HVAC Invoice Templates for Streamlined Billing

Managing billing efficiently is essential for any business that provides services. It helps ensure timely payments, improves customer satisfaction, and keeps financial records organized. One of the most effective ways to simplify this task is by using professionally designed documents that structure all necessary details clearly and concisely.

These documents are not only useful for tracking services rendered but also for maintaining a professional image. With the right format, they can streamline communication with clients, making it easier to specify charges, payment deadlines, and other critical information.

Whether you’re a contractor, technician, or service provider, utilizing customizable layouts allows for better control over your finances. By implementing a well-organized system, you can avoid errors and reduce the time spent on administrative tasks, allowing you to focus on what truly matters – delivering exceptional service.

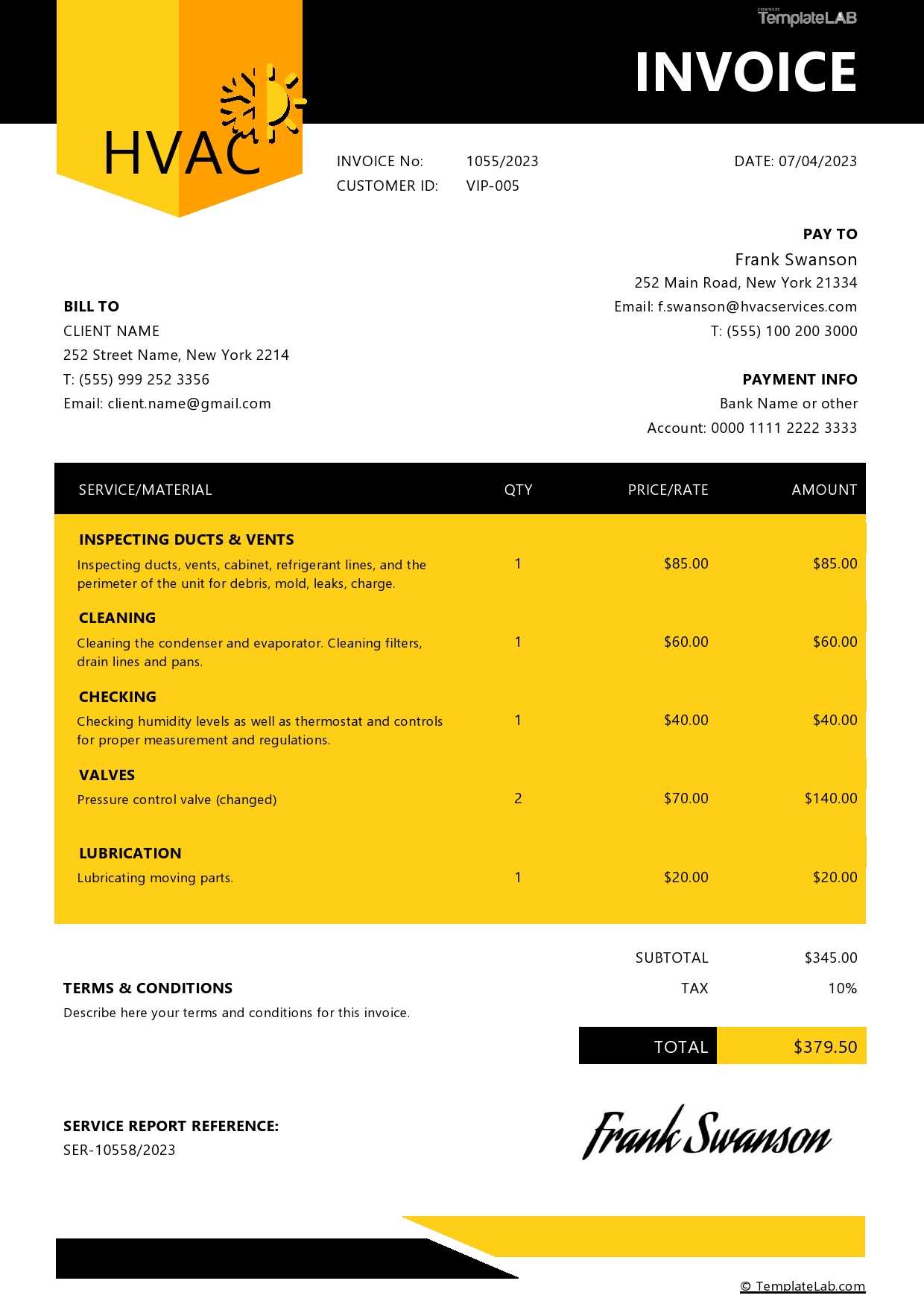

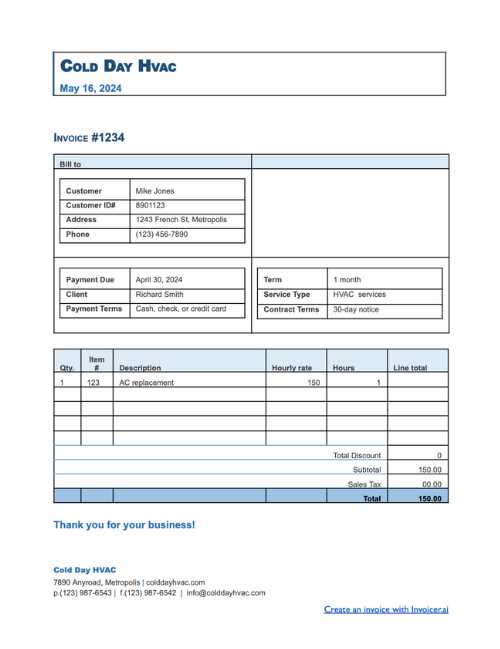

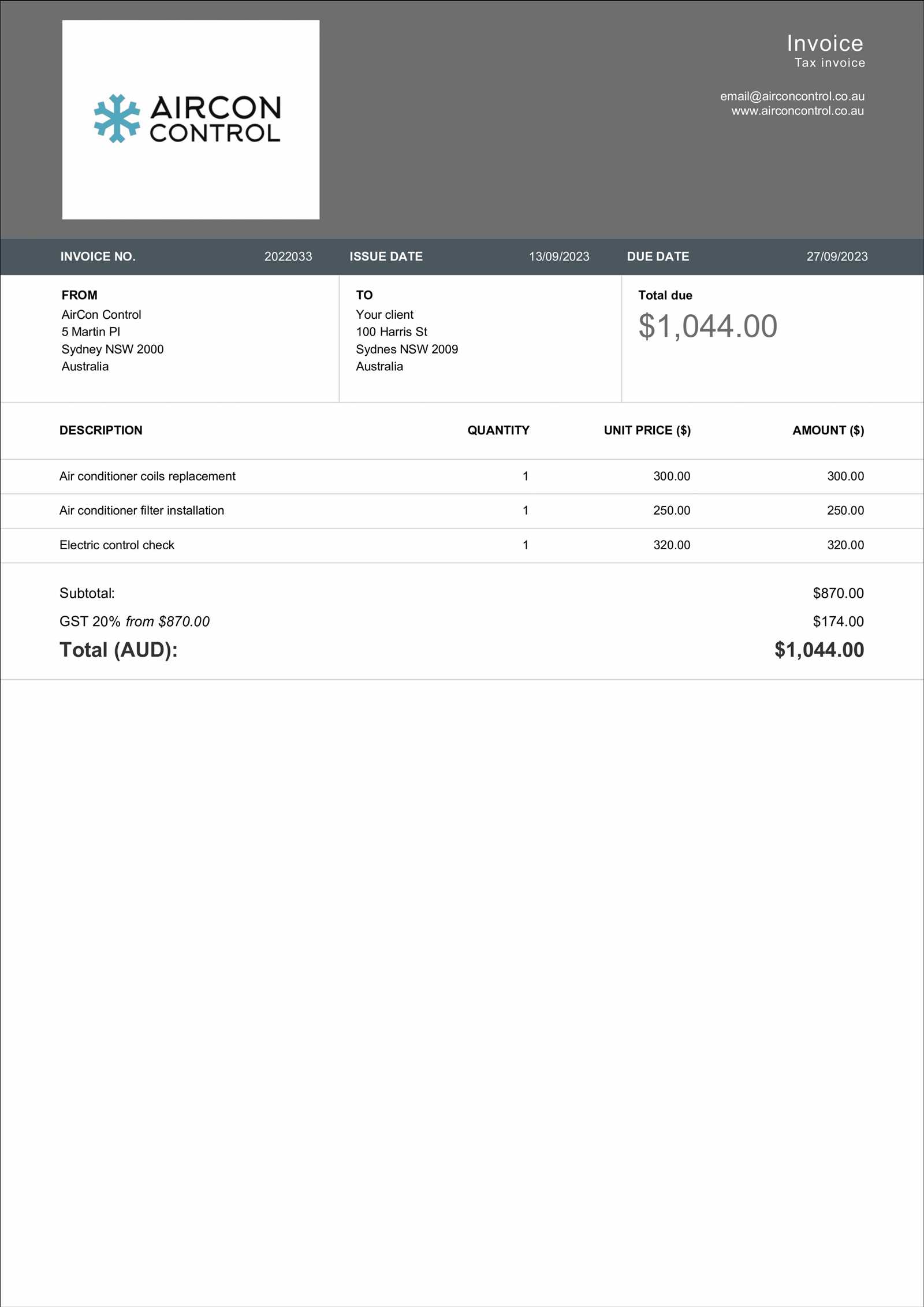

HVAC Invoice Templates Overview

For businesses that offer home or commercial system installations and repairs, having a standardized document for billing purposes is crucial. These documents play a key role in presenting detailed charges, ensuring clarity for both service providers and clients. A well-organized format not only boosts professionalism but also helps streamline the payment process, reducing potential confusion or errors.

Using pre-designed layouts allows businesses to save time while maintaining a clear structure. With customizable fields, these documents can be adapted to meet the unique needs of each project. Essential elements such as service descriptions, pricing breakdowns, and payment terms are easy to integrate, ensuring nothing is overlooked.

| Feature | Description |

|---|---|

| Service Details | Clearly outline the work completed, including materials used and labor costs. |

| Payment Terms | Specify due dates, late fees, and payment methods to avoid misunderstandings. |

| Client Information | Include all relevant contact information for both the provider and the customer. |

| Itemized Breakdown | Provide a detailed list of each charge for transparency and easy understanding. |

Why Use HVAC Invoice Templates

Having a structured and consistent approach to billing is essential for any service-oriented business. Standardizing the documents used for requesting payment not only enhances the professional appearance but also ensures that all necessary information is clearly presented. This organization helps avoid confusion and accelerates the payment process, benefiting both the service provider and the client.

Utilizing ready-made formats offers several key advantages, such as:

- Efficiency: Quickly generate documents with predefined fields, reducing the time spent on administrative tasks.

- Accuracy: Pre-designed layouts ensure that important details, like pricing and service descriptions, are never omitted.

- Professionalism: A clean and organized document reflects well on the service provider and instills confidence in clients.

- Customization: Easy to modify according to the specific needs of each project, allowing for flexibility in the content.

- Consistency: Maintaining uniformity across all transactions helps keep financial records tidy and reduces the likelihood of errors.

By using structured formats, businesses can enhance their workflow, improve client interactions, and streamline the payment collection process.

Key Features of HVAC Invoices

For any service-based business, a billing document is essential to ensure all charges are properly communicated and recorded. A well-crafted document not only captures all the necessary financial details but also enhances transparency between the service provider and the customer. Certain elements are crucial for such a document to be effective, providing both clarity and structure to the payment process.

Some of the essential characteristics that should be included in a service billing document are:

- Detailed Service Description: A clear explanation of the work completed, materials used, and any other relevant information. This helps the client understand exactly what they are paying for.

- Itemized Charges: Breaking down costs into individual components, such as labor, materials, and additional fees, allows for full transparency and easy reference.

- Payment Terms: Clearly stating the due date, acceptable payment methods, and any applicable late fees ensures both parties are aware of expectations regarding payment.

- Client and Provider Information: Including the names, addresses, and contact details of both the service provider and the customer ensures that there are no misunderstandings in communication.

- Unique Identification: A unique reference number or ID for each document ensures proper record-keeping and makes it easy to track payments and match them with specific jobs.

- Professional Appearance: A clean, organized layout that includes the company logo and branding helps establish trust and adds a level of professionalism to the document.

By incorporating these features, businesses can ensure that their billing processes are clear, professional, and efficient, making it easier to maintain a positive relationship with clients while keeping financial records accurate and organized.

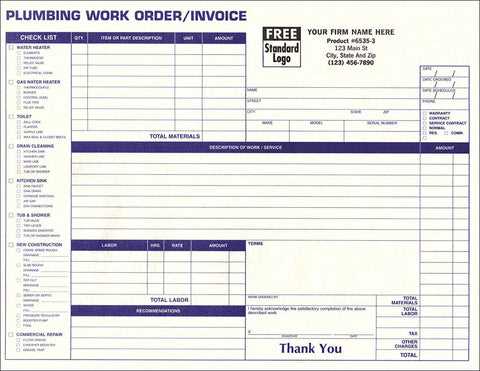

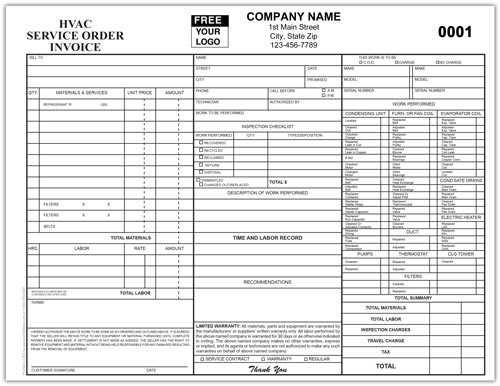

How to Customize Your Invoice

Customizing your billing document ensures it reflects your business’s unique identity while providing all necessary details in a clear, professional format. By adjusting the design and content to suit your specific needs, you can enhance both the client’s experience and your own administrative workflow. A personalized approach helps ensure that all important information is included while maintaining consistency across your records.

There are several key aspects to focus on when tailoring your document:

| Element | Customization Options |

|---|---|

| Logo & Branding | Add your company logo, colors, and fonts to align with your business identity. |

| Service Details | Include specific descriptions of the work performed, adjusting for each job’s unique scope. |

| Payment Terms | Set personalized payment schedules, such as deposit requirements or installment plans. |

| Client Information | Ensure correct details for each customer, such as name, address, and contact information. |

| Charges Breakdown | List each cost separately, including parts, labor, and additional fees, to enhance transparency. |

By adjusting these elements, you can create a document that is not only functional but also reinforces your brand and keeps your financial records in order. Customization can be done easily with digital tools, allowing for quick updates and consistent presentation for each client interaction.

Benefits of Digital Invoice Templates

Utilizing digital formats for billing provides significant advantages over traditional paper methods. With the convenience of electronic documents, businesses can streamline their operations, reduce errors, and improve communication with clients. These digital solutions not only save time but also offer greater flexibility and control over the entire billing process.

Some of the key benefits of using digital formats for creating and managing billing documents include:

- Speed and Efficiency: Generating a document in digital form can be done in minutes, reducing the time spent on manual entry and eliminating the need for physical paperwork.

- Customization: Easily adjust fields, add or remove information, and personalize the layout for each client or project, ensuring that the document meets specific needs.

- Storage and Organization: Digital records are simple to store and organize, making it easy to access past transactions and keep everything in one secure location.

- Eco-Friendly: Reduces paper waste and helps contribute to a more sustainable, environmentally conscious business model.

- Easy Updates and Corrections: Making changes or correcting mistakes is quick and simple, as there is no need to print new copies or start from scratch.

- Integration with Accounting Software: Seamlessly connect digital billing documents with accounting systems for smooth financial tracking and reporting.

By adopting digital solutions for billing, businesses can improve accuracy, save time, and provide a more professional experience for their clients.

Essential Elements for HVAC Billing

When creating a billing document for services rendered, it is crucial to include certain key details to ensure clarity, accuracy, and professionalism. A comprehensive bill should outline all relevant charges and provide clients with the necessary information to understand what they are being billed for. Including all these elements helps maintain transparent communication and encourages timely payments.

Key Information to Include

- Service Description: Clearly explain the work that was completed, including any repairs, installations, or maintenance tasks performed.

- Cost Breakdown: Provide an itemized list of charges, specifying labor costs, materials, and any additional fees.

- Client Details: Include the customer’s name, address, and contact information to ensure the document is properly addressed and traceable.

- Provider Information: Ensure that your business’s contact details, such as name, address, and phone number, are included for easy communication.

Important Financial Details

- Payment Terms: State the due date, payment methods accepted, and any penalties for late payments to avoid confusion.

- Unique Reference Number: Assign a specific number or code to each document to help track payments and ensure proper record-keeping.

- Tax Information: Clearly state any applicable taxes and the total cost after tax to give clients a complete picture of their financial obligations.

Incorporating these essential elements into each document helps to create clear, professional, and easy-to-understand bills, which enhances customer satisfaction and ensures smoother transactions.

Common HVAC Invoice Mistakes to Avoid

Billing errors can lead to confusion, delayed payments, and a loss of trust between service providers and their clients. Even the smallest mistake in a billing document can have significant consequences for both the service provider and the customer. Avoiding these common pitfalls ensures that financial transactions are clear, accurate, and efficient.

Here are some frequent mistakes to watch out for when preparing your billing documents:

- Incomplete Client Information: Failing to include the client’s full name, address, and contact details can delay communication and payments. Always ensure that these details are correct and up-to-date.

- Omitting Service Descriptions: Not clearly outlining the work completed or the materials used can lead to confusion. Always provide a detailed list of the services rendered to ensure transparency.

- Incorrect Pricing: Failing to double-check prices, including labor and materials, can result in overcharging or undercharging. Ensure that all costs are accurate and match the agreed-upon rates.

- Missing Payment Terms: Not specifying the payment due date, accepted methods, or penalties for late payments can create uncertainty and delay transactions. Always include clear payment terms.

- Ignoring Taxes: Forgetting to include applicable taxes or not clearly stating the tax amount can lead to misunderstandings with clients. Always ensure tax information is calculated correctly and included in the total amount due.

- Inconsistent Formatting: A poorly formatted or inconsistent document can look unprofessional and be difficult to read. Stick to a clean, organized layout to ensure clarity and ease of understanding.

Avoiding these common mistakes will help maintain strong professional relationships and ensure that billing is both clear and efficient. Accuracy in every detail is essential for maintaining trust and ensuring prompt payment.

How to Create a Professional Invoice

Creating a professional billing document is essential for any business to ensure clarity and foster trust between service providers and clients. A well-structured document not only ensures accurate payment but also represents the professionalism of your business. Following a clear, organized format makes it easier for clients to understand the charges and for businesses to maintain proper financial records.

To create a polished and efficient billing document, consider including the following elements:

| Element | Details |

|---|---|

| Header | Include your company’s logo, name, and contact information to make it clear who the document is from. |

| Client Information | Ensure the client’s name, address, and contact details are included for accuracy. |

| Service Description | Provide a detailed list of the work performed, including labor and materials, to ensure the client understands what they are being charged for. |

| Itemized Charges | Break down costs into clear categories, such as labor, parts, and additional fees, so clients can easily see where the charges are coming from. |

| Payment Terms | State the due date, accepted payment methods, and any late fees or discounts that apply. |

| Unique Invoice Number | Assign a specific reference number to help with record-keeping and easy tracking of the payment. |

| Tax Information | Clearly indicate any applicable taxes and the final amount due after tax. |

By following these steps, you can ensure that your billing document is professional, clear, and easy to understand. A well-prepared document helps reinforce your business’s reputation and ensures that payments are processed smoothly and efficiently.

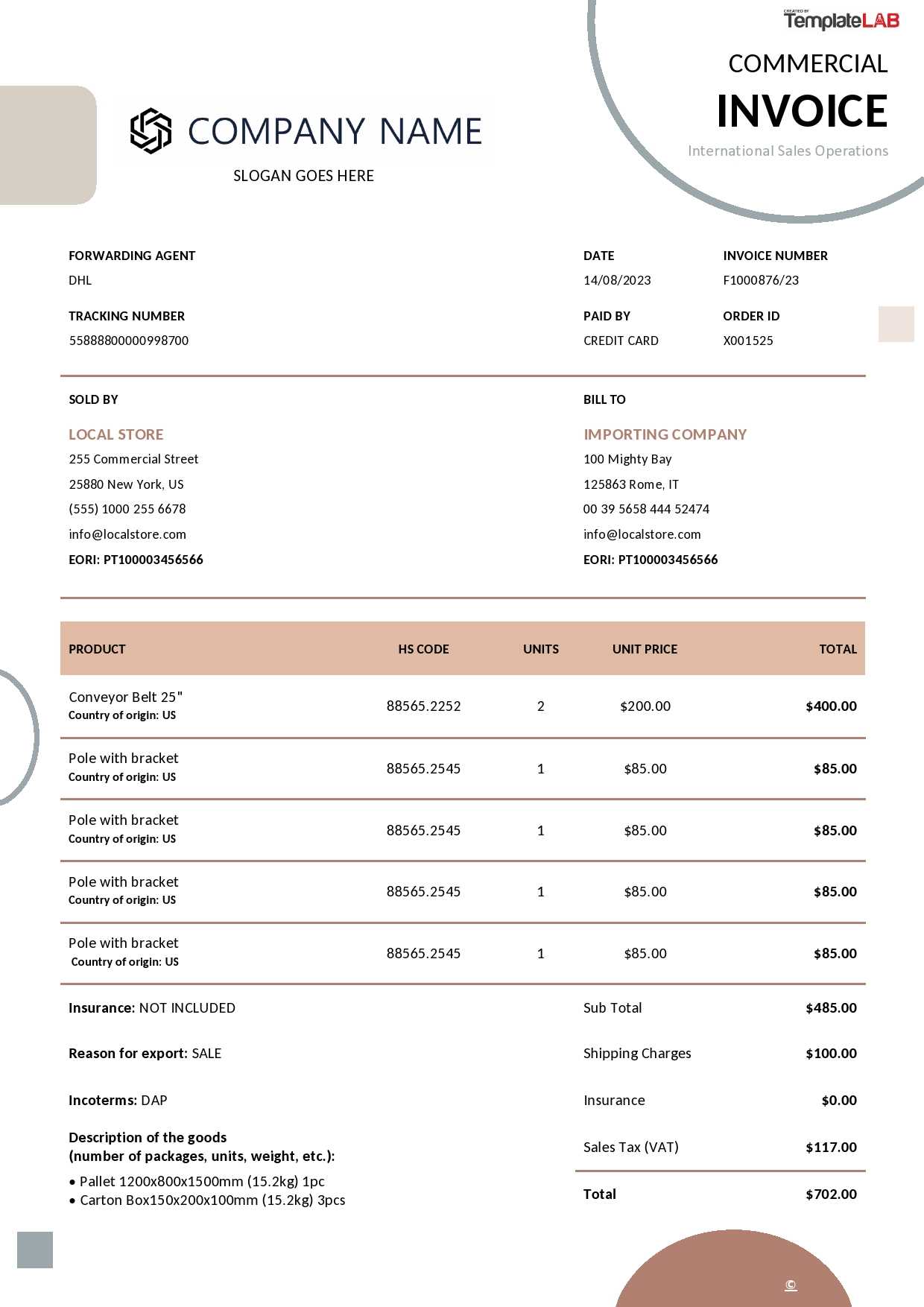

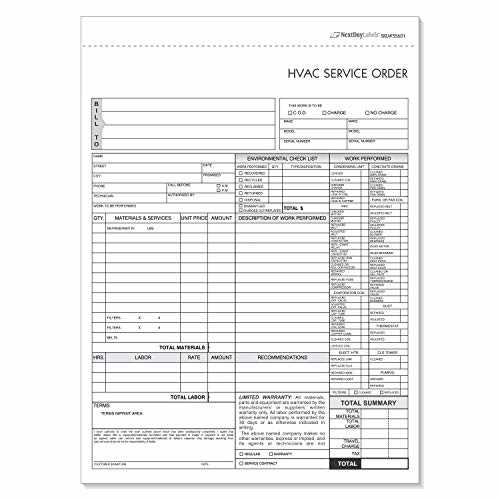

Choosing the Right Invoice Format

Selecting the appropriate format for your billing documents is a key factor in ensuring that the payment process runs smoothly and professionally. The right structure not only helps in organizing all necessary details but also improves clarity, making it easier for clients to review and understand the charges. Choosing a format that suits your business style and client needs can contribute to faster payments and fewer misunderstandings.

When deciding on a format, consider the following factors:

- Client Preferences: Some clients may prefer a detailed, itemized breakdown, while others may want a simple, concise bill. Understanding what your clients prefer can help you choose a format that suits them best.

- Business Type: Depending on the services you offer, you may need to include different types of information. For example, a service-based business may need to provide detailed descriptions of work performed, while a product-based business may need to include part numbers and quantities.

- Customization Options: Consider whether the format allows for easy customization to reflect any discounts, promotions, or special terms that may apply to specific clients.

- Ease of Use: Choose a format that is easy for both you and your clients to understand. A simple, clean layout ensures that there is no confusion about charges, payment terms, or due dates.

- Digital vs. Paper: Think about whether you need a digital format for faster processing and storage or a printed version for clients who prefer paper copies. Many businesses opt for digital formats, which are easy to store and share.

By carefully considering these elements, you can select the right format that suits both your business and your clients, ensuring smooth and professional transactions every time.

Legal Requirements for HVAC Invoices

When creating a billing document for services provided, it is essential to adhere to legal requirements to ensure that the document is both valid and enforceable. Different regions and countries have specific regulations regarding what must be included in financial documents. Complying with these requirements not only avoids legal complications but also ensures that your business operates transparently and professionally.

Key Legal Elements to Include

- Business Details: It is crucial to include the name, address, and contact information of your business, along with any business registration number if required by local laws.

- Client Information: The customer’s full name or company name, as well as their contact details, should be clearly listed to avoid confusion in case of disputes.

- Invoice Date: The date when the bill is issued is important for record-keeping and calculating payment terms. It is also essential for tracking purposes in case of audits.

- Unique Identification Number: Each billing document should have a unique reference number, which helps in organizing records and makes it easier to track payments.

- Clear Description of Services: Include a detailed list of services rendered, along with quantities, rates, and any other charges, so that the client is aware of what they are being charged for.

- Tax Information: If applicable, the document should state the amount of tax charged and the corresponding tax rate to comply with tax regulations.

- Payment Terms: Clearly state the payment due date, the accepted methods of payment, and any penalties for late payments to avoid legal complications regarding overdue accounts.

Additional Considerations

- Currency: If you are working internationally or with clients from different regions, clearly indicate the currency in which payment is expected.

- Compliance with Local Laws: Ensure that your billing document complies with the specific financial or tax regulations of your country or region. This may include specific rules for tax reporting or other required details.

By adhering to these legal requirements, you can ensure that your business remains compliant and your billing documents are both professional and legitimate.

Automating Your HVAC Billing Process

Automating the billing process is a game-changer for businesses looking to streamline operations, reduce errors, and save time. By incorporating digital tools and software, businesses can eliminate manual tasks, ensuring that payment requests are generated accurately and sent promptly. Automation can also help maintain consistency, track payments, and ensure that all legal and financial regulations are met without the need for constant oversight.

Benefits of Automation

- Time-Saving: Automation eliminates the need for manual data entry, allowing businesses to generate billing documents quickly and with minimal effort.

- Accuracy: By using automated systems, the risk of errors is reduced, ensuring that each document reflects the correct amounts, rates, and service details.

- Consistency: Automated systems ensure that every document is generated using the same structure, which can help improve professionalism and brand consistency.

- Faster Payment Collection: Automated billing can trigger reminders and due date alerts, ensuring that clients are promptly notified of upcoming payments, helping speed up the payment process.

- Tracking and Reporting: Automation makes it easier to track payments, generate reports, and analyze cash flow, providing valuable insights for managing business finances.

How to Automate Your Billing Process

- Choose the Right Software: Look for digital solutions that offer customization options, user-friendly interfaces, and integrations with other tools, such as accounting software or customer relationship management systems.

- Set Up Automatic Reminders: Schedule automated reminders for clients to ensure that payments are made on time, and overdue accounts are flagged for follow-up.

- Use Recurring Billing Features: For clients with ongoing services, set up recurring billing cycles that automatically generate and send requests on a regular basis.

- Integrate Payment Processing: Incorporate online payment options within your automated system to allow clients to pay directly from the document, making the process faster and more convenient for them.

By implementing automation in your billing operations, you can focus on growing your business while ensuring that the financial side runs smoothly and efficiently.

Tips for Efficient Invoice Management

Managing financial documents efficiently is essential for any business to maintain a smooth cash flow and ensure timely payments. Streamlining your process can help you stay organized, reduce errors, and improve overall client relationships. By implementing the right strategies and tools, you can simplify tracking, follow-up, and reporting, ultimately saving time and increasing productivity.

Organizational Tips for Managing Financial Documents

- Use a Consistent Naming System: Implement a standard naming convention for each billing document, making it easy to track and locate specific files when needed.

- Centralize Your Data: Store all billing documents in one digital system, such as a cloud-based platform, to ensure easy access and backup.

- Set Clear Payment Terms: Define and communicate clear payment terms upfront, specifying the due dates, payment methods, and any late fees to avoid confusion later on.

- Implement a Digital Filing System: Instead of relying on physical copies, use digital files to improve accessibility and reduce the risk of losing important documents.

Best Practices for Timely Payment Collection

- Automate Reminders: Set up automated reminders to notify clients of upcoming or overdue payments, ensuring that they are informed without manual follow-ups.

- Offer Multiple Payment Methods: Provide different payment options, such as online transfers, credit cards, or checks, to make it easier for clients to settle their balances.

- Track Payments: Regularly monitor payments and mark them as received in your system to maintain accurate financial records and avoid misunderstandings.

- Review Discrepancies Quickly: Address any issues or discrepancies promptly, and communicate with clients to resolve problems before they escalate.

By adopting these strategies, you can ensure that your financial operations are more organized, reduce the risk of errors, and improve cash flow management, ultimately contributing to the growth and success of your business.

Best Practices for HVAC Payment Terms

Establishing clear and fair payment terms is crucial for maintaining smooth business operations and fostering trust between service providers and clients. Clear payment expectations help avoid misunderstandings, reduce late payments, and ensure that financial transactions are handled professionally. By setting effective payment conditions, businesses can improve cash flow and strengthen customer relationships.

Key Considerations for Payment Terms

To create clear and effective payment terms, consider the following best practices:

- Define Payment Due Dates: Specify the exact due date for each transaction to ensure both parties understand when payment is expected. For example, “Due within 30 days of receipt.”

- Offer Payment Flexibility: Providing multiple payment options, such as credit cards, bank transfers, and online payment methods, can make it easier for clients to settle their accounts on time.

- Include Late Fees: Clearly state any penalties for late payments to encourage timely settlements. For example, “Late payments will incur a 5% fee after 30 days.”

- Set Deposit Requirements: For large or ongoing projects, request a deposit upfront to cover initial costs. A typical deposit can range from 10% to 50%, depending on the project size.

Best Practices for Managing Payment Timeliness

- Send Prompt Billing Requests: Ensure that clients receive accurate and clear billing documents as soon as the job is complete or according to the agreed-upon schedule.

- Automate Payment Reminders: Use digital systems to send automatic reminders a few days before the due date, as well as a follow-up notice if the payment becomes overdue.

- Maintain Open Communication: If a payment is delayed, communicate with the client in a respectful and professional manner to resolve any issues promptly.

- Track Payments Effectively: Keep accurate records of all transactions and regularly monitor accounts to ensure that payments are being processed on time.

By implementing these practices, businesses can create a transparent and efficient payment process that benefits both clients and service providers, helping to ensure that projects are completed smoothly and financially secure.

Tracking Payments with Invoice Templates

Efficiently tracking payments is a vital part of maintaining financial health for any business. By using structured documents that outline the terms of each transaction, companies can monitor which payments have been received, which are overdue, and which are pending. These documents not only facilitate organization but also help in identifying issues before they become problems, ensuring a smooth flow of cash.

Benefits of Using Structured Payment Tracking

Adopting organized methods to track payments offers several advantages:

- Clear Payment History: A well-structured document helps keep a clear record of what payments have been made, which balances are outstanding, and when payments are due.

- Reduces Errors: By using predefined formats, the chances of missing details or making mistakes in tracking payments are minimized.

- Improves Cash Flow Management: With clear tracking, businesses can forecast their cash flow more accurately, making it easier to plan for expenses or investments.

- Speeds Up Collections: Having a detailed record of outstanding payments makes it easier to send reminders or initiate follow-up actions in a timely manner.

Key Information to Include for Effective Tracking

For optimal tracking, ensure that your payment records contain the following information:

- Invoice Number: Assign a unique number to each document to keep payments organized and easily traceable.

- Client Information: Include the client’s name, address, and contact details to avoid confusion in case of discrepancies.

- Payment Status: Clearly indicate whether a payment is pending, received, or overdue.

- Due Dates and Payment Terms: Include the expected payment date and any applicable terms to avoid misunderstandings about when payments should be made.

By incorporating these elements into your payment tracking system, you can streamline your financial management processes and maintain a clear understanding of your business’s financial standing.

How to Handle Disputes in Billing

Disagreements over payments are an inevitable part of doing business, but how you handle them can significantly impact your relationships with clients and your bottom line. Addressing billing disputes in a timely and professional manner is key to maintaining trust and ensuring that the issue is resolved quickly. Clear communication, a structured process, and a calm approach are all essential for effectively managing any discrepancies that arise.

Steps to Resolve Billing Disputes

When a dispute arises, it’s important to follow a clear and organized process to resolve the issue. Below are some practical steps to help navigate the situation:

- Review the Billing Details: Begin by reviewing the original billing document and any related communication. Double-check the amounts, services provided, and any agreed-upon terms to ensure accuracy.

- Contact the Client: Reach out to the client in a calm and professional manner. Listen carefully to their concerns and provide clear explanations. Often, misunderstandings arise due to miscommunication, so this step is crucial.

- Provide Supporting Documentation: If there are any discrepancies, provide the client with supporting documentation such as contracts, previous correspondences, or detailed breakdowns of services provided to help clarify the situation.

- Negotiate a Solution: If the issue cannot be resolved quickly, consider negotiating a solution. This may involve offering a partial discount, revising certain charges, or establishing a payment plan for any outstanding amounts.

- Keep Records: Maintain detailed records of all correspondence and actions taken during the dispute resolution process. This ensures you have documentation in case the issue needs to be revisited or escalated later.

Best Practices for Preventing Future Disputes

While it’s impossible to avoid every potential dispute, you can reduce the likelihood of future billing issues by implementing the following best practices:

- Clear Communication: Always provide clients with a detailed breakdown of services, pricing, and terms upfront to avoid misunderstandings down the line.

- Timely Billing: Send out billing statements promptly to give clients ample time to review and process payments before any disputes arise.

- Use Written Agreements: Ensure that all terms and expectations are clearly outlined in written contracts or agreements, including payment schedules and due dates.

- Monitor Payment Status: Stay on top of any overdue payments to catch potential issues early and address them before they become disputes.

By addressing disputes promptly and professionally, and taking steps to prevent them in the future, you can maintain positive client relationships and keep your billing process running smoothly.

Integrating Billing Statements with Accounting Software

Efficient financial management is a cornerstone of any successful business, and automating the flow of data between billing records and accounting systems can save significant time and reduce errors. By integrating payment records with accounting software, businesses can streamline their processes, ensure greater accuracy, and improve the overall financial tracking and reporting. This integration allows for seamless synchronization between billing data and financial statements, simplifying the management of cash flow, taxes, and reporting.

Advantages of Integration

Linking your billing information with accounting software offers several key benefits that can optimize your business operations:

- Improved Accuracy: Automatically transferring data between systems minimizes manual entry errors and ensures that records are consistent and up to date.

- Time Savings: Automation reduces the time spent on repetitive tasks such as manual data entry, allowing your team to focus on more critical tasks.

- Better Financial Insights: Integrated systems provide a clearer picture of your financial health, enabling you to track revenue, outstanding payments, and expenses in real-time.

- Streamlined Tax Reporting: Accurate and organized financial data makes it easier to generate reports for tax purposes, reducing the risk of errors during tax season.

- Enhanced Efficiency: Integration helps ensure that all transactions, from payments to expenses, are accurately reflected in your accounting records without additional manual updates.

How to Integrate Billing with Accounting Software

Integrating your billing system with accounting software is a relatively straightforward process, but it requires careful planning and execution to ensure compatibility. Here’s how to go about it:

- Choose Compatible Software: Ensure that the accounting software you are using supports integration with your billing system. Popular accounting platforms like QuickBooks, Xero, or FreshBooks offer built-in integrations with many billing solutions.

- Set Up Automated Data Sync: Once you’ve selected compatible software, configure the automation settings to sync data between your billing platform and accounting software. This may include settings for when data should be transferred and what information should be included.

- Test the Integration: Before fully relying on the integration, run tests to verify that data is being correctly transferred and that the systems are communicating properly. This step ensures there are no discrepancies or missing information.

- Monitor and Adjust: Regularly check the system to make sure it’s working as expected. Adjust integration settings as needed based on any changes in your billing process or accounting requirements.

By integrating your billing system with accounting software, you can significantly reduce manual efforts, improve the accuracy of your financial data, and ensure smooth business operations across departments.

Choosing Free vs Paid Templates

When selecting a format for managing payment records and billing documents, businesses face the decision between free and paid options. Both offer advantages, but the right choice depends on your business needs, budget, and desired features. Free options often provide basic functionality, while paid solutions can offer advanced customization and enhanced support. Understanding the differences and benefits of each will help you make a more informed decision.

Advantages of Free Options

Free billing formats can be a great starting point for small businesses or those with limited budgets. Some key benefits include:

- No Initial Cost: Free formats come without upfront costs, making them ideal for businesses just starting out or with tight financial constraints.

- Easy Access: Many free options are readily available online and can be downloaded or accessed instantly, saving you time in setup.

- Basic Functionality: Free versions usually provide the essential features needed for basic invoicing or billing tasks, such as itemized charges and payment tracking.

Benefits of Paid Options

Paid solutions, on the other hand, often come with added value that may be worth the investment for businesses looking for advanced features and greater flexibility. Here are some reasons why businesses opt for paid formats:

- Customization: Paid options often offer more flexibility, allowing you to customize the document layout, design, and content to better fit your brand’s needs.

- Advanced Features: Paid solutions may include extra functionality like automated calculations, tax rate management, integration with accounting software, and reporting tools.

- Better Support: Paid services often come with customer support, providing quick assistance when you encounter issues or need help with technical aspects.

- Security and Compliance: Paid formats are more likely to adhere to legal and industry-specific requirements, offering enhanced security features for sensitive payment data.

Making the Right Choice

Choosing between free and paid billing solutions depends on several factors, including the complexity of your business needs, your budget, and your long-term goals. Here’s a quick guide to help you decide:

- Evaluate Your Business Needs: If your business only requires basic billing, a free option might be sufficient. However, if you’re managing large volumes of transactions or need additional features like automatic reminders or detailed reports, a paid version could be worth the investment.

- Consider Customization Requirements: If you need highly personalized billing documents, a paid solution may be the best choice, offering more design and content flexibility.

- Think About Support and Security: If you need ongoing support or are handling sensitive financial data, a paid option may offer the extra peace of mind with customer support and enhanced security features.

Ultimately, the decision will come down to the specific needs of your business and the level of functionality required for efficient billing management.