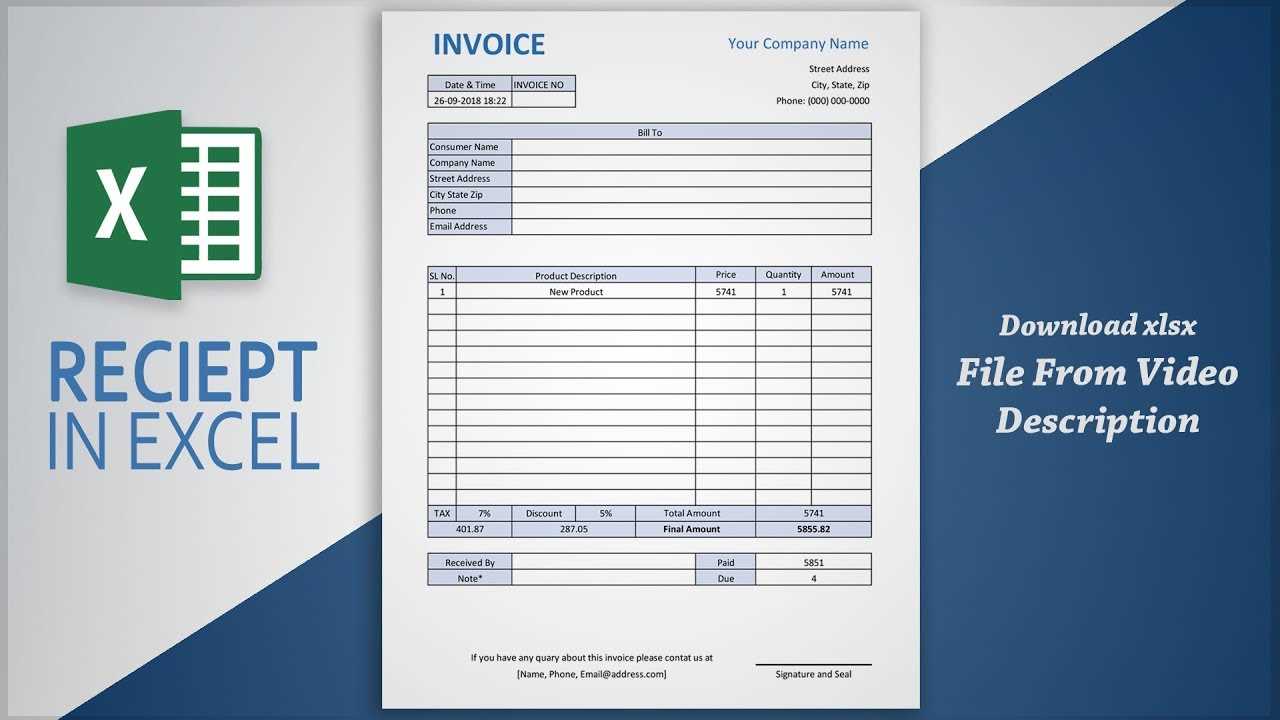

How to Create an Invoice Template in Excel

Designing a functional and efficient billing structure is essential for smooth financial transactions. With the right approach, you can streamline the process of documenting services, products, and payments, saving both time and effort. The right tool can help automate calculations, track due amounts, and ensure that every detail is captured accurately for your business needs.

Using a versatile tool like a spreadsheet application, you can create a flexible system that suits your specific requirements. A well-structured document can help maintain consistency, improve organization, and enhance professionalism. By setting up clear fields and formatting, you can quickly generate documents that reflect your business image while keeping track of financial data in a straightforward manner.

Mastering this process offers the opportunity to save resources and avoid mistakes, ensuring that your records are clean, easy to understand, and ready to be shared with clients or stakeholders. Whether you’re handling small transactions or managing large-scale projects, this method allows for adaptability, efficiency, and reliability in managing financial communication.

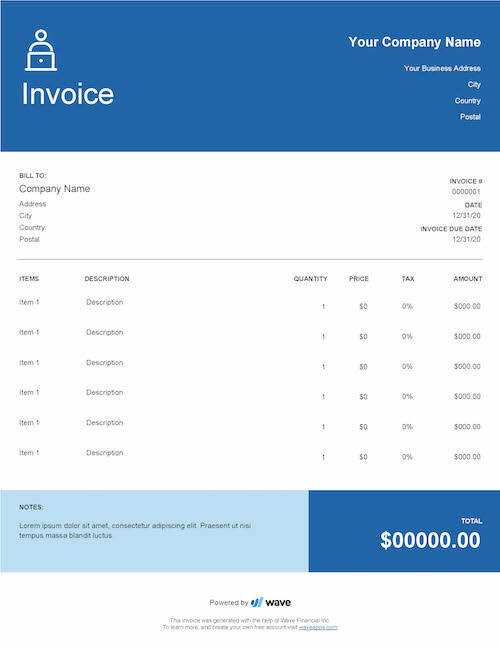

Creating a Billing Document in a Spreadsheet Program

Setting up an organized system for documenting transactions and payments is crucial for managing finances effectively. A well-structured document allows you to record all essential details, ensuring clarity and accuracy for both you and your clients. By using a flexible software tool, you can customize the structure to suit your needs and maintain consistency across all records.

Steps to Set Up Your Billing Document

Follow these steps to create a functional and professional-looking financial record:

- Start with a New Worksheet: Open your spreadsheet program and create a blank file to begin the process.

- Define Key Information: Decide on the necessary fields, such as client name, address, service/product details, and due date.

- Design the Layout: Organize the document into rows and columns for a clean, readable format.

- Include Calculation Functions: Use built-in formulas to automate totals, taxes, and other calculations for easy management.

- Save for Future Use: Once your file is set up, save it as a reusable document for future transactions.

Customizing the Document for Your Business

Tailor the document to fit your specific needs by adding the following features:

- Branding: Include your company logo and colors to make the document align with your business’s identity.

- Payment Terms: Specify payment deadlines and late fees to ensure clear communication with your clients.

- Tracking: Add fields for tracking payment status or invoice numbers to keep a clear record of transactions.

Understanding the Basics of Invoice Templates

Effective documentation for transactions plays a crucial role in managing business finances. A well-structured document ensures that both parties are clear on the services provided, the payment terms, and other key details. The purpose of creating a system for recording these transactions is to maintain accuracy, organization, and professionalism in financial communications.

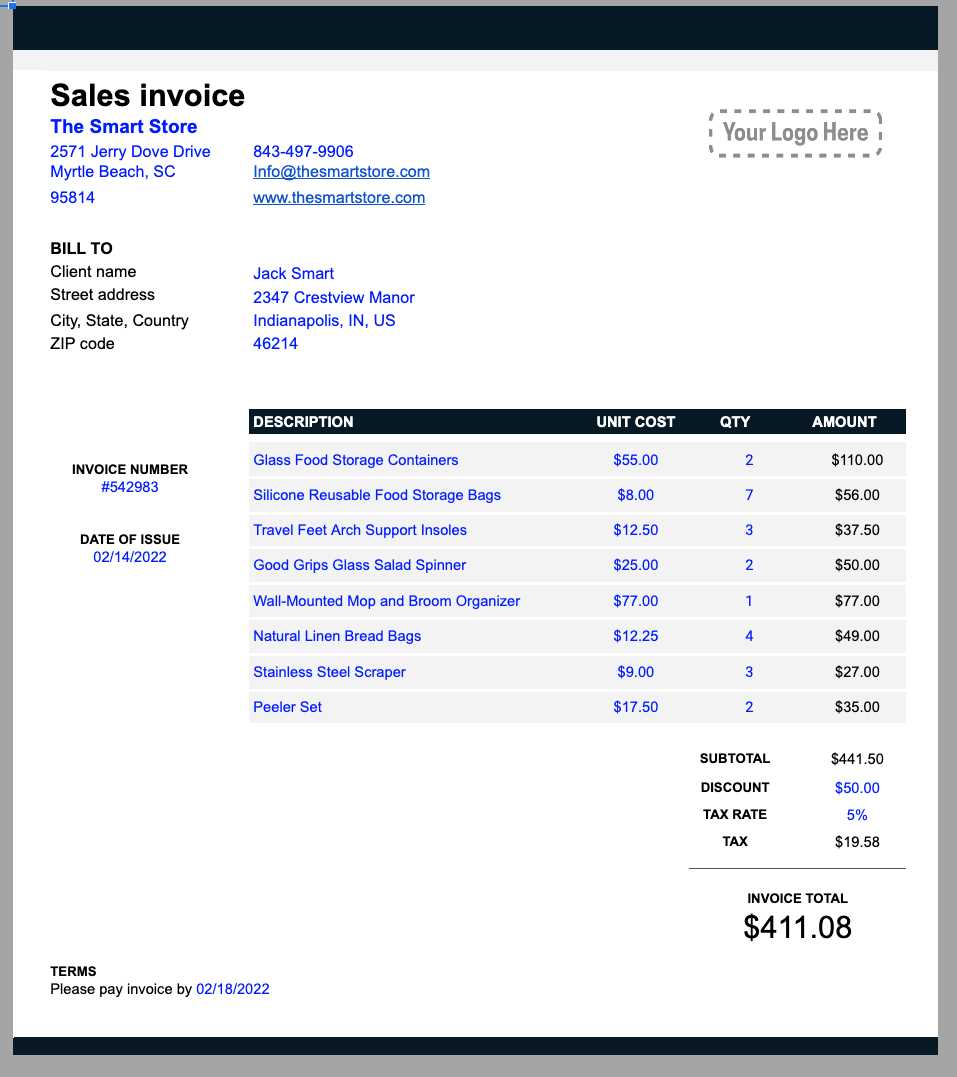

At the core of a reliable system, you need specific fields that capture essential details, such as the recipient’s information, the items or services provided, pricing, and due dates. By ensuring consistency in these fields, you can streamline your billing process, reduce errors, and improve client satisfaction. Additionally, automating calculations within this structure can save valuable time and increase the accuracy of totals, taxes, and discounts.

Choosing the Right Excel Version

Selecting the appropriate software version is a crucial first step when setting up your financial documentation system. Different versions offer varying features and capabilities, which can influence how efficiently you can create, customize, and maintain your documents. It’s important to consider the version that best suits your needs based on your operating system, preferred functionalities, and overall ease of use.

Factors to Consider When Choosing a Version

- Compatibility: Ensure the version is compatible with your computer’s operating system and other tools you may need to integrate with.

- Features: Look for features such as built-in formulas, templates, and customization options that will make your task easier.

- Support and Updates: Consider whether the version you choose will receive regular updates and technical support to ensure long-term reliability.

- Budget: Determine whether a subscription service or one-time purchase better fits your financial plans.

Popular Versions to Choose From

- Office 365: A subscription-based model with cloud storage and automatic updates, offering the latest features and collaboration tools.

- Office 2019: A one-time purchase version that provides essential features for creating professional documents without the ongoing cost.

- Excel Online: A free, web-based version that can be useful for basic tasks and sharing documents with others online.

Setting Up Your Spreadsheet for Invoices

Creating a structured document in a spreadsheet program requires careful planning to ensure that all necessary details are captured efficiently. The goal is to design a layout that is clear, organized, and easy to navigate, allowing you to enter data quickly and accurately. A well-set-up file will enable you to manage your financial records with minimal effort, while also providing a professional appearance to clients.

Key Steps to Structure Your Document

- Create a Clean Layout: Start with a blank sheet and decide how many columns and rows you’ll need for all relevant information such as dates, amounts, and client details.

- Label Important Fields: Clearly label sections like client name, item or service description, pricing, and payment terms. Use bold or colored text to highlight these areas.

- Set Up Columns for Calculations: Ensure you have columns for calculating totals, taxes, and any applicable discounts, making sure that formulas are properly set to automate these processes.

- Adjust Row Heights and Column Widths: Modify the size of rows and columns to ensure that all information fits neatly and is easy to read.

- Include a Header and Footer: Add a header for your business logo and contact details, and a footer for payment instructions or terms.

Formatting for Ease of Use

- Use Borders and Shading: Apply borders around cells to separate different sections and use shading to highlight important information, such as due dates or amounts due.

- Ensure Readability: Choose a clear, professional f

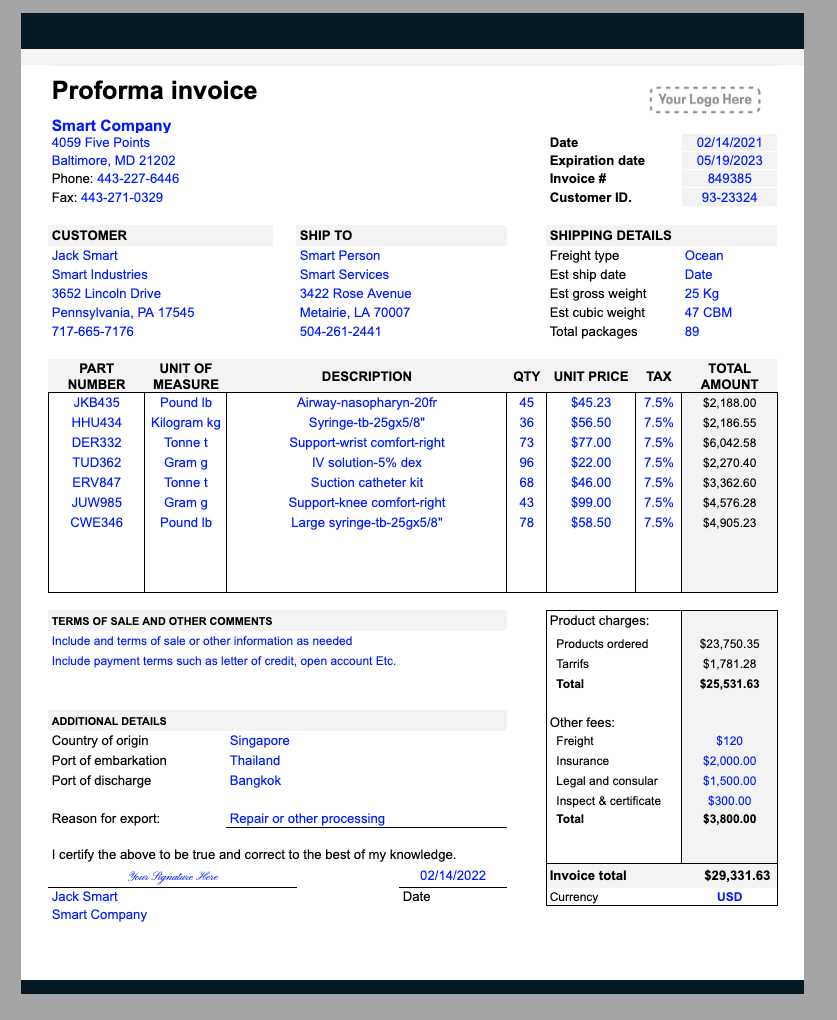

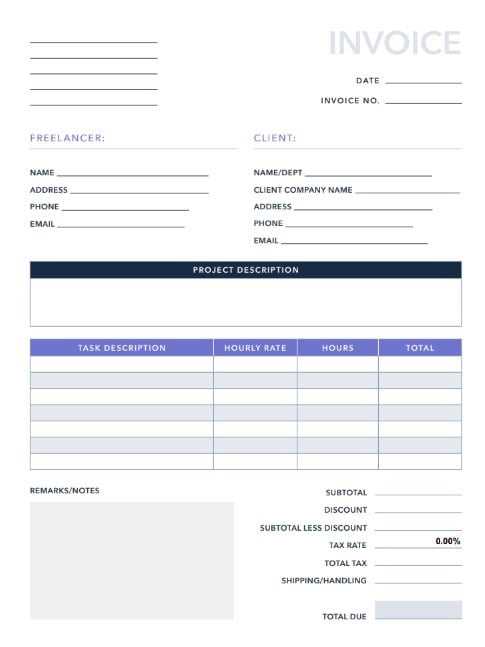

Essential Fields for an Invoice Template

When designing a document for recording financial transactions, it’s crucial to include certain key fields to ensure that all necessary information is captured accurately. These fields help maintain consistency, ensure clarity, and support smooth processing of payments. By carefully selecting and organizing these areas, you can create a document that is both functional and professional.

Each financial record should include basic details such as the recipient’s information, a description of the items or services, pricing, and payment terms. These elements allow both parties to understand the full scope of the transaction, reducing the potential for misunderstandings or errors. Additionally, incorporating fields for calculation and tracking payment status can help streamline your workflow and keep everything organized.

- Client Information: Include fields for the recipient’s name, address, and contact details to ensure proper identification and communication.

- Description of Products or Services: Clearly outline what was provided, including quantities and unit prices, for easy reference.

- Total Amount Due: Calculate the total payment due, including any discounts, taxes, or additional charges.

- Payment Terms: Specify the due date, payment methods, and any late fees or interest for overdue amounts.

- Unique Identifier: Assign a reference number to each document for easy tracking and organization.

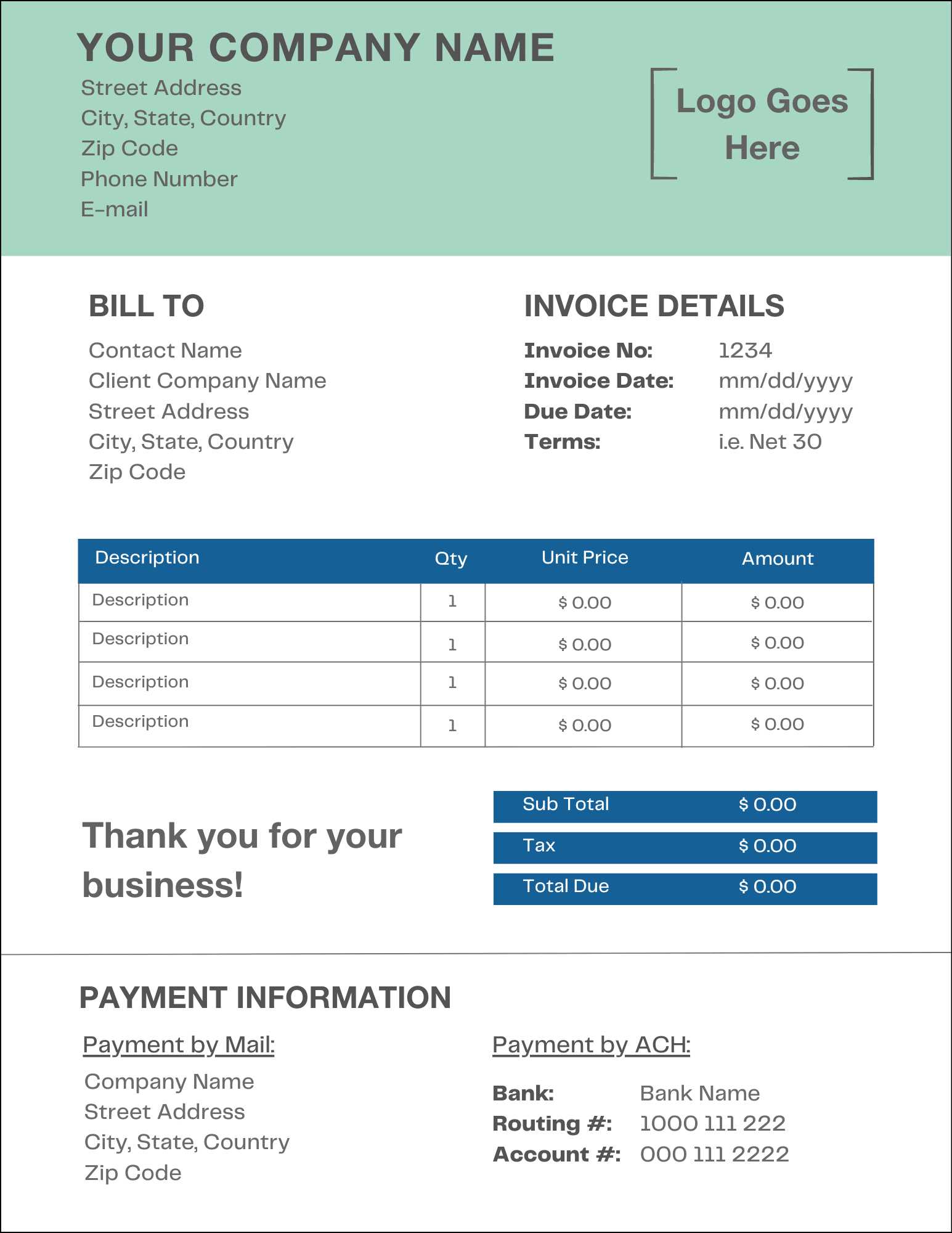

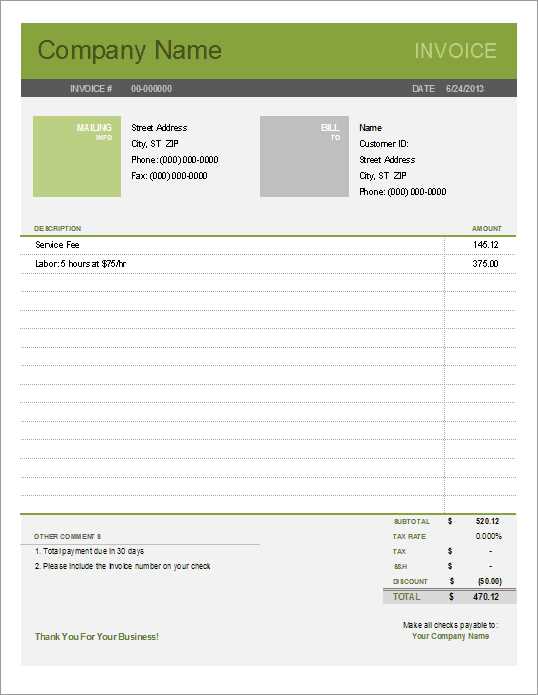

Designing a Simple and Clear Layout

When creating a financial document, simplicity and clarity are key. The layout should be easy to read and navigate, ensuring that both the business and the client can quickly access the relevant information. By focusing on a clean and organized structure, you can avoid unnecessary confusion and make the document look professional.

Essential Design Principles

- Use Clear Headings: Label each section of the document clearly, such as “Client Details,” “Services Provided,” and “Total Amount Due,” to help the reader find information quickly.

- Maintain Consistency: Keep the font style, size, and color consistent throughout the document to create a polished look. This improves readability and ensures the document is visually appealing.

- Use Ample White Space: Avoid cluttering the page by leaving enough space between sections. This makes the document easier to read and prevents information from feeling cramped.

Formatting for Professionalism

- Align Text Properly: Ensure that text is aligned in a way that makes it easy to follow, such as centering headings and aligning numerical values to the right.

- Incorporate Borders or Shading: Use subtle borders or shaded areas to separate different sections or highlight key information like totals, due dates, or payment terms.

- Choose a Readable Font: Select a simple, professional font like Arial or Times New Roman, avoiding decorative fonts that could reduce legibility.

How to Format Your Invoice Template

Proper formatting is essential when creating a professional financial document. A well-formatted record ensures that the information is clear, readable, and easy to understand for both parties. By using the right techniques, you can create a document that looks polished and is easy to work with.

Steps for Formatting Your Document

- Use Bold for Key Information: Highlight important sections like totals, payment terms, and due dates by using bold text. This makes it easier for the recipient to find crucial details quickly.

- Choose the Right Font Size: Ensure the font size is legible. Headings and section titles should be larger than the body text to create a clear hierarchy of information.

- Align Text Consistently: Align text appropriately to ensure readability. For example, left-align text fields, and right-align numerical values such as amounts and totals.

- Apply Borders or Gridlines: Use borders or gridlines to separate different sections of the document, making it visually organized and easy to follow.

Advanced Formatting Tips

- Use Conditional Formatting for Highlights: Apply conditional formatting to highlight specific criteria, such as overdue payments or special discounts, making it easy to spot key details at a glance.

- Incorporate Colors for Visual Appeal: Use subtle background colors for headings or sections to create a clean, modern look without overwhelming the reader.

- Freeze Panes for Navigation: If your document contains a lot of data, use the “Freeze Panes” feature to keep key columns or rows visible as you scroll through the information.

Customizing Your Template for Business Needs

Adapting your document to suit the unique requirements of your business can significantly improve its functionality and efficiency. Customization allows you to tailor the structure and content to reflect your brand, services, and specific invoicing needs. By adjusting the layout, fields, and design elements, you ensure that the document aligns with your business processes and communicates all necessary information clearly.

Key Areas for Personalization

- Branding Elements: Add your company logo, business name, and contact details in the header or footer to enhance the professional appearance of the document.

- Business-Specific Fields: Depending on your industry, include additional fields such as purchase order numbers, project references, or product codes to ensure all relevant details are captured.

- Currency and Taxes: Customize the currency format to match your location and ensure that tax rates, if applicable, are clearly displayed and calculated correctly.

- Payment Instructions: Adjust the payment terms and methods section to reflect your preferred ways of receiving payment, including bank account details, online payment options, or credit terms.

Enhancing Functionality for Your Workflow

- Automating Calculations: Use formulas to automatically calculate totals, taxes, discounts, and balance due, reducing the need for manual input and minimizing errors.

- Including Reminders: Add sections or notes to remind clients of late payment penalties or upcoming due dates to help manage cash flow.

- Creating Multiple Versions: If you offer different types of services or products, customize multiple versions of the document, each tailored for specific transactions.

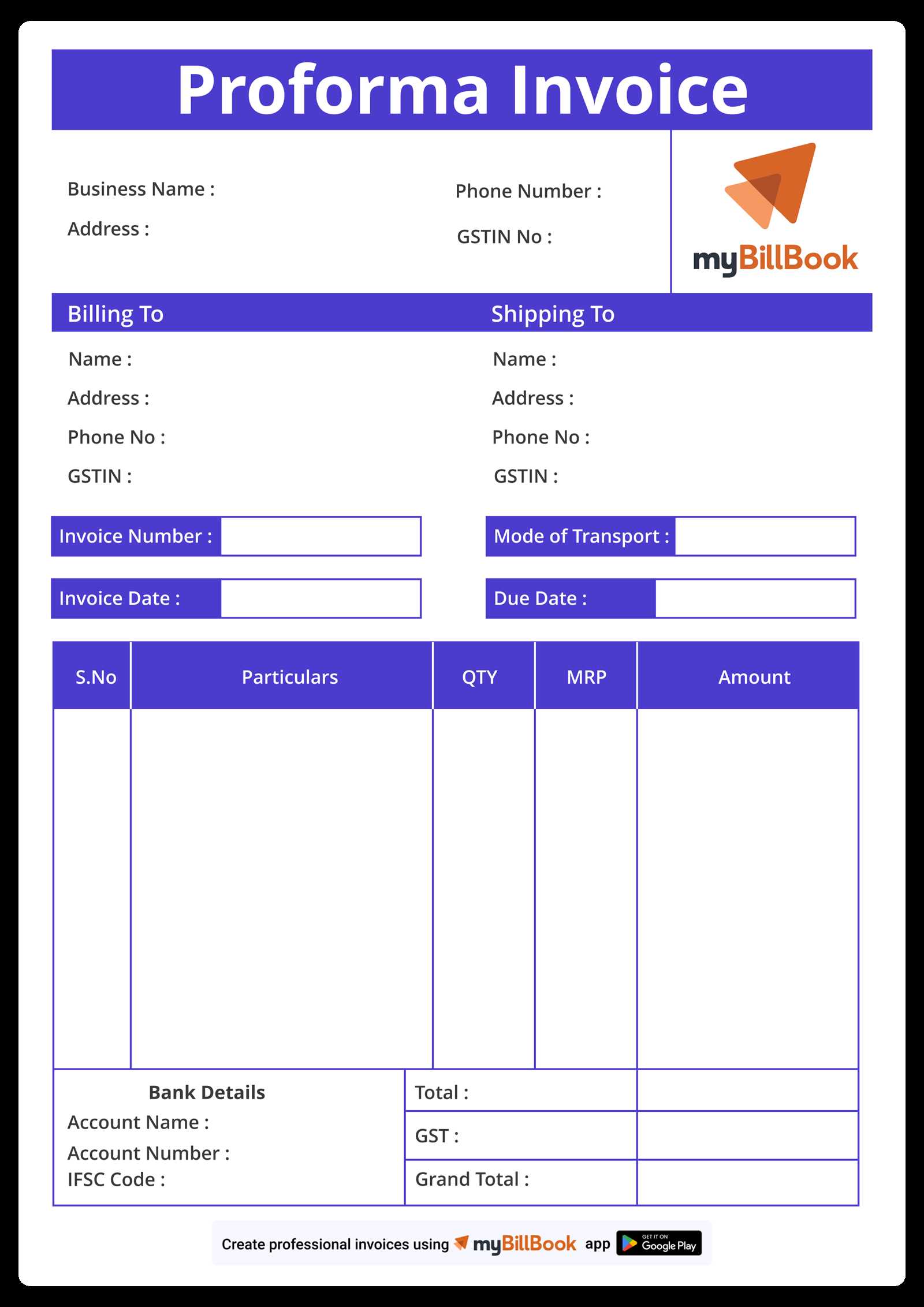

Adding Branding to Your Invoice Template

Incorporating your brand identity into your financial documents helps reinforce your business image and creates a consistent professional presence. By including elements such as your company logo, colors, and font style, you not only make the document look polished but also ensure it reflects your brand values and professionalism. Customizing your document with these details makes it instantly recognizable to clients and adds a personal touch to each transaction.

Key Branding Elements to Include

- Logo: Position your company’s logo prominently at the top of the document. This ensures that your brand is immediately visible and associated with the transaction.

- Brand Colors: Use your company’s official colors for headings, borders, or section highlights to maintain brand consistency throughout your documents.

- Font Style: Choose fonts that align with your business’s style guide. Whether it’s modern, classic, or playful, the right typography can enhance the overall look and feel of your document.

- Tagline or Slogan: If applicable, you can add a short tagline or company slogan near your logo to reinforce your brand message.

Design Considerations

- Consistency Across Documents: Ensure that your branding is consistent across all communication materials, not just on financial documents. This strengthens your overall brand presence.

- Minimalistic Approach: While branding is important, avoid overloading the document with excessive design elements. Keep the layout clean and professional to maintain readability.

- Personalized Contact Information: Include your business’s contact details in the footer or header, using your official phone number, email, and website to encourage communication.

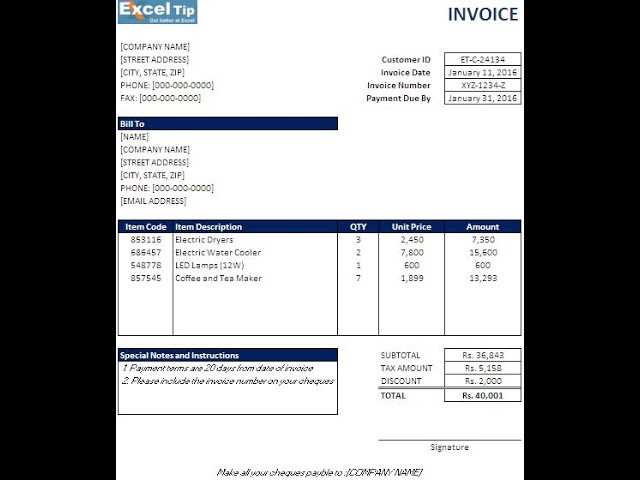

Using Excel Formulas for Automatic Calculations

Integrating formulas into your financial documents simplifies the process of calculating totals, taxes, discounts, and balances. By automating these calculations, you reduce the risk of errors and save time, ensuring that every figure is accurate. With the right formulas in place, numbers are updated dynamically, making it easier to track changes and ensuring that all calculations are consistent and up to date.

Essential Formulas to Use

- SUM: This formula helps calculate the total amount by adding up individual values, such as the cost of each item or service.

- IF: Use this formula to create conditional logic, such as applying discounts or determining tax amounts based on specific criteria.

- PRODUCT: The PRODUCT formula multiplies numbers together, which is useful for calculating the total cost based on quantity and unit price.

- ROUND: To avoid long decimal numbers, the ROUND formula helps format your numbers to a specific number of decimal places, making them more readable.

Advanced Tips for Formula Efficiency

- Named Ranges: Using named ranges for specific cells (such as tax rates or item prices) can make formulas easier to understand and update, especially for large documents.

- Absolute vs. Relative References: Understand the difference between absolute (locked) and relative (moving) references when setting up formulas to ensure they function correctly when copying or modifying your document.

- Auto-update for Recalculation: Set up your formulas so that they automatically update when new data is entered or when changes are made to other parts of the document. This ensures everything remains current without additional effort.

Saving Your Invoice Template for Reuse

Storing your document for future use helps streamline the billing process, saving time on repetitive tasks. By saving your file in an easily accessible format, you ensure that you can quickly generate new records with just a few adjustments. This approach allows you to maintain consistency across your financial documents and reduces the chance of errors, as the structure and layout are already pre-designed.

Choosing the Right File Format

- Excel Workbook: Saving your document as an Excel workbook (.xlsx) preserves all formulas and formatting, allowing for full functionality when you open it later.

- CSV Format: If you prefer working with a plain data format, saving your file as a CSV can be useful for transferring information to other software or databases, though this option doesn’t retain formulas or design elements.

- PDF: If you need to send finalized records to clients, saving your document as a PDF preserves the layout and formatting, ensuring that the document appears the same to all recipients.

Tips for Easy Access and Organization

- Use Descriptive Names: Give your file a name that clearly indicates its content, such as “Client_Name_Billing_Record” or “Monthly_Invoice_Form.” This will help you find the right file quickly.

- Organize Files in Folders: Create dedicated folders for financial documents, categorized by year, client, or project. This organization makes it easier to manage multiple records.

- Cloud Storage: Consider saving your file to a cloud service like Google Drive or Dropbox. This allows for easy access from different devices and offers backup in case of data loss.

How to Add Tax Calculations to Invoices

Including tax in financial documents is essential for compliance and transparency. Accurately calculating tax amounts ensures that your clients are charged correctly and helps you maintain proper records. By incorporating tax calculations, you automate the process of adding the right tax percentage to each transaction, which saves time and reduces errors.

Setting Up Tax Rates

- Fixed Tax Rate: For a consistent tax rate, you can simply apply the same percentage to all products or services. Use a basic formula to calculate this percentage based on the total amount of the transaction.

- Variable Tax Rates: In some cases, tax rates may vary by item or location. You can set up different rates for each product or service by assigning individual tax percentages to different categories in your document.

- Multiple Tax Rates: For regions with more than one applicable tax, such as federal and state taxes, you can create separate columns to calculate each rate and add them together for the final tax amount.

Incorporating Tax Formulas

- Basic Formula: The general formula for calculating tax is:

Total Amount x Tax Rate = Tax Amount. This can be easily entered into your spreadsheet to ensure the correct calculation. - Formula Example: For a 10% tax rate on a $100 total, the formula would be

100 x 0.10 = 10, so the tax amount is $10. - Tax Calculation Across Multiple Items: To apply tax to an entire order, first sum up the prices of all items, then calculate the tax based on the total amount.

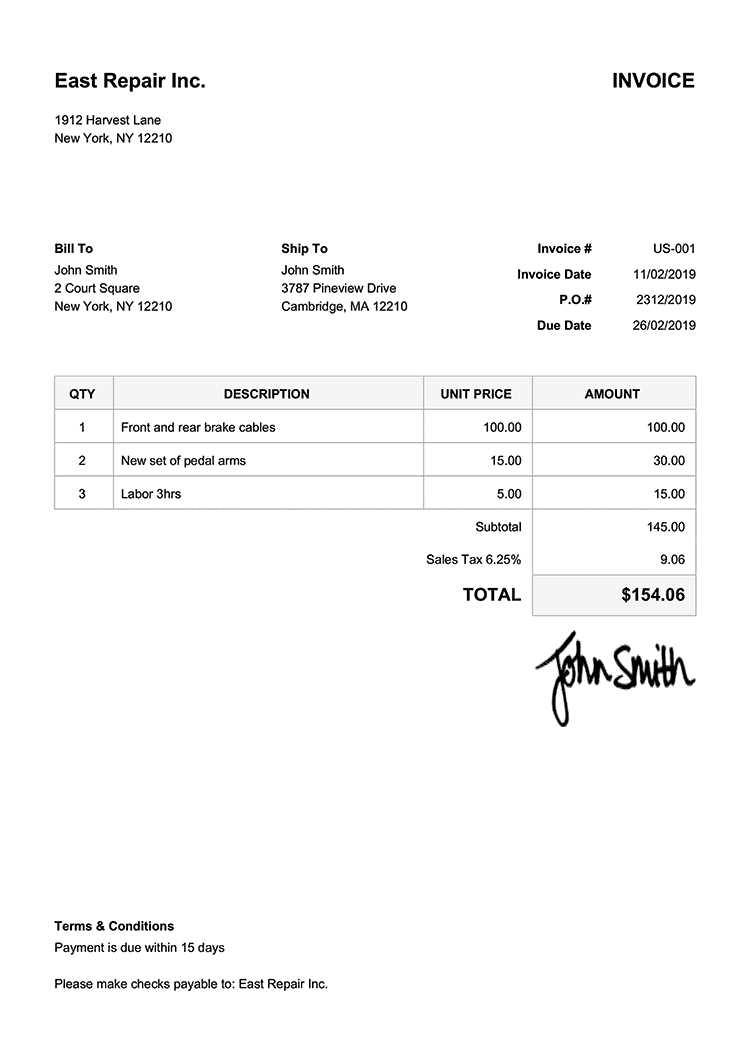

Creating a Professional Invoice Numbering System

Implementing a clear and organized numbering system is vital for managing records efficiently. A well-structured numbering approach helps ensure that each document can be easily identified and tracked. Whether for internal record-keeping or external client management, a professional numbering system enhances consistency, minimizes errors, and streamlines billing processes.

Types of Numbering Systems

- Sequential Numbering: The most straightforward system involves incrementing the number by one with each new record. This approach is easy to understand and maintain, providing a simple structure for all documents.

- Year-Based Numbering: This method includes the year in the numbering format (e.g., 2023-001). It helps you categorize documents by year and makes it easier to locate invoices from a specific time period.

- Client-Based Numbering: For businesses dealing with multiple clients, it may be beneficial to add a client-specific identifier to the number (e.g., 1001-001). This approach personalizes the numbering system and simplifies tracking by client.

Implementing the Numbering System

- Manual Number Entry: In some cases, you may choose to manually enter a number for each record. However, this method can be prone to mistakes, especially when managing a large volume of documents.

- Automated Numbering: If using a spreadsheet, you can set up formulas that automatically generate the next available number. This reduces human error and ensures continuity in the sequence.

- Prefix and Suffix: Consider adding prefixes or suffixes for further clarity (e.g., INV-2023-001). These additions can indicate important details such as document type, year, or client group.

Including Payment Terms on Your Invoices

Clearly outlining payment expectations is crucial for maintaining smooth business transactions. By including payment terms in your documents, you set clear deadlines and avoid misunderstandings with clients. These terms not only ensure timely payments but also help establish professional relationships with your customers. Setting clear guidelines for due dates, late fees, and acceptable payment methods can protect your business from potential delays.

Common Payment Terms to Include

Payment Term Description Net 30 Payment is due within 30 days from the date of the document. This is one of the most common payment terms. Due Upon Receipt The payment is due immediately when the document is delivered to the client. Net 15 Payment is due within 15 days from the date of the document. 2/10 Net 30 A discount of 2% is offered if payment is made within 10 days, otherwise, the full amount is due in 30 days. Additional Considerations for Payment Terms

- Late Fees: Including a late fee clause helps encourage prompt payments. For example, you might add a 1.5% fee per month for overdue balances.

- Preferred Payment Methods: Indicate the acceptable methods of payment, such as bank transfer, credit card, or online payment systems.

- Early Payment Discounts: Offering discounts for early payments can motivate clients to pay quicker, improving your cash flow.

How to Organize and Track Invoices

Efficiently managing financial documents is essential for ensuring timely payments and smooth business operations. Proper organization and tracking of transactions help prevent errors, missed payments, and confusion. By implementing a system to monitor issued documents, businesses can maintain an organized record, streamline accounting tasks, and keep cash flow predictable.

Setting Up a Tracking System

To stay on top of payments, it’s important to use a clear and simple system to track every document sent to clients. This can be done manually or with automated tools that offer better scalability as your business grows. Below is a basic structure that can help you stay organized:

Field Purpose Invoice Number Unique identifier for each document, essential for record-keeping and tracking payments. Issue Date The date the document was created, which helps in calculating due dates. Due Date Indicates when payment is expected and can help track overdue balances. Status Shows whether the document is paid, partially paid, or outstanding. Client Name Ensures that each record is linked to the correct customer. Amount Tracks the total payment expected for each transaction. Best Practices for Tracking

When organizing and tracking your documents, consider the following strategies:

- Digital Records: Use digital spreadsheets or accounting software to automate and centralize your tracking system.

- Clear Categorization: Create separate folders or files for paid, pending, and overdue transactions to quickly identify where follow-up is needed.

- Regular Updates: Ensure that your tracking system is updated regularly, so that any changes in payment status are immediately recorded.

- Reminders: Set up automated reminders to notify clients of approaching due dates or overdue payments.

Printing and Sending Your Invoices

Once your financial documents are prepared, the next step is ensuring they reach your clients promptly. Whether you choose to send them digitally or via physical mail, it’s important to follow a clear and professional process. Properly managing this stage helps ensure timely payments and reinforces the professional image of your business.

Choosing the Right Method for Distribution

There are two primary methods for delivering your documents: digital (email or cloud-based systems) and physical (printed copies). Each method has its advantages and considerations, depending on your client preferences and the nature of your business.

Method Advantages Considerations Digital (Email) Fast, cost-effective, and eco-friendly. Can be easily tracked and stored. Requires accurate email addresses and may not be suitable for all clients. Physical (Printed) Preferred by clients who prefer paper records or are not familiar with digital systems. Higher costs for printing and postage. Slower delivery time. Preparing Documents for Delivery

Before sending out any document, ensure all information is accurate and complete. Double-check for errors in contact details, pricing, and dates. When printing, make sure the layout is clear and professional, with no clutter that could confuse the recipient.

- File Format: Save digital copies as PDFs for compatibility across all devices.

- Quality Printing: Use high-quality paper for printed versions to ensure that the documents look professional.

- Double-Check Contact Information: Verify that the recipient’s name, address, and email address are correct before sending.

Common Mistakes to Avoid in Invoice Templates

When creating documents for billing purposes, it’s essential to ensure they are both accurate and professional. Small errors can cause confusion, delays in payments, or even damage your reputation. Understanding and avoiding common pitfalls will help you present a polished and clear message to your clients.

One of the most frequent mistakes is not including essential details, which can leave the recipient unsure about the payment terms or amount due. Additionally, poor formatting can make the document difficult to read, leading to misunderstandings. Inconsistent numbering systems or incorrect tax calculations are other issues that often arise, impacting the clarity and effectiveness of the document.

Missing or Incorrect Information

It’s crucial to include all relevant data accurately. Missing contact details, incorrect prices, or improperly calculated totals can result in disputes or delayed payments. Always double-check the following:

- Client Details: Ensure the recipient’s name, address, and contact information are correct.

- Accurate Totals: Double-check itemized prices and totals to avoid discrepancies.

- Payment Terms: Be clear about the payment due date, terms, and any late fees.

Poor Design and Layout

While the content is the most important part, a clean and organized layout is just as essential. A cluttered or hard-to-read document can make it more difficult for the recipient to find crucial information. Here are some design tips to improve readability:

- Consistent Fonts: Use simple, professional fonts with a consistent size for headings and body text.

- Clear Structure: Use borders, spacing, and bold text to highlight important sections like the total amount and due date.

- Alignment: Ensure that all data, such as dates, totals, and itemized descriptions, are neatly aligned.

Tips for Optimizing Your Invoice Template

To create a seamless billing experience, it’s essential to streamline your document setup so that both you and your clients can easily process and understand the details. By incorporating a few simple strategies, you can improve the efficiency of your billing cycle, reduce errors, and maintain a professional appearance.

One of the key aspects is simplifying the layout to make important information stand out clearly. Organizing the content logically and using consistent formatting will prevent confusion. Additionally, using automated calculations can save time and eliminate manual errors. Customizing the structure to reflect your business style while keeping it functional is also important.

Automating Calculations

To avoid manual errors and save time, set up automatic calculations for totals, taxes, and discounts. This can be done using basic formulas to quickly adjust amounts as needed, without the need for recalculation each time. Here is an example of a simple setup:

Item Description Unit Price Quantity Total Product A $10 3 $30 Product B $15 2 $30 Subtotal $60 Tax (5%) $3 Total Amount Due $63 Using Templates and Predefined Fields

Many users make the mistake of redesigning their documents from scratch for every new transaction. Instead, set up a reusable structure with predefined fields such as client names, product descriptions, and payment terms. This allows you to easily update and save time for each new bill. Consider using drop-down menus for items or clients if applicable, to further speed up the process.