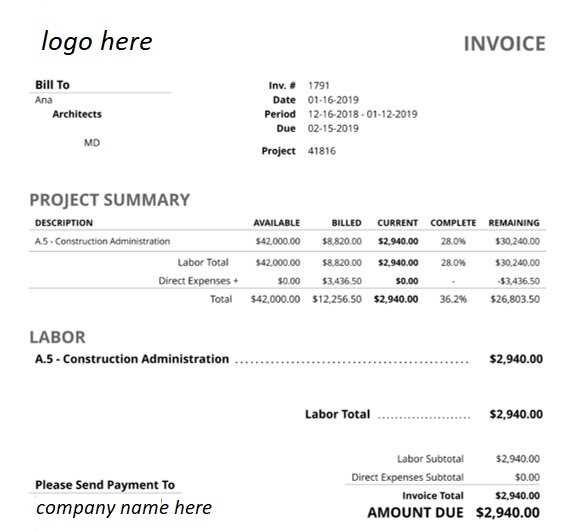

Download Free Architect Invoice Template for Efficient Billing

In the world of design services, managing payments efficiently is essential for maintaining a healthy cash flow and client relationships. Having a well-organized document to request compensation for completed work can save time, reduce errors, and ensure professionalism. A structured document not only helps in clearly communicating the cost of services but also serves as a record for both parties involved.

Effective billing is about more than just asking for payment–it’s about creating a smooth and transparent process. When using a reliable document, professionals can focus on their craft rather than getting bogged down in administrative tasks. Whether you’re just starting or have years of experience, adopting a system that suits your needs can simplify your financial processes and avoid misunderstandings.

There are various options available that allow for easy customization and personalization, giving you the flexibility to tailor the document to your specific projects. From incorporating your branding to adjusting payment terms, the right solution ensures clarity and expedites the financial side of your business. Streamlining this aspect of your work can lead to improved client satisfaction and more time to focus on what you do best.

Why Designers Need a Structured Payment Request

Managing compensation requests in a consistent and professional manner is crucial for any design professional. Without a clear system in place, it can be difficult to track payments, stay organized, and ensure timely receipt of funds. A standardized approach to financial documentation not only reduces errors but also establishes trust with clients by providing transparency in transactions.

Efficiency and Time-Saving

Using a consistent method for requesting payment allows designers to save valuable time. Instead of creating a new document from scratch for each client or project, they can use a pre-designed framework that is already customized to their needs. This saves effort and speeds up the entire process, allowing professionals to focus on their core work.

- Quickly generate documents for any project

- Reduce the need for repetitive data entry

- Maintain consistency across all transactions

Clear Communication and Professionalism

A well-structured payment request document also improves communication with clients. It ensures that all necessary information is provided in a clear, easy-to-read format. This includes itemized lists of services rendered, payment terms, and due dates. Such clarity helps prevent misunderstandings and establishes a more professional reputation.

- Provides clear breakdowns of services and costs

- Improves client trust and satisfaction

- Reduces the likelihood of payment delays

Benefits of Using a Payment Request Document

Having a standardized document for billing can greatly streamline the process of requesting compensation for services rendered. It reduces the likelihood of errors, saves time, and helps maintain a professional image. Instead of starting from scratch with every project, professionals can use a pre-made document that is easily customizable to suit their specific needs, improving both efficiency and organization.

Improved Organization and Consistency

By using a predefined structure, service providers can ensure that each payment request follows the same format, making it easier to manage finances across multiple clients and projects. This consistency not only improves internal organization but also fosters trust with clients, who will appreciate the clarity and professionalism of a uniform billing system.

- Streamlines the payment tracking process

- Ensures all necessary details are included

- Reduces the risk of missing important information

Time-Saving and Efficiency

One of the main advantages of using a ready-made document is the amount of time saved. With all the necessary fields already set up, there’s no need to re-enter the same details repeatedly. This allows service providers to quickly generate and send out requests for payment, speeding up cash flow and reducing administrative overhead.

- Reduces repetitive tasks

- Enables faster document creation

- Increases overall productivity

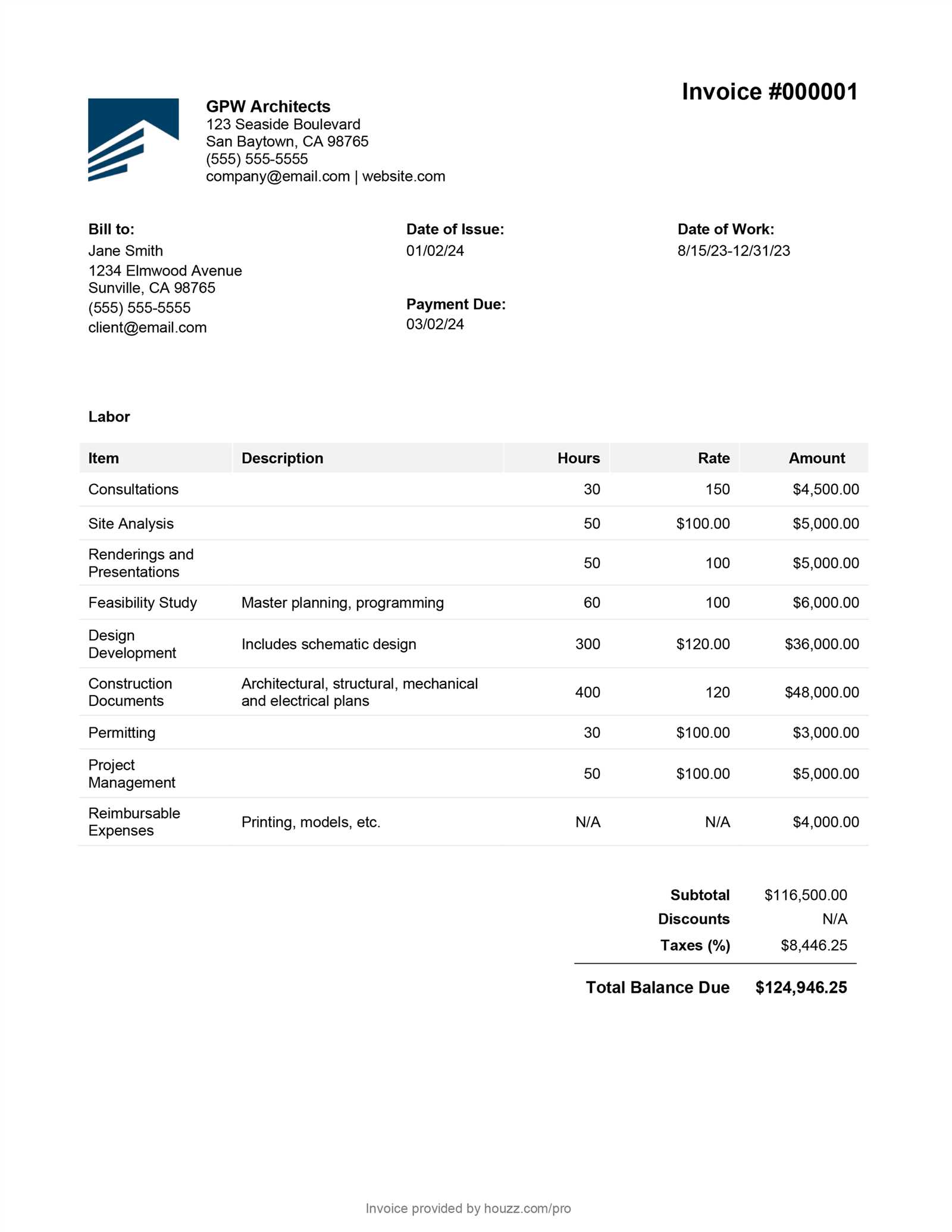

Key Elements of a Design Payment Request

To ensure clarity and avoid misunderstandings, it’s important to include specific details when requesting payment for services rendered. A well-structured document should cover all the essential aspects of the transaction, making it easy for clients to understand what is being charged, why, and when payment is due. Including the right information not only improves the overall process but also helps maintain professionalism and transparency.

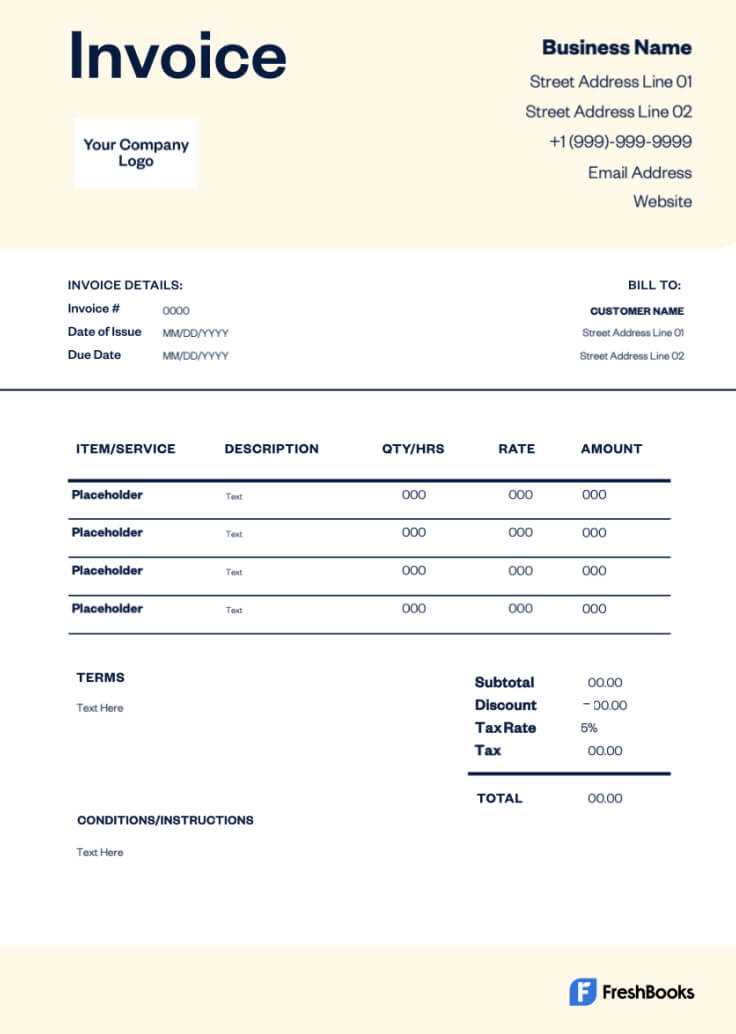

Client and Service Provider Information

The first step in creating an effective document is to include the basic contact details of both parties. This ensures there is no confusion about who is requesting payment and who is expected to make it. It’s essential to have the names, addresses, and phone numbers of both the service provider and the client, along with any relevant project identifiers like a reference number or job title.

- Service provider’s name and contact details

- Client’s name and contact information

- Project name or reference number

Details of Services Provided

Next, the document should clearly outline the services that were performed. This includes a detailed description of the tasks completed, hours worked (if applicable), and any materials used. Breaking down the services in an itemized list ensures that the client can easily see exactly what they are paying for and prevents potential disputes over what is being billed.

- List of services or tasks completed

- Hourly rates or fixed fees, if applicable

- Materials, resources, or other charges

Payment Terms and Due Date

Clearly defining the payment terms is crucial. This includes the total amount owed, the due date for payment, and any late fees that may apply if payment is not received on time. Specifying the accepted methods of payment, such as bank transfer, credit card, or check, is also important to make the process as smooth as possible for both parties.

- Total amount due and payment schedule

- Accepted payment methods

- Late fees or penalties for overdue payments

How to Customize Your Payment Request Document

Personalizing a billing document allows you to tailor it to your specific needs and brand, making it more professional and aligned with your business style. Customization ensures that the document reflects your unique services and creates a seamless experience for both you and your clients. By adjusting key elements, you can make the document more efficient, clear, and visually appealing.

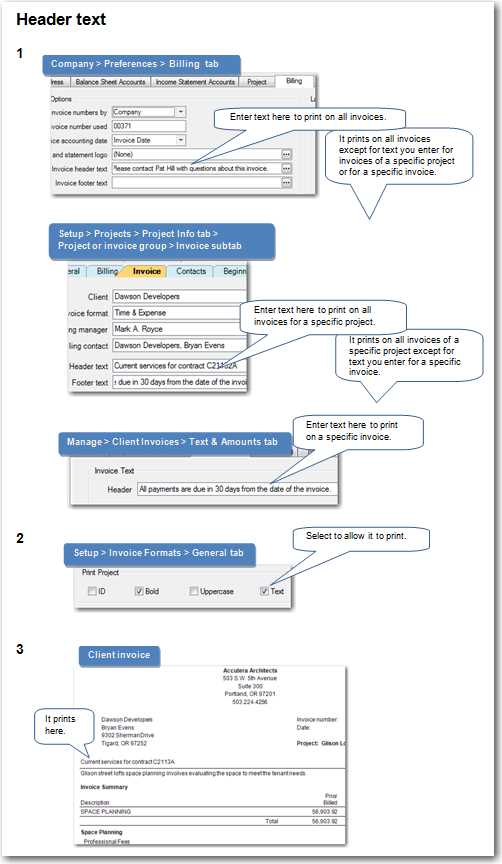

The first step in customizing is adjusting the layout. Choose a design that fits your brand’s aesthetic, whether that’s a clean, minimalist look or a more detailed and creative style. Incorporate your logo, contact information, and company colors to make the document feel more personal and professional. This will help establish your brand identity with every client interaction.

Next, ensure that the fields and sections match the way you conduct business. If you typically bill hourly, include a space to list hours worked along with rates. If your pricing is project-based, be sure to break down each phase or milestone of the job. You should also include space for any relevant terms or conditions that apply to your services, such as payment schedules, cancellation policies, or additional fees.

Don’t forget to adjust the terms of payment. Customizing the payment due date, accepted methods, and late fees ensures that clients understand how and when they should settle their bills. This level of clarity reduces confusion and helps streamline the financial side of your business.

Common Mistakes in Billing Documents

Creating clear and accurate payment requests is essential to ensure timely and correct compensation for services rendered. However, many professionals make common errors when drafting these documents, which can lead to confusion, delayed payments, or disputes with clients. Being aware of these mistakes and avoiding them can help maintain professionalism and improve cash flow.

Missing or Incorrect Client Information

One of the most common mistakes is failing to include complete or accurate contact information for both the service provider and the client. Missing details can cause confusion or delays in communication, especially if there are questions about the charges or if the document needs to be reissued.

- Omitting the client’s address or phone number

- Incorrect or outdated contact details for the service provider

- Failure to include a project reference number or name

Unclear or Incomplete Breakdown of Charges

Another frequent error is not providing enough detail on the services performed or how the final amount was calculated. Clients should never be left wondering why they are being charged a certain amount. An unclear breakdown can cause disputes or delays in payment.

- Vague descriptions of the work performed

- Failure to itemize additional costs such as materials or travel

- Omitting hourly rates or fixed fees for services

Incorrect Payment Terms

Confusion over payment expectations is another major issue. If the payment terms are not clearly defined, clients may miss deadlines or misunderstand the process. It’s crucial to include the correct due date, specify acceptable payment methods, and outline any late fees or penalties for overdue payments.

- Leaving out the payment due date

- Not specifying accepted payment methods (e.g., bank transfer, credit card)

- Not detailing late fees or penalties for overdue payments

Failure to Include Legal or Contractual Information

Many professionals overlook including important terms and conditions, such as refund policies, cancellation clauses, or legal disclaimers. These elements are essential in protecting both parties in case of disputes or issues with payment.

- Omitting payment terms and conditions

- Not including clauses related to late payments or contract breaches

- Failing to reference the initial agreement or contract

Best Practices for Professional Billing

To maintain a smooth and efficient financial process, it’s important to follow best practices when creating payment requests. A professional, well-organized approach helps to foster trust with clients and ensures that payments are processed quickly. By adhering to a set of reliable guidelines, you can avoid common mistakes and streamline your workflow.

Clarity and Detail

Make sure that every document is clear, comprehensive, and easy to understand. Provide a detailed breakdown of services, including descriptions, rates, and any additional costs. This transparency helps prevent confusion and makes it easier for clients to approve the charges without delays.

- Clearly itemize all services and charges

- Use simple, straightforward language

- Provide references to agreements or contracts

Timely Delivery

Send your payment request promptly after completing the work. The sooner it’s sent, the sooner you can expect to be paid. Delays in issuing these documents can lead to delayed payments and strained client relationships.

- Send requests as soon as the work is complete

- Consider setting up automated reminders for regular clients

- Always confirm receipt to avoid misunderstandings

Professional Design

A polished, branded document goes a long way in making a positive impression. Customize your payment request with your logo, contact details, and professional layout. A clean, consistent design reflects the quality of your work and shows that you take the business side of things seriously.

- Incorporate your branding for a professional look

- Keep the design clean and free from unnecessary clutter

- Ensure it is easy to read and visually appealing

Consistency and Record Keeping

Always maintain consistent practices for tracking payments. This means using the same format for each document, keeping a record of sent requests, and following up on overdue payments when necessary. Proper record-keeping ensures that you have everything on hand if there’s ever a need for clarification or disputes.

- Maintain organized records of all requests sent

- Ensure that every request follows the same format

- Follow up promptly on overdue payments

How to Track Payments with Billing Documents

Efficiently managing payments is essential for maintaining a healthy cash flow and ensuring that services are compensated in a timely manner. By using a structured document to track payments, professionals can stay on top of outstanding balances, monitor the status of each transaction, and easily identify any overdue amounts. A well-organized system will reduce confusion and help prevent missed payments.

Record Payment Details Clearly

One of the first steps in tracking payments is ensuring that each document contains clear information about the payment terms and due dates. This includes specifying the total amount due, the expected payment date, and any specific conditions, such as discounts for early payments or fees for overdue amounts. A detailed record helps you stay organized and reminds clients of the terms they agreed to.

- Include the due date and total balance owed

- List payment terms such as discounts or late fees

- Note any partial payments or changes in the total amount due

Update Payment Status Regularly

Regularly updating the status of each payment is key to staying on top of your finances. When a payment is received, mark it as paid and update the remaining balance. If partial payments are made, ensure they are clearly reflected in the document, along with the new due date for the remaining balance. This practice prevents confusion and ensures that all amounts are accurately tracked.

- Mark payments as received with the date

- Update the outstanding balance after each payment

- Monitor partial payments and adjust due dates accordingly

Utilize Software or Tools for Tracking

Using accounting software or digital tools can greatly enhance your ability to monitor and track payments. Many of these tools allow you to input payment information easily and automatically update the status of each transaction. Some tools even send reminders to clients for overdue payments and generate reports, giving you a clear overview of your finances.

- Use accounting software for automatic updates

- Set up reminders for overdue payments

- Generate financial reports to analyze cash flow

Follow Up on Late Payments

When payments are overdue, it’s important to follow up promptly. This can be done through polite reminder emails or phone calls. Make sure to reference the document with the agreed-upon terms to avoid misunderstandings. A consistent follow-up process helps to ensure that clients adhere to the agreed payment schedule.

- Send reminders for overdue payments

- Politely reference the document and payment terms

- Track communication to stay organized

Understanding Payment Terms and Conditions

When creating a formal document for requesting payment, it’s essential to clearly outline the terms and conditions to ensure both parties are aligned on expectations. These terms define when and how payments should be made, what penalties apply for late payments, and other essential details that protect both the service provider and the client. A well-defined agreement minimizes misunderstandings and establishes a clear framework for the transaction.

Payment Due Date

The due date is one of the most crucial elements in any payment request. It specifies when the client is expected to pay the amount owed, helping to avoid delays and ensuring that the professional receives compensation on time. Without a clear due date, it can be difficult to enforce payment timelines, leading to unnecessary stress and confusion.

- Always specify a precise payment due date

- Consider offering a grace period, if appropriate

- Ensure that both parties are aware of the agreed-upon timeline

Late Fees and Penalties

Including terms for late payments is a critical safeguard for maintaining consistent cash flow. Late fees or interest charges act as an incentive for clients to pay on time and help compensate the service provider for any inconvenience caused by delays. Be sure to clearly specify the rate of late fees, when they apply, and how they will be calculated to avoid any confusion.

- Define the late fee percentage or fixed amount

- Specify when the fee will be charged (e.g., after 15 days past due)

- Clarify how overdue amounts will be calculated and charged

Payment Methods and Instructions

Clearly outlining acceptable methods of payment helps avoid any confusion about how funds should be transferred. Whether you accept checks, wire transfers, credit cards, or online payment platforms, specifying the details makes the process smoother for the client. Providing instructions on how to submit the payment will also help ensure that it’s processed correctly and promptly.

- List all accepted payment meth

How to Create a Payment Request Document from Scratch

Creating a payment request document from scratch allows you to customize every aspect of the document to suit your business needs. Whether you are just starting out or want more control over the details, crafting a payment request by hand ensures that you include all the necessary components while maintaining a professional appearance. Follow these steps to create a complete, accurate, and effective document that communicates your services clearly and facilitates timely payment.

Step 1: Include Essential Contact Information

Start by adding your contact details at the top of the document. This includes your name or business name, address, phone number, and email address. You should also include the client’s contact information to ensure clarity about who the payment is being requested from. Additionally, including a reference number or job ID will help both you and your client keep track of the transaction.

- Your name, address, phone number, and email address

- Client’s name, address, phone number, and email address

- Project reference number or job title

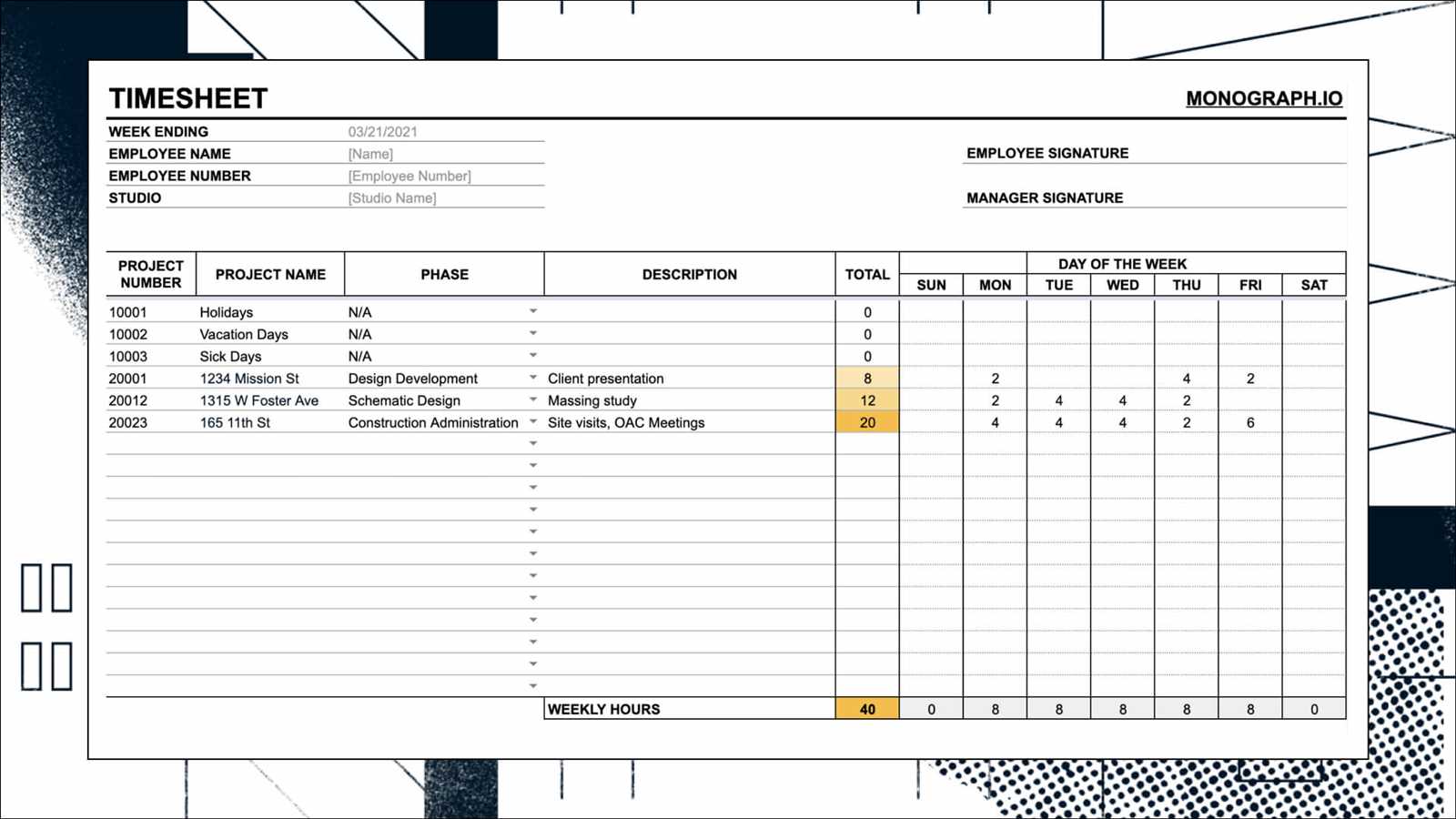

Step 2: Provide a Detailed List of Services

Next, break down the work performed. List each service or task completed, along with the corresponding charge for each. If applicable, include hours worked and the hourly rate. You should also include any additional materials or costs that were part of the project, such as shipping fees or special purchases. A detailed list helps avoid confusion and ensures the client knows exactly what they’re paying for.

- Itemize the services provided

- Include the number of hours worked, if applicable

- Provide the rate for each service or task

- List any additional costs or materials

Step 3: Define the Total Amount and Payment Terms

Once you’ve listed all the charges, calculate the total amount due. This total should include all services and materials, as well as any applicable taxes or fees. Clearly specify the payment terms, such as when the payment is due and what methods are accepted. If you offer early payment discounts or impose late fees, make sure to state these terms as well.

- Sum all charges to determine the total amount

- Include applicable taxes, fees, or discounts

- Clearly state payment methods and due dates

- Outline any late fees or early payment incentives

Step 4: Include Payment Instructions

Provide clear instructions on how the client can make the payment. This might include details for wire transfers, checks, credit card payments, or online payment platforms. If you’re using an online payment system, include a link or instructions on how to access the payment portal.

- List the accepted payment methods (e.g., wire transfer, check, online platforms)

- Include specific payment instructions or bank details

- Provide a payment link if using an online system

Step 5: Set a Payment Due Date

Finally, specify the due date for payment. Including a deadline will help ensure that payments are made on time and avoid any confusion about when the payment is expected. You may also want to add a section that explains late fees or interest charges if the payment is overdue.

- Specify the exact due date for payment

- Consider including a grace period for flexibility

- Outline penalties for overdue payments, if applicable

Once all these elements are included, you’ll have a fully customized p

Free vs Paid Payment Request Documents

When choosing the right format for a payment request, one of the primary decisions is whether to use a free or a paid version. Both options come with their own set of advantages and disadvantages, depending on the needs and resources of the service provider. Understanding the differences between these two types of documents can help you determine which option is best suited to your business practices and budget.

Benefits of Free Payment Request Documents

Free options are readily available and can be a great starting point for individuals or businesses looking to minimize costs. These free resources can be accessed quickly, often with little to no setup required, making them an appealing choice for those just getting started or for one-time projects.

- Cost-effective: No need to spend money upfront

- Easy access: Available from multiple online sources and platforms

- Basic functionality: Ideal for simple transactions and small businesses

- Customizable: Many free options allow for basic adjustments to suit your needs

Advantages of Paid Payment Request Documents

Paid options, on the other hand, provide more advanced features and a higher level of professionalism. These documents are often designed with specific industries in mind and can include additional elements such as automatic calculations, detailed service breakdowns, and integration with accounting systems. For those looking to streamline their financial processes and create a more polished, brand-aligned presentation, paid documents offer a clear advantage.

- Professional design: Customizable to align with branding and industry standards

- Advanced features: Includes automatic totals, tax calculations, and custom fields

- Time-saving: Often integrates with other accounting tools and systems

- Customer support: Access to help and troubleshooting if needed

While free resources are sufficient for basic use, a paid document can be a worthwhile investment for businesses looking to enhance their financial processes, save time, and present a more professional appearance to clients.

How Payment Request Documents Save Time

Creating formal payment requests from scratch can be a time-consuming task, especially when managing multiple clients and projects. Using pre-designed formats streamlines this process, allowing you to focus more on delivering quality work rather than spending valuable hours on administrative tasks. These ready-to-use documents provide structure, consistency, and automation that can significantly reduce the time spent preparing and sending payment requests.

Time-Saving Benefits of Using Pre-Made Documents

By using pre-made documents, you eliminate the need to start from zero every time a new payment is due. These customizable formats can be filled out quickly with essential information, such as client details, services rendered, and payment amounts. Additionally, many digital versions come with automated calculations, further speeding up the process and reducing the chances of errors.

Task Time Spent Without a Pre-Made Document Time Spent Using a Pre-Made Document Creating a payment request 30-60 minutes 5-10 minutes Calculating totals and taxes 10-20 minutes Automatic calculation Formatting and design 15-30 minutes Pre-designed format Tracking due dates and follow-ups Ongoing effort Automated reminders Reducing Errors and Increasing Consistency

Another significant time-saving benefit is the reduction of errors. Pre-made documents often include checks and balances that ensure all required fields are completed, minimizing the chances of forgetting crucial details or making mathematical mistakes. This consistency helps avoid rework or back-and-forth communication with clients, saving you time and enhancing professionalism.

By leveraging these pre-designed formats, you can automate repetitive tasks, avoid manual errors, and ensure your payment requests are always accurate, timely, and professionally presented.

Legal Requirements for Payment Requests

When creating a formal payment request document, it’s essential to follow specific legal requirements to ensure that the document is valid and enforceable. Different jurisdictions may have varying rules regarding what must be included in a payment request, how taxes are applied, and the timelines for issuing and paying. Understanding these legal guidelines can protect both the service provider and the client, minimizing the risk of disputes and ensuring compliance with local regulations.

Essential Legal Information to Include

Regardless of your location, there are several key elements that must be included in any payment request to make it legally binding. These details not only clarify the terms of payment but also ensure that you’re in compliance with tax and business laws.

- Full Contact Information: Both the service provider’s and client’s names, addresses, phone numbers, and email addresses.

- Clear Payment Terms: Include the total amount due, payment methods accepted, and due dates for payment.

- Unique Reference Number: Each request should have a distinct reference number or invoice ID for tracking purposes.

- Accurate Service Descriptions: Provide detailed descriptions of the services rendered, including any terms or agreements related to specific charges.

- Tax Information: Clearly state the applicable sales tax, VAT, or any other taxes required by local regulations, including the tax registration number if applicable.

Taxation and Compliance

Depending on your region, taxation rules for professional services may differ. It’s essential to understand the local tax codes and how they apply to your work. Some regions may require specific tax numbers to be included, such as VAT registration numbers, while others may require detailed breakdowns of tax rates applied to different services.

- Ensure that applicable tax rates are correctly listed

- Provide your business’s tax identification number, if required

- Verify whether specific services are exempt from taxation

Payment Terms and Legal Implications

It’s crucial to specify payment terms clearly to avoid misunderstandings. Many regions require businesses to outline the due date for payments and any penalties or interest charges for overdue amounts. These terms must be agreed upon and legally enforceable. Including late payment fees and interest rates helps ensure that clients are aware of their obligations and the consequences of late payments.

- Specify payment due dates and grace periods

- List any late payment fees or penalties for overdue amounts

- Ensure that payment terms comply with local contract law

By adhering to the legal requirements for creating a payment request, you ensure that your business operates within the law and protects its interests. A legally compliant payment document not only fosters trust with clients but also minimizes the risk of financial or legal complications down the line.

How to Format Your Payment Request Document

Properly formatting a payment request document is crucial for both professionalism and clarity. A well-organized and easy-to-read document ensures that the client can quickly understand the charges and payment terms, while also reducing the likelihood of errors or misunderstandings. Effective formatting involves a combination of logical structure, consistent design, and clear language, making the document both functional and visually appealing.

Basic Structure of a Payment Request

The structure of your document plays a significant role in how clearly your request is communicated. A typical payment request should follow a consistent order of elements that logically guide the reader through the information. Here’s a basic outline to follow:

- Header: Include your business name, logo, contact information, and the client’s details at the top of the document.

- Document Title: Clearly label the document as a “Payment Request” or something similar, so the client understands its purpose right away.

- Unique Reference Number: Assign a unique reference number or job ID to help track the transaction.

- Service Details: List all services or products provided, along with their respective costs.

- Total Amount Due: Clearly state the total amount due, including any taxes or additional charges.

- Payment Terms: Specify the payment due date, accepted methods of payment, and any penalties for late payments.

Tips for Consistent and Professional Formatting

In addition to the basic structure, consistent formatting throughout the document helps maintain clarity and professionalism. Here are some helpful tips to ensure your payment request is visually appealing and easy to navigate:

- Use a Clean Layout: Keep the document free from clutter. Leave enough white space between sections to make it easy to read.

- Highlight Key Information: Bold or underline important details, such as the total amount due and the payment due date, so they stand out.

- Use Consistent Fonts: Stick to professional, easy-to-read fonts like Arial or Times New Roman. Avoid using too many different fonts or sizes.

- Organize Services Clearly: Break down the list of services into clear, separate rows or bullet points. This makes it easier for the client to see what they’re being charged for.

- Include Payment Instructions: Ensure the client knows exactly how to make the payment by providing clear payment methods and bank details (if applicable).

By following these formatting guidelines, you can create a document that is not only functional but also leaves a positive impression on your clients. Clear, organized payment requests help streamline the payment process and reduce the likelihood of misundersta

Integrating Payment Requests with Accounting Software

Integrating payment request documents with accounting software can streamline the financial workflow for any business. By automatically transferring information from payment requests into accounting systems, this integration reduces manual data entry, minimizes errors, and ensures better financial tracking. This approach not only saves time but also improves accuracy and efficiency in managing finances.

Benefits of Integration

Integrating payment requests with accounting software brings a number of advantages, especially when dealing with multiple clients or ongoing projects. Here are some of the key benefits:

- Automatic Data Syncing: When a payment request is created, the details automatically sync with your accounting software, reducing the need for manual input.

- Real-Time Updates: Payment status, due dates, and amounts are updated in real time, providing an up-to-date view of your finances.

- Improved Financial Reporting: Integration allows you to easily generate financial reports, helping to keep track of revenue, taxes, and expenses.

- Fewer Errors: Automating data entry reduces the risk of human error, ensuring more accurate records for accounting and tax purposes.

How to Integrate Payment Requests with Accounting Software

Setting up the integration between your payment request system and accounting software can vary depending on the tools you’re using. However, the process typically follows these basic steps:

- Choose Compatible Software: Ensure that your payment request platform is compatible with the accounting software you use. Popular tools often offer integration features or plugins for seamless connection.

- Connect Your Accounts: Link your payment request system and accounting software by following the integration setup process. This may involve logging into both platforms and authorizing access.

- Map Your Fields: Align the fields from the payment request documents (such as client names, amounts, and due dates) with the corresponding fields in your accounting software to ensure proper data flow.

- Test the Integration: Run a test by creating a payment request and verifying that the information is correctly reflected in your accounting system.

Once integrated, you can seamlessly manage your finances by automatically transferring data from payment requests to your accounting system, allowing you to focus more on your work and less on administrative tasks.

When to Send Payment Requests to Clients

Knowing when to send payment request documents to clients is an essential part of managing cash flow and maintaining professional relationships. Timing plays a critical role in ensuring that payments are received on time, while also avoiding misunderstandings about due dates. It’s important to find a balance between staying on top of your financials and providing clients with enough time to process payments.

Factors to Consider When Timing Your Request

Several factors influence the best time to send a payment request, including the nature of the project, the agreed-upon payment schedule, and industry standards. Here are some key considerations:

- Payment Terms: Review the payment terms outlined in your contract or agreement. If you’ve agreed on specific milestones or a payment schedule, make sure to send the request as soon as the agreed-upon condition is met.

- Project Completion: For projects that have specific completion stages, it’s often appropriate to send payment requests upon completion of each milestone. For example, after delivering a draft or finalizing a design.

- Client’s Preferences: Some clients prefer receiving requests at specific times of the month or after certain deliverables are met. Understanding and accommodating these preferences can help build stronger client relationships.

Timing Breakdown for Payment Requests

Here’s a simple breakdown of when to send a payment request, depending on the type of service and agreement in place:

Scenario Suggested Timing Reason At the start of a project (deposit required) Immediately after contract signing To secure the commitment and cover initial costs After project milestone completion After completing a significant phase of work To ensure timely payments as work progresses Upon project completion Once the final deliverable is submitted To finalize the project and close the financial transaction For ongoing services (monthly/recurring) At regular intervals, based on agreement (e.g., monthly) To maintain a predictable cash flow for both parties Sending payment requests at the right time helps maintain smooth cash flow and fosters a professional relationship with clients. By aligning the timing of your request with the progress of the project or service, you reduce the likelihood of overdue payments and ensure that financial transacti

How to Handle Late Payments in Payment Requests

Dealing with late payments can be a frustrating part of managing a business, but it’s an issue that can be addressed professionally and effectively. When clients don’t pay on time, it can impact your cash flow and lead to unnecessary stress. However, establishing clear terms and maintaining a respectful, proactive approach can help reduce the occurrence of late payments and ensure they are handled efficiently when they do arise.

Steps to Take When Payments Are Delayed

It’s important to address late payments quickly and professionally. Here’s a step-by-step approach to handling overdue payments:

- Send a Reminder: If a payment is overdue, send a polite reminder as soon as the due date passes. This could be an email or a phone call, depending on your relationship with the client.

- Check the Agreement: Review the terms of your contract to ensure the payment terms are clear. Make sure there’s no misunderstanding about when the payment was due or the agreed-upon amount.

- Offer Payment Options: If a client is experiencing financial difficulties, consider offering flexible payment plans or extensions. This can help maintain a good relationship while ensuring you eventually receive payment.

- Contact the Client Again: If the initial reminder doesn’t lead to payment, follow up with a second reminder. At this point, you may need to be firmer in your tone, but always remain professional.

Legal and Financial Considerations

In some cases, persistent late payments may require stronger action. Here are a few considerations to keep in mind:

- Late Fees: Including late fees in your payment terms can encourage timely payments. Make sure these fees are clearly stated in your contract and payment requests.

- Interest on Overdue Amounts: If your terms allow for it, charging interest on overdue amounts can act as a deterrent for clients who frequently pay late.

- Debt Collection: In extreme cases where clients refuse to pay, you may need to engage a collection agency or take legal action. However, this should always be a last resort, as it can damage client relationships.

Addressing late payments doesn’t have to be confrontational. By maintaining a professional and consistent approach, you can encourage timely payments while keeping your business operations running smoothly. The key is to establish clear expectations upfront and follow up regularly when necessary.