Download a Professional Performance Invoice Template for Easy Billing

Managing payments efficiently is crucial for businesses that rely on service-based agreements or performance-based compensation. A well-structured billing document ensures clarity, reduces errors, and facilitates timely payments. For freelancers, contractors, or anyone working with results-driven agreements, it’s essential to have a streamlined approach to invoicing that reflects work completed and the terms of payment.

A properly designed billing form can save both time and effort by automating much of the process. With a customizable layout, it becomes easier to include all relevant details, such as services rendered, payment terms, and specific milestones met. By using such a structured document, you can also maintain professional communication and demonstrate transparency to clients, which fosters trust.

In this guide, we’ll explore how to create and use these essential business tools to enhance your invoicing process. Whether you’re new to creating such documents or looking to improve your current practices, having a clear, professional format will ensure a smoother transaction experience.

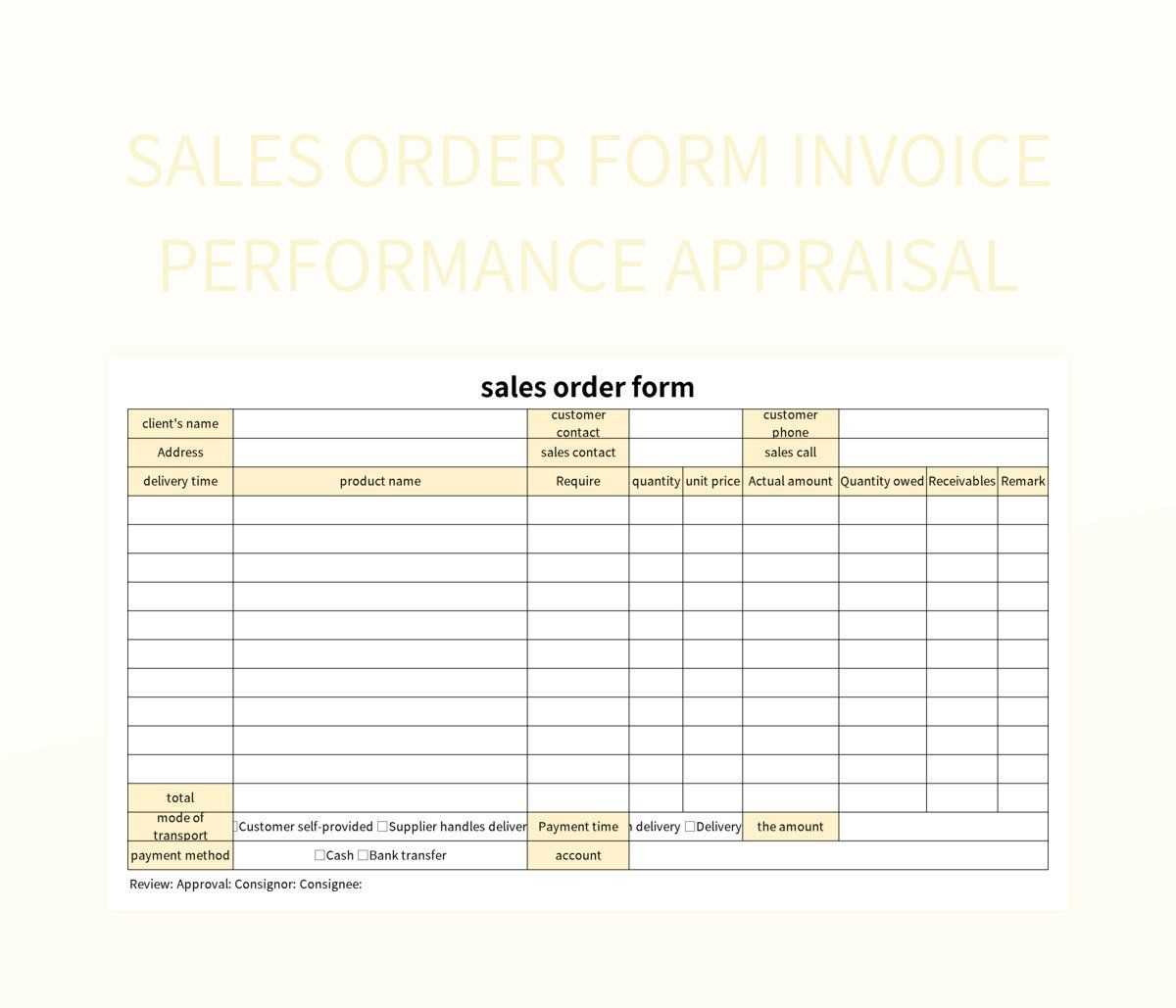

What is a Performance Invoice Template

When businesses or individuals work based on agreed-upon goals or results, it’s important to document the work completed and specify the payment terms clearly. A structured billing form is used to outline the services rendered, the terms of compensation, and the amount owed. This kind of document helps ensure accuracy in transactions, reduces misunderstandings, and establishes a professional relationship between the service provider and the client.

Purpose of the Document

This document serves as a formal request for payment once certain milestones or tasks have been completed. It typically includes details like the scope of work, the amount due, and the specific outcomes or actions tied to the payment. By using a clear, consistent format, both parties can easily review and understand the terms of the agreement without confusion.

Key Features of the Document

A well-structured billing form often includes sections for the client’s contact information, a description of the work completed, any additional fees or charges, and a due date for payment. It may also include fields for tracking previous payments or credit, ensuring transparency throughout the process.

Benefits of Using Performance Invoice Templates

Using a structured billing document offers several advantages for businesses and freelancers, particularly those working on results-based agreements. With a standardized approach, it becomes easier to manage payments, maintain consistency, and ensure that both parties are on the same page regarding the terms of compensation. These documents not only streamline the payment process but also contribute to a more professional and efficient workflow.

Time-Saving and Efficiency

By utilizing a pre-designed format, you can significantly reduce the time spent on creating and managing payment requests. A well-organized structure eliminates the need to manually format each document, saving you time while ensuring all essential information is included. This efficiency becomes even more valuable when dealing with multiple clients or projects at once.

Improved Accuracy and Clarity

A consistent billing structure helps minimize the risk of errors and misunderstandings. Each field in the document serves a specific purpose, ensuring that all relevant information is clearly communicated. This reduces the likelihood of discrepancies and ensures that both the service provider and client have a shared understanding of the agreement.

| Benefit | Description |

|---|---|

| Consistency | Standardized format ensures that all necessary information is included every time. |

| Time Efficiency | Pre-designed forms reduce the time spent on creating payment requests from scratch. |

| Professionalism | Using a clear, consistent format enhances the professional image of the service provider. |

| Accuracy | Pre-built sections reduce the chances of missing or incorrect details. |

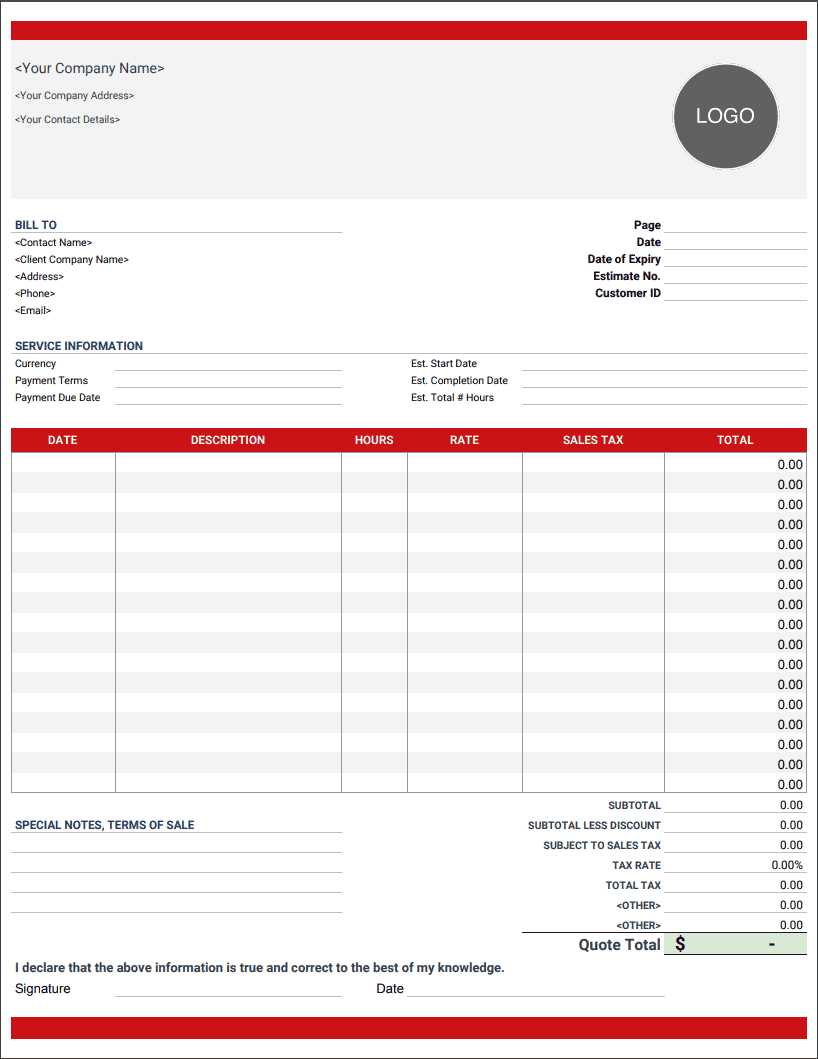

How to Create a Performance Invoice

Creating an effective billing document requires careful attention to detail and a clear structure. It is essential to include all necessary elements that specify the work completed, payment expectations, and agreed-upon terms. This ensures both the service provider and client have a mutual understanding of the compensation process and helps to avoid any confusion or delays in payment.

Steps to Build a Clear Billing Document

To create an efficient billing form, follow these simple steps. Each section should be clearly labeled, and relevant information must be included to ensure smooth processing. With a structured approach, you will be able to track payments, easily communicate with clients, and maintain a professional relationship.

| Step | Action |

|---|---|

| 1. Header Information | Include your business name, address, and contact details along with the client’s information. |

| 2. Work Description | Clearly outline the services provided, including specific tasks or milestones achieved. |

| 3. Payment Terms | Define the agreed payment amount, payment method, and due date. |

| 4. Breakdown of Costs | If applicable, provide a detailed breakdown of any additional fees or expenses incurred. |

| 5. Finalizing | Review the document for accuracy and ensure all fields are correctly filled before sending it to the client. |

By following these steps, you can create a clear and organized document that both you and your client will find easy to understand and manage. Consistency in formatting and including all relevant information will help you maintain a professional appearance and improve your payment collection process.

Key Elements of a Performance Invoice

Creating a comprehensive billing document involves including specific details that ensure clarity and transparency for both the service provider and the client. These essential elements outline the terms of the agreement, the work completed, and the payment expectations, making it easier for both parties to process and understand the financial transaction. Properly structured documents minimize confusion and speed up the payment process.

To create an effective billing document, several key components must be included. Each of these elements plays a role in ensuring the document is clear, professional, and legally sound. Below are the primary components to consider when designing your billing request.

| Element | Description |

|---|---|

| Contact Information | Include both the service provider’s and client’s names, addresses, and contact details to avoid any confusion. |

| Work Description | A clear breakdown of the services or tasks completed, ensuring both parties understand what has been provided. |

| Amount Due | State the total amount to be paid, ensuring it aligns with the agreed-upon compensation terms. |

| Payment Terms | Outline payment deadlines, accepted methods of payment, and any other relevant terms (e.g., late fees, discounts for early payment). |

| Due Date | Clearly specify when the payment is due to avoid delays and ensure timely transactions. |

| Unique Reference Number | A unique identifier for the document to help both parties track the transaction and avoid confusion with other agreements. |

By including these key elements in your document, you can create a straightforward, professional, and organized payment request that benefits both you and your client. Each of these components ensures that both parties are clear on the terms and expectations, which helps to prevent delays and ensure smooth transactions.

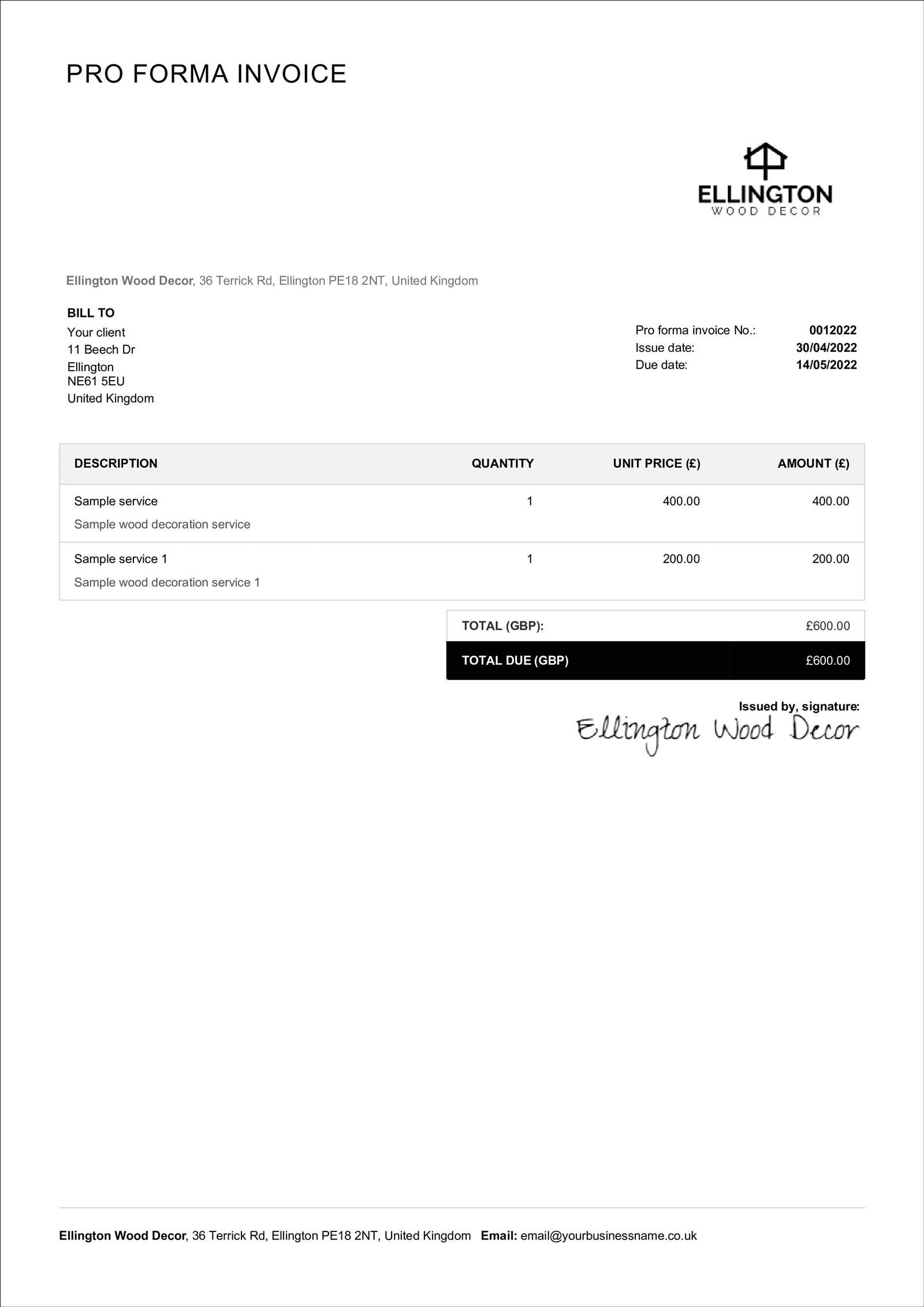

Customizing Your Performance Invoice Template

Tailoring your billing document to fit your specific needs can help streamline the process and ensure that it reflects the unique nature of your services. Customization allows you to include only the relevant details and format the document in a way that suits your brand, making it more professional and easier to understand for your clients. With a few adjustments, you can create a document that effectively communicates all necessary information while maintaining a consistent look across your business communications.

Why Customization Matters

Personalizing your billing request form allows you to better align with your business practices and industry standards. Whether you’re a freelancer, small business owner, or contractor, a custom document helps create a unique identity for your transactions and ensures you include the most important details for each project.

Key Areas to Customize

- Logo and Branding: Add your company logo, colors, and fonts to make your billing document visually consistent with other materials you provide to clients.

- Payment Terms: Adjust the payment terms to reflect your business practices, such as the payment schedule, due dates, or penalties for late payments.

- Service Description: Modify the description of services to include specific tasks or milestones that match the work you provided for the client.

- Additional Fees: Include any extra costs related to the project, such as rush fees, materials, or travel expenses.

- Client Information: Ensure that client details, such as the correct billing address or contact person, are up to date and accurate.

By customizing these areas, you ensure that your billing document serves both your needs and your client’s expectations, making it a more effective tool for managing transactions and maintaining professional relationships.

Common Mistakes in Performance Invoices

When preparing a billing document, even small mistakes can lead to confusion, delays, and payment issues. It’s important to ensure that every detail is accurate and clearly presented to avoid misunderstandings with clients. Many errors are easy to overlook, but they can have a significant impact on your business’s cash flow and professional reputation. Below are some of the most common mistakes made when creating such documents.

Common Errors to Avoid

- Incorrect or Missing Contact Information: Failing to include up-to-date contact details for both parties can result in miscommunication or delays in processing payments.

- Vague Service Descriptions: Not providing enough detail about the work completed can cause confusion and disputes over what was agreed upon.

- Omitting Payment Terms: Leaving out specific payment terms, such as deadlines or methods of payment, can create misunderstandings and lead to delayed payments.

- Failure to Include a Unique Identifier: Not adding a reference number or unique code can make it difficult to track or differentiate between various projects, especially when dealing with multiple clients.

- Ignoring Late Fees or Penalties: Not specifying late payment terms can result in overdue payments that are never addressed.

How to Prevent These Mistakes

- Double-check all client details: Verify that the client’s name, address, and contact information are correct before sending the document.

- Be specific about the services: Clearly outline what was completed, including tasks, milestones, and any relevant dates.

- Clearly define payment terms: Always specify when payments are due, which methods are acceptable, and any penalties for late payments.

- Use reference numbers: Assign a unique reference number to each billing request to avoid confusion with other transactions.

- Set late payment terms: Include any late fees or penalties for overdue payments to ensure that clients understand the consequences of delayed payments.

By addressing these common mistakes, you can create clearer and more effective billing requests that reduce the likelihood of disputes and improve your payment process.

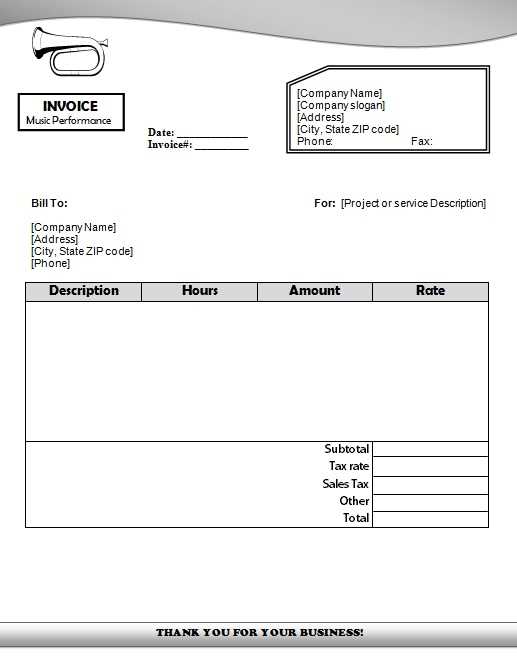

Choosing the Right Invoice Template

Selecting the right billing document layout is crucial for streamlining the payment process and maintaining a professional appearance. A well-chosen format should reflect the nature of your business, the complexity of the services provided, and the expectations of your clients. The right structure not only makes it easier to manage transactions but also ensures that all necessary details are included in a clear and organized manner.

Factors to Consider When Choosing a Layout

There are several key factors to take into account when selecting the appropriate billing document format. These elements can affect both the ease of use for you and your clients, as well as the overall efficiency of your payment processing.

- Business Type: Consider the nature of your work. For example, freelancers may need a simpler design, while businesses providing multiple services may require a more detailed layout.

- Project Complexity: If you are billing for large projects with multiple milestones, choose a layout that can accommodate detailed descriptions, breakdowns of costs, and payment schedules.

- Branding: Ensure that the design is aligned with your business’s branding, including logos, colors, and fonts. A consistent look reinforces professionalism.

- Customization Options: Choose a format that allows you to easily modify fields to suit different clients or projects, especially if your services vary widely.

- Clarity: Opt for a clean and simple design that clearly presents all necessary details, such as amounts, due dates, and service descriptions.

Where to Find the Right Format

Once you’ve identified the features you need, there are various places to find suitable billing documents. Here are some options:

- Online Templates: Many websites offer free or paid customizable formats for different industries. You can adjust them to fit your specific needs.

- Accounting Software: Most accounting platforms provide customizable layouts as part of their services, saving you time by automating some sections.

- Design Software: If you want a more personalized approach, design tools like Canva or Adobe can help you create a unique format from scratch.

By choosing the right billing document layout, you ensure a smooth and efficient payment process for both you and your clients, while enhancing your professional image.

How to Calculate Performance-Based Payments

Calculating payments based on results or completed milestones requires a clear understanding of the agreed-upon terms between the service provider and client. This method typically involves tying compensation to specific deliverables, objectives, or goals rather than an hourly rate. Knowing how to accurately calculate such payments ensures that both parties are aligned on expectations and avoids any confusion about compensation.

To calculate these payments effectively, you should consider a few key factors that influence the final amount due. It is important to determine the criteria for success, the method of evaluation, and the agreed-upon rates for different levels of performance or achievement. Below are the main steps to follow when calculating payments based on results.

Step-by-Step Process for Calculating Results-Based Payments

- Define the Performance Metrics: Identify clear, measurable targets or milestones that need to be met before payment is issued. This could be project completion, sales targets, or any other relevant outcome.

- Agree on Payment Structure: Decide whether payments will be made in full after the target is achieved, or in stages as milestones are met. This will affect how you break down the total payment.

- Set Payment Amounts: Establish the total amount to be paid for achieving the goal or completing the task. You may also define different payment levels depending on the scope of work or additional deliverables.

- Track Progress: Regularly monitor progress against the agreed metrics to ensure both parties are aligned on what has been achieved and what is left to complete.

- Adjust Based on Deliverables: If the original scope or results change during the project, adjust the payment terms accordingly. Ensure that any modifications are clearly agreed upon in writing.

Example of Calculating Payment for a Milestone-Based Project

Imagine you are working on a project with a client, and you’ve agreed that the payment will be divided into four milestones. The total project cost is $4,000, and the payment structure is as follows:

- First Milestone: 25% upon completion of the initial design phase – $1,000

- Second Milestone: 25% upon completion of the development phase – $1,000

- Third Milestone: 25% upon testing and review – $1,000

- Final Milestone: 25% upon project delivery and client approval – $1,000

By breaking down the total payment into smaller, manageable amounts tied to specific milestones, both parties can ensure clarity and satisfaction throughout the project’s lifecycle.

Ensuring Accuracy in Your Invoice

Maintaining accuracy in your billing document is essential to ensure that both you and your client are clear about the agreed-upon terms and compensation. An error-free document helps prevent misunderstandings, delays, and potential disputes, ensuring a smoother transaction process. By taking the time to review and verify the information before sending, you protect both your business interests and your professional reputation.

There are several key areas to focus on when aiming for accuracy. Each section of the document should be carefully checked to ensure that it reflects the true nature of the agreement and that all amounts are correctly calculated. Below are some tips for ensuring the accuracy of your billing documents.

Key Areas to Check for Accuracy

- Client Information: Double-check the client’s name, address, and contact details to avoid any confusion or delivery issues. An incorrect address can delay payment or cause the document to be overlooked.

- Service Descriptions: Ensure that the work performed is described in detail and aligns with what was agreed upon. Vagueness can lead to disputes over the services rendered.

- Dates: Review the dates for both the service period and the payment due date. Ensure that the timeline is clear and realistic for both parties.

- Payment Amount: Double-check the figures. Make sure that the agreed-upon amount is accurate, and all discounts or additional fees are correctly applied.

- Terms and Conditions: Revisit the payment terms and any special conditions agreed upon, such as penalties for late payment or specific payment methods, to confirm they are properly stated.

Tips for Double-Checking Your Billing Document

- Use Tools for Calculation: Leverage spreadsheet software or accounting tools to automatically calculate totals and ensure there are no math errors.

- Take a Break Before Reviewing: After preparing the document, take a short break before reviewing it. A fresh perspective can help you spot mistakes you might otherwise overlook.

- Have Someone Else Review It: If possible, ask a colleague or assistant to review the document for errors, as a second set of eyes can catch mistakes you might miss.

- Use Professional Software: Consider using accounting or invoicing software that automatically checks for common errors and ensures consistency across your documents.

By paying attention to these areas and following these tips, you can ensure that your billing document is both accurate and professional, promoting timely payments and minimizing the risk of issues with your clients.

Integrating Performance Invoices with Accounting Software

Integrating your billing documents with accounting software can significantly streamline your financial processes. By linking these systems, you automate many tasks, ensuring that payments are tracked accurately, reports are generated efficiently, and financial data is organized in real time. This integration reduces the chances of errors and allows for a smoother workflow, saving both time and effort in managing finances.

Accounting software not only helps in creating and sending payment requests, but it also simplifies the tracking of transactions, providing a clear overview of your cash flow. When properly integrated, the two systems work in tandem, eliminating the need for manual data entry and reducing the risk of mistakes. Here’s how you can benefit from integrating your billing documents with accounting software:

Benefits of Integration

- Time Efficiency: Automating the billing process allows you to generate payment documents quickly, without manually entering details each time.

- Accuracy: The software automatically pulls client information, payment amounts, and dates, reducing the chances of human error.

- Real-Time Tracking: Integration provides up-to-date tracking of payments and outstanding balances, making it easier to manage finances.

- Automatic Reminders: Many accounting systems send automated payment reminders to clients, ensuring that deadlines are met without additional effort.

- Comprehensive Reports: With integrated systems, financial reports are automatically updated, helping you to track revenue, expenses, and taxes without manual input.

How Integration Works

Integrating billing documents with accounting software typically involves syncing your client database, payment schedules, and other relevant data. Here’s a simple breakdown of how the integration process usually works:

| Step | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Select Accounting Software | Choose accounting software that suits your business needs and supports integration with billing tools or platforms. | ||||||||||||

| 2. Link Client Data | Sync your client contact details and billing information between the two systems to ensure seamless document generation. | ||||||||||||

| 3. Automate Billing Process | Set up automatic generation of payment requests based on project milestones, completed work, or other predefined conditions. | ||||||||||||

| 4. Track Payments | Once a payment request is issued, the system automatically updates the status, marking it as paid or pending. | ||||||||||||

| 5. Generate Financial Reports | Use the integrated data to produce reports on revenue, expenses, and taxes to help you manage your business finances

Legal Considerations for Performance InvoicesWhen creating a billing document, it’s important to ensure that it complies with legal standards and protects both parties involved. Certain legal aspects govern the creation and execution of these documents, from clear payment terms to adherence to local tax laws. By understanding the legal requirements, you can avoid potential disputes, ensure fair compensation, and protect your business interests. In order to maintain legal integrity, it’s essential to include specific clauses and details in your billing documents. Failing to do so can lead to delayed payments, legal challenges, or even non-payment. Below are some key legal considerations to take into account when preparing your billing requests. Important Legal Aspects to Address

By addressing these legal considerations, you can create a billing document that is not only professional but also compliant with local regulations, helping to safeguard your rights and those of your clients. Always ensure that your documents are clear, accurate, and in accordance with the law to avoid complications down the road. Best Practices for Sending Performance InvoicesSending a billing document is not just about delivering a request for payment; it’s about doing so in a manner that is professional, timely, and clear to both parties involved. Properly sending your payment requests helps ensure that you get paid on time, builds trust with your clients, and reduces the risk of confusion or disputes. Following best practices when submitting these documents can make the entire process smoother and more efficient. Effective communication, attention to detail, and using the right tools can significantly improve the chances of timely payments. From the timing of the request to the method of delivery, understanding the key strategies involved will help maintain a smooth relationship with clients and ensure that payments are processed without delay. Key Considerations When Sending Payment Requests

Timely Follow-Ups and Payment RemindersEven after sending the payment request, follow-up is essential to ensure timely payments. Here’s how to handle follow-ups effectively:

By adhering to these best practices, you can ensure that your payment requests are delivered How to Track Payments from Performance InvoicesEffectively tracking payments is a crucial part of managing any business’s cash flow. When you’re relying on result-based or milestone payments, staying on top of incoming funds ensures that you’re paid on time and that your records are accurate. Proper payment tracking also helps identify potential issues early, such as delayed payments or discrepancies, allowing you to take action before it affects your business operations. There are several methods to track payments, from manual systems to automated tools. Regardless of the method you choose, the key is consistency, accuracy, and timeliness. Below are some strategies for keeping track of payments from billing requests and ensuring you’re always informed about your financial standing. Methods for Tracking Payments

Managing Overdue Payments

Sometimes payments will be delayed or missed entirely. Here’s how to manage these situations effectively:

By using the right tracking tools and staying on top of payment deadlines, you can ensure smooth financial operations and avoid the stress of missed or delayed payments. Regular tracking also helps you maintain accurate financial records, which is essential for both managing cash flow and preparing for taxes. Adjusting Templates for Different IndustriesWhen creating billing documents, it is essential to customize them according to the specific requirements of different industries. Each sector may have unique needs for detailing services, calculating payments, or adhering to regulatory guidelines. Tailoring your documents ensures they are both professional and compliant with industry standards, which can facilitate smoother transactions and improve client relationships. For example, the structure and information required for a technology project may differ greatly from that needed in a construction or consulting service. Adjusting your documents to fit the nuances of each industry not only makes the process more efficient but also helps convey credibility and professionalism to your clients. Customizing for Different Sectors

Why Customization Matters

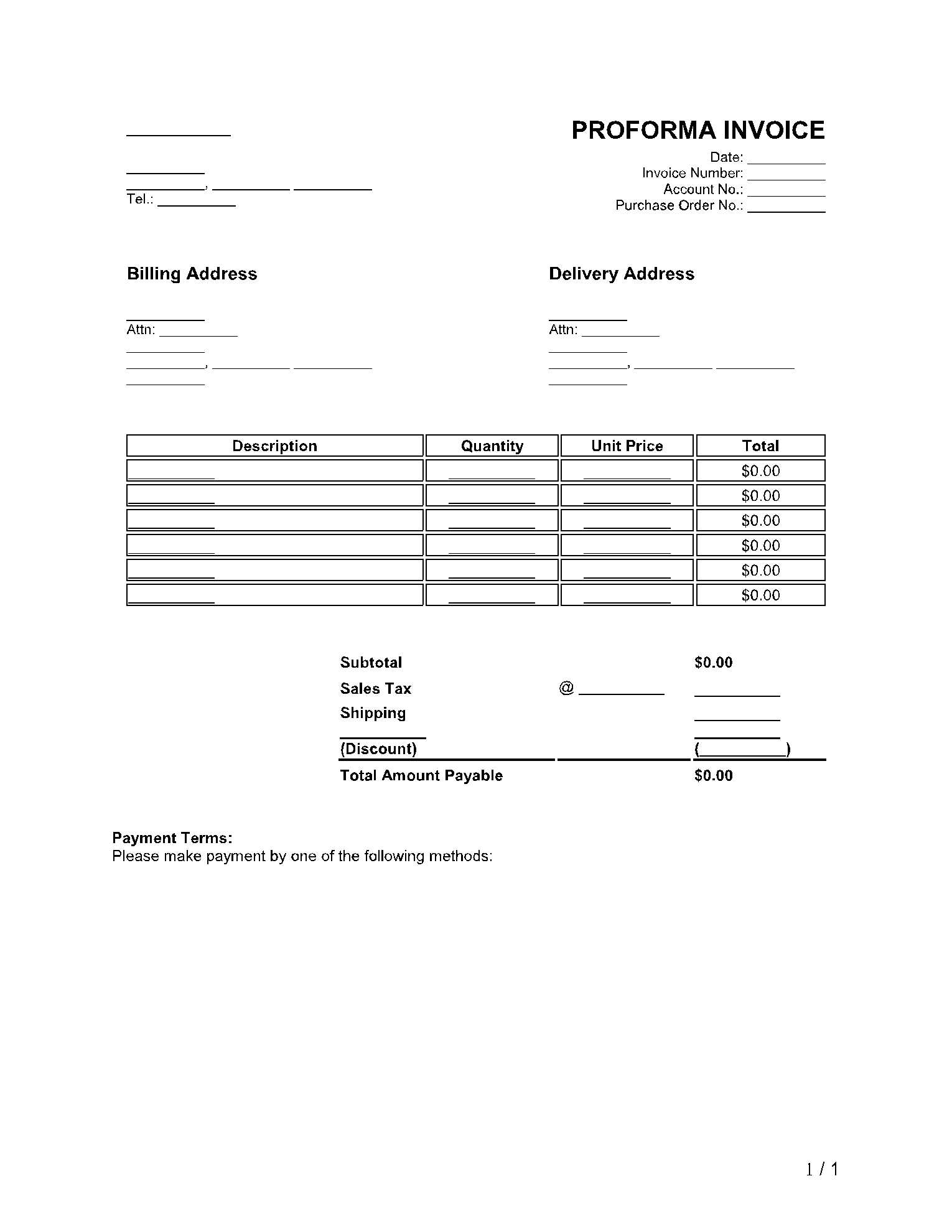

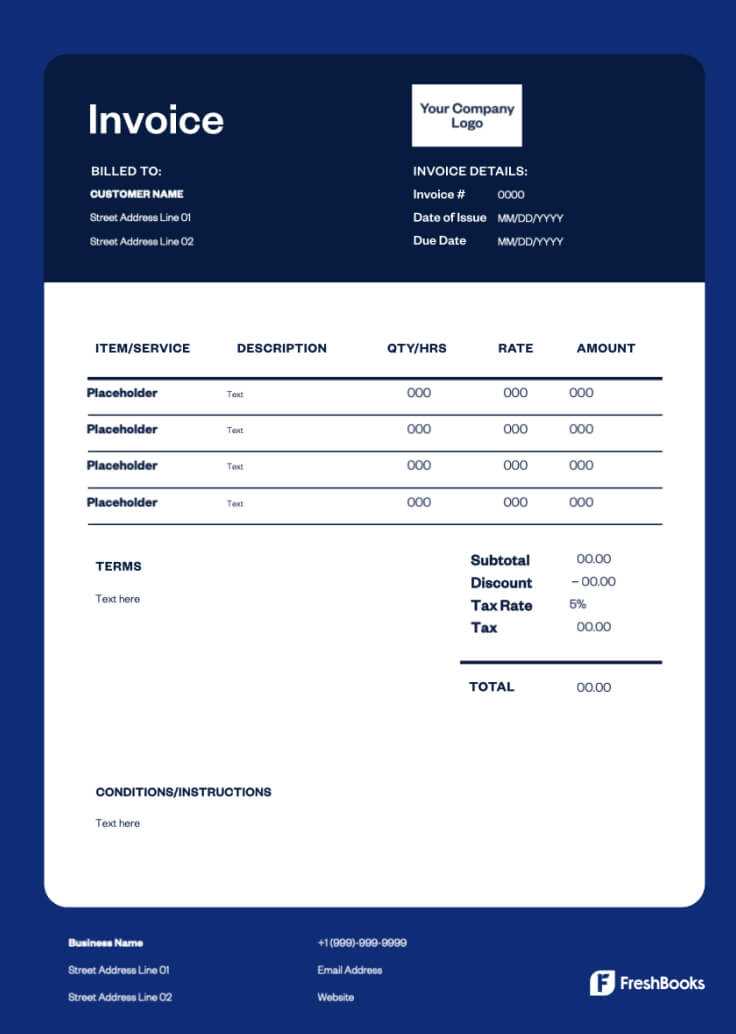

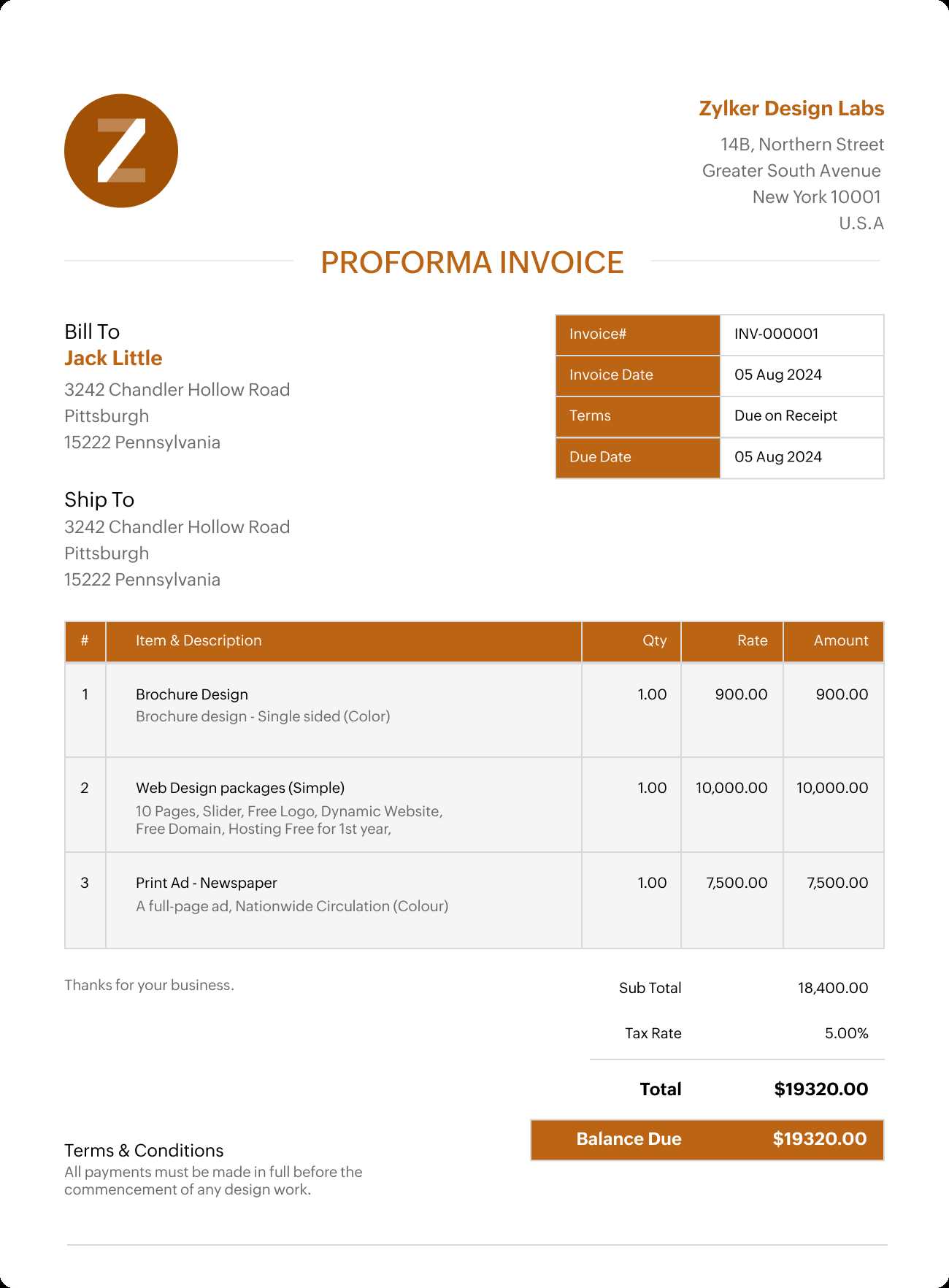

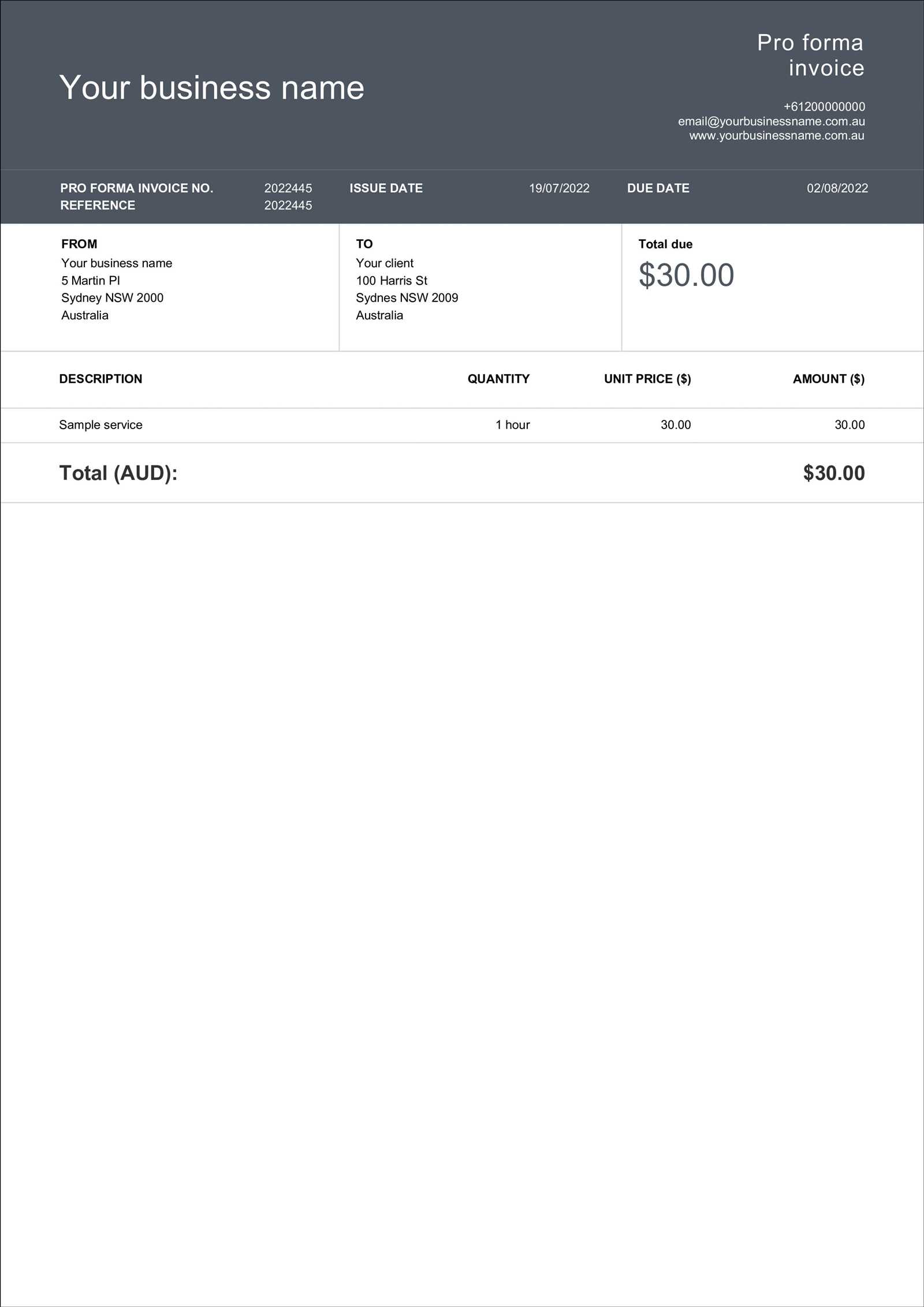

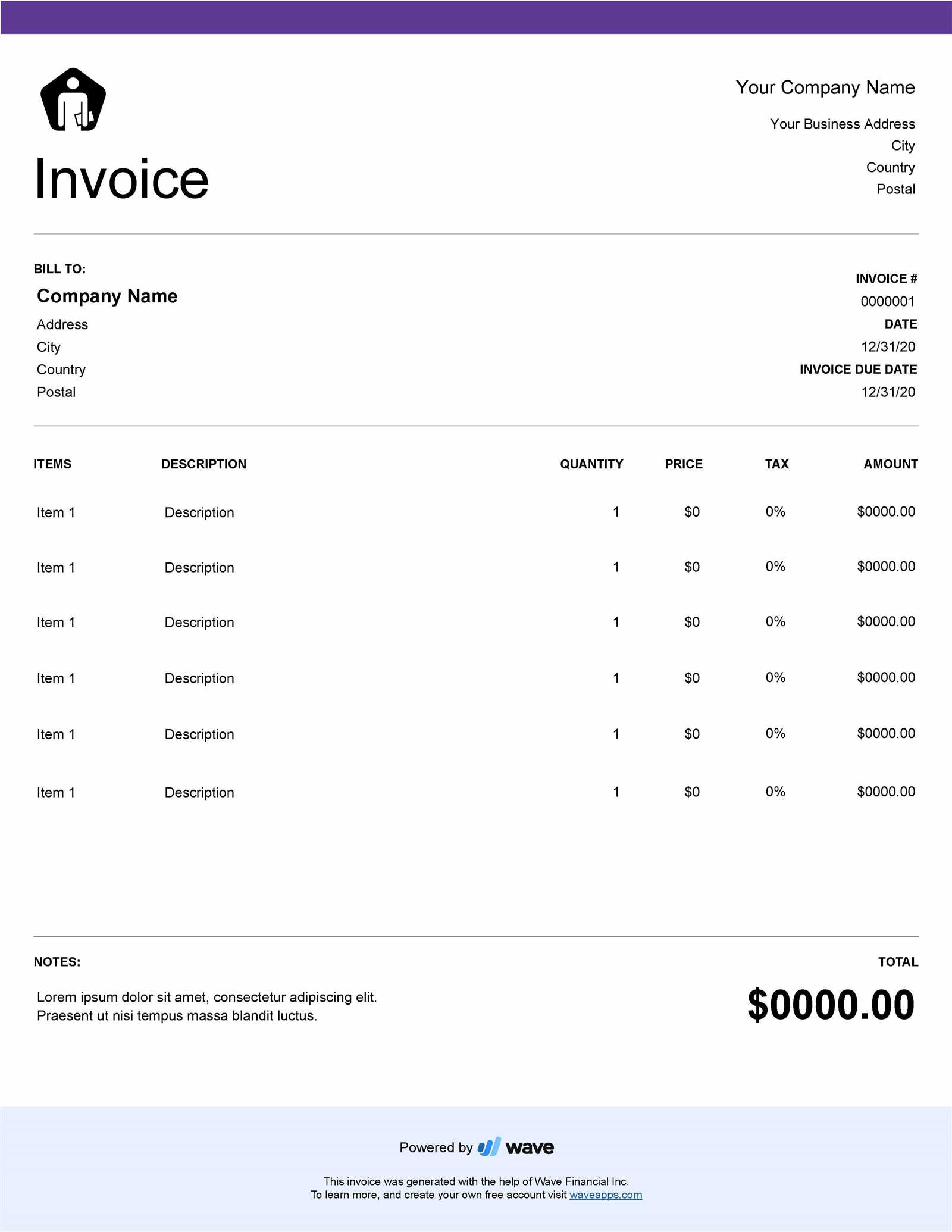

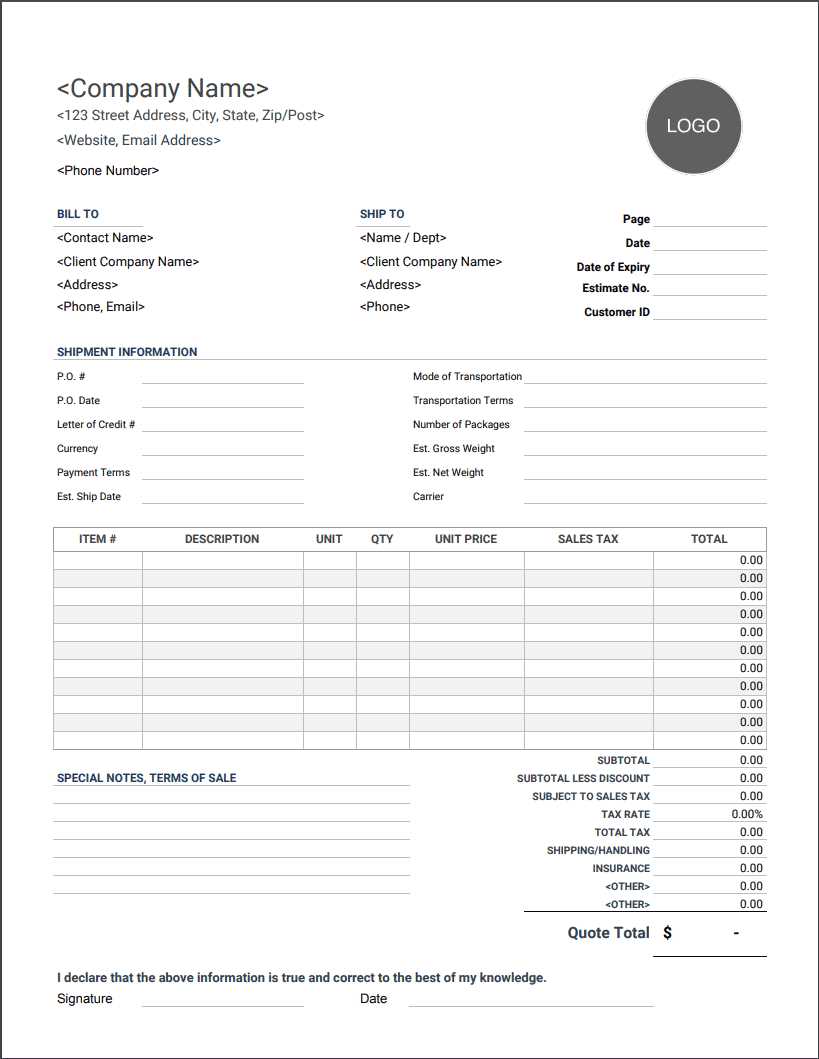

By adjusting your billing documents for different industries, you ensure that each client receives a relevant and professional experience. This not only simplifies the payment process but also helps in fostering trust and long-term business relationships. Free Performance Invoice Templates Available OnlineFor businesses seeking an easy and cost-effective way to manage their billing processes, there are numerous free resources available online. These ready-made documents can be downloaded and customized to suit specific needs, helping businesses save time and ensure accuracy in their payment requests. The availability of free templates makes it possible for even small businesses to maintain professional standards without the need for complex or expensive software solutions. Whether you are a freelancer, contractor, or small business owner, using a pre-designed document can streamline your workflow and ensure consistency across all transactions. These templates are often simple to customize and can be tailored to fit your industry and specific requirements. Where to Find Free Resources

Benefits of Using Free Documents

By leveraging free resources available online, you can ensure that your payment requests are not only consistent and professional but also efficient and cost-effective. These tools provide a convenient way for businesses to stay organized and maintain a high level of professionalism without breaking the bank. |