How Custom Invoice Templates for QuickBooks Online Can Enhance Your Billing Experience

In today’s fast-paced business world, maintaining efficient financial documentation is crucial. Using personalized billing solutions allows companies to streamline their processes, ensuring they are not only effective but also professional. A tailored approach to financial statements helps businesses reflect their brand identity and meet client expectations more precisely.

When you implement a system that adapts to your specific needs, the overall experience becomes more fluid and less time-consuming. This practice also offers flexibility, allowing you to modify layouts, adjust details, and integrate key information that suits your operational requirements. The goal is to create an effortless billing experience that reduces human error and enhances client satisfaction.

Whether you’re managing a small business or a growing enterprise, adopting such tools can greatly improve the way you handle financial documents. By focusing on personalization, you give yourself more control over invoicing and payments, all while presenting a polished, professional appearance to clients.

Custom Invoice Templates for QuickBooks Online

Tailoring your billing documents to suit your business’s unique needs is an essential step towards streamlining your financial processes. With personalized formats, you can create a seamless experience for both your team and clients, ensuring clarity and professionalism. By adapting these documents, you can highlight crucial details, improve readability, and maintain consistency throughout your operations.

By selecting a solution that integrates with your accounting software, you ensure that every transaction is recorded accurately and efficiently. These adaptable forms allow for changes in structure and design, making it easy to reflect your brand’s personality and meet industry standards. Whether it’s altering the layout or including specific fields, having this level of control can significantly improve how you manage your finances.

Furthermore, the ability to modify these documents can save both time and effort. With features that automate calculations, track payments, and send reminders, you reduce the manual work involved in preparing financial reports. This efficiency enhances your workflow and ensures that your records remain error-free and up to date.

Why Use Custom Invoices for QuickBooks

Personalizing your billing documents offers numerous advantages that go beyond mere aesthetics. By adapting these documents to fit your business’s needs, you can increase efficiency, improve client interactions, and ensure your records are more accurate. A tailored approach allows you to focus on the details that matter most to your company while creating a professional experience for your clients.

Here are some key reasons why personalization is essential:

- Brand Consistency: Personalized forms allow you to incorporate your logo, colors, and other branding elements, making your financial statements align with your business identity.

- Improved Accuracy: Customizing the layout ensures that all necessary information is displayed clearly, reducing the chances of errors or missed details.

- Time Efficiency: Custom documents automate calculations and data entry, helping you save time on manual work and reducing human error.

- Enhanced Client Experience: A tailored approach makes your billing process more professional and easier for clients to understand, fostering positive relationships.

- Flexible Structure: With personalized layouts, you can easily adjust the format to suit specific services, industries, or projects, making your process more versatile.

Implementing these modifications can transform your approach to managing financial documents. It not only improves operational efficiency but also leaves a lasting impression on your clients, helping to establish trust and credibility in your business.

Benefits of Personalizing QuickBooks Invoices

Adapting your billing documents to better fit the unique needs of your business can bring significant improvements in both functionality and appearance. By personalizing these documents, you gain greater control over the content, layout, and structure, allowing for a more efficient workflow. Additionally, this tailored approach enhances the overall professionalism of your financial communications, creating a more polished experience for clients and customers alike.

Here are the key advantages of personalizing your billing system:

- Brand Identity: Personalization helps reinforce your brand’s image by incorporating logos, colors, and fonts that reflect your company’s style. This creates a consistent visual identity across all client-facing documents.

- Improved Clarity: When you have the freedom to adjust the design and structure, you can ensure that all relevant information is clearly presented, reducing confusion and helping clients understand the details of each transaction more easily.

- Increased Efficiency: Customizing fields and layouts allows you to automate certain functions, like calculations and payment tracking, which can save time and minimize human error during the invoicing process.

- Better Client Relationships: A personalized approach shows attention to detail and professionalism, helping to build trust and improve the customer experience. A well-crafted document can enhance your reputation and strengthen business relationships.

- Scalability: As your business grows, the ability to adjust billing documents to accommodate new services, client needs, or regulatory requirements ensures your process remains flexible and adaptable.

Personalization empowers you to create an invoicing system that not only meets your operational requirements but also delivers a superior experience for both you and your clients, ultimately improving your business efficiency and client satisfaction.

How to Create Custom Invoice Templates

Designing personalized billing documents can greatly improve how you manage financial transactions. By adjusting the layout, fields, and structure, you can ensure that each statement aligns with your business’s needs and enhances client communication. Creating these documents is a simple yet effective process that allows you to integrate specific details, automate tasks, and present a polished, professional appearance every time.

To create these personalized forms, follow these essential steps:

- Access Your Software: Begin by logging into your accounting software and navigating to the section where you manage billing or documents. Most platforms provide an easy-to-use interface for designing and editing your financial forms.

- Choose a Base Layout: Start with a default layout that fits your general requirements. This can be a simple design that you can modify to suit your needs. Many platforms offer templates with common elements already in place.

- Modify Fields: Adjust the fields to include all the necessary information specific to your business. You might want to add fields such as payment terms, purchase order numbers, or specific service descriptions.

- Design the Layout: Customize the overall structure of the document. Consider your brand’s aesthetic and adjust colors, fonts, and logos to match your company’s style.

- Include Automated Features: Add features like automatic date generation, total calculations, and tax rates to save time and reduce errors during the billing process.

- Preview and Test: Before finalizing, preview the document to ensure that all elements appear correctly. Test the functionality of automated features, like payment reminders or calculation fields, to ensure they work smoothly.

- Save and Apply: Once you’re satisfied with the design, save your new layout and apply it to future transactions. You can easily use it as a template for all your billing needs moving forward.

By following these steps, you can create a personalized billing document that meets your exact needs, streamlines your workflow, and presents a professional image to your clients.

Design Tips for QuickBooks Invoices

Creating well-designed financial documents not only improves their clarity but also reinforces your business’s professionalism. A thoughtfully structured document can enhance client experience, reduce confusion, and ensure all critical information is easily accessible. Below are several design tips to help you create effective billing statements that align with your brand and simplify your financial management process.

Key Elements to Include

- Company Logo and Branding: Make your financial documents consistent with your company’s visual identity by including your logo, color scheme, and fonts. This adds a professional touch and reinforces your brand in every transaction.

- Clear Contact Information: Ensure that your business’s contact details–such as address, phone number, and email–are easy to find. This makes it simple for clients to get in touch if they have questions or need further information.

- Payment Terms and Due Date: Highlight key payment details, including due dates, payment methods, and any late fees. This helps clients stay on track with their payments and reduces the likelihood of misunderstandings.

- Itemized Breakdown: Clearly list the products or services provided, along with prices, quantities, and taxes. An organized, itemized list ensures transparency and minimizes confusion about the charges.

Design Layout Considerations

- Simplicity is Key: Keep the design clean and uncluttered. Use sufficient white space to separate different sections, making the document easier to read and understand at a glance.

- Font Size and Style: Choose easy-to-read fonts and sizes. Avoid overly decorative fonts that may be difficult to read, especially for important information like totals or payment instructions.

- Consistent Alignment: Ensure all text is aligned properly. Aligning text, numbers, and totals in a consistent manner makes the document look polished and ensures the reader can quickly find the information they need.

- Use of Color: Use colors sparingly to highlight important information such as totals or due dates. Too many colors can distract from the main content, so it’s best to stick to your brand’s primary colors.

By following these design tips, you can create billing documents that are not only functional but also visually appealing. A well-designed statement can help maintain professionalism, streamline payment processes, and leave a positive impression on your clients.

Streamlining Billing with Custom Templates

Optimizing your billing process is key to improving efficiency and ensuring that your business runs smoothly. By simplifying the way you prepare and send financial documents, you can reduce manual work, minimize errors, and save valuable time. Tailoring your billing formats to meet your specific needs allows you to automate many aspects of the process, making it faster and more reliable.

Automating Key Features

One of the main advantages of using tailored documents is the ability to automate calculations and repetitive tasks. With automated fields, such as totals, tax rates, and payment reminders, you can eliminate the risk of manual errors and speed up the invoicing process. This also reduces the chances of missing crucial information, ensuring that your clients receive accurate and timely statements every time.

- Automatic Calculations: Set up automatic calculations for totals, taxes, and discounts to eliminate manual entry.

- Payment Tracking: Include fields that track payment status, reducing the need for follow-up and ensuring you always know when payments are due.

- Recurring Billing: For ongoing services, set up recurring billing cycles to automatically generate and send statements at regular intervals.

Improved Client Communication

Personalizing your billing documents doesn’t just streamline internal processes; it also enhances your communication with clients. Clear, easy-to-understand documents with all relevant details help avoid confusion and disputes. With consistent, professional-looking statements, you build trust and demonstrate that you are organized and reliable.

- Clarity and Transparency: Tailoring documents ensures that all necessary information is clearly presented, from itemized lists to payment terms.

- Professional Appearance: Customizing the design to match your brand’s visual identity makes your business look more polished and trustworthy.

- Timely Reminders: Including payment due dates and terms directly in the document helps clients stay on track with their obligations.

By streamlining the billing process with personalized solutions, you can reduce time spent on administrative tasks, minimize human error, and enhance the overall client experience. This efficiency not only boosts your productivity but also strengthens your relationships with clients, contributing to long-term business success.

Enhancing Client Communication with Invoices

Effective communication is crucial when managing financial transactions with clients. Well-structured documents that are clear, precise, and professional not only make it easier for your clients to understand the details but also help build a trusting relationship. By improving the way you present billing information, you can foster better engagement, minimize misunderstandings, and streamline your payment processes.

Key Information to Include

To ensure that your clients have all the necessary details at their fingertips, it’s important to include the following elements in your documents:

| Information | Importance |

|---|---|

| Business Details | Make sure your contact information is clearly visible so clients can reach you easily with questions or issues. |

| Payment Terms | Clearly outline due dates, late fees, and any other payment conditions to avoid confusion. |

| Itemized Breakdown | Provide a detailed list of products or services, their costs, and any applicable taxes to enhance transparency. |

| Payment Instructions | Ensure that your clients know how to make payments, whether it’s through bank transfer, card payment, or other methods. |

Building Stronger Relationships

A clear and consistent approach to financial communication can significantly enhance your client relationships. When clients can easily review and understand their bills, they feel more confident in your professionalism and are less likely to dispute charges. Additionally, by offering a polished, branded document, you are presenting your business in the best light possible, reinforcing trust and reliability.

Including thoughtful touches, such as personalized messages or reminders, further humanizes the interaction and shows clients that you value their business. This proactive approach can improve satisfaction, leading to faster payments and long-term partnerships.

How Custom Invoices Improve Brand Identity

Presenting a cohesive and professional image is essential to building a strong brand. One of the most impactful ways to reinforce your business identity is through the documents you send to clients. By personalizing financial statements, you ensure that every communication is aligned with your company’s values, style, and messaging. This subtle yet effective branding can enhance recognition, build trust, and make your business stand out in a competitive marketplace.

Here are several ways personalized billing documents help strengthen your brand identity:

- Consistent Visual Identity: Incorporating your company logo, color scheme, and fonts into every financial statement creates a unified look across all touchpoints with clients. This consistency helps clients easily recognize your business and reinforces your visual identity.

- Professional Appearance: A well-designed document adds an element of professionalism that can elevate your reputation. Clients are more likely to perceive your business as reliable and established when your communications appear polished and thoughtful.

- Brand Message Reinforcement: Personalized statements provide an opportunity to reinforce your business’s values or mission. Whether it’s a friendly note thanking the client or a reminder of your company’s commitment to quality, every detail can reinforce your brand’s message.

- Memorable Client Experience: When clients receive documents that reflect your business identity, it creates a more memorable experience. This can lead to stronger client loyalty, as they feel more connected to your brand.

- Brand Recognition: Each time a client views a document, they are reminded of your business. The more often they see your logo and branding, the stronger the recognition and trust you build over time.

By customizing your financial statements, you can ensure that your brand’s message is communicated clearly and consistently. This not only improves the client experience but also helps position your business as a professional and trustworthy entity in the eyes of your customers.

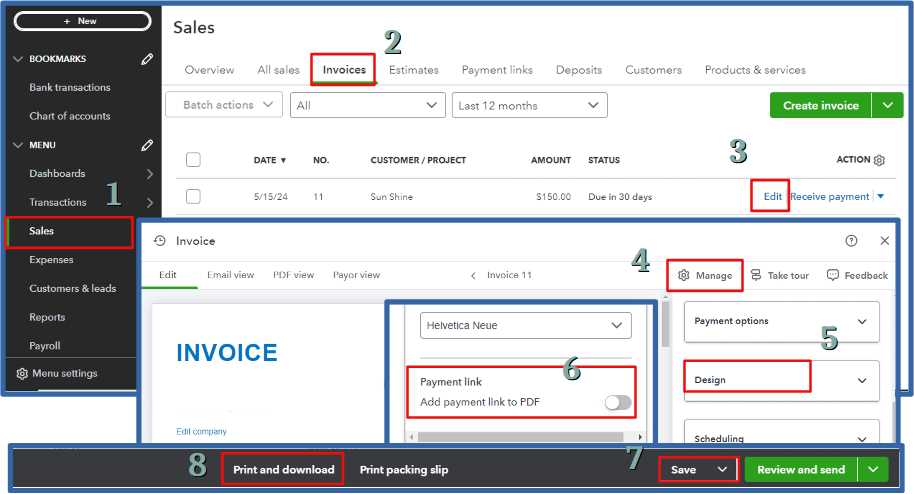

Integrating Custom Templates in QuickBooks

Integrating personalized document layouts into your accounting software can streamline your financial operations and create a more cohesive billing experience. By linking tailored forms to your workflow, you can ensure consistency across all communications and improve efficiency. Once set up, this integration automates several aspects of the billing process, allowing you to focus on more important tasks while maintaining professional, branded financial documents.

Step-by-Step Integration Process

Here’s how you can integrate personalized forms into your accounting system:

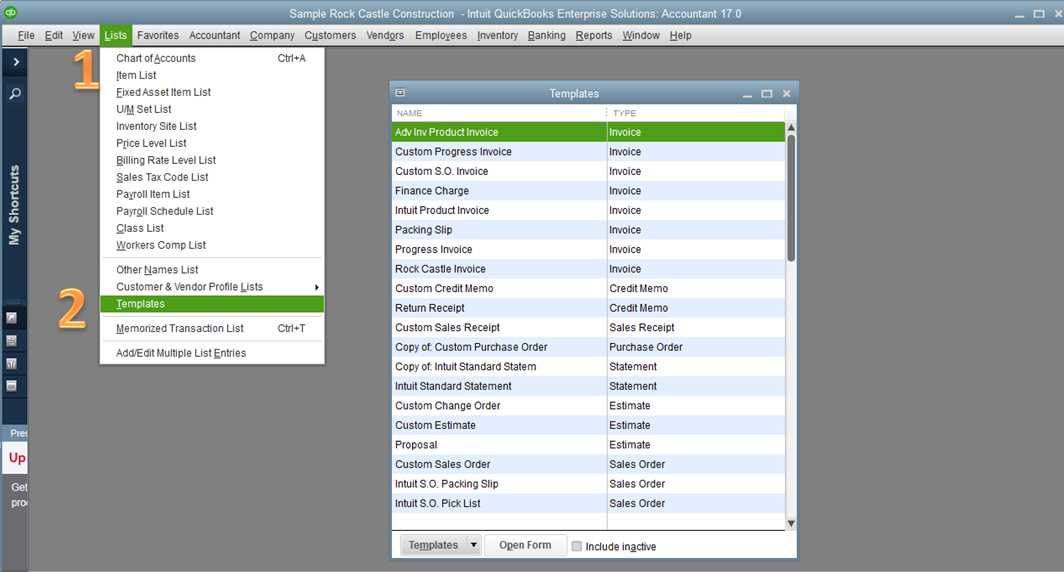

- Access Your Accounting Software: Begin by logging into your accounting system. Navigate to the section that handles financial documents, where you can manage and customize your forms.

- Choose the Layout: Select a base layout that closely matches your needs. This will serve as the foundation for any customizations, making it easier to create a form that fits your specific business requirements.

- Modify the Design: Add or adjust fields such as client information, service details, and payment instructions to match your branding and the nature of your business. Ensure that the layout is user-friendly and visually appealing.

- Save and Apply Changes: Once you’ve made the necessary adjustments, save the new design. Then, apply it to future transactions, ensuring all generated documents reflect your customized layout.

- Test and Review: After applying the new design, test it by generating a few sample documents. Ensure that all fields are displaying correctly, and that automated calculations or payment reminders are functioning as expected.

Benefits of Integration

- Efficiency: Once set up, integrating personalized layouts into your system reduces the time spent manually formatting documents, allowing for faster billing cycles.

- Consistency: Having a unified document design ensures all communications maintain a professional and cohesive look, reinforcing your brand identity across all client interactions.

- Automation: Many features, like tax calculations and payment tracking, can be automated, reducing errors and minimizing the administrative burden.

By integrating personalized forms into your financial management system, you not only create a more streamlined process but also present a more professional image to your clients. The seamless flow between document creation and invoicing improves both internal efficiency and client satisfaction.

Common Mistakes When Customizing Invoices

While personalizing your financial documents can bring significant benefits, it’s easy to make mistakes during the design process that can undermine their effectiveness. Inaccurate or unclear layouts can confuse clients, lead to errors, or damage your business’s professional image. Recognizing and avoiding common mistakes will ensure that your documents not only look great but also function correctly and efficiently.

Here are some of the most frequent errors to avoid when tailoring your billing forms:

- Overcrowding the Layout: Trying to fit too much information into a single document can make it look cluttered and difficult to read. It’s important to balance detail with simplicity, ensuring that key information stands out and that the document is easy for clients to navigate.

- Neglecting Legal and Tax Requirements: Failing to include the necessary legal disclaimers, tax information, or other regulatory details can result in compliance issues. Always ensure that your documents reflect the latest legal requirements and include all mandatory fields like tax rates or registration numbers.

- Inconsistent Branding: A disjointed design that doesn’t match your company’s visual identity can confuse clients and diminish the perceived professionalism of your business. Consistency in logos, colors, and fonts is key to creating a cohesive and recognizable brand image.

- Complex Payment Instructions: If the payment instructions are too complicated or unclear, it can lead to delays or mistakes. Ensure that the payment process is simple to understand and includes all the necessary details, such as accepted methods and due dates, in a concise manner.

- Ignoring Mobile View: Many clients may view your documents on mobile devices. A design that works well on a desktop may look chaotic or hard to read on a smaller screen. Always test your layout on multiple devices to ensure it’s responsive and user-friendly.

- Missing Key Client Information: Forgetting to include crucial client details–like their contact information, project number, or account number–can delay payment and cause confusion. Always double-check that all necessary fields are properly populated before sending documents.

By avoiding these common pitfalls, you can create billing documents that are not only visually appealing but also clear, professional, and functional. Careful planning and attention to detail will ensure that your forms effectively support your business operations and foster positive relationships with clients.

Top Features to Include in Your Template

When designing your billing documents, it’s important to focus on the key features that make the process easier for both you and your clients. The right elements can improve clarity, ensure accuracy, and streamline the payment process. By including essential information in a well-organized format, you can enhance the overall client experience while keeping your business operations efficient.

Essential Elements for a Well-Designed Document

Here are the top features that should be incorporated into any financial form to make it clear, professional, and easy to use:

| Feature | Why It’s Important |

|---|---|

| Business Information | Clear contact details, including business name, address, and phone number, help clients reach you if they have any questions or concerns. |

| Client Information | Including the client’s name, address, and other relevant details ensures accuracy and reduces the likelihood of errors during communication or payment. |

| Unique Identifier | A reference number, project ID, or other unique identifier helps both you and your client keep track of transactions and makes it easier to manage records. |

| Itemized List | Clearly displaying the goods or services provided, along with their quantities, prices, and any taxes, makes it easier for clients to understand what they’re being charged for. |

| Payment Terms | Including due dates, accepted payment methods, and any late fees or discounts gives clients the necessary details to process payments on time. |

| Due Date | Clearly stating the payment due date ensures clients are aware of deadlines, which helps avoid delays and payment issues. |

Additional Features to Enhance Usability

- Payment Reminders: Adding a gentle reminder about the due date or available discounts encourages timely payments and strengthens client relations.

- Banking Information: Including bank details or payment platform instructions makes it easier for clients to complete transactions.

- Terms and Conditions: Providing a brief section outlining your business’s policies ensures that both parties are clear on expectations.

- Personalized Notes: Adding a thank-you note or personalized message shows clients that you value their business and helps to foster long-term relationships.

Incorporating these features into your financial documents not only makes them more functional but also helps to create a professional image and improve the overall experience for your clients. A well-structured document with all the necessary information can reduce confusion, speed up payments, and contribute to smoother business operations.

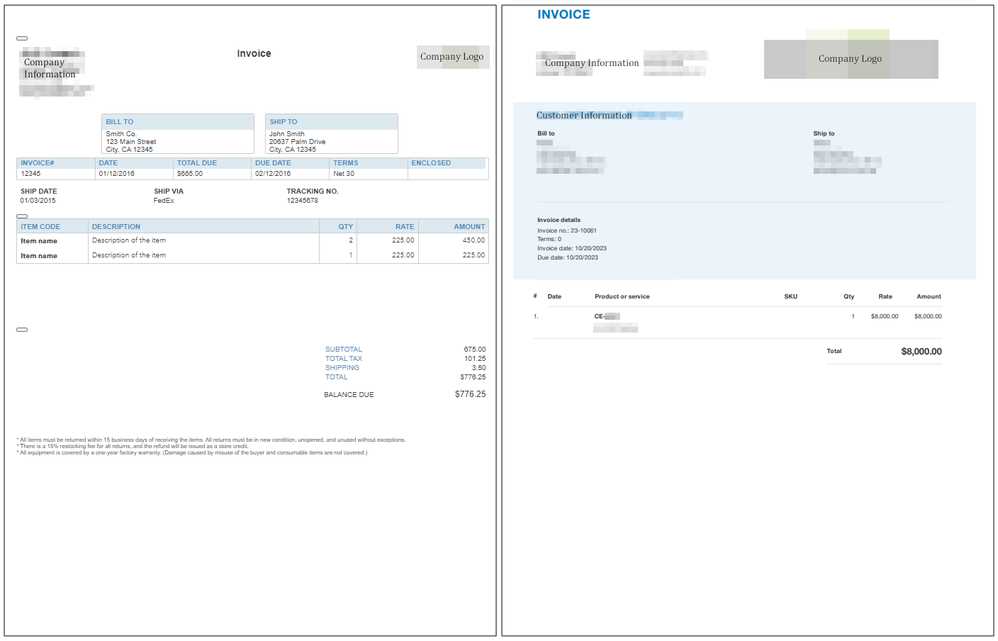

Customizing Invoice Layouts for Different Industries

Each industry has unique requirements when it comes to financial documentation. Whether it’s the level of detail needed or the specific information clients expect, understanding these nuances is crucial for creating effective and professional documents. Tailoring your billing layouts to reflect the needs of your industry ensures that you provide the right information in a format that’s easy for clients to understand and process. This approach not only improves your workflow but also helps build trust with your clients by meeting their expectations.

Industry-Specific Layouts

Different industries often have distinct preferences and standards when it comes to financial documents. Below are examples of how certain industries may benefit from specific design choices:

| Industry | Layout Considerations |

|---|---|

| Retail | In the retail sector, invoices often require clear itemized lists with product names, quantities, unit prices, and total cost. A simple, clean design that emphasizes the items purchased and the total amount due is essential. |

| Freelancing & Consulting | For freelancers and consultants, it’s important to include detailed descriptions of services, hourly rates, and the amount of time spent on each task. A professional layout that highlights the scope of work and payment terms is key to building credibility. |

| Construction | Construction businesses often need to show a breakdown of labor, materials, and other project-related costs. Including project details, such as the address, job number, and completion status, helps clarify the billing process. |

| Healthcare | In healthcare, invoices should clearly separate services from insurance billing and patient payments. A layout that categorizes medical services, codes, and applicable insurance details helps patients and providers understand the charges. |

| Software Development | For software development companies, invoices often need to itemize different stages of a project, such as design, development, and testing phases. Including milestones, project timelines, and payment schedules ensures clarity. |

Benefits of Industry-Specific Layouts

- Improved Clarity: Tailoring your documents to suit industry needs ensures that clients can easily understand the charges and what they are paying for, reducing confusion and disputes.

- Enh

How Custom Templates Save Time and Money

Designing streamlined, consistent billing documents that align with your business needs can lead to significant time and cost savings. When you standardize your forms, you minimize the risk of errors, reduce the need for manual adjustments, and speed up the invoicing process. This not only improves operational efficiency but also helps maintain healthy cash flow by accelerating payment cycles.

Time-Saving Benefits

Here’s how personalized financial forms can save valuable time in your business operations:

- Faster Document Generation: With a pre-designed format, you can quickly generate financial documents without having to manually adjust each one. This eliminates the need for repetitive formatting and allows you to send documents in a fraction of the time.

- Automation of Key Fields: By setting up default fields (like client information, payment terms, or tax rates), the system can automatically fill in repetitive details. This reduces the time spent entering the same information on each document.

- Fewer Errors and Revisions: Standardizing your layout and content reduces the chances of making mistakes. With less time spent on revisions, you can focus on other important tasks and avoid costly errors that might arise from inaccurate billing.

Money-Saving Advantages

In addition to saving time, personalized billing documents can directly impact your bottom line:

- Reduced Administrative Costs: With less time spent on document creation and editing, you can allocate resources to other areas of your business, ultimately reducing labor costs associated with billing processes.

- Improved Cash Flow: Faster and more accurate billing leads to quicker payments. Clients receive clear and professional documents that make it easier for them to process payments on time, improving your cash flow.

- Minimized Risk of Disputes: Clear and consistent financial documents help to avoid misunderstandings about what is being billed, reducing the likelihood of disputes that could delay payments and require costly follow-up.

- Better Client Relationships: When your clients receive timely, well-organized documents, they are more likely to perceive your business as professional and trustworthy, which can lead to repeat business and referrals.

By streamlining your financial documentation process with tailored designs, you not only improve efficiency but also save both time and money. The more efficient your billing cycle, the faster you can focus on growing your business, ensuring that your resources are spent in the most impactful areas.

Using QuickBooks Online for Seamless Invoicing

Managing your billing process efficiently is key to running a successful business. Leveraging cloud-based accounting software can streamline and automate many of the tasks involved in creating, sending, and tracking financial documents. With the right platform, you can ensure that your transactions are processed quickly and accurately, saving both time and resources. A fully integrated system can also help maintain organization and prevent costly mistakes, enabling you to focus on growing your business.

Streamlining Billing with Automation

One of the major benefits of using cloud accounting software is the ability to automate key tasks in your billing process:

- Automatic Data Population: The software can automatically pull client details, payment terms, and other relevant information, reducing manual data entry and the potential for errors.

- Recurring Payments: For businesses with repeat customers, automated billing for regular services or subscriptions ensures that payments are processed without having to manually create each document.

- Payment Reminders: You can set up automatic reminders for upcoming or overdue payments, helping you avoid delays and improving cash flow.

Real-Time Tracking and Access

Another significant advantage of using cloud-based software is the ability to access your financial data from anywhere, anytime:

- Instant Access to Documents: With all of your billing information stored securely in the cloud, you can access it instantly from any device, whether you’re at the office or on the go.

- Track Payment Status: You can easily monitor the status of your transactions, seeing which invoices are paid, overdue, or pending. This transparency helps you stay on top of your finances without manual follow-ups.

- Integration with Bank Accounts: Integrating the software with your business’s bank accounts allows for real-time updates on payments and deposits, streamlining your accounting workflow.

By using cloud-based accounting tools, you can eliminate many of the tedious and time-consuming aspects of billing, reduce the risk of errors, and improve the overall efficiency of your financial processes. The ability to automate tasks, track payments, and access documents on the go makes it easier than ever to manage your business’s finances effectively and efficiently.

Tracking Payments with Custom Invoices

Accurate tracking of payments is essential to maintaining healthy cash flow and ensuring that no transactions are overlooked. By designing billing documents that include detailed payment tracking features, you can easily monitor the status of each transaction, reducing the risk of missed payments or misunderstandings with clients. A well-organized approach helps you stay on top of accounts receivable and avoid delays that can impact your business operations.

Key Features for Payment Tracking

To effectively track payments, your financial documents should include key details that make it easy to identify the status of each transaction:

- Unique Reference Numbers: Including a reference number for each transaction helps you and your clients track payments more efficiently, ensuring there’s no confusion between multiple transactions.

- Due Dates: Clearly marking the payment due date allows clients to know when payments are expected, reducing delays and helping you identify overdue payments quickly.

- Payment Status Indicators: Indicating whether a payment is pending, partially paid, or fully paid on the document itself helps both parties stay informed without needing to check external records.

- Transaction History: Providing a record of previous payments and outstanding balances in the document gives clients a complete overview of their financial relationship with your business.

Benefits of Effective Payment Tracking

By incorporating these features, you can enjoy several benefits that directly impact your business operations:

- Improved Cash Flow: With clear payment tracking, you can identify overdue payments faster and take action to follow up, ensuring a steady cash flow.

- Fewer Errors: Having a detailed payment record reduces the chances of mistakes, such as double billing or overlooking partial payments, helping maintain accuracy.

- Enhanced Client Relationships: Providing clients with detailed and transparent billing documents fosters trust and demonstrates professionalism, which can improve client satisfaction and retention.

- Better Financial Reporting: Accurate tracking makes it easier to generate reports on receivables and financial performance, providing valuable insights into your business’s health.

By designing your billing documents to track payments efficiently, you can streamline the payment process, reduce administrative workload, and ensure that you’re always aware of your financial standing. Proper tracking not only helps with day-to-day operations but also contributes to long-term business success by maintaining consistent and reliable cash flow.

Improving Cash Flow with Custom Invoices

Effective management of cash flow is critical to the success of any business. Timely payments are essential for maintaining smooth operations and covering ongoing expenses. By optimizing your financial documents, you can help ensure faster processing, minimize delays, and encourage prompt payments from clients. When these documents are clear, professional, and contain all the necessary details, they provide clients with the information they need to make timely payments, ultimately improving your cash flow.

Key Elements That Improve Cash Flow

There are several key elements you can include in your financial documents that will streamline the billing process and encourage quicker payments:

Feature Impact on Cash Flow Clear Payment Terms Clearly stated payment due dates and terms (such as “Net 30” or “Due upon receipt”) ensure that clients know when payments are expected, reducing delays. Accurate Breakdown of Charges Providing a detailed list of services or products helps clients understand exactly what they are paying for, reducing confusion and increasing the likelihood of timely payments. Multiple Payment Options Offering various methods of payment (credit card, bank transfer, online payment portals) makes it easier for clients to pay quickly, reducing barriers to payment. Early Payment Discounts Including incentives, such as a small discount for early payment, can motivate clients to settle their accounts sooner, improving cash flow. Why Faster Payments Matter

Implementing these features can have a significant impact on your business’s financial health:

- Enhanced Liquidity: When payments are received on time, you can cover your operating costs without delays, which helps you invest in growth and reduce financial stress.

- Reduced Administrative Costs: Fewer follow-ups and reminders for overdue payments mean less time spent on administrative tasks, freeing up resources for other areas of the business.

- Improved Relationships with Clients: Clear and professional financial documents build trust, ensuring your clients have confidence in the billing process, which can lead to repeat business and referrals.

- Better Forecasting and Budgeting: Timely payments make it easier to predict future revenue, allowing you to make more informed decisions abou