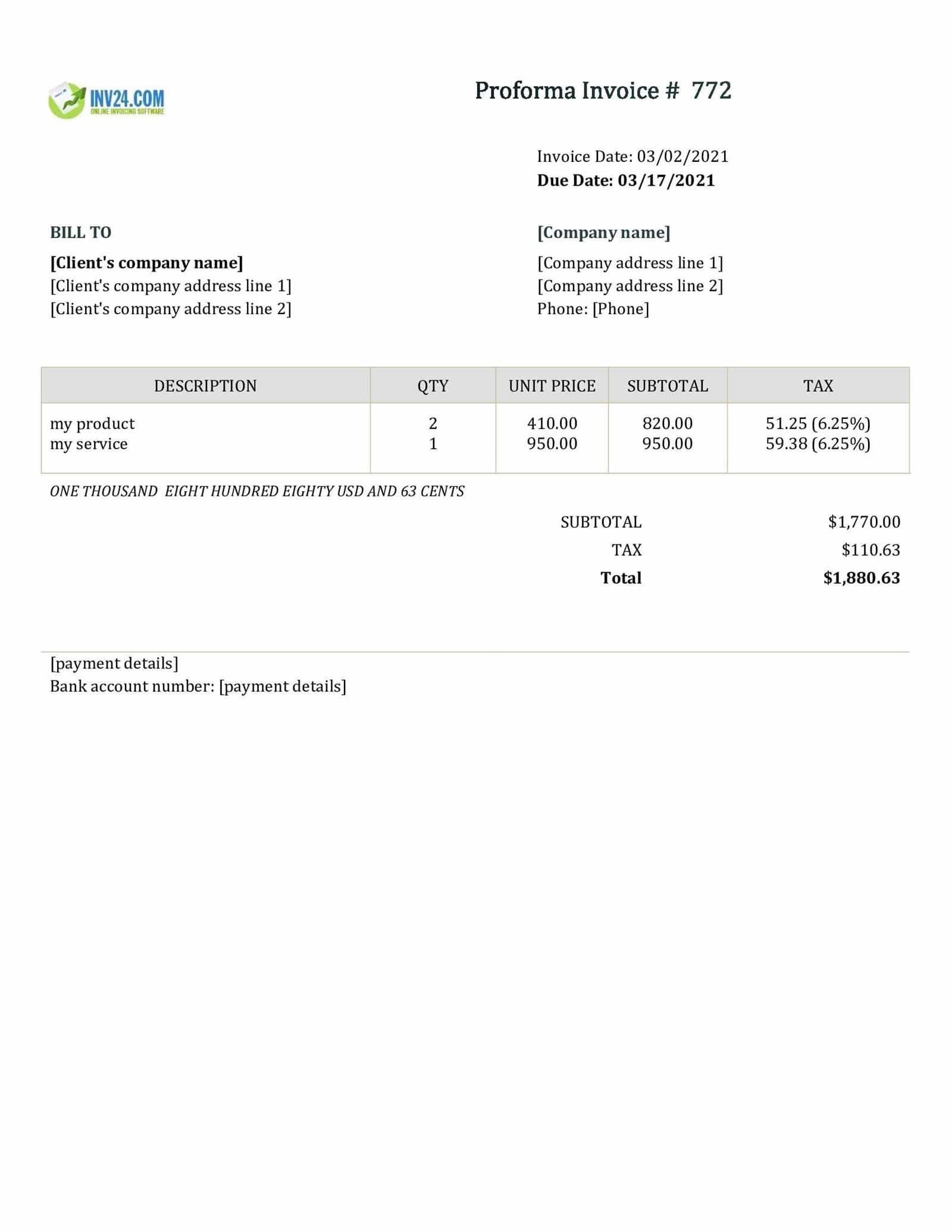

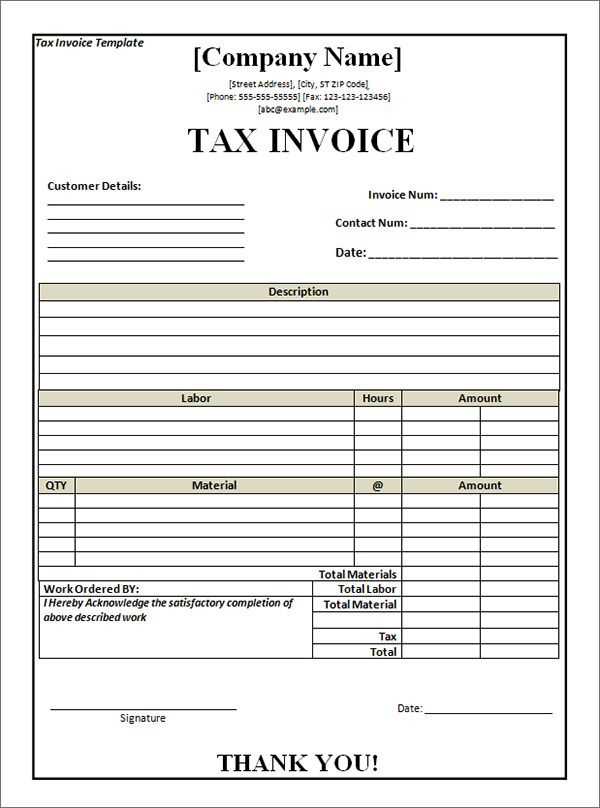

Invoice Sample Template for Creating Professional Billing Documents

Efficient billing is a crucial aspect of any business, ensuring smooth financial transactions and clear communication with clients. A well-structured document for requesting payment helps maintain professionalism and reduces the chances of misunderstandings. Whether you’re a freelancer, a small business owner, or part of a larger enterprise, having a reliable way to generate these important papers is essential.

By using pre-designed documents, you can save time and effort, focusing more on your core business activities while ensuring that all necessary details are included. These documents are highly customizable, allowing you to adjust fields according to your specific needs, ensuring accuracy and clarity. From adding personal branding to setting payment terms, the flexibility of these tools enables businesses to maintain a professional image while streamlining their financial processes.

Understanding Invoice Sample Templates

When managing payments and requests for compensation, having a well-organized and structured document is essential. These documents not only help businesses ensure proper communication but also play a key role in maintaining professionalism with clients and partners. A well-prepared form can streamline the billing process, reduce errors, and save valuable time.

In this section, we will explore the fundamentals of creating effective billing documents, focusing on the critical elements that should be included. The right document structure helps avoid confusion and ensures that all relevant information is captured, making the entire process smoother for both the sender and the recipient.

Key Features of an Effective Document

- Clear Identification: Always include essential details such as your business name and contact information.

- Precise Details: Include a breakdown of services or products provided with quantities, rates, and total amounts.

- Terms and Conditions: State any payment deadlines, late fees, or other specific terms.

- Flexible Layout: Customizable fields allow for the inclusion of discounts, taxes, or specific pricing formats.

Benefits of Pre-Structured Documents

- Time-Saving: Quickly create a professional document without the need to start from scratch each time.

- Accuracy: Pre-defined sections help minimize the risk of missing critical information.

- Professional Appearance: A consistent format ensures that your documents look polished and trustworthy to clients.

Why Use an Invoice Template

Creating well-organized billing documents is vital for businesses of all sizes. A structured approach to documenting transactions ensures that both parties have clear records and helps prevent misunderstandings. Using a pre-made document format offers numerous advantages, from efficiency to professionalism, making the process quicker and more consistent for everyone involved.

By utilizing a pre-designed structure, businesses can ensure that their billing practices are both streamlined and compliant. These forms are designed to cover all necessary details and can be easily customized to fit different business needs, saving time and reducing the risk of errors. With an easy-to-use layout, there’s no need to worry about missing important information or formatting inconsistencies.

Efficiency and Time Savings

One of the key benefits of using a pre-structured document is the time it saves. Rather than starting from scratch each time, you can quickly fill in the necessary details, allowing you to focus on other essential tasks.

Ensuring Accuracy and Consistency

Consistency is crucial in financial documentation. Using a pre-defined format helps ensure that all key elements are included in every document, reducing the chance of missing critical information.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Quickly generate professional documents without creating new formats each time. |

| Accuracy | Minimize the chances of omitting important details such as payment terms or product breakdown. |

| Professionalism | Ensure a polished, consistent appearance that reflects well on your business. |

Benefits of Customizable Invoice Samples

Having the ability to personalize billing documents offers significant advantages for businesses. A customizable approach allows for flexibility in meeting specific needs, ensuring that each document aligns with the unique requirements of both the business and the client. By adapting forms, businesses can maintain a consistent, professional image while accommodating various transaction types and client preferences.

Customizable documents not only make the billing process more efficient but also provide an opportunity to showcase your brand and streamline communication. With adjustable fields, logos, and layouts, these forms can be tailored to enhance the overall user experience, making transactions smoother and quicker for both parties.

Tailoring to Specific Business Needs

Customization enables you to adjust the layout and content based on your business type. Whether you’re a service provider or a product-based company, personalized fields allow you to highlight the most relevant details for each transaction.

Enhancing Brand Identity

With customizable options, businesses can incorporate their logos, color schemes, and font styles into every document. This consistency helps reinforce the brand’s image and ensures that every client interaction is on-brand and professional.

- Personalization: Customize the appearance and fields to match your company’s needs.

- Branding: Include logos, colors, and fonts to reinforce your business identity.

- Adaptability: Quickly adjust for different types of clients and services.

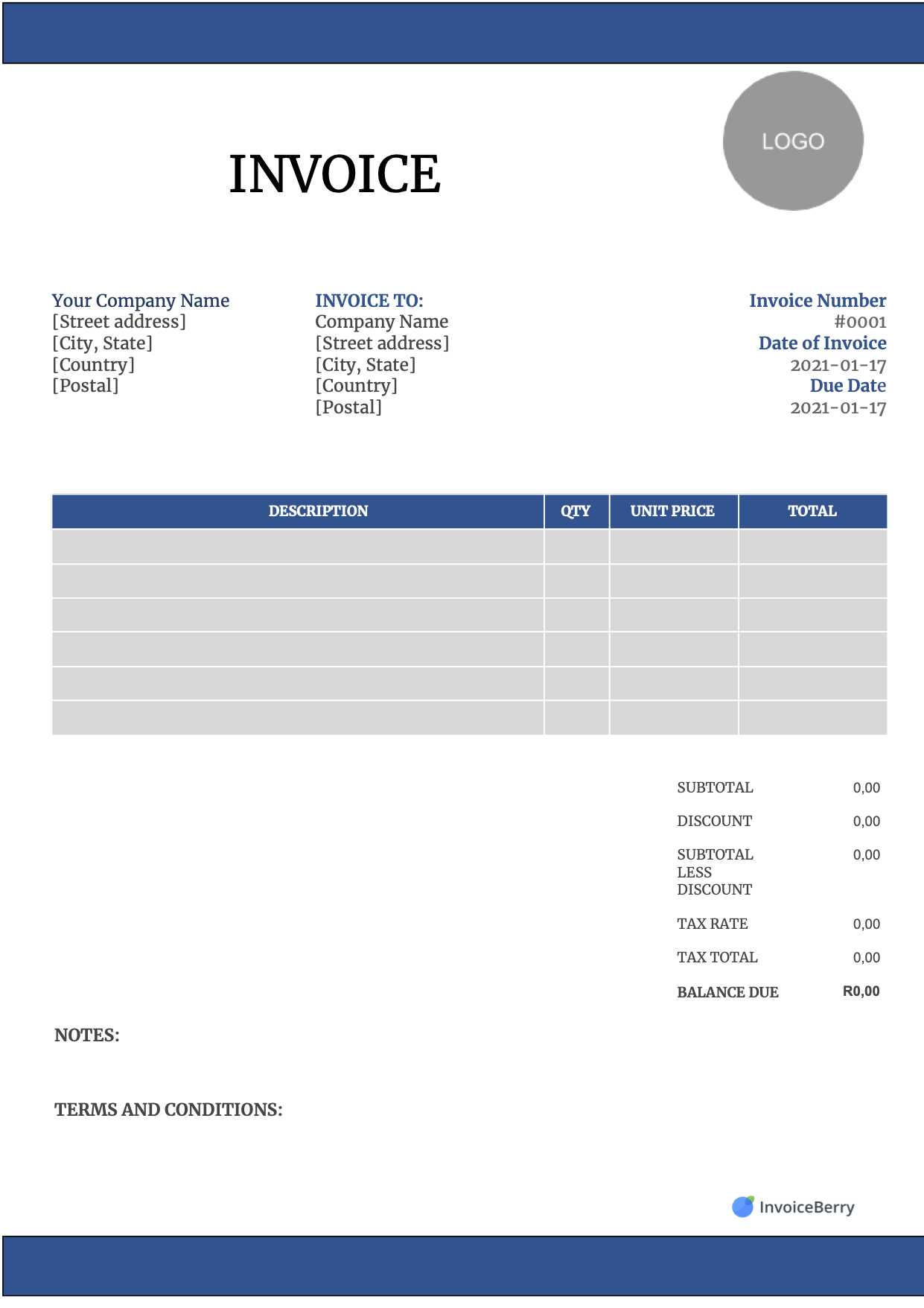

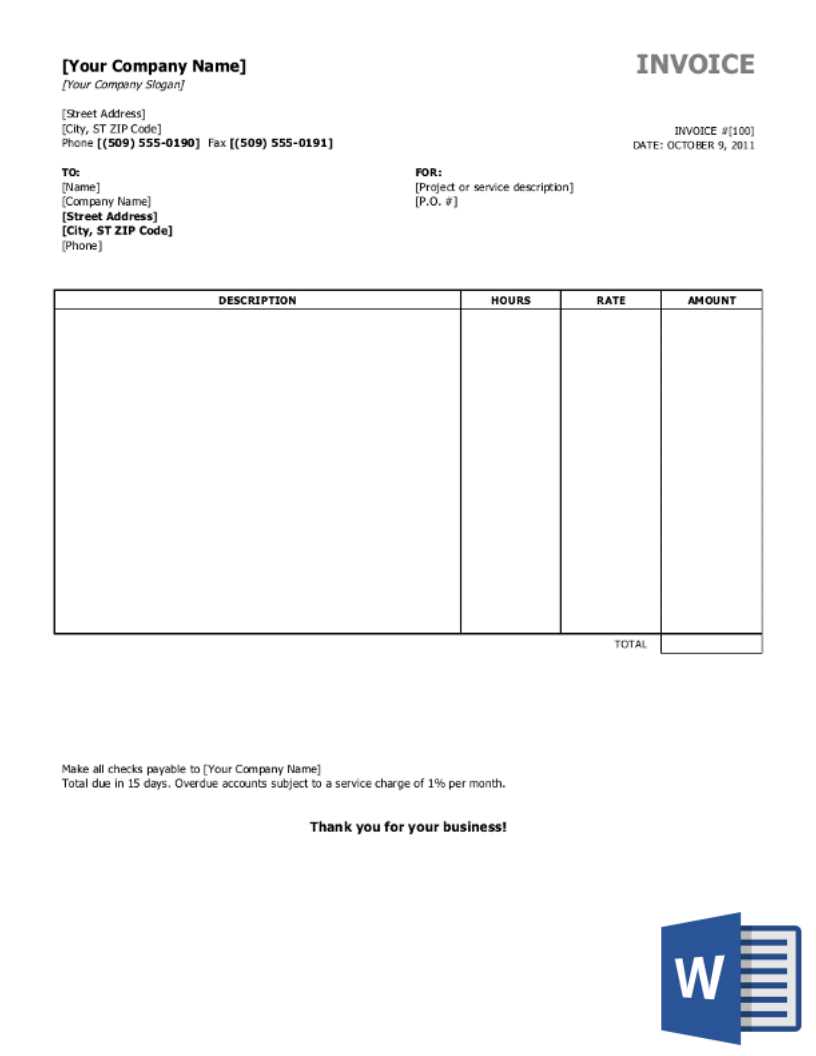

How to Choose the Right Template

Selecting the right format for your billing documents is crucial for ensuring clarity and professionalism. The ideal structure should reflect the nature of your business, provide all necessary information, and be easy to customize. By choosing a well-designed format, you can create documents that streamline the payment process and leave a positive impression on your clients.

When choosing a format, it’s important to consider several factors. These include the complexity of your services or products, the type of clients you work with, and the overall branding of your business. Below are some key points to guide you in selecting the best option for your needs.

Factors to Consider When Selecting a Format

- Business Type: Consider whether you are providing goods, services, or both. Some structures are better suited for product-based businesses, while others work best for service-oriented companies.

- Client Expectations: Think about the level of detail your clients may need. Some clients prefer a simple, clean layout, while others may require more detailed breakdowns.

- Customization Options: Ensure the format can be easily customized to include your business branding, payment terms, and other relevant details.

- Ease of Use: Choose a design that is user-friendly and quick to fill out, allowing you to send documents promptly.

Types of Formats to Consider

- Simple Format: Best for small businesses with straightforward transactions, focusing on key details like item description, price, and total amount.

- Detailed Format: Ideal for service providers or businesses with complex billing needs, including additional sections for hours worked, labor rates, and detailed costs.

- Branded Format: Perfect for businesses that want to include their logo, color scheme, and other branding elements to create a more professional appearance.

Key Components of an Invoice

For any business transaction, a well-structured document that outlines the exchange is essential for ensuring clarity and transparency. To achieve this, there are several critical elements that must be included. These components serve as the foundation for accurate records and help both the sender and receiver to stay aligned on the terms of the transaction.

Each section of the document should provide clear and precise details about the products or services provided, the payment terms, and the expectations from both parties. Below are the key sections that every professional billing document should include to maintain organization and professionalism.

Essential Sections of a Billing Document

| Component | Description |

|---|---|

| Business Information | Includes your company name, contact details, and business registration information, ensuring the recipient knows who is requesting payment. |

| Client Information | Lists the name, address, and contact details of the recipient, making it clear who the payment is directed to. |

| Transaction Date | Specifies the date when the document is issued and often includes a due date for payment. |

| Itemized List | Details the products or services provided, including descriptions, quantities, and individual prices for each item or service rendered. |

| Total Amount Due | Summarizes the total cost for the items or services, including any applicable taxes, discounts, or additional fees. |

| Payment Terms | Defines the payment conditions, such as the due date, acceptable payment methods, and any late fees or penalties. |

Additional Helpful Sections

- Purchase Order Number: Useful for businesses that deal with large clients or complex transactions, allowing for easy t

Invoice Formatting Tips for Clarity

Clear and organized presentation is crucial when creating billing documents. Proper formatting ensures that all relevant details are easy to read and understand, minimizing the chances of confusion or errors. When clients can quickly find the information they need, it helps maintain professionalism and can even expedite the payment process.

To achieve clarity, consider the following formatting tips that will make your documents more accessible and visually appealing. These adjustments can simplify the review process for clients and improve the overall effectiveness of your business communications.

Effective Formatting Tips

- Use Consistent Fonts and Sizes: Stick to one or two fonts and ensure they are easy to read. Choose larger text for headings and smaller, clear text for details.

- Organize Information into Sections: Break the document into well-defined sections such as contact information, services provided, and payment terms to create a logical flow.

- Highlight Key Information: Use bold or underlined text to emphasize critical details like total amounts due, payment due dates, or late fees.

- Leave Adequate White Space: Avoid overcrowding the page. Provide enough spacing between sections and around text to make the document easier to read.

- Use a Clean Layout: Ensure the document is well-aligned and free from clutter. Tables can help organize data such as item descriptions and prices, making the document more structured.

Additional Design Tips

- Align Dates and Numbers: Align all dates to the right and numbers in columns to maintain consistency and make it easier for the reader to scan the document.

- Use Color for Visual Appeal: Subtle use of color can make sections stand out, but avoid overuse to keep the document professional.

- Include

Creating Professional Invoices Quickly

Efficiently generating high-quality billing documents is essential for maintaining smooth business operations. When time is of the essence, it’s important to streamline the process without sacrificing professionalism. By adopting strategies that simplify document creation, businesses can save time while ensuring that each document reflects the quality and attention to detail that clients expect.

There are several approaches that can help you create polished documents quickly. By using pre-made structures, automation tools, and organization techniques, you can speed up the billing process while keeping everything clear and professional.

Using Automation and Software

One of the most effective ways to speed up document creation is by leveraging billing software. Many platforms offer pre-built formats and automatic calculations, allowing you to focus on the unique details of each transaction. With features like saved client information and recurring billing, you can generate documents with just a few clicks.

Streamlining Information Entry

- Pre-fill Client Details: Store your client’s contact information and payment terms in a database to automatically fill in these fields when creating new documents.

- Use Custom Fields: Create custom fields for frequently used items, services, or charges to avoid re-entering the same information each time.

- Batch Process Multiple Documents: If you have several documents to create, process them in batches to avoid switching between tasks and improve efficiency.

Common Mistakes to Avoid in Invoices

Even small errors in billing documents can lead to confusion, delayed payments, or even disputes. To maintain professionalism and ensure timely payments, it is important to avoid common pitfalls in the creation and management of these important documents. Being aware of these mistakes and taking steps to prevent them can save time, reduce misunderstandings, and improve client relationships.

Below are some of the most frequent mistakes made when preparing these documents, along with suggestions on how to avoid them. By paying attention to these details, you can create more accurate and effective documents every time.

Frequent Errors to Watch Out For

Error Consequences How to Avoid Incorrect Contact Information Incorrect billing or client information can delay payment or cause confusion. Double-check all contact details before sending, and ensure they are consistent across documents. Missing or Incorrect Dates Failure to specify accurate dates can lead to missed deadlines or payment delays. Ensure that both the issue and due dates are clearly stated and correctly formatted. Unclear Payment Terms Ambiguous terms can result in misunderstandings about when and how payments should be made. Clearly outline payment deadlines, methods, and penalties for late payments. Omitting Taxes or Fees Failure to include applicable taxes or extra fees can lead to disputes or underpayment. Always include taxes and any additional fees, ensuring they are clearly detailed and calculated. Inconsistent Item Descriptions Vague or inconsistent descriptions can confuse clients and delay payment. Provide clear, consistent, and specific descriptions for every item or service listed. Additional Mistakes to Avoid

- Failure to Include a Unique Reference Number: This can make it difficult for cl

Choosing Between Digital and Printable Templates

When creating billing documents, businesses often face the decision of whether to use digital formats or print their documents for physical delivery. Each method offers unique advantages and challenges, depending on your workflow, the type of business, and client preferences. Understanding the benefits of both options can help you choose the best approach for your needs, ensuring smooth transactions and clear communication.

In this section, we will explore the key factors to consider when deciding between digital and printed documents. By weighing the pros and cons of both, you can make a more informed decision on how to handle your transactions efficiently.

Advantages of Digital Formats

- Faster Delivery: Digital documents can be sent instantly via email or through an online portal, allowing for quick communication with clients.

- Cost-Effective: There are no costs associated with printing, paper, or postage when sending documents electronically.

- Easy to Store and Track: Digital records can be easily organized, stored, and searched, making it simpler to keep track of payments and other financial documents.

- Environmentally Friendly: By reducing the use of paper, digital methods help conserve resources and reduce your environmental impact.

Advantages of Printable Formats

- Physical Paper Trail: Printed documents provide a physical record that some clients may prefer, especially for legal or tax-related reasons.

- Professional Appearance: Some businesses may find that providing a printed document adds a sense of formality and professionalism to their transactions.

- Suitable for Non-Digital Clients: If your clients are not comfortable with digital tools or do not have easy access to technology, printed documents are a better option.

Incorporating Your Branding into Invoices

Integrating your brand identity into financial documents is a powerful way to reinforce your business image and create a cohesive experience for your clients. Whether through logos, color schemes, or specific fonts, incorporating these elements helps convey professionalism and can make your documents easily recognizable. By including your branding in every communication, you reinforce your company’s presence and maintain consistency across all customer interactions.

In this section, we will discuss various strategies for effectively adding branding elements to your financial documents while maintaining clarity and professionalism. These simple adjustments can significantly impact how clients perceive your business.

Key Branding Elements to Include

- Logo: Place your business logo in a prominent location, typically at the top, to establish visual recognition.

- Color Scheme: Use your company’s official colors for headers, borders, or backgrounds to make the document feel aligned with your brand identity.

- Fonts: Choose fonts that match your brand style to ensure consistency with other marketing materials.

- Tagline or Slogan: Including your brand’s tagline can further reinforce your company’s messaging.

Practical Considerations for Branding

Branding Element Benefits Considerations Logo Enhances recognition and establishes a professional identity. Ensure the logo is clear and does not overpower the content of the document. Color Scheme Helps create a visually cohesive and branded experience. Use colors sparingly to avoid making the document appear too busy or difficult to read. Fonts Maintains consistency with other brand materials. Ensure the fonts are legible and appropriate for a business document. Tagline Reinforces your business message and connects with clients. Keep it short and relevant, ensuring it doesn’t distract from key details like pricing and terms. How to Add Taxes and Discounts

When preparing billing documents, it’s crucial to accurately reflect any applicable taxes and discounts to ensure transparency and clarity. Whether you’re adding sales tax, offering a promotional discount, or applying special pricing adjustments, these elements play a significant role in determining the final amount your client owes. By properly calculating and clearly displaying taxes and discounts, you avoid confusion and maintain trust with your customers.

In this section, we will explore how to correctly incorporate both taxes and discounts into your documents. We’ll cover the necessary steps to ensure everything is properly calculated and presented in a way that’s easy to understand.

Adding Taxes to the Total

- Identify the Applicable Tax Rate: Research the current tax rates for your region or industry to ensure compliance with local laws.

- Calculate the Tax: Multiply the subtotal (the total before taxes) by the tax rate. For example, a 10% tax on a $100 subtotal would be $10.

- Display the Tax Clearly: Show the tax amount separately, either as a line item or in a designated area, so the client can see exactly how much tax is being added.

Incorporating Discounts

- Determine the Discount Type: Identify if the discount is a fixed amount or a percentage off the total. A 10% discount on a $100 total would be $10 off.

- Apply the Discount: Deduct the discount from the subtotal or after adding tax, depending on the agreed-upon method with the client.

- Show the Discount Clearly: List the discount as a separate line item so clients understand how it affects the overall total.

Including Payment Terms in Invoice Templates

Clearly defining payment terms is essential for ensuring smooth transactions and minimizing misunderstandings with clients. Payment terms set expectations for when and how clients are expected to pay for goods or services provided. These terms often include payment deadlines, late fees, and accepted methods of payment. By specifying these details in your documents, you ensure that both parties are on the same page regarding payment schedules and conditions.

In this section, we will discuss the importance of including payment terms in your billing documents, as well as key details that should be outlined to avoid confusion and ensure prompt payment.

Payment Term Description Example Due Date Indicates the exact date by which the payment should be made. Payment due by 15th of April. Early Payment Discount Offers a discount for clients who pay before a specific date. 5% discount for payments made within 10 days. Late Fees Specifies the additional charges for payments made after the due date. A $25 late fee for payments not received within 30 days. Accepted Payment Methods Lists the types of payments accepted, such as bank transfers, checks, or credit cards. Payment via bank transfer, credit card, or PayPal accepted. Legal Requirements for Invoice Templates

When creating billing documents, it is essential to ensure that they comply with local laws and regulations. Certain information must be included to meet legal and tax requirements, and failure to do so may result in penalties or delayed payments. Understanding the legal obligations tied to these documents helps businesses maintain proper accounting practices and fosters trust with clients. Proper documentation also ensures that both parties are legally protected in case of disputes.

This section outlines the key legal requirements that should be incorporated when preparing billing documents, ensuring compliance with tax laws and business regulations.

Legal Requirement Description Example Business Information Includes the legal name, address, and contact information of the business providing the goods or services. Company Name: ABC Corp, Address: 123 Business St, City, Country. Client Information Includes the name and contact information of the client receiving the goods or services. Client: John Doe, Address: 456 Client Rd, City, Country. Tax Identification Number (TIN) The business or freelancer’s tax ID number is often required for legal and tax purposes. Tax ID: 123-456-789. Transaction Date Clearly states the date when the goods were delivered or services provided. Date of Service: March 1, 2024. Unique Document Number Each billing document must have a unique reference number to differentiate it from others. Document No: INV-12345. Payment Terms Details about when the payment is due and any penalties for late payments. Payment due within 30 days from the date of issue. Tax Information For businesses operating in regions with value-added tax (VAT), sales tax, or similar taxes, the t Invoice Templates for Different Business Types

Each business type has unique requirements when it comes to documenting transactions. From freelancers and small businesses to large corporations, the structure and details included in billing documents can vary greatly. Understanding these variations is crucial for selecting or designing an appropriate billing document that meets both legal obligations and operational needs. Customizing the format according to your business’s niche ensures that you maintain professionalism and clarity when engaging with clients.

This section covers the different types of businesses and how their billing documents may differ, from service-based industries to product sales. Each business type has specific requirements for presenting charges, tax rates, and payment terms.

Freelancers and Independent Contractors

Freelancers and independent contractors often require simpler, yet highly personalized, billing documents. These documents should clearly outline the scope of services provided, hourly rates, or project-based fees. Since freelancers typically deal with clients on a one-off basis, it’s essential to specify the work completed, the agreed-upon price, and any deadlines for payment.

Retailers and Product-Based Businesses

Retailers and businesses selling physical products have different documentation needs. Billing documents for these types of businesses often include more detailed descriptions of the products sold, quantities, unit prices, and total amounts due. Additionally, businesses in product sales must account for any applicable sales tax and include shipping or handling fees if relevant.

Free vs Paid Invoice Templates

When creating billing documents, businesses often face the decision of whether to use a free option or invest in a paid solution. Both types of documents offer distinct advantages, but the choice largely depends on the specific needs of the business, the level of customization required, and the overall user experience. Free options can be a great starting point for small or new businesses, but paid solutions often provide added features and greater flexibility, especially for companies with more complex requirements.

Understanding the differences between these two options is key to selecting the best solution for your business. While free options might suffice for basic transactions, paid solutions may offer advanced functionalities such as automated calculations, recurring billing, and customer management features, which can save time and reduce human error.

How to Edit and Personalize Templates

Customizing billing documents allows businesses to create a professional and cohesive brand experience for their clients. Personalizing these documents can enhance clarity, reinforce brand identity, and ensure that all necessary details are included. Editing these files is not only about changing text; it also involves adjusting the layout, adding logos, and adapting content to reflect the specific needs of each transaction.

There are several ways to personalize and edit billing documents, ranging from basic adjustments like adding your company logo to more advanced changes such as modifying the structure and including additional fields. Here’s how you can make these changes effectively:

Basic Personalization Steps

- Insert your company logo at the top of the document to establish brand recognition.

- Customize the contact information, such as business name, address, phone number, and email.

- Add payment instructions or terms to ensure clarity about due dates and methods.

Advanced Editing Options

- Modify layout and design elements to align with your company’s visual identity, such as color schemes and fonts.

- Incorporate custom fields for specific services, products, or fees that are unique to your business operations.

- Automate recurring charges or discounts for clients on subscription-based services.

Using Invoice Templates for Faster Payments

Efficient and clear billing can significantly speed up the payment process. By utilizing pre-designed formats, businesses can ensure that all essential information is provided in a consistent and professional manner, reducing the chances of errors or misunderstandings. Well-structured billing documents not only present a polished image but also make it easier for clients to process payments promptly.

Using a structured format for creating billing documents can streamline the process for both businesses and clients. When clients easily understand the charges, payment terms, and due dates, they are more likely to settle bills quickly. Moreover, certain features like automated calculations, clear payment instructions, and multiple payment options can further accelerate the payment timeline.

Here’s a simple breakdown of how using an efficient format can help speed up payment collection:

Feature Benefit Clear Payment Terms Reduces confusion and clarifies when payments are due, ensuring timely settlements. Detailed Breakdown of Charges Helps clients understand the costs, preventing delays caused by questioning charges. Multiple Payment Methods Provides clients with various options, making it easier for them to pay quickly. Automated Calculations Reduces errors and speeds up the generation process, improving efficiency. Best Software for Invoice Template Management

Managing billing documents efficiently is crucial for businesses of all sizes. The right software can help streamline the creation, organization, and tracking of financial documents, reducing errors and saving time. Using specialized tools, businesses can easily customize their documents, track outstanding payments, and maintain a professional appearance across all client communications.

There are several software solutions available, each offering a range of features to simplify the management of financial documents. Some tools are designed for businesses that need advanced customization, while others focus on ease of use and quick document generation. Below are some of the top software options for managing and creating financial records.

Top Software Options

- FreshBooks: Ideal for small businesses and freelancers, this software offers simple tools for creating and sending professional documents. It also includes features for tracking payments and managing client accounts.

- QuickBooks: Known for its robust accounting features, QuickBooks also offers efficient tools for creating, managing, and organizing billing documents. It integrates seamlessly with other financial management features like payroll and tax reports.

- Zoho Invoice: Zoho Invoice is a cloud-based solution that enables businesses to easily create and send invoices. It allows for extensive customization, including adding branding elements, and automates payment reminders.

- Wave: This free software is perfect for freelancers and small businesses. Wave offers intuitive document creation tools and basic accounting features, making it a solid choice for straightforward billing needs.

Choosing the right software depends on your business needs. Whether you’re looking for advanced features or something simple, there’s a solution out there that can help you manage your billing processes more effectively and reduce administrative overhead.