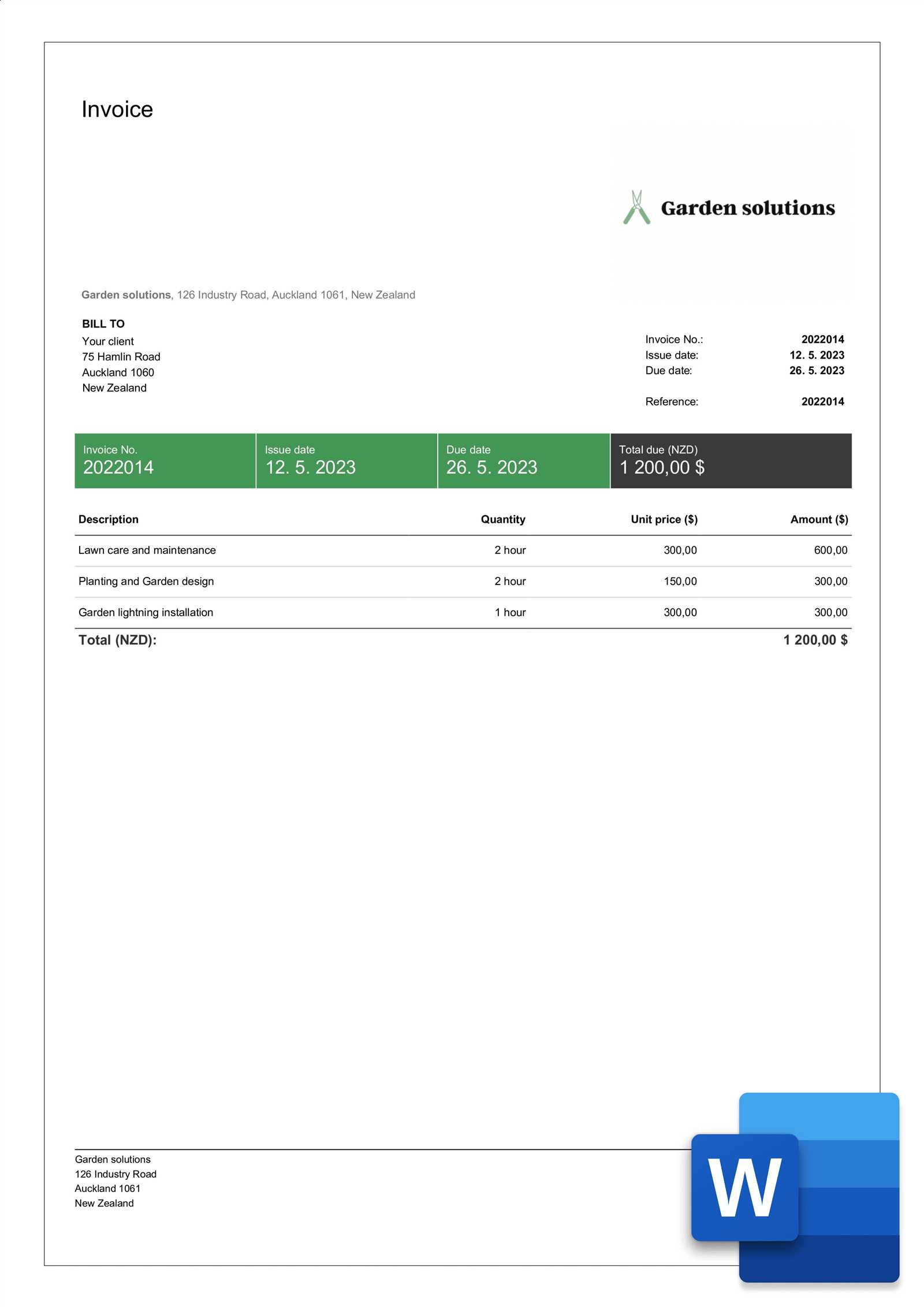

Best Invoice Template Word for Effortless Billing

In today’s fast-paced business world, having a streamlined process for managing financial transactions is essential. A well-structured document for payment requests not only ensures clarity but also reflects the professionalism of your company. Whether you’re a freelancer, small business owner, or part of a larger organization, a reliable tool for generating clear, organized payment forms can make all the difference.

Choosing the right tool for creating these forms is crucial. Many professionals rely on easily accessible software that offers flexibility and customization. A popular choice is a widely used text editor that allows for easy formatting and quick adjustments to meet various needs. The right solution can save time, reduce errors, and improve communication with clients.

In this guide, we’ll explore various options for crafting these essential documents efficiently. From simple designs to more intricate layouts, we’ll cover features and tips that can help you produce polished, error-free forms with ease.

Best Invoice Template Word for Your Business

When managing financial transactions, having the right document structure is key to maintaining professionalism and clarity. An efficient solution can help you streamline billing processes, ensure accuracy, and reduce the time spent on administrative tasks. For small and medium-sized businesses, using a simple yet effective tool to create payment requests is essential for smooth operations.

Here are some important features to consider when choosing the ideal document structure for your business:

| Feature | Importance |

|---|---|

| Customizability | Allows you to add your logo, business details, and adjust the format to match your brand identity. |

| Ease of Use | Simple to edit and fill out, saving time and reducing the risk of errors. |

| Professional Layout | Ensures your documents look polished and presentable to clients and partners. |

| Payment Terms Integration | Easy to include payment instructions, deadlines, and other necessary terms for clarity. |

| Compatibility | Works well across various devices and operating systems, ensuring accessibility and consistency. |

By using an efficient, customizable solution, your business can maintain a professional appearance while streamlining billing tasks. The right document format can help you focus more on your work and less on administrative challenges.

Why Choose a Word Invoice Template

Opting for a simple yet versatile document creation tool can significantly improve how you handle financial requests. A popular option for creating these essential forms offers a blend of accessibility, customization, and efficiency, making it a preferred choice for many businesses. The flexibility to adjust the format, design, and content makes it easy to align the document with your specific needs and branding.

Ease of Use is one of the main reasons many professionals prefer this method. It’s a straightforward process to create, edit, and update documents, even for those with minimal technical skills. The user-friendly interface allows you to focus on content rather than technicalities.

Cost-Effectiveness is another advantage. Many business owners choose this tool because it comes with no additional cost if you already have the software, eliminating the need for subscriptions or premium services. This allows even small businesses to produce high-quality documents without a significant financial investment.

Additionally, its compatibility across multiple platforms ensures that your documents can be easily accessed, shared, and printed, regardless of the device or operating system in use. This makes it a reliable choice for businesses looking for a seamless experience in their documentation processes.

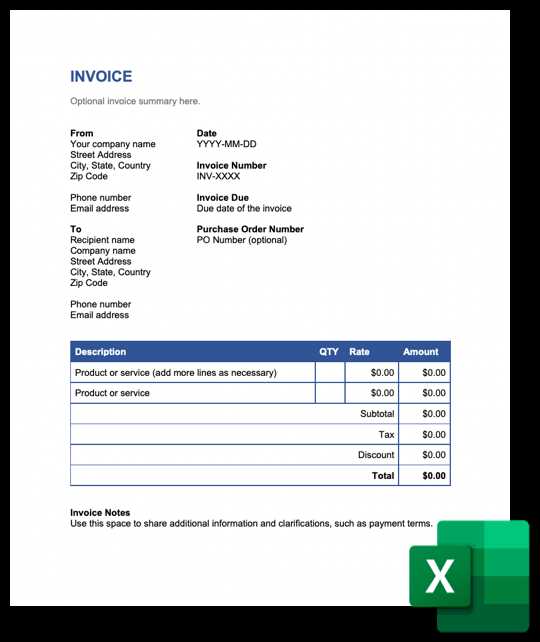

Top Features of an Invoice Template

When selecting a document format for payment requests, there are several key characteristics that make it not only functional but also professional. A well-designed layout with the right features can help ensure that all necessary information is clear, accurate, and easy to understand. These elements can also save you time, reduce errors, and present your business in a polished light.

- Clear Structure: A well-organized format allows for easy reading and quick reference. Key sections like service description, pricing, and payment terms should be clearly separated and easy to locate.

- Customizability: The ability to personalize the document with your company logo, colors, and fonts helps align the payment request with your brand identity, adding a professional touch.

- Itemized Breakdown: An essential feature is a detailed list of products or services provided. This ensures transparency and helps clients understand the charges without confusion.

- Payment Terms and Instructions: Including specific payment deadlines, late fees, and accepted payment methods ensures there’s no ambiguity for the recipient.

- Tax Calculation Fields: Automatic fields for calculating taxes or discounts make it easier to adjust the final amount without manual calculations.

- Professional Design: The aesthetic of the document should be clean and simple. A well-structured layout creates a sense of professionalism and helps improve client trust.

By incorporating these features, you can create payment documents that are not only functional but also contribute to a positive business image, making the payment process smoother for both you and your clients.

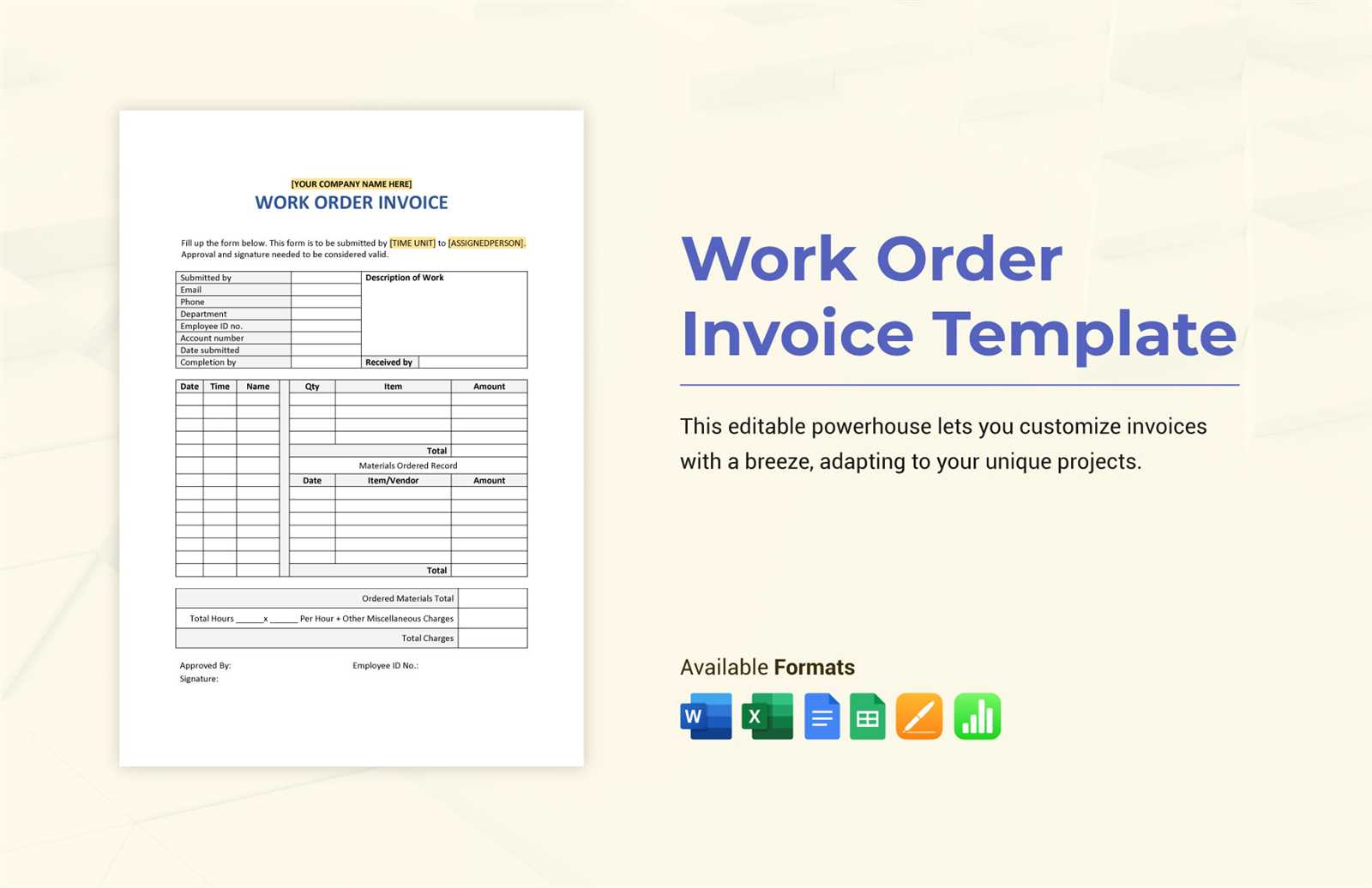

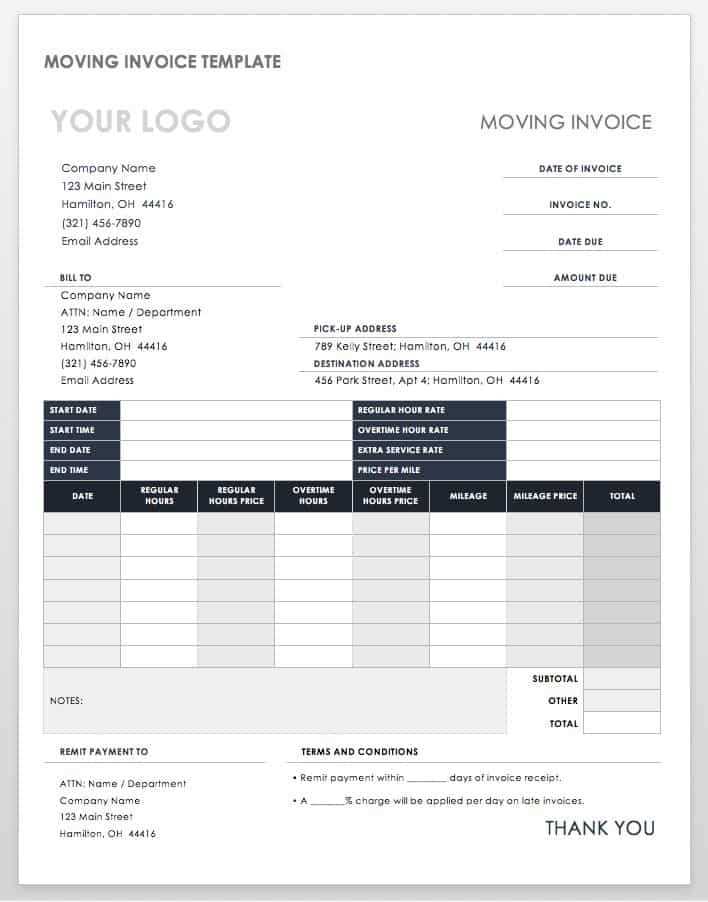

How to Customize Invoice Templates in Word

Customizing a document format for payment requests allows you to create a personalized and professional presentation for your business. The ability to adjust elements like the design, layout, and content ensures that the document reflects your brand identity and meets specific needs. Whether you’re adding your logo or changing the color scheme, simple customizations can greatly enhance the overall look and functionality of your forms.

Step-by-Step Guide to Customization

1. Open the Document – Start by opening the pre-designed format in your text editor. Most tools provide built-in layouts that you can edit directly. Once opened, you can modify the content, such as adding your business name, contact details, and payment instructions.

2. Modify Text Fields – Replace placeholders with relevant details such as client names, dates, and item descriptions. You can also adjust fonts and text size to match your business style.

Enhancing the Design

3. Add Branding – Incorporate your company’s logo, colors, and any other branding elements to create a cohesive look. Most editing tools allow you to easily insert images and adjust colors for headers, borders, or tables.

4. Adjust Layout – Modify the arrangement of sections to highlight important information. For example, you can move the payment terms section to the top for better visibility or resize columns for more concise details.

By following these steps, you can ensure that your payment request forms are not only functional but also aligned with your company’s identity, improving professionalism and client satisfaction.

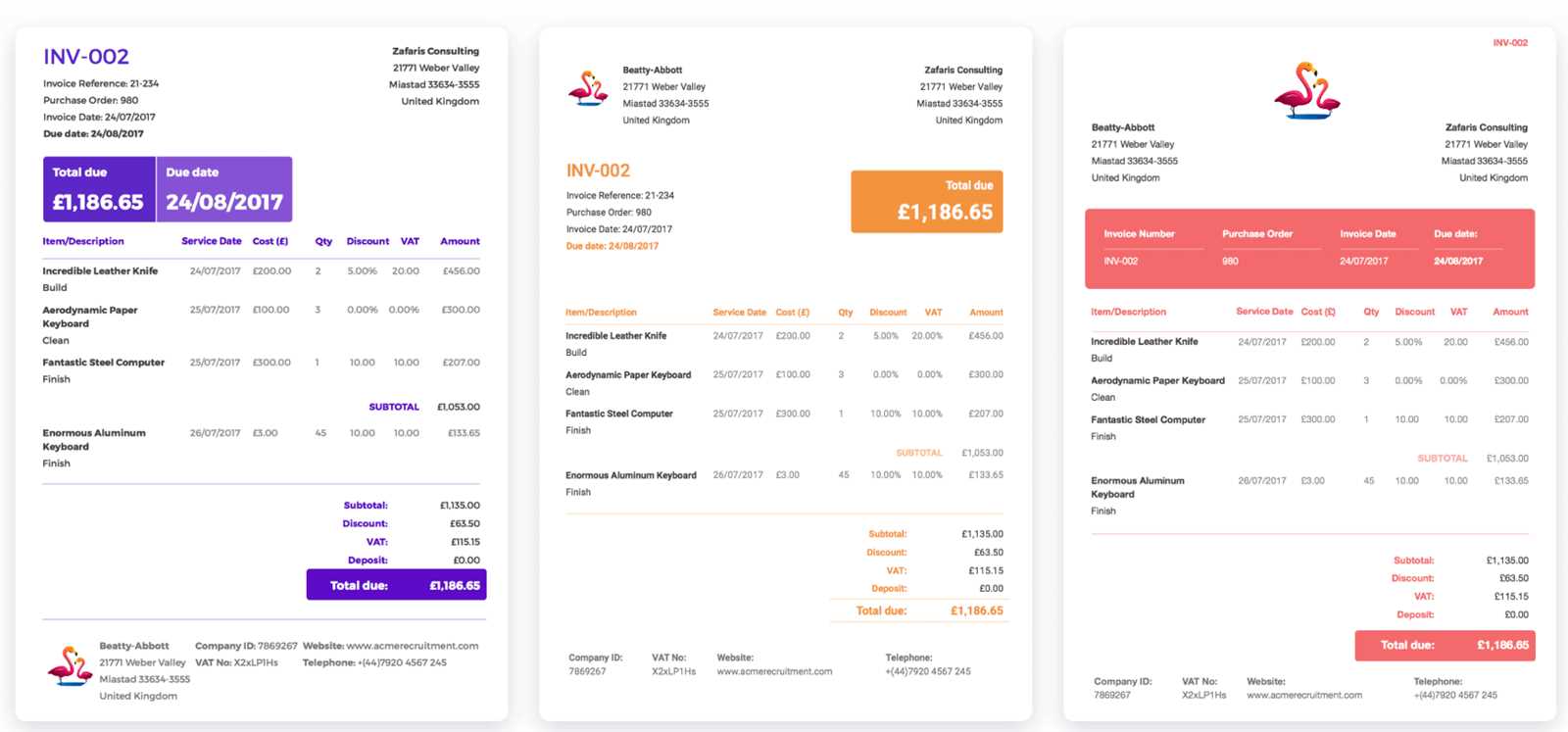

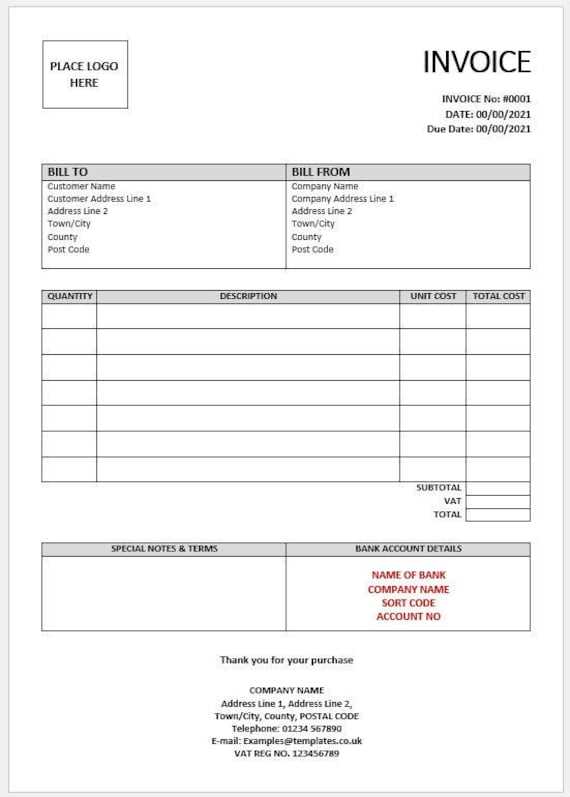

Free vs Paid Invoice Templates

When it comes to choosing a solution for creating professional payment requests, businesses often face the decision between using free options or opting for premium paid designs. Both have their advantages, but the choice largely depends on your specific needs and the level of customization you require. Understanding the differences between these two options can help you make an informed decision based on your budget and business requirements.

Advantages of Free Document Formats

- Cost-Effective: Free formats are obviously the best choice for businesses with a tight budget or those just starting out.

- Easy Access: Many free designs are readily available online, requiring no subscription or payment.

- Simplicity: Free solutions are often simple and easy to use, making them ideal for small businesses with minimal customization needs.

Advantages of Paid Document Formats

- Customization Options: Paid solutions typically offer more flexibility, allowing you to make deeper design and functionality adjustments, such as integrating payment gateways or adding advanced features.

- Professional Design: Premium options often come with more polished and sophisticated layouts, enhancing the overall look and feel of your documents.

- Support and Updates: With a paid service, you typically receive customer support and ongoing updates to ensure your documents remain compliant and up-to-date.

Ultimately, choosing between free and paid solutions depends on the scale of your business, your design preferences, and the specific features you need. Small businesses or freelancers may find that a free solution works perfectly, while larger companies or those needing advanced features may benefit from investing in a premium option.

How to Use Word Templates Efficiently

Creating professional payment forms can be a time-consuming task, but with the right tools, the process becomes much more efficient. By leveraging pre-designed structures, you can save valuable time while ensuring accuracy and consistency in your documents. Learning how to effectively use these tools can help streamline your workflow and improve productivity.

Steps for Efficient Use

1. Choose the Right Layout – Start by selecting a design that fits your needs. Look for structures that are clear, organized, and offer the flexibility to add or remove sections as required.

2. Automate Basic Information – Many systems allow you to set up default details like business name, address, and contact information. This way, you only need to update client-specific details, saving time on repetitive data entry.

Organizing and Customizing

3. Personalize for Your Brand – Add your company logo, choose your brand colors, and adjust fonts to match your business identity. Customizing the appearance enhances professionalism and creates a consistent look for your documents.

4. Save Commonly Used Sections – If you often include specific products, services, or payment terms, create reusable sections. This helps reduce the effort of re-entering similar content every time.

Tips for Streamlined Workflow

| Tip | Benefit |

|---|---|

| Use Fields for Automatic Calculations | Quickly calculate totals, taxes, and discounts without manual entry, reducing errors. |

| Store Templates in a Central Location | Ensure easy access to your formats and make it simple to select and modify when needed. |

| Set Up Keyboard Shortcuts | Speed up the document creation process by using shortcuts for frequently accessed features. |

By following these strategies, you can make the most of pre-designed structures, ensuring that your financial documents are created quickly, accurately, and consistently. With a little preparation and organization, you’ll be able to handle billing tasks efficiently, giving you more time to focus on other aspects of your business.

Benefits of Word Invoice Formats

Choosing the right document format for billing can have a significant impact on your business operations. By opting for an editable and widely accessible solution, you gain numerous advantages that improve both efficiency and professionalism. These formats offer flexibility and ease of use, which are essential for businesses of any size looking to streamline their financial documentation process.

Cost-Effective and Easy to Use

One of the primary benefits of using this type of format is that it is cost-effective. Many businesses already have access to the required software, making it an affordable solution. There’s no need to invest in expensive tools or software packages when a simple, reliable option is available.

Additionally, these formats are user-friendly, even for those with little technical experience. Creating and editing documents requires minimal effort, allowing you to focus on the content rather than struggling with complex features. This ease of use is particularly beneficial for small business owners and freelancers who need a quick and simple solution for managing their billing tasks.

Customizability and Professionalism

Another significant benefit is the customizability these formats offer. You can tailor the document’s appearance to fit your business’s branding by adding logos, adjusting fonts, and choosing color schemes. This ensures that your payment requests reflect your company’s professional image, helping to build trust with clients.

Furthermore, the professional layout available in most formats helps ensure that the document is clear, well-organized, and easy to understand. Sections for itemized services, payment terms, and contact details are often pre-structured, ensuring that clients can easily review the necessary information without confusion.

Incorporating these features makes it easier to create polished and consistent documents that convey reliability and professionalism to your clients, which can ultimately help improve your business’s reputation and payment process.

Best Invoice Template for Small Businesses

For small business owners, managing financial documentation efficiently is crucial to maintaining a smooth workflow. A well-structured document that clearly presents services rendered and payment details can help improve client communication and ensure timely payments. The right format is one that strikes a balance between simplicity and professionalism, offering all the necessary sections without being overly complex.

Here are key features to look for when selecting a document format for small businesses:

| Feature | Description |

|---|---|

| Simple Layout | Clear, easy-to-read structure with sections for client details, services, pricing, and payment terms. |

| Customizable Fields | Ability to add your business logo, adjust fonts, and change colors to match your brand identity. |

| Itemized Breakdown | Detailed listing of products or services with their respective costs, making the payment process transparent. |

| Payment Terms | Clear sections for payment methods, deadlines, and any applicable late fees or discounts. |

| Tax and Discount Calculations | Pre-configured fields to automatically calculate taxes, discounts, or other charges based on your input. |

For small businesses, the ideal document format should be straightforward and efficient, reducing the time spent on paperwork and ensuring a polished, professional presentation for clients. With the right design, you can enhance your business’s image while making financial management less time-consuming.

How to Automate Invoicing with Word

Automating your billing process can save time, reduce human error, and improve the consistency of your documents. By leveraging built-in tools in commonly used text editing software, you can streamline the creation of payment requests and ensure that each one is accurate and professionally formatted. With a few simple steps, it’s possible to set up a semi-automated system that minimizes the amount of manual input required for each new document.

Here’s how to automate parts of the billing process using built-in features:

1. Use Fields for Repetitive Data – Instead of manually entering information like your business name, address, or client details, set up fields that automatically populate these areas. Once the fields are configured, you can reuse the same structure for every document, saving time on repetitive tasks.

2. Create a Master Document – Start by building a master file that includes placeholders for all necessary information. Use variables or content controls for dynamic data like client name, services rendered, or dates. You can then copy and modify this master document as needed without having to start from scratch each time.

3. Set Up Custom Shortcuts – If you frequently use certain phrases or text blocks, set up keyboard shortcuts to insert them with one keystroke. For example, create shortcuts for payment terms, service descriptions, or discounts. This reduces the need for repetitive typing and ensures consistency in every document.

4. Automate Calculations – You can set up basic formulas in some text editors to automatically calculate totals, taxes, or discounts. This feature helps reduce manual errors in calculations and makes generating accurate documents faster.

By integrating these automation techniques, you can speed up your billing process, reduce mistakes, and ensure that your financial documents are always ready when you need them. The key is to set up your system once and then simply update the necessary fields as needed for each new client or project.

Common Mistakes in Invoice Creation

When preparing payment requests, even small mistakes can lead to confusion, delays in payment, or strained client relationships. It’s essential to ensure that all details are accurate, clear, and professional. Many errors are easily avoidable, and understanding the most common pitfalls can help you avoid them and create effective, reliable documents every time.

Here are some common mistakes to watch out for when creating your financial documents:

| Error | Why It’s a Problem |

|---|---|

| Incorrect Client Information | Misspelled names, incorrect addresses, or outdated contact details can delay payments and damage your credibility. |

| Missing or Incomplete Item Descriptions | Lack of clarity on what services or products are being billed for can cause confusion and disputes. |

| Wrong Payment Terms | Misstated deadlines, payment methods, or late fees can create misunderstandings and delay payments. |

| Omitting Taxes or Discounts | Failure to include or calculate taxes and discounts correctly can lead to discrepancies and potential legal issues. |

| Not Including Unique Invoice Numbers | Lack of a unique reference number can make it difficult to track payments and can complicate bookkeeping. |

| Using Unprofessional Formatting | A cluttered or poorly designed document can look unprofessional, affecting how clients view your business. |

By paying attention to these common mistakes, you can create more accurate, effective, and professional documents that improve your payment process and maintain good client relations. Careful attention to detail in each document can save you time, reduce misunderstandings, and help you get paid faster.

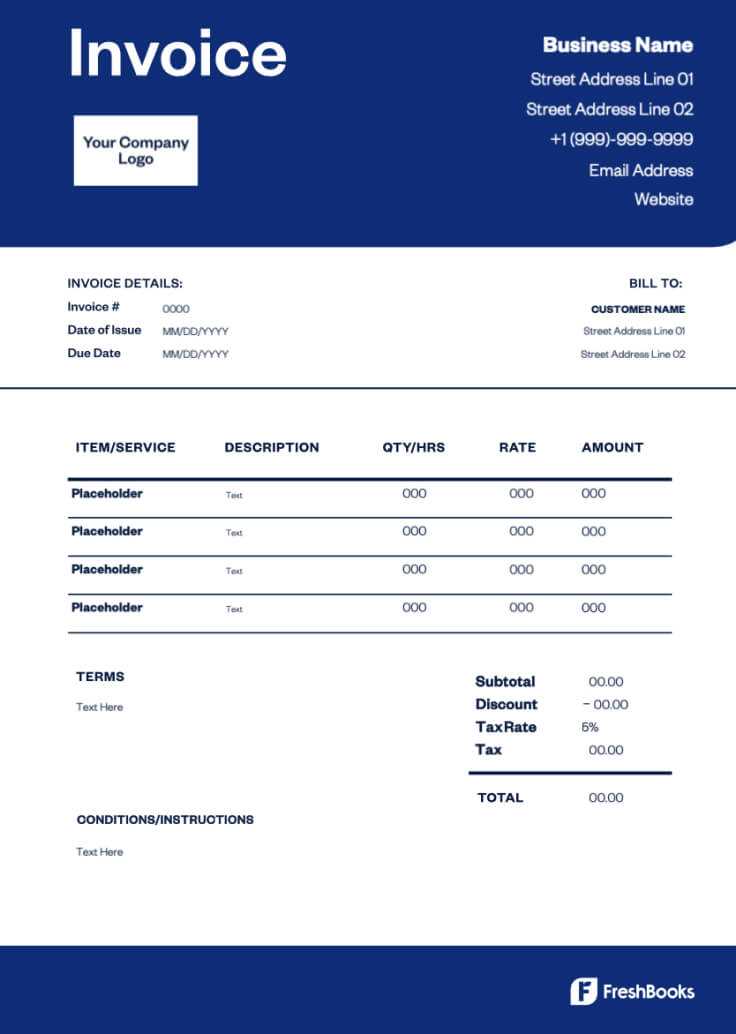

Design Tips for Professional Invoices

Creating well-designed payment requests is essential for maintaining a professional image and ensuring smooth transactions. A clean and organized layout not only enhances readability but also helps build trust with your clients. By paying attention to key design elements, you can create documents that stand out for their clarity and professionalism.

Here are some essential design tips to follow when creating payment requests:

- Use a Clean and Simple Layout – Avoid cluttered designs. Stick to a clear structure with distinct sections for each piece of information. This makes it easier for clients to quickly find the details they need, such as payment terms, totals, and descriptions.

- Choose Legible Fonts – Select easy-to-read fonts like Arial or Helvetica. Use a larger font for headings and a smaller font for the body text. Ensure there’s enough contrast between the text and background for readability.

- Highlight Key Information – Make important details, such as the total amount due, payment deadline, and business contact information, stand out. You can do this by using bold text, larger fonts, or borders around sections.

- Keep Branding Consistent – Incorporate your company’s logo, colors, and fonts to create a cohesive brand identity. This will make your document more professional and help clients recognize your business instantly.

- Use Tables for Clarity – Tables are a great way to organize service or product descriptions, quantities, rates, and totals. They provide a neat structure that is easy to follow and helps prevent confusion.

- Leave White Space – Don’t overcrowd the document with text or design elements. Adequate white space around sections gives the document a clean, open feel and enhances readability.

- Ensure Proper Alignment – Align text consistently, especially in tables. This improves the document’s structure and makes it easier for clients to review the details without distractions.

By following these simple design principles, you can ensure that your payment requests are not only functional but also visually appealing. A well-designed

Ensuring Accuracy in Your Invoices

Accurate financial documents are essential for maintaining a professional reputation and ensuring timely payments. Mistakes in calculations or missing details can lead to confusion, delayed payments, or even disputes. To avoid such issues, it’s important to double-check all the information before sending out any payment requests. Below are key steps you can take to ensure the accuracy of your documents.

Here are some best practices for maintaining precision in your financial documents:

- Double-Check Client Information – Ensure that all client details, such as name, address, and contact information, are correct. Any errors in these fields can lead to miscommunication or delayed payments.

- Verify Service/Item Descriptions – Make sure that each item or service is listed clearly and accurately. Include detailed descriptions, quantities, rates, and any applicable discounts or promotions.

- Confirm Pricing and Calculations – Review all pricing and calculations before finalizing the document. Double-check that the totals, taxes, and any discounts are correct. Using built-in calculation tools can help prevent errors.

- Use a Consistent Format – Stick to a standardized format for all your payment requests. Consistency helps minimize mistakes and ensures that all necessary information is included every time.

- Review Payment Terms – Confirm that payment terms, including deadlines, methods, and late fees (if applicable), are clearly stated and accurate. Ambiguity in this section can lead to misunderstandings.

- Ensure Unique Document Numbers – Always assign a unique reference number to each document. This helps with tracking payments and avoids confusion when dealing with multiple clients.

- Proofread the Document – Read through the entire document carefully before sending it. Look for any spelling, grammatical, or formatting errors that could impact professionalism.

By following these guidelines, you can significantly reduce the chances of errors in your financial documentation. Maintaining accuracy not only streamlines the payment process but also fosters trust with your clients, ensuring long-term business relationships.

Adding Your Branding to Invoice Templates

Incorporating your company’s unique identity into your financial documents is an effective way to present a professional image and strengthen your brand recognition. By customizing the look of your payment requests, you not only create a more cohesive experience for your clients but also reinforce your brand’s values and style. Small changes, such as adding a logo, adjusting colors, or choosing the right fonts, can make a significant impact on how your documents are perceived.

Here are some ways to integrate your branding into your financial documents:

- Include Your Logo – Adding your company logo at the top of the document is the easiest way to personalize the layout and make your brand instantly recognizable to clients.

- Use Brand Colors – Incorporate your brand’s color palette into the document’s design. This could include using your primary brand colors for headings, borders, or accent areas.

- Choose Consistent Fonts – Use fonts that align with your company’s style guide. This ensures that all of your communication, including payment requests, feels consistent and professional.

- Customize the Header and Footer – In addition to your logo, consider adding your business slogan, website URL, or social media handles in the header or footer. This helps keep your brand visible even as clients review the document.

- Maintain a Professional Layout – Use clean lines, sufficient white space, and an organized structure that reflects the professionalism of your business. A cluttered document can detract from your brand’s image.

By adding these elements to your payment documents, you ensure that every client interaction feels cohesive with the overall branding of your business. Not only does this contribute to a more polished image, but it also makes your documents instantly recognizable, improving client trust and encouraging timely payments.

How to Save and Share Word Invoices

Once you’ve created a well-organized payment request, the next crucial step is saving and sharing it with your clients. This process should be efficient, secure, and easy to manage to ensure that you receive timely payments while keeping a record of all transactions. There are several methods you can use to save and share your documents, each offering different benefits depending on your business needs.

Here are some effective ways to save and distribute your payment requests:

- Save in Multiple Formats – After creating the document, save it in the original format for future editing. Additionally, save it as a PDF to ensure the document’s formatting remains intact when shared with clients.

- Organize Files in Folders – Keep your payment requests organized by creating dedicated folders for each client or project. This makes it easier to track past transactions and ensures that important documents are easy to find.

- Use Cloud Storage – Store your documents in cloud-based services like Google Drive, Dropbox, or OneDrive. This enables easy access from anywhere and ensures that your files are backed up in case of hardware failure.

- Send via Email – For quick and direct delivery, email the document to your clients. Attach the PDF version to ensure that the format remains unchanged. Make sure to include a clear subject line and a brief message explaining the content of the document.

- Use Online Payment Platforms – Some payment platforms, such as PayPal or QuickBooks, allow you to create and send payment requests directly through their system. This can streamline the process and offer clients a convenient way to make payments online.

- Set Up a Client Portal – If you frequently work with the same clients, consider setting up a client portal on your website. This allows clients to log in, view, and download their payment requests at any time, adding a layer of convenience for both parties.

By using these methods, you can ensure that your payment requests are securely stored and efficiently shared with clients. This not only helps streamline your workflow but also ensures that all documents are easily accessible and properly organized for future reference.

Using Word Invoices for International Clients

When working with clients from different countries, it’s crucial to adapt your payment documents to meet international standards and ensure smooth transactions. While the core elements of a financial document remain the same, there are key considerations when dealing with international clients, such as currency, language, and tax regulations. By tailoring your payment requests to accommodate these factors, you can foster clearer communication and avoid potential misunderstandings.

Here are some important tips for using payment documents with international clients:

- Include Multiple Currencies – Specify the currency being used for payment, especially if you deal with clients from countries that use different currencies. Including the currency symbol (e.g., USD, EUR) or converting the amount to your client’s local currency can prevent confusion.

- Provide Clear Payment Instructions – Ensure that the payment instructions are detailed and easy to understand. This may include international bank account numbers (IBAN), SWIFT/BIC codes, or PayPal details, depending on your preferred payment method.

- Address Language Barriers – If you’re working with clients who speak different languages, consider offering a translated version of your payment document. At a minimum, ensure that key terms like “total amount due,” “payment terms,” and “due date” are clearly explained.

- Account for International Taxes – Be aware of VAT, GST, or other regional taxes that may apply to your transaction. Make sure to specify whether taxes are included or excluded from the total and include the applicable tax rates if necessary.

- Be Mindful of Time Zones – When specifying deadlines for payments, consider time zone differences. It may be helpful to include the due date in both your time zone and the client’s local time zone to avoid confusion.

By addressing these factors, you can ensure that your financial documents are clear, professional, and aligned with international standards, helping to establish trust with clients across the globe and simplifying the payment process.

Keeping Track of Payments with Word Templates

Efficiently managing and tracking payments is crucial for maintaining a healthy cash flow and ensuring timely follow-ups with clients. Using structured documents to record and monitor payment status can help you stay organized and avoid missed payments. With the right system in place, you can quickly assess which payments have been received, which are due, and which need further attention.

Here are some strategies for keeping track of payments using payment request documents:

- Use a Payment Status Column – Add a “Payment Status” column to your document where you can mark whether the payment is “Paid,” “Pending,” or “Overdue.” This makes it easier to identify the status of each transaction at a glance.

- Include Payment Due Dates – Clearly mark the payment due date on each document. This helps both you and your client keep track of deadlines and ensures timely payments.

- Record Payment Dates – When a payment is received, note the payment date in your document. This provides a clear record of when funds were received and helps track the time it took to receive payment.

- Add Client Reference Numbers – Assign unique reference numbers to each payment request. This makes it easier to cross-reference with bank statements and track payments for specific services or products.

- Organize Payment Documents by Client or Date – Keep your payment records organized by creating separate folders for each client or project. Alternatively, you can organize them chronologically to easily follow up on overdue payments.

- Set Up Reminders – While not directly part of the document itself, setting up calendar reminders or using task management tools can help you follow up with clients when payments are overdue.

By implementing these tracking methods in your payment documents, you can maintain better control over your financial transactions. It will not only streamline your accounting process but also help you ensure that no payments are overlooked, reducing the risk of cash flow issues.