Paralegal Invoice Template for Easy Billing

Managing financial transactions in the legal field requires precision and clarity. Whether you’re offering consultation services or handling client cases, ensuring timely and accurate payment is essential. A well-structured document is key to streamlining this process, offering a clear breakdown of services rendered, hours worked, and agreed-upon rates.

Utilizing a well-designed billing document helps eliminate confusion, avoid discrepancies, and foster trust between you and your clients. With an organized approach, both parties can quickly understand the details of the services provided and the costs involved.

Customizing your billing structure to fit the unique needs of each case ensures that all necessary information is captured efficiently. This not only simplifies your workflow but also enhances professionalism in every transaction. By taking the time to set up an accurate and easy-to-read format, you can ensure smoother financial management and quicker payments.

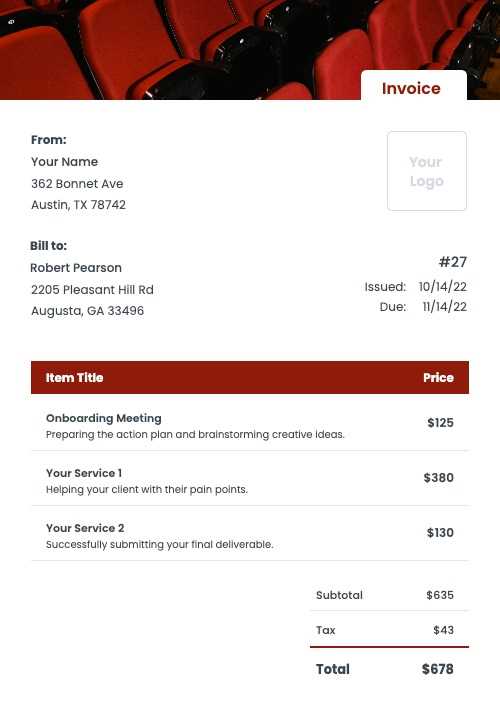

Paralegal Invoice Template Guide

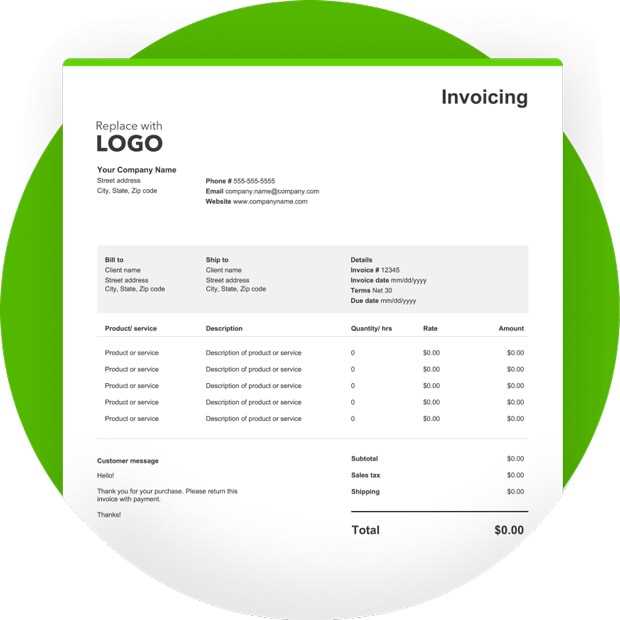

Creating a detailed and accurate billing document is essential for legal professionals to ensure that clients are properly charged for services rendered. This document serves as a formal request for payment and includes all the necessary details to prevent misunderstandings. By using a structured approach, you can clearly outline the scope of work, time spent, and agreed-upon fees.

Start by including the client’s name, contact information, and the service period. A professional layout helps in clearly presenting this information. Break down your services into specific tasks, including descriptions and the corresponding costs. This allows clients to see exactly what they are being charged for and ensures that both parties are on the same page.

Additionally, include payment terms such as the due date and any applicable late fees. Offering flexible payment options can help maintain good client relationships and encourage timely payments. A well-organized billing document not only streamlines the payment process but also enhances your professional reputation.

Understanding the Basics of Billing

In any professional field, maintaining clear financial records and communicating payment expectations effectively is crucial. When working with clients, a transparent approach to documenting services and fees not only ensures timely payment but also builds trust. Understanding the fundamental components of a billing system will help ensure that every detail is captured accurately and in a professional manner.

Key Elements of a Billing Document

A well-crafted financial statement should contain the following key elements:

- Client Information: Include the full name, address, and contact details of the client.

- Service Breakdown: List the specific services provided along with their descriptions.

- Time Tracking: Record the time spent on each task or service, if applicable.

- Payment Terms: Specify due dates, accepted payment methods, and any penalties for late payments.

Why Clarity is Important

Ensuring that the financial document is easy to read and understand helps avoid confusion or disputes. A clear breakdown of charges shows exactly what the client is paying for, reducing the chance of misunderstandings. Additionally, it creates a professional impression that can lead to long-term client relationships.

Why Use a Billing Document Format

Using a standardized format for billing not only saves time but also ensures consistency and professionalism in your financial transactions. With a well-organized structure, you can streamline the process of generating payment requests, minimizing errors and reducing the risk of missing important details. This approach helps in managing client expectations and avoiding misunderstandings about the charges for services rendered.

Time Efficiency and Consistency

Adopting a pre-designed format allows you to quickly fill in the relevant details for each client without starting from scratch. This consistency is especially helpful for professionals who handle multiple clients or cases, ensuring that every document follows the same clear structure. As a result, you spend less time formatting and more time focusing on providing quality services.

Professional Appearance and Accuracy

A well-crafted billing document presents a polished, professional image to clients. It shows that you are organized and detail-oriented, which enhances your reputation and trustworthiness. By using a proven format, you also reduce the chances of errors, such as missing information or miscalculating fees, leading to fewer disputes and smoother transactions.

Key Components of a Billing Document

A well-structured financial document should clearly communicate all necessary details to ensure smooth transactions. Each section plays a vital role in providing transparency and helping both parties understand the scope of services and associated costs. Ensuring that every key element is present and accurate will lead to fewer disputes and quicker payments.

Client Information is essential for identifying both the service provider and the customer. This includes the client’s name, address, and contact information. Without this, it could be difficult to track payments or reference the document later.

Service Description outlines the tasks completed or services provided. Each service should be listed separately with a clear description and, where applicable, the amount of time spent on each task. This helps the client understand exactly what they are being charged for.

Payment Terms define the agreed-upon payment deadlines, methods, and any penalties for late payment. It is important to specify whether you accept checks, bank transfers, or digital payments, as well as the due date for the payment.

Amount Due provides a detailed breakdown of the total charges, including individual service fees and applicable taxes or discounts. This gives the client a clear view of how the final amount was calculated.

How to Customize Your Billing Document

Customizing your billing structure is crucial for aligning it with the specific needs of your clients and services. Tailoring the layout and content ensures that every important detail is highlighted clearly and in a way that best represents your professional approach. A personalized format not only improves the appearance of your documents but also makes them more functional and easier to understand.

Start by adjusting the layout to match your brand’s style. This could involve adding your business logo, choosing specific fonts, and adjusting the color scheme to create a cohesive look that reflects your professionalism. Customizing these visual elements makes the document more recognizable to your clients.

Next, ensure that all relevant sections are included, such as a clear breakdown of services, payment terms, and due dates. Depending on the nature of your work, you might want to include extra sections like a detailed task list or specific payment instructions. Each section should be easy to navigate, with logical headings and spaces for the necessary information.

Finally, review the document’s content to ensure it meets your clients’ expectations. Modify any wording or descriptions that may need clarification. By personalizing your billing structure, you can improve client satisfaction and streamline the payment process.

Setting Payment Terms Clearly

Establishing clear payment expectations is crucial for ensuring smooth transactions and maintaining positive client relationships. When the terms are explicitly outlined, both the service provider and the client have a mutual understanding of what is required and when. This reduces the risk of misunderstandings and late payments.

Key Elements to Include in Payment Terms

There are several key components to consider when outlining your payment terms:

- Due Date: Clearly specify the date by which payment is expected, and ensure it is reasonable based on the services provided.

- Accepted Payment Methods: List the forms of payment you accept, such as credit card, bank transfer, or online payment systems.

- Late Payment Penalties: Outline any fees or interest that will apply if payment is not made on time. This helps incentivize timely payments.

- Discounts for Early Payment: Offering a small discount for early settlement can encourage clients to pay ahead of schedule.

Communicating Payment Expectations Effectively

Clear communication is key when it comes to payment terms. Ensure that your client understands when payments are due, what methods are acceptable, and any penalties for overdue payments. Including this information in a straightforward manner not only improves your financial planning but also demonstrates your professionalism.

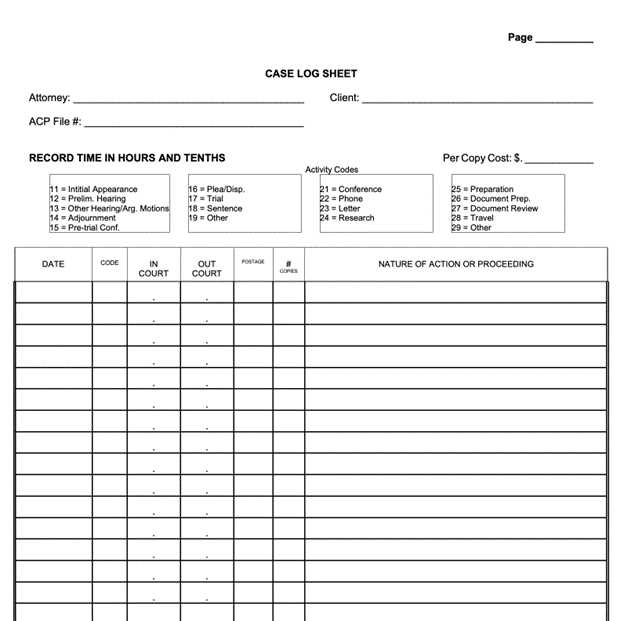

Ensuring Accurate Time Tracking

Accurate time tracking is essential for transparent billing and ensuring clients are charged fairly for the services rendered. Whether you’re billing hourly or on a project basis, maintaining precise records of the time spent on each task helps avoid disputes and ensures that your compensation aligns with the work completed. Properly tracking hours also supports better planning and management of future projects.

Tools and Techniques for Effective Time Management

To ensure accuracy, consider using time-tracking software that logs hours automatically or allows you to start and stop timers as you work. This helps eliminate the risk of forgetting or miscalculating the time spent on tasks. Additionally, manual logs or spreadsheets can be used if software solutions aren’t an option, but they require more attention to detail and regular updates.

Tips for Maintaining Precise Records

- Be Consistent: Record your time at regular intervals throughout the day to avoid missing any activities.

- Break Down Tasks: For large projects, break down the work into smaller tasks and track time for each one separately to ensure you are accurately accounting for your hours.

- Review and Adjust: Regularly review your time entries to ensure they align with the tasks you performed. Adjust any discrepancies as needed before submitting your billing request.

By adopting these methods, you can improve the accuracy of your time records, leading to more accurate payments and a smoother billing process for both you and your clients.

Best Practices for Client Communication

Clear and effective communication with clients is essential for building strong relationships and ensuring smooth project management. Establishing open lines of communication from the start helps prevent misunderstandings and ensures that both parties are on the same page regarding expectations, timelines, and deliverables. Transparent communication not only improves client satisfaction but also fosters trust and professionalism.

Timely and Regular Updates

Keeping clients informed throughout the process is key to maintaining their confidence. Regular updates about the status of tasks or projects show that you are proactive and organized. Whether through emails, phone calls, or meetings, providing timely updates ensures that the client is never left in the dark about the progress of your work.

Clear and Concise Information

- Avoid Jargon: Use clear and simple language to explain services, fees, and project status. Avoid technical jargon that may confuse the client.

- Set Expectations: Clearly outline timelines, deliverables, and payment terms to ensure the client understands what to expect.

- Be Responsive: Respond promptly to client inquiries or concerns. Even if you don’t have an immediate answer, acknowledge the query and let them know when they can expect a response.

By following these best practices, you can create a positive and professional experience for your clients, leading to successful outcomes and long-term relationships.

Common Errors to Avoid in Billing

Accurate and transparent billing is essential for maintaining strong client relationships and ensuring timely payments. However, there are several common mistakes that can occur during the billing process. These errors can lead to confusion, delayed payments, and even disputes. By being aware of these common pitfalls, you can ensure that your billing practices are efficient and professional.

Incorrect Calculations

One of the most common errors is failing to accurately calculate fees for services rendered. Whether it’s due to incorrect hourly rates, missing hours, or miscalculation of applicable taxes, errors in the total amount due can lead to discrepancies and payment delays. To avoid this, double-check all figures before sending out your request for payment.

Omitting Key Details

Leaving out important information, such as a clear description of the work done, due dates, or payment instructions, can lead to confusion. Clients may not fully understand what they are being charged for or when the payment is due. Make sure that all relevant sections, like the services provided, payment terms, and the client’s contact information, are included and easy to follow.

- Double-check Calculations: Always verify that your totals, rates, and taxes are correctly computed.

- Clarify Service Details: Provide clear and detailed descriptions of the tasks completed to avoid any misunderstandings.

- Ensure Payment Instructions Are Clear: Include specific instructions on how and where to make the payment to avoid any confusion.

By avoiding these common errors, you can streamline the billing process, reduce the risk of disputes, and improve the overall experience for both you and your clients.

How to Calculate Legal Fees Correctly

Accurately calculating fees for legal services is critical for both service providers and clients. Ensuring that the fees reflect the actual work performed and are in line with any agreed-upon terms helps to avoid disputes and ensures fair compensation. There are several methods for calculating fees, and choosing the right one depends on the nature of the services provided and the client’s needs.

Common Methods for Calculating Fees

- Hourly Rate: Charging by the hour is one of the most common methods. Keep track of the time spent on each task and ensure that the hourly rate reflects your experience and the complexity of the work.

- Flat Fee: For specific tasks or projects, you may agree to a set price regardless of the time spent. This method provides clarity for the client but requires careful assessment of the work’s scope.

- Contingency Fee: In some cases, the payment is contingent on the outcome of the case. This model is often used in personal injury or other case types where the client only pays if a favorable result is achieved.

- Retainer Fee: A retainer is a pre-paid amount that secures services for a specific period. It can be used as a deposit or a pre-payment for ongoing services.

Steps to Ensure Accurate Calculations

- Track Time Precisely: If you are billing hourly, make sure to document each task and the time spent on it. Use time-tracking tools to avoid errors.

- Factor in Expenses: Remember to include any out-of-pocket expenses incurred during the provision of services, such as court filing fees or expert witness costs.

- Review Agreement Terms: Always refer to the original agreement to confirm the billing structure, any discounts, or specific fee arrangements before finalizing the fee calculation.

By following these methods and steps, you can ensure that your legal fees are calculated accurately and are aligned with the expectations of both you and your clients, fostering trust and professionalism.

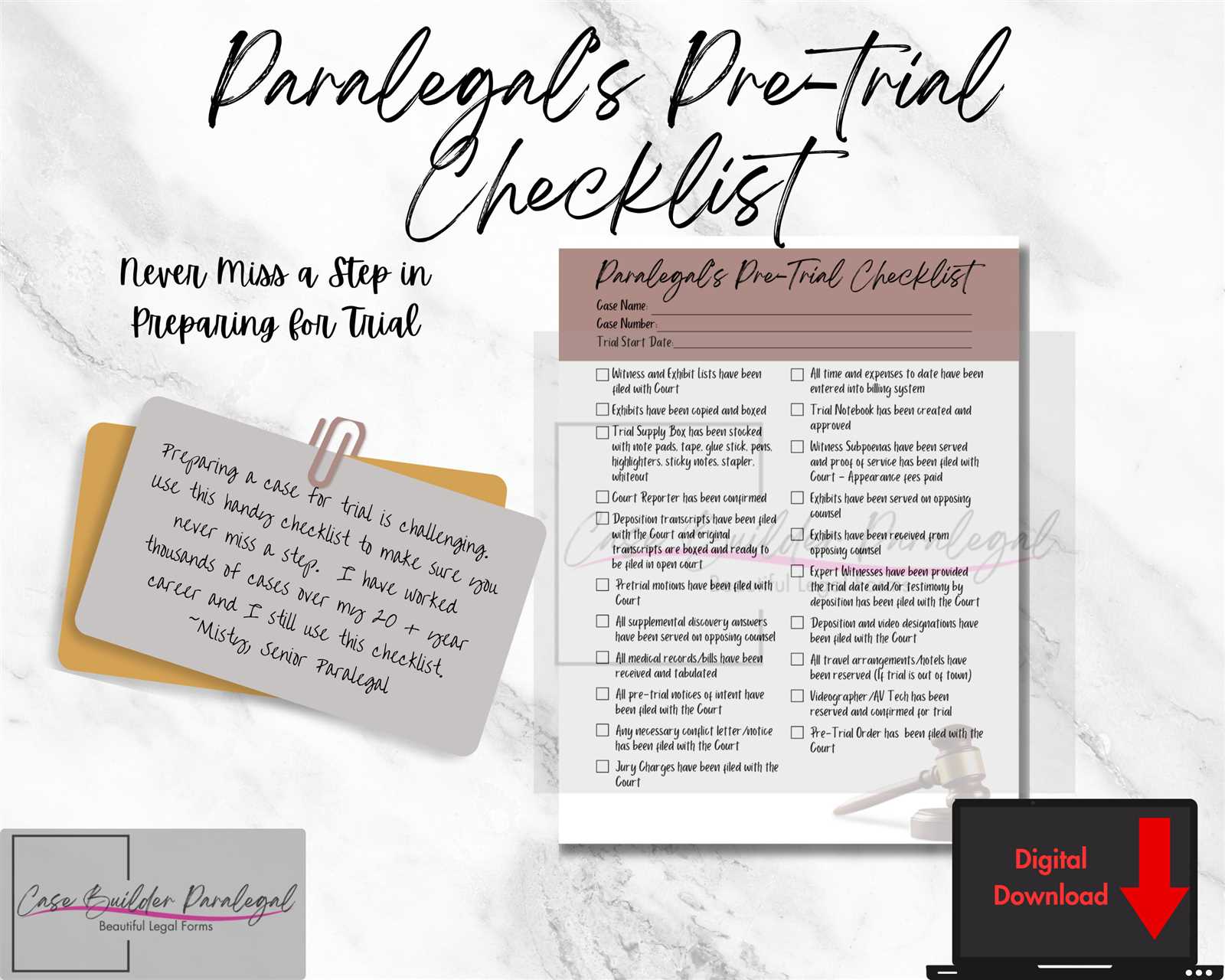

Different Types of Legal Support Services

Legal professionals often require assistance in handling various tasks that help streamline their workload and ensure the smooth operation of cases. These services encompass a broad range of tasks, each designed to support attorneys in providing efficient legal representation. Understanding the different types of support services available can help clients and legal teams determine which services are most relevant to their needs.

Some common support services include document preparation, legal research, case management, and client communication. These tasks, while essential to the legal process, often do not require the full-time involvement of an attorney but still demand specialized knowledge and attention to detail. Below are several examples of key services often utilized in the legal field.

- Document Drafting: The preparation of legal documents such as contracts, pleadings, motions, and discovery materials. This service helps ensure that legal documents are correctly formatted and comply with court procedures.

- Legal Research: Conducting research on case law, statutes, regulations, and legal precedents to assist attorneys in building their cases and preparing for court hearings.

- Case Management: Organizing and maintaining case files, tracking deadlines, and managing important documentation to keep legal teams organized and on schedule.

- Client Communication: Handling routine communication with clients, including updates on case progress and scheduling appointments, ensuring that clients are kept informed throughout the legal process.

- Court Filings: Preparing and submitting documents to the court system, ensuring that filings meet all required guidelines and deadlines.

Each of these services plays a critical role in ensuring that legal work is completed efficiently and effectively, helping to reduce costs and improve the overall quality of client representation.

Creating Detailed Service Descriptions

Clear and precise descriptions of services are essential for transparency and understanding between service providers and clients. When documenting the work performed, it’s important to include enough detail to avoid misunderstandings and ensure that the client fully understands what they are being charged for. Well-crafted service descriptions not only enhance professionalism but also help in maintaining a clear record of tasks for future reference.

To create effective descriptions, consider breaking down the services into easily understandable segments. This not only helps in providing clarity but also ensures that clients can see the value of each task performed. Below are several key aspects to consider when drafting service descriptions.

- Be Specific: Clearly define the task or service provided, including the scope of work and any applicable timeframes. For example, instead of just “legal research,” specify “conducting legal research for case X, including reviewing case law from 2015 to present.”

- Include Time Spent: Whenever possible, break down how much time was spent on each task. This can be particularly useful when billing by the hour and helps clients see exactly where their money is going.

- Use Simple Language: Avoid complex jargon or legal terminology unless necessary. The goal is to ensure that the client understands what is being done, so simplicity is key.

- Itemize Tasks: If multiple tasks were performed, list them individually. This helps clients see exactly what work was completed and can prevent confusion about the overall charges.

By providing detailed and transparent service descriptions, you not only protect yourself from potential disputes but also ensure that your clients have a clear understanding of the value they are receiving.

Invoice Formatting Tips for Professionals

Proper formatting is crucial when preparing a bill for services rendered, as it ensures clarity and professionalism. A well-organized document not only helps clients understand the charges but also fosters trust and demonstrates attention to detail. By adhering to certain formatting principles, professionals can avoid confusion and enhance the overall client experience.

There are several key aspects to consider when structuring a billing document. Below are some formatting tips that can make a significant difference in how the bill is received by clients and in how efficiently payment is processed.

Use Clear and Readable Fonts

Choose a simple, professional font that is easy to read. Avoid overly stylized fonts that might make the document harder to decipher. Common options like Arial or Times New Roman are preferred for their clarity and formal appearance.

Include Essential Information

- Client Information: Clearly list the client’s name, address, and contact details at the top of the document.

- Service Provider Information: Include your business name, address, and contact details, ensuring that the client knows how to reach you if they have questions.

- Invoice Number: Assign a unique number to each billing document for record-keeping and tracking purposes.

- Due Date: Clearly state the due date for payment to avoid any misunderstandings or delays.

Break Down the Charges

Instead of lumping all services together, break down each charge into its own line item. This could include descriptions of services, hours worked, rates, and any applicable taxes or fees. Detailed line items help clients understand exactly what they are paying for and how the total amount was calculated.

- Be Specific: Provide brief but clear descriptions of each service performed.

- Include Quantities: When charging by the hour, include the number of hours worked for each service.

- Include Rates: Specify the rate charged for each service or task to ensure transparency.

By following these formatting tips, professionals can create clear, organized, and professional billing documents that not only improve client satisfaction but also streamline the payment process.

How to Handle Late Payments

Dealing with overdue payments can be a challenging aspect of business, especially when it comes to maintaining good client relationships while ensuring timely compensation for services provided. It’s essential to have a clear process in place to manage late payments effectively, minimizing frustration while protecting your financial interests. Setting clear expectations and using a professional approach can help prevent misunderstandings and ensure that payments are made in a timely manner.

To handle late payments efficiently, it is important to take proactive steps and maintain a professional attitude. Below are strategies for managing overdue accounts that can keep your business running smoothly without damaging client relations.

Set Clear Payment Terms from the Start

One of the most effective ways to prevent late payments is to set clear payment terms right from the beginning. Define the payment deadline, whether it’s a specific date or a set number of days after the service is provided. Including this information in your agreements or contracts helps ensure that both parties are on the same page.

Follow Up Professionally

If a payment is late, it’s crucial to follow up in a timely and professional manner. Here are a few steps you can take:

- Send a Reminder: Send a friendly reminder about the overdue payment. Sometimes, clients simply forget or overlook the due date.

- Offer Payment Options: If the client is facing financial difficulties, consider offering flexible payment arrangements to help them settle their balance.

- Be Firm but Respectful: If the payment continues to be delayed, remind the client of your agreed terms and the importance of honoring them.

By handling late payments in a professional and structured manner, you not only ensure timely payments but also maintain a positive relationship with your clients, even when challenges arise.

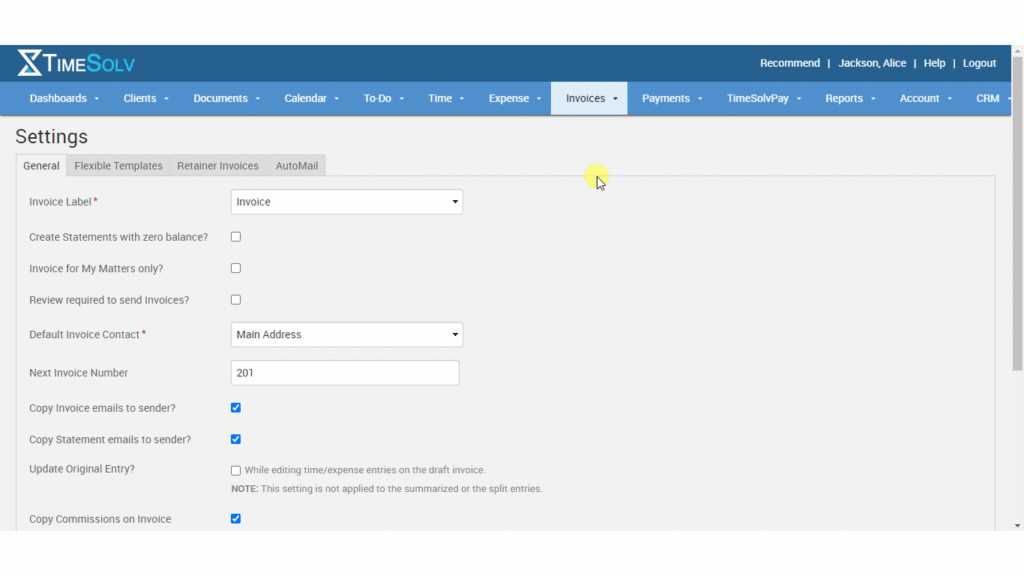

Integrating Your Template with Accounting Tools

In today’s business environment, automating the process of tracking finances is essential for efficiency and accuracy. By integrating your billing documents with accounting software, you can streamline your workflow, reduce manual errors, and save valuable time. This integration allows for seamless data transfer, making it easier to manage financial records and ensure that all transactions are recorded correctly.

When you connect your documents with accounting tools, it can help you track payments, generate financial reports, and maintain accurate records without needing to manually input data into both systems. Below, we will explore how this integration can benefit your business.

Benefits of Integration

Integrating your documents with accounting software offers numerous advantages:

- Time-Saving: Automatically syncing data reduces the need for manual entry, saving time and effort.

- Accuracy: It eliminates the potential for human error when transferring financial data.

- Real-Time Tracking: You can monitor payments and financial status instantly, ensuring that you’re always up-to-date.

- Easy Reporting: With the integration, generating financial reports becomes more straightforward and efficient.

Steps for Integration

Here’s a simple guide to integrating your documents with accounting software:

| Step | Action |

|---|---|

| 1 | Select an accounting tool that supports integration with your document system. |

| 2 | Connect your document platform with the chosen accounting tool by using API or built-in integration features. |

| 3 | Ensure all relevant information such as service descriptions, amounts, and payment terms are transferred accurately. |

| 4 | Test the system to confirm that data is being synced correctly and that there are no errors in the transfer. |

By integrating your financial management tools, you can simplify your billing process, improve efficiency, and reduce the likelihood of errors in your financial records.

Legal Requirements for Paralegal Invoices

Understanding the legal requirements for billing documents is crucial to ensure compliance with industry standards and regulations. These documents not only serve as a record of services rendered but also play a significant role in protecting both the service provider and the client. Meeting the legal obligations ensures that all financial transactions are transparent and properly documented, preventing potential disputes.

While requirements may vary by jurisdiction or the nature of the services provided, there are several key elements that must be included in all professional billing documents to comply with the law. Below are some of the essential legal requirements to consider:

- Identification of the Service Provider: The document must clearly state the name, address, and contact information of the service provider.

- Client Details: The full name and contact information of the client should be included to avoid confusion and ensure that the document is linked to the correct individual or organization.

- Clear Description of Services: A detailed breakdown of the services performed must be provided, including the date(s) of service, hours worked, and the nature of the work done.

- Payment Terms: The document must clearly specify the payment due date, payment methods accepted, and any applicable late fees or interest charges in case of delayed payments.

- Hourly Rate or Fixed Fees: If billing is based on an hourly rate, the rate must be clearly outlined. If a flat fee is charged, this should also be stated clearly, along with any terms that apply to the fee.

- Tax Information: In many cases, applicable taxes must be included on the document. This includes sales tax or other taxes required by local, state, or federal regulations.

- Unique Reference Number: For clarity and organization, each document should have a unique reference or identification number for easy tracking and record-keeping.

- Signature or Acknowledgment: Depending on the jurisdiction, a signature or electronic acknowledgment may be required to validate the document as legally binding.

By ensuring these essential elements are included, you can avoid legal issues and maintain a professional standard of transparency and accuracy in all financial transactions.

Benefits of Using Digital Invoice Templates

Using digital billing documents offers a wide range of advantages for professionals looking to streamline their financial operations. By moving away from manual processes, these electronic solutions provide an efficient, reliable, and cost-effective way to manage payment records. Whether for a single transaction or ongoing services, digital billing systems can make the entire process faster and more organized.

Here are some key benefits of using digital formats for financial documentation:

- Time Efficiency: Digital documents can be created quickly, reducing the time spent on manual calculations and formatting. This allows professionals to focus more on client work rather than administrative tasks.

- Accuracy: Automated fields in digital systems help reduce human errors. Calculations, tax rates, and totals are generated automatically, ensuring that all figures are correct.

- Professional Appearance: Digital documents allow for clean, organized layouts that can be customized to reflect a professional image. This consistency helps build trust with clients.

- Easy Customization: With digital tools, it’s simple to personalize each document to meet specific client needs, including adjusting formats or adding personalized notes.

- Cost Savings: Digital records eliminate the need for paper, ink, and postage, offering savings on materials and shipping costs. Additionally, they help reduce administrative overhead.

- Quick Distribution: Once completed, digital documents can be emailed or uploaded directly to clients, reducing waiting times and enabling faster payment processing.

- Environmental Impact: Going paperless helps to reduce waste, contributing to more sustainable business practices.

- Easy Tracking and Storage: Digital files are easily stored and organized in cloud systems, allowing for efficient record-keeping and quick retrieval when needed.

By incorporating digital solutions, professionals can improve their billing practices, ensuring better organization, faster processing times, and a more eco-friendly approach to business management.

Finalizing Your Invoice Before Submission

Before submitting a billing document, it is essential to ensure that all details are accurate, clear, and professionally formatted. This final step helps avoid delays in payment and reduces the chance of disputes. Taking the time to carefully review the document ensures that all services are correctly itemized, and all necessary information is included. Below are some key elements to check when finalizing your billing document:

| Step | Details to Verify |

|---|---|

| 1. Check for Accuracy | Ensure that the amount charged corresponds with the services provided. Double-check for any errors in pricing, taxes, and total amounts. |

| 2. Service Descriptions | Make sure that each service is clearly described with the correct time, date, and amount. Avoid vague descriptions. |

| 3. Client Information | Verify that the client’s name, address, and contact information are accurate. Incorrect details may cause confusion during the payment process. |

| 4. Payment Terms | Confirm that payment terms, such as due date and methods of payment, are clearly stated to avoid any misunderstandings. |

| 5. Contact Information | Ensure your own contact information is present, including phone number or email address, in case the client needs to reach you with questions. |

| 6. Formatting | Review the document layout for clarity and professionalism. Use clean fonts, and ensure that the document is well-organized and easy to read. |

By thoroughly reviewing these key components, you can finalize your billing document with confidence, ensuring that everything is clear and correct before submission. This will not only reduce the chance of errors but will also convey a professional image to your clients, encouraging prompt payment.