuring your customers receive the necessary documentation for their purchases.

Benefits of Word Invoice Templates

Using pre-designed documents for transaction records offers several advantages for online sellers. These customizable formats simplify the process of creating professional and organized sales paperwork, saving time and reducing the risk of mistakes. By relying on flexible tools, you can quickly generate clear and accurate records for each sale, ensuring that all necessary information is included and well-presented.

Here are some key benefits of using customizable formats for your business needs:

- Ease of Use: Pre-designed documents are user-friendly and easy to fill out, even for those with limited technical skills.

- Time Efficiency: You don’t have to start from scratch every time you make a sale, which helps you process transactions quickly and focus on growing your business.

- Consistency: Using the same structure for all your transaction records ensures uniformity and a professional appearance in every document you issue.

- Customization: These formats can be easily modified to fit the specific requirements of your business, such as adjusting the layout or adding custom fields for shipping or payment details.

- Compatibility: Popular formats are compatible with most word processing software, making them accessible and easy to work with on various devices.

- Cost-Effective: Many of these formats are available for free or at a low cost, which makes them a budget-friendly option for small businesses and solo entrepreneurs.

In summary, using ready-made document formats offers numerous advantages that can help you manage sales more effectively. They save time, reduce errors, and improve the overall professionalism of your transactions, all while being customizable to meet your specific business needs.

How to Create an eBay Invoice

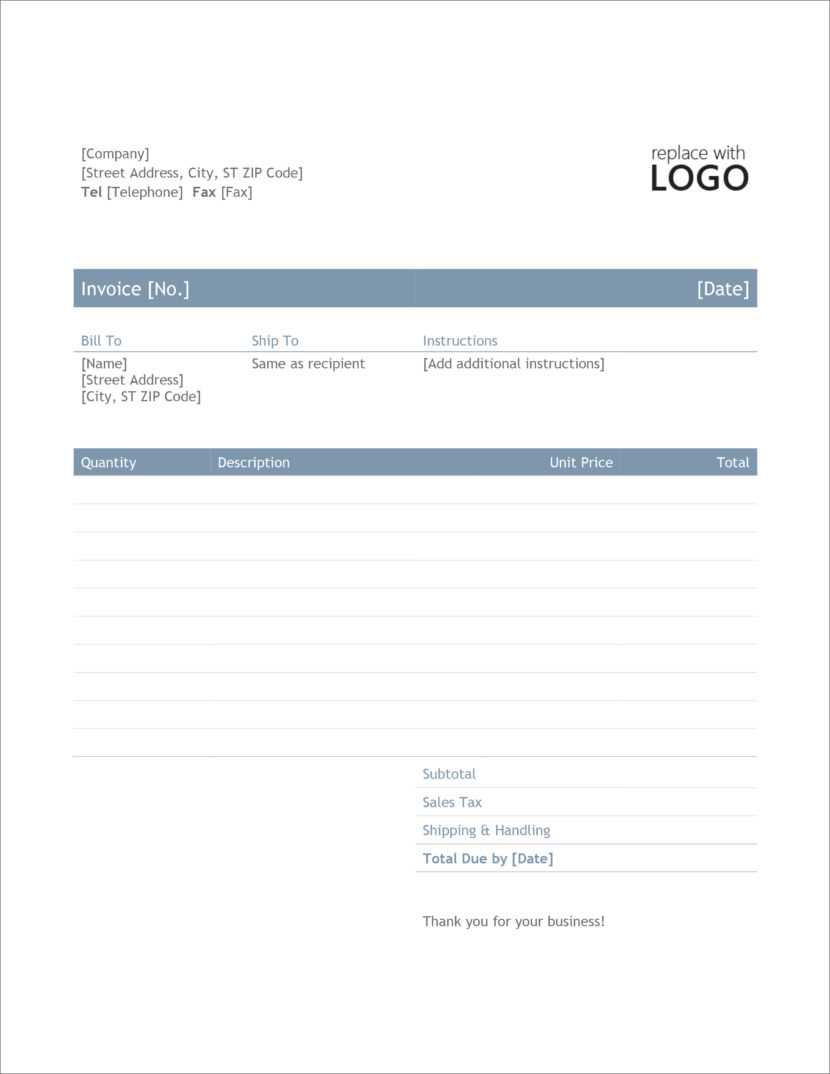

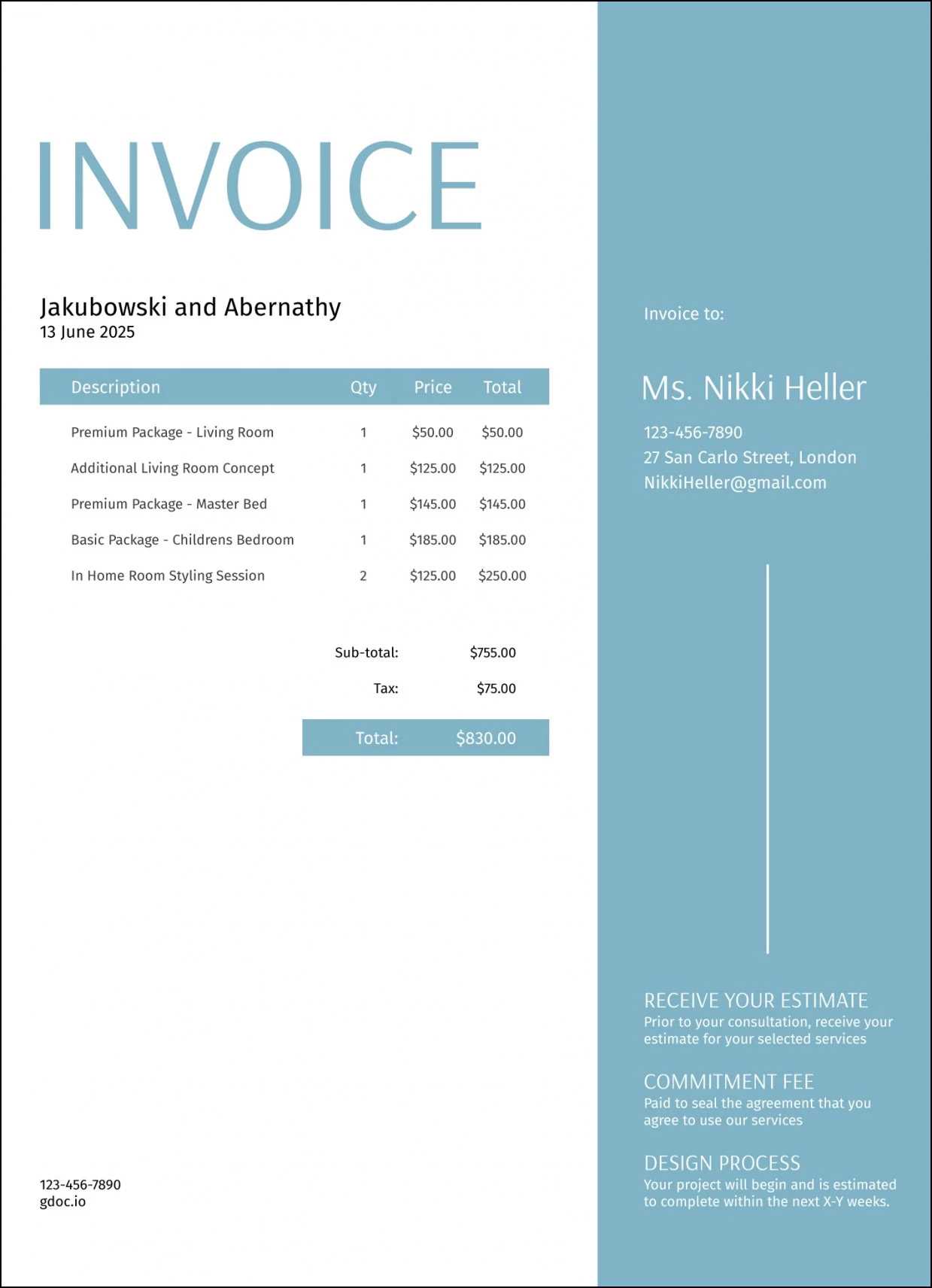

Creating professional transaction records for your online sales is a simple process that can be done in just a few steps. Having a well-organized document for each purchase helps maintain clarity for both you and your customers. The key to a successful record is ensuring it includes all essential details and is easy to understand, with clear formatting and relevant information.

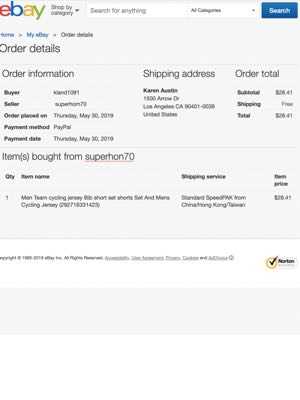

Step 1: Gather the Necessary Information

Before you begin, ensure you have all the relevant details about the sale. This includes the buyer’s name, address, the item or service purchased, the price, shipping costs, and payment method. It’s also helpful to include a unique reference number for each transaction to keep your records organized.

Step 2: Fill Out the Document

Once you have all the information, you can begin populating the fields in the document. Start by entering the seller and buyer’s details at the top, followed by the product or service information, including a brief description, quantity, and unit price. Don’t forget to include the total amount due, along with any taxes or additional charges if applicable. Ensure that the layout is clean and easy to follow, with appropriate spacing between sections.

By following these steps, you can create a professional and comprehensive record for each transaction, which can be easily shared with your customers or kept for your own records. Once the document is complete, simply save it and print a copy for your files or to send to the buyer.

Customizing Your eBay Invoice Template

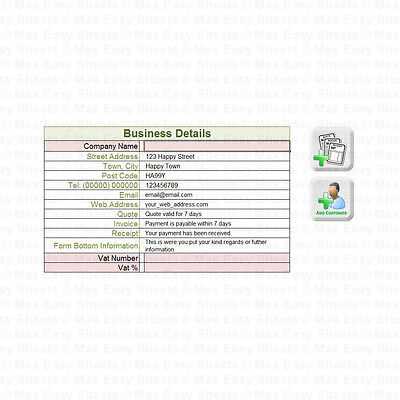

When creating sales documentation, it’s important to tailor the design and content to reflect your business identity and meet your specific needs. Customization allows you to add unique elements, such as your logo, payment details, or additional terms, ensuring that each document is both professional and relevant to your operations. With a few simple adjustments, you can transform a standard document into a personalized tool that suits your brand and enhances your customer’s experience.

Step 1: Add Your Branding

The first step in customization is adding your business’s branding. This can include your logo, company name, and contact information at the top of the document. Make sure your business details are clearly visible, as this adds a personal touch and builds trust with your buyers. Including your brand’s colors and fonts can also help reinforce your company’s image and create consistency across all your documentation.

Step 2: Modify Layout and Fields

Next, adjust the layout and fields to suit the specifics of your business. You may want to include additional sections such as discount codes, specific shipping terms, or a return policy. If you offer multiple payment options, make sure to include those, as well as your payment terms. This ensures that both you and the buyer are clear on the transaction details. Use the flexibility of the format to adjust text size, color, or spacing to improve readability and organization.

| Section | Suggested Customization |

|---|---|

| Header | Include your logo, company name, and contact details for brand consistency. |

| Transaction Details | Adjust the fields to show item descriptions, quantities, and specific payment information relevant to the sale. |

| Footer | Include customer service information, return policies, or warranty details as necessary. |

| Customization Options | Modify font styles, colors, and layout for a personalized appearance that matches your brand’s design. |

Customizing your sales documents ensures that each transaction is clear, professional, and tailored to your specific business needs, while also helping to foster trust and a better experience for your customers.

Free eBay Invoice Templates for Sellers

For online sellers, having access to no-cost, customizable documents can be a game changer. These free tools enable you to generate professional transaction records quickly and without any extra expense. Whether you’re just starting or managing a growing business, these resources allow you to streamline your process and ensure each sale is properly documented.

Benefits of Free Templates

Free document formats provide several advantages for sellers. First and foremost, they reduce costs by offering an alternative to expensive accounting software. Additionally, they are often simple to use and can be customized to match your business needs, ensuring that every sale includes relevant details such as product descriptions, buyer information, and total amounts.

Here are a few ways these free resources can help you:

- No Initial Investment: These formats are available at no cost, making them an accessible option for businesses on a budget.

- Customization: You can adjust the layout, fonts, and information to reflect your unique branding or business model.

- Time Efficiency: Ready-to-use documents save you valuable time by eliminating the need to create records from scratch for each transaction.

- Standardized Structure: They provide a consistent format, ensuring that your documentation always looks professional and well-organized.

In summary, free resources for creating essential documents not only save time and money but also contribute to the efficiency and professionalism of your sales operations. These simple tools make it easier for sellers to manage transactions, keep accurate records, and enhance customer service without unnecessary complexity or costs.

Downloadable eBay Invoice Templates in Word

For online sellers, having access to downloadable documents can be incredibly helpful for streamlining the sales process. These easy-to-access resources allow you to quickly generate essential records for each transaction. By offering customizable and downloadable formats, you can save time while ensuring that each document is well-structured and includes all the necessary details for accurate record-keeping.

How to Access Downloadable Formats

Many websites offer free downloadable document formats specifically designed for online sellers. These formats are available in common file types, making them easy to download and open on most devices. Simply search for the right format that suits your needs, click on the download link, and save it to your computer or cloud storage. From there, you can easily customize the document to fit each individual transaction.

Advantages of Downloadable Documents

Downloadable resources provide several benefits for sellers. They are often pre-designed for efficiency, so all you need to do is fill in the relevant details for each sale. Additionally, these formats are often fully customizable, allowing you to include your branding, adjust the layout, or add specific fields that are unique to your business.

Key advantages include:

- Quick Access: Downloadable formats are ready to use right after downloading, enabling faster document generation.

- Ease of Use: These documents can be edited easily, even without advanced technical knowledge.

- Consistency: By using the same format for every transaction, you ensure uniformity and professionalism in your records.

- Flexibility: Customization options allow you to tailor each document to fit the specific details of every sale.

In conclusion, downloadable documents offer a simple and efficient way for online sellers to maintain accurate records, save time, and present a professional image to customers. With just a few clicks, you can download and personalize each document, ensuring that your business remains organized and your transactions well-documented.

Step-by-Step Guide for eBay Invoices

Creating accurate and professional transaction records is essential for maintaining good business practices. A clear, well-organized document helps both you and your customers keep track of the details of each sale. By following a simple step-by-step process, you can ensure that every transaction is documented properly and presented in a professional manner.

Step 1: Gather All Necessary Information

Before you begin filling out the document, make sure you have all the required details on hand. This includes buyer information, a description of the items or services sold, the total amount, shipping details, and any taxes or additional fees. Having this information ready will streamline the process and help avoid mistakes.

Step 2: Fill in the Document Fields

Once you have everything you need, begin entering the details into the document. Start by adding your business and contact information at the top, followed by the buyer’s details. Then, list each item or service sold, including the description, quantity, and price. Be sure to include any shipping charges, applicable taxes, and the total amount due. This will ensure that the document is comprehensive and clear.

| Field | Description |

|---|---|

| Your Business Details | Include your company name, contact number, and email address for easy communication. |

| Buyer Information | Provide the buyer’s full name, shipping address, and email for record-keeping and communication. |

| Product Details | List each item sold, including a short description, quantity, and unit price. |

| Shipping and Taxes | Include shipping charges and any taxes applied to the sale, if applicable. |

| Total Amount | Sum up the item price, shipping costs, and taxes to get the final total amount due. |

After you have entered all the required details, review the document to ensure accuracy. If everything looks good, save and print it for your records, or send it to the buyer via email or mail. Following this simple guide will help you generate clear and professional transaction records for each sale you make.

Common Mistakes When Creating eBay Invoices

Even the most experienced sellers can make errors when preparing sales documents. These mistakes can lead to confusion, delayed payments, or even disputes with customers. It’s essential to be mindful of common pitfalls that can compromise the clarity and professionalism of your transaction records. By understanding these frequent issues, you can avoid them and ensure that each document is accurate and effective.

1. Missing Key Information

One of the most common mistakes is failing to include all the necessary details on the document. Leaving out important information, such as buyer’s contact details, item descriptions, or payment terms, can lead to confusion or frustration. Make sure each record contains the following essential information:

- Seller and buyer information (name, address, contact)

- Product or service details (description, quantity, price)

- Shipping charges and other additional costs

- Total amount due including taxes and fees

2. Incorrect Pricing or Totals

Another frequent mistake is entering incorrect pricing or calculating the total amount due improperly. This can happen if you forget to include shipping costs, taxes, or apply the wrong tax rate. Double-check all the numbers to ensure that the final amount matches what was agreed upon in the transaction. Small errors in pricing can create mistrust or lead to disputes, so accuracy is key.

Tips for Avoiding Pricing Mistakes:

- Double-check the price of each item and ensure the correct tax rate is applied.

- Verify shipping charges based on the buyer’s location and shipping method selected.

- Always calculate the final total before sending the document to the buyer.

By avoiding these common mistakes, you can create documents that are clear, accurate, and professional, helping to build trust with your customers and ensuring smooth transactions.

Best Practices for eBay Invoice Formatting

When creating professional transaction records, the format and presentation are just as important as the content. A well-organized document enhances clarity, reduces the chance of errors, and helps build trust with customers. By following best practices for document layout, you can ensure that each record looks polished, is easy to read, and includes all relevant details in a logical order.

1. Use Clear and Readable Fonts

The font choice can significantly impact the readability of your document. Stick to professional, easy-to-read fonts such as Arial, Calibri, or Times New Roman. Avoid overly decorative or hard-to-read fonts, as these can make the document look unprofessional and may confuse the reader. Additionally, ensure the font size is large enough (typically 10-12pt) to ensure easy readability without appearing crowded.

2. Organize Information in Logical Sections

It’s important to structure your document logically. Organize the information into clear sections, such as the seller and buyer details, item descriptions, pricing, and total amount due. Use headings and subheadings to distinguish each section and make the document easier to follow. You can also consider using bold or italicized text to highlight important details, such as totals or payment instructions.

Here are some common sections to include:

- Seller Information: Your business name, contact details, and any relevant registration numbers.

- Buyer Information: Name, address, and contact details.

- Product Details: Description of the item(s), quantity, unit price, and total for each product.

- Additional Costs: Shipping fees, taxes, or any other charges.

- Total Amount: The final total due, clearly stated and easy to find.

By following these simple formatting practices, you ensure your documents are not only professional but also easy to navigate, making it more likely that your customers will appreciate the clarity of your transactions.

How to Add Shipping Information to Invoices

Including accurate shipping details in your transaction records is essential for providing transparency and clarity to your customers. Properly documenting shipping information ensures both you and the buyer are on the same page regarding delivery times, costs, and tracking details. It also helps protect you in case of disputes or misunderstandings regarding shipping fees or delivery status.

Step 1: Include Delivery Address

The first piece of shipping information to include is the buyer’s delivery address. This should be clearly listed, with separate fields for the recipient’s name, street address, city, state, and postal code. Ensuring that the address is accurate prevents delivery issues and helps avoid unnecessary delays.

Step 2: Add Shipping Method and Costs

Next, specify the shipping method selected by the buyer (e.g., standard, expedited, or international). Include the corresponding shipping costs for transparency. If there were any additional charges, such as insurance or handling fees, these should also be clearly stated. This information helps the buyer understand exactly what they paid for and avoids confusion during the delivery process.

Example of shipping details:

- Shipping Address: [Buyer’s Name], [Street Address], [City], [State], [Postal Code]

- Shipping Method: [Standard Shipping, Expedited, etc.]

- Shipping Cost: [Amount Paid for Shipping]

- Tracking Number: [Tracking ID, if applicable]

By clearly listing the shipping details in each document, you provide the buyer with the necessary information to track their order and ensure that everything is in order for a smooth delivery process. Proper documentation of shipping helps to avoid any potential disputes and reinforces your professionalism as a seller.

Including Taxes in eBay Invoices

Accurately including taxes in your transaction records is crucial for both compliance and transparency. Whether you’re required to collect sales tax or not, providing clear tax information on your documents ensures that the buyer understands the full cost of the purchase. Including taxes also helps you stay organized and simplifies tax reporting when it comes time to file with the authorities.

Step 1: Understand Your Tax Obligations

Before including taxes in your documents, it’s important to understand your tax obligations. Depending on the location of your business and the buyer, sales tax may be applicable. Ensure you are aware of local, state, or international tax laws and that you are collecting the correct percentage for the specific sale.

Step 2: Add the Tax Breakdown

When adding tax information, clearly itemize the tax amount separately from the price of the products or services. This helps the buyer understand exactly how much of their payment is going towards taxes. If multiple tax rates apply (for example, state and local taxes), list each one along with the corresponding rate and amount.

- Tax Rate: Clearly state the tax percentage applied (e.g., 8%, 10%, etc.).

- Tax Amount: Include the total tax charged for the transaction (e.g., $2.50).

- Subtotal: The cost of the items before taxes are applied.

- Total Amount Due: The final amount, including tax and any other charges such as shipping.

Step 3: Ensure Clarity and Accuracy

Ensure that the tax information is clearly presented, with each element separated for easy understanding. Include a note or reference to the tax rate if necessary, so the buyer can verify the amount charged. If you apply tax-exempt status for certain buyers, be sure to clearly indicate that as well.

By properly including tax details in your transaction records, you can provide clarity for your customers and maintain accurate records for your business. This not only ensures compliance but also builds trust with your buyers, as they can easily see the breakdown of their purchase costs.

Tracking Payments Using eBay Invoices

Effectively tracking payments is vital for managing your finances and maintaining accurate records. A clear system for monitoring transactions ensures that you can quickly identify outstanding balances, confirm completed payments, and keep a detailed history of each sale. By including payment-related details in your transaction records, you can make the process of tracking payments smoother and more efficient.

Step 1: Include Payment Status Information

It’s essential to clearly indicate the payment status within your transaction record. This should specify whether the payment has been received, is pending, or if any issues need to be resolved. By tracking this information in your records, you can avoid confusion and ensure that both you and the buyer are aware of the payment progress.

- Payment Received: Indicate when payment has been successfully received, and consider including the payment method used (e.g., credit card, PayPal, etc.).

- Pending Payment: Note if the payment is still being processed or has not yet been completed.

- Payment Overdue: Mark if the payment is overdue and may need follow-up action.

Step 2: Use Payment Tracking Numbers

If the payment process includes the use of a tracking system (such as with PayPal or bank transfers), be sure to include any relevant tracking or transaction numbers in the record. This makes it easier to verify payments and helps both you and the buyer resolve any potential disputes or questions about payment status.

- Transaction ID: Include any payment identifiers or transaction numbers for easy reference.

- Payment Date: Record the exact date when the payment was received.

- Payment Method: Indicate whether the payment was made via credit card, bank transfer, or another method.

By tracking payments systematically and clearly within your transaction records, you help ensure that your financial processes remain transparent and organized. This not only improves communication with your customers but also helps you stay on top of your finances and avoid any payment-related issues.

How to Edit eBay Invoice Templates in Word

Customizing your transaction records allows you to better align the documents with your business needs. Editing existing templates is a simple process that gives you full control over how you present the details of your sales. With just a few adjustments, you can create professional, clear, and accurate records every time.

Step 1: Open the Document

The first step is to open the document you wish to edit. If you’re using a pre-made template, you can start by downloading it or opening the file in your document editor. Ensure that the software you’re using is compatible with the file format to avoid formatting issues.

Step 2: Modify Text Fields

Next, update the text fields with relevant information. These may include your business name, customer details, item descriptions, prices, and payment terms. Simply click on the text you want to change and replace it with the correct information.

- Business Details: Update your company name, address, contact information, and any other identifying information.

- Buyer Information: Replace placeholder details with the customer’s name, address, and contact information.

- Product Descriptions: Modify item names, quantities, prices, and any other specifics related to the product sold.

Step 3: Customize Layout and Design

After updating the text, consider adjusting the layout and design to suit your preferences. You may want to change the font style, size, or color to match your branding or simply improve readability. You can also rearrange sections if needed, to ensure the document is organized and visually appealing.

- Fonts: Choose fonts that are clear and professional, such as Arial or Times New Roman.

- Sections: Rearrange or resize sections (e.g., move the total cost to the top or bottom) for better presentation.

- Spacing: Adjust line spacing and margins to ensure the document is clean and uncluttered.

Step 4: Save and Export

Once you’ve made all the necessary edits, save the document. You may want to save it as a new file to preserve the original template. Depending on your needs, you can also export it to other formats, such as PDF, to ensure it maintains its layout when shared with customers.

Editing your transaction records ensures that they reflect the specific details of each sale. By following these steps, you can quickly tailor documents to suit your needs and create a professional experience for your buyers every time.

Saving and Printing Your eBay Invoice

Once you’ve customized and finalized your transaction document, it’s important to save and print it properly for record-keeping and customer purposes. A well-organized, saved copy ensures that you can easily access it later for reference, tax reporting, or potential disputes. Additionally, printing a hard copy can be useful for sending physical receipts or packaging orders.

Step 1: Saving the Document

The first step is to save the completed record on your computer or cloud storage. This allows you to access it anytime you need to reference the transaction. Make sure to name the file in a way that’s easy to identify, such as including the buyer’s name or order number. Choose a file format that suits your needs, such as PDF or the native format of your editing software, to preserve the layout and formatting.

- File Name: Use a clear, descriptive name, like “Order_12345_JohnDoe.pdf”.

- Storage Location: Save the document in an organized folder for easy access.

- File Format: Choose a file format like PDF for compatibility across devices and platforms.

Step 2: Printing the Document

Once the file is saved, you can print the document if a physical copy is needed. Printing it out provides a professional touch, especially if you need to include it in a package or mail it to the customer. Ensure that your printer settings are correct, such as choosing the right paper size (usually letter or A4) and adjusting the margins to fit the document content.

- Check Printer Settings: Make sure the page layout, orientation (portrait or landscape), and margins are set appropriately.

- Preview Before Printing: Always preview the document to ensure the formatting looks correct on paper.

- Printing Multiple Copies: If needed, print several copies for your records or for sending with the customer’s order.

By properly saving and printing your transaction records, you ensure that both you and the buyer have a clear, physical copy of the transaction for future reference. This simple step helps keep your business organized and professional, whether you’re storing documents digitally or handling hard copies.

Organizing Your eBay Invoices for Tax Purposes

Maintaining an organized system for your sales records is crucial when it comes to tax time. Properly categorizing and storing transaction documents ensures that you can easily access the necessary information for reporting income, deductions, and other financial details. A clear, well-maintained system can help streamline the process of filing taxes and reduce the risk of errors or missed information.

Step 1: Categorize Your Sales Records

The first step is to categorize your sales documents based on key criteria such as date, product type, or transaction volume. Creating separate folders or files for each category will help you quickly find the information you need. For example, you might organize documents by month or quarter to align with tax reporting periods.

- Monthly or Quarterly Folders: Organize sales into monthly or quarterly folders for easier access during tax filing.

- Product Categories: If you sell multiple types of products, separate the records by category (e.g., electronics, clothing, etc.) to track income more effectively.

- Transaction Status: You can also sort records by payment status (e.g., paid, pending, or refunded) to keep track of completed sales.

Step 2: Store Digital and Physical Copies

Both digital and physical copies of your transaction records should be stored securely. Digital records are easier to manage and access quickly, but it’s also important to maintain physical copies for backup, especially for legal or audit purposes. Ensure that both formats are clearly labeled and organized for efficient retrieval when needed.

- Digital Storage: Use cloud services or external drives to store digital copies of your records, ensuring they are backed up regularly.

- Physical Storage: If you keep hard copies, use filing cabinets or binders with clear labels for each category or time period.

By keeping your transaction documents well-organized, you can simplify the process of preparing for tax season and avoid last-minute scrambling for important records. This approach not only helps with tax reporting but also ensures that you stay compliant with any local or national tax regulations.

Integrating eBay Invoices with Accounting Software

Integrating your transaction records with accounting software can significantly streamline your financial management. By automatically syncing your sales data, you can easily track revenue, expenses, and profits without the need for manual data entry. This integration ensures that your financial information is up-to-date, accurate, and ready for tax season or financial reviews.

Step 1: Choose Compatible Accounting Software

Not all accounting software is designed to integrate with every type of sales record system. It’s essential to choose a platform that supports the file formats or systems you use for managing your sales. Many popular accounting tools allow easy imports of CSV or Excel files, making them ideal for integrating with transaction records generated from your sales platform.

- Popular Accounting Software: QuickBooks, Xero, FreshBooks, Wave

- Supported File Formats: CSV, Excel, PDF

- Automated Sync: Some platforms offer built-in integrations with online sales platforms, syncing data in real-time.

Step 2: Import Transaction Data into Accounting Software

Once you have selected the right accounting software, the next step is to import your transaction data. Most systems offer an easy import option where you can upload your sales records directly. Depending on the software, this may be done through a manual file upload or automatic syncing from your sales platform.

| Software Option | Integration Method | File Format |

|---|---|---|

| QuickBooks | Automatic Sync via API | CSV, Excel |

| Xero | CSV File Upload | CSV |

| Wave | Manual File Upload | CSV |

Once your records are imported, your accounting software will automatically categorize the data, calculate profits, and help you generate accurate financial reports. This eliminates the need for manual calculations, saving you time and reducing the chance of errors.

By integrating your sales records with accounting software, you ensure that your financial data is organized, accurate, and readily available. This integration simplifies bookkeeping, aids in generating financial reports, and helps you stay on top of your business’s financial health.