AI Invoice Template for Quick and Easy Billing

Managing financial transactions efficiently is crucial for businesses of all sizes. Automation has revolutionized the way companies handle their accounting tasks, offering tools that simplify and accelerate the process. One such innovation is the use of artificial intelligence in generating and managing financial documents.

AI-powered solutions provide businesses with the ability to create professional, accurate, and customized financial records with minimal effort. By utilizing intelligent software, companies can automate repetitive tasks, ensuring faster processing and reducing the potential for errors. This technology not only saves time but also enhances the overall efficiency of financial operations.

As businesses increasingly embrace smart technologies, understanding the full potential of these automated tools becomes essential. From small startups to large enterprises, AI-driven systems offer valuable benefits that help streamline complex tasks and improve overall productivity in billing and financial management.

AI Solutions for Businesses’ Billing Needs

In today’s fast-paced business world, managing financial documentation efficiently is essential for maintaining smooth operations. With the advent of intelligent technologies, companies now have access to tools that streamline the process of creating, sending, and tracking payments. These AI-driven solutions are designed to simplify complex tasks and reduce manual effort, offering customizable options that align with each business’s unique requirements.

Automation of Financial Documentation

AI-powered systems enable businesses to automatically generate financial records, tailored to the specific needs of each transaction. By reducing human intervention, companies can minimize errors, enhance accuracy, and improve turnaround times. This level of automation not only saves valuable time but also ensures consistency across all documentation, making the entire billing process more reliable.

Enhanced Efficiency and Customization

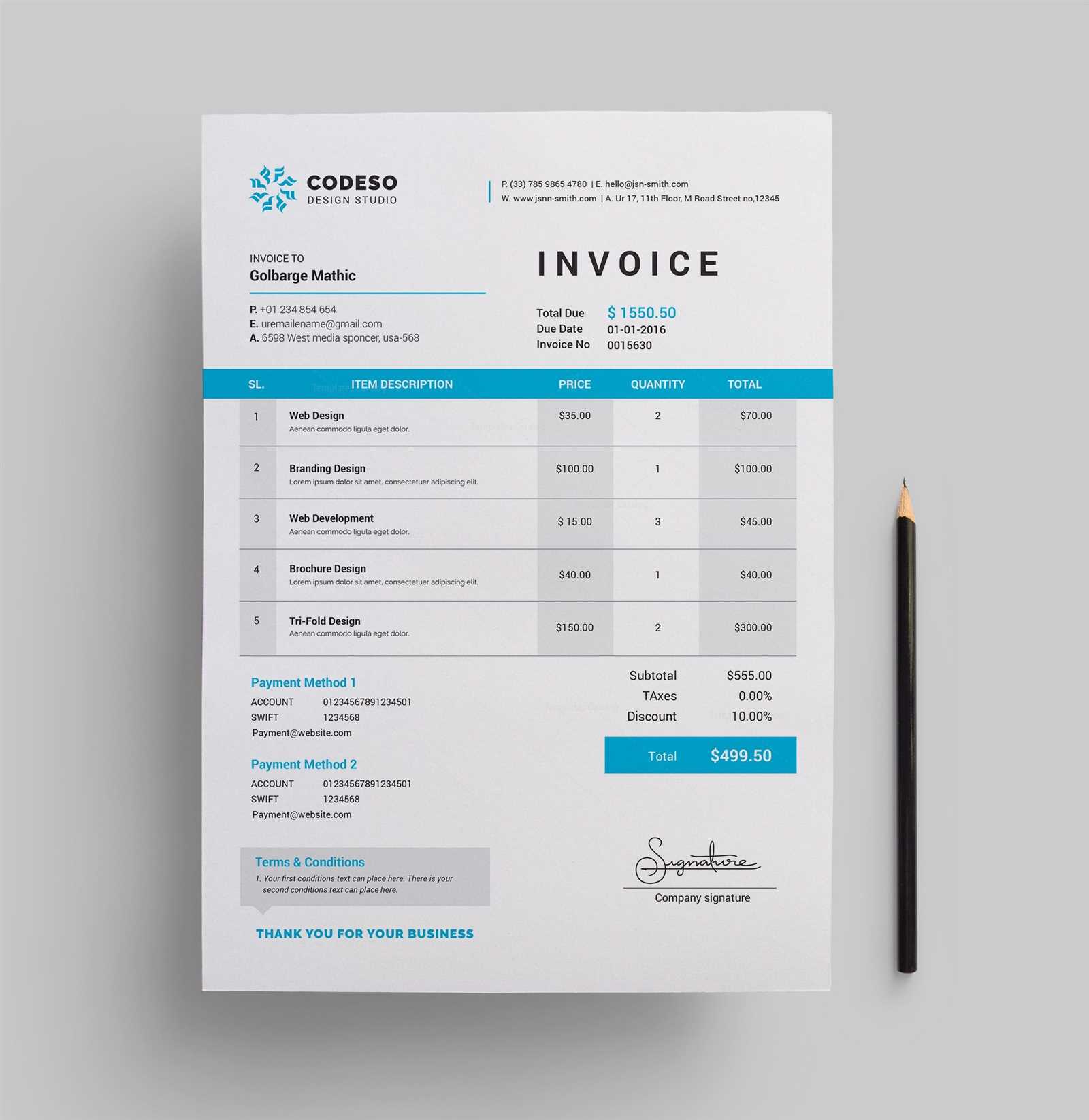

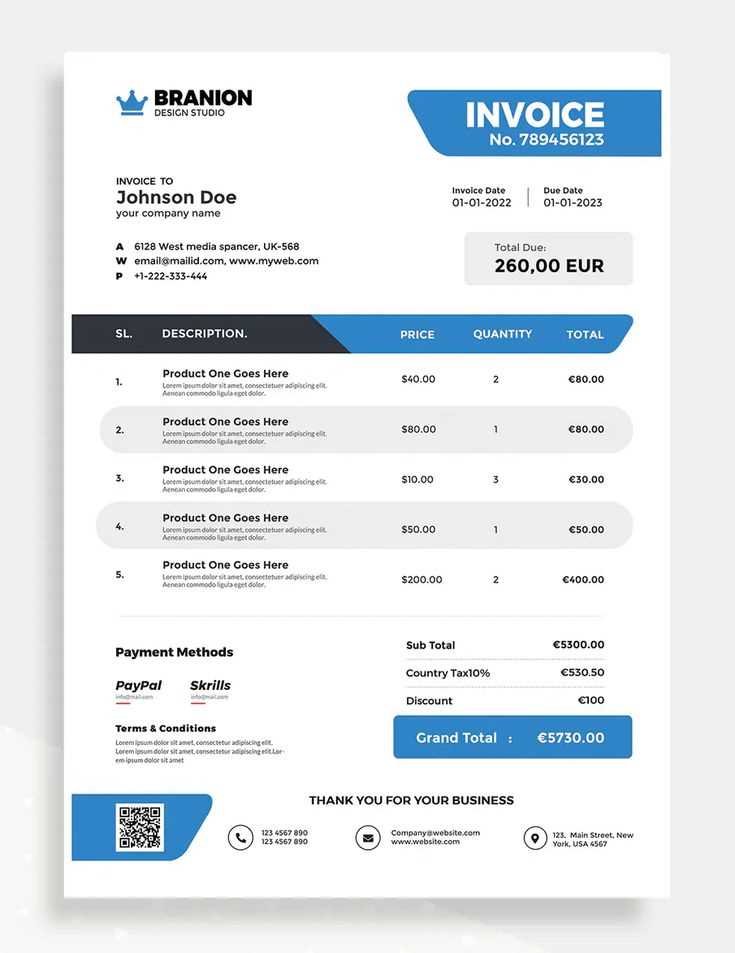

Artificial intelligence allows businesses to create highly personalized financial reports, tailored to individual customer needs. With customizable fields and easy-to-use interfaces, businesses can quickly modify layouts, include specific details, and adjust formats as necessary. This flexibility helps businesses present professional documents while ensuring that all necessary information is included, making the process as efficient as possible.

AI-powered billing solutions also provide insights into trends and analytics, helping businesses track their financial health with ease. These tools can integrate with other systems, providing a seamless experience across various platforms while offering valuable data to improve decision-making and cash flow management.

Benefits of Using AI for Billing

Adopting artificial intelligence in financial processes offers significant advantages for businesses looking to streamline operations. By automating the creation and management of financial records, AI reduces the time and effort needed to handle routine tasks, allowing employees to focus on more strategic initiatives. This technology not only improves efficiency but also enhances the accuracy and consistency of all financial documents.

One of the key benefits is the reduction of human errors. AI systems can process vast amounts of data quickly, ensuring that each financial record is accurate and aligned with the specific requirements. Additionally, these systems can automatically flag discrepancies, preventing costly mistakes that may arise from manual input.

Another important advantage is the increased speed of transaction processing. Businesses can generate and send documents in a fraction of the time it would take using traditional methods. This leads to faster payments and improved cash flow management, which is critical for maintaining business operations.

Moreover, AI-powered tools allow for greater customization. Companies can tailor their documents to meet individual customer needs or industry-specific requirements without having to manually adjust each record. This flexibility makes it easier for businesses to maintain a professional appearance while ensuring that all necessary information is included.

How AI Simplifies Billing Processes

Artificial intelligence revolutionizes the way businesses manage their financial operations by automating time-consuming tasks. With the ability to generate, track, and adjust financial documents in real time, AI makes the entire billing workflow faster, more accurate, and less prone to human error. This efficiency allows businesses to reduce administrative costs and focus on higher-value tasks.

Automation of Routine Tasks

AI systems are capable of automating repetitive tasks such as generating payment requests, applying tax rates, and tracking payment status. By removing the need for manual input, businesses can ensure that their financial records are consistently accurate and updated without human intervention. This automation drastically reduces the workload for accounting teams, allowing them to spend time on more strategic financial decisions.

Faster Payment Processing

AI can speed up the entire payment cycle by automatically generating payment reminders, sending out requests, and tracking overdue balances. This leads to quicker follow-ups and fewer delays, improving cash flow and helping businesses maintain their financial stability. By streamlining the entire process, AI helps businesses stay on top of their financial commitments while reducing the chances of missing critical deadlines.

Creating Custom Billing Documents with AI Tools

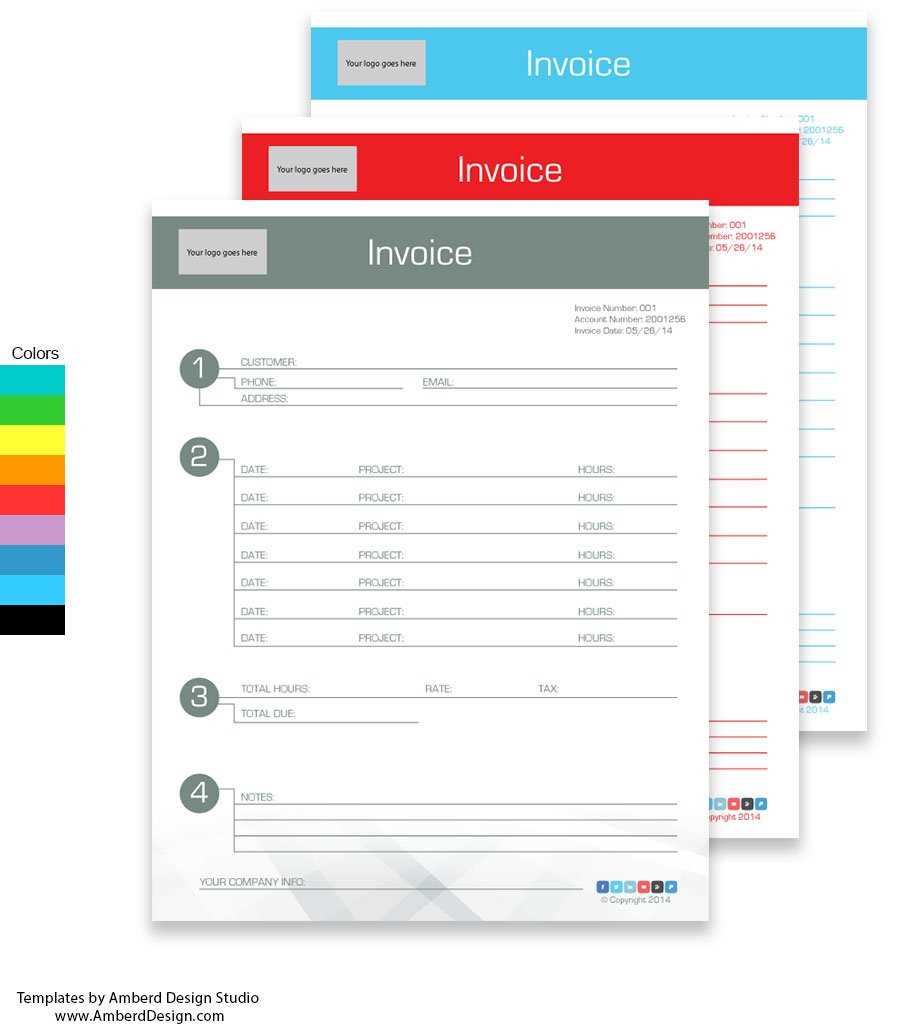

Artificial intelligence provides powerful tools for businesses to create highly personalized financial documents that meet specific customer and industry needs. By leveraging AI, companies can easily customize the layout, content, and structure of these documents without extensive manual effort. This flexibility ensures that businesses can present professional records while tailoring them to fit various requirements.

AI-powered tools offer an intuitive interface that allows users to modify and adapt financial records, from adjusting fields to incorporating unique company branding. With just a few clicks, businesses can produce customized documents that reflect their identity and align with their clients’ expectations.

| Customization Feature | Benefits |

|---|---|

| Automatic Field Insertion | AI automatically populates required fields, reducing manual data entry. |

| Flexible Layouts | Businesses can adjust the arrangement of elements to suit their style. |

| Branding Integration | AI tools allow the addition of logos and personalized color schemes for professional presentation. |

| Custom Data Fields | Customizable fields for unique services, payment terms, and more. |

By utilizing these features, businesses can create tailored financial records that not only meet operational needs but also enhance their professional image and customer satisfaction.

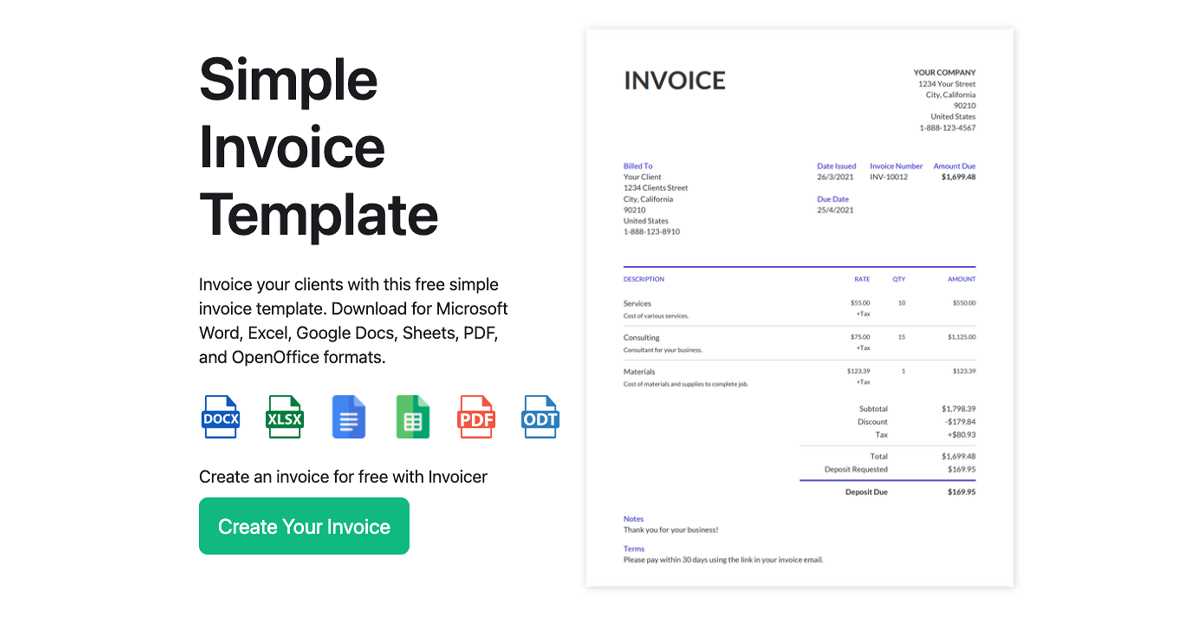

Choosing the Right AI Billing Generator

Selecting the right AI-powered tool for creating and managing financial records is crucial for optimizing your business’s financial workflow. With a variety of options available, businesses need to consider their specific needs and requirements before making a choice. The ideal tool should offer flexibility, ease of use, and integration with other systems to ensure seamless operations.

Here are key factors to consider when choosing the best AI generator for your business:

- Ease of Use: Choose a tool with an intuitive interface that allows your team to quickly adopt the system with minimal training.

- Customization Options: Look for a solution that enables easy modification of document layouts, data fields, and branding elements to match your business’s needs.

- Integration Capabilities: Ensure the AI tool integrates smoothly with your existing accounting, CRM, and payment systems for a unified workflow.

- Automation Features: Select a generator that can automate key tasks like data entry, payment tracking, and reminder generation to save time and reduce errors.

- Security: Ensure the tool adheres to strong data protection standards to safeguard sensitive financial information.

- Cost: Evaluate the pricing model to ensure the tool is affordable while meeting all your business requirements.

By carefully considering these factors, businesses can select an AI solution that not only meets their immediate needs but also scales with growth and evolving operational demands.

Integrating AI Billing with Accounting Software

Integrating AI-driven financial tools with your existing accounting software can significantly streamline your business’s financial operations. By connecting these systems, businesses can ensure seamless data flow between document creation and financial record-keeping, reducing manual work and increasing efficiency. This integration helps eliminate redundant tasks and minimizes the risk of errors caused by transferring information between multiple platforms.

Here are the key benefits of integrating AI tools with accounting software:

- Automated Data Synchronization: AI tools can automatically sync payment information, customer data, and transaction details with accounting systems, saving time and reducing data entry errors.

- Real-Time Financial Tracking: Integration allows businesses to monitor their financial health in real time, with updates on outstanding balances, received payments, and overdue accounts directly within their accounting software.

- Streamlined Reporting: By connecting AI billing systems to accounting platforms, businesses can generate comprehensive financial reports with accurate data, helping decision-makers quickly analyze performance.

- Improved Cash Flow Management: The integration enables faster payment tracking and automatic reminders for pending amounts, leading to better cash flow management.

- Consistency Across Systems: Integrating systems ensures that all financial records are consistent and aligned, preventing discrepancies between different tools and ensuring accurate financial reporting.

When selecting AI tools for integration, businesses should prioritize platforms that offer seamless compatibility with their current accounting software. This will help maximize the benefits of automation while maintaining a smooth and error-free workflow across all financial processes.

Key Features of AI Billing Solutions

AI-powered financial tools offer a range of advanced features that enhance the efficiency and customization of financial document management. These features simplify the process of creating, managing, and tracking business transactions, making it easier to stay organized and ensure accuracy. With AI, businesses can create highly professional and tailored records with minimal effort.

Here are some key features that make AI-driven billing solutions stand out:

- Automation of Data Entry: AI systems automatically populate financial records with relevant information, reducing the time spent on manual input and the risk of human errors.

- Customizable Layouts: AI tools offer flexibility in adjusting the design, layout, and structure of documents, allowing businesses to align them with their branding and specific needs.

- Real-Time Data Processing: AI systems process information instantly, updating records and tracking payments in real time, ensuring businesses have the most up-to-date financial data at their fingertips.

- Integrated Payment Tracking: AI solutions can track payment statuses automatically, providing real-time updates on outstanding payments and overdue balances.

- Error Detection and Correction: AI tools can automatically detect inconsistencies and potential errors in financial data, flagging issues before they lead to problems.

- Multi-Currency and Tax Calculations: AI systems are capable of handling complex calculations, including tax rates and multi-currency conversions, simplifying the process for international transactions.

These advanced capabilities allow businesses to manage their financial documentation with greater accuracy and efficiency, reducing the administrative burden and improving overall workflow. By leveraging these features, companies can streamline their processes and enhance their financial management practices.

AI for Streamlining Payment Tracking

Tracking payments efficiently is crucial for maintaining cash flow and ensuring financial stability. AI-powered tools have transformed the way businesses monitor and manage payments by automating tracking, reminders, and updates in real-time. With the integration of AI, businesses can reduce the manual effort required to follow up on payments and stay on top of overdue amounts, enhancing financial control.

Benefits of AI in Payment Tracking

AI simplifies the payment tracking process through automation and real-time updates, ensuring businesses are always informed about their financial status. The system can automatically detect when payments are due, when they are received, and when they are overdue, making it easier to manage cash flow.

- Automatic Payment Updates: AI tools automatically update payment statuses as soon as transactions are completed, reducing the need for manual checks and ensuring up-to-date records.

- Overdue Payment Alerts: AI systems can send automated reminders and alerts for overdue payments, prompting clients to pay on time and reducing late fees.

- Integration with Financial Systems: Payment data is seamlessly integrated with accounting software, ensuring consistency across platforms and eliminating discrepancies.

- Predictive Insights: AI can provide insights into upcoming payments based on historical data, helping businesses anticipate cash flow and plan accordingly.

Improved Efficiency and Accuracy

By automating payment tracking, AI not only saves time but also enhances accuracy. The risk of human error in manual tracking is minimized, and payment-related discrepancies are identified and addressed quickly. This leads to fewer missed payments, improved client relationships, and a more predictable cash flow.

Cost-Effective Solutions for Small Businesses

For small businesses, managing finances efficiently while keeping costs low is a critical challenge. Leveraging AI-driven solutions can provide significant cost savings by automating repetitive tasks and reducing the need for manual labor. These smart tools enable businesses to streamline operations, improve accuracy, and minimize errors, all while maintaining a tight budget.

AI tools designed for financial management offer a range of affordable features that cater specifically to the needs of small businesses. With minimal upfront costs and subscription-based models, these solutions are scalable, ensuring that businesses can grow without the need for expensive infrastructure upgrades.

- Automation of Routine Tasks: AI tools automatically handle time-consuming tasks such as data entry, tracking payments, and generating documents, allowing small businesses to focus on their core operations.

- Reduction of Human Errors: By minimizing manual input, AI reduces the chances of costly mistakes that could otherwise result in financial discrepancies.

- Affordable Pricing Models: Many AI-driven tools are available on a subscription basis with tiered pricing, making them accessible to small businesses without requiring large investments.

- Scalability: As businesses grow, AI tools can scale with them, offering more advanced features without requiring significant changes or increased costs.

- Data-Driven Insights: AI solutions offer valuable analytics to help businesses make informed financial decisions, ensuring more efficient use of resources.

Incorporating AI-driven solutions into business operations helps small businesses maximize efficiency while minimizing costs, ultimately enabling them to stay competitive in a fast-paced market.

How AI Improves Billing Accuracy

Ensuring the accuracy of financial documents is essential for businesses to maintain trust, avoid errors, and ensure smooth operations. AI-driven tools enhance the precision of these documents by automating data entry, cross-referencing information, and detecting inconsistencies in real-time. By minimizing human intervention, AI helps create error-free records that reflect the true financial status of the business.

AI improves accuracy in several key ways:

- Automated Data Entry: AI tools automatically extract relevant information from various sources, ensuring that the right data is captured and applied to each financial record without manual input.

- Real-Time Error Detection: AI systems can spot discrepancies and flag errors as soon as they occur, preventing issues from affecting the accuracy of documents.

- Consistent Formatting: AI ensures that financial documents follow a uniform structure, reducing mistakes caused by inconsistent formatting or incorrect calculations.

- Cross-Referencing Data: AI can cross-check multiple sources of information, such as client details, payment histories, and service records, to ensure everything aligns properly.

- Dynamic Adjustments: AI can automatically adjust rates, taxes, or discounts based on real-time data and pre-defined rules, further reducing manual errors in the process.

By integrating AI into financial document management, businesses can not only streamline their workflows but also enhance the quality and reliability of their financial records, leading to improved customer satisfaction and financial accuracy.

AI Solutions for Different Industries

AI-powered tools offer industry-specific solutions that help streamline financial processes and ensure greater efficiency. By customizing features for various sectors, these tools cater to the unique needs of each business, whether it’s for managing transactions, tracking payments, or generating detailed reports. With the right AI-driven systems in place, businesses in different industries can automate time-consuming tasks and enhance productivity.

Retail and E-Commerce

In retail and e-commerce, AI solutions help manage high volumes of transactions with ease. These tools enable businesses to track sales, calculate taxes, and generate purchase records quickly, while maintaining accuracy across thousands of items. AI can also integrate seamlessly with inventory systems to update stock levels in real time.

- Automated Sales Tracking: AI tracks customer purchases and payment status in real-time.

- Inventory Integration: Seamlessly updates stock information based on sales data.

- Personalized Customer Data: AI tools can automatically apply customer-specific pricing, discounts, and promotions.

Freelancers and Service Providers

Freelancers and service-based businesses benefit from AI solutions that manage client billing, project tracking, and time management. With these tools, businesses can automatically calculate service hours, apply rates, and create professional records tailored to each client’s needs.

- Customizable Records: AI solutions offer flexible document layouts for various types of services.

- Time and Rate Calculations: Automatically calculates hours worked and applies hourly rates or flat fees.

- Automated Payment Reminders: AI tools send automatic reminders for overdue payments, reducing the need for manual follow-ups.

Each industry benefits from the adaptability and scalability of AI, making it an essential tool for improving operational efficiency and reducing administrative overhead. With tailored solutions, businesses can focus more on their core functions and less on tedious financial tasks.

Real-Time Billing Adjustments with AI

AI-powered financial tools offer the ability to make real-time adjustments to billing documents, ensuring that all information is accurate and up-to-date. This feature is particularly useful when changes occur during transactions, such as pricing updates, discounts, or additional charges. AI enables businesses to modify financial records automatically, reducing the need for manual intervention and ensuring accuracy across all documents.

Instant Price Updates and Discounts

AI systems can instantly apply price changes, promotional offers, and discount rates, ensuring that customers receive the correct pricing every time. These tools automatically adjust the total amount based on predefined rules and real-time data, making sure that any updates are reflected immediately without manual recalculation.

- Dynamic Price Adjustments: AI calculates and applies price changes based on real-time data, ensuring the final amount is always correct.

- Discount Application: Automatically applies discount codes or promotional rates, ensuring customers receive the benefits as intended.

- Real-Time Tax Calculations: AI systems update tax rates automatically according to regional or global regulations, keeping billing accurate.

Seamless Modifications to Payment Terms

AI tools also allow businesses to adjust payment terms in real-time based on customer agreements or contract changes. Whether it’s extending payment deadlines or adding late fees, AI automatically updates the payment schedule and notifies both the business and the customer, preventing potential miscommunications.

- Flexible Payment Terms: AI can adjust payment deadlines and installment schedules based on changing agreements.

- Automated Late Fee Adjustments: Automatically applies penalties for overdue payments based on predefined terms.

By leveraging AI for real-time adjustments, businesses can ensure that their financial documentation is always accurate, up-to-date, and aligned with any changes that arise, streamlining the entire billing process and enhancing customer satisfaction.

AI Billing Solutions vs Manual Billing

In the world of financial management, businesses often face a choice between using AI-powered solutions or sticking to traditional manual methods. While both approaches serve the same purpose, they offer distinct advantages and challenges. AI-driven systems automate many aspects of the billing process, reducing human effort and increasing efficiency, while manual methods require more time and attention but may offer a sense of control and familiarity. Below, we compare the two to help determine which approach best suits different business needs.

| Feature | AI Billing Solutions | Manual Billing |

|---|---|---|

| Automation | Automates data entry, calculations, and document generation, reducing time spent on routine tasks. | Requires manual data entry, increasing the risk of errors and consuming more time. |

| Speed | Instant document creation and adjustments, saving time on repetitive tasks. | Slow process, especially when creating multiple records or modifying data. |

| Accuracy | Minimizes human error by automating data entry and calculations, ensuring more accurate records. | Prone to errors due to manual calculations and data entry, potentially leading to mistakes. |

| Cost | Cost-effective in the long run due to reduced manual labor and time savings. | Can be costlier in terms of labor, as it requires more time and personnel for billing tasks. |

| Flexibility | Highly customizable, allowing businesses to adapt the system to their specific needs. | Offers flexibility, but customization can be time-consuming and may require expertise. |

| Scalability | Easily scales to accommodate growing volumes of transactions without increasing effort. | Scales poorly, as manual methods require more resources as business volume increases. |

While AI-driven billing solutions offer greater speed, accuracy, and scalability, manual methods may still be suitable for businesses with minimal transaction volume or those that prioritize a high level of human oversight. Choosing between the two depends on factors such as business size, volume, and the complexity of the billing process.

Reducing Human Errors in Billing with AI

Human errors in financial documentation can lead to costly mistakes, miscommunications, and damage to a business’s reputation. AI technologies are designed to automate processes that would otherwise require manual intervention, significantly reducing the risk of such errors. By integrating AI into billing workflows, businesses can enhance precision, ensure consistent data entry, and minimize discrepancies across their financial records.

How AI Minimizes Data Entry Mistakes

One of the most common sources of errors in manual billing is inaccurate data entry. Whether it’s incorrect customer information, pricing, or dates, mistakes can easily slip through the cracks. AI tools, however, can automate data collection from reliable sources, ensuring that the right data is pulled every time. This eliminates the risk of typos and incorrect entries while maintaining consistency across all documents.

- Automated Data Capture: AI extracts relevant information from sources like spreadsheets, emails, and databases, reducing human input and the potential for mistakes.

- Real-Time Error Detection: AI continuously checks for inconsistencies and flags potential errors, allowing businesses to correct them before they become problematic.

- Consistency Across Records: AI ensures that all documents follow the same structure and formatting, reducing the chance of conflicting information.

Eliminating Calculation Errors

Manual calculations, especially when dealing with complex pricing structures, discounts, or taxes, can lead to significant errors. AI tools, however, are capable of performing calculations with precision and speed. These systems automatically adjust figures based on real-time data, making sure that the final amount reflects the most accurate information without any manual adjustments.

- Automatic Tax Calculations: AI tools are updated with the latest tax rates, ensuring the correct amount is always applied.

- Dynamic Pricing: AI tools adjust prices, discounts, or service fees based on predefined rules, ensuring accurate amounts every time.

- Real-Time Updates: If changes are made to the transaction or pricing details, AI immediately recalculates the totals, eliminating human oversight.

By utilizing AI to handle key aspects of financial documentation, businesses not only reduce the likelihood of errors but also improve the overall efficiency and reliability of their billing systems, leading to fewer discrepancies and stronger customer trust.

How AI Saves Time for Entrepreneurs

Time is one of the most valuable resources for any entrepreneur, and AI tools have become essential in helping them save time on daily tasks. By automating repetitive and time-consuming processes, AI allows business owners to focus on more strategic and high-value activities. Whether it’s handling administrative tasks, managing finances, or generating reports, AI solutions are streamlining operations and increasing productivity for entrepreneurs.

Automating Repetitive Tasks: Many of the tasks that consume an entrepreneur’s time–such as data entry, generating financial documents, and tracking payments–can be automated using AI-powered systems. These tools eliminate the need for manual effort, completing tasks quickly and accurately while freeing up time for other responsibilities.

- Instant Document Generation: AI tools automatically create essential business documents, saving hours spent on manual document preparation.

- Efficient Data Processing: AI processes large volumes of data in a fraction of the time it would take manually, providing insights and reports instantly.

Reducing Human Errors: Manual tasks are often prone to errors that require correction, wasting additional time. AI systems minimize human errors by ensuring accuracy in every step, from calculations to data entry. This helps to avoid costly mistakes that could take up time to fix.

- Real-Time Error Detection: AI continuously scans for inconsistencies, catching mistakes immediately, saving time in the long run.

- Accurate Data Entry: AI systems ensure that the right information is entered every time, reducing the need for time-consuming corrections.

Improving Decision Making: Entrepreneurs spend a significant amount of time analyzing data to make informed decisions. AI systems can analyze data more quickly and accurately than humans, providing real-time insights that help business owners make decisions faster. With AI, entrepreneurs can focus on growing their business rather than getting bogged down in analysis.

- Advanced Analytics: AI tools analyze customer trends, sales data, and financial performance in real-time, providing valuable insights without the delay.

- Predictive Insights: AI can forecast business trends, allowing entrepreneurs to make proactive decisions ahead of time.

By incorporating AI into everyday operations, entrepreneurs can drastically reduce the time spent on routine tasks, improve decision-making processes, and ultimately devote more attention to growing and expanding their business.

Security Measures in AI Invoice Templates

As businesses increasingly rely on AI-powered systems for handling financial documents and transactions, ensuring robust security measures becomes a top priority. Protecting sensitive data, preventing unauthorized access, and ensuring compliance with regulations are essential aspects of implementing AI in financial workflows. AI solutions designed for document generation and management integrate advanced security protocols to mitigate risks and safeguard business information.

Data Encryption: One of the key security measures implemented in AI systems is encryption. All sensitive data, such as customer details and payment information, are encrypted both during transmission and storage. This ensures that unauthorized parties cannot intercept or access this information, providing peace of mind to businesses and their clients.

| Encryption Method | Benefit |

|---|---|

| End-to-End Encryption | Ensures that only authorized users can access sensitive information from start to finish. |

| Data-at-Rest Encryption | Protects stored data, ensuring that even if systems are compromised, sensitive information remains secure. |

Access Control: AI-powered solutions incorporate access control mechanisms that limit who can view or edit critical documents. By using role-based access, businesses can restrict certain users from accessing specific types of data or making changes to sensitive records. This minimizes the risk of accidental or intentional data breaches.

- Multi-Factor Authentication: Adding an extra layer of security by requiring multiple forms of verification before granting access to systems.

- Role-Based Permissions: Restricting access to documents based on employee roles, ensuring that only authorized personnel can make changes to critical records.

Compliance with Regulations: AI tools used for managing financial data ensure that businesses remain compliant with industry standards and regulations. These tools are designed to meet requirements such as GDPR, HIPAA, or PCI-DSS, ensuring that sensitive data is handled in accordance with legal standards.

| Regulation | Compliance Measure |

|---|---|

| GDPR | Ensures that all personal data is collected and processed lawfully, with clear consent and transparent privacy policies. |

| PCI-DSS | Ensures that businesses handling payment information comply with security standards to protect customer data. |

By incorporating these advanced security measures, AI-powered systems can protect businesses from cyber threats, data breaches, and compliance risks, ensuring the safe handling of financial documents and sensitive customer information.

Future Trends in AI Invoice Technology

The future of AI-driven solutions in the realm of financial document management is promising, with emerging trends that are reshaping how businesses approach tasks such as billing, payment tracking, and document creation. As AI continues to evolve, its applications in automating and streamlining financial processes will become more sophisticated, offering even more efficient and intelligent ways to handle administrative duties.

Increased Integration with Financial Systems

One of the key trends in the future of AI for financial document management is deeper integration with other business systems. AI tools will not only generate and manage documents but also work seamlessly with accounting software, customer relationship management (CRM) platforms, and payment gateways. This will enable real-time updates and synchronization across all financial platforms, making the workflow faster and more accurate.

- Automated Cross-Platform Synchronization: AI will facilitate seamless integration across various software tools, ensuring that data flows effortlessly between systems.

- Instant Updates and Reporting: Real-time data synchronization will ensure that all financial records are consistently up-to-date, improving decision-making and reducing errors.

Enhanced Predictive Capabilities

AI’s ability to analyze vast amounts of data will evolve, providing businesses with even more accurate predictive analytics. Future AI systems will not only automate tasks but also predict trends, cash flow needs, and potential issues, helping entrepreneurs make proactive decisions. These advanced predictive capabilities will be powered by machine learning algorithms that continually improve as they process more data.

- Predictive Cash Flow Analysis: AI will be able to forecast potential cash flow problems based on historical data and upcoming expenses, enabling better financial planning.

- Smart Billing Adjustments: AI tools will learn patterns in customer payments and automatically adjust future billing, ensuring timely collections and reducing overdue payments.

As these trends continue to develop, AI will increasingly become a cornerstone of financial operations, making processes more intelligent, adaptable, and reliable. Businesses will benefit from enhanced efficiency, cost savings, and improved decision-making, all of which will contribute to growth and sustainability in an ever-evolving marketplace.

How to Implement AI Invoicing Solutions

Implementing AI-driven solutions for managing billing processes can significantly enhance efficiency, reduce errors, and improve overall business operations. By leveraging automation, businesses can streamline their financial workflows, making tasks like document creation, payment tracking, and customer communication more efficient. The implementation process requires careful planning and an understanding of both the technical and operational needs of the business.

Steps to Integrate AI into Financial Workflows

To successfully integrate AI into your business, it’s crucial to follow a structured approach that ensures both technical compatibility and smooth operation. Here are the key steps:

- Assess Your Business Needs: Evaluate the specific needs of your business and identify which processes will benefit most from AI automation, such as document creation or payment processing.

- Choose the Right AI Solution: Select an AI tool that aligns with your business objectives, considering factors like scalability, ease of use, and integration capabilities with existing software.

- Data Preparation and Integration: Ensure that your business data is properly organized and clean. Integration with current financial software systems should be seamless, allowing AI to function effectively within your existing infrastructure.

- Test and Train the System: Before full-scale implementation, run tests and train the AI system to ensure it performs accurately, handles errors, and delivers the desired results.

- Monitor and Optimize: Once the system is in place, monitor its performance regularly and fine-tune it based on feedback and operational insights.

Best Practices for Implementing AI Billing Solutions

To maximize the benefits of AI tools, consider the following best practices when integrating them into your financial processes:

- Start Small: Begin by automating simple, routine tasks before moving on to more complex processes. This allows the team to adapt and ensures smoother transitions.

- Ensure Data Security: Given the sensitive nature of financial data, implement strong security measures, such as encryption and multi-factor authentication, to protect business information.

- Regular Training: Train your staff to understand how to use the AI tools effectively, ensuring that they can make the most of the system’s capabilities.

- Continuous Improvement: AI systems should not be static; continue to refine and optimize them to meet the evolving needs of your business.

By following these steps and best practices, businesses can successfully implement AI-driven systems that enhance billing efficiency, improve accuracy, and save valuable time. Properly executed, these solutions will allow companies to focus more on growth and less on routine administrative tasks.