Download Canadian Customs Invoice Template Excel for Simplified Import and Export

Managing international shipments requires accurate and well-organized paperwork to ensure smooth transactions and avoid delays at the border. One of the most critical documents involved in this process is the detailed declaration of goods being shipped, which must meet various regulations and requirements. Without proper documentation, even minor errors can lead to disruptions, increased costs, or legal issues.

Fortunately, with the right tools, this task can be simplified significantly. A well-structured form allows businesses to efficiently record essential details such as the description of goods, their value, country of origin, and the applicable tariffs. Using a flexible, easily customizable tool can help streamline the process, ensuring that all necessary data is accurately captured and compliant with shipping standards.

For businesses engaged in cross-border trade, utilizing a digital solution offers several advantages, including automation, error reduction, and better record-keeping. By utilizing the appropriate tools, you can reduce the likelihood of mistakes and avoid unnecessary delays in customs processing. Whether you are a small enterprise or a large organization, understanding how to properly structure and utilize these documents is crucial for efficient international shipping.

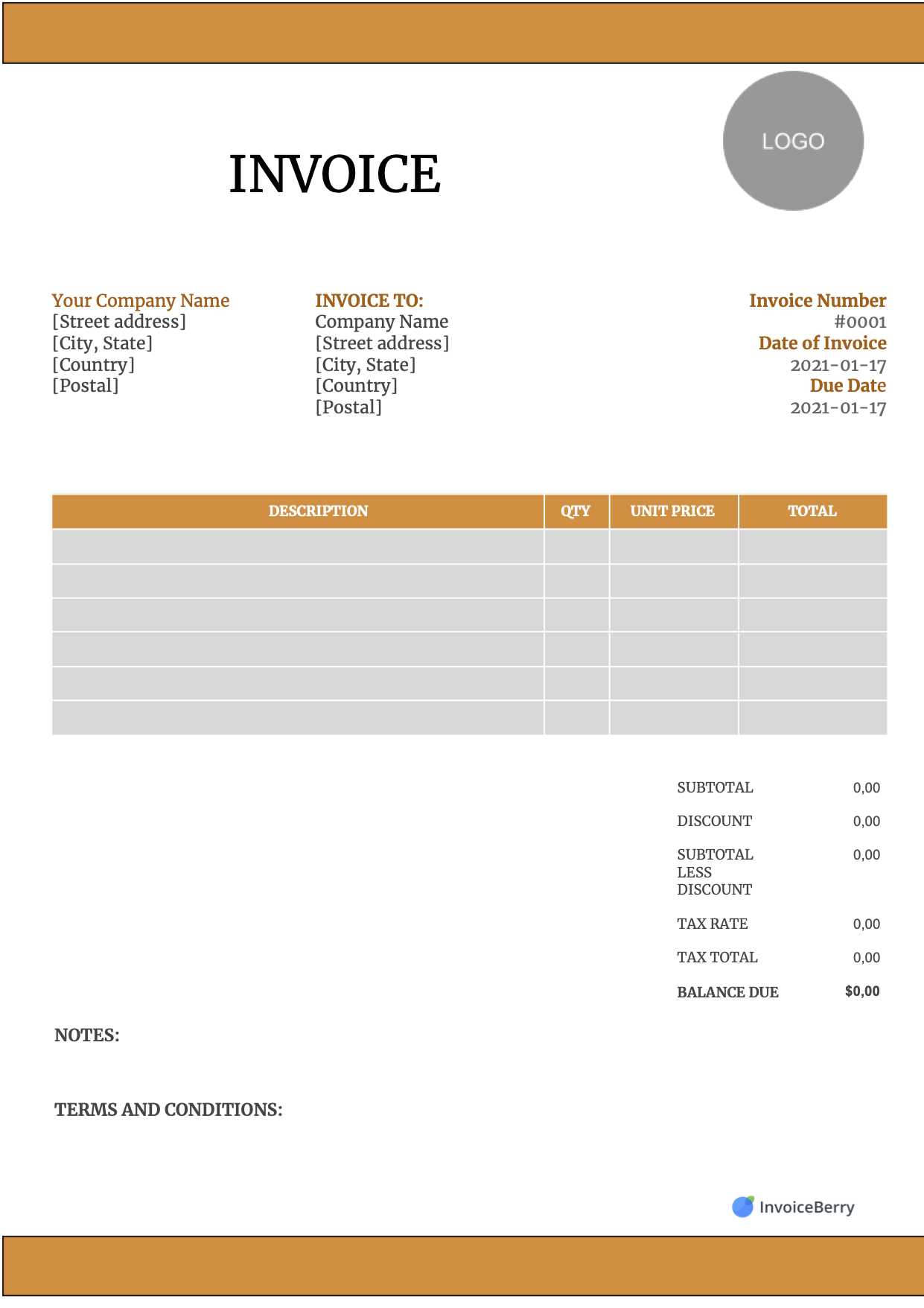

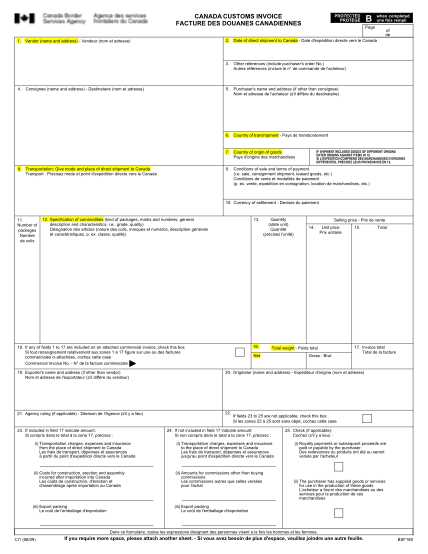

Canadian Customs Invoice Template Excel Overview

When dealing with international shipments, having the right documentation is crucial to ensure smooth processing at the border. A properly designed document allows for accurate reporting of goods, their value, and other essential details required by authorities. The use of a digital document format makes this process more efficient, offering the flexibility to tailor information according to specific needs while maintaining consistency and accuracy across shipments.

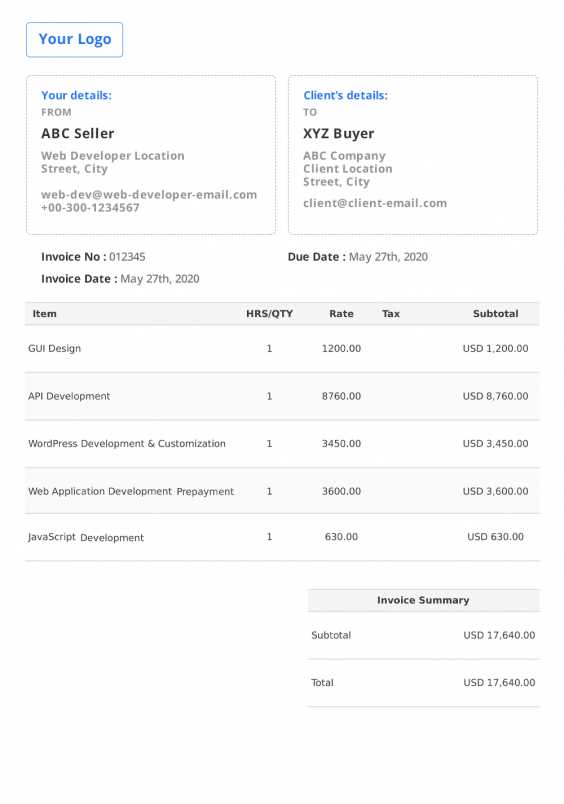

This type of document is typically structured to capture key information such as:

- Description of the goods being shipped

- Country of origin for each item

- Declared value for customs purposes

- Shipping terms and conditions

- Tariffs and applicable taxes

The primary advantage of using a digital format is the ease of modification and automation. With a well-organized form, businesses can quickly update quantities, values, or other specifics without worrying about formatting errors. This reduces the risk of mistakes and ensures that all required data is presented in a compliant manner.

Furthermore, using a digital solution provides the ability to store and share documents more efficiently. With integrated features, it is possible to calculate duties and taxes automatically, track shipments, and even produce reports that give a comprehensive view of international transactions. As global trade grows more complex, having a clear, customizable system for managing these documents becomes essential for both small and large enterprises.

Why Use an Excel Template for Customs Invoices

When managing international shipments, accuracy and efficiency are paramount. One of the best ways to achieve both is by utilizing a flexible, automated document that simplifies the process of declaring goods for cross-border transactions. A digital tool that allows customization and automatic calculations ensures that all the necessary details are entered correctly without tedious manual adjustments. These tools also help businesses stay compliant with regulatory requirements while minimizing errors and delays in the shipment process.

Key Advantages of Using a Digital Document Format

Here are some of the main reasons why a digital document system is beneficial for managing shipping and transaction declarations:

- Automation: Automatic calculations of taxes, duties, and other variables can save time and reduce the chance of errors.

- Customization: The ability to adjust fields and formulas to match specific shipping needs, making it easier to manage various types of shipments.

- Efficiency: Quick updates and changes, particularly for recurring shipments, reduce time spent on paperwork and improve overall productivity.

- Accuracy: Predefined formulas and validation checks help ensure the data entered is consistent and correct, which is critical for avoiding customs delays.

- Cost-Effective: Digital solutions eliminate the need for costly third-party software or physical document management, especially for small and medium-sized businesses.

How a Digital Format Enhances the Process

By adopting a flexible digital document system, businesses can streamline their shipping procedures. Here’s a breakdown of how this method compares to manual alternatives:

| Traditional Method | Digital Document System |

|---|---|

| Manual calculations and data entry | Automatic calculations and pre-set formulas |

| High risk of human error | Built-in validation checks to ensure accuracy |

| Time-consuming updates for each shipment | Quick, easy customization for recurring shipments |

| Difficulty in storing and sharing documents | Digital storage and easy sharing via email or cloud |

Ultimately, using a digital solution not only makes the process more efficient but also helps businesses stay organized and compliant with international regulations. The flexibility of this approach ensures that companies can scale their operations without worrying about managing complex paperwork manually.

Key Features of a Customs Invoice Template

Effective shipping documentation must include several key elements to ensure smooth processing and compliance with international trade regulations. A well-designed form for reporting goods should provide clear fields for essential details, automatic calculations, and flexibility to accommodate various types of shipments. The goal is to create a document that is easy to use, reduces errors, and speeds up the declaration process.

Here are the most important features that a good digital document should include:

- Automated Calculations: Automatic formulas to compute taxes, duties, and other fees based on item values or quantities can save time and reduce errors.

- Customizable Fields: The ability to add or remove fields based on specific requirements allows for flexibility in handling different product types, shipment sizes, or destinations.

- Predefined Data Validation: Built-in checks ensure that the information entered into the form is valid, preventing common errors like incorrect codes or missing details.

- Clear Layout: A user-friendly layout ensures that all necessary data is entered in the correct order, with clearly labeled sections for easy navigation.

- Itemized Listings: An organized section for listing individual products, including their descriptions, values, and quantities, ensures transparency and accuracy for customs officials.

- Currency Support: Support for multiple currencies allows businesses to handle shipments across different regions without needing to adjust the base currency manually.

- Compliance with Legal Requirements: The document should automatically generate the correct fields required for legal compliance in international shipping, helping businesses meet regulatory standards.

These features not only enhance the accuracy of documentation but also improve the overall efficiency of the shipping process. By leveraging these functionalities, businesses can reduce the risk of delays, lower costs, and ensure that shipments are processed smoothly and without issues.

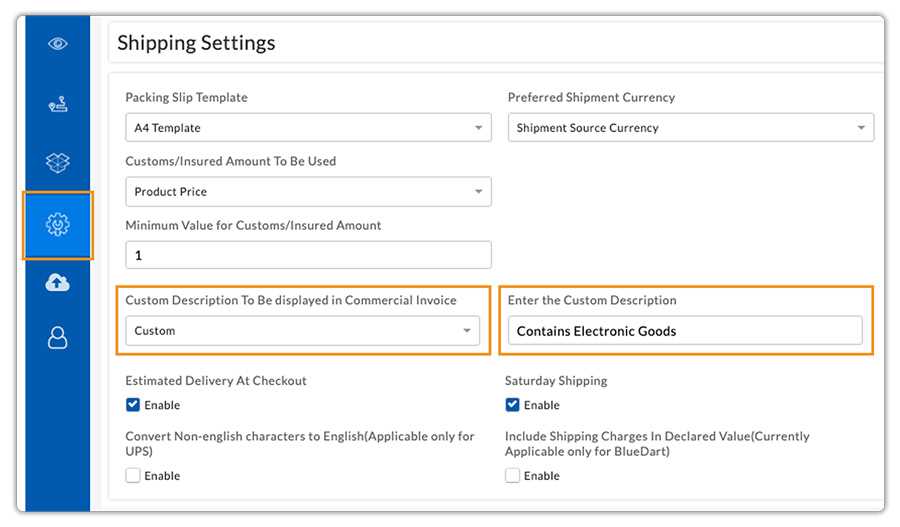

How to Customize Your Canadian Invoice Template

Customizing your shipping declaration document is a critical step to ensure that all relevant details are accurately captured for every transaction. The flexibility to adjust the layout, fields, and formulas based on your specific needs will help streamline the process and reduce the chance of errors. Tailoring your document allows you to meet regulatory requirements while making it easier to manage frequent shipments or unique product categories.

Here are a few steps to help you customize your document:

- Identify Required Fields: Start by determining which pieces of information are mandatory for each shipment, such as product descriptions, value, country of origin, and shipping terms. These fields should be clearly marked and organized for easy data entry.

- Adjust Layout for Your Needs: Organize the document so that the most important information appears first. For example, prioritize the itemized listing of goods, followed by their values and tariff codes. Ensure that each section is visually distinct to enhance readability.

- Include Custom Calculations: Set up formulas to automatically calculate taxes, duties, and other charges based on the values or quantities entered. This reduces the need for manual calculations and minimizes the risk of errors.

- Customize Item Descriptions: If you regularly ship unique or specialized products, consider adding additional fields for product codes or serial numbers. This ensures that every item is clearly identified and described according to its specifications.

- Adapt for Multiple Currencies: If your business deals with international shipments, make sure your document can handle multiple currencies. Add a dropdown menu or a currency converter tool to automatically adjust the values based on the selected currency.

- Set Up Validation Rules: Create rules to ensure that all required fields are filled out correctly. For example, you can set up dropdowns for countries, product categories, or tariff codes to prevent errors in data entry.

By customizing your shipping declaration forms, you can save time and reduce mistakes, ensuring that each shipment is processed efficiently and without delays. Personalizing your document to match your business needs will also enhance your workflow and help maintain compliance with international trade regulations.

Common Mistakes in Customs Invoices

Even a small error in shipping documentation can cause significant delays and complications, especially when dealing with international shipments. Ensuring that all required details are accurate and compliant with regulations is essential to avoid unnecessary issues with authorities. However, there are several common mistakes that businesses often make when preparing their shipping declarations, which can lead to customs holds, fines, or even the rejection of shipments.

Here are some of the most frequent mistakes to watch out for:

- Incorrect or Missing Product Descriptions: One of the most common mistakes is failing to accurately describe the goods being shipped. Customs authorities require a detailed description of each item, including its function and material composition. Omitting this information or providing vague descriptions can lead to delays or fines.

- Wrong Tariff Codes: Using incorrect tariff codes for products can result in incorrect duty assessments. It’s essential to look up the correct HS (Harmonized System) codes for each product to avoid costly errors.

- Failure to Declare Accurate Values: Undervaluing goods in an attempt to reduce duties is a risky practice. Providing inaccurate values can result in penalties or confiscation of the goods. Always declare the true value of the products based on their market price or invoice price.

- Not Including All Required Documents: Often, businesses fail to attach all the necessary supporting documents, such as purchase orders, shipping receipts, or certificates of origin. Missing documents can delay the processing of shipments or lead to rejection by customs officials.

- Inconsistent Currency or Units: Mixing currencies or units of measurement (e.g., weight or volume) between different parts of the document can create confusion and cause errors in customs processing. Ensure consistency throughout the declaration and convert all values to the required units.

- Incorrect or Missing Signatures: Many businesses overlook the requirement to sign certain sections of the shipping declaration. Without the proper signatures, the document may not be considered valid, leading to processing delays or the return of goods.

- Failure to Update Information for Recurring Shipments: Businesses that ship regularly may forget to update their forms with new product information, quantities, or values, leading to outdated or incorrect entries. It’s important to ensure that each new shipment reflects current details.

By being aware of these common mistakes and taking steps to avoid them, you can ensure that your documentation is processed efficiently and without complications. Double-checking all information, using automated tools to calculate values, and staying informed about regulations will help prevent delays and ensure compliance with international shipping standards.

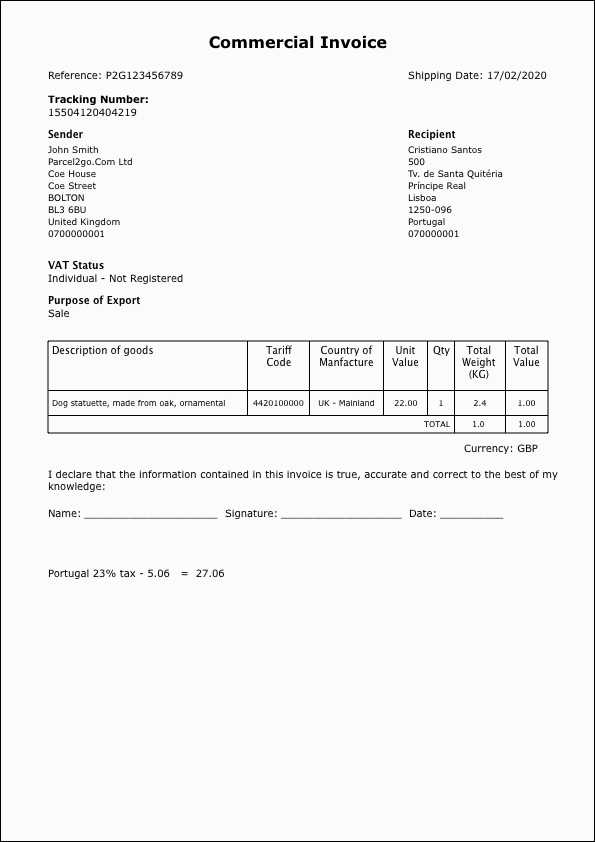

Essential Information for a Valid Invoice

To ensure smooth processing of shipments and avoid delays at borders, it is crucial to include all required details in the shipping declaration. The documentation must contain specific information that not only complies with international trade regulations but also provides clarity and transparency to authorities handling the shipment. Missing or inaccurate data can lead to hold-ups, fines, or rejection of goods. Understanding which details are essential for a valid declaration is the first step in creating an effective shipping document.

Key Elements to Include

A comprehensive declaration should capture the following critical information:

- Detailed Product Descriptions: Each item must be clearly identified, with a precise description including its purpose and material composition. This is necessary to ensure accurate classification and valuation.

- Declared Value of Goods: The value of each item must be stated accurately, based on the market price or invoice price. Undervaluing goods is considered a violation and can result in penalties.

- Country of Origin: Indicating where the product was manufactured or produced is required for tariff and duty calculations. This information helps customs determine applicable duties and potential trade restrictions.

- Quantity of Each Item: Clearly state the quantity of goods being shipped. This helps customs officials verify the shipment and ensure that all items match the declared value and description.

- HS (Harmonized System) Code: Each item must be assigned the correct HS code. This classification system helps determine the appropriate tariffs, taxes, and regulatory requirements for the goods.

Additional Required Information

In addition to the core details above, consider including the following information for full compliance:

- Shipping Terms: Clearly state the agreed-upon

Benefits of Using Excel for Invoice Management

Managing shipping documentation and related financial records efficiently is essential for businesses involved in international trade. A flexible and automated tool can help simplify the process of preparing, tracking, and managing these documents. By utilizing a widely accessible spreadsheet application, businesses can streamline their operations, reduce human error, and improve overall productivity. The ability to easily adjust fields, automate calculations, and store historical records makes this approach particularly valuable.

Key Advantages of Using a Spreadsheet for Shipping Documentation

Here are several key benefits of using a spreadsheet application for managing shipping and financial documents:

- Automation of Calculations: A major advantage of using a spreadsheet is the ability to automate complex calculations. With built-in formulas, you can easily calculate taxes, duties, and shipping costs based on product value, quantity, and other variables. This reduces the need for manual input and ensures accuracy.

- Customizability: A spreadsheet allows for easy customization of fields, layouts, and formulas, making it adaptable to different types of shipments and business needs. Whether you are dealing with a large number of items or specific product categories, the document can be tailored accordingly.

- Efficiency and Speed: Spreadsheets allow for quick updates to data, whether you’re modifying item quantities, values, or product descriptions. With predefined fields and templates, data entry becomes faster and more streamlined.

- Error Reduction: Built-in validation rules and predefined data fields minimize the risk of errors. This is especially important in international trade, where small mistakes can lead to delays or regulatory issues.

- Centralized Record-Keeping: A spreadsheet provides a centralized location for all of your records. You can easily search, update, and reference past shipments, which is valuable for reporting purposes or resolving disputes.

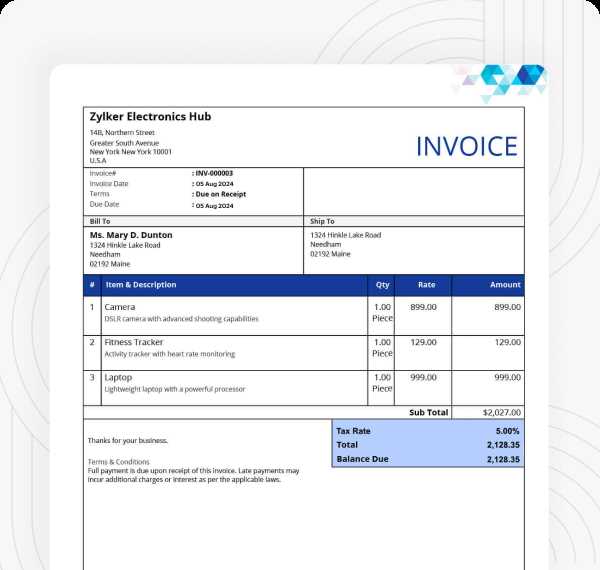

How to Calculate Duties and Taxes in Excel

Accurately calculating the taxes and duties associated with international shipments is an essential part of managing trade documentation. These calculations depend on various factors such as product values, shipping terms, and the applicable tariff rates for each item. A digital tool, such as a spreadsheet, can streamline this process by automating complex calculations, reducing the risk of errors, and ensuring that all applicable taxes and fees are properly accounted for.

Here’s a simple guide on how to set up an automatic calculation for duties and taxes using a spreadsheet:

Steps to Calculate Duties and Taxes

- Enter Product Information: Start by listing all relevant details for each item in the shipment. This typically includes the product description, quantity, unit value, and total value of the shipment.

- Determine Applicable Tax and Duty Rates: Obtain the correct duty and tax rates for the products being shipped. These rates may vary based on the product’s classification, the country of origin, and the destination. You can input these rates manually into the spreadsheet or link them to an external database.

- Create Formulas for Calculations: Use basic formulas to calculate the duties and taxes for each item. For example, to calculate duties, you can use the formula:

= Item Value * Duty Rate

Similarly, to calculate taxes, use:

= Item Value * Tax Rate

- Summarize Total Duties and Taxes: After calculating the duties and taxes for each item, use the SUM function to add up the totals across the shipment:

=SUM(FirstCell:LastCell)

This will give you the total duties and taxes for the entire shipment.

- Adjust for Shipping Terms: If applicable, adjust the final total based on the shipping terms (such as CIF or FOB). For example, if the cost of shipping and insurance is included in the value for tax calculations, factor this into the total value of the shipment.

Example Formula Setup

Here’s an example setup for calculating duties and taxes in a spreadsheet:

Item Description Quantity Unit Price Total Value Duty Rate Tax Rate Duties Taxes Product A 10 $50 $500 5% 8% =500*5% =500*8% Product B 5 $100 $500 7% 8% =500*7% =500*8% Total =SUM(Duties Column) =SUM(Taxes Column) By following this method, you can efficiently calculate the required duties and taxes for all items in your shipment, ensuring that your documentation is accurate and compliant with international regulations.

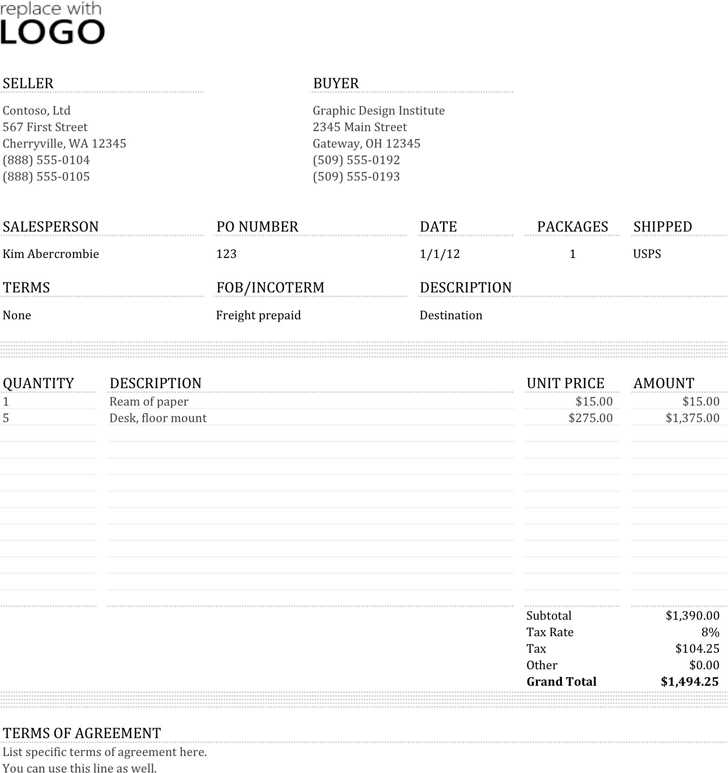

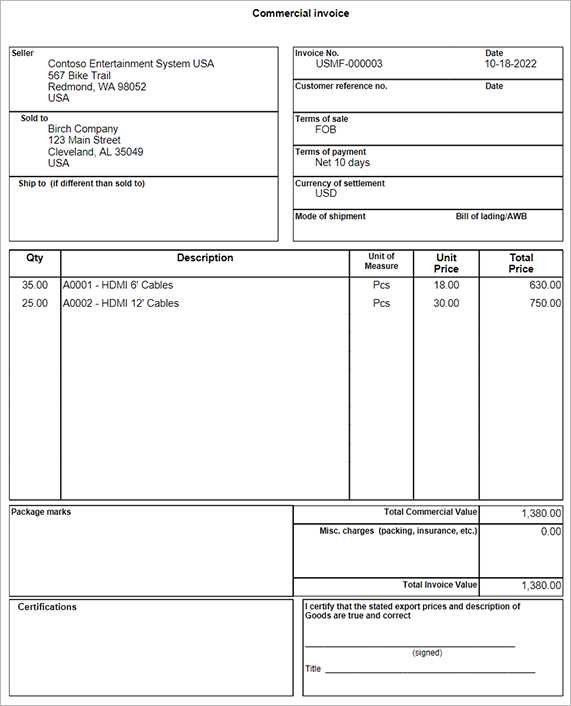

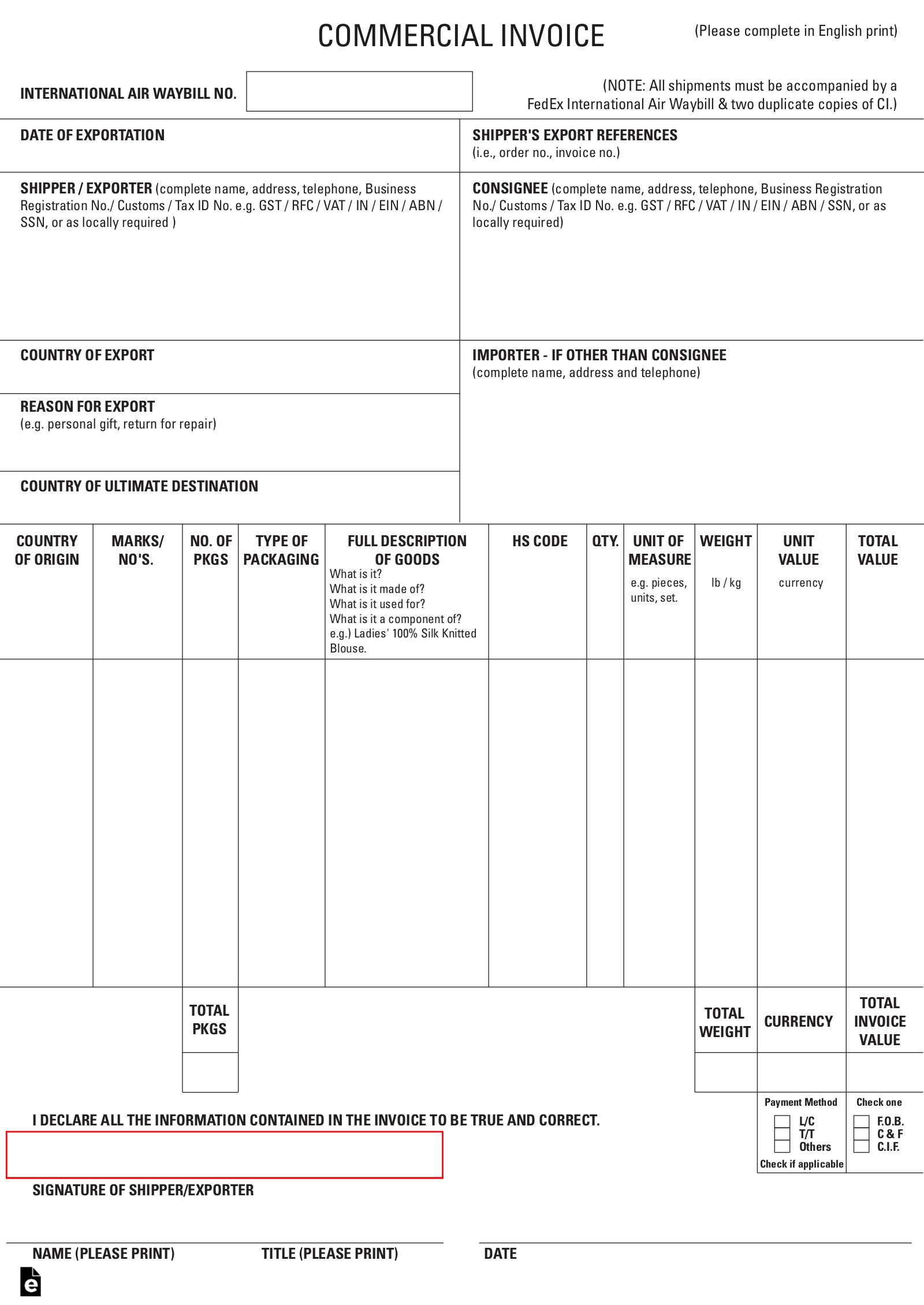

Step-by-Step Guide to Filling Out the Template

Creating accurate and compliant shipping documents is a vital part of the international trade process. Ensuring that all the necessary details are properly filled in will help prevent delays, errors, and complications with border authorities. By following a clear, step-by-step guide, you can efficiently complete the document, saving time and reducing the risk of costly mistakes.

Step-by-Step Instructions

Here’s a detailed guide on how to fill out a shipment declaration form:

- Enter Basic Shipment Information: Start by entering the basic details of the shipment. This typically includes the sender’s and recipient’s information such as:

- Sender’s name, address, and contact details

- Recipient’s name, address, and contact details

- List the Items: In the next section, list all items being shipped. For each product, you’ll need to include:

- Product description: Provide a detailed description of the goods, including material, function, or other identifying features.

- Quantity: Indicate the number of units for each product being shipped.

- Unit value: Include the price per item or unit of measurement (e.g., per kilogram, per box).

- Total value: Multiply the unit value by the quantity to determine the total value of each item.

- Provide Origin and Destination Information: Clearly state the country of origin for each product and the destination country for the shipment. This helps determine applicable duties and tariffs based on international trade agreements.

- Apply Tax and Duty Rates: In the appropriate sections, input the duty and tax rates applicable to each product based on its classification. Use formulas or predefined rates if available to automate this calculation.

- Include Shipping Terms: Specify the shipping terms (e.g., FOB, CIF), which clarify who is responsible for various costs, such as shipping, insurance, and duties. Ensure these are accurately listed in the form.

- Double-Check for Accuracy: After entering all the information, review the document to ensure all fields are filled out correctly. Make sure there are no missing values, such as item descriptions, quantities, or shipping terms.

- Sign and Date: Finally, sign and date the document to confirm that all the information provided is accurate. Some forms may require a digital signature, while others may need a handwritten signature.

Final Checks

Before submitting or sending your completed document, it’s crucial to double-check a few important aspects:

- Ensure that the product descriptions are clear and match the goods being shipped.

- Verify that the declared values are accurate and based on the current market price or invoice amount.

- Check that the correct duty and tax rates have been applied to each item based on its classification.

- Confirm that all signatures, dates, and required documentation are included.

By following these steps, you can confidently complete your shipping documentation, ensuring that your shipment is processed smoothly and complies with all regulations.

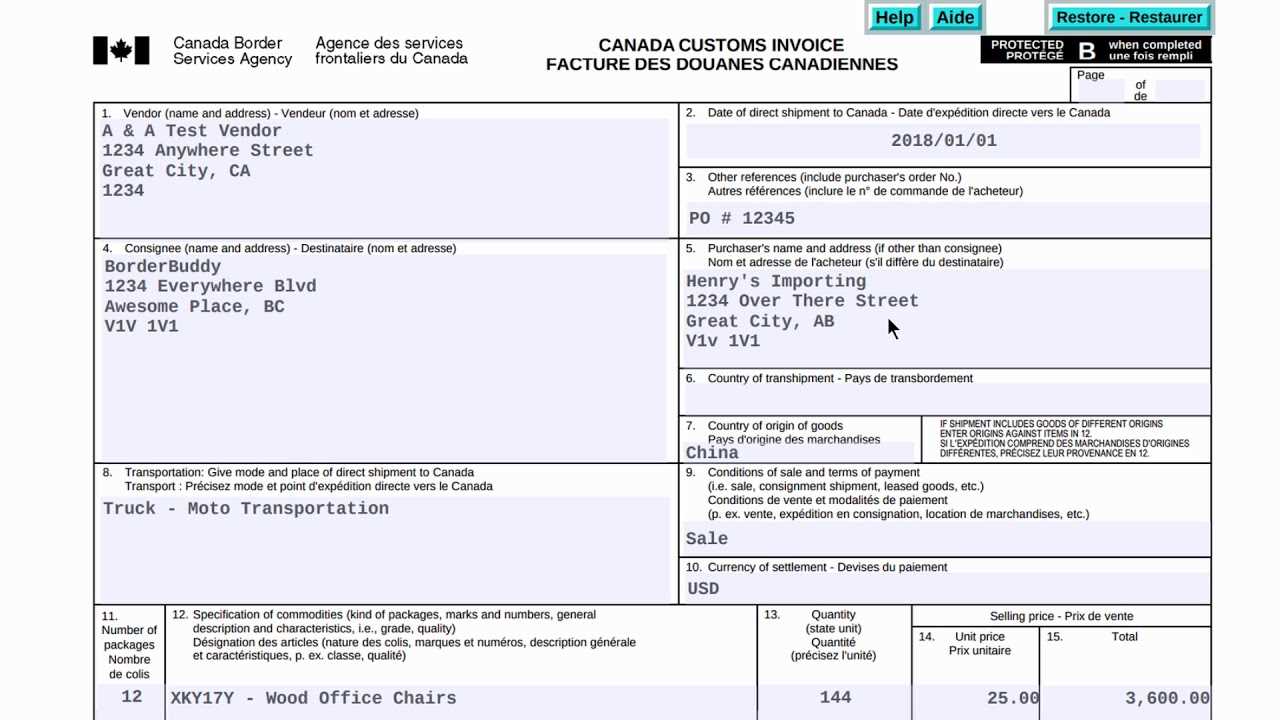

How to Format a Canadian Customs Invoice

Proper formatting of shipping and financial documents is critical to ensuring smooth processing at the border and avoiding delays or rejections. An organized, clear, and compliant declaration will make it easier for authorities to verify the shipment, calculate the correct taxes and duties, and assess the contents of the shipment accurately. Knowing how to structure the document correctly is essential for any business involved in international shipping.

When formatting your shipment paperwork, it’s important to include all the necessary details in a clear, easy-to-read format. Here’s a step-by-step guide to help you create a well-organized and compliant document:

Key Components to Include

The document should be formatted in a way that includes the following essential components:

- Header Information: At the top of the document, include the title of the document (such as “Shipping Declaration” or “Commercial Declaration”), followed by the date of preparation, the sender’s name, and the recipient’s details (name, address, and contact information).

- Itemized List of Goods: A clear, itemized list of all goods in the shipment is essential. For each item, ensure the following is included:

- Description: A detailed and accurate description of each product. Be specific about the material, function, and quantity.

- Quantity: Specify the number of units per product or weight/volume measurements, depending on the type of goods.

- Unit Value: The value of each individual unit or item should be listed. If applicable, include the currency used.

- Total Value: Multiply the unit value by the quantity to calculate the total value of each product.

- Country of Origin and Destination: Clearly state where each product is produced (country of origin) and the destination country where the goods will be delivered.

- Tariff Classification: For each item, include the correct Harmonized System (HS) code. This is used by authorities to classify products and determine the applicable duties and taxes.

- Shipping Terms: Include the agreed-upon shipping terms, such as CIF (Cost, Insurance, and Freight) or FOB (Free on Board). This clarifies who is responsible for shipping costs and insurance during transport.

- Signatures: The document should be signed and dated by the exporter or an authorized agent, confirming that all the details provided are accurate and complete.

Formatting Tips for Clarity

To ensure your document is clear and easily interpretable, consider the following tips for formatting:

- Use a Clean Layout: Maintain a clean, organized layout with clear headings and sections. Use bold or underlined text for headings to help distinguish different sections (e.g., Itemized List, Sender Informati

Legal Requirements for Canadian Customs Invoices

When preparing shipment documentation for international trade, it is essential to ensure compliance with the relevant laws and regulations. Failure to meet legal requirements can lead to delays, fines, or rejection of goods at the border. In order to avoid these issues, it is crucial to include all the necessary details and format the document correctly, according to the legal guidelines set by the relevant authorities. This section outlines the key legal aspects that must be adhered to when creating shipping records.

Mandatory Information for Compliance

The document used for cross-border shipments must contain specific details to meet legal standards. The following elements are necessary to comply with the required regulations:

- Accurate Product Description: Every item in the shipment must be described in enough detail to identify it clearly. General terms like “goods” or “products” are not sufficient. The description should reflect the specific nature, function, and characteristics of the goods being shipped.

- Value of the Goods: The monetary value of each item must be provided. This value should match the actual transaction price or market value and must not be inflated or understated.

- Country of Origin: The country where the goods were manufactured or produced must be clearly stated. This information is crucial for tariff calculations and is required for trade agreements between countries.

- Harmonized System (HS) Code: The correct HS code for each product must be included. This code determines the tariff classification and is used globally to ensure consistency in product categorization for duty purposes.

- Shipping Terms: Clearly outline the terms of shipment, including who is responsible for transportation costs, insurance, and taxes. Common terms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight).

- Recipient’s Information: The recipient’s details, including their name, address, and contact information, must be accurately filled out.

Consequences of Non-Compliance

Failure to comply with the legal requirements for shipment documentation can result in serious consequences, including delays in shipment clearance, fines, or confiscation of goods. Authorities may require additional information or clarification, which can lead to increased processing times. In more severe cases, non-compliance could result in legal action or penalties.

The following table summarizes the legal aspects to be aware of:

Requirement Consequence of Non-Compliance Accurate product description Goods may be delayed or rejected for unclear identification Correct item value Possible fines or goods held for further inspection Country of origin information Tariff miscalculations and potential penalties HS code for How to Automate Invoice Calculations in Excel

Automating calculations in shipment documents can save significant time and reduce the risk of errors. By using formulas and built-in functions, you can quickly compute total values, taxes, duties, and other necessary calculations for international transactions. Automating these processes also ensures consistency and accuracy across multiple shipments, which is critical for maintaining compliance and optimizing efficiency.

In this section, we will walk you through the steps to set up automated calculations for your shipment paperwork, including product values, taxes, and shipping fees.

Setting Up Automated Calculations

To automate your document, you’ll need to use a few key formulas. Here are the basic steps to follow:

- Input Product Data: Start by entering your product details in the relevant columns, including item description, quantity, unit price, and any additional costs (e.g., shipping). These values will be used in subsequent calculations.

- Calculate Item Total: In a new column, use a simple multiplication formula to calculate the total value for each item:

= Quantity * Unit Price

- Apply Tax Rates: To calculate taxes, you can multiply the total value by the applicable tax rate. For example:

= Total Value * Tax Rate

This will automatically compute the tax amount for each item.

- Calculate Shipping Fees: If shipping costs are fixed or based on weight or volume, you can use another formula to automatically calculate shipping. For example, if the shipping cost is based on weight:

= Weight * Shipping Rate

- Calculate Total Invoice Amount: Once individual calculations are completed, use the SUM function to add up the totals for each item and any additional costs:

=SUM(Column Range)

This will give you the grand total for the entire shipment.

Example of Automated Calculation Setup

Here’s an example of a simple automated calculation setup in a spreadsheet:

Item Description Quantity Unit Price Total Value Tax Rate Tax Amount Shipping Fee Total Product A 10 $50 =B2*C2 8% =D2*E2 $30 =D2+F2+G2 Product B 5 $100 =B3*C3 8% =D3*E3 $40 =D3+F3+G3 Tips for Avoiding Customs Delays with Correct Invoices Proper documentation is essential for smooth processing during international shipments. Incorrect or incomplete paperwork can lead to significant delays, increased costs, and potential fines. By ensuring that your shipment records are accurate, clear, and properly formatted, you can avoid unnecessary hold-ups at the border. This section provides practical tips for minimizing the risk of delays by maintaining correct and compliant shipment records.

Key Tips for Accurate Documentation

Here are some essential guidelines to ensure your paperwork is in order and helps speed up the customs clearance process:

- Provide a Clear Product Description: A detailed and accurate product description is vital. Generic or vague terms such as “goods” or “items” can cause confusion. Be specific about the type, quantity, and purpose of the goods to avoid any misinterpretation.

- Ensure Correct Value Declaration: The value of the goods must be accurately declared based on the transaction price or fair market value. Inflating or under-declaring the value to reduce taxes or duties can result in severe penalties.

- List All Necessary Codes: The Harmonized System (HS) codes are used to classify goods for tariff and tax purposes. Ensure that every item is assigned the correct HS code, as incorrect codes can lead to delays and incorrect duty assessments.

- Verify Shipping Terms: Clearly define the terms of shipment (e.g., FOB, CIF) in the paperwork to avoid misunderstandings about who is responsible for shipping costs and insurance.

- Complete Recipient Information: Ensure the recipient’s details, such as their name, address, and contact information, are complete and accurate. Missing or incorrect details can result in shipments being returned or delayed.

Common Mistakes to Avoid

Several common errors can contribute to delays or rejection of shipments. Avoid the following mistakes to ensure smoother clearance:

- Missing Signatures: Failing to sign the document or have it signed by an authorized representative is a common mistake. Always ensure the document is properly signed and dated.

- Inconsistent Data: Inconsistencies between the product descriptions, quantities, and values can raise red flags with authorities. Double-check that the data matches across all sections of the document.

- Incomplete or Incorrect Shipping Instructions: Providing unclear or incomplete shipping instructions can cause confusion. Ensure that all delivery details and instructions are clearly stated, including shipping method, delivery address, and contact numbers.

- Omitting Supporting Documentation: In some cases, additional paperwork may be required (e.g., certificates of origin, licenses, or permits). Make sure that you include all necessary documents to avoid delays in processing.

Example of Comm

Integrating Excel Templates with Other Systems

In today’s fast-paced business environment, streamlining processes across different platforms is essential for efficiency. By integrating spreadsheet-based documents with other software systems, businesses can automate data transfer, eliminate manual errors, and ensure seamless workflow between departments. This integration not only improves accuracy but also saves time by reducing the need for repetitive data entry and the risk of miscommunication between various platforms.

How Integration Enhances Efficiency

Integrating your spreadsheet documents with other systems allows for faster and more accurate data processing. Here’s how it benefits your workflow:

- Data Synchronization: By connecting your spreadsheet to your enterprise resource planning (ERP) system or customer relationship management (CRM) software, you can automatically update records across multiple platforms. This ensures that data is consistent and reduces the need for duplicate entries.

- Automation of Calculations: Integration can automatically pull in the necessary data from external systems, making calculations such as taxes, discounts, and totals easier to manage without manual input. This reduces the likelihood of errors and speeds up the overall process.

- Real-time Data Updates: As external systems receive updates, these changes are automatically reflected in your documents. This enables more accurate decision-making, as you’re always working with the latest information.

- Reporting and Analytics: With integrated systems, data from spreadsheets can be seamlessly transferred into business intelligence platforms, where it can be analyzed and used to generate detailed reports. This gives stakeholders better insight into business performance and trends.

Common Integration Methods

There are several ways to integrate spreadsheets with other software applications, depending on your needs and the systems you are using. Here are some common integration methods:

- API Connections: Many software applications offer APIs (Application Programming Interfaces) that allow for automated data exchange between platforms. By setting up API connections, you can directly integrate your spreadsheet with your other systems.

- Third-party Integration Tools: There are many third-party tools, such as Zapier or Integromat, that can help you integrate your documents with various systems without the need for extensive programming knowledge. These platforms allow you to set up triggers and actions between systems.

- CSV Imports and Exports: A more basic integration method involves exporting your spreadsheet data as a CSV (Comma-Separated Values) file and importing it into another system. While less automated than API integrations, this method is often used for simple data transfer needs.

- Database Connections: If you are working with large sets of data or need more advanced integration, you may choose to link your spreadsheets to an SQL database. This allows for more robust data management and quicker access to real-time information.

Incorporating these integration techniques can improve efficiency, reduce errors, and ul

Best Practices for International Shipping Documentation

Accurate and well-prepared shipping documents are crucial to ensuring smooth international transactions and preventing delays or issues at border crossings. Proper documentation not only helps comply with legal requirements but also streamlines the shipping process, making it easier for both the sender and recipient. This section covers essential practices for managing shipment records effectively to ensure that all international shipments are processed without complications.

Essential Elements of Shipping Documentation

When preparing documents for cross-border shipments, certain key details must always be included to guarantee compliance and minimize the risk of delays:

- Clear Product Descriptions: Accurately describe each item being shipped, including details such as quantity, weight, dimensions, and value. Vague or incomplete descriptions can lead to confusion or hold-ups at the destination.

- Correct Harmonized System (HS) Codes: Use the correct HS code for each item in the shipment. These codes classify goods and help determine duties and taxes. Incorrect or missing codes can result in delays or additional charges.

- Precise Value Declaration: Always declare the true value of the goods being shipped, including the cost of the goods and any additional charges such as shipping or insurance. Under- or over-declaring the value can lead to penalties or legal issues.

- Accurate Sender and Recipient Information: Ensure that all contact details, including names, addresses, and phone numbers, are accurate and complete. Missing or incorrect information can cause delays or prevent the goods from reaching their destination.

- Shipping Terms and Conditions: Clearly specify the shipping terms, such as Incoterms (FOB, CIF, etc.), to define the responsibilities of both the seller and the buyer. This will help clarify who is responsible for shipping costs, insurance, and risk during transit.

Common Mistakes to Avoid

While preparing international shipping documents, there are several common mistakes that can lead to delays, fines, or rejected shipments. Avoiding these errors is critical to ensuring timely and successful delivery:

- Incomplete or Incorrect Documentation: Always double-check all fields to make sure all required information is filled out accurately. Missing signatures, incorrect dates, or missing supporting documents (e.g., certificates of origin) can delay processing.

- Failure to Include Required Supporting Documents: Depending on the destination, certain documents may be required, such as export licenses, permits, or product-specific certificates. Ensure that all necessary paperwork accompanies the shipment.

- Inconsistent Data Across Documents: Cross-check all shipment records for consistency. Inconsistencies between values, descriptions, and shipping information across documents can cause confusion and delay the clearance process.

- Using Vague or Generic Terms: Avoid using generic terms like “goods” or “items” in your descriptions. Being specific and clear in your documentation will help reduce confusion and improve the accuracy of your shipment records.

By following these best practices, you can streamline your shipping process, minimize delays, and ensure that your internation

How to Track and Update Your Invoices in Excel

Maintaining an organized system to monitor and update billing records is crucial for businesses to ensure timely payments and avoid discrepancies. With the right tools and methods, you can easily track the status of your billing documents and make real-time updates without much effort. In this section, we’ll explore how to effectively track and manage your financial records using spreadsheet software, simplifying the entire process from creation to final payment.

Setting Up an Efficient Tracking System

To begin tracking your financial documents in a spreadsheet, it’s essential to establish a structured format. Here are the key steps to set up a tracking system:

- Create a Unique Identifier: Assign a unique number or code to each record, such as a reference number or serial code, to make tracking easier. This will allow you to quickly locate specific records without confusion.

- Include Key Information: Make sure your document includes vital details such as the customer’s name, contact information, the date of issuance, due dates, and the total amount owed. This ensures you have all the relevant data at your fingertips.

- Status Tracking: Add a column to your spreadsheet where you can note the current status (e.g., “Paid”, “Pending”, “Overdue”). This will allow you to quickly assess which documents require follow-up action.

- Payment History: Track any payments received by adding a column for payment dates and amounts. This helps in keeping your records up to date and ensures accurate financial reporting.

Updating and Managing Your Records

Regularly updating your financial documents is essential for maintaining an accurate record of your business transactions. Here are some practical tips:

- Set Reminders for Follow-Up: Set conditional formatting rules in your spreadsheet to highlight overdue payments or upcoming due dates. This will remind you to follow up with clients before payments become too overdue.

- Use Formulas for Automatic Calculations: Take advantage of built-in spreadsheet functions, such as SUM, IF, and VLOOKUP, to calculate totals, overdue fees, and outstanding amounts automatically. This eliminates the risk of manual errors and ensures your records are accurate.

- Keep Backups of Updated Files: Always back up your documents periodically, especially after making significant updates or adjustments. Consider using cloud-based storage to ensure your data is secure and accessible from anywhere.

- Review Regularly: Set aside time each week or month to review and update your billing records. Regular check-ins help maintain accurate accounts and allow you to spot any issues early on.

By following these steps, you can easily manage and track your financial documents, ensuring that no payment or record is overlooked. The ability to update your documents in real time using a structured tracking system can significantly improve your business’s financial efficiency and help maintain a

Saving and Sharing Your Invoice Templates Securely

When handling sensitive financial documents, it is essential to ensure that they are stored and shared securely to prevent unauthorized access or potential data breaches. Whether you are managing customer billing records or preparing transaction details, taking the proper steps to protect your files can safeguard your business and client information. This section will guide you through best practices for securely saving and sharing your financial documents, helping you maintain confidentiality and compliance with privacy regulations.

Best Practices for Secure Storage

Properly storing your business records is the first line of defense against unauthorized access. Here are some tips for securing your financial documents:

- Use Encrypted Storage: Store your files in an encrypted folder or cloud service that offers end-to-end encryption. This ensures that even if someone gains access to your storage account, they will not be able to read the content without the proper decryption key.

- Backup Your Files Regularly: Regular backups are essential to protect your documents against data loss due to system crashes or accidental deletion. Consider setting up automatic backups to a secure cloud service or external hard drive.

- Restrict Access with Password Protection: Add password protection to your documents or folders to limit access. Only share passwords with authorized personnel, and ensure they are strong and unique to prevent unauthorized access.

- Maintain an Organized Filing System: Keep your records organized with a well-structured folder hierarchy. This makes it easier to locate and manage your documents, while also ensuring that sensitive information is grouped together and protected from general access.

Securely Sharing Financial Documents

When sharing your billing records or transaction details with clients, vendors, or colleagues, security is equally important. Follow these guidelines to share documents securely:

- Use Secure File Sharing Platforms: Opt for trusted file-sharing services that offer secure data transfer protocols, such as Dropbox, Google Drive, or OneDrive. Ensure that the platform allows you to control access by enabling features like password protection, link expiration, and restricted viewing permissions.

- Send Files Through Encrypted Emails: If you need to share documents via email, use email encryption to protect sensitive information. Some email providers offer built-in encryption features, or you can use third-party tools to ensure that your documents are sent securely.

- Limit Document Sharing Permissions: When sharing a document online, set permissions to “view only” or “comment only” to prevent unauthorized modifications. This way, recipients can access the information without making any changes to the original content.

- Avoid Public Wi-Fi for File Transfers: When sharing or transferring files, avoid using public Wi-Fi networks as they can be vulnerable to attacks. Use a Virtual Private Network (VPN) for add