Invoice Template with Bank Details in Word Format for Easy Use

In today’s digital world, crafting professional financial documents is essential for any business. Ensuring clarity and accuracy in such paperwork helps build trust with clients and streamlines the payment process. With the right approach, generating effective documents that reflect your company’s professionalism is both simple and efficient.

One of the most important aspects of these documents is the inclusion of crucial financial information. This allows clients to make payments quickly and accurately, reducing the chances of delays or errors. By customizing documents to suit your needs, you can easily provide all necessary details in a clean and organized manner.

Making these documents accessible and editable is key for adapting them to different scenarios, whether you’re working with a local client or an international partner. Flexibility and ease of use should be your primary goals when creating these essential records.

By focusing on the right structure and layout, you can ensure your financial communications are both professional and functional.

Invoice Template with Bank Details in Word Format

Creating professional payment requests is crucial for maintaining smooth financial transactions. A well-structured document not only reflects your company’s professionalism but also ensures clarity in communication between you and your clients. These documents should include all the necessary information that allows for easy and accurate payments to be made without confusion or delay.

When preparing such forms, it is important to include vital financial data such as your company’s payment methods, account numbers, and any other relevant information to facilitate smooth transactions. This data needs to be easily accessible for the recipient and clearly displayed in an organized manner.

Using a flexible file format, such as a commonly used document editor, provides convenience for customization. You can adapt it quickly to your needs, whether it’s adding new payment instructions or adjusting the layout. These editable formats are user-friendly, making it easier to generate consistent, accurate records without the need for complex software.

Why Use Word for Invoice Creation

Creating professional financial documents requires both simplicity and flexibility. One of the most convenient methods for generating such paperwork is by using widely accessible software that allows for easy customization. The right choice of tool can streamline the process of formatting and editing, ensuring that you can produce polished documents without requiring specialized skills or software.

Ease of Customization

Using a popular document editor provides flexibility in adjusting layouts, fonts, and styles to match your business needs. Whether you are creating a document for a small transaction or a large project, you can modify the structure and content effortlessly. This ensures that every financial document can be tailored to the client’s specifications and your company’s branding.

Universal Accessibility

Another reason for using document editors is their widespread availability. Many users are already familiar with this type of software, and it’s compatible with most operating systems, making it accessible to a wide range of clients. You don’t need to worry about compatibility issues when sharing or editing documents, as they are often compatible with both Mac and Windows users.

Furthermore, these editors offer built-in templates and simple tools that help you create professional-looking documents quickly. You don’t need complex features to generate clean, straightforward records that will help facilitate prompt payments and clear communication.

How to Customize Bank Details on Invoices

When preparing financial documents, it’s crucial to ensure that payment information is accurate and easy to find. Customizing payment instructions allows clients to transfer funds efficiently, avoiding errors or delays. Adjusting the relevant sections of your document to include the correct financial data can help streamline the payment process and build trust with your clients.

Identify Key Financial Information

Start by identifying the key elements that need to be included, such as your account number, routing number, payment method, and any other necessary codes. This information should be placed in a clear and prominent spot within the document so that it’s easy for the recipient to locate. Typically, financial information is positioned towards the bottom of the document, but it should be placed in a way that doesn’t distract from the rest of the content.

Adjust Formatting and Layout

Once you’ve identified the relevant financial data, adjust the formatting to suit your needs. You may want to use bullet points, bold text, or tables to organize the payment instructions and make them stand out. Using a simple, clean layout ensures that the recipient can quickly review and access the payment information without confusion.

Consistency is key when modifying these sections. Ensure that the same format is used for every document you create, so clients always know where to find the necessary payment instructions. A professional, consistent approach reinforces the credibility of your business and ensures that payments are processed smoothly.

Benefits of Using Digital Invoice Templates

Utilizing digital tools for creating financial records offers numerous advantages, especially for businesses looking to save time and ensure accuracy. Instead of creating each document from scratch, a pre-designed format allows for quick customization while maintaining a professional appearance. This not only improves efficiency but also reduces the likelihood of errors, making it easier to manage payments.

Time-Saving and Efficiency

One of the primary benefits of using digital formats is the speed at which you can generate documents. Instead of starting from a blank page every time, you can quickly fill in the necessary information, adjust specific details, and produce a polished record in minutes. This efficiency is crucial for businesses that need to send multiple documents in a short time frame.

Consistency and Professionalism

Pre-designed layouts ensure that your documents are always uniform in appearance. This consistency not only saves time but also projects a professional image to clients. A uniform style helps reinforce your brand identity, ensuring that every financial record you send is immediately recognizable and aligns with your company’s standards.

Moreover, digital formats can be easily updated, allowing you to modify payment instructions, company information, or other details whenever necessary. This flexibility helps keep your documents relevant and up-to-date without the need for redesigning or reformatting each time.

Overall, digital solutions simplify the process of creating accurate, professional documents while increasing productivity and reducing the risk of mistakes.

Step-by-Step Guide to Create an Invoice

Creating a professional payment document can be a straightforward process if you follow the correct steps. From gathering necessary information to organizing the layout, each part of the process ensures that your client receives clear instructions for completing payment. In this guide, we will walk you through the essential steps for generating a polished and accurate financial document.

Step 1: Gather Essential Information

Before starting, collect all the required details that need to be included in the document. This typically includes your company name, contact information, payment instructions, transaction amount, and any additional charges. Having everything ready beforehand will help you avoid missing crucial information during the process.

Step 2: Organize the Layout

The layout of your document is important to ensure readability and professionalism. The information should be clearly categorized and easy to follow. A well-structured format not only improves the client’s experience but also speeds up the process for both parties. Below is an example of how you can organize the content:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product/Service Name | 1 | $100 | $100 |

| Additional Fees | – | – | $10 |

| Total Amount Due | $110 | ||

This structure makes it easy to include all essential data and gives a clear breakdown of the total amount due. You can customize the table to fit different pricing models or add discounts as needed.

Step 3: Add Payment Instructions

Once you have listed the products or services and calculated the total, the next step is to include the payment instructions. Specify your accepted payment methods, including any relevant account numbers or transaction details, so that the client knows exactly how to complete the payment process.

Consistency in format and layout will ensure that each document you create is professional and easy to follow, reducing the chances of misunderstandings or payment delays.

Key Elements to Include in Your Invoice

When preparing a professional financial document, it’s essential to include specific information that ensures clarity and facilitates a smooth transaction process. By providing all the necessary details in an organized and easy-to-read format, you can avoid confusion and ensure timely payments. Below, we’ll highlight the key elements that should be present in any payment request document.

1. Contact Information

Always start by including the essential contact details for both you and your client. This includes your company name, address, phone number, email, and website, as well as the recipient’s contact information. This helps both parties keep track of the transaction and ensures clear communication if issues arise.

2. Description of Services or Products

It’s crucial to include a clear breakdown of the products or services provided, along with their corresponding quantities and pricing. A detailed list helps the recipient understand exactly what they are being charged for. Here’s an example layout:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service/Product Name | 1 | $50 | $50 |

| Additional Service | 1 | $20 | $20 |

| Total Amount Due | $70 | ||

3. Payment Terms

Clearly stating the payment terms is vital. Specify the due date, any applicable discounts for early payments, and details of late fees or interest charges if payments are delayed. This helps set expectations for your clients and ensures they know when to pay and what the consequences are for missing the deadline.

By including these key elements, you ensure your payment request is complete, transparent, and professional, facilitating smooth transactions and reducing the risk of disputes.

How to Add Payment Terms in Word Invoices

Clearly defined payment terms are essential for ensuring smooth transactions and avoiding misunderstandings. By specifying when payments are due, the accepted methods, and any penalties for late payments, you set clear expectations for your clients. This section will guide you through the process of adding payment terms to your financial documents effectively.

Step 1: Specify Payment Due Date

The first step in outlining payment terms is to indicate the due date. This is the deadline by which the client must make the payment. Clearly state the date or the period in which payment is expected, such as “Net 30” or “Due upon receipt”. Here are some examples:

- Payment due within 30 days

- Due upon receipt

- Payment due by [specific date]

Step 2: Include Accepted Payment Methods

Next, list all acceptable payment methods to make it clear how the client should settle the amount. This could include bank transfers, credit card payments, or online platforms. Be sure to provide any relevant details such as account numbers or payment links. Examples might be:

- Bank transfer to account number [XXXXXX]

- Credit card payments via [payment processor]

- PayPal: [email address]

Step 3: Late Payment Fees

To encourage timely payments, it’s also important to mention any late payment fees or interest charges. You can specify the percentage added for overdue amounts or a flat fee. Here are some common approaches:

- Late payments incur a 2% monthly interest charge

- A flat fee of $25 will be added for payments received after the due date

Step 4: Offer Discounts for Early Payments

If you offer discounts for early payments, make sure to specify this in the payment terms as well. For example, you could offer a 5% discount if payment is made within 10 days. This provides an incentive for clients to pay quickly and helps improve cash flow. Example wording:

- 5% discount for payments made within 10 days

By incorporating these elements, you ensure that both parties are clear on the terms and conditions of the transaction, helping to avoid confusion and ensure timely payments.

Common Mistakes to Avoid in Invoices

When creating financial documents, small mistakes can lead to delays in payment or confusion with your clients. Ensuring accuracy is essential for maintaining professional relationships and ensuring smooth transactions. In this section, we’ll highlight common errors that are often overlooked but can cause problems if not addressed.

1. Incorrect or Missing Contact Information

One of the most common mistakes is failing to include complete and accurate contact information. Missing details like your company name, phone number, or the recipient’s contact can delay communication or create confusion. Always double-check that both parties’ contact details are clearly listed.

2. Not Itemizing the Services or Products

Providing a clear breakdown of the items or services delivered is essential. If this information is vague or missing, clients may not know exactly what they are being charged for, which can lead to disputes or delayed payments. A detailed list helps clarify charges and makes the payment process easier for both sides. Below is an example of how to organize your list:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product/Service Name | 1 | $150 | $150 |

| Consultation Service | 2 hours | $50/hour | $100 |

| Total Amount Due | $250 | ||

3. Not Including Clear Payment Instructions

Another common issue is failing to provide clear payment instructions. If the recipient doesn’t know how to make the payment, it may lead to unnecessary delays. Be specific about your payment methods, whether it’s by bank transfer, credit card, or another method. Always include your account information, payment platform links, or other relevant details clearly.

4. Missing Due Date or Payment Terms

Leaving out the due date or payment terms can cause confusion and lead to late payments. Be sure to include a specific deadline for payment, along with any late fees or early payment discounts. Without this information, clients may not know when the payment is expected or what charges they may incur if the deadline is missed.

5. Failing to Double-Check Calculations

Errors in pricing or calculations can cause frustration for both you and your client. Always double-check the math to ensure that the total is correct and that any taxes, discounts, or additional charges have been accurately applied. A simple mistake can erode trust and delay payment.

By avoiding these common mistakes, you can ensure that your documents are clear, accurate, and professional, leading to faster payments and stronger relationships with your clients.

Best Practices for Invoice Layout and Design

Having a clear, well-organized structure for your financial documents is key to creating a professional impression and ensuring that your clients can easily understand the payment details. The design and layout of the document should facilitate quick reading, while also conveying all the necessary information. In this section, we’ll go over the best practices for designing a document that is both functional and visually appealing.

1. Keep It Simple and Clean

The design of your document should be straightforward, with a focus on clarity. Avoid cluttering the page with unnecessary elements or overly complex graphics. A clean layout makes it easier for the recipient to find the most important details quickly, such as the payment amount and due date. Stick to a simple font, use bullet points or tables for organization, and leave enough white space to avoid a crowded look.

2. Prioritize Key Information

The most important information should be easy to locate. Start by placing your company details and the recipient’s information at the top of the document, followed by the transaction summary and payment instructions. This structure ensures that both parties can quickly access the most critical data, like the total amount due and the due date. Use bold headings or a larger font size to make this information stand out.

For example:

- Company Name and Contact Information

- Recipient Name and Contact Information

- Transaction Breakdown (services/products)

- Total Amount Due

- Payment Terms and Instructions

3. Use Tables for Clarity

When breaking down the charges, using a table can provide clarity and organization. Tables allow you to list each item, its quantity, unit price, and total in a neat and easy-to-read format. This also makes it easier for your client to verify the charges and ensures transparency.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product/Service | 2 | $50 | $100 |

| Additional Charge | 1 | $20 | $20 |

| Total Due | $120 | ||

By adhering to these best practices, you can create financial documents that are not only easy to read but also present a p

How to Use Bank Account Information Correctly

Accurately sharing your financial details is crucial when requesting payments from clients. Including precise account information helps ensure that transactions are processed smoothly and without errors. However, it’s important to present this sensitive data in a secure and professional manner, ensuring that both parties understand how and where payments should be made. This section outlines how to use account information properly in financial records.

1. Provide Complete Account Information

When you include account details, ensure that all required information is provided clearly. This includes your account number, routing number, and any additional identifiers (such as IBAN or SWIFT codes) depending on the payment method. Make sure this data is accurate, as errors could delay payments or cause them to be sent to the wrong account.

For example:

- Account Name: [Your Company Name]

- Account Number: [123456789]

- Routing Number: [987654321]

- IBAN: [GB29NWBK60161331926819]

- SWIFT/BIC: [NWBKGB2L]

2. Keep Information Secure

Due to the sensitivity of financial data, it’s important to protect the information you share. Only include account details in secure communications, such as encrypted emails or trusted payment platforms. Avoid sending this information via insecure channels, like regular email or text messages, to minimize the risk of fraud or unauthorized access.

3. Clarify Payment Instructions

Along with the account details, make sure you provide clear instructions on how the client should make the payment. Specify the method (e.g., bank transfer, online payment system) and any additional steps required to complete the transaction. This helps your client avoid confusion and ensures that payments are processed quickly and accurately.

Example payment instructions:

- Please use the following account details for the payment: [Include your bank information]

- Transfer the total amount due to the specified account number.

- Ensure the payment reference includes [Invoice Number or Client ID] to avoid delays.

By presenting your financial details clearly and securely, you ensure a smoother payment process and build trust with your clients.

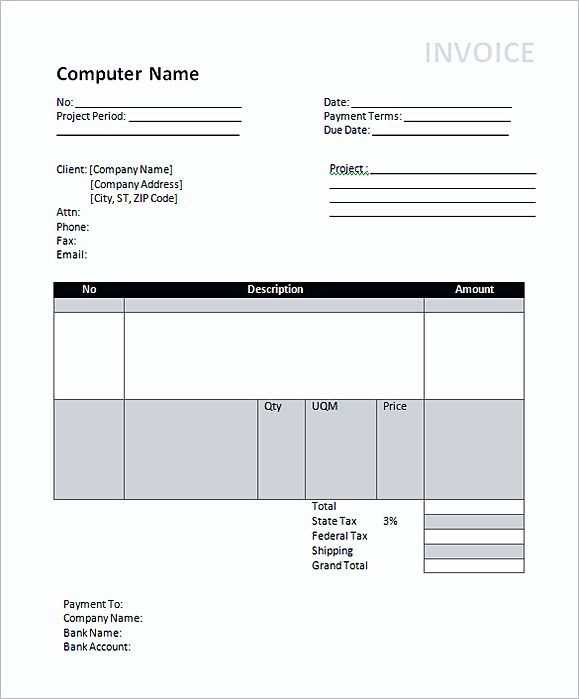

Free Invoice Templates for Word You Can Use

If you’re looking for an easy way to create professional-looking payment documents without starting from scratch, using free pre-designed layouts can save you time and effort. These free resources offer structured formats that you can simply fill in with your own details. Whether you’re an entrepreneur or a small business owner, there are plenty of options available to meet your needs.

1. Simple Layout Templates

A clean, minimalist design is ideal for businesses that prefer a straightforward approach. These layouts focus on essential information such as the services rendered, total amount due, and payment terms, without any unnecessary frills. They are easy to customize and allow you to create a professional document in no time. Examples include:

- Basic payment request

- Service breakdown with pricing

- Flat-rate charge format

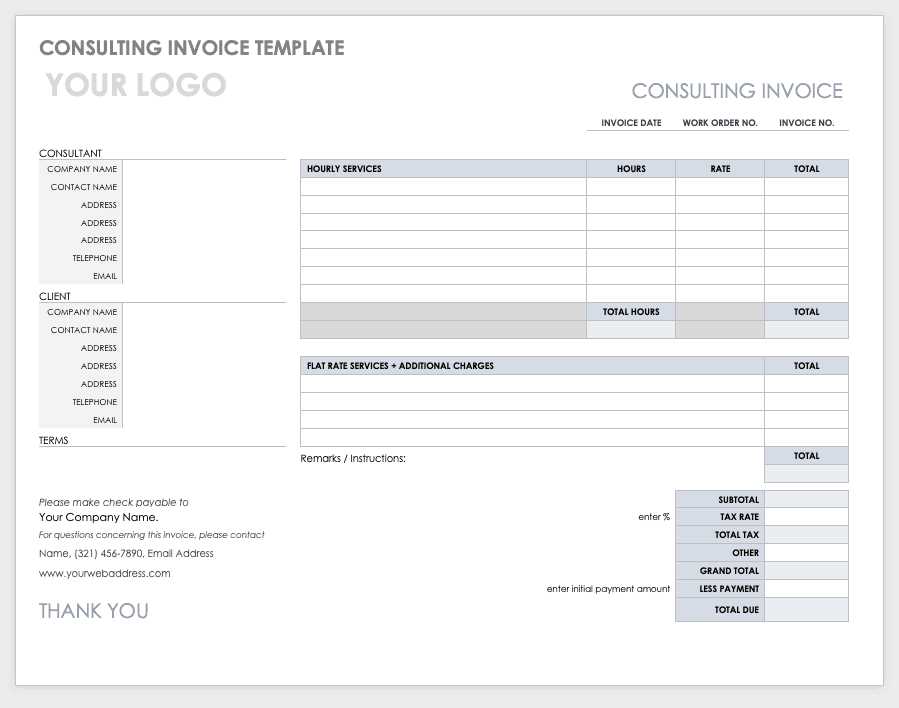

2. Professional Business Templates

For businesses that need a more polished and branded document, professional designs include sections for company logos, contact details, and customized payment terms. These templates are perfect for those who want to impress clients with a visually appealing document while still keeping it functional. Some examples are:

- Business-style invoices with logos and headers

- Incorporating tax details and multiple itemized sections

- Payment schedules for recurring services

3. Specialized Templates for Freelancers

Freelancers and independent contractors often need templates that cater to their specific needs, such as hourly rates, project milestones, or customized terms. These types of designs make it easier to present detailed work breakdowns and ensure clients understand the payment structure. Common options include:

- Hourly rate calculators

- Progress-based payment schedules

- Milestone-based billing formats

4. Fully Customizable Options

If you want complete control over the design and structure, many free resources allow full customization. These templates are great if you want to adjust the layout to suit your branding or include additional sections like discounts or shipping fees. Customizable formats include:

- Editable fields for flexible item entries

- Options to change colors, fonts, and styles

- Blank templates for complete personalization

All these free resources are designed to make the invoicing process quicker and more professional. You can easily find the right one to match your business needs and create clear, accurate financial documents in just a few clicks.

How to Ensure Accurate Invoice Payment Details

Accuracy in the financial section of your documents is essential to avoid payment delays and potential disputes. Providing clear, precise payment information ensures that clients can easily complete their transactions without confusion. This section highlights the key steps to follow in order to guarantee that the payment details are correctly presented and processed smoothly.

1. Double-Check Your Account Information

It is crucial to verify that all account-related details are entered correctly. Any discrepancies in account numbers, routing codes, or payment links can cause significant delays or prevent payments from being processed. Before finalizing any document, take the time to carefully review the account information and ensure that all details are accurate and up to date. This includes:

- Account number

- Sort code or routing number

- Payment reference numbers (if applicable)

- IBAN and SWIFT/BIC codes for international transactions

2. Specify the Correct Payment Method and Instructions

Clearly stating the method of payment and any specific instructions is essential. Whether you are accepting direct transfers, online payments, or credit card transactions, the process should be straightforward. Providing complete details on how to complete the transaction will reduce errors and ensure that the client follows the correct procedure. You can use a table format for clarity:

| Payment Method | Details |

|---|---|

| Bank Transfer | Account Number: [1234567890], Sort Code: [12-34-56] |

| PayPal | Email: [[email protected]] |

| Credit Card | Via [Payment Gateway], Instructions: [Link or details] |

By clearly specifying the payment methods and including all relevant details, you make the process easier for your clients and reduce the chances of payment errors.

Tips for Professional Invoice Appearance

The visual presentation of your payment documents plays a significant role in how clients perceive your business. A well-organized, polished layout not only conveys professionalism but also ensures that essential information is easy to find. In this section, we’ll cover practical tips to help you create documents that reflect a high standard of professionalism.

1. Keep the Design Clean and Minimalistic

A cluttered design can overwhelm the reader and make it difficult for them to find the key information. Focus on simplicity: use clear fonts, sufficient white space, and concise headings. Avoid unnecessary images, icons, or decorative elements that may distract from the primary details. A clean, minimal layout conveys professionalism and ensures readability.

2. Use Consistent Branding Elements

Your documents should align with your company’s branding to reinforce your business identity. This includes using your logo, color scheme, and fonts that match your marketing materials. Consistent branding helps build recognition and trust with your clients. Make sure your company name, contact information, and logo are placed prominently at the top of the document.

3. Organize Information with Tables

When breaking down services, products, or charges, tables are a great tool for presenting the information clearly and systematically. Tables make it easy for your clients to verify the charges and understand the payment structure. Group similar information together, such as item descriptions, quantities, and prices, to ensure clarity.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 2 | $50 | $100 |

| Consultation Service | 1 | $150 | $150 |

| Total Due | $250 | ||

4. Choose Legible Fonts and Proper Formatting

Select professional, easy-to-read fonts like Arial, Calibri, or Times New Roman. Avoid using overly stylized fonts that can make the document harder to read. Use proper text formatting–bold headings, clear separation of sections, and bullet points where applicable–to guide the reader’s eye and improve the o

Legal Considerations for Invoice Information

When creating financial documents for your business, it’s essential to ensure that the information provided complies with legal requirements. Not only does this help avoid potential disputes with clients, but it also ensures that your business operates within the framework of tax laws and industry regulations. This section covers the key legal considerations when including payment and company information in your documents.

1. Include Required Business Information

Depending on your location and type of business, there may be certain legal requirements for the information that must appear on any payment request. Common requirements include your business name, address, tax identification number, and registration number. For businesses in many jurisdictions, including this information is mandatory for legal and tax purposes. Ensure that all mandatory fields are correctly filled to avoid penalties or compliance issues.

- Business name and contact details

- Tax identification number (TIN) or VAT number

- Business registration number (if applicable)

- Legal business address

2. Follow Local Tax Regulations

Tax laws vary by region, so it’s important to include the necessary tax information in your documents. This could include VAT (Value Added Tax), sales tax, or other applicable taxes based on the nature of your business. Always check with a local tax advisor or legal professional to ensure compliance with current tax regulations. Incorrect tax reporting can result in penalties or legal issues with authorities.

- Clearly show tax rates and amounts for taxable goods or services

- Include tax registration numbers where required

- Ensure the format of tax details complies with local standards

3. Be Aware of Payment Terms and Late Fees

Legal considerations also include clearly defining payment terms. Specify the time frame within which the payment is due, as well as any applicable late fees or interest for overdue payments. These terms should be clearly communicated upfront, ideally at the time of agreement, and should be reflected on the final payment request. In some jurisdictions, there are legal limits to the amount of interest or late fees that can be charged, so it’s important to ensure compliance with local laws.

- Clearly state payment due date and grace period

- Specify interest or late fees for overdue payments, ensuring they are within legal limits

- Define any other specific terms or conditions related to payments

By understanding and adhering to these legal requirements, you can protect both your business and your clients, ensuring smooth transactions and reducing the risk of legal complications.

How to Save and Share Invoices in Word

After creating your payment document, it’s essential to know how to save and share it effectively to ensure secure delivery and easy access for your clients. Proper file management ensures that the document remains intact and accessible when needed. This section outlines the best methods for saving and sharing your payment requests, helping you streamline the process.

1. Save the Document in the Right Format

When you’re ready to save your payment request, the first step is to choose the right format. Saving your document in a widely accepted file format ensures that it can be easily opened by your client regardless of the software they are using. The most common and preferred formats are:

| File Format | Purpose |

|---|---|

| Preserves formatting and can be opened on almost any device or software | |

| DOCX | Editable format for those who may need to make changes before finalizing the document |

| RTF | Universal format that maintains basic formatting and can be read on most platforms |

2. Use Cloud Storage for Easy Access

Once you’ve saved the document, consider uploading it to a cloud storage platform such as Google Drive, Dropbox, or OneDrive. Cloud storage not only allows you to access your documents from any device but also provides an additional layer of security by storing them online. This ensures that both you and your clients can retrieve the document at any time, even if files are lost or deleted from a local computer.

3. Share the Document Securely

When it comes to sharing your document, security is key. You can share the payment document via email, using either a direct attachment or a shareable cloud link. If you’re sending sensitive information, consider using encryption or password protection to safeguard the contents. Below are some secure sharing methods:

- Email with a PDF attachment and password protection

- Cloud-sharing links with restricted access and expiration dates

- Using secure file-sharing platforms like WeTransfer for large files

By following these practices, you can ensure that your payment documents are saved properly and shared securely, making the transaction process smoother and more efficient for both you and your clients.

Why Bank Details Matter in Invoices

Including accurate financial information in your payment documents is critical for ensuring that transactions are processed smoothly and promptly. The information you provide regarding payment methods and account numbers directly impacts your ability to receive payments on time. In this section, we’ll explore why these specific financial details are so important for both you and your clients.

1. Ensures Timely and Accurate Payments

Clear and correct payment information allows clients to transfer funds quickly without delays. When your client has access to accurate banking information, they can complete payments without confusion, minimizing the chances of errors. Missing or incorrect details can lead to payment delays, which could harm your cash flow and create friction in the professional relationship.

2. Avoids Disputes and Confusion

Having precise financial data listed in your documents helps avoid misunderstandings between you and your clients. Clients are less likely to dispute payments or claim they were not able to make a transfer if the payment instructions are clear and comprehensive. Providing the right information–such as the exact account number, payment method, and reference codes–makes it easier for clients to fulfill their obligations without any ambiguity.

In short, accurate financial information is essential for ensuring that you get paid on time, reducing administrative delays and potential conflicts with clients.